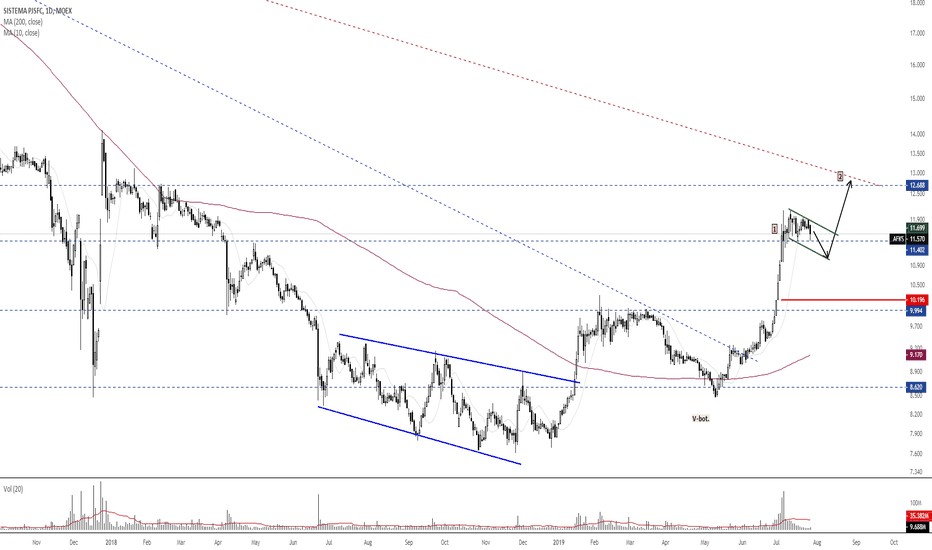

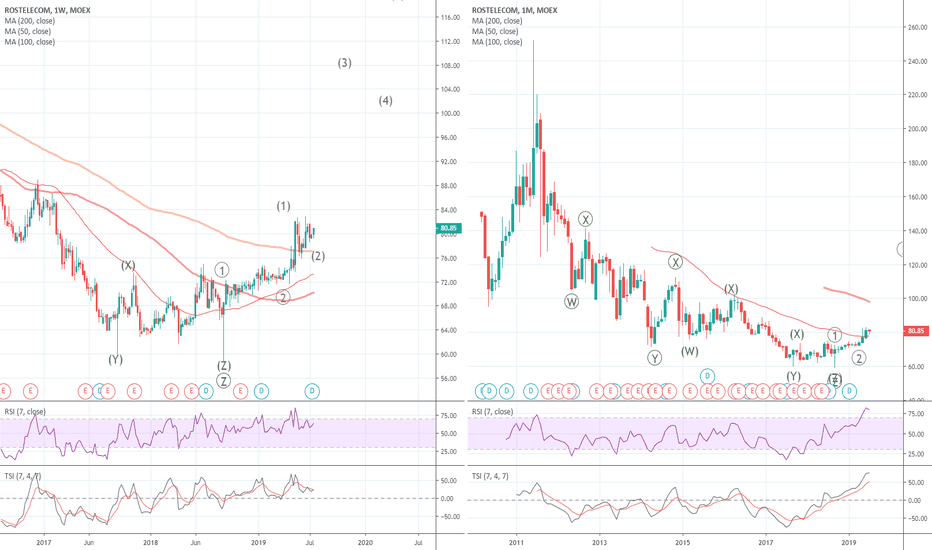

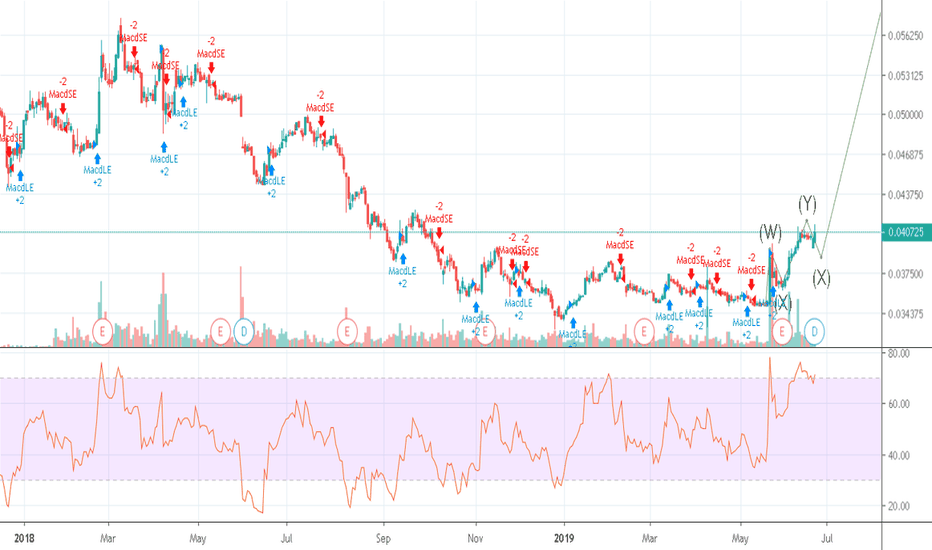

It feels like RTKM soon will explodeI read Stratfor this morning

'The Russian government has signed a number of agreements with several state-owned enterprises to distribute responsibilities for the development of a wide range of technologies. Under the new contracts, Russia's state-controlled Sberbank will be responsible for the development of AI technologies, Russian Railways will manage the development of quantum communications, Rosatom will manage the development of quantum computing as well as material sciences, Rostec will develop quantum sensors, and both Rostelecom and Rostec will head the development of Russia's 5G infrastructure. The budgets for these developments were not included in the contracts, but are expected to be released closer to fall.'

and went to see the chart. Indeed RTKM looks like it is going to the moon. I will allocate 10% of the portfolio to this stock.

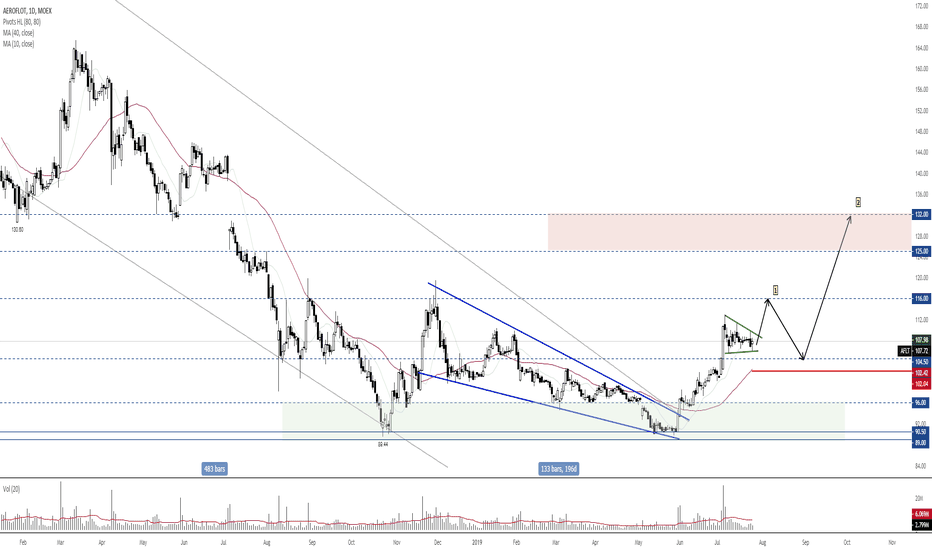

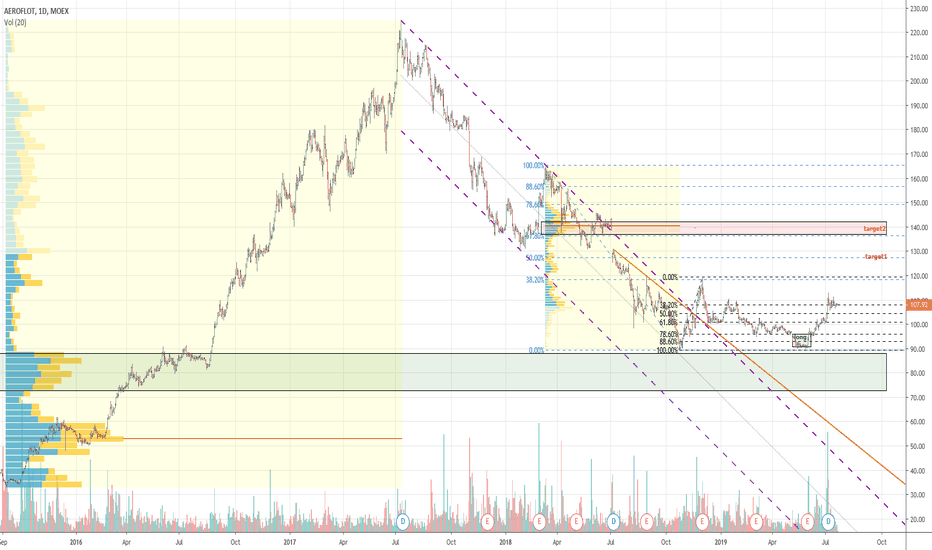

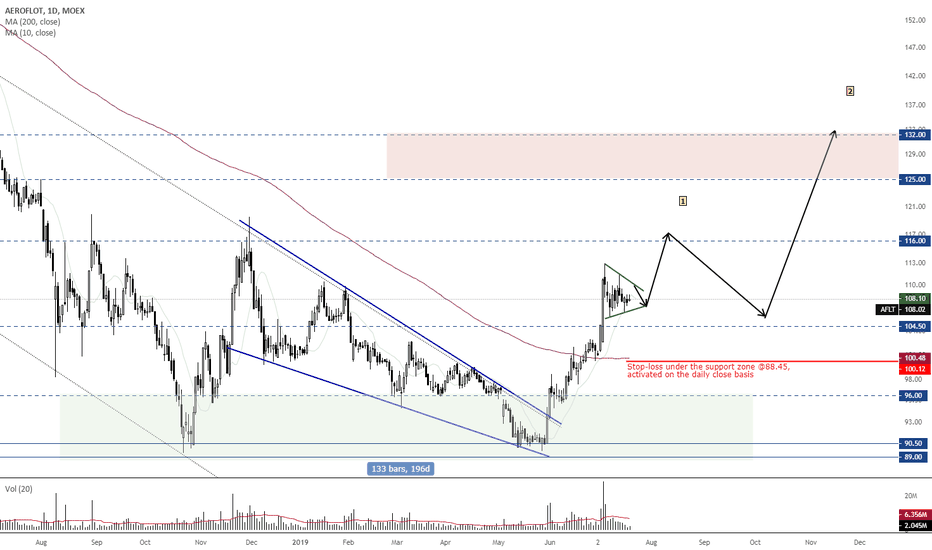

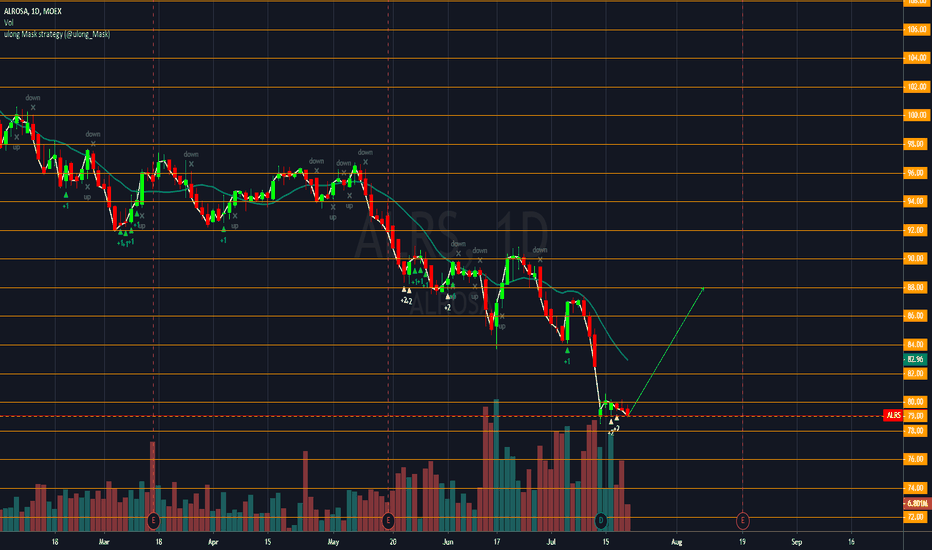

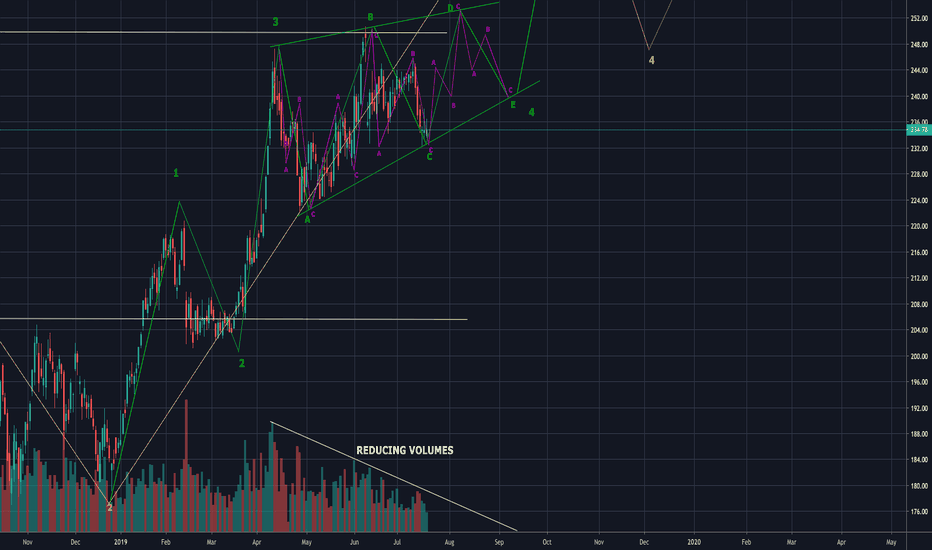

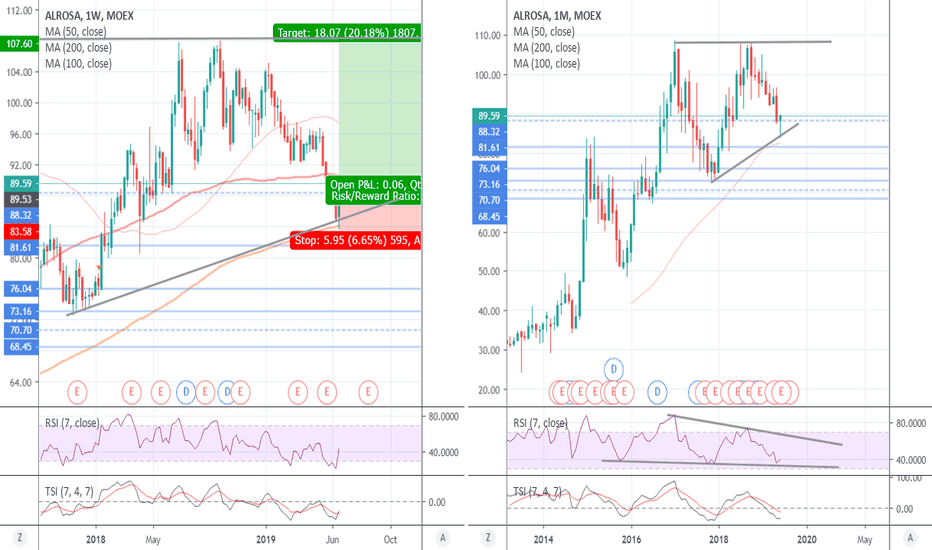

Buying dip in Alrosa #2020/7The week is far from being over and it is the middle of the month. So basing my trade on W and M charts are a bit premature. However, broad bullish sentiment that moved OANDA:SPX500USD , TVC:USOIL , OANDA:XCUUSD , OANDA:XAUUSD etc. make me conclude that MOEX:ALRS being a mining company is also moving to new highs or forming a bullish pennant.

Risk - 0,24% of my capital

TIme horizon: approx 6 months

Exit strategy: close 50% of the position at 107.6, move SL to 0 loss and wait for the pennant to confirm before adding

I will consider adding midway if there is welcoming price action.

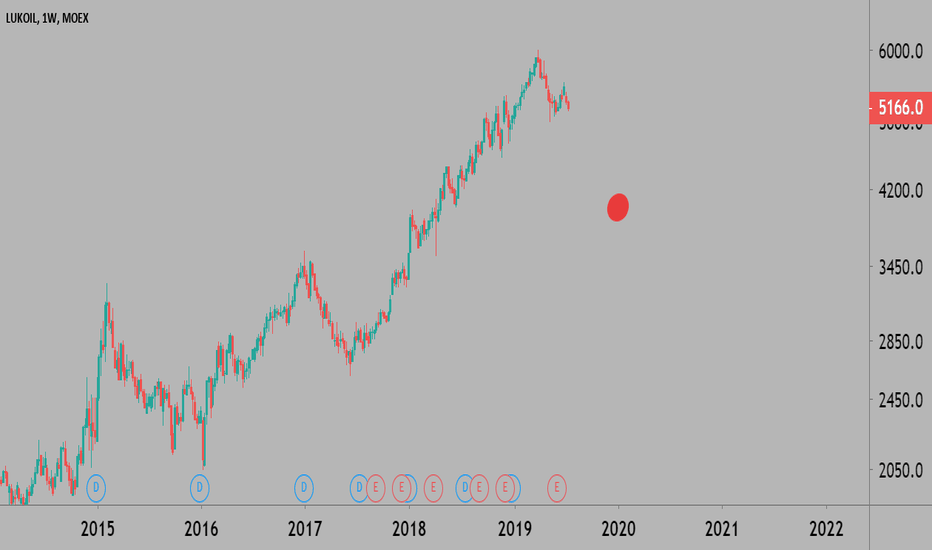

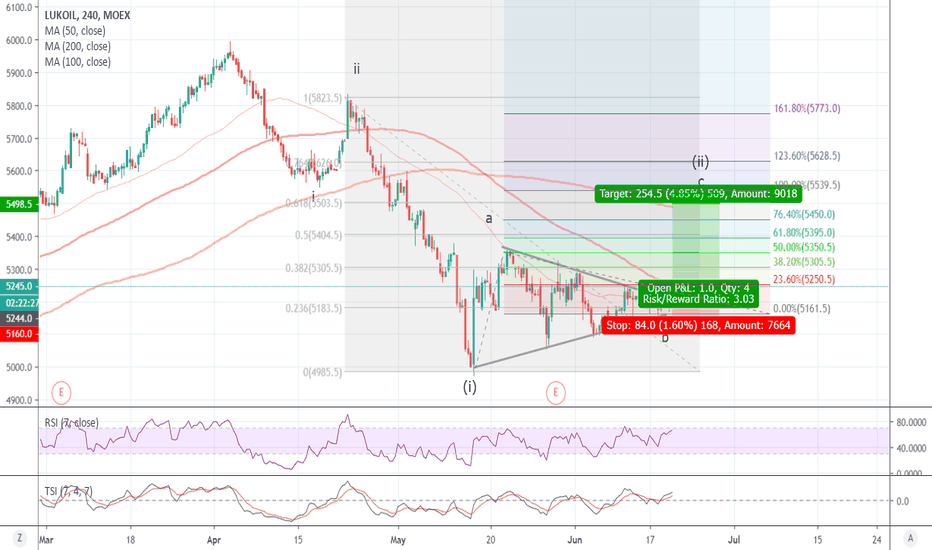

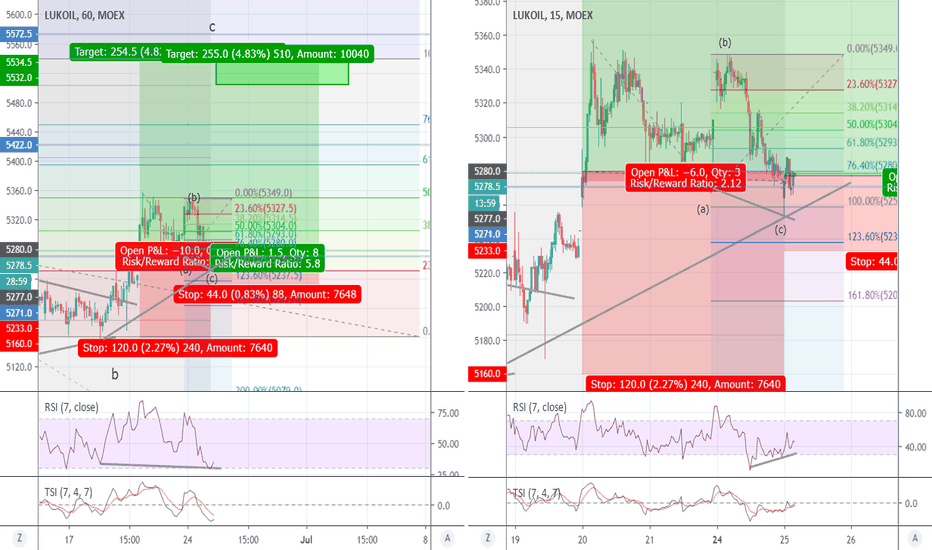

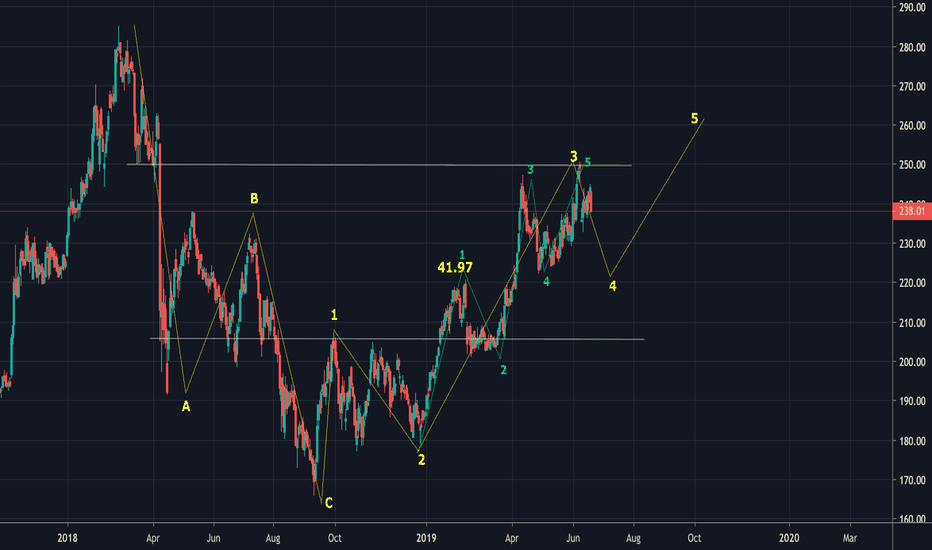

Flipping from short to long in LKOHI am closing my earlier trade with 0,08% (of total account) loss because price action on lower TM signalled that my analysis seems to be wrong.

Triangle is still worth a trade, so I reconsidered my count and opening trade in the opposite direction.

Position size: limited by the rule that holding of a single company should not exceed 5% of the total portfolio,

Risk on trade: 0,10% of the total account

Risk reward: 3.0

Exit strategy; close 100% at TP

Duration; 1 week. Daily monitoring.

Accelerating the LKOH trade 2020/8aI have noticed something that I think is ABC pattern which allows to effectively double the previous trade while keeping the same risk exposure.

ABC pattern is confirmed by divergence with indicators and by PA against support level on 1H chart.

Moving stops and doubling the position. Everything else is as per 2020/8 trade.

Risk reward has gone up to 5.8

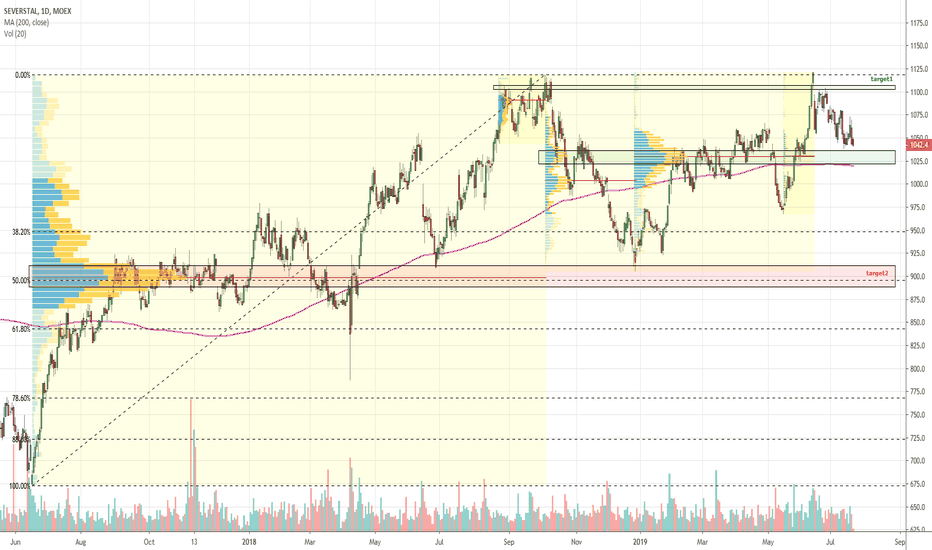

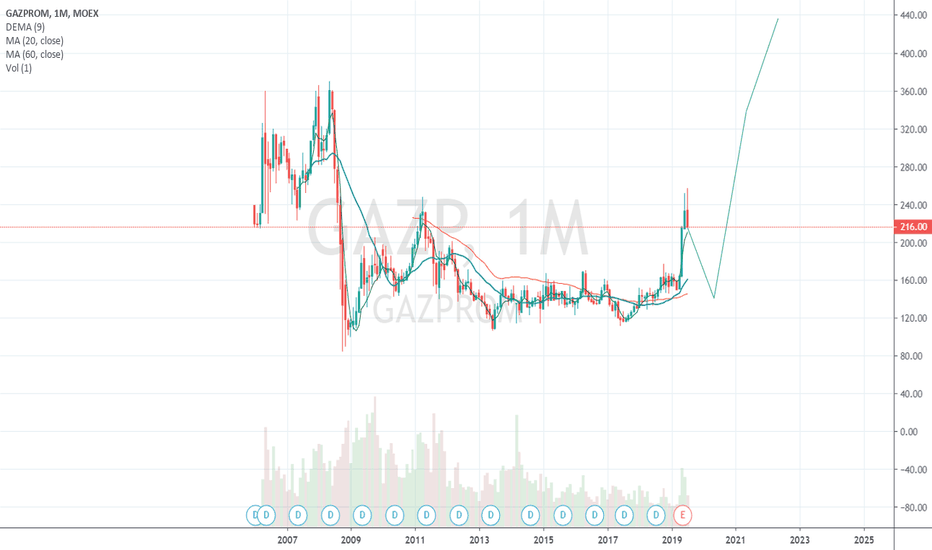

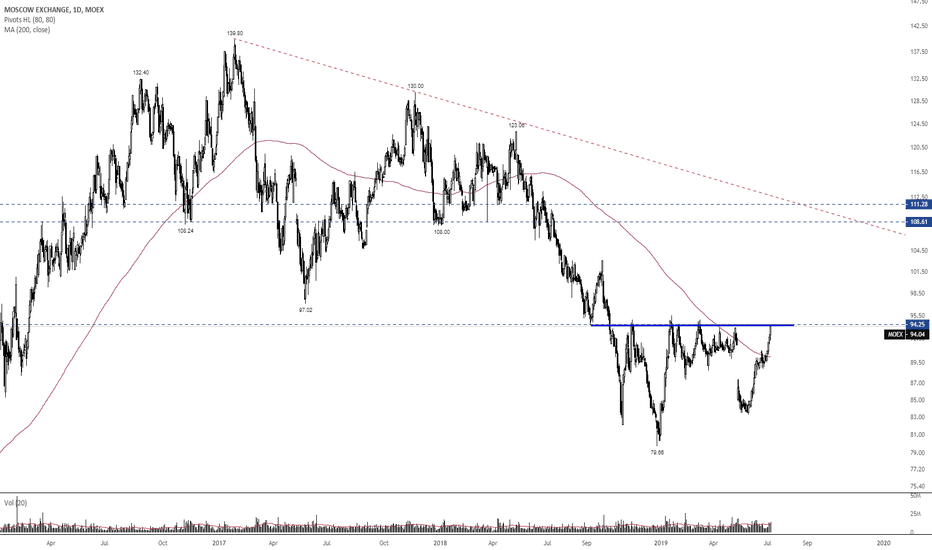

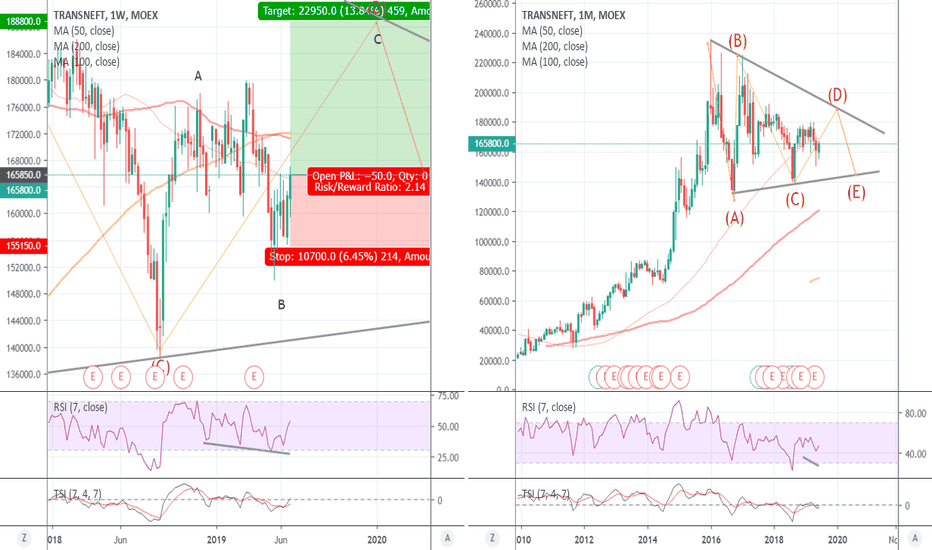

Transneft triangle Transnet is a monopoly and pays not bad dividends, is in good health and has a high net worth. It is state-owned. Could be a nice long-term stock to have.

It is a low risk / low return trade (RW ration is 2).

Risk exposure is slightly above my threshold 0,6% of total portfolio and company exposure is 7% (lots are expensive)

Trade horizon: until the end of the year (6 months)

Exit strategy: 100% at TP and then upon confirmative PA short the stock