Our opinion on the current state of CLIClientele Life (CLI) operates as a small insurance company, offering both short- and long-term policies and underwriting insurance products. Their distribution channels include agents, brokers, and tele-sales.

A significant development for the company was its acquisition of 1Life Insurance for R1.914 billion, to be paid through the issuance of 117,815,756 ordinary shares in Clientele. This acquisition likely aimed to expand Clientele's market reach and product offerings.

However, in its financial results for the six months ending December 31, 2023, Clientele reported a decline in headline earnings per share (HEPS) by 35%. The company attributed this decrease to lower insurance revenue, which was down 5% compared to the previous period. This decline was mainly due to a lower release of the Contractual Service Margin (CSM) and Risk Adjustment (RA), driven by higher-than-expected withdrawal experience.

Despite the decline in earnings, the company's price-to-earnings (P/E) ratio stands at 6.6, which appears cheap relative to its earnings. This may present an opportunity for investors seeking undervalued stocks. Moreover, the share is traded heavily enough to accommodate most private investors.

Overall, Clientele Life may offer reasonable value at its current P/E ratio, especially considering its potential to benefit from improvements in the South African economy. However, investors should carefully consider the impact of the acquisition of 1Life Insurance and monitor the company's financial performance and market position.

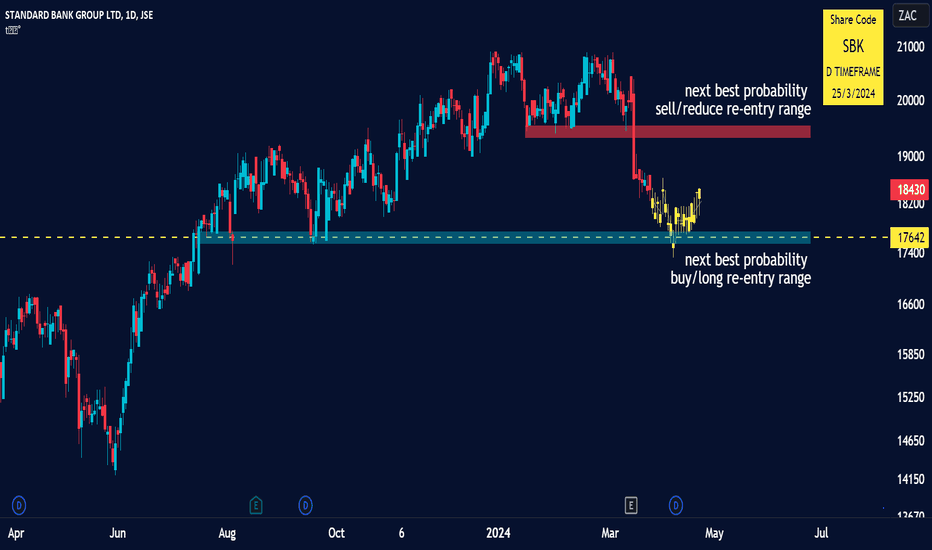

SHP: bouncing form support?A price action above 25100 supports a bullish trend direction.

Further bullish confirmation for a break above 25800.

The target price is set at 26800 (its 23.6% Fibonacci retracement level).

The stop-loss price is set at 24100 (its 78.6% retracement level).

Testing its 200-day simple moving average, which might act as major support.

Our opinion on the current state of TKGTelkom (TKG) has undergone significant transformations since its days as the government-controlled provider of fixed-line telephone connectivity in South Africa. The advent of cell phones forced Telkom to subsidize the development of its competitors, resulting in substantial financial burdens. CEO Sipho Maseko noted that Telkom has effectively subsidized other networks to the tune of R70 billion over the past two decades.

Currently listed, Telkom operates independently, divided into five divisions:

1. Open Serve: South Africa's primary supplier of wholesale connectivity.

2. Telkom Consumer: A leading supplier of broadband internet connectivity with a growing mobile phone network.

3. Yellow Pages: Provides advertising and marketing services to local businesses.

4. BCX: An ICT solutions company operating in Southern Africa.

5. Swiftnet: Formed to manage Telkom's masts, towers, and property interests.

While Telkom faces challenges related to regulatory decisions on interconnect fees by ICASA, it has been well-managed, with downsizing expected to lead to improved profitability. The company is transitioning from fixed-line to mobile services.

The resignation of CEO Sipho Maseko and plans to list its property and towers division separately as Swiftnet were significant developments. However, the listing was postponed due to market conditions, including the war in Ukraine. The company also faced investigations into the sales of Iway Africa and Africa Online.

Various acquisition offers, including a R7 billion bid for the government's stake and CEO Sipho Maseko's consortium's proposal to acquire 35% of Telkom for R12 billion, demonstrated interest in the company.

In its financial results, Telkom reported revenue and headline earnings per share (HEPS) growth for the six months ending September 30, 2023. Lower depreciation charges and growth in EBITDA contributed to profit, despite higher interest rates increasing net finance costs. The company's revenue and EBITDA remained stable in the following quarter.

The announcement of the sale of Swiftnet for R6.75 billion to reduce Telkom's debt was a significant development. However, Telkom's share price has experienced volatility, falling from highs in June 2019 to lower levels in March 2020. The company's high debt relative to its market capitalization poses risks for investors, indicating challenges in navigating the difficult economic landscape and stiff competition.

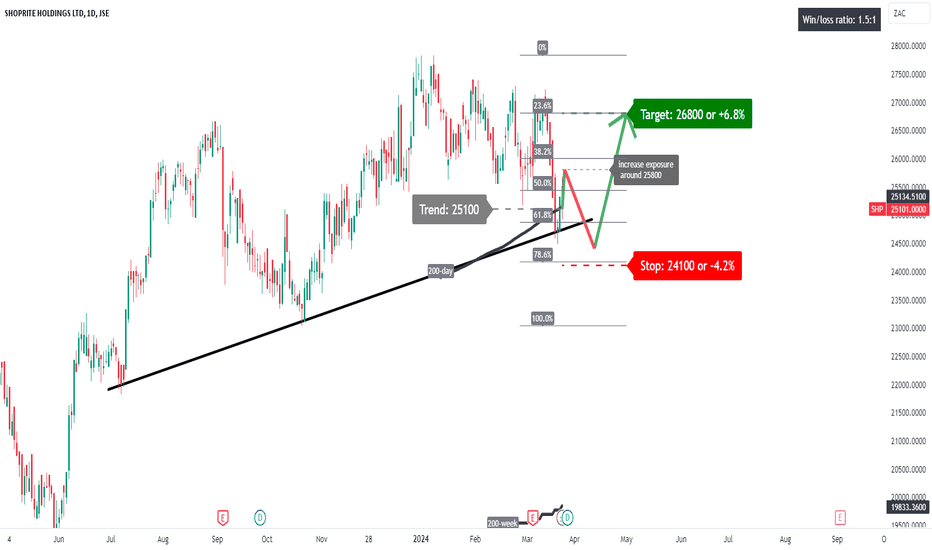

Our opinion on the current state of TLMTelemasters (TLM) is a provider of voice, data, and cloud communications services, offering fixed line, fixed cellular, fixed data, and PBX solutions. Its operations are divided into three main divisions:

1. Catalytic Connections (Pty) Limited, a diversified ICT managed solutions provider catering to medium and small enterprises.

2. Contineo Virtual Communications (Pty) Limited, which operates a Next Generation Unified Communications platform based on Cisco Broadsoft technology.

3. PerfectWorx Consulting (Pty) Limited, a specialized network systems integrator.

4. Ultra Data Centre (Pty) Limited, responsible for building and operating a data centre located outside of Pretoria.

In its financial results for the year ending June 30, 2023, Telemasters reported a slight decline in revenue by 1.3% but saw a significant improvement in headline earnings per share (HEPS), which stood at 0.81c compared to a loss of 3.73c in the previous year. The company noted several positive developments:

- Operating profit recovered from the prior year's loss, showing an improvement of R2.8 million year-on-year.

- The DataCentre business experienced growth and is now generating sustainable profits.

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) continued to grow, increasing to R8 million from R7 million in the prior year.

- Telemasters maintained its dividend policy, declaring dividends of 0.85 cents per share during the year.

In a trading statement for the six months ending December 31, 2023, the company estimated a significant increase in HEPS by 160%. However, it's worth noting that the share is thinly traded, with less than R1400 worth of shares changing hands each day. The majority of shares are held by a single shareholder, the Maison D-Obsession trust, which may make it impractical for private investors to trade.

Our opinion on the current state of GMLThe Gemfields Group (GML), formerly known as Palinghurst Group, is a mining company with two significant projects: (1) Kagem, the world's largest producer of emeralds (located in Zambia) and rubies (at Montepuez in Mozambique); and (2) Jupiter Mines, a South African manganese producer. Led by Brian Gilbertson, former CEO of BHP Billiton, Gemfields identified an opportunity for consolidation and professional management in the underdeveloped semi-precious stones market, leading to its current operations.

Gemfields divested 60% of Jupiter Mines during its listing on the Australian Stock Exchange (ASX) in April 2018, aligning with its strategic decision to focus solely on gemstones and cease being a diversified mining company. With an average daily turnover of approximately R5 million, Gemfields shares are relatively liquid. However, like all commodity shares, they carry inherent risks, particularly dependent on international prices of emeralds and rubies, as well as the challenges associated with mining in developing countries.

Despite these risks, Gemfields has carved out a niche in the market with limited competition and is poised to benefit from the global economic recovery. Operations at MRM resumed on October 24, 2022, following an insurgent attack, signaling resilience in the face of adversity. Furthermore, on August 7, 2023, the company announced plans to construct a new processing plant at the Montepuez ruby mine, aiming to triple its output.

In its financial results for the six months ending June 30, 2023, Gemfields reported revenue of $153.6 million, compared with $193.2 million in the previous period, with headline earnings per share (HEPS) at 0.8c (US) compared to 3.7c in the previous period. Despite the decline, the company maintained a strong balance sheet, with net cash of $62 million and 97% collection of auction receivables amounting to $63.8 million.

In an operational update for the six months ending December 31, 2023, Gemfields reported total auction revenues of $242 million and net cash of $11.1 million, highlighting strong auction revenues and pricing for both emeralds and rubies. However, in a trading statement for the year ending December 31, 2023, the company estimated a headline loss of 16c compared to a profit of 78.3c in the previous year.

Technically, the share experienced a strong upward trend until July 2023 when the trendline was broken. We recommend waiting for the establishment of a new upward trend before considering further investment.

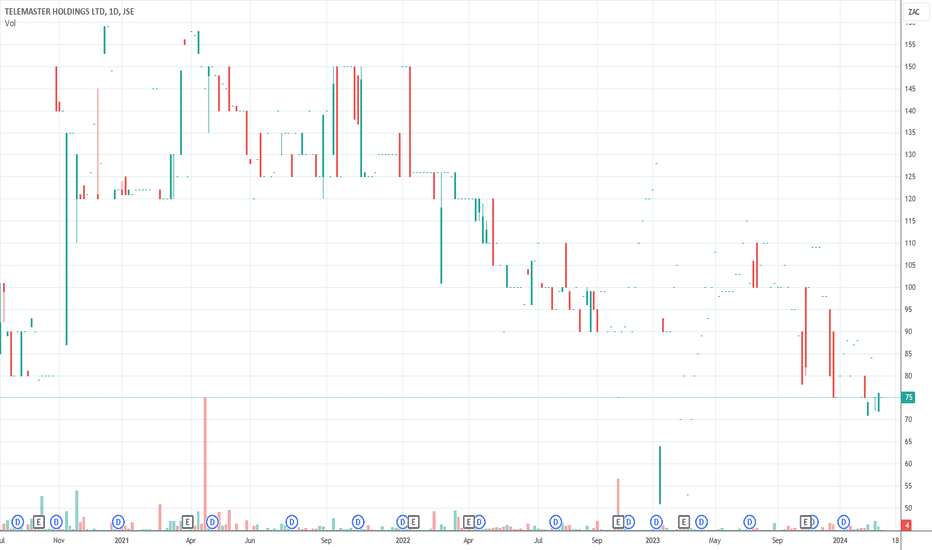

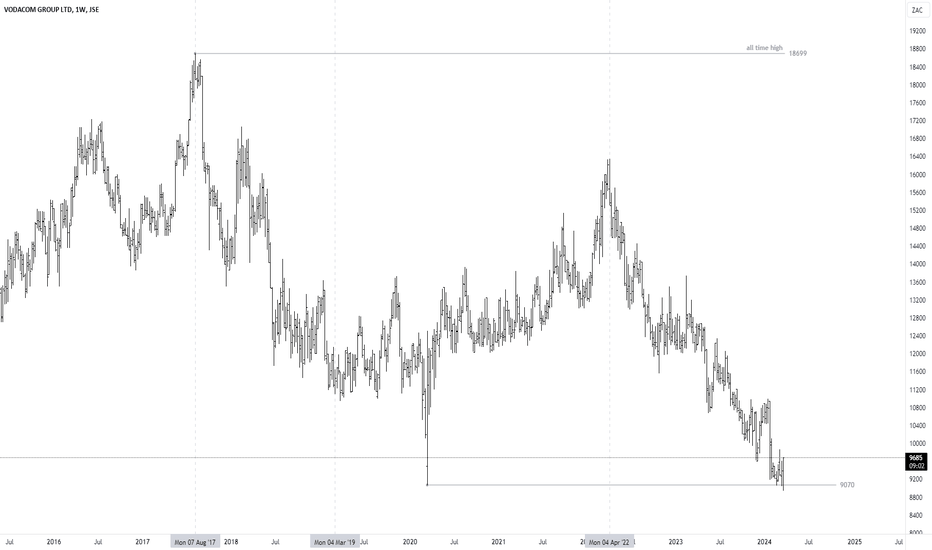

$JSEVOD - Vodacom: 9070cps Target Reached, Now What?See link below for previous analysis.

Vodacom continued its sell-off and has reached the price target of 9070, the March 2020 low.

There is no evidence yet of any reversal so i will sit on my hands.

I will monitor price action at this level for a potential double bottom reversal.

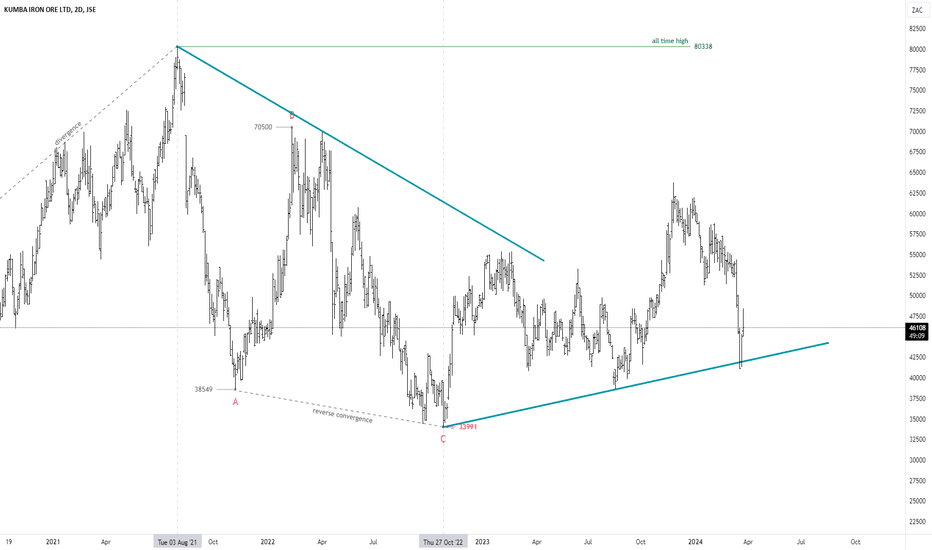

$JSEMRF - Merafe Resources: Double Bottom Neckline BreakSee link below for previous analysis.

Merafe has broken above the critical 146 neckline and looks likely to close the week above it.

This confirms the double bottom pattern and the price target 200cps.

Price can still reverse back below 146 but the bullish outlook is invalidated below 104 cps.

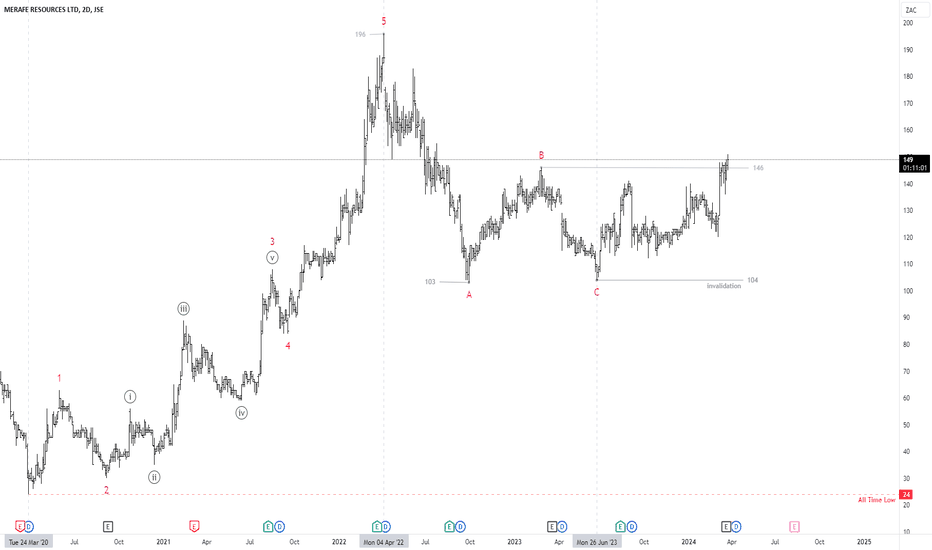

$JSETBS - Tiger Brands: The Tiger Roars But I Count Five WavesSee link below for previous analysis.

Tiger Brands has traded as forecasted.

Wave (iii) was ignited by the CEO stepping down and the momentum was sustained with very small pullbacks.

Wave (iv) has unfolded as a flat pattern and wave (v) is underway with the invalidation level now raised to 18930.

Wave (v) is always risky as it is hard to forecast how it will unfold and how strong it will be but i will maintain a bullish stance above 18930.

Our opinion on the current state of JSEThe Johannesburg Stock Exchange (JSE), listed on its own platform, serves as a securities exchange facilitating the trading of shares, bonds, and derivatives. With approximately 320 listed and quoted shares, it stands as the largest stock exchange in Africa by market capitalization and ranks 17th globally. Historically, the JSE has been consistently profitable, largely due to its former monopoly on equity trading in South Africa.

However, in 2017, several competing stock exchanges were registered and licensed to trade equities in South Africa, with the A2X emerging as the most notable competitor. A2X has attracted a growing number of listings, including major players like Naspers and Standard Bank, and claims to offer trading at significantly lower costs compared to the JSE. Responding to this competition, the JSE has reduced its costs, yet still maintains a dominant market share of 99.7% in South Africa.

Benefitting from increased trading volumes amid the volatility of COVID-19, the JSE remains a relatively stable investment, well-capitalized and trading at a P/E ratio of around 11.23. Although significant competition from A2X may take time to materialize, it is steadily gaining ground.

In its financial results for the year ending 31st December 2023, the JSE reported a 12.2% increase in headline earnings per share (HEPS) and a return on equity (ROE) of 19.4%, with revenue up by 6.2%. The growth in revenue was supported by diversified business segments and asset classes, including Information Services and JSE Investor Services (JIS).

Despite concerns over a steady downward trend in its share price and a reduction in the size of the JSE due to delistings surpassing new listings, the share has been moving sideways for the past three years. It remains a relatively secure blue-chip investment, though impacted by COVID-19 and local economic mismanagement.

Our opinion on the current state of OUTOUTsurance (OUT) assumed the listing of Rand Merchant Insurance (RMI) effective from 7th December 2022. Following this transition, RMI divested its interests in Discovery (DSY) and Momentum (MTM), and divested its 30% stake in Hastings Plc for R14.6 billion. By March 2023, the insurance business of OUTsurance remained as the sole focus of RMI.

In its financial results for the six months ending 31st December 2023, OUTsurance reported a 22.5% increase in gross written premiums and a notable 38.8% rise in the annualised new business premium. The company attributed the increase in the claims ratio, from 54.4% to 59.1%, to R678 million in higher natural perils claims incurred by Youi. However, it noted that Youi's working loss ratio, excluding natural perils, improved from 51.9% to 50.8%, indicating that the deterioration was entirely accounted for by the higher natural perils.

From a technical standpoint, while currently at a cycle low, OUTsurance's share price has been steadily climbing since the unbundling, and the outlook suggests continued positive performance ahead.

Our opinion on the current state of REMJohann Rupert's Remgro (REM) operates as an investment holding company, boasting a diverse portfolio of investments. Notably, it holds a 28.2% stake in Rand Merchant Bank Holdings (RMH) and a 3.9% interest in FirstRand. Additionally, Remgro owns Mediclinic, an international healthcare company with divisions in Switzerland, Southern Africa, and the United Arab Emirates, which has been delisted from the JSE. Recently, Remgro sold its 25.8% stake in the London-listed Unilever Group, acquiring the Unilever spreads business in Southern Africa, which includes renowned brands like Flora and Rama.

In the foods division, Remgro owns significant stakes in Distell (31.8%) and RCL Foods (77.2%). The Unilever spreads division may find a home within a new subsidiary called "Silver 2017." Remgro also holds interests in the insurance sector, with a 29.9% stake in RMI, among other investments, including a 23.1% stake in Grindrod and a 30% stake in Seacom. The acquisition of Vumatel by Community Investment Ventures Holdings (CIVH), a Remgro subsidiary, has been approved by the Competition Tribunal, with conditions requiring free uncapped fibre services to nearby schools for the next decade.

Remgro announced plans to increase its stake in RCL Foods and venture into electricity generation to supply its businesses due to concerns about Eskom's reliability. Moreover, a significant development occurred with Heineken's offer to buy 100% of Distell for R41.1 billion, a transaction from which Remgro stands to benefit substantially given its 31.7% ownership. Additionally, a partnership with Vodacom resulted in the creation of "Infraco," wherein Remgro retains a majority stake focused on dominating South Africa's fibre provision.

Furthermore, Remgro recently completed the acquisition of the remaining 55% stake in Mediclinic, delisting the company from the JSE. However, its latest financial results for the six months ending 31st December 2023 showed a 39.1% decrease in headline earnings per share (HEPS) and a 4.6% decline in intrinsic net asset value (INAV). Remgro attributed the discrepancy between HEPS and headline earnings to the accretive impact of shares repurchased during the financial year.

Technically, Remgro's share price experienced a low at 8388c on 7th September 2020 and was on an upward trend. However, recent disappointing results caused the share to break out of this trend. Currently trading at 12471c with a P/E ratio of 12.36, once the negative news is fully discounted, the share may represent good value. We recommend applying a 65-day exponential moving average and waiting for a clear upside break before further investigation.

Our opinion on the current state of TGAThungela (TGA) represents Anglo American's coal assets, which were unbundled into the hands of Anglo shareholders and separately listed on the JSE and the LSE due to Anglo's policy of transitioning away from carbon-based fossil fuels like coal. Anglo completed the sale of its final 8% stake in Thungela on 25th March 2022 for R1.67 billion. Thungela operates as a major thermal coal exporter in South Africa, boasting over 7,500 employees and exporting coal to various regions including Asia, India, SEA, and East and North African countries. The company holds a 50% stake in Phola, which operates a coal processing plant, and a 23.22% interest in the Richards Bay Coal Terminal (RBCT). With a capacity to produce over 90 million tons of coal per annum, Thungela operates 7 mines in South Africa, consisting of 4 open-cast and 3 underground mines.

In its results for the year ending 31st December 2023, the company reported a profit of R5 billion, down from the previous year's profit of R18.2 billion. Earnings per share (EPS) fell to 3766c from 12708c. Thungela paid out a dividend of R2.8 billion and repurchased R500 million worth of its own shares. The company highlighted, "Industry railed volume of 47.9Mtpa in 2023, deterioration of 5% from last year • Mutual cooperation agreement establishes framework for procurement of critical spares on behalf of TFR• Industry deployed additional security on coal line."

Initially trading on the JSE from 7th June 2021, Thungela's share price experienced an immediate decline to 2190c from 2600c. Initially estimated to be worth a minimum of 4400c, the share price reached a high of 37752c on 16th September 2022. However, since then, it has been moving sideways and downwards, influenced by lower coal prices and challenges with Transnet. The company is also subject to the inherent volatility associated with being a single commodity share and reliant on Transnet for transporting its product to port. Thungela has committed to paying out at least 30% of "adjusted operating free cash flow" in the form of a dividend.

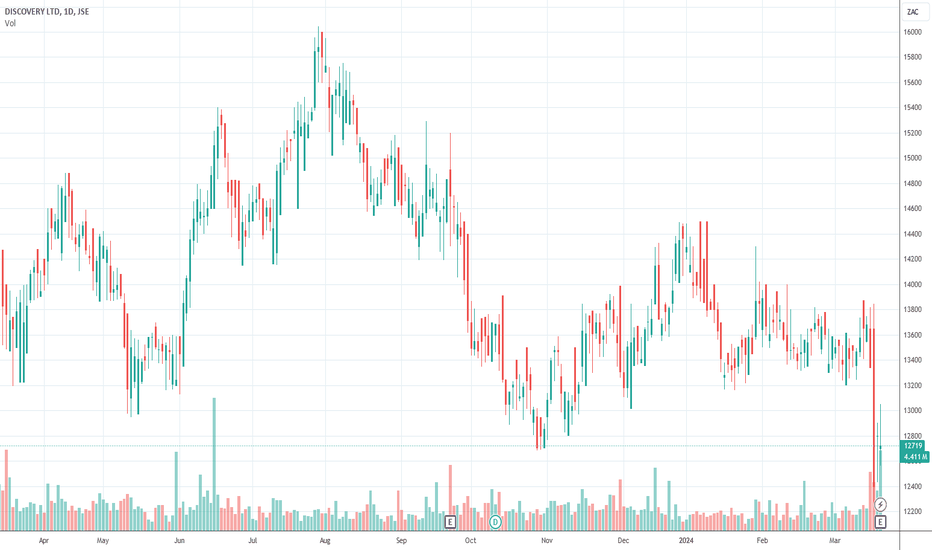

Our opinion on the current state of DSYDiscovery (DSY), developed and built by Adrian Gore over the past 25 years, offers the A/B income group of people a matrix of financial services which are inter-linked and cross-selling. Thus a customer can begin with his/her medical aid and then add to that a variety of insurance products and now, most recently, personal banking products.

Discovery's "Vitality" concept, which rewards clients for looking after their health in various ways, is extended to their driving record and a rewards system that ensures that there are attractive benefits for taking the full range of Discovery debit-order products. The Vitality platform tracks over 1000 customer activities and 50 biometrics a minute by using the Apple watch in South Africa, the UK, China, Europe and the US to ensure a process of healthy aging and retirement planning.

Discovery's Chinese company, Ping An Health, in which Discovery has a 25% stake, saw membership grow by 60% over the year, and written premiums increased by 87% to $753m. Ping An is rapidly developing into Discovery's "Tencent".

Discovery's move into banking offers existing clients a range of banking and credit card facilities. The banking license was approved in November 2017 and should significantly increase the profits being generated by the group in time. This is a disruptive development which will seriously shift the banking of A/B income group consumers away from existing banks.

Discovery Bank's aim was to bring in 1000 new accounts per day from the end of August 2019. The company has seen a drop in car accident claims and medical insurance claims since the lockdown. This is a highly rated share despite the decline in its share price over the past two years. Discovery Bank has now reached 700 000 active clients and those clients are mostly of very high quality - but the progress has been relatively slow partly because of the pandemic.

Discovery shares remain expensive, but we regard this as one of the best shares for a private investor to hold for long-term growth. CEO, Adrian Gore, says "I am a great believer that opportunities are not in good times" - indicating his belief that growth comes from investing during the difficult times such as South Africa is currently experiencing. Gore has also stated that the NHI, as it is proposed, is unaffordable for South Africa and that there are insufficient medical resources to implement it.

Discovery became the first large, listed company to require all its staff to be vaccinated. On 20th June 2022 the bank reported that it had more than 1 million accounts and was taking on about 750 new accounts per day.

In its results for the six months to 31st December 2023 the company reported headline earnings per share (HEPS) down 1% and net asset value (NAV) up 20%. Embedded value per share increased by 11%. The company said, "The Group generated normalised operating profit growth of 13% to R5 622 million with positive contributions from each composite, as South Africa (SA) increased 9%, United Kingdom (UK) increased 13% and Vitality Global (VG) increased 71%. The UK and VG results benefitted from a weaker rand compared with the prior period".

Technically, the share has been moving sideways since December 2020. Due to the quality of its management and business model, we see this as a "must have" share for any private investor's portfolio.

Our opinion on the current state of TCPTransaction Capital (TCP) is a company which has three divisions - minibus taxis, risk services, and 75% of WeBuyCars (WBC). Its subsidiary, SA Taxi, specialises in financing, repairing, insuring and selling minibus taxis in South Africa. It completely dominates the entire value chain associated with the minibus taxi industry. The company listed in June 2012 and since then and until 2023, the company generated an annual compound growth in earnings per share of 21% since 2014.

That ended abruptly in 2023 when the company revealed that it had to make a R1,8bn provision for bad debts in its minibus taxi division. About 69% of South African households use taxis with more than 15m trips per day. Most of this is non-discretionary - which means that this industry tends to be defensive and not generally impacted by the state of the economy at large. The South African Taxi Council (Santaco) acquired a 25% stake in SA Taxi for R1,7bn in 2018 which is benefiting both parties. The directors of TCP own 32% of the company.

The company has had a compound growth in earnings of 20% per annum for the past five years and was partially derailed by COVID-19. The company is also involved in debt-collection in South Africa and Australia through Transaction Capital Risk Services (TCRS). It is apparent that the taxi industry has suffered from a perfect storm of rising interest rates, rising fuel costs and lower consumer spending resulting in a massive increase in TCP's bad debt provision.

The average taxi owner was unable to afford to make repayments of around R6000 a month in the face of steep increases in the fuel price, rising interest rates and declining commuter traffic. The result was that SA Taxi stopped financing and buying as many as 600 new Toyota minibuses a month and was reduced to selling between 180 and 200 refurbished taxis. The company was owed about R17bn by taxi owners most of whom are behind on their repayments.

On 15th March 2023 the company reported that the controlling Hurwitz family trust had sold 1,6m shares in December 2022 - since then the share has halved in price. To us, the sell-off in TCP shares since the beginning of May 2022 and the sharp 40% drop following its results presented a buying opportunity. Notably, the company announced on 23rd March 2023 that Coronation had increased its holding in TCP to 16,57% of the issued shares.

In its results for the year to 30th September 2023 the company reported a headline loss of R3,7bn mainly because of a R1,1bn write down of repossessed taxis. Much now depends on SA Taxi's debt funders and it is expected that a deal with them to re-finance will be in place by March 2024. WBC earnings fell by 14% and Nutun's earnings increased by 10%. The group made a headline loss of 99c per share down from the previous year's profit of 224,4c.

In a report in the Business Day on the 12th of December 2023, the company reported that it will no longer finance new minibus taxis - only second hand ones. SA Taxi attributes its problems to: "...elevated fuel prices, - high interest rates, - increasing cost of parts and maintenance, - record levels of load shedding, - persistently lower commuter volumes as a result of depressed economic activity, and - taxi operators' inability to increase fares given already financially stretched consumers."

Hopefully, if you were holding the shares, you sold out on your stop back in May 2022 at prices above R40 per share. On 13th May 2023 we recommended that you apply a 65-day exponentially smoothed moving average to the Transcap share price and wait for a break above that. That happened on 6th November 2023 at 577c per share. Since then it has moved up to 826c - a gain of over 43% in 3 months.

On 12th September 2023 the company announced that its CEO, David Hurwitz, would resign with effect from 31st December 2023. The news caused the share price to drop sharply. We see this share as a potential turnaround that is probably cheap at current levels. On 31st January 2024 the company announced that it intended to unbundle and separately list WeBuyCars due to the poor performance of the taxi business in 2023. On 19th March 2024 the company announced that they had raised R902,7m through the issue of 40m new WBC shares and the sale of 8,145m WBC shares by Transcap.

It also reported that during the 4 months WeBuyCars had increased revenue by 16% and core earnings by 20%. The company said, "Revenue continues to grow in line with the growth in number of vehicles sold as the existing branch network matures. WBC is consistently expanding its market share in a highly fragmented market." Our view is that WeBuyCars will be a solid investment when it comes to the JSE.

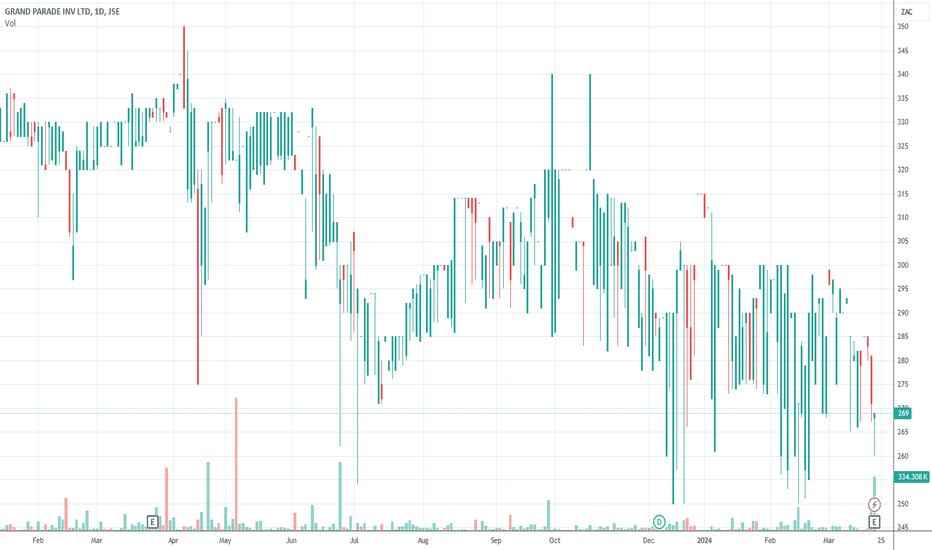

Our opinion on the current state of GPLGrand Parade Investments (GPL) is an investment holding company primarily focused on the gaming industry, operating as a Black Economic Empowerment (BEE) entity. Listed on the JSE in 2008, the company has undergone significant changes in its portfolio over the years. Notably, it terminated its franchises with Dunkin' Doughnuts, Baskin Robbins, and Burger King in February 2019 and February 2020, respectively. Furthermore, GPL sold its remaining 10% stake in the Spur Corporation back to Spur in June 2019.

On June 15, 2022, GPL announced the unbundling of its 9.28% shareholding in Spur, with shareholders receiving 1 Spur share for every 56 GPL shares held on the unbundling record date of June 10, 2022. In its financial results for the six months ending December 31, 2023, GPL reported revenue of R12.7 million, with headline earnings per share (HEPS) increasing to 11.9c from 9.8c in the previous period. The company attributed the decrease in central costs to operational restructuring and cost-saving initiatives implemented during the review period.

Significant changes occurred in GPL's ownership structure, with GBM Liquidity, a private company, acquiring a 27.88% stake in the company on October 25, 2022, later increased to 35.14%. Additionally, Sun International increased its holding to 10.56% on November 11, 2022. On April 11, 2023, GBM Liquidity Corporation, a family trust of Greg Bortz, obtained control with 53.65% of the company's issued capital.

Despite these ownership changes and potential takeover rumors, GPL's share performance has been relatively stagnant since 2017, moving sideways and not presenting an attractive investment opportunity from a technical perspective.

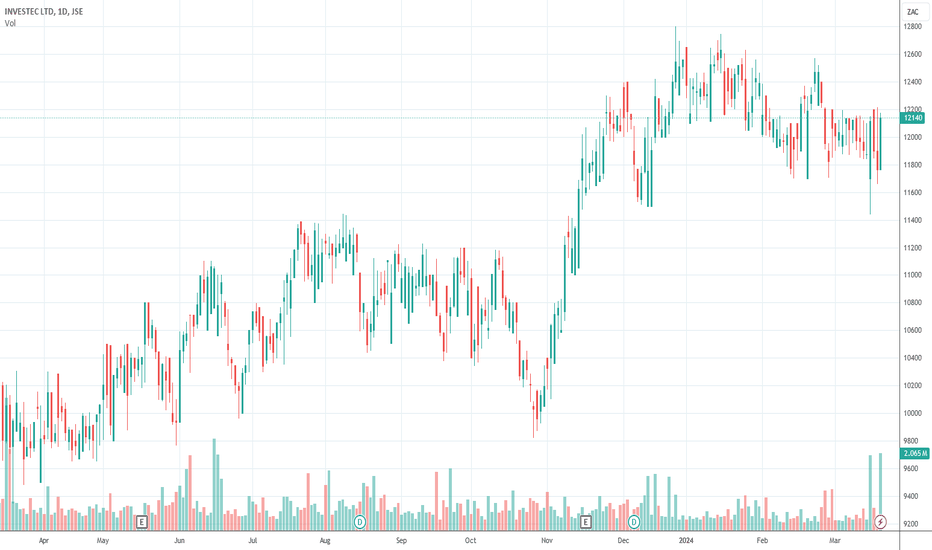

Our opinion on the current state of INLInvestec (INL) operates as a specialist banking and asset management firm with a global presence spanning South Africa, Australia, Europe, the UK, and several other countries. Over the past four years, the company has faced pressure on its shares due to the uncertainties surrounding Brexit in the UK. However, Investec's decision to separately list its asset management division as Ninety-One has been instrumental in unlocking shareholder value, a trend that is becoming increasingly apparent as the effects of the pandemic subside.

The separate listing of Ninety-One posed a significant challenge for Investec, particularly in convincing investors of its international asset management capabilities rather than being solely reliant on the South African market. To expand its client base, Investec targets individuals with an annual income of at least GBP300,000 and assets exceeding GBP3 million. Currently, the company has approximately 6000 such clients and aims to increase this number to 9000.

In its latest financial results for the six months ending September 30, 2023, Investec reported a notable increase in headline earnings per share (HEPS) by 15.3%. Additionally, the company raised its credit loss impairment by 57.7% and conducted a share buyback worth R6.8 billion.

In a pre-close update for the fiscal year ending March 31, 2024, Investec projected a further increase in HEPS ranging between 4.8% and 10.6%. The company highlighted that its UK business, including Rathbones Group, is expected to achieve adjusted operating profit growth of at least 15.0% compared to the previous year. Furthermore, the Southern African business anticipates adjusted operating profit to be at least 10.0% higher in Rands compared to the prior year.

From a technical standpoint, Investec's shares are on a strong upward trend, which is anticipated to continue. With a price-to-earnings ratio (P:E) of 7.62 and a dividend yield (DY) of 5.11%, the company appears undervalued among blue-chip companies trading on the JSE. Given these factors, Investec is poised to continue its strong performance in the market.

Our opinion on the current state of SOHSouth Ocean (SOH) operates as a manufacturer of low-voltage electrical cables and an importer of light fittings and electrical accessories. The company's primary manufacturing plant, located in Alrode, employs approximately 400 individuals. Additionally, South Ocean functions as an investment holding company with two operating subsidiaries specializing in the production of low-voltage electrical cables. It also holds property for investment purposes, including Anchor Park, a property company under its ownership.

The company has experienced fluctuations in its share price over the years, with notable highs and lows in its trading history. For instance, in December 2010, South Ocean's share price reached as high as 245c. However, persistent losses led to a significant decline in its share price, trading at around 22c, albeit on very thin volumes.

In its latest financial report for the year ending December 31, 2023, South Ocean reported a noteworthy improvement in its financial performance, with revenue increasing by 26% and headline earnings per share (HEPS) surging by 99%. The company attributed this growth to expanded distribution channels and the enlargement of its customer base.

Despite this positive momentum reflected in the share price, which has risen to 147c, it remains unsuitable for private investors due to the persistently low trading volumes. The lack of liquidity in the market makes it challenging for investors to buy and sell shares efficiently, rendering South Ocean's stock ill-suited for investment by private individuals. Therefore, it is advisable for investors to exercise caution and seek alternative investment opportunities with better liquidity and trading activity.

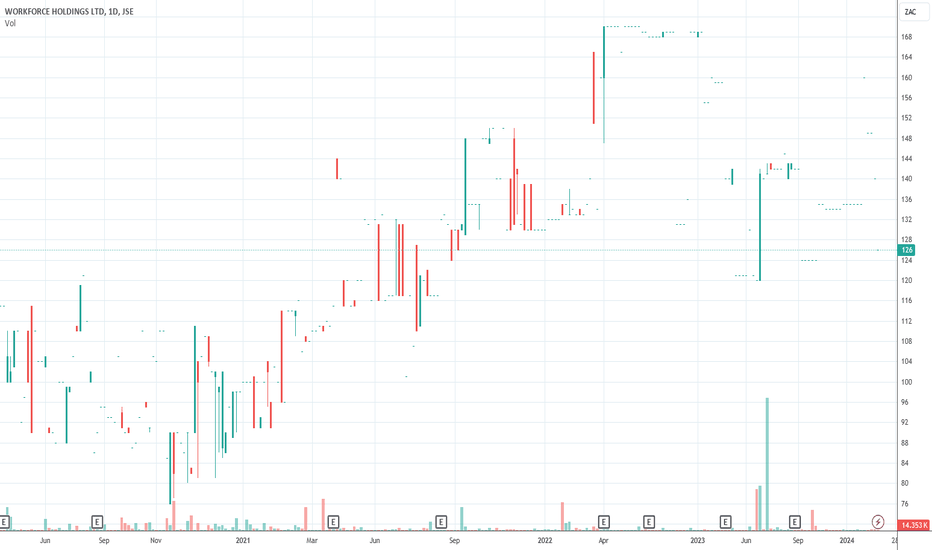

Our opinion on the current state of WKFWorkforce (WKF) operates as a comprehensive labor broker, offering recruitment, specialist staffing, training, consulting, employee health management, and financial and insurance products. The landmark "Assign" case decision by the Constitutional Court clarified the relationship dynamics within the labor broker industry, establishing a tri-partite relationship between the labor broker, the employee, and the client. According to this ruling, temporary employees would be deemed permanent after three consecutive months of employment, providing much-needed clarity to the status of temporary workers.

Workforce has strategically diversified its offerings beyond labor broking into insurance and other ancillary products, which has been advantageous for its business. However, in its results for the six months ending June 30, 2023, the company reported a 7% increase in revenue but a significant decline in headline earnings per share (HEPS), dropping to 1.7c from 14.7c in the previous period. The company attributed this decline to various factors including low economic activity, load shedding, high interest rates, decreased client confidence, and reduced demand for personnel services. Additionally, overhead costs rose by 12% due to inflation rates and operating expenses.

To mitigate these challenges, Workforce has initiated a workforce reduction plan, aiming to decrease staff by 10% to 15%. However, despite these efforts, the company projected a headline loss for the year ending December 31, 2023, estimating between 11.36c and 16.04c loss per share compared to a profit of 46.8c in the previous year.

One notable limitation of investing in Workforce from a private investor's perspective is its thinly traded nature. With only 8% of its issued shares available to the public and sporadic trading activity, the share lacks the liquidity necessary to justify investment. As a result, it may not be a viable option for private investors seeking to enter the market. Therefore, we do not recommend investing in this share due to its limited liquidity and trading activity.

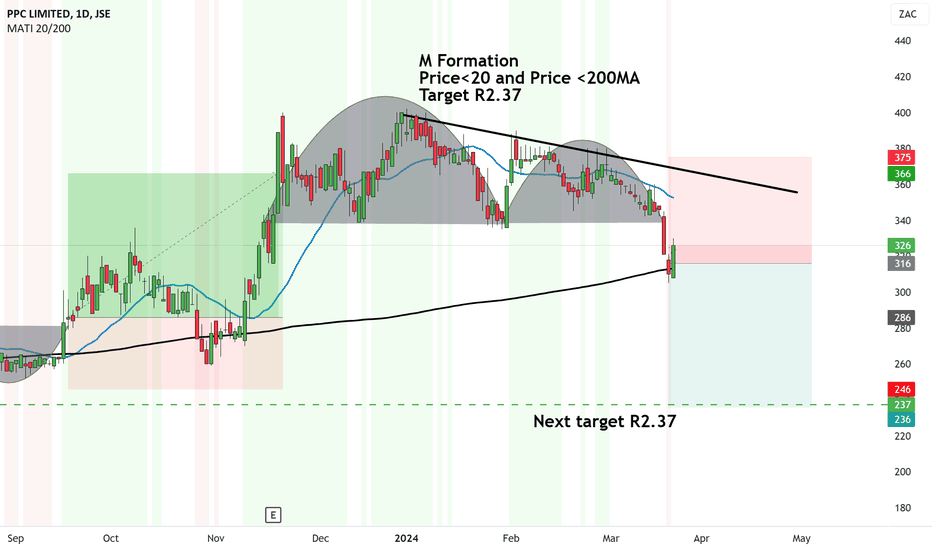

PPC made a bad turn taking it to the next target R2.37M Formation has recently formed on PPC.

We are seeing negative signs more than positive.

On Tuesday, the price crossed below the 200MA which confirmed downside to come.

Now we can expect a test and a consolidation period before further downside, but well need the price to cross and close below the 200MA first.

Target R2.37

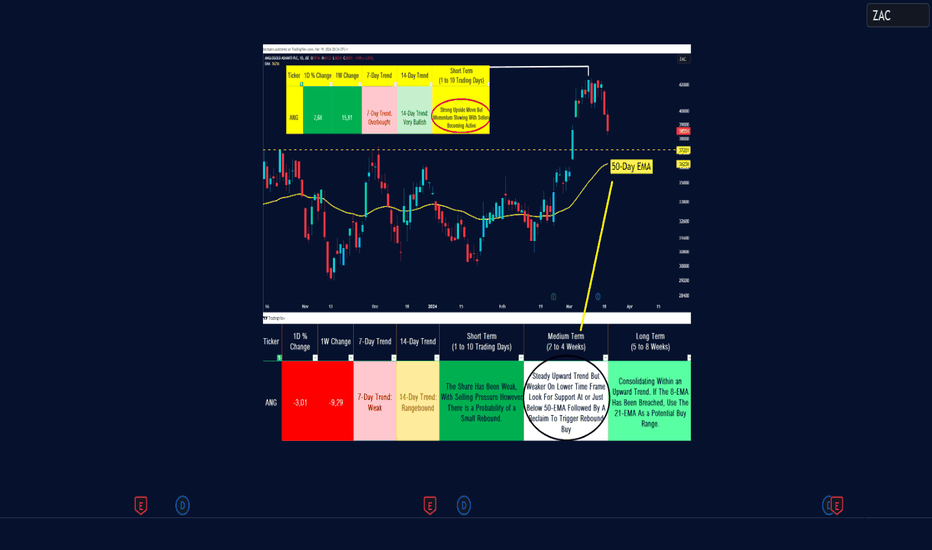

ANG: Automating InformationWednesday 20 March 2024, 06h30 | ANG Anglogold Ashanti | This year’s highest end-of-day close for the share was on Monday 11 March at 42373c. At the end of that trading day, the Tactical Trading Guide gave you the following reading: “Strong upside move but momentum is slowing, with sellers becoming active”. During the next trading session, the share was lower by 4.28% and has since declined further, testing a low of 38239c during yesterday’s session. Below is the updated chart as of yesterday’s close, shown with the reading on the day which the share peak. Below the chart is yesterday’s end of day reading from the Tactical Trading Guide. For long re-entries, the previous breakout level at the 50-day EMA is a confluence zone. As you’ll note the medium term time frame (2 to 4 weeks) states that traders could watch the 50-day EMA as a range for a rebound buy/long. For active traders, there are plenty of opportunities.