Our opinion on the current state of DISCOVERY(DSY)Discovery (DSY), developed and built by Adrian Gore over the past 25 years, offers the A/B income group of people a matrix of financial services that are inter-linked and cross-selling. Thus, a customer can begin with his/her medical aid and then add a variety of insurance products and, most recently, personal banking products.

Discovery's "Vitality" concept, which rewards clients for looking after their health in various ways, is extended to their driving record and a rewards system that ensures attractive benefits for taking the full range of Discovery debit-order products. The Vitality platform tracks over 1000 customer activities and 50 biometrics a minute using the Apple Watch in South Africa, the UK, China, Europe, and the US to ensure a process of healthy aging and retirement planning.

Discovery's Chinese company, Ping An Health, in which Discovery has a 25% stake, saw membership grow by 60% over the year, and written premiums increased by 87% to $753m. Ping An is rapidly developing into Discovery's "Tencent."

Discovery's move into banking offers existing clients a range of banking and credit card facilities. The banking license was approved in November 2017 and should significantly increase the profits generated by the group in time. This is a disruptive development that will seriously shift the banking of A/B income group consumers away from existing banks. Discovery Bank's aim was to bring in 1000 new accounts per day from the end of August 2019.

The company has seen a drop in car accident claims and medical insurance claims since the lockdown. This is a highly rated share despite the decline in its share price over the past two years. Discovery Bank has now reached 700 000 active clients, and those clients are mostly of very high quality—but the progress has been relatively slow, partly because of the pandemic.

Discovery shares remain expensive, but we regard this as one of the best shares for a private investor to hold for long-term growth. CEO Adrian Gore says, "I am a great believer that opportunities are not in good times," indicating his belief that growth comes from investing during the difficult times South Africa is currently experiencing. Gore has also stated that the NHI, as it is proposed, is unaffordable for South Africa and that there are insufficient medical resources to implement it.

Discovery became the first large, listed company to require all its staff to be vaccinated. On 20th June 2022, the bank reported that it had more than 1 million accounts and was taking on about 750 new accounts per day.

In its results for the six months to 31st December 2024, the company reported total revenue up 42% and headline earnings per share (HEPS) up 33%. The company said, "Capital ratios remained strong across every business and liquidity at each regulated entity, and at the centre, remains well in excess of the required buffers. The cash conversion ratio remained steady at 75% of after-tax normalised operating profit compared with the prior period, notwithstanding the strong growth in normalised profit from operations."

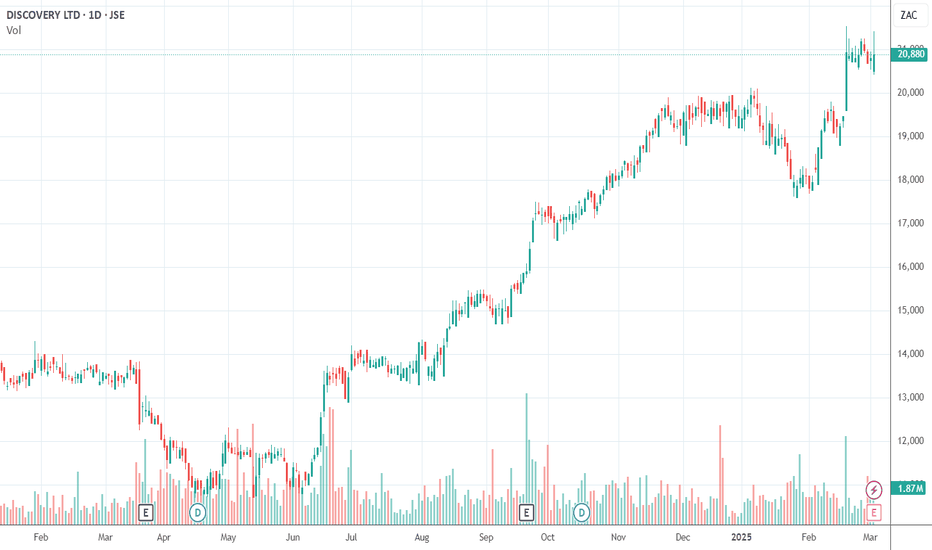

Technically, the share has been in a strong upward trend since June 2024. We added it to the Winning Shares List (WSL) on 1st August 2024 at 14280c. It has subsequently moved up to 20882c. Due to the quality of its management and business model, we see this as a "must-have" share for any private investor's portfolio.

Our opinion on the current state of CLIENTELE(CLI)Clientele Life (CLI) is a small insurance company selling short- and long-term policies and underwriting insurance products. Their products are sold through agents and brokers as well as through tele-sales.

On 3rd November 2023, the company announced that it had acquired 1Life Insurance for R1,914bn, to be paid by issuing 117,815,756 ordinary shares in Clientele.

In its results for the year to 30th June 2024, the company reported headline earnings per share (HEPS) and net profit down 4%. The company said, "The total net insurance service result increased by 4% to R171.6 million. The total net investment result of R254.9 million is double the prior year figure. Net insurance finance income is 19% higher than the prior year at R207.3 million. Revenue from contracts with customers increased by 11% to R380.4 million."

In a trading statement for the six months to 31st December 2024, the company estimated that HEPS would increase by between 2% and 17%. The company said, "...shareholders are encouraged to appreciate the noteworthy impact of the once-off recognition of a bargain purchase gain of R469 million arising from the fair value measurement at the date of acquisition of 1Life."

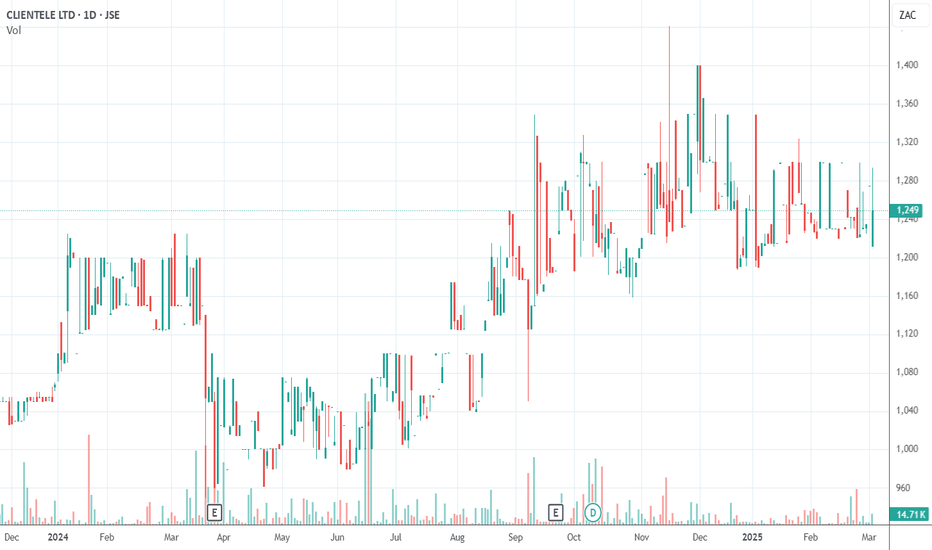

The share trades on a P:E of 12,7, which seems cheap to us. The share is heavily traded enough for most private investors. In our opinion, this share continues to represent reasonable value at the current P:E. It should benefit directly as and when the South African economy improves as a result of the newly appointed government of national unity (GNU).

Our opinion on the current state of NAMPAK(NPK)Nampak (NPK) is Africa's largest packaging company, operating in South Africa and ten other African countries. About 60% of its turnover comes from South Africa, but only 36% of its trading profit. The rest of Africa accounts for 59% of trading profit and only 31% of turnover. The company also has small interests in the UK and Ireland.

Nampak produces four kinds of packaging products—plastics, metals, paper, and glass. The majority of its trading profits come from metals, primarily beverage cans. The company has successfully repatriated R3,5bn (US$265m) of surplus cash from Zimbabwe, Nigeria, and Angola, demonstrating strong management in navigating African markets. However, it has halted its African expansion strategy after writing down its businesses in Angola and Nigeria by R3bn.

The company was affected by COVID-19 and the decline in the oil price, impacting its operations in Nigeria and South Africa. However, it avoided selling assets or conducting a rights issue to pay down debt of nearly R6bn. The announcement of a R1,35bn rights issue to reduce debt caused a 30% drop in the share price. This was later reduced from R2bn to R1,5bn, and shareholders approved raising up to R1bn on 30th June 2023.

On 20th April 2023, CEO Eric Smuts resigned with immediate effect and was replaced by Phil Roux. On 16th May 2024, the company announced the sale of its entire Nigerian operation for $68,5m.

In its results for the year to 30th September 2024, the company reported revenue from continuing operations up 1% and headline earnings per share (HEPS) of 3361,1c, compared with a loss of 39004,6c in the previous period. The company said, "The Beverage category continues to grow, in particular beverage in cans, a format which is growing in terms of consumer preference. Challenges faced in the second half relating to the installation of the new 500ml production line at Springs meant that Nampak was unable to fully capitalise on this increased demand."

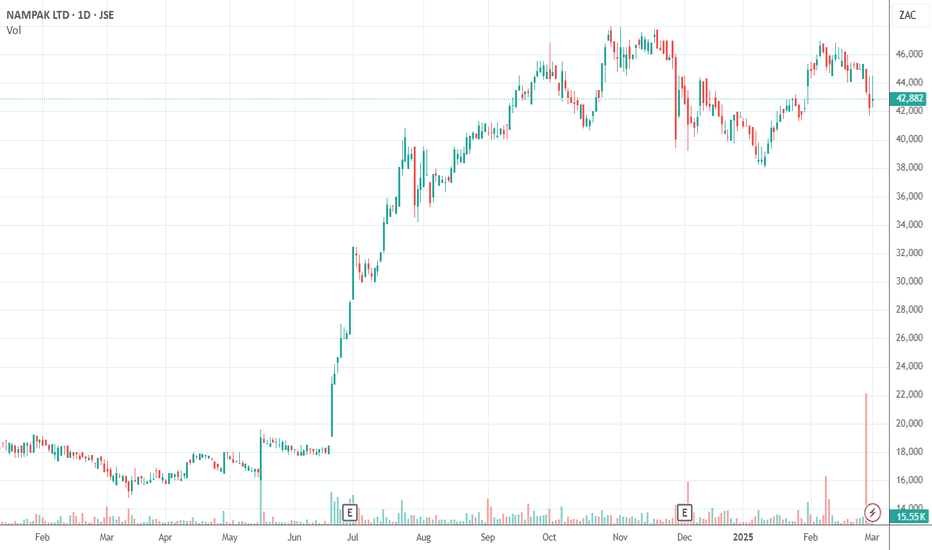

On 31st January 2025, the company announced the sale of Bevcan Nigeria for $68,2m. The share remains in an upward trend but is a volatile commodity share, and the trend may be coming to an end.

Our opinion on the current state of SABCAP(SBP)Sabvest Capital (SBV) is an investment holding company that listed on the JSE in 1988. Previously, the company had both ordinary and "N" shares, which were very thinly traded. To rectify this situation, a new company was registered called Sabcap, and the shares of Sabvest were swapped out for Sabcap shares. This happened on 12th May 2020.

Sabcap has investments in five private companies, by far the largest of which is SA Bias, where its investment is 60% and worth R673m. SA Bias is predominantly involved in the textiles industry but also has an interest in a company involved in handling equipment and parts. The other private companies in which it has an interest are: Classic Food Brands (30%), Flexo Line Products (47,5%), Mandarin Holdings (30%), JAA Holdings (35,7%), and Sunspray Food Ingredients (28,2%).

Aside from this, Sabvest has a listed portfolio worth about R700,000 and offshore investments worth about R573,000. It also owns 11,7% of Metrofile, worth R82,3m, 300,000 shares in Net1 UEPS, and 31% of Rolfes.

In its results for the six months to 30th June 2024, the company reported net asset value (NAV) up 7,8% to 11,786c per share. Headline earnings per share (HEPS) increased by 63,2%. The company said, "The compounded annual growth rate in NAV per share over 15 years with dividends reinvested was 18,5%."

In a trading statement for the year to 31st December 2024, the company estimated that the company's NAV would increase by between 17% and 21%.

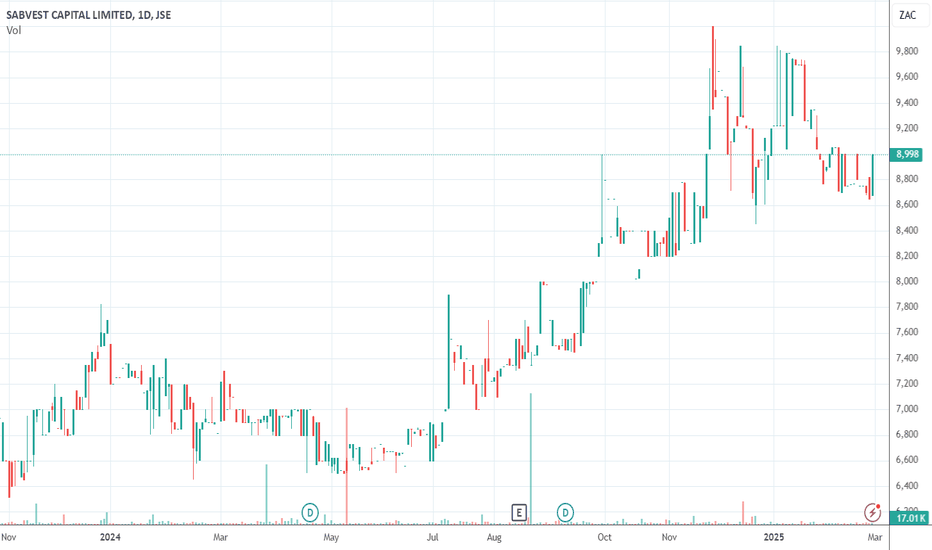

This share is very difficult to analyze because of its diverse and constantly changing portfolio. The restructuring of the business does appear to have increased the volumes traded a little, with an average of about R248,000 worth of shares changing hands each day, and the share does appear to be in an upward trend. Like most investment holding companies, it trades at a significant discount to its NAV.

Our opinion on the current state of SALUNGANO(SLG)Salungano, previously Wescoal, engages in the mining and trading of coal. The company began production in 2021, producing coal from its Moabsvelden mine for Eskom. Today, the company produces 300 million tons from five coal mines. Mining accounts for 82% of revenue, but it owns 50% of the Arnot Mine and is looking to broaden its business into other parts of energy.

In its financials for the six months to 30th September 2023, the company reported revenue down 30% and a headline loss of 90c per share compared with a loss of 19,64c in the previous period. The company's net asset value fell to 37c per share from 178c in the previous period.

The company said, "The Group continued to operate with only one Eskom contract, with the Elandspruit and Vanggatfontein Collieries continuing to supply Eskom through rectification into the Neosho contract."

The company will apply for the lifting of the suspension now that the FY2023 financial results and integrated annual report, as well as the FY2024 interim financial results, have been published, but that has not yet happened.

On 4th July 2023, the company announced that three of its directors had resigned, resulting in a sharp drop in the share's price.

On 21st August 2023, trading was suspended in Salungano shares by the JSE. It appears from a quarterly update that the 2024 financials are now only expected to be published by 30th June 2025—so the share remains suspended.

Our opinion on the current state of THUNGELA(TGA)Thungela (TGA) is Anglo American's coal assets which has been unbundled into the hands of Anglo shareholders and separately listed on the JSE and the LSE because of Anglo's policy of moving away from carbon-based fossil fuels like coal. Anglo sold its last 8% of Thungela on 25th March 2022 for R1,67bn.

Thungela is a major thermal coal exporter in South Africa. It has over 7500 employees and exports coal to Asia, India, SEA, and East and North African countries. The company owns 50% of Phola, which operates a coal processing plant, and it has a 23,22% interest in the Richards Bay Coal Terminal (RBCT). The company has the capacity to produce over 90m tons of coal per annum. The company operates seven mines in South Africa, four open cast and three underground.

In its results for the six months to 30th June 2024, the company reported revenue up 17% and headline earnings per share (HEPS) down 58%. The company said, "Group capital expenditure of R1.5 billion, reflecting the disciplined execution of the life extension projects in South Africa - Profit of R1.2 billion, including R419 million from Australia, demonstrating the benefits from the Group's geographic diversification."

In a pre-close statement on the year to 31st December 2024, the financial director said, "...we are confident that we will exceed the full-year export saleable production guidance in South Africa and Australia. The various Transnet Freight Rail (TFR) initiatives, supported by the coal industry, have allowed for the annualised run rate to 30 November 2024 to increase to approximately 52Mt, or 56Mt."

The share began trading on the JSE on 7th June 2021 and immediately fell to 2190c from 2600c. It was originally estimated to be worth a minimum of 4400c but reached a high of 37752c on 16th September 2022. Since then, it has been moving sideways and downwards with lower coal prices and problems with Transnet. Obviously, it is also subject to the volatility of being a single commodity share and dependent on Transnet to get its product to port.

The company has committed to paying out at least 30% of "...adjusted operating free cash flow" in the form of a dividend.

In a trading statement for the year to 31st December 2024, the company estimated that HEPS will be between 24% and 31% lower than in the comparable period. It will drift sideways until the price of coal increases—if it ever does.

On 21st January 2025, the company announced that its CEO, July Ndlovu, will retire in July 2025 and be replaced by Moses Madondo on 1st August 2025.

Our opinion on the current state of HARMONY(HAR)Harmony (HAR) was probably South Africa's most marginal gold mine until it got Mponeng gold mine working effectively. The development of this mine and its processing plant are expected to cost around US$2,8bn – and Harmony does not at this stage have its share of that cash (about R20bn). During 2021, the company purchased Mponeng gold mine for R4,2bn. Mponeng is the world’s deepest mine and has all the problems of ultra-deep level mining.

The company is building a 30MW solar park in the Free State and has plans to build a further 80MW of green power. On 6th October 2022, the company announced that it had agreed to buy 100% of the Eva copper project in Australia for R4,1bn. Harmony remains a volatile gold producer and hence risky – although recent acquisitions could change its direction significantly, taking it out of precious metals. Eva is only expected to commence production in three years and is expected to add 260 000 ounces of gold and 1,7 billion pounds of copper to Harmony's reserves.

On 3rd April 2024, the company announced that it had signed a wage deal with all of its unions for the next five years.

In its results for the year to 30th June 2024, the company reported an underground grade of 6,11 grams per ton, a 6% increase in gold produced, and an 11% increase in the US dollar price received. Headline earnings per share (HEPS) were 1852c (SA) compared with 800c in the previous period. The company said, "By investing in our higher-grade gold mines, expanding our surface retreatment business, and growing our international gold and copper assets, we will continue to transform and de-risk Harmony as we go from strength to strength."

In an operational update for the three months to 30th September 2024, the company reported gold production down 1%, with Mponeng production up 28%. The recovered grade was 6,32 grams per ton, and costs rose by 14%. The gold price received rose 21% to $2356 per ounce. The company said, "Strong, flexible balance sheet with net cash position increasing to R6.3 billion (US$362 million) and liquidity of R15.7 billion (US$909 million) in cash and undrawn facilities."

In an update on the six months to 31st December 2024, the company reported gold production of between 790 000 ounces and 805 000 ounces with higher recovered grades. The company said, "All of our underground operations (except Target 1, which is still in a turnaround process after being recapitalised) generated meaningful positive operating free cash flows."

In a trading statement for the six months to 31st December 2024, the company estimated that HEPS would increase by between 24% and 42%. The company said, "The average gold price received increased by 23% to R1 405 020/kg in H1FY25 from R1 141 424/kg in H1FY24."

Technically, the share, while volatile, is in a strong upward trend. It is a play on the gold price and the rand/US dollar exchange rate. It was added to the Winning Shares List (WSL) on 16-11-23 at 9920c. It is now trading for 18887c.

On 5th February 2025, the company announced that two employees had lost their lives at the company's mines.

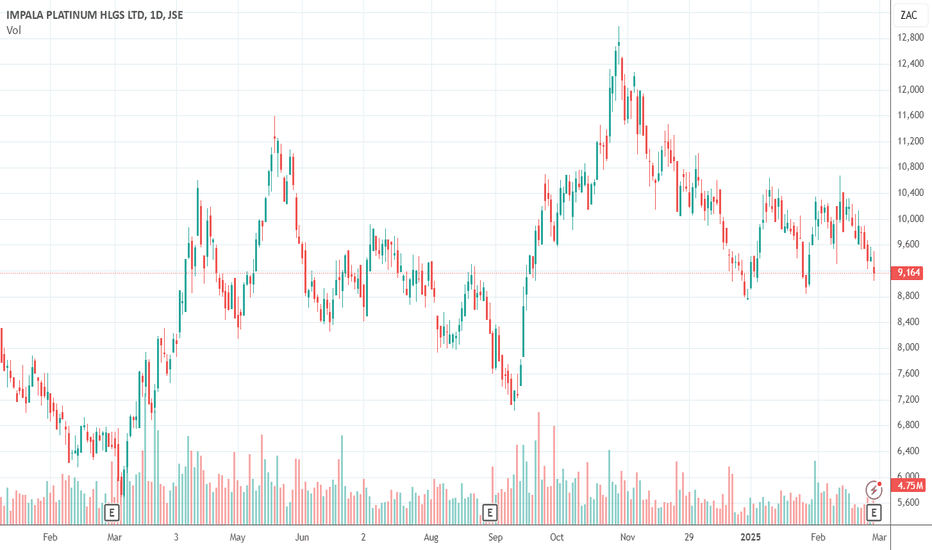

Our opinion on the current state of IMPLATS(IMP)Impala Platinum Holdings (IMP), or Implats, is the world's third-largest platinum group metals (PGM) producer. It has been suffering over the past seven years from aggressive union action and legislative uncertainty. The CEO says that they are focused "...on developing a portfolio of long-life, low-cost, shallow, modern, mechanised mining assets." This is similar to what Anglo American Platinum has been doing for the past ten years.

The market for platinum itself has been damaged by a reduction in auto catalyst demand recently, especially for diesel trucks. Palladium and rhodium still have strong markets, but platinum has been oversupplied on world markets. The company plans to grow its production from Zimbabwe by 14% due to the Mupani shaft coming on stream in 2022. Its newly acquired Canadian operation should also increase production.

On 20th July 2023, the company announced that it had acquired 56,52% of RB Plats as a result of its mandatory offer. Northam also announced its decision to sell its 34,5% holding to Implats. On 28th June 2022, the company announced that it had reached a five-year wage deal with its major union, the Association of Mine Workers and Construction Union (AMCU), for an average wage increase of 6,6% per annum.

On 28th November 2023, the company reported that 11 people had died and 75 were hospitalised following an incident at its No. 11 shaft in Rustenburg.

In its results for the six months to 31st December 2024, the company reported refined and saleable 6E production up 2% and sales up 5%, with rand revenue down by 8%. Headline earnings per share (HEPS) fell by 43,6%. The company said, "Group profitability remained challenged by lacklustre rand PGM pricing. The benefit of strong operational delivery, higher sales volumes and cost containment were negated by lower revenue."

Technically, the share was in a downward trend from March 2022 to March 2024, mainly as a result of lower PGM prices, increased costs, and loadshedding. It has recovered somewhat since then but remains a volatile commodity share.

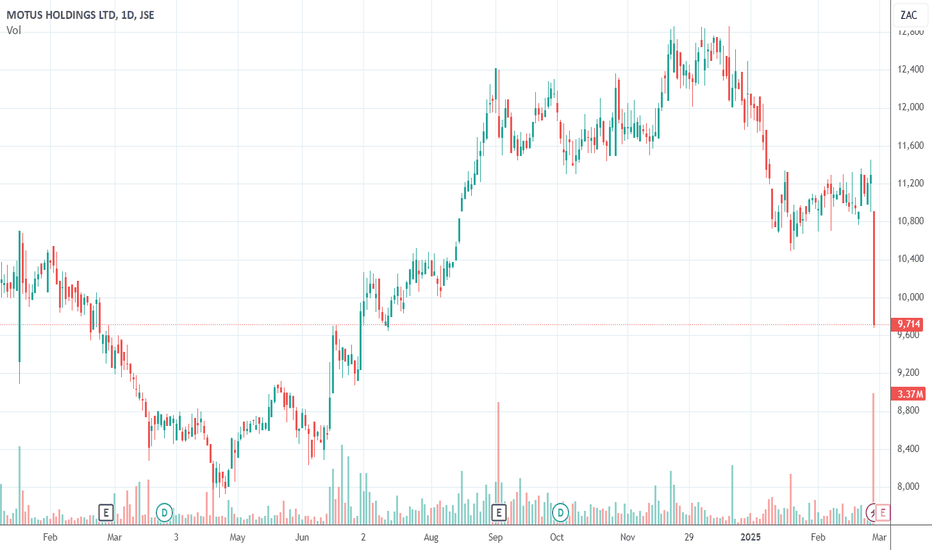

Our opinion on the current state of MOTUS(MTH)Motus (MTH) was unbundled from Imperial (IPL) and separately listed on the JSE on 22nd November 2018. It is a company that owns motor dealerships in South Africa, the UK, and Australia. The company has four divisions – import and distribution, retail and rental, motor-related and financial services, and aftermarket parts. It imports and sells more than 80,000 vehicles per annum and runs 356 dealerships and 134 rental outlets for Tempest and Europcar. It offers vehicle finance and fleet management in South Africa with 730,000 clients. It retails parts and accessories for older vehicles through 720 franchised outlets.

Altogether, it has a 20% share of the South African retail vehicle market, selling roughly 100,000 vehicles per annum. It is the importer of Hyundai, Kia, Mitsubishi, and Renault. The CEO, Osman Arbee, said that the company plans to pay generous dividends because of its strong cash flows. The company generates 65% of its turnover in South Africa and 93% of its operating profit. On 1st October 2021, the company announced that it had acquired FAI Automotive in the UK for R550m.

In its results for the year to 31st December 2024, the company reported revenue down 2% and headline earnings per share (HEPS) up 3%. The company said, "The business experienced a challenging first quarter on the back of a slowdown in the economies in which we operate and an improved performance for the second quarter. The second quarter was supported by improved business confidence, lowering of interest rates, and the introduction of the two-pot retirement system in SA."

Technically, the share fell from a high above R130 in September 2022 to levels around R80 in April 2024. It has subsequently recovered to R127 by mid-December 2024 but has been in a downward trend since then. The latest results caused the share price to drop sharply. It is now on a P:E of 6.57 – which makes it reasonably priced in our estimation.

We see this as a very well-established company that is to some extent dependent on the state of the economy and the level of consumer spending. We think it will turn out to be a good investment, especially as the economy improves with the end of loadshedding and the new government of national unity (GNU).

Our opinion on the current state of OUTSURE(OUT)OUTsurance (OUT) took over the listing of Rand Merchant Insurance (RMI) with effect from 7th December 2022. RMI unbundled its stakes in Discovery (DSY) and Momentum (MTM) and sold its 30% stake in Hastings Plc for R14,6bn. By March 2023, all that was left was the insurance business of OUTsurance.

In its results for the year to 30th June 2024, the company reported earnings up 20.3% and a special dividend of 40c per share. Earnings per share (EPS) rose to 265.5c compared to 194.5c in the previous period. The company said, "The Group sold its stake in AutoGuru, an Australian-based associate, for R68 million. OHL acquired Youi shares from a minority shareholder for AUS$42.5 million, thereby increasing its stake in Youi from 92% to 94.6%. The Group capitalised its Irish subsidiary with a total of R1 870 million (€91.1 million)."

In a trading statement for the six months to 31st December 2024, the company estimated that HEPS would increase by between 42% and 48% due to, "...significantly lower natural perils claims incurred compared to the six months ended 31 December 2023 (comparative period) by particularly Youi and also OUTsurance SA; the strong premium growth of the operating segments."

Technically, the share has been climbing steadily since the unbundling, and we believe it will continue to perform. We added it to the Winning Shares List (WSL) on 15th June 2024 at a price of 4457c. It has since risen to 7034c - a gain of 57.8% in just over 8 months.

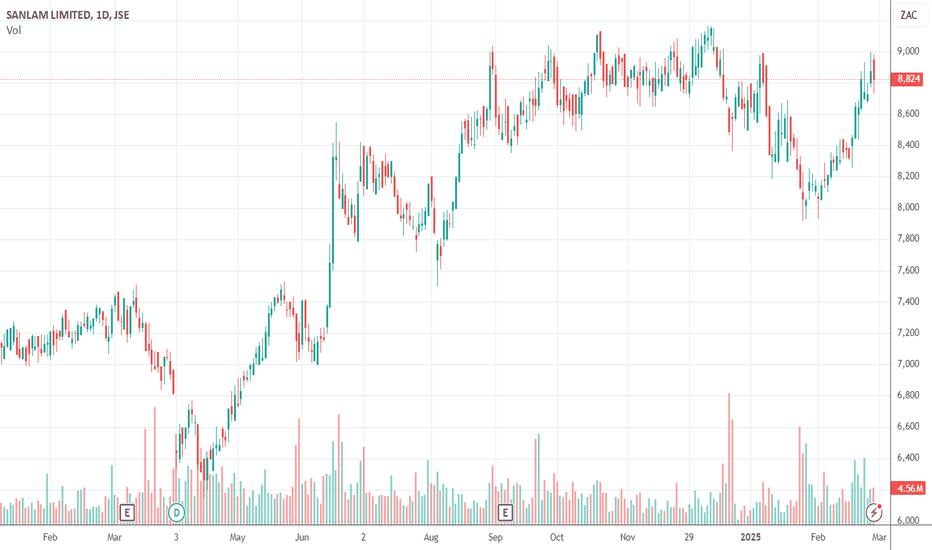

Our opinion on the current state of SANLAM(SLM)Sanlam (SLM) is one of the largest insurance and financial services groups in South Africa. It was established in 1918, demutualised in 1998, and then listed on the JSE and the Namibian Stock Exchange. It has operations in South Africa, the UK, America, Europe, India, and Australia, as well as a range of other African countries. Its product range includes general insurance, life insurance, asset management, banking, credit, health, and bancassurance.

The business has four essential elements:

1. Sanlam Investment Holdings (SIH) - now 25% owned by African Rainbow Capital.

2. Sanlam Emerging Markets - which includes its 84.5% interest in Saham.

3. Sanlam Personal Finance.

4. Santam - in which it owns 61%.

Outside of South Africa, it has operations in 11 other African countries and Malaysia. Saham has operations in 33 French-speaking countries with 3,000 staff members operating out of 700 branches, offering a similar product mix to Sanlam. Sanlam also owns 26% of Shriram, a leading provider of insurance products and financial services in India. It also made a deal to acquire 69% of Catalyst Fund Managers, a Cape-based manager of listed property assets, and 100% of an Irish company, CIG Fund Management.

About 50% of Sanlam's profits come from its personal finance operation, which is primarily based inside South Africa. It is therefore impacted by the low levels of consumer spending in this country as well as the economic recession. Sanlam is 18% black-owned and has initiated a partnership with African Rainbow Capital (ARC), in which it intends to focus on lower- and middle-income consumers and small companies. Sanlam will provide R2bn of seed capital.

On 14th June 2021, the company announced that it had acquired the Alexander Forbes group risk and retail life business for R100m. The company announced that, like Discovery, it would require employees to be vaccinated against COVID-19 from 2022.

In its results for the six months to 30th June 2024, the company reported headline earnings per share (HEPS) up 40%. The company said, "The group's earnings momentum continued, growing net result from financial services (NRFFS) by 14%, reflecting strong trading performances across our businesses. Our life and health insurance operations grew net results from financial services by 14%, general insurance reported a 16% rise, investment management performance was satisfactory with 10% growth, while the group's credit and structuring operations recorded growth of 9%. NRFFS per share increased by 19% due to a lower adjusted weighted average number of shares in 2024 relative to 2023."

In a trading statement for the year to 31st December 2024, the company estimated that HEPS would increase by between 30% and 40%.

Sanlam is one of the JSE's foremost blue-chip shares with a history of steady growth over a long period of time. After recovering somewhat from the fall in markets due to the coronavirus pandemic, it is currently trading on a P:E of 10.55. We consider it to be good value at these levels.

In a joint announcement on 18th June 2024, Sanlam agreed to buy 60% of MultiChoice’s insurance business for R1.2bn in cash.

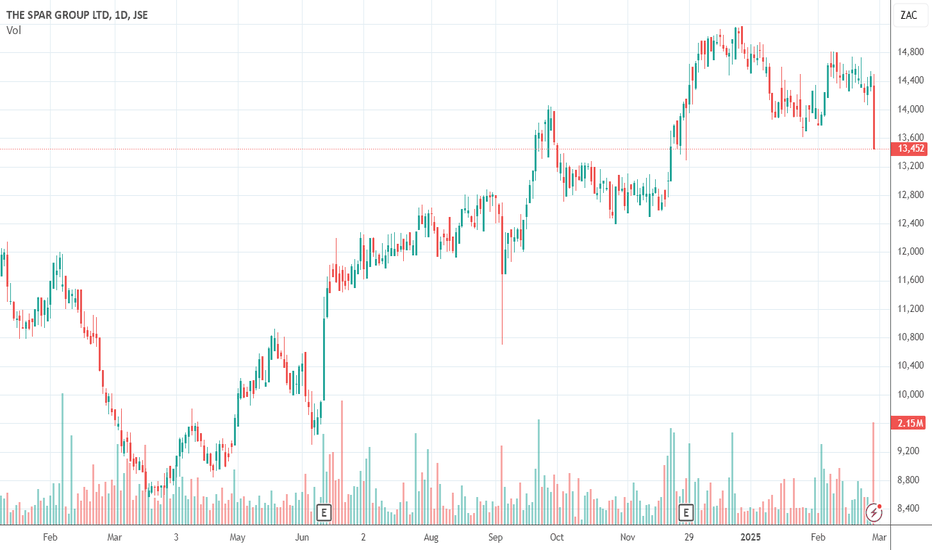

Our opinion on the current state of SPAR(SPP)Spar (SPP) runs a chain of supermarkets across Southern Africa with 2,402 stores. It also operates the Build-It chain in hardware and building materials and the Tops Liquor chain. Additionally, it has operations in Southern Ireland under the name "BWG," which operates through 1,392 stores, as well as the Spar chain of 388 stores in Switzerland.

As a group, Spar is a serious competitor in the South African retail industry, making extensive use of franchising to expand its network. The development of its new Polish enterprise has been frustrated by COVID-19. Its diversification into Ireland and Switzerland provides it with a solid rand-hedge component, which does not appear to be reflected in its valuation.

In its results for the year to 30th September 2024, the company reported turnover up 4% and headline earnings per share (HEPS) up 11.1%. The company stated, "...gross profit margin for SPAR South Africa, including SPAR, Tops and Build it, decreased from 8.7% to 8.5%. BWG Group saw a slight increase in its overall gross profit margin from 15.1% to 15.2%, driven by a more favourable category mix. Improved margin management within the wholesale and TopCC cash and carry business saw SPAR Switzerland's gross margin improve from 17.8% to 18.3%."

In an update on the 18 weeks to 31st January 2025, the company reported group turnover down 1.6% and retail sales up 3.4%. The company stated, "Growth was particularly robust in our lower-income grocery stores with subdued growth in our middle- and higher-end stores. Sales growth was impacted by the planned closure of 13 grocery stores in our South Rand Region."

In our view, the share is now underpriced at current levels and represents a bargain. We originally advised waiting for a break up through its long-term downward trendline, which happened on 12th June 2024 at a price of 11,065c. It has subsequently moved up to 13,450c.

On 4th September 2024, the group announced that it would pay an estimated R2.7bn to settle the debts of its Polish operations in order to sell them to a local retailer for R185m. At the time, the once-off cost caused the Spar share price to drop sharply.

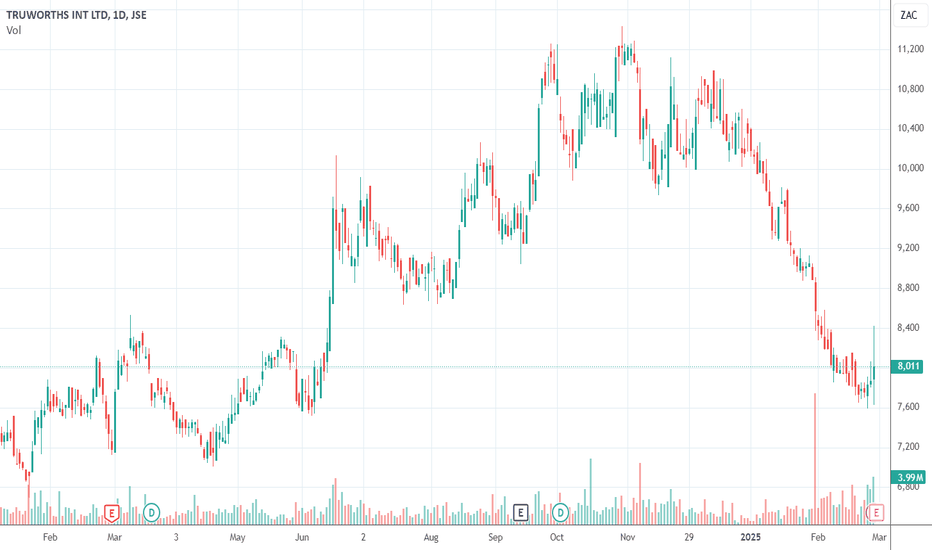

Our opinion on the current state of TRUWTHS(TRU)Truworths (TRU) is a clothing, footwear, and accessories retailer that operates in Southern Africa and the UK and is listed on the JSE and the Namibian Stock Exchange. It makes 70% of its sales in South Africa on credit, making its credit management strategies critical.

The company operates in a highly competitive industry where numerous retailers, including Woolworths, Checkers, Pick 'n Pay, the Foschini Group, Mr. Price, Ackermans, and Pep, offer similar products. The industry is also challenged by the entry of international brands like Cotton On and is entirely dependent on consumer confidence and spending. Additionally, its sales are influenced by rapid changes in the fashion industry, making profitability difficult.

Truworths follows a conservative approach and continuously refines its business model. It operates 767 stores in South Africa, 37 in the rest of Africa, and 132 stores in the UK, Germany, and Ireland. The company acquired Barrie Cline Ladieswear, a supplier for 30 years, and is in the process of launching a new low-cost value chain called "Primark" to compete with Mr. Price and Jet. It plans to roll out 15 to 20 new value stores in the coming months.

In its results for the 26 weeks to 29th December 2024, the company reported merchandise sales up 2,5% and retail sales up 2,4%. Headline earnings per share (HEPS) fell 4,6%, while the company's net asset value (NAV) increased by 21,9%. The company stated, "Truworths Africa’s retail sales decreased 1.1% relative to the prior period. Account sales decreased by 0.9% and comprised 70% (Dec 2023: 70%) of the segment’s retail sales for the current period. Cash sales decreased by 1.6%. Online sales continued to show good growth in the current period, increasing by 38% and contributing 5.8% to Truworths Africa’s retail sales."

The share reached a high of 11,212c on 4th November 2024 before entering a new downward trend. Our advice is to wait for the share to break up through its downward trendline before investigating further.

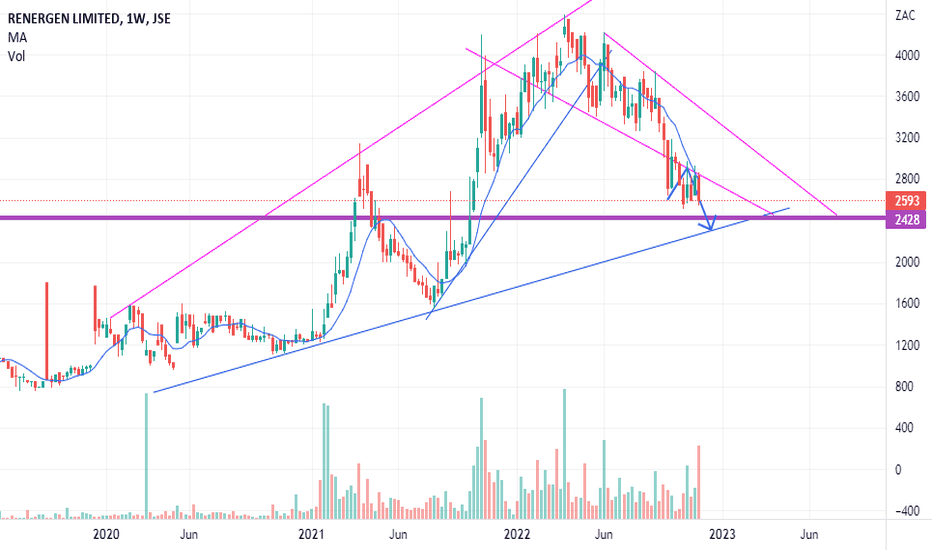

Renergen $JSEREN Almost Time to Load-upThe price for Renergen has been in a downtrend since rejection on the upper resistance of the broadening wedge. Ideally price must find support at the lower support trendline in blue. This should give price a good bounce initially to more than R30 or some 40% capital gain where profit can be harvested leaving some capital invested with increased price action monitoring. Recent volume shows capitulation which is somethin you always want to see near the bottom or turning point.

Risk : If the broader market turns downwards then Renergen risks falling out of the broadening wedge preparing price to visit the pre-covid levels. These risks will be assessed into 2023 with updates.

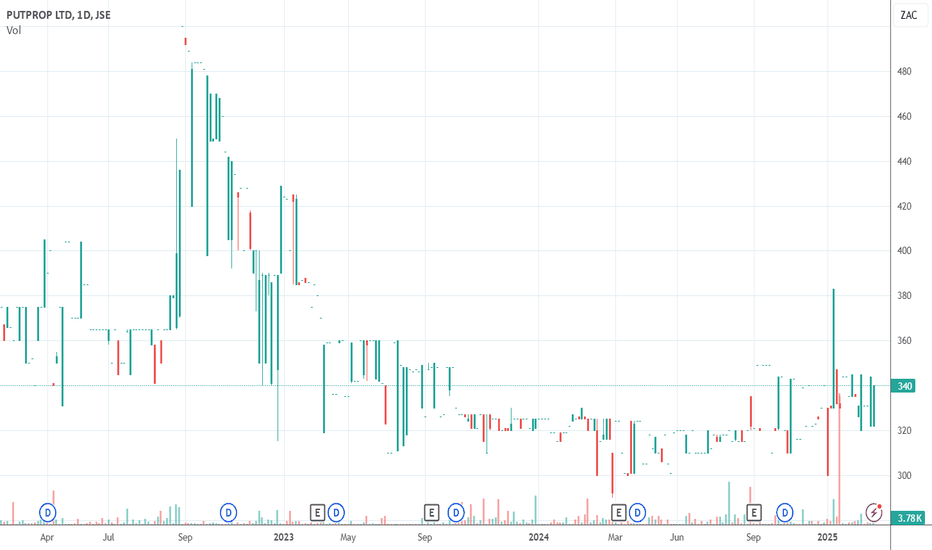

Our opinion on the current state of PUTPROP(PPR)Putprop (PPR) is a property company that was spun out of Putco (the bus company) and separately listed on the JSE in July 1988. The company owns 16 properties in the industrial, retail, and office sectors, with a gross lettable area (GLA) of 97,601 square meters and a total value of R1,095 million.

In its results for the year to 30th June 2024, the company reported rentals and recoveries of R140,3 million compared with R128,4 million in the previous period. Headline earnings per share (HEPS) was 46,54c compared with 93,22c in the previous period. The company's loan-to-value (LTV) was 36,9%, and its net asset value (NAV) was 1,668c per share.

The company said, "The property currently has a vacancy of 274m². Rentals per m² continue to be substantially below pre-COVID rates. However, there appears to be a slight increase in demand for office space, which should translate into higher future rates."

In a trading statement for the six months to 31st December 2024, the company estimated that HEPS would increase by between 16,7% and 36,7%.

From a private investor's perspective, the main problem with this share is that it is very thinly traded, with many days on which there are no trades at all. It is clearly not a share that institutional investors are interested in. We believe that there are better counters in the property sector.

Our opinion on the current state of NEPIROCK(NRP)Nepi-Rockcastle (NRP) is a R124bn real estate investment trust (REIT) which operates more than 56 shopping malls in 9 central and eastern European countries, mostly in Poland (24%), Romania (35%), Slovakia (9%), Bulgaria (8%), Croatia (5%), and Hungary (11%).

The share fell with the rest of the Resilient group (as a result of the 360ne report in January 2018) from its high of R217 in December 2017 to as low as R99 in November 2018, and then the COVID-19 pandemic took it down to under R55 in March 2020. Since then, it has staged a recovery to around R103,06. The company's total portfolio is worth 6,3bn euros (R124bn), and it ranks as the largest property share on the JSE.

On 1st February 2022, the company announced that it had to pay 30m euros in a civil judgment by the Arbitral Tribunal in Poland. In its results for the year to 31st December 2024, the company reported rental and related income up 13,2% and headline earnings per share (HEPS) up 14,9%.

The company said, "Distributable earnings (both in absolute terms and per share) and net operating income ("NOI") were the highest in the Group's history. The 11.8% increase in distributable earnings (5.6% on a per share basis) exceeded the guidance communicated."

Technically, the share recovered convincingly from the pandemic and has been in a strong upward trend since 1st November 2023. We still regard it as good value at current levels and expect the upward trend to continue.

On 18th October 2024, the company announced that it had raised 300m euros through the sale of 41,7m ordinary shares (6,2% of its issued share capital) at 7,191 euros (R137,85) per share, a discount of 4,36% to the closing price on 17-10-24 (R144,13). Technically, the share remains in an upward trend.

Our opinion on the current state of GRINDROD(GND)Grindrod (GND) is an international freight and financial services company which operates in twenty-eight countries. In mid-June 2018, Grindrod unbundled and separately listed its loss-making shipping division (Grinship - GSH). This accounts for the "cliff" in the share price at that time. The company is now focused on its two remaining divisions - freight and financial services.

Grindrod owns the North-South railway line from Beitbridge to Victoria Falls as well as port terminals at Richards Bay, Natal, Walvis Bay, Namibia, and Maputo. The company is positive on the growth of its financial services division, which is about 30% of the business. It is focused on getting its retail banking division involved with small and medium-sized businesses.

The conflict in northern Mozambique is a problem for this share. The flooding in Natal caused five of their sites to be suspended for several weeks. In its results for the six months to 30th June 2024, the company reported revenue down 1% and headline earnings per share (HEPS) flat.

The company said, "Port of Maputo grew its own handled volumes by 18% to 6.9 million tonnes underpinned by strong demand for chrome. Grindrod's dry bulk terminals handled 8.4 million tonnes. Richards Bay volumes rebounded to 1.6 million tonnes for the period, reflecting a 20% growth on the prior period. Ships agency and clearing and forwarding businesses achieved strong headline earnings growth of 38% on the back of a higher customer base and port calls. This growth was, however, dampened by the continuing negative impact of logistics constraints on the container handling depot throughput and transport, resulting in the overall logistic earnings growth of only three percent."

On 6th November 2024, the company reported that it had closed down all its rail, port, and terminal operations in Mozambique because of the closure of the Lebombo border post due to violence on the Mozambique side. A few days later, on 8th November 2024, the company reported that the restrictions at Lebombo had been lifted - but the event showed Grindrod's vulnerability and exposure to unrest in Mozambique.

In a pre-close trading update on 19th December 2024, the company reported that the average price of its dry bulk commodities had fallen by 28%, but chrome, copper, and manganese were up 10%. The company said, "Gross debt as at 30 November 2024 was R3.1 billion (2024 June: R2.9 billion), an increase of R0.2 billion deployed mainly on bulk infrastructure and rail."

In a trading statement for the year to 31st December 2024, the company estimated that HEPS would fall by between 25% and 28%. The company said, "HEPS and earnings per share ("EPS") were impacted by the fair value and expected credit losses of R522.9 million which resulted from the disposal of the non-core North Coast property-backed loans for R500 million, and R165.5 million additional provision for warranties on specific non-core loans that were sold as part of the Grindrod Bank deal."

Technically, the share made a descending triple top between July and October 2024 and then began a sharp downward trend. The share then fell to a low of 1143c on 19-12-24 before beginning a recovery, which is ongoing. We expect the share to continue to perform well despite being volatile.

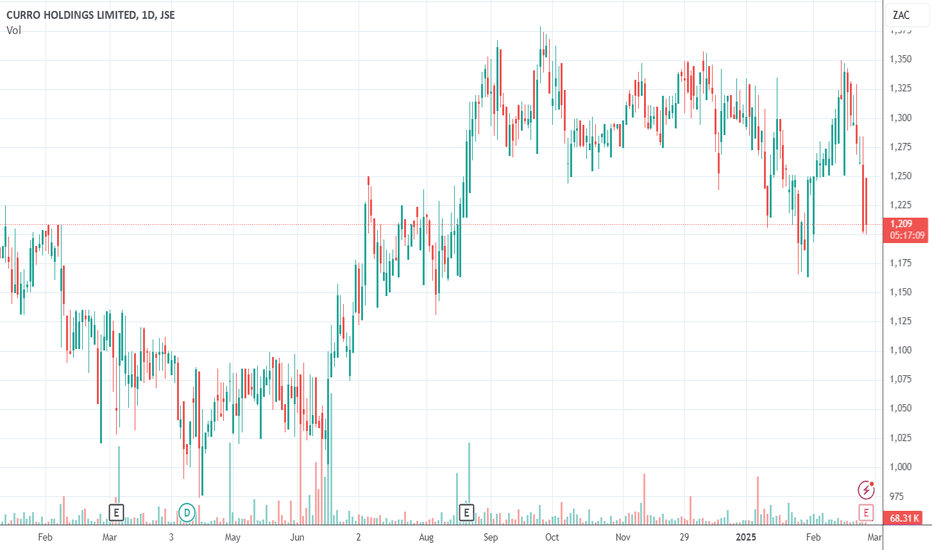

Our opinion on the current state of CURRO(COH)Curro (COH) is a private education group that concentrates on building and running schools for children up to matric. Their tertiary division was unbundled with effect from 3rd October 2017 and separately listed on the JSE as Stadio (SDO).

Curro has taken advantage of the general decline in government education since 1994. It is a spin-off from PSG (which now holds 17.2%). On 30th December 2015, it reached one of the highest price:earnings (P:E) ratios ever recorded on the JSE at 245. This was mostly because of its perceived "blue sky" potential. There seemed to be no limit to the expansion of its business model as it acquired or built more and more schools.

Curro runs 178 schools and 76 campuses with an average of just over 72,000 students. The company has reported falling pupil numbers and parents under financial pressure to pay school fees. It has also impaired the value of its schools by R202m and increased its bad debts provision.

On 1st March 2022, PSG announced that it would be unbundling its holding in Curro (63.6%) into the hands of PSG shareholders. The objective is to release value into the hands of PSG shareholders. The company is engaged in legal actions with the City of Johannesburg to prevent schools from being classified as businesses for the purposes of rates. This action was found in their favour on 2nd March 2023.

In its results for the six months to 30th June 2024, the company reported revenue up 8.3% and headline earnings per share (HEPS) up 16.2%. The average number of learners increased by 0.5% to 72,758. The company stated, "The total school fee revenue increased by 6.8% due to the growth in learners, coupled with the annual increase in school fees for this year, which averaged about 6.0% per learner for this year. The group recorded a strong increase in ancillary revenue, which was 17.2% higher than the previous period."

In a trading statement for the year to 31st December 2024, the company estimated that HEPS would increase by between 9.3% and 17.5%. EPS was expected to increase by between 117.1% and 217.1% due to the reversal of impairments worth between R340m and R380m.

Technically, the share is in a strong upward trend which has been in place since June 2023. Education is generally a good investment because parents tend to pay in advance for their children's education, which means the education companies have lower working capital requirements. While they do not tend to have union problems, they are capital intensive as each school requires significant infrastructure to function, and this adds risk.

Our opinion on the current state of ARM(ARI)African Rainbow Minerals (ARI) is a diversified mining company controlled by Patrice Motsepe, involved in a variety of mining ventures. Its interests include platinum group metals (PGM), iron ore, manganese, chrome, coal, and copper. It also owns 12.2% of Harmony Gold.

There has been some speculation about a possible acquisition. One possibility is an involvement in the Wafi-Golpu copper and gold resource, which is jointly owned by Harmony and Australian mining company, Newcrest. Harmony is looking for help in financing its share of the development cost of this massive resource—estimated at around R21bn—so ARM could potentially be part of that solution. The company is also looking for acquisitions of "green metals" mines that produce metals used in the move to avert climate change.

In its results for the year to 30th June 2024, the company reported headline earnings down 43%. The company stated, "The decline in headline earnings was mainly due to the decline in the average US dollar 6E PGM basket price and the lower thermal coal prices. This was partially offset by a weaker average rand/US dollar exchange rate and higher average realised export iron ore prices."

In a trading statement for the six months to 31st December 2024, the company estimated that HEPS would fall to between 678c and 829c compared with 1507c in the previous period, "...due to a 22% reduction in average realised US dollar iron ore prices, lower iron ore and manganese ore sales volumes, higher cash costs and a stronger rand/US dollar exchange rate."

Technically, the share has been falling since July 2024 due to weaker commodity prices. We think that this is a good mining share that is gaining stability from its diversification into base metals—but it remains risky and volatile.

Our opinion on the current state of SIBANYE-S(SSW)Sibanye (SSW) is a mining house that has been on a rapid acquisition trail, accumulating platinum and gold mines in South Africa and America. It is now broadening its scope to include base metals and minerals, especially so-called "green" metals.

The company is run by Neal Froneman, who is well-known in the mining industry for his toughness, expertise, and experience. Froneman has said that he intends to retire in about 2024/5 but aims to double the size of the company before he does. Sibanye is also considering moving into the base minerals used in motor vehicle batteries, such as vanadium, copper, nickel, and lithium.

On 1st June 2021, the company announced a share buy-back program to repurchase up to 5% of its issued shares. On 3rd July 2024, *Business Day* reported that Sibanye had retrenched 11,000 workers over 18 months.

In its results for the year to 31st December 2024, the company reported revenue up 7% in the final six months, with a gold price that "...drove a 216% increase in adjusted EBITDA1 to R3.6 billion." South African PGM costs were up 6%, and "US PGM - consistent production and 27% reduction in AISC to US$1,367/2Eoz for 2024..." The CEO, Neal Froneman, stated, "Our strategic diversification and proactive actions in response to many of the forces currently driving global change have ensured that the Group is well positioned to sustain a longer period of low prices."

Technically, the share has been in a downward trend since March 2022, mainly due to falling commodity prices. On 13th February 2024, the company announced that CEO Neal Froneman will be retiring on 30th September 2025 and will be replaced by Richard Stewart.

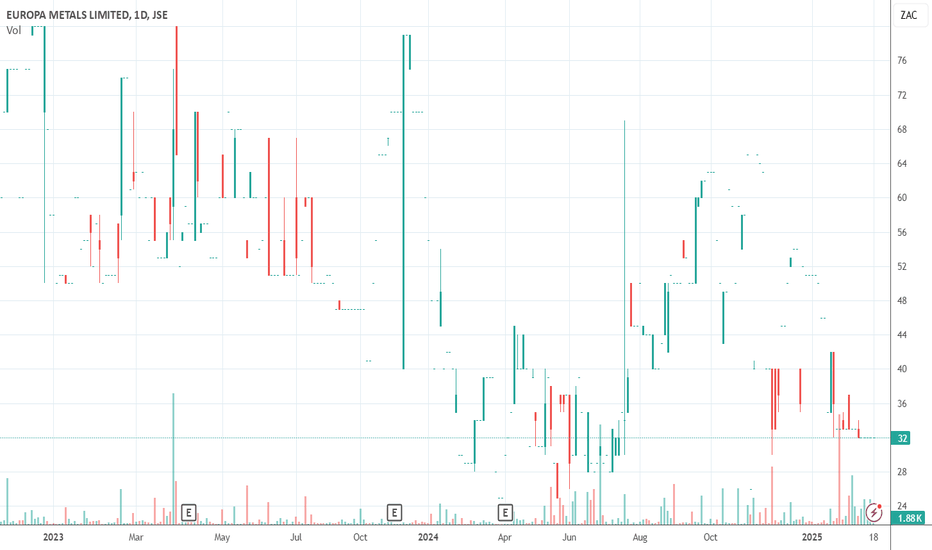

Our opinion on the current state of EUROMET(EUZ)Europa (EUZ) is a European metals developer that operates primarily in Spain, where it mines lead, zinc, and silver. The company owns 100% of the Toral project in Leon Province, which has a three-year investigation permit. In December 2018, a comprehensive scoping study was completed, and Europa is now pursuing infill drilling in high-grade areas toward a full feasibility study.

This is a mining exploration company included in the JSE's fledgling index. It recently applied to terminate its listing on the Australian Stock Exchange (ASE) and to move its listing from the JSE's main board to the Alt-X.

In its results for the year to 30th June 2024, the company reported an income of $277,000 and a loss of $632,800. The company has accumulated losses of $52.8m and cash in the bank of $252,000. Europa is a penny stock that was oscillating between 47c and 80c on thin volumes. It is highly risky because it does not yet have a productive mine.

In an update on 21st February 2025, the company said, "The Company is very aware that, since the resumption of trading on AIM, the share price has declined considerably, however the Company is not aware of any reason for this decline."

This share is volatile, unpredictable, and difficult to evaluate.