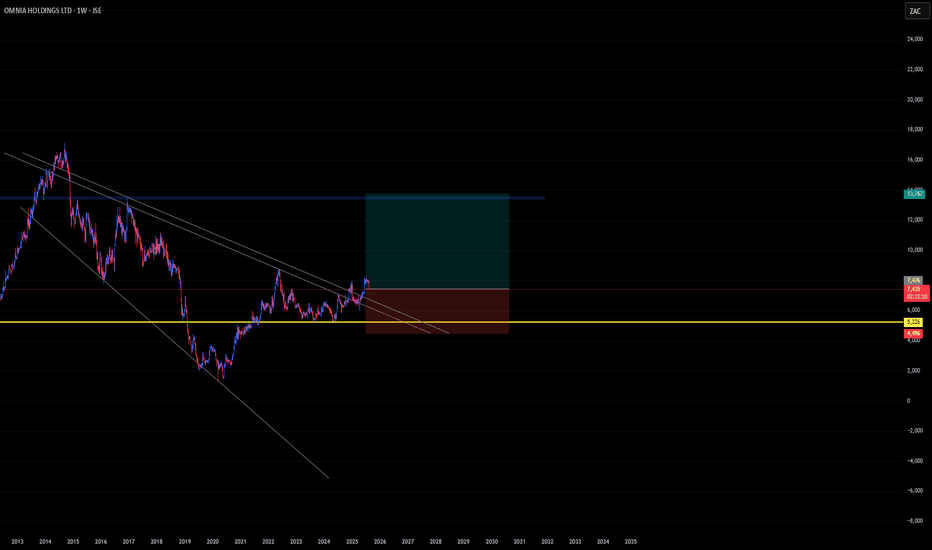

OMN Long Term Long PositionJSE:OMN had an increase in its revenue & earnings figure by 3% and 1%, respectively. Whilst maintaining a steady operating profit at +/- R1,700m. Despite being in a dispute with the taxman and the experiencing a deterioration in the chemicals sector, the improvement may be a result of geographical expansion in offshore operations and diversification into mining.

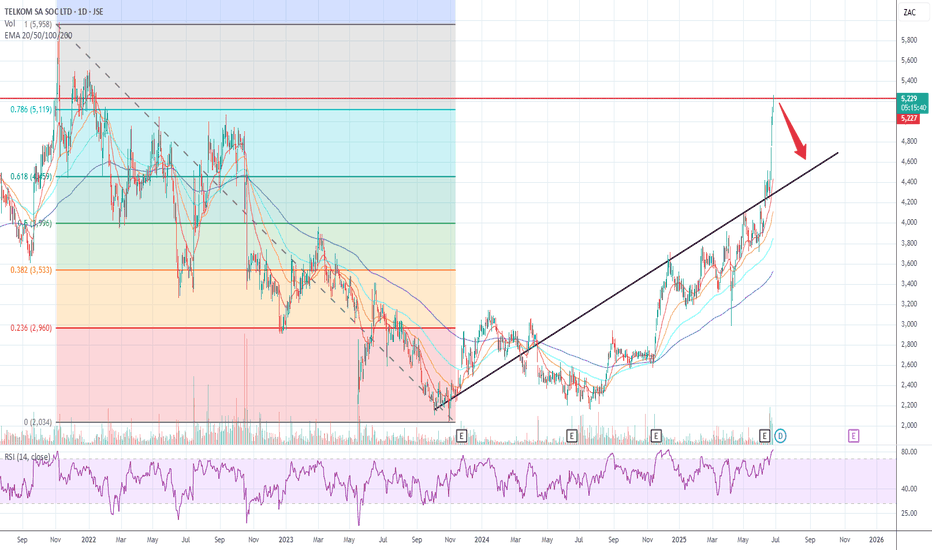

Evidently as we can see on the chart, the stock has been recovering and creating HH since the brink of COVID. Price was supported at 5200 ZAC and broke through our resisting trendline, which then signals a possible bullish move.

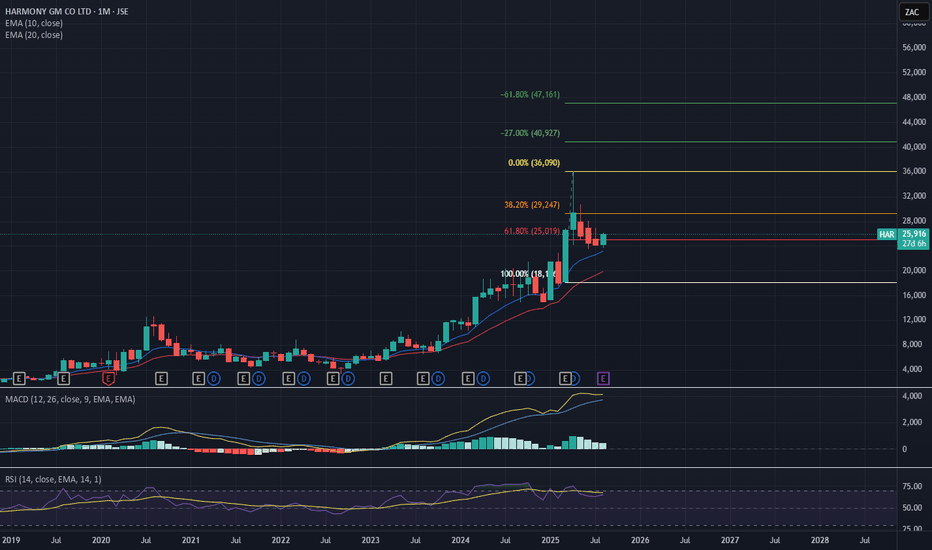

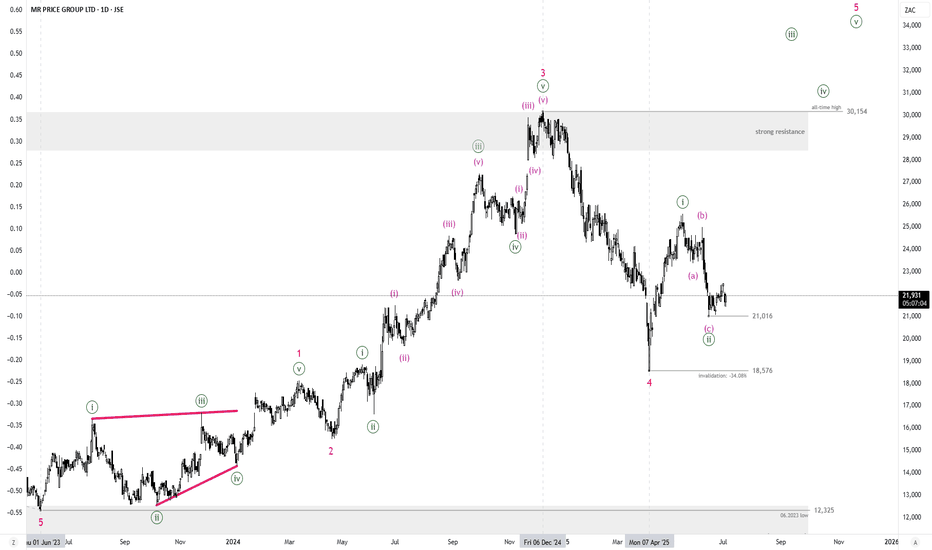

STRONG BUY | HARMONY GOLDStrategy: Impulse Correction

Direction: Bullish

Moving Average: Blue above Red

Fib Retracement: 61.80% reached

MACD > 0

1st Target = 36,000

2nd Target = 40,927

3rd Target = 47,161

Lots: Can't trade on Meta, but hold 75 of the stock.

RISK: Tariff Wars continue to hamper global growth as supply chains feel the brunt of the disruption.

Trade 3/20

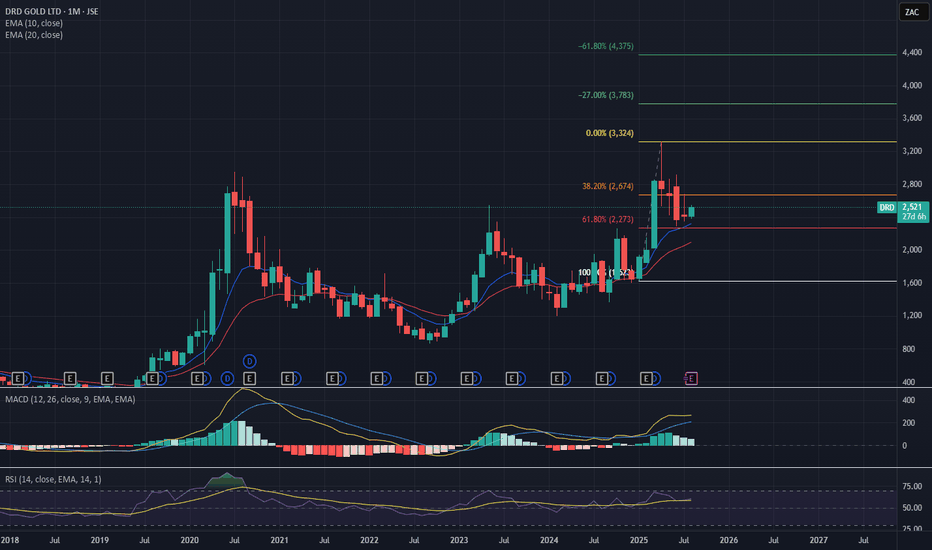

STRONG BUY | DRD Strategy: Impulse Correction

Direction: Bullish

Moving Average: Blue above Red

Fib Retracement: 38.2 reached

MACD > 0

1st Target = 3324

2nd Target = 3783

3rd Target = 4375

Lots: Can't trade on Meta, but hold 5000 of the stock.

RISK: Tariff Wars continue to hamper global growth as supply chains feel the brunt of the disruption.

Trade 2/20

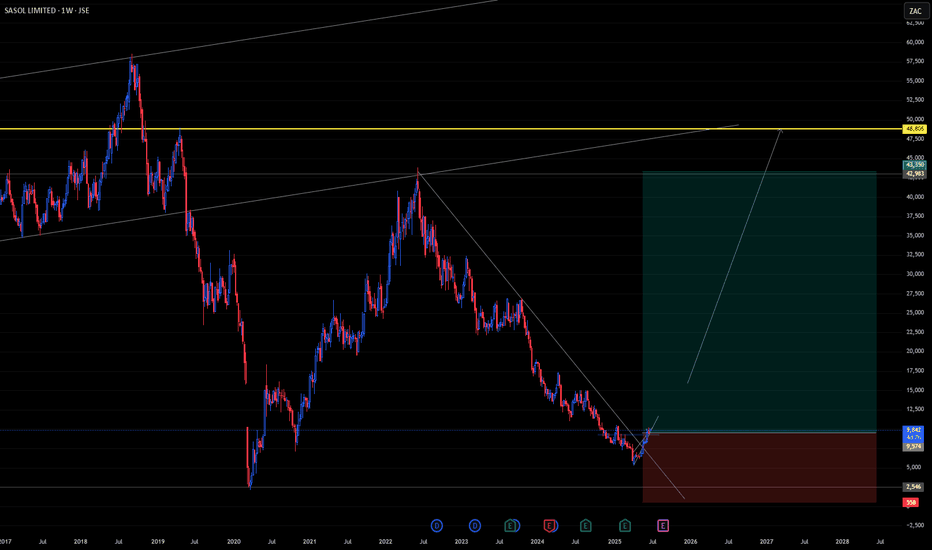

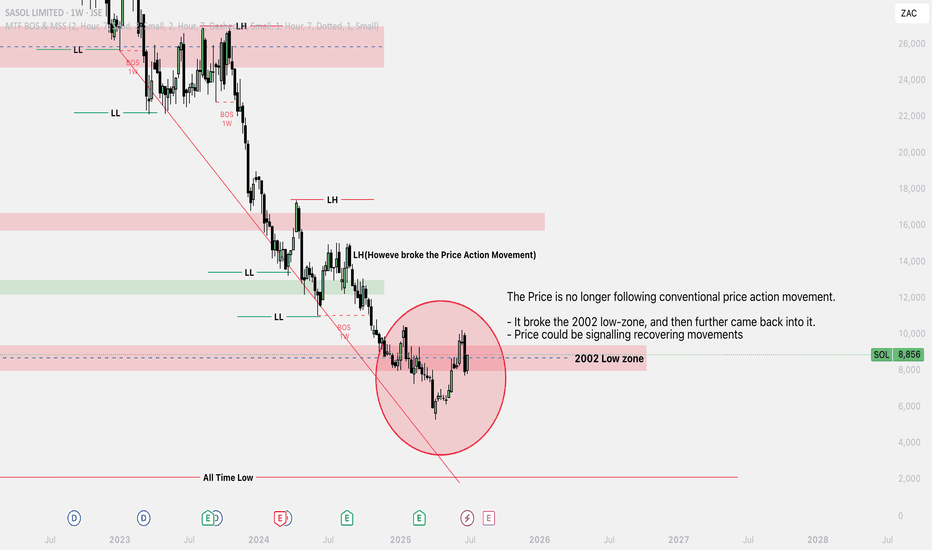

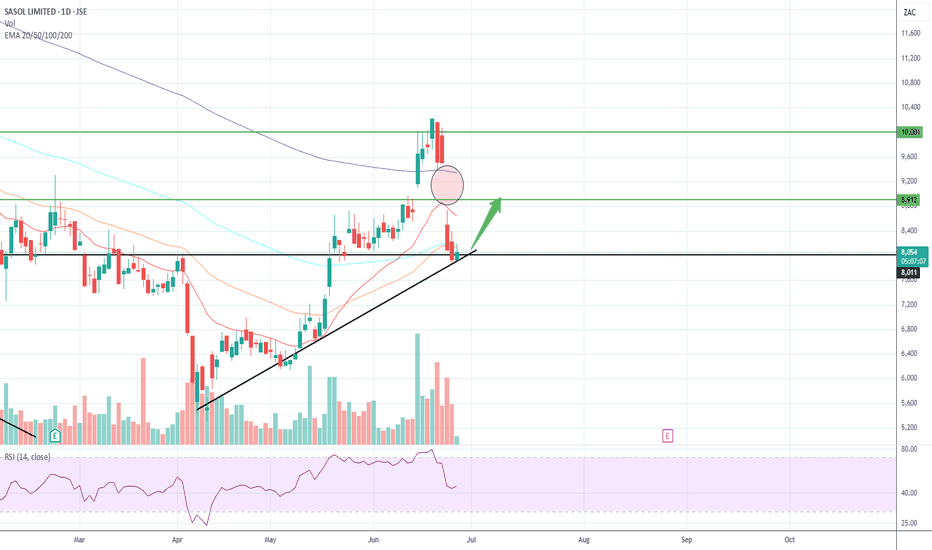

SOL Long Term Long PositionJSE:SOL credit rating has been stamped with a Ba1 by Moody's which is very unfavourable to the company, wholistically. This is as a result of its weakening operating performance mainly attributed to low demand in the chemicals market and weak oil prices.

With expectations of higher FX:USOIL prices and JSE:SOL being pretty much undervalued, trading near its supporting level of 8600 ZAC, a positive outlook is still evident. Long positions have been executed at 9574 ZAC with a possibility to further capitalize when necessary.

Cite: Sasol outlook downgraded to negative by Moody's Ratings, Ba1 rating affirmed - Luke Juricic

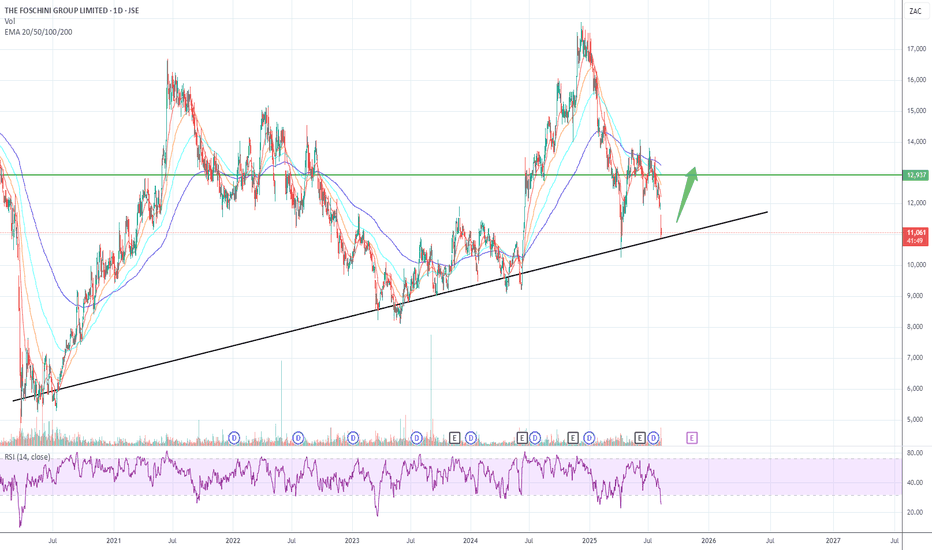

I am expecting a bullish runFrom 2022 to mid 2024 around July we had a bearish run we kept maintaining bearish order flow. Until we had order flow disruption to the upside which is the first indication of the bulls taking control and second confirmation was the unwillingness to the downside followed by bullish break of structure (continuation) I will be looking to take long positions..... This will be interesting price action

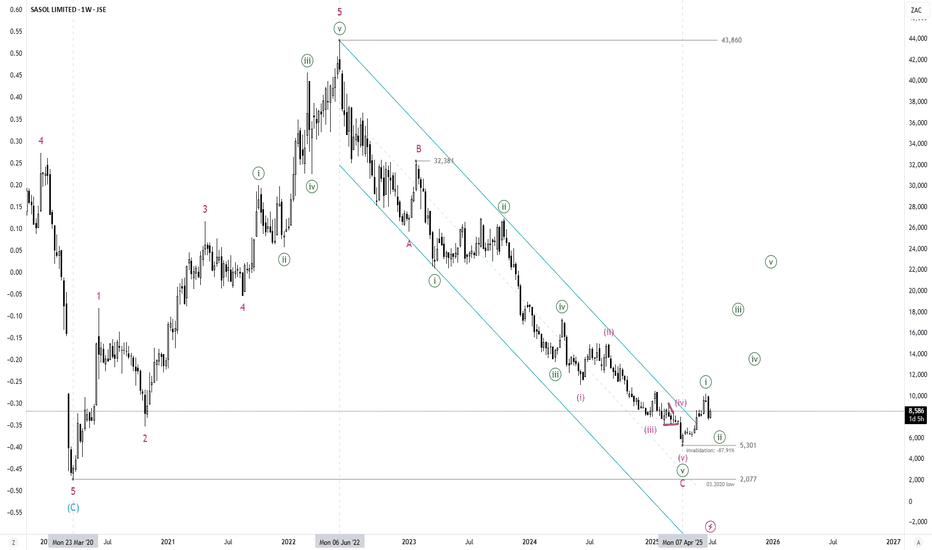

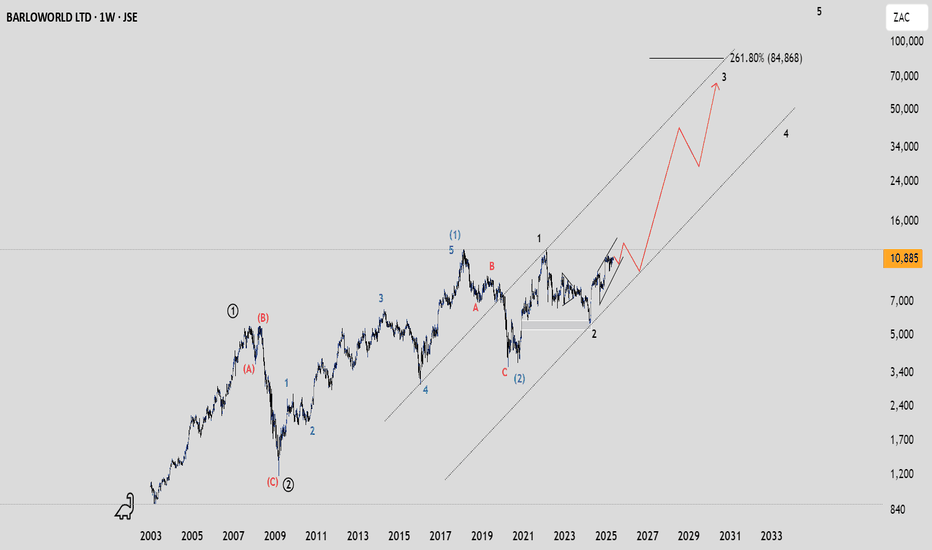

$JSESOL - Sasol: 5301 cps The Key Level To WatchTrade summary:

The major correction from 43860 cps has seen the share price decline by 87.91%.

The decline traced out a zigzag pattern and has potentially bottomed at 5301 cps, which is the key invalidation level.

The bounce from 5301 can be labelled as a five-wave advance when looked at in the daily timeframe.

Any retracement must hold above 5301 cps for the bullish outlook to remain valid.

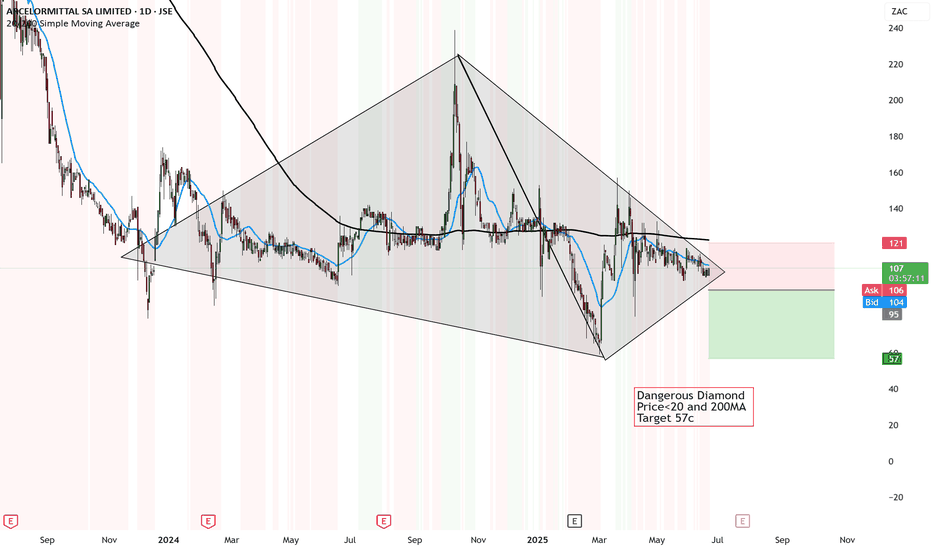

DANGER Diamond for ArcelorMittal to 57 cents?Dangerous Diamond has been forming since 2024.

What happens is there is indecisiveness between the buyers and sellers.

And because the prior trend is down, means there is a strong incline of downside to come when it BREAKS below the diamond.

Price<20 and 200MA

Target 57c

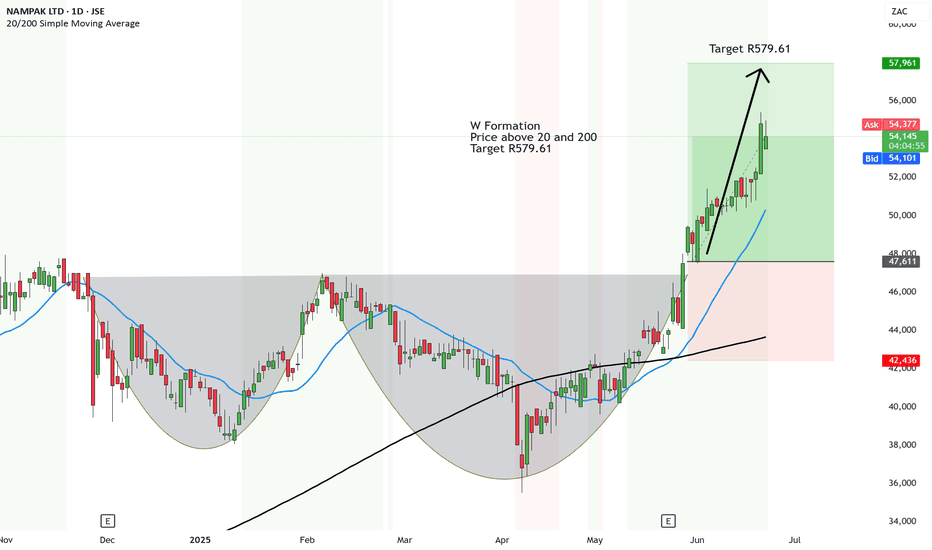

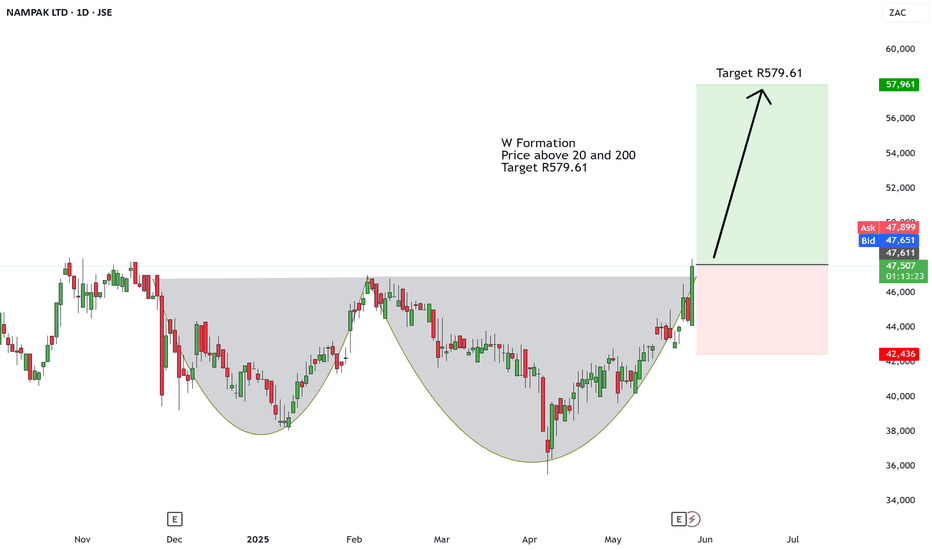

Nampak target still on the way to R579.61W Formation price broke above and has shown strong signs to upside.

Price above 20 and 200MA and the momentum seems to be on par with upside.

Target to R579.61 remains.

It seems to be one of the hedges while the markets are in turmoil with potential World War 3 action between Israel, Iran and possibly the UK and Russia soon.

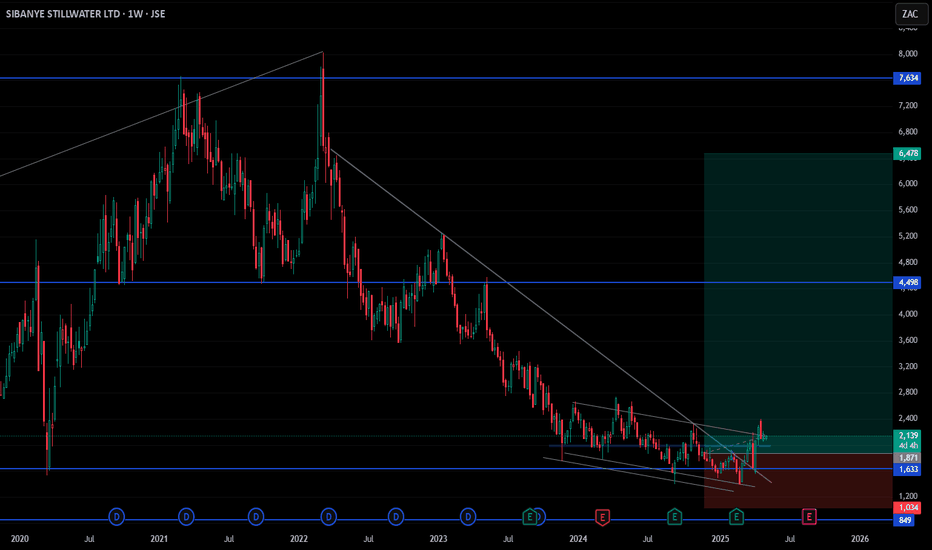

SSW Long Term Long PositionThe South African JSE stock has been gradually degrading for the past 3-4 years. It has reached support level 1633 ZAC which was last tapped in 2020. There is a possibility that it might drop even lower but we are in the mid trough or end of its depressing stage of its cycle before recovery commences . Overall JSE:SSW is a good pick for long term investing.

Nampak is packing great upside to R561It's been the underdog for a while now.

WHich the price just moving sideways since late 2024.

But now it's had a major breakout to the upside.

What's causing it, I'm not sure but we can suspect a few things.

1. Debt Restructuring Complete

Nampak finalized its debt renegotiation, easing investor fears of default.

2. Improved Cash Flow

Asset sales and cost cuts have strengthened free cash flow.

3. Packaging Demand Rebound

Recovery in the FMCG and beverage sectors boosts demand for cans and packaging.

4. Undervalued Stock

The share trades well below book value, attracting value investors.

And the technicals look great.

W Formation

Price above 20 and 200

Target R579.61

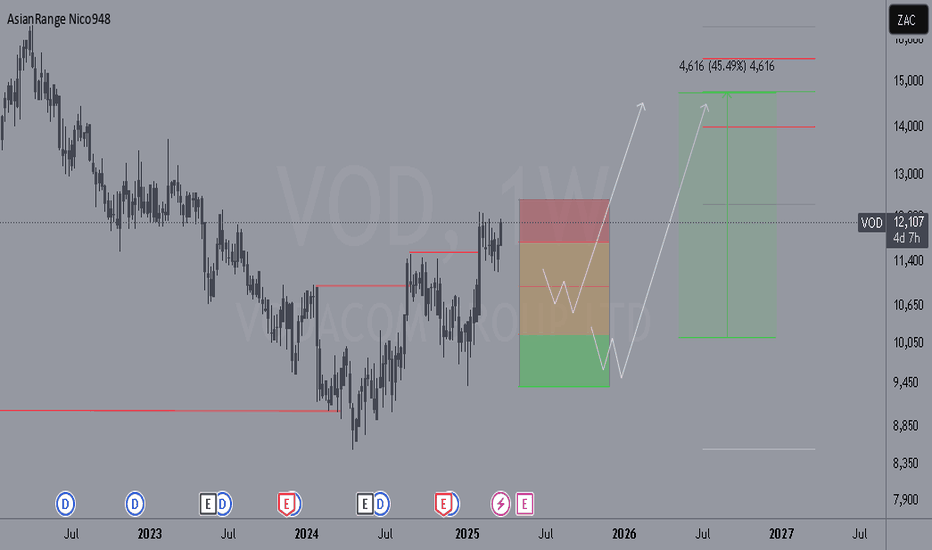

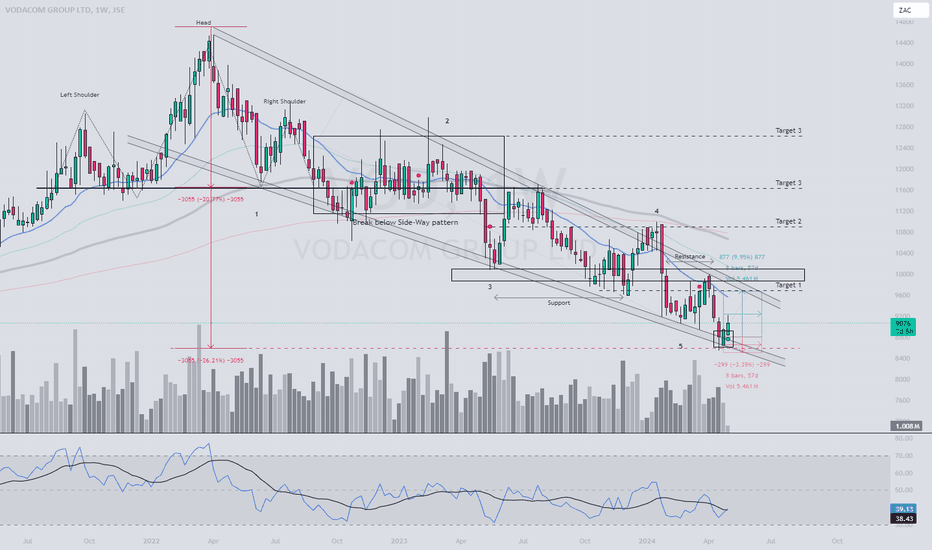

VODACOM GROUP (VOD)They are down nearly 40% since its peak in March 2022. This pullback mirrors similar trends observed in other South African Inc stocks. Currently, the share price has retreated to the lower trend line that has been established since 2022, finding support at R86.50. This pullback may potentially position the stock for a rebound.

Our Entry: R88.00

There are some concerns to consider:

- Upcoming earnings around the 13th of May

- Elections scheduled for the 29th of May

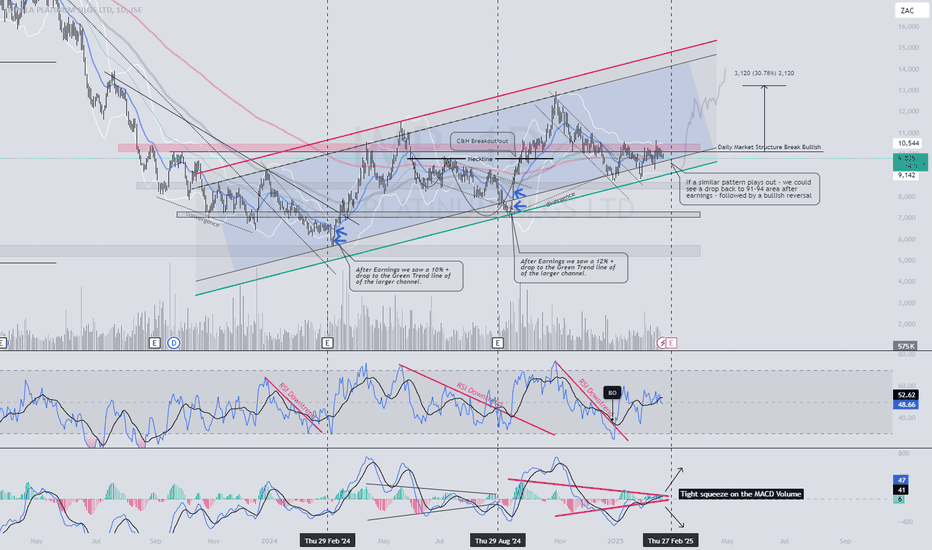

IMPALA PLATINUM (IMP)It looks like IMP (JSE) is at a decision point.

Previous Earnings Pattern: In Feb & Aug 2024, the stock dropped 10-12% post-earnings, continuing the downtrend before hitting the bottom trend line (green), which acted as a strong support and reversal zone (blue arrows).

Current Setup: MACD is tightening into a squeeze, sitting in a bottleneck, gearing up for a breakout either way—not clear yet.

What I’m Watching: If it follows the same pattern, we could see another drop to the bottom trend line before any reaction. If it breaks below, the downtrend could extend. If it holds, history suggests a bounce.

Right now, just waiting for confirmation—need to see how price reacts before making a call.

Note:

Platinum Market Overview

The platinum market is projected to record its third consecutive annual deficit this year, with demand outpacing supply.

Impala Platinum Holdings Limited (Implats) Update

Implats is scheduled to release its Interim Financial Results for the six months ended December 31, 2024, on February 27, 2025.

Given the anticipated market deficit and sustained demand from the automotive sector, the platinum market may experience upward price pressure. However, Implats' operational challenges and the broader industry's cautious outlook on new mining projects is likely to influence the company's performance.

Our opinion on the current state of THARISA(THA)Tharisa (THA) is a mining company that mines and beneficiates platinum group metals (PGMs) and chrome. The company is listed in London and on the JSE. The Tharisa mine on the south-west limb of the Bushveld Igneous Complex (BIC) is an open pit operation with an estimated life of 17 years.

The company owns a subsidiary, Arxo Metals, which beneficiates chrome to produce high-grade chrome concentrates. The company is planning to expand into the Great Dyke area of Zimbabwe.

In our view, this is one of the best mining investments on the JSE with a cost of production which is well below current metals prices and some good options for expansion. The company has been involved in the Vulcan Plant which will improve chrome recovery to 82% from 65% and cost $54,2m. The target is to reach 200 000 ounces of PGM's (platinum group metals) and 2m tons of chrome ore production using a proprietary technology. The open pit operation is relatively low cost and does not have the problems associated with underground operations.

The company is planning to build a 5MW furnace that will enable it to produce iron alloys which are rich in platinum group metals and would sell for a far better price.

On 27th March 2023 the company announced that it had raised $130m (about R2,3bn) in finance from ABSA and Soc Gen.

In its results for the year to 30th September 2024 the company reported PGM production up 0,3% and chrome production up 7,6%. Revenue was up 11% and headline earnings per share (HEPS) was down by 0,7%. The company said, "Other operating expenses increased by 15.9% to US$66.6 million (2023: US$57.4 million). The largest cost component of other operating expenses was employee related expenses of US$33.7 million which contributed 50.7% to total other operating expenses. EBITDA totalled US$177.6 million (2023: US$136.8 million), a 29.8% increase primarily due to the strengthening of chrome prices and despite the decrease in the PGM basket price."

In a production report for the first quarter to 31st December 2024 the company reported PGM production of 29,9koz – down from 37,1koz in the previous quarter. The company said, "PGM prices averaging at US$1 381/oz for the quarter (Q4 FY2024: US$1 370/oz) – Average metallurgical grade chrome concentrate prices at US$271/t for the quarter (Q4 FY2024: US$314/t) – Group cash on hand of US$175.1 million (30 September 2024: US$217.7 million), and debt of US$86.1 million (30 September 2024: US$108.8 million)".

In a production update for the second quarter to 31st March 2025 the company reported PGM production of 31,5koz up from 29,9koz and chrome production of 381 kilotons up from 374,4 in the previous quarter. The company said, "A solid quarter dampened by unprecedented rainfall and weather interruptions, which necessitated higher than budgeted in pit evacuations in line with safety protocols and thus affected mining mix and volumes."

Technically, the share is well traded with over R200 000 worth of shares changing hands on average each day. The share has been falling since July 2024 due to declining commodity prices.

The share remains a risky commodity counter dependent on the international prices of the commodities which it produces.