Our opinion on the current state of THUNGELA(TGA)Thungela (TGA) is Anglo American's coal assets which have been unbundled into the hands of Anglo shareholders and separately listed on the JSE and the LSE because of Anglo's policy of moving away from carbon-based fossil fuels like coal. Anglo sold its last 8% of Thungela on 25th March 2022 for R1,67bn.

Thungela is a major thermal coal exporter in South Africa. It has over 7500 employees and exports coal to Asia, India, Southeast Asia, and East and North African countries. The company owns 50% of Phola, which operates a coal processing plant, and it has a 23,22% interest in the Richards Bay Coal Terminal (RBCT). The company has the capacity to produce over 90 million tons of coal per annum. It operates seven mines in South Africa, four open cast and three underground.

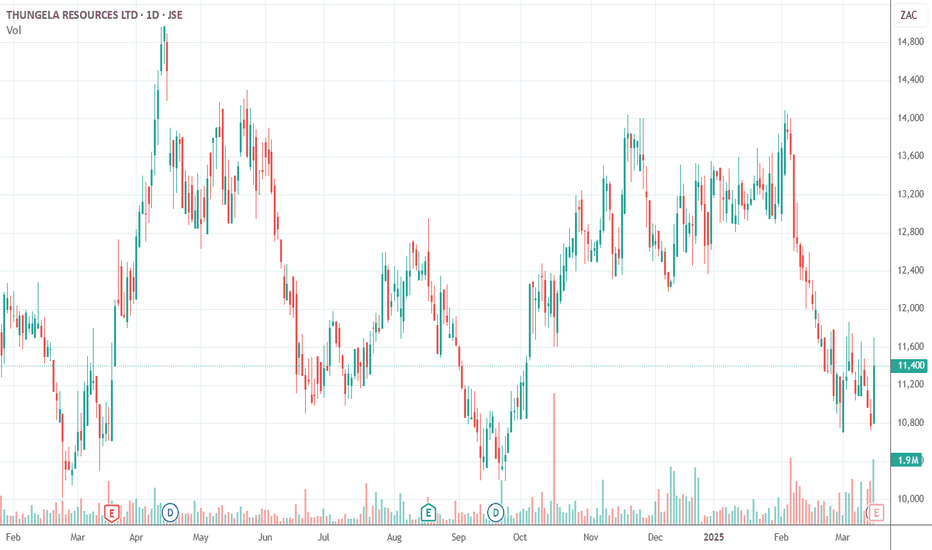

The share began trading on the JSE on 7th June 2021 and immediately fell to 2190c from 2600c. It was originally estimated to be worth a minimum of 4400c but reached a high of 37752c on 16th September 2022. Since then, it has been moving sideways and downwards with lower coal prices and problems with Transnet. Obviously, it is also subject to the volatility of being a single commodity share and dependent on Transnet to get its product to port. The company has committed to paying out at least 30% of "...adjusted operating free cash flow" in the form of a dividend.

In its results for the year to 31st December 2024, the company reported revenue up 16% and headline earnings per share (HEPS) down 27%. The company said, "Adjusted operating free cash flow* of R3.6 billion for the year and net cash* of R8.7 billion at 31 December 2024, after capital expenditure of R3.4 billion. Declaration of a final cash dividend of R11 per share, taking full-year dividend to R13 per share. Share buyback announced of up to R300 million."

Thungela will drift sideways until the price of coal increases—if it ever does. On 21st January 2025, the company announced that its CEO, July Ndlovu, will retire in July 2025 and be replaced by Moses Madondo on 1st August 2025.

Our opinion on the current state of OUTSURE(OUT)OUTsurance (OUT) took over the listing of Rand Merchant Insurance (RMI) with effect from 7th December 2022. RMI unbundled its stakes in Discovery (DSY) and Momentum (MTM) and sold its 30% stake in Hastings Plc for R14,6bn. By March 2023, all that was left was the insurance business of OUTsurance.

In its results for the six months to 31st December 2024, the company reported gross written premiums up 17,4% and new business up 17,9%. Embedded value rose by 6,8% to 1969c per share. The company said, "In response to the lower inflationary environment, interest rates and our investment income generation will be adversely impacted. These macroeconomic trends will, however, support a more favourable real growth outlook for the South African and Australian operations."

Technically, the share has been climbing steadily since the unbundling, and we believe it will continue to perform. We added it to the Winning Shares List (WSL) on 15th June 2024 at a price of 4457c. It has since risen to 6364c, but it is looking "toppish" now and may be in for a downward trend.

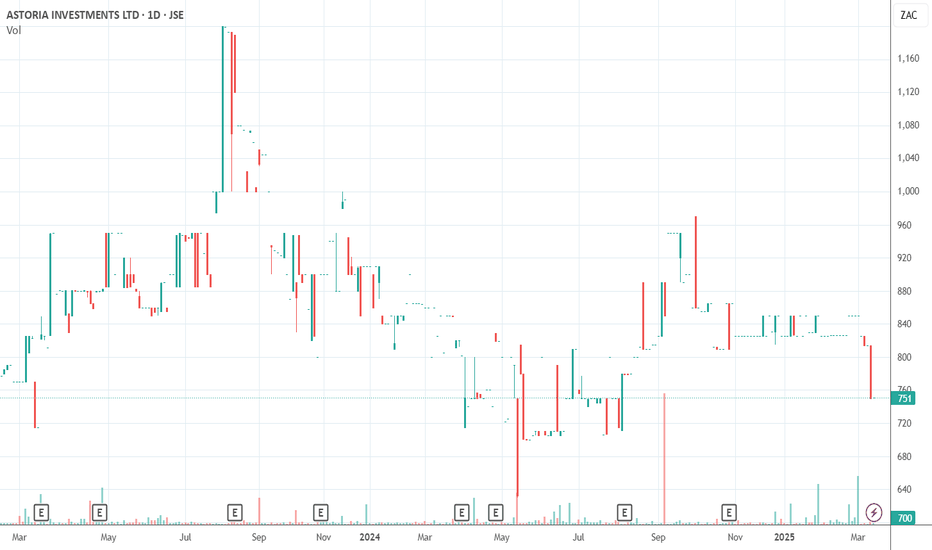

Our opinion on the current state of ASTORIA(ARA)Astoria (ARA) is an investment company that was formed to give investors exposure to an international selection of equities in developed economies.

The share trades well below its NAV and has only recently begun trading after being suspended from September 2020 to April 2021. The company benefited from the sale of "non-lethal self-defence" products during the period as a result of the civil unrest. It owns one-third of Outdoor Investment Holdings, a 35.7% stake in Trans Hex, and has sold its stake in CNA.

On 19th April 2021, the company announced that following the distribution of 51.15m shares, trading in the company's shares had resumed.

In its results for the six months to 30th June 2024, the company reported headline earnings per share (HEPS) of 79.29c compared with a loss of 18.32c in the previous period. The company's net asset value (NAV) rose from 74.76c (US) per share to 77.2c.

In an update on the 3 months to 30th September 2024, the company reported headline earnings per share of 70.62c compared with a loss of 7.3c in the previous period. The company's net asset value (NAV) was slightly higher at 1407.67c per share.

In a trading statement for the year to 31st December 2024, the company estimated that its NAV would be between 59.6c (US) and 63.58c—a decrease of between 20% and 25%.

Volume traded on the share has increased to R131,000 worth of shares per day on average, with some days without any trades. It remains in a downward trend.

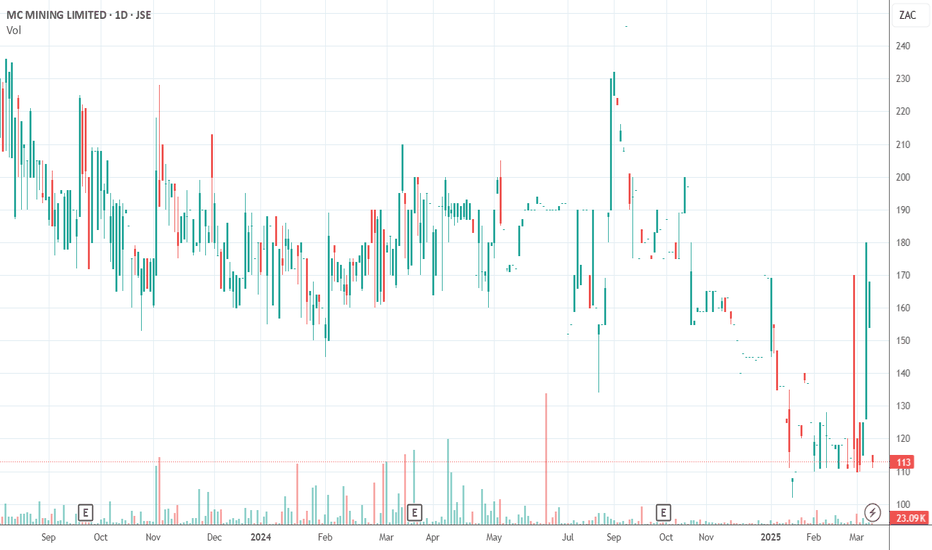

Our opinion on the current state of MC-MINING(MCZ)MC Mining (previously "Coal of Africa") (MCZ) is a small metallurgical coal-mining company with a single producing mine, Uitkomst.

Aside from Uitkomst, the company is developing the Makhado project, the Vele colliery, and MbeuYashu. The Makhado project is the company's flagship operation in the Limpopo province. It is an opencast mine with a life of 16 years and the potential to be extended. In January 2019, the company announced the acquisition of surface rights, which will make the Makhado project viable. Production was initially expected to commence at the end of 2020, and the mine was projected to produce 800,000 tons of hard coking coal and 1 million tons of export thermal coal. The Makhado purchase improves the risks substantially and makes this into a viable investment.

The IDC has provided R245m for the project, but a further R530m is still needed. The company owns 69% of Baobab Mining and Exploration, which owns the Makhado project.

On 8th April 2024, Business Day reported that Goldway Capital had received acceptances from shareholders amounting to 83.67% of the issued shares—more than the 82.15% required for the takeover to proceed. On 24th June 2024, the company announced that Godfrey Gomwe would resign with effect from 30th June 2024.

In its results for the six months to 31st December 2024, the company reported an after-tax loss of $8.4m—up 40% from the previous period—with revenue down 67%. Administrative expenses rose by 55%, and finance costs increased by 19%. The headline loss per share was 1.83c compared with 1.45c in the previous period.

The company said, "Cash and cash equivalents of $3.9 million compared to cash and cash equivalents of $0.2 million at 30 June 2024. Net asset value increased slightly to $75.6 million from $75.4 million in 30 June 2024."

This remains a volatile commodity share with only about R20,000 worth of shares changing hands on average each day, high debt levels, and all the risks of mining exploration and development.

Our opinion on the current state of RENERGEN(REN)Renergen (REN) describes itself as an "...integrated alternative energy business..." which invests in renewable energy projects in Africa. The company listed on the JSE in June 2015 and has been losing money every year since. This is reflected in its falling share price.

Renergen is investing in liquified natural gas (LNG) and helium. The R125m rights issue was fully underwritten and enabled it to access a R218m loan facility. Its initial public offer (IPO) on the Australian Stock Exchange (ASX) was more than two times over-subscribed. It claims to have proven helium reserves of over 6bn cubic feet. On 18th May 2018, the US government identified helium as critical to national security, causing the price to rise by 135%.

On 7th June 2023, the company announced that it had received $750m in further funding from Standard Bank and the International Development Finance Corporation for its Virginia Gas project.

In its results for the six months to 31st August 2024, the company reported revenue of R25,6m, up from R23,8m, and a headline loss of 45,73c compared to a loss of 29,87c in the previous period. The company said the loss was "...broadly as a result of the reduction in gross profit contribution, higher operating costs1 (employee costs, depreciation and amortization, professional fees, insurance cost and repairs and maintenance expenses), higher interest expenses1, lower deferred tax credit, which were offset by a higher other operating income mainly consisting of foreign exchange gains and lower share-based payment expenses."

The share may be a speculative opportunity, but it is making losses and is very risky and volatile. We advised at least waiting for the share price to break up through its long-term downward trendline before investigating further, which happened on 14-3-25 when the company announced its first commercial sales of helium. The announcement caused the share price to jump.

We advise caution, at least in the short term.

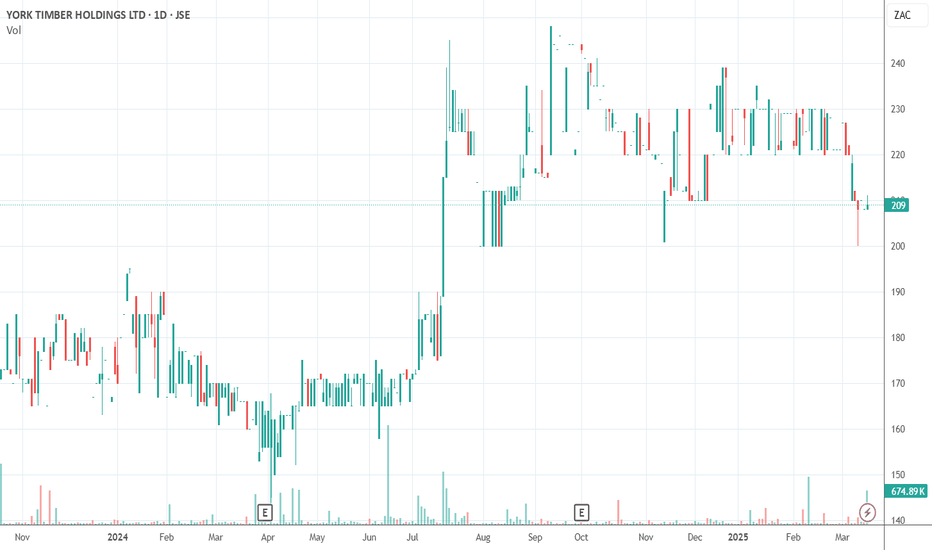

Our opinion on the current state of YORK(YRK)York Timber Holdings (YRK) is a forestry company that owns plantations and processing plants, as well as a wholesaling distribution network. It is the biggest player in the South African plywood and timber market. The company was founded by a Russian immigrant, Herman Katzenellenbogen, in 1916 and was listed on the JSE in 1946.

The National Union of Metalworkers of South Africa (NUMSA) is the majority union at the company. York has been impacted by the general decline in the construction industry since the sub-prime crisis in 2008. In July 2007, York's shares reached a peak at R40. Since then, the share has mostly been falling or drifting sideways.

On 13th May 2022, the company announced that a strike at its Escarpment operations would negatively impact production. Escarpment contributes 51% of the company's revenue. On 5th December 2022, the company announced its intention to conduct a rights issue to raise R250m. Existing shareholders would receive 43.12791 new shares for every 100 shares already held at a price of 175c each. The announcement caused the share price to drop sharply.

In its results for the year to 30th June 2024, the company reported revenue up 5% and headline earnings per share (HEPS) of 30.11c compared with a loss of 75.89c in the previous period. The main contributor to profit was a R254.6m revaluation of the company's "biological assets"—which likely refers to their forests.

In a trading statement for the six months to 31st December 2024, the company estimated that HEPS would be between 14.22c and 14.45c compared with 4.67c in the previous period. The company has about R186,000 worth of shares changing hands each day, making it practical for investment by private investors.

It remains a volatile, construction-linked counter. We recommended waiting for a clear break up through its downward trendline before investigating further. That break happened on 19th April 2024 at 165c per share. It has since moved up to 248c and then slumped back to 210c. We do not see this as an exciting investment.

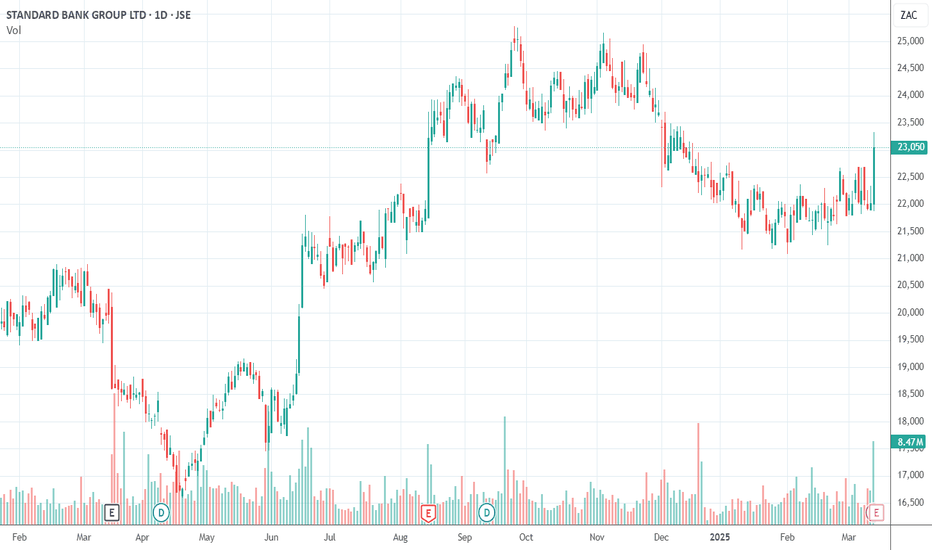

Our opinion on the current state of STANBANK(SBK)Standard Bank (SBK) is 160 years old and is South Africa's second-largest bank by market capitalization, after First National Bank. It has widespread interests across Africa, which now contribute 34% of its headline earnings.

20% of its shares are owned by the Industrial and Commercial Bank of China (ICBC), and it owns 40% of ICBC Standard Bank—previously Standard Bank Plc in the UK (ICBCS). Following COVID-19, the bank had about 70% of its staff working from home. Like most businesses in South Africa, it is affected by load-shedding and the lingering economic effects of the coronavirus pandemic.

We see Standard Bank as an excellent investment for private investors at current levels, but it is a long-term play. As COVID-19 fades, the economy will pick up, and Standard Bank's profits will improve. On 15th July 2021, the company announced an offer for the ordinary and preference shares in Liberty Holdings (LBH). Liberty shareholders received 0.5 Standard Bank shares and R25.50 in cash for each LBH ordinary share, implying a valuation of just under R90 per LBH share—a 33% premium to its price (R67.48) before the announcement.

The bank is benefiting from increased client numbers and rising interest rates. In its results for the year to 31st December 2024, the company reported headline earnings per share (HEPS) up 4% and a return on equity (ROE) of 18.5%. The company's net asset value (NAV) increased from 14269c per share to 15281c, compared to its current share price (13-3-25) of 23051c.

The 2024 financials were far less positive than those of 2023, when the company increased HEPS by 27%. The share price has been falling since its cycle high on 26th September 2024 at 25042c, but it now looks like very good value with a dividend yield (DY) of 5.23%. The stock has just completed a "saucer bottom" and may be entering a new upward trend.

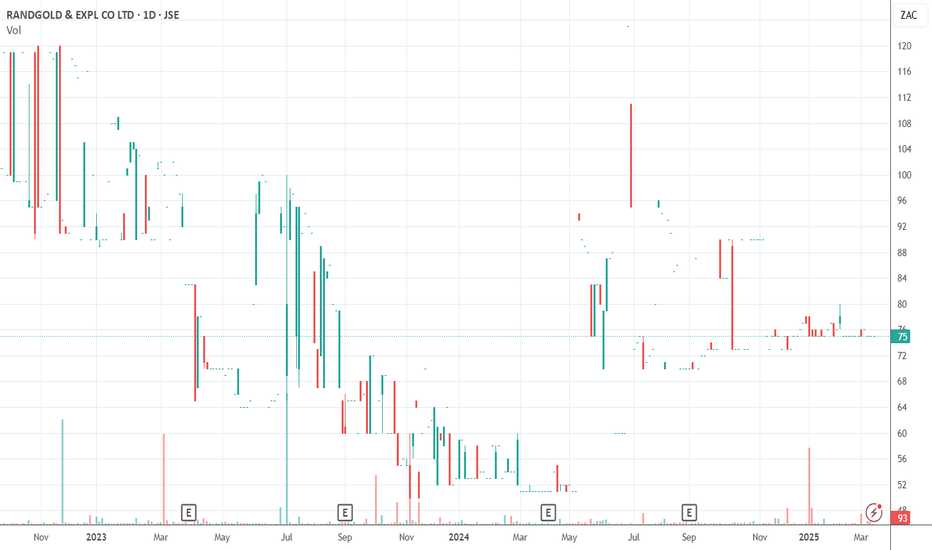

Our opinion on the current state of RANGOLD(RNG)Rangold (RNG) is a mining exploration company with a strong asset base, which is now mostly in cash. This cash is being used to pursue legal claims and may also be applied to investment opportunities.

Since the death of Brett Kebble, the company has been actively pursuing legal claims against various entities. In early 2011, it paid a dividend of 90c following a British court order against Paul Main, who was forced to repay GBP4m. In July 2014, the company was able to pay out a dividend of 225c due to a R150m settlement with auditors PWC. There are still various legal matters outstanding, which could potentially result in further settlements of around R3bn.

In its results for the six months to 30th June 2024, the company reported an operating loss of R10,9m and a headline loss per share of 11,6c compared with a loss of 16,61c in the previous period. The company stated, "The majority of income recognised in the period under review was derived from interest earned on cash investments in unlisted securities and funds. R&E had a net asset value of R0.79 per share at 30 June 2024 (R0.90 per share at 31 December 2023). The decrease in net asset value was due to the loss incurred during the period."

In a trading statement for the year to 31st December 2024, the company estimated that it would make a headline loss of between 15,28c and 18,48c per share compared with a loss of 32c in the previous year. The company said, "The reason for the improvement in the current reporting period is mainly due to less legal expenditure incurred."

The share is thinly traded and has been drifting down on low volumes for many years. It is of little interest to private investors.

Our opinion on the current state of EXXARO(EXX)Exxaro (EXX) is a BEE coal company with interests in iron and heavy minerals. It has operations in Australia, America, and Europe and is a provider of coal to Eskom's Medupi power station.

The company has been working to increase coal production from 48 million tons to about 60 million tons by 2022, but this strategy might be reconsidered due to lower global demand for coal. Exxaro is a highly cash-generative operation that is usually profitable, depending on the price of coal. While demand for coal has been strong both locally and in the export market, the shift toward renewable energy is seen as a long-term threat to the business. The difficulty of obtaining funding for new coal-fired power stations is growing, as banks face pressure from environmental groups.

On 9th April 2021, the company announced that it had sold its interest in Exxaro Coal Central (Pty) Ltd and the Leeuwpan Coal Mine operation. The Ukraine conflict initially had a beneficial impact on Exxaro due to rising commodity prices, but that effect has now disappeared. The company announced that, with lower coal prices, it was no longer viable to transport coal to port by truck, a measure it had been forced to take due to inefficiencies in South Africa’s rail and port systems.

In its results for the year to 31st December 2024, the company reported revenue up 5% and headline earnings per share (HEPS) down 36%. The company said, "In line with our production guidance, overall coal production volumes, excluding buy-ins, reduced by 7% to 39.5Mt in FY24, from 42.3Mt in FY23. The decrease in production volumes was largely driven by lower Eskom demand at Grootegeluk mine. Belfast mine production improved by 21% to 3.5Mt in FY24 compared to 2.9Mt in FY23, after operating for the full year."

Exxaro remains a commodity play. Technically, the share is volatile but has been in a volatile upward trend since November 2015. Within that, it has been moving sideways and downwards since April 2022.

Our opinion on the current state of ADVTECH(ADH)ADvTECH (ADH) is one of three listed commercial educational companies on the JSE (the others are Curro and its separately listed sister company, Stadio). ADvTECH has two divisions - a schools division (including Crawford, Trinity House, and Abbots) and a tertiary division (including Varsity College, Rosebank College, and a variety of specialist tertiary offerings). The group includes 109 schools and thirty-three campuses with 78,500 students.

In the past, the company was supported mainly by its schools division, but in the last few years, the schools division has faced increasing competition, which has squeezed margins. At the same time, the tertiary division has become the company's primary source of profits. The company's acquisition of Monash College with its IIE campus in the West Rand has added 6,500 students in a state-of-the-art facility that includes laboratories, four residences, and sports facilities.

In its results for the six months to 30th June 2024, the company reported revenue up 9% and headline earnings per share (HEPS) up 16%. Total group enrollments were up 6%. The company said, "Group operating profit increased by 15% to R865 million (2023: R754 million) with the education division’s operating profit increasing by 16%. Resourcing’s operating profit increased by 3%, notwithstanding the decline in revenue. The group operating margin improved to 20.2% (2023: 19.2%). The operating margin in the education divisions improved to 23.5% (2023: 22.8%)."

In a trading statement for the year to 31st December 2024, the company estimated that HEPS would increase by between 13% and 18%. Technically, the share has been in a strong upward trend since the end of May 2020. It is now on a multiple (P:E) of 16.92, and we think it still has upside potential.

In our view, this is a solid, blue-chip company with good medium-term prospects, and it is relatively cheap. Any significant improvement in the South African economy will benefit this company directly, and it will benefit directly from the newly appointed GNU. Traditionally, parents have always been willing to make significant sacrifices to pay for their children's education, which makes this share very defensive in times of low growth.

On 1st October 2024, the company announced that it had acquired FNB's 47,000 square meter training and conference center in Sandton. On 21st November 2024, the company announced that it had acquired an Ethiopian school group for $7.5m.

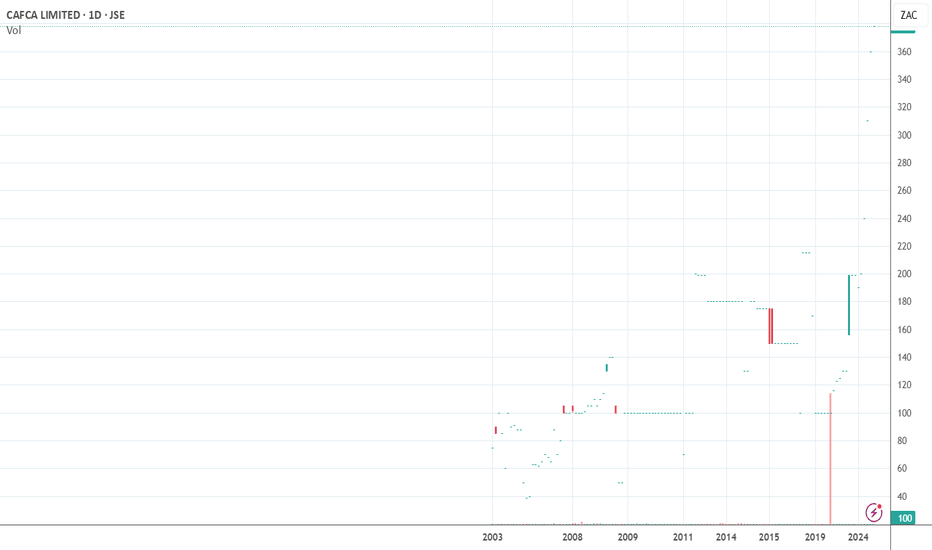

Our opinion on the current state of CAFCA(CAC)Cafca (CAC) is a cable manufacturer that produces over 900 cable and transmission products. Most of its business is conducted in Southern Africa. The company is 70% owned by Reunert. Cafca is listed on the JSE as well as the London Stock Exchange and the Zimbabwe Stock Exchange. Cafca is also involved in recycling copper and other materials.

In its results for the year to 30th September 2024, the company reported volumes up 10%, but revenue and operating profit in Zimbabwean Gold (ZiG) were lower than the prior year by 5% and 18%. The company said, "The trading environment has been volatile during the year under review. The decline in commodity prices of most metals and alloys, as well as the impact of the drought for the 2023/24 agricultural season, dampened aggregate demand. Currency instability reflected by the inflation rate at 37.5% in September 2024, and exchange rate fluctuations, remain a significant challenge to value preservation."

In a trading update for the 3 months to 31st December 2024, the company reported volumes up 23% and revenue up 29%. The company said, "In the first quarter ended 31 December 2024, we have witnessed industry and commerce adjusting to various changes, including the September 2024 currency devaluation, reduced expansionary spending on road infrastructure, increased power disruptions, and a rise in informal retail."

The enduring problem with this share from a private investor's point of view is the very low volumes traded, which makes it completely impractical as an investment.

Our opinion on the current state of MERAFE(MRF)This is a ferrochrome operation controlled by Glencore, which operates mines, furnaces, and smelters in Mpumalanga and Limpopo. The Glencore-Merafe joint venture can produce up to 2,3 million tons of ferrochrome per annum. Merafe gets 20,5% of the proceeds, and the balance goes to Glencore.

The problem is electricity supply, because smelters require huge amounts of current. The 15,6% increase in Eskom tariffs last year was a major factor, and the current year's increase of just under 10% from 1st April 2022 is a further problem. The company is concerned about Eskom's ability to supply additional power for expansion. Their Lion 3 expansion has accordingly been suspended until this difficulty can be overcome. All smelters except Lydenburg are operating. The availability of trains from Transnet to move its product is another problem.

Obviously, this is a commodity share and has risks, but the world's demand for stainless steel did increase with the economic boom in America, but that now appears to be coming to an end. In its results for the year to 31st December 2024, the company reported revenue down 9% and headline earnings per share (HEPS) down 29%. The company said, "Weaker commodity prices and increasing costs made for a challenging year for Merafe. Earnings slumped by 62% to R667 million, after the full impairment of the Boshoek smelter of R575 million. Ferrochrome prices were impacted by surplus supply as a result of new Chinese production capacity." The company's net asset value (NAV) decreased by 7%.

Technically, the share reached a high of 192c on 4th April 2022 and was trending down or moving sideways since then. It has found some brief support at 104c per share. It remains a volatile commodity share.

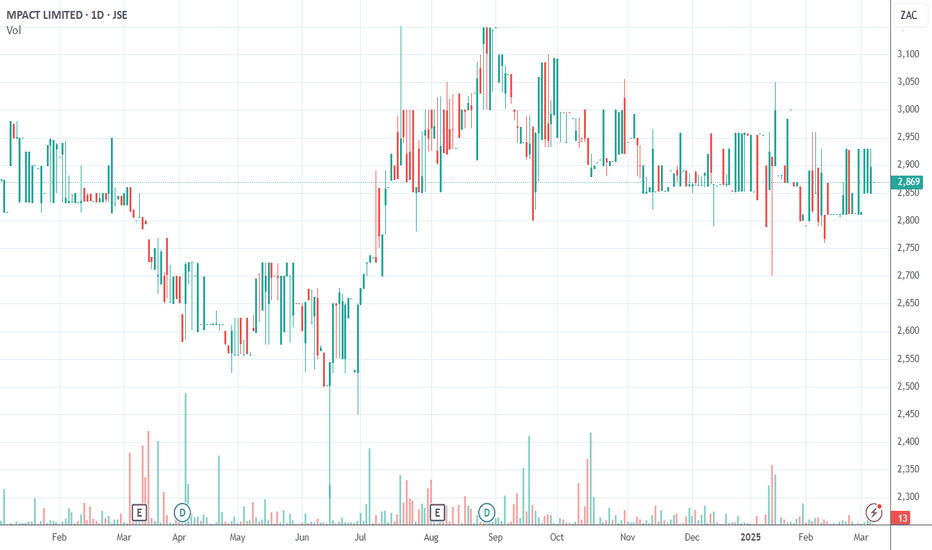

Our opinion on the current state of MPACT(MPT)Mpact (MPT) is a large producer of paper and plastics packaging in Southern Africa. It recycles paper and cardboard and makes corrugated cardboard containers for a variety of industries as well as polystyrene trays for the food industry. It has 20 manufacturing operations, with South African sales accounting for 86% of its business. It employs over 5000 people.

The business is impacted by the general level of consumer spending (which has been depressed because of COVID-19 and was improving at least until the advent of the Ukraine crisis) as well as weather considerations, which affect the demand for corrugated containers for fruit and other agricultural products, especially in the Cape. Like many businesses in the current environment, Mpact has been working to preserve cash, but it has benefited from a switch to local suppliers during the pandemic.

In its results for the year to 31st December 2024, the company reported revenue up 3,6% and headline earnings per share (HEPS) down 29,9%. The company said, "Trading was hampered by a weak economy underpinned by high interest rates, cost inflation, load shedding and other service delivery failures, negatively affecting consumer and business confidence."

The share fell from a high of R51 in April 2016 to levels around R8 in March 2020 but has since recovered to R29. At the current level, it is on an earnings multiple of 8,43 - which looks cheap. Technically, the share looks like it may be entering a new upward trend, but it has been moving sideways since August 2022.

Our opinion on the current state of SUNINT(SUI)Sun International (SUI) is a casino and hotel operator with interests in South Africa, Chile, Peru, and recently, Argentina. The depressed economy in South Africa impacted the performance of South African casinos and hotels even before COVID-19.

The company increased its stake in Sun Dreams in Peru by 10% to 65%. It also bought a hotel and casino in Argentina for $25,5m. The company invested R4bn in the Time Square casino near Pretoria, which was beginning to perform before COVID-19. The group also owns well-known South African casino/hotel operations like Sun City, Carnival City, and Grand West.

The share has fallen from a high of R142 in February 2015 to current levels around R18.24. At this level, its debt was close to double its market capitalisation. The company plans to sell its Nigerian interests and has received a number of offers. It has not paid any dividends in the past two years and only expects to resume dividends in a further two years or so. The company retrenched 2195 staff and its debt fell sharply.

In its results for the six months to 30th June 2024, the company reported income up 5% and adjusted headline earnings per share (HEPS) up 9,1%. The company said, "The group's 5.0% increase in income, combined with effective cost control, yielded a continuing adjusted EBITDA margin of 27.3% which was in line with the prior period. This consistency highlights the effectiveness of cost optimisation initiatives implemented by the group and lower diesel costs following the reduction in load shedding. The group is in a strong financial position with South African debt (excluding IFRS 16 lease liabilities) at R5.4 billion."

In a trading statement for the year to 31st December 2024, the company estimated that HEPS would increase by between 14,1% and 19,8%. The company said, "Sun International retains a strong financial position as it continues to de-gear, with debt (excluding IFRS 16 lease liabilities) decreasing from R5.7 billion in FY23 to R5.2 billion as at 31 December 2024."

Technically, the share has been in a volatile upward trend since its low point in May 2020. It should continue to recover.

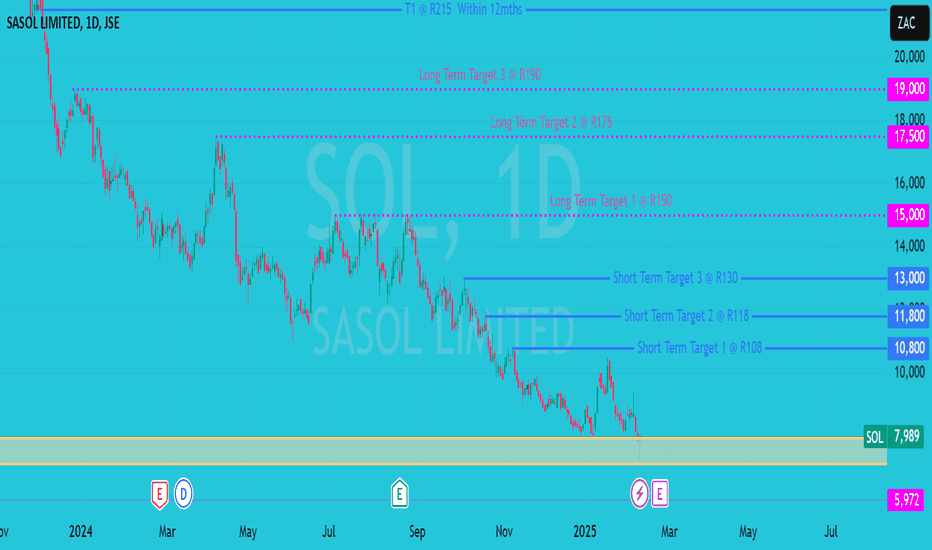

Sasol (SOL) UpwardsTECHNICAL ANALYSIS

1. SOL bounced from a supply/support zone that was created @ end Oct 2020 R71 to R75(marked in yellow.

2. Multiple short & long term BUY opportunity offered as long as price remains above R70

3. Short term = < 12 months

4. Long term is above 12 to 24 months

TRADE IDEA

1. Buy with stop below R70

2. Once in a trade, give it time to develop.

Our opinion on the current state of Sea Harvest (SHG) is South Africa's most popular frozen fish brand with about 38% of the market. It was controlled by Brimstone, which had a 54,92% stake. Sea Harvest catches, processes, and freezes fish for local and export consumption.

They acquired the business of Viking, which began 40 years ago and now employs 1 600 people with a fleet of 30 vessels operating in Cape Town, Durban, Hout Bay, Mossel Bay, and Maputo. Viking catches, processes, and sells horse mackerel, hake, pilchards, anchovy, prawns, tuna, and rock lobster. As part of this deal, they have also acquired 50% of Viking's aquaculture business, which is one of the largest in South Africa. The cost was a total of R565m, of which R315m was paid in cash and the balance through the issue of 19,2m Sea Harvest shares.

Sea Harvest announced the acquisition of the Ladismith Cheese Company for R527m. This company produces cheese, butter, and related products and signals Sea Harvest's intention to diversify away from the fishing industry. The price paid seems quite high since it is based on Ladismith's R58m after-tax profit for the year to January 2018. On 8th March 2023, the company announced that it was increasing its stake in Viking Aquaculture to 82% for R210m.

In its results for the year to 31st December 2024, the company reported revenue up 16% and headline earnings per share (HEPS) down 45%. The company said, "The Sea Harvest Group experienced its most challenging year since listing in 2017, impacted by hake catch rates at historical lows, weak market conditions in abalone, continued soft global prawn pricing, and high interest rates. This was offset by strong demand and improved pricing in hake, a solid performance from the newly acquired Sea Harvest Pelagic business, and a firm result from Ladismith despite challenges from foot-and-mouth disease (FMD), resulting in the Group delivering EBIT of R609 million (2023: R577 million, up 6%) and HEPS of 55 cents (2023: 100 cents, which included a once-off gain on purchased loans of R93 million that contributed 34 cents to HEPS)."

The Sea Harvest share is fairly volatile, with reasonable volume traded. From its listing in March 2017, the share has moved mostly sideways and more recently downward since June 2022. Obviously, the Viking acquisition has changed the nature of this business substantially, but it remains subject to the weather (which affects the catch) and the regulatory environment (where quotas can be changed by the government). In our view, given the volatility, the share remains fairly fully priced.

On 15th May 2024, the company announced that the acquisition of 100% of Terrasan had received approval from the Competition Tribunal.

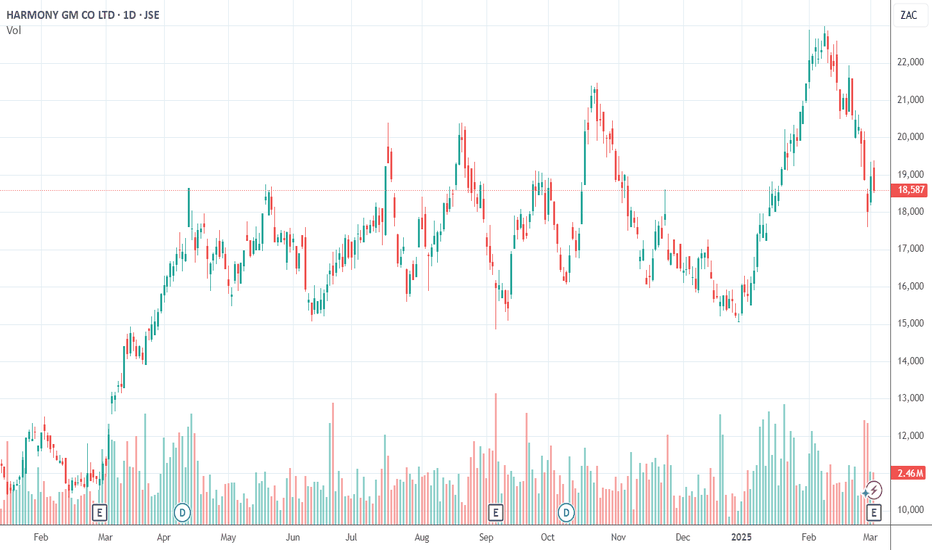

Our opinion on the current state of HARMONY(HAR)Harmony (HAR) was probably South Africa's most marginal gold mine until it got Mponeng gold mine working effectively. The development of this mine and its processing plant are expected to cost around US$2,8bn - and Harmony does not at this stage have its share of that cash (about R20bn). During 2021 the company purchased Mponeng gold mine for R4,2bn. Mponeng is the world’s deepest mine and has all the problems of ultra-deep level mining.

The company is building a 30mw solar park in the Free State and has plans to build a further 80mw of green power. On 6th October 2022, the company announced that it had agreed to buy 100% of the Eva copper project in Australia for R4,1bn. Harmony remains a volatile gold producer and hence risky - although recent acquisitions could change its direction significantly, taking it out of precious metals. Eva is only expected to commence production in 3 years and is expected to add 260 000 ounces of gold and 1,7 billion pounds of copper to Harmony's reserves.

On 3rd April 2024 the company announced that it had signed a wage deal with all of its unions for the next five years. In its results for the six months to 31st December 2024 the company reported gold revenue up 19% and headline earnings per share (HEPS) up 33%. The company said, "Operating free cash flow, up 46% to R10 392 million (US$579 million) driven by the high average gold price received. Strong, flexible balance sheet in a record net cash position of R7 283 million (US$386 million)."

Technically, the share, while volatile, is in a strong upward trend. It is a play on the gold price and the rand/US dollar exchange rate. It was added to the Winning Shares List (WSL) on 16-11-23 at 9920c. It is now trading for 18586c. On 5th February 2025 the company announced that two employees had lost their lives at the company's mines.

Our opinion on the current state of MUSTEK(MST)Mustek (MST) is South Africa’s largest assembler of personal computers under its *Mercer* brand and also imports various computer products, including Samsung, Acer, and Microsoft. Historically, the company has traded well below its net asset value (NAV).

The company has been exploring growth opportunities in the fibre-to-the-home market and has seen strong sales in cables supporting this sector. CEO David Kan has expressed optimism about the potential exponential growth in this area. Additionally, Mustek is positioned to benefit from increased demand for remote education and work-from-home technologies post-COVID-19.

However, in its results for the year to 30th June 2024, Mustek reported revenue down 16% and headline earnings per share (HEPS) down 82.1%. The company attributed this decline to weak corporate and government spending and the sudden end of the *green energy boom*, which had previously driven strong sales. Mustek found itself with surplus stock in an environment of high interest rates and declining demand for alternative energy products.

In a trading statement for the six months to 31st December 2024, the company estimated that HEPS would fall by between 70% and 80%, citing *"the adverse impacts of the prevailing local and economic challenges."*

Despite these negative results, the share appears undervalued. It has recently broken above its 200-day moving average, which could signal the beginning of a recovery. If economic conditions improve and corporate/government spending resumes, Mustek may see better performance in the medium to long term.

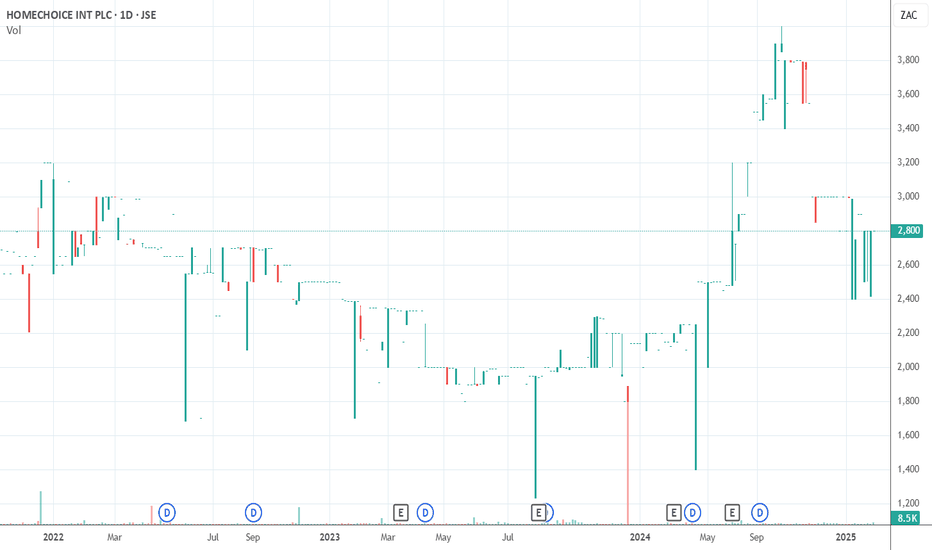

Our opinion on the current state of HOMCHOICE(HIL)HomeChoice (HIL) is South Africa's largest home shopping retailer, operating through two divisions: retail and financial services. It offers a broad range of home appliances, clothing, fashion, footwear, and related products through showrooms and online channels. The share is tightly held, with over 92% of issued shares controlled by Richard Garrat and his family.

A planned share issue, which would have improved liquidity, was shelved due to challenging retail sector conditions. This has left the stock thinly traded, making it unsuitable for most private investors despite its potential as an investment if liquidity improves.

HomeChoice has been expanding into brick-and-mortar retail, with five stores already open and another twenty-five planned. These stores help attract new customers for both retail sales and micro-loans. The company has also extended its financial services offering to include micro-loans, insurance products, and funeral cover. Given the tough economic climate, it has had to increase provisions for impairments on both its retail credit and micro-loan books.

The company primarily serves women in Living Standards Measure (LSM) categories 4 to 8 and has over 870,000 active customers. It continues investing in its digital platform to enhance online shopping and financial services. Online loans are seeing strong growth, with 20,000 new customers signing up each month. Additionally, it is rolling out "bright pink" container shops in townships, allowing customers to collect online orders or apply for business loans.

In its results for the six months to 30th June 2024, HomeChoice reported revenue up 14.6% and headline earnings per share (HEPS) up 37%. The company said, *"HIL has delivered a strong financial performance, with exceptional growth from Weaver Fintech, which is contributing 95% of the group's operating profit. Our digital-first approach continues to provide scalability and efficiency to our businesses and outstanding customer convenience."*

In a trading statement for the year to 31st December 2024, the company estimated that HEPS would increase by between 20% and 30%. While the company shows strong financial performance and growth potential, its limited trading volume makes it highly risky for private investors.

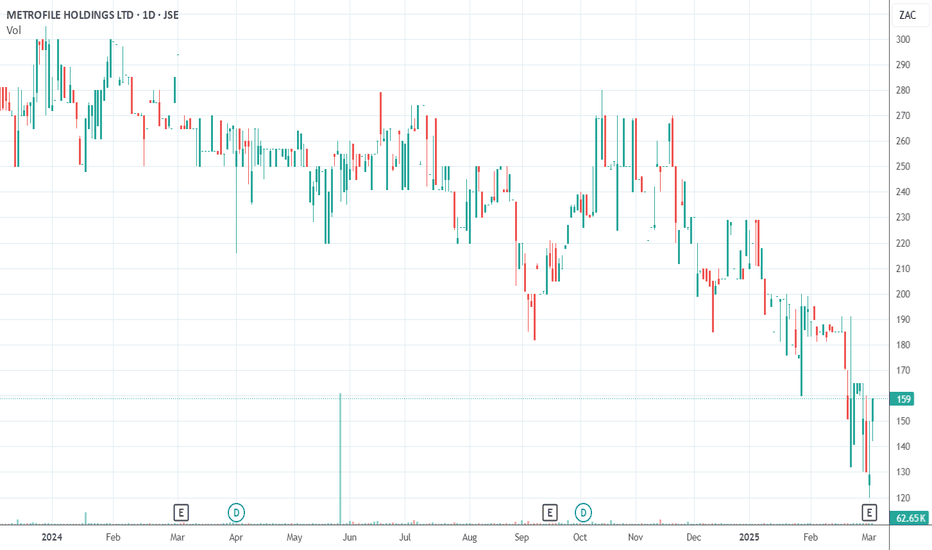

Our opinion on the current state of METROFILE(MFL)Metrofile (MFL) is a company specializing in records storage and management, image processing, and backup services. Listed since 1995, it has a 57.4% Black ownership, with the Mineworkers Investment Company holding 38.64% and Sanlam 5%.

The company's record management division operates 52 facilities across 27 locations, offering over 100,000 square meters of office and warehousing space. A US-based firm, Housatonic Partners, made an offer to buy 100% of Metrofile at 330c per share but delayed the transaction due to COVID-19, awaiting financial results and market stability before proceeding.

In its results for the six months to 31st December 2024, Metrofile reported revenue down 7% and headline earnings per share (HEPS) down 38%. The company said, *"Revenue decreased by 7% to R537 million (1HFY2024: R577 million), mainly due to the reduction in product sales following the exit of the Tidy Files manufacturing operation. Excluding the Tidy Files contribution, revenue was up by 4%, mainly due to growth in secure storage and cloud services."*

While Metrofile remains a high-quality small business, it is facing challenges in a difficult economic climate. Technically, the share appears to be in a new downward trend. On 5th September 2024, the company announced that CEO Pfungwa Serima would resign, effective 30th September 2024, and be replaced by Thabo Seopa.

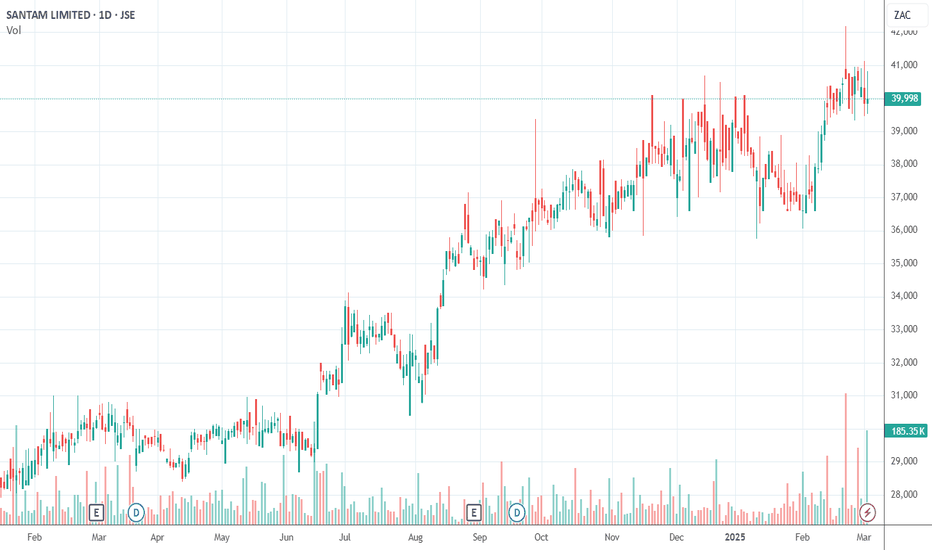

Our opinion on the current state of SANTAM(SNT)Santam (SNT) is South Africa's largest short-term insurer, holding about 22% of the market. Unlike life insurers, it does not engage in endowment insurance, annuities, or investment-linked policies. Instead, Santam insures assets such as buildings and vehicles, as well as individuals against risks they cannot afford, such as income loss due to disability or death.

The company covers the first R150m of any claim before relying on its reinsurance policy. It has Level 1 BEE status and employs over 6000 people. Following the Ma-Afrika judgement, Santam increased its provision for contingent business interruption (CBI) claims by R1,7bn.

Santam is widely regarded as one of the JSE's most reliable and high-quality shares. The company was impacted by the civil unrest in July 2021 but has continued to show resilience.

In its results for the year to 31st December 2024, the company reported revenue up 12% and headline earnings per share (HEPS) up 51%. The company said, *"Conventional insurance net earned premium (NEP) growth of 10% to R32.2 billion. Conventional insurance net underwriting margin of 7.6% (3.5% in December 2023). Alternative risk transfer (ART) profit before tax of R781 million (R516 million in December 2023). Return on shareholders' funds of 31.9%."*

The share trades on a P:E of 11,46. Santam exemplifies a blue-chip stock with a strong balance sheet and a long history of steadily improving earnings. Its share price has followed a consistent upward trajectory for the past 39 years—trading at 90c in 1985 and now around R398. Given its stability and long-term performance, Santam remains a solid choice for any private investor's portfolio.

Our opinion on the current state of AFRO-C(ACT)Afrocentric (ACT) is a black-owned investment holding company that focuses on health administration and insurance.

Sanlam recently acquired 28,7% of the company, which will help with its financing and marketing. The group owns:

- 100% of Pharmacy Direct (a courier company).

- 100% of Curasana (a pharmaceutical wholesaler).

- 100% of Activo Health, having recently acquired the remaining 74% for R588m in cash and shares, at a multiple of 9,3 times Activo's most recent after-tax profit (R63m).

Its largest asset is its controlling stake in Medscheme, which administers medical schemes covering 3,2m lives in South Africa, Namibia, Kenya, Botswana, Zimbabwe, and Swaziland. Afrocentric is intent on leveraging the Medscheme client base to sell its other products.

On 11th October 2022, Sanlam made an offer to buy between 36,9% and 43,9% of Afrocentric for R6 per share, causing the share price to rise sharply.

In its results for the six months to 31st December 2024, the company reported revenue down 51,8% and headline earnings per share (HEPS) down 90,6%. The company said, *"The directors have no reason to believe that the Group will not be a going concern in the foreseeable future based on review of forecasts and budgets and available cash resources."*

Technically, the share bounced off support at around 280c, but the recent results disappointed, and it has fallen further to 143c. We advise waiting for it to break up through its downward trendline before investigating further.