Our opinion on the current state of HCI(HCI)Hosken Consolidated Investments (HCI) is a BEE investment holding company owned by the South African Clothing and Textile Workers' Union. HCI has a diverse portfolio that spans across various sectors including gaming, hotels, media, transport, mining, and property. Notably, it owns 47% of a suite of gaming companies including JSE-listed Tsogo Sun, which operates casinos and hotels, as well as Galaxy Bingo and Vukani Gaming, which operates gaming machines. Additionally, HCI owns the JSE-listed E-Media group, which encompasses ENCA, Openview HD, and E-Sat TV.

In the transport sector, HCI holds a 74% stake in Hosken Passenger and Logistics, which owns Golden Arrow Bus Services. It also owns 52% of Niveus Investments and 84% of Deneb, alongside 100% of HCI Coal—a junior coal mining operation with two operational mines. In the property segment, HCI Properties manages a portfolio that includes conference and exhibition properties like the Gallagher Convention Centre. Moreover, HCI owns a 40% stake in a technology company called BSG.

On 26th April 2022, HCI announced that a prospecting company, in which it has an effective 10% share, made a significant light oil discovery, leading to an initial surge in its share price. For the six months ending on 30th September 2023, HCI reported a 6% increase in revenue but a 13% decline in headline earnings per share (HEPS). The company's net asset value (NAV) saw a substantial increase of 21%, reaching 23990c per share. HCI noted, "The Group’s television and radio advertising revenue increased by 1%, while its market share decreased slightly from 36% to 35% during the current period. Casino revenue and net gaming win combined increased by 9%, assisted by strong growth in food and beverage, and rooms revenue. Normalized revenue, adjusted for the prior comparative period receipt of the hotel management agreement cancellation fee of R399 million from Tsogo Sun (TSG), increased by 34% to R2 790 million, following significant increases in rooms (41%) and food and beverage (29%) revenue and rental income (38%)."

In a trading statement for the year ending on 31st March 2024, HCI estimated that HEPS would fall by between 24.1% and 34.1%. The company explained, "Headline earnings per share has been negatively impacted by equity losses of R528 million in respect of Impact Oil and Gas, which included an effective R483 million in equity losses in respect of its investment in Africa Energy Corp."

HCI's investment portfolio is diverse and somewhat unfocused, currently trading on a P/E of 9.34. We previously suggested that this share was cheap at R80 in February 2022, and it has since risen to R178 and may climb further.

Our opinion on the current state of SALUNGANO(SLG)Salungano, formerly known as Wescoal, is involved in the mining and trading of coal, having commenced production in 2021 with coal sourced from its Moabsvelden mine primarily for Eskom. The company has grown substantially, now producing 300 million tons from five coal mines, with mining operations constituting 82% of its revenue. Additionally, Salungano holds a 50% stake in the Arnot Mine and is exploring opportunities to expand its business into other energy sectors.

In its financial report for the year ending 31st March 2023, published on 21st May 2024, Salungano reported a decline in revenue to R4.79 billion from R5.14 billion the previous year, along with a headline loss of 58.65 cents per share, significantly wider than the loss of 6.13 cents per share in the prior period. The company attributed the disappointing results to "notably lower" production and sales volumes across its operations due to various operational challenges, which led to a 6.8% decrease in revenue.

The global energy market's volatility, particularly with the looming threat of a recession, is impacting Salungano's performance. Additionally, the company is working to lift the suspension of its shares on the JSE, initiated following the publication of its financial results and the interim financial results for FY2024.

Compounding the company's challenges, on 4th July 2023, three directors resigned, triggering a sharp decline in the share price. Subsequently, on 21st August 2023, trading of Salungano shares was suspended by the JSE. The confluence of operational difficulties, leadership changes, and market conditions suggests a period of significant uncertainty for Salungano.

Our opinion on the current state of THARISA(THA)Tharisa (THA) is a mining company that mines and beneficiates platinum group metals (PGMs) and chrome. The company is listed in London and on the JSE. The Tharisa mine on the south-west limb of the Bushveld Igneous Complex (BIC) is an open pit operation with an estimated life of 17 years. The company owns a subsidiary, Arxo Metals, which beneficiates chrome to produce high-grade chrome concentrates. The company is planning to expand into the Great Dyke area of Zimbabwe. In our view, this is one of the best mining investments on the JSE with a cost of production which is well below current metals prices and some good options for expansion.

The company has been involved in the Vulcan Plant which will improve chrome recovery to 82% from 65% and cost $54.2 million. The target is to reach 200,000 ounces of PGMs and 2 million tons of chrome ore production using proprietary technology. The open pit operation is relatively low cost and does not have the problems associated with underground operations. The company is planning to build a 5MW furnace that will enable it to produce iron alloys which are rich in platinum group metals and would sell for a far better price.

On 5th October 2021, the company announced the cold commissioning of its Vulcan chrome beneficiation plant which is expected to increase chrome recoveries by 20%. On 4th February 2022, the company announced that it had signed an agreement to implement a solar farm of more than 40 megawatts. On 27th March 2023, the company announced that it had raised $130 million (about R2.3 billion) in finance from ABSA and Soc Gen.

In its results for the year to 30th September 2023, the company reported PGM production down 19.3% and revenue down 5.3%. Headline earnings per share (HEPS) fell 31.1%. The company said, "The decline in reef mined primarily emanates from access restrictions to the open pit due to limitations on mining activities in close proximity to the nearby community, adverse weather conditions experienced as well as the processing of suboptimal reef horizons which were supplemented by purchased ROM ore to maintain plant throughput."

In a production update on the 3 months to 31st December 2023, the company reported mill throughput for PGMs and chrome up 8.7% with chrome at a record 462.8 kilotons. The CEO, Phoevos Pouroulis, said, "We have made good operational improvements, with waste mining advances leading to a better mining and plant performance, resulting in record quarterly chrome production."

In a production report for the second quarter ending on 31st March 2024, the company reported PGM output unchanged and the basket price received slightly down. At the end of the quarter, the company had cash of $184.6 million and debt of $114 million. The CEO said, "Operationally we performed well, building on a record first quarter and on track to meet guidance."

In a trading statement for the six months to 31st March 2024, the company estimated that HEPS would fall by between 23.3% and 29%. Technically, the share trades an average of R228,000 per day, which makes it practical for private investors. It was in a strong upward trend until April 2022 but then turned down in line with commodity prices. Since March 2024 the share price has been rising in line with the improved prospects for PGMs. We recommended waiting at least for a break up through the downward trendline before investigating further. That break came on 26th March 2024 at 1405c and the share has since moved up to 1800c. The share remains a risky commodity counter dependent on the international prices of the commodities which it produces.

Our opinion on the current state of Transaction Capital (TCP) is a company with two divisions—minibus taxis and risk services. It has unbundled and separately listed WeBuyCars (WBC). Its subsidiary, SA Taxi, specializes in financing, repairing, insuring, and selling minibus taxis in South Africa and completely dominates the entire value chain associated with the minibus taxi industry. The company listed in June 2012 and until 2023, the company generated an annual compound growth in earnings per share of 21% since 2014. That ended abruptly in 2023 when the company revealed that it had to make a R1.8 billion provision for bad debts in its minibus taxi division. About 69% of South African households use taxis with more than 15 million trips per day. Most of this is non-discretionary, which means that this industry tends to be defensive and not generally impacted by the state of the economy at large. The South African Taxi Council (Santaco) acquired a 25% stake in SA Taxi for R1.7 billion in 2018, which is benefiting both parties. The directors of TCP own 32% of the company.

The company is also involved in debt collection in South Africa and Australia through Transaction Capital Risk Services (TCRS). Following the impact of COVID-19, the taxi industry has suffered from a perfect storm of rising interest rates, rising fuel costs, and lower consumer spending resulting in a massive increase in TCP's bad debt provision. The average taxi owner was unable to afford to make repayments of around R6000 a month in the face of steep increases in the fuel price, rising interest rates, and declining commuter traffic. The result was that SA Taxi stopped financing and buying as many as 600 new Toyota minibuses a month and was reduced to selling between 180 and 200 refurbished taxis. The company was owed about R17 billion by taxi owners, most of whom were behind on their repayments. On 15th March 2023, the company reported that the controlling Hurwitz family trust had sold 1.6 million shares in December 2022. In a report in the Business Day on the 12th of December 2023, the company reported that it will no longer finance new minibus taxis—only second-hand ones. SA Taxi attributes its problems to: "...elevated fuel prices, high interest rates, increasing cost of parts and maintenance, record levels of load shedding, persistently lower commuter volumes as a result of depressed economic activity, and taxi operators' inability to increase fares given already financially stretched consumers." On 12th September 2023, the company announced that its CEO, David Hurwitz, would resign with effect from 31st December 2023. On 22nd March 2023, the company announced that it had sold its holding in Nutun Australia for A$58.3 million.

On 11th April 2024, with the separate listing of WeBuyCars, the Transcap share fell to 361c as expected. In its results for the six months to 31st March 2024, the company reported revenue of R981 million down from R1.295 billion and a headline loss of 164.9c per share compared with a loss of 224.6c in the previous period. The company said, "The key highlight of the half year ended 31 March 2024 ('H1 2024') was the successful unbundling, placement, and separate listing of WeBuyCars on the main board of the JSE Limited ('JSE'). This allowed Transaction Capital to return R5.2 billion to shareholders through the distribution of 256.3 million WeBuyCars shares. The group further raised R1.0 billion via the placement." In our view, the share remains risky and difficult to assess. Much will depend on growth in the South African economy following the elections.

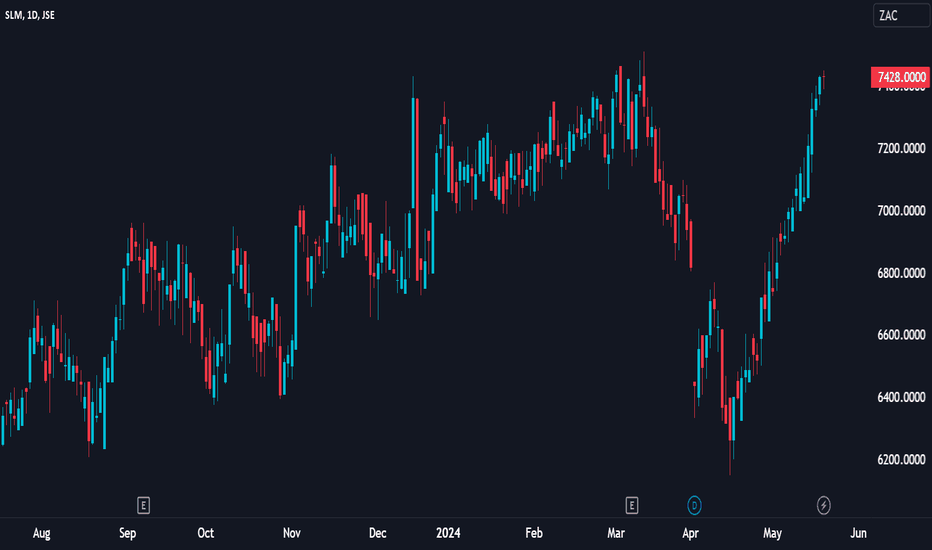

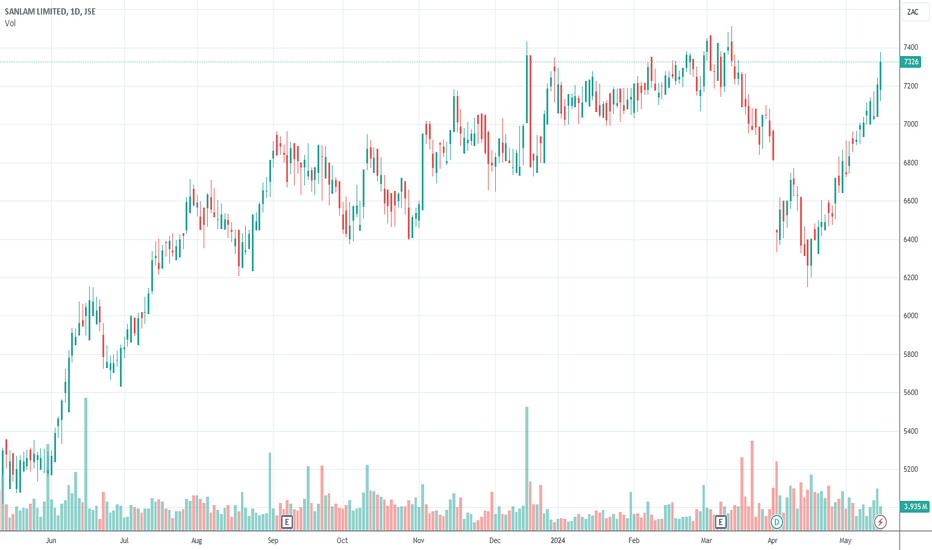

SLMTuesday 21-May-2024.This is a high risk idea thus smaller positions will apply. The share has developed a 'V-shaped' reversal, with aggressive buying in recent weeks, however, the current rating reflects excessively overbought conditions into overhead resistance. Failure to hold the prior session highs would be indicative of a early price weakness and could lead to the start of a topping structure followed by a bearish reversal. As always, traders could consider the following if/when the prices approaches the target: bank/take profit, partially scale out, adjust the stop-loss to protect profits. Time Stop: Wednesday, 28 August 2024.

Entry: 7428

Target: 7015

Stop-loss: 7625

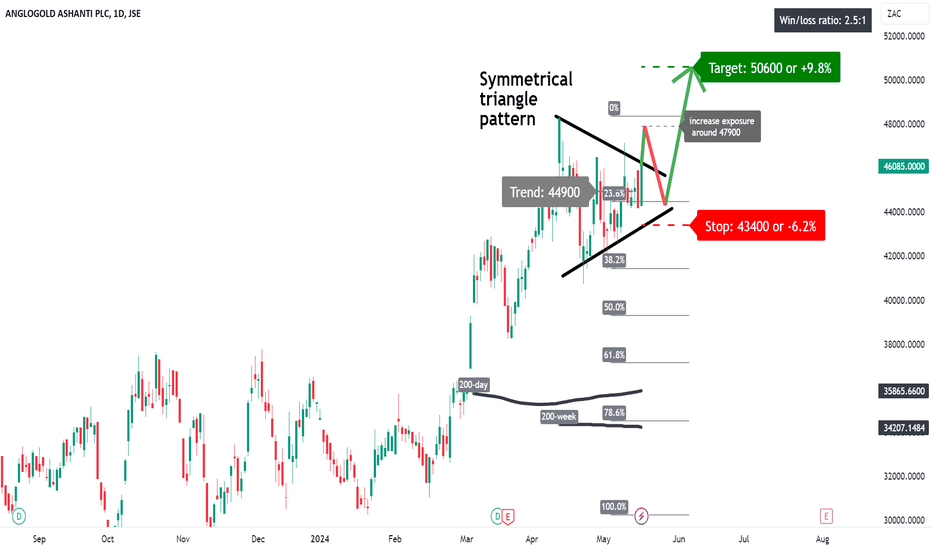

ANG: symmetrical triangle pattern?A price action above 44900 supports a bullish trend direction.

Further bullish confirmation for a break above 47900.

The target price is set at 50600.

The stop-loss price is set at 43400.

A break-up out of the symmetrical triangle pattern might trigger further upside potential.

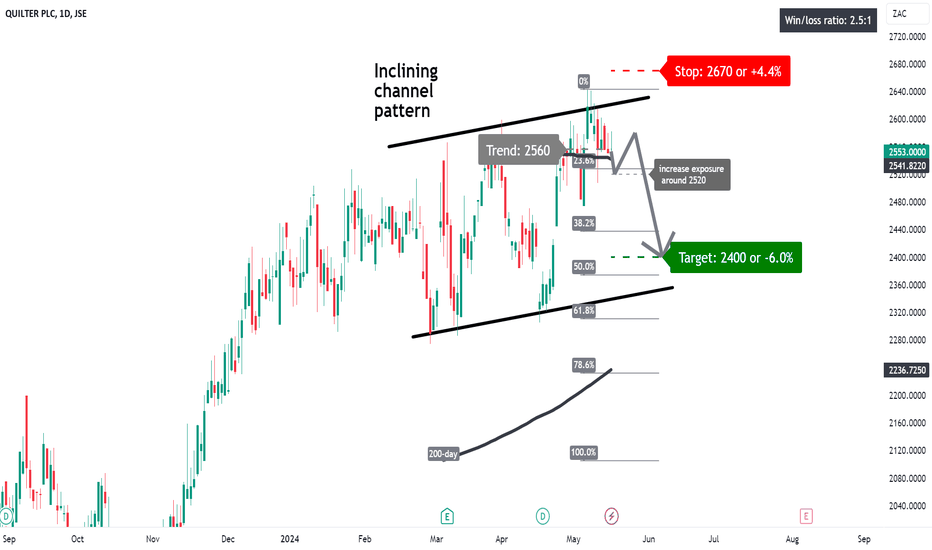

QLT: temporary correctionA price action below 2560 supports a bearish trend direction.

Crossing below 2520 will support further bearish strength.

The target price is set at 2400.

The stop-loss price is set at 2670.

Downside price momentum also applicable.

Remains a risky trade as the price action is against the general upward trend direction of the incliig channel patter.

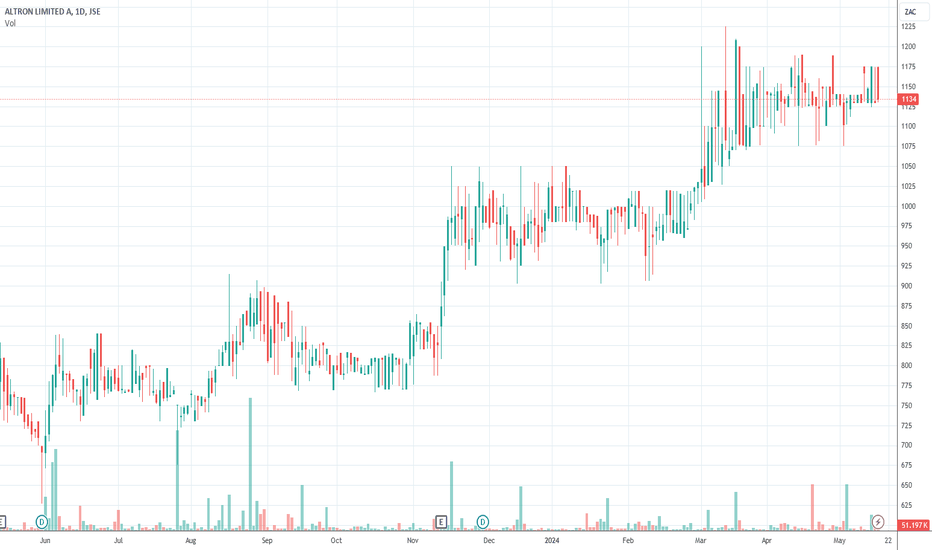

Our opinion on the current state of ALTRON-A(AEL)Allied Electronics Corp, or Altron (AEL), is an information and communications technology company founded by Bill Venter in 1965. Recently, the company has been refocusing on its core business, which has involved selling its 80% stake in Powertech and its 100% subsidiary, Altech UEC (a developer of set-top boxes). Powertech was also sold to a BEE consortium. Altron is currently in the process of selling CBI Telecom Cables. The company operates in six African countries, as well as the UK and Australia.

Altron has reported "...secured key wins in both the public and the private sector...", including the Gauteng Broadband Network phase 2 contract and FNB's data and analytics contract. Netstar, another Altron venture, won a three-year contract for vehicle tracking for 7000 vehicles in eThekwini. Bytes, in the UK, which has now been unbundled and separately listed both in the UK and in an inward listing on the JSE, secured a 5-year contract for Windows 10 from the NHS (UK). Altech is restructuring its debt to reduce its interest bill and has resumed paying dividends. They acquired Phoenix Software in the UK for R698m.

On 17th December 2020, Altron announced the successful listing of its subsidiary Bytes Technology on the London Stock Exchange (LSE) at a price of GBP2.70. This event unlocked considerable value for Altron shareholders but resulted in a "cliff" in the Altron share price chart.

In its financial results for the six months to 31st August 2023, Altron reported a revenue increase of 4% and headline earnings per share (HEPS) up 19%. The company noted, "Altron Group results were impacted by provisions and impairments (collectively referred to as the 'Non-Cash Adjustments') raised in two non-core subsidiaries, namely Altron Nexus of R334 million, in relation to the restructuring of Altron Nexus due to the loss of the Gauteng Broadband Network contract and the City of Tshwane exposure, and Altron Document Solutions of R95 million. This includes the goodwill impairment raised at Altron Group level of R33 million in relation to Altron Nexus."

In a trading statement for the year to 29th February 2024, Altron estimated that HEPS from continuing operations would increase by between 35% and 38%. The company elaborated, "Normalising for the sale by Altron Managed Solutions of its ATM Hardware and Support Business (the 'ATM Business'), which was effective 1 July 2023, the Group's Continuing Operations are delivering year-to-date revenue growth, with double-digit growth in EBITDA and Operating Profit."

Technically, the share has been moving sideways between 750c and 1330c since December 2020. At its current price, it is trading below its net asset value (NAV), but it is now in an upward trend.

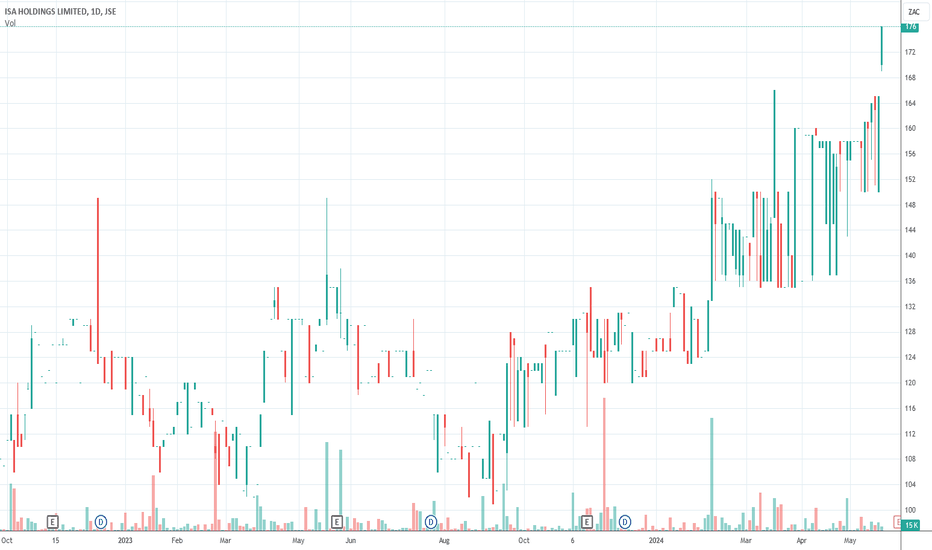

Our opinion on the current state of ISA Holdings (ISA) ISA Holdings (ISA) is a small Alt-X listed IT company that operates in sub-Saharan Africa, specializing in network, internet, and information security. The company is recognized for employing some of the leading IT security specialists in the region and boasts a robust set of tools and experience to deliver effective information security solutions.

In its financial results for the six months ending on 31st August 2023, ISA reported a significant turnover increase of 42% and an earnings per share (EPS) increase of 27%. The company noted, "Profit before other income and expenses increased by 22% during the current reporting period to R23.1 million, representing a gross margin of 47% compared to 55% in the prior reporting period."

Looking ahead, in a trading statement for the year ending on 29th February 2024, ISA estimated that headline earnings per share (HEPS) would increase by between 25% and 45%. This projection underscores the company's ongoing profitability and resilience, despite recent challenges.

However, a potential issue for investors is the limited liquidity of ISA's shares; with only about R36,000 worth of shares traded on average each day, it can be risky for private investors to acquire a significant stake. Nevertheless, with a price-to-earnings (P/E) ratio of 11.21 and a dividend yield of 7.14%, ISA's shares appear to offer good value, attracting those looking for investment opportunities in the IT sector.

Our opinion on the current state of NASPERS-N(NPN)Naspers (NPN), Africa's largest company, is a massive international social media, gaming, and IT company whose main asset is a 73% stake in Prosus (PRX), which in turn owns 26% of Tencent—a Hong Kong-listed company providing social media services and gaming in China. Tencent boasts 10 of China's top 20 mobile applications, reaching over 1.1 billion users. Naspers itself maintains an archaic capital structure dominated by its 907,128 unlisted "A" ordinary shareholders. Each "A" ordinary share has 1,000 times the voting power of the 438.3 million "N" shares listed, effectively controlling the company with 67.4% of the vote.

Naspers has many other interests, primarily in e-commerce, operating in 120 countries worldwide. It recently invested an additional $500 million in Letgo—an American classifieds platform with over 100 million users. It also owns Takealot and Mr. D Food in South Africa, among other interests—though these are overshadowed by its stake in Tencent. The discount of the share to its inherent value is mainly due to its "N" share structure, which is frowned upon in the investment community.

On 11th September 2019, Naspers separately listed Prosus on the Euronext in Amsterdam, housing all its international assets, including its stakes in Tencent, Mail.Ru, and other internet brands. Naspers held 73% of Prosus, with a 25% free float. The Euronext listing mitigates the risk inherent in the rand, elevating Prosus to become Europe's largest consumer internet company. Tencent continued to grow throughout the pandemic as more people turned to online gaming.

On 27th January 2023, Bloomberg announced that Naspers intended to retrench about 30% of its workforce. In its financial results for the six months ending 30th September 2023, the company reported a 9% increase in revenue from continuing operations and a 90% increase in core headline earnings. The company stated, "This was primarily due to improved profitability of our e-commerce consolidated businesses and equity-accounted investments, particularly Tencent, and higher net interest income during the period. At 30 September 2023, the ongoing open-ended share repurchase programme has reduced the Naspers net share count by 14% and generated US$25 billion for our shareholders."

Technically, since October 2022, the share has staged a recovery but has been moving sideways since March 2023. We still regard this share as underpriced at current levels. On 18th September 2023, the company announced that Bob van Dijk would resign as CEO with immediate effect. On 17th May 2024, the company announced that Fabricio Bloisi would take over as CEO of both Naspers and Prosus, effective from 1st July 2024.

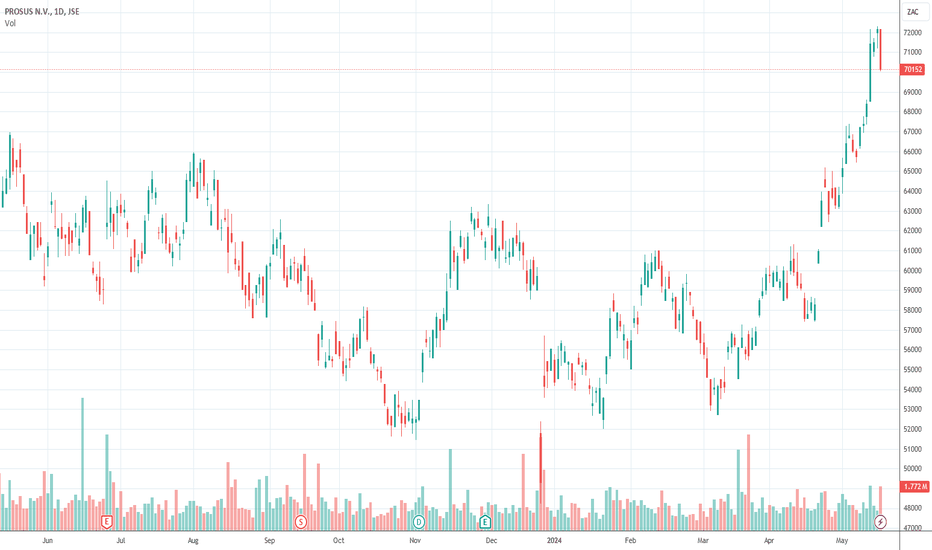

Our opinion on the current state of PROSUS(PRX)On 11th September 2019, Naspers (NPN) separately listed Prosus (PRX) on the Euronext in Amsterdam to house all its international assets including its stake in Tencent, Mail.Ru, and other internet brands. Naspers holds 73% of Prosus, and there is a 25% free float. One of the benefits of the Euronext listing is that it removes the risk inherent in the rand, making Prosus a rand-hedge which rises when the rand weakens and vice versa. Prosus is now Europe's largest consumer internet company.

The main asset of Prosus is a 26% stake in Tencent - a Hong Kong-listed company that provides social media services and gaming in China. Tencent operates 10 of China's top 20 mobile applications, reaching over 1.1 billion users. However, Tencent remains vulnerable to the authoritarian regulators in China and their involvement in the gaming industry.

Prosus describes itself as, "...a global consumer internet group operating across a variety of platforms and geographies and is one of the largest technology investors in the world. The Prosus Group's businesses and investments serve more than 1.5 billion people in 89 markets and are the market leaders in 77 of those markets. The Prosus Group's consumer internet services span the core focus segments of Classifieds, Payments and Fintech as well as Food Delivery, plus other online businesses including Etail and Travel."

On 18th May 2022, Tencent issued a statement saying that its profit in the March 2022 quarter was half of what it had been in 2021, leading to a negative impact on Prosus shares. On 24th June 2022, the company said that it intended to sell some of its Tencent shares to finance an extended open-ended share buy-back program. This caused the share price to jump up. On 24th October 2022, the re-election of Chinese leader Xi Jinping for a third term caused Prosus shares to fall heavily, as Jinping is part of a faction in Chinese politics which aims to keep the "disorderly expansion of capital" under control.

In its results for the six months to 30th September 2023, the company reported revenue up 13% and headline earnings up 85%, "...primarily due to improved profitability of our e-commerce consolidated businesses and equity-accounted investments, particularly Tencent, and higher net interest income during the period." Core headline earnings per share (HEPS) almost doubled to 76c per share. Technically, the Prosus share has been trending up in November 2023. We still believe that the share is undervalued at current levels.

On 18th September 2023, the company announced that CEO, Bob van Dijk, would resign with immediate effect. On 17th May 2024, the company announced that Fabricio Bloisi would take over as CEO of both Naspers and Prosus with effect from 1st July 2024.

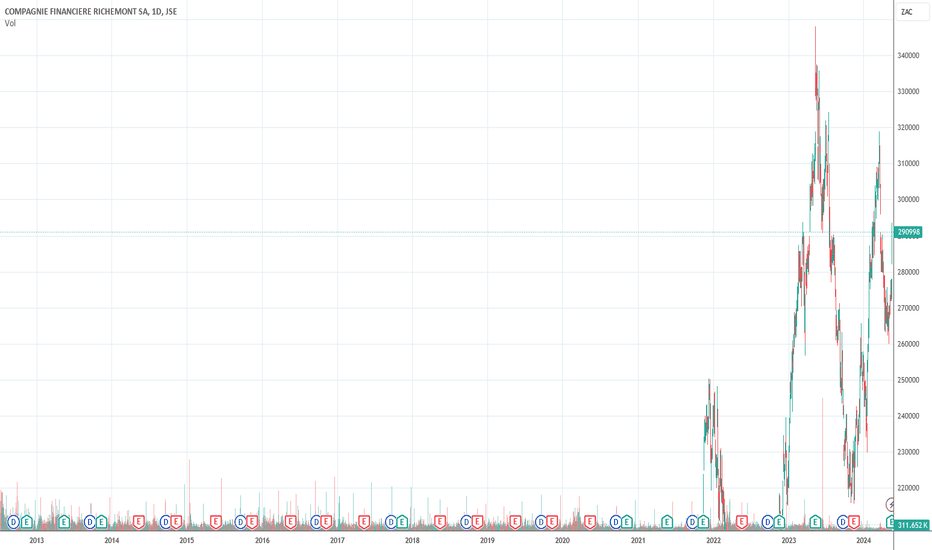

Our opinion on the current state of RICHEMONT(CFR)Richemont (CFR), controlled by the Rupert family in Stellenbosch, is the world's second-largest supplier of luxury goods. The company's sales are entirely located overseas, making it an excellent rand-hedge. Its prestigious luxury brands include Mont Blanc, Cartier, Lancel, Jaeger-LeCoultre, Van Cleef, and Piaget. Richemont has significantly enhanced its online sales, which now constitute 21% of its turnover. This increase was facilitated by the acquisition of Yoox-Net-A-Porter (YNAP) and Watchfinder, a UK online group, as well as by entering into a joint venture with Alibaba to develop apps to penetrate the Chinese market and offer its line of luxury goods. Additionally, its products are available through Alibaba's Tmall Luxury Pavilion.

Richemont's business is closely tied to the global economic recovery post-pandemic. Although the company's sales were negatively impacted by COVID-19, they are expected to continue rising, particularly due to its aggressive online sales strategies. However, the share is influenced by the economic slowdown in China and developments in Central and Eastern Europe. It stands to benefit from the global economic recovery but remains susceptible to fluctuations in the strength of the rand.

In its financial results for the year ending 31st March 2024, Richemont reported a sales increase of 3%, and 8% in constant currencies. However, headline earnings per "A" share decreased by 4%. The company highlighted that its "Jewellery Maisons are delivering a 33.1% operating margin, with sales up 6% at actual exchange rates (+12% at constant exchange rates).” Richemont also reported a strong net cash position of EUR 7.4 billion, with a significant increase in cash flow generated from operating activities, which rose to EUR 4.7 billion.

The share experienced an "island" formation in October and November of 2023 before it began a new upward trend. While Richemont is clearly an effective rand hedge, its performance is highly dependent on the Chinese consumer market. Despite this, the company is expected to perform well, although it is important to note that with a price-to-earnings (P/E) ratio above 22, its shares are not cheap.

Our opinion on the current state of TREMATON(TMT)Trematon (TMT) is an investment holding company with subsidiaries, joint ventures, and associate companies, primarily located in the Western Cape. The company engages in investing both in listed and unlisted shares. Initially, most of Trematon's investments were related to property, but its portfolio has since diversified beyond this sector. Among its holdings is Club Mykonos.

In its financial results for the six months ending on 29th February 2024, Trematon reported a 2% increase in revenue. However, its headline earnings per share (HEPS) decreased by 68%. Despite this, the company's net asset value (NAV) experienced a modest increase of 1% to 339c per share. The company stated, "Total group INAV reduced to R912.9 million from R991.8 million at 31 August 2023. This is in line with the capital distribution paid to shareholders and is reflected in the decrease in group cash."

The trading volume of Trematon shares is relatively low, with only about R31,000 worth of shares changing hands each day, making it less practical for private investors. Despite the current downward trend in its share price, there is a belief that Trematon could become a worthwhile investment, particularly if it can expand its growth in the education sector, now that the pandemic is substantially behind us.

South Africa and the WorldMain ideas:

The US and South African elections in 2024: The outcome of the elections in both countries will have long-term and pervasive impacts on the markets, especially if Biden wins in the US and Zuma runs again in South Africa.12

The US economy and the war in Gaza: The US economy is booming, but inflation and interest rates are higher than expected. The war in Gaza has hurt Biden's popularity and he is trying to negotiate a peace settlement with the help of the CIA.34

The Chinese economy and the Shanghai stock exchange: The Chinese economy has been struggling for the past three years, mainly due to the property sector bubble and the collapse of Evergrande. The Shanghai stock exchange has been in a downward trend, but the government has been intervening to support the market.56

The war in Ukraine and the role of NATO: The war in Ukraine is a proxy war between Russia and NATO, and it has resulted in a huge loss of lives and humanitarian crisis. NATO has been supplying weapons and aid to Ukraine, but has not yet committed troops on the ground. Putin is fighting for his survival and may resort to desperate measures.78

The South African economy and the coming election: The South African economy has been affected by load shedding, low savings rate, poor service delivery, and corruption. The coming election will be influenced by the ANC's performance, the rise of Mkhonto we Sizwe, and the return of Zuma to politics.910

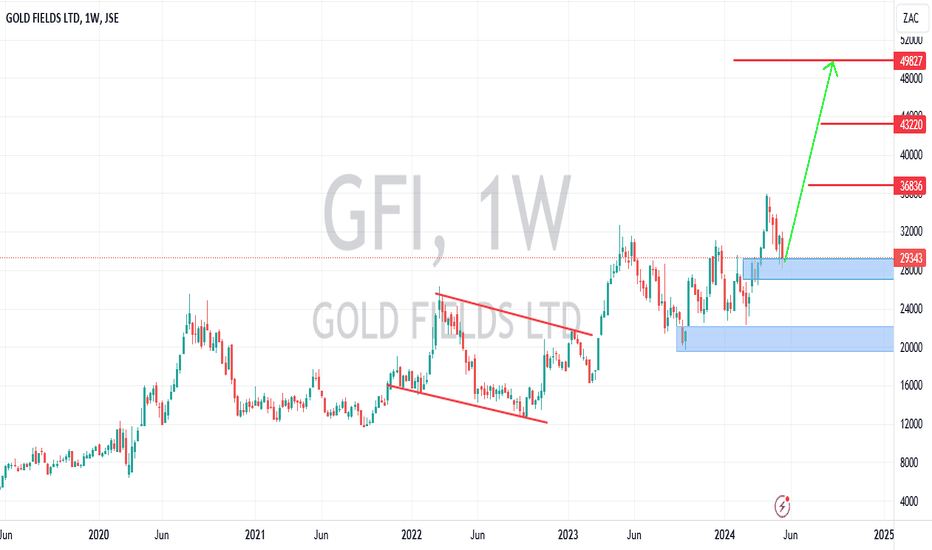

Some commodities and companies to watch: The price of platinum group metals has declined by one-third this year, but may recover as the commodity cycle turns. The price of gold has also been falling, but may be at a cycle top. Bitcoin has been volatile and faces regulatory challenges. Some companies that are worth considering are Barloworld, Sibanye, and Purple Capital.1112

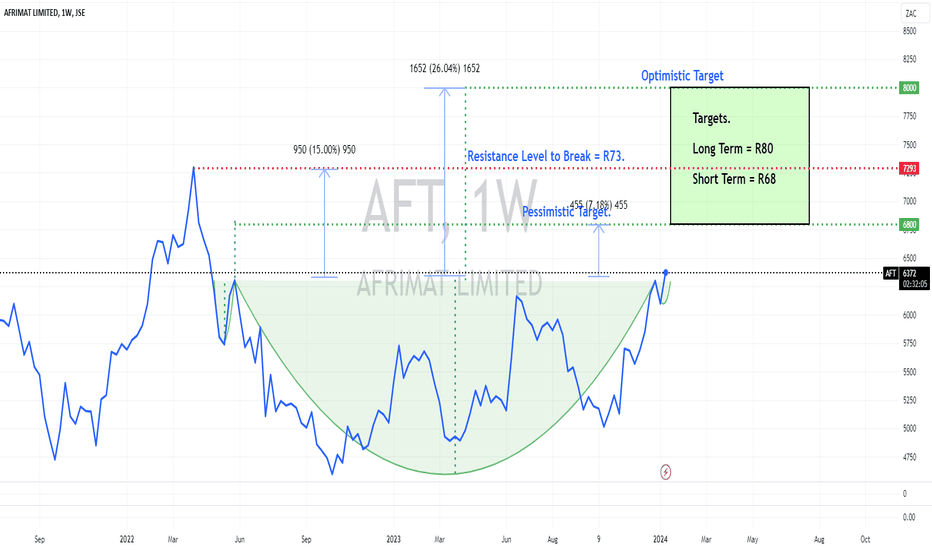

AFT.JO Prints an IH&S Pattern 1 Year Study.Afrimat has printed an Inverse Head and Shoulders Pattern.

I know the Shoulders are small & Cute!

In this 1 Year Study Analysis I've Switched to a simple line Chart as to easily depict the Pattern.

The Chart Depicts the possible Upsides.

As always get a few Experts Advice before making any Investments or Trade decisions.

Smash that Rocket Boost Button to show your Appreciation for my Analysis Studies.

Prosperous Investing for 2024 to All.

Regards Graham.

Our opinion on the current state of SANLAM(SLM)Sanlam is a powerhouse in the insurance and financial services industry, not just in South Africa but on a global scale. Established in 1918, it has expanded its operations significantly over the years, now reaching into multiple continents including Africa, Europe, America, and Asia, with particularly strategic operations in the UK, America, Europe, India, Australia, and across several African nations. This extensive geographic footprint underscores its status as one of the most influential and comprehensive providers in the financial and insurance sectors worldwide.

Operational Structure and Strategic Acquisitions:

Sanlam’s business structure is divided into four primary segments:

1. Sanlam Investment Holdings (SIH): A significant portion (25%) of which is owned by African Rainbow Capital.

2. Sanlam Emerging Markets: This includes an 84.5% interest in Saham, a major player with operations in 33 French-speaking countries.

3. Sanlam Personal Finance: This is the biggest contributor to profits, largely focused within South Africa.

4. Santam: Sanlam owns a 61% stake in this South African insurer.

Sanlam’s strategic acquisitions, such as the majority stake in Catalyst Fund Managers and the purchase of Alexander Forbes group risk and retail life business, further demonstrate its aggressive growth strategy and commitment to diversifying its portfolio.

Financial Performance and Market Position:

For the six-month period ending on 30th June 2023, Sanlam reported an impressive increase in net results from financial services by 26% and a dramatic rise in headline earnings per share (HEPS) by 118%. The company’s performance was bolstered across various lines including general insurance, life insurance, and credit structuring.

Further, the nine-month operational update to 30th September 2023 showed new business volumes up by 13% and operational earnings up by 35%, with a robust solvency cover ratio of 170%, reflecting strong financial health and regulatory compliance.

In its latest trading statement for the year ending 31st December 2023, Sanlam projected a significant increase in HEPS of between 43% and 53%, attributed mainly to higher investment returns on the shareholder capital portfolio.

Investment Outlook:

Sanlam has demonstrated a consistent ability to generate robust growth and maintain a solid financial base, making it a compelling choice for investors. With a current price-to-earnings (P/E) ratio of 10.43, the company is positioned as an attractive investment relative to its past performance and future growth potential. This valuation suggests that Sanlam offers good value, particularly considering its strong recovery post the coronavirus market downturn and its historical performance stability.

Conclusion:

As one of the JSE’s blue-chip stocks, Sanlam represents a substantial investment opportunity, especially for those looking to invest in a company with a broad international presence and a diversified service offering. Its proactive approach to growth through strategic partnerships and acquisitions, combined with a solid track record in financial performance, positions Sanlam as a strong contender for long-term investment.

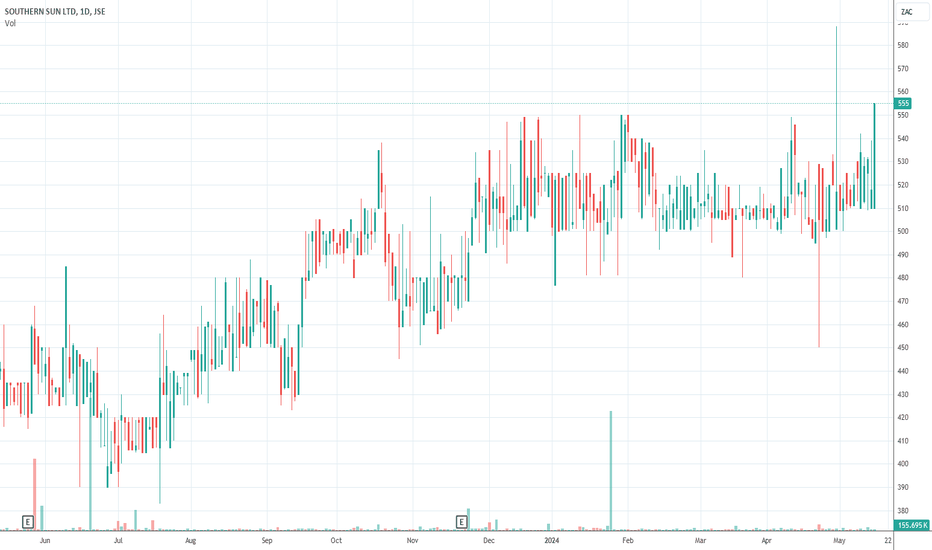

Our opinion on the current state of SSU(SSU)Southern Sun Hotels, previously known as Tsogo Sun Hotels, is a prominent player in the gaming, hotel, and entertainment industry in South Africa. The company strategically separated its gaming and hotel operations into distinct entities, aiming to unlock shareholder value and enhance focus within each business unit.

Economic Context and Business Adaptation:

The economic stabilization efforts by President Ramaphosa, particularly post-pandemic, are anticipated to bolster business and consumer confidence gradually. Southern Sun Hotels has capitalized on these improving conditions, especially with its investment in limited payout machines (LPM) and electronic bingo terminals (EBT), which are predominantly located in restaurants and bars. These smaller-scale gambling outlets have shown profitability, although they were affected by COVID-19 related disruptions.

Financial Performance Overview:

For the six-month period ending 30th September 2023, Southern Sun Hotels reported an occupancy rate of 56.3% and a 21% decline in headline earnings per share (HEPS). Despite this decline, the company's income rose by 34%, and it executed share buy-backs worth R389 million. The adjusted headline profit for the period was R255 million, a substantial improvement from R17 million in the previous year. This notable recovery in profits was largely driven by robust trading in the Western Cape, buoyed by major events like the Netball World Cup held at the Cape Town International Convention Centre.

Future Outlook and Trading Statement:

Looking ahead, Southern Sun Hotels provided a positive outlook in its trading statement for the year ending 31st March 2024, projecting an increase in HEPS of between 5% and 9%. The company attributes this optimistic forecast to the effective maintenance of cost efficiencies realized during the comprehensive restructuring throughout the COVID-19 period. Additionally, the significant exposure of its owned hotel portfolio to the Western Cape, particularly Cape Town, has been beneficial. The region has enjoyed a strong year marked by a resurgence in tourism, business travel, and events.

Stock Performance and Investment Considerations:

The stock performance of Southern Sun Hotels reflects a significant recovery since the onset of the COVID-19 pandemic. Described as "oversold" during the pandemic, the company's shares exhibited an "island formation" in trading patterns, suggesting a potential reversal in trends. Following a decisive upside break through the downward trendline on 21st March 2021 at 175c per share, the stock has risen sharply, reaching current levels around 555c. This rapid appreciation indicates robust investor confidence and a positive market reception to the company's recovery strategies and financial performance.

Conclusion:

Southern Sun Hotels appears well-positioned to benefit from the ongoing recovery in South Africa's economic landscape, particularly in the hospitality and gaming sectors. The company's strategic focus on operational efficiency and its strong foothold in a region experiencing significant travel and event-driven activities contribute to its positive outlook. Investors considering this stock should continue to monitor broader economic indicators, tourism trends, and the company’s execution of strategic initiatives, as these factors will play critical roles in sustaining its growth trajectory.

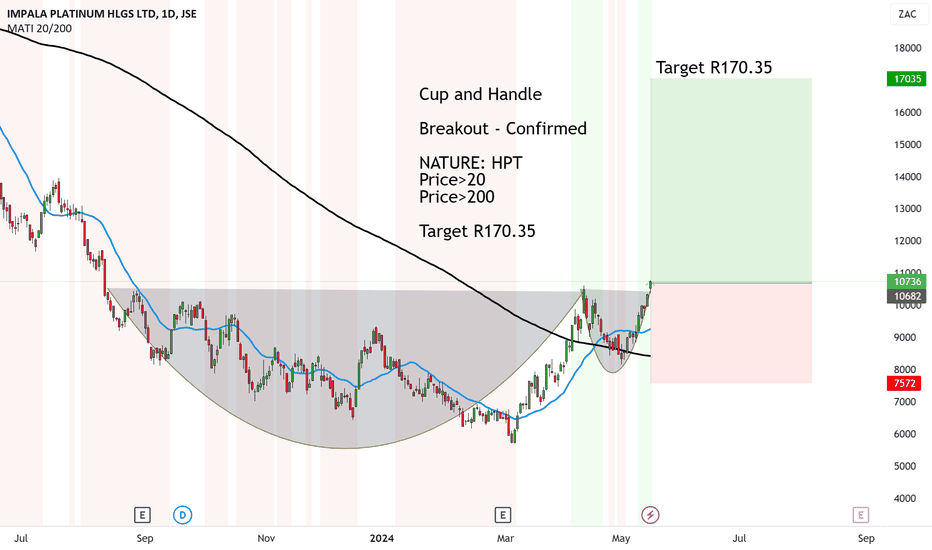

Impala PLatinum fantastic for upside to R170.35With the PLatinum price running up very nicely and setting it's for a rally - JSE PLatinum stocks are looking almost perfect to buy.

We have a Cup and Handle with a breakout above and confirmed. We'll need to wait for Monday's Open price to confirm above the Breakout.

NATURE: HPT (High Probability Trade)

Price>20

Price>200

Target R170.35

Great trade analysis for the system!

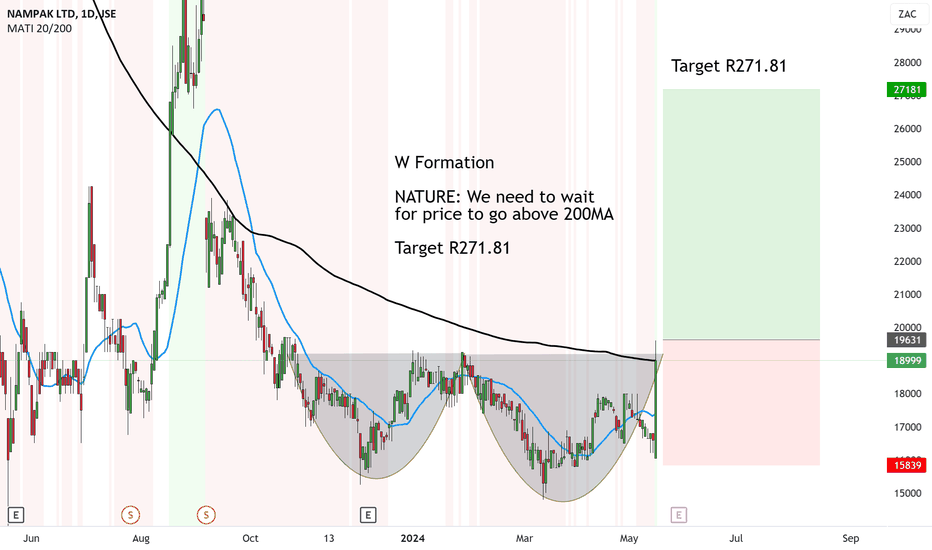

Nampak huge upside to come after announcement to R271.81W Formation has confirmed and formed after the announcement they are leaving Nigeria.

This pumped up the price over 17% in a day.

However, high volatility is always a risky biscuit and big candles normally results in the counter candle.

So I'd wait for the price to break ABOVE the W Formation and for the price to break above the 200MA.

Then the nature will be HPT and the target will be around R271.81

Our opinion on the current state of CORONAT(CML)Coronation Fund Managers (CML) is a significant figure in South Africa’s asset management landscape, recognized as one of the largest managers in the country and the only one directly listed on the Johannesburg Stock Exchange (JSE). Established in 1993, the company experienced robust growth until a pivotal leadership change in 2015 when Adrian Pillay took over as CEO following the resignation of the founding CEO.

Leadership and Investment Challenges:

Despite Pillay’s strong qualifications, his tenure has been challenging. Notably, Coronation faced substantial losses due to investments in African Bank and Steinhoff, both of which significantly underperformed. These financial missteps have shaken investor confidence, leading to a re-evaluation of Coronation’s asset selection capabilities and resulting in substantial institutional outflows. The asset management sector heavily relies on maintaining trust and confidence, and these setbacks highlight the inherent risks in fund management where even experienced teams can face significant challenges.

Regulatory and Financial Setbacks:

Further complicating matters, in February 2023, Coronation lost an appeal with the South African Revenue Service (SARS), resulting in additional tax liabilities and a potential suspension of its dividend. This development adversely affected the company's share price. For the fiscal year ending 30th September 2023, Coronation reported a 2% decrease in revenue and a significant 50% drop in headline earnings per share (HEPS). The company managed R602 billion in assets, but noted net outflows amounting to 10% of average assets under management (AUM). This outflow was attributed to broader industry trends, including global emerging markets' declining demand after a decade of underperformance and shrinking savings pools within South Africa.

Recent Financial Performance:

Looking ahead, a trading update for the six months ending 31st March 2024 suggested a potential recovery in HEPS, estimating it to be between 199.7c and 200.9c, compared to just 6.2c in the previous corresponding period. This forecast indicates some stabilization, although it’s early to determine a full turnaround.

Stock Performance and Investment Outlook:

From a technical analysis perspective, Coronation’s stock performance mirrored its operational challenges. The share price saw significant growth from 2008 until it peaked at R115 per share on 30th December 2014. Under new management, coupled with several external setbacks, the share price declined notably, reaching a low of 2541c during the COVID-19 outbreak. Since then, the trend has been mostly sideways to downward.

Currently, with a price-to-earnings (PE) ratio of around 17.9, the shares might appear reasonably valued in comparison to historical averages and the broader market. However, the sustained downward trend and ongoing challenges suggest caution. Investors are advised to monitor the stock for a clear break above the long-term downward trendline before considering entry, as the current market conditions and company-specific factors do not yet indicate an imminent reversal of the downward trajectory.

Conclusion:

For potential investors, Coronation presents a mixed picture. While there are signs of potential stabilization, the historical performance, ongoing outflows, and recent financial results suggest that careful consideration and continued monitoring are advisable before making investment decisions in this stock.

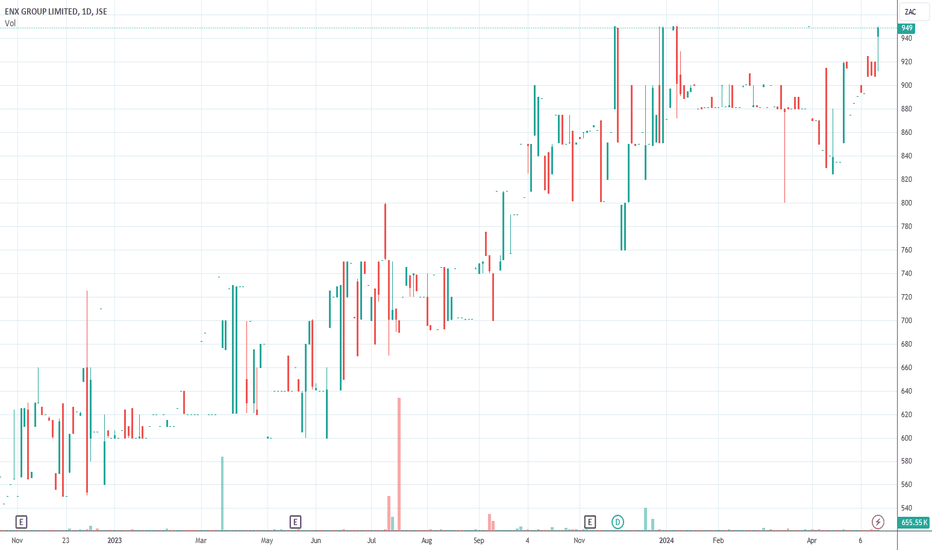

Our opinion on the current state of ENXGROUP(ENX)The enX Group is a diversified industrial company operating primarily in Southern Africa, with a portfolio that spans across several key sectors, including petrochemicals, fleet management, logistics, and industrial equipment. The company has a strategic focus on distributing branded products and services, making it integral to industrial and commercial operations in the region.

**Diverse Operations and Strategic Disposals:**

enX’s operations are quite diverse, reflecting its involvement in various facets of the industrial sector. This includes Austro, which focuses on distributing woodworking equipment and tooling, and New Way Power, known for its manufacturing, installation, and maintenance services for diesel generators. The fleet division of enX is involved in fleet management and logistics as well as vehicle tracking, whereas ENX Petrochemicals engages in the production and marketing of oil lubricants, plastics, polymers, rubber, and specialty chemicals.

The company has been actively managing its portfolio through strategic disposals, which have been key to its financial strategy and capital allocation. Notable transactions include the sale of Eqstra to Bidvest for R3.1 billion in July 2019, and the sale of its British forklift and container business for GBP 31 million in April 2021. These disposals have enabled the company to pay down debt significantly, demonstrating a proactive approach to improving its financial health.

**Special Dividends and Financial Performance:**

enX has also declared special dividends following these sales, highlighting its commitment to returning value to shareholders. This includes a special dividend of 200c per share in April 2022 following the sale of the EIE subsidiary and another special dividend of R1.50 per share in August 2022 after disposing of Impact Forktrucks and the EIE Group.

For the six months ending on 29th February 2024, enX reported a 5% increase in revenue and a substantial 110% rise in headline earnings per share (HEPS). However, the net asset value (NAV) experienced a slight decline to 1386c per share. The growth in revenue was primarily driven by increased sales volumes across its product lines—particularly polyethylene, specialty chemicals, and generators, which have been in high demand by large data-center customers. Despite an increase in toll-blending volumes, the average selling prices dipped, influenced by lower base oil pricing.

**Market Position and Investment Outlook:**

enX trades an average of R320,000 worth of shares daily, making it accessible and practical for private investors. The company's recent financial results and proactive management of its asset portfolio underscore its resilience and strategic positioning within the industrial sector. Currently, the share is on an upward trend, likely reflecting positive investor sentiment towards its operational success and strategic disposals.

Given the breadth of enX's operations and its strategic focus on core industrial services and products, the company is well-positioned to benefit from any improvements in the South African economy. Its ability to make strategic acquisitions both locally and in the UK further supports its growth trajectory, making it an attractive prospect for investors looking for exposure in the industrial sector.