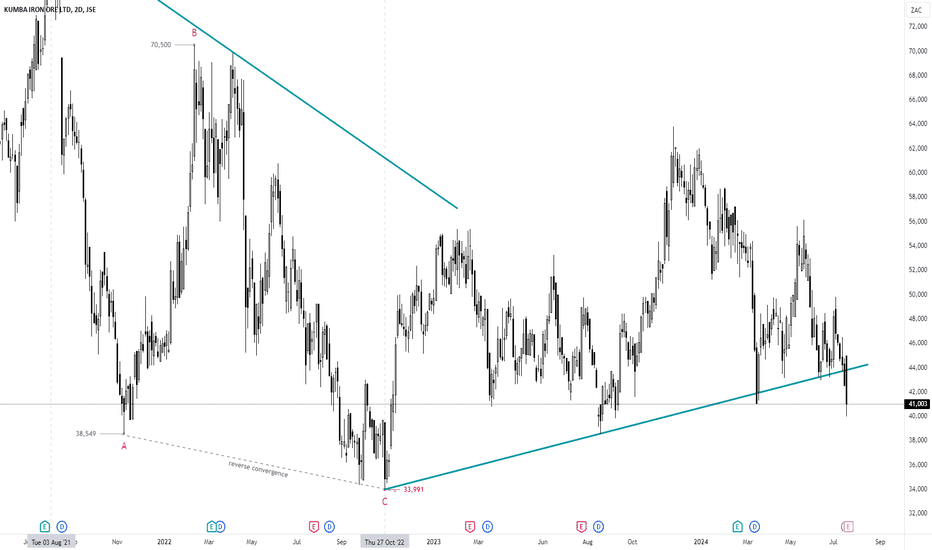

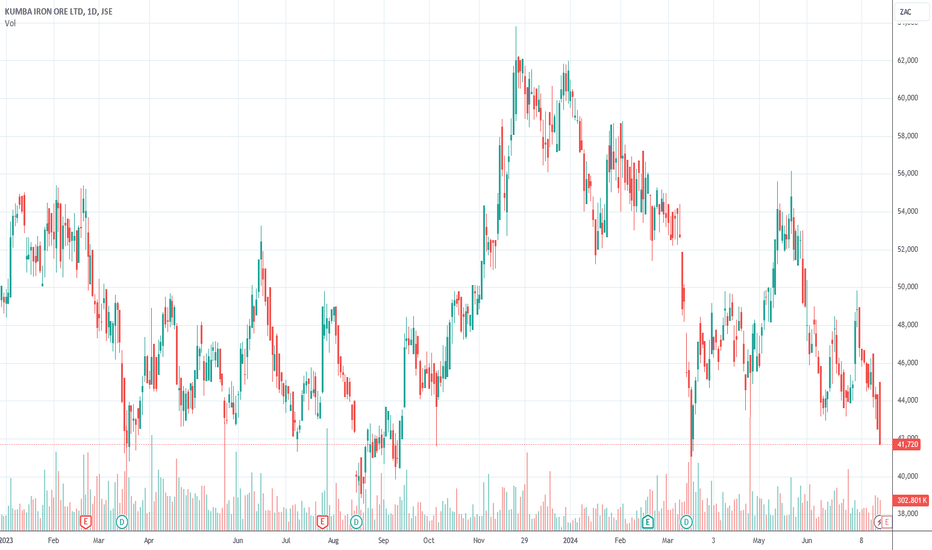

$JSEKIO - Kumba Iron Ore: Bearish Support Trendline Break See link below for previous analysis.

The advance from October 2022 was in three waves which is corrective in nature.

The stock has now had a strong weekly close below the support trendline which adds to the bearish.

I am bearish Kumba with a price target at 32000 cps.

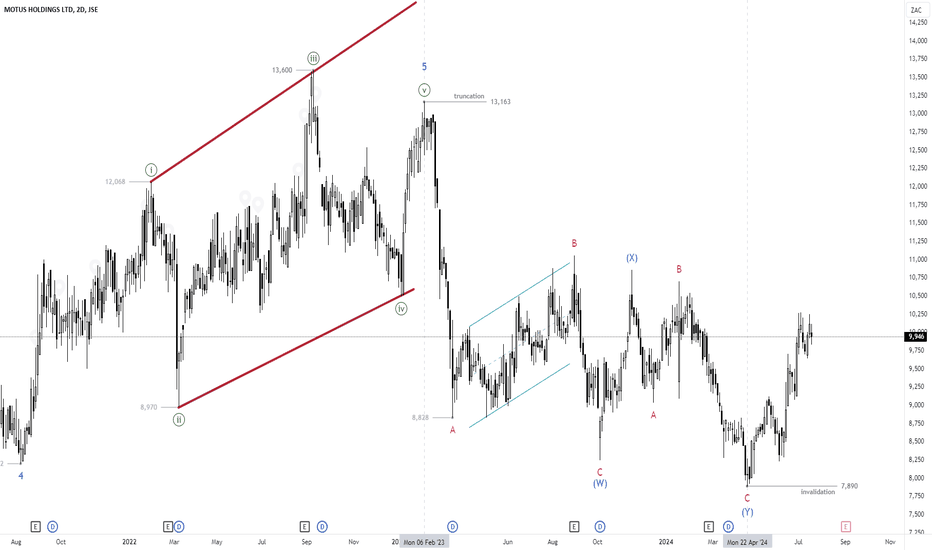

$JSEMTH - Motus Holdings: Could A Bottom Be In?See link below for previous analysis.

The sell-off in Motus has not been as strong as I initially expected and this has raised the question of whether of not the stock has bottomed.

The correction from 13163 to 7890 can be labelled as a double-zigzag.

The bounce from 7890 looks strong so I will maintain a bullish stance above 7890 with a buy the dips strategy.

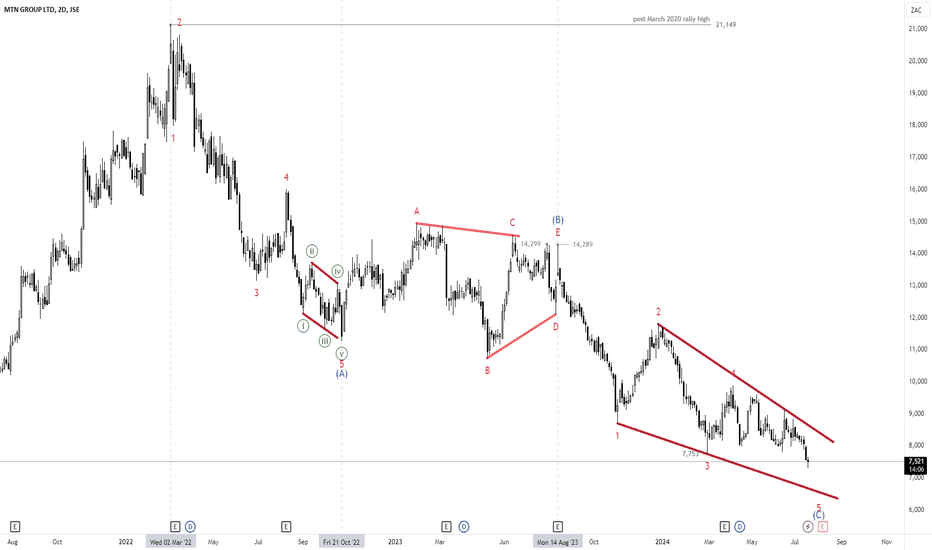

$JSEMTN - MTN: 7753 Invalidated, Now What?See link below for previous analysis.

7753 cps eventually gave way triggering an update of the wave count.

I have shifted the terminal wave E of the (B) wave triangle and I an now counting the sell-off from 14289 cps as an ending diagonal/falling wedge.

I maintain that a bottom is near and I will monitor price at the low trendline of the wedge.

The MACD is still giving a bullish convergence signal, indicating that selling momentum is weak.

I am neutral at this juncture as it is a bit late to be bearish.

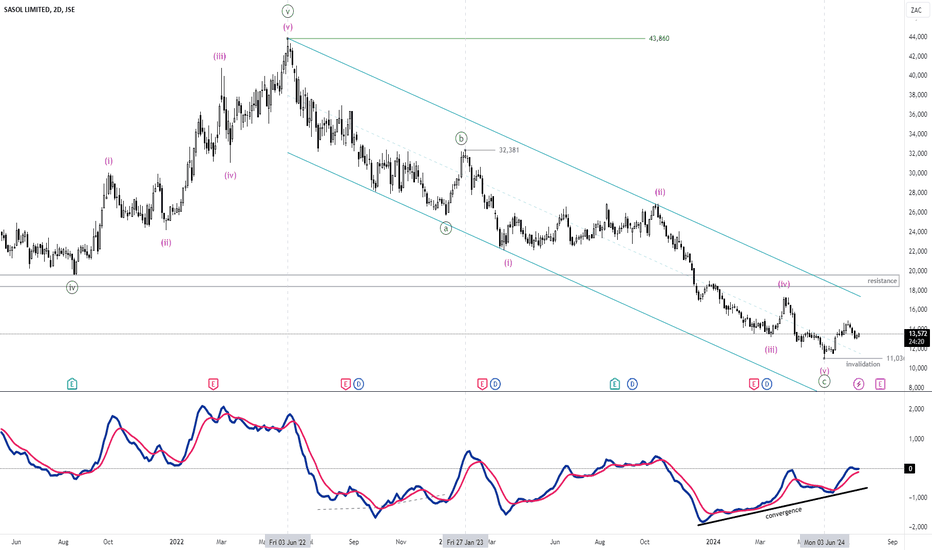

$JSESOL - Sasol: I Count Five Waves Down; 11036 cps Key LevelSee link below for previous analysis.

Fives waves can be counted from 32381 to 11036 cps for wave of the zigzag.

The bounce from 11036 has not yet unfolded in five waves to give me strong conviction but it was preceded by MACD/price bullish convergence; I am neutral to bullish at this early stage.

11036 is the key invalidation level.

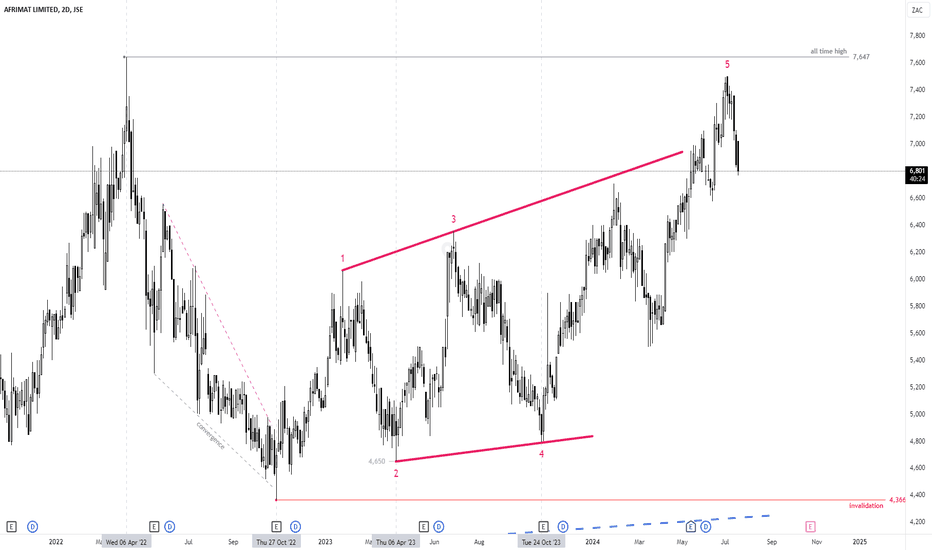

$JSEAFT - Afrimat: Creeping Towards All Time HighsSee link below for previous analysis.

The leading diagonal outlook has not changed, the fifth wave seems to have extended and travelled beyond the upper trendline creating an overshoot.

An alternative; instead of being a leading diagonal, this pattern could be an ending diagonal which would call for a steep decline in price at the completion of wave 5.

I am neutral at this juncture.

Our opinion on the current state of KUMBA-IO(KIO)Kumba (KIO) is a highly successful iron mining operation that is 79% owned and controlled by Anglo American. The share price saw a significant drop to R223 in March 2020 due to COVID-19 but recovered to R668 before falling again after the March 2022 quarterly results. Notably, exports account for 94% of the company's total sales, making it less reliant on local sales but more vulnerable to the strengthening of the rand and the efficiency of rail transport to ports.

To mitigate its reliance on Eskom, Kumba plans to build a 100MW solar park over the next three years. The company has faced challenges such as heavy rain and poor rail performance. On 10th October 2022, Kumba announced that due to the force majeure at Transnet, it would lose about 50,000 tons of production per day, increasing to 90,000 tons after seven days. This would result in a loss of approximately 120,000 tons of exports, costing the company about $8.5 million per day in production and $11.7 million in lost export revenue.

In its results for the year ending 31st December 2023, Kumba reported revenue up 16% and headline earnings per share (HEPS) up 26%. The company noted, "Average realised FOB export price of US$117/tonne, 15% above benchmark - Cost savings of R1.0 billion, underpins C1 unit costs of US$41/tonne - Resilient EBITDA* margin of 53%, up from 50% - Closing net cash* of R13.2 billion." The company is considering 490 retrenchments.

In an update for the three months ending 31st March 2024, Kumba reported total production down 2% and sales down 10%, largely driven by a 12% decrease in Kolomela's production to 2.7Mt, while Sishen's production increased by 4% to 6.6Mt.

In a production and sales update for the six months ending 30th June 2024, the company reported volumes down 2% and sales down 5%. The company stated, "The iron ore market pulled back strongly in the first half and the reconfiguration of our business to a lower production and cost profile is helping to build greater resilience in the challenging market environment. Weak steel demand in China and Europe coupled with robust iron ore supply contributed to the Platts IODEX 62% Fe CFR benchmark iron ore price falling by 26% since the start of the year."

The share trades at a multiple of 5.89 and offers a dividend yield (DY) of 8.97%, which compensates investors to some extent for the commodity risk in this rand-hedge share. However, it remains volatile and hence risky. The offer by BHP to buy Anglo includes the unbundling of Kumba. At this stage, it is not certain that the deal will go ahead.

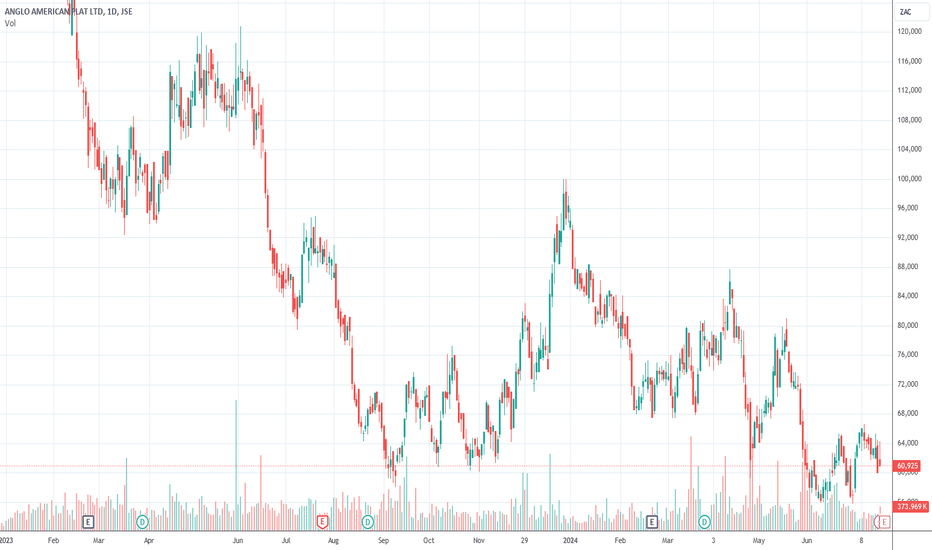

Our opinion on the current state of AMPLATS(AMS)Anglo American Platinum (AMS), or Amplats, is the world's second-largest platinum-producing company (after Sibanye), responsible for a significant portion of global platinum production. Anglo American owns 77.62% of Amplats. The company was a pioneer in the South African platinum mining sector, shifting from expensive deep-level mining to shallower, more mechanised mining operations. Over the past five years, Amplats has reduced the number of its mines from 18 to 7, cut overheads by 50%, and halved its workforce. These strategic changes are now yielding substantial benefits.

The Mogalakwena open-cast operation, a palladium-rich mine, boasts some of the lowest costs in the platinum group metals (PGM) industry worldwide. A new project at Mogalakwena is set to increase platinum production by 250,000 ounces and palladium production by 270,000 ounces. Additionally, Amplats recently acquired Glencore's 40.2% stake in their joint venture Mototolo mine and the adjacent Der Brochen property for R1.5bn. The Mototolo mine is a highly mechanised shallow operation that can be extended into Der Brochen without the need for new surface infrastructure.

The platinum market faces challenges from an efficient recycling industry, which produces about 2 million ounces annually by recovering platinum from old auto catalysts. Despite these challenges, we believe AMS is the best PGM share on the JSE, although it remains a volatile and unpredictable commodity share.

As part of its expansion plans at Mogalakwena, Amplats plans to relocate 1,000 families of its employees, which could lead to potential unrest. On 10th December 2021, the company announced a R3.9bn extension to the life of its Mototolo/De Brochen mines, extending their operational life to beyond 30 years. On 15th February 2023, the company announced that CEO Natascha Viljoen would resign but would serve out her 12-month notice period.

In its results for the year to 31st December 2023, Amplats reported refined PGM production down 1%, with the rand basket price of PGMs per ounce down 26%. Revenue fell 24%, and headline earnings per share (HEPS) decreased by 71%. The company stated, "Refined production was 1% lower, primarily due to lower metal-in-concentrate production and the impact of Eskom load-curtailment of c.82,000 PGM ounces. This was offset by the release of concentrate stocks. Sales volumes increased by 2% due to the drawdown in refined stock. Our realised dollar basket price fell by 35% in 2023 to $1,657 per PGM ounce - the lowest level since 2019."

This share is a speculation on the international prices of the platinum group metals it produces and is hence very volatile. In an update for the three months to 31st March 2024, Amplats reported PGM production down 7% and PGM sales volumes unchanged. In a trading statement for the six months to 30th June 2024, the company estimated that HEPS would be between 15% and 25% lower. The company stated, "Earnings have decreased for the year largely due to a 24% lower realised ZAR PGM basket price relative to H1 2023."

Technically, the share has been falling since March 2022, mainly due to industry challenges including loadshedding and falling prices for their production. We recommend waiting for a clear upside break through the downward trendline before investigating further. On 19th February 2023, the company announced the possible retrenchment of 3,700 employees.

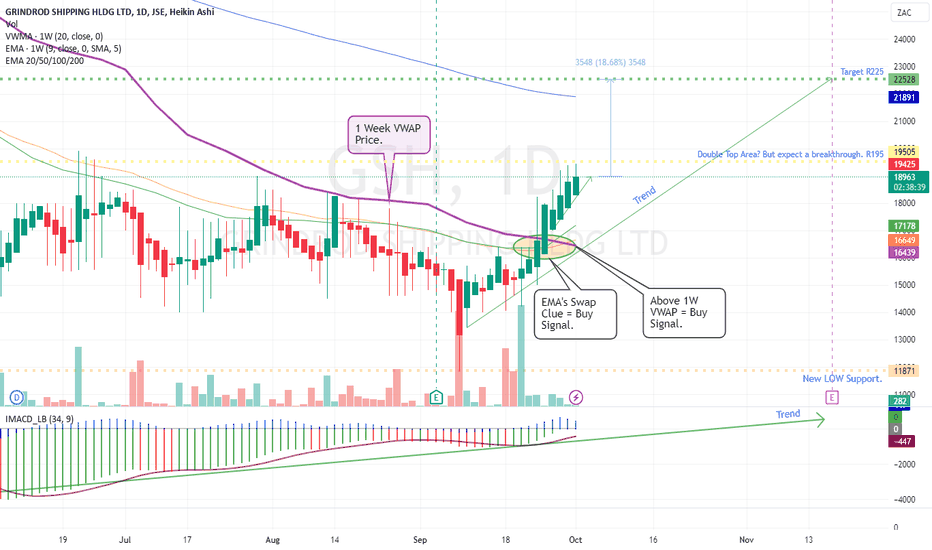

Grinship JSE above 1 Week VWAP.Grinship JSE is above the 1 Week VWAP.

However this stock has a low volume trade.

The latest SENS seems to taken as a positive signal due to the upcoming Capital Reduction.

As with all Investment's one must do their own research or get expert advice.

I hope this ticker is discussed on the Business TV news so more insight can be gleaned.

If you do Trade, always use a trailing Stop Loss to protect your Capital.

Regards Graham.

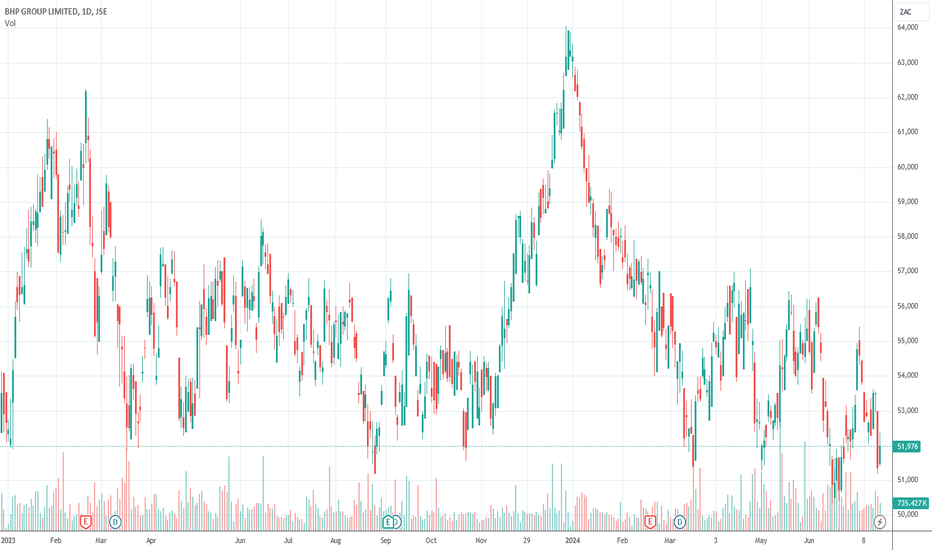

Our opinion on the current state of BHP(BHG)BHP is a global commodities company headquartered in Melbourne, Australia, with a workforce of 62,000 primarily based in the Americas and Australia. The company processes a diverse range of minerals, oil, and gas, including copper, iron ore, coal, oil, and gas.

BHP owns significant interests in several major mining operations worldwide:

- **Escondida Mine** (Chile): BHP holds a 57.5% stake in this mine, which is one of the world's largest producers of copper and also yields gold and silver.

- **Antamina Mine** (Peru): BHP owns 33.75% of this mine, which produces copper and zinc.

- **Pampa Norte** (Chile): This operation produces copper cathode in the Atacama Desert.

- **Samarco** (Brazil): BHP holds a 50% stake in this iron ore production operation.

- **Cerrejon** (Colombia): BHP owns one-third of this open-cut coal mine.

- **Saskatchewan (Canada)**: BHP holds mineral rights to one of the world's largest unexploited potash deposits.

- **Olympic Dam** (Australia): This site hosts one of the largest ore bodies for copper, uranium, and gold globally.

- **Western Australia Iron Ore**: A system of five mines connected by more than 1000km of railways.

- **Queensland Coal**: This includes the Mitsubishi Alliance and Mitsui Coal.

- **Mt. Arthur Coal Mine** (New South Wales): An open-pit coal mine.

- **Nickel West** (Australia): A nickel mining and processing operation.

- **Petroleum Resources**: High-quality resources in the Gulf of Mexico, Australia, Trinidad, and Tobago.

In its results for the six months to 31st December 2023, BHP reported a 6% increase in revenue but a 48% decline in headline earnings per share (HEPS). The company's tangible net asset value (NAV) per share was $8.68, slightly down from $8.91 in the previous period. The company highlighted strong production records at its copper operations in South Australia and Chile, and noted progress in the Jansen Stage 2 project in Canada, which will nearly double its planned potash production capacity. Despite volatility in global commodity prices and softer-than-expected demand in the developed world, demand from China remains healthy, and India is seen as a bright spot.

For the nine months to 31st March 2024, BHP remained on track to meet its production targets for copper, iron ore, and energy coal. Copper volumes increased by 10%, driven by strong performance and additional production from South Australia, record year-to-date output from Spence, and improved grades and production at Escondida. In its operational review for the year ending 30th June 2024, BHP reported a strong performance across its copper business, with the highest production in four years at Escondida and another record year at Spence.

As a diversified international mining company, BHP is directly impacted by commodity prices and global economic recovery. The share price has been on a long-term upward trend since the commodity cycle turned upwards in January 2016 but experienced a sharp decline with the coronavirus pandemic. It recovered strongly post-March 2020, continuing its upward trend but facing pressures from falling commodity prices since early 2024.

On 25th April 2024, BHP announced a share offer for the entire issued share capital of Anglo American, contingent on Anglo unbundling Amplats and Kumba. The offer was initially rejected by Anglo, followed by two further improved offers, with negotiations still ongoing. This bid might spark a bidding war with other industry giants such as Rio Tinto and Glencore.

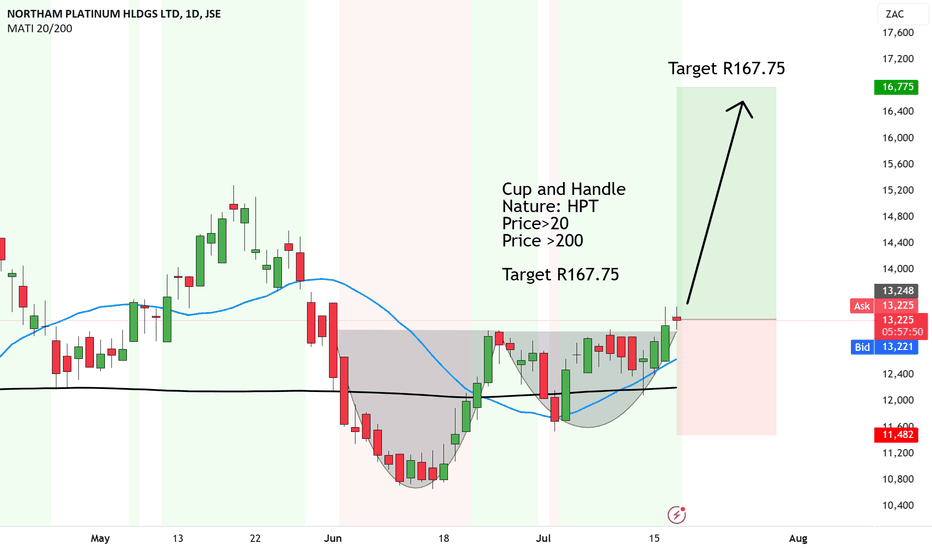

Northam just broke out of its cup and handleCup and Handle formed on Northam and the momentum is looking good for upside.

As many brokers and market maker in SA don't allow trading PLatinum, the only next options we have are platinum stocks. So this one is one that is almost mimicking the precious metal.

We are seeing price above 20 and 200MA. And this means it's a High probability analysis...

Target R167.75

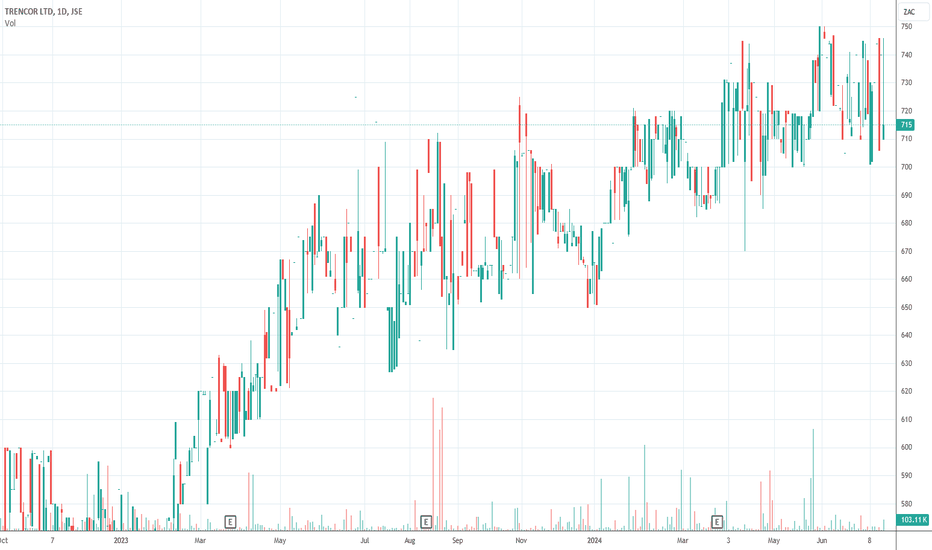

Our opinion on the current state of TRENCOR(TRE)Trencor's (TRE) primary asset is its 47.78% ownership of Textainer, a US-listed company specializing in the rental of shipping containers (Twenty-foot Equivalent Units or TEUs). Notably, Trencor spent R100 million buying back its own shares between 4th October 2018 and 6th December 2018. Investors have expressed dissatisfaction with Textainer's performance compared to its competitors. For instance, Triton had a return on equity of 16%, while Textainer's was only 1.7%.

Trencor has unbundled its holding of Textainer into the hands of its shareholders, resulting in a tax liability of R17 million. In its results for the year to 31st December 2023, the company reported headline earnings per share (HEPS) of 71.5c, a significant increase from 1.7c in the previous period. The company's net asset value (NAV) rose to 813c per share.

However, in a trading statement for the six months to 30th June 2024, the company estimated that HEPS would fall by between 84.6% and 86.1%. The company noted, "The SA rand/US dollar exchange rate at any point in time can have a material impact on basic earnings and headline earnings per share."

The share has an average daily trading volume of R660,000, making it practical for investment. Additionally, the share is in an upward trend, which may be appealing to potential investors.

Our opinion on the current state of RICHEMONT(CFR)Richemont (CFR) is the world's second-largest supplier of luxury goods, controlled by the Rupert family in Stellenbosch. Its sales are entirely located overseas, making it an excellent rand-hedge. The company’s luxury brands include Mont Blanc, Cartier, Lancel, Jaeger-LeCoultre, Van Cleef, and Piaget. Richemont has boosted online sales to 21% of turnover by acquiring Yoox-Net-A-Porter (YNAP), Watchfinder, a UK online group, and entering into a joint venture with the online giant Alibaba. This joint venture aims to develop apps to penetrate the Chinese market and offer its line of luxury goods through Alibaba's Tmall Luxury Pavilion.

Richemont is directly linked to the recovery of the world economy following the pandemic. While the company's sales clearly took a hit from COVID-19, they are expected to continue rising, especially now that it is aggressively offering its products online. This share is also impacted by the slowdown in the Chinese economy and the developments in Central and Eastern Europe. It will benefit from the recovery in the world economy but will be impacted by changes in the strength of the rand.

In its results for the year to 31st March 2024, the company reported sales up 3% and 8% in constant currencies. Headline earnings per "A" share fell by 4%. The company said, "Jewellery Maisons delivering a 33.1% operating margin, with sales up 6% at actual exchange rates (+12% at constant exchange rates). Strong net cash position of EUR 7.4 billion, with a solid increase in cash flow generated from operating activities to EUR 4.7 billion."

In an update on the first quarter to 30th June 2024, the company reported sales up 1% in constant currencies and, "Mid-single digit growth at the Jewellery Maisons and the Group's 'Other' business area (which includes the Group's Fashion & Accessories Maisons) offsetting lower sales at the Specialist Watchmakers impacted by strong exposure to Asia Pacific."

This share made an "island" formation in October and November of 2023 before beginning a new upward trend. It is clearly a rand hedge, but it is dependent on the Chinese consumer. We expect it to perform well, but on a P/E of 21,57 it is not cheap.

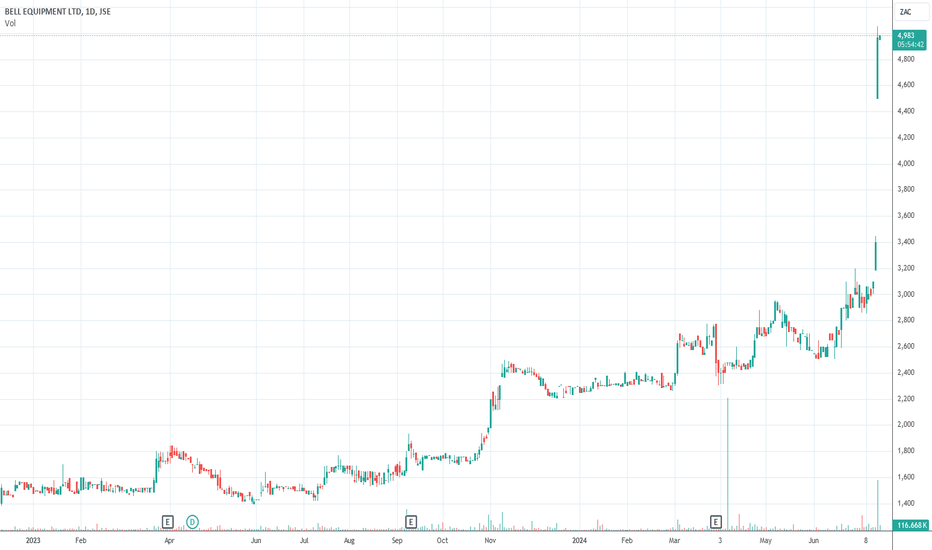

Our opinion on the current state of BELL(BEL)Bell (BEL) is a manufacturer and distributor of heavy and earth-moving equipment to the mining, construction, agriculture, and waste management industries. The company has been directly impacted by the slowdown in construction since 2008 and the collapse of the mining industry. Bell's articulated dump trucks are exported worldwide from South Africa and Germany. Bell also has dealerships for several other global manufacturers, giving it a product range of over 120 products. Roughly 60% of its business comes from outside South Africa. The company employs 3200 people, of whom 88,6% are in South Africa.

The CEO of Bell, Gary Bell, has indicated to Business Day that the company would consider delisting, with 1A Bell making an offer to minorities (but he did not disclose at what price). Some minority shareholders are now saying that the board has a fiduciary duty to put the company up for sale to the highest bidder. On 18th February 2021, the company announced that a deal had been struck for 1A Bell to buy a further 31,4% of Bell, giving it a 70% stake at R10 per share - a 13% discount to the share price.

In its results for the year to 31st December 2023, the company reported revenue up 32% and headline earnings per share (HEPS) up 69%. The company's net asset value (NAV) increased 21% to 5527c per share. The share trades over R1m worth of shares on average each day, making it suitable for a private investor. There was an on-balance-volume (OBV) buy signal on 7th September 2023 at 1752c per share. Since then, the share has moved up to 2480c.

On 15th July 2024, the company announced that the Bell family had made a firm offer to buy out the 30% of Bell which it did not own at R53 per share - which is an 82,3% premium to the 30-day volume weighted average price (VWAP) of the price of 11th July 2024 (3100c). The share will be delisted once the transaction is completed.

This move to delist at a substantial premium indicates confidence from the Bell family in the company's future prospects. For current investors, this offer represents a significant return on their investment, and for potential investors, it highlights the importance of monitoring company buyout offers for opportunities.

Our opinion on the current state of M&R-HLD(MUR)Murray and Roberts (MUR) is a large South African construction company that has suffered from the sub-prime crisis and the slump in construction spending following the 2010 World Cup. This brought the share down from a massive double-top formation at around R100 per share to a low below R5 in May 2020. The company has been consolidating and reducing costs. It has transformed itself into a "...multinational engineering and construction Group focused on the natural resources market sectors..." with three primary business platforms: underground mining, oil & gas, and power & water.

On 27th March 2023, the company announced that it had sold its Australian operations (65% of Insig Technologies) for A$1, thus disposing of A$7m in liabilities. On 8th December 2023, the company reported that it would be able to reduce its debt from R2bn in April 2023 to R350m as a result of "Cementation Canada Inc's recently renewed banking facility agreement with a Canadian bank will provide for Cementation Canada to pay CAD40 million."

In its results for the six months to 31st December 2023, the company reported revenue of R6,6bn, up from R5,9bn in the previous period. The company made a headline loss of 16c per share, compared to the loss of 27c made in the previous period. The order book fell from R16,1bn to R14,7bn and net debt reduced to R247m from R1,96bn. The company said, "Interest for the reporting period decreased to R75 million (FY2023 H1: R134 million*) and the tax charge was R81 million (FY2023 H1: R65 million*). Interest is expected to not exceed circa R100 million per annum, as from the new financial year."

Murray and Roberts remains a relatively risky penny stock, but there are signs that it may be on a recovery path. On 15th July 2024, the company announced that it had won a $200m multi-year contract in Latin America.

The company's transformation and recent contract wins suggest potential for recovery, but caution is advised due to its historical volatility and current penny stock status. Investors should monitor the company's performance and news closely for further signs of stabilization and growth.

Our opinion on the current state of NORTHAM(NPH)Northam (NPH) is a fully empowered platinum mining company operating in the Bushveld complex. In the current difficult legislative environment where the 3rd mining charter is regarded as unfriendly from an investment point of view, Northam is probably the only mining house buying up new properties.

It has come to an arrangement with Anglo American to exploit a property adjacent to its Zondereinde mine (the deepest platinum mine in South Africa). It has also bought Eland Platinum from Glencore for R175m, which it intends to re-start at a cost of R2bn. On 29th October 2019, the company announced the acquisition of Maroelabult for R20m, which is west of the Eland mine with an analogous ore body. This has accelerated the bringing to production of Eland and required very little capital. With the Eland mine, Northam got a concentrator plant which can process up to 250,000 tons a month. In return, Glencore got the right to market all of Northam's chrome.

At the same time, Northam has recently commissioned a new smelter to try to process its backlog of platinum ore, which is estimated to be worth about R2,5bn. Zondereinde is a deep-level mine which has all the problems associated with mining at depth, while Booysendal is a shallow mechanised mine which is much easier to manage. Both mines are profitable, but the empowerment structure results in Northam always reporting a loss because of the preference dividend that must be paid. Once Booysendal is complete, the company should generate strong cash flows.

The appointment of Mcebisi Jonas (former South African Minister of Finance) and Jean Nel (previously CEO of Aquarius Platinum) as non-executive directors will significantly add to the strength of the board. The company has the stated intention of doubling its workforce as it strives to become a major PGM supplier in the world. With plans to increase production of PGM's over the next few years to 1 million ounces, this is probably one of the better options in the industry. The company has also sold its Impala shares for R3,1bn.

In its results for the six months to 31st December 2023, the company reported sales revenue down 25,5% and headline earnings per share (HEPS) down 92,5%. The company said, "Disposal of Northam’s investment in RBPlat into the Implats Mandatory Offer for R9.0 billion in cash and 30 065 866 Implats Shares, significantly strengthening our balance sheet and liquidity position. The PGM industry is currently navigating significantly depressed PGM prices and high inflation, together with a raft of global geopolitical uncertainties and locally, Eskom load curtailment events. For the 6-month period ended 31 December 2023 (H1 F2024), the ZAR 4E basket price achieved decreased by 42.3%."

In a voluntary production update on the year to 30th June 2024, the company reported a 10,4% increase in the production of refined 4E metals and a 7,3% increase in total metals sold. The company said, "The current price environment may endure for some time, and this, combined with higher general inflation, continues to exert pressure on the entire PGM sector. Given our UG2 dominant resource base, well-capitalised mining assets and proactive balance sheet management, Northam remains well-positioned."

Since April 2021, there has been a steady decline in the share price, which has seen it fall back substantially. Despite this, we see a good future for this company in the longer term, but it remains a volatile commodity share. We recommend waiting for a clear break up through the downward trendline before investigating further.

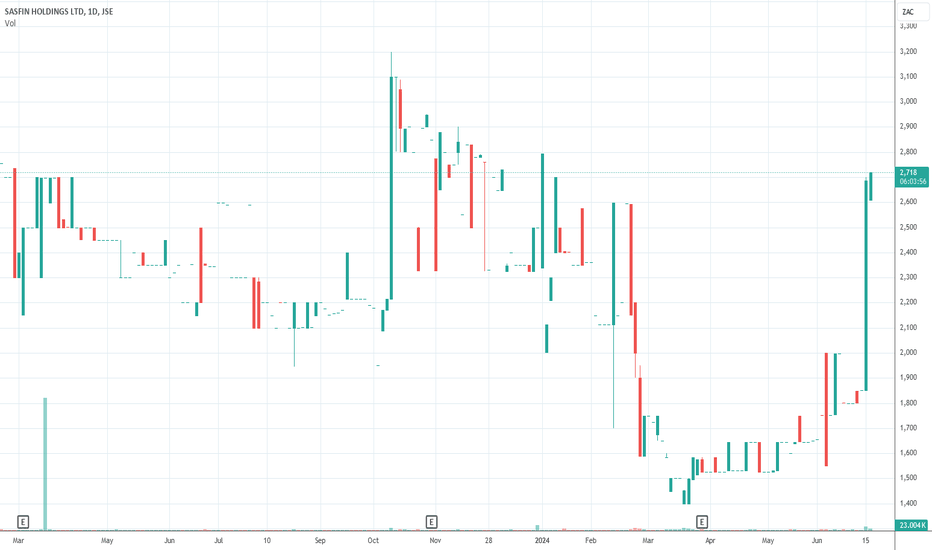

Our opinion on the current state of SASFIN(SFN)Sasfin (SFN) is a banking group that specialises in various types of finance for small businesses and high net-worth individuals. It was listed on the JSE in 1987. The company has been investing heavily into its digital platforms and acquisitions.

The share was in a strong downward trend, and we advised investors to wait until there was a measurable turn in the price, such as an upside break through its long-term trendline, before investigating further. That upside break has not yet occurred, mainly because of the impact of COVID-19, but there are signs that the share is beginning to recover. On 16th October 2023, the company announced, "Sasfin has entered into binding heads of agreement to dispose of its capital equipment finance and commercial property finance businesses to African Bank Limited." This caused the share price to rise sharply.

On 27th February 2024, the company announced that it had received a civil summons from the South African Revenue Services (SARS) for a damages claim of R4,782bn plus interest and penalties in respect of income tax, value-added tax (VAT), and penalties allegedly owed by former foreign exchange clients of the bank. The company has a market capitalisation of just R484m.

In its results for the six months to 31st December 2023, the company reported headline earnings per share (HEPS) down 62.39% and net asset value (NAV) up 4.09% to 5191c per share. The company said, "The primary reasons for the decrease were negative adjustments to the Group's fair value loans and private equity portfolio as well as an increase in credit impairments, reflecting the challenging economic environment for businesses within South Africa."

The share is fairly thinly traded, with only about R110 000 worth of shares changing hands on average every day. On 15th July 2024, the company announced that it intended to delist from the JSE. Shareholders will be offered R30 per share - a 66% premium to the 30-day VWAP on 12th July 2024.

Our opinion on the current state of PICKNPAY(PIK)Pick 'n Pay (PIK) is a retail grocery chain with over 2000 stores, mostly in South Africa, but also in the rest of Africa. The company was started by Raymond Ackerman in 1967 and became the dominant grocery retailer over time, before being displaced by Shoprite/Checkers. Summers has once again resumed the role of CEO, following his stint at Pick n Pay as CEO between 1999 and 2007.

In its results for the 52 weeks to 25th February 2024, the company reported turnover up 5.4% and a headline loss of 203.06c compared with a profit of 259.25c in the previous year. The company said, "Trading profit declined 87.4% to R385.0 million, reflecting a R1.5 billion trading loss for Pick n Pay (a sharp reversal versus FY23's R1.3 billion profit), and a R1.9 billion trading profit for Boxer (R1.8 billion profit in FY23). The result was further impacted by a 198.8% increase in net interest paid to R701.8 million, as a result of higher gearing and increased interest rates."

Technically, Pick 'n Pay has been in a downward trend since 2016 and has lost substantial ground to Shoprite. On the latest results, it remains in a long-term downward trend. The link-up with Mr. D and Takealot should help the company to catch up in the online shopping market. To re-capitalise the business, it is planning to separately list Boxer and conduct a rights issue to raise R4bn in mid-2024. The rights issue was approved by shareholders at a general meeting on 26th June 2024.

The company will issue 252.2m nil paid letters of allocation (NPL) in the ratio of 51.11 NPLs for every 100 Pick n Pay shares held - resulting in a dilution of 33.8%. The NPLs will be listed separately for a period. The take-up price will be 1586c per share - a discount of approximately 32.48%. Obviously, when the rights issue is complete, the price of Pick 'n Pay shares can be expected to fall by roughly one-third. The rights issue would require the Ackerman family to inject R1bn to retain their holding at 25% of the company.

We recommended that you apply a 200-day simple moving average and wait for a clear upside break before investigating further. That break came on 27th May 2024 at a price of 2558c. The share has since moved up to 2750c. Despite this, the share remains risky.

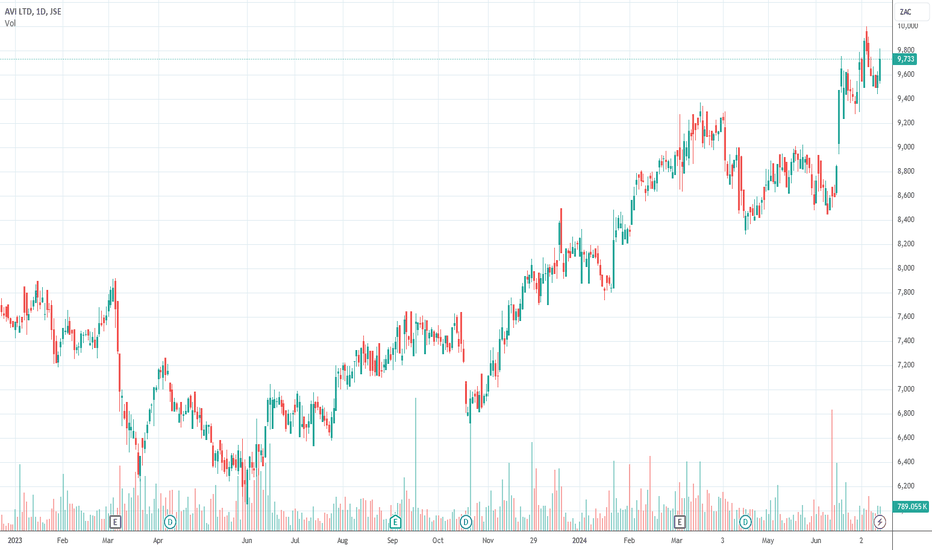

Our opinion on the current state of A-V-I(AVI)Anglovaal Industries (AVI) is a diversified producer of consumer products in the food, cosmetics, and apparel sectors. It boasts a range of well-known South African brands such as I&J fish, Five Roses tea, Salticrax, Frisco, Provita, Yardley, Spitz, and Kurt Geiger. The company announced that it had sold its Australian seafood company Simplot for R633 million, yielding a net after-tax profit of about R370 million.

Over the decades, AVI has undoubtedly been one of the best blue-chip shares trading on the JSE. Its share price has shown a remarkable rise over the past twenty years. Twenty years ago, the share was trading for around 150c, and today it trades for about R65 at a cyclical low point. It has been a steady payer of dividends throughout that period. An investment in Anglovaal is an investment in the South African economy, but one which has shown itself to be virtually recession-proof until COVID-19. The coronavirus had an impact on consumer spending, and the AVI share price fell quite heavily because of this. More recently, it has been falling due to the crisis in Ukraine.

In its results for the six months to 31st December 2023, the company reported revenue up 7.1% and headline earnings per share (HEPS) up 17.4%. The company said, "Revenue growth in Entyce was driven by a combination of improved sales volumes and higher selling prices taken in response to significant input cost pressures. Snackworks achieved revenue growth in both biscuits and snacks due to higher selling prices and improved snacks volumes. I&J had a difficult semester with revenue declining 5.1% due to poor catch rates."

In a trading statement for the year to 30th June 2024, the company estimated that HEPS would increase by between 21% and 25%. The company said, "Group revenue increased by 6.3% underpinned by selling price increases to offset cost pressures and volume growth in the beverage categories. The Group's consolidated gross profit grew ahead of revenue supported by improved gross profit margin in most categories. Selling and administrative expenses increased at rates marginally higher than CPI."

On a P/E of 15.98 and a dividend yield (DY) of 4.21%, the share looks reasonably priced, even cheap. In our view, this company will improve as the South African economy improves, and it should be accumulated on any significant weakness. We advised waiting for a clear break above its long-term downward trendline, which happened on 8th November 2023 at a price of 7418c per share. The share has subsequently moved up to 9734c.

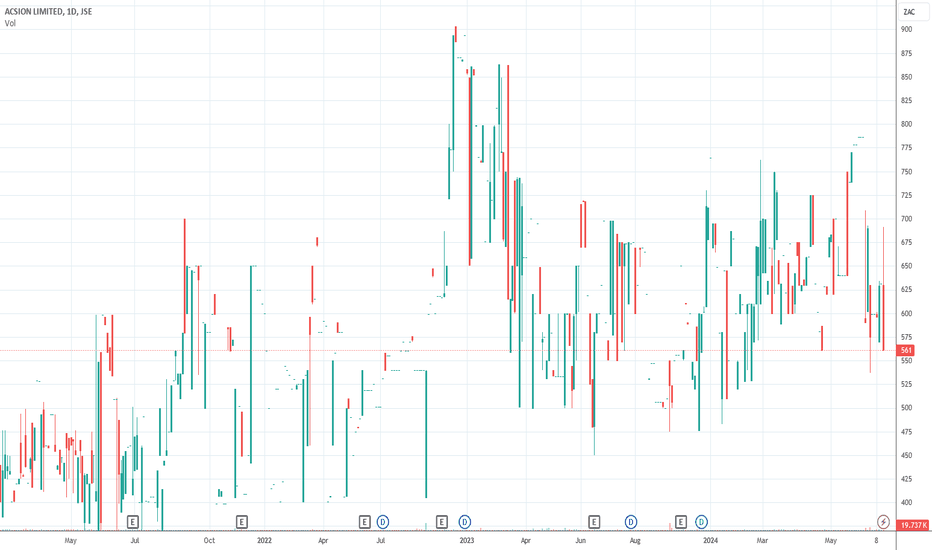

Our opinion on the current state of ACSION(ACS)Acsion (ACS) is a real estate investment trust (REIT) with properties mainly in the retail sector. The portfolio is worth R8.3 billion with a gross lettable area (GLA) of 37,628 square meters across 9 properties. In its results for the year to 29th February 2024, the company reported revenue up 21% and headline earnings per share (HEPS) down 18%. The company said, "A continued area of focus is investment in renewable sources of energy to mitigate energy shortages and allow for operational cost efficiencies. The planned investment to increase our current generation capacity from 11mWp to 20mWp over the next 12 months supported by 20mWh battery storage is progressing within budget and the project completion timeline of 28 February 2025."

The problem with this share, from a private investor's perspective, is that it is relatively thinly traded with only R73,000 worth of shares changing hands on average each day. This makes it practical only for a small investment of up to R20,000.

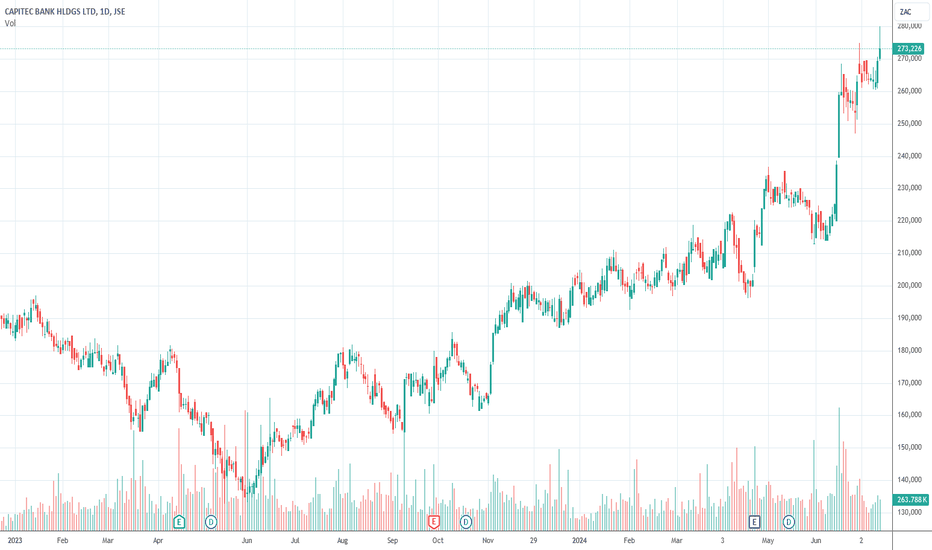

Our opinion on the current state of CAPITEC(CPI)Capitec Bank (CPI), now the country's largest bank by customer numbers (21,1m), was launched by PSG and has been a major disruptor in the South African banking system. It has steadily taken retail market share from the other banks by offering a cheaper and easier solution, especially for the previously unbanked section of our population. The company is adding about 90,000 funeral policies every month. In our view, this share is a "must-have" for any private investor's portfolio.

Capitec's parent company, PSG, has now unbundled its holding of Capitec shares to release shareholder value. Capitec's client base is mostly in the lower living standards measure (LSM) levels, and so it has just less than 10% of the retail deposit base despite its enormous number of clients. Capitec's annual average growth in HEPS for the past 19 years since 2003 is 32,2% per annum - an incredible record.

On 19th January 2022, the company announced that it intends to conduct a BBBEE transaction by giving about R1bn worth of its shares to staff who have been working at the company since the beginning of 2019 or earlier. The issue is expected to dilute the share and caused the share price to fall.

In its results for the year to 29th February 2024, the company reported headline earnings per share (HEPS) up 16% and return on equity (ROE) of 26%. The bank increased its number of active clients by 10% to 22,2 million. The company said, "Non-interest income made a significant contribution to the 16% growth in headline earnings for the 2024 financial year and increased to 72% of income from operations after credit impairments."

In a trading statement for the six months to 31st August 2024, the company estimated that HEPS would increase by between 25% and 35%. The company said, "The lower CLRs have persisted into the 2025 financial year and the net transaction and commission income including value-added services has continued to contribute to strong growth in non-lending income."

Technically, the share has been rising since June 2023. It is now on a multiple of 29,79 - which is still well above the JSE Overall index (13,61) and other leading banks. Despite this, in our view, Capitec remains excellent value. This is a share you should accumulate on weakness.

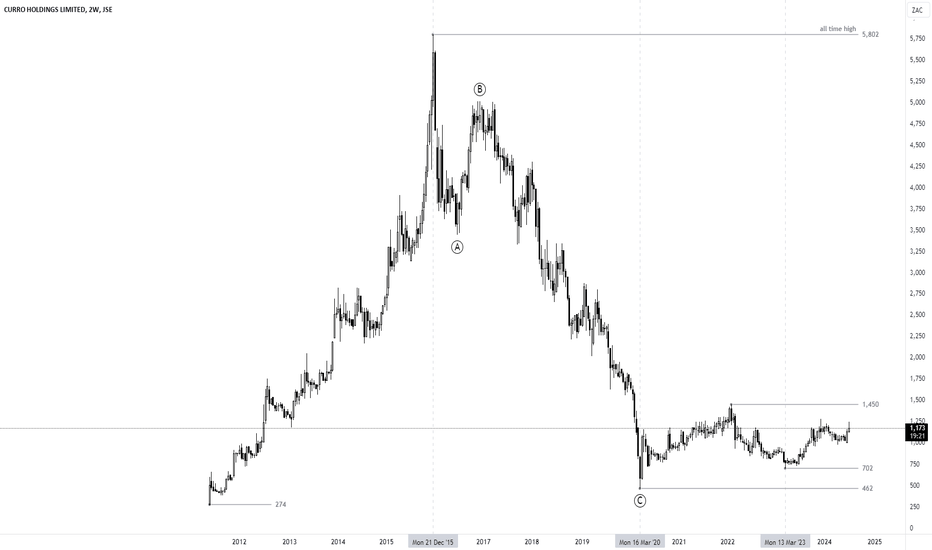

$JSECOH - Curro: The Big PictureFirst time coverage.

Curro took off like a rocket after its IPO peaking in 2015 @ 5802 cps.

Fast growth always has sustainability questions and the market has not been kind since.

The stock, like many others, found a bottom in March 2020 after the covid outbreak but the bulls have been timid, perhaps highlighting the fundamental picture.

From an Elliot Wave perspective, the big bear from 5802 to 462 unfolded as a zig zag which in all likelihood is complete.

This could be a value trap; the technicals might look good but one has to take a deeper dive into the fundamentals.

I am neutral to bullish.

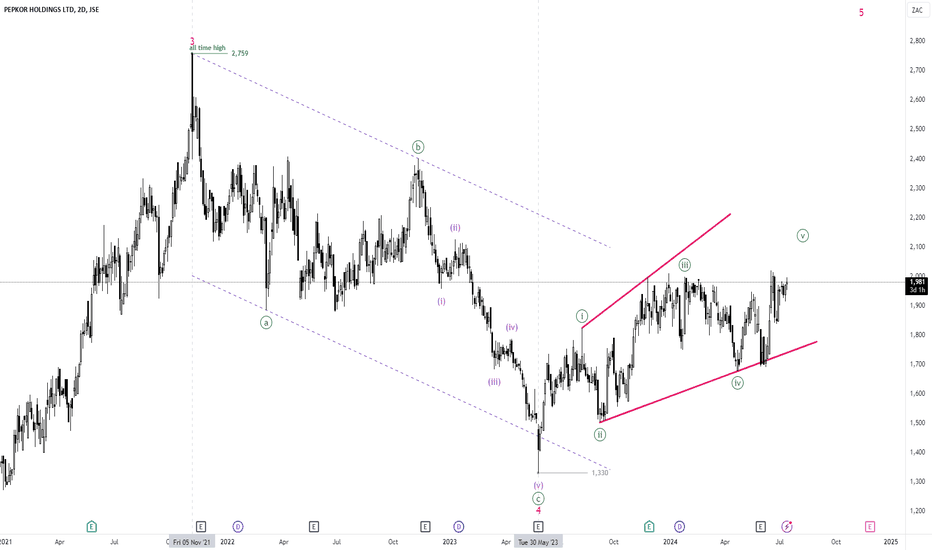

$JSEPPH - Pepkor: Still A Slow & Steady GrindSee link below for previous analysis.

Nothing much has changed in 6 months of trading.

The leading diagonal outlook is still valid and the longer-term trend is still bullish though i anticipate a correction after the completion of the fifth wave of the leading diagonal.

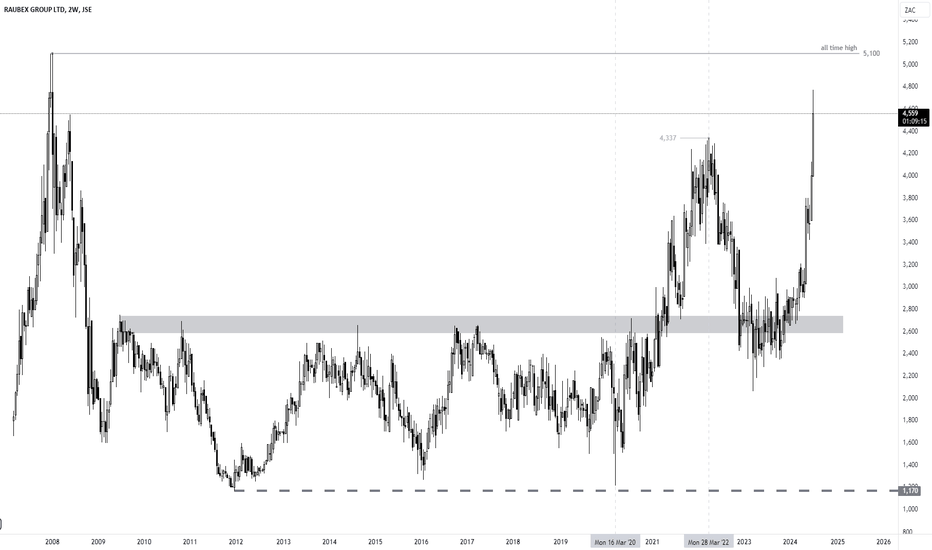

$JSERBX - Raubex: Targeting New All-Time HighsSee link below for previous analysis.

The stock certainly took its time and for the first time since i started looking at the stock i am bullish.

The trend is clearly to the upside and momentum looks very strong with very shallow pullbacks.

It's a bit late to jump in here but the stock looks likely to make a new all time high soon.