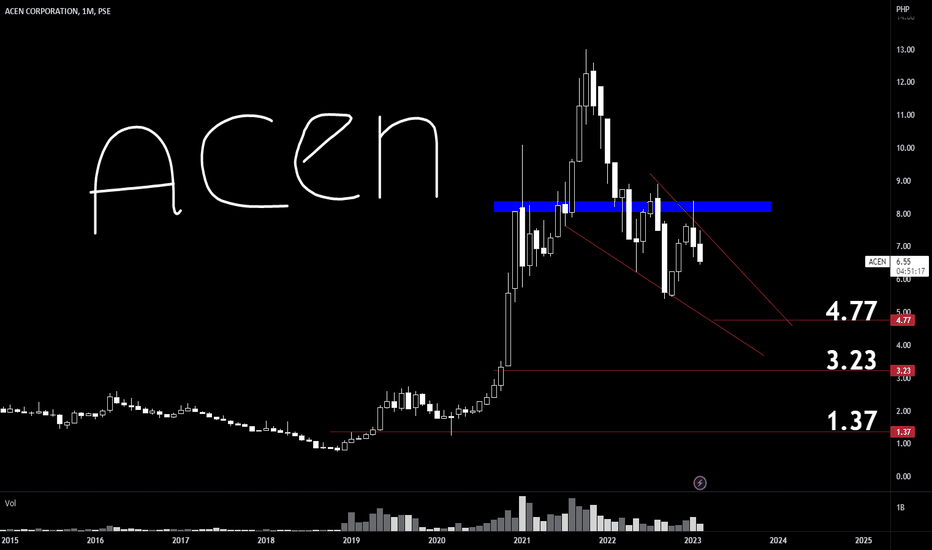

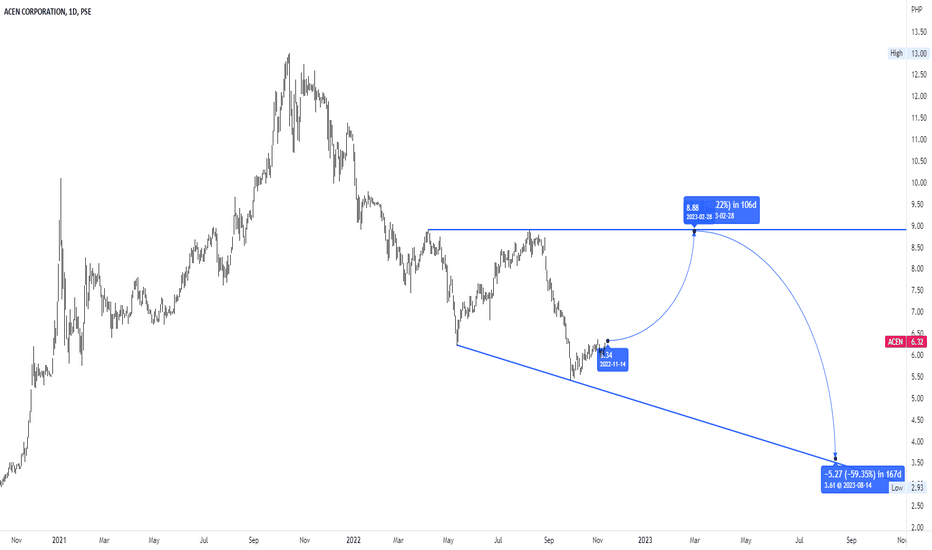

ACEN 6.55 | Key Levels for Buy Back energy politics and power

it takes 15 ++ years to recover capex

and with aggressive expansion

it looks like MARKET discounted the future revenue already

should stablize at key levels

for SECURiTIES under collateral

buy back at BRUTAL discount for Holders at the top should be

rewarding for patient player who missed the run up by Deutshe Bank from 0.79 cents

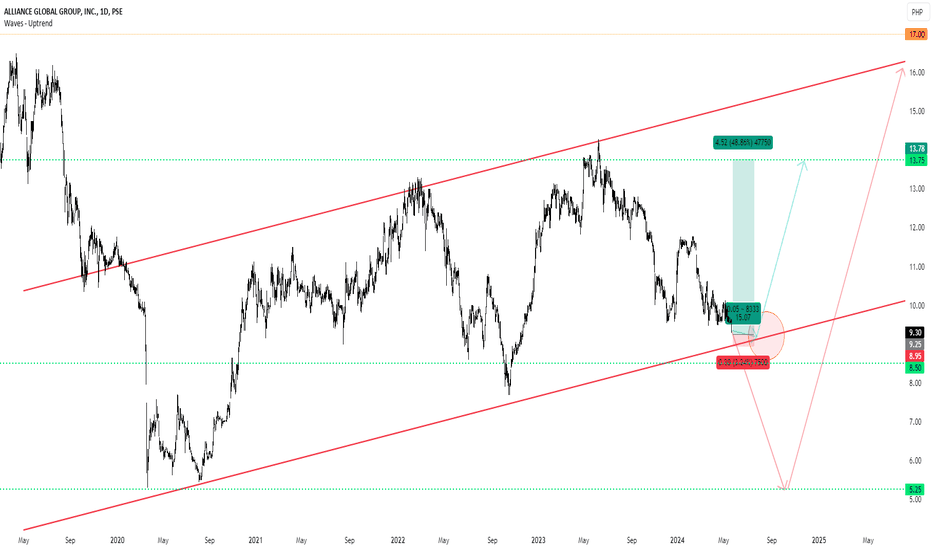

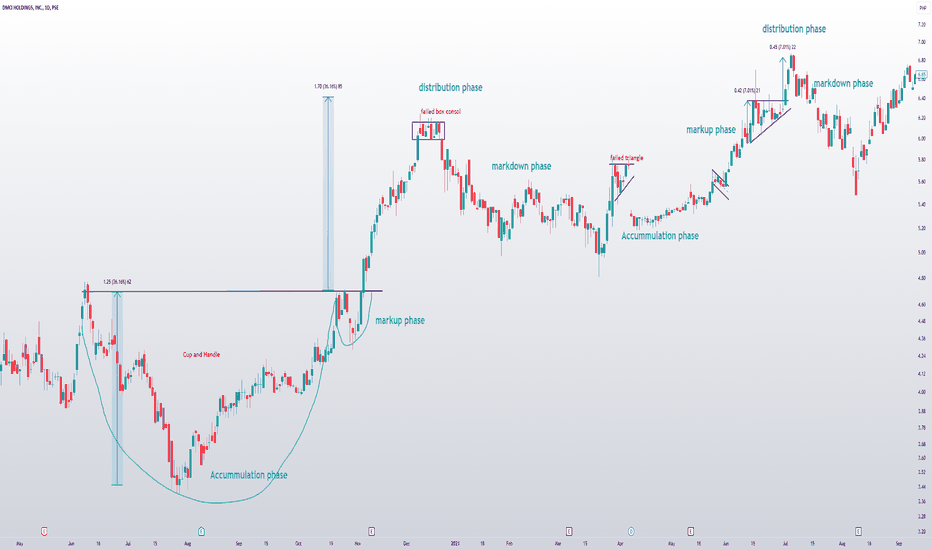

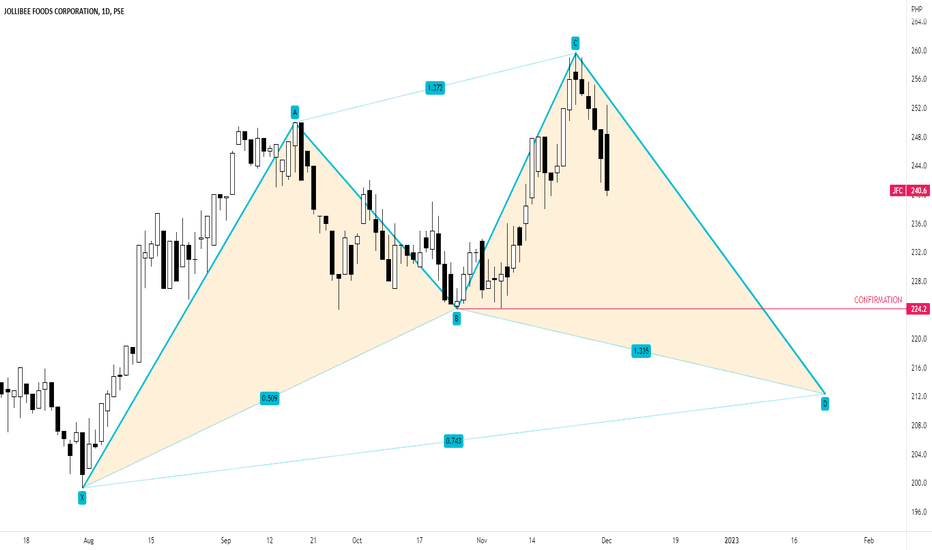

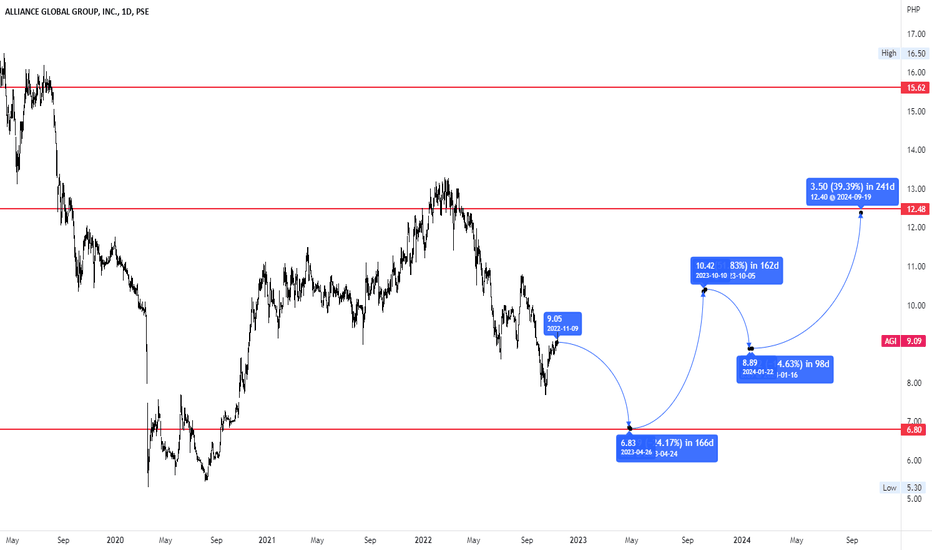

Bullish Hidden Divergence on PSE:AGI - Trend Continuation? I’ve identified a bullish hidden divergence on PSE:AGI. This signal suggests a potential continuation of the current uptrend despite the recent pullback.

Chart Analysis:

Price Action: The price has formed a higher low, indicating the strength of the uptrend.

Indicator: The Stochastic is showing a lower low, confirming the hidden divergence.

Support Levels: The price is currently holding above 9.00 support.

Volume: There is an increase in volume, supporting the potential for a trend continuation.

Trade Plan:

Entry: Consider entering a long position at the current price level or on a slight pullback.

Stop Loss: Place a stop loss below the recent low to manage risk at below 8.50.

Target: Aim for a target near the recent high or use a trailing stop to maximize potential gains at 13.75.

Additional Confirmation:

Look for bullish candlestick patterns such as a hammer or bullish engulfing to strengthen the signal. Monitor overall market conditions and any relevant news that might impact the ticker.

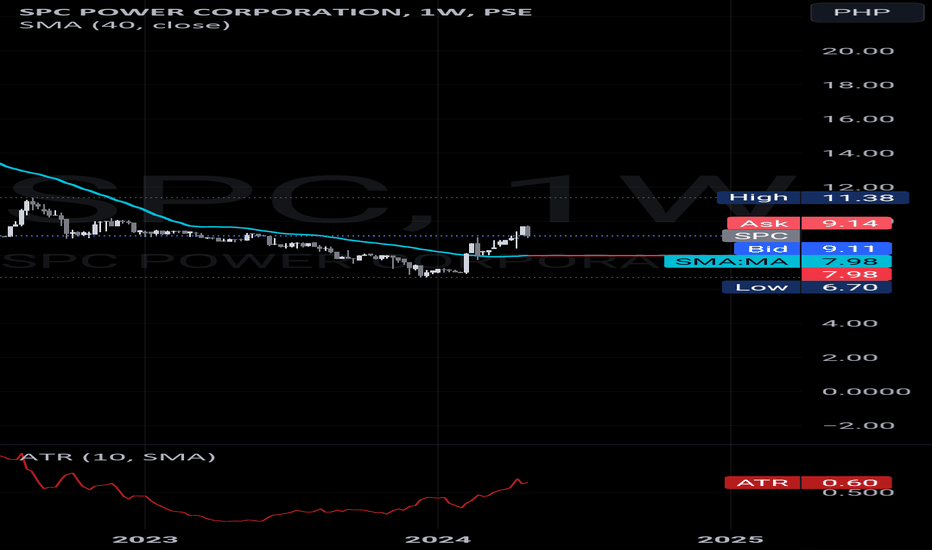

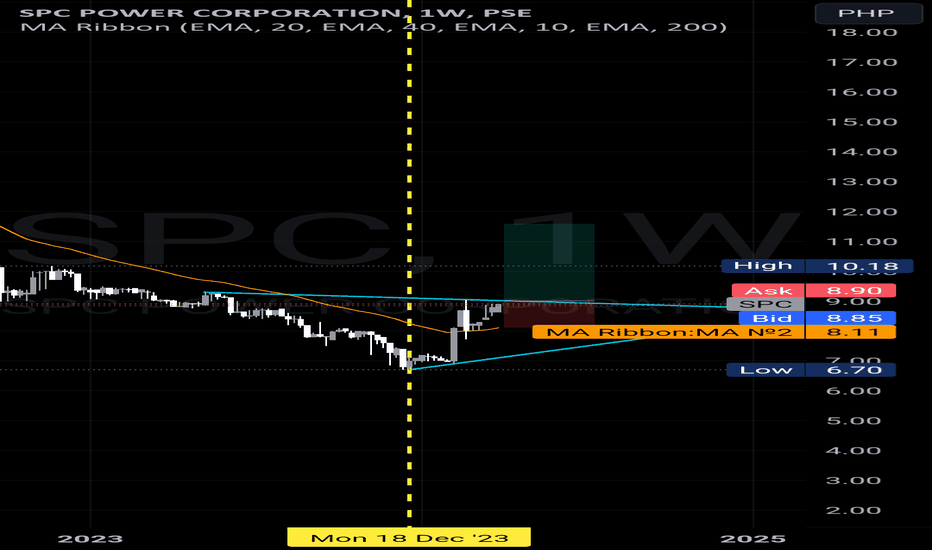

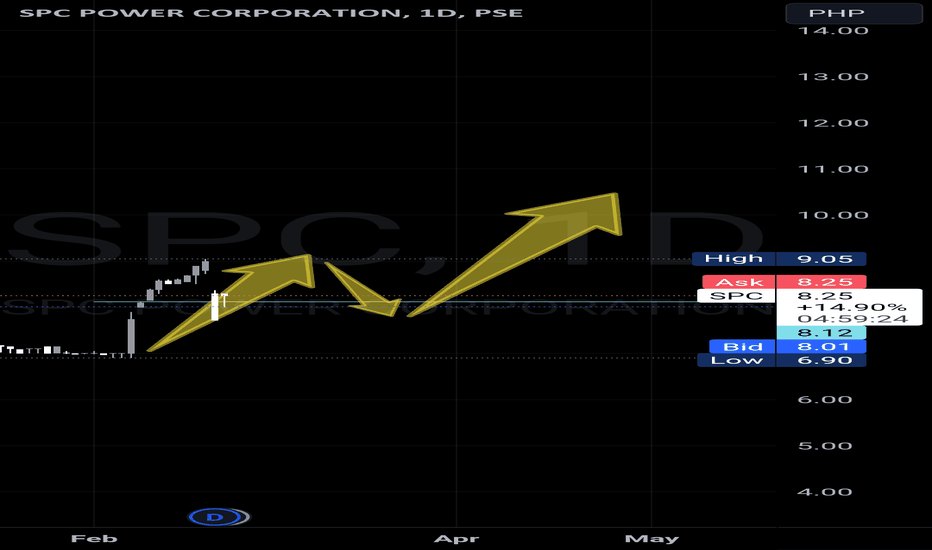

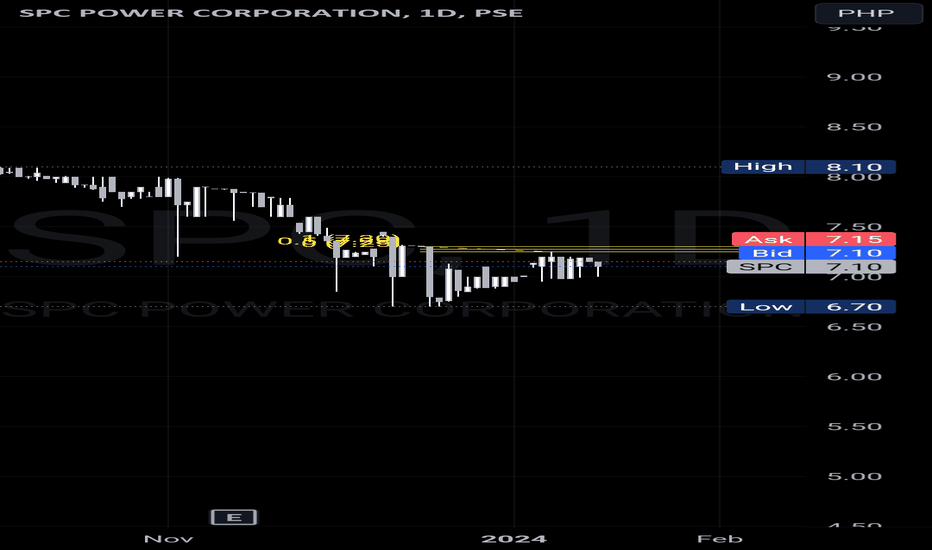

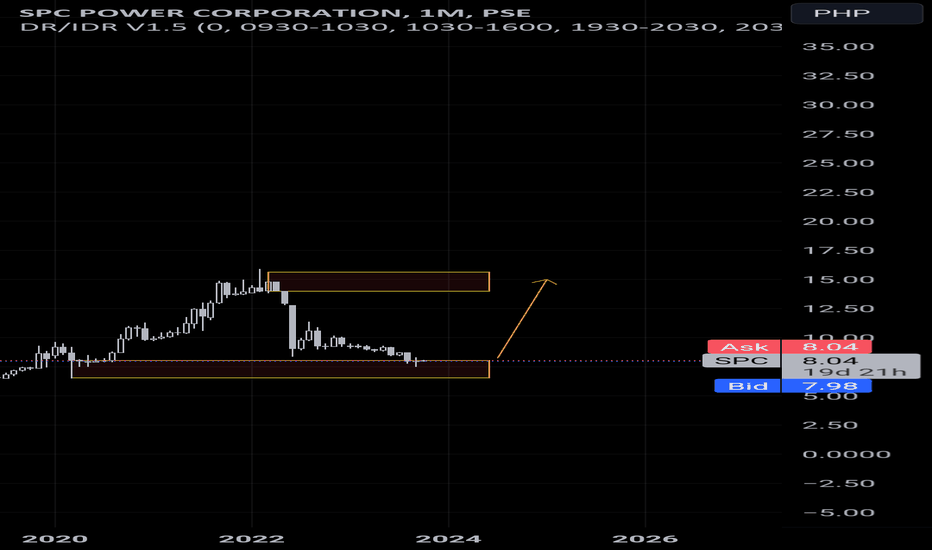

Spc remains a good buy for long as we enter mayAs electricity is a necessity in Philippines especially because the temperature is hot because summer, more people consume and there is high demand for spc electricity service.

May also spc will release dividends; hence spc is consistent; one of the good ones; and therefore worth holding or buying more.

40 sma weekly is also below the current price. So we have both technical and fundamental in check.

I definitely will be buying more this may.

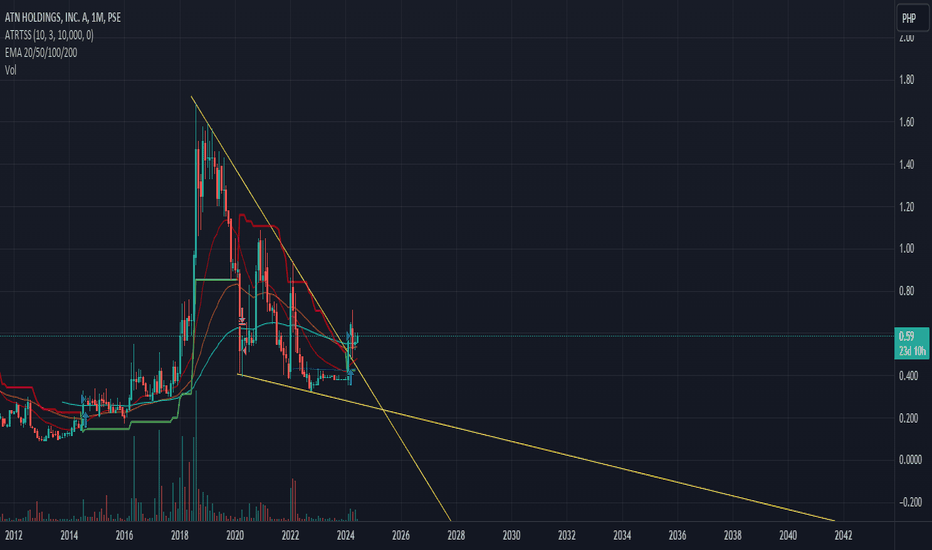

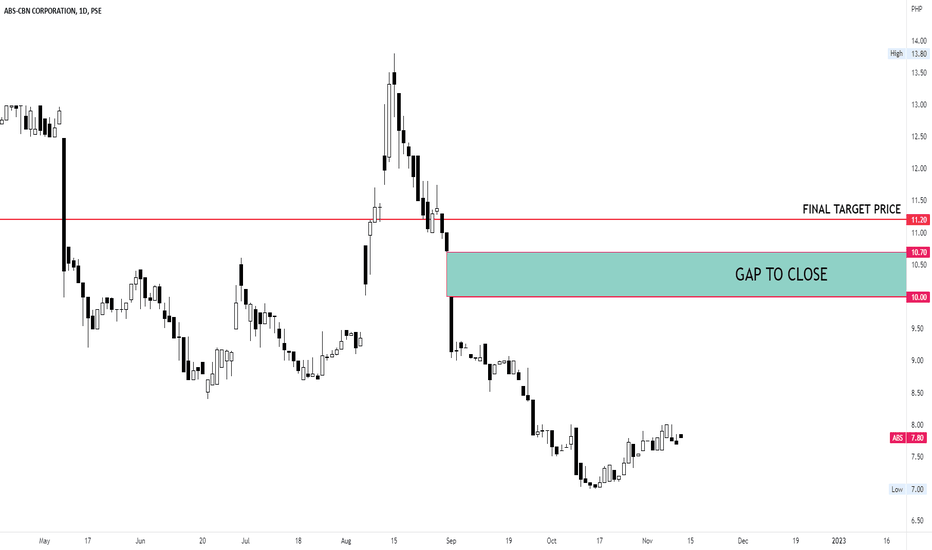

$ABS undervalued target 11.20 per shareABS CBN is already undervalued by the market. Traders and investors soon will realize that the company has positive results on its total revenue, gross profit, operating income, and pretax income.

We have a gap to close around 10.00 – 10.70 area and expected to overshoot until 11.20 as my final Target Price.

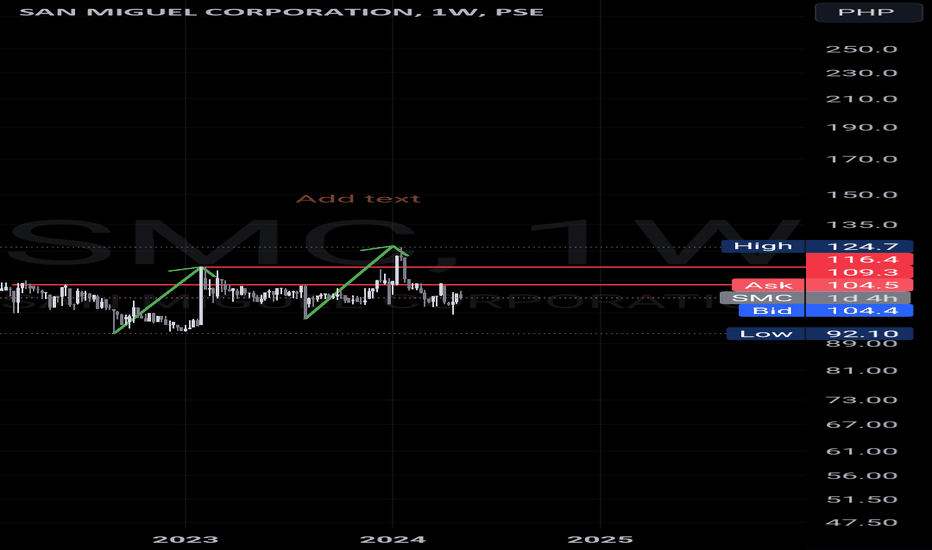

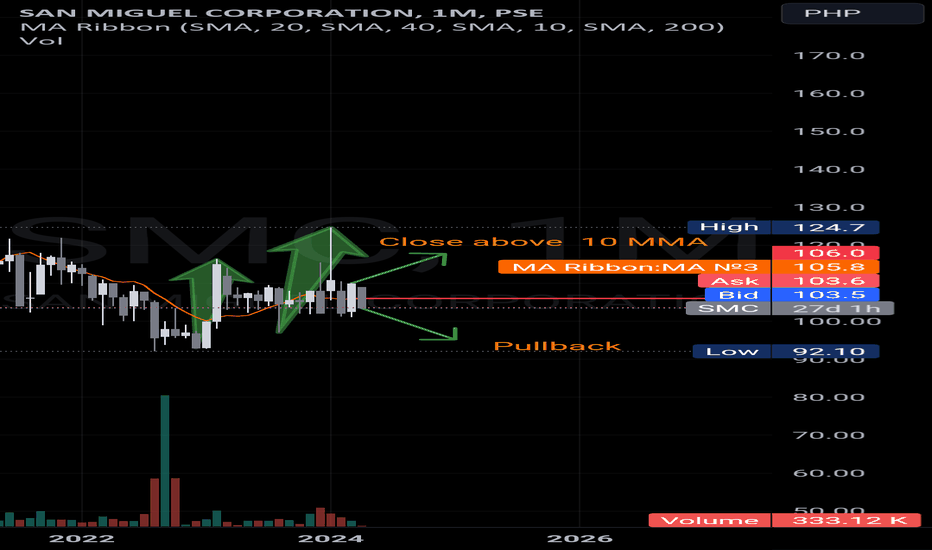

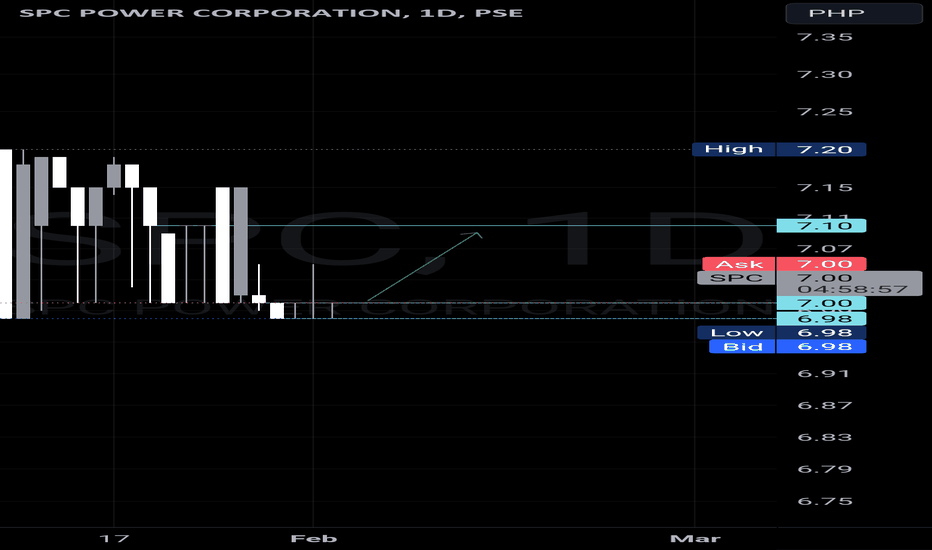

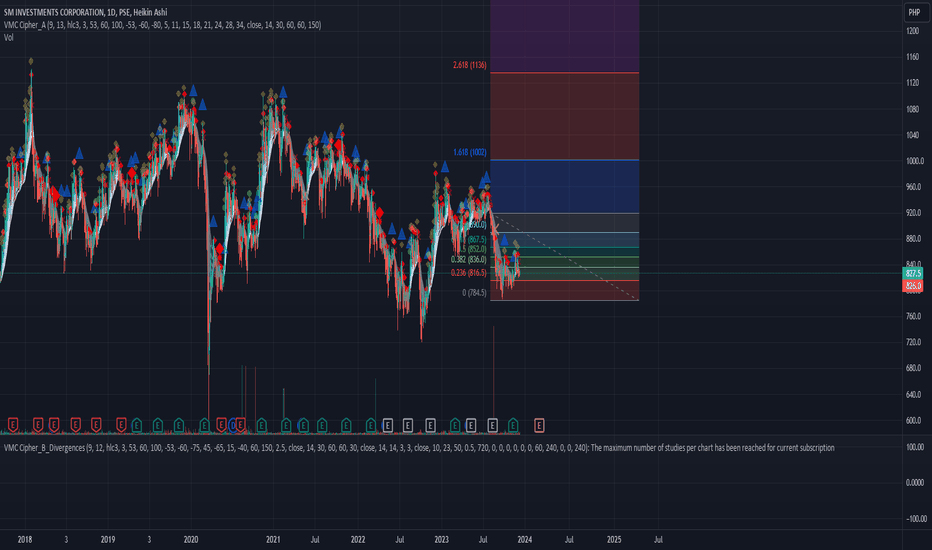

Golden cross Strong A to BFundamentally growing

5yr growth on assets 13%, 15% on equity, 14.59% on invested capital.

Increase from .2 to .6 dividends per share. 5.8% growth over the past 5 years.

Strong A to b move and golden cross of 20 40 daily ema.

Price volume shows it is undervalued.

Hence a good stock to buy and hold for a long long time.

Because everyone needs electricity and that is not going to change any time soon.

Fundamentals are good Spc fundamentals are better than last year. Awaiting the new annual report to update. As the fundamentals improved, one should buy and hold.

7 last daily close resistance, needs breaking, initial target atleast 7.1 from there, let's take it one step at a time until it becomes a 10 bagger.

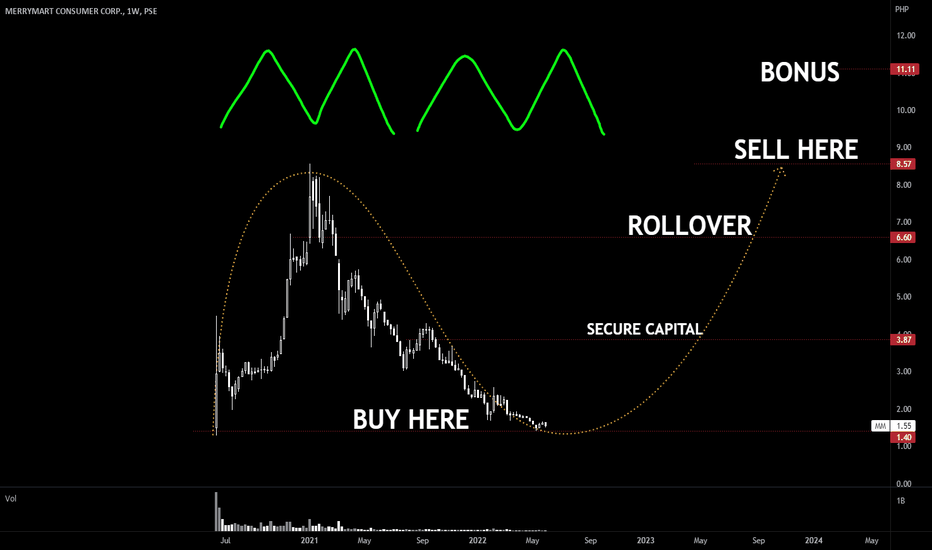

MM: ₱1.55 | 35 Branches of 1,200nto rolloutreminds me of waltermart and should be transitioning towards its 2030 vision

a supermart minimart organically growing in the outskirts of the capital

7/11 had the same plan in 2005 that made it the local convenience shop across the country

with an impressive merhandising strategy bringing Kpop Jpop culture