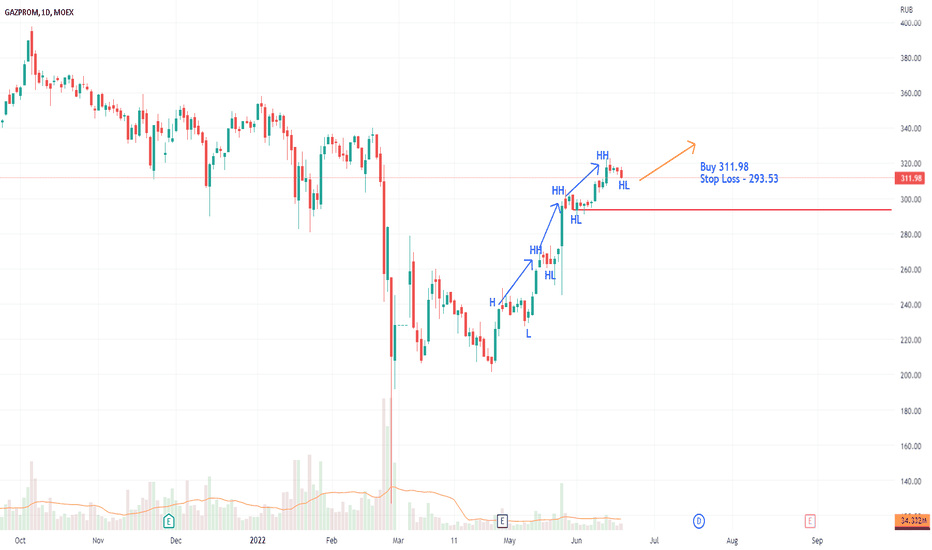

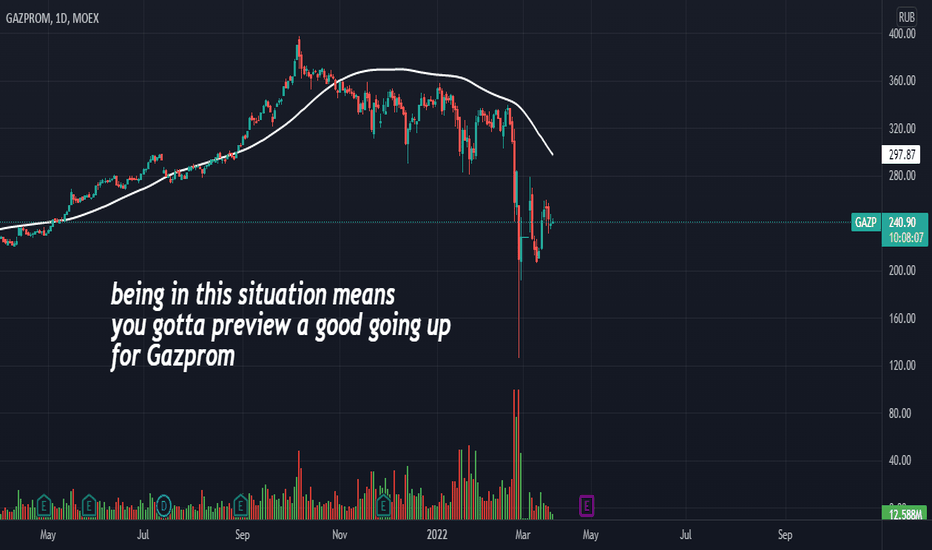

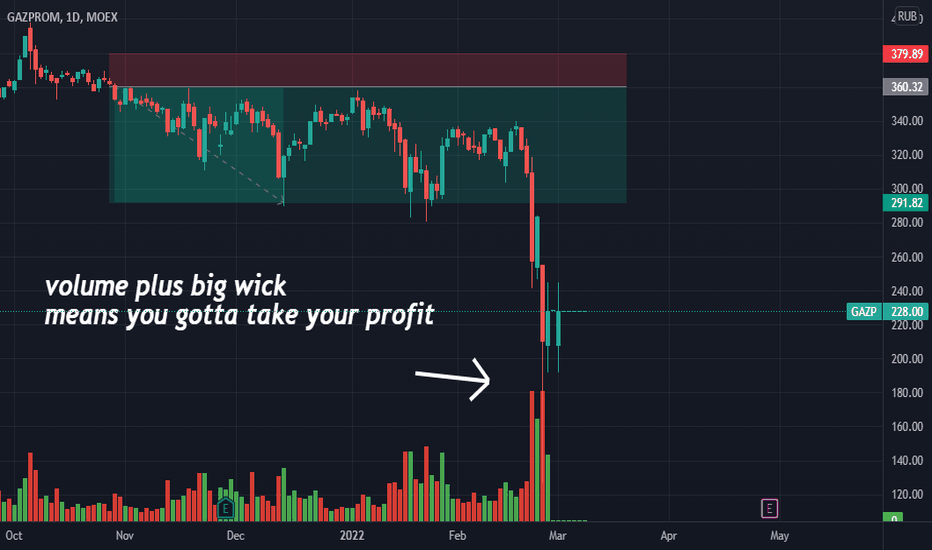

Russian Gas monopolist is facing it's downfall?☝️What happened?

After taking decision not to pay dividents this year, Gazprom stock dropped almost 40% in the moment.

☝️Why they didn't pay dividents?

Also, prices on gas soared up high, company still decided that it needs spare money in case of unpredictable future problems. There is a theory that one of such problems could be complete stop of gas supply to europe that russian government can take in the near future.

☝️What's next?

From technical point of view we formed triangle and as volatility gets lower, it more likely that we will break it down and fall more.

I want to remind you that currently Gazprom doesn't supply gas to Europe as they are completing planned technical services until 22.07.

I expect further fall to the closest strong level at 160.00

What do you think of this idea? What is your opinion? Share it in the comments📄🖌

If you like the idea, please give it a like. This is the best "Thank you!" for the author 😊

P.S. Always do your own analysis before a trade. Put a stop loss. Fix profit in parts. Withdraw profits in fiat and reward yourself and your loved ones

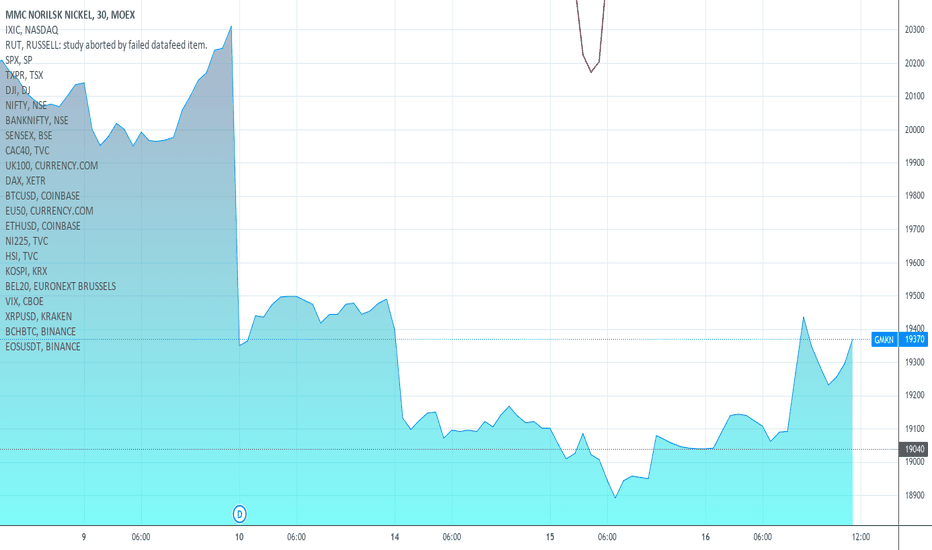

Nickel Commodity Europe Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

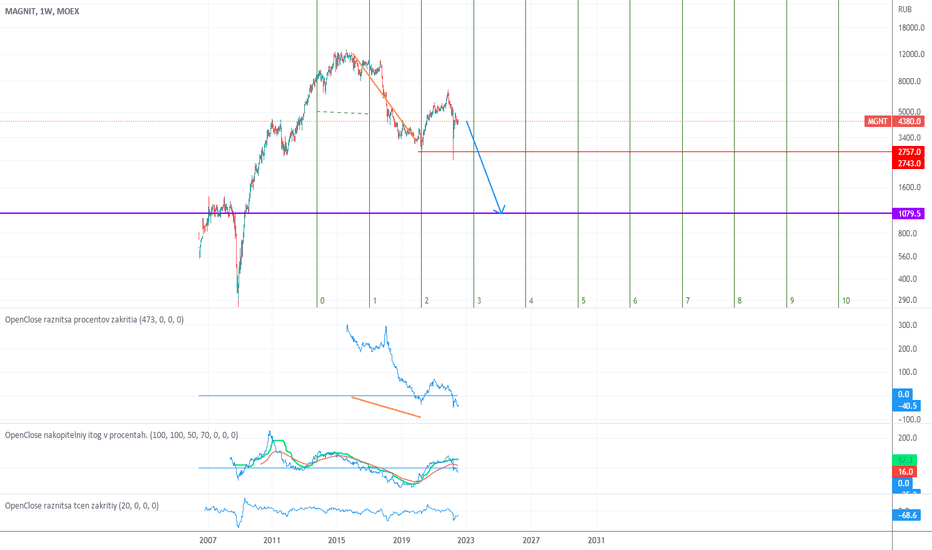

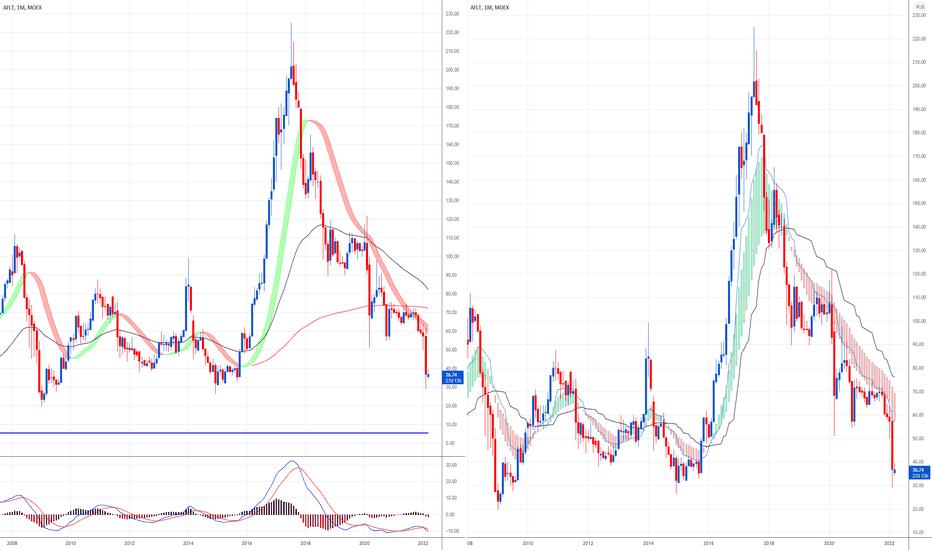

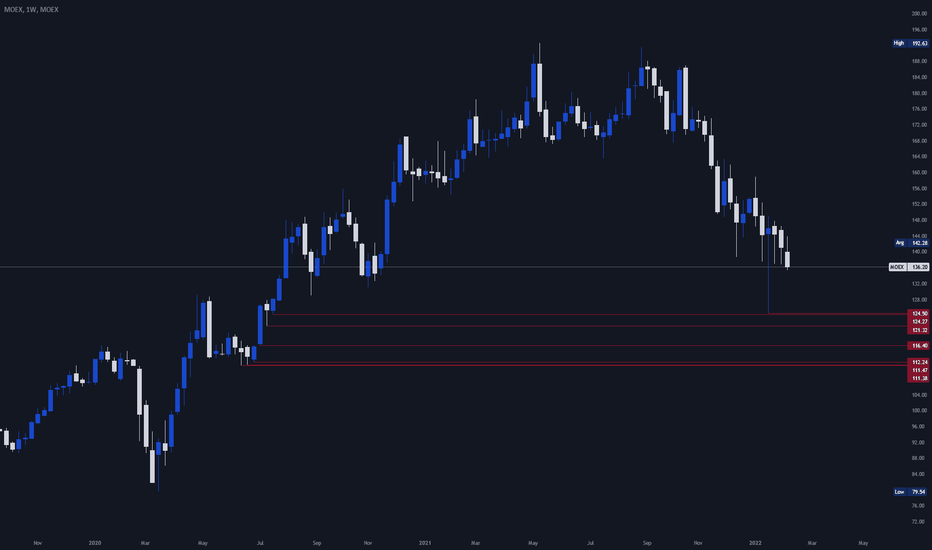

Russian stock continue to dipRussia Stock Market

Russian Stocks End Week 8% Lower

Technically speaking Russian stock has being in a down trend since the war as it continues to form lower highs and lower lows.

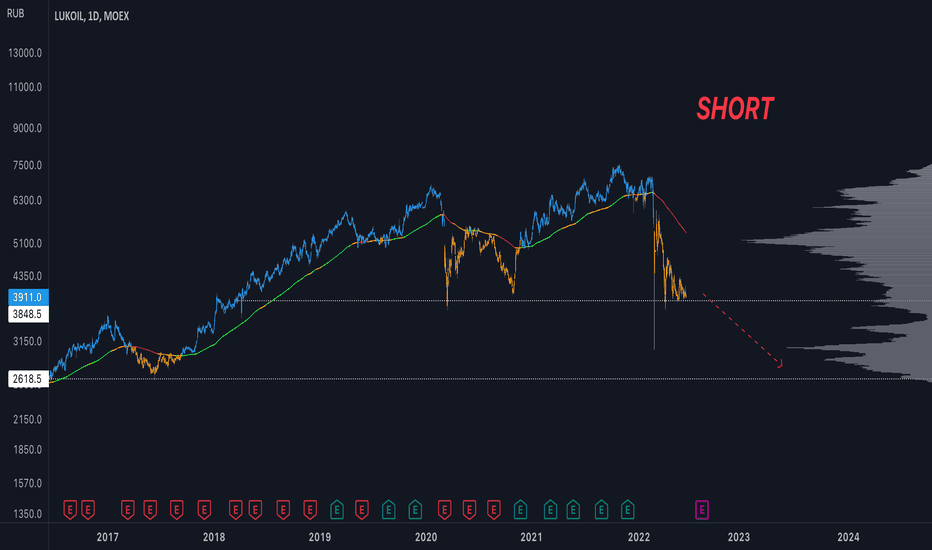

The MOEX Russian Index closed 1.7% down at 2,232 on Friday, extending the weekly loss to 8%, pressured by financial stocks as investors continue to monitor moves by the Central Bank of Russia ahead of their meeting next week. After stating that the Russian economy “will enter a period of structural transformation” in the 2nd and 3rd quarters, interpreted as signals of harsh economic contraction, CBR Governor Nabiullina signaled that the bank could slash rates further in its next decision. Risks of a sixth EU sanctions package pressured Sberbank to lose 1.4%. Lukoil declined 3.7%, closing the week 22% down, as European states seek alternative energy supplies while the EU Commission announced it was working on cost cutting measures to make a Russian oil embargo possible. Meanwhile, Novatek fell 2.9% after it announced it will not publish its operating results for Q1, citing the suspensions of depository receipts from international bourses and sanctions as reasons.

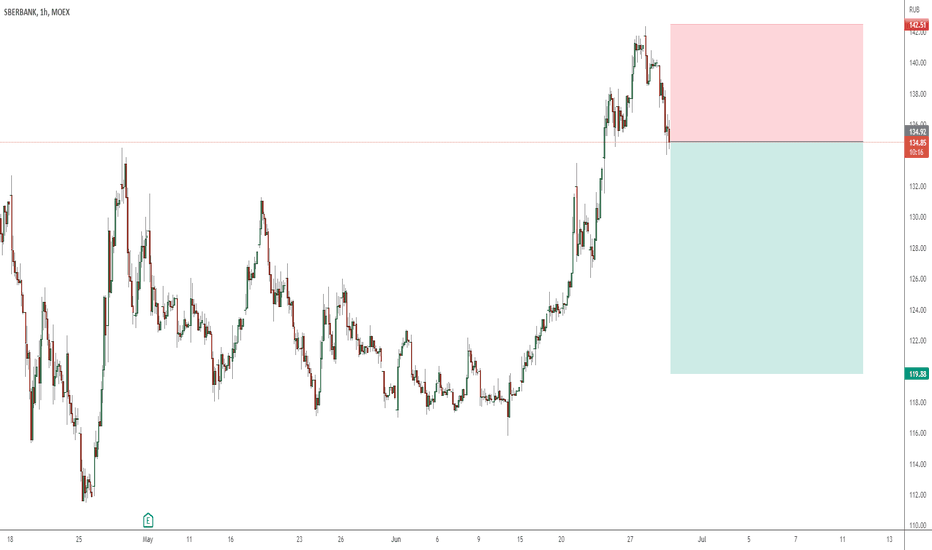

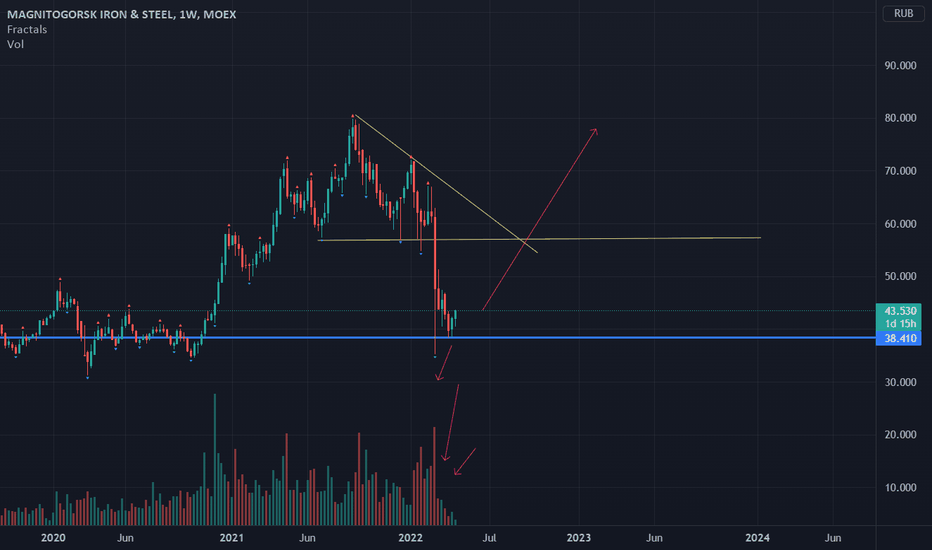

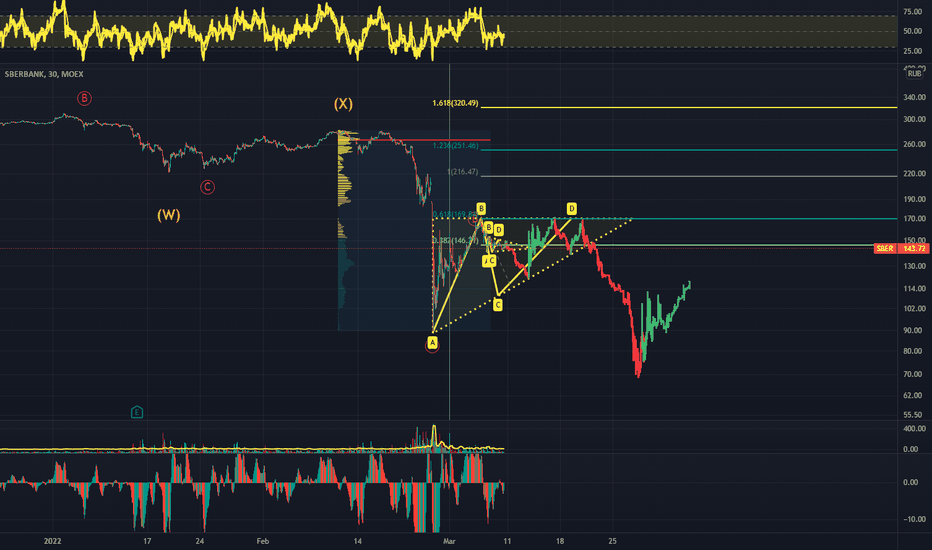

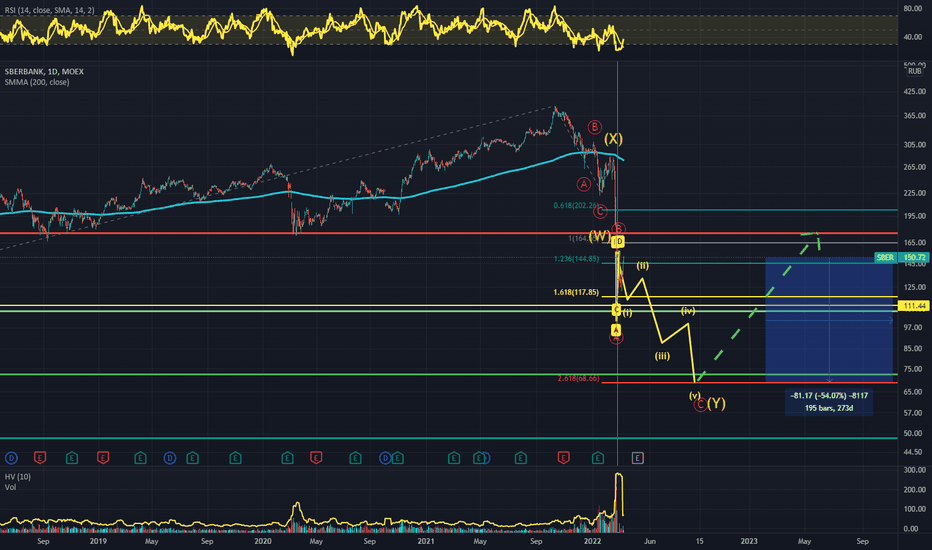

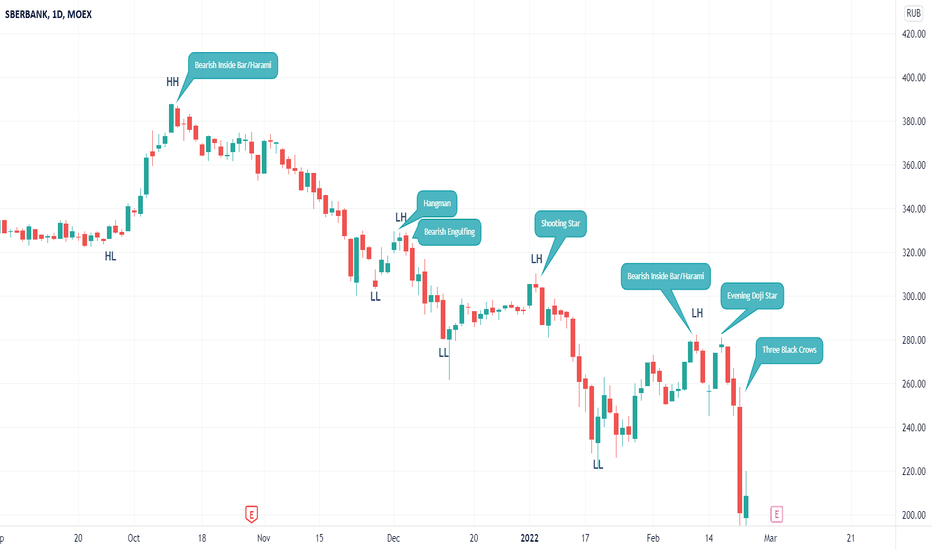

Why you can lose your investments on SBER So technically we have the same picture like Alibaba - WXY

PUSRPOSE IS 68 rub

WHY WILL WE HAVE SO TOUGH FALL:

1) Short position denial

2) non-residents have no ability to sell

3) WE HAVE 1 TRILLION FOR BUYING STOCKS AND WE STILL DIDN'T SEE THAT MONEY IN THE DEPTH OF MARKET( FNB doesn't want to buy at these levels )

4)Traders are not fools and they are gonna make a lot of limit positions i guess

Make a screen if i'm gonna be right don't tell me that i didn't warned you :)

- If like my analysis subscribe and make a comment bellow about that stock

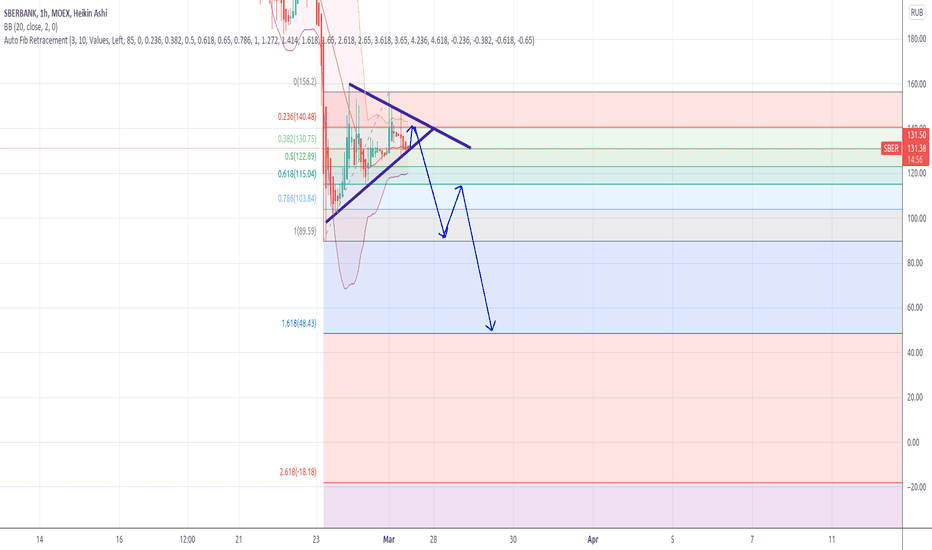

Symmetrical Triangle in Downtrend (Bearish) SBER In my opinion, there is a very small probability that the price will reach 140, but such a phenomenon is quite possible as a false breakdown. Classic textbook triangle. The price jump was caused by the purchase of the product by the Ministry of Finance of Russia, there is an assumption that interest in this instrument will fall.

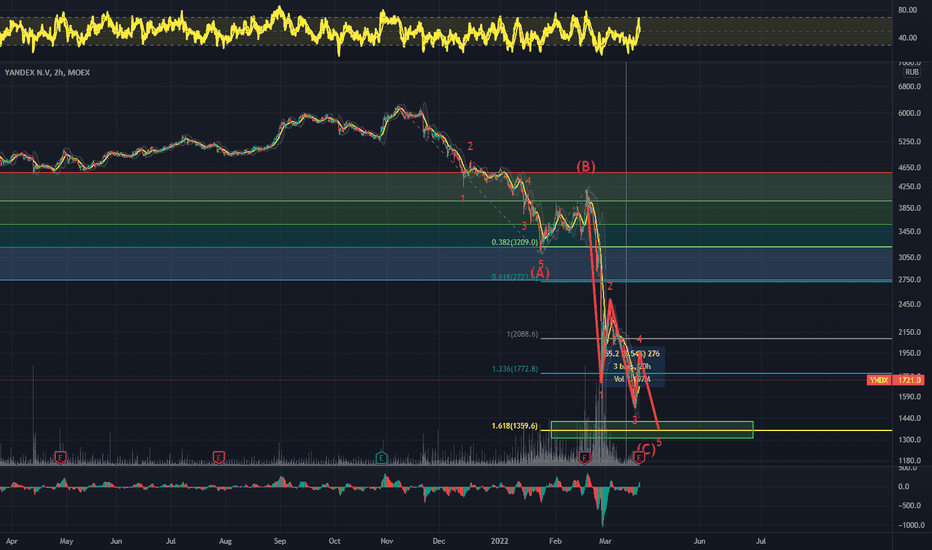

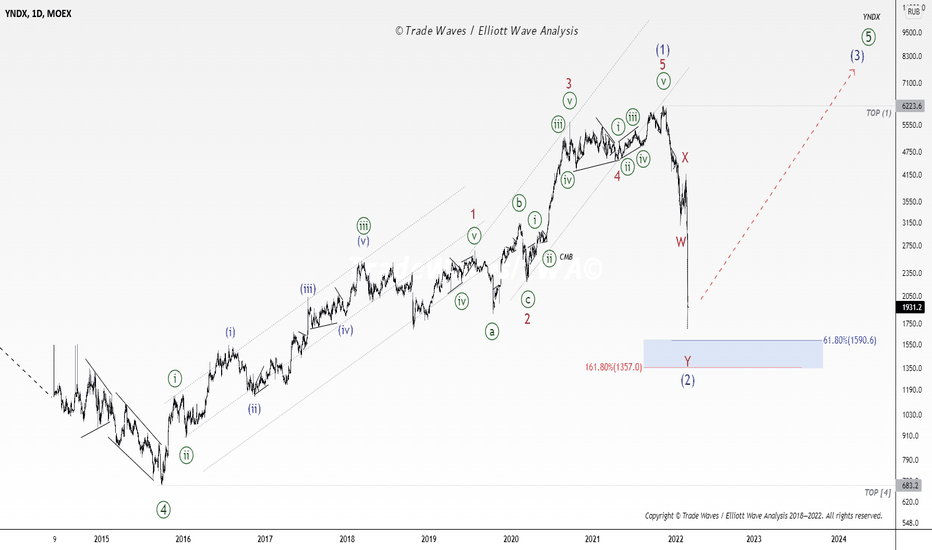

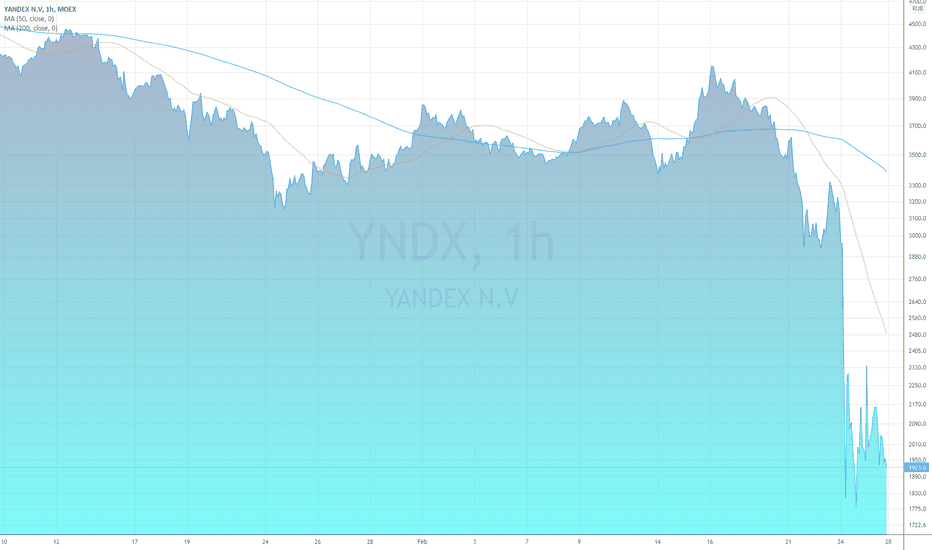

🧑🚀Yandex. Growth prospects.● YNDX: 🕐 1D

In the long term, Yandex shares may rise in price significantly, however, like most other securities of Russian issuers.

The counting of the wave structure on the daily interval encourages the adoption of a trading decision in favor of a long position.

_______________________________________

● YNDX: 🕐 2h

Perhaps the complication of ⓒ of Y of (2) to the ending diagonal with the achievement of the target zone indicated by the blue channel. A buy recommendation from my side will follow only if there are waves 1 - 2 as part of the expected intermediate wave (3) .

_______________________________________

Disclaimer:

— The owner of the TradeWaves-EWA © community is not responsible and has no direct or indirect obligations to the User/Customer in connection with any possible losses or financial damages related to any content of this community.

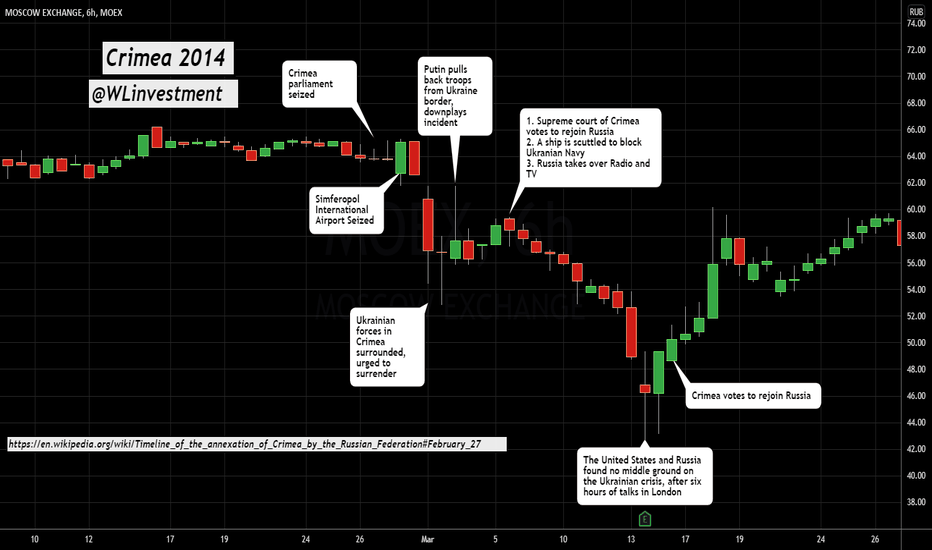

Crimea 2014 vs. TodayThis is an event based chart for context on the current Ukraine/Russia war. Crimea was certainly different but the comparison could be valuable. What I can gleen from this is markets bottomed when bilateral talks began. Whether Russia defaults or not remains to be seen (bond payment is due Mid March)

no World War 3 - better be long MOEXhi fellow traders,

since very long time that such a simple theme popped on my radar and it is so easy to lay down the reasoning.

all is based on a single geo-political fact, war world 3 to happen or not, if happens I assume that all stock markets will free fall, crash, and get demolished. including MOEX.

if world war 3 will not start, we have the MOEX as attractive long for the following reasons:

1- commodities rally of recent months to serve MOEX and the Russian Ruble very well, they are going to cash the commodities rush.

2- the Russian Ruble is heavily oversold, its handling by the Russian central bank is very healthy and offers great nominal carry reward, MOEX is quoted in Rubles.

3- if we get off the headlines of the "news" institutions/organizations, Russia is definitely a young tiger wishing to turn into a great tiger.

remember, central bank with positive real yields is strong signal for very healthy macro policy running the economy.

in case you are interested, I have list of specific listed companies that are on my buy and hold list, the investment theme includes calculation made for future dividends and in general it is a theme for the next 3-10 years with clear targets for scale-out / scale-in activities during the journey every 8/21 weeks cycle depends on each specific listed stock within the theme. for that you need to contact me directly.

so, risk is world war 3 and reward is best available investment in a currency and stock index directly exposed to commodities bull/boom/flight cycle.

the ideas are mine, the decision is yours!

good luck