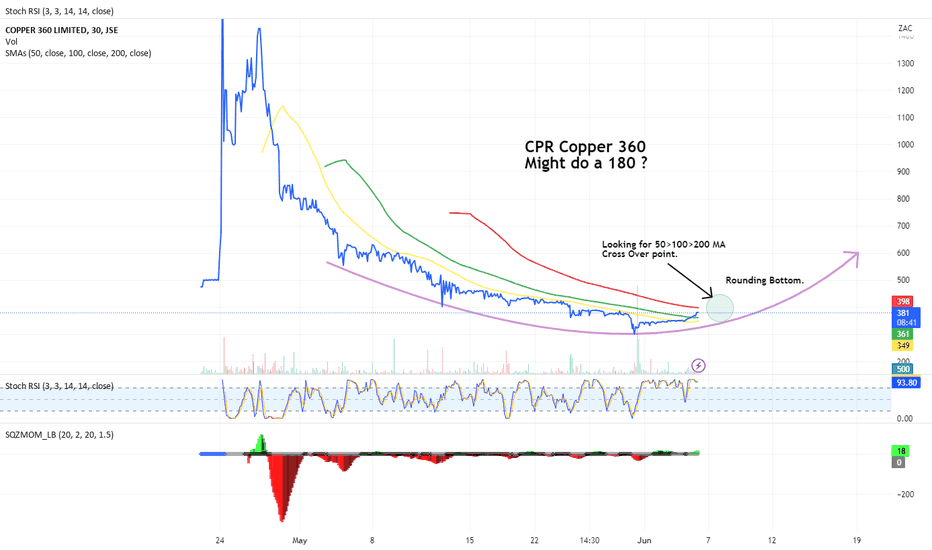

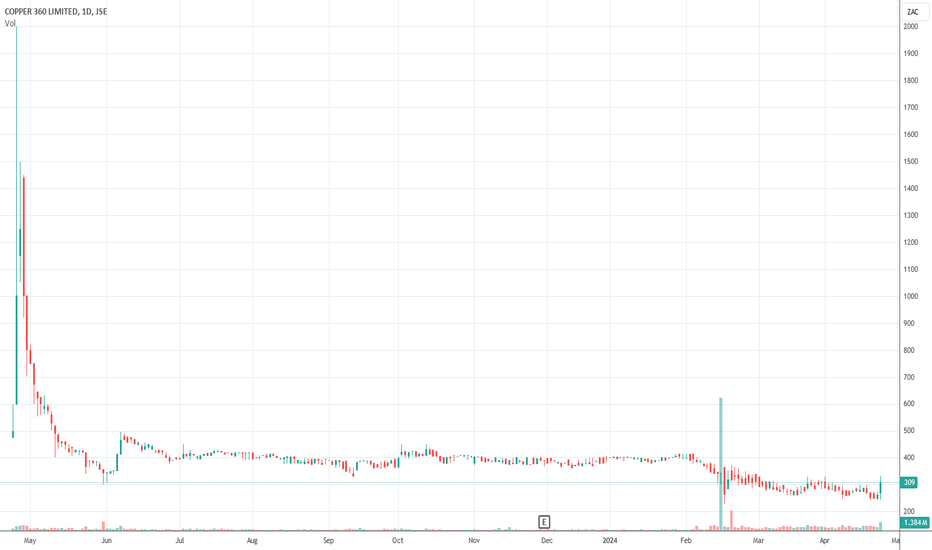

CPR Copper 360 Might do a 180 ?Its early days but CPR Copper 360 might do a 180 ?

Here's an except from JSX SENS :-

DRILLING RESULTS CONFIRM HIGH GRADE COPPER INTERSECTIONS AT RIETBERG COPPER MINE AND INITIAL SAMPLING LEADS TO DISCOVERY OF NEW HIGH GRADE COPPER DEPOSIT ON SURFACE.

All the world will need more copper for the Green Revolution with EV's and Solar, and South Africa especially to assist with our Energy shortages.

Will observe but CPR is starting to show some possible strength.

Regards Graham.

Our opinion on the current state of ANGLO(AGL)Anglo American (AGL) is well-regarded for its strategic approach to mitigating the typical risks associated with commodity stocks. The company achieves this through two primary means: a diversified portfolio and a robust balance sheet.

**Diversity of Minerals:** Anglo American's portfolio includes a variety of minerals, which spreads the risk and lessens the impact of any single mineral's price fluctuations. This diversification is crucial in stabilizing earnings as different commodities may experience cycles at different times.

**Strong Financial Position:** The second strategy Anglo employs is maintaining a strong balance sheet with significant liquidity, which enables the company to withstand negative market trends. This financial resilience is essential for riding out periods of economic downturn.

Anglo American markets itself as a globally diversified mining company with an impressive array of world-class operations and undeveloped resources. Since the start of 2016, commodity prices generally trended upward until the COVID-19 pandemic triggered a downturn in March 2020. However, the sector has seen a robust recovery post-pandemic, driven by economic expansion in major economies like the United States, Europe, and parts of Asia.

A notable project under Anglo American's belt is the Quellaveco mine in Peru, a significant copper venture where Anglo owns a 60% stake. The project, which cost $5.6 billion to develop, is expected to pay back its investment within approximately four years, with a projected operational lifespan of 30 years thereafter. This mine exemplifies the company's capacity for executing large-scale and profitable projects.

The global economic landscape, including the COVID-19 recovery and geopolitical tensions such as the conflict in Ukraine, continues to influence commodity prices. Precious metals, in particular, have seen price increases due to heavy sanctions on Russia. These factors collectively contribute to a favorable outlook for companies like Anglo American, which are poised to benefit from the ongoing commodity boom.

However, challenges persist. Issues such as unreliable rail service from Transnet, especially impacting operations like Kumba, and increased load shedding have posed significant operational challenges. Despite these hurdles, Anglo American plans to fully transition to renewable energy sources in South Africa by 2023, reflecting its commitment to sustainability.

Financially, Anglo American faced a tough year in 2023, with revenue down 13% and earnings per share (EPS) dropping dramatically by 94% in US dollars. The full ramp-up of Quellaveco was a high point, but it couldn't offset the significant revenue impacts from cyclically low prices in PGMs and diamonds. The company is undergoing a comprehensive review of all its assets to improve financial health further.

Despite these pressures, Anglo American's share price has shown resilience. After declining significantly, it began to recover following an acquisition offer from BHP, which proposes to exchange 0.7097 BHP shares for each Anglo share, post the unbundling of Kumba and Amplats. This offer could potentially increase, especially if competitors like Rio Tinto or Glencore enter the fray.

In conclusion, Anglo American's strategic management of commodity risks, coupled with its robust project pipeline and operational challenges, paints a complex but potentially rewarding picture for investors. As always, potential investors should monitor these developments closely, considering both the opportunities and the risks inherent in the commodity sector.

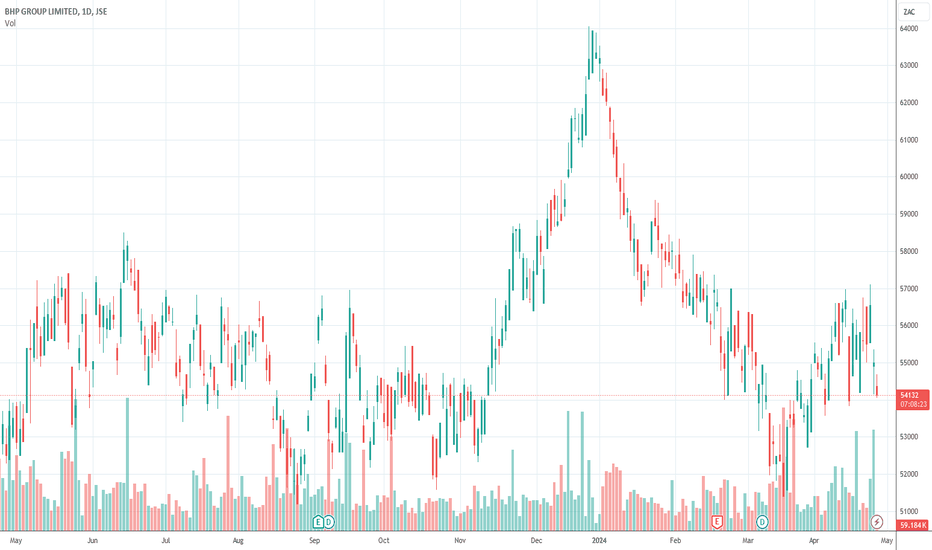

Our opinion on the current state of BHP(BHG)BHP is a global commodities company based in Melbourne, Australia, with a workforce of 62,000 employees predominantly in the Americas and Australia. It is engaged in the extraction and processing of minerals, oil, and gas. BHP's extensive operations include ownership stakes in some of the world's leading mineral resources.

BHP owns a significant 57.5% of the Escondida mine in Chile, one of the largest copper producers globally, which also yields gold and silver. It has a 33.75% stake in Antamina in Peru, known for its copper and zinc production. It fully owns Pampa Norte, which produces copper cathode in Chile's Atacama Desert. In Brazil, BHP holds a 50% share in Samarco, an iron ore producer, and a one-third interest in the Cerrejon coal mine in Colombia.

In Canada, BHP holds mineral rights in Saskatchewan, home to one of the largest unexploited potash deposits globally. In Australia, it owns the Olympic Dam, one of the largest bodies of copper, uranium, and gold ore in the world, and Western Australia Iron Ore, a system of five mines connected by over 1000km of railway lines. Additionally, BHP owns Queensland Coal, which includes the Mitsubishi Alliance and Mitsui Coal, and the Mt. Arthur coal mine in New South Wales. Its Nickel West operation in Australia includes a nickel mine with smelters, concentrators, and a refinery. In the petroleum sector, BHP possesses high-quality resources in the Gulf of Mexico, Australia, Trinidad, and Tobago.

For the six months ending on 31st December 2023, BHP reported a revenue increase of 6% but saw a significant drop in headline earnings per share (HEPS) by 48%. The company's tangible net asset value (NAV) decreased slightly from $8.91 to $8.68 per share. BHP highlighted strong performances at its iron ore operations in Western Australia and record copper production in South Australia and Chile. The company is also expanding its potash production capacity in Canada, illustrating its strategic growth initiatives.

Despite global commodity price volatility and varied demand across different markets, BHP noted healthy demand from China and a strong market in India. As of the nine-month report to 31st March 2024, BHP remains on track to meet its annual production targets for copper, iron ore, and energy coal, with copper volumes increasing by 10%.

The share price trajectory of BHP has been influenced by broader economic factors, including the commodity cycle. Since a sharp decline at the onset of the coronavirus pandemic, the share price had been on an upward trend until early 2024 when it faced challenges from falling commodity prices.

On 25th April 2024, BHP announced a significant move in making a share offer for the entire issued share capital of Anglo American, contingent on the unbundling of Amplats and Kumba. This strategic attempt could potentially initiate a bidding war with major industry players such as Rio Tinto and Glencore, highlighting BHP’s active role in industry consolidation.

BHP's portfolio, marked by its diversity and scale, positions it uniquely in the mining sector, though it remains susceptible to the inherent volatilities of the commodity markets. This backdrop frames BHP as a potentially lucrative yet fluctuating investment option, reflective of the dynamic nature of the global commodities industry.

Our opinion on the current state of CORONAT(CML)Coronation Fund Managers (CML) is a prominent asset management firm in South Africa, notable for being the only one of its kind listed on the Johannesburg Stock Exchange (JSE). Established in 1993, the company experienced significant growth until 2015, at which point the founding CEO resigned and Adrian Pillay took the helm. Despite Pillay's qualifications, his tenure has seen challenging times for Coronation, particularly due to investment missteps.

The firm faced substantial losses from investments in African Bank and Steinhoff, which significantly impacted its reputation and led to a reevaluation of its asset selection capabilities by the investment community. This scrutiny has resulted in a noticeable outflow of institutional funds, which is critical in a business heavily reliant on confidence and trust in judgment and expertise.

The asset management industry depends on maintaining a high level of trust with institutional fund managers, who must believe in the asset manager's decision-making abilities. This typically requires a team of highly qualified individuals with proven track records. However, even the most skilled teams can make errors that result in financial losses, as seen in Coronation's case.

Further complicating matters, on February 8, 2023, Coronation announced a lost appeal with the South African Revenue Service (SARS) regarding additional taxes, which may lead to the suspension of its dividend payments. This news sharply drove down the share price. For the fiscal year ending on September 30, 2023, the company reported a 2% decrease in revenue and a dramatic 50% decline in headline earnings per share (HEPS). With R602 billion under management, the firm also noted net outflows amounting to 10% of average assets under management (AUM). These outflows were attributed to a combination of industry-wide withdrawals from global emerging markets due to a decade of lackluster performance and the shrinking South African savings pool.

Looking ahead, in a trading statement for the six months ending March 31, 2024, Coronation estimated that HEPS would rebound to at least 190c compared to just 6.2c in the previous period, suggesting a possible recovery or stabilization.

Technically, Coronation's shares saw a significant rise from 2008 until peaking at R115 per share on December 30, 2014. Under new leadership, the share price has faced declines, particularly with the onset of COVID-19, and has continued on a downward trajectory, now moving sideways and downwards. The current price-to-earnings (P/E) ratio stands at around 16.31%, which might seem attractive, but the potential for further declines cannot be dismissed. Given this backdrop, a cautious approach would be advisable for potential investors. It is recommended to monitor the stock for a clear upward break from its long-term downward trend before considering investment, though such a shift does not appear imminent.

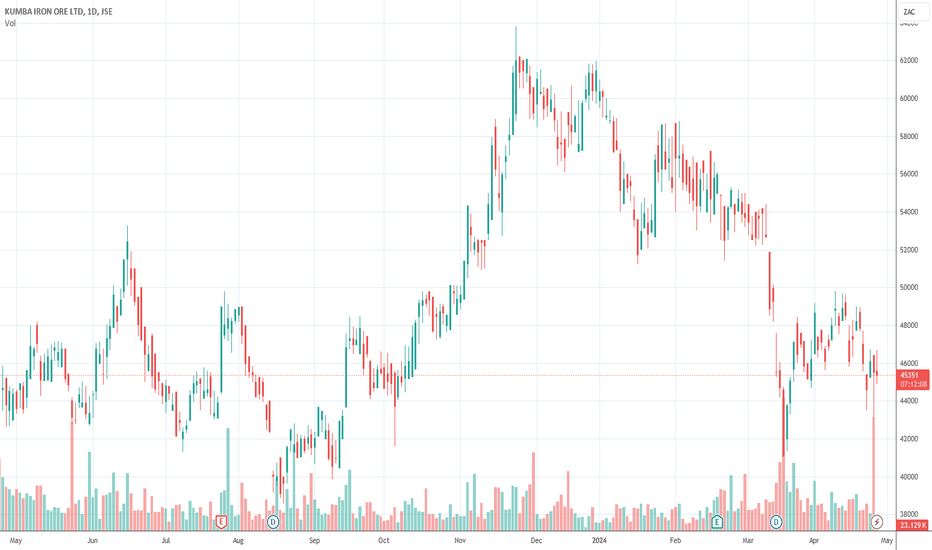

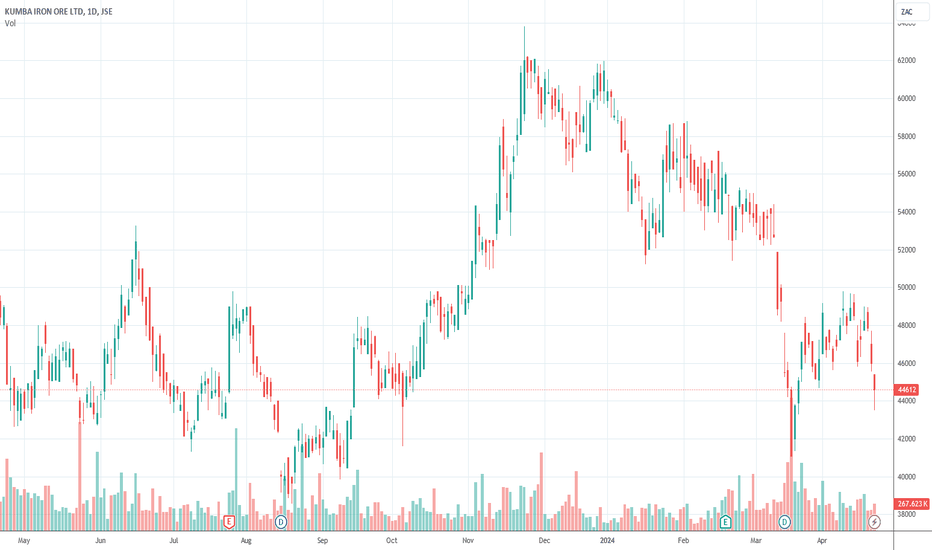

Our opinion on the current state of KUMBA-IO(KIO)Kumba Iron Ore (KIO), a subsidiary mainly controlled by Anglo American with a 79% stake, is one of the top iron mining operations, renowned for its substantial success in the industry. The company’s share price experienced significant volatility, dropping to R223 in March 2020 due to the COVID-19 pandemic, but it managed a strong recovery to R668 before facing another decline after the March 2022 quarterly results.

Kumba's business model heavily relies on exports, which constitute 94% of its total sales. This large percentage indicates that while the company is less dependent on the local South African market, it remains susceptible to fluctuations in the rand's value and logistical challenges related to rail transport to ports. In response to operational challenges and to lessen its dependence on Eskom, Kumba plans to construct a 100mw solar park over the next three years.

In October 2022, the company faced significant disruptions due to a force majeure declared by Transnet, leading to substantial production losses—estimated at about 50,000 tons per day initially, escalating to 90,000 tons after seven days. This incident severely impacted the company’s ability to meet its export commitments, resulting in considerable financial losses estimated at around $8.5 million per day in production and $11.7 million in lost export revenue.

Despite these challenges, Kumba reported a strong financial performance for the year ending 31st December 2023, with a 16% increase in revenue and a 26% rise in headline earnings per share (HEPS). The company achieved an average realized FOB export price of US$117 per tonne, which was 15% above the benchmark, and managed to reduce its C1 unit costs to US$41 per tonne, thanks to cost savings of R1.0 billion. These factors contributed to a resilient EBITDA margin of 53%, up from 50%, and a robust closing net cash position of R13.2 billion.

However, Kumba is considering reducing its workforce by 490 employees, indicating ongoing efforts to streamline operations and manage costs. For the first quarter ending 31st March 2024, Kumba reported a 2% decrease in total production and a 10% reduction in sales, primarily driven by a 12% decrease in production at the Kolomela mine. In contrast, production at the Sishen mine increased by 4%, supported by healthy buffer stocks.

The company's shares are currently trading at a price-to-earnings (P/E) multiple of 6.43 and offer a dividend yield of 8.23%. These figures suggest that while the investment presents risks associated with commodity price fluctuations and operational challenges, it also offers potential high returns through dividends.

Additionally, the ongoing offer by BHP to purchase Anglo American includes plans for the unbundling of Kumba. This proposal adds another layer of uncertainty regarding Kumba’s future, making it a potentially volatile but rewarding investment for those willing to navigate the complexities of the commodity market and corporate restructuring.

Our opinion on the current state of MC-GROUP(MCG)MultiChoice Group (MCG) is a prominent player in the African entertainment industry and stands out as one of the world's fastest-growing pay-TV broadcast providers. With a subscriber base of 21.1 million across 50 countries, the company's operations are split between South Africa, where it holds 42% of its subscribers, and the rest of Africa, accounting for the remaining 58%. Originally spun out of Naspers, MultiChoice was listed on the Johannesburg Stock Exchange (JSE) on 27th February 2019.

The structure of MultiChoice’s business is particularly attractive to private investors. The company’s revenue primarily comes from annuity income generated through debit orders from a diverse clientele, which provides a stable financial inflow. Furthermore, as a service company, MultiChoice does not require significant working capital nor does it need to maintain large inventory stocks, enhancing its operational efficiency.

However, MultiChoice faces potential challenges from regulatory changes and technological advancements. The Independent Communications Authority of South Africa (Icasa) is contemplating regulatory changes that could affect MultiChoice's dominance in the pay-TV market, particularly concerning its ability to secure exclusive sports broadcasting rights. Additionally, the widespread adoption of 5G and the availability of free online content could dilute the market share of traditional pay-TV services.

Despite these challenges, MultiChoice has shown resilience and adaptability. The COVID-19 pandemic, for instance, temporarily boosted demand for home entertainment, benefiting MultiChoice. Moreover, the company's strategic partnerships, such as those with Sky News and NBC Universal to enhance its Showmax service, demonstrate its commitment to staying competitive in a rapidly evolving media landscape.

For the six months ending on 30th September 2023, MultiChoice reported a slight decline in revenue and headline earnings per share (HEPS), which the company attributed to a contraction in its subscriber base and operational disruptions caused by load shedding in South Africa. Despite these setbacks, the company's robust base in the Rest of Africa continues to grow.

The corporate dynamics at MultiChoice have been further complicated by Canal+'s increased stake in the company, leading to a mandatory takeover bid. After initially rejecting Canal+'s offer as too low, MultiChoice eventually entered into a cooperation agreement to facilitate the takeover, reflecting the evolving corporate governance landscape within which the company operates.

In conclusion, while MultiChoice faces certain challenges from regulatory pressures and market competition, its strong subscriber base, strategic initiatives, and recent corporate developments suggest it remains a valuable investment. However, investors should remain cautious and consider the potential impacts of regulatory changes and market competition on the company’s future performance.

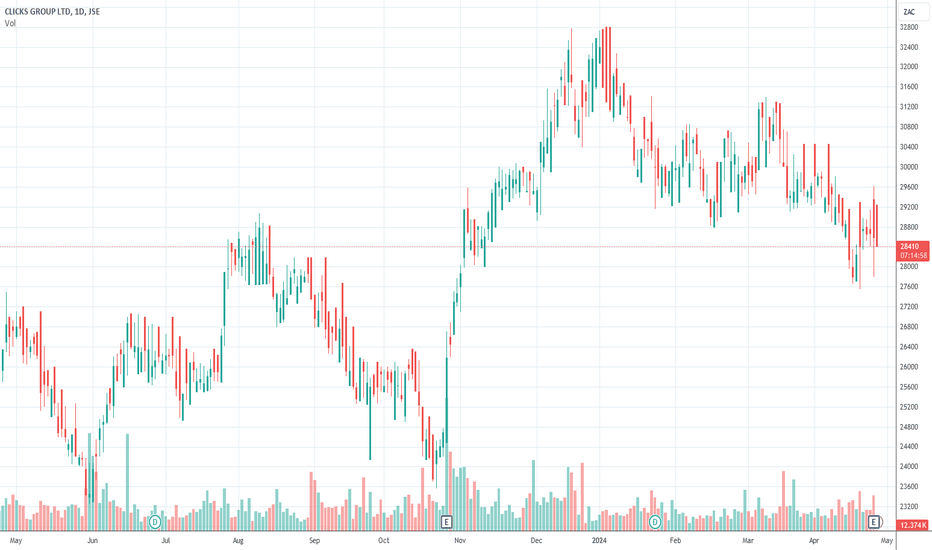

Our opinion on the current state of CLICKS(CLS)Clicks Group describes itself as a retail-led healthcare group, comprising its flagship brand Clicks, as well as GNC and The Body Shop. It operates 782 stores, 585 of which include pharmacies, making it the largest pharmacy chain in Southern Africa. Despite the increasing trend of retail outlets incorporating pharmacies, Clicks' main competitor remains the listed company, Dischem. A previous challenge for the group was its association with the fifty-nine Musica stores, which have now been closed.

On 10th May 2021, Clicks made a significant expansion by acquiring the pharmacy business of Pick n Pay, which included twenty-five pharmacies located within Pick 'n Pay stores. These pharmacies are being rebranded to Clicks, further solidifying its market presence. Historically, Clicks has shown remarkable stability and growth; the share price has surged by more than 2500% since its listing, significantly outperforming the JSE's average over the same period. This performance underscores Clicks as one of the top blue-chip shares on the JSE.

The company has demonstrated resilience, proving to be relatively recession-proof and continuing to deliver impressive results. For the six months ending on 29th February 2024, Clicks reported a 9% increase in turnover and a 13% rise in headline earnings per share (HEPS). The company highlighted a 14.1% growth in total income to R6.6 billion, driven by strong sales in higher-margin private label products and the beauty category, along with revenue from Sorbet franchise fees.

Despite its high price-to-earnings (P/E) ratio of 27.37, Clicks is viewed as an excellent medium-term investment, suitable for every private investor's portfolio. The share's consistent upward trajectory over the past 15 years resembles a line moving from the bottom left-hand corner of the screen to the top right-hand corner, illustrating its steady growth. Although the share price has experienced a slight decline since the beginning of 2024, this could present a favorable buying opportunity for investors.

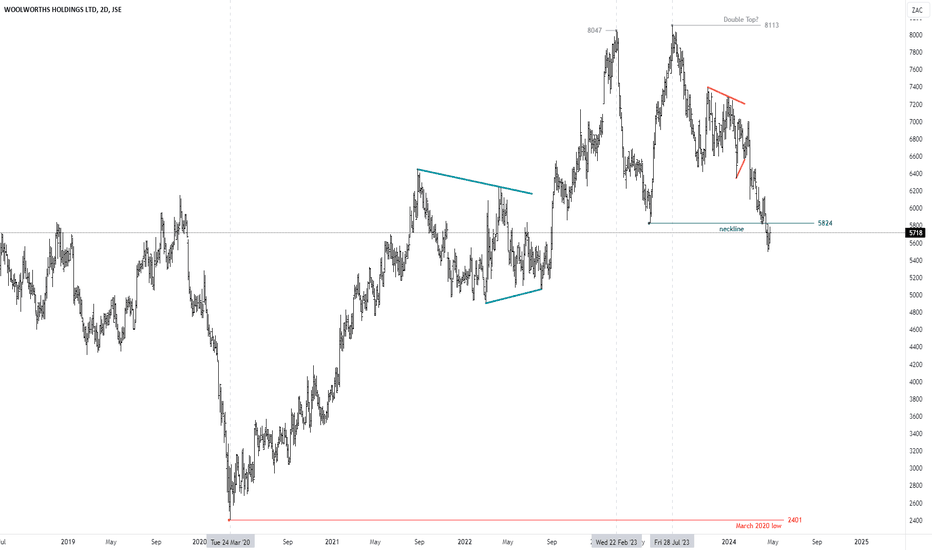

$JSEWHL - Woolworths: Double Top Neckline Breached!See link below for previous analysis.

Price has breached the 5824 neckline.

Now, there are two ways to interpret this pattern:

1- the tradition way; in this case this is a Double Top and the price target is 3600cps.

2- the Elliot Wave way; this is a flat and price can resume the uptrend.

The only certainty is uncertainty; this is the why it is key to think in probabilities.

I will sit on my hands and allow price to guide me.

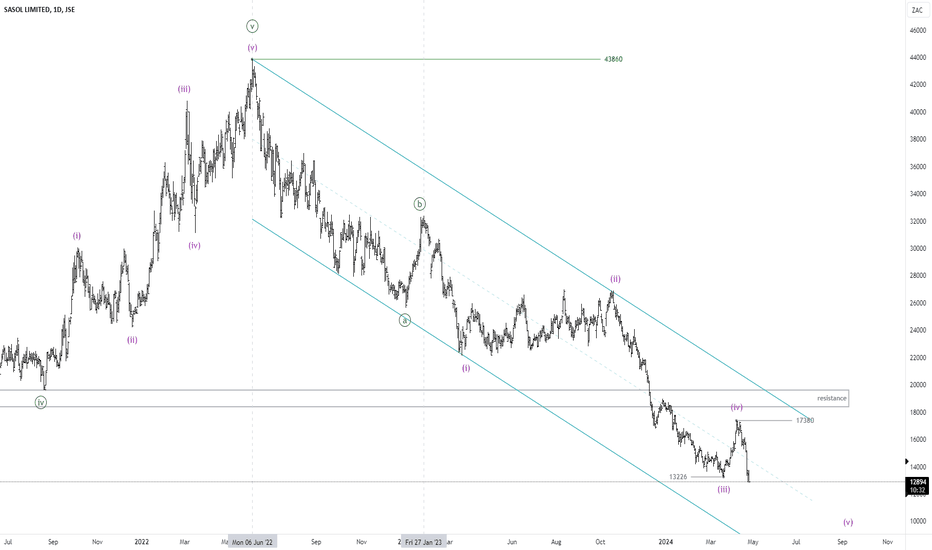

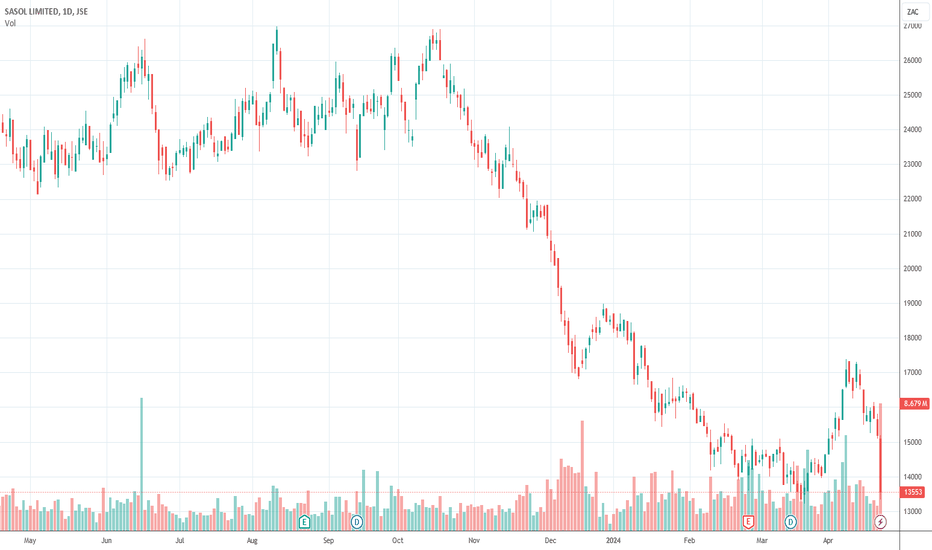

$JSESOL - Sasol: 13226 Gives Way, What Now?See link below for previous analysis.

Sasol did not take long to confirm that the down move was not complete.

The bounce from 13226 to 17380 is for wave (iv); the current sell-off is for wave (v) of .

The earliest indication that wave (v) is done will be a break above 17380.

It's a bit late to be bearish and at this mature stage of the trend, I am more interested in buying opportunities.

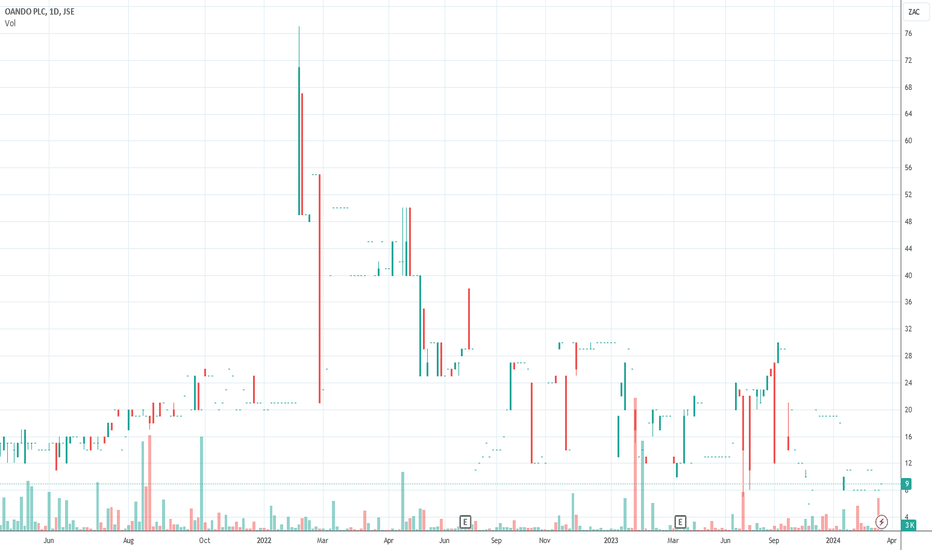

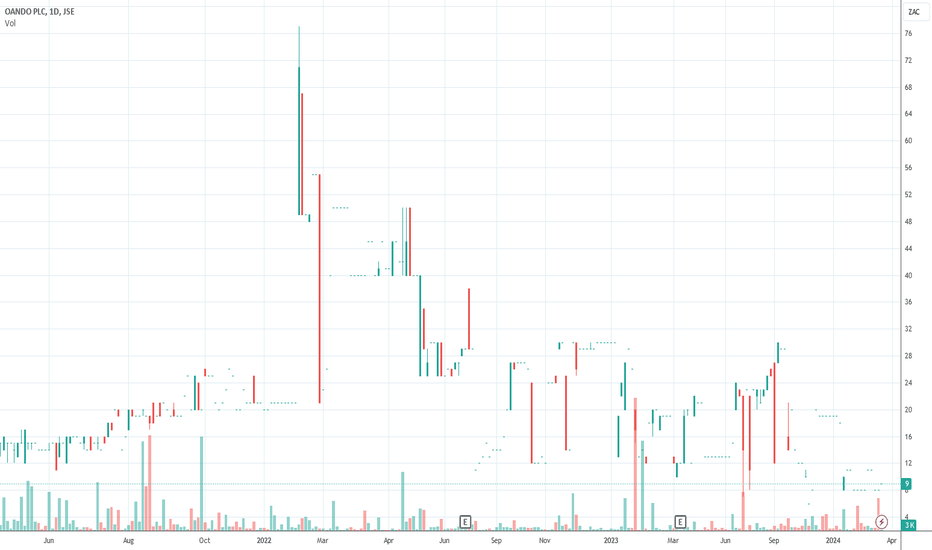

Our opinion on the current state of OANDO(OAO)Oando PLC (OAO) is an oil and gas company with significant operations in Nigeria and listings on both the Johannesburg Stock Exchange (JSE) and the Nigerian Stock Exchange. The company's shares present a high-risk investment profile for several reasons that are intrinsic to its operational context and the nature of its industry.

**1. Commodity Price Volatility:** As an oil and gas company, Oando's financial performance is heavily dependent on the fluctuating international prices of oil. This exposes the company to global market trends and economic cycles over which it has little control.

**2. Political and Economic Instability:** Operating primarily in Nigeria adds another layer of risk due to the country's political instability and economic fluctuations. This environment can affect operations and profitability through changes in regulation, fiscal policies, and other governmental actions that could impact the business.

**3. Thinly Traded Shares:** Oando’s shares are thinly traded, which can result in liquidity issues for investors. This means buying or selling shares without affecting the price can be difficult, potentially complicating entry and exit strategies for private investors.

**Recent Financial Performance:**

- **For the year ending 31st December 2020:** Oando reported a substantial after-tax loss of 141 billion naira, indicating a downturn in business performance with a 17% drop in turnover.

- **For the year ending 1st December 2021:** The company saw a reversal in fortunes, albeit on a much smaller scale, reporting a profit of 34.7 million naira.

- **For the year ending 31st December 2022:** The company returned to a loss, posting an 81.2 million naira deficit.

**Regulatory and Trading Issues:**

- On 3rd April 2024, Oando’s share trading was suspended on the JSE, pending the publication of its year-end results for 2022 and interim results for 2023, reflecting regulatory concerns and potentially significant issues in financial reporting or operational performance.

- Trading remains suspended as of the latest updates, with the share price last recorded at 9 cents.

Given these circumstances, Oando represents a highly speculative investment. The combination of high operational risks, political and economic instability in its primary region of operations, commodity price dependence, and recent financial performance makes it a precarious choice for private investors seeking stable returns.

Investors should exercise extreme caution, considering both the macroeconomic factors affecting the oil and gas sector and the specific challenges facing Oando. It is advisable to closely monitor developments related to the company’s regulatory issues, financial health, and the broader Nigerian political and economic environment before considering an investment in such a volatile entity.

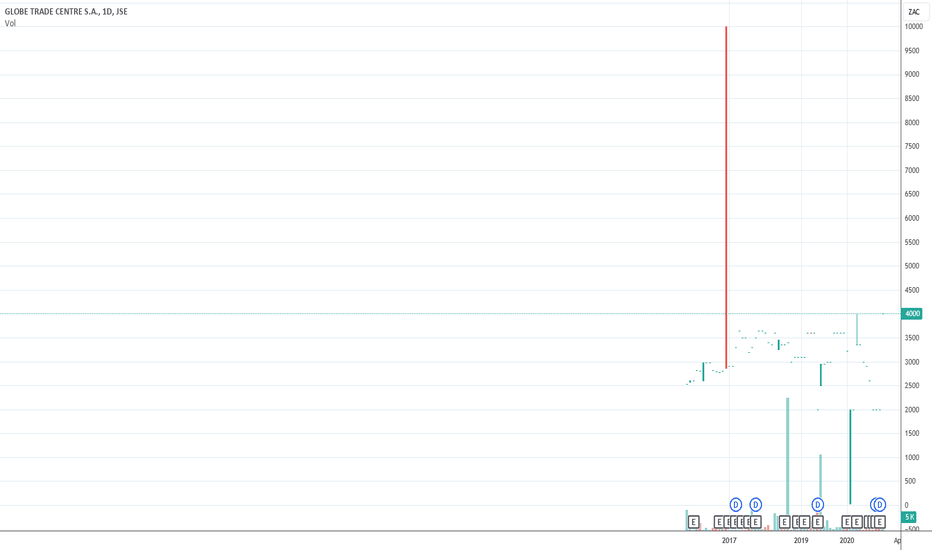

Our opinion on the current state of GTCSA(GTC)GTC, or Globe Trade Centre, is a significant player in the real estate market of Central and Eastern Europe, managing a substantial portfolio of properties across several key cities including Warsaw, Bucharest, Budapest, Belgrade, Sofia, and Zagreb. The company's operations encompass forty-seven office buildings and six retail properties, combining for a gross lettable area (GLA) of approximately 829,000 square meters. With assets valued around 2.35 billion euros, GTC plays a crucial role in the region’s property market.

The company is dual-listed, with shares available on both the Warsaw Stock Exchange (WSE) and the Johannesburg Stock Exchange (JSE). For the year ending 31st December 2023, GTC reported a 10% increase in rental revenue, reflecting a strong operational performance despite various market challenges. The loan-to-value (LTV) ratio stood at 49.3%, indicating a moderate level of debt used in financing the company's assets. This level of LTV shows that the company is leveraging its capital structure efficiently, balancing risk and growth effectively.

Occupancy rates were robust at 87%, a healthy indicator of the demand for GTC’s property offerings and management effectiveness in a competitive market. Additionally, the company concluded the year with a strong liquidity position, holding 60 million euros in cash. This financial health is crucial for sustaining operations and pursuing further growth opportunities.

Despite its operational successes and strategic market positioning, GTC faces a significant challenge regarding its stock's liquidity on the Johannesburg Stock Exchange. The shares are noted as being extremely thinly traded, which poses difficulties for private investors looking to buy or sell the stock without affecting its price significantly. This lack of liquidity can deter investment, as it may complicate entry and exit strategies for investors.

For those considering investing in GTC, it's important to weigh the solid operational performance and strategic asset portfolio against the potential trading challenges on the JSE. The company’s strong presence in a diverse range of key Eastern European markets, combined with its sound financial management, positions it well for future growth. However, the trading liquidity issue is a significant consideration that needs careful evaluation, particularly for those looking to engage in more flexible or short-term trading strategies.

Overall, GTC appears well-managed and positioned to capitalize on the growth opportunities in Central and Eastern European real estate markets. Prospective investors should keep an eye on developments that might increase JSE trading volumes or consider alternative ways to invest, such as directly on the Warsaw Stock Exchange where liquidity issues may be less pronounced.

Our opinion on the current state of COPPER360(CPR)Copper 360 is a company primarily focused on two aspects: processing historical mined copper rock dumps and mining surface and shallow copper resources. This dual focus not only targets copper production but also aims at environmental cleanup, which is increasingly significant in today’s mining industry.

The company has leveraged an extensive database acquired from major mining entities like Newmont and Gold Fields, who previously operated in the district. This strategic move has provided Copper 360 with valuable historical data that could enhance its exploration and production capabilities.

Financially, Copper 360 showed signs of improvement in its fiscal year ending 31st August 2023. Although still operating at a loss—R4.9 million—it marked a significant reduction from the R31.6 million loss reported in the previous period. This improvement was attributed to increased production and the end of major capital expenditures. Furthermore, the acquisition of Nama Copper Resources has poised the company to boost production while reducing execution build and delivery risks. The company has set an ambitious target for FY 2025 with an expected EBITDA of over R650 million and plans for major resource upgrades to enhance mining flexibility and growth.

In terms of funding, the company successfully raised R274 million on 21st December 2023 to support the acquisition of Nama Copper and to foster production growth at the Rietberg mine. Earlier, in February 2023, the company had also raised just under R100 million through a share sale, underscoring ongoing efforts to secure the capital necessary for expansion.

A notable strategic development was the memorandum of understanding signed with Far West Gold Recoveries in March 2024, indicating potential collaborations to leverage existing mining infrastructure and technology. This agreement aligns with the company’s disclosure that the dumps could contain up to 450,000 tonnes of copper metal, illustrating the significant untapped potential of its resources.

The recent production report from 24th April 2024 indicated that Copper 360 had produced 136 tons of high-grade copper concentrate (over 30%) from the Northern Cape, which showcases the quality of the extracted copper and the efficacy of their processing methods.

However, the company’s share price trajectory has shown volatility since its listing on 12th April 2023, with a noticeable drift downwards from the initial 500c to 371c. This performance may raise concerns about the company’s valuation and market confidence, especially given the inherent risks of the commodity market and the specific challenges of operational ramp-up in mining.

For investors, Copper 360 presents a high-risk, high-reward opportunity. While the company is making strides in increasing production and improving financial health, the fluctuating nature of commodity prices, the necessity of further capital, and the operational risks associated with mining startups make it a volatile investment. Prospective investors should approach with caution, closely monitor the company’s operational progress and market conditions, and consider waiting for more stability in the share price before committing capital.

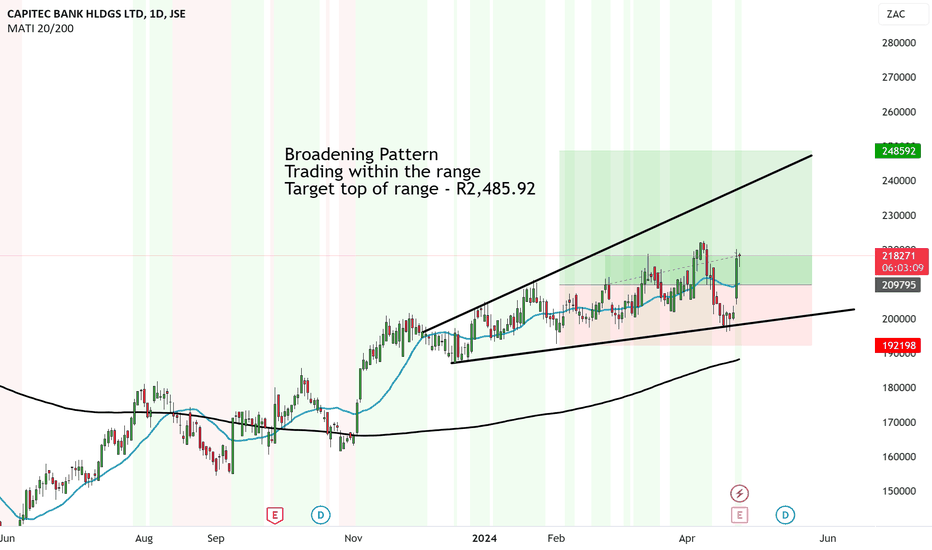

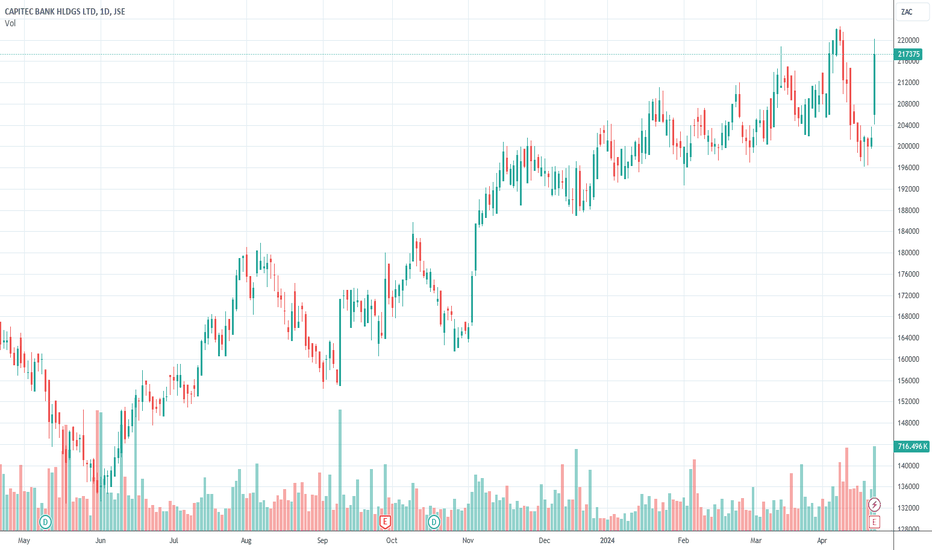

Capitec Vuvuzela with bullish bias & strong fundaments to R2,485Capitec has been in this Broadening Pattern (Vuvuzela) formation since November 2023.

It breaks into higher highs and lower lows. But the overall momentum and trend channel is up.

It will continue trading in this range until we get a breakout of the resistance or support. My bet is it will first trade to the top of the range at R2,485.92.

Capitec has always been the outlier compared to the other banks with very little correlation. WHen it does well, it runs up regadless what the bigger banks are doing.

Also fundamentally, it doesn't seem to follow suit with the Big 5.

Firstly, Capitec announced a substantial 15% growth in headline earnings, which reached R9.7 billion.

This increase was driven by growth across various sectors of the bank, including a notable 124% profit surge in its business banking sector and a significant increase in net lending, investment, and insurance income

Also, Capitec has been actively investing in innovative digital solutions and client rewards programs, which have contributed to its strong performance.

They introduced a variety of digital payment solutions like Apple Pay, Samsung Pay, and Google Pay with zero transaction fees, as well as their own secure online payment tool, Capitec Pay.

So ye, big up to an innovative unclipped wings bank like Capitec.

Our opinion on the current state of SASOL(SOL)Sasol, a prominent international chemicals and energy company based in South Africa, has its origins in the oil-from-coal technology developed during the apartheid era. The company is significantly influenced by fluctuations in the oil market, with about 50% of its profits directly linked to oil prices. Sasol's major growth initiatives include its 50% stake in the ethane cracker plant in Louisiana, USA, known as the "Lake Charles Chemical Project" (LCCP), and its expanding gas operations in Mozambique, where it has been granted licenses to explore an extensive area of about three thousand square kilometers.

Sasol is also noted for its substantial environmental footprint, being the largest producer of greenhouse gases in South Africa and one of the top 100 fossil-fuel companies contributing to global emissions. This position places Sasol under continual international pressure to effectively manage and reduce its carbon emissions.

The impact of COVID-19 initially led to a significant recovery in Sasol's share price, driven by rising oil prices. However, this recovery has been undermined by recent declines in commodity prices, particularly oil, which have adversely affected the company's financial performance. For the six months ending on 31st December 2023, Sasol reported a decrease in revenue from R149.8 billion to R136.3 billion, primarily due to lower chemical prices and weaker oil prices. The company experienced a 34% drop in headline earnings per share (HEPS) and a 2% decrease in net asset value (NAV).

Sasol's operations continue to be impacted by the volatile macroeconomic environment, characterized by fluctuating petrochemical prices and unstable product demand. Additional challenges include inflationary pressures and the underperformance of state-owned enterprises critical to Sasol's supply chain. Despite these challenges, Sasol has made some operational improvements in South Africa and has recently been successful in an appeal against environmental regulatory decisions that threatened its Secunda plant operations.

The company has also begun to diversify its energy sources, securing 550 megawatts of renewable energy, which aligns with its goals to reduce carbon emissions. However, production issues, particularly at the Secunda plant, led to a 9% drop in production in the quarter ending March 2024, prompting Sasol to revise its full-year production guidance for 2024 to between 6.9 and 7.1 million tons.

These developments have resulted in a sharp decline in Sasol's share price, which continues to trade well below its long-term downward trendline, reflecting the stock's high volatility and the broader uncertainties in the global commodity markets.

For investors, Sasol presents a complex case. While the company holds significant potential due to its strategic initiatives in the energy sector and its efforts to transition towards more sustainable operations, it remains highly susceptible to external economic and environmental factors. Potential investors should carefully consider the inherent risks associated with Sasol's dependency on global commodity prices and its ongoing challenges in operational and environmental compliance before making investment decisions.

Our opinion on the current state of OANDO(OAO)Oando (OAO) is a Nigerian oil and gas company that operates both within Nigeria and internationally, with listings on the Johannesburg Stock Exchange (JSE) and the Nigerian Stock Exchange. The company’s shares embody high risk for several reasons, primary among them being its exposure to the volatile oil market and the political instability in Nigeria.

Historically, Oando has faced significant challenges, including regulatory scrutiny and allegations of financial misconduct. In April 2018, trading of Oando's shares was suspended by the Nigerian Securities and Exchange Commission to allow for a forensic audit into allegations of corruption and insider trading. The outcomes of these proceedings have cast a long shadow over the company's reputation and operational stability.

Further complicating matters, on June 3, 2019, the Nigerian SEC ordered certain board members to resign and imposed fines on the company, which Oando contested in court. This situation mirrors issues faced by other companies in Nigeria, such as MTN, indicating a pattern of contentious relations between corporate entities and regulatory bodies in the country.

Financially, Oando has been under considerable pressure. In 2019, it was reported that the company's liabilities exceeded its assets, casting doubt on its ability to continue as a going concern. Although Oando reported a shift in corporate strategy to focus on dollar-earning assets, which included the sale of a significant stake in Axxela to Helios Investment Partners, its financial performance has been inconsistent. For the year ending December 2019, Oando posted a significant loss, and although there was a brief return to profitability in 2021, the company reported another substantial loss in 2022.

The trading of Oando’s shares has been marked by low volume, indicating a lack of investor confidence and liquidity. This situation was exacerbated when the JSE suspended trading of its shares in April 2024, pending the publication of its overdue financial results for 2022 and interim results for 2023. When the company finally published its 2022 results, it revealed yet another loss.

Given these circumstances, Oando represents a highly speculative investment with considerable risks associated with its financial instability, regulatory challenges, and the geopolitical environment within Nigeria. Potential investors should exercise extreme caution, considering the company’s history of volatility and the ongoing concerns about its financial health and regulatory compliance. The recommendation would be to avoid this stock unless one has a high tolerance for risk and a deep understanding of the Nigerian market’s complexities.

Our opinion on the current state of KUMBA-IO(KIO)Kumba Iron Ore (KIO) is a leading iron ore mining operation, primarily owned (79%) and controlled by Anglo American. The company's performance has been significantly influenced by global market dynamics and local operational challenges. The share price experienced a dramatic drop to R223 in March 2020 due to the COVID-19 pandemic but managed a robust recovery to R668 before experiencing a decline following the March 2022 quarterly results.

A critical aspect of Kumba's business model is its heavy reliance on exports, which constitute 94% of its total sales. This international focus exposes the company to fluctuations in the rand exchange rate and the efficiency of rail transport logistics to ports, which are vital for its export operations. In response to operational challenges, including dependency on Eskom for power, Kumba plans to develop a 100mw solar park over the next three years, aiming to enhance its energy self-sufficiency.

In October 2022, Kumba faced significant disruptions due to a force majeure declared by Transnet, resulting in substantial production and export losses. This event highlighted the vulnerabilities in its supply chain, significantly impacting its financial performance due to lost production and export revenues.

For the fiscal year ending 31st December 2023, Kumba reported a 16% increase in revenue and a 26% rise in headline earnings per share (HEPS). The company achieved an average realized FOB export price of US$117/tonne, which was 15% above the benchmark. Cost-saving measures contributed to a reduction in C1 unit costs to US$41/tonne, supporting a resilient EBITDA margin of 53%, an improvement from the previous 50%. The company also reported a strong closing net cash position of R13.2 billion.

Despite these financial strengths, Kumba is considering 490 retrenchments as part of its operational adjustments. The first quarter of 2024 saw a 2% decrease in total production and a 10% reduction in sales, primarily due to a 12% decrease in production at the Kolomela mine. Conversely, production at the Sishen mine increased by 4%, buffered by healthy stock levels throughout the value chain.

Kumba's shares currently trade at a price-to-earnings (P/E) multiple of 6.3 and offer a dividend yield of 8.39%. These metrics suggest that the investment may offer reasonable compensation for the inherent commodity risk and the volatility associated with being a rand-hedge share. However, potential investors should consider the risks of operational dependencies and global market sensitivities that could affect Kumba’s performance. Overall, while Kumba Iron Ore presents potential for strong returns, especially via dividends, it remains subject to significant operational and market risks that require careful consideration.

Our opinion on the current state of CAPITEC(CPI)Capitec Bank (CPI) stands as a formidable presence in the South African banking sector, having significantly disrupted the market since its inception by PSG. Known for its customer-centric model, Capitec has successfully attracted a vast client base, primarily serving the previously unbanked segments of the population. This approach has enabled it to become the country's largest bank by customer numbers, boasting 21.1 million clients.

Capitec's strategy of offering accessible and affordable banking solutions has been instrumental in its ability to capture retail market share from traditional banks. Its innovative offerings, such as adding approximately 90,000 funeral policies every month, underscore its commitment to addressing the diverse needs of its clientele.

The bank's performance has been robust, with an impressive average annual growth in headline earnings per share (HEPS) of 32.2% over the past 19 years. This growth trajectory highlights Capitec's effective management and strong market positioning. Despite holding less than 10% of the retail deposit base—a reflection of its focus on lower living standards measure (LSM) levels—Capitec continues to expand its influence in the financial sector.

A significant development in Capitec's corporate strategy was the unbundling of its holding by parent company PSG, a move aimed at unlocking shareholder value. Additionally, Capitec's commitment to broad-based black economic empowerment (BBBEE) was demonstrated through its plan to distribute approximately R1 billion worth of shares to long-serving staff, initiated on 19th January 2022. Although this move led to a temporary dip in share price due to expected dilution, it reflects a long-term investment in employee stakeholder engagement and equity.

For the fiscal year ending on 29th February 2024, Capitec reported a 16% increase in HEPS and a return on equity (ROE) of 26%. The bank also grew its number of active clients by 10% to 22.2 million. Notably, non-interest income significantly contributed to the earnings growth, comprising 72% of income from operations after credit impairments. This shift towards non-interest income is a strategic move that diversifies revenue streams and reduces dependence on traditional interest-based income.

The stock has been on an upward trajectory since June 2023, currently trading at a price-to-earnings (P/E) ratio of 23.7. While this is higher than the JSE Overall index and other leading banks, Capitec's strong fundamentals, consistent performance, and strategic market positioning justify this premium.

In conclusion, Capitec remains a compelling investment within the South African banking sector. Its innovative approach to banking, combined with significant growth and strategic expansions, position it well for continued success. Investors should consider accumulating shares on any market weakness, taking advantage of Capitec's potential for long-term growth and value creation.

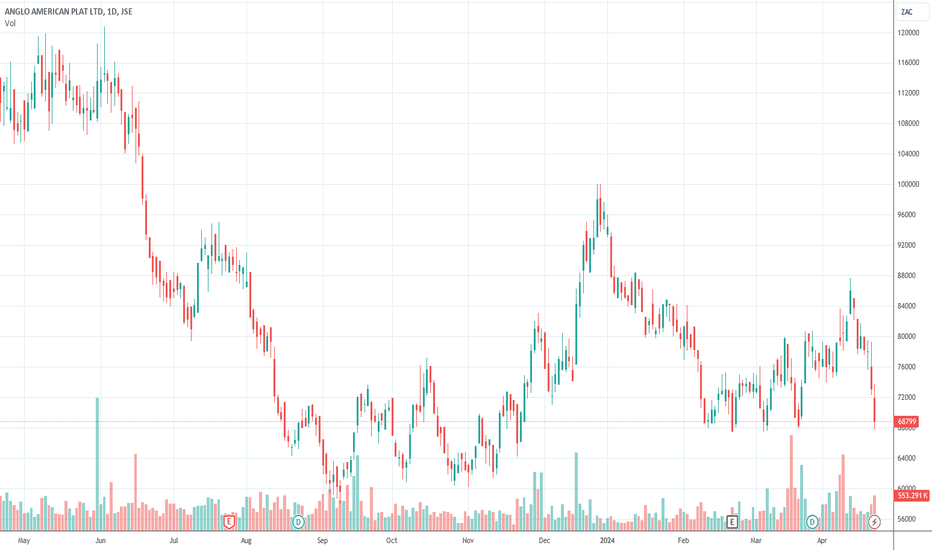

Our opinion on the current state of AMPLATS(AMS)Anglo American Platinum (Amplats or AMS) stands as the second-largest platinum producer globally, under the majority ownership (77.62%) of Anglo American. In recent years, Amplats has strategically shifted from deep-level mining to more economical and mechanized methods, significantly reducing its operational footprint from 18 mines to 7. This transition has notably cut overhead costs and the workforce by 50%, enhancing operational efficiency and profitability.

Amplats' flagship Mogalakwena operation, known for its palladium-rich deposits, operates within the lowest cost quartile of the platinum group metals (PGM) industry worldwide. A planned expansion at this site is expected to significantly increase platinum and palladium output, reinforcing the company's strong position in the PGM market.

Additionally, Amplats has consolidated its mining interests by acquiring Glencore’s 40.2% stake in the Mototolo mine and the adjacent Der Brochen property for R1.5 billion. This acquisition allows Amplats to expand the Mototolo mine into Der Brochen without additional surface infrastructure, optimizing production and resource use.

However, the platinum industry faces challenges from an effective recycling industry, which recovers approximately 2 million ounces annually from old auto catalysts, potentially impacting demand for newly mined platinum. Despite this, Amplats remains a leading choice among PGM shares on the Johannesburg Stock Exchange (JSE), though it is subject to the inherent volatility and unpredictability of commodity stocks.

In December 2021, Amplats announced a significant R3.9 billion investment to extend the life of the Mototolo/De Brochen mines beyond 30 years, underscoring its commitment to long-term production sustainability. However, the company faces potential unrest with plans to relocate 1,000 families to boost production at Mogalakwena, highlighting the social challenges associated with mining operations.

Financially, the year ending 31st December 2023 was challenging for Amplats. The company reported a slight decrease in refined PGM production and a significant 26% drop in the rand basket price per ounce, contributing to a 24% decline in revenue and a 71% fall in headline earnings per share (HEPS). Factors such as Eskom's load curtailment adversely impacted production, although this was partially offset by releasing concentrate stocks.

Looking ahead to the first quarter of 2024, PGM production decreased by 7%, while sales volumes remained unchanged, indicating ongoing operational challenges. Amplats continues to face industry-wide issues such as load shedding and declining commodity prices, which have pressured the share price since March 2022.

Given these dynamics, potential investors should approach Amplats with caution. The company's performance and stock price are heavily influenced by fluctuating international prices for PGMs and operational challenges. Investors are advised to look for a clear upward trend before considering entry, as indicated by the recent suggestion to watch for a break through the downward trendline for more favorable investment conditions. Additionally, the announced potential retrenchment of 3,700 employees in February 2023 could further affect the company’s operations and stock performance.

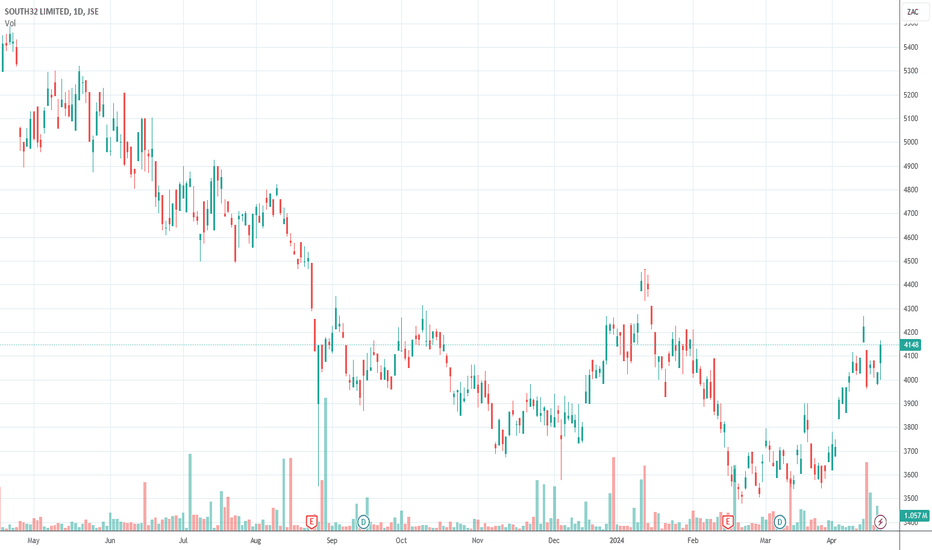

Our opinion on the current state of SOUTH32(S32)South32 (S32) is a major player in the global mining sector, initially spun off from BHP Billiton in 2015 to manage BHP's South African coal assets. Today, it stands as a diversified miner involved in the extraction of base metals and minerals like zinc, coal, aluminium, silver, lead, nickel, and manganese, with operations extending across South Africa, South America, and Australia.

Significant strategic shifts have been a hallmark of South32's operational strategy. In a notable move, the company divested its South African coal assets, which primarily supplied Eskom, to Seriti as of 1st June 2020. This divestiture is part of a broader trend where South32 is reducing its exposure to South Africa, citing administrative and legislative uncertainties. This sentiment is mirrored in comments by CEO Graham Kerr, who has expressed reservations about mining exploration in South Africa until the mining charter is finalized.

Concurrently, South32 has enhanced its investment in base metals through the acquisition of the remaining 83% of Arizona Mining, not previously owned. This acquisition is strategic, considering Arizona Mining's rich portfolio in zinc, manganese, and silver, which Kerr described as "one of the most exciting base metal projects in the world."

Financially, South32 has faced challenges with its revenue down 20% for the year ending 30th June 2023. However, headline earnings per share (HEPS) stood at 22.6 cents (US), a decrease from the previous year's 59.5 cents. Despite this downturn, the company has reported strong production growth in commodities crucial for a low-carbon future, achieving record production levels in aluminium, base metals, and manganese.

Continued operational updates through 2023 and into 2024 reveal a company adapting to market demands and environmental considerations. Notably, South32 plans to transition its Hillside smelter to renewable energy sources and reduce dependence on Eskom over the next decade. This is part of a $1.4 billion share buy-back plan, indicating confidence in the company's value and future.

Recent production updates have been mixed, with stable guidance overall but specific challenges such as the impact of hurricane Megan on its Australian manganese operations. The company's share price has mirrored the volatility in the commodity markets, showing resilience post-COVID19 but facing declines as commodity prices fell since March 2023.

In conclusion, South32 remains a robust entity in the mining sector with a strategic focus on diversification and sustainability. It offers significant potential for investors looking to engage with a company actively transitioning towards commodities that support a low-carbon future while navigating the complexities of global and regional mining landscapes.

Our opinion on the current state of ORIONMIN(ORN)Orion Minerals (ORN) is an Australian-based exploration company, also listed on the Johannesburg Stock Exchange and the Australian Stock Exchange in Sydney. It focuses on the development of its copper and zinc assets in Prieska, South Africa. This mine, formerly operated by Anglovaal, ceased operations in 1990 after two decades of extracting significant quantities of zinc and copper concentrate. One of the critical challenges Orion faces at this site is managing the flooding that has occurred since the mine's closure.

Orion is planning a revival of the Prieska mine with a mechanized and minimal labor strategy. Additionally, the potential development of a smelter by Vedanta Resources, which operates the nearby Gamsberg mine, could provide essential support to the entire mining region, including potential inputs from Namibia. This smelter would be instrumental once Orion commences the substantial task of pumping out nearly 9 million cubic meters of water from the mine to begin production, anticipated to start in 2024.

Exploration and mining carry inherent risks, making them some of the most volatile investments on the JSE. Orion's venture into this field is particularly precarious, as evidenced by its fluctuating financial performance and the nature of penny stocks. On the funding front, Orion has taken significant steps, securing R34.5 million from the Industrial Development Corporation (IDC) for a 43.75% stake in its new Okiep copper mining operation and a R250 million line of credit for further project development.

For the six months ending 30th June 2023, Orion reported a consistent loss of A$15.2 million, with a slight improvement in its headline loss per share. The company has emphasized the role of the IDC as a strategic funding partner, underlining the critical support it receives for its flagship projects in Okiep and Prieska.

Recently, Orion announced a major discovery in its Okiep Copper Project, reporting a "Spectacular High-Grade Copper Intercept" that significantly impacted its share price, propelling it from 19c to 24c. This news highlights the potential upsides of investing in mining explorations, despite their inherent risks.

Investors considering Orion should be cautious, given the company's history of losses and the overall volatility associated with mining stocks. While the recent discovery could offer considerable upside, the general advice would be to maintain a strict stop-loss level to manage potential risks effectively. This strategy is crucial in navigating the highs and lows typical of the mining sector, especially for companies like Orion, which operate on the frontier of resource extraction.

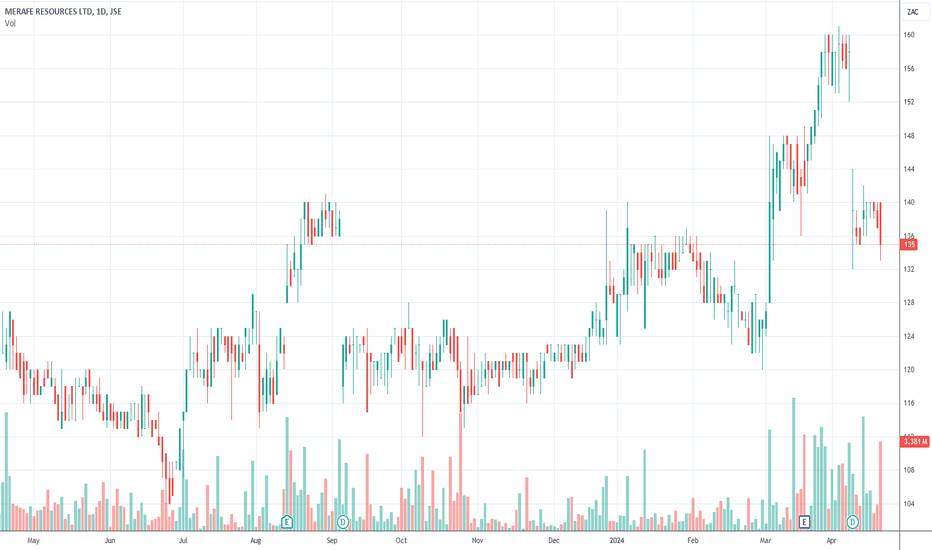

Our opinion on the current state of MERAFE(MRF)The Glencore-Merafe joint venture, a significant player in the ferrochrome industry, operates mines, furnaces, and smelters predominantly in Mpumalanga and Limpopo, South Africa. This joint venture is one of the largest ferrochrome producers globally, with the capacity to produce up to 2.3 million tons of ferrochrome annually. Merafe Resources, as part of this partnership, receives 20.5% of the proceeds, with the majority stake held by Glencore.

One of the critical challenges facing the operation is the electricity supply. Ferrochrome smelting is energy-intensive, and the recent increases in electricity tariffs by Eskom—15.6% last year and an additional increase of just under 10% from 1st April 2022—have significantly impacted operational costs. Furthermore, concerns about Eskom's ability to provide sufficient power have led to the suspension of their Lion 3 expansion project, indicating the severity of the energy challenges.

Operational difficulties extend beyond energy, with issues also arising in logistics, specifically the availability of Transnet trains to transport their products, which is another bottleneck affecting the venture's efficiency.

Despite these challenges, the financial performance for the year ending 31st December 2023 showed a revenue increase of 16% and a slight improvement in headline earnings per share (HEPS), rising from 56.4c to 60.1c. Merafe reported a record profit of R1.753 billion during a tough economic period, supported by high demand and supply constraints in the chrome market, although ferrochrome itself saw weaker demand and lower sales volumes.

Looking ahead to the first quarter of 2024, the company noted a significant reduction in chrome production, approximately 26%, primarily due to the non-operation of the Rustenburg smelter in response to market conditions. This adjustment reflects the broader challenges within the ferrochrome market and the impact of global economic shifts.

In terms of stock performance, the share price of the joint venture peaked at 192c on 4th April 2022 but has experienced a general downward trend since, with a brief rally in September 2022. Recently, the share found some support at 104c, showing a slight upward trend, though the recovery was short-lived, underscoring the share's volatility.

Overall, while the Glencore-Merafe joint venture operates in a sector with robust potential, given the global demand for stainless steel, it faces significant operational and market challenges. These include not only energy and logistical issues but also the broader economic conditions affecting commodity prices and demand. As such, it remains a volatile commodity share, susceptible to both external market forces and internal operational challenges. Investors interested in this sector should be mindful of these risks and consider the broader economic indicators that influence commodity markets.