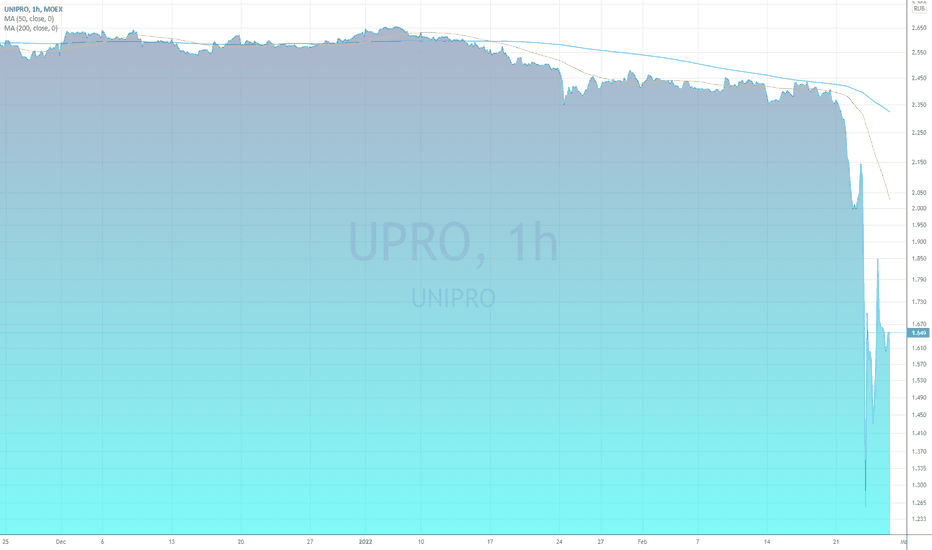

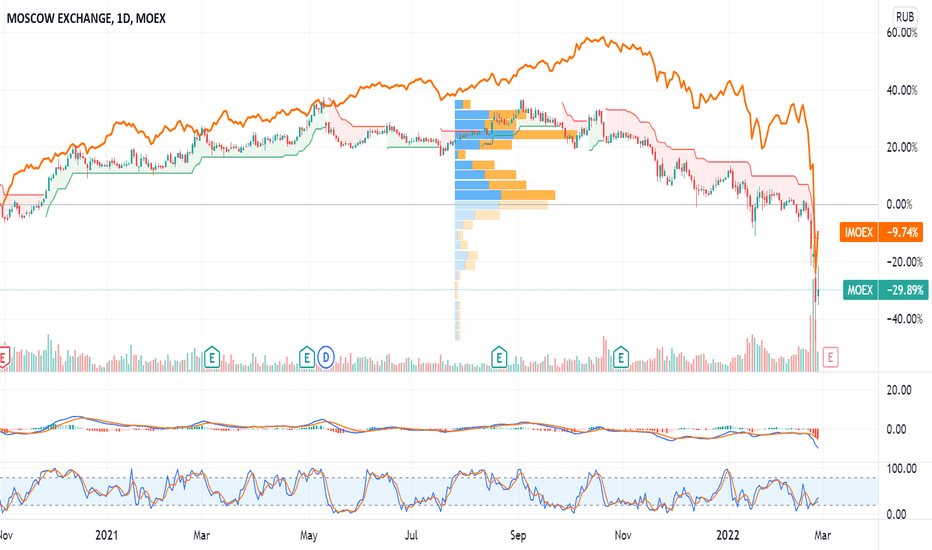

MOEX: - Moscow Exchange shares to the MOEX IndexYes, the situation is lousy, but it provides an opportunity to make money - to buy shares of the Moscow stock exchange at a huge discount. Also interesting is the correlation between the index.

I am a realist, but now I am sure that the situation with the war will be resolved quickly enough and the market will return its capital capacity, so like this.

The target is 20% on medium-term growth.

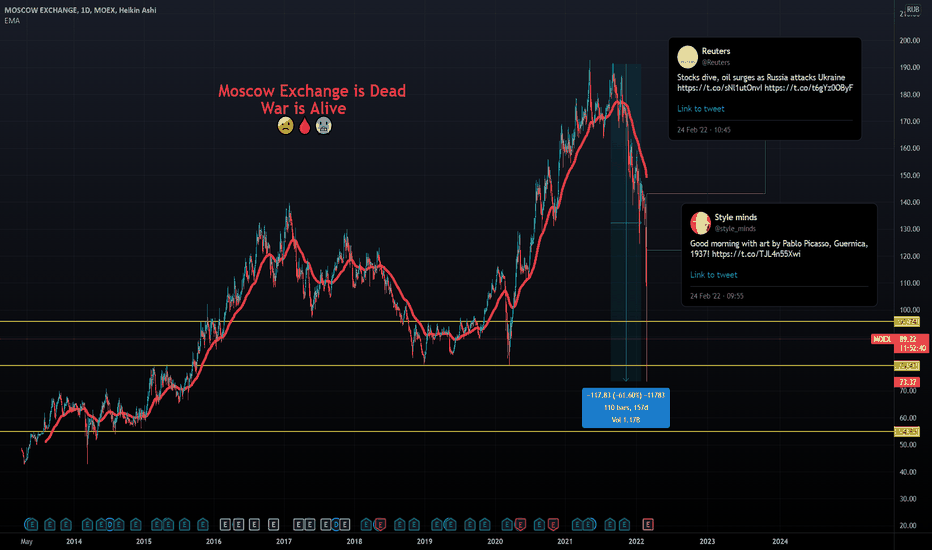

Markets In Guernica - Sad Day for Humanity 🤕🩸🥶''In Guernica Lyrics

In Guernica the dead children were layed out in order on the sidewalk

In their white starched dresses

In their pitiful white dresses

On their foreheads and breasts the little round holes where death came in as thunder while they were playing their important summer games

Do not weep for them, Madre

They are gone forever, the little ones

Straight to heaven to the saints

And God will fill the bullet holes with candy''

May Peace and Logic prevail immediately. Such a small planet, yet so much stupidity 🤕🩸🥶

the FXPROFESSOR

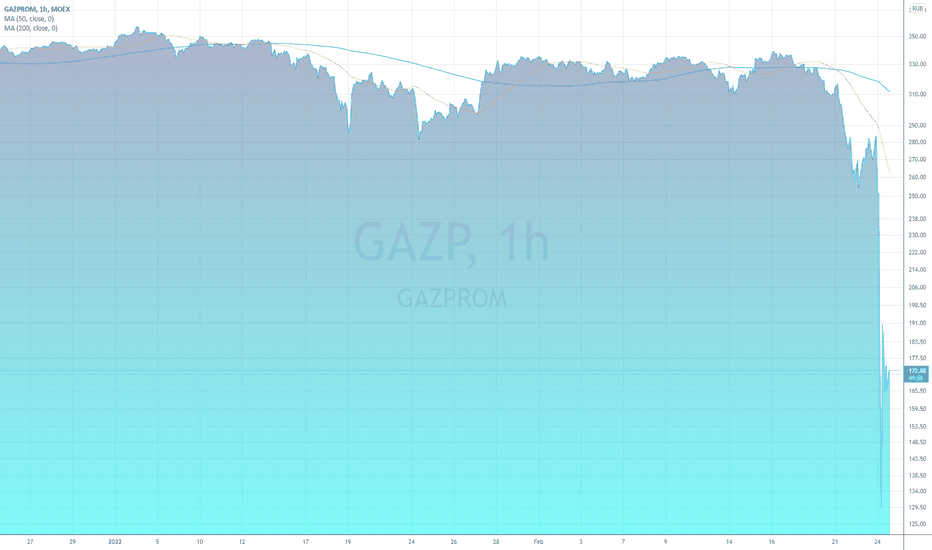

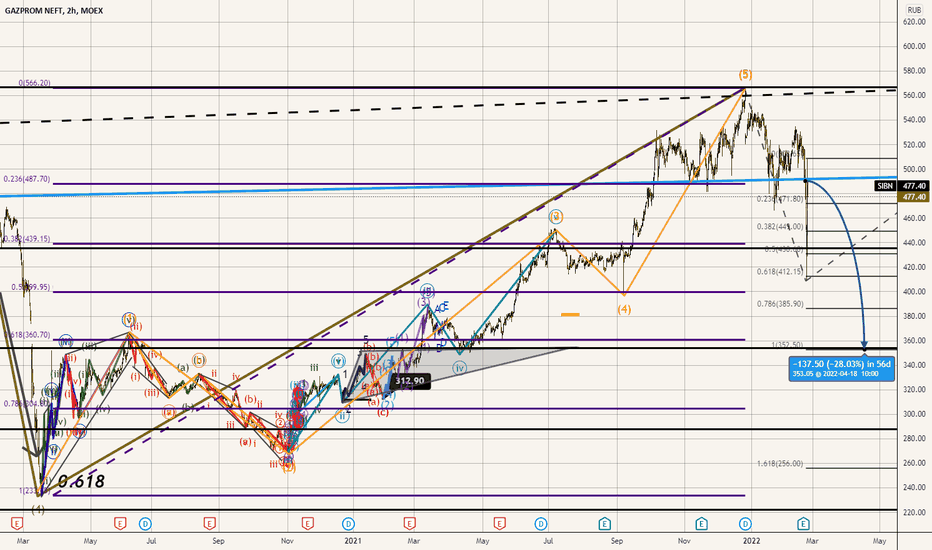

Gazprom - a drop in the ocean of shares.Continuation.

On average, 90% of all stocks move down with the market, and 75% move up.

The wave principle applies to some extent to individual stocks, but counting waves for them is often confusing and does not have much practical significance. But since 50 % of the shares are owned by the state and the company has a large capitalization, we assume that the state of Gazprom's shares depends on mass psychology.

With time in the distant future, not everything is clear.

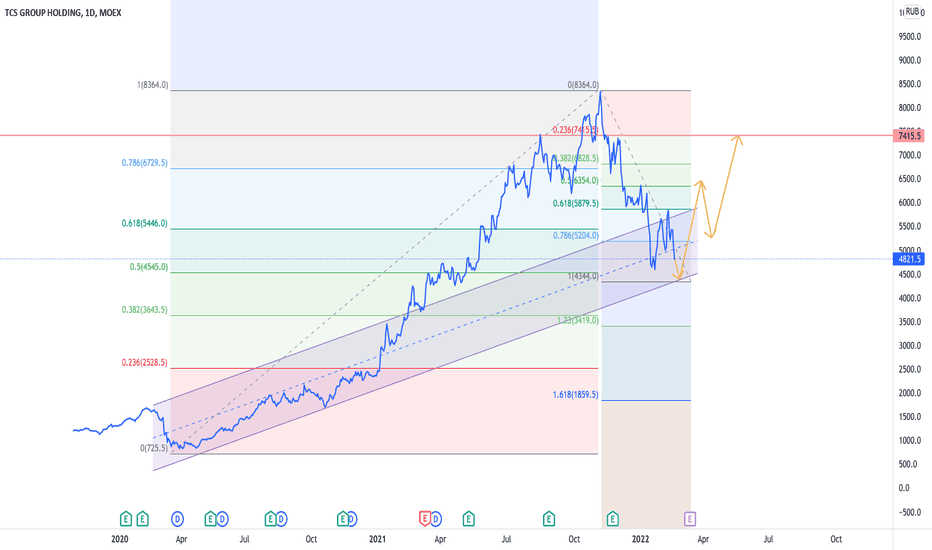

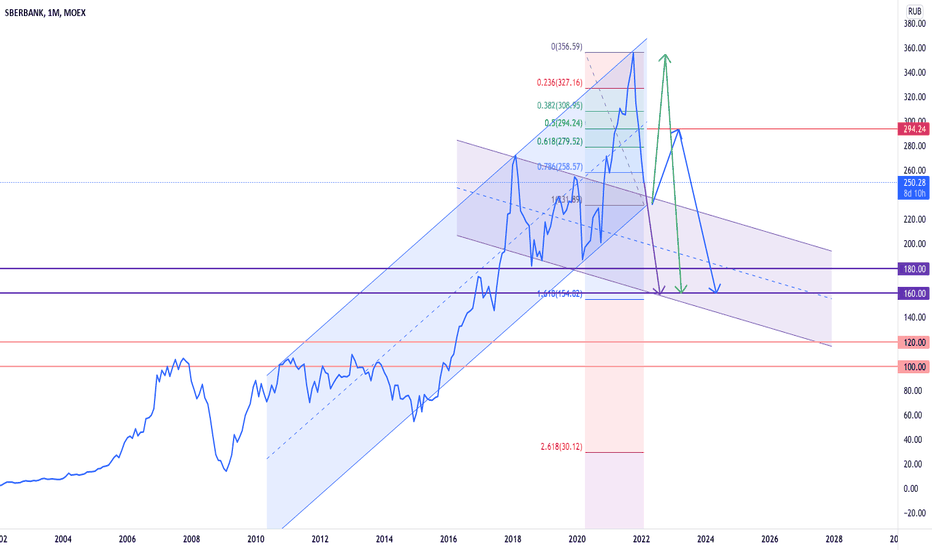

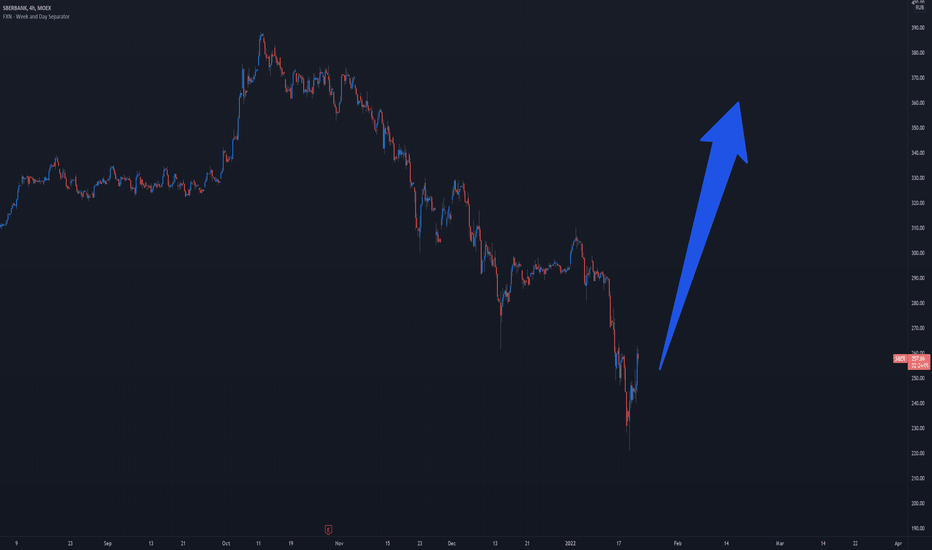

SBER Bank Forecast Sberbank ✅

$SBER

There are now two scenarios, but the ultimate goal is to reach 160-180 rubles. The purple scenario has a higher probability than the green and blue scenarios. This year, we will witness such figures. As we reach 160-180 rubles, there will be a correction. After that, you'll need to keep an eye on price level of 100-120 rubles.

(This is not an investment advice.)

#investment #russia #russiaukraine #russianfederation #banking #markets #stocks #equities #emergingmarkets #financialmarkets #economy #banks

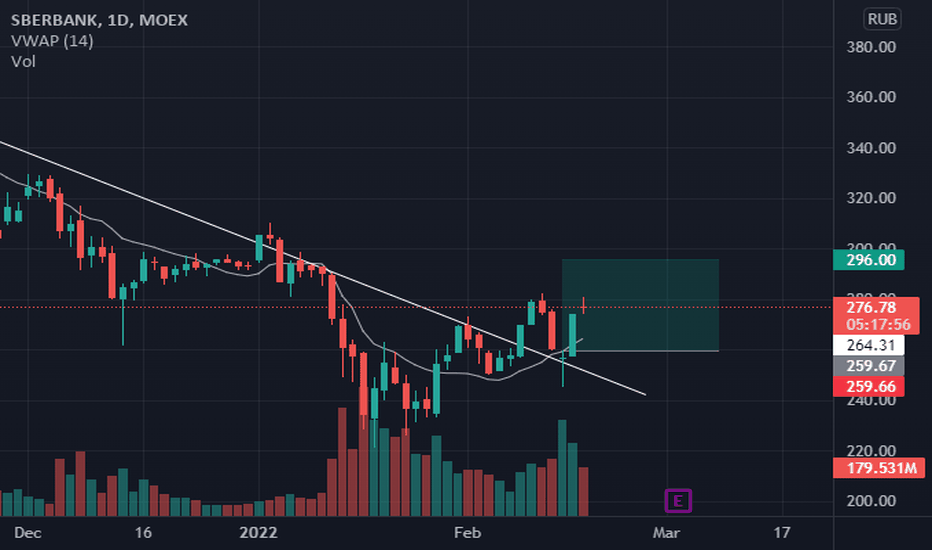

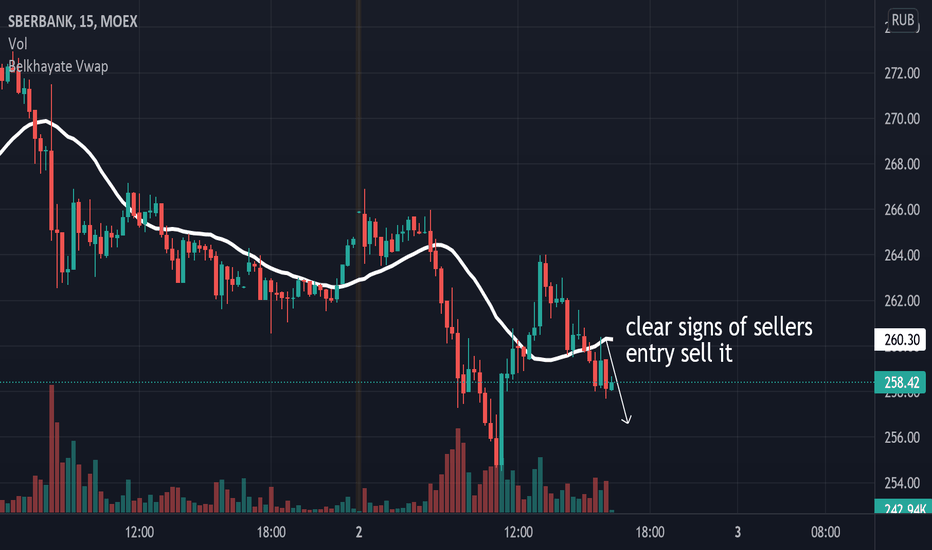

SBER TODAY IS A GOOD DAY TO RENFORCE YOUR POSITIONGOOD MORNING,

after the uptrend, in the last two days, today is a good day to confirm your position as a buyer although the red candle today because it's just a "feint" so keep quiet if there is a surprise I will tell

check my profile the last 10 analyses in the daily frame are all correct

check it

GOOD LUCK

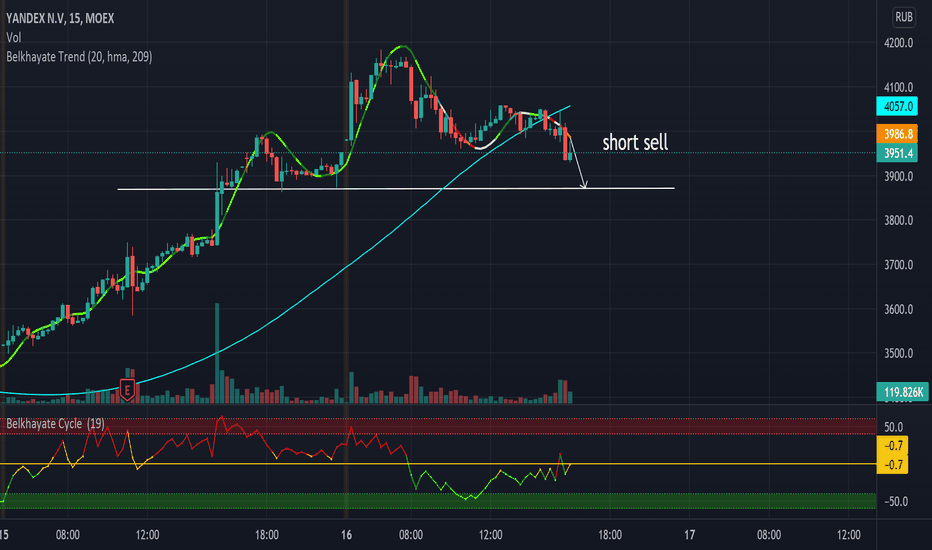

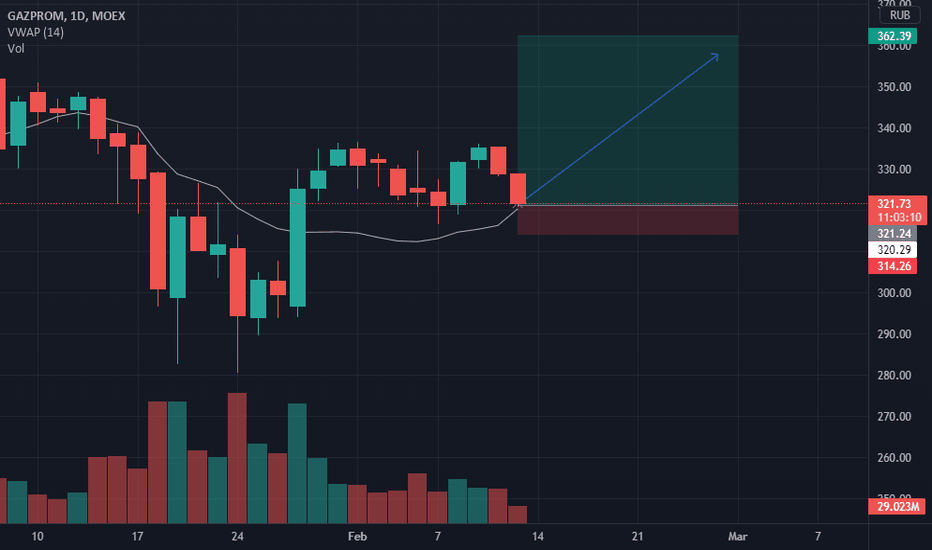

all depends on today for the GAZPROM stocks Today, despite the absence of volume, is a very important day in the GAZPROM market as it is expected that there will be a very strong indication of what will happen in this market in the coming days because the candle approaches VWAP when it bounces, it will be a signal to buy, but if it breaks down, it will be a real signal to sell.

so don't sleep today...

good evening.

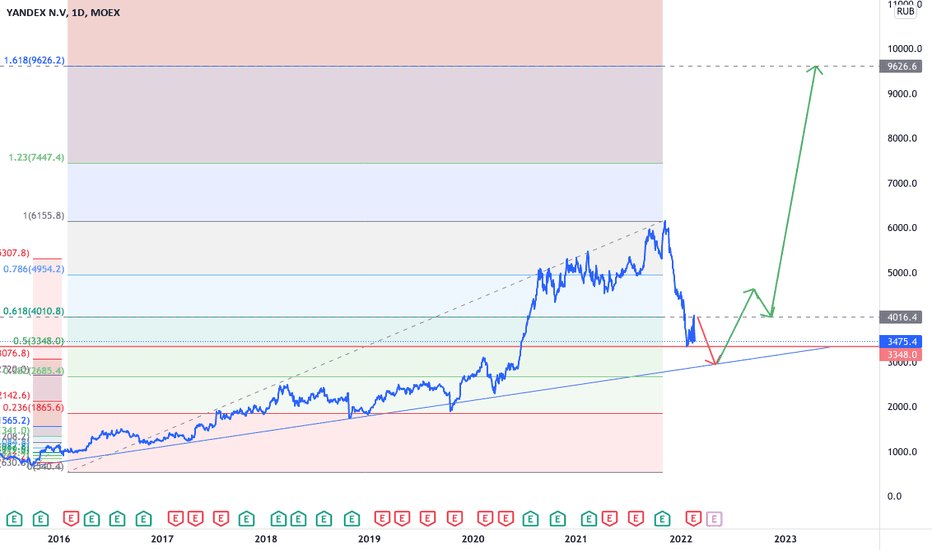

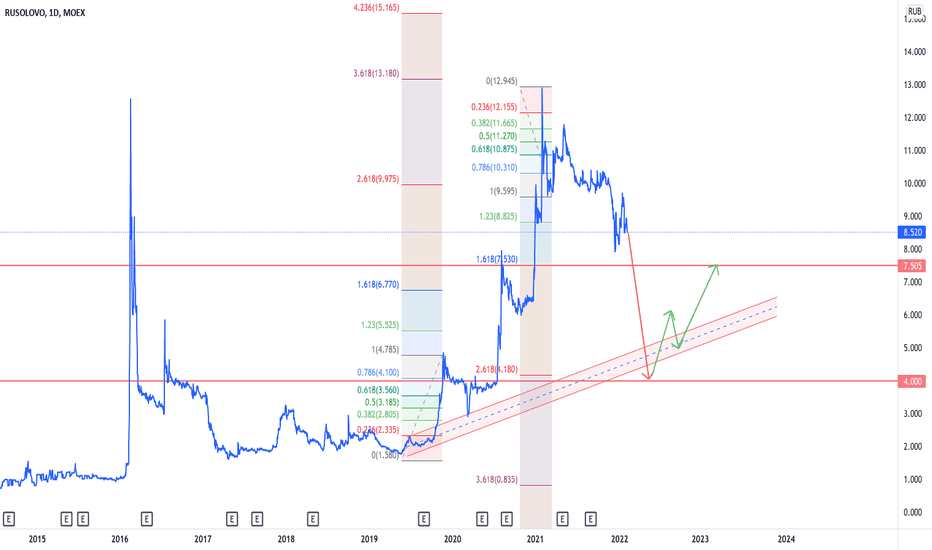

YATEC (YAKG) - The potential unicorn at LNG Market (Part II)Another confirmation of my confidence in the YATEC (MOEX:YAKG) - Zhejiang Provincial Energy Group Co Ltd buys 10% of YAKG and its subsidiary - GlobalTec for 500 million euro.

The Chinese company evaluated YAKG as 500 RUB per share, current market price is 140. I suppose it will grow more than 5 times next autumn.

Its not investment suggestion, but Im buying YATEC for long.

#LNG #YAKG #MOEX #ZHEIJANG

Gazprom ProjectionLooking at technical alone here, suggest that Gazprom has plenty of room to go up with the daily and the weekly RSI severely oversold.

On top of that we can see quite clear positive bullish divergence and looks to be set up to break out of the descending bullish flag.

Watch out for the resistance around the 370 mark - a break and a retest is ideal and you could potential buy at the retest, but buying from the descending bullish flag is ideal for profit maximisation.

Great profit/loss ration here too.

GAS IS EPXENSIVE IN EUROPE!