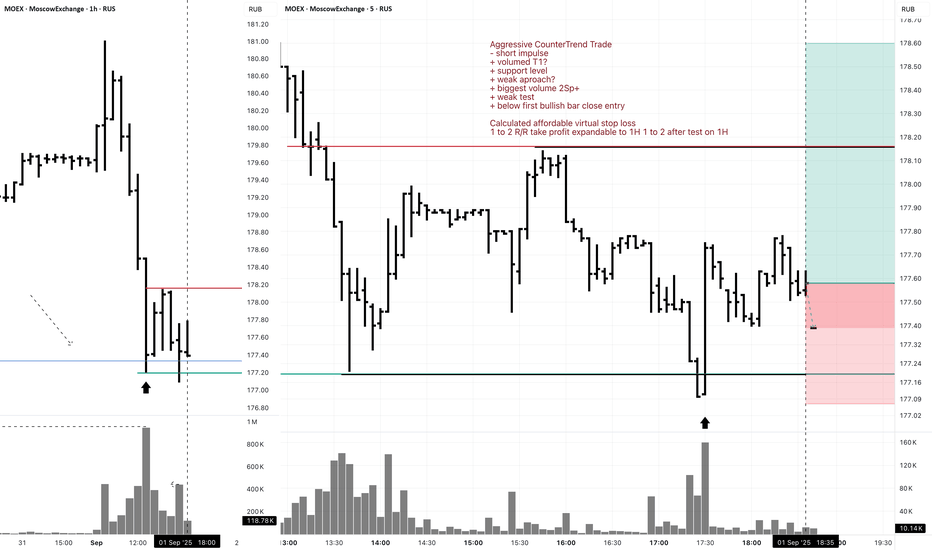

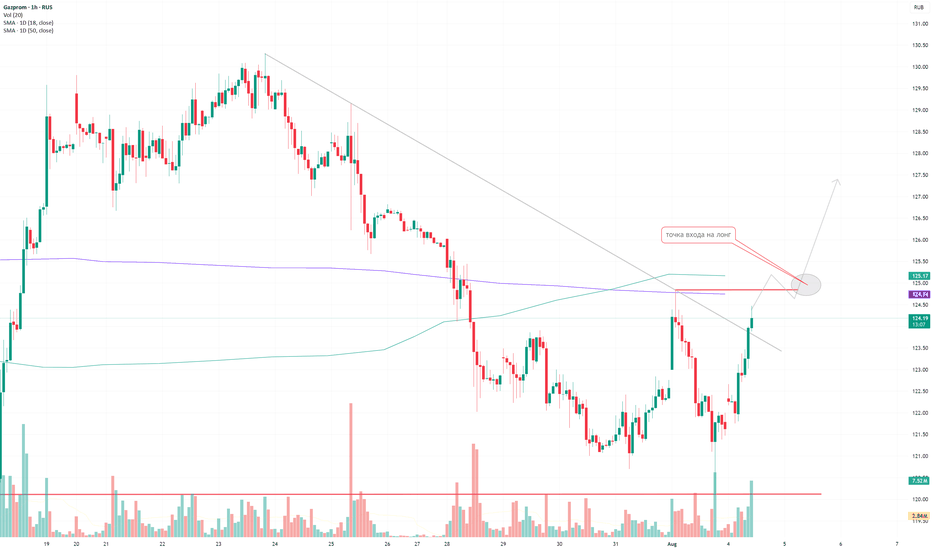

MOEX 5M DayTrade Aggressive CounterTrend TradeAggressive CounterTrend Trade

- short impulse

+ volumed T1?

+ support level

+ weak approach?

+ biggest volume 2Sp+

+ weak test

+ below first bullish bar close entry

Calculated affordable virtual stop loss

1 to 2 R/R take profit expandable to 1H 1 to 2 after test on 1H

1H CounterTrend

"- short impulse

+ volumed T1

+ support level

+ bar closed above 1D support level

+ volumed manipulation bar closed above T1"

1D Trend

"+ long impulse

+ SOS level

+ support level

+ 1/2 correction

+ volumed interaction bar"

1M Trend

"+ long impulse

- expanding T2

+ support level

+ volumed 2Sp-

+ 1/2 correction"

1Y Trend

"+ long impulse

- weak break

+ neutral zone"

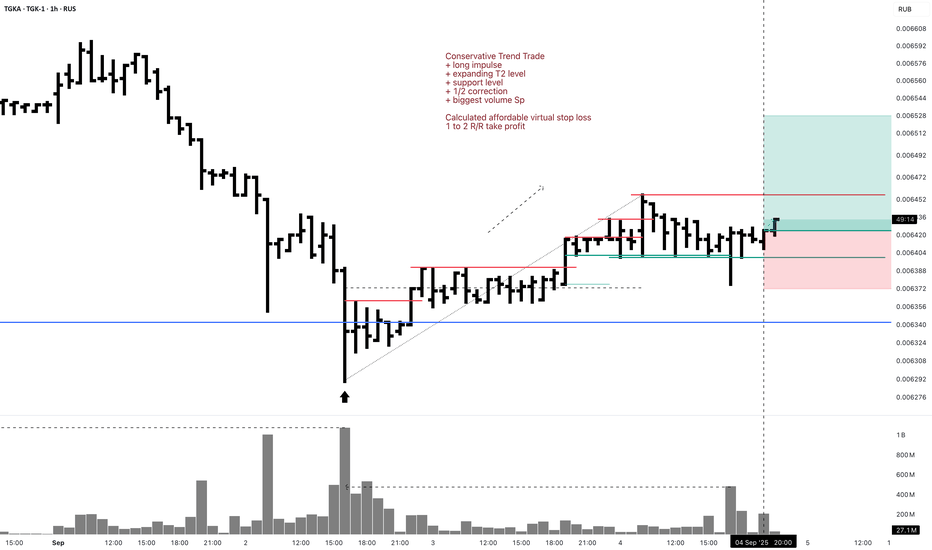

TGKA 1H Swing Conservative Trend TradeConservative Trend Trade

+ long impulse

+ expanding T2 level

+ support level

+ 1/2 correction

+ biggest volume Sp

Calculated affordable virtual stop loss

1 to 2 R/R take profit

Day Trend

"+ long impulse

+ T2 level

+ biggest volume 2Sp-

+ support level

+ 1/2 correction"

Monthly Trend

"+ long impulse

- below 1/2 correction

+ expanding T2 level

+ support level"

No context on Year

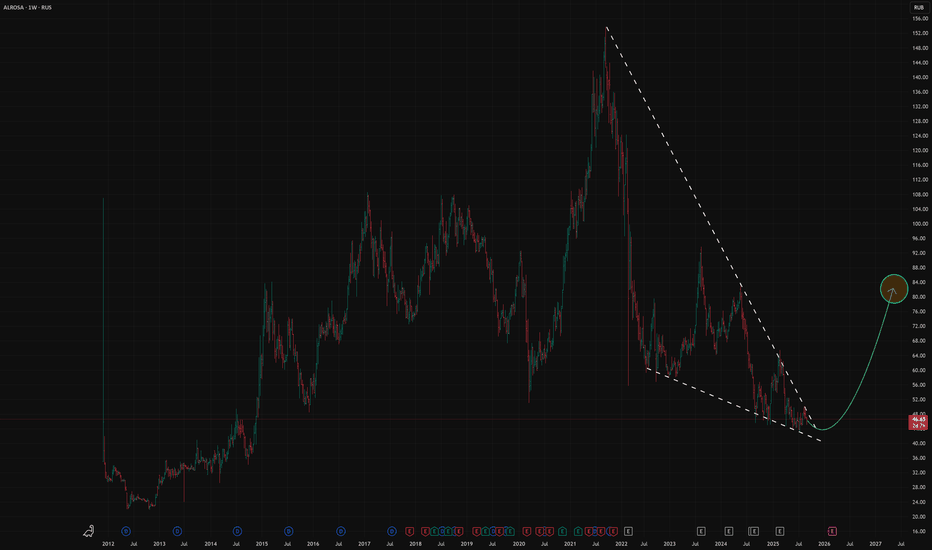

Alrosa is the Most Efficient Diamond Mining Company in the WorldWe have already made a note about the diamond mining industry in the World.

We will add information to this post and present it as an investment idea for subscribers from Russia

There are two main companies in the World diamond mining market: Alrosa (Russia. World market share ~28%) and De Beers (US. World market share ~22%)

Even with the dollar below 90 rubles and with sanctions obstacles, it remains profitable

At the same time, American De Beers reduced production by 36% in the second quarter of 2025 compared to the data of a year ago

EBITDA will be negative for the second half of the year in a row

If EBITDA is negative, then operating profit is deeply negative.

Another company from this sector, Petra Diamonds, is trying to survive in 2025, although only 3 years ago it underwent restructuring and zeroed out its net debt.

The rest of the sector is doing even worse

Judging by the state of affairs at De Beers, a significant share of the world's capacity is unprofitable at current diamond prices.

The main thing is that ALROSA is operationally profitable in the most difficult conditions, unlike its competitors.

ALROSA has a very large working capital

The basis of working capital is ready-to-sell diamonds

ALROSA has already incurred production costs to extract these diamonds from the ground, but has not yet received revenue.

ALROSA can get about 25% of its capitalization from working capital in the future by selling off stocks.

We indicated earlier in the post why demand for diamonds will return

OGKB 5M Investment Aggressive CounterTrend TradeAggressive CounterTrend Trade

- short impulse

+ biggest volume T1 level

+ biggest volume 2Sp-

+ weak test

+ first bullish bar close entry

Calculated affordable stop limit

1/2 yearly level take profit at 0.459

1H Counter Trend

"- short impulse

+ biggest volume TE / T1 level

+ support level

+ volumed 2Sp-"

1D Trend

"+ long impulse

+ JOC level

+ support level

+ 1/2 correction

+ volumed manipulation"

1M Trend

"+ long impulse (in 1d 4h)

+ neutral zone"

1Y CounterTrend

"""- short impulse

+ 2Sp-

+ perforated support level"""

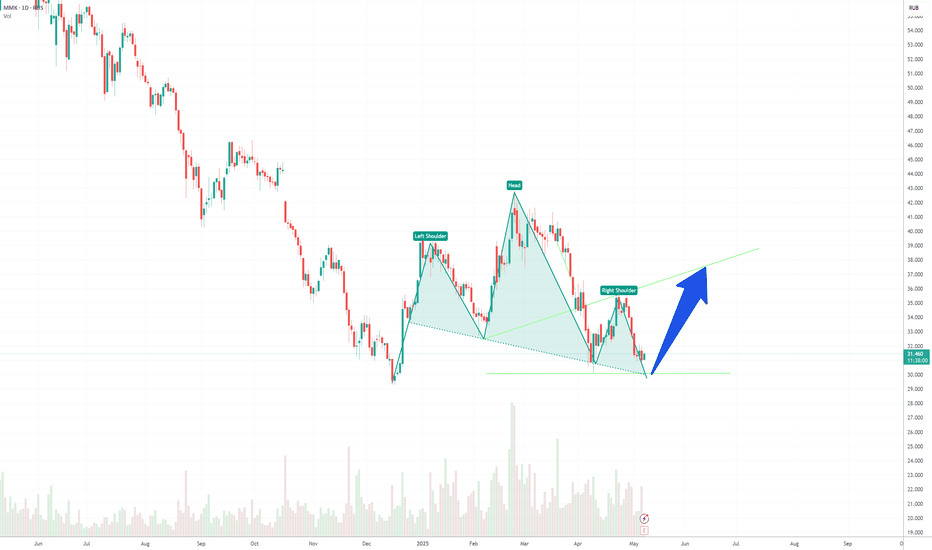

GMKN Long 1D Investment Conservative Trend TradeConservative Trend Trade

+ long impulse

+ SOS test / T2 level

+ 1/2 correction

+ biggest volume Sp

Calculated stop limit

1 to 2 R/R take profit

Monthly Trend

"+ long impulse

- SOS reaction bar level

+ 1/2 weak correction"

Yearly Trend

"+ long impulse

- below SOS

+ 1/2 correction"

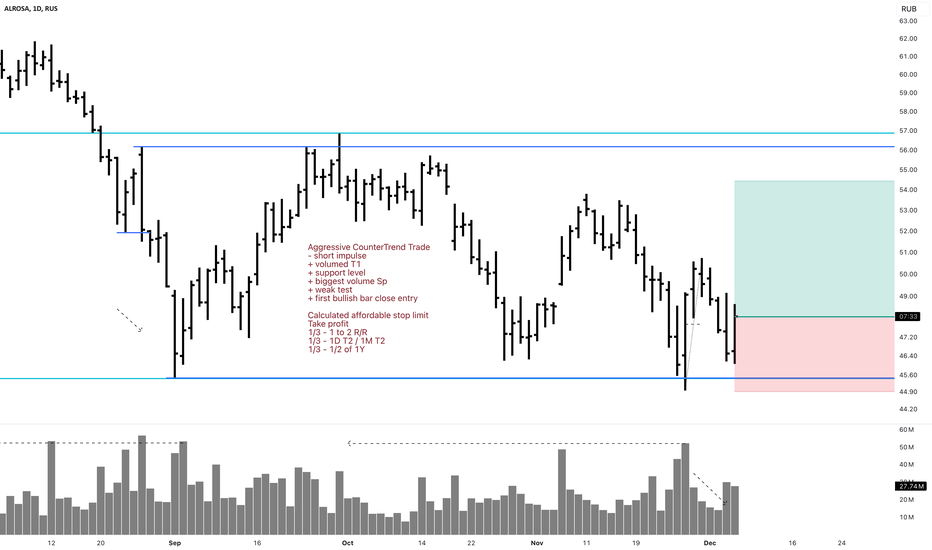

ALRS 1D Long Investment Aggressive CounterTrend TradeAggressive CounterTrend Trade

- short impulse

+ volumed T1

+ support level

+ biggest volume Sp

+ weak test

+ first bullish bar close entry

Calculated affordable stop limit

Take profit

1/3 - 1 to 2 R/R

1/3 - 1D T2 / 1M T2

1/3 - 1/2 of 1Y

Calculated affordable stop limit

Take profit

1/3 - 1 to 2 R/R

1/3 - 1D T2 / 1M T2

1/3 - 1/2 of 1Y

Monthly CounterTrend

"- short impulse

+ volumed TE / T1

+ support level

+ volumed Sp

+ test"

Yearly Trend

"+ long impulse

+ 1/2 correction

+ T2 level

+ support level

+ manipulation"

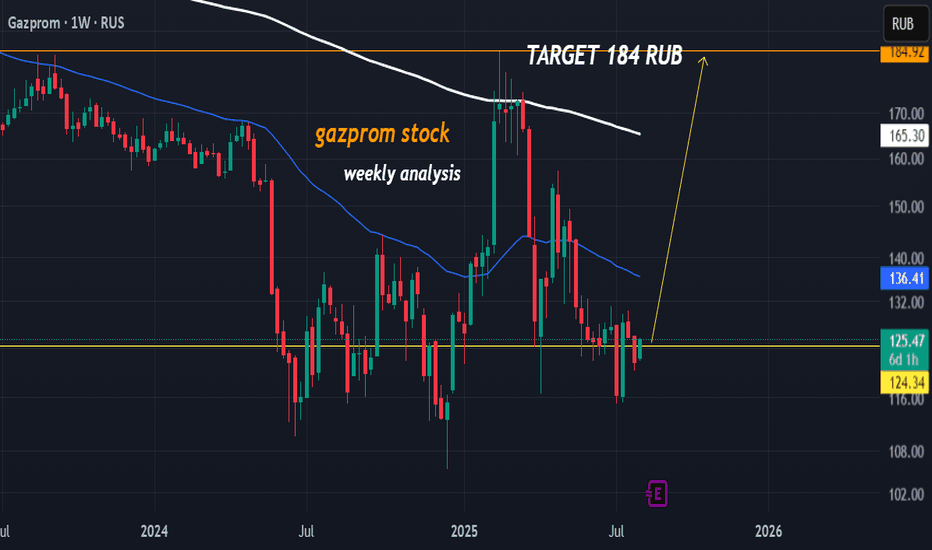

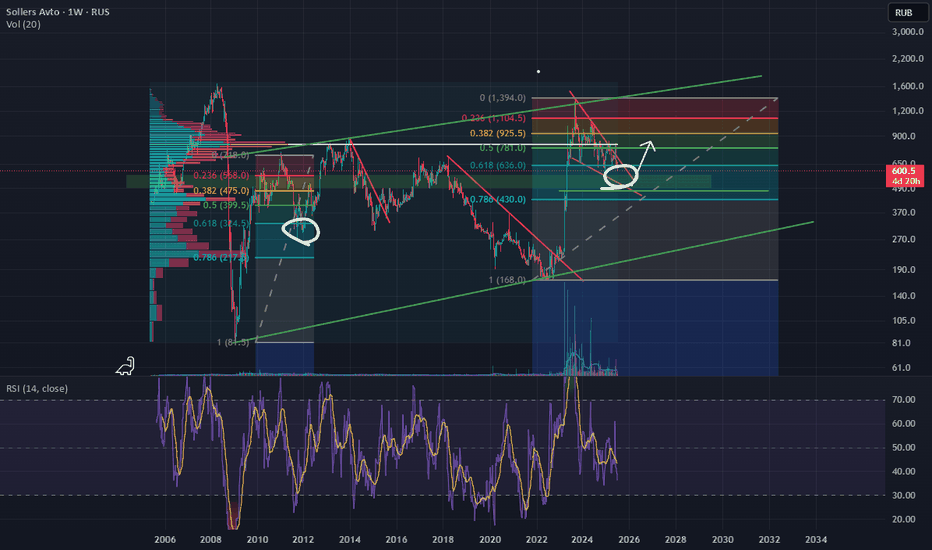

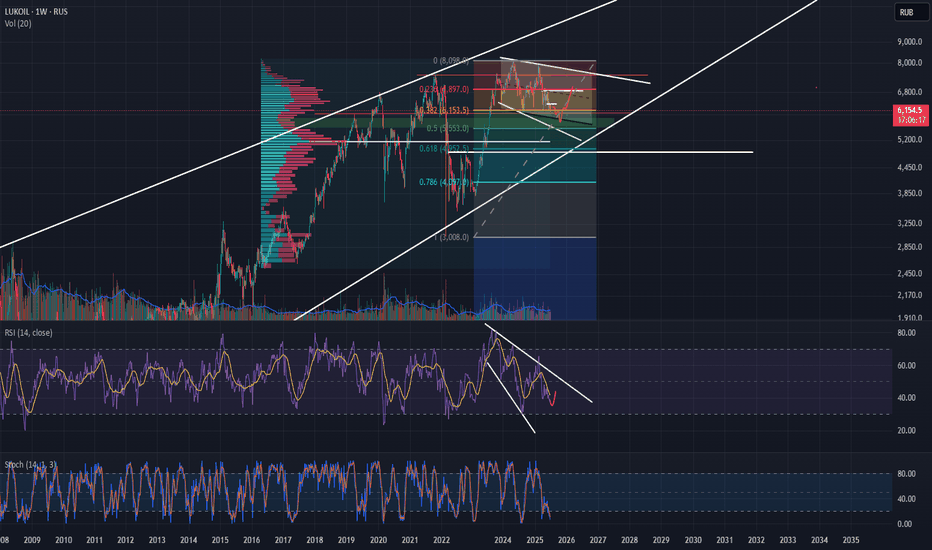

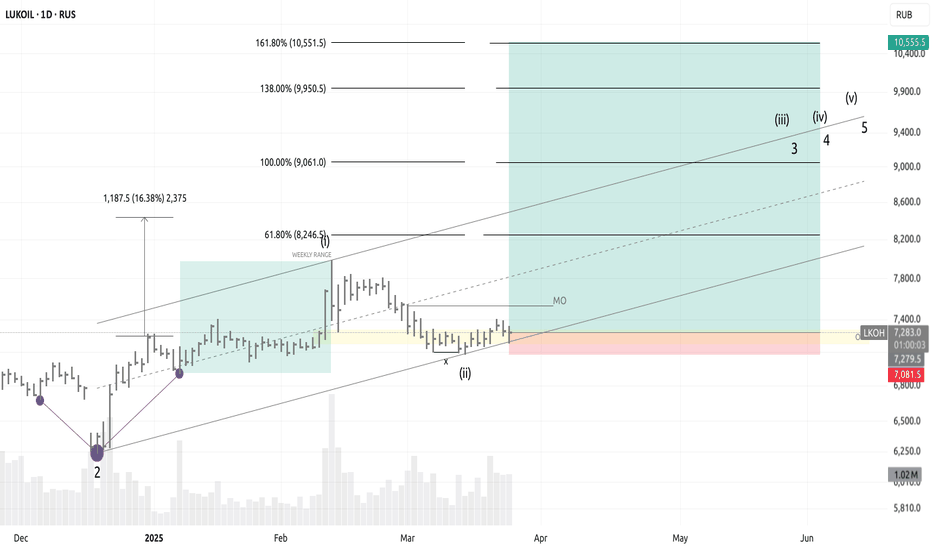

LKOH / LONG / 25.03.25⬆️ BUY LKOH 25.03.25

💰 Entry: 7279.5

🎯 Goal: 10555.5

⛔️ Stop: 7081.5

Entry reasons:

1) OSOK:

— Month minimum was set at the 2nd weekly

2) Eliott waves:

— 1D: 2th wave is formed, 3th is forming

3) Larry Williams:

— Long term point is formed

4) Range:

— Weekly bullish range, correction into OTE

5) Additional arguments:

— Divergence delta cluster

— Divergence delta oscillator

— Weekly liquidity is captured

Strategy: #osok #wave #larry #cluster

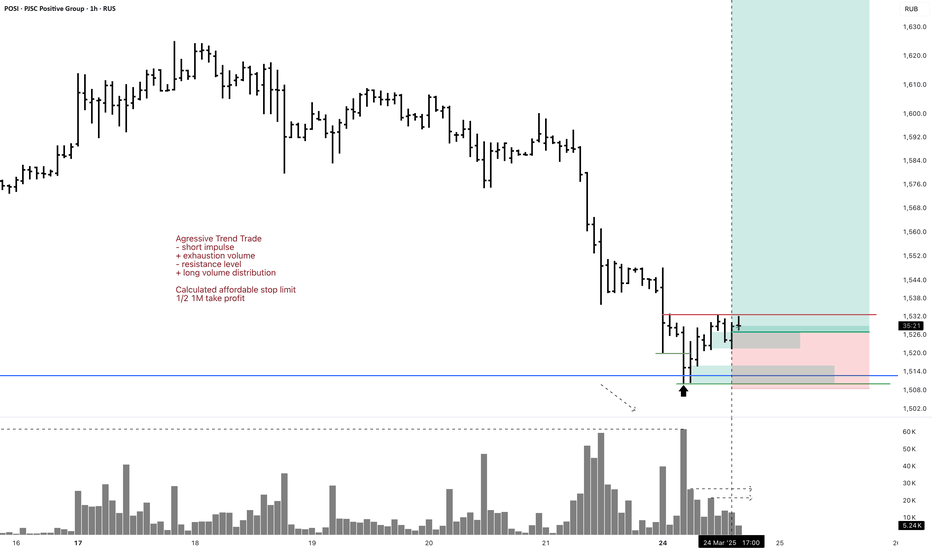

POSI 1H Investment Long Aggressive Trend TradeAggressive Trend Trade

- short impulse

+ exhaustion volume

- resistance level

+ long volume distribution

Calculated affordable stop limit

1/2 1M take profit

1D Trend

"+ long impulse

+ support level

+ T2 level?

+ 1/ 2 correction

+ weak approach"

1M Trend

"+ long impulse

+ 1/2 correction

+ biggest volume expanding T1

+ support level

+ biggest volume manipulation"

1Y Impulse

+ long impulse

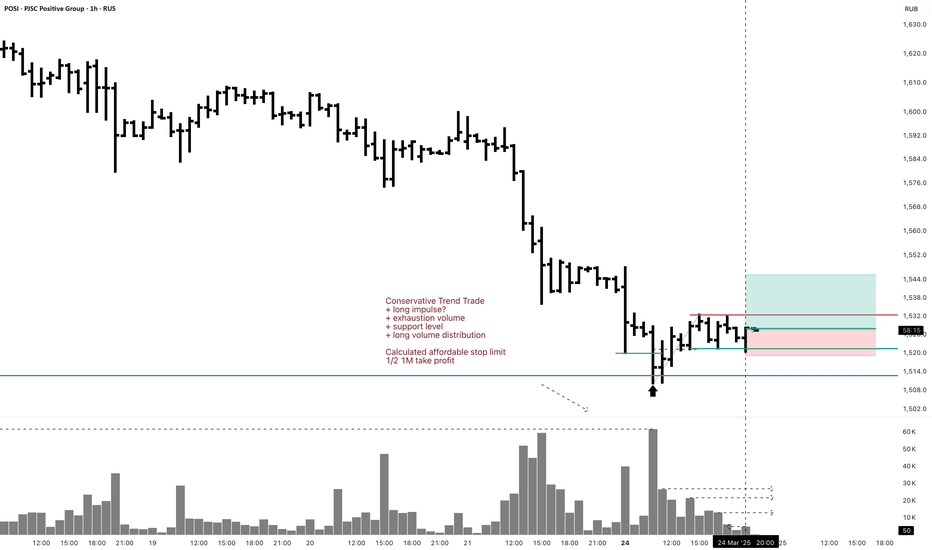

POSI 1H Swing Long Conservative Trend TradeConservative Trend Trade

+ long impulse?

+ exhaustion volume

+ support level

+ long volume distribution

Calculated affordable stop limit

1/2 1M take profit

1D Trend

"+ long impulse

+ support level

+ T2 level?

+ 1/ 2 correction

+ weak approach"

1M Trend

"+ long impulse

+ 1/2 correction

+ biggest volume expanding T1

+ support level

+ biggest volume manipulation"

1Y Trend

+ long impulse

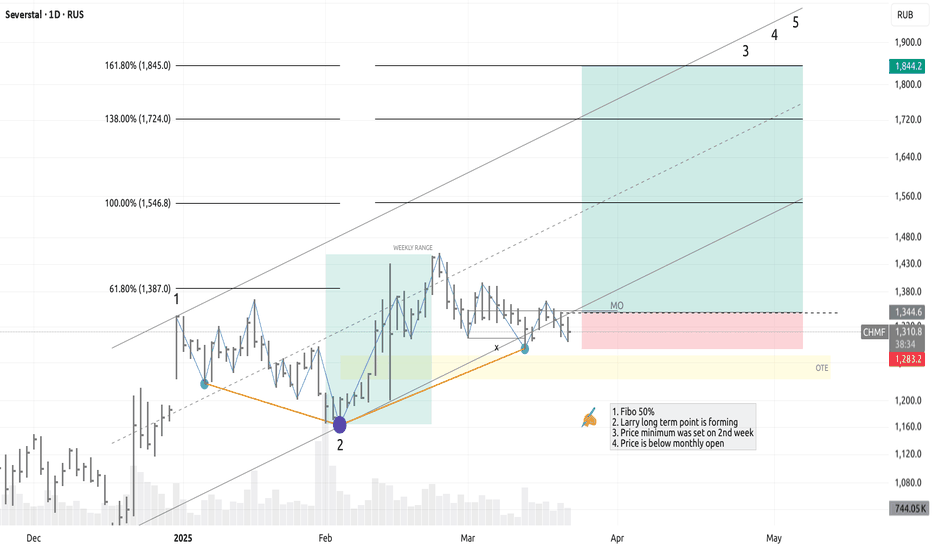

CHMF / LONG / 21.03.25⬆️ BUY CHMF 21.03.25

💰 Entry: 1344.6

🎯 Goal: 1844.2

⛔️ Stop: 1283.2

Entry reasons:

1) OSOK:

— Month minimum was set at the 2nd weekly

2) Eliott waves:

— 1D: 2th wave is formed, 3th is forming

3) Larry Williams:

— Long term point is forming

3) Range:

— Weekly bullish range, correction into discount zone

4) Additional arguments:

— Divergence delta cluster

— Weekly liquidity is captured

Strategy: #osok #wave #larry #cluster

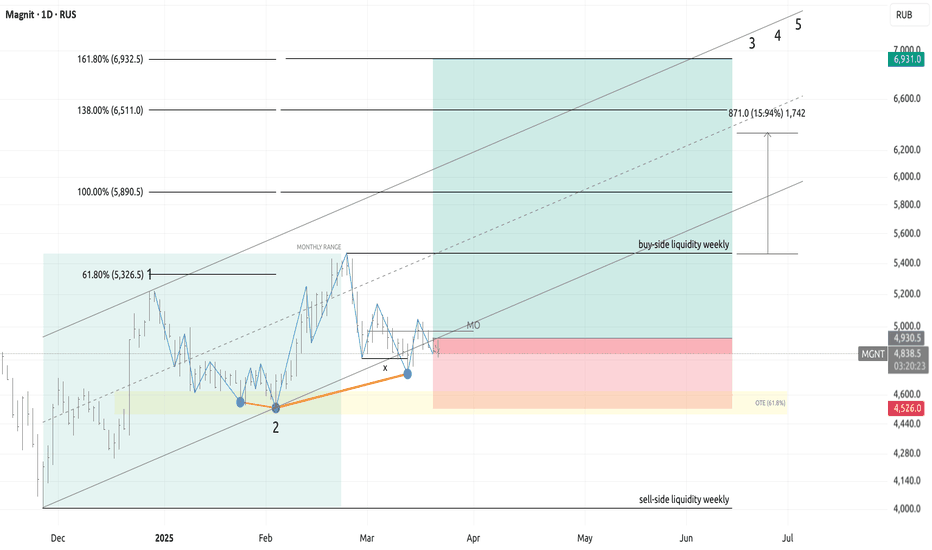

MAGNIT / LONG / 21.03.25⬆️ BUY MAGNIT 21.03.25

💰 Entry: 4930.5

🎯 Goal: 6931.0

⛔️ Stop: 4526.0

Entry reasons:

1) OSOK:

— Month minimum was set at the 2nd weekly

2) Eliott waves:

— 1D: 2th wave is formed, 3th is forming

3) Larry Williams:

— Long term point is forming

3) Range:

— Monthly bullish range, correction into zone OTE

4) Additional arguments:

— Divergence delta cluster

— Divergence oscillator 1d

— Weekly liquidity is captured

Strategy: #osok #wave #larry #cluster

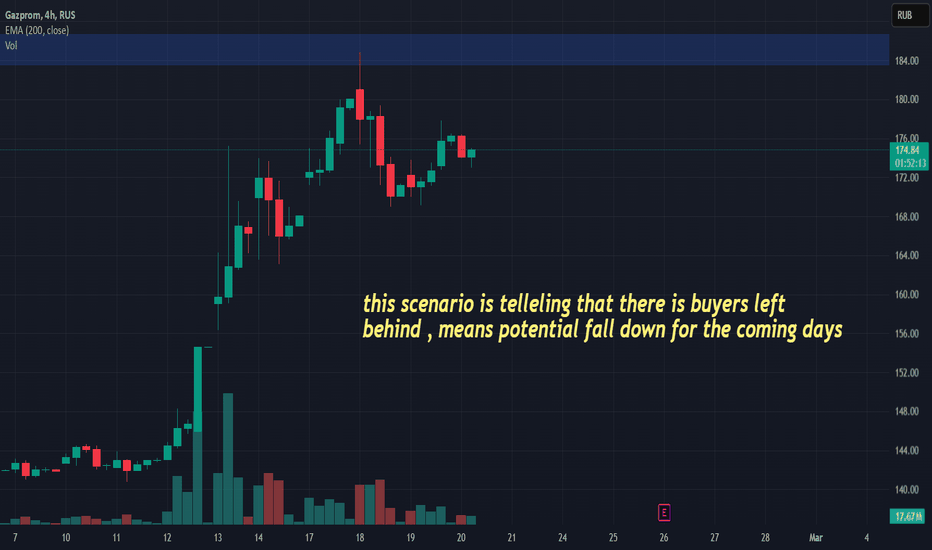

Unipro UPRO Stock Technical Analysis and Fundamental Analysis📊 Technical Analysis of Unipro ( RUS:UPRO ) Stock

Current Price: 2.043 RUB (+2.46%)

Trend: The stock is in a growth phase, but signs of overbought conditions are emerging.

RSI (14): 78.91 (overbought, possible correction ahead)

MACD (12,26,9): +0.13 (bullish signal, but a reversal is possible)

Support Levels: 1.95 RUB and 1.80 RUB

Resistance Levels: 2.10 RUB and 2.30 RUB

Entry Points:

A pullback to 1.95 RUB may be a good opportunity for long positions.

If the price consolidates above 2.10 RUB, further growth toward 2.30 RUB is likely.

Stop-Loss: 1.85 RUB (if breached, the trend could reverse downward)

📈 Fundamental Analysis

Financial Performance:

Revenue remains stable, but growth rates are slowing.

Net profit declined in 2024 due to rising operating expenses.

Debt burden is low, ensuring resilience to macroeconomic shocks.

Impact of the Russian Central Bank:

The high key interest rate is limiting market capitalization growth.

Investors are waiting for rate decisions—any cuts could accelerate stock growth.

Dividends:

Expected to remain at 6 RUB per share.

Dividend yield remains attractive for long-term investors.

Macroeconomic Factors:

External sanctions and political risks may influence business growth.

A potential IPO of RTK-DPC (a Unipro subsidiary) could strengthen the company’s financial position.

🔍 Conclusion

Short-term: The stock may experience a correction due to overbought conditions. The best entry point is around 1.95 RUB.

Mid-term: If the price consolidates above 2.10 RUB, growth toward 2.30 RUB is likely.

Long-term: Unipro remains attractive for investors focused on dividends and stability.

❗ Keep an eye on Russian Central Bank decisions and overall market sentiment.

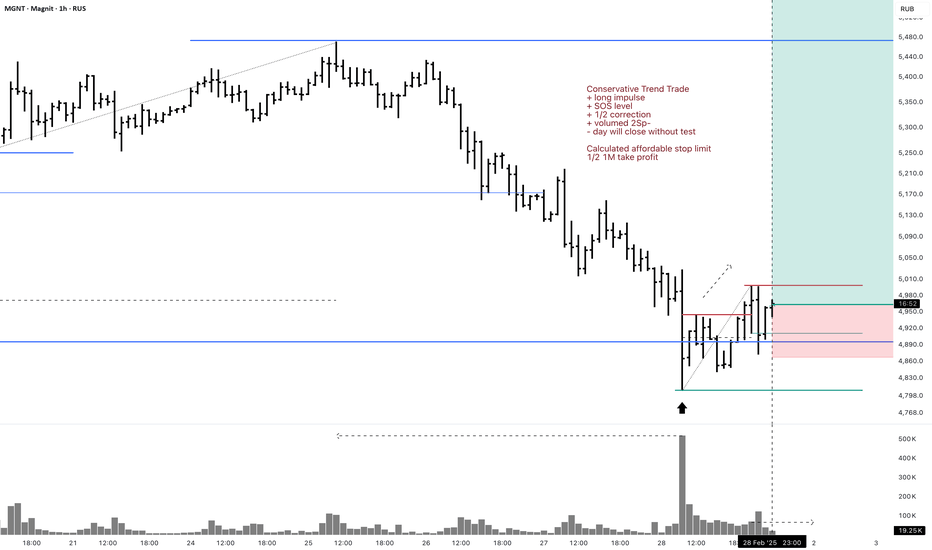

MGNT 1H Long Investment Conservative Trend TradeConservative Trend Trade

+ long impulse

+ SOS level

+ 1/2 correction

+ volumed 2Sp-

- day will close without test

Calculated affordable stop limit

1/2 1M take profit

Daily Trend

"+ long impulse

+ SOS test / T2 level

+ support level

- strong approach from volume zone

+ biggest volume manipulation"

Monthly Trend

+ long impulse

+ expanding biggest volume T2

+ support level

+ 1/2 correction

+ unvolumed 2Sp-

+ strong buying bars

+ weak selling bar / test

Yearly no context

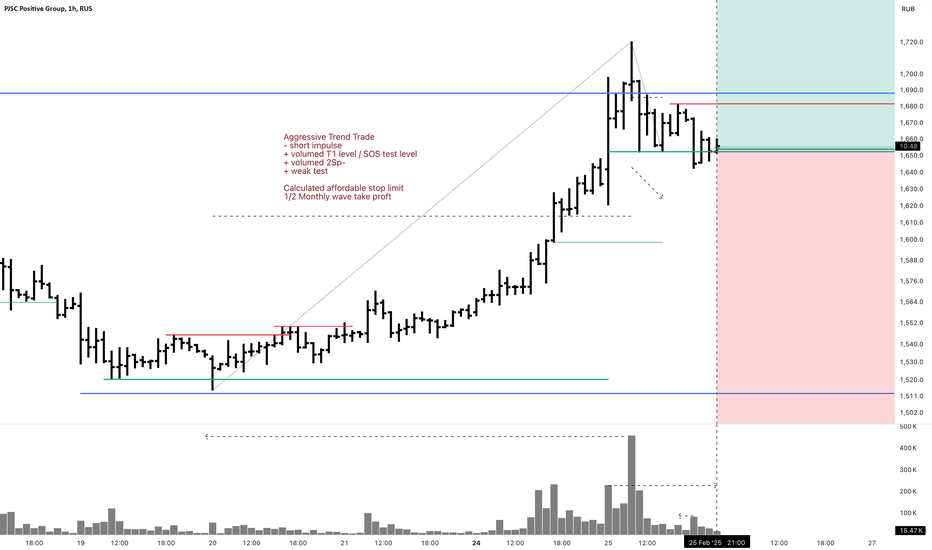

POSI 1H Investment Aggressive Trend TradeAggressive Trend Trade

- short impulse

+ volumed T1 level / SOS test level

+ volumed 2Sp-

+ weak test

Calculated affordable stop limit

1/2 Monthly wave take profit

Daily Trend

"+ long impulse?

- resistance level

- short volume distribution"

Monthly Trend

"+ long impulse

+ 1/2 correction

+ volumed expanding T1

+ support level

+ biggest volume manipulation"

Yearly Trend

+ long impulse

Weird set up. Market is strong and Monthly look a lot like exhaustion!

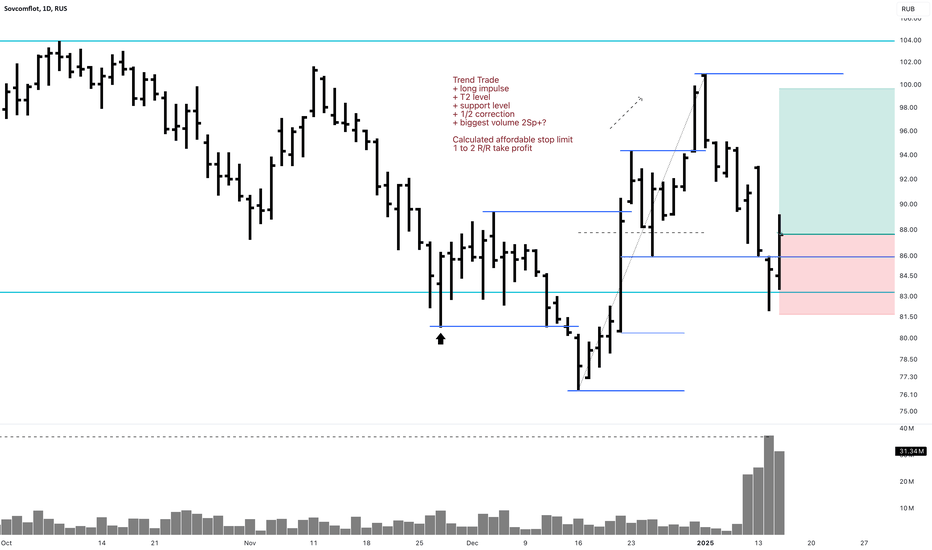

FLOT 1D Long Investment Trend TradeTrend Trade

+ long impulse

+ T2 level

+ support level

+ 1/2 correction

+ biggest volume 2Sp+?

Calculated affordable stop limit

1 to 2 R/R take profit

Monthly countertrend

"- short impulse

+ volumed T1

+ 2Sp+

+ bigger volume on test"

Yearly context

"+ long impulse

- correction"