Our opinion on the current state of CASHBIL(CSB)Cashbuild is the leading retailer in Southern Africa for building materials and hardware, primarily focusing on the home improvement market. The company's growth strategy in the region, characterized by slow economic activity, primarily revolves around expanding its store footprint. This expansion is viewed as a positioning strategy to capitalize on any potential recovery in the broader economic environment of Southern Africa.

For the six months ending on 24th December 2023, Cashbuild reported a modest revenue increase of 2%, but experienced a significant reduction in headline earnings per share (HEPS), which decreased by 20%. Additionally, the company's net asset value (NAV) declined by 16% to 7757 cents per share. These financial indicators reflect the challenging conditions in which Cashbuild operates. The company noted that while revenue from pre-existing stores (312 stores existing before July 2022) saw a slight increase of 1%, the nine new stores also contributed a 1% increase to total growth. However, despite stable gross profit levels, the gross profit margin percentage decreased from 25.3% to 24.7%. This margin contraction was alongside a modest selling price inflation of 3.2% as of December 2023 compared to the previous year.

In its update for the third quarter ending 31st March 2024, Cashbuild continued to report revenue growth, albeit limited to 3%, with the nine new stores again contributing 1% to this growth. Selling price inflation was slightly lower at 2.4%. These figures suggest ongoing efforts to manage costs and pricing in a tight economic context.

From a technical perspective, Cashbuild’s shares have experienced significant volatility. The stock was on a downward trend from March 2018, hitting a low in March 2020 at R120 per share. It then saw a substantial rise to R337 in February 2021, before entering another downward trend. Currently priced at R143.50, the stock trades at a P/E ratio of 13.29 and offers a dividend yield of 3.66%.

Despite Cashbuild's strong management and strategic positioning to leverage any economic upswing, the company operates in a highly competitive sector that demands continual adaptation to market forces and consumer behavior. Although the share price has seen declines, making it more accessible, it still presents as somewhat pricey given the broader market conditions. Potential investors should weigh the robust management against the operational challenges and market position before considering an investment, especially in light of the competitive pressures and economic uncertainties prevailing in Southern Africa.

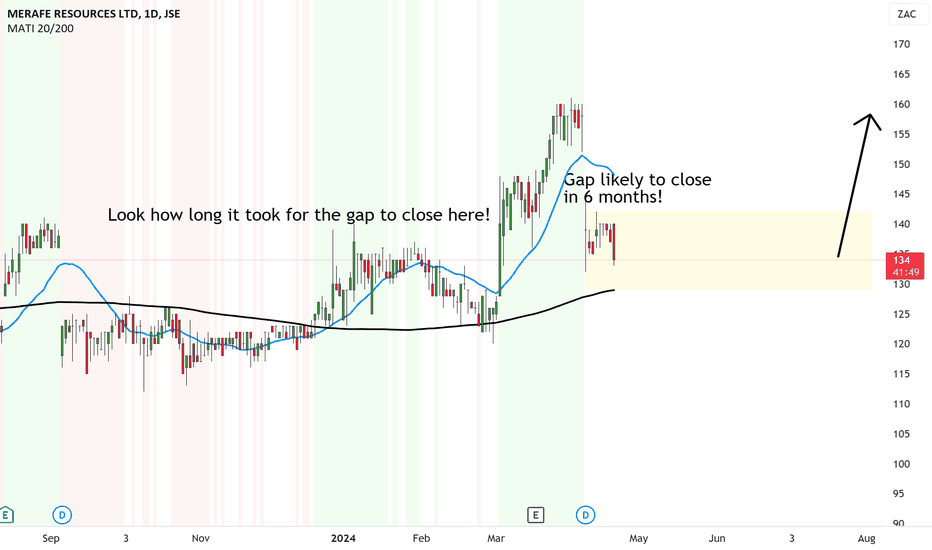

Merafe Dividend messed up analysis to the upside of R2.00What a difference a dividend makes!

The payment went out on the 15 April 2024, and because there are derivatives that traders can trade off - the algorithm droped the share price quite significantly.

I don't think this company should be providing such high dividends if it wants growth in the share price, but hey I'm just the guy behind a computer.

So last time, we saw a Dividend release in September, it took 6 months for the share price to make it's way up and close the gap.

Now it is likely for the same thing to happen.

This is not a technical analysts haven type market because fundamentals trump the price action.

But overall, I guess shareholders are remotely happy for their income distribution and in the long run Merafe will one day hit R2.00 :D

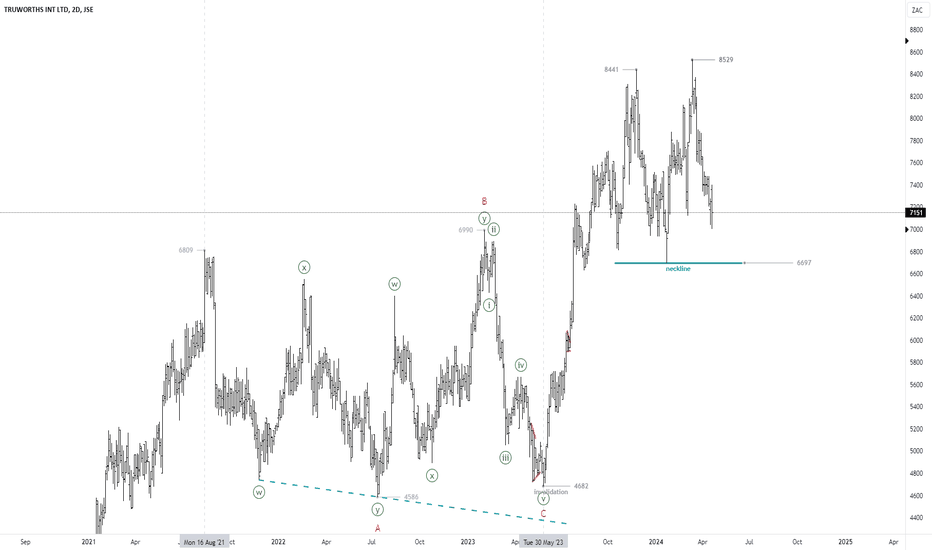

$JSETRU - Truworths: Potential Double Top AlertSee link below for previous analysis.

Truworths has met resistance in the 8441 to 8529cps zone.

Though premature to call this a Double Top, how price action reacts around the 6697cps neckline will hold the key for the short-term outlook.

I am neutral for now.

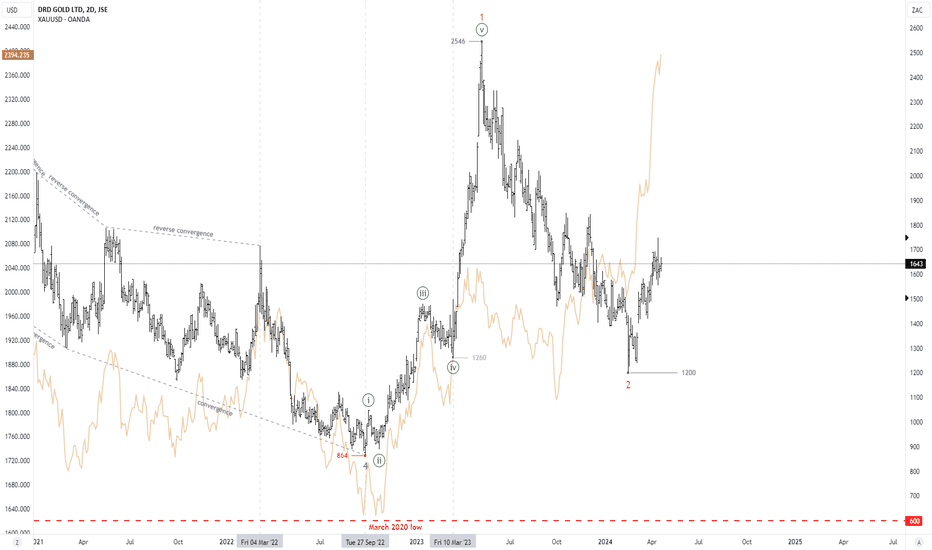

$JSEDRD - DRD Gold: Will The Laggard Play Catch-Up?See link below for previous analysis.

Gold and JSE Gold gold stock have been on a strong run lately.

DRD clearly did not get the memo as the stock is trending up but very slowly comapared to its peers and with the tailwinds provided by the gold price.

When such a disconnect occurs, one needs to take a deep look into the fundamentals which is beyond the scope of this analysis.

From an Elliott Wave perspective;

The bull run from 864 to 2546 cps is in five wave for wave 1.

The bear from 2546 to 1200 is for wave 2.

The current rally is the early stage of wave 3.

I will maintain a bullish stance above 1200 though with low conviction.

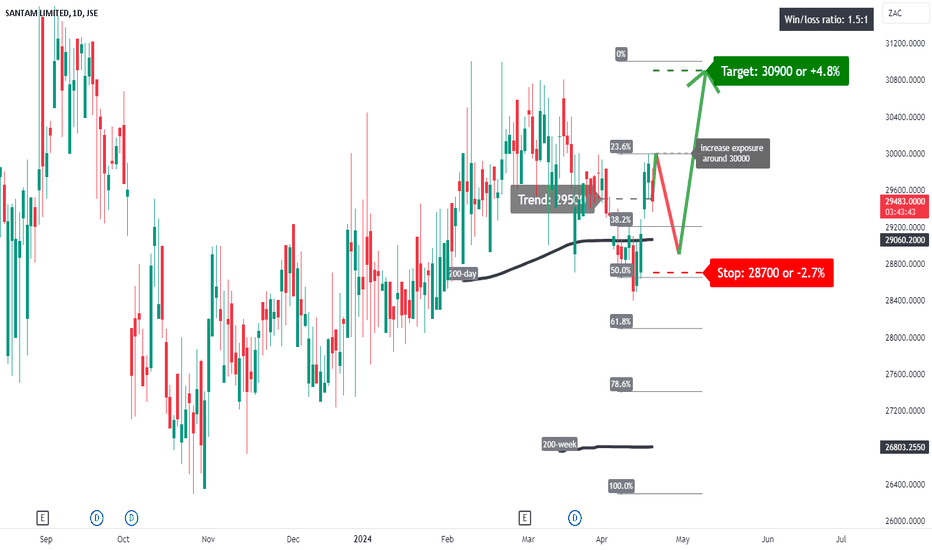

SNT: some upside potential?A price action above 29500 supports a bullish trend direction.

Increase long exposure for a break above 30000.

The target price is set at 30900 (its 100% Fibonacci retracement level).

The stop-loss price is set at 28700 (its 50% retracement level).

Remains above its 200-day and a correction to its 200-day simple moving average will be regarded as an opportunity to increase long exposure.

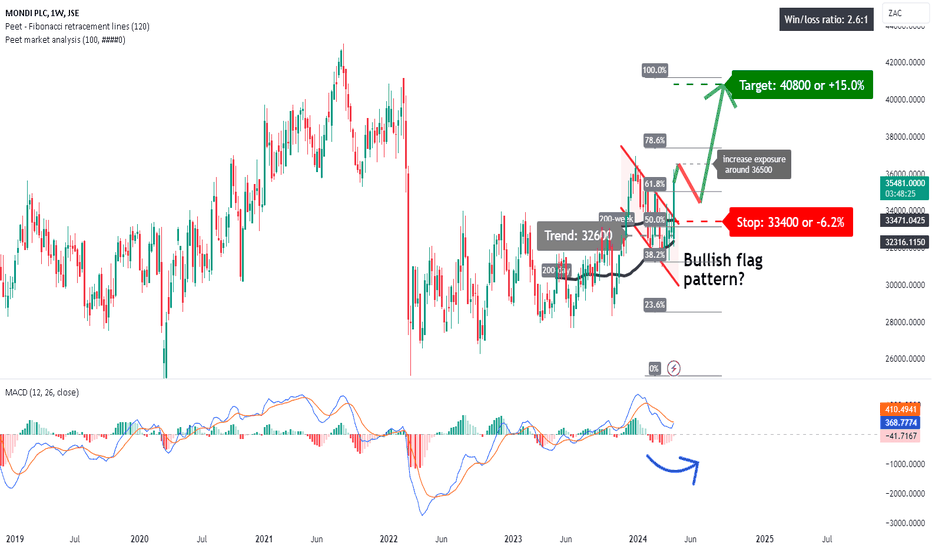

MNP: bullish flag pattern?A price action above 32600 supports a bullish trend direction.

Increase long exposure for a break above 36600.

The target price is set at 40800 (its 100% Fibonacci retracement).

The stop-loss price is set at 33400 9its 50% retracement and also its 200-week simple moving average.

Keep in eye out for the MACD bullish crossover that might support the bullish flag pattern.

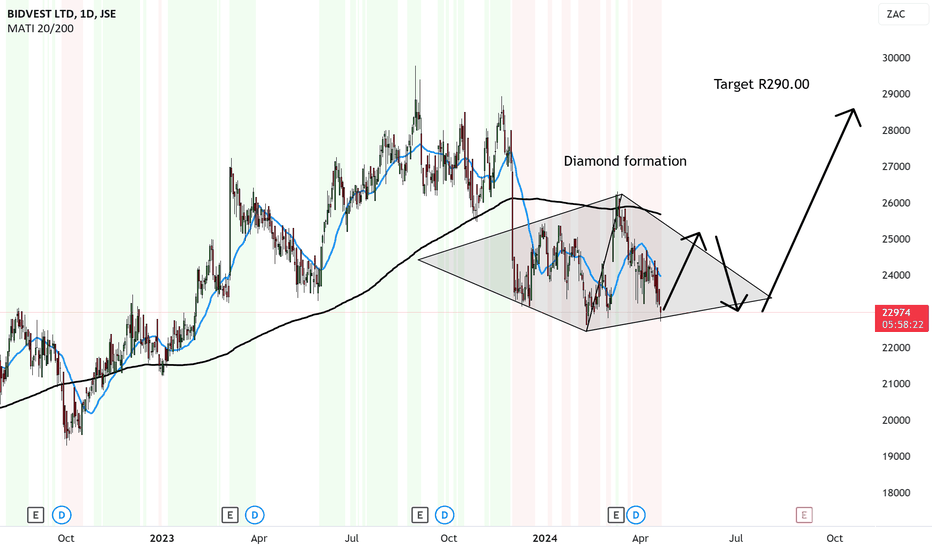

Bidvest in resting mode until the big breakout up to R290.00Bidvest has been moving in a sideways consolidation pattern called a Diamond Pattern since November 2023.

This is where there is a tug of war between the bulls and the bears.

BUt the fact that the price is holding quite well despite the international market crashes, means the buyers are holding the stock strong.

It will most like need a few more weeks/months for the pattern to play out. But once it breaks above the consolidation, we can easily see the price head up to R290.00

It's a patience game for Bidvest.

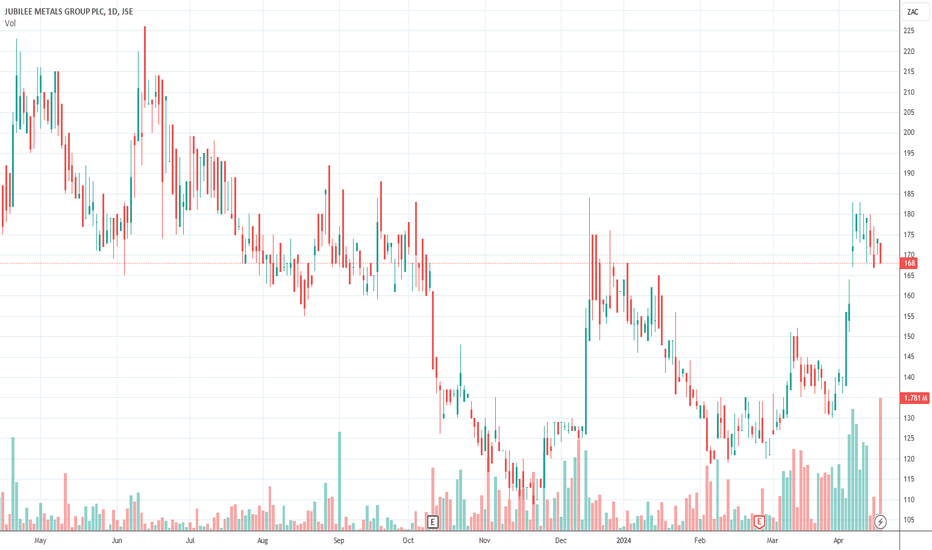

Our opinion on the current state of JUBILEE(JBL)Jubilee Metals Group (JBL) is a distinguished player in the metals recovery industry, primarily focused on the reprocessing of mine waste and surface materials. The company is listed on the London AIM market and the Johannesburg Stock Exchange's Alt-X. Its geographical footprint spans across South Africa, the UK, Madagascar, Australia, and includes a joint venture in Zambia, underscoring its international operations and strategic diversification.

Jubilee primarily produces platinum group metals (PGM) and chrome. One of its significant assets is a 63% stake in the Tjate project on the Western limb of the Bushveld Igneous Complex, which is noted for being the world's largest undeveloped block of platinum ore with an estimated potential of 65 million ounces. Despite the high potential of this asset, in recent years, Jubilee has shifted its focus towards smelting and beneficiation as a strategic move to enhance cash flow and operational sustainability.

In a recent expansion of its operations, Jubilee invested approximately R154 million to consolidate its PGM retreatment business. This investment was directed towards acquiring a chrome processing operation and approximately 1.8 million tons of tailings from PlatCro Minerals, further bolstering its resource processing capabilities.

Jubilee's financial performance for the six months ending on 31st December 2023 demonstrated significant growth, with an 18.4% increase in revenue. PGM production rose by 11.2%, and chrome production increased by 7.4%. The company also reported strong growth in its Zambian copper operations, driven by ongoing investment in expansion projects and an anticipated sharp increase upon the completion of upgrades to the Roan copper concentrator.

The first quarter of 2024 saw Jubilee achieving record monthly chrome production of 408,710 tons, a substantial increase from 381,114 tons in the previous quarter. However, PGM production experienced a slight decline of 3.6% year-to-date. Despite this, Jubilee remains optimistic about its capacity for continued growth and operational success, as reflected in its latest quarterly update.

Jubilee Metals Group's strategic approach to resource recovery and beneficiation, combined with its international diversification and focus on low-cost production, positions it as a compelling option within the mining sector. However, potential investors should be aware of the inherent volatility and risks associated with the commodity markets and the specific challenges of metal recovery operations.

On 12th December 2023, Jubilee announced the acquisition of one of the largest dumps of copper waste in Zambia, which notably increased the share price by 19%. The company's share price trajectory recently confirmed a positive shift as it broke through the long-term downward trendline on 8th April 2024 at 171 cents per share, suggesting a potential bullish trend in the near term. Despite the promising aspects, the investment in Jubilee Metals should be approached with caution, considering the fluctuating nature of commodity prices and the specific challenges facing the mining and metals recovery sectors.

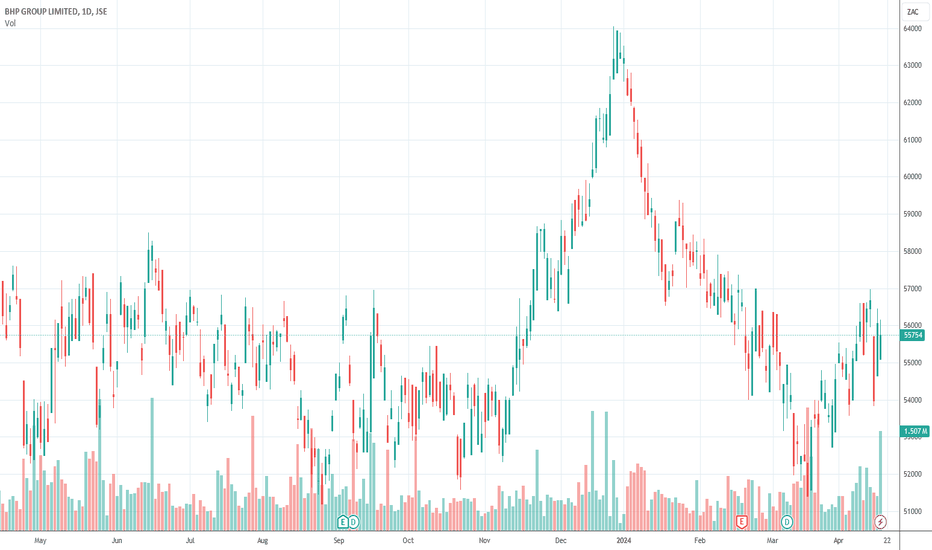

Our opinion on the current state of BHP(BHG)BHP Group, headquartered in Melbourne, Australia, stands as one of the largest and most diversified global commodities companies. With operations primarily in the Americas and Australia, BHP employs around 62,000 people and engages in the production of essential commodities such as copper, iron ore, coal, oil, and gas.

Among its notable assets, BHP holds a 57.5% stake in the Escondida mine in Chile, the world's largest copper producer, which also yields gold and silver. It also owns significant shares in other major mining operations such as the Antamina mine in Peru, producing copper and zinc, and the 100% owned Pampa Norte, which produces copper cathode in Chile's Atacama Desert.

In Brazil, BHP owns 50% of the Samarco mine, known for its iron ore production. It also holds a one-third interest in the Cerrejon coal mine in Colombia, one of the largest open-cut coal mines in the world. In Canada, BHP holds rights to one of the world's largest unexploited potash deposits in Saskatchewan.

BHP's Australian operations are extensive, including the Olympic Dam, one of the largest deposits of copper, uranium, and gold globally. The Western Australia Iron Ore operation consists of a network of five mines connected by over 1,000 kilometers of railway, reinforcing its status as a major player in the iron ore market. Additionally, BHP owns Queensland Coal, which includes the Mitsubishi Alliance and Mitsui Coal, and the Mt. Arthur open-pit coal mine in New South Wales. Its Nickel West operation in Australia includes a fully integrated mine with smelters, concentrators, and a refinery.

In the petroleum sector, BHP possesses high-quality resources in the Gulf of Mexico, Australia, Trinidad, and Tobago, which complements its solid minerals portfolio.

For the six months ending on 31st December 2023, BHP reported a revenue increase of 6% despite a 48% drop in headline earnings per share (HEPS). The company's tangible net asset value (NAV) slightly decreased from $8.91 to $8.68 per share. BHP noted operational highlights, including record production in copper at its operations in South Australia and Chile, and strong performance in Western Australia's iron ore sector. Furthermore, BHP is expanding its potash production capacity in Canada, illustrating its ongoing strategic growth initiatives.

Looking at the nine months to 31st March 2024, BHP remains on track to meet its production targets for copper, iron ore, and energy coal. This reflects robust performance and favorable ore grades, particularly highlighted by increased copper volumes from operations in South Australia and Chile.

BHP's performance is intricately linked to global commodity prices, making its shares subject to significant volatility. Despite this, the company has shown resilience, managing to recover from the impacts of the coronavirus pandemic with a strong upward trend in its share price since March 2020, though it has faced challenges with falling commodity prices starting in 2024. As a major player in the global commodities market, BHP's fortunes are closely tied to the overall health of the global economy, with specific attention to demand from regions like China and India. As such, while BHP is positioned for long-term growth, investors should be mindful of the inherent volatility associated with the commodities sector.

Our opinion on the current state of OCEANA(OCE)Oceana Group, Southern Africa’s largest fishing business, holds a prominent position in the industry with a significant presence not only locally but also in the United States through its subsidiary, Daybrook Fishing. The company's broad product range includes canned fish, fish meal, fish oil, hake, mackerel, lobster, and squid. Oceana is dual-listed on the Johannesburg Stock Exchange (JSE) and the Namibian Stock Exchange, reflecting its substantial market reach.

The business is heavily regulated, subject to government-issued quotas, which can fluctuate due to policies such as Black economic empowerment. Additionally, operations are significantly impacted by weather conditions, which can affect catch sizes and operational efficiency.

For the six months ending 31st March 2023, Oceana reported impressive financial results, with revenue up 48% and headline earnings per share (HEPS) increasing by 123%. The company attributed this strong performance to its diversified portfolio across different species, geographies, and currencies. High initial inventory levels of canned fish, fishmeal, and fish oil, coupled with robust demand for canned fish and favorable pricing for fish oil, helped the company navigate challenging operating conditions.

In its trading update for the 11 months up to 27th August 2023, Oceana noted an 8% increase in Lucky Star canned fish sales volumes, though there was a 5% decrease in US landings of fish. Horse mackerel sales remained stable. Looking ahead to the six months ending 31st March 2024, Oceana estimated that HEPS would rise by 89% to 99%. This forecasted growth is primarily driven by higher sales volumes of fishmeal and fish oil by Daybrook, along with strong pricing for fish oil in US dollars, and enhanced canned food sales from the Lucky Star brand.

The company's share price has been on an upward trajectory since July 2022, currently trading at an earnings multiple (P/E) of around 9.62. This valuation suggests that Oceana is well-regarded as a solid blue-chip stock, although its exposure to environmental factors and regulatory changes introduces a degree of volatility.

Oceana's strategic direction includes exploring opportunities in aquaculture. However, the company faces constraints due to competition regulations within South Africa. This limitation has prompted considerations for potential acquisitions outside of South Africa to bypass these restrictions and expand its operational footprint.

Noteworthy corporate developments include the resignation of PWC as its external auditor in May 2022 and the acquisition of a secondary listing on the A2X exchange as of 27th March 2023. These actions reflect ongoing adjustments in its corporate governance and market engagement strategies.

In summary, Oceana Group presents as a robust investment with potential for significant growth, underscored by a strong operational base and strategic market positioning. However, potential investors should be mindful of the inherent risks due to regulatory, environmental, and market volatility factors.

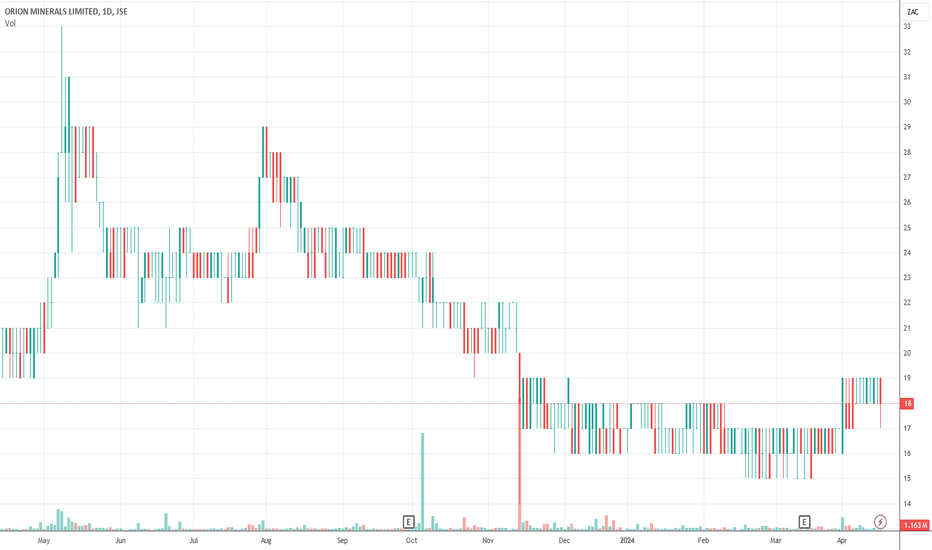

Our opinion on the current state of ORIONMIN(ORN)Orion Minerals (ORN) is an Australian-based exploration company dual-listed on the Johannesburg Stock Exchange (JSE) since September 2017 and the Australian Stock Exchange in Sydney. The company focuses on revitalizing the Prieska copper and zinc mine, which was previously operated by Anglovaal and ceased operations in 1990 after two decades of active mining, yielding significant quantities of zinc and copper concentrate.

Orion is exploring opportunities to reboot the Prieska mine using a mechanized approach that minimizes labor, aiming to address the main challenge of flooding that has plagued the mine. This ambitious project involves pumping out nearly 9 million cubic meters of water from the mine’s flooded infrastructure. Production is optimistically slated to begin in 2024.

In addition to these efforts, Vedanta Resources, operating the adjacent Gamsberg mine, is considering the development of a smelter that would potentially service the entire regional mining sector, including potential resources from Namibia. This development could provide significant synergistic benefits to Orion's operations if realized.

On the financial front, Orion has taken significant steps towards funding its initiatives. On 8th September 2022, the company secured R34.5 million from the Industrial Development Corporation (IDC) for a 43.75% stake in its new Okiep copper mining venture. Subsequently, on 21st October 2022, Orion secured a R250 million line of credit with the IDC. These moves demonstrate a robust partnership with the IDC, which has become a strategic funding ally for Orion’s flagship projects, including both the Okiep Copper Project and the Prieska Copper Zinc Mine.

Despite these strategic advances, Orion remains a high-risk investment. For the six months ending 30th June 2023, the company reported a consistent loss of A$15.2 million. The headline loss per share slightly improved to 31c from 33c in the previous period. Furthermore, the company has recently updated its mineral resource estimates for the Prieska Copper Zinc Mine (PCZM), increasing the resource estimate to substantial new levels, which suggests potential for future development.

As of 30th September 2023, Orion reported having $15.74 million in cash, indicating a solid liquidity position to support its immediate operational needs. However, the recent announcement on 17th April 2024 regarding the acquisition of the Okiep mineral rights and a subsequent halt on trading due to a material announcement about exploration results at the Okiep copper mine indicates significant ongoing developments and potential volatility.

Investors considering Orion Minerals must weigh the high-risk nature of mining exploration against the potential for substantial returns if Orion successfully navigates the considerable operational and financial challenges ahead. Caution is advised, with the implementation of a strict stop-loss strategy to manage potential losses, given the volatile nature of the stock and the exploration sector it operates within.

Our opinion on the current state of INSIMBI(ISB)Insimbi Group is engaged in the manufacturing and supply of specialist products within the industrial sector. Their operations encompass sourcing, buying, packaging, processing, and recycling of ferrous and non-ferrous alloys, refractory and foundry materials, as well as plastic blow-moulding and injection moulding. The group also offers technical support to users of their products, which adds a service dimension to their primary manufacturing and supply operations.

In their financial update for the six months ending 31st August 2023, Insimbi reported a revenue decline of 4% and a decrease in headline earnings per share (HEPS) by 6%. The company attributed these results to challenging operating conditions, though it noted that price fluctuations in key commodities like copper, aluminium, nickel, and steel had somewhat balanced out. Despite these challenges, revenue was largely maintained at over R3 billion, a slight decline compared to the same interim period in 2022, with operating profit falling by 9%.

Looking ahead, Insimbi issued a trading statement for the year ending 29th February 2024, forecasting a substantial reduction in HEPS, anticipated to be between 50% and 60% lower than the previous period. This significant expected drop in earnings highlights ongoing operational challenges and possibly continued volatility in commodity prices which directly impact their business model.

From a technical analysis perspective, Insimbi’s share price has seen considerable fluctuations over the years. The stock was on an upward trend until June 2018, but it then fell to a low of 50c by December 2020. The share price saw a recovery, climbing to a high of 139c in June 2023, before entering another downward trend. These movements suggest a volatile stock, heavily influenced by external market conditions and internal operational factors.

Given the company's exposure to the fluctuating prices of commodities, Insimbi’s performance is intrinsically linked to the broader economic conditions, particularly within South Africa. A recovery in the South African economy could potentially benefit Insimbi, yet the stock remains a high-risk investment due to its susceptibility to market cycles and commodity price changes. Additionally, with an average daily trading volume of around R29,000, the share is considered marginal for investment by private investors due to liquidity concerns, which could make entry and exit positions more challenging to manage.

In conclusion, while Insimbi may stand to gain from an economic upturn, potential investors should carefully consider the risks associated with its commodity-dependent business model and relatively low liquidity in the market.

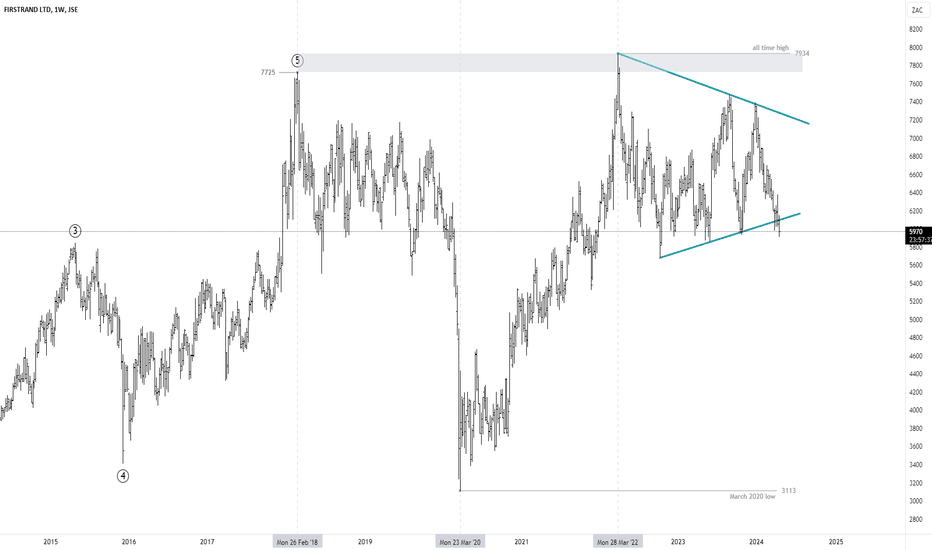

$FSR - FirstRand: At An Interesting JunctureSee link below for previous analysis.

FirstRand has found the 7700-8000cps zone hard to push through.

The two sell-offs at this zone give what can be viewed as a Double Top.

Price has recently been consolidating in a contracting triangle which now looks to be breaking down.

The trend looks bearish and my initial target is 5000cps.

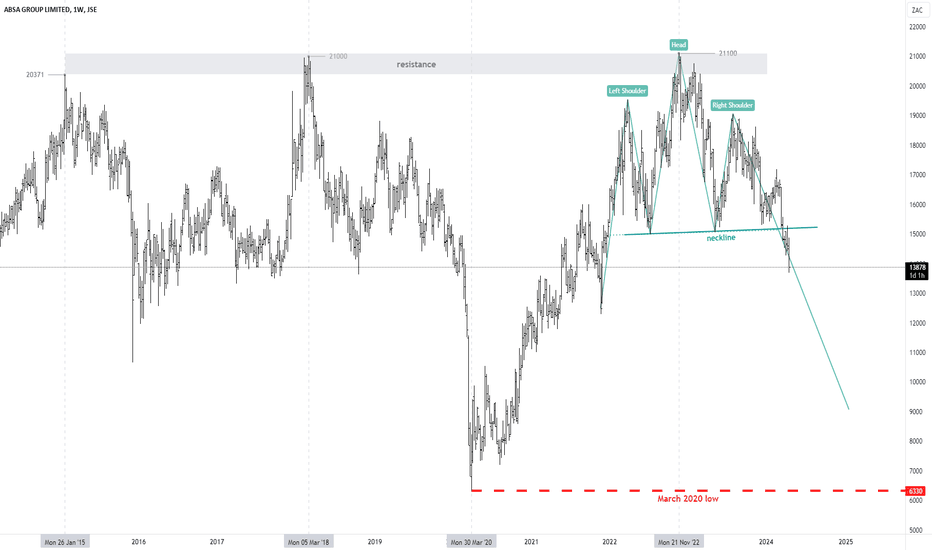

$JSEABG - ABSA: Heavy Resistance + Head & Shoulders = BearishSee link below for previous analysis.

A look at the bigger picture of ABSA shows that the stock has a very strong resistance zone between 20371 to 21100cps.

The stock has tested this zone on three occasions giving what can be viewed as a Triple Top over 7 years.

Interestingly, the bull market from March 2020 has culminated in a textbook Head & Shoulders pattern which has recently been validated by a break below the neckline.

The traditional Head & Shoulder price target is around 9000cps.

*Price tends to fail in reaching the traditional approximation.

The trend is clearly bearish.

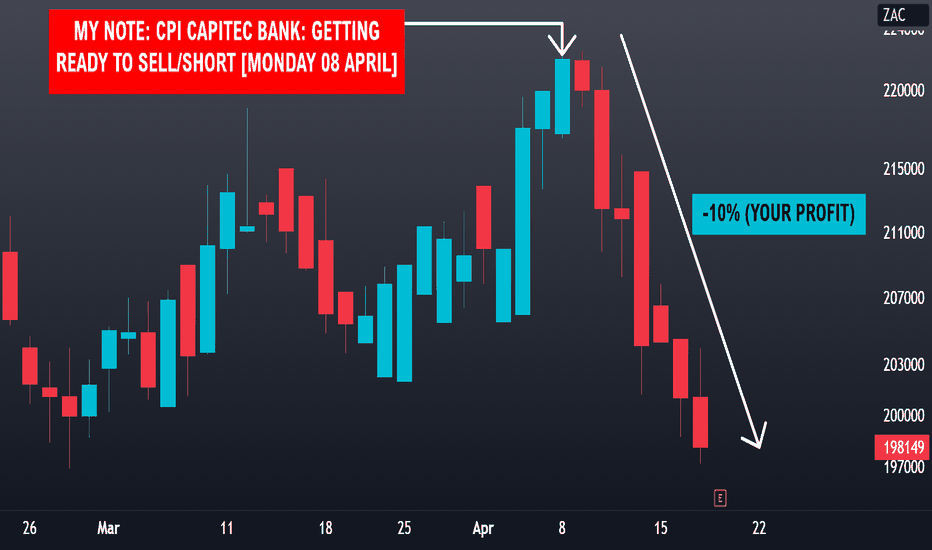

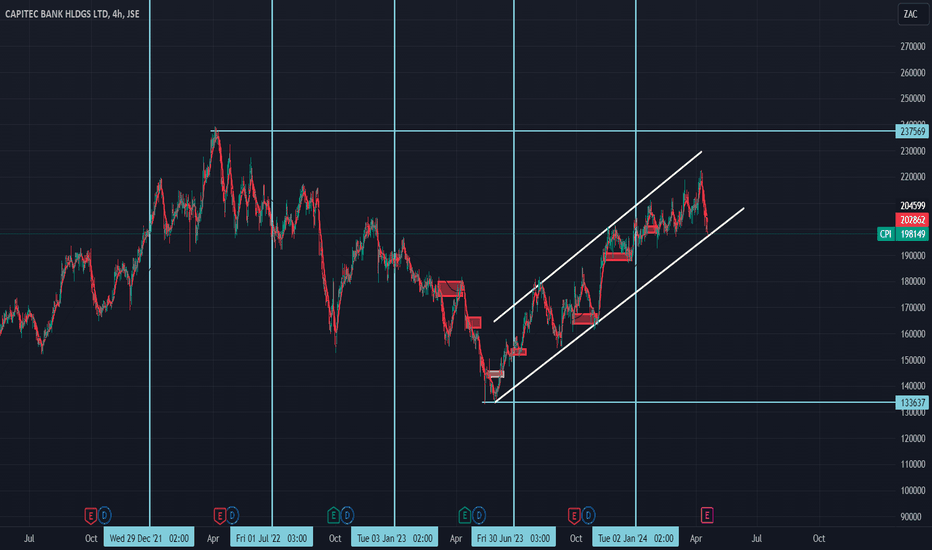

CPI - In The MoneyThe chart below highlights the performance of Capitec Bank, which has declined by over 10% since last week's research note where clients were to a pending sell/short.

Included in my note was the following:

1. Weekly Chart highlighting the potential price path.

2. The TTG as of Friday's close.

3. The 7-day Technical Trend Rating shows the share as trading in overbought territory.

4. The 7-Week Technical Trend Rating shows the share as trading in 'high bullish momentum/approaching overbought' territory.

5. A common valuation metric for banks is Price-to-book. As of Friday's close, Capitec trades at 6.48x vs substantially lower levels for it's peer group.

Biggest micro lender could be hurt by the dollar (short)South Africa's biggest micro lender could be hurt by the dollar and global uncertainty around the world since the banks make profit from people paying back loans and putting in deposits, people deposit less when everything in the economy becomes expensive because savings lags when compared to current state of the value of money and the purchasing power people have. This year financial stocks could also be hurt by the uncertainty that comes with elections also the policies that the new or current leadership of the country could choose to implement.

Our opinion on the current state of AFRIMAT(AFT)Afrimat, an open-pit mining company based in Southern Africa, has developed a robust reputation for its diverse supply of composites, construction materials, and other commodities to various industries. Historically one of the best performing shares on the Johannesburg Stock Exchange (JSE) until the end of 2015, Afrimat has navigated through periods of economic turbulence, including the COVID-19 crisis, and demonstrated resilience in a fluctuating commodities market.

The company reached a notable high of R76 on April 6, 2022, but since then, its share price has experienced a decline, coinciding with the downturn in the commodities cycle. Afrimat has, however, strategically insulated itself from the broader difficulties facing the construction industry through its acquisition of the Demaneng iron mine in the Northern Cape. This acquisition underscores Afrimat’s approach to mitigating sector-specific risks and stabilizing its earnings.

Further diversification efforts have seen Afrimat expanding into other base minerals such as manganese, chrome, and coal. The CEO, Andries van Heerden, has emphasized the company's proactive strategy in acquisitions, which has been a significant component of its growth. Notable acquisitions include a non-binding interest in Unicorn Capital Partners for an anthracite mine, the purchase of Coza Mining, which is involved in mining for iron and manganese, and the acquisition of the Gravenhage manganese mine in the Kalahari Manganese Field for $45 million plus an additional R15 million. The company also acquired Glenover Phosphate for R550 million.

On March 20, 2022, Afrimat transitioned its listing from the Basic Materials Construction and Materials sector to the General Mining sector on the JSE, reflecting a more accurate representation of its business operations. This was followed by the strategic acquisition of the construction materials company Lafarge for $6 million, demonstrating Afrimat's continued expansion and consolidation within the industry.

Financially, Afrimat has shown strong performance, with a report for the six months to August 31, 2023, indicating a revenue increase of 9.6% and a rise in headline earnings per share (HEPS) by 4.4%. The company's net asset value (NAV) also increased by 10.8% to 2750c per share. Afrimat maintains a strong balance sheet with a significant net cash balance and a favorable debt-to-equity ratio, highlighting its financial health and operational efficiency.

Looking forward, Afrimat provided a trading statement estimating that HEPS for the year ending February 29, 2024, would rise by between 21% and 26%. This forecast suggests continued financial improvement and operational success.

Despite the general decline in commodity prices, which has impacted shares across the sector, Afrimat's well-diversified business model and low debt levels position it as a valuable investment. The recent approval from the Competition Commission for its acquisition of Lafarge further strengthens this position. With a price-to-earnings (P/E) ratio of 13.44, Afrimat presents as a reasonably priced investment, particularly for those looking to capitalize on opportunities within the mining and materials sector.

Our opinion on the current state of PURPLE(PPE)Purple Group (PPE) operates as a dynamic trading platform and asset management company focused predominantly on the private investor market in South Africa. The company stands out for offering the lowest trading fees on the Johannesburg Stock Exchange (JSE), making it a compelling choice for budget-conscious investors. Its operational model is divided into three primary segments:

1. **Easy Equities**: This division democratizes investing by allowing the purchase of fractional shares at exceptionally low costs. For example, purchasing R100 worth of shares costs just 64c, making it accessible even for those with minimal investment capital. This platform has proven especially popular among first-time investors, with 95% of its accounts belonging to newcomers and a robust active investor base of 150,000.

2. **Emperor Asset Management**: This segment manages funds on behalf of clients, providing tailored investment solutions and strategies to maximize returns.

3. **GT247**: Serving as a derivatives trading platform, GT247 caters to more sophisticated investors interested in leveraging derivatives to speculate on price movements or hedge existing investment positions.

On the financial front, Purple Group successfully finalized a rights issue on 18th May 2023, raising R105 million with the backing of over 27% of its shareholders. The terms of the issue offered shareholders 10.20567 new shares for every 100 shares held at a price of 81c each, representing a 31.87% discount to the volume-weighted average price as of the week ending 16th May 2023.

For the six-month period ending 29th February 2024, Purple Group reported a remarkable revenue increase of 29.3% and a shift in headline earnings per share (HEPS) from a loss of 0.84c to a gain of 0.78c. This positive turnaround underscores the company’s resilience and the growing trust among its client base, even amid challenging economic conditions.

Purple Group’s shares are actively traded, with an average daily turnover of around R400,000. After experiencing a "double top" formation peaking around 340c in early 2022, the share price suffered a decline but has shown signs of recovery since early March 2024. Following our investment strategy advice, the stock broke through its 65-day exponentially smoothed moving average on 4th March 2024 at 66c and has since advanced to 90c.

Given the recent performance improvements and strategic initiatives, we see significant upside potential for Purple Group. The company's innovative approach to investing, combined with its ability to adapt to market demands and maintain high service levels, positions it well for continued growth and makes it an attractive investment prospect in the South African financial services sector.

$JSEPPE - Purple Group: Bullish On Fundamentals & TechnicalsSee link below for previous analysis

Purple Group released its interim group results for the six months ended 29 February 2024 yesterday and the market loved it.

Highlights:

-Group revenue increased by 29.3% to R188.8 million

-Group operating expenses decreased by 0.4% to R141.8

-Profit attributable to ordinary shareholders of R10.9 million, compared to a loss of R10.6

million in the prior comparative period, representing an increase of 202.3%.

- Group basic and headline earnings per share increased 192.9% to 0.78 cents per share

- The Group's net asset value per share increased by 7.4% to 41.60 cents

Technically, we have all that I previously mentioned; mainly

-the target of 46cps has been reached to the cent

-a clear break and consolidation above the zero-line by the MACD

-12/50EMA has given a buy signal and the EMAs are now providing support

-strong volume over the last 14 trading sessions

These are good reasons to be optimistic that a bottom is in at 46cps.

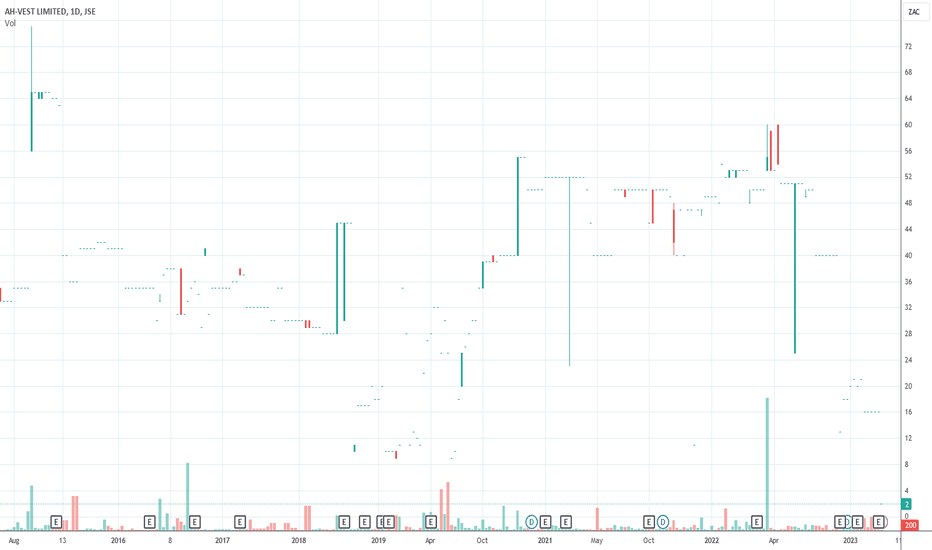

Our opinion on the current state of AH-VEST(AHL)AH Vest, trading under the All-Joy brand, is a significant player in South Africa's condiment market, notably as the country's second-largest producer of tomato sauce. The company is actively expanding its product offerings into ready meals, soups, and canned vegetables, diversifying beyond its traditional sauce lines to capture a broader share of the food market.

For the six-month period ending 31st December 2023, AH Vest reported a modest revenue increase of 1.9%, alongside a substantial rise in headline earnings per share (HEPS) by 37%. This growth in earnings is particularly notable, suggesting improved operational efficiency or cost management. The company's net asset value (NAV) stood at 48.24c per share, indicating a stable financial position.

A significant development for AH Vest during this period was the installation of generators at its production facility. This investment was aimed at enhancing service levels, which increased from 80.8% in the previous year to 82.7%. Despite this improvement, the company noted that its service levels still lag behind the industry average. The need for increased working capital was highlighted as a pressing concern, impacting the business's overall performance as it seeks to maintain and expand its operational capabilities.

However, one of the main challenges facing AH Vest is its market liquidity. The share is virtually untraded on the Johannesburg Stock Exchange (JSE), presenting a significant barrier for private investors interested in the company. This lack of trading activity can make it difficult for investors to enter or exit positions, potentially leading to higher risks associated with price volatility when trades do occur.

Given the company's strategic expansion and the recent improvements in operational infrastructure, AH Vest appears to be positioning itself for future growth. However, the trading issues present a notable caveat for potential investors, emphasizing the need for careful consideration of market liquidity when evaluating investment opportunities in smaller or less actively traded companies.