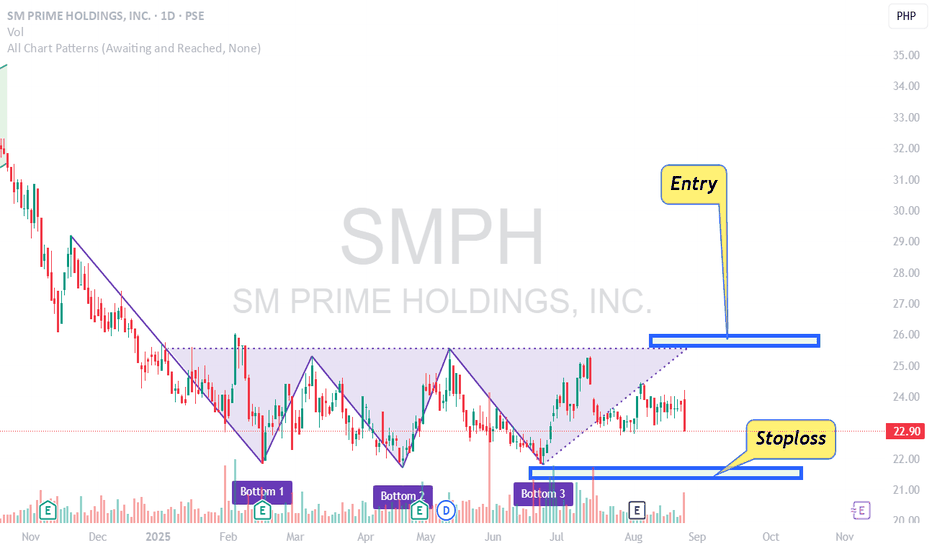

SMPH Chart Analysis Aug 26, 2025First off, SMPH is a bluechip stock in PSE.

The price of SMPH made a triple bottom chart pattern. Triple bottom is a bullish reversal pattern. The entry is on the break of the neckline. You put a stoploss below the right (3rd) shoulder after entry.

Triple bottom chart pattern is a "prove me your s

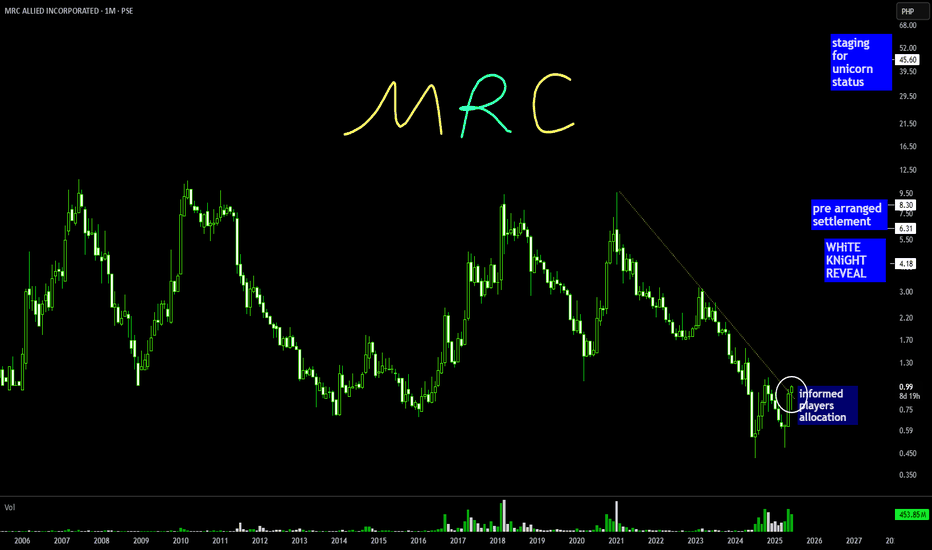

MRC: 0.99 | a Mining Telco jack of all stories SuperStock a cyclical issue with a great story backed up by solid funding

and experts across sectors

it is a survivor

and it rewards early speculators

even strong hands who can average down before the facts news and disclosures

whatever the TREND is

this stock is a facility for heavy hitters to bankroll

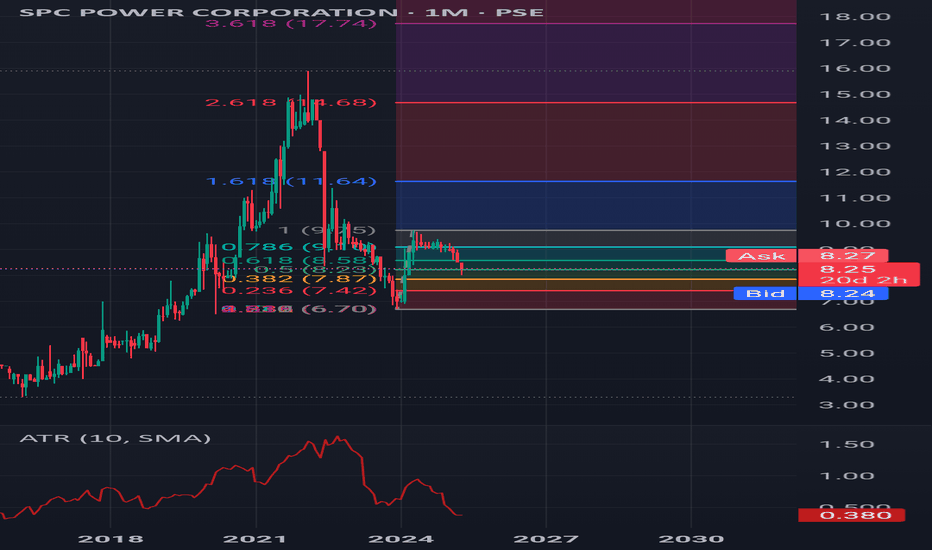

$PLUS Shows a Strong Uptrend: Long at $16.66!DigiPlus Interactive Corp ( PSE:PLUS ) is in a “Strong Uptrend” on a 1-week chart. 📈 We bought at $8.24 and sold at $10.35 previously. Now at $39.45, we’re in a long position at $16.66. With a Trend Score of 6/8 and 66.7% signal alignment, the short-term projected price is $44.2 (+19.1%) , but b

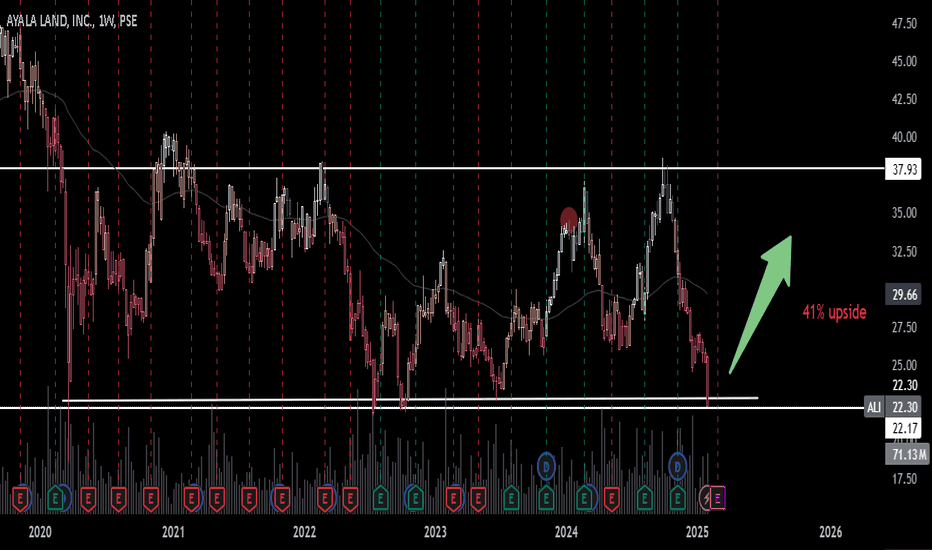

Buy and holdA good business may at times be priced wrong. And when it is, that's when you buy.

Learn to put a value on things even if it's just book value over market price per share and when you see there is a discrepancy and a discount and when you believe something will continue to go up over time especial

SMPH Possible Trend ReversalAfter months of downtrend, SMPH seems to be somehow recovering from its bearish sentiment. From downtrend to sideways

Confluence

Macro: Shift from downtrend to sideways

Daily chart: higher lows

RSI: higher lows

Short term outlook: Looking like a 1 month short term uptrend.

Other Notes

Possibly loo

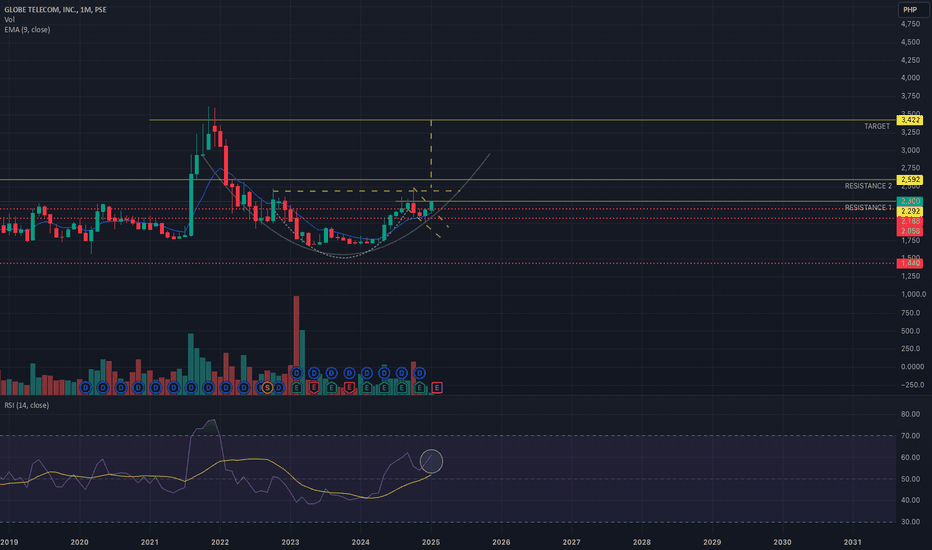

Bullish formation. Globe Telecom stock 🧐

• Potential to reach ₱5,000 per share.

• Last year, the stock was down by 50% from its previous all-time high.

• There’s a possibility of recovery this year, potentially reaching ₱3,400, followed by consolidation.

• A cup-and-handle formation could form, setting the stage f

See all popular ideas

Community trends

Hotlists

Stock collections

All stocksTop gainersBiggest losersLarge-capSmall-capLargest employersHigh-dividendHighest net incomeHighest cashHighest profit per employeeHighest revenue per employeeMost activeUnusual volumeMost volatileHigh betaBest performingHighest revenueMost expensivePenny stocksOverboughtOversoldAll-time highAll-time low52-week high52-week lowSee all

Sector 10 matches | Today | 1 week | 1 month | 6 months | Year to date | 1 year | 5 years | 10 years |

|---|---|---|---|---|---|---|---|---|

| Finance | ||||||||

| Retail Trade | ||||||||

| Utilities | ||||||||

| Transportation | ||||||||

| Consumer Non-Durables | ||||||||

| Communications | ||||||||

| Energy Minerals | ||||||||

| Consumer Services | ||||||||

| Non-Energy Minerals | ||||||||

| Consumer Durables |