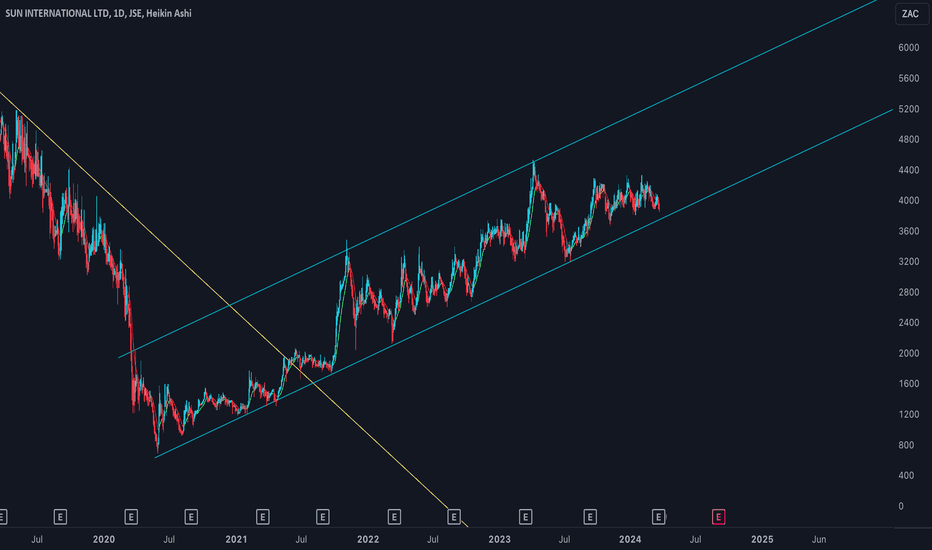

Sun International - Near bottom of the rangeSUI is trading in a clear upward channel and currently the price is trading near the bottom of the range or area of support. One can look to go long any price below 39.00 with minor resistance at around 43 - 43.20 initially. Stop loss is a close below 36.70

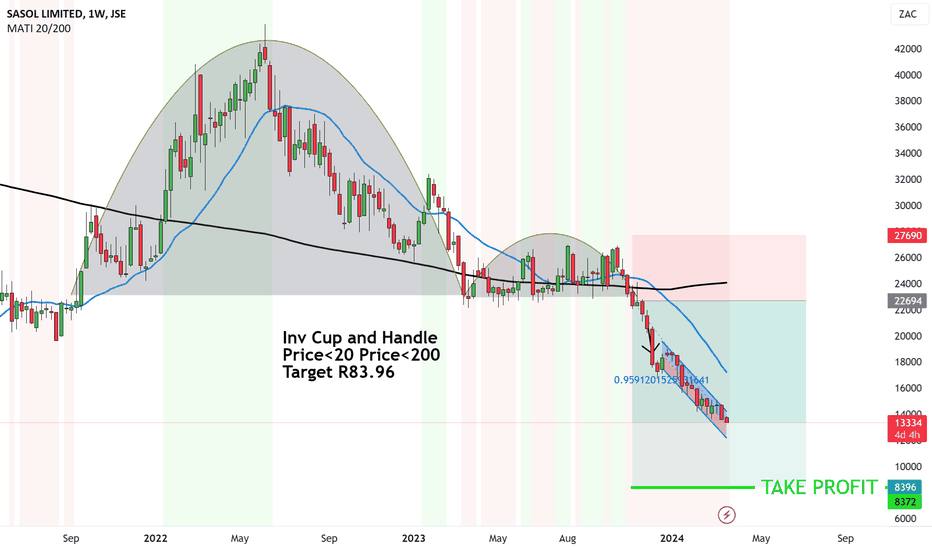

UPDATE: Sasol next target is more morbid to R83.96We've held onto the Sasol short and extended the take profit.

Purely based on the bigger picture on a weekly chart.

There's an even larger Inv Cup and Handle.

Price has broken below the Brim level and entered into a Down regression channel. By the looks of it, the price will tank down to R83,96.

The nature of the trade is HIGH probability as the Price<20 Price<200

Target R83.96

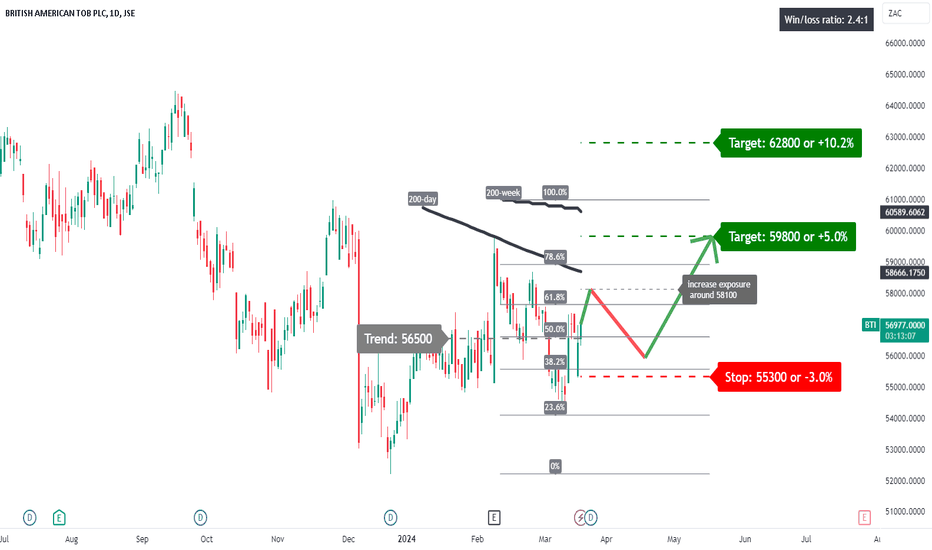

BTI: some upside?A price action above 56500 supports a bullish trend direction.

Further bullish confirmation for a break above 58100.

The first target price is set at 59800. The second target price is set at 62800.

The stop-loss price is set at 55300.

The 200-day simple moving average might act as major resistance.

Remains a risky trade.

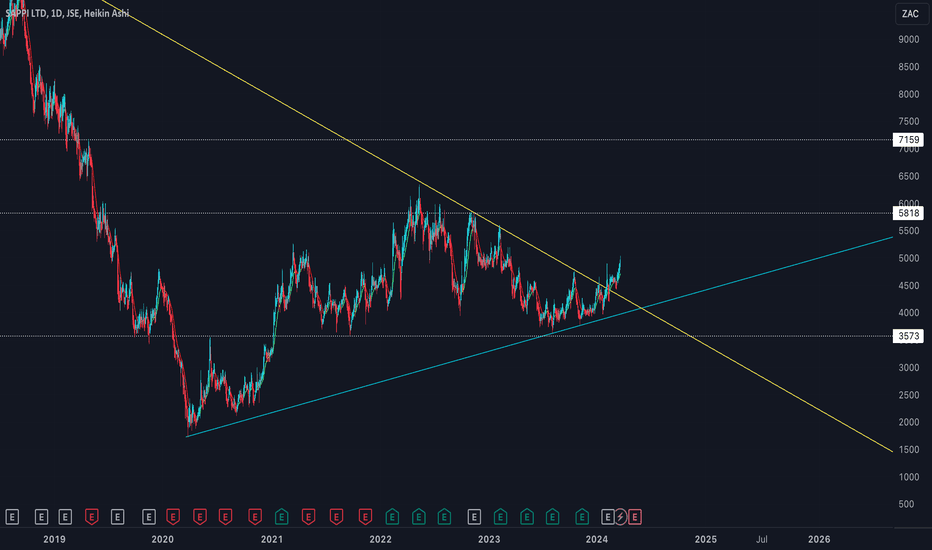

SAPPI - Broken its downtrendSappi has traded strongly recently and has now managed to break the yellow downward trend line. . As such, we could possibly see a retest of the yellow band before moving higher or, price could continue moving upwards in this relatively strong move. Initial target on this move would be around 58.18 and stop loss would be placed on a close below 40.80 or, on a close below the blue upward TL.

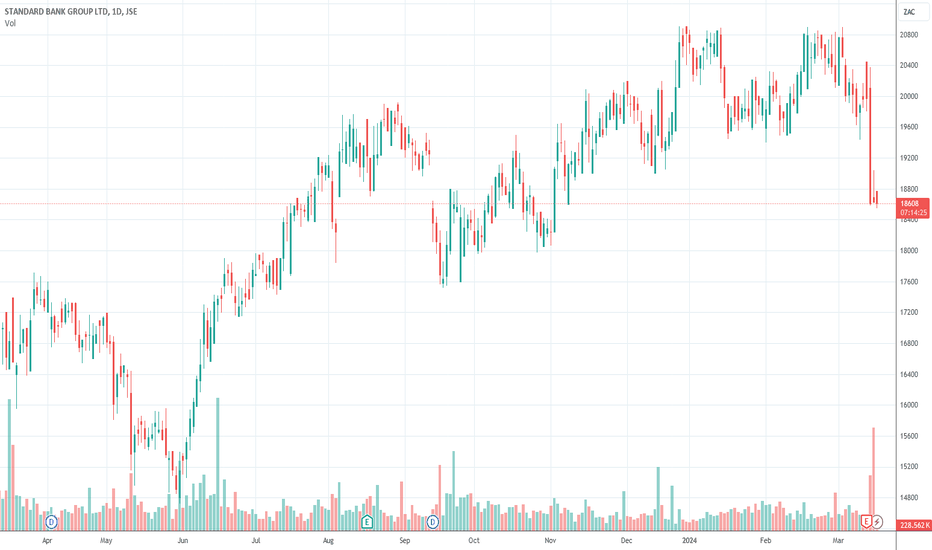

Our opinion on the current state of SBKStandard Bank (SBK), a stalwart in South Africa's financial landscape with a 160-year history, stands as the country's second-largest bank by market capitalization, trailing only behind First National Bank. Its footprint extends across Africa, with operations in various countries on the continent contributing 34% of its headline earnings. Notably, 20% of its shares are held by the Industrial and Commercial Bank of China (ICBC), and the bank itself owns 40% of ICBC Standard Bank.

The bank has adapted to the challenges posed by the COVID-19 pandemic, with approximately 70% of its staff transitioning to remote work arrangements. However, it continues to grapple with issues such as load-shedding in South Africa and the lingering effects of the coronavirus on the economy. Despite these challenges, Standard Bank presents an enticing long-term investment opportunity for private investors, particularly as economic conditions improve post-COVID-19.

Standard Bank's strategic moves, such as its offer for the ordinary and preference shares in Liberty Holdings (LBH) announced on July 15, 2021, have bolstered its position. Liberty shareholders received 0.5 Standard Bank shares and R25.50 in cash for each LBH ordinary share, implying a valuation of just under R90 per LBH share—a 33% premium to its pre-announcement price.

The bank's financial performance for the year ending December 31, 2023, reflects its resilience and growth trajectory. Headline earnings per share (HEPS) surged by 26%, accompanied by a robust return on equity (ROE) of 18.8%. Additionally, the company's net asset value (NAV) rose by 8% to 14269c per share.

A significant driver of this performance is the bank's Africa Regions franchise, which contributed 42% to group headline earnings. Notable contributors include operations in Ghana, Kenya, Mauritius, Mozambique, Nigeria, Uganda, Zambia, and Zimbabwe. Standard Bank benefits from the current high interest rate environment and its diversification into African markets.

From a technical standpoint, Standard Bank's share price has been on a strong upward trend since hitting a low at 14910c on May 30, 2023. With a price-to-earnings ratio (P:E) of 7.18 and a dividend yield (DY) of 6.12%, the stock is considered to offer good value to investors.

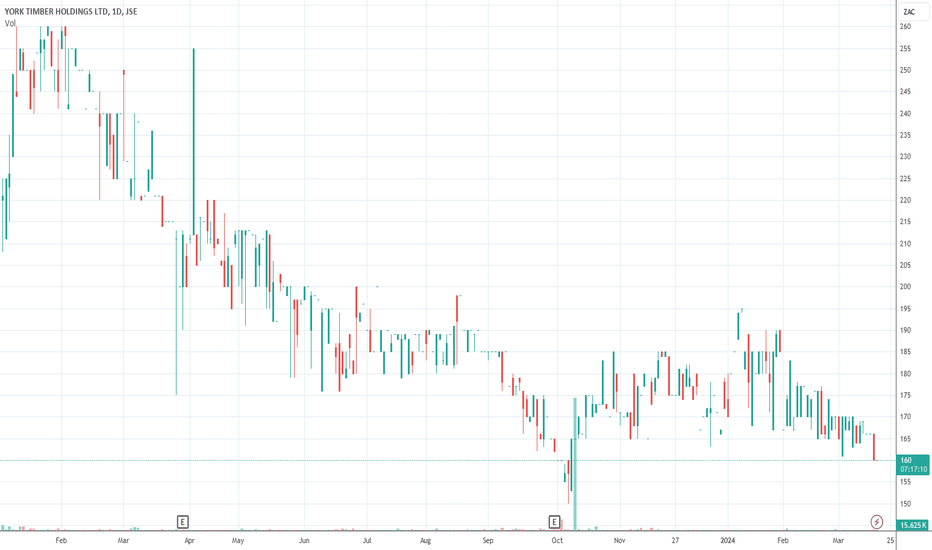

Our opinion on the current state of YRKYork Timber Holdings (YRK) is a prominent forestry company in South Africa, boasting ownership of plantations, processing plants, and a wholesaling distribution network. Established by Russian immigrant Herman Katzenellenbogen in 1916, the company has been listed on the JSE since 1946 and holds a significant position in the country's plywood and timber market.

Over the years, York Timber Holdings has faced challenges stemming from the construction industry's downturn, particularly since the onset of the sub-prime crisis in 2008. Despite reaching a peak in July 2007 with shares valued at R40, the company has experienced a downward or sideways trend in its share price since then.

Recent announcements have further impacted investor sentiment. A strike at the company's Escarpment operations, responsible for 51% of its revenue, was reported on May 13, 2022, contributing to production disruptions. Additionally, a decision to conduct a rights issue to raise R250 million, announced on December 5, 2022, led to a sharp decline in the share price.

In its financial results for the year ending June 30, 2023, York Timber Holdings reported a 9% decrease in revenue and a headline loss per share of 76c, compared to a restated profit of 53c in the previous period. The company attributed the loss to various factors, including costs related to load shedding, diesel, external log purchases, and reduced sales, resulting in a decline in net asset value (NAV) from 857c to 579c per share.

Despite these challenges, York Timber Holdings remains accessible to private investors, with approximately R183,000 worth of shares traded daily. However, the company's technical outlook indicates a downward trend since the beginning of 2022, underscoring its volatility and its sensitivity to construction-related factors.

In a trading statement for the six months ending December 31, 2023, the company projected a further decline in headline earnings per share (HEPS) by 62% to 67%, citing expectations of significantly lower cash generated from operations compared to the previous comparative period. Investors should consider these factors when evaluating York Timber Holdings as an investment opportunity.

Our opinion on the current state of CLIClientele Life (CLI) operates as a small insurance company specializing in the sale of short- and long-term policies and underwriting insurance products. The company distributes its products through agents, brokers, and tele-sales channels.

In its financial results for the year ending 30th June 2023, Clientele Life reported a 15% increase in headline earnings per share (HEPS) and achieved a return on average shareholders' interest of 43%. Additionally, the company attained a return on embedded value of 12%. Clientele Life highlighted the challenging trading environment marked by factors such as low economic growth, persistent load-shedding, and difficulties in premium collections.

On 3rd November 2023, Clientele Life announced the acquisition of 1Life Insurance for R1.914 billion, to be funded by issuing 117,815,756 ordinary shares in Clientele. Despite anticipating a decline in HEPS ranging between 37% and 57% in the trading statement for the six months ending 31st December 2023, the company emphasized its sound solvency and liquidity position, with continued strong positive cash flows.

Trading at a price-to-earnings (P:E) ratio of 7.8, the company's shares appear attractively priced. Moreover, Clientele Life's shares witness sufficient trading activity to accommodate most private investors. From our perspective, the current valuation offers reasonable value, with potential for direct benefits as the South African economy shows signs of improvement. Investors should consider these factors when evaluating investment opportunities in Clientele Life.

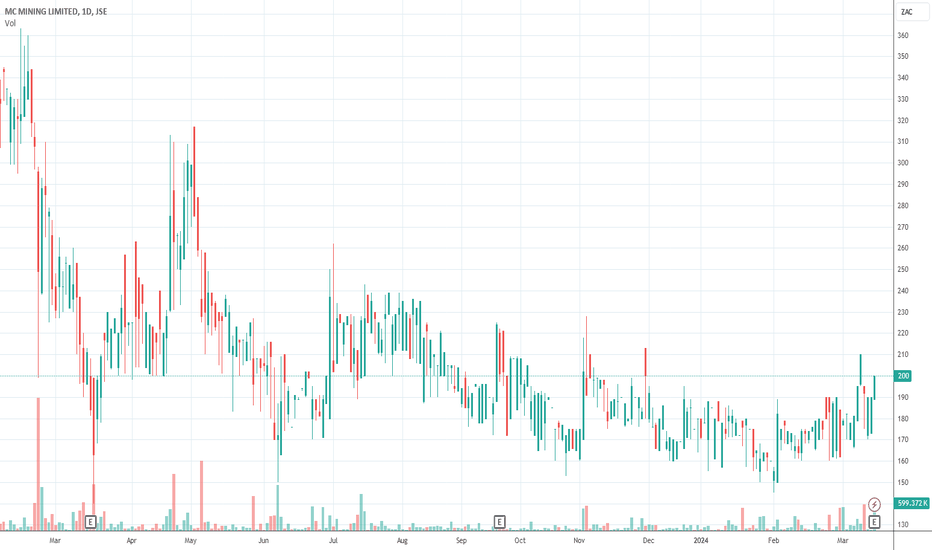

Our opinion on the current state of MCZMC Mining (previously "Coal of Africa") (MCZ) operates as a small metallurgical coal-mining company primarily focused on its single producing mine, Uitkomst. In addition to Uitkomst, the company is actively developing several projects including the Makhado project, the Vele colliery, and MbeuYashu. Among these, the Makhado project stands out as the flagship operation situated in the Limpopo province. This opencast mine boasts a projected lifespan of 16 years with the potential for extension.

A significant milestone for the Makhado project was reached in January 2019 with the announcement of the acquisition of surface rights, crucial for its viability. Production at Makhado is anticipated to commence by the end of 2020, aiming to produce 800,000 tons of hard coking coal and 1 million tons of export thermal coal. This acquisition substantially reduces risks associated with the project, enhancing its attractiveness as an investment opportunity.

To support the Makhado project, the Industrial Development Corporation (IDC) has provided R245 million in funding, yet an additional R530 million is still required. The company holds a 69% stake in Baobab Mining and Exploration, the entity that owns the Makhado project.

In its financial results for the six months ending 31st December 2023, MC Mining reported a remarkable 80% increase in revenue. However, the company experienced a headline loss of 145c (US) per share, a significant increase from the loss of 50c in the previous period. Despite challenging international thermal coal prices, Uitkomst Colliery delivered encouraging results, generating revenue of $16.3 million and operating cash flows of $5.1 million for the period.

From a technical perspective, the share price of MC Mining exhibited a spike between July and September 2022, followed by a subsequent decline to lower levels. As a volatile commodity share, MC Mining faces inherent risks associated with mining exploration and development, coupled with high debt levels. On average, approximately R280,000 worth of shares change hands each day, indicating relatively low liquidity in the market for this stock. Investors should carefully consider these factors before making investment decisions.

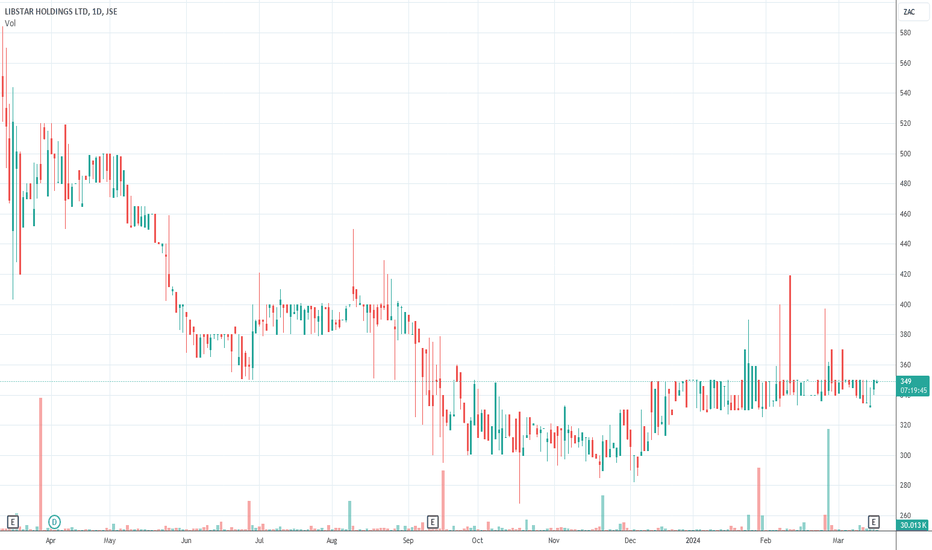

Our opinion on the current state of LBRLibstar (LBR) is a recently listed decentralised food and beverage company that specializes in producing "consumer packaged goods." The company successfully raised R3 billion in an initial public offer (IPO) in May 2018. Libstar boasts ownership of prominent brands like Denny, a leading mushroom supplier, and Lancewood, renowned for its dairy products and other food brands. With a diverse portfolio, Libstar manufactures over 9000 products and has introduced 88 new products in the past six months alone.

One of Libstar's key strategies involves producing private label brands for major retailers such as Spar, Woolworths, Pick 'n Pay, and Shoprite. The company operates with a decentralized structure, where autonomous production units receive support and investment from a centralised head office. Additionally, Libstar actively engages in acquisitions, providing capital, expertise, and support to bolster its operations.

However, Libstar faces challenges stemming from various economic factors, including load-shedding, civil unrest, retrenchments, high unemployment, the lingering effects of COVID-19, and recent developments in central Europe. Given its heavy reliance on consumer spending, these factors significantly impact its performance.

In its financial results for the year ending 31st December 2023, Libstar reported a 5.2% increase in revenue, while normalised headline earnings per share (HEPS) declined by 11.2%. The company attributed 10.0% of its sales growth to selling price inflation and mix changes. However, sales volume experienced a 4.8% decline across retail, industrial, and export channels.

Moreover, Libstar faced a notable increase in net finance costs on interest-bearing debt, rising by 53.3% due to the full-period impact of the Johannesburg interbank average lending rate (JIBAR) compared to the previous period.

Currently, Libstar trades at a multiple of 7.34 with a dividend yield (DY) of 3.43%. From a technical standpoint, the share has been on a downward trend for some time. It is advisable to wait for a clear break above the long-term downward trendline before considering further investment.

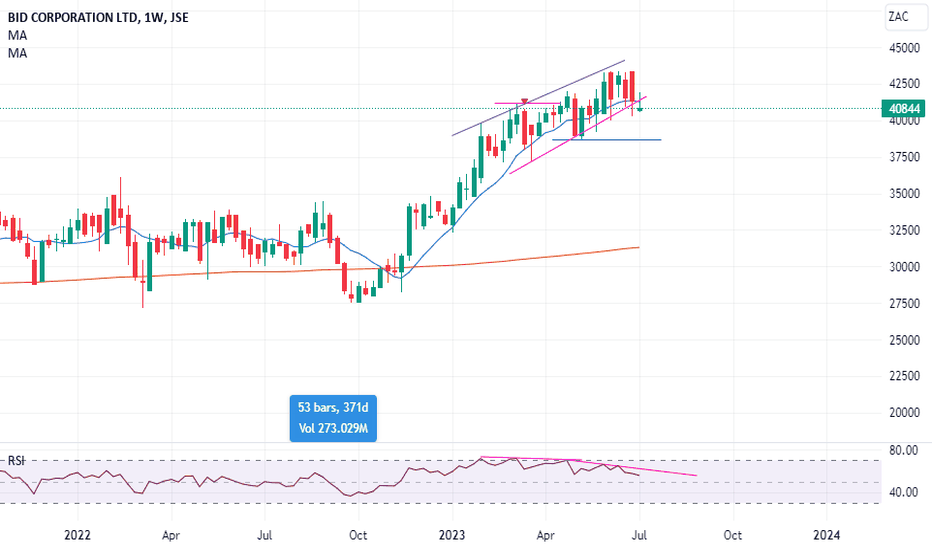

BID Poised for a Weekly LowThe share appears to be in distribution, the RSI is already showing negative divergence building up. The blue line is where we expect price to fully confirm that a weekly drop is well underway besides the weekly swing high already confirmed. We can also see price has exited the rising wedge & has backtested it, long positions are best taking profit at these levels.

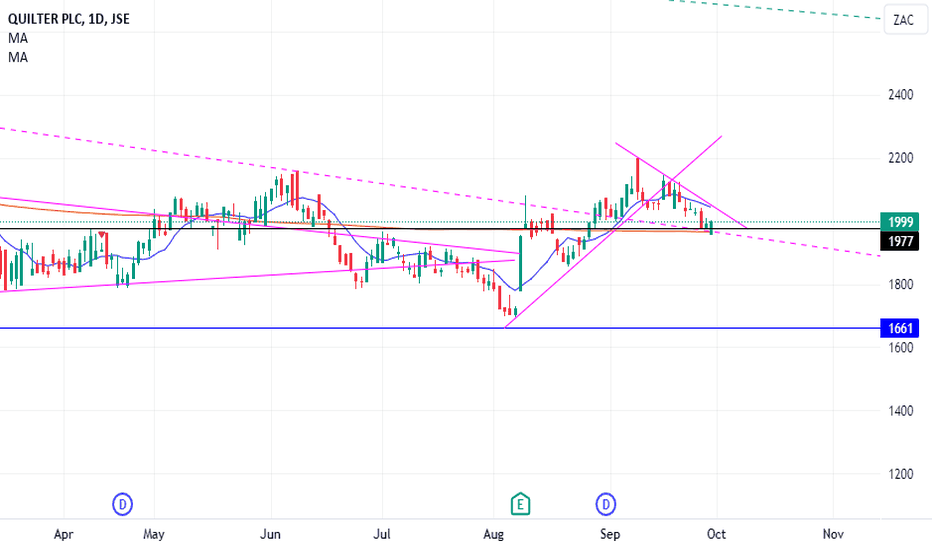

Quilter Seeking A Cycle LowQuilter is in the timing band for a daily cycle low, we will know this is confirmed when price closes above the pink resistance line set over recent price action. Investors who missed the bus can consider this as a safer entry point, higher risk accepting investors can buy before confirmation by considering how price is bouncing off the support of 200DMA, dashed trendline & horizontal black line, triple support is much stronger support to break on pullbacks.

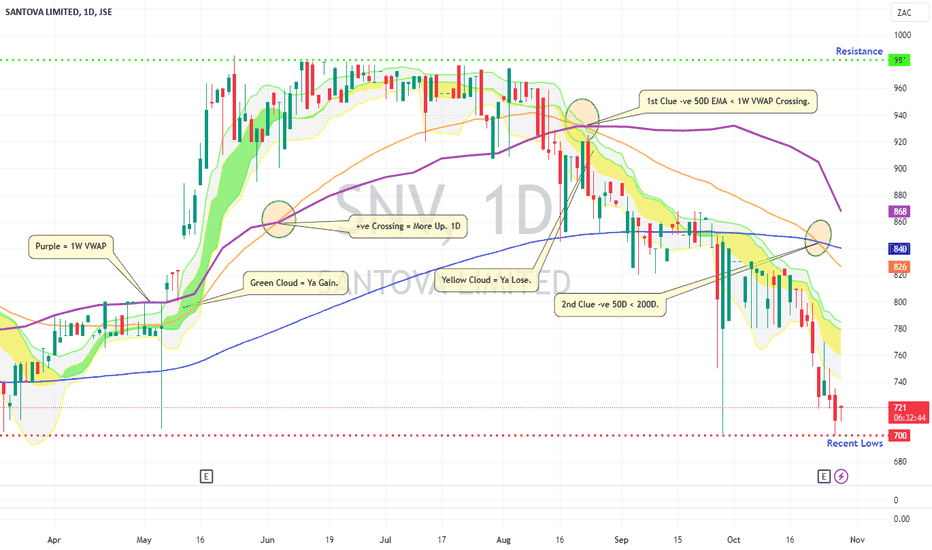

Santova 1D Chart Analysis Trend Cloud.This is my Santova 1D Chart Analysis Trend Cloud Study.

The Chart is self explanatory.

On the Chart I show where there are clues for Upside and Downside momentum.

Please do your own research before making any decisions.

Smash the Rocket Boost Button if you appreciate my Chart Study.

Many Thanks.

Graham.

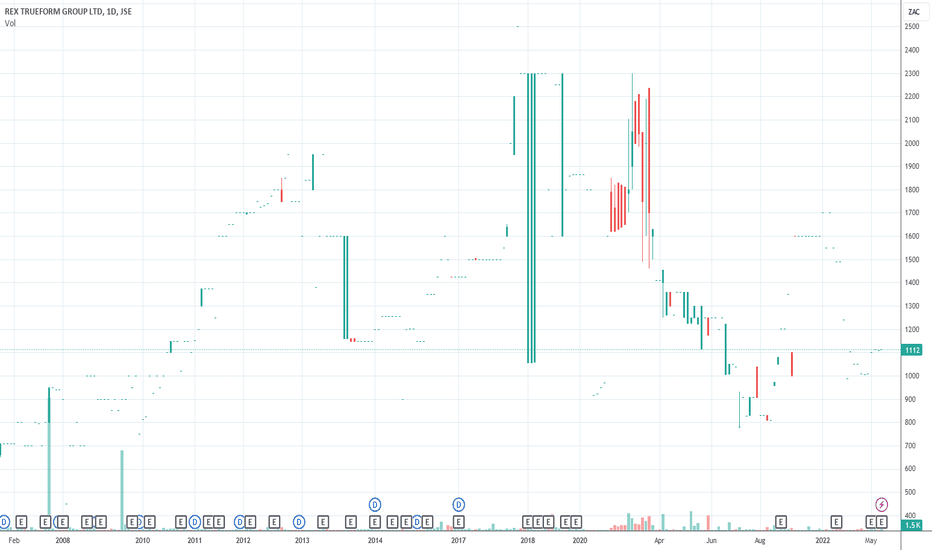

Our opinion on the current state of RTOThis share represents an example of extremely thinly traded companies listed on the JSE, rendering them impractical for private investors in their current state. RTO, established in 1937 and listed on the JSE since 1945, specializes in manufacturing and marketing clothing and accessories through a nationwide chain of Queenspark and J. Crew stores. Additionally, it holds a portfolio of properties in the Cape Town area. The group is under the control of a consortium led by Marcel Golding and his partner Hugh Roberts.

Recently, the group made a significant investment of R81 million to acquire a 33.8% stake in Sembcorp Siza, a company specializing in water reticulation and specialist pipe services operating in Natal. With a robust balance sheet, the company has been actively seeking diversification opportunities. In its financial results for the year ending 30th June 2023, RTO reported a remarkable 35.1% increase in revenue and a substantial 78.2% surge in headline earnings per share (HEPS). The company's net asset value (NAV) also saw a notable 41% rise to 1888c per share.

RTO attributed the revenue growth primarily to an increase in turnover within the retail segment, while other revenue streams, including media and broadcasting income, rental income, tenant recoveries, and management fee income, experienced a significant uptick, mainly driven by the acquisition of Telemedia and property assets. Investment income also saw a healthy increase of 34.7%.

However, a trading statement for the six months ending 31st December 2023 forecasted a substantial 62.2% decrease in HEPS. Unfortunately, neither its ordinary nor its "N" shares trade at levels sufficient to attract investor interest at this time.

Our opinion on the current state of EXXExxaro (EXX) is a BEE coal company with interests in iron and heavy minerals, operating in Australia, America, and Europe. It is a significant provider of coal to Eskom's Medupi power station. The company aims to increase coal production from 48 million tons presently to about 60 million tons by 2022, although this plan might be revised due to the lower demand for coal on the global market. The price of export coal has declined from $100 per tonne at the end of 2018 to as little as $60 per tonne.

Despite fluctuations in coal prices, Exxaro is a cash-generative operation, usually profitable depending on coal price movements. However, the long-term viability of the coal business is challenged by the shift towards renewable energy. Obtaining funding for new coal-fired power stations has become increasingly difficult as banks face pressure from environmental groups.

On 9th April 2021, the company announced the sale of its interest in Exxaro Coal Central (Pty) Ltd and Leeuwpan Coal Mine operation. In its results for the year to 31st December 2023, Exxaro reported a 17% decrease in revenue and a 22% decrease in headline earnings per share (HEPS). The company attributed the decline in EBITDA to a 36% decrease in Coal EBITDA, despite a 16% increase in revenue contribution from its energy operations.

The share price of Exxaro has been declining since the beginning of 2023. While the Ukraine conflict initially boosted the share price due to higher commodity prices, this effect has since dissipated. The company announced that, due to the lower price of coal, it was no longer economically viable to transport coal to port by truck, highlighting challenges with the inefficiency of the South African rail and port systems.

Exxaro remains a volatile commodity play, currently experiencing a downward trend, but there are indications it may be bottoming out. However, ongoing shifts in the energy landscape and global market dynamics continue to pose challenges to the company's long-term prospects.

Our opinion on the current state of AILAfrican Rainbow Capital (AIL) is a BEE investment company that was formed in 2015 and listed on the JSE in September 2017. Since it was formed, AIL has invested in more than forty listed and unlisted investments in a wide range of industries from telecommunications to mining, construction, energy, property, agriculture, insurance, asset management, and banking.

ARC Investments is 44.4% effectively owned by African Rainbow Capital Proprietary Limited (ARC), which in turn is 100% owned by Ubuntu-Booth Investments Proprietary Limited (UBI). UBI effectively owns 51.2% of ARC Investments. AIL is thus owned through Ubuntu-Botha Investments by the Motsepe family through their trusts. In the South African context, it has a significant advantage in finding suitable companies in which to invest because it can offer them a solid, reliable BEE shareholder.

AIL has benefited from an investment by Sanlam and owns a stake in the Sanlam subsidiary, Santam. The company acquired 100% of TymeDigital which has launched a digital bank in partnership with Pick 'n Pay. It offers digital banking, especially for those who cannot afford normal banking, via their phones, and had the distinction of being the only bank in South Africa not to charge transaction fees. It competes with other new banks in South Africa like Discovery Bank and Bank Zero.

AIL has taken a hit on its investment in EOH (which may now be improving) but has done well in most other areas. Roughly half of the AIL portfolio is in what it describes as "early lifestyle stage businesses" such as Tymebank, Rain, and Kropz. These investments are seen as disruptive in their sectors, but will take time to mature. It also owns 7% of Afrimat having reduced its stake from 18.4%.

If there is a criticism of this investment holding company, it must be its lack of focus. It appears to be invested in a very diverse range of industries without significant synergies or economies of scale. The need of most South African companies to have a stable BEE partner gives it an edge in finding and negotiating good deals, but its lack of focus may eventually become a problem.

The share trades at a fraction of its intrinsic NAV. It was 59% of its NAV after falling about 25% in the last six months to 2023. The discount makes it good value and may result in "unbundling" some of that value into the hands of shareholders in due course. The directors have said that they will consider delisting from the JSE if the discount persists because the listing cannot be used to raise further capital at current share prices.

On 21st November 2023, the company announced a rights issue to raise R742.35m. Shareholders will get 11.06579 new shares for every 100 shares that they hold at a 7.32% discount to the volume-weighted average price on 10th November 2023. In its results for the six months to 31st December 2023, the company reported intrinsic net asset value (NAV) up 12.9% to 1115c per share. The company said, "ARC Fund acquired investments amounting to R 632 million, as part of its strategy to support the existing investments where there are expansion plans and to grow financial services. These transactions included additional investments in Rain, Tyme Global, and Kropz. The ARC Fund’s net fair value gains amounted to R784 million. The main driver in these gains is an increase from the Financial Services portfolio."

The share still trades for much less than half its net asset value (NAV). Technically, the share has been falling since March 2023. We recommend applying a 200-day moving average and waiting for a clear upside break before investigating further.

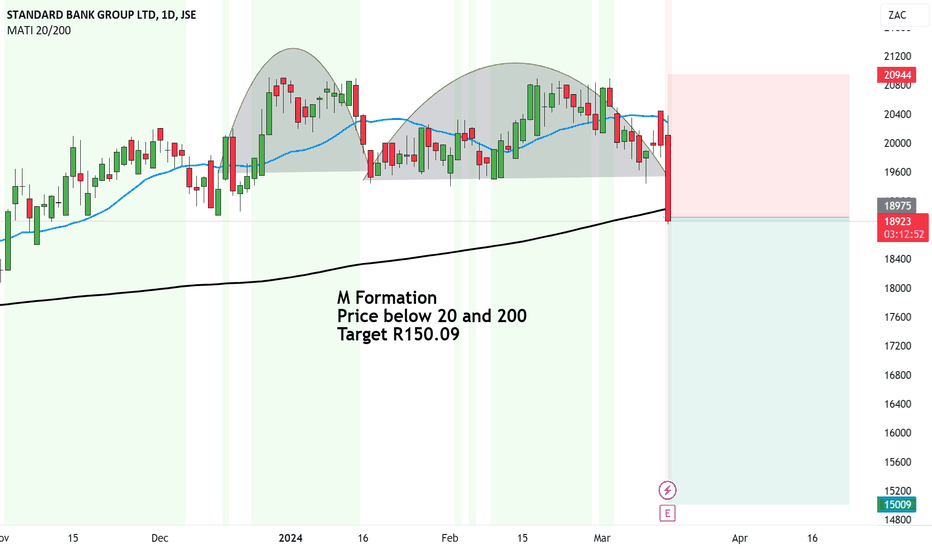

Standard Bank just made a huge signal to SELL to R150Standard Bank has formed an M Formation.

The nature of the analysis is down and is a sell as it's broken below the neckline and the price is below both the 20 and 200MA>

So it looks like the next target is R150.00.

FUNDAMENTALS

Fundamentals also came out today and yesterday which could influence the price and the large candle today.

Standard Bank Group Says FY Headline Earnings Per Ordinary Share At 2590.4 Cents

Standard Bank posted a 27% in annual profit.

And there was an appointment of a non-executive director