Our opinion on the current state of ARCINVEST(AIL)African Rainbow Capital (AIL) is a BEE investment company that was formed in 2015 and listed on the JSE in September 2017. Since its inception, AIL has invested in more than forty listed and unlisted investments in a wide range of industries, from telecommunications to mining, construction, energy, property, agriculture, insurance, asset management, and banking.

ARC Investments is 44.4% effectively owned by African Rainbow Capital Proprietary Limited (ARC), which in turn is 100% owned by Ubuntu-Booth Investments Proprietary Limited (UBI). UBI effectively owns 51.2% of ARC Investments. AIL is thus owned through Ubuntu-Botha Investments by the Motsepe family through their trusts. In the South African context, it has a significant advantage in finding suitable companies in which to invest because it can offer them a solid, reliable BEE shareholder.

AIL has benefited from an investment by Sanlam and owns a stake in the Sanlam subsidiary, Santam. The company acquired 100% of TymeDigital, which has launched a digital bank in partnership with Pick 'n Pay. It offers digital banking, especially for those who cannot afford normal banking, via their phones, and had the distinction of being the only bank in South Africa not to charge transaction fees. It competes with other new banks in South Africa like Discovery Bank and Bank Zero.

AIL has taken a hit on its investment in EOH (which may now be improving) but has done well in most other areas. Roughly half of the AIL portfolio is in what it describes as "early lifestyle stage businesses" such as Tymebank, Rain, and Kropz. These investments are seen as disruptive in their sectors but will take time to mature. It also owns 7% of Afrimat, having reduced its stake from 18.4%.

If there is a criticism of this investment holding company, it must be its lack of focus. It appears to be invested in a very diverse range of industries without significant synergies or economies of scale. The need of most South African companies to have a stable BEE partner gives it an edge in finding and negotiating good deals, but its lack of focus may eventually become a problem.

The share trades at a fraction of its intrinsic NAV. It was 59% of its NAV after falling about 25% in the last six months to 2023. The discount makes it good value and may result in "unbundling" some of that value into the hands of shareholders in due course. The directors have said that they will consider delisting from the JSE if the discount persists because the listing cannot be used to raise further capital at current share prices.

On 21st November 2023, the company announced a rights issue to raise R742.35m. Shareholders will get 11.06579 new shares for every 100 shares that they hold at a 7.32% discount to the volume-weighted average price on 10th November 2023. In its results for the year to 30th June 2024, the company reported that its intrinsic net asset value (NAV) increased by 8.5% to 1238c per share, while Tymebank and Linebroker achieved break-even. Rain, which is 26% of the total portfolio, is the most preferred network in South Africa. The total value of listed and unlisted investments was R20.2bn.

The share still trades for much less than 60% of its NAV. Technically, the share has been falling since March 2023. We recommended applying a 200-day moving average and waiting for a clear upside break before investigating further. That break came on 26th April 2024 at 544c per share. Since then, the share has moved up to 727c.

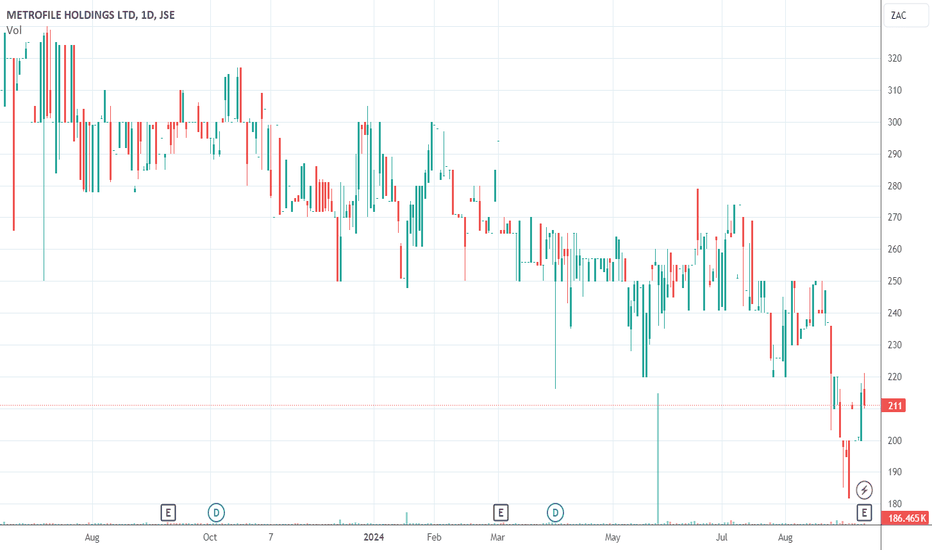

Our opinion on the current state of METROFILE(MFL)Metrofile (MFL) is a company that specialises in records storage and management, image processing, and backup. The company has been listed since 1995 and has a 57.4% Black ownership. The Mineworkers Investment Company owns 38.64% of the business, and Sanlam owns 5%.

The company's record management division has 52 facilities at 27 locations with over 100,000 square meters of offices and warehousing. Housatonic Partners, a US company, made an offer to buy 100% of Metrofile for 330c per share but delayed the deal because of COVID-19. They indicated that they would want to see the end-June 2020 results and "three months of normal trade" before reconsidering. Despite this, they have assured the company of their wish to continue with the possible transaction for the acquisition of Metrofile.

In its results for the year to 30th June 2024, the company reported revenue up 1% and headline earnings per share (HEPS) down 49%. The company said, "General market conditions were weak. Demand for cloud services remained strong and now contributes 32% (2023: 26%) of our digital services revenue."

We see this as a good-quality small business that seems to be battling in a very tough economic climate. Technically, the share now appears to be in a new downward trend. On 5th September 2024, the company announced that its CEO, Pfungwa Serima, would resign with effect from 30th September 2024. He will be replaced by Thabo Seopa.

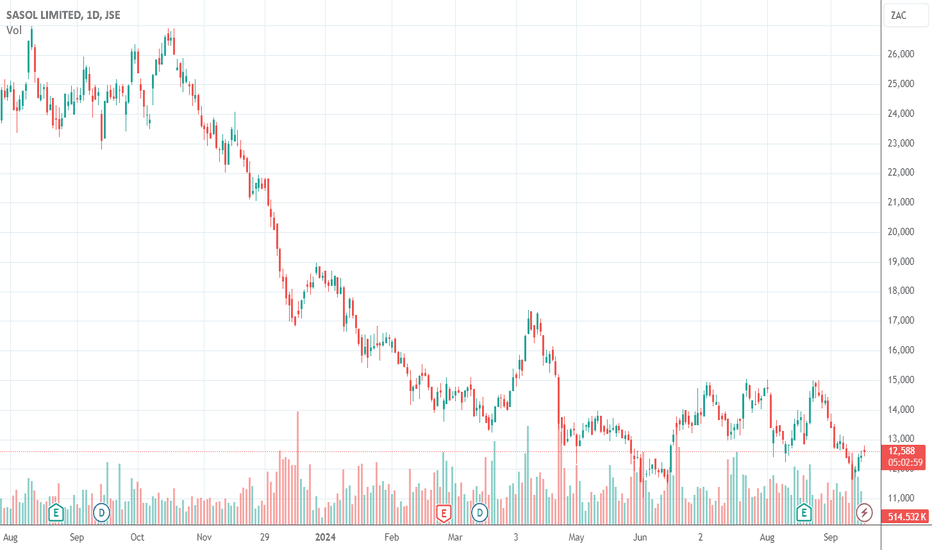

Our opinion on the current state of SASOL(SOL)Sasol (SOL) is a massive international chemicals and energy company which has its roots in the oil-from-coal technology developed during the apartheid era in South Africa. About 50% of the company's profits are directly linked to the oil price. It has two main growth areas - its 50% stake in an ethane cracker plant in Louisiana, America, known as "Lake Charles Chemical Project" (LCCP), and its development of gas resources in Mozambique.

Sasol was awarded two new licences in Mozambique to explore for gas in an onshore development of approximately three thousand square kilometres. This could significantly add to its existing gas projects in the Rovuma province. One area of concern for Sasol is that it is the biggest producer of greenhouse gases in South Africa and on the JSE. It is listed as one of the 100 fossil-fuel companies world-wide that contribute to more than 70% of Greenhouse gases. The company remains under international pressure to deal with its carbon emissions effectively.

After the impact of COVID-19, the share made a dramatic recovery which was brought to an end by the decline in commodity prices, especially oil. On 7th April 2024, the company announced that the Minister of the Environment, Barbara Creecy, had upheld its appeal against a decision by the national air quality officer that might have put the continued activity at its Secunda oil-form-coal plant at risk.

Sasol operates six coal mines which deliver 10m tonnes of thermal coal feedstock to its operations at Secunda and Sasolburg and for the export market. In its results for the year to 30th June 2024, the company reported a headline earnings per share (HEPS) down 66% and a 16% drop in its net asset value (NAV). This was mainly due to the R58,9bn impairment of the Chemicals America Ethane value chain, a R5,3bn impairment of Chemicals Africa, and a R7,8bn impairment of Secunda.

The company said, "The business benefitted from a weaker R/US$ average exchange rate, and a favourable rand oil price, however constrained margins impacted negatively on our fuels and chemicals businesses. The financial results were further impacted by various operational challenges across the business." Sasol remains a volatile commodity share in a long-term downward trend. We suggest waiting until it breaks up through its downward trendline before investigating further.

On 16th September 2024, the company announced the appointment of Ms. Muriel Dube as Chairman of the board with immediate effect.

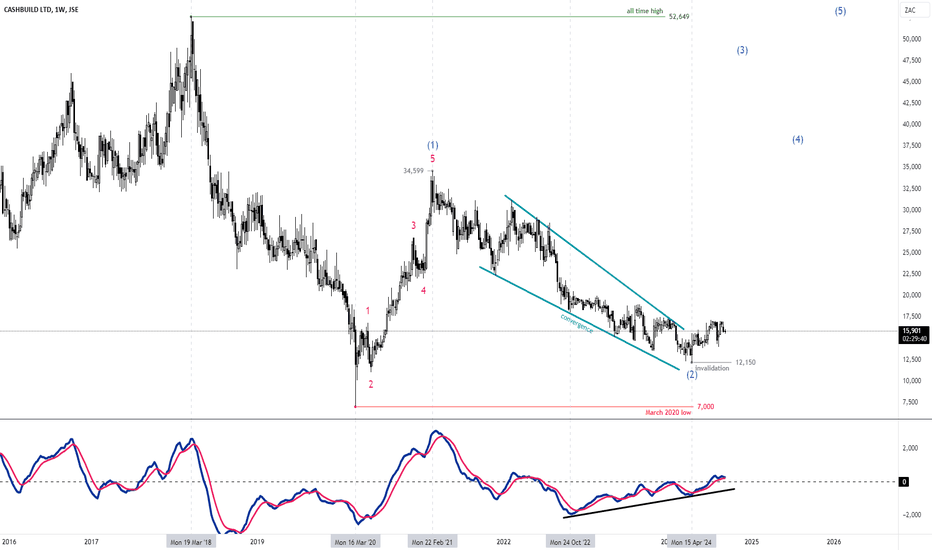

$JSECSB - Cashbuild: Two Technical Reasons For Bullish OutlookSee link below for previous analysis.

Cashbuild has been trading in a falling wedge pattern for over two years but the April 2024 low could be significant.

There are two technical reasons for optimism in Cashbuild:

1) Price looks to have broken out of the wedge pattern, though without much acceleration.

2) The MACD has been converging with price since October 2022 and is now holding above the

zero line.

I will maintain a bullish stance above the key invalidation level of 12150.

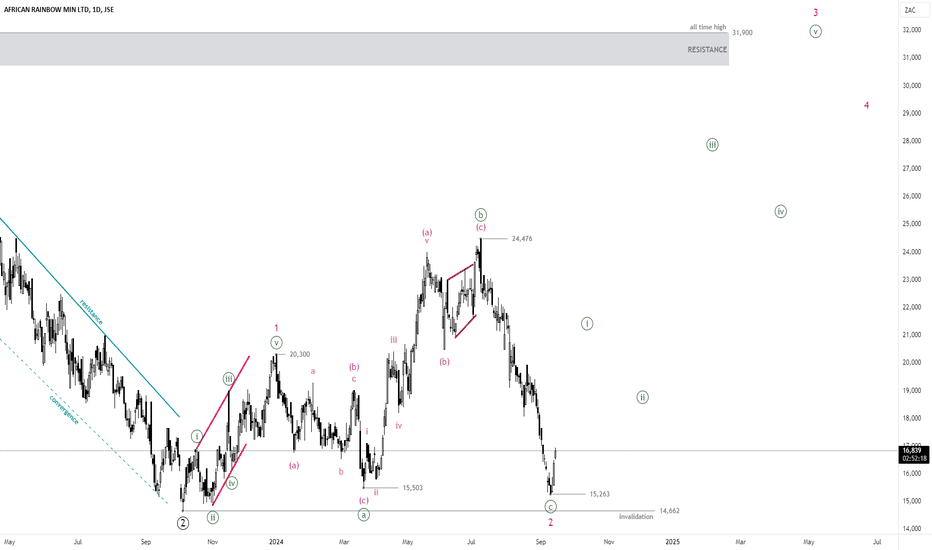

$JSEARI-African Rainbow Minerals: A New Road Map if 14662 HoldsSee link below for previous analysis.

Price continued higher to peak at 24476 cps after the previous analysis.

The strong sell-off broke below 15503 thereby invalidating the outlook.

Reason for optimism though is that the key invalidation level of 14662 still holds.

I am now looking at the large corrective structure as an expanded flat for wave 2.

For this outlook to remain valid, 14662 must continue to hold and to a lesser degree, 15263 could be a key bottom as well.

I am bullish above 14662 cps.

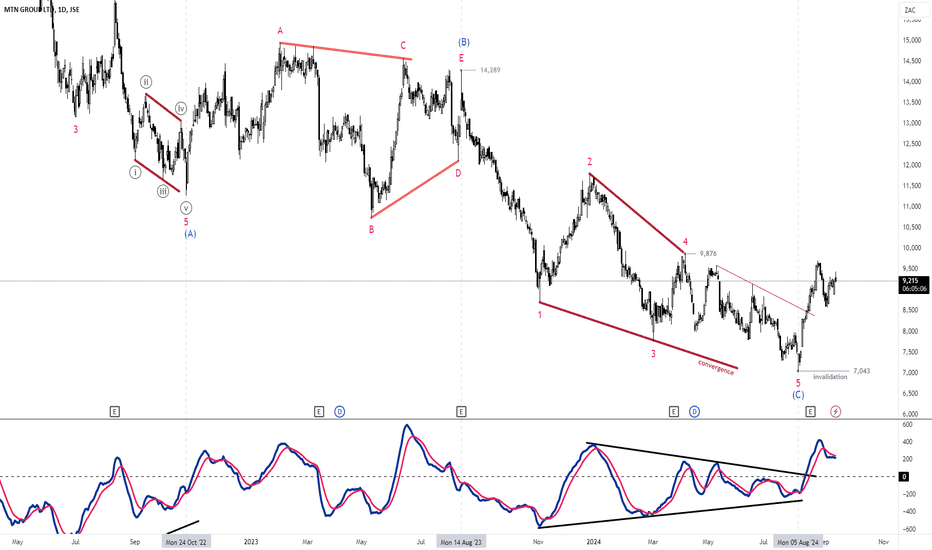

$JSEMTN - MTN: Is The Bottom Finally In? 7043cps Holds The KeySee link below for previous analysis.

MTN did not take long to reverse aggressively after the previous analysis.

The bounce from 7043 cps looks impulsive and has broken above an intermediate trendline with wave 5 of (C); I will get more conviction with a break above 9876 cps as that will confirm that wave 5 is complete in the context of the ending diagonal.

The MACD also shows positive signals; there has been strong convergence below the zero line and the momentum indicator has broken a strong resistance trendline above the zero line.

I am bullish above 7043 cps with a buy the dips strategy.

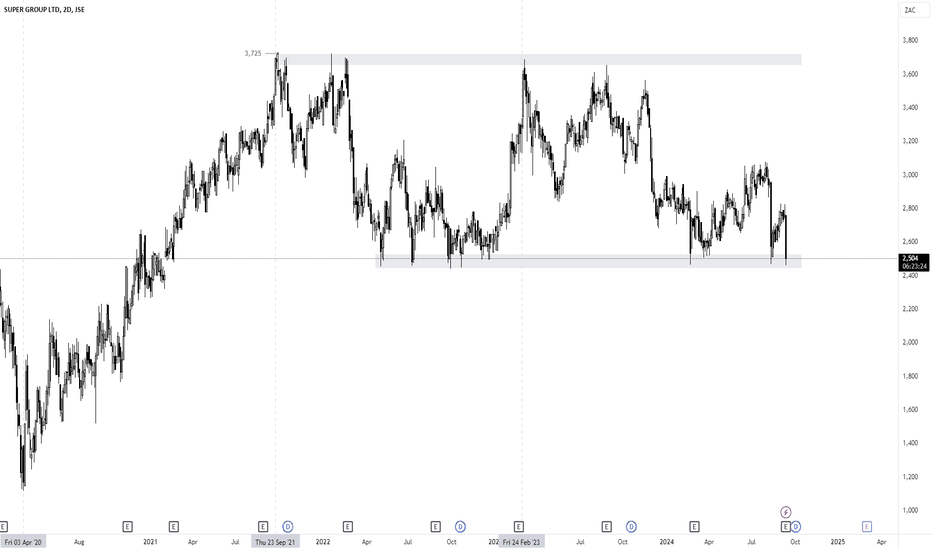

$JSESPG - Super Group: Will Rectangle Support Hold?See link below for previous analysis

SPG stock has traded back to the support zone of the large rectangle pattern that started forming back in September of 2021. Price has been consolidating in the 2400-3700 price range.

Current momentum is still to the downside so it will be interesting to see what price does at this critical lower support zone.

I will sit on my hands for now though my bias is a reversal.

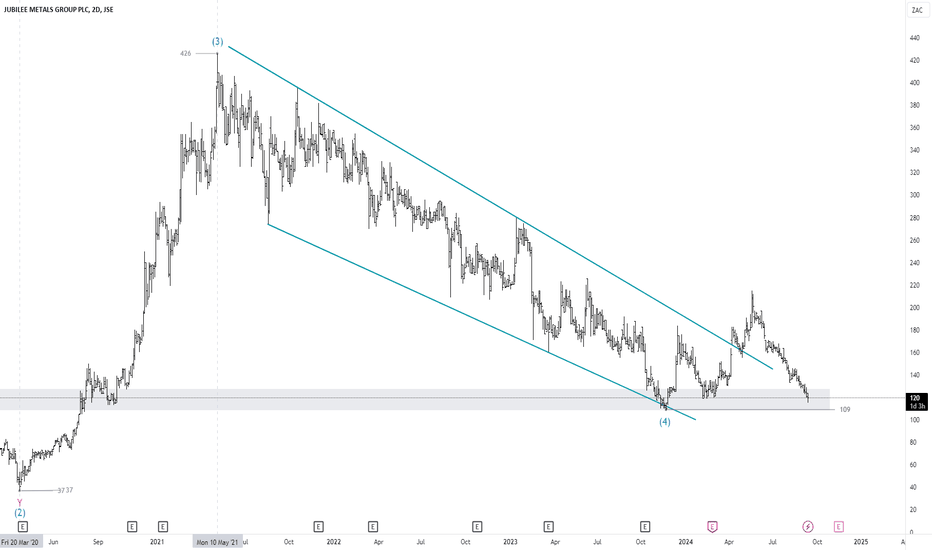

$JSEJBL - Jubilee: Not Following Script, 109 cps Under PressureSee link below for previous analysis.

The dip has kept on dipping since the last analysis and the invalidation level of 109 cps looks under threat.

A break below 109 will prompt a fresh outlook of the bigger picture so now we wait and see what price does.

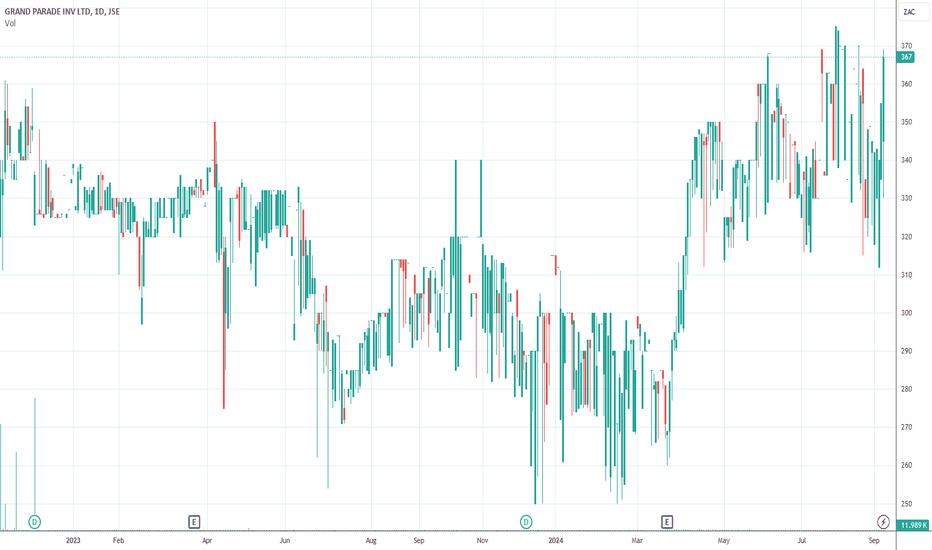

Our opinion on the current state of GRANPRADE(GPL)Grand Parade Investments (GPL) is an investment holding company primarily involved in the gaming industry. As a BEE company, it has been listed on the JSE since 2008. The company decided to exit its food franchises, including Dunkin' Doughnuts and Baskin Robbins in February 2019, and Burger King in February 2020. Additionally, GPL sold its remaining 10% stake in Spur Corporation back to Spur in June 2019. On 15th June 2022, GPL announced the unbundling of its 9.28% shareholding in Spur, where shareholders received 1 Spur share for every 56 GPL shares they held as of 10th June 2022 (the unbundling record date).

In its financial results for the six months ending 31st December 2023, GPL reported revenue of R12.7m and headline earnings per share (HEPS) increased to 11.9c from 9.8c in the previous period. The company attributed the improvement to a 34% reduction in net central costs, which dropped to R7.9m due to a restructuring of operations, the write-back of R11m in prescribed dividends, and various cost-saving initiatives.

On 20th October 2022, GPL gave a strong on-balance-volume (OBV) buy signal amid rumors of a potential takeover. On 25th October 2022, GBM Liquidity, a private company, acquired a 27.88% stake in GPL, later increasing this to 35.14%. Additionally, on 11th November 2022, Sun International boosted its stake to 10.56%. Another OBV buy signal emerged on 8th November 2022 at 330c, signaling heightened activity. Subsequently, on 11th April 2023, GPL announced that GBM Liquidity Corporation, a family trust of Greg Bortz, had secured control with 53.65% of the company's issued capital.

In a trading statement for the year ending 30th June 2024, GPL estimated HEPS between 18.94c and 19.46c, a significant improvement compared to 2.56c in the prior year. This improvement was largely driven by a reduction in restructuring costs associated with the exit from non-core investments in the previous year.

Despite these developments, GPL's share price has been moving sideways since 2017. From a technical perspective, it does not appear to offer a particularly compelling investment opportunity at this time.

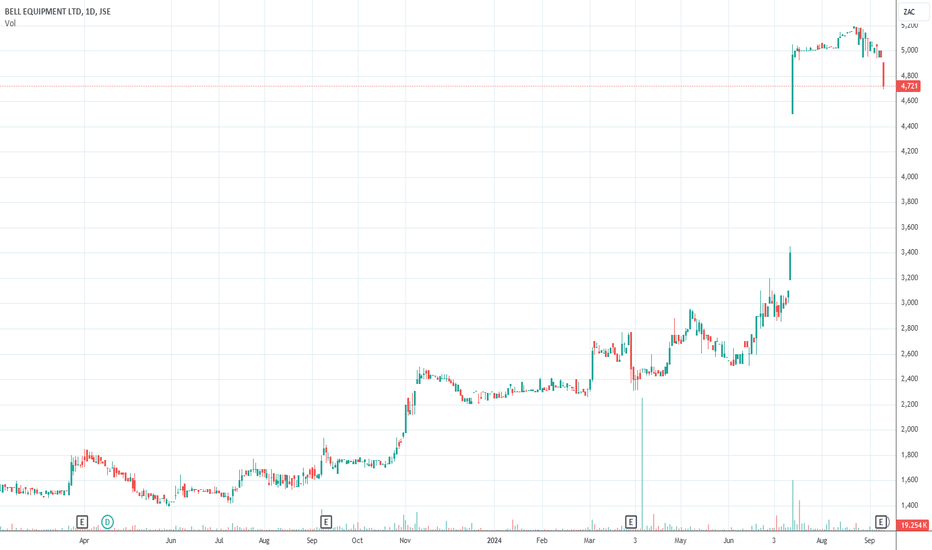

Our opinion on the current state of BELL(BEL)Bell (BEL) is a manufacturer and distributor of heavy equipment, primarily for the mining, construction, agriculture, and waste management industries. It has been impacted by the global slowdown in construction since 2008 and the collapse of the mining sector. Bell's articulated dump trucks (ADTs) are exported worldwide from its manufacturing bases in South Africa and Germany. In addition to its own products, Bell also distributes equipment for global manufacturers, offering a range of over 120 products. Approximately 60% of the company's business comes from outside South Africa. Bell employs 3,200 people, of whom 88.6% are in South Africa.

CEO Gary Bell has indicated that the company might consider delisting, with 1A Bell (the Bell family entity) making an offer to minority shareholders. However, some of these shareholders believe the board has a fiduciary duty to put the company up for sale to the highest bidder. On 18th February 2021, the company announced that 1A Bell would buy a further 31.4% of Bell, giving it a 70% stake at R10 per share, a 13% discount to the share price at that time.

In its results for the six months to 30th June 2024, the company reported revenue up 6% but headline earnings per share (HEPS) down 6%. The company highlighted strong demand for ADTs in the USA, where it improved its market share despite a highly competitive environment and high inventory levels across the industry. Southern hemisphere markets like South Africa and Zambia, driven by mining demand, proved more resilient than northern hemisphere markets like Europe and the UK.

The stock trades over R3m worth of shares on average each day, making it suitable for private investors. There was an on-balance-volume (OBV) buy signal on 7th September 2023 at 1752c per share, and since then, the share has moved up to 2480c. On 15th July 2024, the company announced that the Bell family had made a firm offer to buy out the remaining 30% of Bell, which it did not own, at R53 per share. This offer represents an 82.3% premium to the 30-day volume-weighted average price (VWAP) of the share price on 11th July 2024 (3100c). The share will be delisted once the transaction is completed.

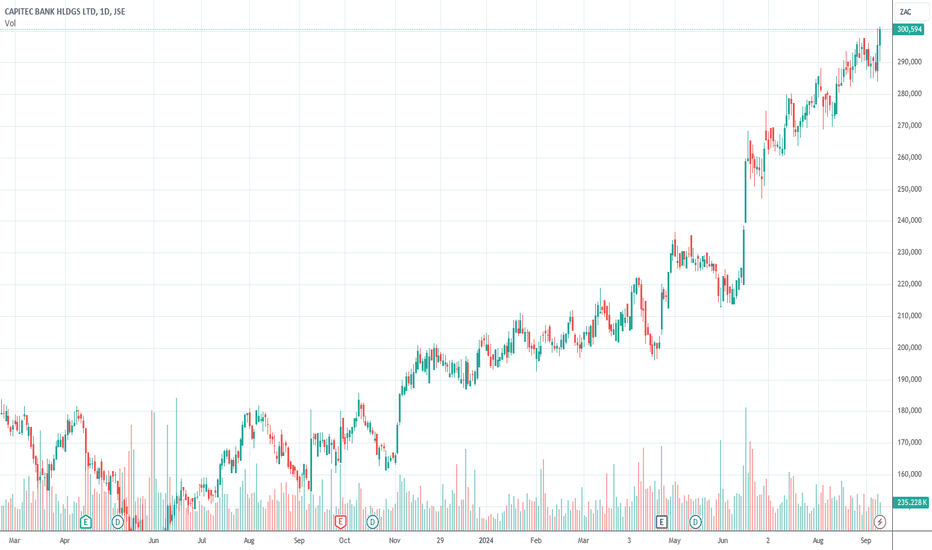

Our opinion on the current state of CAPITEC(CPI)Capitec Bank (CPI), now the country's largest bank by customer numbers (21,1m), was launched by PSG and has been a major disrupter in the South African banking system. It has steadily taken retail market share from the other banks by offering a cheaper and easier solution, especially for the previously unbanked section of the population. The company is adding about 90 000 funeral policies every month. In our view, this share is a "must-have" for any private investor's portfolio. Its parent company, PSG, has now unbundled its holding of Capitec shares to release shareholder value.

Capitec's client base is mostly in the lower living standards measure (LSM) levels, so it has just less than 10% of the retail deposit base despite its enormous number of clients. Capitec's annual average growth in HEPS for the past 19 years since 2003 is 32,2% per annum – an incredible record. On 19th January 2022, the company announced that it intends to conduct a BBBEE transaction by giving about R1bn worth of its shares to staff who have been working at the company since the beginning of 2019 or earlier. The issue is expected to dilute the share and caused the share price to fall.

In its results for the year to 29th February 2024, the company reported headline earnings per share (HEPS) up 16% and return on equity (ROE) of 26%. The bank increased its number of active clients by 10% to 22,2 million. The company said, "Non-interest income made a significant contribution to the 16% growth in headline earnings for the 2024 financial year and increased to 72% of income from operations after credit impairments."

In a trading statement for the six months to 31st August 2024, the company estimated that HEPS would increase by between 35% and 37%. The company said, "The lower CLRs have persisted into the 2025 financial year and the net transaction and commission income, including value-added services, has continued to contribute to strong growth in non-lending income."

Technically, the share has been rising since June 2023. It is now on a multiple of 32,21 – which is still well above the JSE Overall Index (14,88) and other leading banks. Despite this, in our view, Capitec remains excellent value. This is a share you should accumulate on weakness.

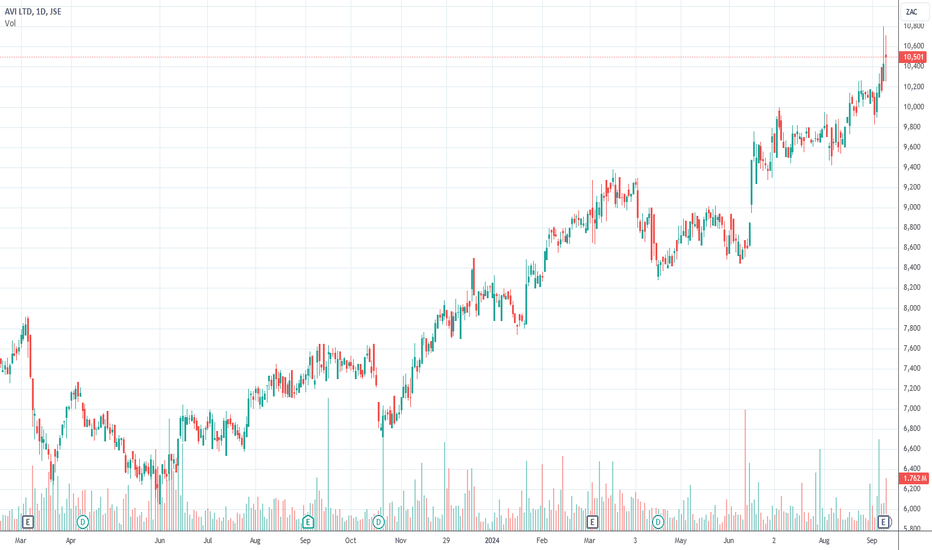

Our opinion on the current state of AVIAnglovaal Industries (AVI) is a generalised producer of consumer products in the food, cosmetics, and apparel sectors. It has a diverse range of very well-known South African brands such as I&J fish, Five Roses tea, Salticrax, Frisco, Provita, Yardley, Spitz, and Kurt Geiger. The company announced that it had sold its Australian seafood company, Simplot, for R633m, yielding a net after-tax profit of about R370m.

Over the decades, this share has undoubtedly been one of the best blue chips trading on the JSE. Its share price has shown a remarkable rise over the past twenty years. Twenty years ago, the share was trading for around 150c, and today it trades for about R65 at a cyclical low point. It has been a steady payer of dividends throughout that period. An investment in Anglovaal is an investment in the South African economy, but one which has shown itself to be virtually recession-proof until COVID-19. The coronavirus had an impact on consumer spending, and the AVI share price fell quite heavily because of this. More recently, it has been falling due to the crisis in Ukraine.

In its results for the year to 30th June 2024, the company reported revenue up 6,3% and headline earnings per share (HEPS) up 24,1%. The company said, "Gross margins recovered to pre-COVID levels - Strong cost control and efficiencies support operating leverage - Group operating profit for the year increased by 21,7%." On a P:E of 15,18 and a dividend yield (DY) of 4,53%, the share looks reasonably priced, even cheap.

In our view, this company will improve as the South African economy improves, and it should be accumulated on any significant weakness. We advised waiting for a clear break above its long-term downward trendline, which happened on 8th November 2023 at a price of 7418c per share. The share has subsequently moved up to 10429c.

Our opinion on the current state of SUNINT(SUI)Sun International (SUI) is a casino and hotel operator with interests in South Africa, Chile, Peru, and recently, Argentina. The depressed economy in South Africa impacted the performance of South African casinos and hotels even before COVID-19. The company increased its stake in Sun Dreams in Peru by 10% to 65%. It also bought a hotel and casino in Argentina for $25,5m. The company invested R4bn in the Time Square casino near Pretoria, which was beginning to perform before COVID-19. The group also owns well-known South African casino/hotel operations like Sun City, Carnival City, and Grand West.

The share has fallen from a high of R142 in February 2015 to current levels around R18.24. At this level, its debt was close to double its market capitalisation. The company plans to sell its Nigerian interests and has received a number of offers. It has not paid any dividend in the past two years and only expects to resume dividends in a further two years or so. The company retrenched 2,195 staff, and its debt fell sharply.

In its results for the six months to 30th June 2024, the company reported income up 5% and adjusted headline earnings per share (HEPS) up 9,1%. The company said, "The group's 5.0% increase in income, combined with effective cost control, yielded a continuing adjusted EBITDA margin of 27.3% which was in line with the prior period. This consistency highlights the effectiveness of cost optimisation initiatives implemented by the group and lower diesel costs following the reduction in load shedding. The group is in a strong financial position with South African debt (excluding IFRS 16 lease liabilities) at R5.4 billion."

Technically, the share has been in an upward trend since its low point in March 2020. It should continue to recover.

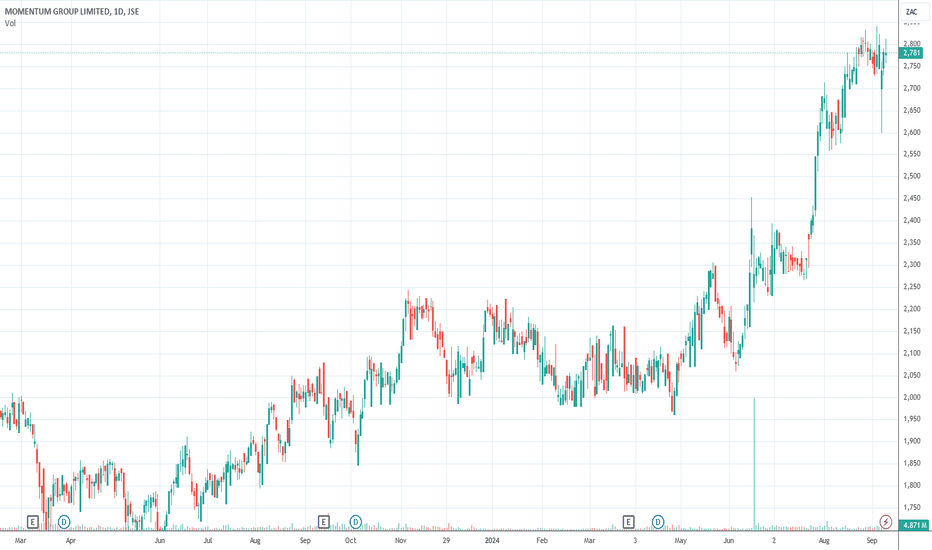

Our opinion on the current state of MOMMET(MTM)Momentum Metropolitan (MTM) is an insurance company listed on the JSE and the Namibian stock exchanges. It was formed by the merger of Momentum and Metropolitan in December 2010. The company participates in all aspects of short and long-term insurances and various financial services. The company was the first insurance company to achieve level 1 BBBEE status. The company is closing its businesses in Mozambique, Mauritius, Zambia, Tanzania, and Swaziland. At the time of the merger between Momentum and Metropolitan, they had a combined 24% of the life insurance market in South Africa. Today that has been reduced to just 17%. The company paid out almost R4bn in death claims in the 1st quarter of 2021 - three times higher than it anticipated, mainly due to the 2nd wave of the virus. The company said that it would consider managing with about 60% of its current office space because of the move to work-from-home as a result of COVID19.

On 26th May 2023, Business Day reported that Jeanette Marais would take over from Hilgard Meyer as CEO on 30th September 2023. In its results for the year to 30th June 2023, the company reported net income of R125bn, up from the previous year's R70,1bn. Earnings per share (EPS) increased to 313,3c compared with 260,6c in the previous year. The company said, "During July 2022, the Group, through its wholly owned subsidiary, Metropolitan International Holdings (Pty) Ltd, disposed of its entire shareholding in Metropolitan Cannon Life Assurance Ltd and Metropolitan Cannon General Insurance Ltd. A loss on disposal of R112 million was recognised. During October 2022, the Group’s holding in Aditya Birla Health Insurance Company Ltd (ABHI) was diluted from 49% to 44.1% with the introduction of a new shareholder as a partner in the business. As a result, a gain on deemed disposal of R563 million was recognised. The Group bought back a total of 73 million shares (for a cost of R1 250 million including transaction costs) during the current year. These shares were cancelled prior to 30 June 2023."

In an operational update for the 3 months to 30th September 2023, the company reported new business premiums up 18% and a claim ratio of 66% - down from the previous period's 70%. The company said, "As at 20 November 2023, the Group had bought back 24 million shares, of which 16.5 million have been cancelled, for a total consideration of R498 million."

In the nine months to 31st March 2024, the company reported recurring premium income down 15% and single premiums up 32%. Assets under management (AUM) were up 14% at R265bn. In a trading statement for the year to 30th June 2024, the company estimated that HEPS would increase by between 41% and 46%. Technically, the share has begun to move up in recent months and may be entering a new upward trend. On a P:E of 10,54 and a dividend yield (DY) of 3,8%, it looks reasonably priced to us.

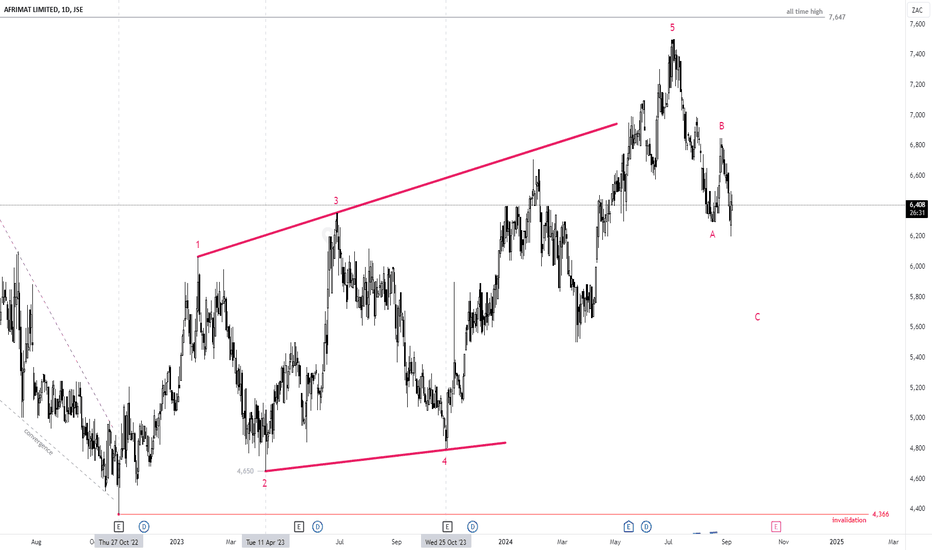

$JSEAFT - Afrimat: Leading or Ending Diagonal? Time Will TellSee link below for previous analysis.

The advance from 4366 cps to the peak just below the all time is best labelled as a diagonal, but the big question is, is it a leading or ending diagonal?

I am tentatively labelling the sell-off as a simple zigzag but the extent of the sell-off will provide clues.

I am on the fence on this one.

$JSETRU - Truworths: Wave 4 Pullback; Buy The DipSee link below for previous analysis.

Wave 3 has unfolded as a textbook five wave impulse. The correction from 10269 cps is for wave 4 and is still showing downside potential.

My initial price range target for wave 4 is between 9000-8400 cps.

The outlook is still bullish as wave 5 still needs to unfold.

A deep sell-off below 7800 will invalidate this outlook.

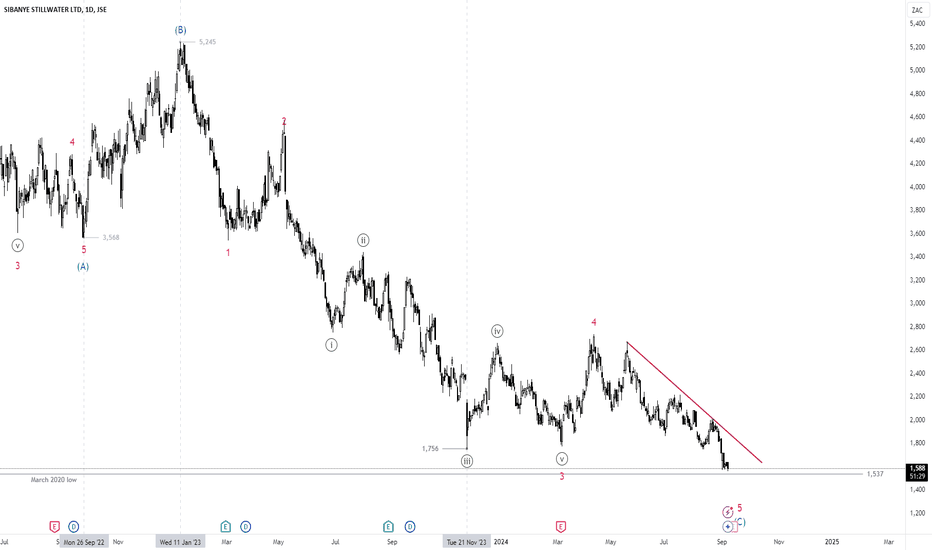

$JSESSW - Sibanye: 1756 cps Invalidated, Now What?See link below for previous analysis

The break below 1756 cps has prompted an update of the wave count.

A minor wave count adjustment shows wave 3 of (C) extended into five sub-waves and wave 5 is now currently unfolding and looks to break below the March 2020 low of 1537 cps.

The momentum is still to the downside but wave (C), which began in January of 2023 looks to be at a mature stage so I will not recommend shorts at this late stage of the downtrend.

The MACD is still giving buy convergence signals.

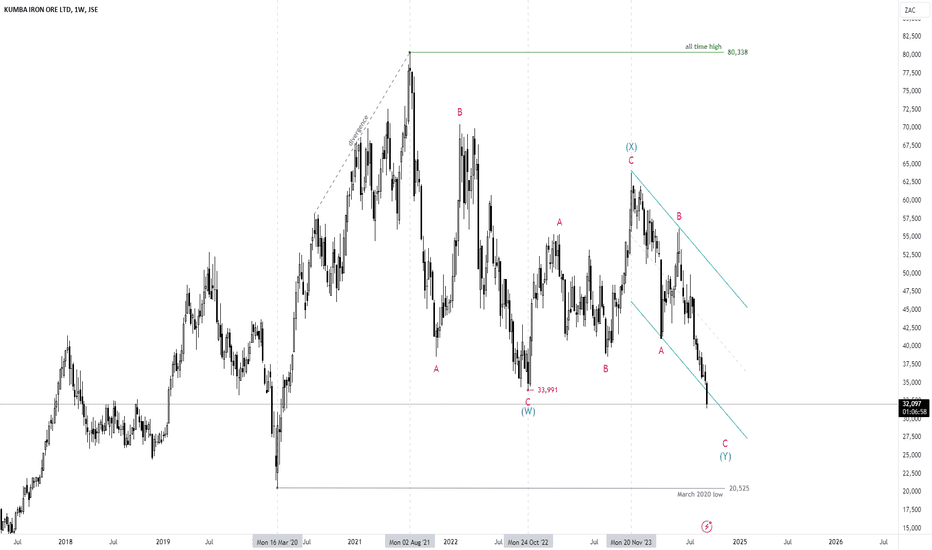

$JSEKIO - Kumba Iron Ore: A New Perspective On The Big BearSee link below for previous analysis.

There is more clarity on the big bear from the 2021 all time high.

The bear looks to be unfolding as a double zigzag (WXY).

There is no sign of a reversal yet and 25000 cps looks a likely short-term target followed by the March 2020 low so I maintain the bearish stance.

$JSESOL - Sasol: 11036 cps Still Holds The KeySee link below for previous analysis.

There is a case to be made that the bounce from 11036 cps is a five wave impulse.

The correction looks like a flat pattern which must hold above 11036 to keep the bullish outlook valid.

A break above 15000 cps without first breaking below 11036 cps will add to my conviction that Sasol bulls are back.

Bullish with a stop-loss @ 11036.

Our opinion on the current state of PAN-AF(PAN)Pan African Resources (PAN) is a gold mining company listed on both the London and Johannesburg Stock Exchanges, with a focus on re-treatment gold production. With the Elikhulu plant, it has significantly enhanced its production capacity, with the potential to produce approximately 700,000 ounces of gold annually at a cost of around R450,564 per kilogram. Given the current gold price hovering around R1 million per kilogram, this presents a substantial profit margin for the company. The Elikhulu plant is expected to generate approximately R15 billion in revenue over its life, with R5.3 billion contributing back to the economy. This has established Pan African Resources as a highly profitable entity with relatively low operational risks, especially given that re-treatment operations typically have fewer uncertainties compared to traditional mining.

The company has also embraced renewable energy by approving the construction of a 10MW solar power plant, which should help reduce its reliance on grid electricity and lower operating costs in the long term.

In its financial results for the six months ending 31st December 2023, Pan African Resources reported gold production up 6.7% and all-in sustaining costs (AISC) of $1287 per ounce, against a gold price of just over $2000 per ounce. This margin underscores the company's profitability. Headline earnings increased by 46.4%, while earnings per share (EPS) were up 46.1%. At the reporting period-end, the company had access to $31.3 million in cash and $86.4 million in undrawn credit facilities, maintaining a healthy liquidity position.

For the year ending 30th June 2024, the company continued to perform well, with production up 6.2% and AISC at $1350 per ounce. The average gold price over the period was $2021 per ounce. Net debt increased to $106.4 million due to construction costs at the MTR project. On 4th June 2024, the company secured a five-year wage agreement with the National Union of Mineworkers (NUM) for an annual increase of 5.3%, which provides stability in its labor costs.

In its trading statement for the year ending 30th June 2024, the company estimated a headline earnings per share (HEPS) increase of between 27% and 37%, driven by a 16.8% increase in revenue, mainly due to higher gold sales and an 11.3% increase in the average US dollar gold price.

Technically, the share has been in an upward trend since reaching a low of 288c in June 2023. It was added to the Winning Shares List (WSL) on 31st January 2024 at 430c and has since risen to 692c, representing strong growth. While Pan African Resources presents a good investment opportunity, especially given the upward momentum of the gold price, investors should remain cautious due to the inherent volatility of the gold market and the company's exposure to fluctuating gold prices. However, with gold breaking above long-term resistance at $2060, it could offer a speculative opportunity for those willing to take on some risk.

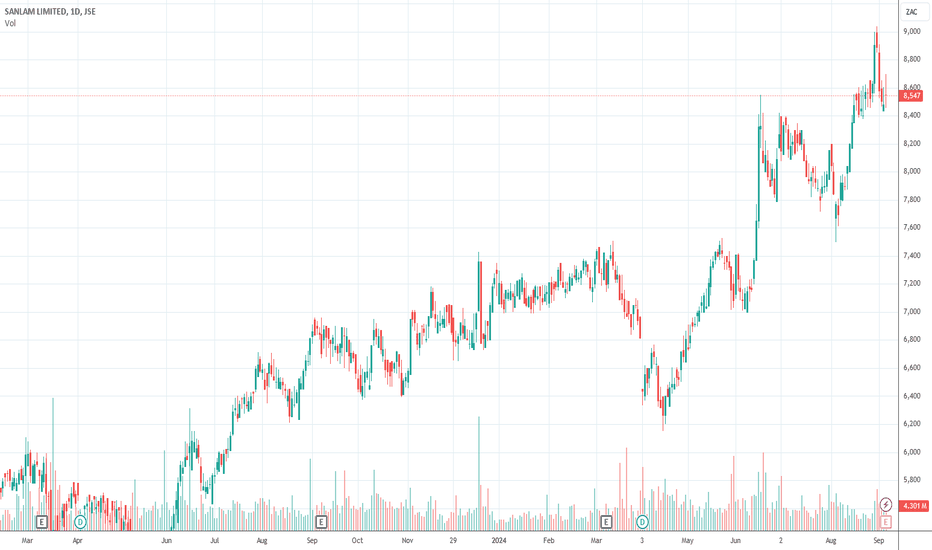

Our opinion on the current state of SANLAM(SLM)Sanlam (SLM) is one of the largest and most established insurance and financial services groups in South Africa, with a rich history dating back to 1918. The company demutualised in 1998 and is listed on both the JSE and the Namibian Stock Exchange. Sanlam has a wide range of operations spanning South Africa, the UK, the USA, Europe, India, Australia, and several African countries. Its product offerings include general insurance, life insurance, asset management, banking, credit, health, and bancassurance.

Sanlam's business is divided into four key divisions:

1. Sanlam Investment Holdings (SIH) – Now 25% owned by African Rainbow Capital.

2. Sanlam Emerging Markets – This includes an 84.5% stake in Saham, which operates in 33 French-speaking countries.

3. Sanlam Personal Finance – This is a core area contributing about 50% of Sanlam's profits, primarily focusing on the South African market.

4. Santam – Sanlam owns a 61% stake in Santam, the largest short-term insurer in South Africa.

Sanlam also has international interests, including a 26% stake in Shriram, a prominent provider of insurance products in India, and various other investments in the UK, Ireland, and Malaysia. Saham is a significant part of its African operations, with 3,000 staff members across 700 branches.

The company's partnership with African Rainbow Capital (ARC) is aimed at growing its presence in the lower- and middle-income markets, with Sanlam providing R2 billion in seed capital for these efforts. This partnership is expected to help expand its business to underserved markets.

In its financial results for the six months ending 30th June 2024, Sanlam reported a strong performance with headline earnings per share (HEPS) rising by 40%. The company showed solid growth across its core businesses, with net result from financial services (NRFFS) up 14%, driven by a 14% rise in life and health insurance, 16% in general insurance, 10% in investment management, and 9% in credit and structuring operations. This reflects broad-based operational strength and earnings momentum.

Sanlam continues to be one of the JSE's blue-chip stocks, with a long track record of consistent growth. Its current price-to-earnings (P:E) ratio of 12.17 makes it an attractive value proposition at current levels, especially as it continues to expand its operations both locally and internationally.

On 18th June 2024, Sanlam announced a significant acquisition, agreeing to buy 60% of Multichoice's insurance business for R1.2 billion in cash. This deal should further bolster its insurance operations and provide new opportunities for growth.

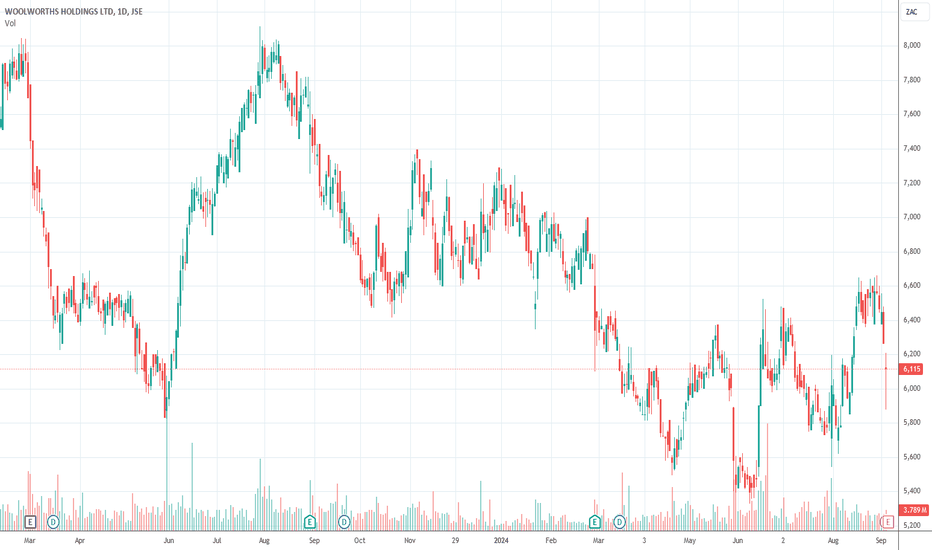

Our opinion on the current state of WOOLIES(WHL)The fall of Woolworths' (WHL) share price can largely be attributed to the costly acquisition of David Jones in Australia for AU$2.1 billion in 2014, which has since resulted in a R12 billion write-down from the original purchase price of R20 billion. Woolworths' food division has been the primary support for the group, while its fashion and clothing section has struggled in challenging trading conditions.

On 14th January 2020, Woolworths appointed Roy Bagattini, from Levi Strauss, as Group CEO, replacing Ian Moir, with effect from 17th February 2020. Bagattini has been tasked with steering the company back to profitability, especially in the non-food sectors.

In the results for the year ended 30th June 2024, Woolworths reported a 4% increase in turnover from continuing operations, but a 16.8% decline in headline earnings per share (HEPS). The company ended the year with net borrowings of R5.6 billion, though its Australian subsidiaries held a net cash position of AU$39 million. Woolworths achieved a net debt-to-EBITDA ratio of 1.45 times, within its targeted gearing ratio, and reported a Return on Capital Employed (ROCE) of 18.7%, well above its weighted average cost of capital (WACC) of 13.9%.

We advise caution and suggest considering Woolworths shares only if they break upward through their current downward trendline. The current price-to-earnings (P:E) ratio stands at around 16.78, but the shares are still falling, although they may be stabilizing.

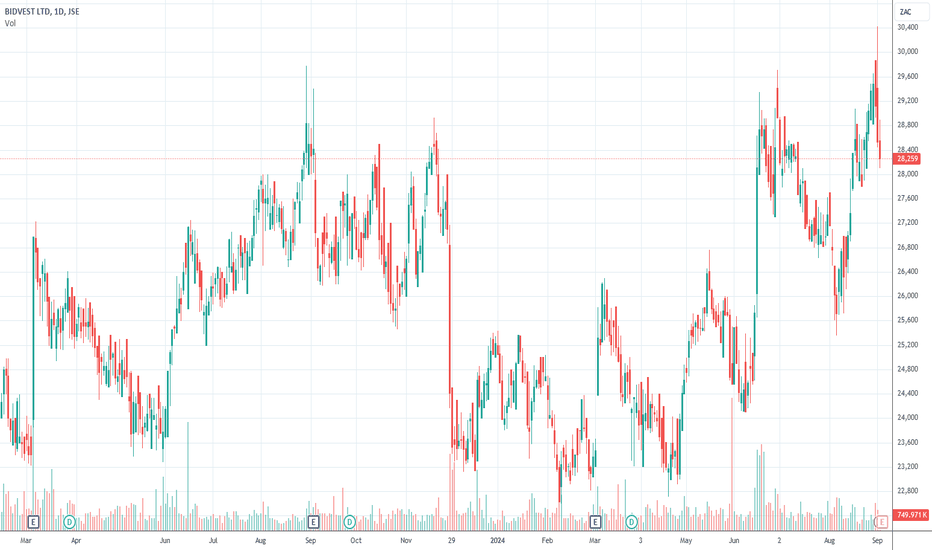

Our opinion on the current state of BIDVEST(BVT)Bidvest (BVT) is a highly diversified South African company with numerous subsidiaries, organized into six main divisions: Services, Freight, Automotive, Office, Print & Commercial Products, Financial Services, and Electrical. The company operates with a decentralized management structure, allowing directors of each operating company significant autonomy as long as they produce good returns. This strategy contrasts with most listed companies that typically focus on a single area of business and divest non-core assets. Bidvest's diversification reduces risk by balancing performance across its divisions, with some performing well even when others may not be.

Bidvest's notable investments include a 66% stake in Bidvest Namibia, which also owns a large property portfolio leased to various Bidvest companies, and a 56.13% stake in Adcock Ingram. The company's ongoing strategy includes regular acquisitions to drive growth. The acquisition of PHS, the UK's largest cleaning service provider, was particularly well-timed, as it preceded a significant increase in demand for cleaning services following the COVID-19 pandemic. Bidvest's investment in alternative energy sources is also viewed as a promising area for future profits.

On 3rd July 2024, Bidvest announced its intention to seek buyers for Bidvest Bank and FinGlobal, alongside its acquisition of Citron Hygiene LP. In its results for the year ended 30th June 2024, Bidvest reported revenue growth of 6.7% and a 6.6% increase in headline earnings per share (HEPS). The company attributed its success to top-line growth, effective gross margin management, and excellent expense control, which resulted in an 8.5% increase in group trading profit. Additionally, cash flow from operating activities grew strongly by 18.7%.

Bidvest currently trades at a price-to-earnings (P:E) ratio of 14.92, which, despite the recent performance, still suggests good value at these levels. Technically, the share has just emerged from an island formation and is on a strong recovery path, indicating potential for continued growth.