Our opinion on the current state of BLUBlue Label Telecoms (BLT) is a company with a significant stake in Cell-C, a telecommunications provider in South Africa. The performance of Cell-C has a substantial impact on Blue Label's overall results.

Since acquiring a 45% stake in Cell-C in September 2016, Blue Label's financial performance has been closely tied to the performance of Cell-C. However, Cell-C has faced challenges, including high levels of debt and a downgrade of its credit rating by S&P Global Ratings in April 2019 due to an unsustainable capital structure.

To address these challenges, Blue Label Telecoms has been actively involved in recapitalizing Cell-C. For instance, in September 2022, Blue Label announced a recapitalization plan involving a R1.03 billion injection from Bluetel, increasing its stake in Cell-C to 49.5%. This move was received positively by the market, leading to an increase in Blue Label's share price.

Blue Label Telecoms has also taken steps to improve its own financial position, including achieving positive cash flows and divesting its 3G handset division to reduce debt levels.

In its financial results for the six months ending November 30, 2023, Blue Label reported a decline in revenue and headline earnings per share (HEPS). The decrease in core headline earnings was primarily attributed to a decrease in the performance of Comm Equipment Company (CEC), partially offset by improvements in other entities within the group.

Technical analysis indicated a break through the downward trendline for Blue Label Telecoms' share price on February 29, 2024, signaling a potential turnaround. Since then, the share price has experienced a notable increase.

Additionally, the resignation of Douglas Stevenson as CEO of Cell-C in March 2023 could signal changes within the company's leadership and strategy, which might impact Blue Label Telecoms' future performance.

Overall, Blue Label Telecoms' fortunes are closely tied to the performance of Cell-C, and the company's ability to navigate challenges in the telecommunications industry will be critical for its future success. Investors should monitor developments in both companies closely.

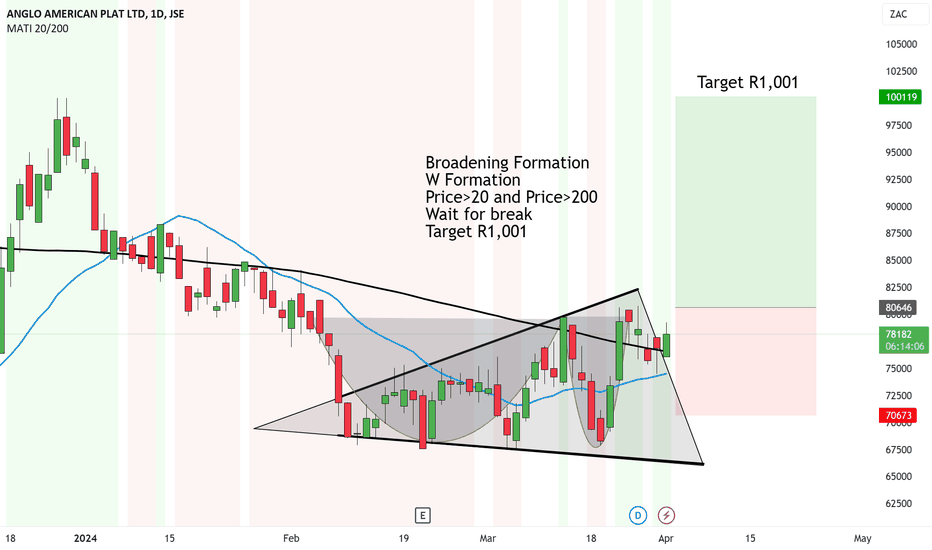

Anglo American Plats rare metal and rare formation showing upsidBroadening Formation (Vuvuzela) and W Formation is forming on AngloPlats.

We are seeing synergy with the upside with the platinum price and platinum stocks.

I guess no suprise knowing they work in tandem with each other.

Also, there is a good chanc eof upside with the price above both:

Price>20 and Price>200

Wait for break above the necklines and we could get a Target of R1,001

Moving onto the fundamentals:

The increase in Anglo American Platinum's stock price in 2024 can be connected to the broader market dynamics affecting platinum prices.

Factors like a global supply deficit, driven by production challenges and rising demand from sectors such as automotive and green technologies, contribute to the metal's price increase.

As Anglo American Platinum is a major producer of platinum, these market conditions likely positively impact the company's stock price by enhancing profitability prospects due to higher platinum prices.

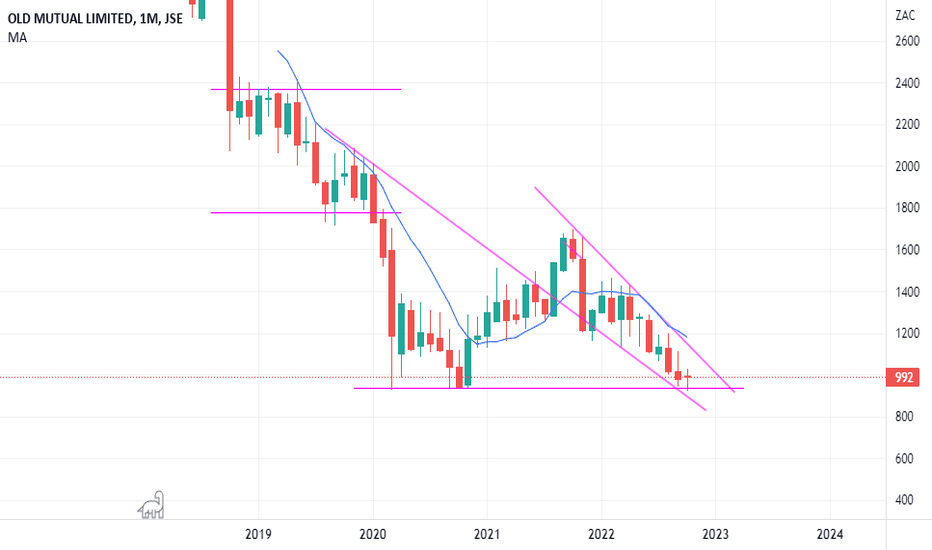

Old Mutual: Bears Reaching End of ChannelOld Mutual is seeking a low on the long-term time frame. Currently bouncing off support. More risk accepting investors can accumulate at these levels as weekly swing low is confirmed, longer term traders can wait for a swing low confirmation on a monthly basis. The target profit from this move is at least 25% at which point a downtrend can be expected to resume targeting a break of support before finding the ultimate bottom in 2023.

Our opinion on the current state of ASCAscendis Health (ASC) is a South African company with operations in health products for animals, plants, and humans. Over recent years, the company has undergone significant restructuring efforts to address its financial challenges and refocus on its core businesses.

In January 2020, Ascendis Health emphasized the importance of its asset Remedica to the group's earnings and margin growth. However, by January 2021, negotiations began with L1 Health and Blantyre Capital for a recapitalization deal to address the company's debt. This deal, finalized in May 2021, involved the exchange of debt for ownership of various assets, including Remedica.

Subsequent to shareholder approval in October 2021, Ascendis Health sold its animal health division in July 2021, generating proceeds to reduce its debt burden. Following these recapitalization efforts, the company is contemplating delisting from the JSE.

In its financial results for the six months ending December 31, 2023, Ascendis Health reported a decrease in revenue but a significant improvement in headline earnings per share (HEPS) compared to the previous period, indicating progress in its financial performance. Notably, the reduction in interest paid was attributed to the repayment of outstanding term loan debt.

From a technical standpoint, Ascendis Health's share price has been relatively flat since its peak in October 2016, showing no clear signs of a new upward trend. However, the announcement of a firm intention by a consortium to acquire all shares of the company at 80c per share and delist from the JSE caused a spike in the share price to match the offer price.

Overall, Ascendis Health's recent initiatives aimed at reducing debt and refocusing its operations signal efforts to stabilize the company's financial position. However, the potential delisting and the volatile nature of its share price make it a risky investment, subject to the success of its restructuring efforts and the terms of any acquisition deal.

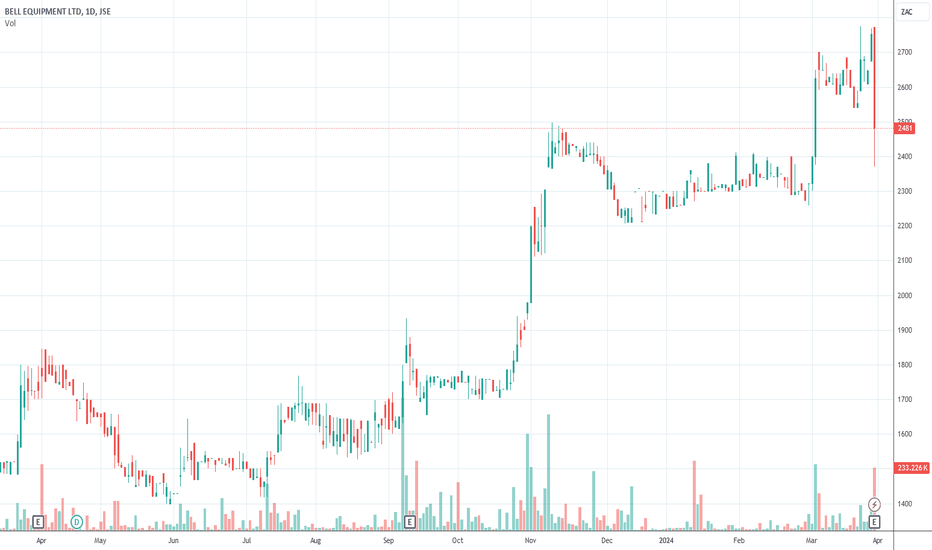

Our opinion on the current state of BELBell (BEL) is a prominent manufacturer and distributor of heavy equipment, specializing in earth-moving machinery for industries such as mining, construction, agriculture, and waste management. The company, which produces articulated dump trucks exported globally from South Africa and Germany, has faced challenges due to the slowdown in construction since 2008 and the decline of the mining industry.

Despite these challenges, Bell has maintained a diversified product range, with dealerships for various global manufacturers, offering over 120 products. Approximately 60% of its business comes from international markets, with the company employing 3,200 people, primarily in South Africa.

Recently, CEO Gary Bell hinted at the possibility of delisting the company, with 1A Bell expressing interest in acquiring a further 31.4% stake at a discounted price of R10 per share. This move sparked discussions among minority shareholders, who argue that the board has a fiduciary duty to consider all options, including selling the company to the highest bidder.

In its financial results for the year ending December 31, 2023, Bell reported robust performance, with revenue increasing by 32% and headline earnings per share (HEPS) rising by 69%. The company's net asset value (NAV) also saw a significant increase, rising by 21% to 5527c per share.

With an average daily trading volume of over R1 million, Bell's shares are actively traded, making them suitable for private investors. An on-balance-volume (OBV) buy signal was observed on September 7, 2023, at 1752c per share, and since then, the share price has appreciated to 2480c. This positive momentum suggests growing investor confidence in Bell's prospects.

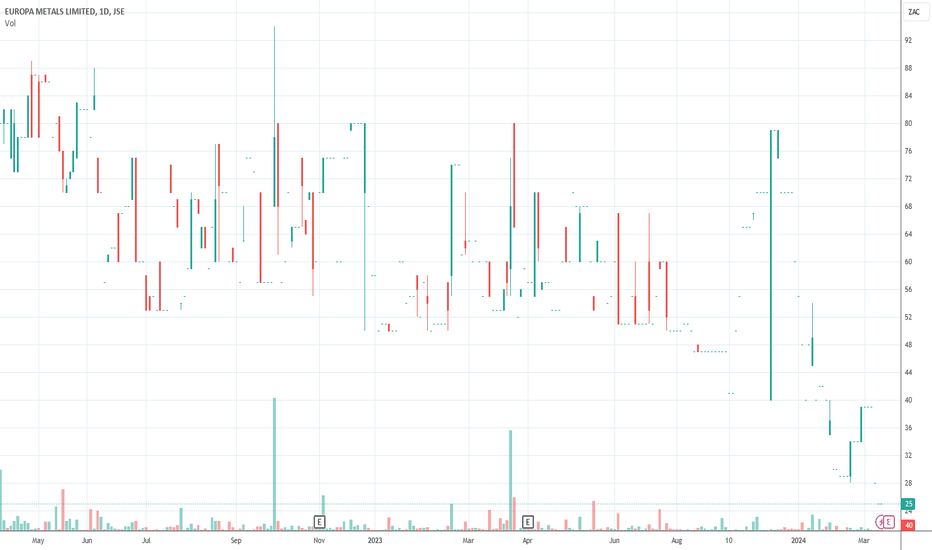

Our opinion on the current state of EUZEuropa (EUZ) is a European metals developer primarily operating in Spain, where it focuses on mining lead, zinc, and silver. The company owns 100% of the Toral project located in Leon Province, holding a 3-year investigation permit. Following the completion of a comprehensive scoping study in December 2018, Europa has been advancing towards a full feasibility study through infill drilling in high-grade areas.

Despite being included in the JSE's fledgling index, Europa recently applied to delist from the Australian Stock Exchange (ASE) and move its listing from the JSE's main board to the Alt-X.

In its financial results for the six months ending December 31, 2023, the company reported an after-tax loss of A$248,761, an improvement from the loss of A$1.2 million in the previous period. Europa highlighted its ongoing drilling campaign focused on confirmatory and infill drilling within the project's known indicated resource area, which comprises approximately 7 million tonnes at 8.1% Zinc Equivalent, including lead credits, 5% zinc, 3.7% lead, and 29g/t silver.

Europa's stock is considered a penny stock, typically oscillating between 47c and 80c on thin volumes. As the company does not yet have a productive mine, it is considered highly risky for investors. The stock has shown significant volatility, including a strong on-balance volume (OBV) buy signal at 52c on July 17, 2020, which propelled the share price to 191c before retreating. Currently trading at 25c, the share remains volatile, unpredictable, and challenging to evaluate. Investors should exercise caution and conduct thorough research before considering an investment in Europa.

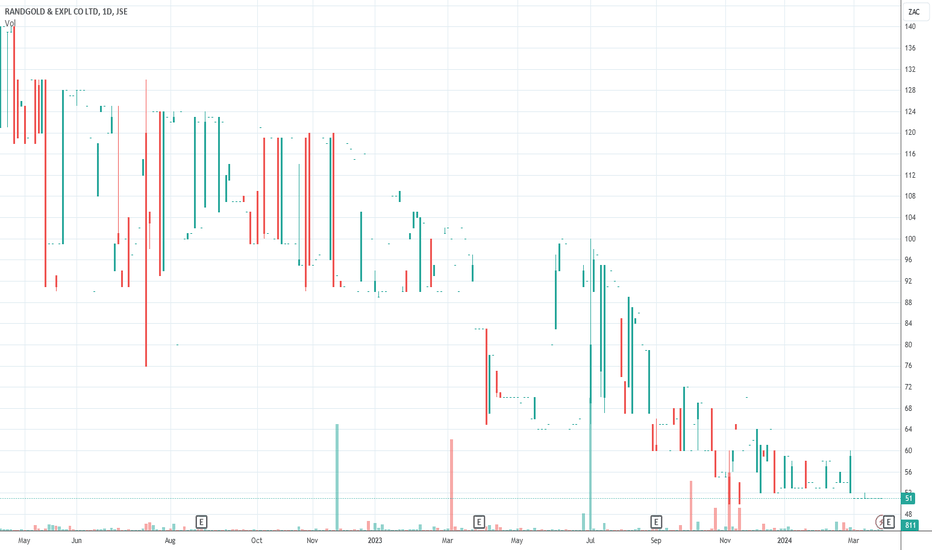

Our opinion on the current state of RNGRangold (RNG) operates as a mining exploration company with a substantial asset base, primarily consisting of cash reserves. The company has been actively pursuing legal claims and seeking investment opportunities with its asset base.

Following the death of Brett Kebble, Rangold has focused on pursuing various legal claims against entities it believes owe it compensation. Over the years, the company has achieved some success in these legal battles, resulting in significant settlements. For instance, in early 2011, Rangold paid a dividend of 90 cents per share due to a British court order against Paul Main, compelling repayment of GBP 4 million. Similarly, in July 2014, the company distributed a dividend of 225 cents per share following a R150 million settlement with auditors PwC.

Despite these successes, Rangold still has several legal matters pending, which could potentially result in further settlements totaling around R3 billion.

In its financial results for the year ending December 31, 2023, Rangold reported a headline loss of 32 cents per share, compared to a loss of 23.11 cents per share in the previous period.

It's worth noting that Rangold's shares are thinly traded, and the stock has been drifting down on low volumes for many years. This illiquidity and downward drift may pose challenges for investors considering investing in Rangold.

In conclusion, Rangold operates as a mining exploration company with a focus on pursuing legal claims and exploring investment opportunities. While the company has achieved some success in legal battles, its financial performance and illiquid shares may deter potential investors. Therefore, investing in Rangold warrants careful consideration and assessment of its risk factors.

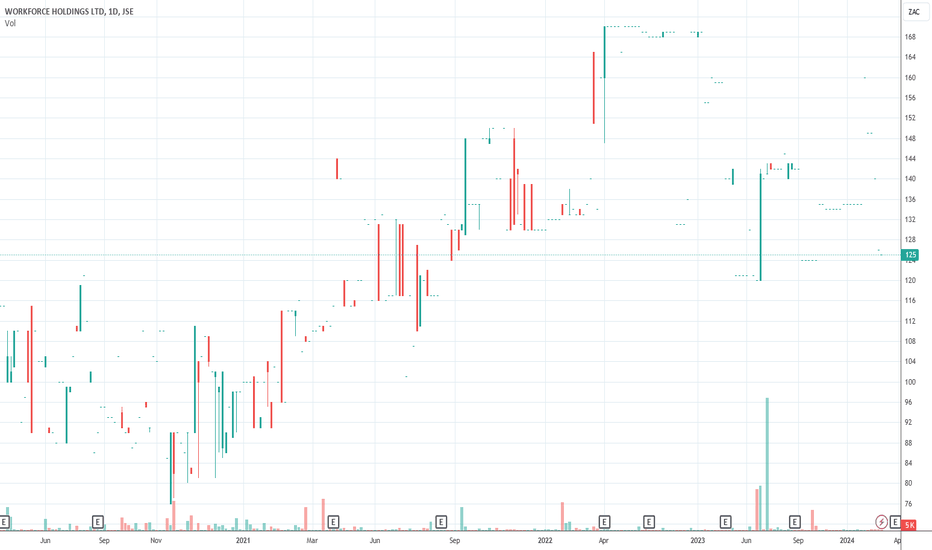

Our opinion on the current state of WKFWorkforce (WKF) operates as a diversified labor broker, providing services in recruitment, specialist staffing, training, consulting, employee health management, and the sale of financial and insurance products. The company faced a significant legal challenge with the "Assign" case, which clarified the status of temporary employees and legitimized the labor broking industry.

Despite the legal clarity, Workforce has encountered challenges, including the need to reduce staff by 10% to 15%. However, the company has diversified its offerings away from labor broking into insurance and other products, which has helped mitigate some risks.

In its financial results for the year ending December 31, 2023, Workforce reported a 4% increase in revenue. However, the company experienced a headline loss of 13.3 cents per share, a stark contrast to the profit of 46.8 cents per share in the previous period. Workforce attributed this performance to a harsh operating environment, where increased overheads outpaced revenue growth.

One challenge for private investors considering investing in Workforce is the liquidity of its shares. Only 8% of its issued shares are available to the public, and trading occurs sporadically. Given this illiquidity, it may not be practical for private investors to invest in the company's shares.

In conclusion, while Workforce has diversified its services and faced legal challenges, its financial performance and illiquid shares pose challenges for private investors. Therefore, investing in Workforce may not be advisable due to these factors.

Our opinion on the current state of YRKYork Timber Holdings (YRK) is a forestry company deeply entrenched in South Africa's plywood and timber market, with operations spanning plantations, processing plants, and a wholesaling distribution network. Established in 1916 by Russian immigrant Herman Katzenellenbogen, the company went public on the JSE in 1946, solidifying its position in the industry over the decades.

Despite its longstanding presence, York Timber has faced challenges, particularly in navigating the downturns in the construction industry stemming from the global financial crisis in 2008. This has been reflected in its share price performance, which has mostly trended downward or remained stagnant since reaching a peak in July 2007 at R40 per share.

Recent events have further compounded York Timber's struggles. A strike at its Escarpment operations, which contribute significantly to the company's revenue, was announced on May 13, 2022, impacting production. Additionally, the company's announcement on December 5, 2022, regarding a rights issue to raise R250 million led to a sharp drop in its share price.

In its financial results for the six months ending December 31, 2023, York Timber reported a 2% decline in turnover and a significant decrease in headline earnings per share (HEPS) to 4.67c compared to 13.27c in the previous period. Factors such as high raw material prices and unreliable log supply from the South African Forestry Company (SAFCOL) were cited as contributors to the unfavorable results.

Trading activity for York Timber shares averages around R89,000 per day, making it feasible for small investments by private investors. However, the stock remains volatile, particularly due to its ties to the construction industry.

From a technical standpoint, the share price has been on a downward trajectory since the beginning of 2022. Given its volatility and market conditions, investors may want to wait for a clear breakout above its downward trendline before considering further investment.

In conclusion, York Timber Holdings faces challenges amidst a challenging economic environment and industry-specific issues. Investors should carefully monitor the company's performance and market conditions before making investment decisions.

Our opinion on the current state of SFNSasfin (SFN) is a banking group that focuses on providing various financial services tailored for small businesses and high net-worth individuals. Established in 1987 and listed on the JSE, Sasfin has been actively investing in its digital platforms and pursuing strategic acquisitions to enhance its offerings.

Despite its efforts, Sasfin's share price had been on a downward trend, prompting investors to await a clear signal of a turnaround, such as an upside break through its long-term trendline. While the impact of COVID-19 hindered this recovery, there have been indications of improvement in the share's performance.

A notable development occurred on October 16, 2023, when Sasfin announced its agreement to dispose of its capital equipment finance and commercial property finance businesses to African Bank Limited, leading to a sharp rise in the share price.

However, on February 27, 2024, Sasfin faced a setback as it received a civil summons from the South African Revenue Services (SARS) for a significant damages claim related to alleged tax liabilities of former foreign exchange clients.

In its financial results for the six months ending December 31, 2023, Sasfin reported a notable decline in headline earnings per share (HEPS), down by 62.39%. This decline was attributed to negative adjustments to the group's fair value loans and private equity portfolio, along with increased credit impairments, reflecting the challenging economic environment for businesses in South Africa.

Despite these challenges, Sasfin managed to achieve a modest increase in its net asset value (NAV) by 4.09% to 5191 cents per share.

It's worth noting that Sasfin's shares are thinly traded, with relatively low liquidity, as indicated by an average daily trading volume of about R110,000. This limited liquidity may impact the accessibility of the stock for individual investors.

In summary, Sasfin faces various challenges, including legal disputes and economic headwinds, which have influenced its financial performance and share price dynamics. Investors should carefully monitor developments and assess the company's ability to navigate these challenges effectively before considering investment opportunities.

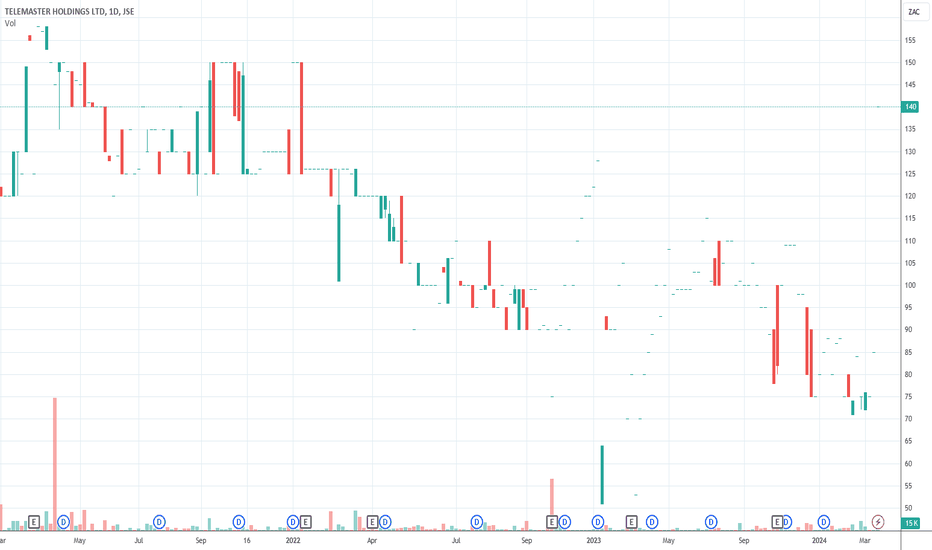

Our opinion on the current state of EOHTelemasters (TLM) operates in the telecommunications sector, providing voice, data, and cloud communication services through various technologies and divisions. The company's offerings include fixed line, fixed cellular, fixed data, and PBX services, catering primarily to medium and small enterprises.

Telemasters comprises several divisions, each focusing on specific aspects of ICT solutions and services:

1. Catalytic Connections (Pty) Limited: This division offers diversified ICT managed solutions targeted at medium and small enterprises.

2. Contineo Virtual Communications (Pty) Limited: It operates a Next Generation Unified Communications (UC) platform based on Cisco Broadsoft technology, providing advanced communication solutions.

3. PerfectWorx Consulting (Pty) Limited: This division specializes in network systems integration, offering niche services in this domain.

4. Ultra Data Centre (Pty) Limited: Telemasters owns and operates a data center located outside of Pretoria, catering to the growing demand for data storage and management services.

In its financial results for the six months ending on December 31, 2023, Telemasters reported a slight decline in revenue but managed to achieve positive headline earnings per share (HEPS) compared to a loss in the previous period. The company highlighted the maintenance of a gross profit margin of 56% and efficient cost control measures resulting in a decrease in operational expenses.

However, Telemasters' shares are thinly traded, with limited liquidity in the market, as a significant portion of the shares is held by a single shareholder, the Maison D-Obsession trust. This limited trading volume may make it impractical for private investors to actively participate in buying or selling shares of Telemasters.

Overall, while Telemasters operates in a vital sector and has reported improved financial performance, its low liquidity and concentrated ownership structure may pose challenges for individual investors looking to engage with the company's shares.

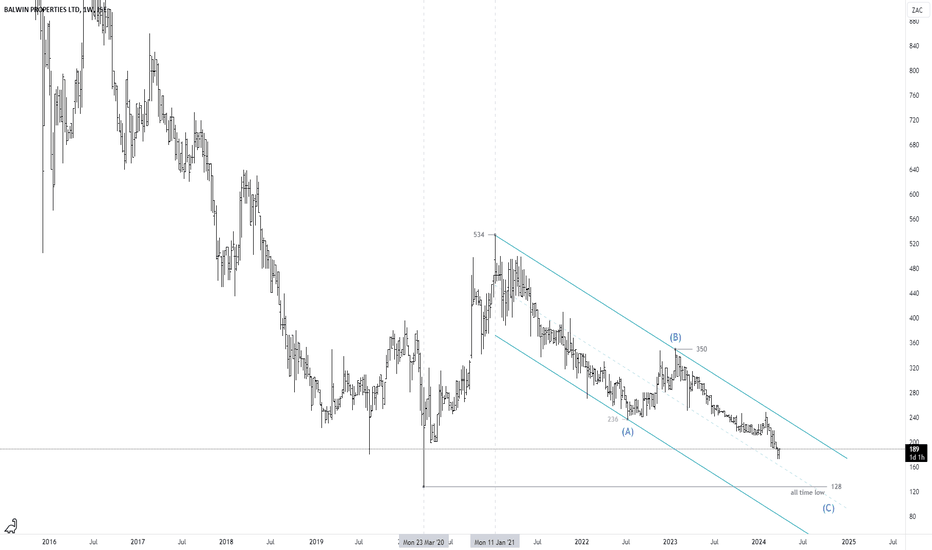

$JSEBWN - Balwin Properties: New All Time Low LoomingSee link below for previous analysis.

The previous analysis was quickly invalidated; this is why we use stop-losses!

The stock has been trending downwards for over three years now and looks likely to set a new all time low below 128.

A break above the upper resistance trendline would give an early signal for a potential reversal but there is no sign of bullishness yet.

I will remain short until I get contrary evidence.

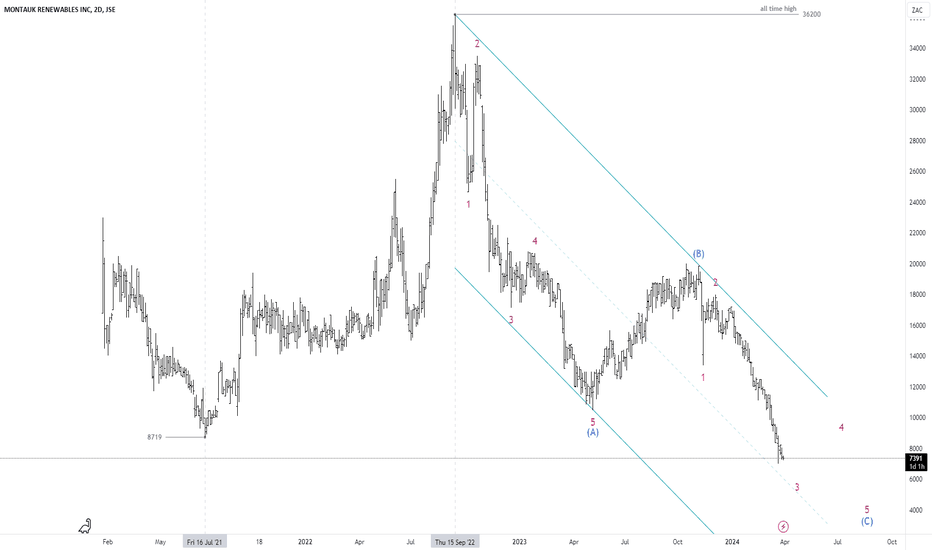

$JSEMKR - Montauk Renewables: Down, Down, Down, She GoesSee link below for previous analysis.

Montauk recently released it FY'23 annual results and they were not pretty.

The renewable-energy company posted fiscal 2023 earnings of $14.9 million, or 11 cents a share, down from $35.2 million, or 25 cents a share, in the same quarter last year.

Analysts polled by FactSet were looking for earnings of $20 million, or 15 cents a year.

Revenue for 2023 was $174.9 million, down from last year's $205.6 million and below the $185 million analysts were expecting.

The company said lower prices for natural gas and renewable identification numbers, used to track renewable transportation fuels, resulted in lower revenue for the year.

For 2024, Montauk expects renewable natural gas revenue to be $195 million to $215 million, and expects RNG production volumes of 5.8 million to 6.1 million MMBtu, above this year's RNG production of 5.5 million MMBtu.

Technically, the big bear Elliott Wave pattern looks to be unfolding as a zig zag with the stock in wave 3 of (C).

I will maintain a bearish stance until the completion of wave 5 of (C).

Our opinion on the current state of EOHEnterprise Outsourcing Holdings (EOH) has undergone significant transformations in recent years, transitioning from Africa's largest information technology company to a leaner organization amidst challenges and controversies. The company, once praised for its consistent profit growth, faced a series of setbacks, including allegations of involvement in state capture and tender frauds, leading to a decline in its share price.

The resignation of CEO and founder Asher Bohbot in 2017 marked a significant leadership change, with subsequent CEOs striving to steer the company through turbulent times. The consolidation of EOH's 200 subsidiaries into three divisions and efforts to centralize debt collection and procurement reflect strategic moves to streamline operations and address financial challenges.

Despite facing scrutiny and potential government blacklisting due to past controversies, EOH embarked on initiatives to alleviate its financial burdens. A rights issue and private placement in 2022, which were oversubscribed, aimed to reduce debt and strengthen the company's financial position.

In its recent financial results for the six months to January 31, 2024, EOH reported a slight decrease in revenue compared to the previous period but managed to narrow its headline loss per share. The company emphasized cost reduction strategies and highlighted improvements in interest charges due to capital raises and refinancing efforts.

From a technical standpoint, EOH's share price has been on a downward trajectory, reflecting investor caution and a wait-and-see approach amid ongoing debt reduction efforts and attempts to reposition the company. While the share may be nearing its bottom, it remains a risky investment due to lingering uncertainties and the need for EOH to reinvent itself in a challenging market environment.

Investors should closely monitor EOH's progress in reducing debt, implementing cost-saving measures, and rebuilding its reputation to gauge the company's long-term viability and potential for recovery.

Our opinion on the current state of BAWBarloworld (BAW) is a prominent international supplier of heavy earth-moving equipment and vehicles across various sectors, including mining, agriculture, infrastructure, power, automotive, and logistics. With operations spanning 24 countries, particularly in Southern Africa, Russia, and other emerging markets, Barloworld boasts a diverse portfolio that provides some resilience against economic downturns.

The company's renowned brands like Caterpillar, Avis, Massey-Ferguson, and Challenger contribute to its strong market presence. Barloworld recently divested its Spanish and Portuguese operations, freeing up funds for potential investments, such as the acquisition of the US-owned Wagner Asia Group in Mongolia.

While geopolitical tensions, especially the Ukraine crisis, have posed challenges in receiving payments from Russian customers and impacted commodity prices, Barloworld remains financially equipped to navigate these uncertainties. Despite experiencing a decline in share price, the company reported positive results for the fiscal year ending September 2023, with revenue from continuing operations increasing by 14% and headline earnings per share (HEPS) rising by 5.5%.

In subsequent trading updates, Barloworld reported revenue decreases attributed to the mining sector slowdown and geopolitical conflicts. However, the company's EBITDA margin improved, indicating operational efficiency despite revenue challenges.

From a technical perspective, Barloworld's share price experienced significant fluctuations in response to the COVID-19 pandemic but showed signs of recovery with an upside breakout from an extended "island formation" and a breakthrough of its long-term downward trendline. While the share price has been drifting sideways and downwards since January 2022, it is perceived as good value at current levels, especially considering its low price-to-earnings (P/E) ratio of 4.65.

Barloworld's strategic initiatives, including the share buyback program, demonstrate confidence in its future prospects. However, ongoing developments in Ukraine and Russia will continue to influence the company's performance and investor sentiment.

Our opinion on the current state of ASCAscendis Health (ASC) is a South African company operating in the health sector, manufacturing products for animals, plants, and humans. The company underwent significant restructuring and financial transactions to address its debt burden and refocus its business strategy.

In January 2020, Ascendis Health announced its intention to focus on four core business areas: pharmaceuticals, medical, consumer health, and animal health. Despite considering the sale of its subsidiary Remedica, the board opted to negotiate a recapitalization deal with L1 Health and Blantyre Capital to address the company's debt issues.

Following negotiations, a deal was struck in May 2021, where the consortium acquired 100% of Remedica and Sunwave, along with other assets, in exchange for debt and financing facilities. This recapitalization aimed to safeguard the business and improve its liquidity.

As part of its restructuring efforts, Ascendis Health sold its animal health division in July 2021 to reduce debt. Despite a decline in revenue and gross margin in the financial year ending June 2023, the company managed to decrease operating costs and eliminate senior debt, leaving it with cash reserves of R102 million.

In a trading statement for the six months ending December 2023, Ascendis Health estimated a significant improvement in headline earnings per share (HEPS) from continuing operations compared to the previous period, indicating a positive turnaround.

Technically, the company's stock has experienced significant volatility, peaking in 2016 before declining sharply and moving sideways. Despite a recent jump in share price following the announcement of a buyout offer and delisting from the JSE, the stock remains a risky penny stock, priced at around 81 cents.

Overall, Ascendis Health's restructuring efforts and improved financial performance suggest a positive trajectory, but investors should be cautious due to the company's history of volatility and the ongoing risk associated with its penny stock status.

Our opinion on the current state of ADHADvTECH (ADH) is a prominent player in the commercial education sector in South Africa, operating in both schools and tertiary education divisions. The schools division, comprising institutions such as Crawford, Trinity House, and Abbots, historically formed the backbone of the company's operations. However, increased competition in the schools sector has led to margin pressures in recent years, shifting the focus towards the more profitable tertiary division.

The tertiary division, including Varsity College, Rosebank College, and specialized tertiary offerings, has emerged as the primary profit driver for ADvTECH. The acquisition of Monash College with its IIE campus has significantly bolstered this division, adding 6,500 students and modern facilities to the company's portfolio.

In its financial results for the year ending December 31, 2023, ADvTECH reported a commendable 13% increase in revenue and a 19% rise in headline earnings per share (HEPS). Operating margins in the education divisions improved, driven by operating leverage, although net finance costs increased due to additional leases and higher borrowing costs.

From a technical standpoint, ADvTECH's stock has been on a strong upward trend since May 2020. With a price-to-earnings ratio (P/E) of 16.65, the stock is deemed relatively cheap, suggesting further upside potential. Moreover, the company's solid market position, coupled with its defensive nature in times of low economic growth, makes it an attractive investment option, especially considering parents' willingness to prioritize education spending.

Overall, ADvTECH appears to be a solid blue-chip company with promising medium-term prospects. Any improvements in the South African economy are likely to directly benefit the company, further enhancing its growth trajectory.

Our opinion on the current state of MTNMTN, a leading emerging market mobile operator, serves a vast customer base of 290 million people across 19 countries in Africa and the Middle East, with significant subscriber bases in Iran, Nigeria, and South Africa. The company operates in a challenging environment characterized by fierce competition and declining voice revenue, offset to some extent by the growth in data usage. However, political risks in key markets such as Iran and Nigeria add to its overall risk profile.

To diversify its revenue streams and address these challenges, MTN is expanding into fintech services, partnering with Sanlam to offer insurance products and rolling out mobile money services in several countries. The company aims to become a digital operator with a focus on fintech, digital, enterprise, and wholesale business areas.

Despite its efforts to expand into new sectors, MTN faces regulatory and tax challenges in some markets. For instance, it received a tax assessment of $773 million from Ghanaian authorities, reminiscent of similar challenges in Nigeria. However, partnerships such as the one with Mastercard, which took a significant stake in its fintech business, provide opportunities for growth and innovation.

In its financial results for the year ending December 31, 2023, MTN reported a 6.9% increase in service revenue but a significant decline of 72.3% in headline earnings per share (HEPS). The decline in HEPS may be attributed to various factors, including regulatory challenges and economic volatility in key markets like Nigeria.

With a current price-to-earnings ratio (P/E) of 29.14, MTN's stock appears expensive, especially considering its recent downward trend since March 2022. Investors are advised to monitor the stock closely and wait for a clear upside break from the downward trendline before considering further investment.

Our opinion on the current state of GMLThe Gemfields Group (GML), formerly known as Palinghurst Group, operates as a mining group with significant projects in the production of emeralds and rubies. Its major projects include Kagem, the world's largest producer of emeralds (located in Zambia), and rubies (at Montepuez in Mozambique), as well as Jupiter Mines, a South African producer of manganese. Led by Brian Gilbertson, formerly the CEO of BHP Billiton, the company identified the underdeveloped semi-precious stones market as an opportunity for consolidation and professional management, leading to the establishment of Gemfields.

Gemfields disposed of 60% of Jupiter Mines when it was listed on the Australian Stock Exchange (ASX) in April 2018, aligning with its strategic decision to focus purely on gemstones rather than being a diversified mining company. The company's shares are relatively well-traded, with an average daily trading volume of approximately R5 million worth of shares.

However, being a commodity-based company, Gemfields faces inherent risks tied to fluctuations in the prices of emeralds and rubies on the international market, as well as the challenges associated with mining operations in third-world countries. Despite these risks, Gemfields has managed to carve out a niche for itself with limited competition, positioning it well to benefit from the global economic recovery.

On October 24, 2022, the company announced the resumption of operations at MRM (Montepuez Ruby Mine) following an insurgent attack near the mine. Additionally, on August 7, 2023, Gemfields announced plans to construct a new processing plant to triple its output from the Montepuez ruby mine.

In its financial results for the year ending December 31, 2023, Gemfields reported a 23% decline in revenue and a headline loss of 0.9 cents (US) per share, compared to a profit of 4.8 cents in the previous period. The company attributed this performance to the withdrawal of a higher-quality emerald auction in November 2023 and an unrealized write-down of Gemfields' non-core equity holding in Sedibelo Resources, a platinum group metals mining company.

From a technical standpoint, the share price of Gemfields rose after an island formation, entering a strong upward trend that lasted until July 2023 when the trendline was broken. It is advisable to wait for the establishment of a new upward trend before considering investment in Gemfields.

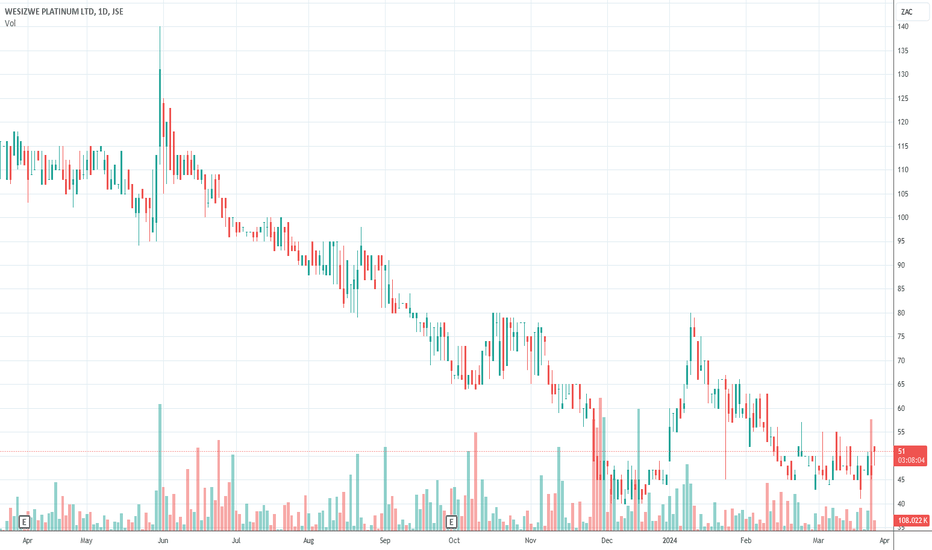

Our opinion on the current state of WEZWesizwe (WEZ) is engaged in platinum group metals mining, primarily through the development of the Bakubung Platinum Mine (BPM), located near Rustenburg on the Western limb of the Bushveld complex. The company's focus includes accessing the Merensky and Upper Group 2 (UG2) resources. Additionally, Wesizwe owns a 17.1% stake in projects 1 and 3 of Maseve Investments.

In its financial results for the six months ending June 30, 2023, Wesizwe reported a loss per share of 59.63 cents, a significant increase compared to a loss of 4.09 cents in the previous period. The company attributed the total comprehensive loss of R981.5 million to higher total administration expenses, which included both administration expenses and capitalized costs.

In a trading statement for the fiscal year ending December 31, 2023, Wesizwe estimated a headline loss ranging between 0.95 cents and 1.77 cents per share, compared to a loss of 8.24 cents in the previous period.

Despite being viable for private investors with an average daily trading volume of about R176,000 worth of shares, Wesizwe is considered a marginal precious metals company. Its performance is subject to the volatility of platinum group metals (PGM) prices, making it inherently risky. The share price has declined from a high of 197 cents in October 2021 to levels around 47 cents following the recent results. Given its risk profile, investors may find better opportunities in other PGM market options.

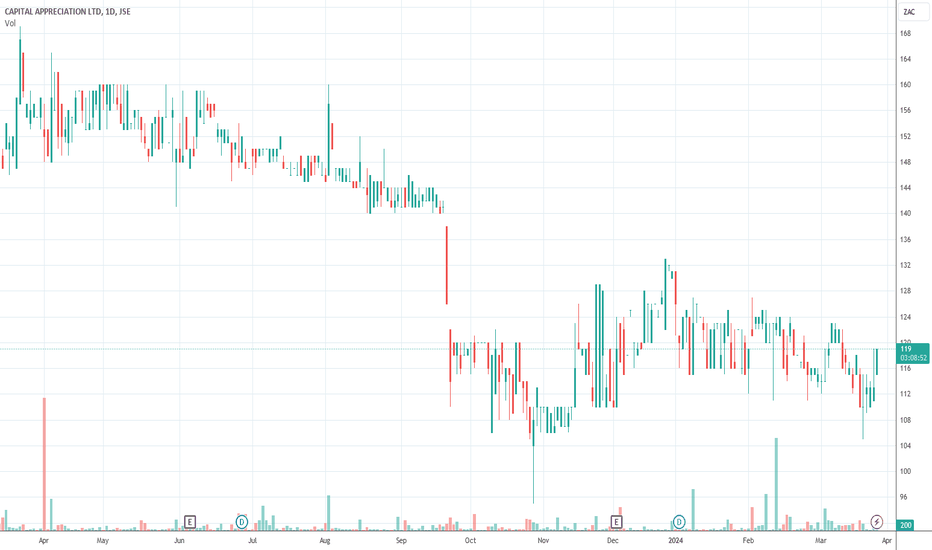

Our opinion on the current state of CTACapprec (CTA) is a fintech company offering payments and payment infrastructure, as well as software and services. It counts Patrice Motsepe's African Rainbow Capital (ARC) among its stakeholders. The company's payment services are facilitated through African Resonance and Dashpay, while its software segment involves systems development and consulting. Additionally, Capprec owns a 17.5% stake in Resonance Australia, a startup business. It boasts major South African banks among its clients.

In its financial results for the six months ending September 30, 2023, Capprec reported a 3% increase in revenue and a substantial 105.6% surge in headline earnings per share (HEPS). The company's net asset value (NAV) also grew by 3.3% to 124.5 cents per share. Capprec attributed the growth in headline earnings to a reduction in the expected credit loss raised for GovChat during the reporting period.

In a business update for the fiscal year ending March 31, 2024, Capprec noted increased business activity in the Payments division, improved expense management, and strong cash flows, resulting in a robust improvement in the group's financial performance in the second half of the financial year. Both the Payments and Software divisions continued to attract new clients, diversify revenue sources, and grow market shares.

The share is currently trading at a price-to-earnings (P/E) ratio of 10.67. With an average daily trading volume of roughly R1.3 million worth of shares, Capprec presents a feasible investment opportunity for private investors. The company appears to be well-managed, profitable, and cash-flush, which may attract institutional interest. However, from a technical perspective, the share has been in a downward trend since January 2022. Investors are advised to wait for a break above its downward trendline before considering further investment.