Our opinion on the current state of GRINDROD(GND)Grindrod (GND) is an international freight and financial services company operating in twenty-eight countries. The significant change in the company's structure came in mid-June 2018, when it unbundled and separately listed its shipping division, Grinship (GSH), leading to a notable drop in its share price. Post-divestiture, Grindrod's focus sharpened on its freight and financial services divisions. Among its key assets are the North-South railway line stretching from Beitbridge to Victoria Falls and port terminals located in Richards Bay, Natal, Walvis Bay in Namibia, and Maputo.

The financial services division, which constitutes about 30% of the business, is seen as a growth area. Grindrod is particularly keen on integrating its retail banking division with small and medium-sized enterprises. However, challenges persist, notably the conflict in northern Mozambique and flooding in Natal, which temporarily halted operations at five sites.

For the fiscal year ending 31st December 2023, Grindrod reported an 18% increase in headline earnings per share (HEPS), a 13% rise in net asset value (NAV) to 1368c per share, despite a 23% drop in revenue. This financial performance was bolstered by interest earned on the proceeds from the sale of Grindrod Bank in 2022, alongside earnings from various initiatives totaling R45.3 million in the current year, compared to R167.1 million in 2022.

Technically, Grindrod's share price has shown signs of recovery, forming a rising triple-bottom pattern and entering a new upward trend. The recommendation was to wait for a break through the long-term downward trendline before purchasing shares. This break occurred on 15th July 2020 at a price of 340c, and the shares have since appreciated significantly to 1275c, marking a 275% gain in over three years.

The global economic recovery and a steady increase in international trade are expected to benefit the company. Given these factors, Grindrod's shares are still considered to offer value to investors.

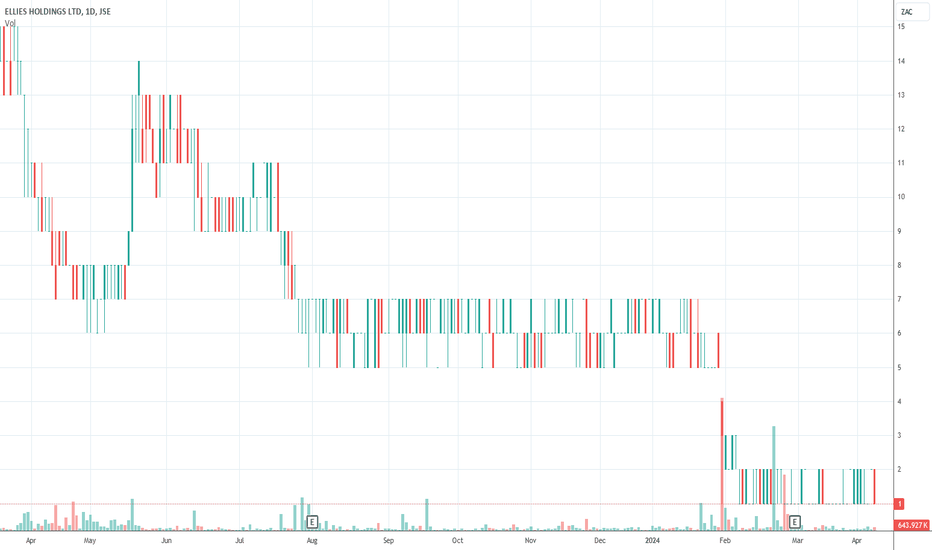

Our opinion on the current state of ELLIES(ELI)Ellies, an emerging electronics firm known for importing and distributing electrical products and offering solar power solutions, has experienced significant shifts in its market standing since its peak in 2013. At that time, shares traded close to R10 each, but have since plummeted to a mere 2 cents, reflecting a stark downturn. The company, now a penny stock, sees roughly R100,000 in shares traded daily, indicating a relatively low level of liquidity.

The company's trajectory took a notable turn on 2nd March 2020 with the announcement of Section 189 proceedings under the Labour Relations Act, leading to the retrenchment of 183 staff members. Such moves hint at Ellies' strategic adjustments to align with broader economic shifts and potentially position itself to benefit from any future uplift in South Africa's economic landscape. The current share price suggests a low valuation that might appeal to some investors looking for speculative opportunities.

Ellies has been actively working to diversify its business model, particularly by reducing its dependence on MultiChoice and the installation of DSTV dishes, pivoting towards the burgeoning solar energy sector. However, the initiation of a Section 189 procedure on 26th September 2022, signaling impending retrenchments, had a detrimental impact on the share price, leading to a nearly 20% drop.

The half-year results up to 31st October 2023 further highlighted the challenges faced by Ellies, reporting a 30.6% decrease in revenue and a headline loss per share of 13.2 cents, a significant deterioration from a loss of 4.58 cents in the previous period. The company's negative equity position of 7.3 cents per share underscores the severe financial distress it is undergoing.

The share price was further battered by the latest financial results and news, driving it down to just 1 cent. In a move reflecting the company's dire straits, Ellies announced on 31st January 2024 that it had entered into business rescue, a last-ditch effort to salvage the business. The situation seemed to exacerbate when, on 7th April 2024, four of its non-executive directors resigned, perhaps signaling a lack of confidence in the company's ability to navigate its way back to profitability.

Ellies' journey from a once thriving electronics company to its current precarious position illustrates the volatile nature of the tech and electronics market, especially within the challenging economic context of South Africa. The company's shift towards solar energy reflects a strategic pivot aimed at capturing new growth areas, yet its immediate future remains highly uncertain, evidenced by its recent entry into business rescue and the resignation of key board members. Investors and stakeholders will be keenly watching for any signs of recovery or further decline in the coming months.

Our opinion on the current state of MCGMultiChoice Group (MCG) is a premier entertainment enterprise in Africa, standing out as one of the world's most rapidly expanding pay-TV broadcast providers. With a subscriber base reaching 21.1 million across 50 countries, MultiChoice boasts a significant footprint. The distribution of its 90-day subscriber base is notably divided, with 42% (8.9 million) in South Africa and the remaining 58% (12.2 million) across the rest of Africa. The company's journey to becoming an independent entity, following its spin-off from Naspers, was marked by its listing on the Johannesburg Stock Exchange (JSE) on 27th February 2019.

MultiChoice represents an almost ideal investment for private investors, primarily due to its annuity-based income model, facilitated through debit orders among a highly diversified client base. As a service-centric company, it operates with minimal working capital requirements, negating the need for substantial inventory holdings. Additionally, the company's workforce is largely skilled, mitigating some of the labor-related challenges, despite previous union issues.

The pay-TV market in Africa, where MultiChoice is a dominant player, shows significant potential. However, future growth may face headwinds from advancements in 5G internet technology and the availability of free online content platforms. Regulatory changes are also on the horizon, with the Independent Communications Authority of South Africa (Icasa) considering revisions to pay-TV market dominance rules. Such changes could particularly affect MultiChoice's stronghold on exclusive sports broadcasting rights, which has been a major draw for its service.

The COVID-19 pandemic had a temporary positive impact on the home entertainment sector, benefiting companies like MultiChoice. In an effort to enhance its offerings, MultiChoice entered into agreements with Sky News and NBC Universal on 2nd March 2023 to bolster its Showmax service, aiming to cement its leadership in Africa's entertainment space.

Despite these strategic moves, the company reported a slight dip in revenue by 1% and a 5% decrease in headline earnings per share (HEPS) for the six months ending 30th September 2023. The decline in the overall 90-day active subscriber base by 2% to 21.7 million was reported, alongside a growth in the Rest of Africa subscriber base. The South African segment of the business was particularly challenged by extensive power outages during the reporting period.

Recently, the French media conglomerate Canal+ increased its stake in MultiChoice to 35.01%, triggering a mandatory takeover offer at R105 per share, which was deemed insufficient by MultiChoice. Following a ruling by the Takeover Regulation Panel (TRP) on 28th February 2024, Canal+ revised its offer to R125 per share on 6th March 2024. Subsequently, on 7th April 2024, a cooperation agreement was announced between MultiChoice and Canal+, outlining a collaborative approach to the takeover process.

From a technical analysis perspective, MultiChoice's shares experienced a decline leading up to 6th March 2023. However, a notable turnaround occurred on 19th December 2023 when the share price crossed the 65-day exponential moving average at 7440c, leading to a significant increase to 11793c. This suggests a potential bullish outlook for investors, considering the recent developments and strategic partnerships, although the company continues to navigate challenges within the highly competitive and rapidly evolving pay-TV market.

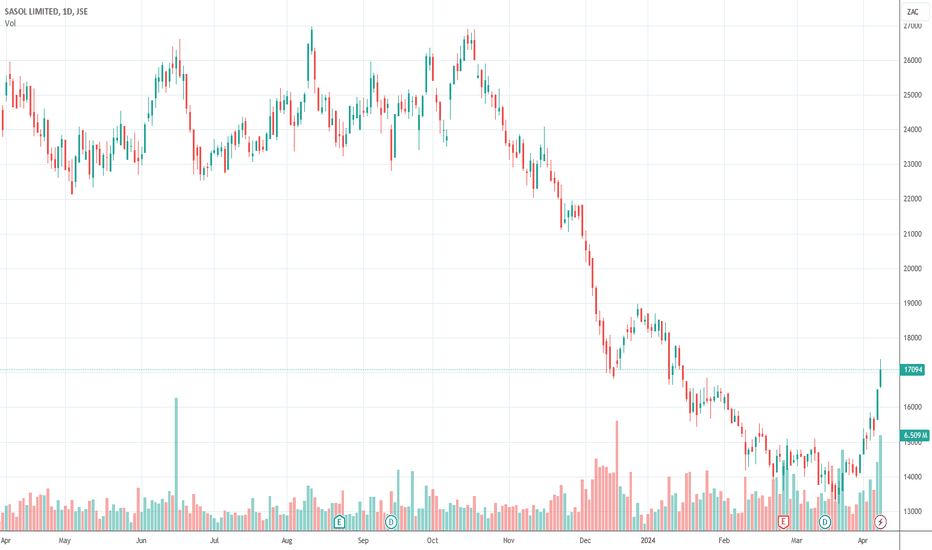

Our opinion on the current state of SOLSasol, a behemoth in the international chemicals and energy sector, traces its origins to the oil-from-coal technology developed during South Africa's apartheid era. With approximately 50% of its profits tied directly to oil prices, Sasol's performance is closely linked to the volatile energy market. The company has strategically positioned itself for growth through two primary initiatives: its 50% investment in the ethane cracker plant in Louisiana, known as the "Lake Charles Chemical Project" (LCCP), and the expansion of its gas projects in Mozambique. The awarding of two new licenses for gas exploration in an onshore area of about three thousand square kilometers in Mozambique highlights its potential to significantly boost its existing operations in the Rovuma province.

However, Sasol faces significant environmental scrutiny. It is the largest producer of greenhouse gases in South Africa and is listed among the top 100 fossil-fuel companies globally contributing to over 70% of greenhouse gas emissions. This has placed Sasol under considerable international pressure to effectively manage its carbon footprint.

The COVID-19 pandemic initially led to a dramatic recovery in Sasol's share price, but the resurgence was short-lived due to declining commodity prices, particularly oil. For the six months ending on 31st December 2023, Sasol reported a decrease in revenue to R136.3bn from R149.8bn in the previous period, attributing the downturn to lower chemical prices and weak oil prices. The company's headline earnings per share (HEPS) and net asset value (NAV) also saw declines of 34% and 2%, respectively.

Sasol's first half of 2024 continued to be marred by a challenging macroeconomic environment, characterized by weaker oil and petrochemical prices, fluctuating product demand, and rising inflation. Operational improvements in South Africa were overshadowed by the persistent underperformance of state-owned enterprises involved in Sasol's value chain, compounded by a weaker global growth outlook, adversely affecting business performance.

On a positive note, on 7th April 2024, Sasol announced that the Minister of the Environment, Barbara Creecy, had upheld its appeal against a decision by the national air quality officer, a ruling that could have jeopardized the operation of its Secunda oil-from-coal plant. This decision comes as a relief for Sasol's operations, albeit temporarily alleviating some regulatory pressures.

Sasol's stock initially benefited from a spike in Brent oil prices to around $127 per barrel, although prices have since receded to about $90, reflecting the inherent volatility and risk associated with commodity shares. In its pursuit of environmental stewardship, Sasol has made a notable stride by securing 550mw of renewable energy, marking progress toward achieving its carbon emission reduction goals. This move signifies Sasol's commitment to transitioning towards more sustainable energy sources amidst the evolving energy landscape and regulatory pressures.

Our opinion on the current state of MCZMC Mining, formerly known as "Coal of Africa," is a modestly sized company focused on metallurgical coal mining, with Uitkomst as its only producing mine. Besides Uitkomst, the company is actively developing several projects, including the Makhado project, the Vele colliery, and MbeuYashu, showcasing its commitment to growth within the sector.

The Makhado project, located in the Limpopo province, stands out as the company's flagship operation. It is an open-cast mine with a significant lifespan of 16 years, which may be extended further, emphasizing the project's long-term potential. In January 2019, a pivotal moment for MC Mining occurred with the acquisition of surface rights, making the Makhado project feasible. With production anticipated to start by the end of 2020, the mine is expected to yield 800,000 tons of hard coking coal and 1 million tons of export thermal coal annually, marking a significant milestone for the company. The viability and reduced risks associated with the Makhado project have significantly enhanced its investment appeal.

Financial backing for the Makhado project is partly secured, with the Industrial Development Corporation (IDC) contributing R245m, although an additional R530m is still required. Ownership stakes are strategically structured, with MC Mining holding a 69% interest in Baobab Mining and Exploration, the entity that owns the Makhado project.

For the six-month period ending on 31st December 2023, MC Mining reported an 80% increase in revenue alongside a headline loss of 145c (US) per share, an escalation from a 50c loss in the prior period. This financial performance reflects the volatility and challenges in the coal market, with international thermal coal prices experiencing significant pressure. Despite these challenges, the Uitkomst Colliery managed to generate satisfactory results, with revenue of $16.3 million and a gross profit of $1.5 million, alongside operating cash flows of $5.1 million. These figures demonstrate the colliery's resilience amid fluctuating coal prices.

A significant development for MC Mining was reported on 8th April 2024 by Business Day, revealing that Goldway Capital had received acceptances from shareholders for 83.67% of the issued shares, surpassing the 82.15% threshold needed for the takeover to proceed. This move marks a crucial phase in MC Mining's corporate journey.

From a technical perspective, the company's shares have exhibited volatility, with notable spikes between July and September 2022 before retracting to lower levels. This volatility underscores the inherent risks associated with commodity shares, coupled with MC Mining's high debt levels and the challenges of mining exploration and development. With approximately R280,000 worth of shares traded daily, the company's stock remains a high-risk but potentially high-reward investment option in the mining sector.

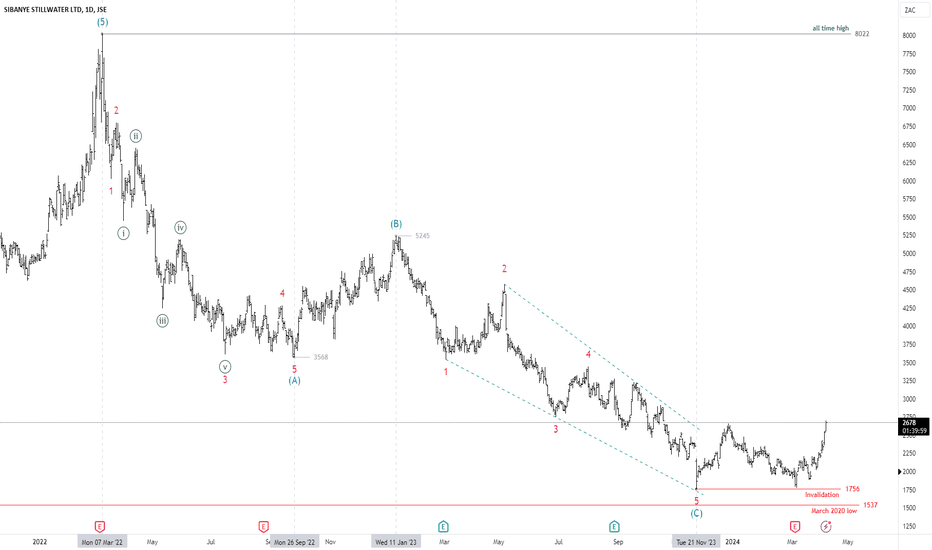

$JSESSW - Sibanye: 1756 Holds + Double Bottom = More BullishnessSee link below for previous analysis.

Sibanye's stock made a strong pullback since the previous analysis and challenged the key 1756 invalidation level. Most importantly, price managed to just hold above 1756 therefore keeping the bullish outlook valid.

The re-test of 1756 has also created a double bottom reversal pattern which adds to my bullish conviction.

1756 remains the key invalidation level.

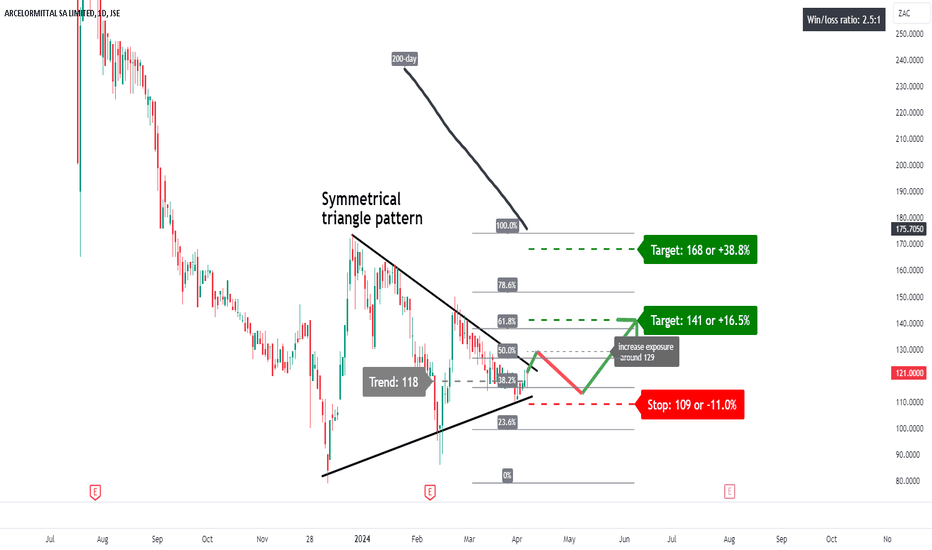

ACL: symmetrical triangle pattern?A price action above 118 supports a bullish trend direction.

Further bullish confirmation for a break above 129.

The first target price is set at 141 (its 61.8% Fibonacci retracement level).

The second target price is set at 168 (its 100% retracement level).

A break up out of the symmetrical triangle pattern might support such upside potential.

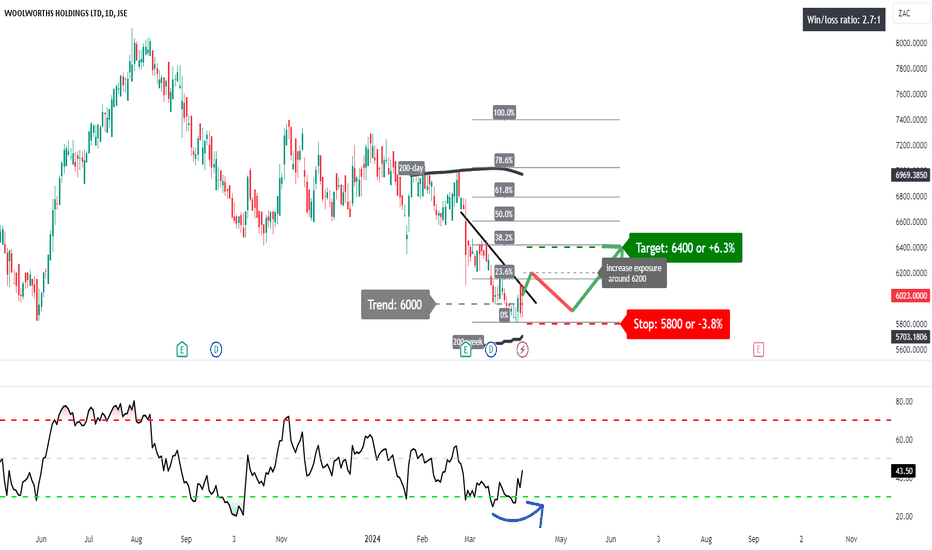

WHl: bouncing from oversold territoryA price action above 6000 supports a bullish trend direction.

Furhter bullish confirmation for a break above 6200.

The target price is set at 6400 (its 38.2% Fibonacci retracement level).

The stop-loss is set at 5800 (its 0% retracement level).

Testing major resistance.

A bounce from oversold territory on the RSI supports a speculative long opportunity.

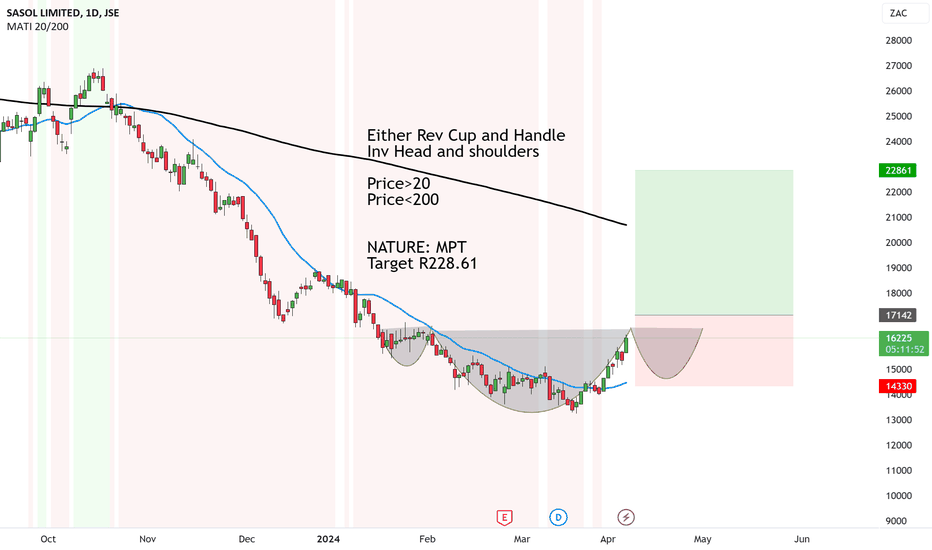

Sasol showing upside to come with two patterns target R228.61There are two potential rising formations to come for Sasol.

Either Rev Cup and Handle or Inv Head and shoulders

We do need the confirmation though for upside to continue to come.

Moving averages yield a Medium Probability setup with

Price>20

Price<200

Oil is also confiriming a short to medium term rally which will help push up the price

Target R228.61

Real yield in uptrendThe weekly real yield is in uptrend, which should act as support for the USDOLLAR and as a headwind for the risk markets.

This video is intended for the users of Stratos Markets Limited, Stratos Trading Pty. Limited and Stratos Global LLC, (collectively “FXCM Group”).

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (trading as “FXCM” or “FXCM EU”), previously FXCM EU Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763). Please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this video are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed via FXCM`s website:

Stratos Markets Limited clients please see: www.fxcm.com

Stratos Europe Ltd clients please see: www.fxcm.com

Stratos Trading Pty. Limited clients please see: www.fxcm.com

Stratos Global LLC clients please see: www.fxcm.com

Past Performance is not an indicator of future results.

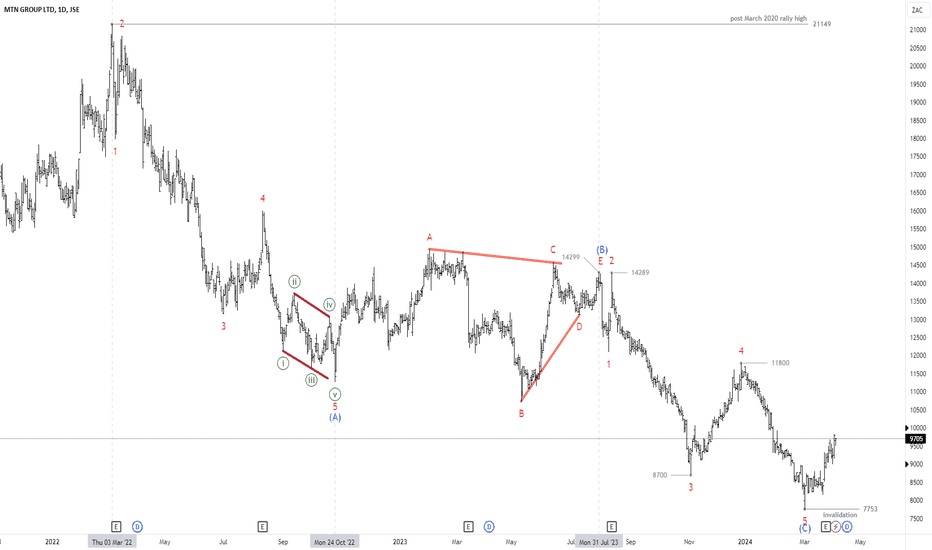

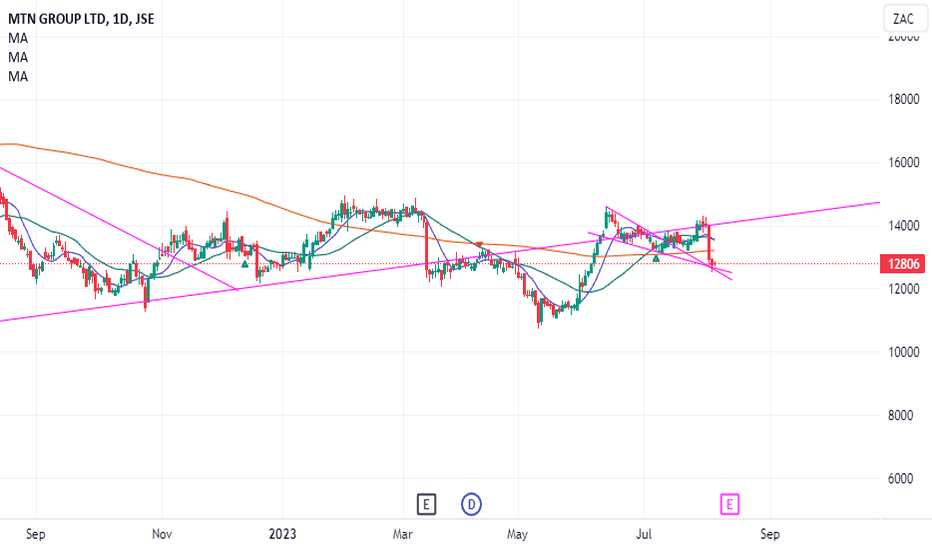

$JSEMTN - MTN: Is The Bottom Finally In? 7753 Needs To HoldSee link below for previous analysis.

MTN released its FY'23 results on the 25th of March and it was a mixed bag of results.

Salient features:

Group service revenue grew by 6.9% (13.5%*) to R210.1bn (2022: R196.5bn)

EBITDA (before once-off items) down by 0.5% (9.8%*) to R90.5bn (2022: R90.8bn)

EBITDA margin lower by 3.0 percentage points (pp) to 40.9% (1.2 pp* lower to 41.5% *)

Basic earnings per share (EPS) decreased by 78.5% to 227cps (2022: restated 1 054cps)

Reported headline earnings per share (HEPS) down by 72.3% to 315cps (2022: restated 1 137cps);

non-operational impacts decreased HEPS by 888cps

Holding company (Holdco) leverage improved to 1.4x (December 2021: 0.8x)

Adjusted return on equity (ROE) increased by 0.2pp to 24.4% (restated 2022: restated 24.2% )

Total subscribers increased by 2.0% to 294.8 million

Final dividend declared of 330cps (2022: 330cps)

These results did not deter investors much as the stock shrugged of the results and the stock trended higher in the following sessions.

Technically, the reversal signals I was looking for have materialized.

*The MACD gave a buy signal and has broken above the zero-line.

*The five wave decline from 14299 looks complete at 7753.

No matter how good the wave count looks, one can never be certain that a bottom is in but I am bullish and this outlook will only be invalidated by a break below 7753

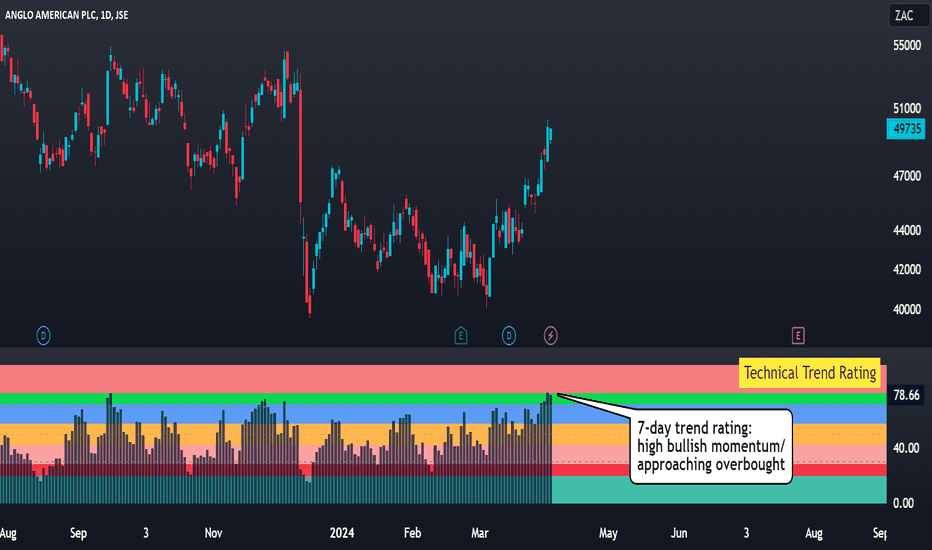

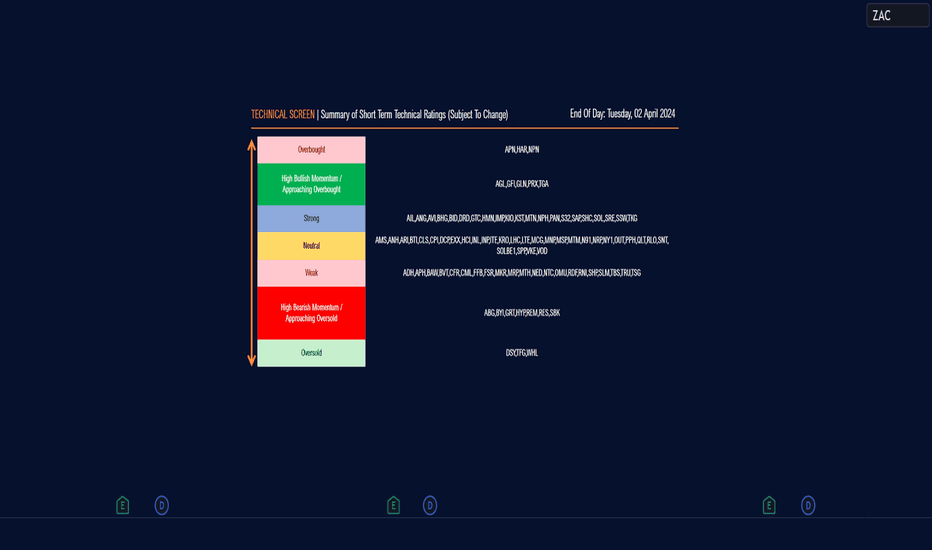

AGLReading Time: 1 Minute

On Thursday, AGL traded above R500, exceeding the R478 upside target.

At current levels, the share is in a high bullish momentum phase, while also approaching an overbought range.

Traders need to monitor for a deteriorating short term candle structure which could mean that the upside momentum is being lost. Failure to the previous session(s) range highs, would suggest that an ultra short term reversal is underway (possible tactical short/sell setup).

The share is extended versus it's 21-DAY EMA by the most since December 2022. This shows the extent of the short term overbought conditions.

In the pairs space, the LONG AGL vs SHORT KIO idea is now higher by 20%.

The current chart, with the potential short term price path is shown below.

Our opinion on the current state of MTUPreviously known as Mine Restoration, this company invests in mining resources. It owns the Langpan Project which mines and processes chrome with a high concentration of platinum group metals (PGM). The Langpan orebody consists of 3.1 million tonnes of open cast resource and over 4.9 million tonnes of underground resource, as confirmed by MSA Competent Persons report.

In its results for the six months to 31st August 2023 the company reported revenue of R13m and a loss of R16m or 10c per share. The company has R63,5m worth of assets and R254m worth of liabilities.

In a trading statement for the year to 29th February 2024 the company estimated that it would make headline earnings per share (HEPS) of between 0c and 1c compared with a loss of 12c in the previous year.

It is an untraded, loss-making penny stock which is apparently technically insolvent. It is clearly not suitable for private investors at this time.

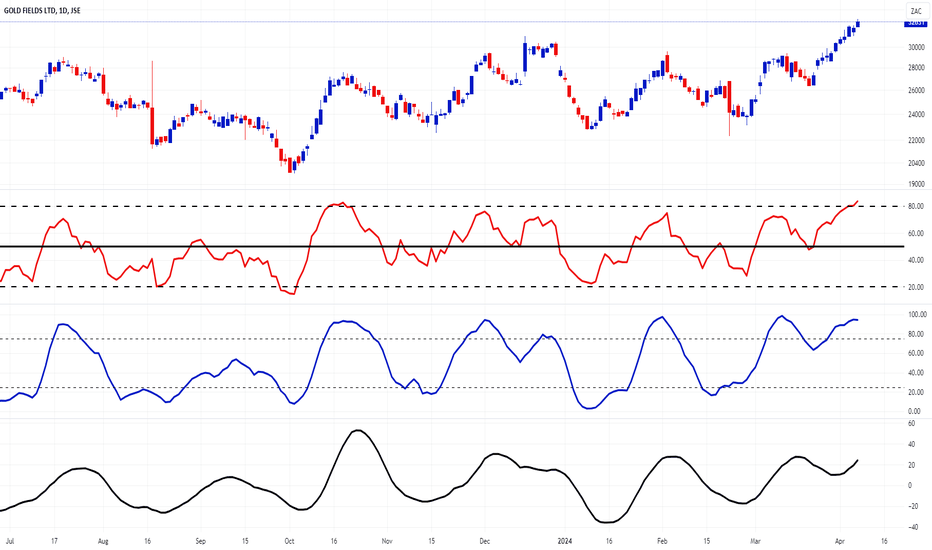

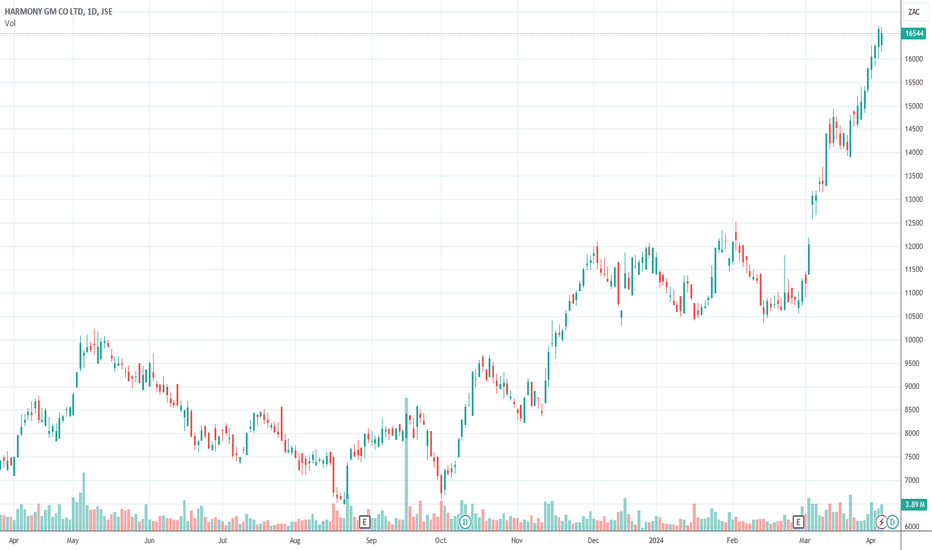

Our opinion on the current state of HARHarmony (HAR) is probably South Africa's most marginal gold mine. A marginal gold mine is one which has a cost of extraction which is relatively close to the current gold price. This means that small movements in the rand price of gold can have a radical impact on the mine, pushing it from profit to loss and back to profit very quickly. The result tends to be a volatile share price and a lot of uncertainty which investors generally do not like.

Their margin is relatively thin and there is not much room for cost increases or a fall in the rand gold price. In the future, Harmony will be relying on the Wafi-Golpu mine in Papua New Guinea which it owns 50% of, together with Newcrest Mining. Harmony and Newcrest have signed a "memorandum of understanding" with the government of Papua New Guinea which gives the development of the mine a firm time frame. The development of this mine and its processing plant are expected to cost around US$2,8bn - and Harmony does not at this stage have its share of that cash (about R20bn).

During 2021 the company purchased Mponeng gold mine for R4,2bn. Mponeng is the world’s deepest mine and has all the problems of ultra-deep level mining. The company is building a 30mw solar park in the Free State and has plans to build a further 80mw of green power.

On 9th May 2022, the company announced that 4 of its employees had been killed at Kusasalethu mine. On 6th October 2022, the company announced that it had agreed to buy 100% of the Eva copper project in Australia for R4,1bn. Harmony remains a volatile, marginal gold producer and hence risky - although recent acquisitions could change its direction significantly, taking it out of precious metals.

Eva is only expected to commence production in 3 years and is expected to add 260 000 ounces of gold and 1,7 billion pounds of copper to Harmony's reserves. In its results for the six months to 31st December 2023 the company reported a 14% increase in the amount of gold produced and an 8% decline in the rand leading to an 18% increase in the average price received. The result was that headline earnings per share (HEPS) increased by 226% and the company declared a dividend of 147c per share. The company said, "Mponeng extension project approved, extending mine life from 7 to 20 years and increasing margins - Hidden Valley generated operating free cash flow of R1 769 million (US$95 million), due to excellent recovered grades."

On 3rd April 2024 the company announced that it had signed a wage deal with all of its unions for the next five years. Technically the share is in a volatile upward trend and remains a commodity play based on the international price of gold.

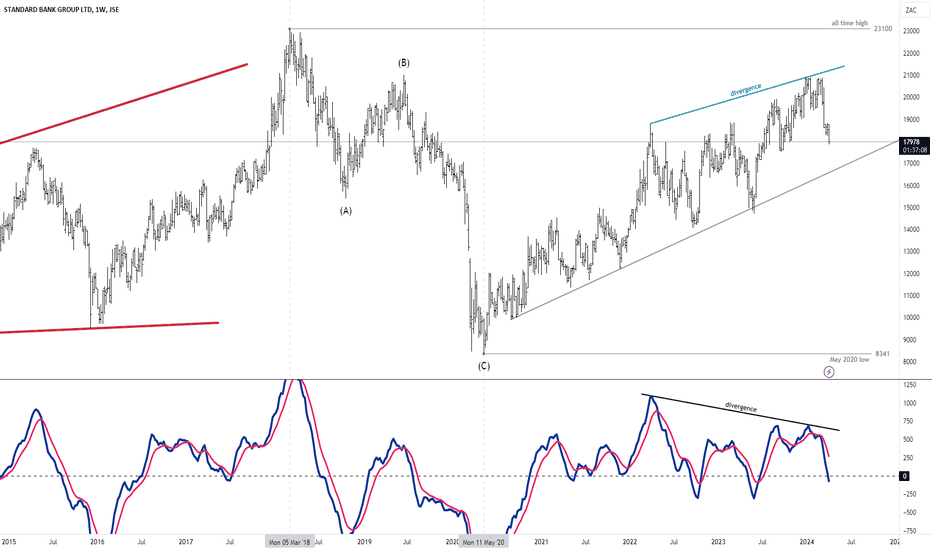

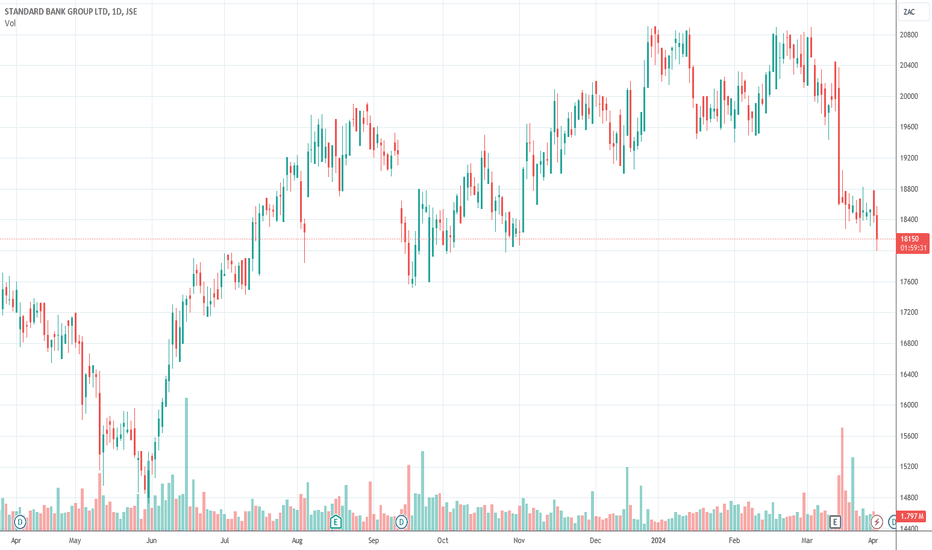

$JSESBK - Standard Bank: Creeping Along But Losing MomentumSee link below for previous analysis.

The best way to describe the ascent from the May 2020 low is creepy-crawling.

SBK stock has been steady with price well supported by the mid-sloping trendline.

As price has continued making higher highs, the MACD has made lower highs giving a bearish divergence signal. This does not imply a bearish reversal but that a pullback could occur, which as a first target, could take price back to the support line.

I am neutral and will monitor price action and volume at the support trendline.

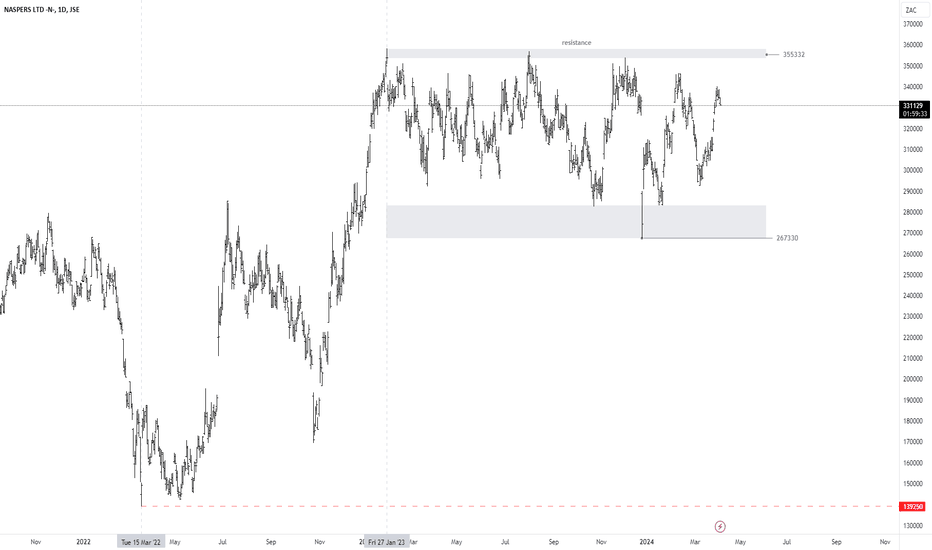

$JSENPN - Naspers: Major Resistance AheadNaspers has found the going tough since the January 2023 peak, trading sideways in a wide range.

The consolidation has not been a textbook rectangle with supporting shifting zones but the resistance has been stern around 355300 cps.

The stock caught a big at 267330 and is again approaching the resistance for a third attempt to break above it.

I am neutral at this point and will monitor price action and volume at the resistance zone.

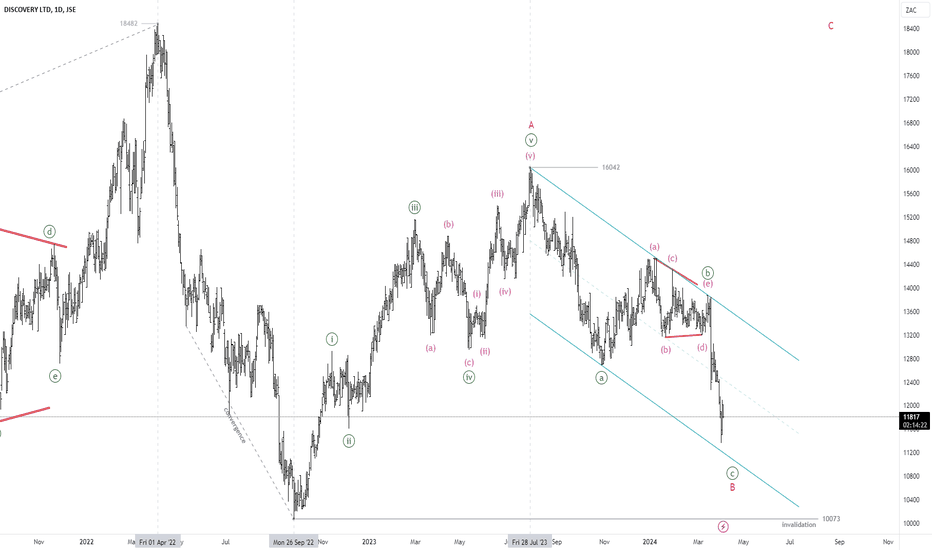

$JSEDSY - Discovery: At An Interesting JunctureSee link below for previous analysis.

Discovery has traced out the three wave decline I forecasted after the five wave advance from 10073 to 16042.

The decline is labelled as a zigzag with a triangle wave and wave is now near the support trendline of the falling channel.

There is no evidence of a reversal yet.

For this bullish, bigger picture ABC outlook to remain valid, wave B must terminate above 10073.

I will remain neutral until price action gives signs of a reversal.

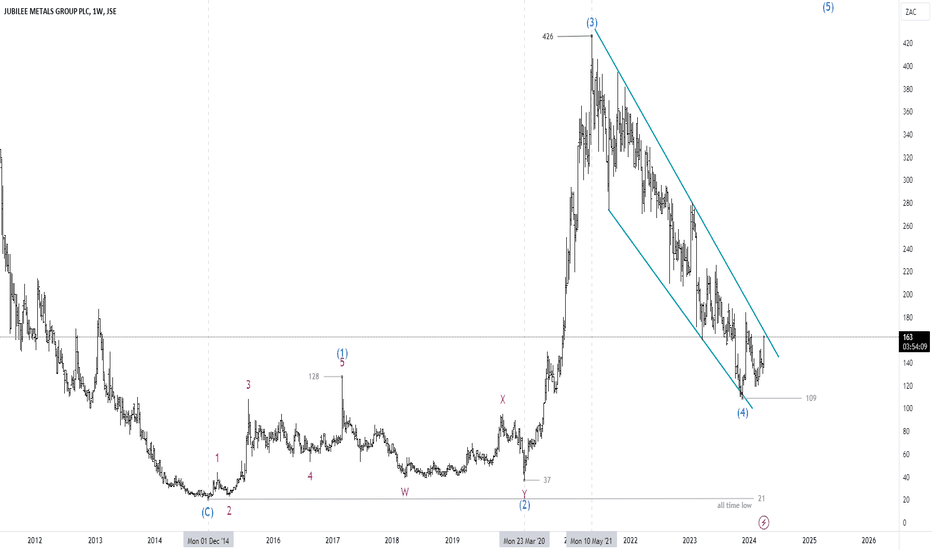

$JSEJBL - Jubilee: Impulse Invalidated, Falling Wedge ContractsSee link below for previous analysis.

Jubilee has continued to trade lower and having breached 128, i am tentatively abandoning the five wave count as wave (4) has penetrated the price territory of wave (1) violating one of the golden rules of an impulse.

The bear market from 426 is forming a falling wedge which is bullish but price can still go lower.

I will remain bearish until we get a clear breakout from the falling wedge, preferably on higher than average volume.

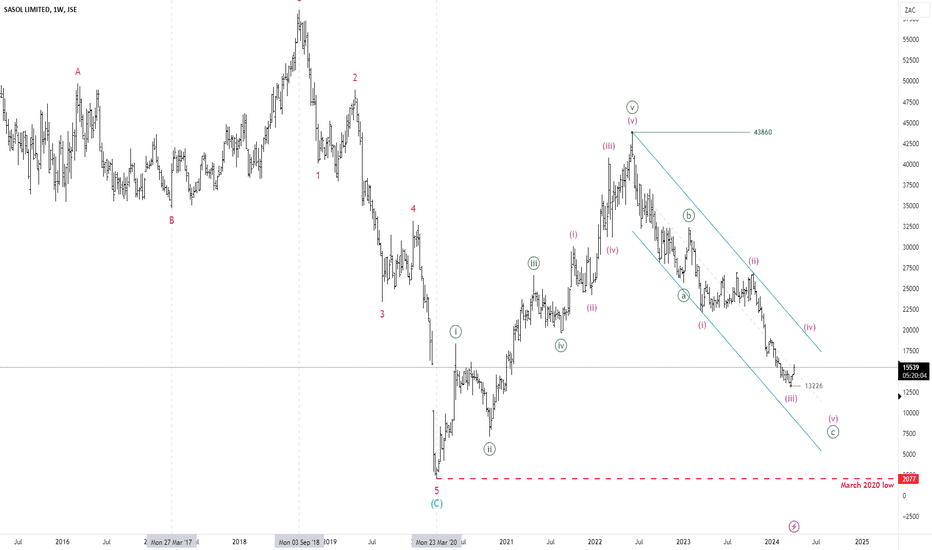

$JSESOL - Sasol: Bear Trend Still Intact, How Much Lower?See link below for previous analysis.

Sasol has continued its strong selloff, going well below the support zone of my previous analysis.

Price action is giving better Elliott Wave context.

I am looking at the bear market from 43860 as a zigzag with the bounce from 13226 for wave (iv) of .

The zigzag is well contained in a falling channel and a clear break out off this channel will give conviction that the bear is over.

I will maintain a bearish stance until we get five waves down for wave and/or a break out off the channel.

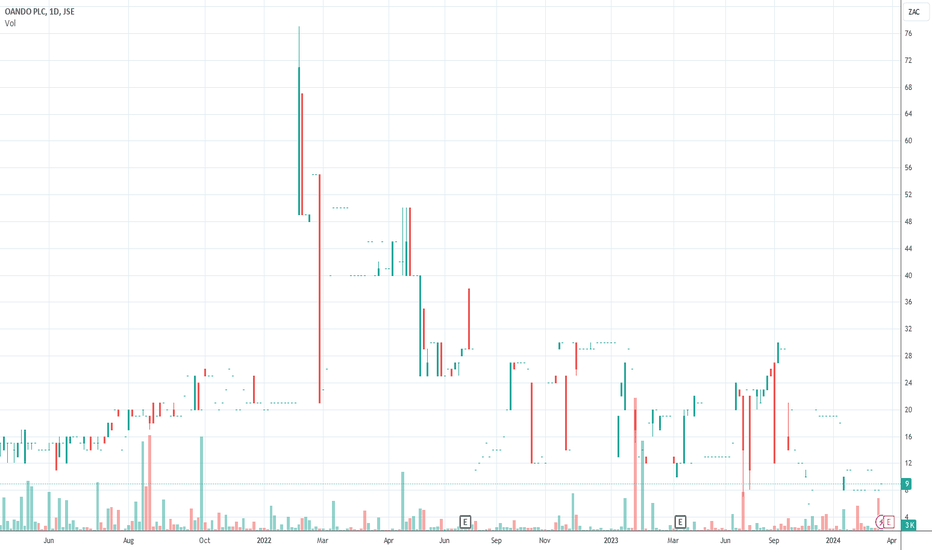

Our opinion on the current state of OAOOando (OAO) is an oil and gas company located primarily in Nigeria. It has listings on both the JSE and the Nigerian stock exchange. The problem with a share like this from a private investor's perspective is that it is highly risky.

Firstly, it is a commodity share whose fortunes are determined by the international price of oil. Secondly, its business is located in Nigeria which tends to be politically unstable. The Nigerian Securities and Exchange Commission suspended its shares for six months to conduct a forensic audit into allegations of corruption and insider trading which was lifted in April 2018 - but the report has yet to be published.

On 3rd June 2019, the Nigerien Securities and Exchange Commission (SEC) issued a ruling in terms of which certain board members were to resign and the company was to pay a fine. The company said that the SEC's findings were without basis and immediately got a court order suspending the SEC's order. This process is very reminiscent of what happened to MTN in Nigeria.

Oando's shares are also very thinly traded. From mid-October 2017 until April 2018, when not suspended, the share hardly traded at all and remained at its lows. The share has also fallen from its high of 1650c in May 2008 to its current level.

Oando recently reported that it had repaid most of the $2,5bn debt which it incurred when acquiring oil and gas assets in 2014. On 1st April 2019, Business Day reported that Oando's auditors had warned that there was doubt that Oando could continue as a going concern because their liabilities exceeded their assets.

On 22nd June 2022 the company published its results for the year to 31st December 2019. It reported a 6% increase in production with a 15% increase in turnover. The company made a loss of 207,1bn naira (the Nigerian currency) compared with a profit of 28,8bn naira in the previous period. The company said, "2019 witnessed the completion of our corporate strategy of divesting from our naira earning businesses to focus on a dollar-earning portfolio following the sale of our 25% residual stake in Axxela to Helios Investment Partners."

On 29th March 2023 the company published its results for the 12 months to 31st December 2020 reporting turnover down 17% and an after-tax loss of 141bn naira. On 26th April 2023 the company published its results for the year to 1st December 2021 reporting a profit of 34,7m naira.

The share price is now 13c - but it remains a very thinly traded, highly speculative investment. So our opinion is to leave this share well alone. On 3rd April 2024 the company announced that trade in its shares had been suspended by the JSE pending the publication of its year-end results for 2022 and its interim results for 2023.

MTN Cycle Has Failed EarlyMTN price went below R131.25 representing a cycle failure, since this is early in the cycle, we can expect price to begin trending downwards with high probability we are going below R107.35 (the previously weekly low). The share has also failed to recover the broadening wedge. In the short-term we can expect a weak bounce out of a half cycle correction.

Our opinion on the current state of SBKStandard Bank (SBK) is one of South Africa's oldest and largest banks, with significant operations across Africa. Despite challenges such as the impact of COVID-19 and load-shedding in South Africa, the bank has demonstrated resilience and remains an attractive investment opportunity for private investors, particularly in the long term.

The bank's strategic partnerships, including its 20% ownership by the Industrial and Commercial Bank of China (ICBC) and its stake in ICBC Standard Bank, provide it with international exposure and opportunities for growth.

Standard Bank's acquisition of Liberty Holdings (LBH) further enhances its market position and diversification. The offer made to Liberty shareholders represented a significant premium and demonstrates Standard Bank's confidence in its ability to create value through strategic investments.

In its financial results for the year ending December 31, 2023, Standard Bank reported impressive growth in headline earnings per share (HEPS) and return on equity (ROE). The bank's net asset value (NAV) also saw a notable increase, reflecting the strength and momentum of its business operations.

Standard Bank's performance is supported by its robust franchise and expanding presence across Africa. The bank's operations in various African countries contribute significantly to its overall earnings, highlighting its successful penetration into key markets on the continent.

From a technical perspective, Standard Bank's share price has shown resilience, with a strong upward trend observed since May 2023. With a price-to-earnings (P/E) ratio of 7.18 and a dividend yield (DY) of 6.12%, the stock appears undervalued and offers attractive returns for investors.

Overall, Standard Bank presents a compelling investment opportunity, backed by its strong financial performance, diversified operations, and strategic positioning in key markets. While short-term challenges may persist, the bank's long-term prospects remain promising, making it a favorable choice for private investors seeking stable returns and capital appreciation.