Our opinion on the current state of SEAHARVST(SHG)Sea Harvest (SHG) is South Africa's most popular frozen fish brand with about 38% of the market. It is controlled by Brimstone, which has a 54.92% stake. Sea Harvest catches, processes, and freezes fish for local and export consumption. They acquired the business of Viking, which began 40 years ago and now employs 1600 people with a fleet of 30 vessels operating in Cape Town, Durban, Hout Bay, Mossel Bay, and Maputo. Viking catches, processes, and sells horse mackerel, hake, pilchards, anchovy, prawns, tuna, and rock lobster. As part of this deal, they have also acquired 50% of Viking's aquaculture business, which is one of the largest in South Africa. The cost was a total of R565m, of which R315m was paid in cash and the balance through the issue of 19.2m Sea Harvest shares.

Sea Harvest announced the acquisition of the Ladismith Cheese Company for R527m. This company produces cheese, butter, and related products and signals Sea Harvest's intention to diversify away from the fishing industry. The price paid seems quite high since it is based on Ladismith's R58m after-tax profit for the year to January 2018. On 8th March 2023, the company announced that it was increasing its stake in Viking Aquaculture to 82% for R210m.

In its results for the year to 31st December 2023, the company reported revenue up 6% and headline earnings per share (HEPS) down 5%. The company's net asset value (NAV) rose 7% to 1216c per share. The company said, "The Group's performance benefited from strong demand across all markets and channels and improved pricing while its 43% hard currency exposure allowed it to benefit from the weaker rand. Performance, however, was constrained by lower volumes as a result of difficult fishing conditions, above-inflation cost increases, load shedding, and prawn prices under severe pressure globally."

In a trading statement for the six months to 30th June 2024, the company estimated that HEPS would increase by between 13% and 18%. The company said, "The South African fishing business was challenged by continued low catch rates resulting in lower sales volumes, however, this was offset by strong demand in all markets and channels resulting in firm pricing."

The Sea Harvest share is fairly volatile with reasonable volume traded. From its listing in March 2017, the share has moved mostly sideways with a downward trend since June 2022. Obviously, the Viking acquisition has changed the nature of this business substantially, but it remains subject to the weather (which affects the catch) and the regulatory environment (where quotas can be changed by the government). In our view, given the volatility, the share remains fairly fully priced. On 15th May 2024, the company announced that the acquisition of 100% of Terrasan has received approval from the Competition Tribunal.

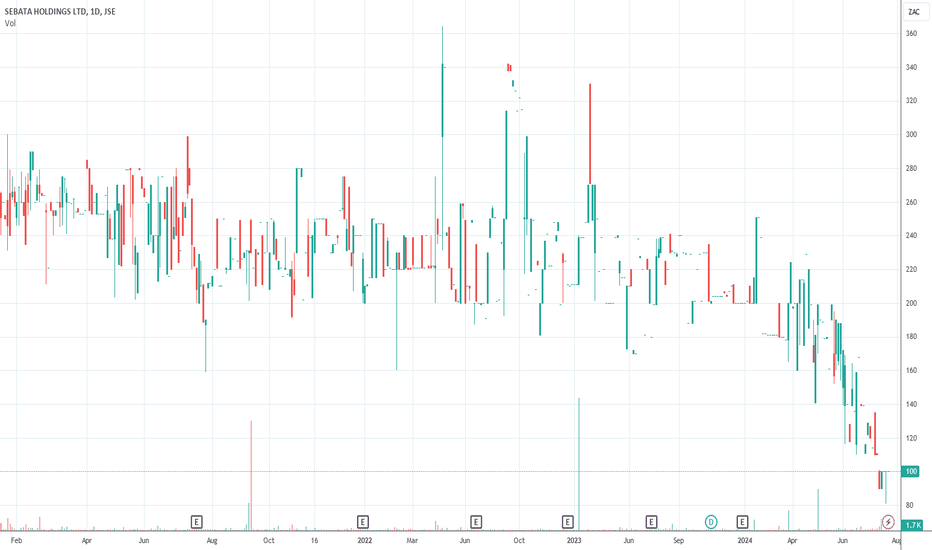

Our opinion on the current state of SEBATA(SEB)Sebata (SEB) is an investment holding company with four divisions: software solutions, water technologies, ICT support services, and consulting.

Their software solutions division consists of Sebata, which offers IT services to municipalities and public entities; Freshmark, which provides IT solutions to fresh produce providers; and Rdata, which offers an accounting package for the public sector. The water technologies division consists of Utility Systems, which provides electronic water control and pre-payment devices, and Amanzi Meters, which supplies water meters to the residential market.

The ICT support services division includes Turrito Networks, which provides telecommunications and managed solutions to the SME and corporate market, and Dial-a-Nerd, which provides IT support to SMMEs and professionals. The consulting division consists of Utility Management Services, which assists municipalities with meter reading and debt management, and Mubesko Africa, which consults to local government supplying draft policies and long-term financial planning.

Its market, which consisted primarily of municipalities, is renowned for being badly managed and for failing to pay their debts. In its results for the six months to 30th September 2023, the company reported revenue down 2,07% and a headline loss of 9,91c per share compared with a loss of 5,27c in the previous period. The company said, "Trading conditions in which the group operates remain arduous. These conditions have been exacerbated by the slowdown in the local economy and resultant slowdown in the spend of local authorities, specifically within the water sector. Local authorities are under pressure, with many being entirely dependent on funding from National Government in order to operate."

In a trading statement for the year to 31st March 2024, the company estimated that it would make a headline loss of between 100,75c and 103,65c compared with a loss of 14,48c in the previous year. The value traded in the share is less than R5 000 per day on average, which makes it impractical even for a small investment. Clearly, it does have some prospects in the UK.

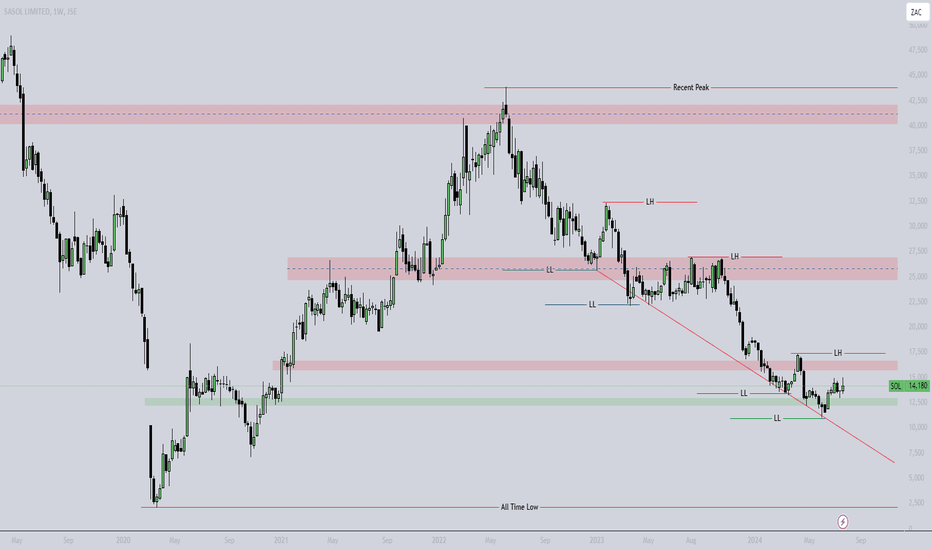

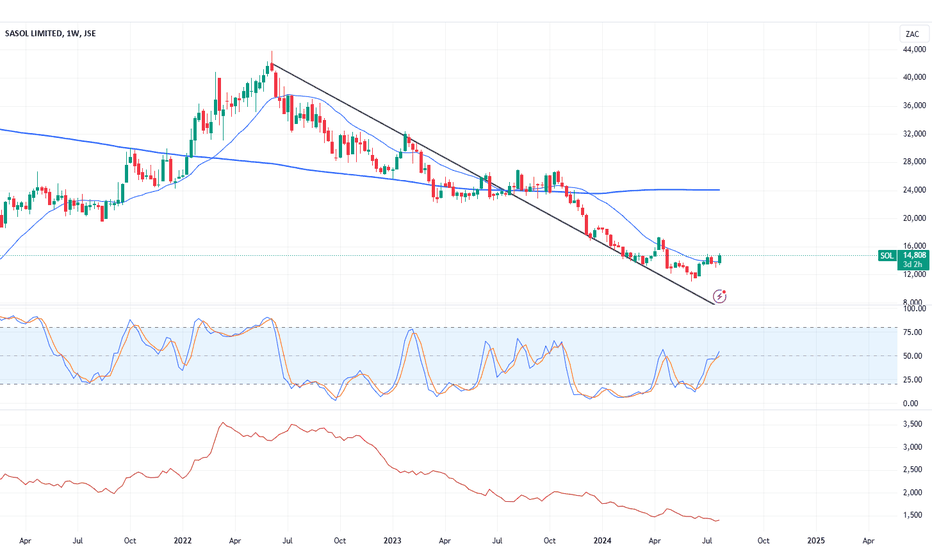

Will SASOL's market price make a Market Structure Shift?Support and Resistance Levels:

All-Time Low: At 2,110c

Highlighted Support Zones:

Around 12,000c — 13,000c (Green shaded zone) — This has been tested multiple times, indicating a strong support level.

Around 10,900c(Recent support zone marked as LL) — Recently established support zone.

Highlighted Resistance Zones:

Around 15,700c — 16,000c (Red shaded zone near recent highs) — This has been tested, indicating a strong resistance level.

Recent peak and major level at around 43,600c

Descending Trend Line: Connecting lower highs (LH) from mid-2021 onwards.

Potential Reversal: Indicated by the recent break of the descending trend line.

Lower Highs (LH) and Lower Lows (LL):

Lower Highs (LH): Indicate a bearish trend in the long term, showing that the price is making lower highs over time.

Lower Lows (LL): Indicate continued bearish sentiment as lows are lower than previous lows, supporting the trendline.

Current Price Action:

Current Price: Around 14,900c, showing a significant positive movement (+1,255c or +9.20%).

Price Consolidation: The price is consolidating between the support level of 12,000c and the resistance level of 16,000c.

Trend Reversal: The recent break above the descending trend line suggests a potential reversal in the long-term bearish trend.

Potential Scenarios:

Bullish Scenario:

Break Above Resistance: If the price breaks above the resistance zone around 16,000c and sustains above it, it could aim for the next resistance level near the 24,600c mark.

Continued Lower Highs and Lower Lows: The price making higher highs and higher lows would confirm the bullish trend reversal.

Bearish Scenario:

Failing to Hold Support: If the price fails to hold the current support around 12,000c and breaks below it, it might test lower support levels around 11,000c or even lower.

Resumption of Downtrend: A break below the recent support could signal a continuation of the bearish trend or a more extended correction phase.

Sideways Movement:

Price Consolidation: The price might continue to consolidate between 12,000c and 16,000c, forming a range-bound movement until a clear breakout direction is established.

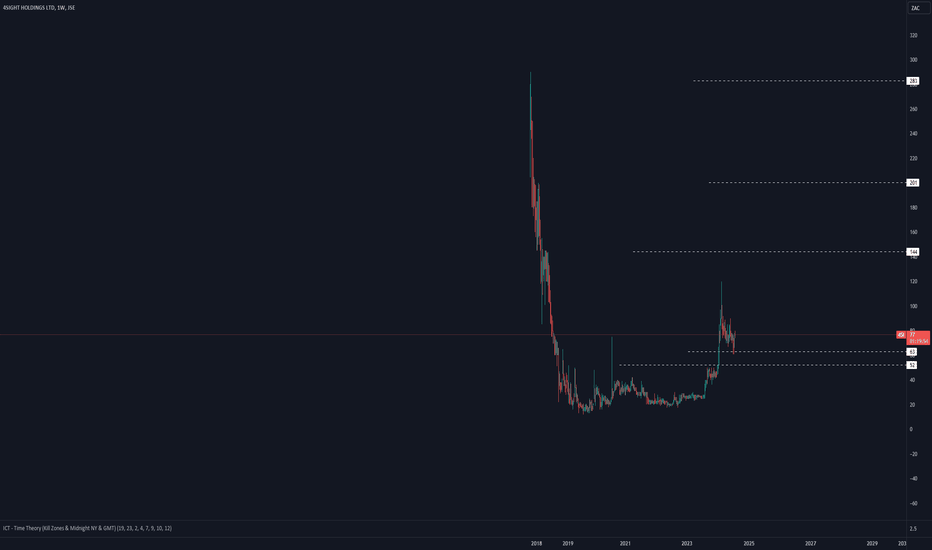

Sasol short about to get stopped out - Ready for a swing longTrades don't always work out.

The trick is to prepare for not only the stop loss to be hit but also the counter action immediately afterwards at times.

So in this case, the false break below lead to a rounding bottom and following another higher rounding bottom

If it breaks above, we will be stopped but the next trade will be imminent for a long position.

This is how we do it as active or hyper traders :)

R207.16 - New target upside

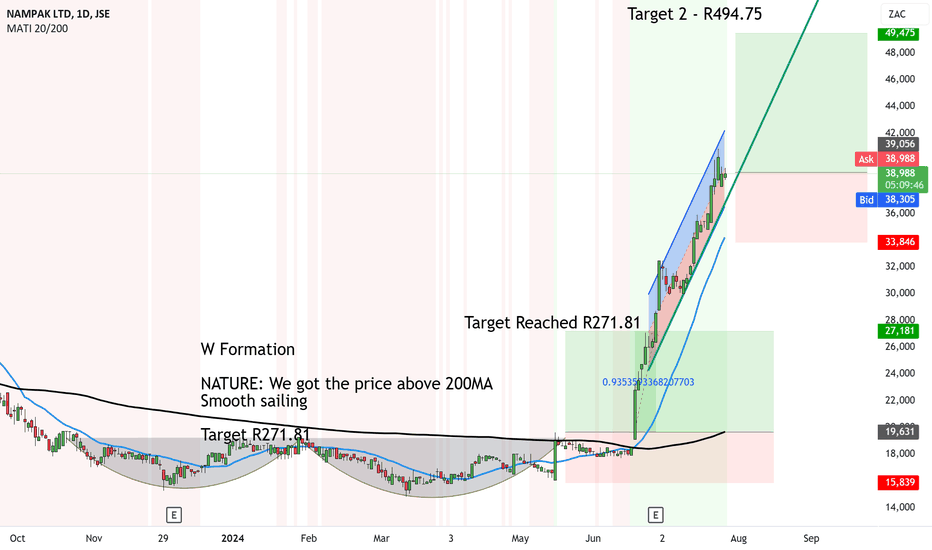

UPDATE Nampak target 2 set to R494 thanks to RegressionNampak W Formation broke above the neckline and rallied in a few short days to the first target at R271.81.

Now there is no breakout pattern emerged but there is a Regression channel showing a trend. With an uptrend line.

Below the uptrend line is the safety like which means, we can expect the price to continue up for now until it hits the target at R494.75.

Looks good

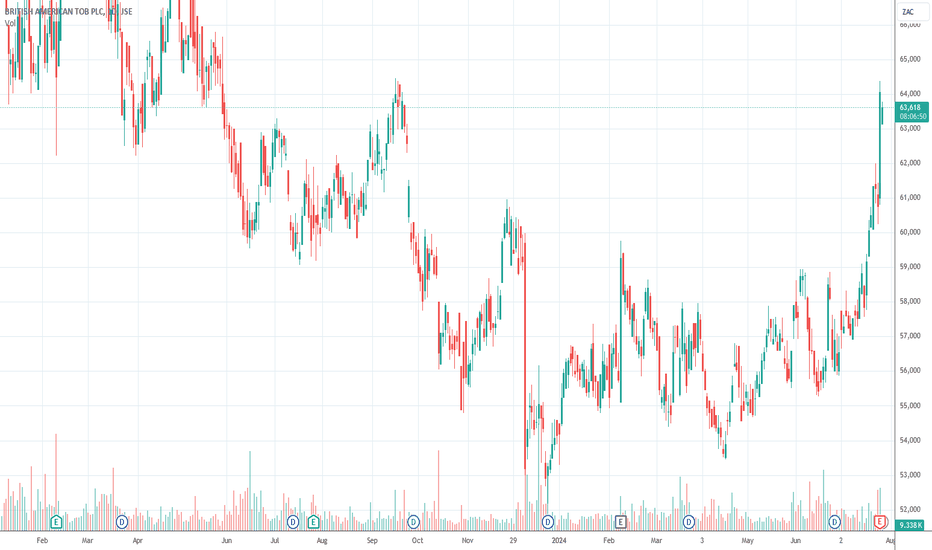

Our opinion on the current state of BATS(BTI)British American Tobacco (BTI) describes itself as a "leading consumer goods company" - which is a euphemistic way of saying that they produce and sell an enormous number of cigarettes and related products worldwide. It is also the second largest company on the JSE after Naspers. In recent decades, cigarette companies have become increasingly oppressed. Their ability to advertise their products and even package them has been severely curtailed in many countries. They are seen to be exploiting an addiction which is clearly anti-social and very bad for the individual's health, and which regularly involves them in lawsuits for damages.

BAT owns well-known brands like Camel, Peter Stuyvesant, Rothmans, Benson & Hedges, Dunhill, Pall Mall, Kent, and Lucky Strike. In an effort to get away from the negative perceptions of cigarettes, the company has diversified into "new category" products such as vaping and electronic cigarette markets, which it claims offers it a long-term prospect for growth. Recently, especially in the United States, these products have also come under the spotlight for health reasons leading to a drop-off in sales.

As an investment, the company offers some attractions. Roughly 20% of the world's population still smokes - making a truly massive market. Setting aside our distaste for the business which BAT conducts, the share looks like very good value at current levels. This is one of the shares that has performed well and perhaps even benefited from COVID-19. The CEO says that he aims to double non-combustible sales by the 2023/24 year. It is interesting that BAT considers South Africa's illegal cigarette market to be the largest in the world.

On 6th December 2023, Business Day reported that BAT had impaired its US operations by GBP25bn (R595bn) leading to a drop of 10% in the BTI share price. In its results for the six months to 30th June 2024 the company reported revenue down 8,2% with smokeless products accounting for 17,9% of revenue. Diluted earnings per share (EPS) rose by 13,8%. The lower revenue was caused by, "The sale of the Group's businesses in Russia and Belarus in the second half of 2023, with £385 million revenue included in the prior year; Lower organic Combustibles volume (down 6.9%) largely due to the challenging Combustibles market and inventory movements in the U.S. combined with the negative impact of the supply chain disruption in Sudan and the headwind on revenue as the Group exited a number of markets in APMEA (largely in Africa); and a translational foreign exchange headwind of 4.5%." The share now looks cheap to us on a P:E of 7,61.

Our opinion on the current state of ANGLO(AGL)With Anglo American (AGL), the risk normally associated with commodity stocks is mitigated in two ways. Firstly, the company has diversity of different minerals which reduces the impact of any one mineral entering a bear trend. Secondly, the traditional mechanism to avoid risk is to have a very strong balance sheet with plenty of headroom. That way, if things turn bad, you can ride out the storm. Anglo has such a balance sheet.

Anglo describes itself as a globally diversified mining company with a portfolio of world-class mining operations and undeveloped resources. It is true that commodity prices as a group tend to move in trends, and since the beginning of 2016, that trend has been steadily upward until the coronavirus caused markets to fall into a new downward trend in March 2020. The upward trend has now resumed, with a strong recovery already taking place.

An Anglo project is Quellaveco in Peru which is a massive copper mine in which Anglo owns 60% of. It will have a very rapid payback period now that it has begun producing. It is costing $5,6bn to build which should be recovered in about 4 years - and then the mine has a life of 30 years. We believe that the boom in commodity prices is continuing, and that COVID-19 is substantially behind us - commodity prices will be driven on by the economic expansion which began in America and spread to Europe and the East. Of course, the conflict in Ukraine is pushing commodity prices up, especially precious metals, because of the heavy sanctions on Russia.

So, if you are looking for an investment which is likely to be more exciting than buying one of the big banks or property REITs, and which will benefit directly from the growth in the world economy, you could do worse than to consider Anglo American. One of the factors holding the company back has been the poor availability of Transnet’s rail service, especially at Kumba. The company plans to get 100% of its energy needs from renewables in South Africa by 2023.

In its results for the six months to 30th June 2024 the company reported earnings before interest taxation depreciation and amortisation (EBITDA) of FWB:5BN - with reduced costs offsetting a 10% drop in its basket of commodity prices. Iron and copper contributed $3,5bn of the EBITDA. Debt was $11,1bn and headline earnings fell to $0.42 per share (HEPS) from $1.35 (US) in the previous period. The company, "...delivered steady volumes and a 4% improvement in unit costs, while still facing weak cyclical markets for PGMs and diamonds."

We recommended that you wait for the share to break up through its long-term downward trendline (connecting the peak in January 2023 with that of December 2023). That happened on 2nd April 2024 at a price of 47926c. The share then rose to 63480c - mainly because of an offer first announced on 13th May 2024 from BHP to buy Anglo after unbundling Kumba and Amplats. In terms of the third iteration of the offer, Anglo shareholders would get 0,8860 BHP shares for every share of Anglo that they held which would result in Anglo shareholders owning 17,8% of BHP. Anglo announced that it had rejected this third BHP offer, but opened the door for negotiations. On Wednesday 29th May 2024, BHP withdrew its offer and the downward trend in Anglo shares continued as hopes of a takeover faded. Anglo remains a commodity share linked to the international prices of various commodities. Its restructuring will leave it with Kumba and its manganese interest in South Africa.

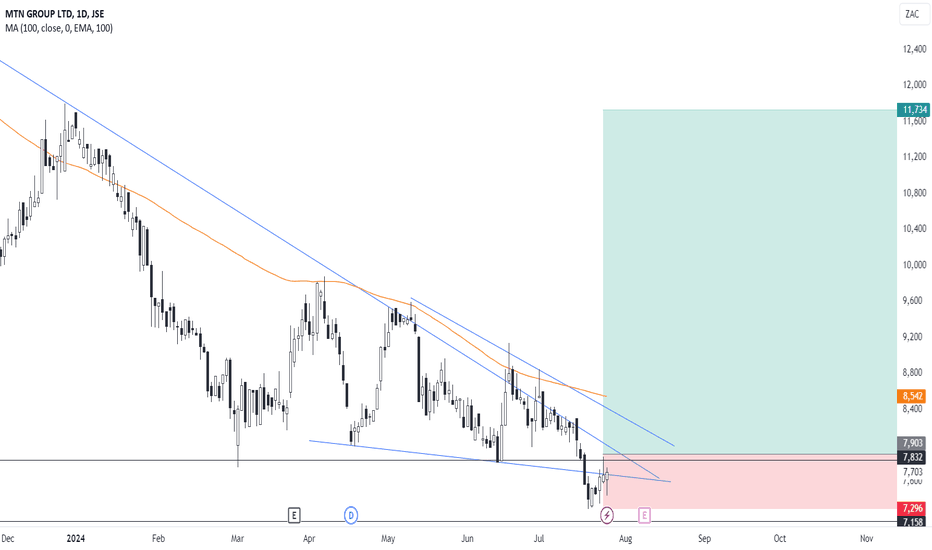

LONG MTN Group pending trend reversalJSE listed telecommunication entity, one that has a footprint in many African countries has had their share price under some pressure for some time now. Trading near near it's lowest levels pre-covid, which it broke due to panic selling during the pandemic. It then made significant recovery since those lows that hammered values with over 200% gains. All those gains have lost in the past 2 years of trading. MTN is a large South African entity with dominance considering it only has 2 other competitors it wrestles for market share. Earnings should be coming out soon, hopefully these will change investor sentiment positively.

Looking for price to close above previous support of R78.32 to signal buying taking place. This will be a value play for me, meaning I'll be looking to hold the stock as part of portfolio till I enough valid reasons to sell it. Current yield is at 4.8%, an increase in the share price would cover the below inflation return

Our opinion on the current state of AECI(AFE)AECI (AFE) is a leading producer of chemicals and explosives in South Africa. It supplies products for the mining industry, water treatment, animal health, food and beverages, and the industrial sector. It has businesses in Australia, North America, Europe, Asia, and Africa. It employs 7600 people in 22 countries. It also has a property division called "Acacia". This company has successfully diversified away from its exposure to South Africa (40% of total revenue) and shown its ability to make acquisitions which boost turnover and profits.

In its results for the year to 31st December 2023, the company reported revenue up 5,4% and headline earnings per share (HEPS) down 11,7%. The company said, "In an environment characterised by high inflation and interest rates, supply chain and logistics challenges as well as declining commodity prices; the performance of AECI Mining, our core division, steered the results. Net debt improved to R4 338 million (2022: R5 345 million) driven by stringent net working capital management in the year."

In a trading statement for the six months to 30th June 2024, the company estimated that HEPS would increase by between 54% and 60%. The company said, "One-off events, contributed to unusually high operating costs and consequently, the Group's earnings for the period are expected to be lower relative to the record performance achieved in the first half of 2023."

On a P:E of 8,36 and a dividend yield (DY) of 1,84%, we believe that the share may fall further. Technically, the share has been trending sideways for most of the last ten years. Within that, it appears to be approaching the bottom of a downtrend and ready for some recovery.

Our opinion on the current state of BALWIN(BWN)Balwin Properties (BWN) is a developer of secure sectional title properties in South Africa. The company is now turning its attention to renting out some of the properties that it develops to improve its income. The company reports strong demand for its units and is also moving into supplying solar power and internet fibre.

The share was listed 5 years ago at R10 per share but trades today for 270c. Obviously, the property development market is a function of consumers' disposable income and the state of the economy. The last three years have been very tough for consumers and the economy has been in a full-blown recession. In our view, the move to rental is a good one as it will build up a passive income which can be used to meet fixed overheads and contribute to profits.

Balwin owns 25% of Balwin Rental which has the right to buy as many as 4544 units developed by Balwin. This should help to stabilise the company's income. Eventually, it is expected that Balwin Rentals will be listed. On 4th October 2020, the company launched its Mooikloof Mega City construction project as a R44bn public/private partnership aimed at middle-income South Africans who earn between R3500 and R22000 a month (known as the "gap housing market"). This caused the share to rise by 13%.

In its results for the year to 29th February 2024, the company reported revenue down 29% and headline earnings per share (HEPS) down 48%. The company's net asset value (NAV) increased 4% to 858,49c per share. The company said, "The annuity business portfolio experienced strong growth off a low base and increased its revenue to R132.5 million, contributing 5.6% (2023: 2.3%) to the total group revenue." The group ended the period with a loan-to-value (LTV) of 40,5%.

In a voluntary update on 24th July 2024, the company stated its intention to increase its rental portfolio up to 7300 units over the next 8 to 10 years. This is seen as complementing its build capacity of 2000 to 3000 units per annum. Technically, the share has been in a long-term downward trend and we advise waiting for it to break up through its downward trendline before investigating further. We believe it will recover as the economy recovers. It is trading for 22,7% of its net asset value (NAV) - which looks really cheap.

Our opinion on the current state of VODACOM(VOD)Vodacom (VOD) is South Africa's largest airtime and data provider for cell phones. It is a subsidiary of the international company Vodafone. Its competitors are MTN, Cell-C, and Telkom. The cell phone industry has been hammered by a steady decline in voice revenue which has to some extent been compensated by a sharp rise in data usage.

The disadvantage which Vodacom has as an investment is that a foreign parent owns it. This was graphically demonstrated when its share price fell 7% in two days because it was feared that its parent company would be pressured to sell off its non-European subsidiaries. Vodacom has businesses in Mozambique, Tanzania, the DRC, and Lesotho. Now the group is looking to develop a business in Africa's fastest-growing economy, Ethiopia, with a population of 105 million.

On 2nd December 2019, the Competition Commission ruled that Vodacom and MTN had to cut their interconnect fees by between 30% and 50%. Much of Vodacom's revenue comes from interconnect fees and it saw its share price drop by 5%. The company is launching a "super-app" in conjunction with Jack Ma's Alipay to boost its non-voice revenue.

On 10th November 2021, the company announced that it was entering into a new venture called "Infraco" with Remgro in which it would own 30% potentially rising to 40%. This venture will incorporate Remgro's Dark Fiber Africa (DFA) and Vumatel and Vodacom will inject R9bn in cash. The idea is to dominate the fibre business in South Africa. It has also spent R4bn to mitigate the impact of loadshedding.

We believe that this share will perform well, but may take some time to reach former heights. In its results for the year to 31st March 2024, the company reported revenue up 26,4% and headline earnings per share (HEPS) down 10,8%. The company said, "Our acquisition of Egypt contributed significantly to the 29.1% increase in Group service revenue, supported by a resilient performance in our largest market, South Africa. A 6.4% increase in net profit showcased the robustness of our strategy and our execution track-record of adapting to changes in our operating environments, despite elevated global economic pressures."

In a trading update for the 3 months to 30th June 2024, the company reported group revenue up 1,5% in constant currencies and 10% in normalised terms. Egypt grew service revenue by 43,7% in local currency and financial services revenue by 87%. The company said, "We now process US$400 billion in mobile wallet transaction value annually."

Technically, the share has been falling since its high of 16214c on 1st April 2022 and we suggest waiting for a clear break up through its downward trendline which may now be happening. It looks cheap at current levels with a dividend yield (DY) of around 4,96% - but it is in an environment where the technology and regulation shift continuously making it risky.

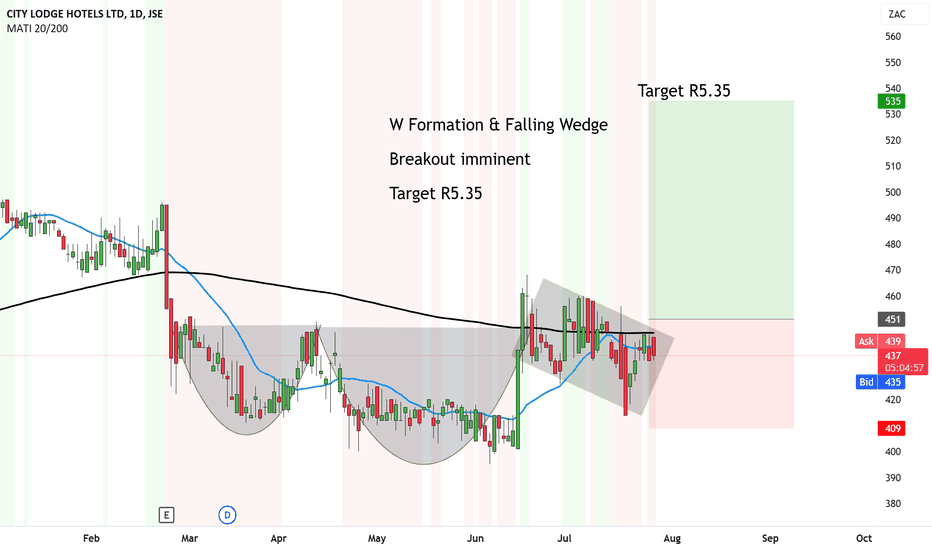

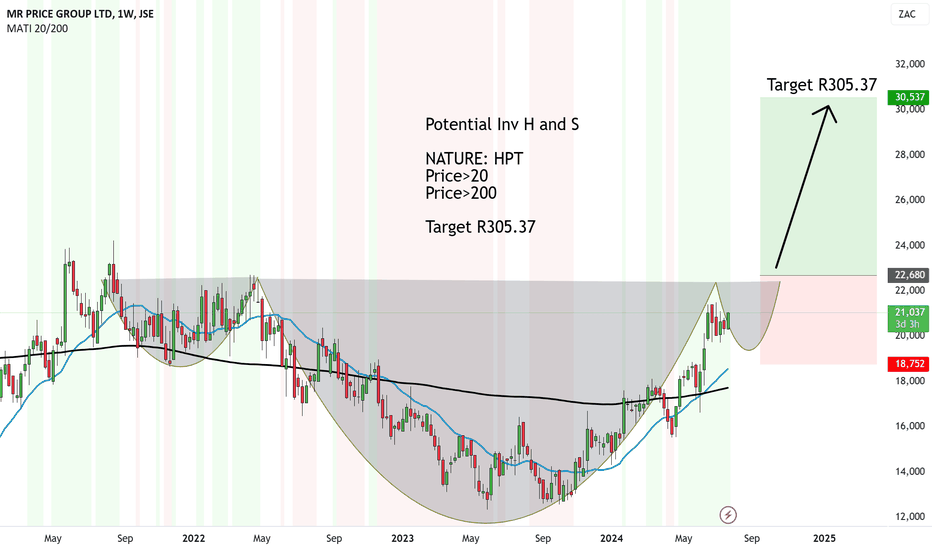

Mr Price priming for MAJOR upside in 2025Potential Inv H and S has been forming since September 2021.

Mr Price, has tested its lows at R125.00 multiple times, and the price continues to rocket up.

It now needs to form one more shoulder, higher low and cross above.

And we could see Mr Price at R305.37 by 2025.

NATURE of the analysis: High Probability

Price>20

Price>200

Target R305.37

Our opinion on the current state of SOUTH32(S32)South 32 (S32) was spun out of BHP Billiton in 2015 and contained all of BHP's South African coal assets. It is, in its own right, a diversified miner of base metals and minerals such as zinc, coal, aluminium, silver, lead, nickel and manganese. It operates in South Africa, South America, and Australia.

The company has separated out its coal assets in South Africa and especially those which supply Eskom into a separate entity which was sold on 1st June 2020 to Seriti. At the same time, the company announced that it had bought the remaining 83% of Arizona Mining which it did not already own. Arizona Mining has extensive interests in zinc, manganese, and silver described by South 32's CEO, Graham Kerr, as "...one of the most exciting base metal projects in the world." Clearly, this is another international mining house that is distancing itself from South Africa because of the administrative and legislative uncertainty here. Kerr has stated that "...mining exploration is out of the question in South Africa until the new mining charter is finalised." In moving away from South African investments, South 32 is following in the footsteps of BHP and Anglo.

In our view, South32 is an excellent mining conglomerate with good medium-term potential to exploit the recovery in base metals and minerals. The company has said that for the moment it plans to hold onto its South Deep mine. The company is continuing with its $1,4bn share buy-back. The company is working to supply its Hillside smelter with renewable energy and transition away from Eskom over the next 10 years.

In its results for the year to 30th June 2023, the company reported revenue down 20% and headline earnings per share (HEPS) of 22,6c (US) compared with 59,5c in the previous year. The company said, "During the year, we delivered strong production growth in commodities that are critical for a low-carbon future. We set three annual production records and realised the benefit of our recent portfolio improvements, increasing aluminium production by 14 per cent, base metals by 17 per cent and manganese by 4 per cent."

In a report on the 3 months to 30th September 2023, the company said manganese production was up 4% and alumina was up 3%. The CEO said, "We have maintained annual production guidance for all of our operations with a strong start to the year at our manganese operations, a 34 per cent increase in production at Brazil Alumina and continued growth in low-carbon aluminium volumes."

In an update on the 3 months to 31st December 2023, the company reported copper equivalent production reduced by 3% and record aluminium production and zinc production up 13%. In a report on the 3 months to 31st March 2024, the company reported unchanged guidance with the exception of its Australian manganese operations which were impacted by hurricane Megan. In an update on the 3 months to 30th June 2024, the company reported achieving 98% of its copper equivalent guidance. The company said, "Our performance enabled us to capitalise on stronger commodity prices, lift sales volumes and release working capital, boosting cash generation in the quarter."

Technically, the share was in an upward trend after COVID-19 but has been falling since March 2023 as commodity prices fell.

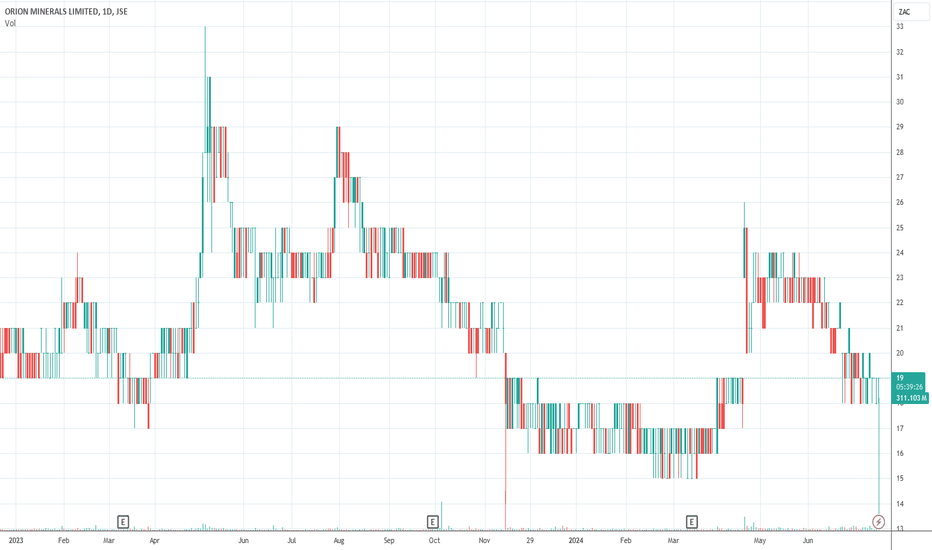

Our opinion on the current state of ORIONMIN(ORN)Orion Minerals (ORN) is an Australian exploration company which is listed on the JSE (September 2017) and on the Australian Stock Exchange in Sydney. It is trying to find funding for its copper and zinc mine in Prieska. The Prieska mine was previously operated by Anglovaal, but stopped operating in 1990 after 20 years during which it extracted more than 1 million tons of zinc and 430 000 tons of copper concentrate. The main problem with the mine is flooding. Orion hopes to exploit this resource with a mechanised approach and minimum labour. Vedanta Resources, which runs the Gamsberg mine next to Orion's resource, is looking at building a smelter that could service all the mines in the area and even resources from Namibia. Once construction begins on the Prieska mine, they will need to pump out nearly 9 million cubic meters of water from the existing structure. Production is expected to begin in 2024.

Mining exploration is probably one of the riskiest investments on the JSE. In our view, this is a volatile penny stock engaged in a particularly risky venture. On 8th September 2022, the company announced that it had secured R34,5m from the Industrial Development Corporation (IDC) for a 43,75% stake in its new Okiep copper mining company. On 21st October 2022, the company announced that it had agreed to a R250m line of credit with the Industrial Development Corporation (IDC).

In its results for the six months to 30th June 2023, the company reported a loss of A$15,2m unchanged from the previous period. The headline loss per share was 31c compared with a 33c loss in the previous period. The company said, "The IDC to become a strategic funding partner at project level in both the Okiep Copper Project and Prieska Copper Zinc Mine, with pre-development funding agreements reached, providing a total of ZAR 284.58M for Orion’s two flagship projects."

In a report on the 3 months to 30th September 2023, the company reported, "Updated PCZM +105 Mineral Resource reported, increasing the resource to 2.3Mt at 1.7% Cu and 1.6% Zn including an Indicated Resource of 1.9Mt at 1.82% Cu and 1.70% Zn and increases the total PCZM Mineral Resource to 31Mt grading 1.2% Cu and 3.6% Zn." At 30th September 2023, the company had $15,74m in cash.

In a report on its acquisition of the Okiep copper project on 17th April 2024, the CEO said, "We are extremely pleased that we have finally received confirmation that the majority of the outstanding conditions have been fulfilled for the acquisition of the Okiep mineral rights first announced on 2 February 2021." On 17th April 2024, the company asked for a halt on the trading in its shares because of a "...material announcement on exploration results at Okiep copper mine." On 22nd April 2024, the company announced a "Spectacular High-Grade Copper Intercept at Okiep Copper Project, Flat Mines Area 49m at 4.89% Cu including 10.23m at 12.47% Cu." This caused the share price to jump from 19c to 24c.

Investors should be very careful of this loss-making penny stock and maintain a strict stop-loss level. On 24th June 2024, the company reported strong assay results as follows: "...at Okiep Copper Project, Flat Mine East – High-Grade Potential Confirmed 9.27m at 3.01% Cu and 15m at 4.80% Cu within 78m averaging 1.57% Cu." In an update on the 3 months to 30th June 2024, the company reported, "A$7.7 million (~ZAR92.3 million) capital raising completed in July 2024, with funds raised to be used principally to progress the development of the Prieska Copper Zinc Mine and permitting and acceleration of infrastructure development." On 25th June 2024, the company requested an immediate stop to trading in its shares pending an announcement.

Our opinion on the current state of MR-PRICE(MRP)Mr. Price (MRP) is a retailer of clothing, household goods, and sportswear through shop fronts and online in Africa and Australia. Unlike most retailers, Mr. Price receives most of its sales in cash, but there is a growing credit element. Mr. Price has a reputation for being cheaper than other stores. This was a definite advantage during COVID-19 as consumers tried to stretch the buying power of their income. In our view, this is a good share doing extremely well in a very difficult industry, especially in the current economic environment in South Africa. There is little doubt that Mr. Price has grown its market share at the expense of other clothing retailers during the COVID-19 period.

On 15th March 2021, the company announced the acquisition of Yuppiechef, a primarily online retail kitchenware business for an undisclosed amount. On 13th April 2022, the company announced that it had purchased 70% of Blue Falcon Trading for R3,3bn in cash. Blue Falcon is the "...largest independent retailer of branded leisure, lifestyle and sporting apparel and footwear in South Africa."

In its results for the 52 weeks to 30th March 2024, the company reported retail sales up 16,2% and headline earnings per share (HEPS) up 6,7%. The company said, "Despite a challenging retail environment, the group delivered a strong second half performance as diluted headline earnings per share grew 17.4%, due to significantly improved sales momentum, GP margin expanding 160bps to 40.6% and market share gains of 90bps." In a trading update for the 13 weeks to 29th June 2024, the company reported retail sales up 4,6% with comparable sales down 0,2%. The company said, "The group has gained market share for 11 consecutive months and on a 12-month rolling basis has gained just over R1.1bn in market share."

Technically, the share was in a downward trend from April 2022. On 23rd November 2023, the share broke up through its downward trendline at a price of 16055c indicating a new upward trend. It has since moved up to 20899c. In our view, this is a very high-quality share that should be accumulated on weakness. On a P:E of 16,25 it still looks like good value.

Our opinion on the current state of MPACT(MPT)Mpact (MPT) is a large producer of paper and plastics packaging in Southern Africa. It recycles paper and cardboard and makes corrugated cardboard containers for a variety of industries as well as polystyrene trays for the food industry. It has 20 manufacturing operations with South African sales accounting for 86% of its business. It employs over 5000 people.

The business is impacted by the general level of consumer spending (which has been depressed because of COVID-19 and was improving at least until the advent of the Ukraine crisis) as well as weather considerations which affect the demand for corrugated containers for fruit and other agricultural products, especially in the Cape. Like many businesses in the current environment, Mpact has been working to preserve cash, but it has benefited from a switch to local suppliers during the pandemic.

In its results for the year to 31st December 2023 the company reported headline earnings per share (HEPS) up 8% and net asset value up 11,2% at 3363c per share. The company said, "The weak economy, weighed down further by load shedding and other public infrastructure failures, impacted many businesses and consumers who were already struggling because of high interest rates and a prolonged period of high inflation." In a trading statement for the six months to 30th June 2024 the company estimated that HEPS from continuing operations would fall by between 32,5% and 37,8%. The company said, "The Group's operating profit margin for the six-months ended 30 June 2024 decreased from the high levels achieved in the six months ended 30 June 2023 ("prior period"), which benefited from a strong recovery in Paper margins following selling price increases at the end of 2022."

The share fell from a high of R51 in April 2016 to levels around R8 in March 2020 but has since recovered to 2870c. At the current level it is on an earnings multiple of 5,6 - which looks cheap. Technically, the share looks like it may be entering a new upward trend but it has been moving sideways since August 2022.

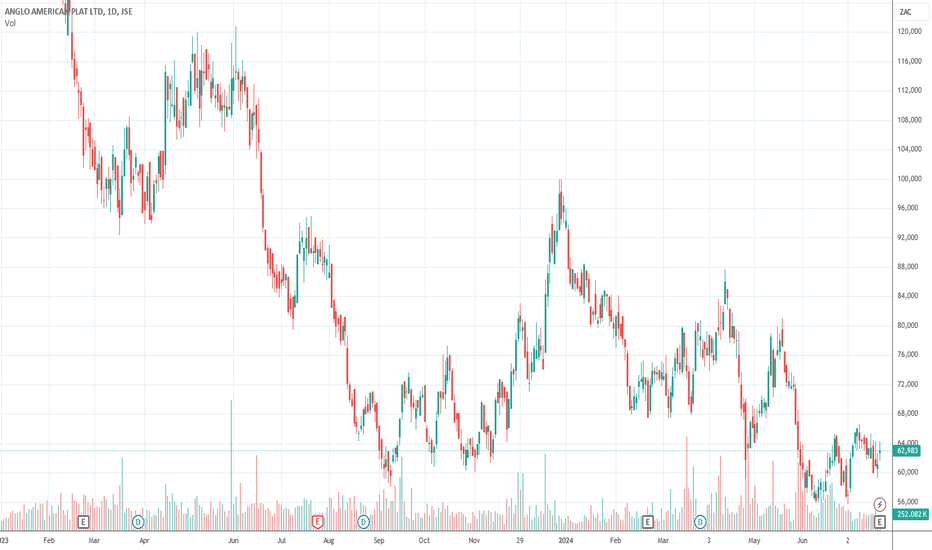

Our opinion on the current state of AMPLATS(AMS)Anglo American Platinum (AMS), or Amplats, is the second largest platinum producing company in the world (after Sibanye), producing a large portion of the world's platinum. It is owned 77,62% by Anglo American. Amplats was one of the first platinum mining companies in South Africa to move away from expensive deep-level mining towards shallower, more mechanised mining. The company has reduced the number of mines it is operating from 18 to 7 over the past 5 years, decreased overheads by 50% and its number of employees by 50%. This shift is now paying handsome dividends.

The Mogalakwena open-cast operation is a palladium-rich operation with costs in the lowest quartile in the platinum group metals (PGM) industry world-wide. A new project at Mogalakwena will see platinum production up by 250 000 ounces and palladium production up by 270 000 ounces. Amplats also recently bought out Glencore's 40,2% stake in their joint venture Mototolo mine and the adjacent Der Brochen property for R1,5bn. Mototolo is a highly mechanised shallow mine which can be extended into Der Brochen without putting in new surface infrastructure. The platinum price is plagued by an effective re-cycling industry which produces about 2 million ounces a year by recovering from old auto catalysts. We believe AMS is the best of the PGM shares on the JSE - but it remains a commodity share and thus volatile and unpredictable.

As part of its plans to boost production at Mogalakwena, the company has plans to relocate 1000 families of its employees which could result in unrest. On 10th December 2021 the company announced a R3,9bn extension to the life of its Mototolo/De Brochen mines to beyond 30 years. On 15th February 2023 the company announced that CEO, Natascha Viljoen, would resign but would serve out her 12 month notice period.

In its results for the six months to 30th June 2024 the company reported tonnes milled down 7%, production of refined PGMs up 5% and revenue down 19%. Headline earnings fell 18% and the company said, "Realised PGM dollar basket price fell 24% to an average of US$1,442 per PGM ounce due to declining realised palladium and rhodium metal prices, which were 34% and 49% lower respectively."

This share is a speculation on the international prices of the platinum groups metals that it produces and hence very volatile. Technically, the share has been falling since March 2022. This mainly due to the challenges faced by the industry including loadshedding and the falling prices that they are getting for their production. We recommend that you wait for a clear upside break through the downward trendline before investigating further. On 19th February 2023 the company announced the possible retrenchment of 3700 employees.

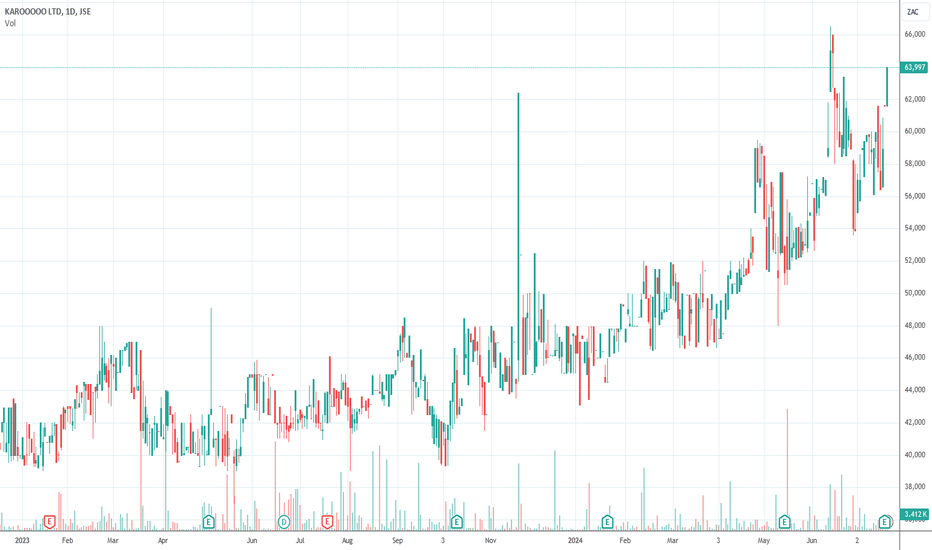

Our opinion on the current state of KAROO(KRO)Karooooo (KRO), formerly known as Cartrack, is a vehicle recovery, insurance, telematics, and fleet management company operating in 24 countries worldwide. The company boasts a 92% recovery rate, claiming it to be the best in the industry. Karooooo has demonstrated rapid organic growth, with a 21% compound annual growth rate in its subscriber base over the past six years. Approximately 96% of the company's turnover is annuity income, providing a stable and predictable revenue stream.

Zak Calisto, the founder, holds a significant ownership stake of 68.5% in the Singapore-based firm Karooooo. The company has almost no working capital requirements, and its annuity income ensures that overheads are covered before the month begins, making it an attractive investment option, especially for private investors seeking a rand-hedge.

Karooooo's listing on NASDAQ with an inward listing on the JSE enhances its ability to raise funds on the international market, attracting strong institutional interest. The company's financial performance continues to be robust. In its results for the year ending 29th February 2024, Cartrack subscribers increased by 15% to 1.97 million, and subscription revenue rose by 17%. Operating profit grew by 18% to a record ZAR1,043 million, and earnings per share increased by 24% to ZAR23.85.

On 12th February 2024, Karooooo announced a buyback program for up to 1 million of its own ordinary shares in the market. In the first quarter update, the company reported a 17% increase in subscribers and a 15% rise in subscription revenue. Operating profit for the quarter grew by 34% to ZAR300 million, and earnings per share increased by 41% to ZAR7.17.

Despite trading at a P/E ratio of 26.87, which is relatively high, Karooooo's impressive growth track record and strong financial performance justify its valuation. The company's stable annuity income, minimal working capital needs, and global presence make it a resilient investment. Given these factors, Karooooo remains a "must-have" investment for private investors, and accumulating shares on any weakness is recommended.