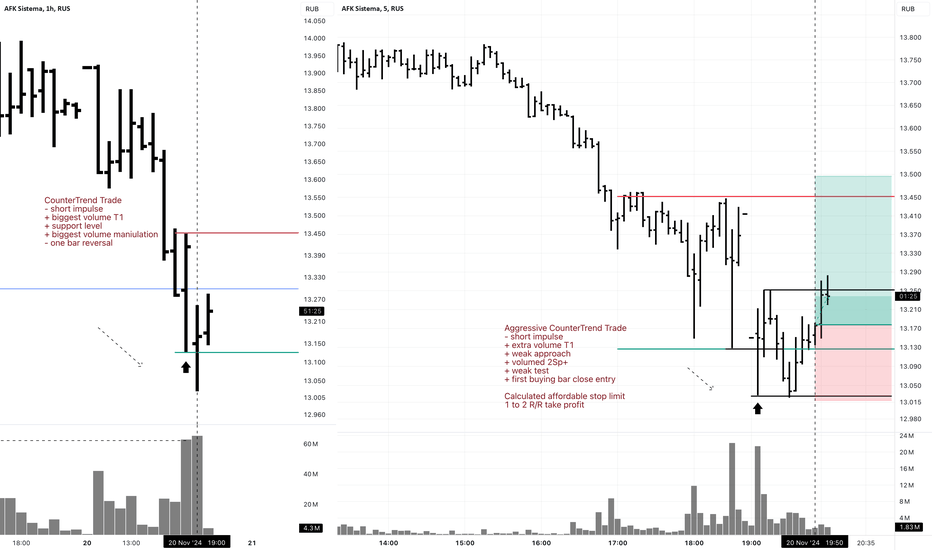

AFKS 5M Daytrade Aggressive CounterTrend TradeAggressive CounterTrend Trade

- short impulse

+ extra volume T1

+ weak approach

+ volumed 2Sp+

+ weak test

+ first buying bar close entry

Calculated affordable stop limit

1 to 2 R/R take profit

1H CounterTrend

"- short impulse

+ biggest volume T1

+ support level

+ biggest volume maniulation

- one bar reversal"

1D Trend

"+ long impulse

+ 1/2 weak correction

+ SOS level

+ support level

+ reverse volume distribution

+ volumed manipulation"

1M Trend

"+ long impulse

- below 1/2 correction

+ expanding T2 level

+ support level

+ support level

+ volumed manipulation"

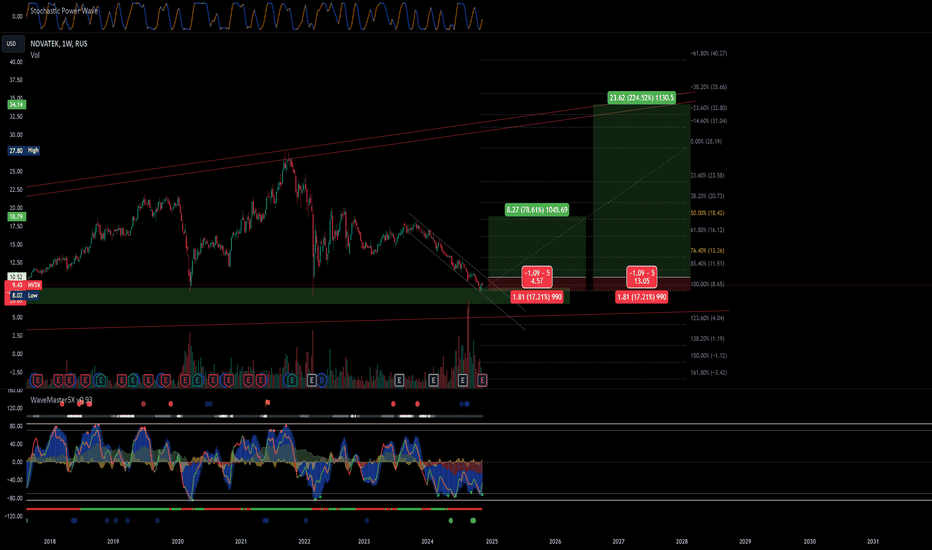

1Y Countertrend

"- short impulse

- neutral zone"

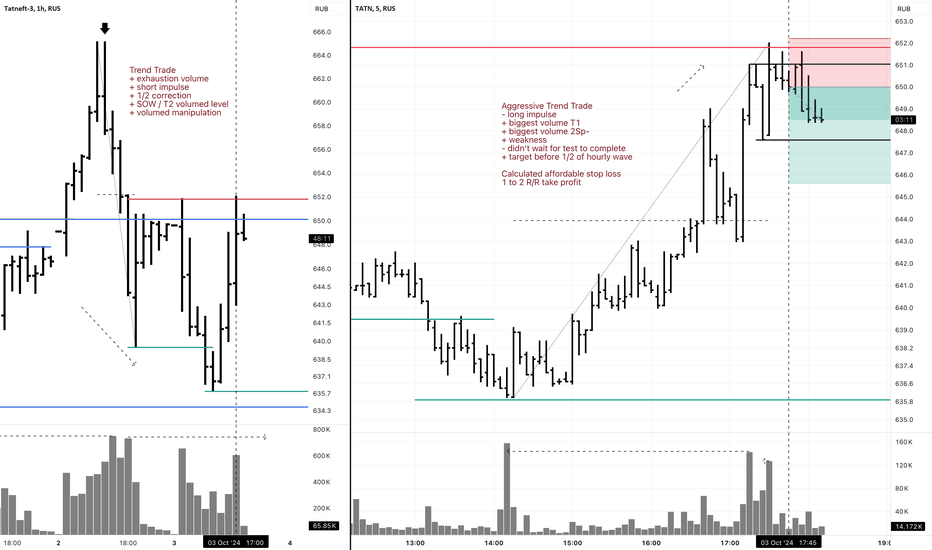

TATN 5M Daytrade Short Aggressive Trend TradeAggressive Trend Trade

- long impulse

+ biggest volume T1

+ biggest volume 2Sp-

+ weakness

- didn't wait for test to complete

+ target before 1/2 of hourly wave

Calculated affordable stop loss

1 to 2 R/R take profit

1H Trend

"+ exhaustion volume

+ short impulse

+ 1/2 correction

+ SOW / T2 volumed level

+ volumed manipulation"

1D CounterTrend

"- long impulse

- T1 level

+ resistance level

+ biggest volume manipulation"

1M Trend

"+ short impulse

+ SOW level

+ 1/2 correction

+ resistance level"

Convertible to Swing / Investment trade if 1H and 1D close right.

Watch out for the gap since it's a stop market!

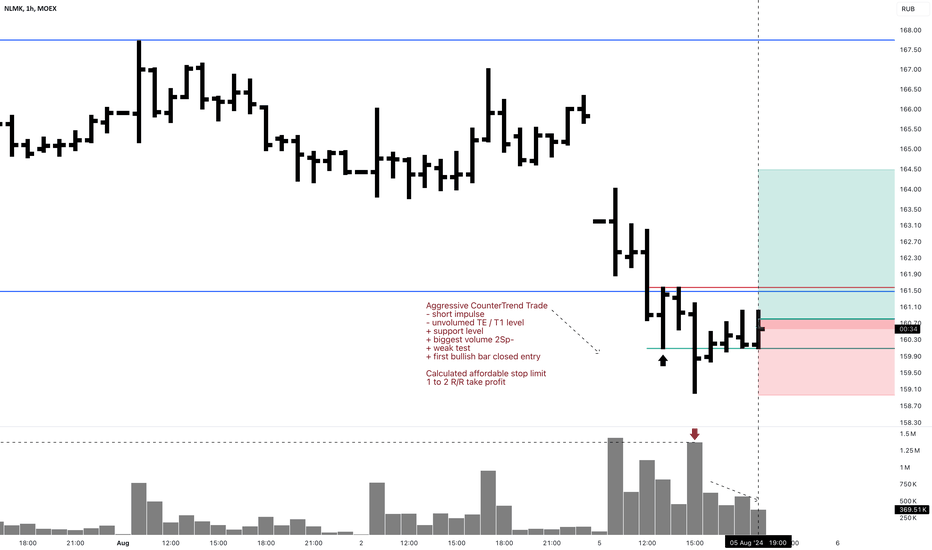

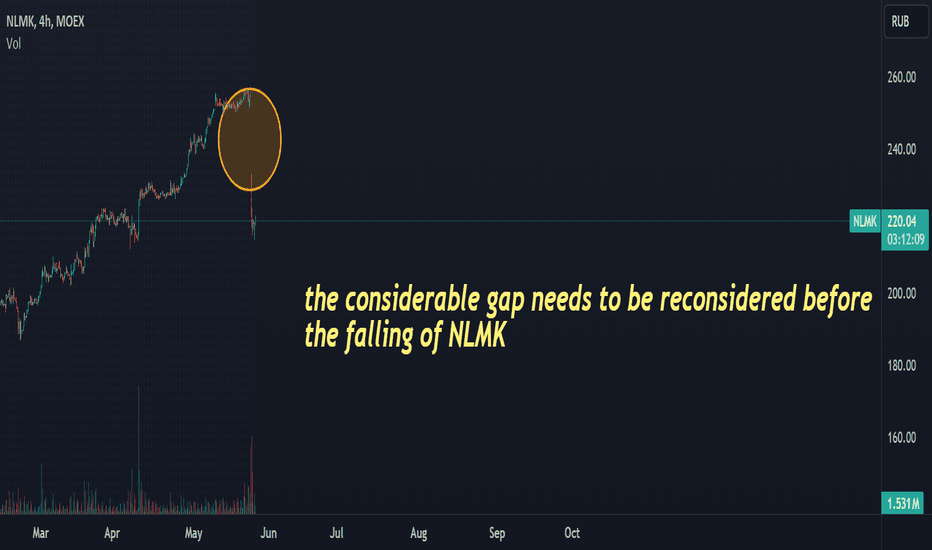

NLMK 1H Long Swing Aggressive CounterTrend TradeAggressive CounterTrend Trade

- short impulse

- unvolumed TE / T1 level

+ support level

+ biggest volume 2Sp-

+ weak test

+ first bullish bar closed entry

Calculated affordable stop limit

1 to 2 R/R take profit

Daily CounterTrend

"- short impulse

+ volumed TE / T1

+ support level

+ volumed manipulation"

Monthly CounterTrend

"+ long impulse

+ T2 level

+ support level"

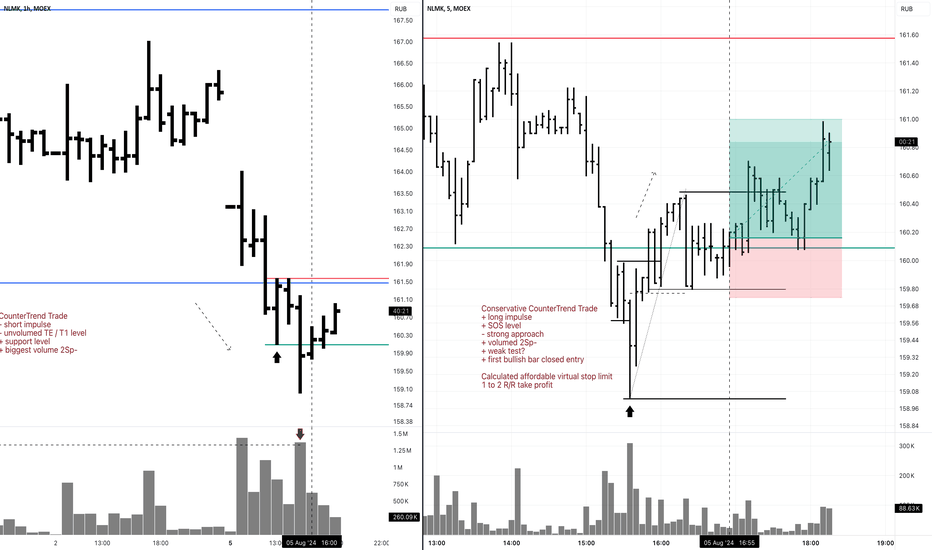

NLMK Daytrade 5M Conservative CounterTrend TradeConservative CounterTrend Trade

+ long impulse

+ SOS level

- strong approach

+ volumed 2Sp-

+ weak test?

+ first bullish bar closed entry

Calculated affordable virtual stop limit

1 to 2 R/R take profit

Hourly CounterTrend

"- short impulse

- unvolumed TE / T1 level

+ support level

+ biggest volume 2Sp-"

Daily CounterTrend

"- short impulse

+ volumed TE / T1

+ support level

+ volumed manipulation"

Monthly Trend

"+ long impulse

+ T2 level

+ support level"

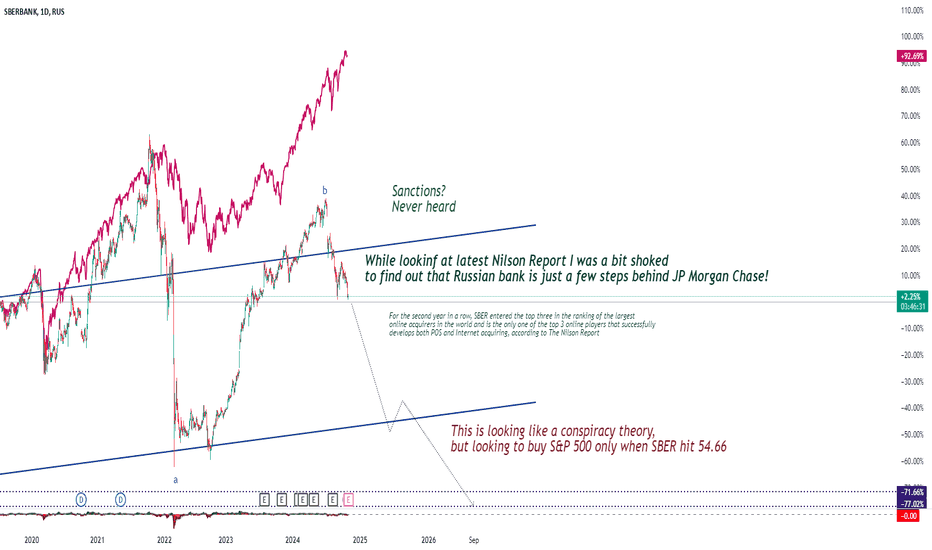

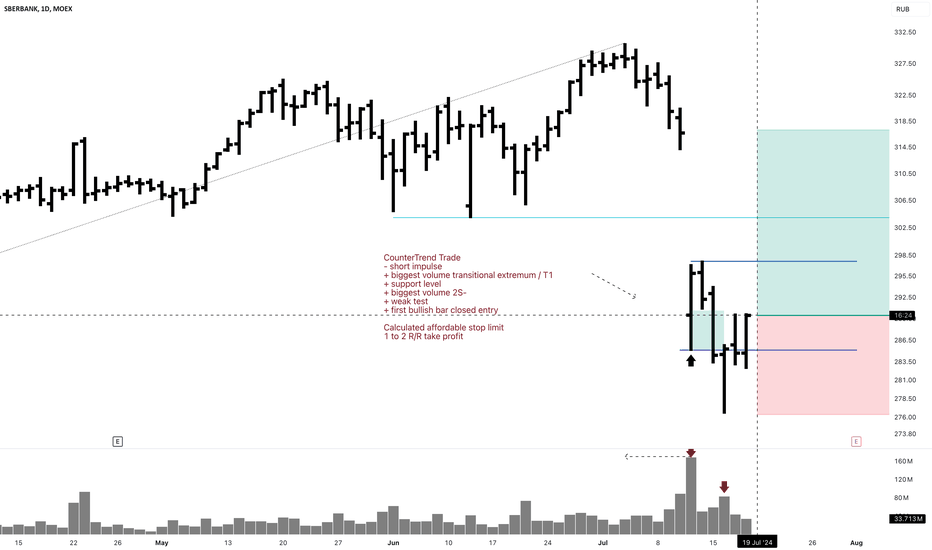

SBER 1D Investment Long Aggressive Trend TradeAggressive Trend Trade

- short impulse

+ biggest volume transitional extremum / T1

+ support level

+ biggest volume 2S-

+ weak test

+ first bullish bar closed entry

Calculated affordable stop limit

1 to 2 R/R take profit

Monthly context

" Trend trade

+ long impulse

+ SOS level

+ support level

+ 1/2 correction"

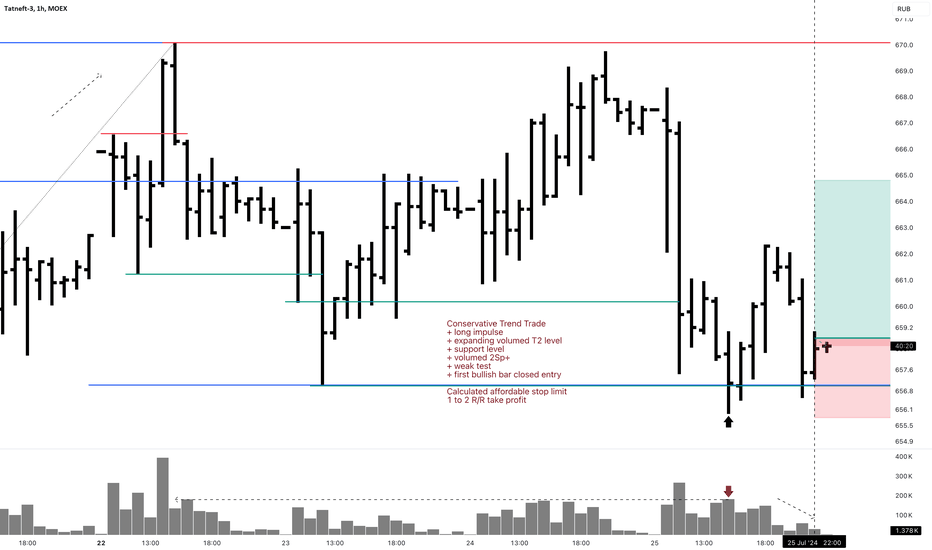

TATN 1H Swing Long Conservative Trend TradeConservative Trend Trade

+ long impulse

+ expanding volumed T2 level

+ support level

+ volumed 2Sp+

+ weak test

+ first bullish bar closed entry

Calculated affordable stop limit

1 to 2 R/R take profit

Day trend

"+ long impulse

+ T2 level

+ support level

+ 1/2 correction?"

Month trend

"+ long balance

+ expanding T2 level

+ support level"

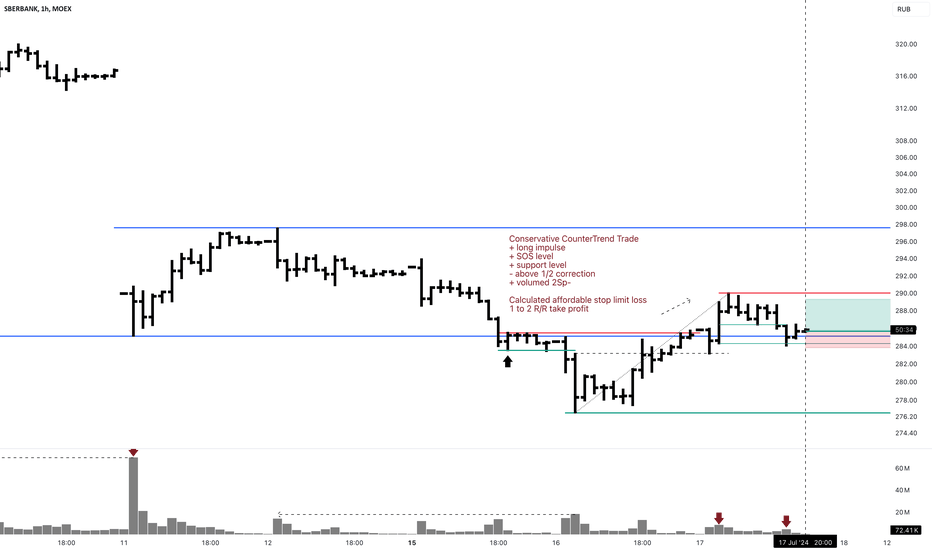

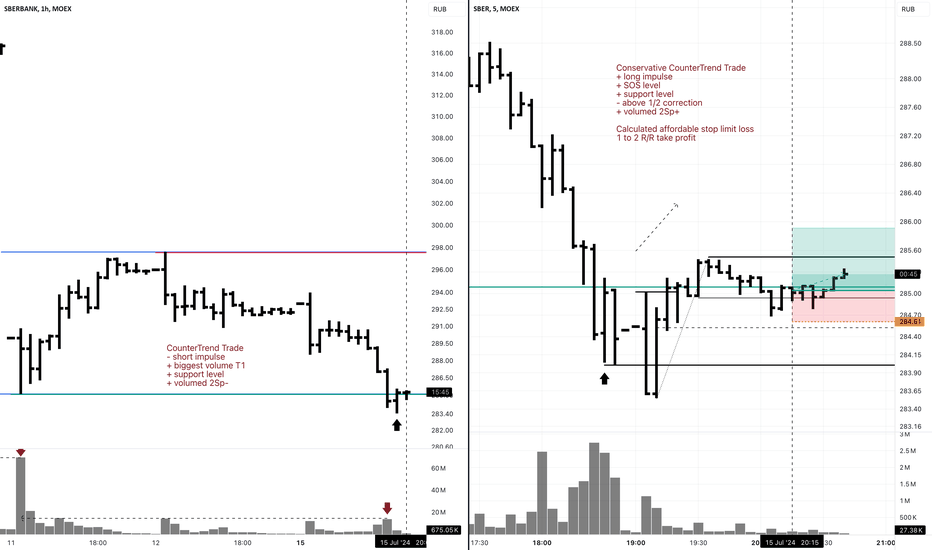

SBER 1H Long Swing Conservative CounterTrend TradeConservative CounterTrend Trade

+ long impulse

+ SOS level

+ support level

- above 1/2 correction

+ volumed 2Sp-

Calculated affordable stop limit loss

1 to 2 R/R take profit

Daily context:

"- short impulse

+ biggest volume transitional extremum / T1

+ support level

+ biggest volume 2S-"

Monthly context:

"+ long impulse

+ SOS level

+ support level

+ 1/2 correction"

SBER 5M Long Daytrade Conservative CounterTrend TradeConservative CounterTrend Trade

+ long impulse

+ SOS level

+ support level

- above 1/2 correction

+ volumed 2Sp+

Calculated affordable stop limit loss

1 to 2 R/R take profit

Hourly context:

'"- short impulse

+ biggest volume T1

+ support level

+ volumed 2Sp-"

Daily context:

"- short impulse

+ biggest volume transitional extremum / T1

+ support leve

+ volumed manipulation"

Monthly context:

"+ long impulse

+ SOS level

+ support level

+ 1/2 correction"

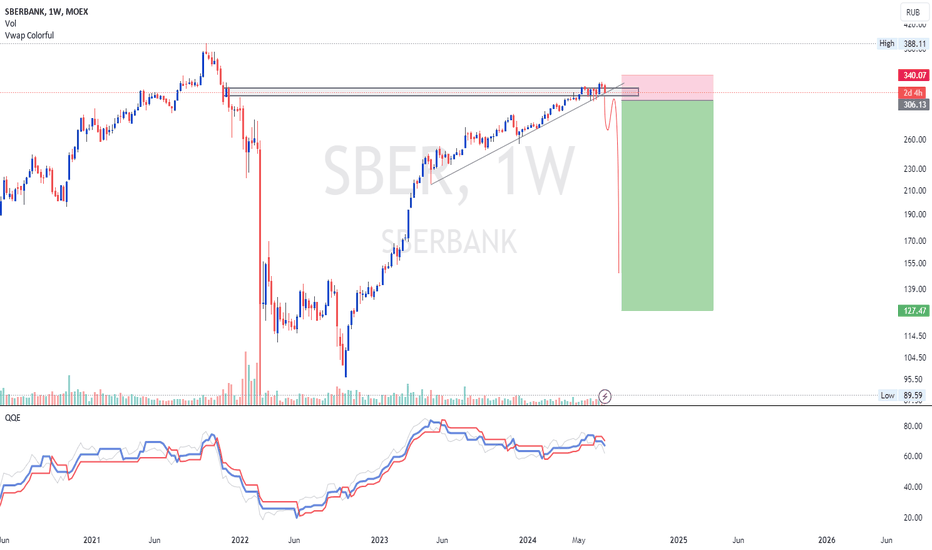

RUSSIAN STOCK SBER BANKPeriod: W1 Current trend: bullish

Analysis: based on price trend, SMC, high/low volume indicators and QQE

Forecast: bearish but after the repeated break of the weekly order block and the trend line at the round figure 305 the price is likely to fall sharply

I think and suggest that we should prepare to sell this stock...

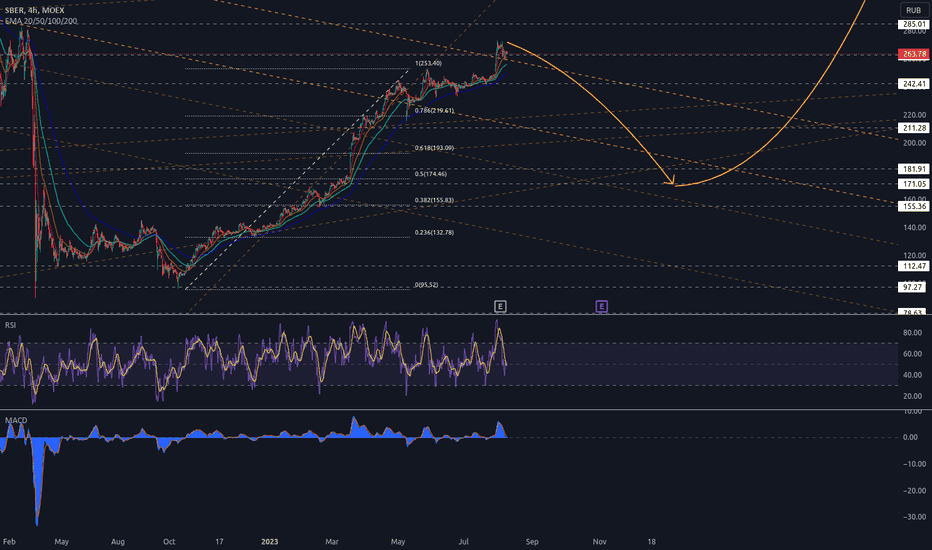

$SBER needed to get colder before the next roundMOEX:SBER in my point of view is going to move down to 170-180 before it will be ready to start a new circle of long position.

Points to buy for the future long: 220, 200, 180, 170

Does not constitute a recommendation.

#furoreggs #investing #stocks #shares #idea #forecast #trading #analysis

If you want to discuss, please subscribe and challenge this point of view )

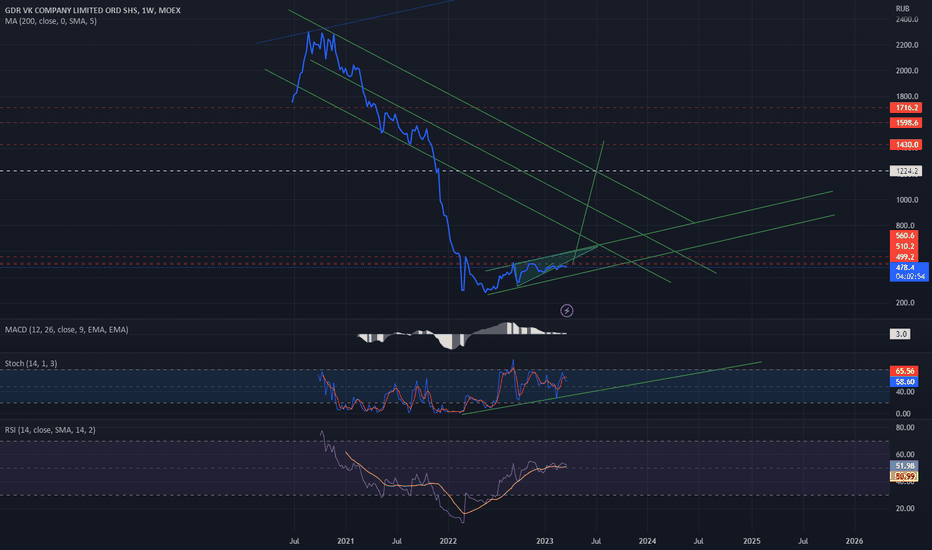

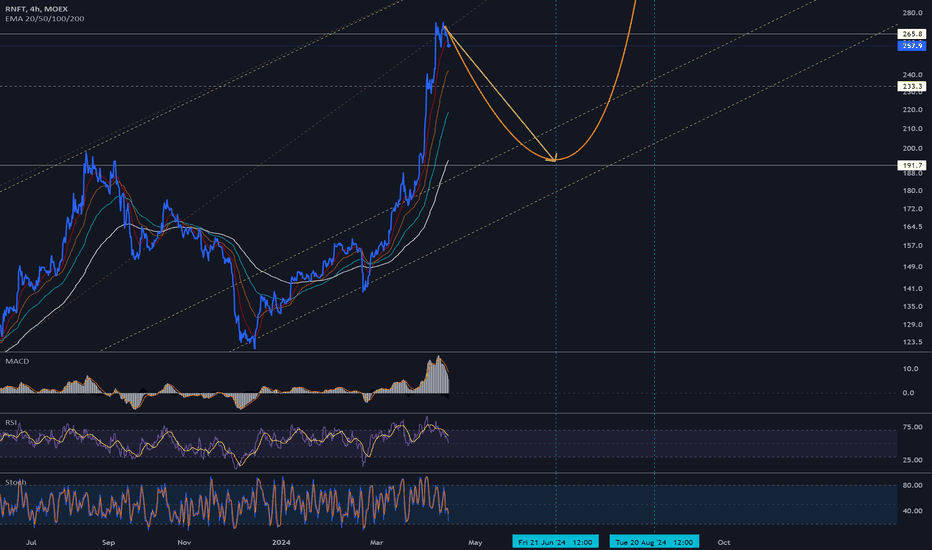

$RNFT is planning to find a new baseline for the future jumpMOEX:RNFT is highly overbought and we must give time to let it to build up an energy a bit.

My prediction is that it can find a bottom somewhere near 195.

Does not constitute a recommendation.

#furoreggs #investing #stocks #shares #idea #forecast #trading #analysis

If you want to discuss, please subscribe and challenge this point of view )

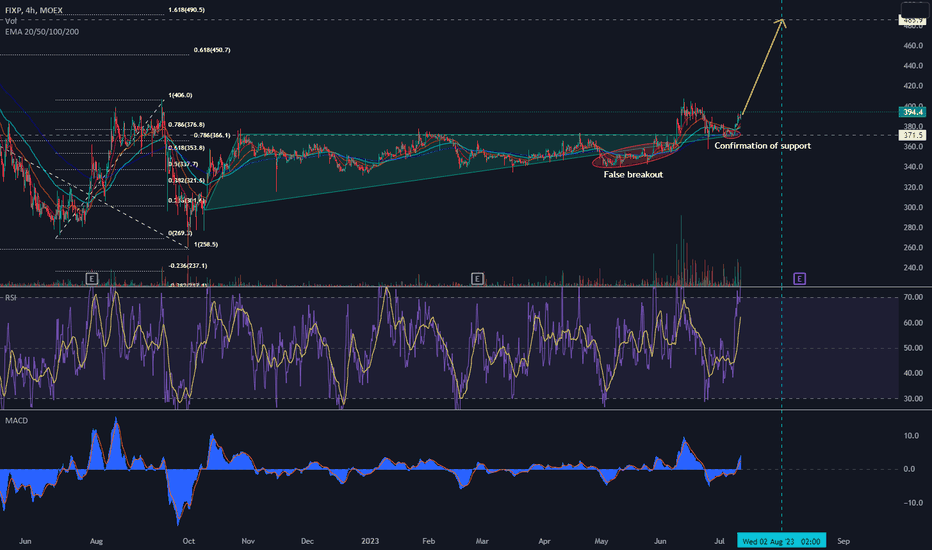

$FIXP is ready for a tripMOEX:FIXP is a popular retail company, which was moving down for a long time after staying a public company. This is a moment to start ascending trip to the moon.

First ste p is already near here.

Level 1 is about 480.

Does not constitute a recommendation.

#investing #stocks #idea #forecast #furoreggs

Please, subscribe and challenge my point of view )

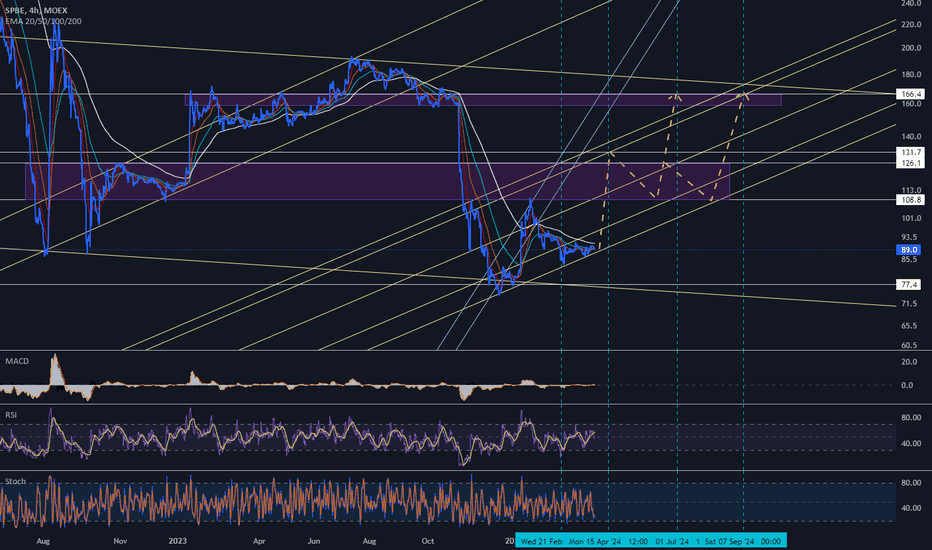

$SPBE has a huge potential for coming back to the fair priceI see that the recent MOEX:SPBE investors distrust slowly but surely returning to the expectations of the better future of this instrument. We are observing creation of the double bottom graph as well as of the baseline arrangement for the next two-steps raising moving.

Potential is to take about 40-50% in 1 month and about 100% during next 3-6 months (depends of scenario).

Does not constitute a recommendation.

#furoreggs #investing #stocks #shares #idea #forecast #trading #analysis

If you want to discuss, please subscribe and challenge this point of view )