Our opinion on the current state of STANBANK(SBK)Standard Bank (SBK) is 160 years old and is South Africa's second-largest bank by market capitalization, after First National Bank. It has widespread interests across the rest of Africa, which now contribute 34% of its headline earnings. 20% of its shares are owned by the Industrial and Commercial Bank of China (ICBC), and it owns 40% of ICBC Standard Bank, which was previously Standard Bank Plc in the UK (ICBCS). Following COVID-19, the bank had about 70% of its staff working from home. This business is also obviously impacted by load-shedding in South Africa and the lingering effects of the coronavirus.

In our view, this is an excellent investment for private investors at current levels, but it is a long-term play. As COVID-19 fades, the economy will pick up, and Standard Bank's profits will improve. On 15th July 2021, the company announced that it would make an offer for the ordinary shares and preference shares in Liberty Holdings (LBH). Liberty shareholders received 0,5 Standard Bank shares and R25.50 in cash for each LBH ordinary share they held. This gave an implied valuation of just under R90 per LBH share, which was a 33% premium to its price (R67.48) prior to the announcement.

The bank is benefiting from increased client numbers and rising interest rates. In its results for the six months to 30th June 2024, the company reported headline earnings per share (HEPS) up 4% and return on equity (ROE) of 18,5%. The company's net asset value (NAV) increased 5% to 14564c per share. The company said, "This performance is underpinned by continued franchise growth in our banking businesses and robust earnings growth in our insurance and asset management business."

The share made a cyclical low at 16707c on 17th April 2024, and since then, it has been in a strong upward trend. On a P:E of 8,97 and a dividend yield (DY) of 4,9%, we regard it as good value.

Our opinion on the current state of STADIO(SDO)Stadio (SDO) is a tertiary education institution that offers a wide range of post-school training. The company provides higher education through five universities, offering higher certificates, degrees, master's, and PhD qualifications. It currently has over 46,000 students enrolled in six faculties, offering more than 50 accredited training programs. Of these students, 86% study online. The company envisions having 100,000 students, with the majority expected to be distance learning students.

In its results for the year to 31st December 2023, the company reported revenue up 16% and headline earnings per share (HEPS) up 19%. The company's net asset value (NAV) increased by 1% to 212c per share. The company stated, "...despite a challenging economic environment, with good growth in student numbers for the year, specifically in new student numbers. The growth in EPS, HEPS, and CHEPS is due to an increase in student numbers, coupled with good cost controls and efficiencies."

In a business update at their AGM, the company reported that student numbers increased by 8% in the year to June 2024. This was comprised of 86% of students in distance learning and 14% in contact learning. In a trading statement for the six months to 30th June 2024, the company estimated that core HEPS would increase by between 14% and 24.3%.

We believe that Stadio has a great future, given the general ineffectiveness of government tertiary education in South Africa. At current prices, and following their results, Stadio has been in a strong upward trend. We are bullish on its prospects.

Our opinion on the current state of EXXARO(EXX)Exxaro (EXX) is a BEE coal company with interests in iron and heavy minerals. It has interests in Australia, America, and Europe. It is a provider of coal to Eskom's Medupi power station. The company is trying to improve coal production from 48 million tons presently to about 60 million tons by 2022, but this policy might be changed due to the lower demand for coal on the world market. This is an immensely cash-generative operation that is usually profitable depending on what happens to the price of coal.

The demand for coal both locally and in the export market has been strong, but the shift towards renewable energy is seen as a long-term threat to the business. It is becoming increasingly difficult to obtain funding for new coal-fired power stations as banks feel the pressure from environmental groups. On 9th April 2021, the company announced that it had sold its interest in Exxaro Coal Central (Pty) Ltd and Leeuwpan Coal Mine operation.

Obviously, the Ukraine conflict initially had a beneficial impact on this share through higher commodity prices, but that effect has now disappeared. The company announced that, with the lower price of coal, it was no longer viable to transport coal to port by truck—something it had been forced to do because of the inefficiency of the South African rail and port systems.

In its results for the six months to 30th June 2024, the company reported revenue up 1% and headline earnings per share (HEPS) down 37%. Operationally, the company produced 19.3 million tons of coal and sold 18.9 million tons. Group revenue was static at about R19bn. The company said, "Group EBITDA decreased by 33% to R5 118 million (1H23: R7 660 million), mainly attributable to the 27% decrease in Coal EBITDA discussed in more detail under the coal business performance."

Exxaro remains a volatile commodity play. Technically, the share is volatile but has been in a volatile upward trend since November 2015.

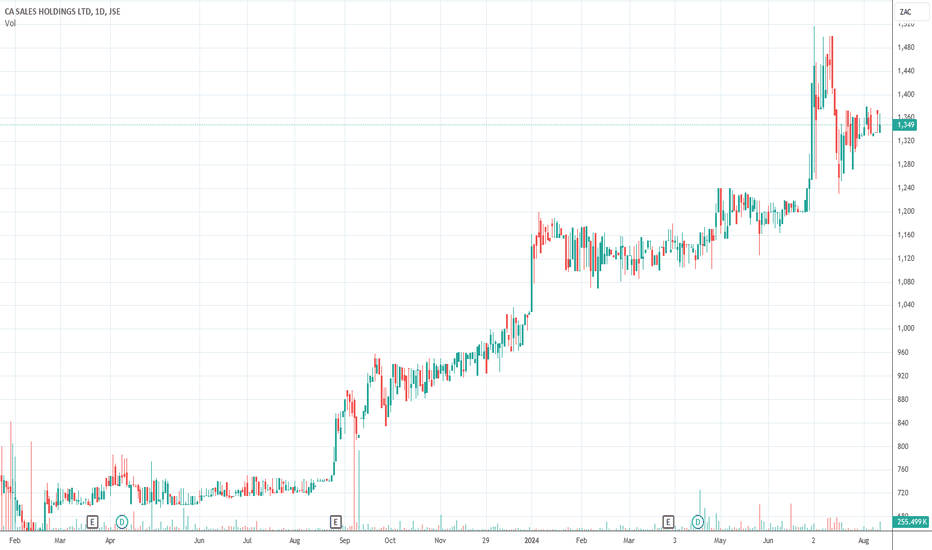

Our opinion on the current state of CA-SALES(CAA)CA Sales listed on the JSE on 27th June 2022 and traded 34 deals on the day, opening at 505c and closing at 745c. The company supplies food, health, alcohol, and fast-moving consumer goods (FMCG) to a wide range of companies. It is involved in warehousing, distribution, marketing, and point-of-sale.

In its results for the year to 31st December 2023, the company reported revenue up 19,4% and headline earnings per share (HEPS) up 25,3%. The company said, "Total assets increased by 26.0% to R5.2 billion due to the increase in fixed and intangible assets as a result of business combinations as well as working capital due to increased revenue."

In a trading statement for the six months to 30th June 2024, the company estimated that HEPS would increase by between 17% and 22%. This was one of the only new listings on the JSE in 2023 and, after an initial period of sideways movement, the share price has been rising steadily.

We added it to the Winning Shares List on 25th August 2023 at a price of 775c. By 12th August 2024, it was trading for 1366c, a gain of 76% in a year. We believe it will continue to perform.

Our opinion on the current state of AVENG(AEG)The once-massive construction company, Aveng (AEG), which traded at R69 a share in 2008, was reduced to a penny stock. This sad demise was brought about by a number of factors. Among these, the reduction in construction spending following the sub-prime crisis has been critical. The government ceased infrastructure development after the 2010 World Cup, which had a further detrimental impact. This was then followed up by the Competition Commission's R1,4bn fines in the construction industry. The difficult operating environment was made worse by losses on various construction contracts, which have required extensive write-downs and impairments.

Aveng's objective has been to focus on McConnell Dowell in Australia and the mining contractor Moolmans, both of which are now profitable. On 26th January 2021, the company announced the terms of a fully underwritten rights issue to raise R300m by selling about 20 billion shares at 1,5c each. Shareholders were offered 103.122 rights for every 100 shares held. This obviously substantially diluted the existing shareholders. On 12th October 2021, the company announced a 500-for-1 consolidation effective 8th December 2021, which resulted in the share price rising to around R28.

The company announced the sale of Trident Steel on 3rd May 2023 for R1,2bn, which effectively leaves the company debt-free. In its results for the six months to 31st December 2023, the company reported revenue of A$1,5bn and headline earnings of A$11,3m. The company also announced its intention to report in Australian dollars in the future, not rands, because it said 91% of its income was now received in Australian dollars. Headline earnings per share improved from 5,2c to 8,8c.

The company said, "At 31 December 2023, Aveng grew its revenue from continuing operations, which excludes Trident Steel, by 39% to A$1.5 billion. In the current period, McConnell Dowell accelerated their repayments and repaid A$10 million of the term debt facility. The remaining balance of A$13 million is expected to be settled by June 2024."

In a trading statement for the year to 30th June 2024, the company estimated that it would report a positive HEPS compared with the loss of 61,6c (A$) in the previous year. The company said, "McConnell Dowell is expected to report a positive performance for the year ended 30 June 2024. Operating earnings are expected to reflect an improvement on the prior year. Moolmans is expected to report marginal operating earnings for the year ended 30 June 2024. Operating margins remain under pressure, primarily associated with the Tshipi contract."

Technically, the share has been moving up since mid-May 2024 and looks to be entering a new upward trend.

Our opinion on the current state of GFIELDS(GFI)Gold Fields (GFI) is a relatively high-cost international gold mining house with a single mine in South Africa—South Deep. South Deep was bought by Gold Fields in 2006, and it has struggled to make the mine profitable, pouring in a total of R32bn (R22bn purchase price plus R10bn in development costs) into it over the past 14 years. Brett Kebble once described South Deep as "the world's most expensive long drop." South Deep is 3 kilometers deep and a very difficult mine with many technical complications, but it is the second largest unmined gold resource in the world—hence Gold Field's persistence.

Gold Fields is working with an independent power producer (IPP) to build a 50MW project in South Africa. The company has spent a total of $502m over the past two years to ensure that Damang and Gruyere (international operations) would produce 2 million ounces a year for the next ten years. South Deep now has R800m less in costs and R400m less in capital expenditure. The company is focusing on bringing the new Salares Norte gold mine in Chile into production. On 11th July 2022, the company said that it would list on the Toronto Stock Exchange and that it would adopt a dividend policy of paying between 30% and 45% of profits out.

Its protracted investment in South Deep is definitely beginning to pay off, with output expected to rise by about 25% over the next four years. In its results for the year to 31st December 2023, the company reported headline earnings per share (HEPS) of 94c (US) compared with 119c in the previous period. The average rand/US dollar exchange rate weakened by 13%, and the company's debt increased by $320m to $1024m.

In an update on the first quarter of 2024 ending on 31st March 2024, the company reported 464,000 ounces of attributable production with an all-in sustaining cost of $1738 per ounce. The company said, "Production for the quarter was severely impacted by weather-related events and operational challenges, particularly at the Gruyere, St Ives, South Deep, and Cerro Corona mines, resulting in group attributable equivalent gold production (excluding Asanko) for the quarter being 18% lower year on year (YoY) and 22% lower quarter on quarter."

In a trading statement for the six months to 30th June 2024, the company estimated that HEPS would fall by between 25% and 33%. The company said, "Gold volumes sold are expected to improve in the second half of 2024 with the ramp-up of Salares Norte and production improvements at the Gruyere, St Ives, and South Deep mines." On 12th August 2024, the company announced that it had acquired the remaining 50% of Osisko Mining for $1.57bn (R29bn).

Technically, the share is very volatile and subject to shifts in the international price of gold, but it has been in an upward trend over the past five years. It remains a volatile commodity play.

Our opinion on the current state of ITLTILE(ITE)Italtile (ITE) is a franchisor of tiles, sanitary ware, flooring, and home finishing products, which it manufactures and wholesales itself. The company is controlled by the Ravazotti family. It has 206 stores and 6 online web stores. It also has a property portfolio of retail and industrial properties worth about R4,3bn. The company has acquired 95,47% of Ceramic Industries and 71,54% of Ezee Tile, which it styles as its manufacturing business (as opposed to its retail business).

The company gained an increased "share of wallet" and improved the management of stockholding and working capital. It appears to be benefiting from increased sales as people work from home and seek to improve their home environments. It plans to add between 10 and 15 new stores this year. It has also bought back about R240m worth of its own shares at lower levels. The company closed 18 stores in Natal and 16 other stores for 10 days during the civil unrest. Two stores at Orange Farm and Spruitview were destroyed. There have also been store closures due to COVID-19 during July 2021.

In its results for the six months to 31st December 2023, the company reported turnover down 2% and headline earnings per share (HEPS) down 15%. The company's net asset value (NAV) rose 10% to 684,4c per share. The company said, "Our retail stores are financially sound, underpinned by robust operating models. Encouragingly, the retail operation's results were creditable, given the high comparable base, fiercely competitive landscape and weak consumer demand. The Group's strong balance sheet and cash generative nature is evidenced by cash reserves of R1.5 billion (2022: R0.8 billion)."

In a trading statement for the year to 30th June 2024, the company estimated that HEPS would fall by between 4,7% and 10,3%. The company said, "Homeowner confidence remained subdued in light of sustained high interest rates and inflation, and demand was at low levels across the industry. In the context of low GDP growth and weak consumer sentiment and spend, the building cycle downturn has yet to recover."

Technically, the share moved sideways for two years until COVID-19 took it down to levels around R10. It has been moving sideways and downwards for a few months. The share broke up through its long-term downward trendline on 28th June 2024 at a price of 1107c, and it has since moved up to 1126c. It will probably benefit from new building activity expected to follow the formation of the new GNU in South Africa.

Our opinion on the current state of MERAFE(MRF)This is a ferrochrome operation controlled by Glencore which operates mines, furnaces, and smelters in Mpumalanga and Limpopo. The Glencore-Merafe joint venture can produce up to 2.3 million tons of ferrochrome per annum. Merafe gets 20.5% of the proceeds, and the balance goes to Glencore.

The problem is electricity supply because smelters require huge amounts of current. The 15.6% increase in Eskom tariffs last year was a major factor, and the current year's increase of just under 10% from 1st April 2022 is a further problem. The company is concerned about Eskom's ability to supply additional power for expansion. Their Lion 3 expansion has accordingly been suspended until this difficulty can be overcome. All smelters except Lydenburg are operating. The availability of trains from Transnet to move its product is another problem.

Obviously, this is a commodity share and has risks, but the world's demand for stainless steel did increase with the economic boom in America, but that now appears to be coming to an end. In its results for the six months to 30th June 2024, the company reported revenue down 0.4% and headline earnings per share (HEPS) of 28.2c compared with earnings of 42c in the previous period. Ferrochrome production was down 17%, and the company's net asset value (NAV) increased by 3%.

Technically, the share reached a high of 192c on 4th April 2022 and was trending down until a rally in September 2022. It found some brief support at 104c per share and then trended up—but the rally was short-lived. It remains a volatile commodity share.

Our opinion on the current state of RENERGEN(REN)Renergen (REN) describes itself as an "integrated alternative energy business" that invests in renewable energy projects in Africa. The company listed on the JSE in June 2015 and has been losing money every year since, which is reflected in its falling share price. Renergen is investing in liquified natural gas (LNG) and helium. The R125m rights issue was fully underwritten and enabled it to access a R218m loan facility. Its initial public offer (IPO) on the Australian Stock Exchange (ASX) was more than two times oversubscribed. It claims to have proven helium reserves of over 6bn cubic feet.

On 18th May 2018, the US government identified helium as critical to national security, causing the price to rise by 135%. On 10th December 2020, the company announced the development of an aluminum case that can keep vaccines cold for up to 30 days, which could be a game changer. On 21st June 2021, the company announced a helium discovery at Evander with a concentration of 1.1%. On 9th March 2021, Renergen announced a significant gas strike in the Karoo, and then on 12th April 2021, it announced that it had concluded its first deal to sell helium.

In an announcement on 3rd November 2021, the company announced a 620% increase in 1P helium reserves, which caused the share to spike upwards. The announcement of the first production of liquid helium from its Virginia gas project caused the share to rise by just over 9%; however, it remains in a long-term downward trend. On 7th June 2023, the company announced that it had received $750m in further funding from Standard Bank and the International Development Finance Corporation for its Virginia Gas project.

In its results for the year to 29th February 2024, the company reported revenue up 128.4% and a headline loss of 75.07c per share compared with a loss of 19.89c in the previous period. The company reported "some unexpected operational challenges at the VGP, the Group’s primary asset of which it now holds 94.5% subsequent to the sale of the 5.5% stake to MGE (“MGE Transaction”), relating to the LNG and helium operations."

The share may be a speculative opportunity, but it is very risky and volatile. We advised at least waiting for the share price to break up through its long-term downward trendline before investigating further. On 12th August 2024, the company announced that it was fully online and producing liquid helium for sale. The announcement caused the share price to jump, breaking above its long-term downward trendline. We advise caution, at least in the short term.

Our opinion on the current state of SASOL(SOL)Sasol (SOL) is a large international chemicals and energy company with origins in the oil-from-coal technology developed during apartheid in South Africa. Approximately 50% of the company's profits are directly tied to the price of oil. Sasol has two primary growth areas: its 50% stake in the Lake Charles Chemical Project (LCCP) in Louisiana, USA, and the development of gas resources in Mozambique. The company was awarded two new licenses in Mozambique to explore gas in an onshore area of about 3,000 square kilometers, potentially enhancing its existing gas projects in the Rovuma province.

One significant concern for Sasol is its status as the largest producer of greenhouse gases in South Africa and on the JSE, making it one of the 100 fossil-fuel companies worldwide that contribute to over 70% of greenhouse gas emissions. The company faces international pressure to address its carbon emissions effectively.

After the impact of COVID-19, Sasol's share price saw a dramatic recovery, which was later halted by a decline in commodity prices, particularly oil. On 7th April 2024, the company announced that the Minister of the Environment, Barbara Creecy, upheld its appeal against a decision by the national air quality officer, which could have jeopardized the continued operation of its Secunda oil-from-coal plant.

Sasol operates six coal mines that supply 10 million tonnes of thermal coal feedstock to its operations in Secunda and Sasolburg and for export. In a production report for the end of June 2024, the company stated, "Overall, operational performance across all segments consistently met market guidance, notwithstanding persistent macroeconomic volatility impacting on profitability. The Energy Business achieved operational improvements in Mining, Gas, and Secunda Operations (SO) in Q4 FY24. Despite these improvements and a strong rand oil price, we continue to see the impact of lower diesel differentials and inflationary pressure on our liquid fuels segment."

In a trading statement for the year ending 30th June 2024, Sasol estimated that headline earnings per share (HEPS) would decrease by between 59% and 77%, with core HEPS down by between 9% and 27%. The company attributed these results to challenging market conditions, including depressed chemicals prices and constrained margins.

Sasol remains a volatile commodity share in a long-term downward trend. It is advisable to wait until it breaks up through its downward trendline before considering further investigation.

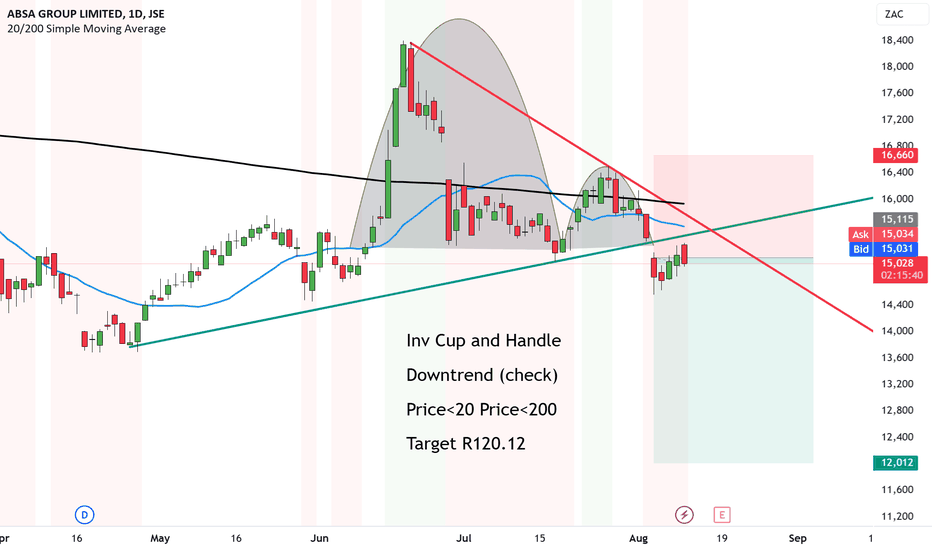

Absa showing downside to come to R120 but I am not buying it LOLOk so I am taking this analysis with a pinch of salt.

The JSE Top 40 is showing major upside to come. And yet the Banking sector is showing conflicting signals.

I mean we have an Inv Cup and Handle.

We have a strong downtrend (safety line) - confirmed

We have price<20 and 200MA - Making it a high probability short.

Everything about the system is saying SHORT But I am calling BS on this analysis.

A part of me wants to go short just for the sake of it because the system says the next target is at R120.12.

Are banks predicting a bigger short and crash than we think?

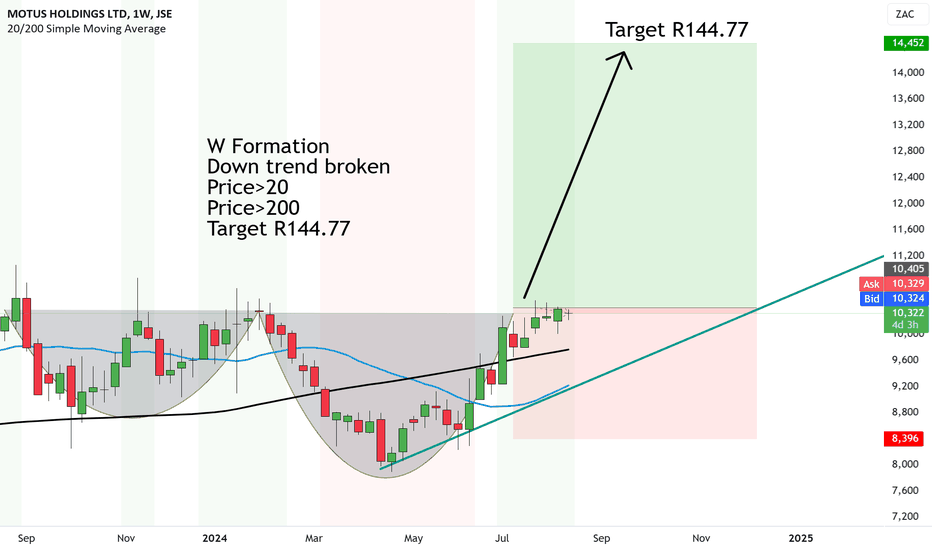

Motus on par to the first target - but it can take a whileW Formation formed on Motus.

This share is VERY slow with movement, I had to change the time frame to weekly.

But the downtrend has broken, the uptrend (safety line) is in check and we have the price above both 20 and 200MA>

All bullish signals with the target to R144.77

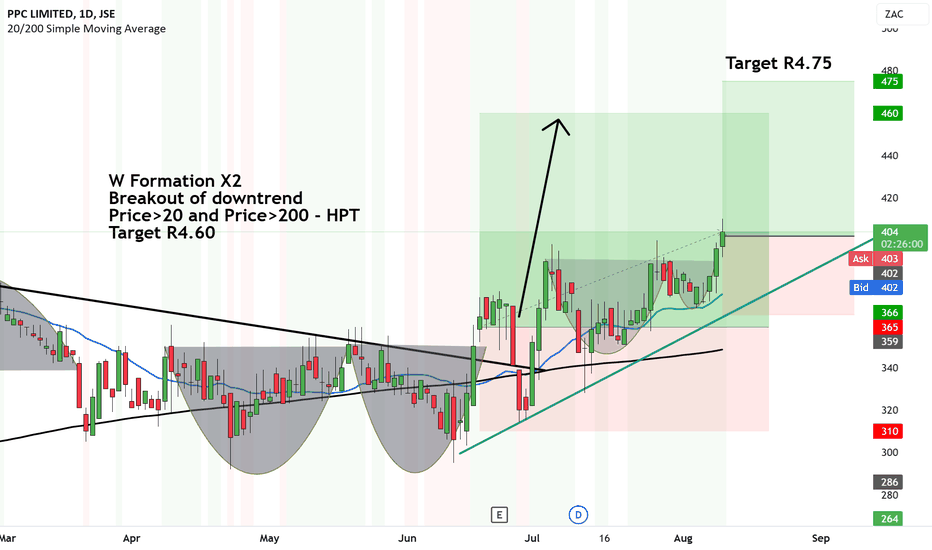

Another 2 major BUY signals for PPC Limited to R4.75It's always great when you don't only get one Bullish breakout signal, but two more!

Another W Formation has formed along with a strong uptrend driving the price up.

So with this accompanied with Price>20 and Price>200 - make sit a HIGH probability analysis.

The first target remains at R4.60 and the second target at R4.75.

BULLISH

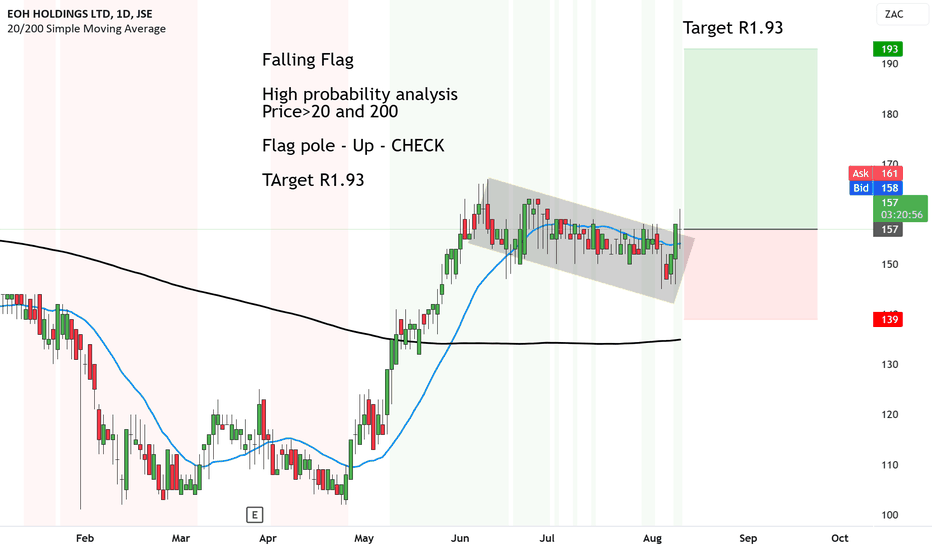

EOH time to finally shine like the Penny it is to R1.93Falling Flag has formed over the last three months on EOH.

It's been moving in a somwehat consolidation period not with hardly any convincing downside and supply.

So now that that the price has broken above th Flag and is showing strong upward momentum, means that it's more likely for the price to rally up.

High probability analysis

Price>20 and 200

Flag pole - Up - CHECK

TArget 1 will be up to R1.93

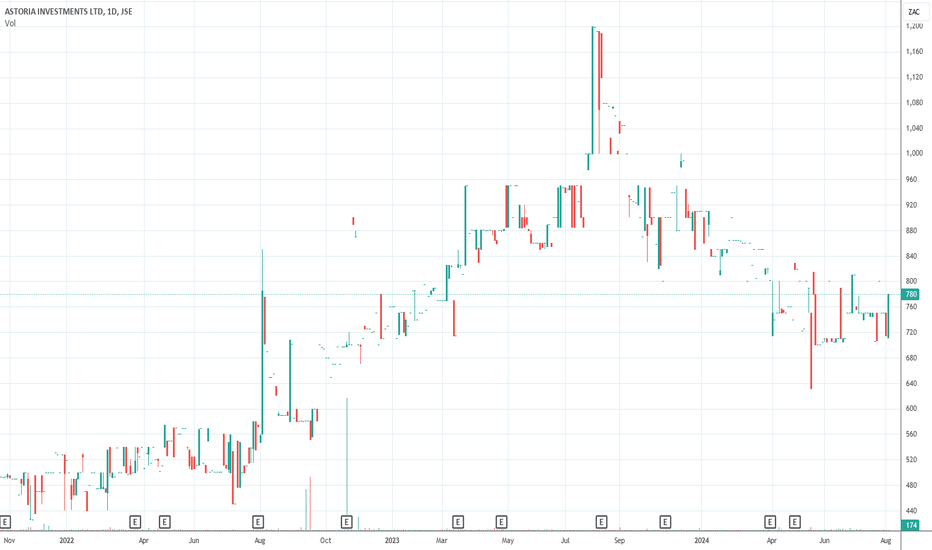

Our opinion on the current state of ASTORIA(ARA)Astoria (ARA) is an investment company established to provide investors with exposure to a diverse selection of international equities in developed economies. The share has been trading at a significant discount to its net asset value (NAV) and only recently resumed trading after being suspended from September 2020 to April 2021.

The company saw benefits from the sale of "non-lethal self-defense" products during a period marked by civil unrest. Astoria currently owns one-third of Outdoor Investment Holdings, holds a 35.7% stake in Trans Hex, and has divested its stake in CNA. On 19th April 2021, the company announced that trading in its shares had resumed following the distribution of 51.15 million shares.

In its results for the six months ending 30th June 2024, the company reported headline earnings per share (HEPS) of 79.29 cents, a significant improvement from a loss of 18.32 cents in the previous period. The company's net asset value (NAV) increased from 74.76 cents (US) per share to 77.2 cents.

Trading volume for the share has seen some improvement, with an average of R227,000 worth of shares traded per day, although there are still days with no trades. The share is currently under a cautionary announcement and appears to offer good value at its current levels.

Our opinion on the current state of EXXARO(EXX)Exxaro (EXX) is a BEE coal company with interests in iron and heavy minerals, with operations in Australia, America, and Europe. It is a major provider of coal to Eskom's Medupi power station. The company has been aiming to increase coal production from 48 million tons to about 60 million tons by 2022, though this policy might be adjusted due to the lower demand for coal on the world market. Despite the challenges, Exxaro is known for being a cash-generative operation, usually profitable depending on coal prices.

While demand for coal has been strong both locally and in the export market, the global shift towards renewable energy poses a long-term threat to the business. It is becoming increasingly difficult for the company to secure funding for new coal-fired power stations, as banks are pressured by environmental groups. On 9th April 2021, Exxaro announced the sale of its interest in Exxaro Coal Central (Pty) Ltd and the Leeuwpan Coal Mine operation.

In its results for the year to 31st December 2023, the company reported a 17% decrease in revenue and a 22% decline in headline earnings per share (HEPS). The company stated, "The revenue contribution from our energy operations was 16% higher than FY22. Energy generation from the Cennergi operating wind assets was higher, driven by improved wind conditions compared to the prior year. Group EBITDA decreased by 29% to R13 399 million (FY22: R19 001 million), mainly attributable to the 36% decrease in Coal EBITDA."

The share has been on a downward trend since the beginning of 2023. The Ukraine conflict initially had a beneficial impact on Exxaro's share price through higher commodity prices, but that effect has since dissipated. The company announced that, with the lower price of coal, it was no longer viable to transport coal to port by truck—something it had been forced to do due to inefficiencies in the South African rail and port systems.

Exxaro remains a volatile commodity play, with its share price currently in a downward trend but potentially bottoming out. In a pre-close update on 25th June 2024, the company stated, "Total coal production (including buy-ins) and sales volume for 1H24 are expected to decrease by 14% and 12% respectively, mainly due to the reduced demand from Eskom at Grootegeluk, based on their latest internal plan."

In a trading statement for the six months to 30th June 2024, Exxaro estimated that HEPS would fall by between 31% and 45%, attributing this to lower sales prices and volumes amid ongoing logistical challenges and reduced offtake from Eskom, partially offset by a slightly weaker exchange rate at its coal business. Technically, the share has been volatile but has remained in an upward trend since November 2015.

Our opinion on the current state of GFIELDS(GFI)Gold Fields (GFI) is a relatively high-cost international gold mining house with a single mine in South Africa—South Deep. South Deep was bought by Gold Fields in 2006, and the company has struggled to make the mine profitable, pouring a total of R32bn (R22bn purchase price plus R10bn in development costs) into it over the past 14 years. Brett Kebble once described South Deep as, "The world's most expensive long drop...". South Deep is 3 kilometers deep and a very difficult mine with many technical complications, but it is the second-largest unmined gold resource in the world—hence Gold Fields' persistence.

Gold Fields is working with an independent power producer (IPP) to build a 50MW project in South Africa. The company has spent a total of $502m over the past two years to ensure that Damang and Gruyere (international operations) would produce 2 million ounces a year for the next ten years. South Deep now has R800m less in costs and R400m less in capital expenditure. The company is focusing on bringing the new Salares Norte gold mine in Chile into production.

On 11th July 2022, the company said that it would list on the Toronto Stock Exchange and that it would adopt a dividend policy of paying between 30% and 45% of profits out. Its protracted investment in South Deep is definitely beginning to pay off, with output expected to rise by about 25% over the next 4 years.

In its results for the year to 31st December 2023, the company reported headline earnings per share (HEPS) of 94c (US) compared with 119c in the previous period. The average rand/US dollar exchange rate weakened by 13%, and the company's debt increased by $320m to $1024m. In an update on the first quarter of 2024 ending on 31st March 2024, the company reported 464 000 ounces of attributable production with an all-in sustaining cost of $1738 per ounce. The company said, "Production for the quarter was severely impacted by weather-related events and operational challenges, particularly at the Gruyere, St Ives, South Deep, and Cerro Corona mines, resulting in group attributable equivalent gold production (excluding Asanko) for the quarter being 18% lower year on year (YoY) and 22% lower quarter on quarter."

In a trading statement for the six months to 30th June 2024, the company estimated that HEPS would fall by between 25% and 33%. The company said, "Gold volumes sold are expected to improve in the second half of 2024 with the ramp-up of Salares Norte and production improvements at the Gruyere, St Ives, and South Deep mines."

Technically, the share is very volatile and subject to shifts in the international price of gold, but it has been in an upward trend over the past five years. It remains a volatile commodity play.

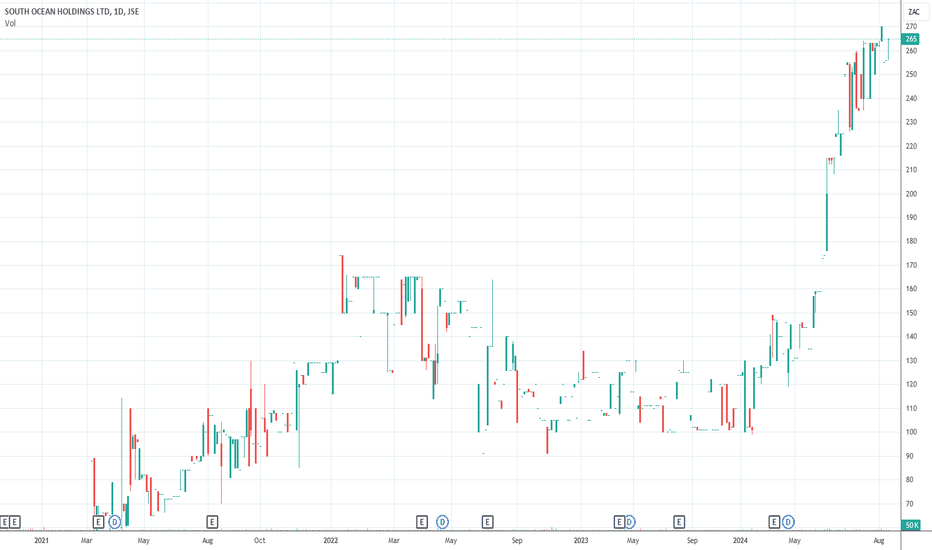

Our opinion on the current state of S-OCEAN(SOH)South Ocean (SOH) is a manufacturer of low-voltage electrical cables and an importer of light fittings and electrical accessories. The company has an electrical cable manufacturing plant at Alrode and employs 400 people. The company described itself as, "...an investment holding company, comprising two operating subsidiaries which manufacture low-voltage electrical cables, and which holds property for investment purposes." It also owns Anchor Park, which is a property company.

In December 2010, this share traded for as much as 245c, but then it fell back on persistent losses to trade at around 22c - on very thin volumes.

In its results for the six months to 30th June 2024, the company reported revenue up 5,7% and headline earnings per share (HEPS) down 10%. The company said, "Group profit before tax decreased by 10.6% (2023: 47.0%, increase in earnings before tax) to a profit of R59.0 million (2023: R66.0 million) compared to the prior period."

The share is in a strong upward trend, and volumes traded have increased sharply. The share was added to the Winning Shares List (WSL) on 6th July 2024 at 225c.

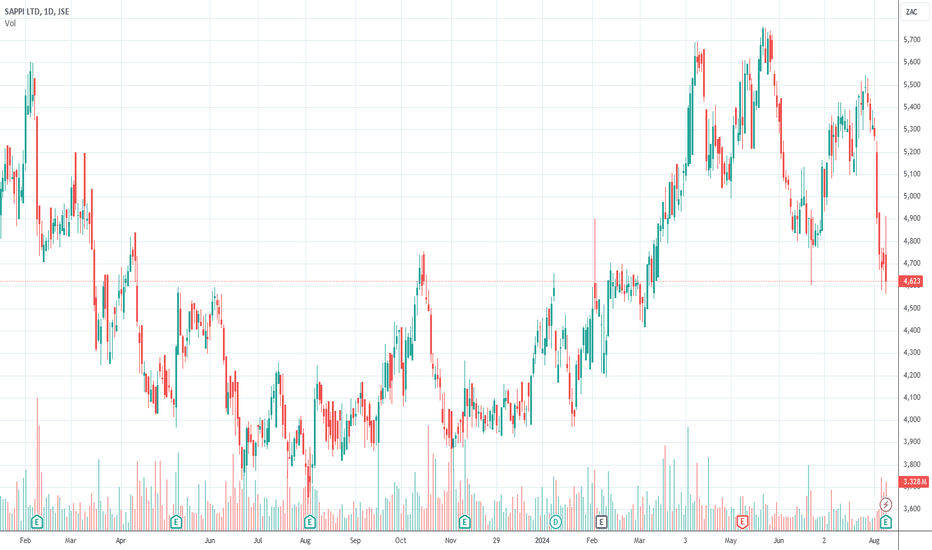

Our opinion on the current state of SAPPI(SAP)Sappi (SAP) manufactures paper, dissolving wood pulp (DWP), and paper pulp internationally and supplies products in 150 countries. DWP is used to manufacture clothing, packaging products, and many other applications. DWP, specialty, and packaging products were seen as the profit generator in the future, but until recently, the price of DWP had fallen sharply. Then in 2021, the price of DWP began to rise as demand from China surged. It is directly linked to the level of consumer spending, and it is well-diversified geographically, selling products in 150 countries.

The company said that the civil unrest in July 2021 had cut its profit by R220m. The company has had problems with the backlogs at Durban port and rising energy costs. On 13th April 2022, the company reported that the excessive flooding in the Natal province had caused it to close three of its mills. The company claimed $28m (about R430m) from insurers. On 21st April 2022, the company said that there had been no material damage and that operations had resumed, but 23,000 tons of production was lost, and 45,000 tons of inventory was damaged.

In an update on the quarter to 1st March 2023, the company reported HEPS down 67%. The company said, "Sappi delivered an EBITDA excluding special items of US$167 million against a backdrop of a challenging global economy and significantly weaker paper and pulp markets." In an update on the nine months to 30th June 2023, the company reported sales down 18% and headline earnings per share (HEPS) down 43%. The company's net asset value (NAV) was up 6% at 446c per share. The company said, "The Group faced persistent challenges in the global economy and encountered ongoing weakness in paper and pulp markets, leading to a reduction in EBITDA to US$106 million for the quarter ended June 2023."

In its results for the year to 30th September 2023, the company reported sales down 20% and HEPS down 62% in US dollars. The company's net asset value (NAV) was 5% higher at 438c per share. The company said, "The widespread disruption caused by ongoing geopolitical instability, weak global economic growth, rising interest rates, and an underperforming Chinese economy negatively impacted markets for our products."

In an update on the 3 months to 31st December 2023, the company reported sales down 23% and a headline loss per share of 22c (US) compared with a profit of 34c in the previous period. The company said, "Profitability was negatively impacted by approximately US$45 million due to the lower production volumes associated with the planned maintenance shutdowns at the Saiccor, Ngodwana and Cloquet mills offset somewhat by a US$26 million positive plantation fair value price adjustment."

In an update on the second quarter ending on 31st March 2024, the company reported sales down 6% and HEPS down 58%. The company's net asset value (NAV) dropped 13% to 387c per share. The company said, "Operating performance for the second quarter was slightly ahead of expectations with the group delivering EBITDA(2) excluding special items of US$183 million, which was 10% above the prior year."

In an update on the 3 months to 30th June 2024, the company reported sales up 3% and net asset value (NAV) down 9% at 405c (US) per share. The company said, "Operating performance for the third quarter was substantially above last year with the group delivering EBITDA(2) excluding special items of US$151 million."

Technically, the share has been in an upward trend since August 2023 but has become volatile in recent weeks. It is essentially a commodity share and hence somewhat risky.

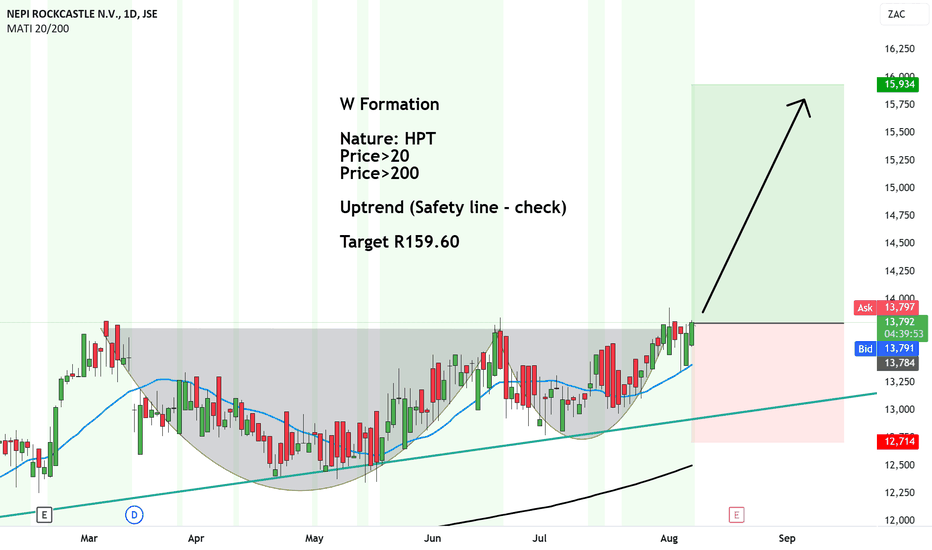

NEPI Castle ready to Rock up to R159.60 W Formation formed on NEPI.

It's a W Formation because the second rounding bottom is more than 50% the height of the first.

Nature: High probability analysis

Price>20

Price>200

Uptrend (Safety line - check)

First target will be at R159.60

I personally don't have experience trading this market, so not sure how it will play out - but the candles and liquidity seem ok.

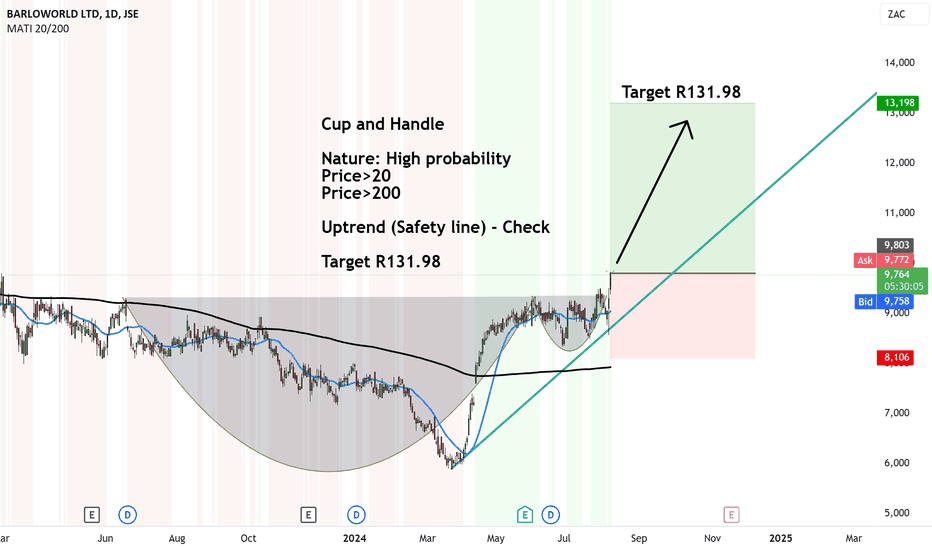

Barlo ready to rock shareholders world to R131.98Cup and Handle formed on the daily after sideways consolidation over the last year.

We had a strong breakout and the nature is igh probability

Price>20

Price>200

We have an Uptrend (Safety line) in Check which gives some security for upside.

Target R131.98

Our opinion on the current state of MPACT(MPT)Mpact (MPT) is a large producer of paper and plastics packaging in Southern Africa. It recycles paper and cardboard and makes corrugated cardboard containers for a variety of industries as well as polystyrene trays for the food industry. It has 20 manufacturing operations, with South African sales accounting for 86% of its business. It employs over 5000 people.

The business is impacted by the general level of consumer spending, which has been depressed because of COVID-19 and was improving at least until the advent of the Ukraine crisis, as well as weather considerations that affect the demand for corrugated containers for fruit and other agricultural products, especially in the Cape. Like many businesses in the current environment, Mpact has been working to preserve cash, but it has benefited from a switch to local suppliers during the pandemic.

In its results for the six months to 30th June 2024, the company reported revenue slightly down at R6.17bn and headline earnings per share (HEPS) of 144.6c compared with 211.6c in the previous period. The company's net asset value (NAV) increased 9% to 3411c per share. The company said, "The uncertain socio-political environment leading up to the national elections, high levels of loadshedding that continued until the end of March, high inflation and interest rates all contributed to weak consumer and business sentiment."

The share fell from a high of R51 in April 2016 to levels around R8 in March 2020 but has since recovered to 2902c. At the current level, it is on an earnings multiple of 5.66 - which looks cheap. Technically, the share looks like it may be entering a new upward trend, but it has been moving sideways since August 2022. On 1st August 2024, the company announced that it had sold its Versapak business for R267.7m.