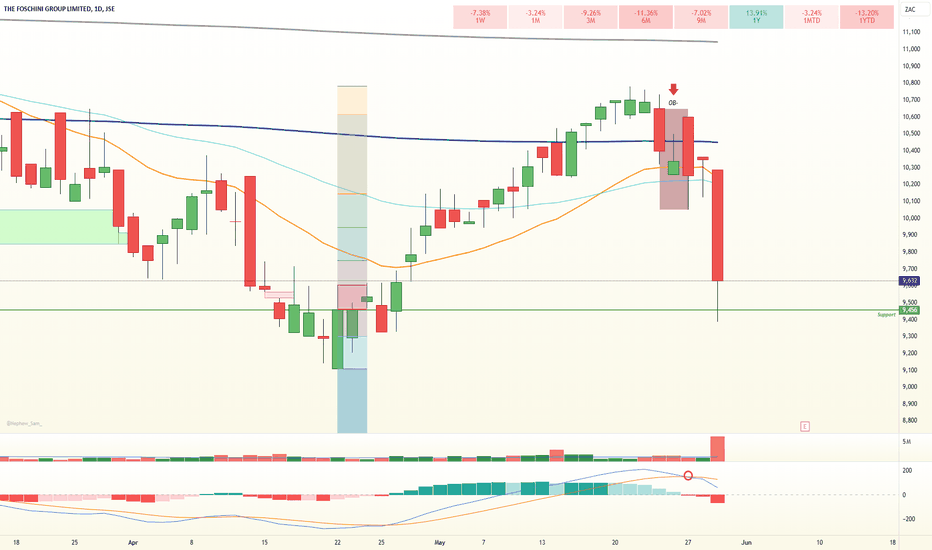

Our opinion on the current state of AFINE(ANI)Afine (ANI) is a real estate investment trust (REIT) formed in 2021, specializing in acquiring petrol stations. The company acquired five petrol stations in February 2021 and two more in May 2021. In its results for the year to 29th February 2024, the company reported revenue up 2.7% and headline earnings per share (HEPS) down 4.1%.

The company said, "Afine’s balance sheet comprised assets of R408.2 million at year-end, consisting of 10 service stations valued at circa R397.8 million. This showed an increase of 11.6% over 2024. Operating profit before fair value adjustments and tax amounted to R38.9 million. Basic earnings were 94.70 cents per share, a very pleasing increase of 176.66% over the previous period. The growth can be attributed to a Fair Value Adjustment in investment property."

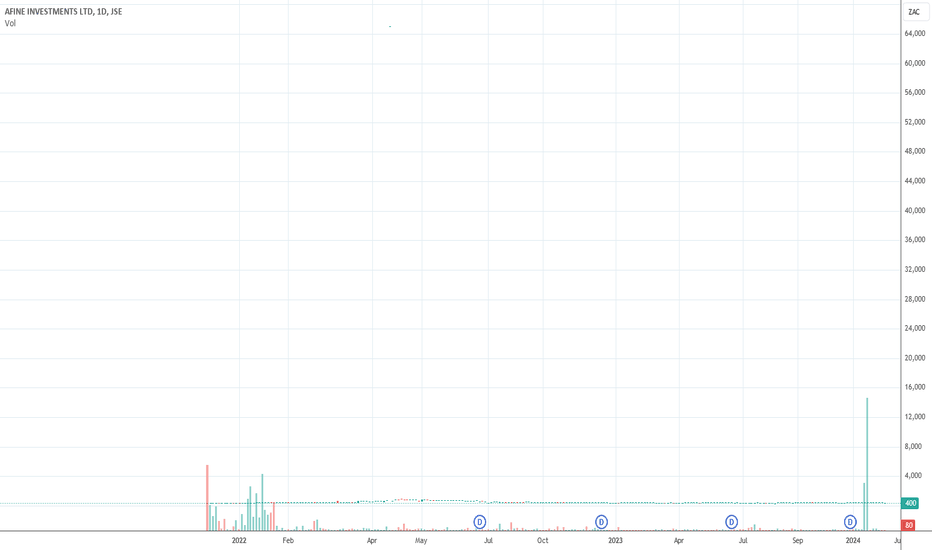

Despite these financial results, the company has less than R1,000 worth of shares changing hands each day on average, which makes it completely impractical for private investors. The low trading volume indicates a lack of liquidity, which can pose significant risks for investors looking to enter or exit positions in the stock.

Key Points for Investors:

1. Specialization in Petrol Stations: Afine focuses on acquiring petrol stations, providing a niche but potentially stable revenue stream.

2. Improving Financials: The company reported an increase in revenue and a significant increase in basic earnings per share due to fair value adjustments.

3. Low Trading Volume: The very low average trading volume makes the share impractical for private investors due to liquidity risks.

4. Balance Sheet: The balance sheet shows a healthy increase in assets, driven by the valuation of their petrol station investments.

Conclusion:

While Afine has shown improvement in its financial results and asset valuations, the extremely low trading volume makes it an impractical investment for private investors. The lack of liquidity poses a significant risk, as it can be difficult to buy or sell shares without impacting the share price. Investors should consider these factors and the niche nature of Afine's business before making any investment decisions.

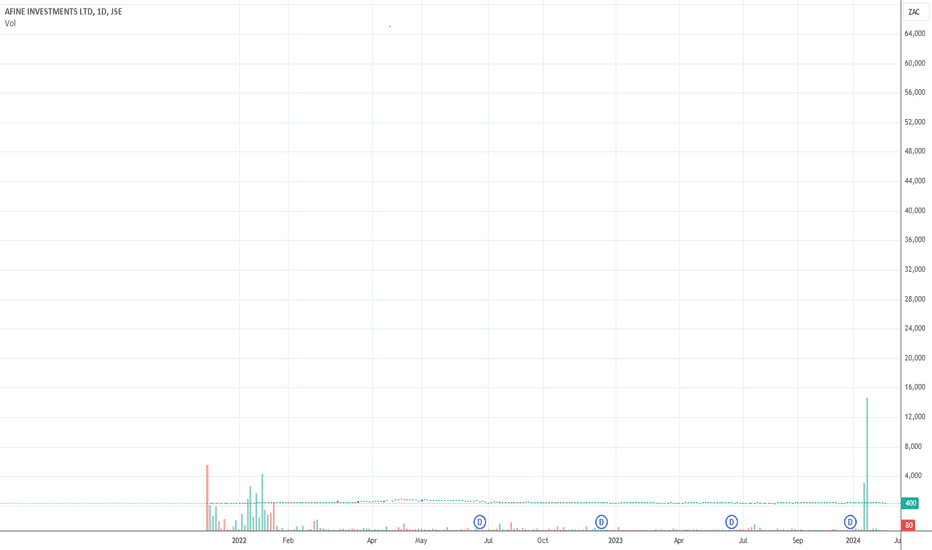

Our opinion on the current state of CAPPREC(CTA)Capprec (CTA) is a fintech company offering payments and payment infrastructure as well as software and services. Patrice Motsepe's African Rainbow Capital (ARC) owns a stake in the company. The payments side of the business is managed through African Resonance and Dashpay, while the software side involves systems development and consulting. The company also owns 17.5% of Resonance Australia, a startup business. Capprec counts all the major banks in South Africa among its clients.

In its results for the six months to 30th September 2023, the company reported revenue up 3% and headline earnings per share (HEPS) up 105.6%. The company's net asset value (NAV) increased 3.3% to 124.5c per share. The company said, "Headline earnings growth benefited from a reduction in the expected credit loss raised for GovChat in the reporting period."

In a business update for the year to 31st March 2024, the company said, "...increased business activity in the Payments division, improved expense management, and strong cash flows resulted in a robust improvement in the Group's financial performance in the second half of the financial year. Both the Payments and Software divisions have continued to attract new clients, diversify their revenue sources, and grow their market shares."

In a trading statement for the year to 31st March 2024, the company estimated that HEPS would increase by between 81% and 84.8%. The company said, "...increased business activity in the Payments division, improved expense management, and strong cash flows resulted in a significant improvement in Capital Appreciation's financial performance in the second half of the financial year." The share now trades at a P:E of 10.76. Roughly R1.3m worth of shares change hands each day, which makes this share quite feasible for private investors.

The company appears to be well-managed, profitable, and cash-flush, which means that it is beginning to attract institutional interest. Technically, the share has been in a downward trend since January 2022, and we advise waiting for a break up through its downward trendline, which does not look like it will happen anytime soon.

Key Points for Investors:

1. Strong Financial Performance: Significant improvements in HEPS and NAV, indicating robust financial health.

2. Diversified Client Base: Major South African banks as clients and growing market share in both Payments and Software divisions.

3. Institutional Interest: Increasing interest from institutional investors due to the company's strong financial performance and strategic positioning.

4. Technical Analysis: The share is in a downward trend; investors should wait for a clear break above the trendline before considering an investment.

Conclusion:

Capprec presents a promising investment opportunity due to its strong financial performance, diversified client base, and growing institutional interest. However, investors should be cautious and wait for a clear technical signal before investing. The company's ability to continue attracting new clients and managing expenses effectively will be key to its future growth.

Our opinion on the current state of TRUSTCO(TTO)Trustco (TTO) is a financial services group operating out of Namibia and controlled by its CEO, Dr. Q. van Rooyen, who holds just over 50% of the shares. The company has three main areas of activity:

1. **Insurance & Investments**

2. **Resources**

3. **Banking/Finance**

In its results for the six months to 28th February 2023, the company reported a loss of NAD 250m and net asset value (NAV) down 13.6% to NAD 1584bn. The company said, "The loss per share was 25.38c, compared to earnings per share of 138.07c in the previous corresponding period. As Trustco continues to invest in strategic growth areas, it is expected to deliver improved financial performance in the future."

In a trading statement for the six months to 29th February 2024, the company estimated that headline earnings per share (HEPS) would increase by between 134.01% and 154.01%. The company said, "The Group's investment portfolio maintains an average weighting of 38% in US Dollar-based assets and 62% in Namibian Dollar-based assets, providing a stable foundation for growth."

This company is diversified both in terms of the various businesses it is in and geographically. Because it is controlled by van Rooyen, its activities can be difficult to predict. The share was suspended in November 2022 until 23rd March 2023 due to not publishing its financial statements. The volumes traded in the share have improved in recent months but still only R38,000 worth of shares are changing hands on average each day, which adds to the share's risk.

Given the recent financial performance and trading suspension, potential investors should be cautious. The increased HEPS forecast is promising, but the company's historical volatility and the control exerted by Dr. van Rooyen present significant risks. Investors should monitor the company's future financial disclosures and consider the liquidity risk associated with the low trading volumes before making any investment decisions.

Our opinion on the current state of ZEDA(ZZD)Zeda is a car rental company unbundled and spun out of Barloworld, with a fleet of 250,000 vehicles and 14 dealerships around South Africa. It holds the license for the Avis brand in South Africa. The company is 55 years old and listed on the JSE on 13th December 2022, with Ramasela Ganda as its CEO.

In its results for the six months to 31st March 2024, the company reported revenue up 19%, while headline earnings per share (HEPS) decreased by 15.8%. The company said, "Despite the challenging trading conditions, the EBITDA margin and Operating margin remained strong at 34.0% and 15.0% respectively, underpinned by a healthy and diversified mix of product offerings from both the rental and leasing businesses. The Net debt to EBITDA ratio improved from 1.6x in March 2023 to 1.5x in March 2024."

By November 2023, the share was showing signs of a new upward trend and trading on a P:E of 3.12, which looks like very good value. The company is benefiting from the problems at Transnet, which have caused many mines to transport their goods to port by road. Zeda has a fleet of rental trucks that have been impacted by the truck attacks on the N3 highway.

Given the current trading conditions and Zeda's strong margins, the company appears to be well-positioned despite the challenges. The low P:E ratio suggests that the share is undervalued, making it potentially attractive for investors. However, the risks associated with the transportation sector, including the recent truck attacks, should be carefully considered.

Investors should monitor Zeda's ability to maintain its margins and manage its debt while navigating the ongoing challenges in the transportation sector. If the upward trend continues and the company can capitalize on the issues faced by Transnet, Zeda may present a compelling investment opportunity.

Our opinion on the current state of WOOLIES(WHL)The sad fall of the Woolworths (WHL) share price was largely due to the decision of previous CEO, Ian Moir, and his board to buy David Jones in Australia for AU$2.1bn. This acquisition has now had R12bn written off its original purchase price of R20bn in 2014. The only aspect sustaining the Woolworths group was its food sales. On 14th January 2020, Woolworths announced that they had appointed Roy Bagattini, from Levi Strauss, to replace Ian Moir as Group CEO with effect from 17th February 2020. Woolies' fashion and clothing section was also not performing well in a very difficult trading environment.

In its results for the six months to 24th December 2023, the company reported group turnover down 16.7% and headline earnings per share (HEPS) down 31%. The company said, "The Group's results for the first half of the 2024 financial year ('current period' or 'period') are not directly comparable to that of the prior period, given the inclusion of the David Jones contribution in the prior period." In a trading statement for the 53 weeks to 30th June 2024, the company estimated that HEPS would fall by at least 20% - partly due to its disposal of David Jones in Australia.

We recommend that you only consider Woolies shares when they break up through their current downward trendline, which does not look like happening anytime soon. The current P:E is around 13.18, and the shares are still falling.

Given the challenging retail environment, the significant write-downs on the David Jones acquisition, and the ongoing issues with its fashion and clothing segment, Woolworths faces significant headwinds. Investors should be cautious and look for signs of a sustainable turnaround, such as improved financial performance and breaking the downward trendline, before considering investing in Woolworths shares.

Our opinion on the current state of SANTOVA(SNV)Santova (SNV) is an international logistics company with 19 offices in 7 countries. The company designs, implements, coordinates, controls, and monitors international supply chain activities. Through a virtual client-centric information system, the company facilitates inventory management to provide far more than simple tracking and tracing services. Santova has offices in the East in Thailand, Vietnam, and Malaysia, in Europe in Germany, the Netherlands, and the UK, and in major cities in South Africa. It also has offices in Mauritius and Sydney, Australia.

In its results for the year to 29th February 2024, the company reported revenue of R617.7m, down from R654.4m in the previous period. Earnings per share (EPS) was 111.81c compared with 154.74c in the previous period. Technically, the share had been in a steady upward trend from May 2020, which ended in August 2023. It has since fallen back down to 752c per share but may be at the start of a new upward trend.

The share is fairly well-traded, making it practical for private investors, and it should benefit from any improvement in the South African and UK economies. Given its international presence and robust supply chain solutions, Santova is well-positioned to capitalize on global trade recovery and economic growth.

Investors should keep an eye on the broader economic indicators in the regions where Santova operates, particularly any signs of recovery or growth in the logistics and supply chain sectors. Additionally, monitoring the company's ability to adapt to changing global trade dynamics and its ongoing performance will be crucial for assessing its long-term investment potential.

Our opinion on the current state of REINET(RNI)Reinet (RNI) is an investment holding company whose main asset is a holding of roughly 2.12% of British American Tobacco (BAT) worth about $1.8bn, which now accounts for 31% of its net asset value (NAV) - down from 85% ten years ago. This decline from a year ago is because the price of BAT shares has fallen. Most of this reflects the more difficult legal environment for tobacco, especially in the US where the Food and Drug Administration is considering changing the laws on menthol cigarettes.

In our view, Reinet shows no great urgency to divest itself of the BAT stake - which continues to contribute good dividends from growth in third world countries, while cigarette sales in first world countries fall. As the price of BAT has fallen, the other assets in the Reinet portfolio have become more significant. The largest of these is its 46% stake in Pension Insurance Corporation (Penscorp), which now represents 36.8% of its portfolio. Aside from Penscorp, the company also owns a spread of private equity investments, accounting for around 15% of the portfolio.

In its results for the year to 31st March 2024, the company reported its net asset value up 8.1% at 3402 euro cents per share. The company has a compound growth rate of 8.8% per annum since March 2009. The share is obviously a rand-hedge and, although it fell from its high of R343 in February 2020 to lows in January 2021, it has since recovered.

We advised waiting for a break up through its long-term downward trendline. That break came on 16th September 2019 at R270 per share. It is now trading for R490.50. It obviously took a hit as a result of the BATS announcement that it was writing the value of its US operation down by GBP25m (R595bn), resulting in a 10% fall in the BATS share price. This share benefits from any weakness in the rand, and investors should consider the rand's future prospects before buying.

Given the diversification of its portfolio and its rand-hedge properties, Reinet remains an attractive investment option for those looking to hedge against local currency risk. However, the dependence on BAT and the volatile legal environment for tobacco should be taken into account. Investors should weigh these factors alongside the broader economic context and their own risk tolerance before making a decision.

Our opinion on the current state of PEPKORH(PPH)Pepkor Holdings (PPH), previously known as Pep, is 71.01% owned by Steinhoff International. Following the collapse of the Steinhoff group due to admissions of "accounting irregularities," the directors of Pep decided to change their name back to Pepkor Holdings to avoid negative publicity. The group includes Ackermans, PEP Stores, Bradlows, and HiFi Corporation. Since the problem began in December 2017, and with the COVID-19 pandemic, the share price fell as low as R10 per share in May 2020. Over the next year, the share staged a remarkable recovery, more than doubling.

The company raised R1.9bn in an accelerated book-build, with the proceeds used to reduce debt as a precautionary measure. On 3rd February 2022, the company announced the acquisition of 87% of the Brazilian clothing retailer Avenida. On 13th April 2022, the company announced that its Isipingo distribution center had suffered significant damage due to the flooding in the Natal area and had to be temporarily closed. The company has adequate insurance to cover the damage.

In its results for the six months to 31st March 2024, the company reported revenue up 9.5% and headline earnings per share (HEPS) down 3.8%. The company said, "Sales growth strengthened further in the second quarter - Market share expansion on three-, six- and 12-month basis (Retailers' Liaison Committee (RLC) March 2024) - Recovery in retail gross profit margin - Avenida expansion accelerated and ahead of plan."

Technically, the share has been moving sideways and downwards since November 2021 and remains vulnerable. Despite this, Pepkor Holdings is seen as a good quality investment, but it is potentially vulnerable to lower levels of consumer spending. Investors should consider the broader economic context and the company's exposure to consumer behavior, especially in times of economic uncertainty.

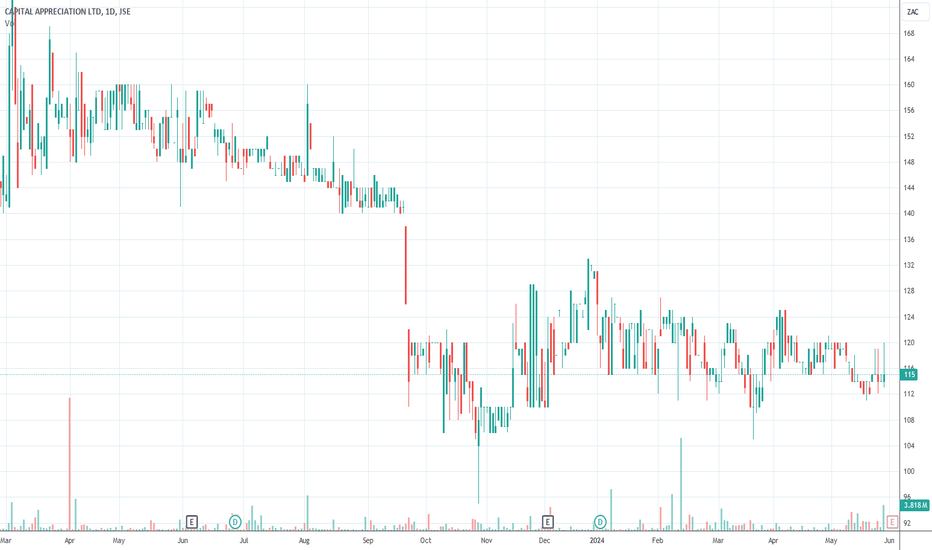

Our opinion on the current state of GTCSA(GTC)GTC is a property group operating in Central and Eastern Europe, with properties in Poland, Bucharest, Budapest, Belgrade, Sophia, and Zagreb. The company manages forty-seven office buildings and six retail properties with a gross lettable area (GLA) of 829,000 square meters, worth about 2.35 billion euros. It is listed on the Warsaw Stock Exchange (WSE) and the JSE.

In its results for the year to 31st December 2023, the company reported rental revenue up 10% and a loan-to-value (LTV) of 49.3%. Occupancy was 87%, and the company ended the year with 60 million euros in cash. The company stated, "As of 31 December 2023, the book value of the Group's total property portfolio, including non-current financial assets (related to investment property), was EUR 2,449.2m."

In an update on the three months to 31st March 2024, the company reported rental revenue up 7% and a loan-to-value (LTV) of 48.1%. The company noted, "46 completed commercial buildings, including 40 office buildings and six retail properties, with a total combined commercial space of approximately 755 thousand sq m of GLA, an occupancy rate at 86%, and a book value of EUR 2,008.5m, which accounts for 85% of the Group's total property portfolio."

Unfortunately, the share on the JSE is extremely thinly traded, which makes it impractical for private investors. Despite the company's strong financials and attractive property portfolio, the lack of liquidity on the JSE presents a significant risk for private investors looking to enter or exit positions efficiently.

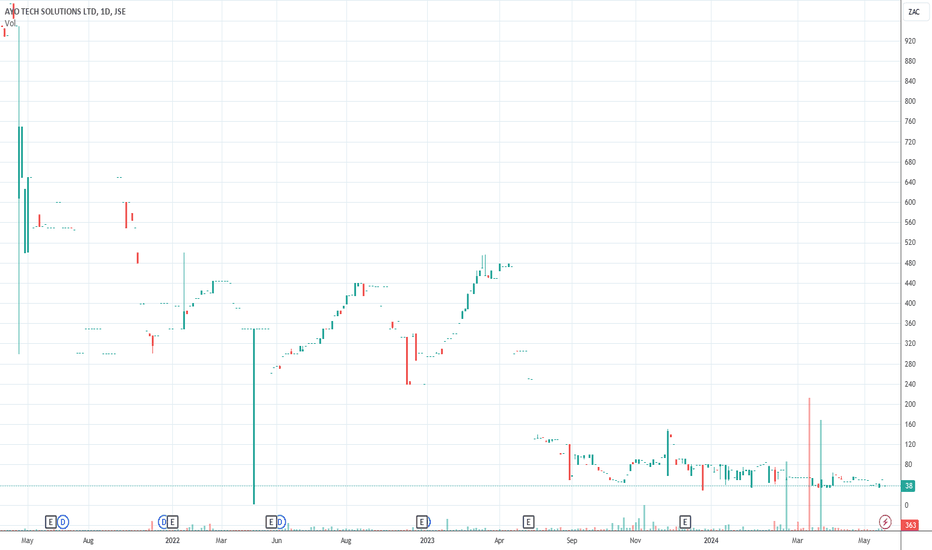

Our opinion on the current state of AYOAYO is a black-owned technology company that was spun out of AEEI, which still holds 49.4% of the company. There were suspicious circumstances surrounding a massive R4.3bn investment by the Public Investment Corporation (PIC), which has been the subject of a court action by the PIC. This was finally settled on 31st March 2023, with AYO paying the PIC R619m. In effect, PIC pensioners appear to have been fleeced out of billions of rands. Ayo shares listed at R43, fell to as low as 105c, and are now around 305c after their latest results. Volumes traded are very thin, with many days where it does not trade at all. The company has 1,400 employees. What income it received appeared to be from interest on the remainder of the PIC loan.

Assessing this share is difficult, and it is considered potentially dangerous, especially after testimony from the former financial director, Siphiwe Nodwele, before the Mpati Commission, that the company is probably only worth R700m. Additionally, Naahied Gamieldien, previously the CFO, testified that she had to "...adjust margins to increase the company's profit," resulting in the profit doubling. In October 2019, the Financial Sector Conduct Authority (FSCA) conducted a raid on Surve's offices as part of an ongoing investigation. FNB has closed Ayo's bank accounts at Ayo Technology Solutions, citing reputational risk. Ayo is opposing this in a court action and, in an announcement on 30th April 2021, claims to have put in place "alternative third-party solutions" to enable the company to continue trading.

Investors are advised to stay well clear of this share until the uncertainties surrounding the Mpati Commission can be resolved. On 1st June 2021, British Telecom (BT) announced that it was severing ties with Sekunjalo due to "misrepresentation of facts" before the standing committee on finance in parliament. On 10th February 2022, the JSE announced that two Ayo directors had been barred from being directors of a listed company for five years because of failing to carry out their oversight duties, leading to incorrect, false, or misleading financial statements. On 22nd December 2022, the JSE published a censure of Ayo because of their involvement in related-party transactions without complying with the JSE rules on such transactions.

On 24th March 2023, the company announced that it had reached an undisclosed out-of-court settlement with the PIC, but it seems unlikely that the PIC will recover the R4.3bn it advanced to Ayo. In its results for the year to 31st August 2023, the company reported revenue up 28% and a headline loss per share of 176.46c compared with a loss of 60.25c in the previous year. The company said, "The Group’s gross profit percentage decreased from 22% in the prior year to 16% in the current year due to lower margins achieved in the managed services divisions as a result of fewer service contracts and more procurement of equipment distribution contracts in the public sector."

In a trading statement for six months to 29th February 2024, the company estimated that it would make a headline loss of between 25.21c and 41.03c compared with a loss of 79.13c in the previous period. On 6th September 2023, the JSE publicly censured a director of Ayo, Khalid Abdulla, for breaching the listing requirements and failing to exercise his fiduciary duties. He was fined R2m, and Ayo was fined R6.5m.

Given these circumstances, we cannot recommend this share to private investors due to concerns about the company's financial reporting and the overall uncertainty surrounding its operations and governance.

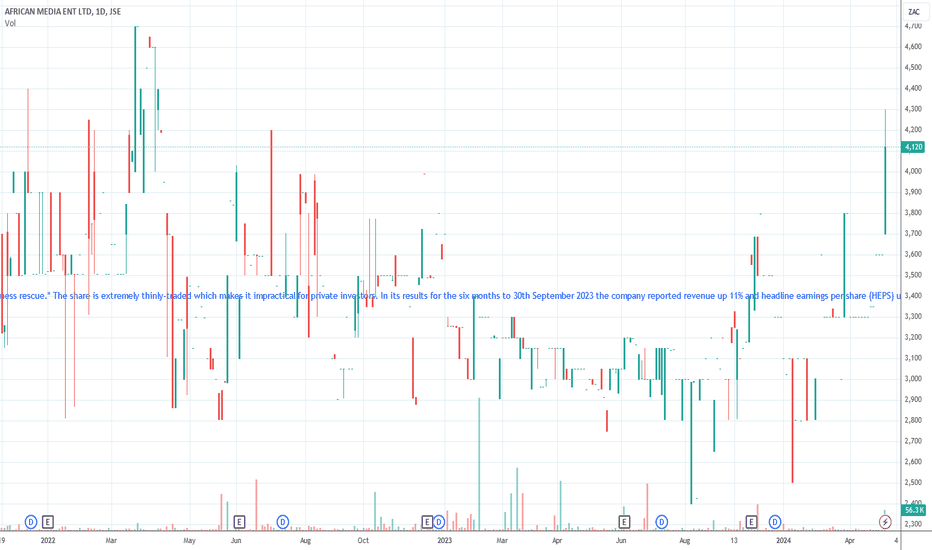

Our opinion on the current state of AMEAfrican Media Entertainment (AME) is a company specializing in running radio stations, with revenue coming principally from advertising on those stations. It has four divisions:

1. **Algoa FM**: Broadcasts from the Garden Route to the Wild Coast.

2. **OFM**: Broadcasts in the Free State, North-West province, Northern Cape, Southern Gauteng, and Northern Natal.

3. **United Stations**: Sells and creates advertising material for the radio stations.

4. **Radio Heads**: Offers media planning and buying, creative strategy and copywriting, and syndicated programming.

AME recently acquired Moneyweb and a share of Classic FM. The company said, "On 30 September 2019 Classic FM South Africa (Pty) Ltd was placed under voluntary business rescue." The share is extremely thinly traded, making it impractical for private investors.

In its results for the six months to 30th September 2023, the company reported revenue up 11% and headline earnings per share (HEPS) up 39%. The company said, "The group generated cash from operating activities of R23.4 million (September 2022: R18.2 million), paid tax of R7.6 million (September 2022: R5.5 million), spent R2.6 million (September 2022: R3.8 million) on capital expenditure and paid dividends to its equity holders and non-controlling interest holders of R20.2 million (September 2022: R15.7 million)."

In a trading statement for the year to 31st March 2024, the company estimated that HEPS would increase by between 53% and 67%. The share trades an average of R85,000 per day, which makes it practical for a small investment. Its portfolio of radio stations has relatively small, specialized audiences. Moneyweb has battled for years to produce significant profits.

Despite the company's improved financial performance and optimistic outlook, the thin trading volume and the specialized nature of its audience and services mean it remains a niche investment. Investors should be cautious and consider the liquidity risk and the challenges faced by the media and advertising industry.

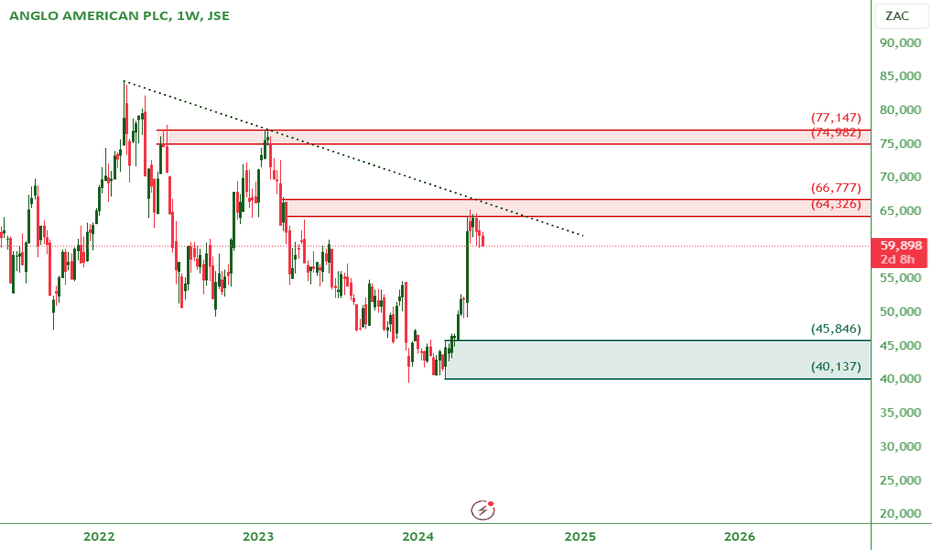

Our opinion on the current state of ANGLO(AGL)Anglo American (AGL) mitigates the typical risk associated with commodity stocks in two ways. Firstly, the company has a diverse portfolio of different minerals, reducing the impact of any one mineral entering a bear trend. Secondly, it maintains a very strong balance sheet with plenty of headroom, allowing it to ride out economic downturns. Anglo describes itself as a globally diversified mining company with a portfolio of world-class mining operations and undeveloped resources.

Commodity prices tend to move in trends, and since the beginning of 2016, the trend has been steadily upward until the coronavirus pandemic caused markets to fall into a new downward trend in March 2020. The upward trend has now resumed, with a strong recovery already taking place. One of Anglo's key projects is Quellaveco in Peru, a massive copper mine in which Anglo owns 60%. This project will have a very rapid payback period now that it has begun producing. It is costing $5.6bn to build, which should be recovered in about four years, and the mine has a life of 30 years.

We believe that the boom in commodity prices is continuing, and that COVID-19 is substantially behind us. Commodity prices will be driven by the economic expansion that began in America and spread to Europe and the East. Additionally, the conflict in Ukraine is pushing commodity prices up, especially precious metals, due to heavy sanctions on Russia.

If you are looking for an investment that is likely to be more exciting than buying one of the big banks or property REITs, and which will benefit directly from the growth in the world economy, you could consider Anglo American. One of the factors holding the company back has been the poor availability of Transnet’s rail service, especially at Kumba. The company plans to get 100% of its energy needs from renewables in South Africa by 2023.

Anglo’s share price went up six-fold in under three years and rose to R425 before the coronavirus epidemic. It fell to R210 and then recovered to over R800 before the problems at Los Broncos. The current fall in the share price is also a result of the drop in commodity prices. It is clear that the company is being impacted by both the increased load shedding and problems with the South African rail service.

In its results for the year to 31st December 2023, the company reported revenue down 13% and earnings per share (EPS) down 94% in US dollars. The company said, "Quellaveco fully ramped up and produced 319,000 tonnes of copper at a unit cost of 111 c/lb. On track to reduce annual costs by c.$1 billion and capex by c.$1.6 billion over 2024–2026. Underlying EBITDA of $10.0 billion, a 31% decrease; 2% volume increase and unit costs held to +4% despite high inflation, more than offset by $5.5 billion revenue impact of PGMs and diamonds at cyclical lows." The company has debt of $10.6bn and is involved in a complete review of all its assets.

Technically, the share appears to have completed a head-and-shoulders formation and broken down through the neckline at R525, setting the stage for further falls. On 11th December 2023, Business Day reported that Anglo had announced capital expenditure cuts of R1.8bn, causing the share price to drop by 13.3%. We recommended waiting for the share to break up through its long-term downward trendline (connecting the peak in January 2023 with that of December 2023). That happened on 2nd April 2024 at a price of 47926c. Since then, the share has risen to 63480c, mainly because of an offer first announced on 13th May 2024 from BHP to buy Anglo after unbundling Kumba and Amplats.

In terms of the third iteration of the offer, Anglo shareholders would get 0.8860 BHP shares for every share of Anglo that they held, which would result in Anglo shareholders owning 17.8% of BHP. Anglo announced that it had rejected this third BHP offer but opened the door for negotiations. On Wednesday, 29th May 2024, BHP withdrew its offer. Our view is that there may be other offers, perhaps from Rio Tinto or Glencore.

BHP Group Takeover Bid for Anglo American PLC: Deadline ApproachThe clock is ticking as we approach the 6pm deadline Friday for Anglo American PLC to respond to BHP Group's takeover bid. This is a significant moment for both companies and the mining industry as a whole. Let's dive into the charts and analyze the current situation.

Daily Timeframe Analysis 📉

Looking at the daily chart, the price of Anglo American PLC has been in a long-term decline. Recently, it touched the supply zone between 64.32 and 66.77. This contact resulted in a strong reaction, indicating a potential reversal or at least significant resistance at these levels. From my perspective, buying this stock right now doesn't seem prudent. If BHP proceeds with the acquisition at these prices, they could face substantial financial challenges.

Weekly Timeframe Insights 📊

Switching to the weekly chart, we observe a different story. There's a demand zone between 40.137 and 45.846. Historically, buyers have stepped in aggressively when prices reached these levels. Should the price decline to this range before Friday, it might present a more attractive entry point for potential buyers. This area could see significant buying pressure, providing a stronger foundation for a potential turnaround.

Key Takeaways 🔍

Daily Chart: Long-term decline, strong reaction at supply zone (64.32-66.77).

Weekly Chart: Potential demand zone (40.137-45.846) where buyers might step in.

While the market's reaction and the final decision of Anglo American PLC remain to be seen, these technical levels provide critical insights for traders and investors alike.

📈💼 Remember, this analysis reflects my personal views and should not be taken as financial advice. Always do your own research before making any investment decisions. Happy trading!

Disclaimer: The views expressed in this article are my personal opinions and should not be considered as financial advice. Please conduct your own research and consult with a financial advisor before making any investment decisions.

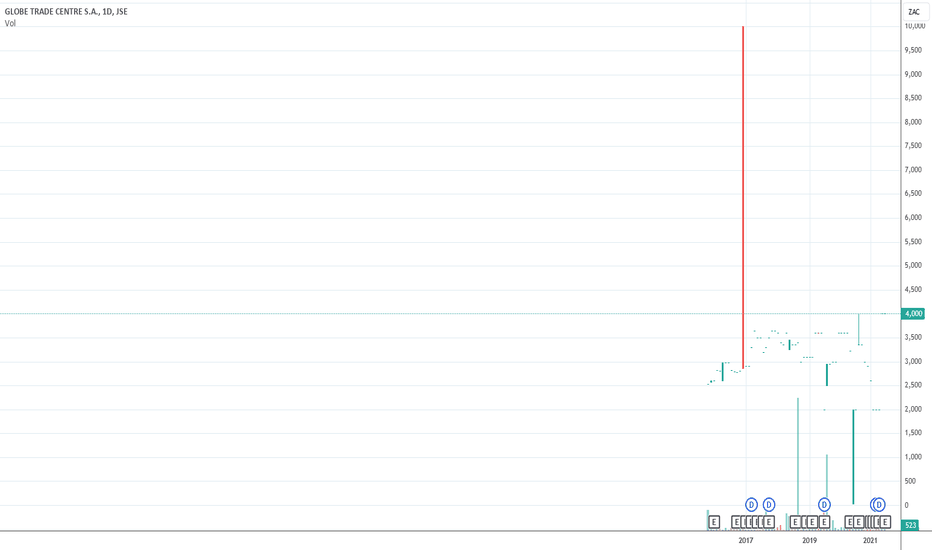

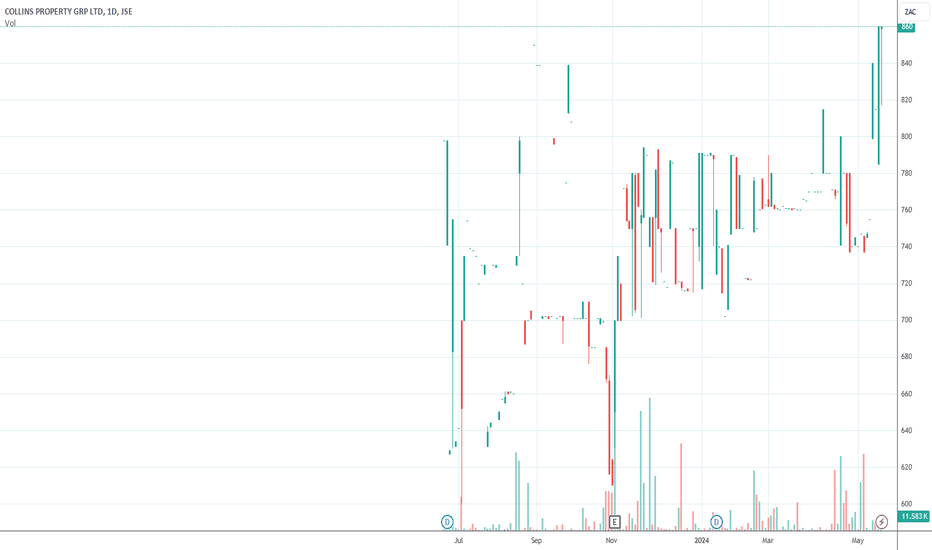

Our opinion on the current state of COLLINS(CPP)Collins (previously Tradehold) has a portfolio of more than 140 properties with a total gross lettable area of 1.6 million square meters. Most of these properties are industrial, including major distribution centers and industrial complexes let on long-term triple-net leases to leading corporate clients. Collins also manages Tradehold’s Namibian portfolio, consisting of sought-after properties in that country’s main towns such as Windhoek, Walvis Bay, and Gobabis.

Tradehold was a real estate investment company in Southern Africa, which is 48% owned by Christo Wiese. More than 40% of its assets were in the UK, held through its 100% holding of the Moorgarth Group, which owns 23 properties in the UK that have now been sold. It owns 100% of Tradehold Africa, which owns properties in Africa outside of South Africa, and 100% of the Collins Group, which owns 153 properties inside South Africa. It has spun off its financial services business interests into a separately listed entity, Mettle, which is now listed on the Alt-X of the JSE.

The South African economy is facing difficulties with the cost of 10 years of state capture and corruption coming to light, followed by the impact of COVID-19 and now the civil unrest. In a report on the unrest, the company said, "...a total of 21 of Tradehold’s properties in KwaZulu-Natal were damaged during the recent unrest in South Africa. The estimated cost of damage is R41 million, excluding loss of rental. This represents approximately 0.5% by value of Tradehold’s property portfolio in South Africa."

In its results for the year to 29th February 2024, the company reported revenue up 6.3% and headline earnings per share (HEPS) up 149%. The company had vacancies of 3.9% and a loan-to-value (LTV) of 51%. Technically, the share has been in a downward trend since April 2016 and is now trading at a significant discount to its net asset value (NAV) per share.

In our view, this share is mostly a local property play which will probably perform better as the South African economy recovers, but we do not see it as an exciting investment prospect - mainly because of its high LTV. The company is selling off its Mozambique properties. Volumes are around R98,000 worth of shares changing hands each day, which makes it more risky for private investors.

Our opinion on the current state of BARWORLD(BAW)Barloworld (BAW) is an international supplier of heavy earth-moving equipment and vehicles to the mining, agriculture, infrastructure, power, automotive, and logistics sectors. Its best-known brands include Caterpillar, Avis, Massey-Ferguson, and Challenger. It operates in 24 countries, especially in Southern Africa, Russia, and other emerging markets. Its wide diversity of operations and geographical activities give it some insulation against recession.

BAW has sold its Spanish and Portuguese operations for about R2.5bn, which it is now looking to invest in Mongolia with the acquisition of the US-owned Wagner Asia Group. The Ukraine crisis is making it more difficult for Barloworld to get payments from customers in Russia and has pushed up the cost of some commodity prices, but the company says it has sufficient funds to manage the situation. This has seen its share price fall quite sharply.

In its results for the six months to 31st March 2024, the company reported revenue down 8% and headline earnings per share (HEPS) down 8%. The company's net asset value (NAV) increased by 9% to 9111c per share. The company said, "The group’s revenue of R19.2 billion decreased by 8% compared to the prior period, driven by a 24% decrease in revenue in VT, a 10% decrease in Equipment southern Africa and a 3% decrease in Ingrain. This decline was, however, offset by a 43% revenue increase in Barloworld Mongolia."

Technically, the share fell heavily in March 2020 in response to COVID-19 and then moved sideways in an extended "island formation." There has been an upside breakout from the island, and it has also broken up through its long-term downward trendline. On 9th April 2024, the share gave a strong on-balance-volume (OBV) buy signal and it has been rising ever since. We believe it is still good value at current levels. Obviously, developments in Ukraine and Russia will have a major impact on this share.

On 26th May 2022, the company announced that it will be buying back 10% of its issued shares. On a P:E of 7.96, this share looks cheap to us.

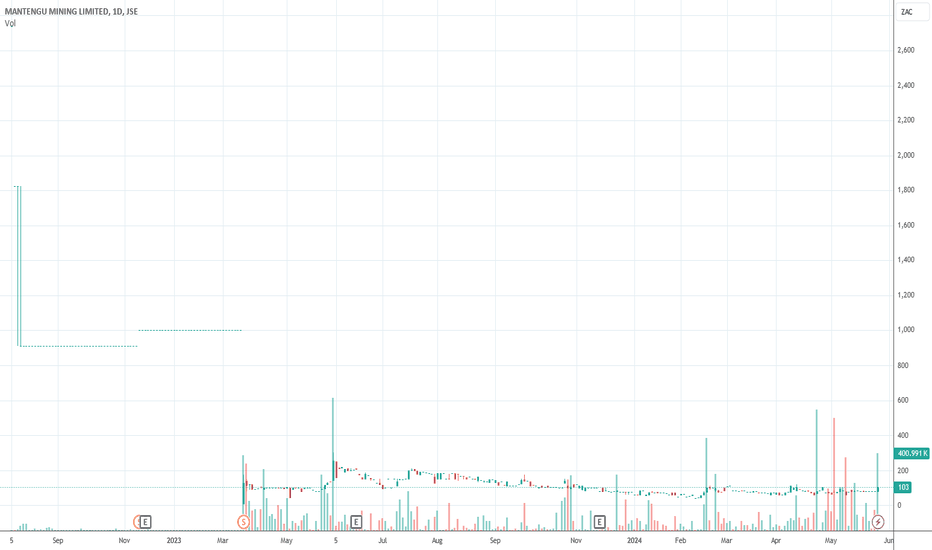

Our opinion on the current state of MANTENGU(MTU)Previously known as Mine Restoration, this company invests in mining resources. It owns the Langpan Project, which mines and processes chrome with a high concentration of platinum group metals (PGM). The Langpan orebody consists of 3.1 million tonnes of open cast resource and over 4.9 million tonnes of underground resource, as confirmed by the MSA Competent Persons report.

In its results for the year to 29th February 2024, the company reported revenue of R109.9m compared with R4.5m in the previous year. Headline earnings per share (HEPS) was 1c compared with a loss of 12c in the previous year. The company said, "The most pleasing aspect is the fact that these results were achieved with the Langpan LG plant only operating at a steady state level from January 2024, and for the last two months of the financial year. Approximately R60.1 million of revenue was generated during these two months."

The share trades an average of R141,000 each day, and the price has been rising. It remains a risky commodity share due to the volatility inherent in the mining sector and the reliance on commodity prices. However, the recent operational success and revenue growth indicate potential for future performance.

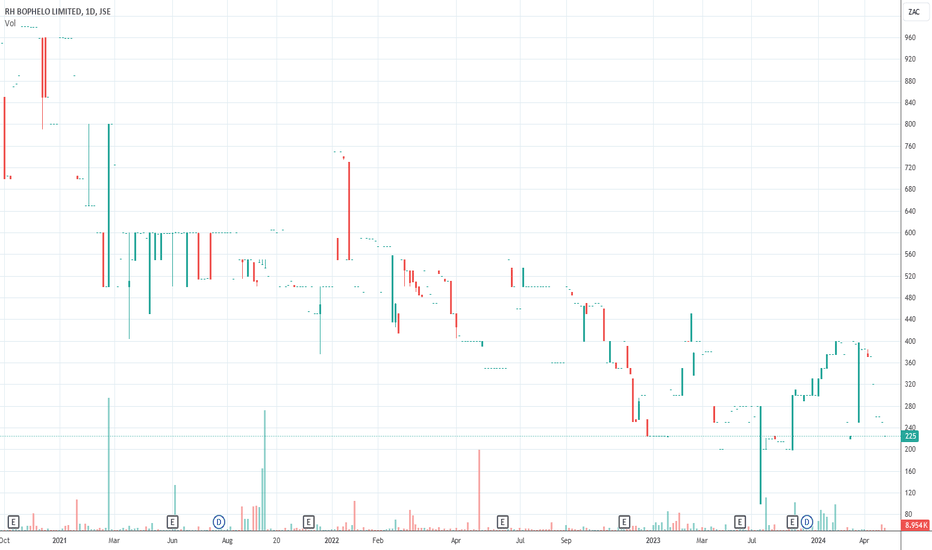

Our opinion on the current state of RHBOPHELO(RHB)RH Bophelo (RHB) is a black-owned African healthcare company that listed on the JSE in July 2017 as a "special purpose acquisition company" (SPAC) after raising R500m (50,000 shares at R10 per share). It has since acquired shares in African Healthcare (Pty) Ltd. (AHC), Vryburg Private Hospital (VPH), and Rondebosch Medical Center (Pty) Ltd. (RMC), resulting in its reclassification by the JSE on 30th September 2018. The company acquired 30% of RMC, a company that was independently valued at R34.6m.

In its results for the year to 29th February 2024, the company reported headline earnings per share (HEPS) of 282.3c compared with a loss of 49.8c in the previous period. The company's net asset value (NAV) increased 19% to 1599c per share. During the year, the company acquired:

- 29% of Ambit Health Proprietary Limited ("Pelo") for R1.075 million in March 2023. Pelo operates a pathology services company.

- 100% of MMed Distribution Services Proprietary Limited ("MMed") for a purchase price of R1. The company subsequently advanced a bridging loan of R4.8 million to assist in operations. MMed is a pharmaceutical distributor with distribution licenses across South Africa.

- RazoHealth Radiology Proprietary Limited ("Razohealth").

From a private investor's perspective, the primary issue with RH Bophelo is that it has almost no volume traded, and the share price has been falling, which makes it unattractive as an investment. Despite the company's positive financial results and strategic acquisitions, the lack of liquidity and declining share price present significant risks for potential investors.

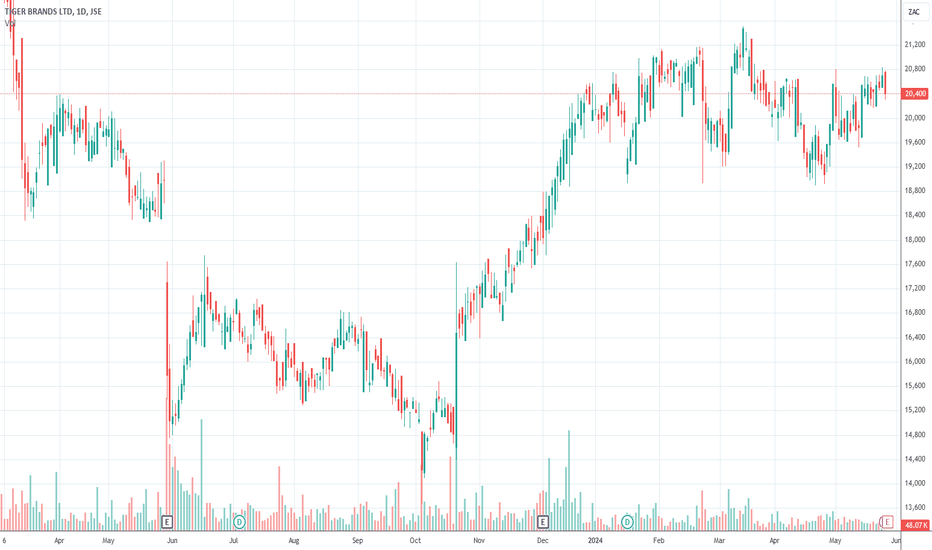

Our opinion on the current state of TIGBRANDS(TBS)Tiger Brands (TBS) is a massive, diversified food producer and marketer in South Africa. It produces and sells well-known brands such as Jungle Oats, Tastic Rice, Koo, All Gold, Albany bread, Purity, Renown, Oros, Five Roses, Black Cat, and Fizzer. The company went through extreme difficulties over the listeriosis outbreak, which was linked to two of its factories and an abattoir. The outbreak resulted in the death of over 200 people. The company has insurance that covers any potential losses as a result of the listeriosis problem but does not cover exemplary, punitive, or constitutional damages.

On 17th August 2020, the company announced that it had sold its meat processing businesses for R311m, which is considered a very low price. The company is vulnerable to lower consumer spending and rising input prices, especially maize. The Ukraine crisis may push food inputs up by as much as 20%, causing knock-on food inflation. The company is now planning for stage 8 load-shedding.

In its results for the six months to 31st March 2024, the company reported revenue down 1% and headline earnings per share (HEPS) up 11%. Price inflation was 8%, and volumes fell 9%. The company said, "In divisions such as Bakeries, the loss in volume was a deliberate strategy to reduce the reliance on sub-optimal promotional activity and improve price realizations. Volume growth in Exports was offset by declines in the Domestic Business."

Technically, the share was moving sideways and showing volatility since the COVID-19 low of March 2020. It broke above its long-term downward trendline on 18th July 2022 at 15689c and then rose to 21796c. However, in March 2023, the impact of load-shedding, higher raw materials costs, and constrained consumer spending caused the share price to drop sharply. For the last seven months, the share has been rising, but it remains risky due to its exposure to food prices and consumer spending.

On 20th October 2023, the company announced that Tjaart Kruger would take over from Noel Doyle as CEO from 1st November 2023.

Our opinion on the current state of PICKNPAY(PIK)Pick 'n Pay (PIK) is a retail grocery chain with 1,858 stores, mostly in South Africa but also in the rest of Africa. The company was started by Raymond Ackerman in 1967 and became the dominant grocery retailer over time, before being displaced by Shoprite/Checkers. Pick 'n Pay was in a slump when Richard Brasher took over as CEO in early 2013. Brasher set in motion a centralisation of distribution, which is now beginning to have a significant impact on efficiency and prices. He also implemented a store roll-out and a revamping of existing stores, which brought customers back to the chain.

The essential difference between Brasher's strategy and that of Pick 'n Pay's main rival, Shoprite, has been that he focused on making the South African operation more efficient and winning back customers through good pricing. Shoprite, on the other hand, expanded aggressively into Africa, which has not always been beneficial. This is shown by the fact that it was forced to abandon Nigeria and is subject to the relatively high inflation rate in Angola, which became a distinct problem for Shoprite. Summers has once again resumed the role of CEO, following his stint at Pick 'n Pay as CEO between 1999 and 2007.

In its results for the 52 weeks to 25th February 2024, the company reported turnover up 5.4% and a headline loss of 203.06c compared with a profit of 259.25c in the previous year. The company said, "Trading profit declined 87.4% to R385.0 million, reflecting a R1.5 billion trading loss for Pick 'n Pay (a sharp reversal versus FY23's R1.3 billion profit), and a R1.9 billion trading profit for Boxer (R1.8 billion profit in FY23). The result was further impacted by a 198.8% increase in net interest paid to R701.8 million, as a result of higher gearing and increased interest rates."

Technically, Pick 'n Pay has been in a downward trend since 2016 and has lost substantial ground to Shoprite. On the latest results, it remains in a long-term downward trend. The link-up with Mr. D and Takealot should help the company to catch up in the online shopping market. To recapitalise the business, it is planning to separately list Boxer and conduct a rights issue to raise R4bn in mid-2024. This would require the Ackerman family to inject R1bn to retain their position as 25% shareholders.

We recommended that you apply a 200-day simple moving average and wait for a clear upside break before investigating further. That break came on 27th May 2024 at a price of 2558c. Despite this, the share remains risky.

Our opinion on the current state of DATATEC(DTC)Datatec (DTC) is an international IT and telecommunications company operating in more than fifty countries. It operates in the United States, South America, Europe, Africa, the Middle East, and Asia. Its business is divided into three main divisions: technology distribution through Westcon International, integration and managed services through Logicalis, and consulting and financial services through Datatec Financial Services and Analysys Mason. The CEO, Jens Montanana, is a 10% shareholder.

On 3rd September 2019, Logicalis announced that it had purchased 70% of Cilnet, a Cisco systems integrator and services management company in Portugal. This acquisition expands Datatec's capabilities on the Iberian Peninsula. Additionally, it acquired Orange Networks in Germany. The company continues to grow by making "bolt-on" acquisitions, including Stelacon in Sweden for $2.6m, Nexia in Norway, and Mars Technologies and Clarotech in South Africa. On 1st June 2021, the company announced the acquisition of Siticom, a 5G company operating in Germany.

In its results for the year to 29th February 2024, the company reported revenue up 6.1% and headline earnings per share (HEPS) of 14.2c (US) compared with a loss of 9.3c in the previous period. The company said, "Westcon International continues on its growth trajectory, delivering an exceptional performance in FY24. Logicalis International also performed well; however, Logicalis Latin America faced numerous challenges in Argentina and Brazil, which impacted its financial performance."

Technically, the share fell during the COVID-19 pandemic to around 2067c but then rallied to around 4119c. The Ukraine crisis took the share down to 3100c on 8th March 2022, but it has been recovering since then. We believe it will continue to perform, especially as the use of artificial intelligence (AI) becomes more widespread.

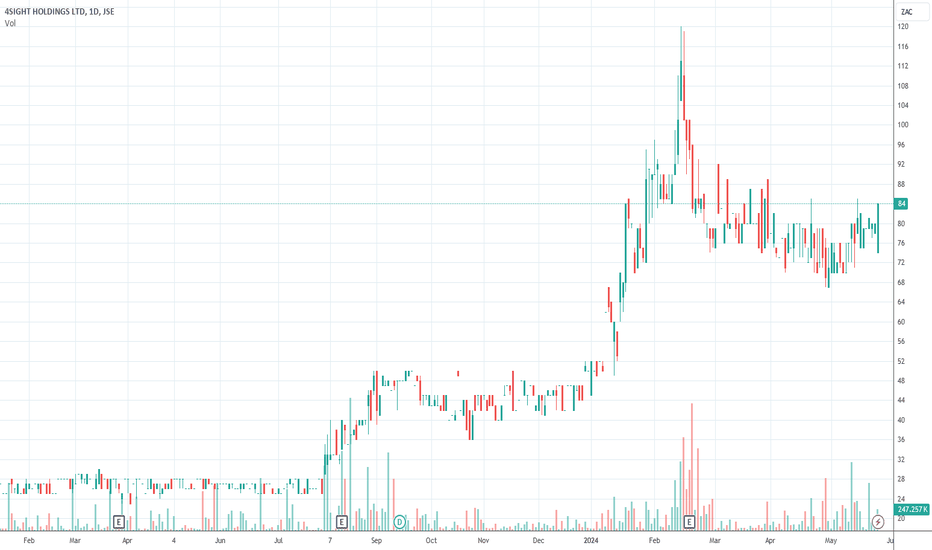

Our opinion on the current state of 4SIGHT(4SI)4Sight (4SI) is a Mauritian company specializing in investing in "4th Industrial Revolution" companies and technologies. The first industrial revolution is seen as that which was involved in mechanization with water and steam power, the second came about when products were mass-produced, the third was the advent of computers and automation, and the fourth is what are called "cyber-physical systems." Cyber-physical systems involve cloud computing and the internet of things, evident in the development of so-called "smart factories."

The business is divided into two areas: mining & manufacturing, and software, cloud, and enterprise solutions. It has 400 employees and 3,000 customers in 30 countries. It claims to have 42% of its income coming from outside South Africa. Since listing in October 2017, the share price fell from 235c to levels around 13c in September 2019. Since then, it has rallied to 31c. The company does not yet pay dividends.

A company like this is extremely difficult to evaluate unless you have a deep understanding of the 4th industrial revolution. We would recommend a strict stop-loss strategy. On 6th October 2020, the company announced that it had bought back 30.6% of its issued ordinary shares and had finalized its sale of Digitata for just over R90m.

In its results for the 14 months to 29th February 2024, the company reported revenue up 57.7% from the year to 31st December 2022. Headline earnings per share (HEPS) were 153.8% higher. The company said, "Cash balance increased by 57.8% from R70.3 million to R110.8 million. Increase in net asset value per share by 29.6% to 57.8 cents per share. Revenue excluding consulting revenue increased by 54.5% from R479.0 million to R740.1 million, which contributed to the increase in the cost of sales by 53.1% from R361.4 million to R553.3 million." Note: The company has changed its financial year end to 29th February from 31st December.

We added this share to the Winning Shares List on 3rd August 2023 at 31c. Over the following six months, it moved up to 84c per share. Technically, the share is a penny stock that trades about R168,000 per day on average, which makes it practical for private investors.

Our opinion on the current state of AFINE(ANI)Afine (ANI) is a real estate investment trust (REIT) formed in 2021 that specializes in acquiring petrol stations. The company acquired five petrol stations in February 2021 and two more in May 2021. In its results for the year to 28th February 2023, the company reported revenue up 29.74% and headline earnings per share (HEPS) down 16.09%. The company's net asset value (NAV) increased by 1.97% to 362c per share.

In a trading statement for the year to 29th February 2024, the company estimated that earnings per share (EPS) would increase by 114.4% and HEPS would be within 20% of the previous comparable year. However, the company has less than R1000 worth of shares changing hands each day on average, which makes it completely impractical for private investors.