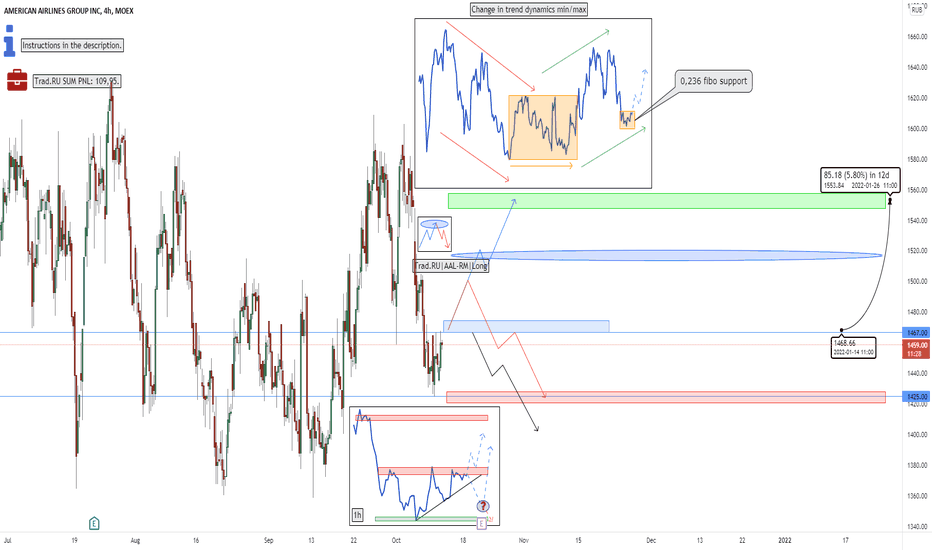

Trad.RU|AAL-RM|LongLong AAL-RM

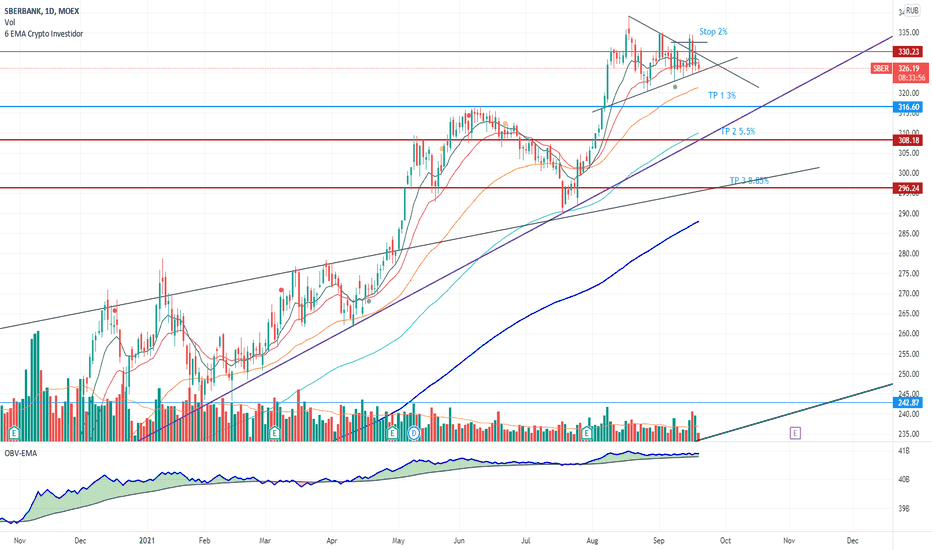

The system trading idea is activated only when it is fixed in the highlighted blue zone, if the price has gone beyond the highlighted zone, then the transaction is activated 2 minutes after the breakout.

* The author reserves the right to close the deal before reaching the take zone and the stop zone. Closing a deal for subjective reasons does not completely cancel the idea and is not a call to the same action, you can continue developing the idea according to your data, but without the support of the author.

The level indicated by the ellipse is a zone of increased resistance, a reversal is possible in this area for correction, please take this factor into account in this transaction.

The term "forecast" was used to indicate the percentage potential in this idea. The author does not take into account the date and time of the trade, only the percentage change.

Blue zones are activation zones.

Green zones are take zones.

The red zone is the stop zone.

Working out of the take level takes place without fixing on a "pending order", working out of the stop level only when fixing in the stop zone or breaking through this zone.

SUM PNL: This parameter displays the total % of all closed ideas (according to the author) for this sector at the time of publication of the idea. The calculation is very "clumsy" just the sum of the profits of all the ideas, based on this indicator, you can more accurately assess the risks when working with my ideas of this sector. I present you the construction of the idea, you can use it yourself as you like based on your subjective view and risks, the calculation of the PNL indicator is carried out only on transactions that the author closed on TV in manual mode or by take.

!This idea is in the format of a systemic trading idea, losses will be mandatory, the goal is to gain a positive PNL at a distance by using the system. Follow your own risk and money management parameters if you are going to use these ideas.!

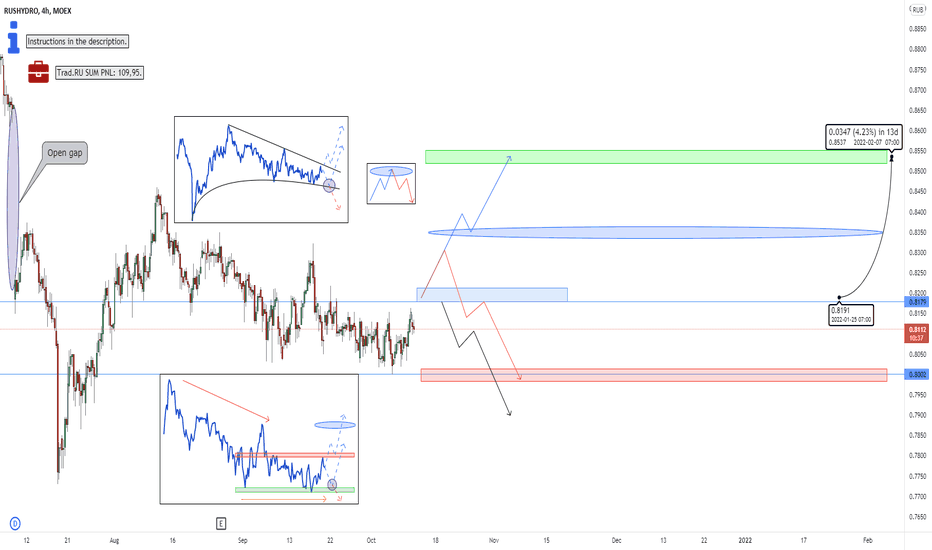

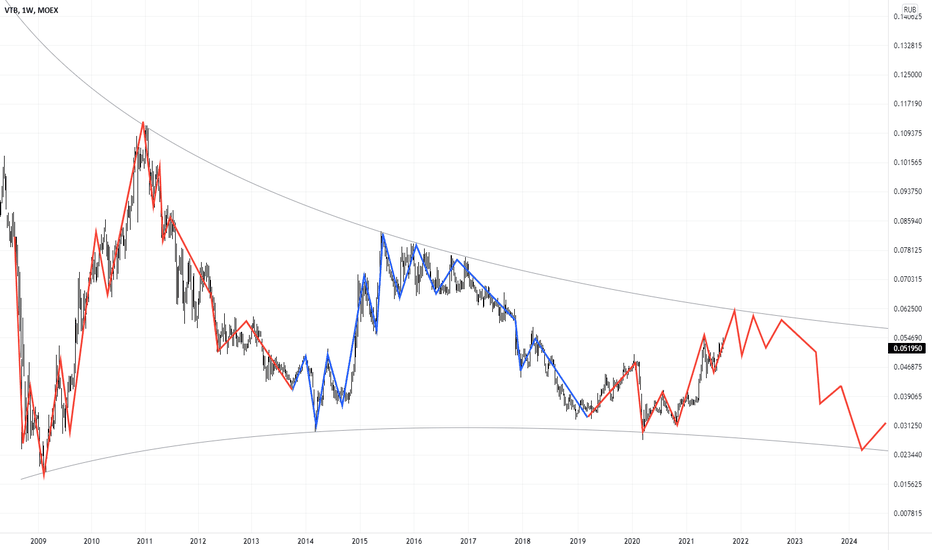

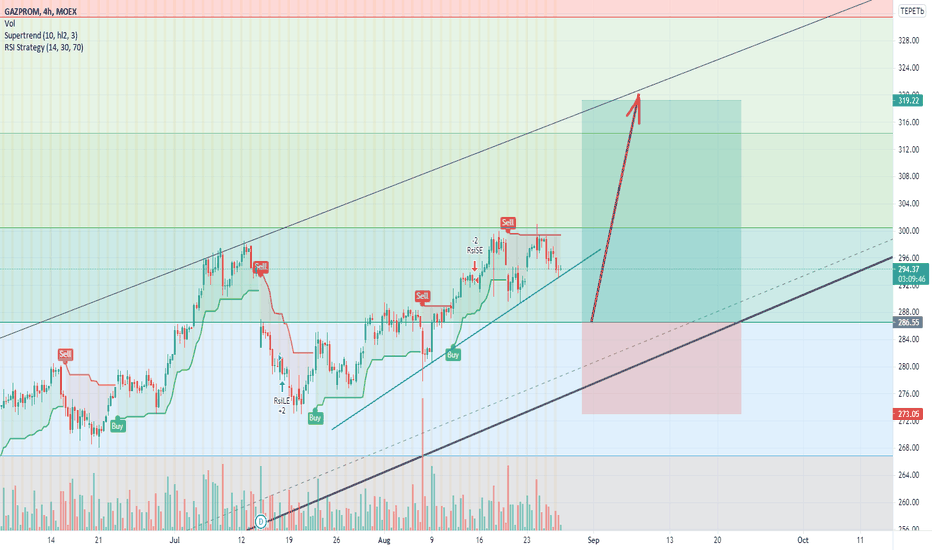

Trad.RU|HYDR|LongLong HYDR

The system trading idea is activated only when it is fixed in the highlighted blue zone, if the price has gone beyond the highlighted zone, then the transaction is activated 2 minutes after the breakout.

* The author reserves the right to close the deal before reaching the take zone and the stop zone. Closing a deal for subjective reasons does not completely cancel the idea and is not a call to the same action, you can continue developing the idea according to your data, but without the support of the author.

The level indicated by the ellipse is a zone of increased resistance, a reversal is possible in this area for correction, please take this factor into account in this transaction.

The term "forecast" was used to indicate the percentage potential in this idea. The author does not take into account the date and time of the trade, only the percentage change.

Blue zones are activation zones.

Green zones are take zones.

The red zone is the stop zone.

Working out of the take level takes place without fixing on a "pending order", working out of the stop level only when fixing in the stop zone or breaking through this zone.

SUM PNL: This parameter displays the total % of all closed ideas (according to the author) for this sector at the time of publication of the idea. The calculation is very "clumsy" just the sum of the profits of all the ideas, based on this indicator, you can more accurately assess the risks when working with my ideas of this sector. I present you the construction of the idea, you can use it yourself as you like based on your subjective view and risks, the calculation of the PNL indicator is carried out only on transactions that the author closed on TV in manual mode or by take.

!This idea is in the format of a systemic trading idea, losses will be mandatory, the goal is to gain a positive PNL at a distance by using the system. Follow your own risk and money management parameters if you are going to use these ideas.!

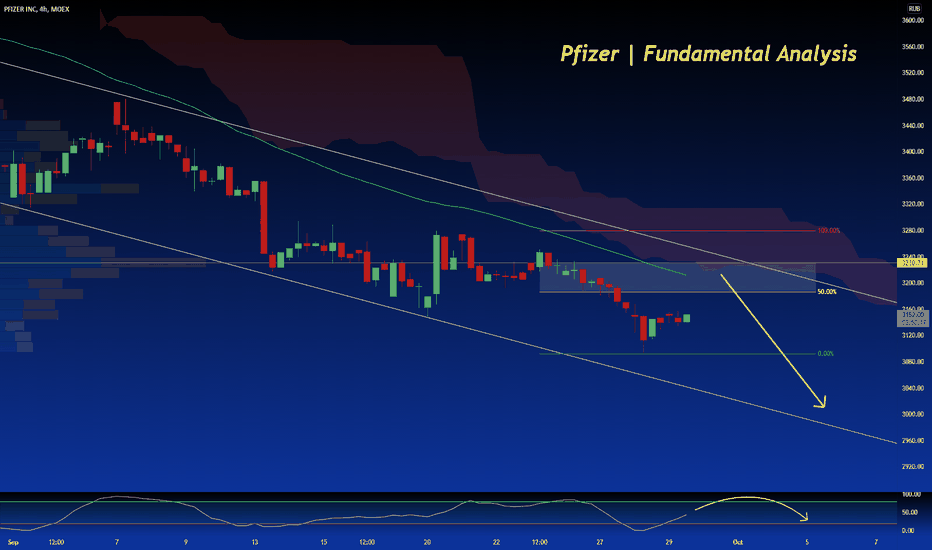

Pfizer | Fundamental Analysis | Short view Many would agree that a half victory is better than a total defeat. Pfizer and BioNTech have seen this through firsthand experience.

The two partners had hoped that an FDA advisory committee would recommend revaccination with the COVID-19 vaccine to all Americans 16 years of age and older. A week ago, however, the committee voted 16-2 against recommending the Pfizer-BioNTech vaccine for a wide age range.

It wasn't just bad news for these drug companies, however. The FDA advisory committee also voted unanimously to recommend the boosters for U.S. citizens age 65 and older, and anyone at high risk for severe COVID-19. And now you're probably wondering, could Pfizer stock be a reasonable investment choice after this partial victory?

The FDA still has to decide whether to revaccinate the Pfizer-BioNTech vaccine. If the agency follows the commission's recommendations and the Centers for Disease Control and Prevention (CDC) agrees with them, many additional vaccines could soon become available.

As per the U.S. Department of Health and Human Services' Office on Aging, there were about 52.4 million Americans age 65 and older in 2018. Today, that number is undoubtedly higher.

Vaccination rates among older Americans are higher than any other age group. According to the CDC, nearly 85 percent of people between the ages of 65 and 74 have been fully vaccinated. Nearly 80% of Americans age 75 and older have been fully vaccinated.

We don't know how many of these people received the Comirnaty COVID-19 vaccine from Pfizer and BioNTech. However, overall, Comirnaty accounts for about 57% of all COVID-19 vaccine doses administered to date.

It is estimated that about 25 million Comirnaty revaccinations could be administered in the following months if the FDA and CDC give the green light to revaccination. Based on previous vaccine prices, the total cost of revaccination for the groups recommended by the FDA panel could approach $500 million.

At first glance, the possibility of an additional $500 million over the next few months may seem significant. However, there are several reasons not to get so excited.

Most importantly, none of the companies are likely to get "extra" money from boosters shortly. The U.S. has already ordered a total of 500 million doses from Pfizer and BioNTech, plus another 500 million doses for transfer to other countries. At least at this time, it is doubtful that extra doses will be purchased by the government to vaccinate Americans.

Keep in mind also that Pfizer and BioNTech share profits from Comirnaty. Even if the companies could expect additional orders from the U.S. government for boosters, the financial impact for Pfizer would not be huge. In the second quarter, the company had revenue of $19 billion and profits of nearly $5.6 billion.

There is really no good reason to buy Pfizer stock based on the recommendation of the FDA advisory committee. Nevertheless, there are other reasons why investors might seriously consider stock in this major pharmaceutical company.

The need for an annual refill for everyone is still a real possibility. If Pfizer can count on strong recurring revenues from Comirnaty for years to come, the stock will look much more attractive.

No doubt, Pfizer doesn't just rely on its COVID-19 vaccine. The pharmaceutical giant has other growth drivers that should appeal to investors, notably the rare heart disease drug Vyndaqel/Vyndamax and the blood-thinning drug Eliquis.

Pfizer's pipeline could bring even more big wins. A pill for COVID-19 may be on the way. The drugmaker also has more than 20 other late-stage programs. It is also adding to its portfolio through deals, including intentions to buy Trillium Therapeutics.

Last, but not least, is Pfizer's dividend. Many income investors will like the dividend yield, which is currently 3.5%.

For some investors, Pfizer stock looks like a good choice. But any endorsement for older Americans boosters isn't much of a factor in deciding whether or not to buy the stock one way or the other.

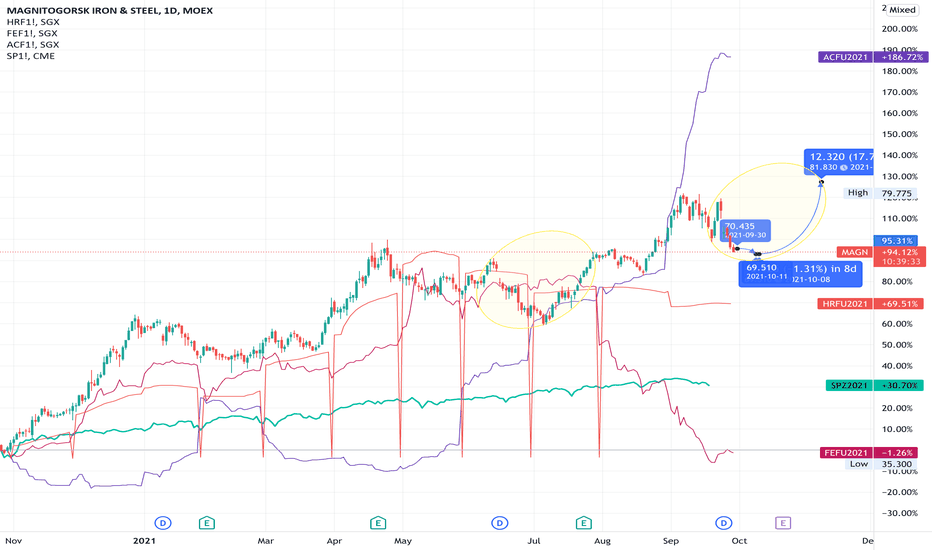

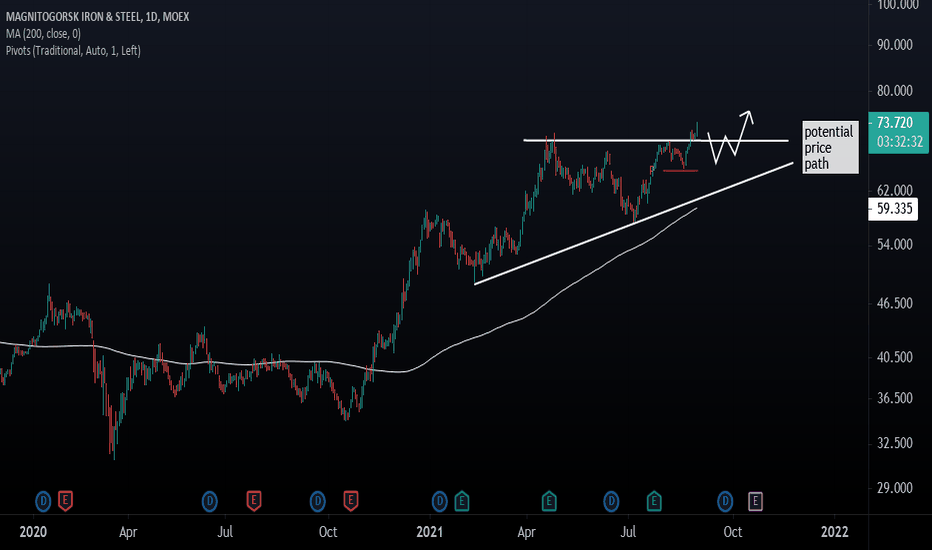

MMK: Stock price will repeat the 2nd quarterAgainst the backdrop of strong fin. indicators of the 3rd quarter

Key factors and catalysts

Annual forward dividend approximate to 40% in H2 2021

Should significantly increase production up to 30%

Cost less than competitors in one sector on P/E and EV/EBITDA multiples

Beneficiary of commodity supercycle 2021

Most likely going to be included in the MSCI Russia index

The desire of the main shareholder to increase free-float by 2%, which gives an increase in FIF by 0.5 and weight in the MSCI index

Main beneficiary from the transition from duties to MET tax from the beginning of 2022

Main beneficiary from the decline in world prices for iron ore and high prices for hot-rolled steel

Negative debt load

Making every effort to be ESG friendly

An unprecedented openness and disclosure of information to investors

It is a super clear and transparent business with a double-digit dividend history

We calculate financial indicators for the 3rd quarter of 2021

Revenue - $ 3302.6 million to increase by 1.5% q / q (3370 * 980)

EBITDA - $ 1,380.7 million decrease by 3.8% q/q including the effect of duties $ 60 million (3,370 * 427.5-60000)

Profit - $ 1017 million (1380.7-125) * (1-0.19)

Total NWC - a decrease by $ 259 million due to a significant decrease in world prices for iron ore and a decrease in prices for finished products due to the introduction of temporary duties on inventories (1425 * (0.4 * 0.33 + 0.20 * 0.25))

FCF - $ 1,045 million, an increase of 92% q/q (EBITDA-Change in PSC-CAPEX-Taxes = 1380.7 + 259-350-245)

Dividend - $0.11. an increase of 222% taking into account compensation over a cappex ((1045 + 350-175) / 11174.33) or 9.4% in quarter

Fundamental KAZT Buy1. Natural gas is used in the production of nitrogen fertilizers.

2. Natural gas price increased more than 115% since the beginning of the year.

3. Nitrogen fertilizers price increased by 50%

4. KAZT receives 40% of the proceeds from nitrogen fertilizers.

5. KAZT buys gas at previously fixed low price by the way foreign fertilizer producers buy gas at market prices.

Resume: growth of marginality and market value for a medium and long term.

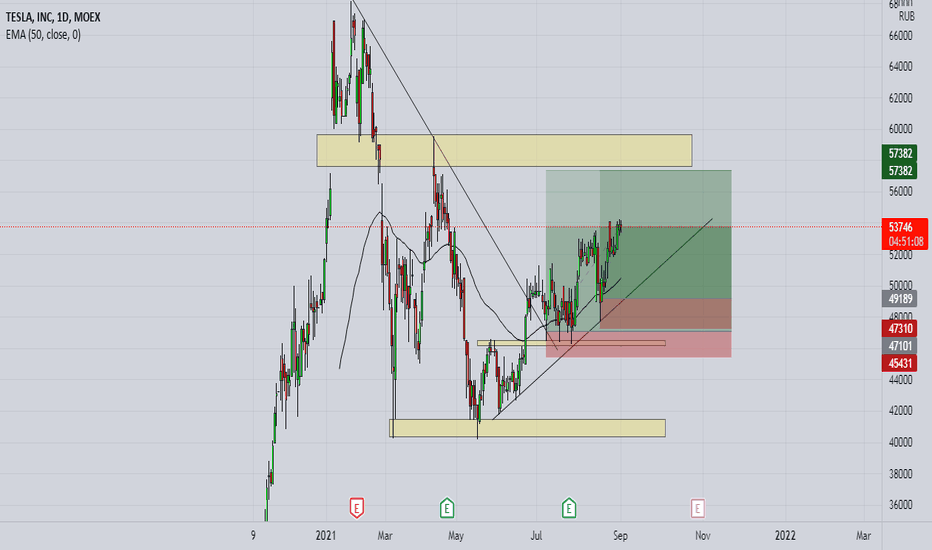

TESLA it's nice example of technical analyseI love TESLA <3

It was just apperently. eating

stock stockkekkekekekkekekekkeekkkkkckckecekcekeckeeckecekckekcek