Our opinion on the current state of ISA Holdings (ISA) ISA Holdings (ISA) is a small Alt-X listed IT company offering network, internet, and information security services in sub-Saharan Africa. The company claims to employ some of the leading IT security specialists and to have the tools and experience to offer effective information security solutions.

In its results for the year to 29th February 2024, the company reported revenue up 33% and headline earnings per share (HEPS) up 35%. The company said, "The high proportion of subscription-derived turnover in the current reporting period is indicative of the trend in terms of which customers are showing a preference for subscribing to consumption-based security solutions." This looks like a good quality IT company that is profitable but has gone through a tough time.

The problem is that the share is thinly traded with only about R46,000 worth of shares changing hands on average each day. This makes it risky for private investors to buy a meaningful number of shares. However, on a P:E of 11.15 and a dividend yield of 7.18%, the shares look like good value. It was added to the Winning Shares List (WSL) on 8th February 2024 at 140c per share and has subsequently moved up to 175c.

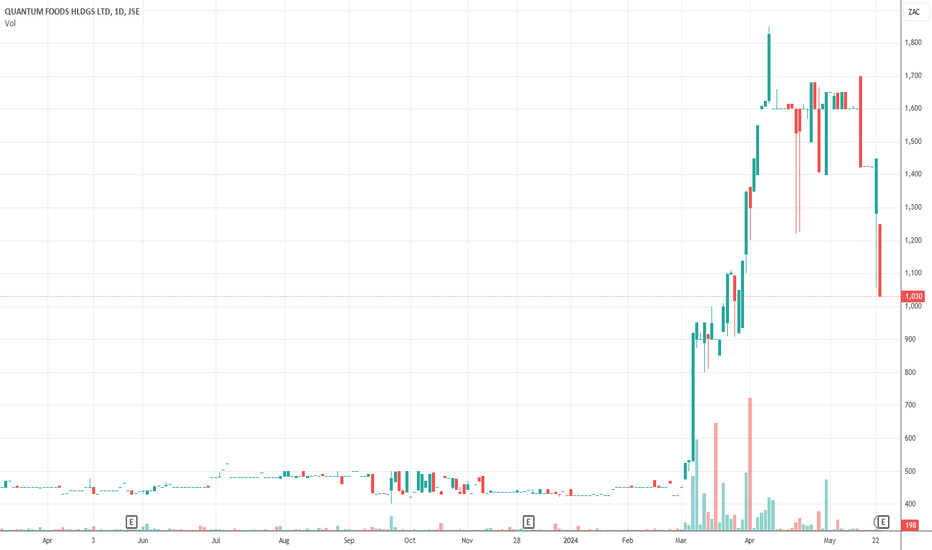

Our opinion on the current state of QUANTUM(QFH)Quantum (QFH) is in the chicken business, operating through four divisions: Animal Feeds, Eggs and Layers, Broilers, and an African Division where it sells related products. Quantum was significantly impacted by the drought in Southern Africa, but since that abated and the price of animal feeds came down, it has benefited from much higher prices of eggs and the lower cost of feeds. In general, the chicken business is a tough industry. It is labour-intensive, creating exposure to union action, involves large quantities of working capital tied up in stock and, to a lesser extent, debtors. The business is subject to unexpected disease threats like avian flu or Newcastle disease and has experienced the dumping of cheap chicken onto the South African market from Europe, Brazil, and America.

With top-class management, a sustainable profit can be achieved, but the industry is regarded as relatively high risk by investors, which accounts for its low price-to-earnings (P:E) multiple and its high dividend yield (DY). The unprotected strike at Kaalfontein Farm has restricted output and cost an estimated R10m. The company suffered an outbreak of HPAI at its Lemoenkloof Farm, as well as loadshedding and labour unrest.

In its results for the six months to 31st March 2024, the company reported revenue down 13% and headline earnings per share (HEPS) of 21.7c compared with 2.9c in the previous period. The company said, "During the current reporting period, the average price of yellow maize on the South African Futures Exchange (“SAFEX”) decreased by 16.6%; and the average landed price (Cape Town harbour) of soya meal decreased by 5.7%". Nobody knows what difficulties the business may experience over the next 12-month period. So, if you plan to invest in this share, be prepared for considerable volatility. This company sometimes has difficulty in passing on higher raw materials costs to consumers, especially in the current economic environment.

On 7th March 2024, the company announced that 9.77% of its shares had been sold by Astral Foods. This sale caused the share to jump by about 73% because there is apparently a takeover battle looming. On 13th March 2024, the company announced that it had received a letter from Country Bird Holdings (CBH) indicating that it had no intention of making a takeover bid.

Our opinion on the current state of BRIMSTON(BRT)Brimstone (BRT) is a black-controlled investment holding company with a diverse portfolio of holdings. It owns:

1. 54.2% of Sea Harvest, which is a listed fishing company and has a market capitalization of just over R4.5bn.

2. 100% of Lion of Africa, a loss-making insurance company, which decided in November 2018 to cease operations and close its doors.

3. 100% of House of Monatic, a loss-making clothing manufacturer.

4. 24% of Oceana, the largest fishing company in South Africa with a market capitalization of R8.6bn. Brimstone is increasing its shareholding by buying 8m shares from Tiger Brands, which will take its holding to 22.9%.

5. 6.1% of Grindrod.

6. 18% of Aon Re Africa.

7. 25% of South African Enterprise Development.

8. 49.8% of Vuna Fishing Company.

9. 12.8% of Milpark Education.

10. 25% of Obsidian (a black-owned investment holding firm positioned to benefit from the rollout of the NHI), which it increased to 80% for R35.7m in January 2020.

Brimstone also holds a variety of other smaller shareholdings in property, healthcare, 3.9% of Long4Life, and 5.3% of Stadio. The company has been selling down its stakes in Life Healthcare, Lion of Africa, House of Monatic, Equites, Multichoice, and Phuthuma Nathi. It has used the proceeds to pay down R1bn of its debt.

In its results for the year to 31st December 2023, the company reported revenue up 5.1% and headline earnings per share (HEPS) up 4%. The company said, "The year under review was characterised by high inflation, a weaker Rand and high interest rates. Continued load shedding and pressure in the domestic transport network, in particular the ports, have weighed heavily on the economy. The high unemployment rate continued to impact consumer spending in an environment where the consumer was already under pressure."

Both ordinary and "N" shares are thinly traded, but the ordinary shares are worse. We regard the ordinary share as too thinly traded for private investors and, unless they begin to unbundle the portfolio, the extra value is likely to remain locked in. On 24th May 2024, the company reported that its intrinsic net asset value (NAV) had fallen 6.7% by the end of March 2024 to 1132c per share.

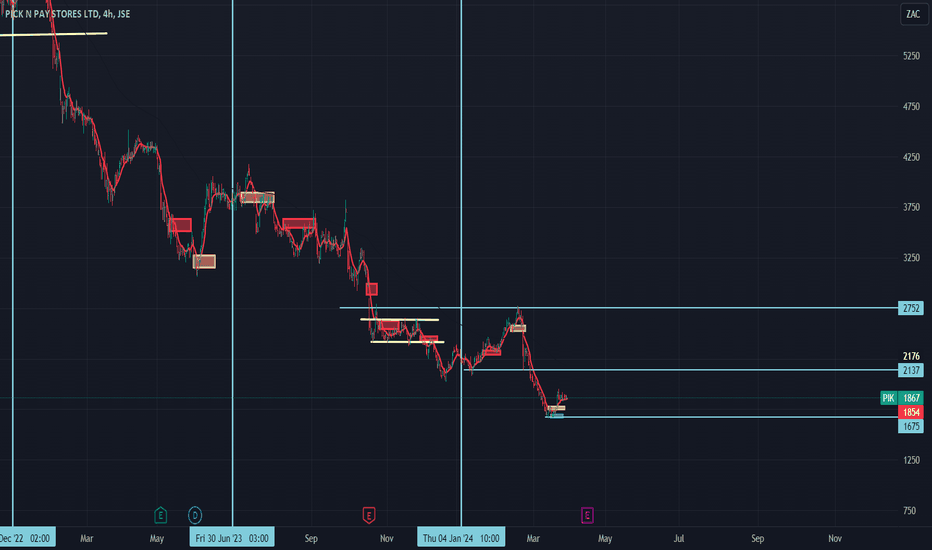

Expecting a recovery the value of the brand and company. Firstly expecting to continue trending upwards if the starts trading above R1800-R2000.

This is one company that seem to be resilient and functions in bad time because of how big the name is what it means to the people. Looking at Pick n Pay , fundamental it looks like it far fetch for it recover but it is one of the staple names in South African households. In his book 'Same as Ever' author Morgan Housel he leaves a few questions at the end of the book and one of my favorite ones is 'What's always been true?' and the answer to that big name and household company names survive and recover if it is well run. Looking at the chart the recent low could the lowest the share price has been at R1675 which is last years financial low at the end of the fourth quarter and last years high at R5720 which creates a huge potential in value to be recovered in the upcoming years.

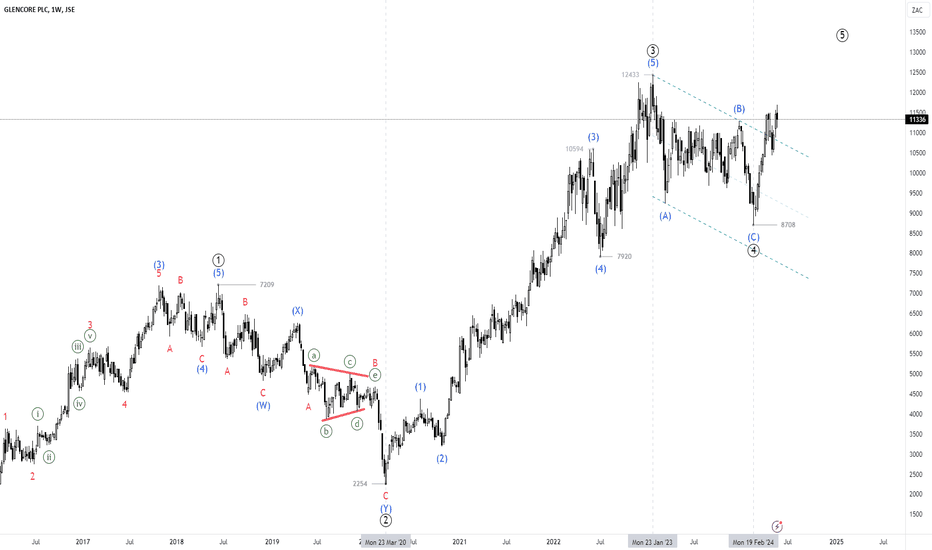

$JSEGLN - Glencore: How Far Can The Fifth Wave Go?See link below for previous analysis.

Glencore did not take long to reverse after the previous analysis.

The stock was in a hurry and did not go low enough to test the lower support channel.

The strong reversal from 8708 has prompted an update with wave labelled as a zigzag pattern and price has now broken out of the channel added further evidence that the stock is now in wave .

Fifth waves can be very strong in commodity stocks so the question is how far can wave go?

Buy the dips, if we get any.

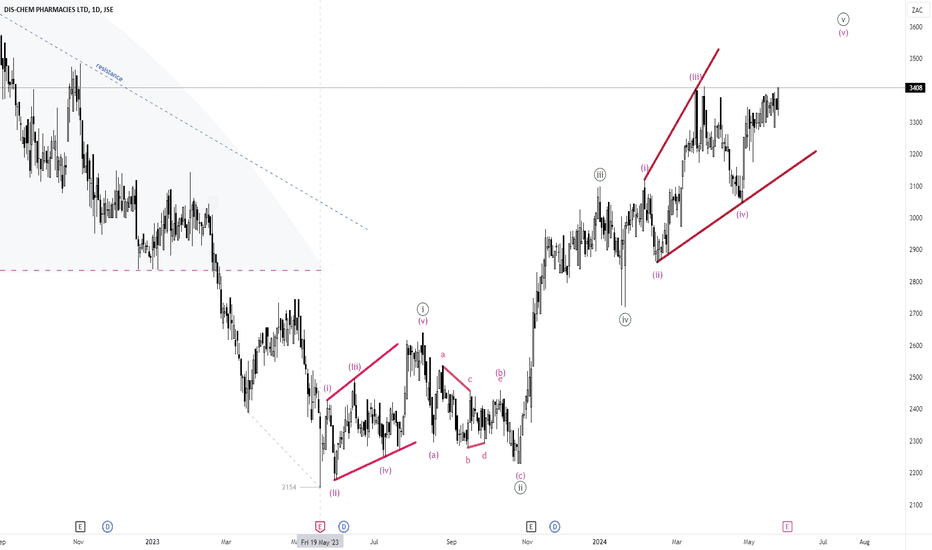

$JSEDCP - Dischem: Ending Diagonal & Loss of Momentum CautionSee link below for previous analysis.

Dischem is still trading in the fifth and final wave of the advance from May 2023.

Wave is unfolding as an ending diagonal pattern and has surpassed the previous target of 3300 cps.

There is also a clear loss of momentum in the stock as new highs have not been confirmed by the MACD thereby giving a bearish divergence signal.

The stock can still go much higher though locking in profits is wise at this stage of the trend.

UPDATE: Life Health Care exceeded our targets big timeLife Health Care was presenting a simple Head and Shoulders with a usual drop for a short.

The price started off well then went to the entry.

Wake up and not only did it go past R15.96 target...

The market opened aty R10.80 exceeding our expectations and profits. It's these trades that we absolutely love and can't help but get excited when things go extraordinary to our favour.

Now there is a W Formation and the price has broken up. So looking at a Medium Probability setup, we can expect the price to head to R14.29.

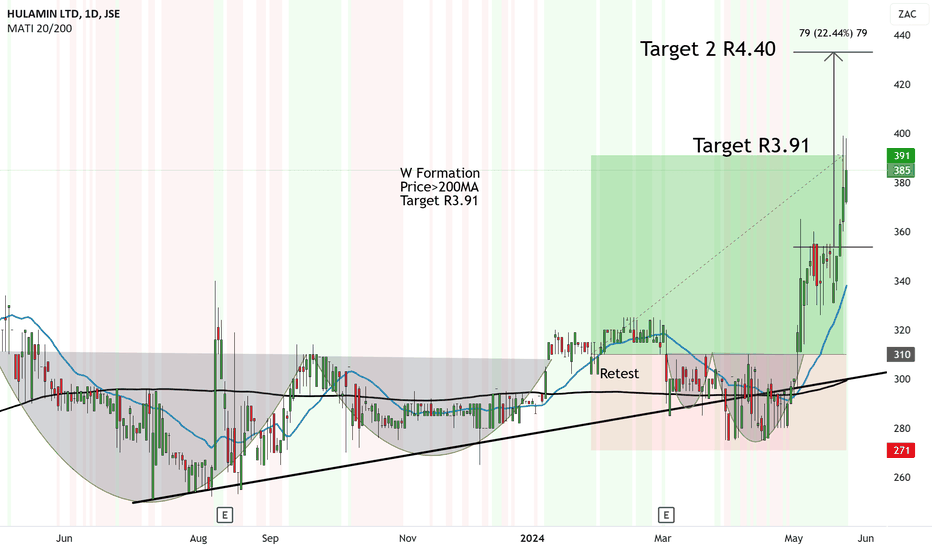

UPDATE: Hulamin hit target at R3.91 heading to R4.40After a long wait once the price broke above the W Formation.

Then moved sideways and crossed above with the Cup and Handle.

The first target of Hulamin hit at R3.91.

The momentum is still strong and on the up. And we can easily see further upside to come.

So, the next target with similar momentum will be to R4.40.

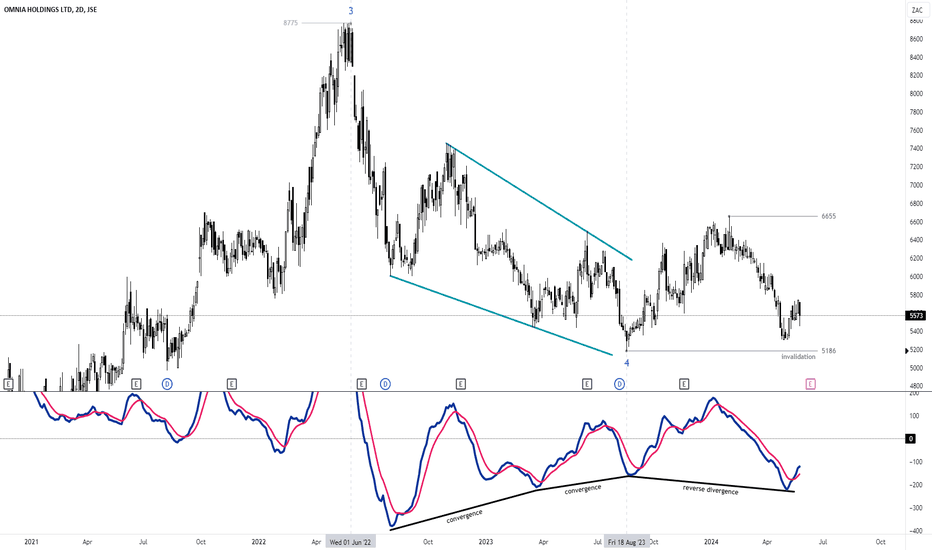

$JSEOMN - Omnia: 5186 Under Pressure, Will It Hold?See link below for previous analysis.

Price has pulled back sharply after reaching 6655 cps.

The invalidation level of the bullish outlook at 5186 is under pressure but still holding.

What is a positive sign of a potential reversal is the reverse (hidden) divergence as the MACD has made a new low relative to the 2023 low but price has not.

I am neutral-to-bullish and will become more bullish once price pushes beyond 6000 cps without first breaking below 5186.

Our opinion on the current state of STEFSTOCK(SSK)Stefanutti (SSK) is a South African construction company offering services in roads and earthworks, marine construction, concrete structures, bulk pipelines, piling, geotechnical services, open pit contract mining, affordable housing, mine residue disposal, and other areas. It operates in sub-Saharan Africa and the United Arab Emirates (UAE). The company is considering further downsizing to match its falling order book, which will mean retrenchments. The share price has fallen from its high of 2650c in November of 2007 to current levels around 56c. The company is not paying dividends.

Construction is always a risky investment in South Africa. Much will depend on the progress of the South African economy and the availability of construction work from the government. This share is probably going to continue its long-term downward trend for the foreseeable future. We consider it to be a poor investment even as a speculation.

In July 2020, Stefanutti was accused by Eskom of being overpaid R1bn for work done on Kusile, which the company denies. In a restructuring plan, the company is selling non-core assets and plant and equipment and trying to obtain further funding of R430m to counter the impact of COVID-19. The company is engaging in a restructuring plan which involves the sale of non-core assets, securing additional short-term funding of R430m, and cutting costs. The company is technically insolvent, and we think that this company may well follow many of its peers in the construction industry into consolidation or business rescue if the current restructuring does not work.

In its results for the year to 29th February 2024, the company reported revenue up 17% and a headline loss per share of 55.73c compared with a loss of 38.73c in the previous period. The company said, "...at 29 February 2024 the group's current liabilities exceeded its current assets by R1,136 million (Feb 2023: R1,141 million), and the group's total liabilities exceed its total assets by R52 million (Feb 2023: R66 million)." The company's shares have become a "penny stock" and it remains a highly risky loss-making business.

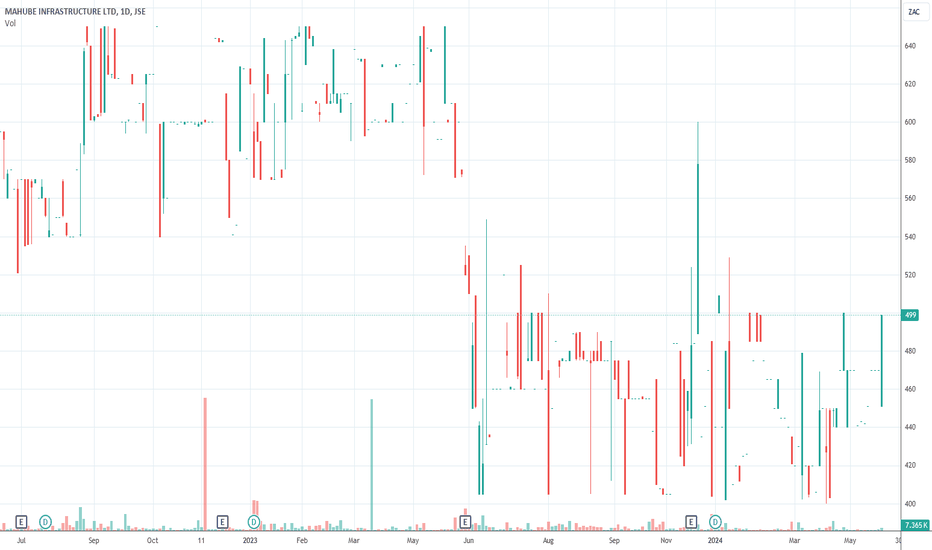

Our opinion on the current state of MAHUBE(MHB)Mahube (MHB) is an infrastructure holding company which reversed into Gaia and is involved in large-scale energy transport, water, and sanitation projects. It is 41.35% owned by the Government Employees Pension Fund (GEPF). The company says, "Mahube Infrastructure owns five renewable energy assets – two wind farms and three solar PV (photovoltaic) farms – all of which were licensed by South Africa’s Department of Energy in the first round of bids of the renewable energy independent power producer procurement programme. The assets are all currently in operation, generating electricity, which they sell to Eskom in accordance with 20-year power purchase agreements."

In its results for the six months to 31st August 2023, the company reported revenue up 38.8% and headline earnings per share (HEPS) of 47.8c compared with 29c in the previous period. The company said, "The dividend income earned by the Company during the period under review increased from R11.0 million to R23.0 million. This higher dividend resulted from receipt of a special dividend from two of the solar photovoltaic projects in which Mahube is invested, following the refinancing of these projects."

In a trading statement for the year to 29th February 2024, the company estimated that HEPS would be between 91.05c and 100.64c compared with a loss of 53.68c in the previous period. The company said, "The reasons for the abovementioned improvement are an increase in the total revenue mainly due to: • healthy dividends received from Mahube's investee companies, including special dividends received resulting from the refinancing of certain projects; and • a favourable change in the fair value of financial assets, due to a revision of wind forecasts and more favourable macro-economic indicators."

The average value trading in the share is only R11,000, which makes it impractical for private investors.

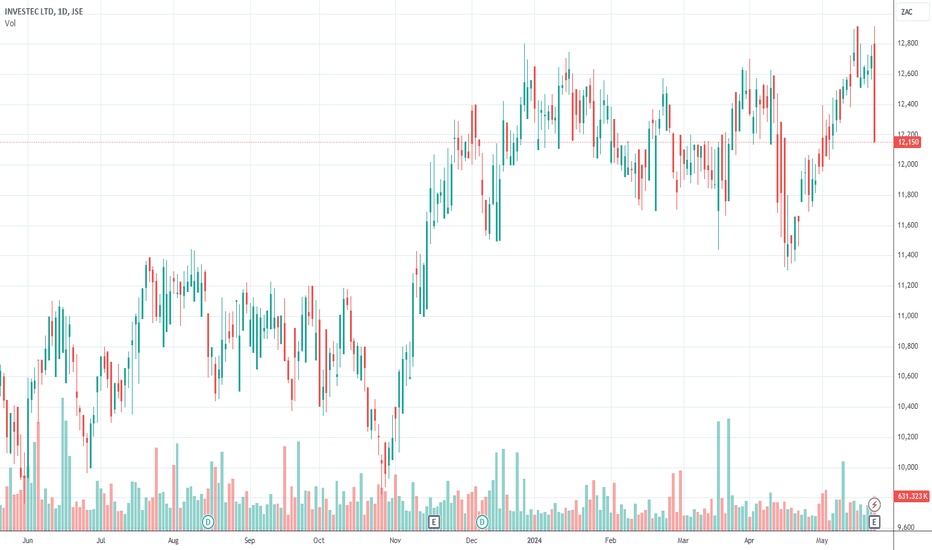

Our opinion on the current state of INVLTD(INL)Investec (INL) does specialist banking and asset management in South Africa, Australia, Europe, the UK, and a few other countries. Brexit in the UK has put pressure on Investec shares over the past four years. The decision to separately list its asset management division in the form of Ninety-One has unlocked shareholder value, which is becoming more apparent now that the pandemic is coming under control. The new listing's major challenge has been to convince investors that it is not a South African play but has international asset management capability.

The company is going after clients with an annual income of at least GBP300,000 a year and assets of at least GBP3 million. So far, they have about 6,000 clients but plan to increase this to 9,000. The company distributed 15% of its shares in Ninety-One and retained 10%.

In its results for the year to 31st March 2024, the company reported adjusted earnings per share (EPS) up 13.4% and revenue of GBP2.09 billion, up from GBP1.99 billion. Assets under management (AUM) increased 5.5% to GBP20.9 billion, and the company bought back R6.8 billion worth of its own shares in the market. Technically, the shares are in a strong upward trend, which we expect to continue. Trading at a P:E of 7.62 and a dividend yield (DY) of 5.10%, we believe that this share is undervalued among blue chip companies trading on the JSE and that it will continue to perform well.

Our opinion on the current state of HCI(HCI)Hosken Consolidated Investments (HCI) is a BEE investment holding company owned by the South African Clothing and Textile Workers' Union. It has investments in gaming, hotels, media, transport, mining, and property. It owns 47% of a suite of gaming companies, including JSE-listed Tsogo Sun, which owns casinos and hotels, Galaxy Bingo, and Vukani Gaming (which operates gaming machines). They also own the JSE-listed E-Media group, which includes ENCA, Openview HD, and E-Sat TV.

In transport, they own 74% of Hosken Passenger and Logistics, which owns Golden Arrow Bus Services. They own 52% of Niveus Investments and 84% of Deneb. They have 100% of HCI Coal, which is a junior coal-mining operation with two operational mines. HCI Properties has a portfolio of conference and exhibition properties like the Gallagher Convention Centre. Finally, it owns 40% of a technology company called BSG.

On 26th April 2022, the company announced that a prospecting company that it has an effective 10% share of an investment in a company which has made a significant light oil discovery. This has caused the share to shoot up initially.

In its results for the year to 31st March 2024, the company reported revenue up 6% and headline earnings per share (HEPS) down 29%. The company's net asset value (NAV) increased 5% to 23504c per share. In our view, this is a diverse and somewhat unfocused group trading on a P:E of 9. We suggested that this share was cheap at R80 in February 2022, and it has since risen to R171.62 and may climb further.

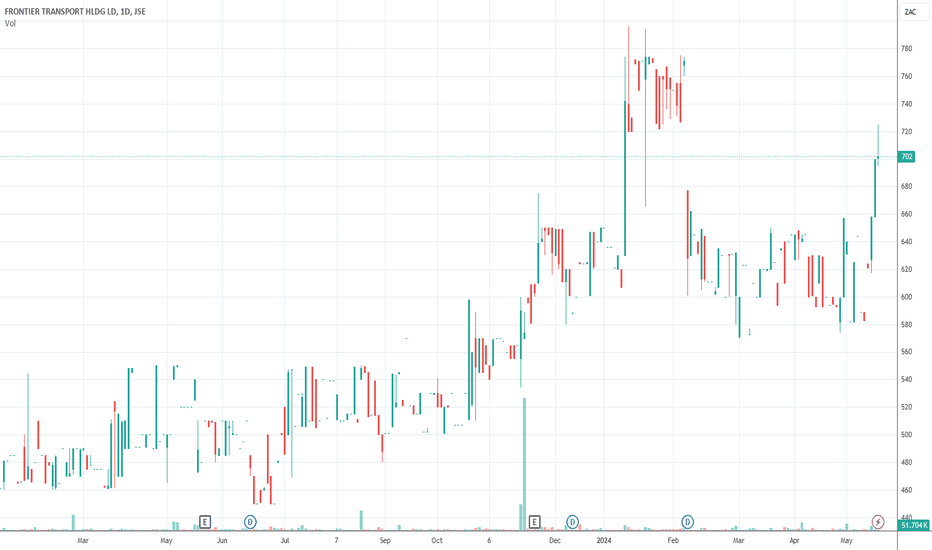

Our opinion on the current state of FRONTIERT(FTH)Frontier Transport (FTH) is a bus company whose major asset is Golden Arrow Bus Services, but which also owns Sibanye Bus Services, Table Bay Rapid Transit, N2 Express, Eljosa Travel and Tour, Shuttle Up, and Alpine Truck and Bus. The company says, "The current portfolio is rooted in the commuter bus and luxury coach segments. Through its principal subsidiary Golden Arrow Bus Services, with over 160 years of proven operational expertise."

In its results for the year to 31st March 2024, the company reported revenue up 8.9% and headline earnings per share (HEPS) up 37.8%. The company said, "The Group is pleased to show attributable Group profit for the period of R394.5 million (a 42.2% increase on prior year) and headline earnings at R385.3 million (an increase of 38.1% on prior year). The increase in finance costs of 45.1% is mainly due to the acquisition of new commuter buses. Investment income increased by 60.1% from R35.6 million to R56.9 million in the current period."

Technically, the share trades about R92,000 worth of shares on average every day and has been in a gradual upward trend. Obviously, a company like this was heavily impacted by COVID-19 and travel restrictions, but it does appear to have recovered.

Our opinion on the current state of BYTES(BYI)Bytes Technology was spun out of Altron and separately listed on the London Stock Exchange (LSE) and the JSE. At listing, it had a market capitalization of about R13bn, which has subsequently grown to R26.5bn. Altron shareholders received GBP542m in shares and cash at the demerger in a significant release of value. It describes itself as "...one of the UK's leading software, security, and cloud services specialists."

The company is the biggest reseller of Microsoft products in the UK and receives about 60% of its revenue in annuity form. In its results for the year to 29th February 2024, the company reported gross income up 26.7% and headline earnings per share (HEPS) up 15.8%. The company said, "The exceptional level of growth was underpinned by strategically important contract wins in the public sector (most notably with the NHS and HMRC) and by continued demand from corporate customers. - Revenue increased 12.3% to £207.0 million (2022/23: £184.4 million)."

Technically, the share rose strongly to a cycle high of 16100c on 25th January 2024 from a low of 6800c. We believe that it will exceed this high in the not-too-distant future. This share is a solid rand-hedge and will perform well going forward. On 21st February 2024, the company announced the resignation of its CEO, Neil Murphy, with immediate effect. He is replaced by Sam Mudd.

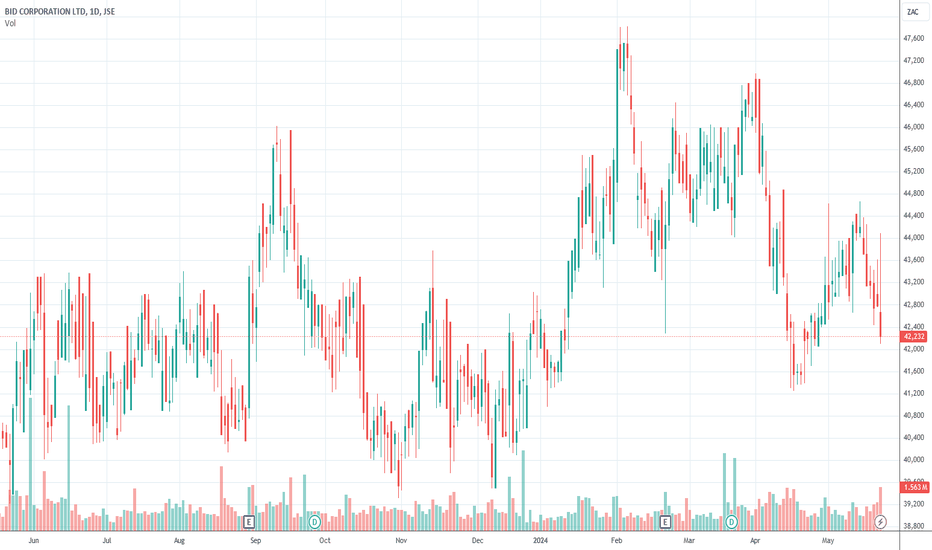

Our opinion on the current state of BIDCORP(BID)Bidcorp (BID) is a diversified international food company which operates in 34 countries around the world. It was spun out of Bidvest in June 2017 to release shareholder value. We see this as a solid blue chip, rand hedge share which should perform well. About 95% of its income is generated outside South Africa.

Bidcorp focuses on the wholesaling and delivery of what it describes as "fit-for-purpose" product ranges which it says will continue to grow strongly. In its results for the six months to 31st December 2023 the company reported revenue up 24% and headline earnings per share (HEPS) up 18.6%. The company said, "Europe produced an excellent performance under the circumstances both in terms of revenue growth and margins, with almost every business showing solid growth. Australasia’s revenue growth moderated however both Australia and New Zealand delivered strong trading performances. The UK delivered good volume growth from the prior contract wins and acquisitions although profitability was impacted by lower margins and higher costs. Emerging Markets benefited from a strong performance from our South African businesses, however, the negative macro in Greater China impacted the half-year outcome."

In an update on the 10 months to 30th April 2024 the company reported sales up 8.8% with weighted average food inflation of 2.6%. The company said, "For YTD to April 2024, the group made a pleasing EBITDA before IFRS 16 margin of 5.6% of net revenue, similar to an exceptionally strong comparative F2023." Obviously, this company is highly diversified and has made a speciality of acquiring "bolt-on" companies to grow.

Technically, the share was in a steady upward trend until June 2023. Now after a period of sideways movement it has entered a new upward trend. It is on a P:E of 18.66 - which is an indication of its blue chip, rand-hedge status. We expect it to continue to perform well, benefiting directly from the general recovery of the world economy.

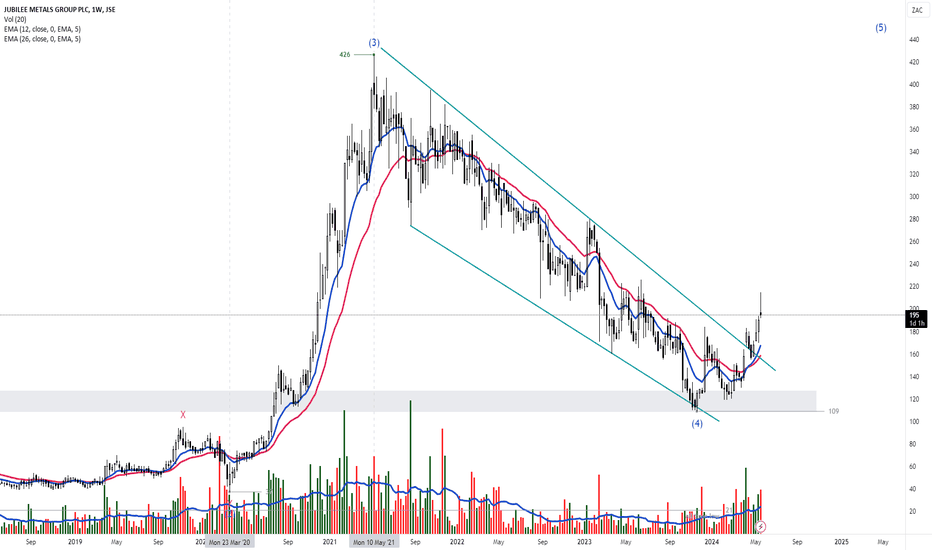

$JSEJBL - Jubilee: The BreakoutSee link below for previous analysis.

Jubilee did not waste time breaking out of the falling wedge since the last analysis.

Volume has been good on the breakout and for the first time since March 2020, we have a 12/26WEMA cross buy-signal.

The longer the stock stays above the resistance line, the greater will be my conviction that a bottom is in at 109 cps.

Buy the dips above 109 cps.

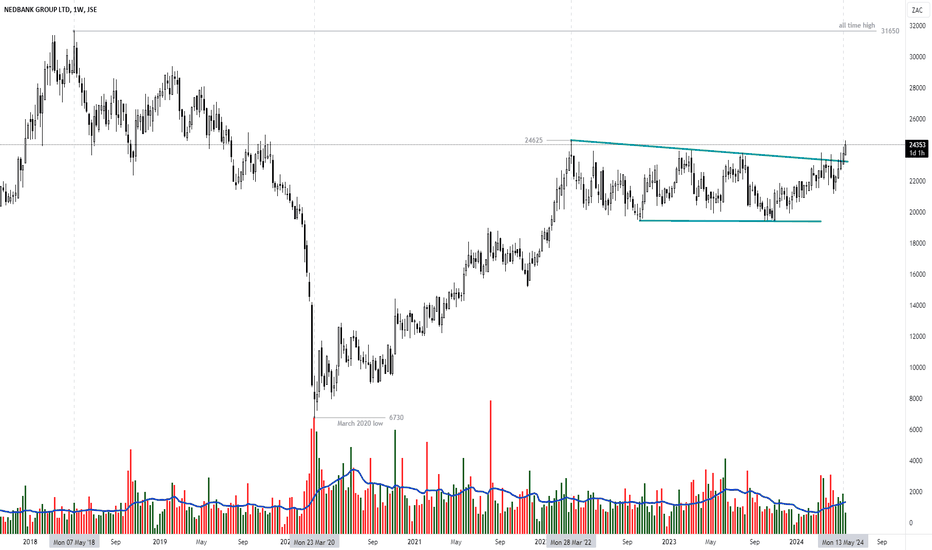

$JSENED - Nedbank: The BreakoutSee link below for previous analysis.

Nedbank has finally broken out of a two year consolidation-continuation pattern.

The stock looks set to have its second consecutive weekly close above the resistance line.

The breakout has been on average volume but is valid nonetheless.

I will maintain a bullish stance above 20000 cps with a medium-term target of a new all-time high.

Our opinion on the current state of LIFEHC(LHC)Life Healthcare (LHC) is the second-largest healthcare company listed on the JSE main board, operating private hospitals, same-day clinics, surgeries, and healthcare companies in South Africa, the UK (Alliance Medical), and Western Europe. The outgoing CEO, Shrey Viranna, has indicated that the group is shifting its focus from conventional hospitals to day clinics and non-acute services. Additionally, there is an effort to diversify from reliance on medical aid schemes towards serving individuals who pay for medical services out of pocket. This is exemplified by the launch of MyLife Clinic, which offers consultations and basic medication for R300.

In its annual results for the year ending 30th September 2023, Life Healthcare reported a revenue increase of 10.3% but a decrease in headline earnings per share (HEPS) by 16.9%. The company attributed this performance to "The Group's SA operations experienced strong demand for their services in the current year driven by the Group being the preferred network provider for medical aids. This led to higher utilisation of the Group's hospitals and complementary services which delivered PPD growth of 9.5%."

For the six months ending 31st March 2024, a trading statement projected that earnings per share would increase by more than 20%, a boost largely due to the disposal of Alliance Medical Group. However, this disposal would not impact HEPS. The subsequent results for this period reflected a revenue increase of 7.8% and a 2.3% rise in paid patient days (PPD) in the acute section. HEPS from continuing operations saw a significant increase of 29.9%. The company noted, "The Group is in a net cash position as at 31 March 2024 due to the proceeds received from the sale of AMG. The Group remains in a strong financial position with net debt to normalized EBITDA (as per bank covenant definitions) of 0.8 times after the payment of the special dividend on 8 April 2024."

Technically, Life Healthcare’s shares peaked at R47 in September 2014 but have since been in a long downward trend. Currently trading around 1130c, the shares have a P/E ratio of 13.85, reflecting the company's expectation of improved results, its defensive nature, and its overseas diversification, which offers some rand-hedge characteristics.

Given these factors, Life Healthcare shares appear to offer reasonable value, particularly now that the company has resumed paying dividends. This positions the shares as a potentially attractive option for investors looking for exposure in the healthcare sector with a blend of local and international operations.

Our opinion on the current state of 4SIGHT(4SI)4Sight is a Mauritian company that specializes in investing in technologies and companies associated with the "4th Industrial Revolution." This revolution is characterized by cyber-physical systems that integrate cloud computing and the internet of things, exemplified by the development of "smart factories." The company operates in two main areas: mining & manufacturing, and software, cloud, and enterprise solutions. It employs 400 people and serves 3000 customers across 30 countries, with 42% of its income derived from outside South Africa.

Since its listing in October 2017, 4Sight's share price has experienced significant volatility. Initially listed at 235c, the share price plummeted to around 13c by September 2019 but has since rallied to 31c. The company does not yet pay dividends, reflecting its growth-focused strategy. On 6th October 2020, the company announced a significant buyback of 30.6% of its issued ordinary shares and finalized the sale of Digitata for just over R90 million.

In its financial results for the year ending 31st December 2023, 4Sight reported a 34.9% increase in revenue and a 127.8% rise in headline earnings per share (HEPS). The company attributed the increase in other income mainly to forex currency gains of R2.9 million, compared to a loss of R1.2 million in the prior period. Total operating expenses for the period rose by 24.1% to R348.6 million from R280.8 million in the previous year.

For the 14 months ending 29th February 2024, 4Sight estimated that HEPS would range between 5.742c and 6.128c, compared with 2.379c per share for the period ended 31 December 2022. Notably, the company has changed its financial year-end to 29th February from 31st December. We added this share to the Winning Shares List on 3rd August 2023 at 31c, and it has since climbed to 79c.

Technically, the share qualifies as a penny stock, with an average daily trade value of about R158,000, making it accessible to private investors. It entered a strong uptrend following its latest results, although this uptrend may have temporarily plateaued. As such, 4Sight represents a challenging investment to evaluate without a deep understanding of the technologies driving the 4th industrial revolution, suggesting the use of a strict stop-loss strategy to manage investment risk.

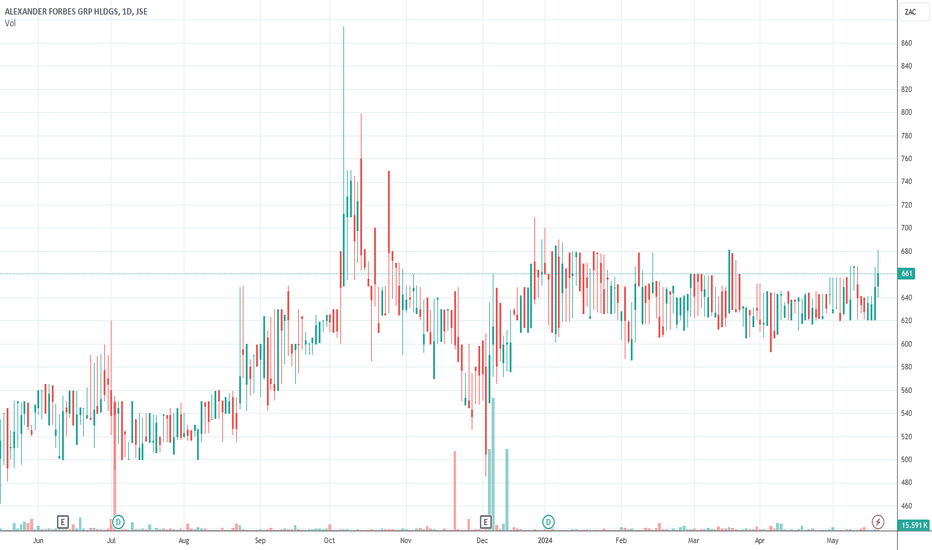

Our opinion on the current state of AFORBES(AFH)Alexander Forbes (AFH) is a prominent financial services company that provides asset management, insurance, healthcare, retirement consulting, and wealth management to both corporate and private clients. It operates not only in South Africa but also has a presence in five other African countries: Namibia, Nigeria, Botswana, Uganda, and Zambia. Historically, the company's share price has experienced a significant drop, falling from just over R10 in February 2015 to around 430c today. This decline was largely attributed to the leadership of its former CEO, Andrew Darfoor, who was said to have lost the confidence of the board and institutional investors, compounded by the resignation of the financial director, Naidene Ford-Hoon, after less than a year with the company. Changes to the board have been significantly influenced by Patrice Motsepe's African Rainbow Capital (ARC).

In its financial results for the year ending 31st March 2023, Alexander Forbes reported an 8% increase in operating income and a 22% rise in headline earnings per share (HEPS) from continuing operations. The company highlighted, "The group balance sheet remains robust, supported by the strong cash flow generated from continuing operations, with a sound regulatory surplus position of R1,516 million and available cash of R933 million." Subsequent trading statements further reflect the company's recovery and growth: for the six months to 30th September 2023, HEPS was estimated to increase by between 85% and 105%, attributed in part to the base effects from the performance of discontinued operations in the prior year.

Looking ahead to the year ending 31st March 2024, the company anticipated that HEPS would increase by between 23% and 33%. This optimistic forecast is attributed to "solid growth in operating income owing to acquisitions and new business." Currently, the company trades at a P/E ratio of 10.77 and has recently sold its group risk and retail life business for R100 million, potentially to fund further acquisitions.

Given these factors, Alexander Forbes is considered to be reasonably valued at current levels and is seen as being in a steady upward trend. This assessment suggests that the company could be a worthwhile investment, especially for those looking at financial services stocks within the South African and broader African markets.

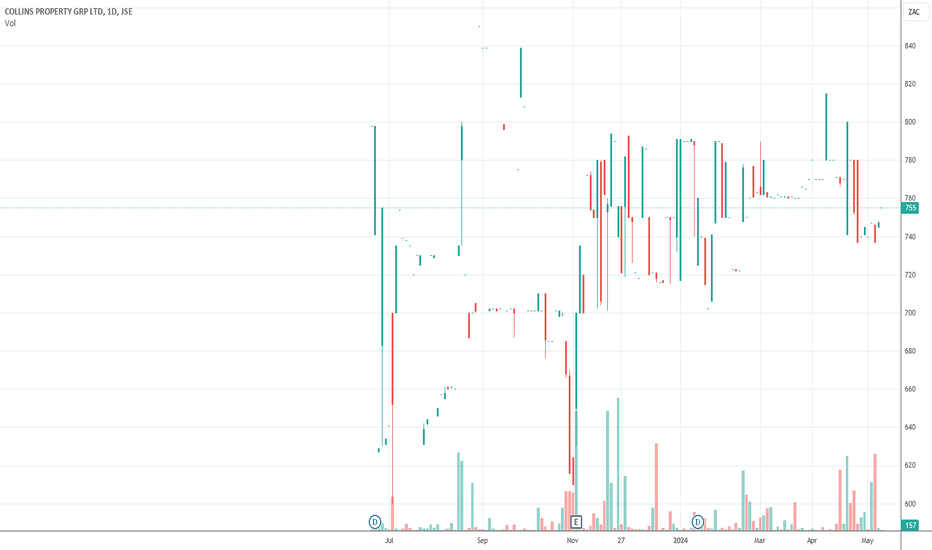

Our opinion on the current state of COLLINS(CPP)Collins, previously known as Tradehold, boasts a portfolio of over 140 properties with a total gross lettable area of 1.6 million square meters. Most of these properties are industrial, including major distribution centers and industrial complexes let on long-term triple-net leases to leading corporate clients. Additionally, Collins manages Tradehold’s Namibian portfolio, which includes a number of sought-after properties in major towns such as Windhoek, Walvis Bay, and Gobabis.

Originally, Tradehold was a real estate investment company in Southern Africa, 48% owned by Christo Wiese. More than 40% of its assets were in the UK, managed through its 100% holding of the Moorgarth Group, which owned 23 properties in the UK and has now been sold. It owns 100% of Tradehold Africa, which owns properties in Africa outside of South Africa, and 100% of the Collins Group, which owns 153 properties inside South Africa. Tradehold has spun off its financial services business interests into a separately listed entity, Mettle, now listed on the Alt-X of the JSE.

The South African economy has faced significant challenges, including the repercussions of 10 years of state capture and corruption, the impact of COVID-19, and recent civil unrest. In a report on the unrest, the company disclosed that a total of 21 of Tradehold’s properties in KwaZulu-Natal were damaged, with the estimated cost of damage at R41 million, excluding loss of rental. This represents approximately 0.5% by value of Tradehold’s property portfolio in South Africa.

In its results for the six months to 31st August 2023, the company reported revenue of R581 million, up from R570 million in the previous period, and an attributable profit of R108 million compared with a loss of R958 million. The company noted, "The disposal of the Company's UK assets in the second half of 2022 formed part of an extensive restructuring of the business over the past six months."

In a trading statement for the year to 29th February 2024, the company estimated that the distribution per share (DPS) would increase by between 33.33% and 53.33%. Technically, the share has been in a downward trend since April 2016 and is now trading at a significant discount to its net asset value (NAV) per share. In our view, this share is mostly a local property play which will probably perform better as the SA economy recovers, but we do not see it as an exciting investment prospect.

The company is also selling off its Mozambique properties. While it is cheap at current prices, and volumes are around R80,000 of shares changing hands each day, making it just practical for private investors.

Our opinion on the current state of CORONAT(CML)Coronation (CML) is one of South Africa's largest asset managers and the only one listed on the JSE. Founded in 1993, the company experienced significant growth until 2015. At that point, the founding CEO resigned and was replaced by Adrian Pillay. Despite Pillay's qualifications, the company has faced challenges under his leadership, particularly due to significant losses from investments in African Bank and Steinhoff. These missteps have led to a re-evaluation of Coronation's ability to select winning investments, resulting in an outflow of institutional funds. The fund management business relies heavily on confidence, and these events have shaken the trust that institutional fund managers place in Coronation.

On 8th February 2023, Coronation announced it had lost a SARS appeal, which may result in the suspension of its dividend, causing the share price to drop sharply. However, in its results for the six months ending on 31st March 2024, the company reported a revenue increase of 4.3% and headline earnings per share (HEPS) of 200.5c, compared with 6.2c in the previous period. Assets under management (AUM) grew by 5% to R631bn. The company noted, "Net outflows for the period were in line with our expectations at 4% of average AUM. This is largely due to the weak SA savings industry, to which Coronation is significantly exposed. It also reflects the experience of the broader industry, as active asset managers around the world experience persistent net outflows."

From a technical perspective, Coronation's shares experienced strong growth from 2008 until they peaked at R115 per share on 30th December 2014. Under the new management, the share value fell to a low of 2541c during the COVID-19 outbreak. A long-term downward trendline was observed, with a potential upside break appearing imminent. The share was added to our Winning Shares List (WSL) on 11th May 2024 at 3281c. Since then, it has risen to 3415c and appears poised for further increases.