Our opinion on the current state of PICKNPAY(PIK)Pick 'n Pay (PIK) is a retail grocery chain with over 2000 stores, mostly in South Africa, but also in the rest of Africa. The company was started by Raymond Ackerman in 1967 and became the dominant grocery retailer over time, before being displaced by Shoprite/Checkers. Summers has once again resumed the role of CEO, following his stint at Pick n Pay as CEO between 1999 and 2007.

In its results for the 52 weeks to 25th February 2024, the company reported turnover up 5.4% and a headline loss of 203.06c compared with a profit of 259.25c in the previous year. The company said, "Trading profit declined 87.4% to R385.0 million, reflecting a R1.5 billion trading loss for Pick n Pay (a sharp reversal versus FY23's R1.3 billion profit), and a R1.9 billion trading profit for Boxer (R1.8 billion profit in FY23). The result was further impacted by a 198.8% increase in net interest paid to R701.8 million, as a result of higher gearing and increased interest rates."

Technically, Pick 'n Pay has been in a downward trend since 2016 and has lost substantial ground to Shoprite. On the latest results, it remains in a long-term downward trend. The link-up with Mr. D and Takealot should help the company to catch up in the online shopping market. To re-capitalise the business, it is planning to separately list Boxer and conduct a rights issue to raise R4bn in mid-2024. The rights issue was approved by shareholders at a general meeting on 26th June 2024. This would require the Ackerman family to inject R1bn to retain their position as 25% shareholders.

We recommended that you apply a 200-day simple moving average and wait for a clear upside break before investigating further. That break came on 27th May 2024 at a price of 2558c. The share has since moved up to 2739c. Despite this, the share remains risky.

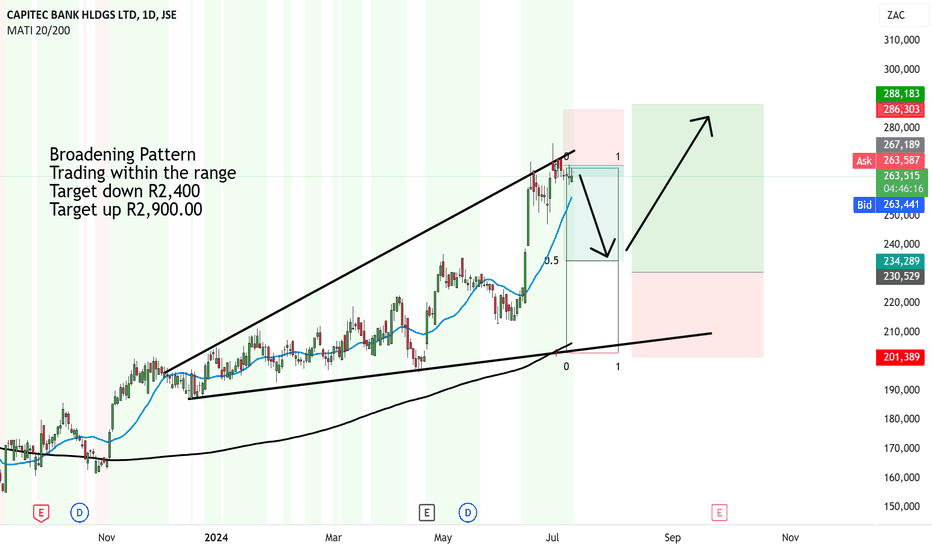

REVERSAL Idea - Capitec Bank - first down to R2400 then up 2900Broadening Pattern has formed with Capitec.

When this pattern forms it bounces between ranges.

Right now it bounced off the top of the range, and is most likely to come down 50% from the most recent rally.

Once it comes down to a target of R2,400 then it could consolidate move sideways and then breakup to the next target at R2,900.

This is a little different from breakout trading, but I was asked for an analysis around this.

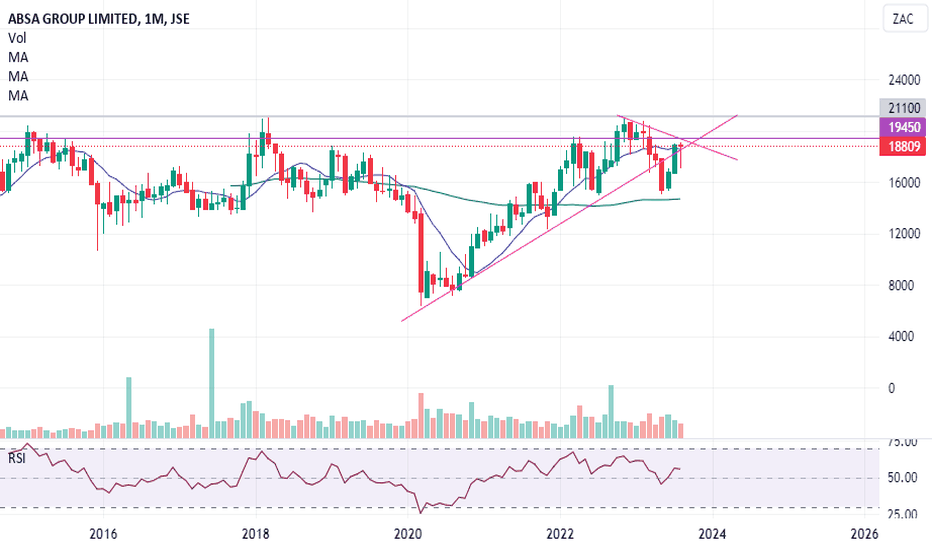

Absa: The Longer-Term ViewAbsa lost the support that sustained price from the COVID lows, now price is attempting to recover that line. At the same time we are expecting price to seek or confirm a yearly low, usually this happens when we have a failed weekly cycle, this has not happened so far. If price is rejected at re-entry attempt we can expect a swift move down to lower than R150.70.

On the other hand we would know the yearly low is confirmed if price closes above the declining resistance on a monthly basis or when we have reasonable confirmation a a likely close above that line. What gives the bearish thesis a higher probability is the RSI & TSI are showing negative divergence.

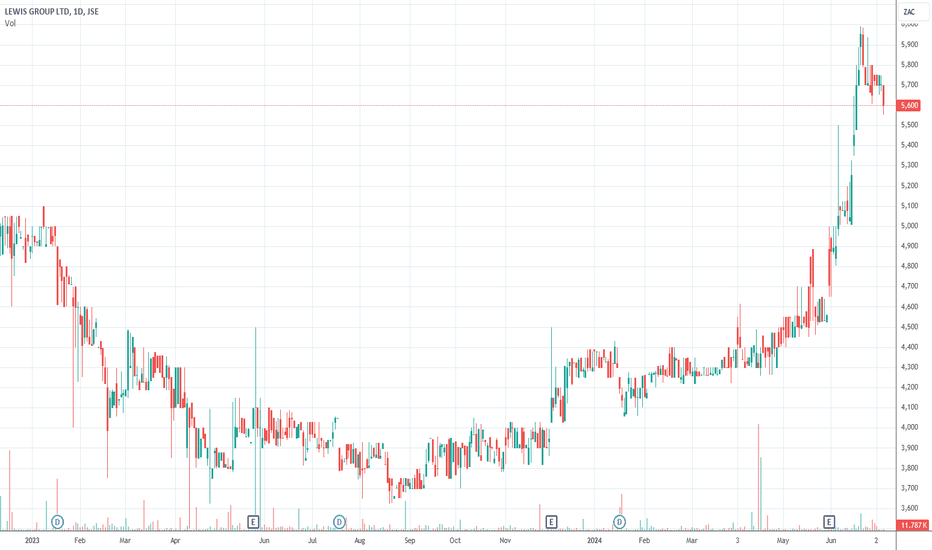

Our opinion on the current state of LEWIS(LEW)Lewis (LEW) is a retailer of furniture and electrical appliances operating through 840 stores under the Lewis (492 stores), Beares (151 stores), Best Home (154 stores), and most recently, United Furniture Outlets (43 stores) brands. Of these, 134 are in neighboring countries. The company does 59.9% of its business on credit and offers customers credit insurance and other financial products. The plan is to increase the number of UFO stores from 39 to 70 over the next few years.

At current levels, the share is trading on a P/E of just 6.16, and the share price is well below its net asset value (NAV). The company's balance sheet remains debt-free, which is extraordinary among listed retailers in this post-COVID-19 period. The company is in the process of buying back 10% of its issued share capital. We have always said that this share represents a bargain. It will benefit directly from any increase in consumer spending. It is an extremely tightly managed company with no debt and a huge store footprint. It has been growing both organically and by acquisition.

Obviously, as a retailer of furniture and white goods, it is vulnerable to any economic downturn, but we see it as cheap right now and expect its share to rise as the economy improves. Certainly, it is one of the few retail outlets in South Africa which is doing reasonably well in the circumstances. The company is engaged in a share buy-back program in which it has so far bought back 29.9 million shares at an average price of R34.20 per share.

In its results for the year to 31st March 2024, the company reported merchandise sales up 4.7% and headline earnings per share (HEPS) up 7.1%. The company said, "The strong credit sales growth trend continued, with credit sales increasing by 15.8% and cash sales declining by 11.8%. Credit sales have grown at a compound annual rate of 16.9% over the past three years and now account for 66.2% of total merchandise sales (2023: 59.9%). The group has maintained its prudent credit granting criteria in the constrained spending environment and the credit application decline rate increased to 35.1% (2023: 34.7%)."

The modest results show that consumers are under pressure from high interest rates, but the end of loadshedding should be a benefit. This share remains one of the best-run businesses on the JSE at the moment. The company believes that it is under-valued on the JSE by 30% - and we think that is conservative. We added Lewis to the Winning Shares List (WSL) on 1st December 2023 at 4150c. It is now trading 38.5% higher at 5700c. Technically, the share has broken up through its downward trendline and is in a strong new upward trend.

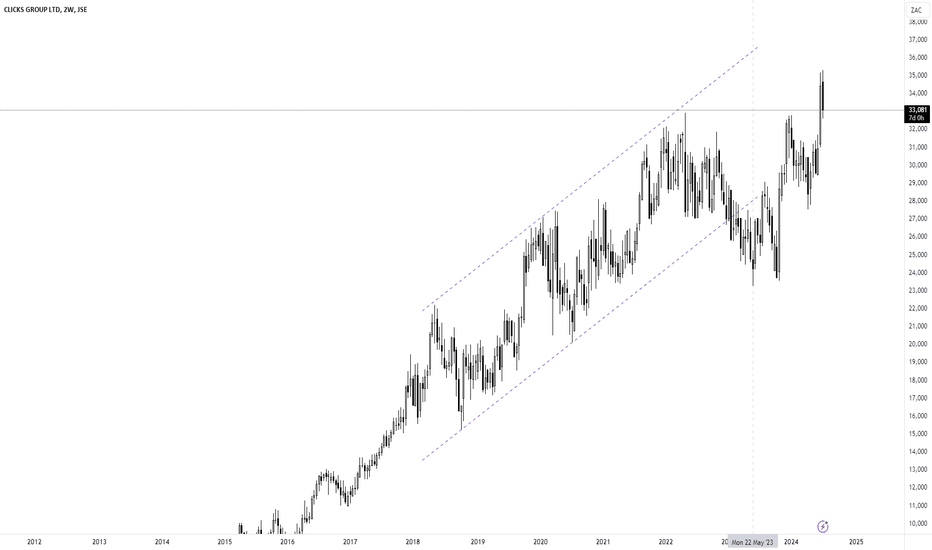

$JSECLS - Clicks: Defensiveness Invalidates Bearish OutlookSee link below for previous analysis.

Talk about a defensive stock; Clicks did not budge much from the previous bearish analysis.

The stock has shown its resilience by making a new all time high.

I have not looked at fundamentals or valuations but i have to turn bullish now with a buy the dips strategy.

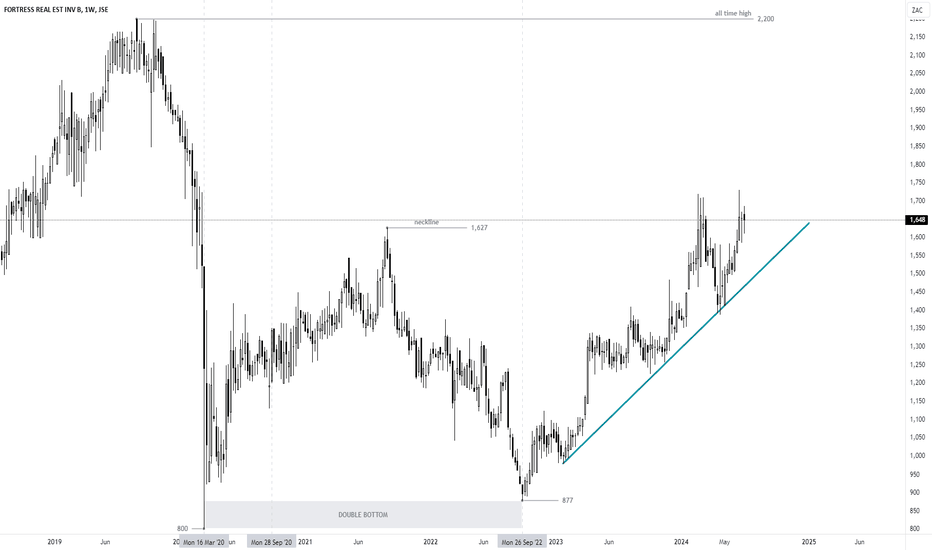

$JSEFFB - Fortress: Double Bottom Targets New All Time HighFirst time coverage.

The two bottoms at 800 cps and 877 cps have formed a very large Double Bottom reversal pattern.

The price target for this pattern is 2500 cps.

Price has been trending upwards from 877 and the trend is well supported by mid-sloping trendline.

Buy the dips.

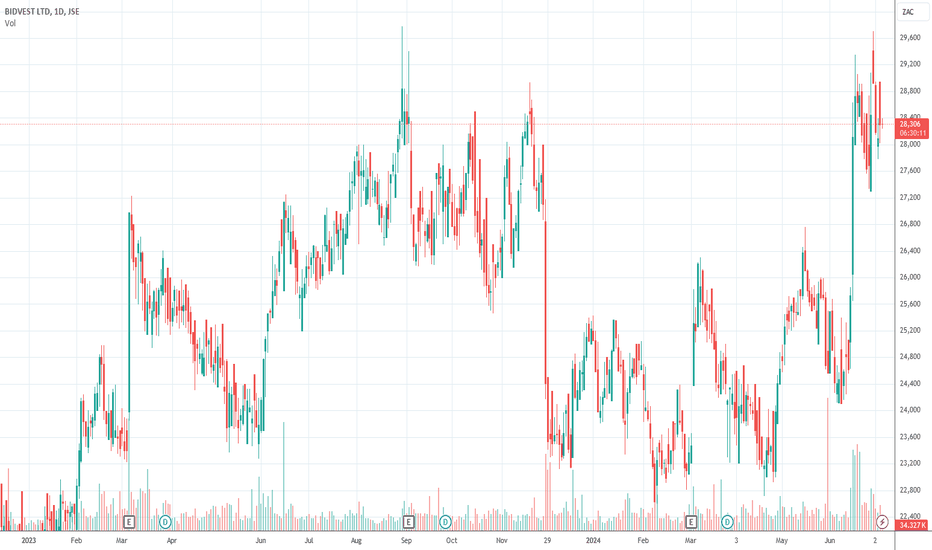

Our opinion on the current state of BIDVEST(BVT)Bidvest (BVT) is a highly diversified South African company with dozens of subsidiaries. Its most notable investments include a 66% stake in Bidvest Namibia, which also owns a large property portfolio rented out to various Bidvest companies, and a 56.13% stake in Adcock Ingram. The company's subsidiaries are organized into six divisions: Services, Freight, Automotive, Office, Print & Commercial Products, Financial Services, and Electrical. The directors of each operating company are given considerable autonomy within this structure, provided they produce good returns.

This decentralized management style contrasts with most listed companies, which aim to retain their focus on a single area of business and constantly sell off or close down "non-core" businesses. Diversification of this sort reduces risk as different divisions can balance each other out when one is performing poorly while others perform well. Additionally, Bidvest is constantly making new acquisitions. The acquisition of PHS, the UK's largest cleaning service, was well-timed, coming immediately before the huge increase in demand for cleaning that followed COVID-19. The company's investment in alternative energy sources is seen as a potential profit generator.

In its results for the six months to 31st December 2023, the company reported revenue up 8.8% and headline earnings per share (HEPS) up 5.3%. The company stated, "Group NAV per share grew from R89.88 in the prior period to R100.08 as at 31 December 2023. Cash generated by operations almost doubled. We spent R3.2 billion on acquisitions, invested in maintaining and growing our asset base, as well as awarded our shareholders with a higher dividend."

On 3rd July 2024, the company announced that it would be looking for a buyer for Bidvest Bank and FinGlobal. At the same time, it announced the acquisition of Citron Hygiene LP. Bidvest now trades on a P/E of 15.23, but we believe it still represents good value at these levels. Technically, it has just emerged from an island formation and is on a strong recovery path.

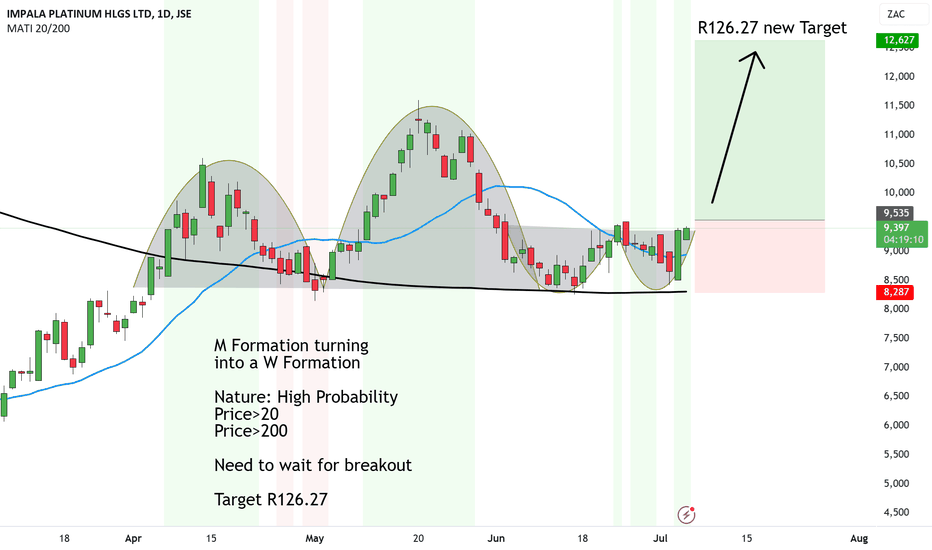

Impala Platinum new target now UP to R126.27M Formation is now turning into a W Formation

We never had the break down and now it is looking up, along with the platinum price.

So we need to adjust course.

Now we are waiting for a breakout above the Neckline of the W Formation then the next target will be around R126.27

Nature: High Probability

Price>20

Price>200

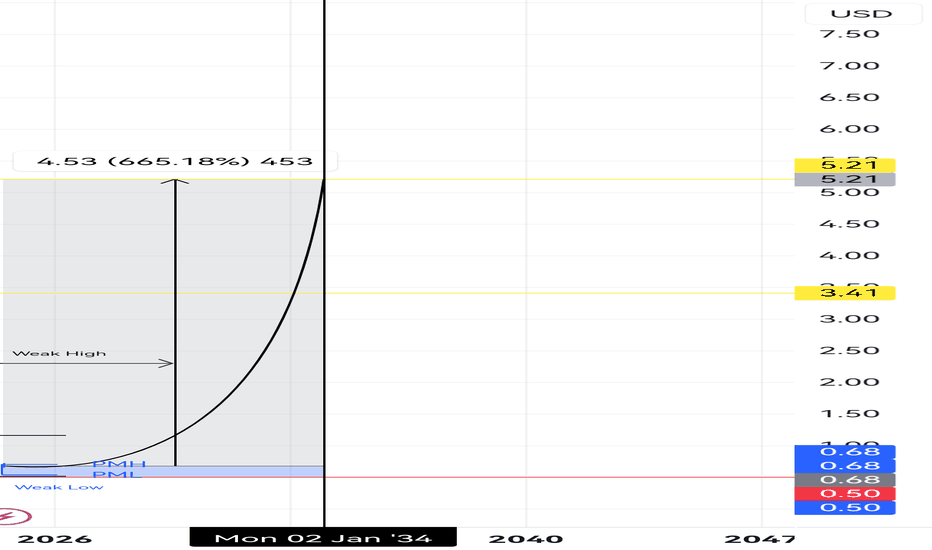

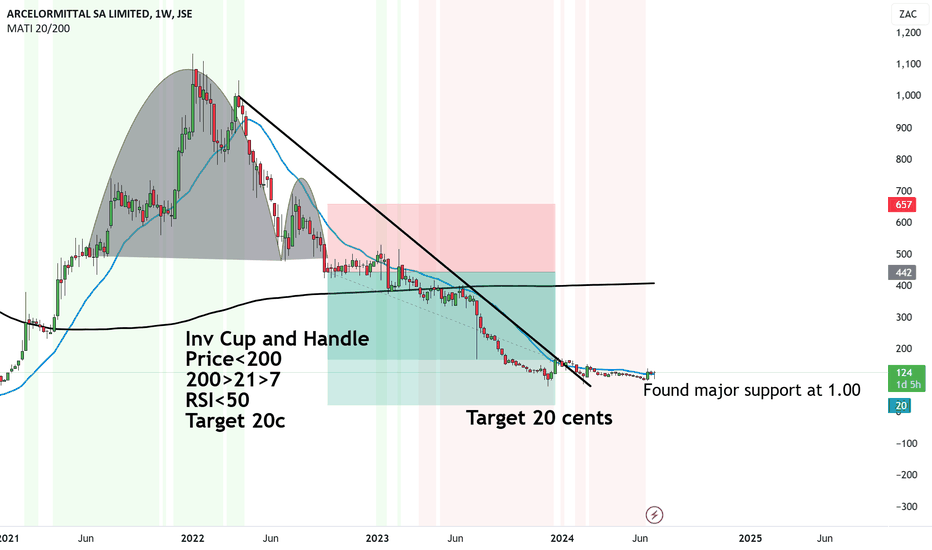

UPDATE: Arcelormittal found major support - Still warningThese illiquid and low volatile penny stocks need weekly charts to remotely see the biger picture.

There are two facts.

The price broke below the Inv Cup and Handle with price bring below both 20 and 200 MA.

Second, the price has stabilised around an extremely strong and important support level at R1.00.

If it breaks R1.00 it's doomed to 20c.

I'll try be an optimistic but keeping to my analysis for now.

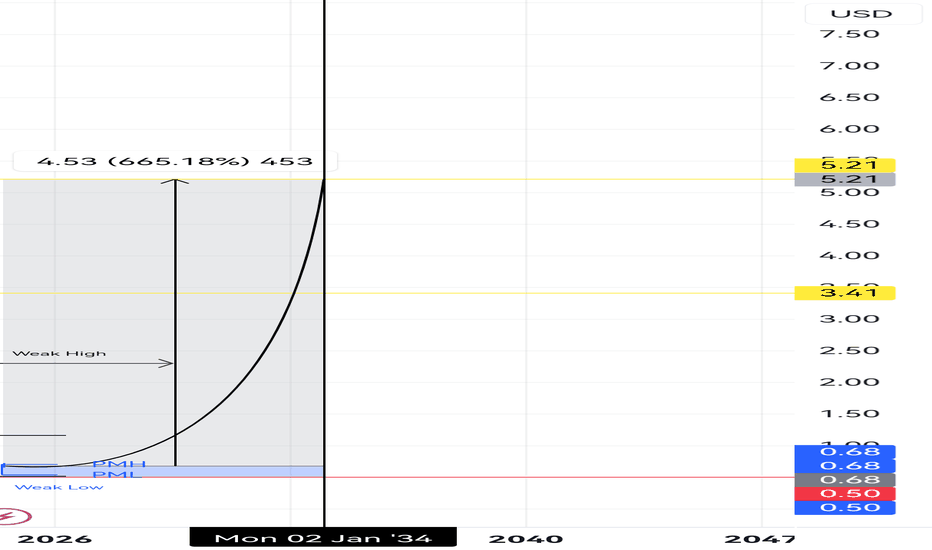

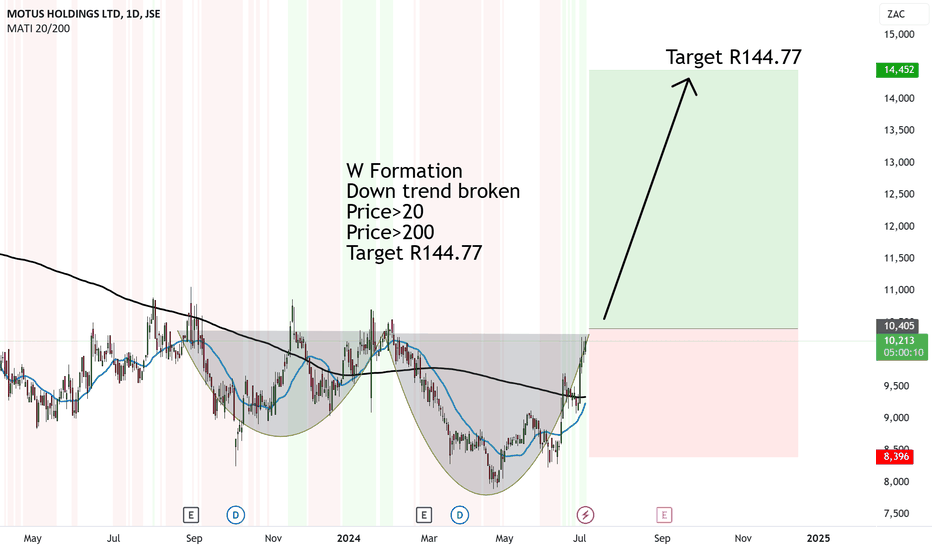

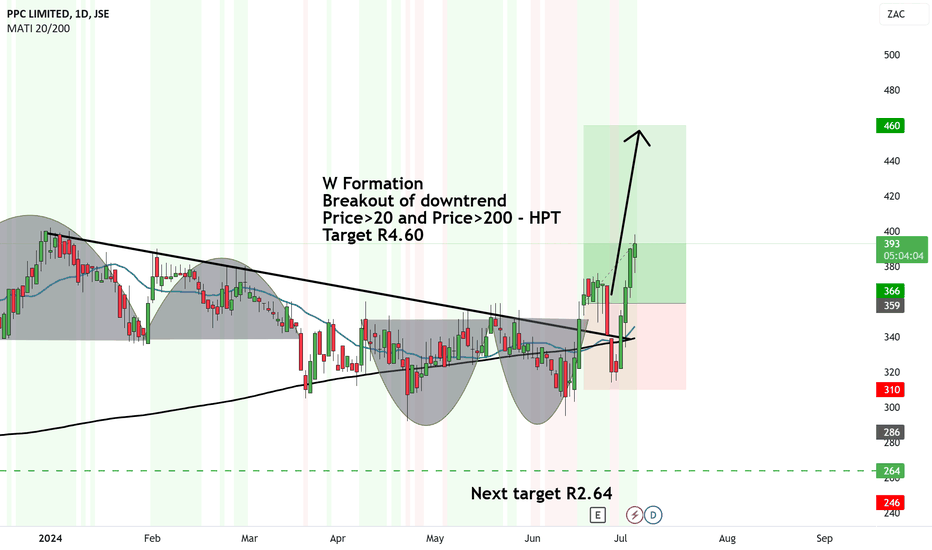

PPC target has been extended to R4.60W Formation formed on PPC.

The price broke out of the downtrend since January 2024.

and we have further confirmation with price above both 20 and 200MA.

The target has therefore been increased to R4.60.

With the new building of the malls in South AFrica and the property boom, I don't blame a company like PPC to have invested interest from the shareholders.

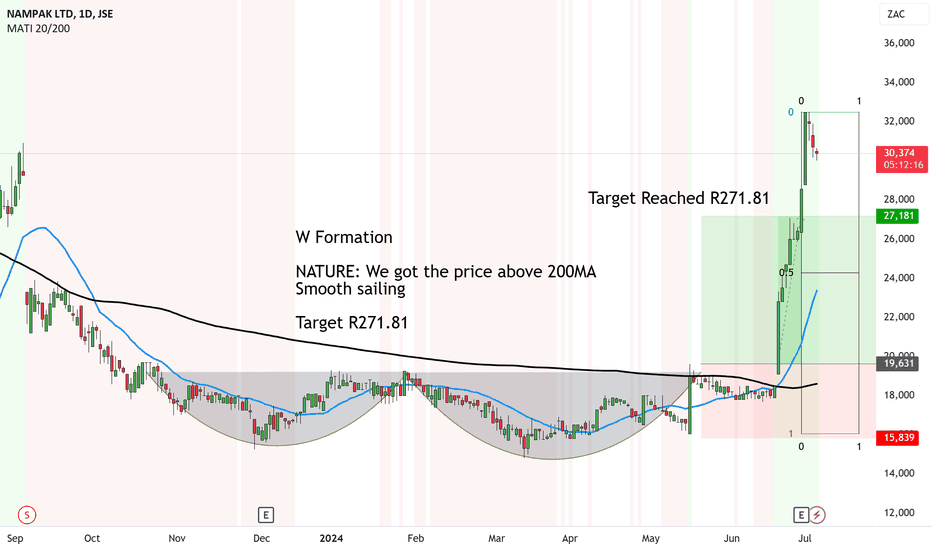

UPDATE: Target reached Nampak at R271.81 what's next?Nampak shot up a LOT faster than I ever imagined.

And it destroyed the first target at R271.81.

Problem is the uptrend is extremely steep which can signal flat panic amongst the buyers. I would now wait for a 50% pull back from the most recent low and high to about R243 and then some consolidation before it runs up again.

It's still very bullish but there needs to be some form of equilibrium for the market.

Let's see.

Our opinion on the current state of SIBANYE-S(SSW)Sibanye (SSW) is a mining house that has been on a rapid acquisition trail, accumulating platinum and gold mines in South Africa and America. The company is now broadening its scope to include base metals and minerals, especially so-called "green" metals. The company is run by Neal Froneman, who is well-known in the mining industry for his toughness, expertise, and experience. Froneman has said that he intends to retire in about 2024/5 but plans to double the size of the company before he does. Sibanye is also considering moving into the base minerals used in motor vehicle batteries like vanadium, copper, nickel, and lithium.

On 1st June 2021, the company announced a share buy-back program to repurchase up to 5% of its issued shares. On 30th June 2022, the company announced its intention to increase its stake in Keliber, a Finnish lithium producer, to 80% at a cost of about R7.7bn. On 9th November 2023, the company announced that it is to acquire Reldan, a US-based metals recycler, for $211.5m. We believe that in time Sibanye will continue to make new all-time record highs due to superb strategic management. Thus, the current drop in the share price could be viewed as a buying opportunity. Froneman believes that Sibanye shares are undervalued, and we tend to agree with him, but everything will depend on the prices of the metals which he sells.

On 25th October 2023, the company announced that it had commenced section 189 consultations for the retrenchment of 4095 employees. On 6th November 2023, the company announced that it had made a five-year deal with AMCU at its Kroondal PGM operation for a minimum 6% per annum wage hike. On 21st November 2023, the company announced that it would raise $500m by issuing a convertible bond that will pay 4% to 4.5% until it can be converted in 2028. The news caused some shareholders to switch out of the shares, resulting in a 20% drop in the share price.

In its results for the year to 31st December 2023, the company reported revenue down 18% and a loss of R37.4bn. The CEO said, "We are confident that the PGM price weakness during 2023 does not signal a structural change in PGM fundamentals like that of the nickel market, but is more temporary in nature and we are beginning to see increasing signs which support a better demand outlook." On 11th April 2024, the company announced that it was commencing section 189 inquiries for the retrenchment of 3107 employees and around 900 contractors in its gold mines. On 3rd July 2024, Business Day reported that Sibanye had retrenched 11000 workers over 18 months.

Technically, the share has been in a downward trend since March 2022, mainly because of falling commodity prices. In an update on the three months to 31st March 2024, the company reported a 3% increase in 4E PGM production. The company said, "Sandouville nickel production increased by 42% and Nickel equivalent sustaining cost reduced by 36%. The Keliber lithium project is on budget and progressing according to schedule. The Reldan acquisition was successfully concluded with integration underway." We recommended waiting for it to break up through its downward trendline before investigating further. That upside break came on 2nd April 2024 at a price of 2230c. The share has subsequently moved up to 2290c and remains a volatile commodity producer.

Our opinion on the current state of ARCMITTAL(ACL)ArcelorMittal (ACL) is South Africa's largest steel-producing company. It has survived where companies like Highveld Steel have disappeared. Arguably, ArcelorMittal felt the impact of the sub-prime crisis more than any other South African company and has fallen from its high of R260 in June 2008 to as low as 25c in August 2020. Since then, it has rallied strongly and now trades at 1052c.

The company has had to deal with the collapse of the construction industry locally, which was a major consumer of steel, and the massive imports of cheap Chinese steel which were dumped onto our market. Those imports have slowed down somewhat, and ArcelorMittal was successful in getting certain tariffs in place to discourage imports. We believe that this company came close to closure in July 2020 when the share price reached 25c. It has been rescued by the rising steel price combined with severe cost-cutting.

In its results for the six months to 30th June 2023, the company reported revenue down 5.1% and a headline loss of R448m. The company said, "Falling international commodity demand affected most sectors. Understandably, steel demand remained muted, which put significant pressure on local prices. The company committed to adopt a flexible approach to operating plants in reaction to the available order book, adjusting fixed cost levels accordingly, and following an assertive cash management process." The share fell 43% after the trading statement. This share remains a commodity share subject to the international price of steel.

In late April 2023, talks between ACL and NUMSA deadlocked, and the union said it was preparing for a major strike. On 17th July 2023, the company announced the resignation of its chief financial officer (CFO), Siphamandla Mthethwa, and he would be replaced by Gavin Griffiths in an acting capacity. On 28th November 2023, the company announced that it had decided to wind down its "Long Steel Products" business in Newcastle, which would probably result in the retrenchment of as many as 3500 workers. The decision was caused by logistics problems, the slow economy, and the advantage of scrap over iron ore.

In an update on 3rd July 2024, the company said, "The Longs steel product operations ("Longs Business") have been operationally stable for H1 2024. The Flats steel product operations ("Flats Business") in Vanderbijlpark experienced notable levels of instability at its blast furnaces in April and May 2024. Due to the intensive cash management actions, the net borrowings position is anticipated to remain within tolerable levels."

We recommend waiting for the share to break above its 200-day moving average before investigating further.

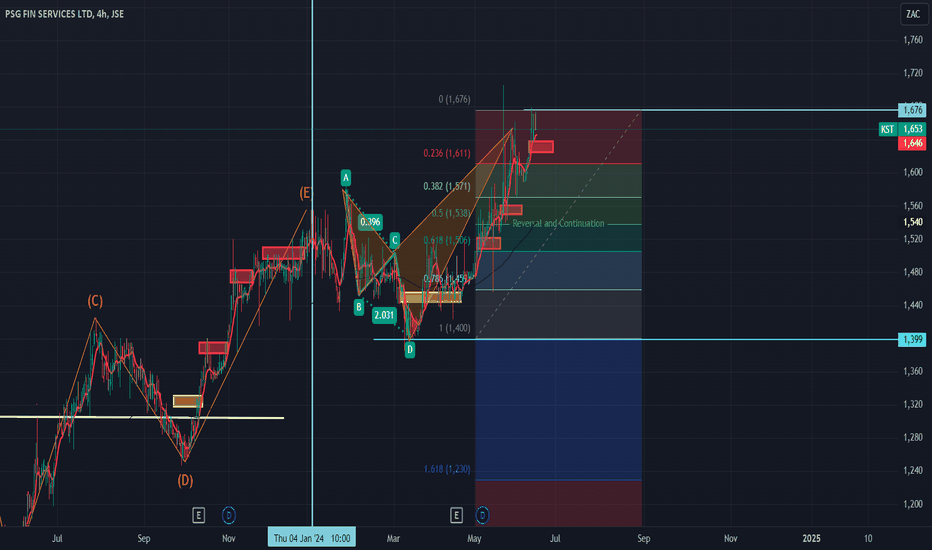

Stock correction.Looking at the recent dividend results the company's dividend yield experienced a minor drop from 2.77% to 2.76 and while the company's P/E ratio increased ( from 18.89 - 20.60) which is not a good sign from an investment perspective and looking at the trend and Elliot wave count which completed at the beginning of the year and Bat harmonic pattern completion at beginning of 2024/2025 financial year, this could be sign of a minor correction waiting to happen.

Our opinion on the current state of CONDUIT(CND)Conduit Capital (CND) is a small financial services company primarily operating in the insurance industry. It has two main divisions: Investments and Insurance & Risk. Through its subsidiary, Conduit Risk & Insurance Holdings, the company engages in underwriting, investments, and earning commissions. Conduit Capital offers a variety of niche insurance products, including medical malpractice, primary health, funeral, and life insurance, guarantee and indemnity solutions, medical evacuation, and motor and property insurance. The company operates through brokers and agents.

The company is currently undergoing a turnaround initiated by new management. However, its listed investments remain under pressure. On 23rd May 2022, the company announced that Constantia’s gross exposure to claims resulting from the KZN floods was not expected to exceed R25 million.

On 1st August 2022, Conduit Capital reported that the Prudential Authority of the Reserve Bank had placed its subsidiary, Constantia Insurance, under prudential curatorship. Constantia Insurance accounts for 94.4% of Conduit's revenue, making its liquidation catastrophic for the company. This event caused Conduit's share price to drop sharply from 35c to 18c. Subsequently, on 21st September 2022, the company announced that trading of its shares on the JSE had been suspended following the liquidation of its largest subsidiary, Constantia Insurance Company.

On 14th December 2023, Conduit Capital mentioned that the audited results for the 2022 year-end, along with the Group's Integrated Annual Report, would likely be published in January 2024. A provisional liquidation order for Conduit's main subsidiary, Constantia Insurance Company, was confirmed in the high court on 14th September 2022.

In an update on 28th March 2024, the company stated it was still working on the publication of its financials for the year ending 30th June 2022. In a trading statement for the year ending 30th June 2024, the company estimated it would make a headline loss of between 29.64c and 33.76c, compared to a loss of 20.6c in the previous period. In a quarterly update on 28th June 2024, Conduit Capital noted that a final draft of the 2022 AFS was submitted to the auditors on 27 May 2024. The auditors are currently finalizing their review, after which the 2022 AFS will be published. Work on the interim results for the six months ended 31 December 2022 and for the year ended 30 June 2023 has also commenced. Final timelines for the publication of these results will be determined upon the completion of the 2022 year-end results.

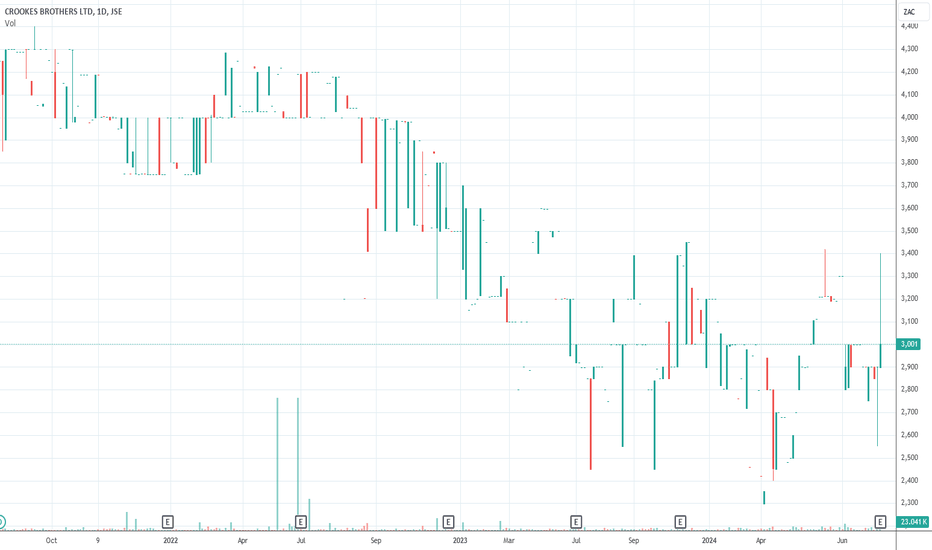

Our opinion on the current state of CROOKES(CKS)Crookes Brothers (CKS) is an agricultural and property company formed in 1913 and listed on the JSE in 1948. The company produces sugar cane, bananas, macadamia nuts, and deciduous fruit, and has a property division. It owns Renshaw Farm, which consists of 1800 hectares between Scottburgh and Umkomaas. Of this, 266 hectares have been re-zoned for development, with 52 hectares subject to a contested land claim. The company has decided to sell the 28 hectares being developed as Renshaw Hills, a 500-unit residential development.

The deciduous fruit operation consists of five farms in the Western Cape with 43 hectares of deciduous orchards. The macadamias are grown on a farm in Mozambique on a 99-year lease. The sugarcane operation is on four leased farms in Mpumalanga, plus other farms in KwaZulu-Natal, Swaziland, and Zambia.

In its results for the year ended 31st March 2024, the company reported revenue up 18% and headline earnings per share (HEPS) of 334.5c compared with a loss of 708.8c in the previous period. The company's net asset value (NAV) increased by 8% to 7124c per share. The company said, "The 2024 reporting period saw a marked improvement in prices in the group's sugar cane and banana operations and a reduction in fertilizer and other agricultural input costs. Additionally, the group sold its deciduous fruit business and used the proceeds to settle debt, reducing interest costs going forward."

A problem with this share is that it is relatively tightly held. The average value of shares changing hands each day is about R121,000, but on many days it does not trade at all. This generally makes it riskier even for private investors.

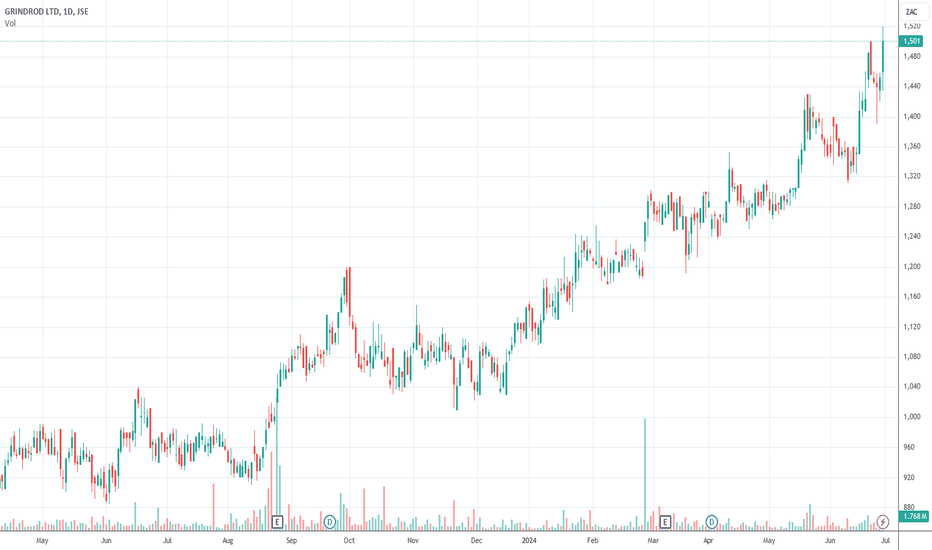

Our opinion on the current state of GRINDROD(GND)Grindrod (GND) is an international freight and financial services company operating in twenty-eight countries. In mid-June 2018, Grindrod unbundled and separately listed its loss-making shipping division, Grinship (GSH). This accounts for the "cliff" in the share price at that time. The company is now focused on its two remaining divisions: freight and financial services.

Grindrod owns the North-South railway line from Beitbridge to Victoria Falls as well as port terminals at Richards Bay, Natal, Walvis Bay, Namibia, and Maputo. The company is positive about the growth of its financial services division, which constitutes about 30% of its business. It is particularly focused on getting its retail banking division involved with small and medium-sized businesses. However, the conflict in northern Mozambique poses a problem for this share, and the flooding in Natal caused five of their sites to be suspended for several weeks.

In its results for the year to 31st December 2023, the company reported headline earnings per share (HEPS) up 18%, net asset value (NAV) up 13% at 1368c per share, and revenue down 23%. The company stated, "The Group segment results benefited from the interest earned on the proceeds from the disposal of Grindrod Bank in 2022. Current year results include R45.3 million (2022: R167.1 million) from initiatives."

In a pre-close update for the 5 months to 31st May 2024, the company reported an average price drop in the commodities it deals with of 19%. The company noted, "Port of Maputo achieved record volumes of 5.8 million tonnes, up 17% on the prior period. Grindrod's dry bulk terminals in Mozambique handled 4.6 million tonnes, down 6% on the prior period."

Technically, the share has completed a rising triple-bottom and has risen off this base into a new upward trend. We recommended waiting for an upward break through its long-term downward trendline before buying. That break came on 15th July 2020 at a price of 340c. The share has since moved up strongly to 1504c, a gain of 342% in just under four years.

The company should benefit directly from the recovery in the world economy and the steady rise in international trade. We believe that this share still represents value.