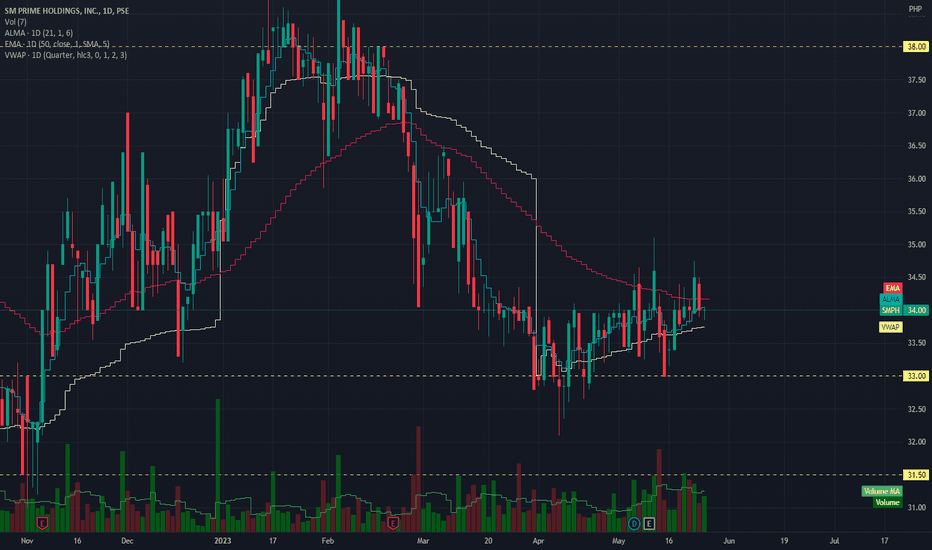

SMPH - SM Prime Holdings InitiationUpdate:

I apologize for the long break. I had a lot on my plate with working full time and moving from my rented apartment to my own home. It took up all my time and energy to generate and post my trading ideas. But now I'm back with a new trading idea.

Analysis:

I'm starting to cover SMPH because of the huge trading volume it had in the last few days. The stock is trading at 34 right now. I'm setting my immediate support for this stock at 33 and its resistance at 38. My target price is 43.50. This is the only stock that I'm watching but I will cover multiple stocks soon as I have the time.

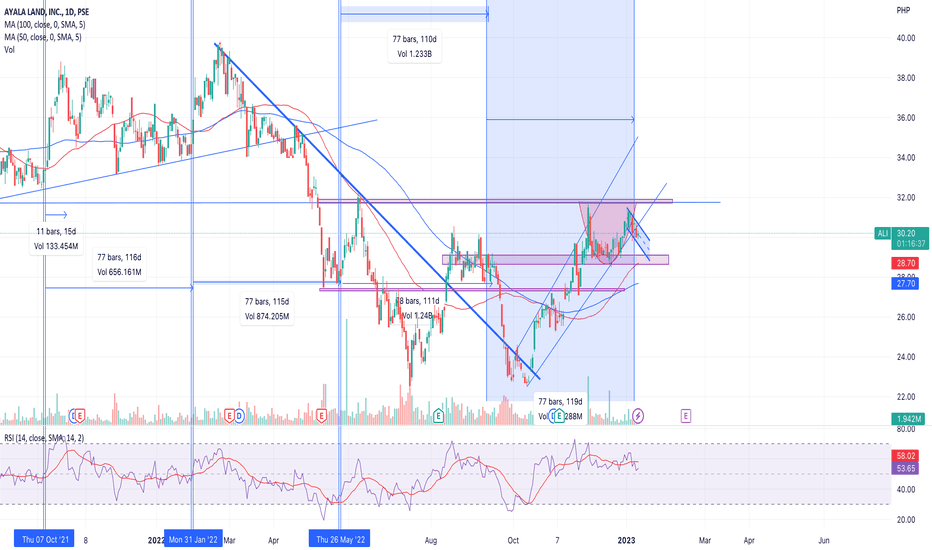

Philippine Market not looking good1D TF

- A Pattern form a Symmetrical Triangle

- A higher probability of breaking below and targeting the Demand Block at a 22.49%

- It is my first time TA this chart and not really familiar with PSE

- it just got me interested and wonder where the price will go and what will be the directions of the Philippine Market

- I haven't invested in Philippine Market but way back in 2015 I bought around 50k pesos of Mutual funds and after 5 years my investment had a loss of 2%

- Definitely, not a good investment, I waited for 5 years and had a loss, and my confidence in the Market really tested me.

- Sold all my positions and until now I haven't bought back

- That is why i look for other alternative assets and that is why i found Bitcoin and look into Crypto Markets

- Currently my focus is Bitcoin Only

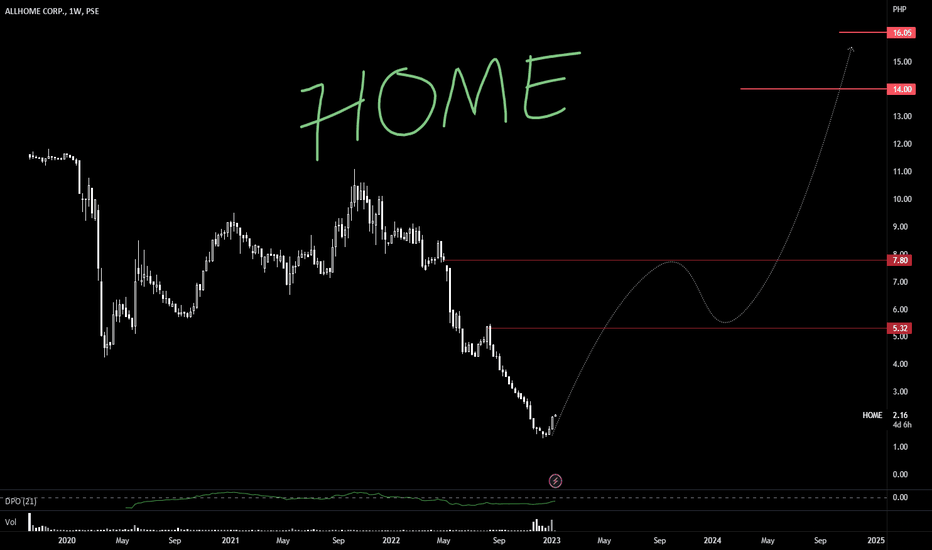

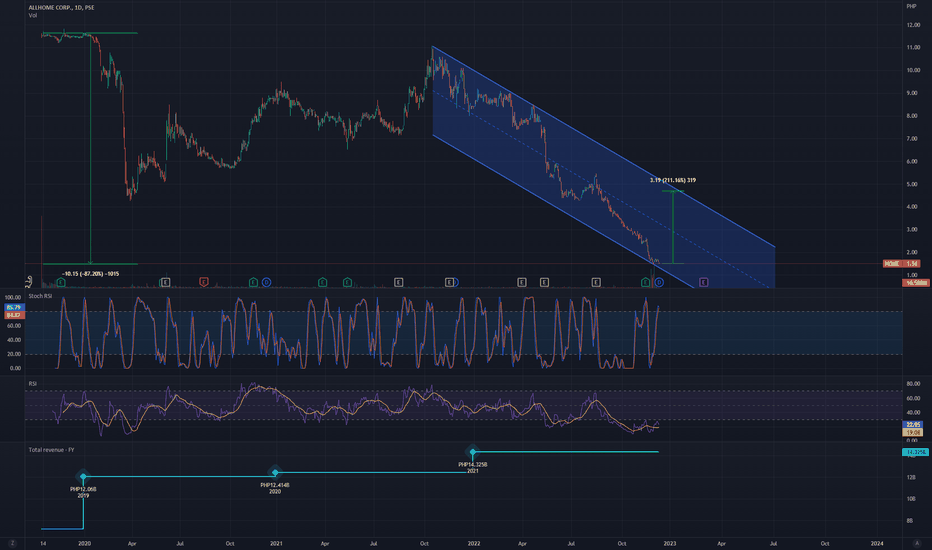

HOME 2.10 | a different kind of niche in the HOME DEPOT spacefinding value in a greater bull run is a matter of luck or faith

this could eventually be a runner

great finds value for money and expanding across the islands

catering to new markets and the rise of middle class

the ecommerce site is made simple .. intuitive for first timers and OGs in the online shopping world

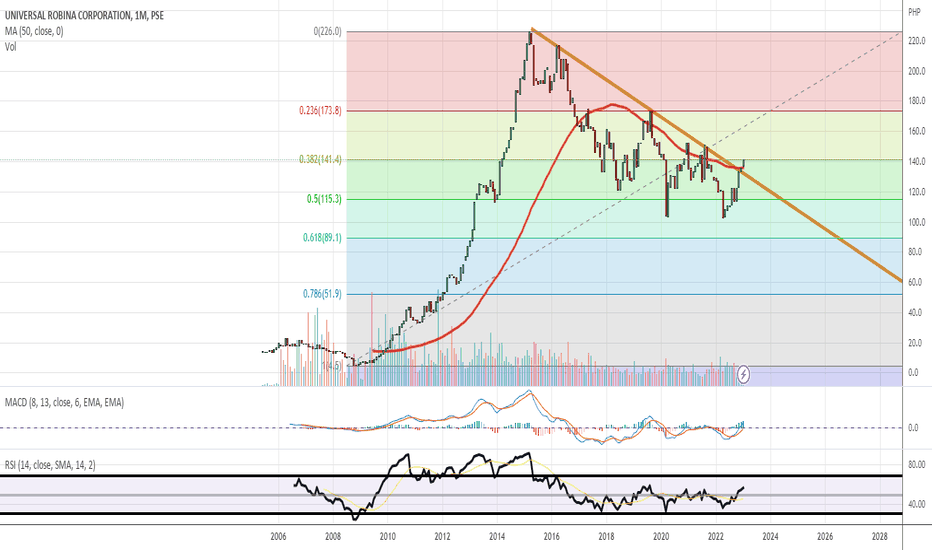

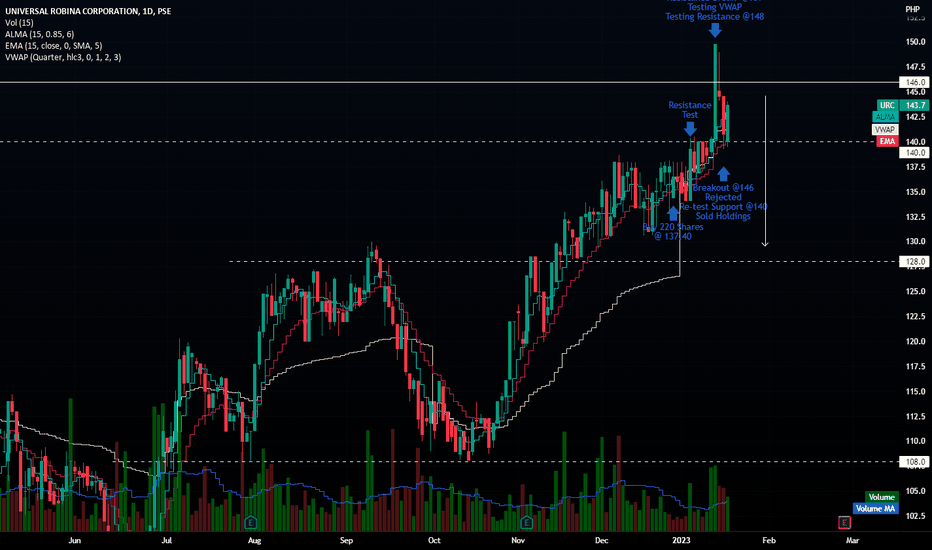

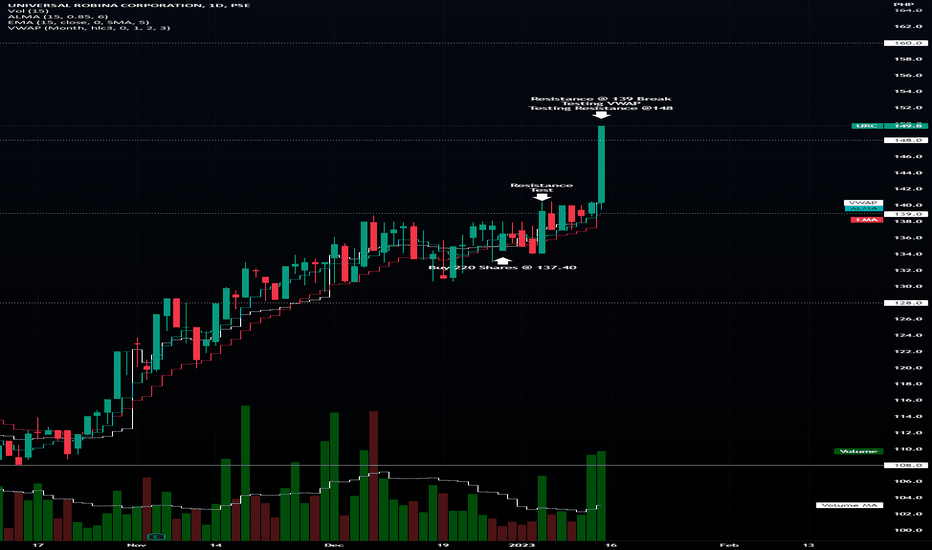

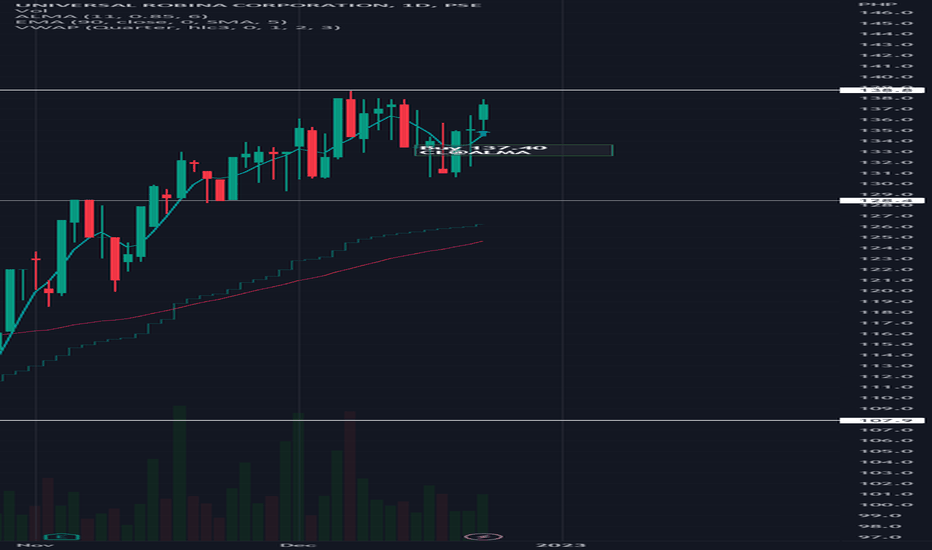

Universal Robina Corporation (URC) 1/13/2022The stock jumped to almost 7% today as it broke its October 2022 Resistance Area at 139/share.

At the same time, the stock is also testing another resistance area at 148/share. If this price area is rejected, we will find out if the 139 lines will become the new support area for this stock.

Universal Robina Corporation (URC) 12/22/2022I placed an order for URC at 137.40 today as it continues its uptrend and will likely break its short-term resistance level at 138.80.

I placed my cut loss just below the ALMA line. I may also leave the stock if it rejected the the said resistance price I mentioned above.

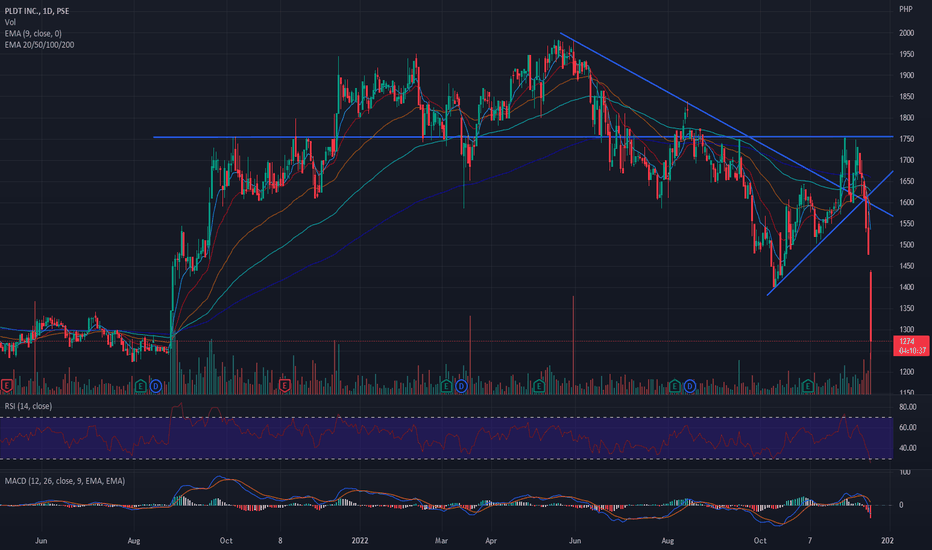

Extremely Oversold Looking to BounceTEL has already lost P76bn in market cap, 22% down since the chart breakdown from 1,600, and 29% from its most recent high. RSI readings are extreme oversold. The sell-off emanates from news that it had overspent CAPEX by P42bn in the last 4 years since 2019. The company is undergoing a major management shake-up and had suspended its CFO among other officers. I believe the sell off ha overdone and the market cap loss is over and above the 42bn overspend in CAPEX. Traders may want to put in some money into a bounce in the next few days. Stop: 1200. TP: 1480 and 1600.

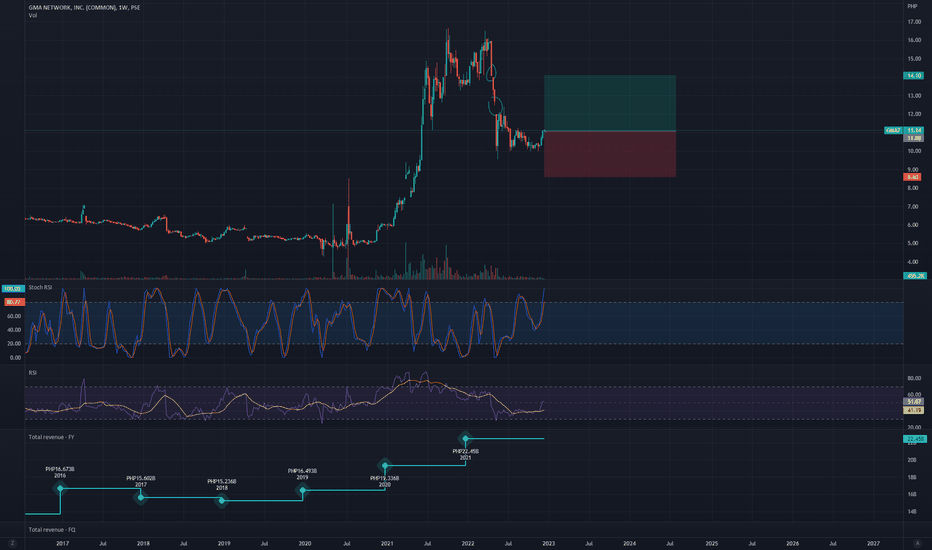

GMAScenario 1 : Quick scalp to Upsde of 27% from current price to close the gap.

Scenario 2 : May not close the gap at all due to bad 2023 dividend.

I have been holding this stock since 2014.

I believe this may have reached a short-term peak. 2023 Dividends will probably miss public estimates. Once gap closes further drop will continue.

If posted dividend and financials are higher than what I expect this analysis is invalid.