Our opinion on the current state of PURPLE(PPE)Purple Group (PPE) is a distinctive entity in the financial sector, specifically tailored for private investors and known for providing some of the lowest trading costs on the Johannesburg Stock Exchange (JSE). The company is segmented into three divisions: Easy Equities, Emperor Asset Management, and GT247.

**1. Easy Equities:** This platform is particularly innovative as it allows investors to purchase fractional shares with minimal transaction costs. For example, buying R100 worth of a share costs only 64c. This feature has attracted a significant number of first-time investors, with 95% of the accounts opened under this category, resulting in about 150,000 active investors.

**2. Emperor Asset Management:** This division manages funds on behalf of clients, leveraging expertise to deliver competitive investment returns.

**3. GT247:** This platform caters to more sophisticated investors interested in derivatives trading, rounding out Purple Group’s offerings to cover a broad spectrum of investment needs.

In May 2023, Purple Group undertook a rights issue to raise R105 million, supported by over 27% of its shareholders. This funding strategy offered shareholders an opportunity to buy additional shares at a substantial discount, specifically 81c per share, which was 31.87% below the volume-weighted average price as of mid-May 2023.

Financial performance for the fiscal year ending 31st August 2023 showed a marginal revenue increase of 0.8%, though the company reported a headline loss of 2.05c per share, a downturn from the previous year's profit of 1.12c. Despite this loss, the net asset value (NAV) saw a growth of 6.3% to 40.8c per share. Notably, the client base expanded by 17.5%, with institutional client inflows up by an impressive 169.9%, pushing the assets managed across Purple Group’s platforms to R14.5 billion.

For the six-month period ending on 29th February 2024, the company's trading statement projected an improvement in headline earnings per share (HEPS), estimating a range between 0.74c to 0.82c, which contrasts with a loss of 0.84c in the prior comparable period. This anticipated turnaround suggests a positive trajectory in operational performance.

The shares of Purple Group are actively traded, with an average daily trading volume of around R400,000. The stock experienced a “double top” formation around 340c in early 2022, followed by a decline until early March 2024. Since then, the shares have been on an upward trend. Following our analysis, we recommended monitoring the 65-day exponentially smoothed moving average, which indicated a buying signal on 4th March 2024 at 66c. The share price has since increased to 70c, indicating a potential recovery and offering a possible entry point for investors considering the stock's recent performance and growth prospects.

Our opinion on the current state of MC-GROUP(MCG)MultiChoice Group (MCG) is a major player in the African entertainment landscape and ranks among the world’s fastest-growing pay-TV providers, boasting 21.1 million subscribers across 50 countries. The subscriber demographics split with 42% (8.9 million) located in South Africa and the remaining 58% (12.2 million) spread across the rest of Africa. Since its spin-off from Naspers and subsequent listing on the Johannesburg Stock Exchange on 27th February 2019, MultiChoice has positioned itself as an attractive investment, particularly due to its reliable annuity income derived from debit orders across a diverse customer base.

The company operates with minimal working capital, typical of service companies, which negates the need for large stock inventories. Despite its streamlined operations, MultiChoice has faced union challenges historically, although it does not employ a large unskilled or semi-skilled workforce. The potential for pay-TV growth in Africa is significant, though future challenges may arise from advancements in 5G internet technology and the availability of free online content, which could erode traditional pay-TV’s market share. Additionally, regulatory changes by the Independent Communications Authority of South Africa (Icasa) aimed at increasing competition could impact MultiChoice’s dominance, particularly in sports coverage, which is a major draw for the service.

The COVID-19 pandemic initially boosted the home entertainment sector, aiding MultiChoice’s business. On 2nd March 2023, the company enhanced its competitive edge by partnering with Sky News and NBC Universal to bolster its Showmax service, aiming to dominate the African market. However, the first half of the financial year up to 30th September 2023 saw a slight decline in revenue by 1% and headline earnings per share (HEPS) by 5%. The overall 90-day active subscriber base saw a contraction of 2%, although the Rest of Africa base experienced a modest growth of 1%. The South African operations were notably affected by extensive power outages, impacting nearly half of the days in the reporting period.

On the corporate front, significant developments include Canal+'s increased stake in MultiChoice, which as of early 2024 triggered a series of mandatory takeover bids, initially deemed too low by MultiChoice but subsequently raised to a more acceptable R125 per share. By April 2024, Canal+ had acquired a 40.01% share, leading to necessary regulatory filings with the Takeover Regulation Panel and the Companies and Intellectual Property Commission.

From a technical standpoint, MultiChoice’s share price has been on a downward trend since March 2023 but experienced a rebound after breaking through the 65-day exponential moving average on 19th December 2023 at a price of 7440c. The share price has since climbed to 11750c, illustrating a significant recovery. MultiChoice remains a solid blue-chip stock, albeit with some exposure to the volatile dynamics of competitive products and regulatory changes. This investment scenario suggests that while risks exist, the company's strategic initiatives and market adaptations could continue to provide substantial value to investors.

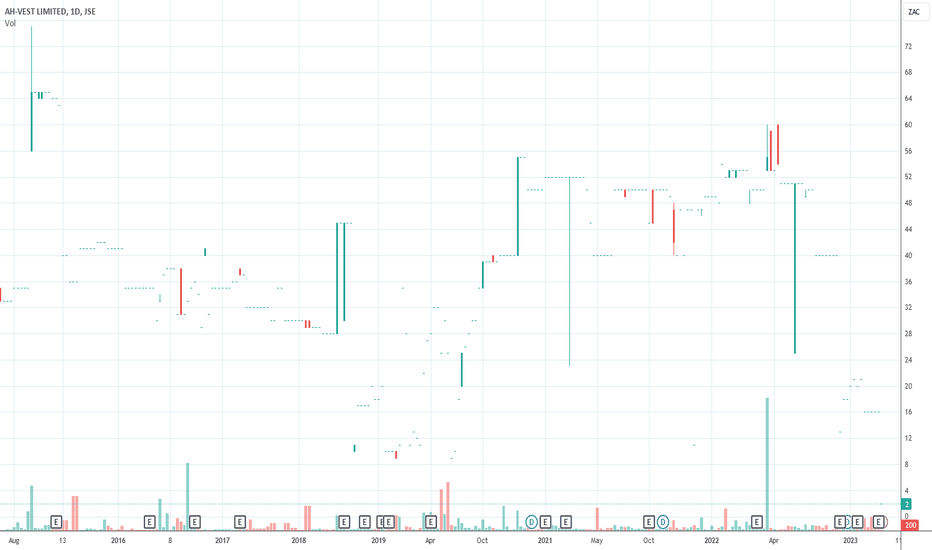

Our opinion on the current state of AH-VEST(AHL)AH Vest (AHL) produces a range of sauces under the All-Joy brand and seeks to diversify into ready meals, soups and canned vegetables. It is the second largest producer of tomato sauce in South Africa. In its financials for the year to 30th June 2023 the company reported revenue up 2,5% and headline earnings per share (HEPS) down 33,2%.

The company said, "The gross profit margin decreased by 3.1% from 37.9% to 34.9% in the current year. This was mainly attributable to higher raw material input costs, higher production costs caused by load shedding and higher shipping costs." In a trading statement for the six months to 31st December 2023 the company estimated that HEPS would increase by 37%. The problem with this share is that it is virtually untraded on the JSE, making it impossible for private investors.

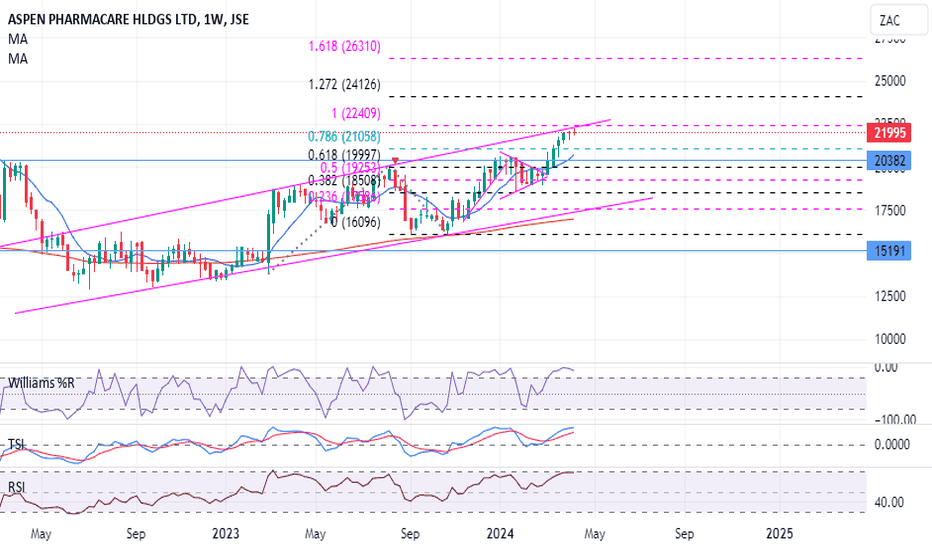

Aspen Seeking to Push into Weekly Cycle HighAspen is consolidating in a symmetrical triangle, it has good support in the triangle and the median line of Pitchfork. On the weekly perspective we are in time for a half cycle correction hence I expect the price to resolve upwards.

The stop-loss is R185.41

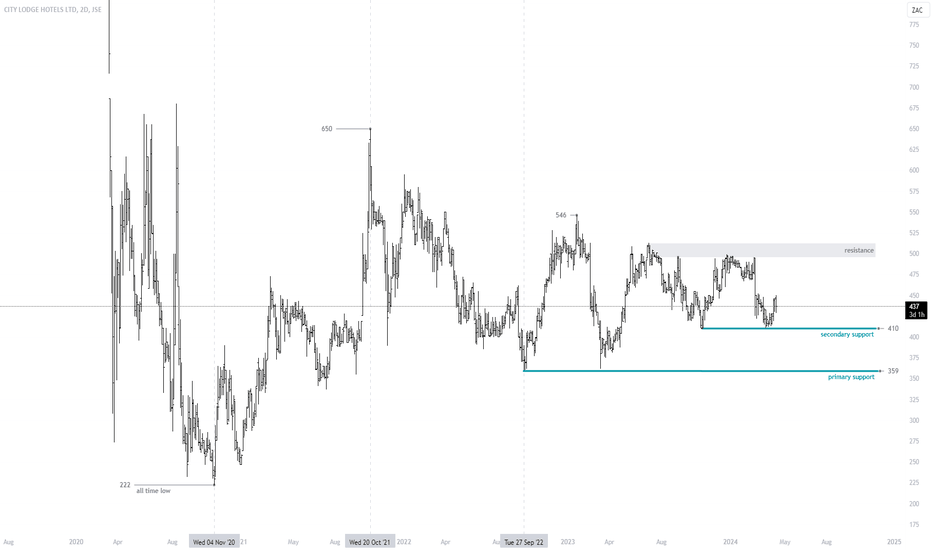

$JSECLH - City Lodge: No Clear Pattern, Still ConsolidatingSee link below for previous analysis.

City Lodge has not taken off as I anticipated.

The stock has continued to consolidate sideways without a clear pattern though we have two areas of support and a resistance zone.

I have no view at this stage and I will sit on my hands on this one.

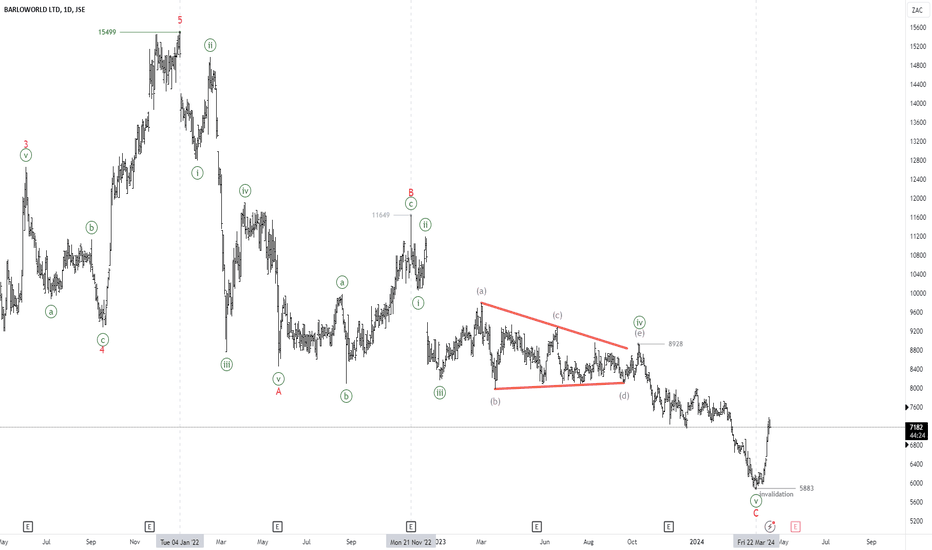

$JSEBAW - Barloworld: Is The Bottom Finally In? 5883 Hold KeySee link below for previous analysis

Barlo stock has caught a strong bid at 5883 and the rally looks strong.

This give me confidence that wave C is probably complete at 5883.

Not one to chase momentum, though the stock can continue higher with little pullbacks, i would like to see consolidation or a three wave pullback that holds above 5883 to join the bulls.

The invalidation level of this bullish outlook is a break below 5883.

Our opinion on the current state of SIBANYE-S(SSW)Sibanye is a prominent mining house that has been aggressively expanding its portfolio, acquiring platinum and gold mines in South Africa and the United States, and is now diversifying into base metals and minerals, particularly those essential for green technologies. The company, under the leadership of Neal Froneman, known for his robust expertise and experience in the mining industry, is on a mission to double its size before his planned retirement around 2024/5.

Sibanye has shown interest in crucial minerals for electric vehicle batteries, such as vanadium, copper, nickel, and lithium, aligning its operations with future market demands. Notably, on 1st June 2021, Sibanye announced a share buy-back program to repurchase up to 5% of its issued shares. Further solidifying its position in the lithium market, it increased its stake in Keliber, a Finnish lithium producer, to 80% on 30th June 2022, for about R7.7 billion. Additionally, the acquisition of Reldan, a US-based metals recycler, for $211.5 million on 9th November 2023, underscores its strategic expansion into recycling essential metals.

Despite these strategic moves, Sibanye has faced challenges, including a significant share price drop, which has been viewed by the company’s leadership as a buying opportunity. Froneman has expressed that the shares are undervalued, a sentiment supported by their aggressive expansion and diversification strategy. However, the volatile prices of the metals they extract remain a pivotal factor in the company's financial health.

In the latter part of 2023, Sibanye initiated Section 189 consultations to retrench 4095 employees, reflecting ongoing restructuring efforts within the company. Moreover, it secured a five-year deal with AMCU at its Kroondal PGM operation on 6th November 2023, ensuring a minimum 6% annual wage increase. In a move to bolster its finances, Sibanye announced on 21st November 2023 the issuance of a $500 million convertible bond, although this led to a 20% drop in the share price as some investors exited their positions.

For the year ending 31st December 2023, Sibanye reported an 18% decrease in revenue and a significant loss of R37.4 billion. Despite these figures, Froneman remains optimistic about the non-structural nature of the PGM price weakness and anticipates a recovery based on favorable demand indicators.

As of 11th April 2024, further restructuring was announced with Section 189 inquiries for the retrenchment of 3107 employees and around 900 contractors in its gold mines, indicating continued challenges in maintaining operational efficiency.

Technically, Sibanye’s shares have been in a downward trend since March 2022, primarily due to falling commodity prices. However, an upward trend break on 2nd April 2024 at 2230c suggested a potential turnaround, with the share price subsequently rising to 2495c. Despite this recent uplift, the stock remains a volatile investment tied closely to the fluctuations of commodity markets.

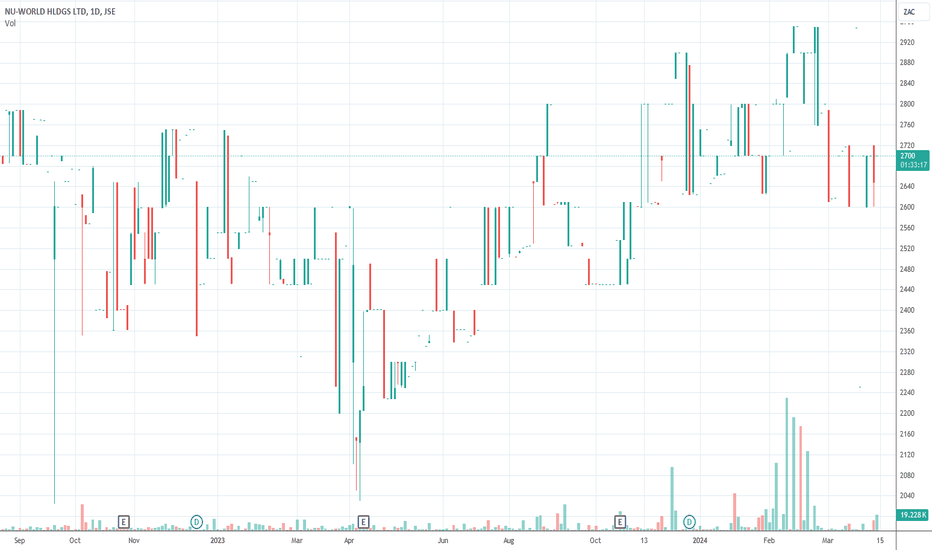

Our opinion on the current state of NUWORLD(NWL)NuWorld, a company established on the JSE since 1987, operates as an importer and exporter of consumer goods, focusing primarily on consumer electronics, appliances, and durables. The company's product lineup includes well-known brands like Telefunken and JVC, alongside a variety of items such as vacuum cleaners, fans, large and small appliances, cell phones, heaters, and liquor. Over the years, NuWorld has maintained a consistent track record of generating profits and distributing dividends, illustrating its stability in the industry.

Despite its long-standing presence and profitability, the share is relatively thinly traded, with several days often passing without any trading activity. This characteristic renders the stock less suitable for private investors who might seek more liquidity. In the latest financial results for the six-month period ending on 29th February 2024, NuWorld reported a slight decline in revenue by 2.8% and a decrease in headline earnings per share (HEPS) by 5%. However, it's not all downward trends for the company; the net asset value (NAV) saw a positive increase of 4.8% to 7258.3c per share.

The company highlighted several challenges affecting its local sales, including high interest rates, increased shipping costs, the devaluation of the South African Rand, load shedding, and rising fuel costs. However, it also noted a silver lining with its international sales, which demonstrated a 6.6% growth in turnover during the same period. This indicates that while NuWorld faces significant headwinds domestically, its international operations are contributing positively to the overall business.

Technically, the trading pattern of NuWorld shares reflects the company's low liquidity, with the share price having declined since March 2022. Nonetheless, there are indications of a potential recovery, suggesting that despite the current challenges, there may be opportunities for the stock to regain some ground. Investors interested in NuWorld would need to consider the low trading volume and potential for sporadic price movements, balanced against the company's long-standing history of profitability and resilience in a fluctuating market.

Our opinion on the current state of TRANSCAP(TCP)Transaction Capital (TCP) is a diversified company that operates three divisions: minibus taxis, risk services, and holds a 75% stake in WeBuyCars (WBC). Its subsidiary, SA Taxi, dominates the value chain of the minibus taxi industry in South Africa, handling financing, repairs, insurance, and sales. Since its listing in June 2012, TCP experienced a significant compound annual growth in earnings per share of 21% from 2014 until an abrupt halt in 2023 due to a R1.8 billion provision for bad debts in the minibus taxi division.

The minibus taxi industry is crucial in South Africa, with 69% of households relying on taxis for more than 15 million trips daily. These trips are mostly non-discretionary, which typically shields the industry from economic downturns. However, recent challenges such as rising interest rates, increased fuel costs, and decreased consumer spending have led to a perfect storm, significantly impacting TCP’s finances. The average taxi owner struggled with repayments around R6000 per month amidst these rising costs, leading to SA Taxi reducing its new vehicle financing and focusing on selling refurbished taxis.

In 2018, the South African Taxi Council (Santaco) acquired a 25% stake in SA Taxi for R1.7 billion, which has been mutually beneficial. Yet, the company’s broader financial health has been shaken, as evidenced by the considerable bad debt provisions and a reported headline loss of R3.7 billion for the year to 30th September 2023. This loss included a R1.1 billion write-down of repossessed taxis. The future of SA Taxi hinges on renegotiating terms with its debt funders, expected by March 2024.

On the corporate front, significant shareholder changes occurred with Coronation increasing its stake to 16.57% in March 2023, and the Hurwitz family trust selling 1.6 million shares in December 2022, which preceded a sharp decline in share price. Additionally, CEO David Hurwitz announced his resignation effective 31st December 2023, further impacting the company's share price.

In response to the ongoing challenges in the taxi division, TCP announced a strategic shift in January 2024 to unbundle and separately list WeBuyCars. This decision followed the poor performance in the taxi business throughout 2023. Following the unbundling, WeBuyCars demonstrated a positive trajectory with a 16% increase in revenue and a 20% rise in core earnings over four months, indicating potential as a solid standalone entity on the JSE.

Further reshaping its portfolio, TCP sold its holding in Nutun Australia for A$58.3 million in March 2023. As of April 2024, following the separate listing of WeBuyCars, the TCP share price adjusted to 361c, reflecting the market’s reaction to the restructuring.

This array of strategic moves and market challenges paints a complex picture for TCP. While the company faces significant hurdles, the strategic divestiture and focus on potentially more profitable segments like WeBuyCars could provide a foundation for recovery and future growth, presenting what could be an appealing investment opportunity at current valuations.

Our opinion on the current state of WEBBUYCARS(WBC)WeBuyCars was separately listed on the JSE on 11th April 2024. It was unbundled from Transaction Capital (TCP) in order to raise capital and to protect it from that company's difficulties in its taxi division. The company has 417,2m shares in issue which began trading on the JSE at around R20 per share giving it a market capitalisation of just over R8,5bn. The company's free float is about 57,5% of its issued shares with significant institutional participation. Read this article for more information.

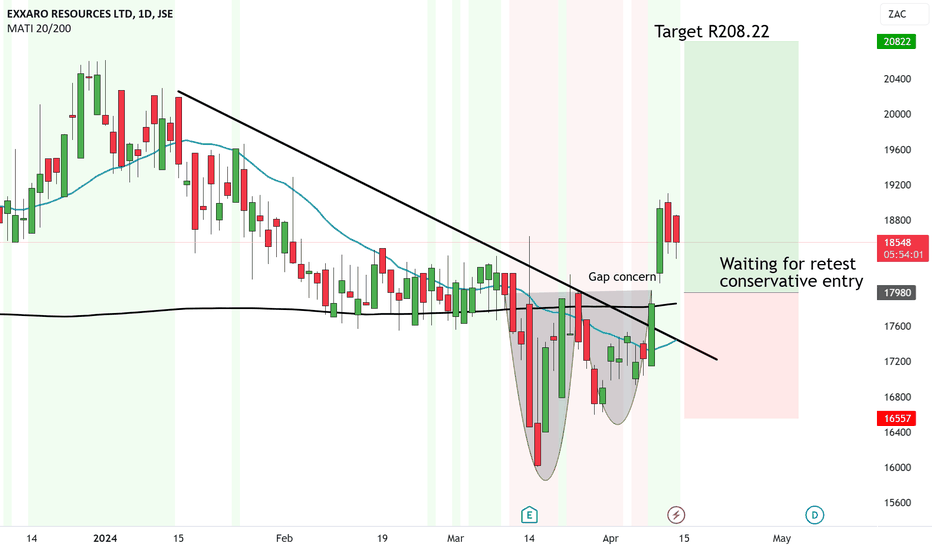

Exxaro looks fantastic to R208.22! We recently saw it break out of the medium downtrend since January 20024.

The price broke above the W Formation's neckline and above the 20 and 200MA.

This states the medium term nature is HIGH probability for upside.

The concern is the price gapped up and now needs to fill.

SO I am patiently waiting for the Gap to close and then rebuy on the bounce of the retracement.

Target to R208.22.

Our opinion on the current state of AFRIMAT(AFT)Afrimat, a prominent open-pit mining company in Southern Africa, provides a broad range of products including composites and construction materials. Until the end of 2015, it stood out as one of the JSE's top-performing shares, showcasing resilience and growth even through the COVID-19 pandemic. This growth trajectory saw the share price reach a peak of R76 on 6th April 2022. However, the end of the commodities cycle has since led to a decline in its share value.

A significant factor in Afrimat's sustained performance has been its strategic acquisition of the Demaneng iron mine in the Northern Cape. This move has not only buffered the company against the construction industry's volatility but also marked a pivot towards diversification into other base minerals like manganese, chrome, and coal. CEO Andries van Heerden highlighted Afrimat's reputation for successful acquisitions and indicated ongoing evaluations for potential growth opportunities.

In a strategic move to deepen its mining portfolio, on 26th May 2020, Afrimat proposed a non-binding expression of interest for Unicorn Capital Partners, targeting an anthracite mine and offering 1 Afrimat share for every 280 Unicorn shares. The company's timely acquisitions, bolstered by the surge in iron ore prices due to supply constraints and rising demand from China, underscore its strategic market positioning.

Further expansions include the purchase of Coza Mining in August 2020 for R300m, the acquisition of the Gravenhage manganese mine in May 2021 for a combined total of $45m and R15m, and the acquisition of Glenover Phosphate for R550m in December 2021. Reflecting its transition towards more diversified mining activities, Afrimat's listing was shifted to the General Mining sector in March 2022.

The acquisition spree continued with the purchase of Lafarge for $6m, as announced in June 2023, enhancing Afrimat's footprint in the construction materials sector. For the six months ending on 31st August 2023, the company reported a 9.6% increase in revenue and a 4.4% rise in headline earnings per share (HEPS). The net asset value (NAV) also saw a significant increase, with the company maintaining a strong balance sheet and a favorable debt-to-equity ratio.

Despite the downturn in commodity prices affecting the industry at large, Afrimat's diversified portfolio and low debt levels stand out as key factors underpinning its value proposition. The recent approval from the Competition Commission for the acquisition of Lafarge, announced on 10th April 2024, marks another milestone in Afrimat's expansion journey. With a price-to-earnings (P:E) ratio of 12.8, Afrimat presents itself as a reasonably priced investment in the mining sector, promising continued growth and stability.

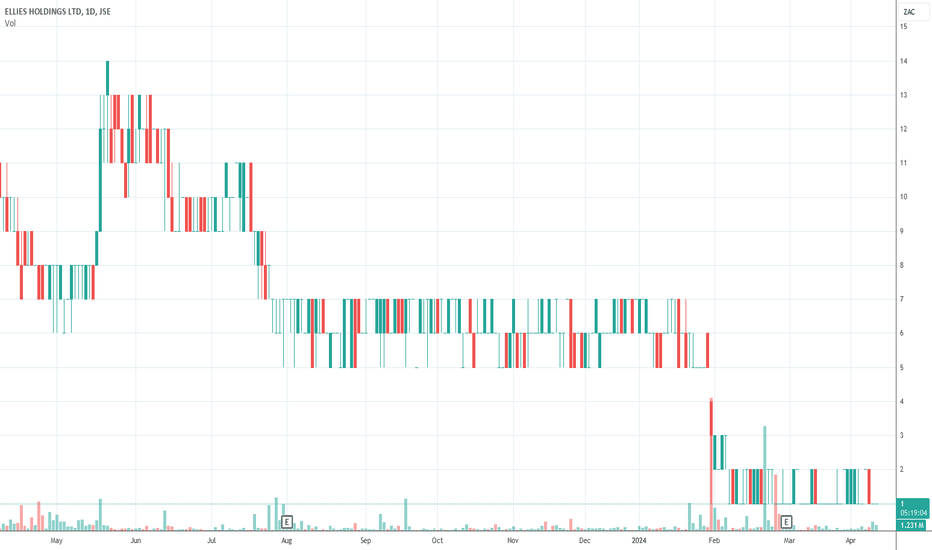

Our opinion on the current state of ELLIES(ELI)Ellies, once a promising electronics company known for importing and distributing electrical products and providing solar power solutions, has experienced a significant decline from its peak in 2013, when shares were nearly R10 each, to a current value of just 2 cents. This drastic downturn is reflected in its designation as a penny stock, with approximately R100,000 worth of shares traded daily, indicating limited market activity.

The company has faced numerous challenges, including initiating Section 189 proceedings under the Labour Relations Act on 2nd March 2020, which led to the retrenchment of 183 staff members. These actions highlight the company's efforts to adapt to an evolving market and economic landscape, with a strategic pivot towards solar energy solutions and away from its previous reliance on MultiChoice and the installation of DSTV dishes.

However, the shift in strategy has yet to yield positive financial outcomes. On 26th September 2022, Ellies announced another Section 189 procedure, signaling further retrenchments and contributing to a nearly 20% drop in its share price. The financial results for the six months ending 31st October 2023 revealed a substantial 30.6% decrease in revenue and a significant widening of the headline loss per share from 4.58 cents to 13.2 cents, alongside negative equity of 7.3 cents per share.

The culmination of these challenges led to the share price plummeting to 1 cent. In a critical move, Ellies announced on 31st January 2024 its entry into business rescue, followed by the resignation of four non-executive directors on 7th April 2024, indicating severe governance and operational crises.

The most recent announcement on 10th April revealed the company's decision to proceed with liquidation, as determined by the business rescue practitioners who saw no viable path to recovery. This decision marks the end of Ellies' efforts to restructure and revive its business, underscoring the harsh realities faced by companies struggling to adapt to rapidly changing market demands and economic conditions.

Our opinion on the current state of THARISA(THA)Tharisa (THA) stands out in the mining sector, focusing on the extraction and beneficiation of platinum group metals (PGMs) and chrome. The company's primary operations are anchored in the Tharisa mine, strategically located on the Bushveld Igneous Complex's south-west limb. This open pit mine boasts an impressive life expectancy of 17 years, highlighting the company's sustainable resource management. Tharisa's commitment to innovation and efficiency is further demonstrated through its subsidiary, Arxo Metals, which specializes in producing high-grade chrome concentrates.

Looking beyond its established operations, Tharisa is eyeing expansion into Zimbabwe's Great Dyke area, presenting promising growth avenues. This ambition underscores the company's position as one of the JSE's premier mining investments, boasting production costs significantly lower than current metal prices, alongside notable expansion potential.

The company's investment in the Vulcan Plant marks a pivotal development in enhancing chrome recovery rates from 65% to 82%, at a cost of $54.2 million. This initiative is aimed at boosting production to 200,000 ounces of PGMs and 2 million tons of chrome ore annually through proprietary technology. The operational efficiency of Tharisa's open pit mining operation, free from the challenges of underground mining, positions it advantageously in the industry.

In a strategic move to add value to its product range, Tharisa plans to construct a 5MW furnace to produce platinum-rich iron alloys, targeting higher market prices. Recent milestones include the cold commissioning of the Vulcan chrome beneficiation plant on 5th October 2021, expected to enhance chrome recovery by 20%, and the signing of an agreement on 4th February 2022 for the implementation of a solar farm exceeding 40 megawatts. Furthermore, on 27th March 2023, Tharisa secured $130 million in financing, bolstering its financial position and project implementation capabilities.

However, the year to 30th September 2023 presented challenges, with a decrease in PGM production by 19.3% and a 5.3% dip in revenue. Factors such as mining restrictions near community areas, adverse weather conditions, and the processing of lower-grade ore adversely affected performance. Despite these hurdles, operational improvements in the following quarters led to record chrome production, demonstrating the company's resilience and adaptive strategies.

As of the second quarter ending 31st March 2024, PGM output remained stable, with a slight dip in the basket price received. The company's robust cash position and manageable debt level reflect its solid financial health and operational efficiency.

From a trading perspective, Tharisa is highly active, with daily share transactions exceeding R1.1 million, making it accessible to private investors. Although the share experienced a downward trend in line with commodity prices until April 2022, recent improvements in PGM prospects have led to a price recovery. The share price broke through the downward trendline on 26th March 2024 at 1405c, climbing to 1575c, indicating positive momentum. Despite its potential, Tharisa's performance remains closely tied to international commodity prices, presenting inherent risks associated with the volatile nature of commodity markets.

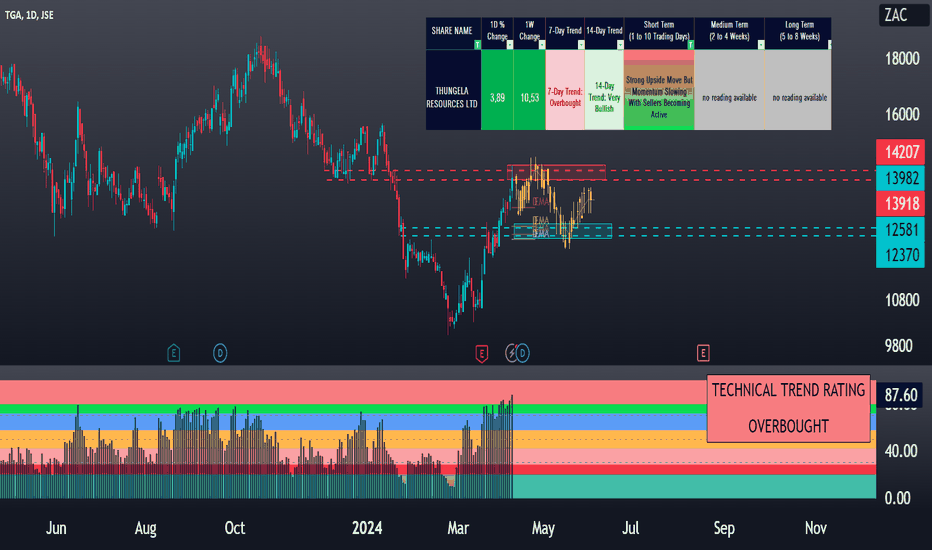

TGATGA

The accompanying reading is from my research model which provides an automated comment on a share for 3x time frames (ST, MT and LT).

Today, the short term rating states the following: "strong upside move but momentum slowing with sellers becoming active".

A few days ago I also noted that 140-143 was a level to reduce, i.e. the 200-day and the previous swing high.

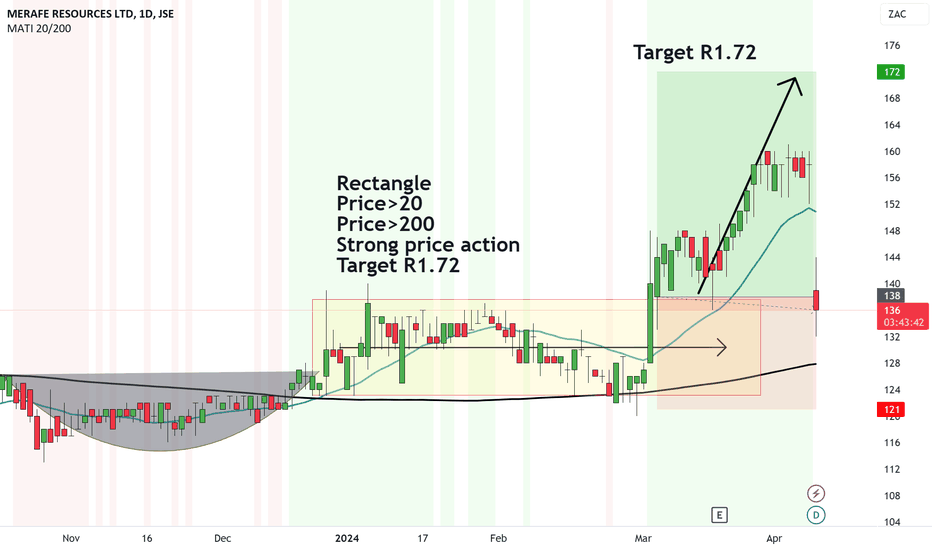

Merafe Dividend payout caused a break in analysisMerafe was easily set to great upside to R1.72

This was due to a Box Formation, Upside and Price above the moving averages.

But then 22 cents Dividend was given out which caused the share price to drop quite quickly.

So is the analysis still on? I guess it is as long as it hasn't hit the risk level.

But these are things to take into account and learn from.

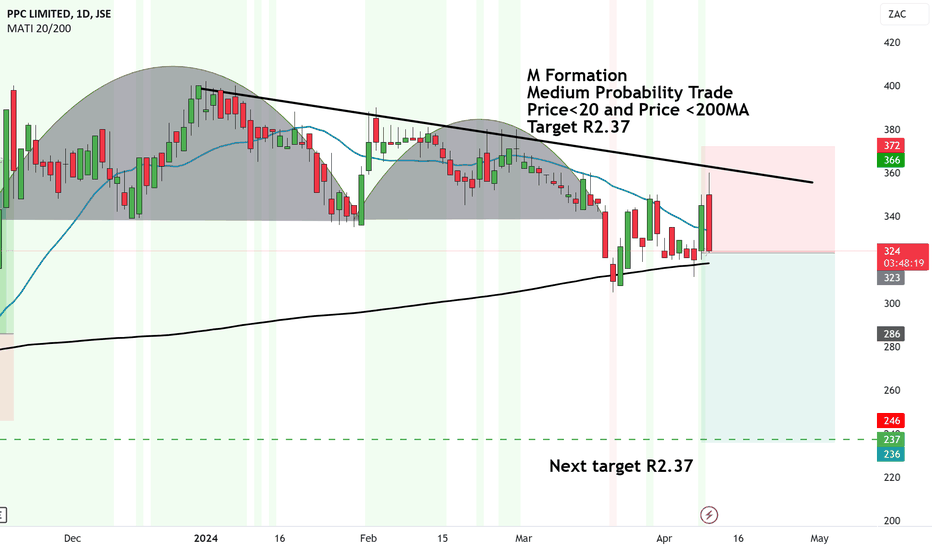

PPC M Formation ready to break down to R2.37?M Formation has formed on PPC since November 2023.

This is a very risky trade analysis due to the high volatile nature of the share.

But if the uptrend holds strong and lower highs continue, we could see a very big fall with the cement company.

Medium Probability Trade

Price<20 and Price <200MA

Target R2.37

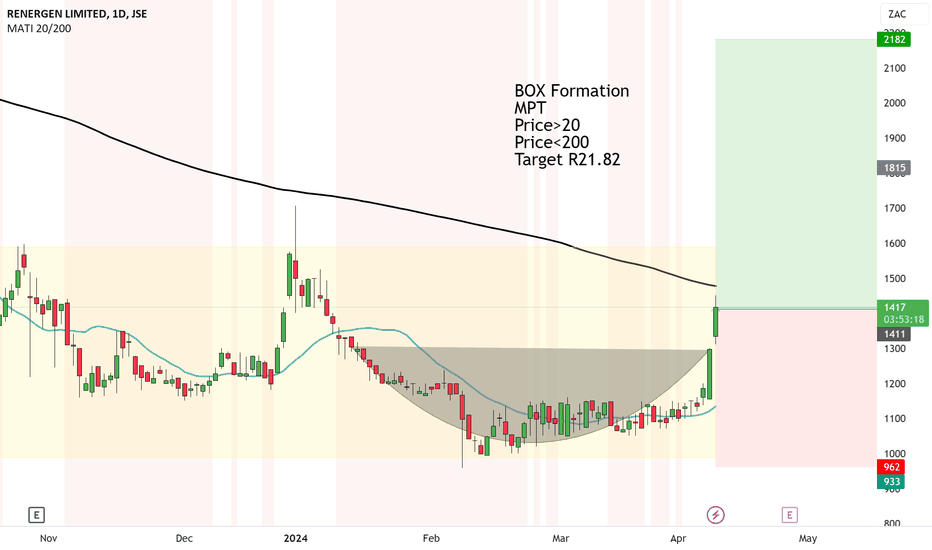

Renergen showing tremendous upside to come BOX Formation has formed on Renergen. Also there is a rounding bottom.

The price has broken above the neckline of the Rounding Bottom but not the box form yet.

Once it does, we should get an easy indication that the market wants to head up.

The nature of the analysis is Medium probability due to

Price>20MA

Price<200MA

Target 1 will be to R21.82

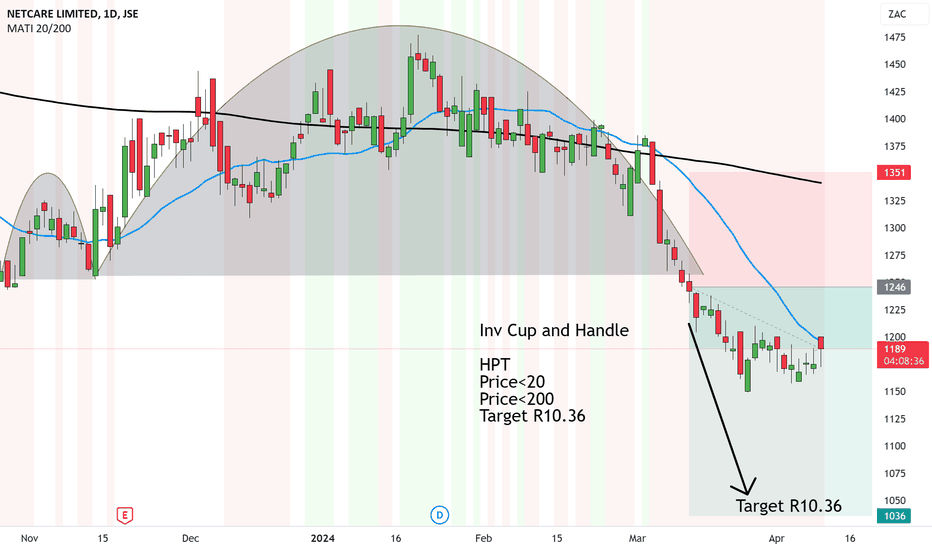

Netcare looking sick at the moment - Target R10.36Inv Cup and Handle has formed on Netcare since November 2023.

It is a high probability nature that the price is likely to drop as the price is below both 20MA and 200MA.

First target is to R10.36.

NOTE: I do acknowledge that there could be a short term W Formation which could cause some chop and even short term upside.

So this is indeed a medium term analysis.

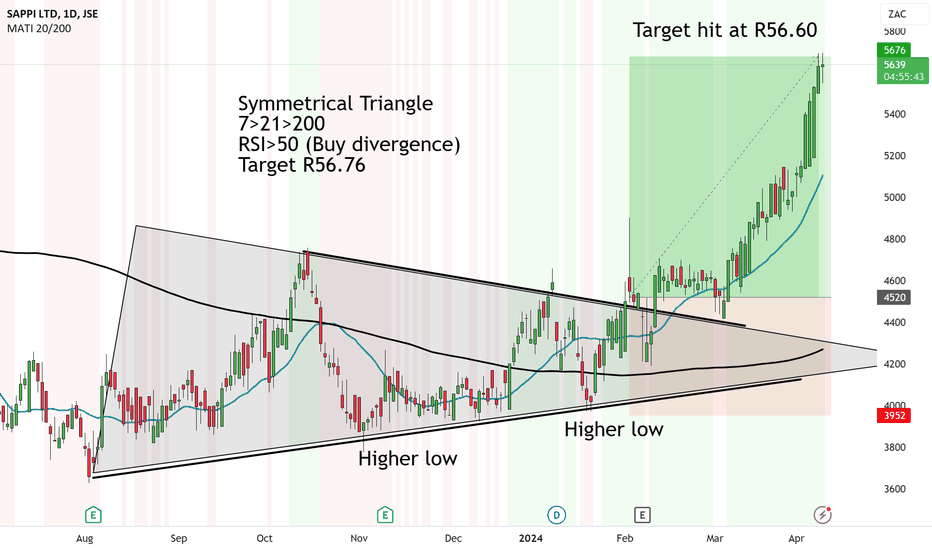

UPDATE SAPPI Target reached at R56.60 - Omwards and UpwardsSAPPI has performed great since it broke above the Symmetrical Triangle,.

The analysis was done in February, it broke above the Apex and since then has rushed to its first target at R56.60.

No ways, is this worth a punt to the short side. We can now expect some sideways chop, possible pattern form and then will provide another buy signal.

What is the opposite of Timber!!!! ?

ABSA showing major downside to come to R76.08Head and Shoulders has formed ont he dail since Early 2022...

The price broke below the neckline and has since then, been showing lower highs within the down channel,

We also have confirmed downside with the Moving Averages.

Price< 20 and <200

It looks bleak but the system is the system, so the first target is set to R76.08

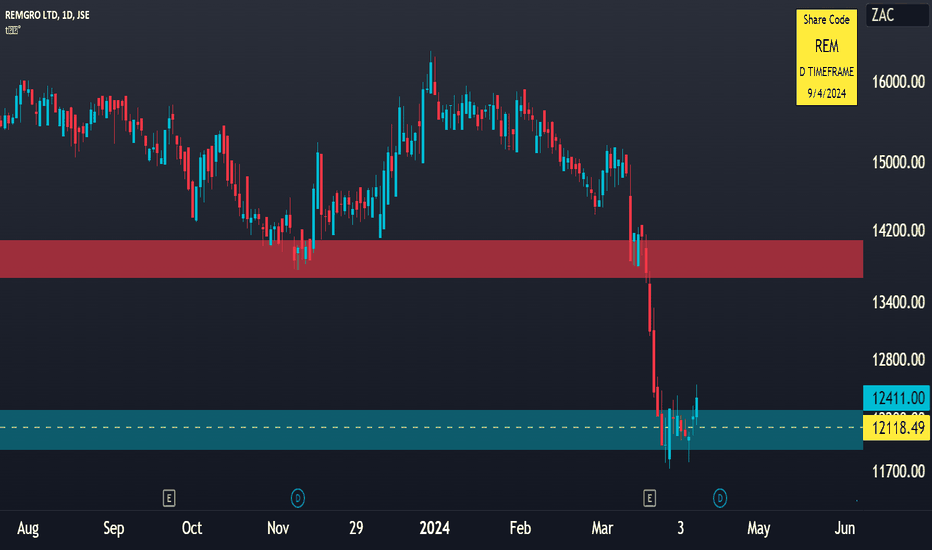

REMThe share has started to find support off the provisional buy range.

My comment last week 02 April 2024 was as follows:

REM REMGRO - (1) Aggressive selling pressure but attempting to settle around multi-year support (it can fluctuate around this level) - down from 16300c at the beginning of the year (2) 48% Discount To Net Asset Value (NAV 23695c vs Last Close of 12208c).