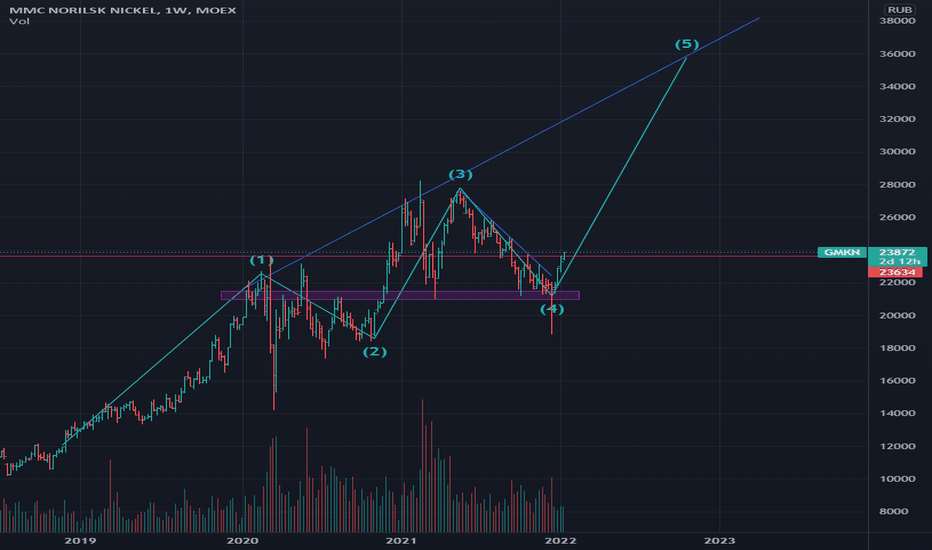

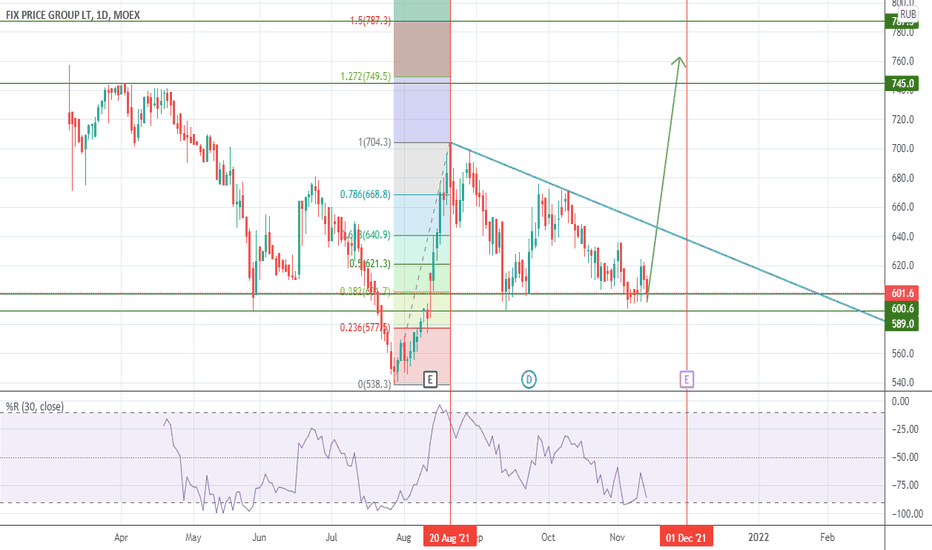

Medium-term FIXP dealFix Price is Russia's largest chain of low fixed price stores in terms of revenue and number of stores, significantly ahead of other players. The Fix Price store chain includes more than 4,000 stores in Russia and the CIS. Founded in 2007. Revenue ₽57.9 billion (Q3 2021). Capitalization ₽460 billion

On December 23, the instrument approached the strong level of ₽540, which was formed by a trend break and from which the growth was >30%.

I think that now the setup is stronger than what it was at the end of July.

To date, we see a five-day candle trading -> accumulation near the level is an important factor for entering a medium-term deal. Yesterday we saw a strong breakdown of the support level by almost 17%, the formed false breakdown ensured the collection of liquidity and significantly added confidence in the further development of events + the daily candle closed above the close of the previous day.

I expect a good long movement from the instrument.

Long with current

Price now: ₽549.8

Goal 1: ₽595

Goal 2: ₽655

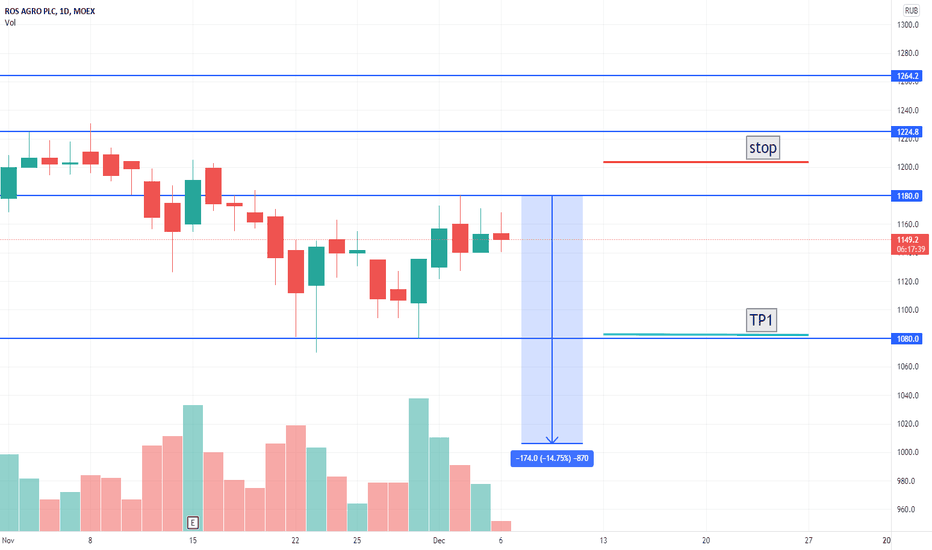

🔴 Rusagro with discountRusagro Group of Companies is the largest vertical agricultural holding in Russia. Rusagro holds leading positions in sugar production, pig farming, crop production and fat and oil business. The Group's land bank is 637 thousand hectares. Founded in 1995. Revenue ₽104.4 billion (I p/y 2021). Capitalization ₽152.5 billion

A deal to rebound from the resistance level (₽1180).

The instrument almost reached a historical maximum in October, the energy to continue moving and overcome the extremum is not yet observed in the instrument. From October 2020 to October 2021, the GDR grew by more than 70%, a strong uptrend left a wide potential area for correction.

1) The closing of the daily candle is far from the level.

2) Completion of the technical rebound from the level of ₽1080.

3) Trend movement.

4) They are not allowed to go up.

Short from ₽1178.8

Goal 1: ₽1081

Target 2 (open): ₽880-1000 (range, fixing as the price moves)

Stop above ₽1200

NOT IRR.

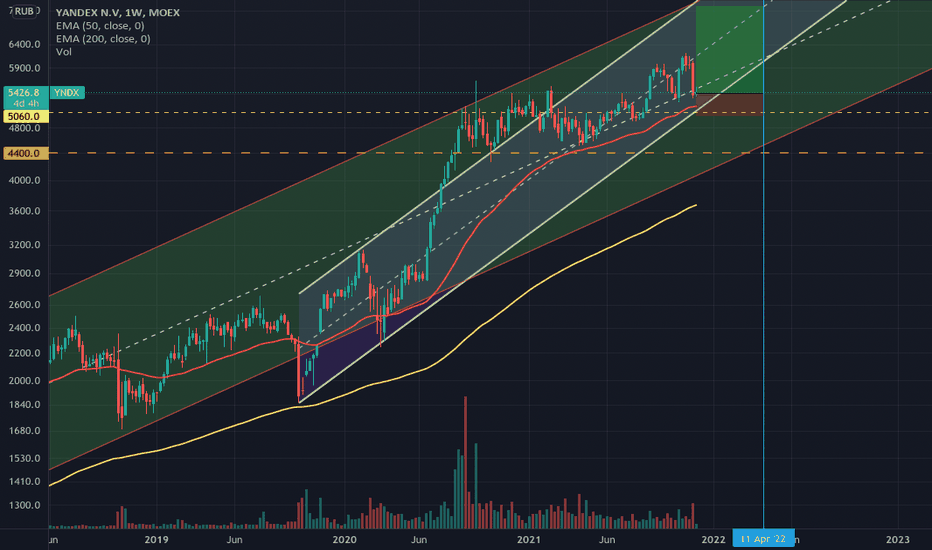

Ecosystem xbetYandex N.V., an internet and technology company, provides internet search engine in Russia and internationally. In line with internet shopping, delivery services, taxi, etc. Recently company's revenue has started sharp rise.

My personal opinion is that since 2020 yandex has become leading ecosystem in Russia and neighbour countries that speak Russian. It provide better search quality and review algorithm for restaurants than TripAdvisor. Better maps then Google. Good marketplace. Better translator than google if use RUS/... . Integrated in ecosystem taxi services with internal bonus system that can be used to pay on Marketplace or to buy YANDEX+ subscription.

The closest rivals are Ozon in marketplace business and Sberbank as large ecosystem with similar services.

While Ozon has great revenue loses for few quarters in a row Sberbank is state-owned enterprise with almost no experience in competitive fields.

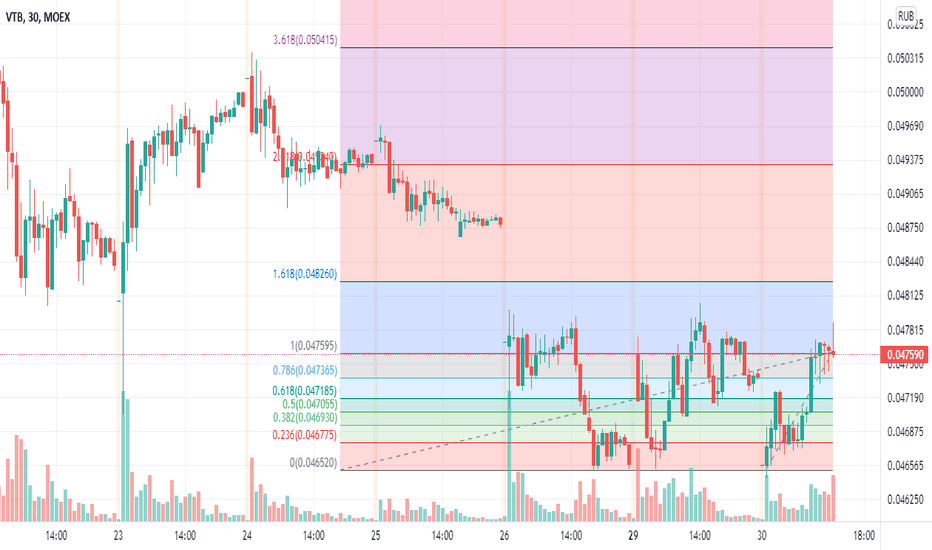

VTB the russian bank interesting perspectives in the near futureVTB is one of the most important banks in the Russian market and overall one of the pillar of the dynamics of the russian economy

first of quick view of the news :

** hit record retail loans

** earnings are on the rise but monitoring the interest rate is a must for next year forecast

** successful deal of selling the magnit from it's portfolio

second a quick view of the charts

the volumes are steady and the MA 9/MA 50 /MA 200 are forecasting a potential rise of the price of the stock

Idea about MagnitMagnit is a chain of retail stores, the third largest private company in Russia by revenue (after Lukoil and X5 Group). It consists of more than 15 thousand grocery stores, 500 supermarkets, 5 thousand perfume and cosmetics stores, 1 thousand pharmacies, manages a greenhouse complex and its own fleet of 5.7 thousand cars. Founded in 1995. Revenue ₽1553.8 billion (2020). Capitalization ₽600.5 billion

The deal is on the rebound from the support level.

The tool is not fast, it forms an impulse through a long sideways movement.

Support levels ₽5525/₽5650/₽5750

1) A deal on the trend.

2) 200 EMA - day support.

3) The instrument needs a correction to collect liquidity.

Long: ₽5675

Until then: $5530

Target : ₽5950 (speculative)

Stop below ₽5400

NOT IRR.

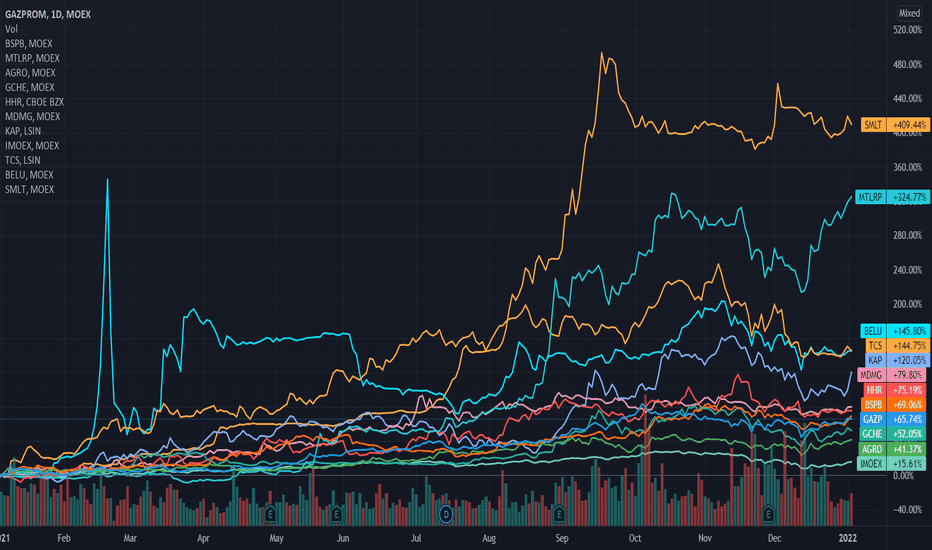

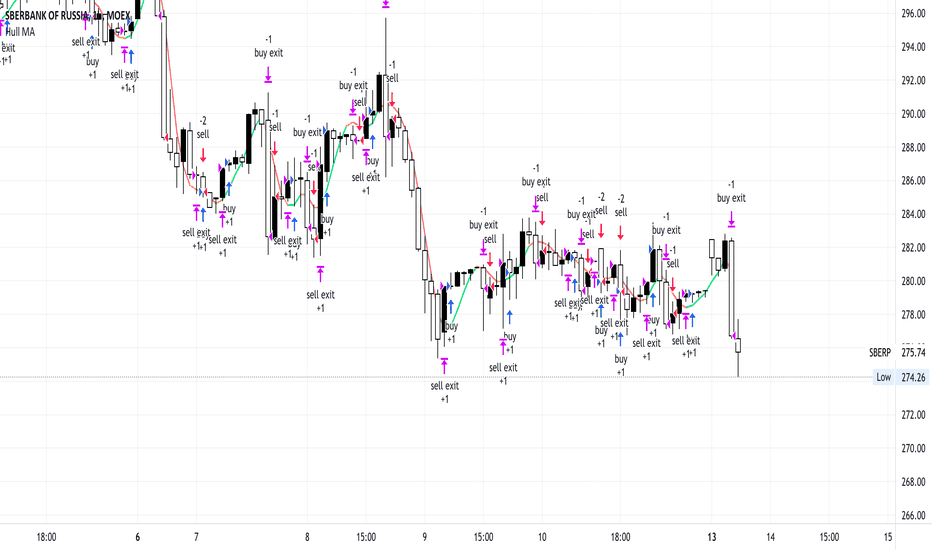

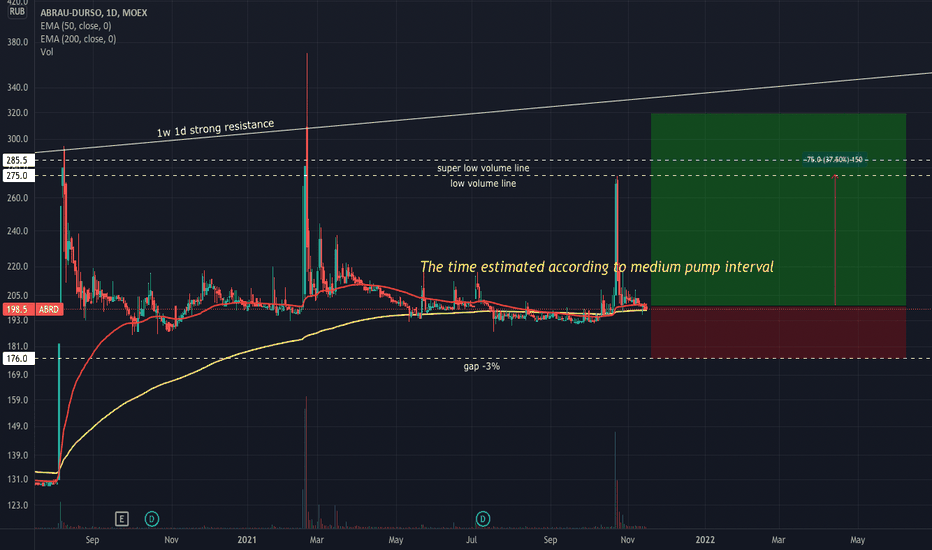

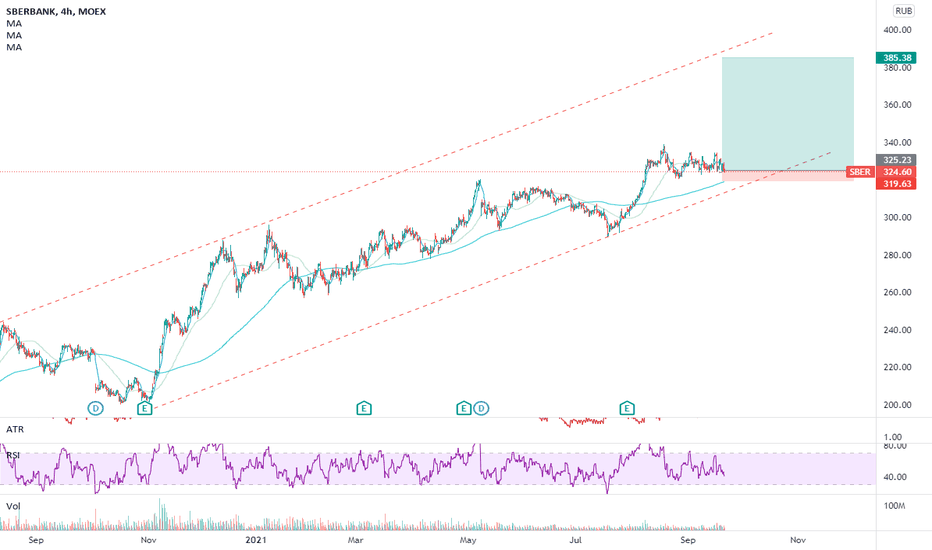

Go drink COMRADE Plan A: Set TP at 319 and chill 260 days.

Plan B: If the price would not consolidate above 275 fastly (within 1W) than sell at 260-275 range.

SL is 176

Idea:

The company has diversified portfolio of low cost vines and champagne. Few soft drinks, heavy alcohol and apple wine.

Cheap price and spread of low-alcohol beverages culture may push stock price

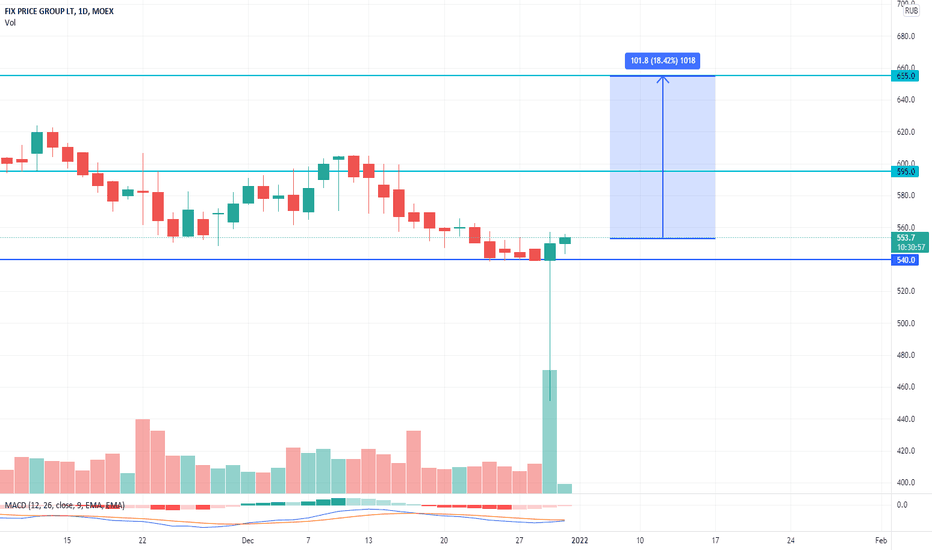

FIXP to go uptrend (FIXprice Group)FixPrice (FIXP) due to tech analysis found a good support at range 598-600.00 as a point of optimal point to start uptrend as an and of ABS to 1st impulse.

ISKJ | Fundamental Growth +30%0. Top Russian Medical Genetic company

1. Develop alternative to Sputnik COVID-19 vacine named Betuvax-CoV-2

2. Russian Health Ministry approves clinical trails of Betuvax at September 27 2021. Clinical trails involve 116 volonteer without chronic diseases

3. Forecast release date midwinter 2021.

4. In case of anual vaccination of 1% Russian population target price: 120 RUB

5. In case of anu vaccination rate of 4%, target: 320 RUB

6. Govermental support rate up to +10-20% price impact

7. Lot's of other medical projects that support ISKJ fundamental price at 85 RUB without Betuvax project impact.

Target price: 125 RUB

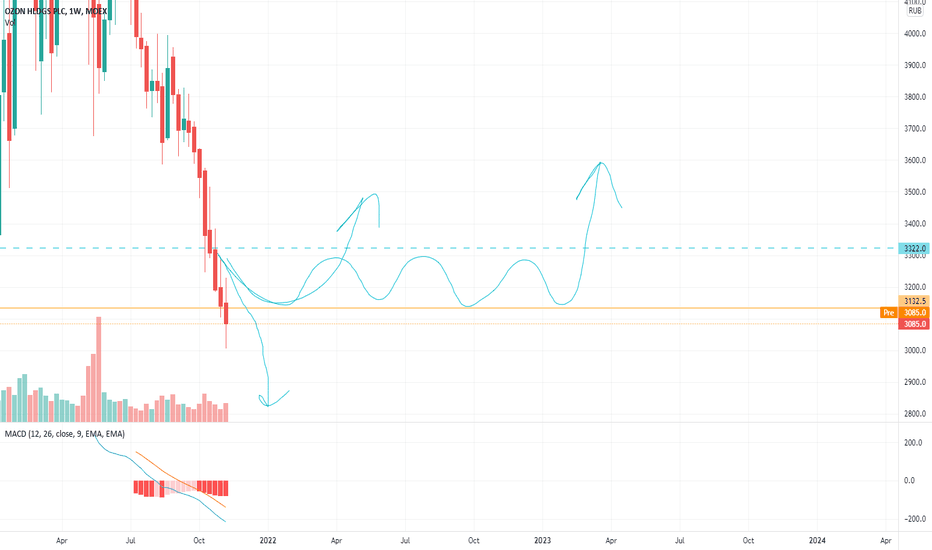

OZON. Update.In the last post on OZON, I wrote about the short from the current levels (₽3190) to ₽3000 (support), since the level with this round number is unlikely to be ignored by the market and it should be expected at least a local rebound from it.

After reaching the level of ₽3130, the price bounced, failing to cross the local maximum of ₽3230. The price returned to the level of the limit player, bouncing consistently with less energy. This situation provides for the continuation of the downtrend and entry into the short on the breakout of the level of the limit buyer. After the breakout, the price with long candles reached the nearest support level indicated above.

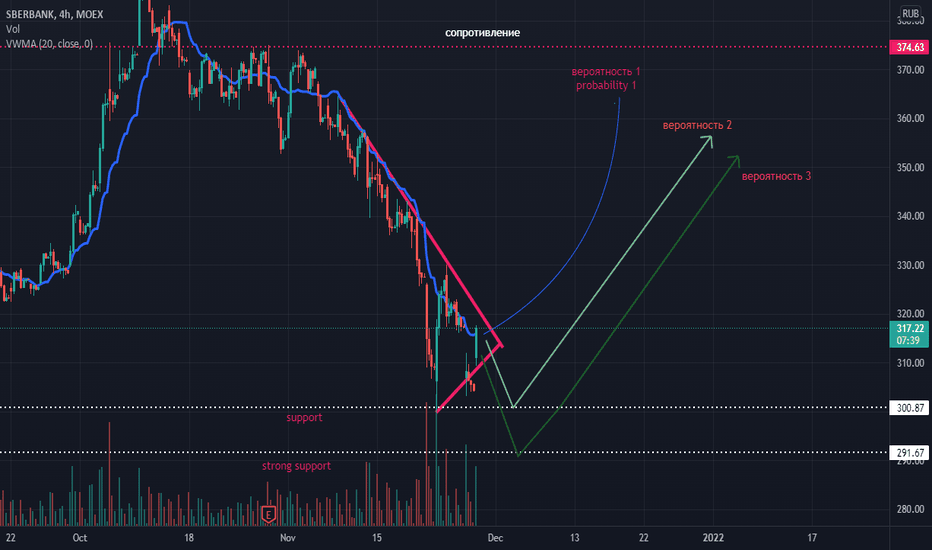

Next, I expect one of three scenarios.

1) Formation of DD with a local rebound (entry into a long in the range of ₽3000-3015). I do not believe in a trend reversal without forming a base (trading near the level).

2) Formation of an accumulation base near the level of ₽3000 with a subsequent trend reversal.

3) Breakdown of the level of ₽3000 and moving to the areas of interest ₽2700-2800 / ₽2400-2500, in which it will be necessary to monitor buyers' readiness for a trend reversal.

I consider the third option the most probable, so it's better not to rush to buy $ OZON for the medium term.

NOT IRR.

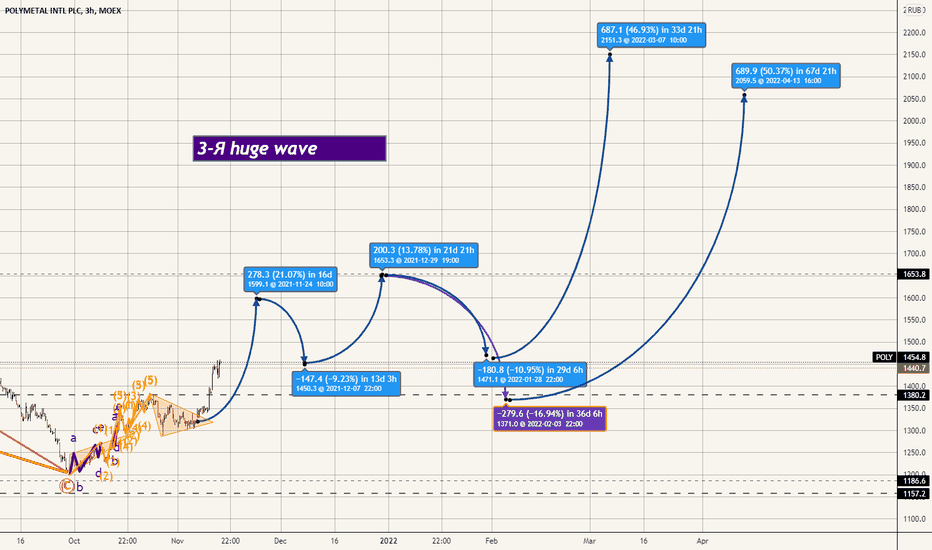

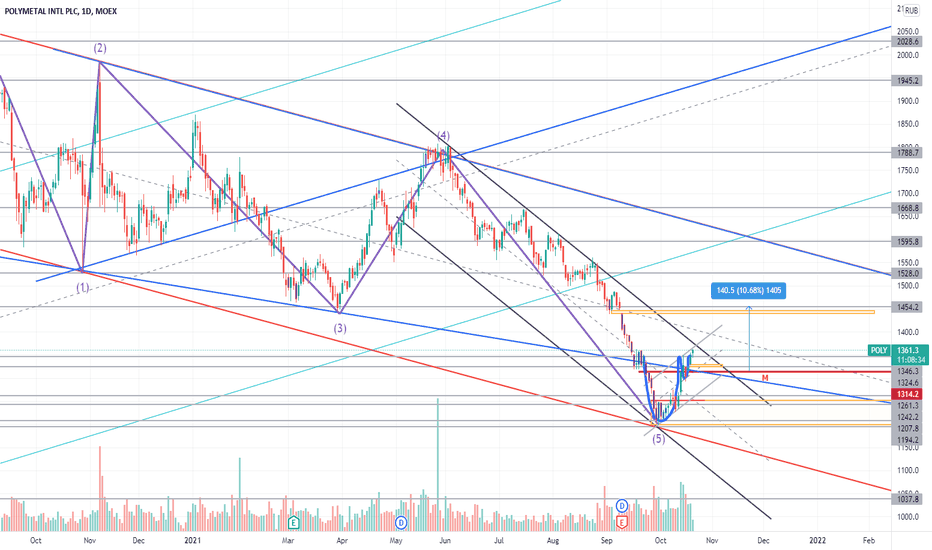

Polymetal(POLY) "Continuation"Disclaimer/

On average, 90% of all stocks move down with the market, and 75% - up.

The wave principle applies to some extent to individual stocks, but counting waves for them is often confusing and has little practical significance. But since the company has a large capitalization, we assume that the state of the shares depends on the psychology of the masses

According to our old plans, we have reached a turning point. Now the 3rd wave is coming.

Gold, contrary to the correction that we have observed recently and will, most likely, observe for some time, is at the top (Price range:1950-1550USD, Delta:400, Average:1750), which is a good thing for gold mining companies. (Relative stability)

"The Group's revenue and most of its loans are denominated in US dollars, while the bulk of the Group's expenses are denominated in Russian rubles and Kazakhstani tenge. Thus, changes in exchange rates may affect the financial results and performance of the Group. The strengthening of functional currencies relative to the US dollar may adversely affect enterprises in Russia and Kazakhstan and lead to higher operating costs denominated in local currency and lower margins. ". I have been waiting for the strengthening of EUR, USD for a long time. Now there is also a turning point.

Other gold mining "Russian companies" are in a similar position.

SENSITIVITY TO RUB/USD, GOLD PRICE(1H 2021 FINANCIAL RESULTS)(At the 1H 2021 average realized price)

Effect on FCF :

A 1 RUB/USD movement in domestic currency $17-21m

A $100/oz movement in the gold price ~$150m

POLYI am a poor man

sitting on the corner of

Your Conscious

and Your Reality.

All day everyday

I sit in that spot and

beg for change.

But keep your quarters, nickels, dimes

for someone else

'cause all I want is a cup of change.

A cup of change

to water my feeble hope, thorny rose

rooted in concrete hatred.

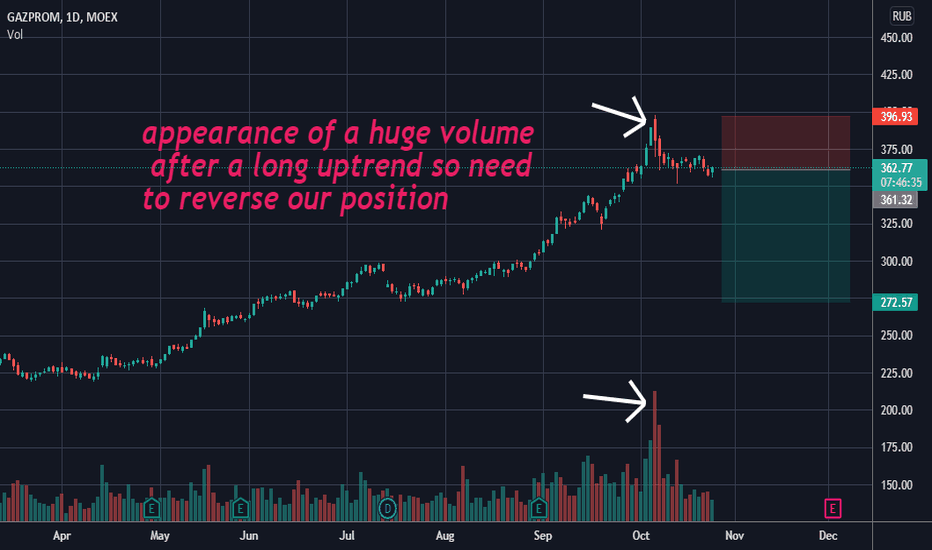

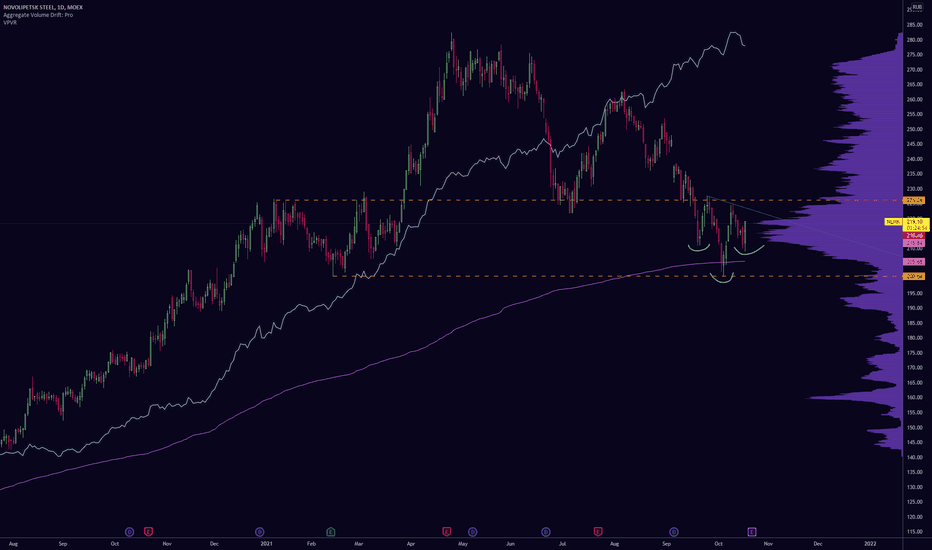

NLMK - Deep Value, Inverse H&S, Fat DivsNon stop accumulation, it retraced to the value zone, today's engulfing raising the odds of setting an inverse head and shoulders.

The pink line is an anchored VWAP from the March 2020 low.

Huge dividends.

Aggregate Volume Drift: Pro using 3-minute accumulation data.