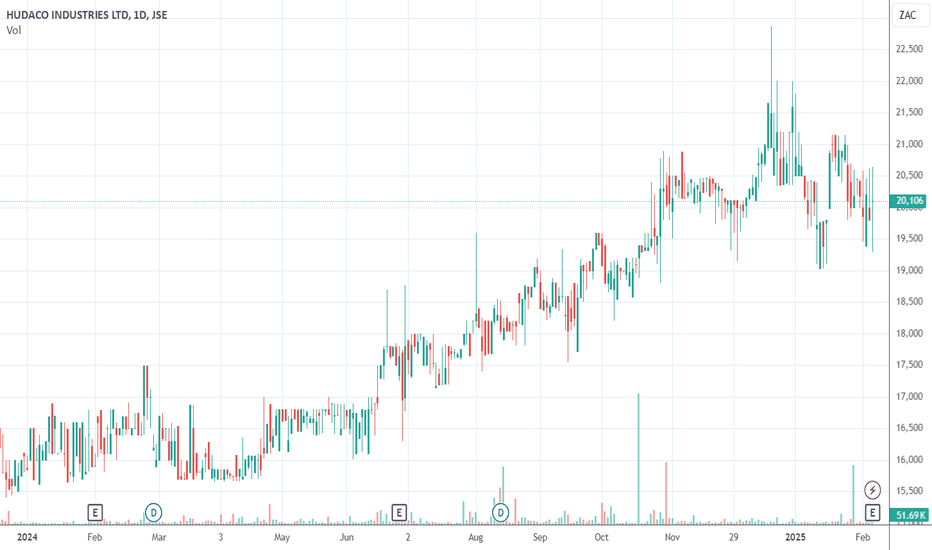

Our opinion on the current state of HUDACO(HDC)Hudaco (HDC) is an importer and supplier of "...automotive, industrial and consumer products" mostly in Southern Africa.

Its business has two sides:

(1) Supplying automotive security, power tools, communications, and business supply products to the consumer market.

(2) Supplying mainly the mining and manufacturing industries with mechanical and electrical power transmissions, diesel engines, hydraulics and pneumatics, steel and thermoplastics, and fittings and bearings.

The company has a very well-established business with 26 warehouses, 800 international suppliers, and 140 branches. Through this network, they supply about 230,000 products. The company has been battling to export goods because of inefficiencies at South African ports, especially Durban.

The group constantly makes bolt-on acquisitions to build and enhance its business.

In its results for the year to 30th November 2024, the company reported revenue down 5.8% and headline earnings per share (HEPS) down 6.3%.

The company said, "For the five months from the formation of the GNU to the end of the financial year, through strong management of gross profit margin, tight control of expenses and the reduction of inventory, operating profit increased by 0.2%, and headline and comparable earnings per share were up by 3.5% on the equivalent period in the prior year."

Hudaco is an extremely well-managed company operating in a difficult economy. As the economy improves, Hudaco's results will benefit directly.

The share trades on a P:E of 9.99 and a dividend yield (DY) of 4.08%, which looks cheap to us. In our view, this share should be bought on weakness and offers solid, long-term investment potential as the South African economy improves.

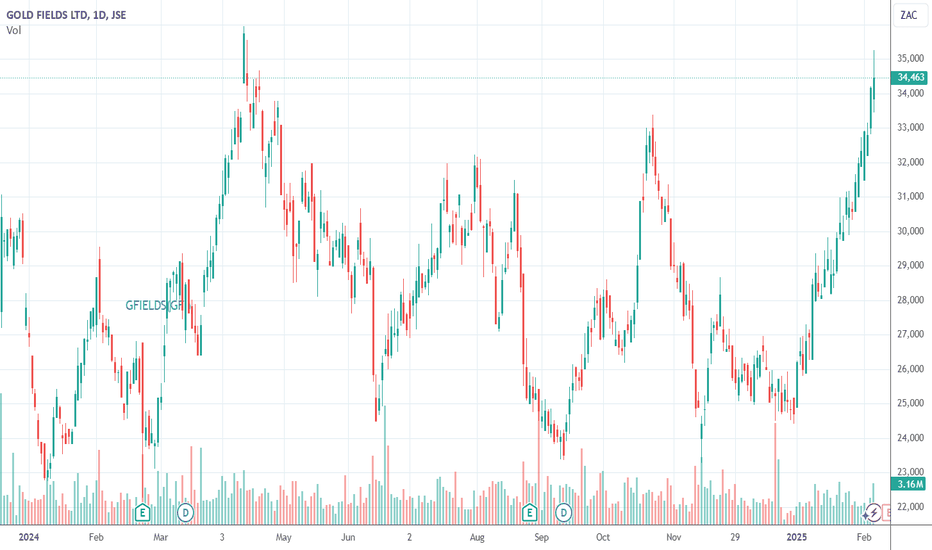

Our opinion on the current state of GFIELDS(GFI)Gold Fields (GFI) is a relatively high-cost international gold mining house with a single mine in South Africa - South Deep.

South Deep was bought by Gold Fields in 2006, and it has struggled to make the mine profitable, pouring in a total of R32bn (R22bn purchase price plus R10bn in development costs) into it over the past 14 years. Brett Kebble once described South Deep as, "The world's most expensive long drop...".

South Deep is 3 kilometres deep and a very difficult mine with many technical complications, but it is the second-largest unmined gold resource in the world - hence Gold Fields' persistence. Gold Fields is working with an independent power producer (IPP) to build a 50MW project in SA.

The company has spent a total of $502m over the past two years to ensure that Damang and Gruyere (international operations) would produce 2 million ounces a year for the next ten years. South Deep now has R800m less in costs and R400m less in capital expenditure.

The company is focusing on bringing the new Salares Norte gold mine in Chile into production. On 11th July 2022, the company said that it would list on the Toronto Stock Exchange and that it would adopt a dividend policy of paying between 30% and 45% of profits out.

Its protracted investment in South Deep is definitely beginning to pay off with output expected to rise by about 25% over the next four years. On 12th August 2024, the company announced that it had acquired the remaining 50% of Osisko Mining for $1.57bn (R29bn).

In its results for the six months to 30th June 2024, the company reported attributable production down by 20% at 918,000 ounces. All-in sustaining costs were $2,060 per ounce. Earnings per share (EPS) was down 22% at 40c (US) compared with 51c in the previous period.

The company said, "Group performance in H1 2024 was impacted by weather-related events and operational challenges at some of our assets."

In a trading statement for the six months to 30th June 2024, the company estimated that HEPS would fall by 21% in rands. The company said, "...the Group generated auction revenues during the period of USD 120.6 million, as well as USD 6.6 million from Fabergé, contributing to another profitable period albeit at a reduced level when compared to the same period last year."

In an operational update for the 3 months to 30th September 2024, the company reported production up 12% and all-in sustaining costs down 3%. The company said, "Net debt decreased by US FWB:30M to US$1,123m at the end of September 2024, mainly due to strong cash generation which was partially offset by payment of the interim dividend of US$152m (June 2024: US$153m)."

In a trading statement for the year to 31st December 2024, the company estimated that HEPS would increase by between 41% and 52%.

Technically, the share is very volatile and subject to shifts in the international price of gold, but it has been in an upward trend over the past five years. It remains a volatile commodity play.

Our opinion on the current state of DRDGOLD(DRD)DRDGOLD (DRD) was listed in 1895 and is the JSE's oldest listed company. It was followed by SA Breweries, which was listed in 1897 and has now been acquired by Anheuser Busch.

DRD is now a gold surface treatment operation which is at an all-in sustaining cost of extraction of just over R627247 per kilogram which compares to the average received gold price of R917996. They are re-treating surface dumps which still have traces of gold that can be profitably extracted with modern extraction methods.

The benefit of this type of operation is that it is far less risky than underground gold mining operations because it has far less union exposure and has none of the expenses or difficulties of an underground operation. Its life and grade, and hence its profitability, are precisely known.

The share tends to be volatile because it depends on the current price of gold, but the company has a debt-free balance sheet and strong free cash flows. A deal was concluded for Sibanye to swap out its surface dumps for an additional 265m DRD shares - which took Sibanye to a shareholding of 38%. Then on 10th January 2020, Sibanye announced that it had exercised its option to increase its stake to 50,1% at a cost of R1086m.

The CEO of DRD Gold, Niel Pretorius, wants to join up with other tailing projects on the West Rand to create a massive unified re-processing operation. The company is building a 20mw solar and battery facility.

In its results for the year to 30th June 2024 the company reported revenue up 14% and headline earnings per share (HEPS) up 4%. Gold production and sales were down 5% while cash operating costs increased by 20% in rands. The company said, "We are now positioning to bring on stream by the financial year ending 30 June 2028 ("FY2028") a combination of reclamation sites designed to lift tonnage throughput to 3 million tonnes per month, and gold production to just over 6 tonnes per annum."

In an update on the 3 months to 30th September 2024 the company reported production up 7% and sales up 4%. All in sustaining costs fell by 5% to R933686 per kilogram. The company said, "Cash operating costs per kilogram of gold sold decreased by 4% from the previous quarter to R856,723/kg due to an increase in gold sold, despite an increase in total cash operating costs driven mainly by two months of winter tariffs which Eskom charges between June and August each year."

In a trading statement for the 6 months to 31st December 2024 the company estimated that HEPS would increase by between 60% and 70%. The company said, "Group revenue increased by R828.1 million, or 28%, to R3,802.3 million (2023: R2,974.2 million), as a result of a 26% increase in the Rand gold price received, and a marginal increase in gold sold from 2,535kg to 2,567kg."

Technically, the share made a high of 2458c on 9th May 2023 and then began a downward trend. It broke up through its long-term downward trendline on 3rd July 2024 at 1673c indicating a new upward trend. It remains a volatile commodity share subject to the international gold price.

Our opinion on the current state of ARCMITTAL(ACL)ArcelorMittal (ACL) is South Africa's largest steel-producing company. It has survived where companies like Highveld Steel have disappeared.

Arguably, ArcelorMittal felt the impact of the sub-prime crisis more than any other South African company and has fallen from its high of R260 in June 2008 to as low as 25c in August 2020. Since then, it has rallied strongly and now trades at 1052c.

It has had to deal with the collapse of the construction industry locally, which was a major consumer of steel, and the massive imports of cheap Chinese steel which were dumped onto our market. Those imports have slowed down somewhat, and ArcelorMittal was successful in getting certain tariffs in place to discourage imports.

We believe that this company came close to closure in July 2020 when the share price reached 25c. It has been rescued by the rising steel price combined with severe cost-cutting.

In its results for the year to 31st December 2024, the company reported revenue down 7% and a headline loss of R5,1bn compared with a loss of R1,89bn in the previous period. The company recorded an "Operational EBITDA loss - before the Longs Business wind-down charge, severance packages charge and the write-down of inventory – of R1 816 million (2023: R56 million profit), includes R670 million of losses relating to the Q2 2024 Blast Furnace instability and R1 514 million of inventory disposal losses in support of improved liquidity."

These results brought the new upward trend to an abrupt halt, taking the shares back down to and through support at around 100c.

On 6th January 2025, the company announced that it had taken the decision to wind down and close its Longs steel division, leading to a sharp drop in the share price.

Our opinion on the current state of AMPLATS(AMS)Anglo American Platinum (AMS), or Amplats, is the second-largest platinum producer in the world (after Sibanye) and plays a key role in the platinum group metals (PGM) industry. The company is 77.62% owned by Anglo American and has been at the forefront of transitioning from deep-level mining to shallow, mechanized mining, which has significantly improved efficiency and reduced costs.

Strategic Developments & Operations

Over the past five years, Amplats has reduced its number of mines from 18 to 7, cut overheads by 50%, and halved its workforce. This restructuring has enhanced profitability, particularly through its Mogalakwena open-cast mine, a palladium-rich operation with some of the lowest costs in the industry worldwide.

A new project at Mogalakwena is set to increase platinum production by 250,000 ounces and palladium production by 270,000 ounces. Amplats also acquired Glencore’s 40.2% stake in the Mototolo mine and the adjacent Der Brochen property for R1.5 billion, enabling a cost-effective expansion without additional surface infrastructure.

However, platinum prices remain under pressure due to an effective recycling industry, which adds about 2 million ounces per year to the supply by recovering metal from old auto catalysts. Despite this, we believe Amplats remains the best of the PGM shares on the JSE, although it is highly volatile as a commodity stock.

Key Risks & Challenges

- As part of its Mogalakwena expansion, Amplats plans to relocate 1,000 families, which could lead to social unrest.

- Loadshedding and falling PGM prices continue to be significant headwinds.

- The company announced the retrenchment of 3,700 employees on 19th February 2023.

- On 23rd July 2024, Business Day reported that Amplats was considering listing on the London Stock Exchange (LSE).

Financial Performance

In its results for the six months to 30th June 2024, Amplats reported:

- Tonnes milled down 7%

- Refined PGM production up 5%

- Revenue down 19%

- Headline earnings down 18%

The company explained, "Realised PGM dollar basket price fell 24% to an average of US$1,442 per PGM ounce due to declining realised palladium and rhodium metal prices, which were 34% and 49% lower, respectively."

In its third-quarter update for 30th September 2024, Amplats reported:

- PGM production from own-managed mines down 9%

- PGM sales volumes up 16%

- Maintained 2024 production guidance at 3.3-3.7 million PGM ounces

- Increased refined production guidance to 3.7-3.9 million ounces

In a trading statement for the year to 31st December 2024, the company estimated HEPS would decline by 36%-46%, stating, "The decrease in earnings compared to 2023 is primarily due to a 13% decline in realised ZAR PGM prices. Most notably, palladium and rhodium realised US dollar prices decreased 24% and 30%, respectively."

Technical & Investment View

- The share price has been declining since March 2022, driven by loadshedding, weaker PGM prices, and industry challenges.

- Recently, it has moved sideways, indicating some stabilization but no clear upward trend yet.

- PGM prices remain under pressure, which could limit near-term upside.

Conclusion: Amplats remains a high-quality, but highly volatile commodity share. It is largely dependent on PGM prices, making it speculative. While long-term fundamentals remain strong, the current market conditions and price pressures make it risky in the short term. Investors should wait for a clear break above the downward trendline before considering an entry.

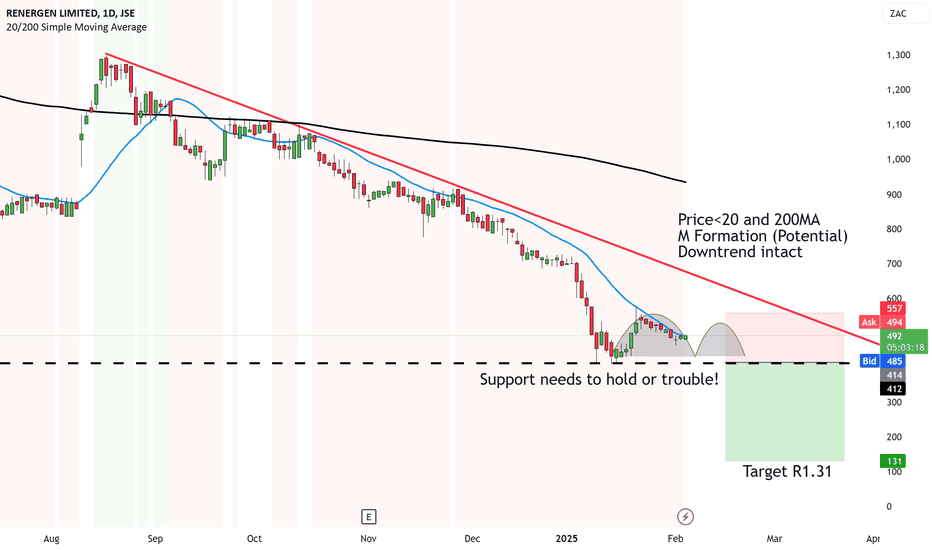

Renergen losing it's energy - Support needs to hold or troubleRenergen has been on a one way trajectory down along with the solid downtrend.

We have the price below 20MA and 200MA

Now if the support does not hold, it could confirm an M Formaiton, which will send the price further down to R1.31

If the price has bottomed then there may be some type of hope for Renergen.

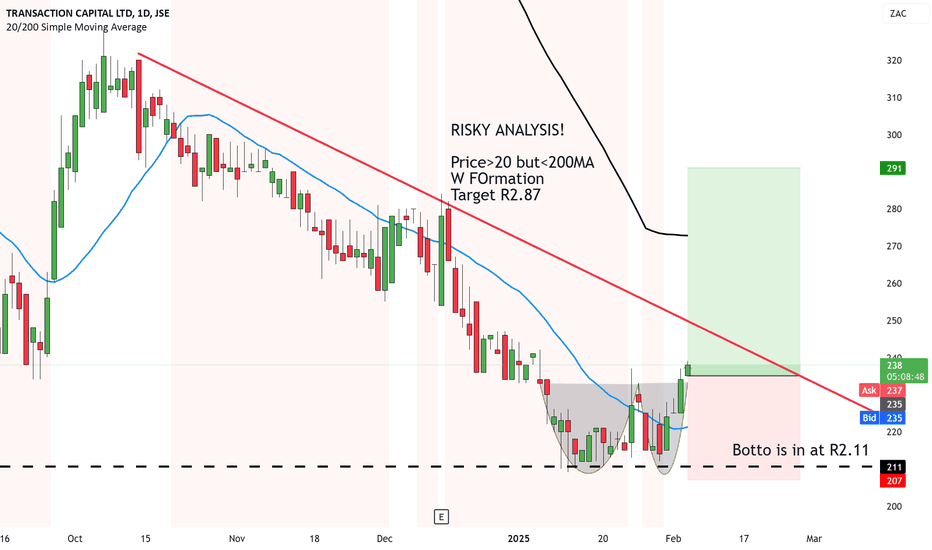

Transcap bottomed and could go up from here to R2.11RISKY ANALYSIS alert.

It looks like the bottom is in for Transcap. But the downtrend is strong and there is a prominent resistance line that definitely needs to break first.

Also it's a medium analysis because the Price>20 but<200MA

We have a small W Formation that has formed and price has broken above the neckline.

So I have a small target of Target R2.87.

The analysis will play as long as the support holds at R2.11.

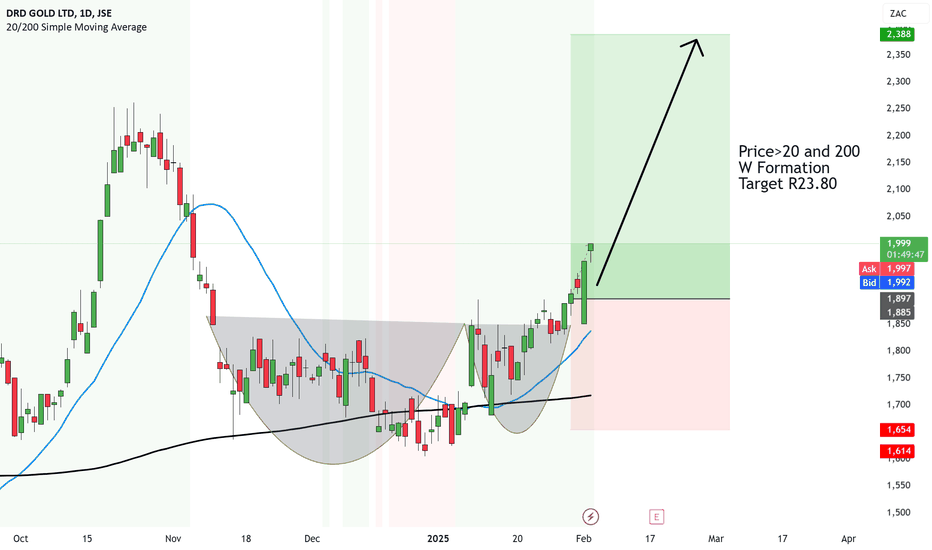

DRD leading the resources pack and heading up R23.80DRD is looking like one of the better resources that are showing upside to come.

Despite the Expropriation Bill, Depsite the uncertainty with Tariffs and US pulling funding.

DRD looks to be the star child of resources.

Price>20 and 200

W Formation

Target R23.80

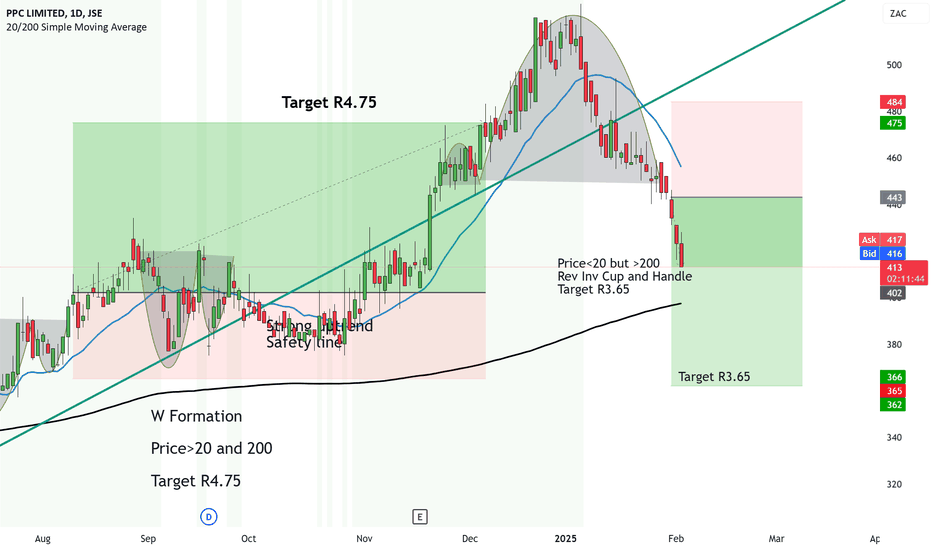

UPDATE PPC hit target up and now we have a down target to 3.60The PPC target worked well hitting R4.75 despite it taking some time.

But then, it was top heavy turned around and crashed like no tomorrow.

DUring the crash it formed a Rev Inv Cup and Handle and broke below the rim.

So here's the update with a new target.

Price<20 but >200

Rev Inv Cup and Handle

Target R3.65

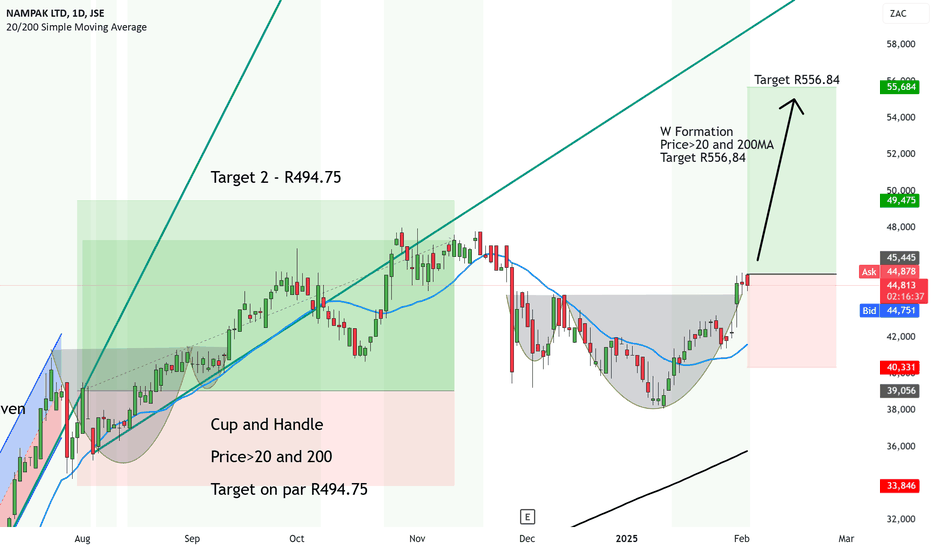

UPDATE Nampak setting for a HIGHER targetJust a quick update on Nampak.

Before a Cup and Handle formed, broke above the Rim and since then it's being moving sideways with higher lows.

Now, we have another W Formation with a consolidation pattern completing. So now that the price has broken above, it gives a stronger confirmation of upside to come.

W Formation

Price>20 and 200MA

NEW Target R556,84

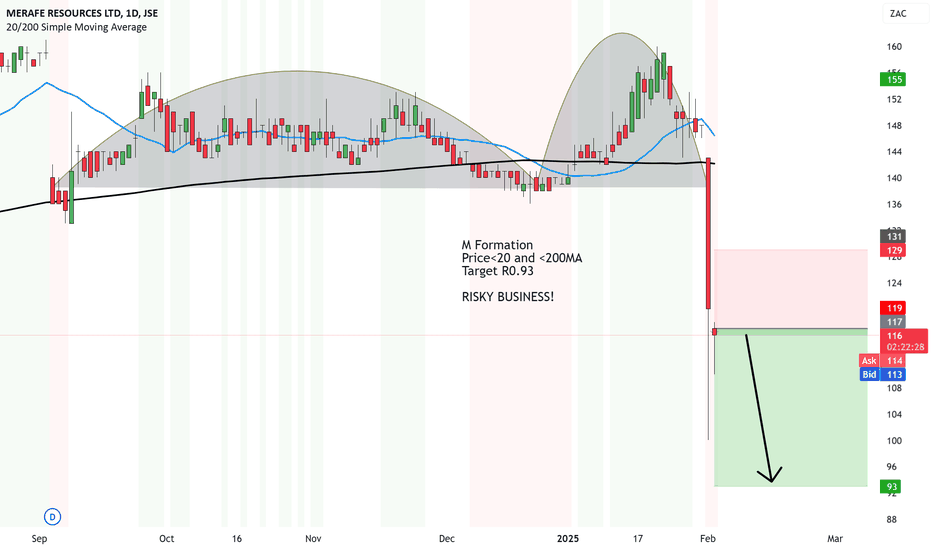

Merafe really took a HUGE dunk! And more to come to 93 centsMErafe dropped 18% yesterday.

Big unexpected move due to an array of events~

First we had Trump pulling funds from SA.

Second with the major expropriation bill that is leading to Foreign direct investments to leave SA.

Merafe Resources has announced that it may start suspending some of its ferrochrome furnaces in May 2025, leading to a substantial decrease in ferrochrome production in South Africa.

This decision follows a business review launched by Merafe, in collaboration with Glencore Operations South Africa through their chrome Pooling and Sharing Venture, as they evaluate possible strategies to tackle ongoing market challenges.

Either way, this is a BIG black swan for Merafe and it seems like there is more downside to come with the technicals.

M Formation

Price<20 and <200MA

Target R0.93

RISKY BUSINESS!

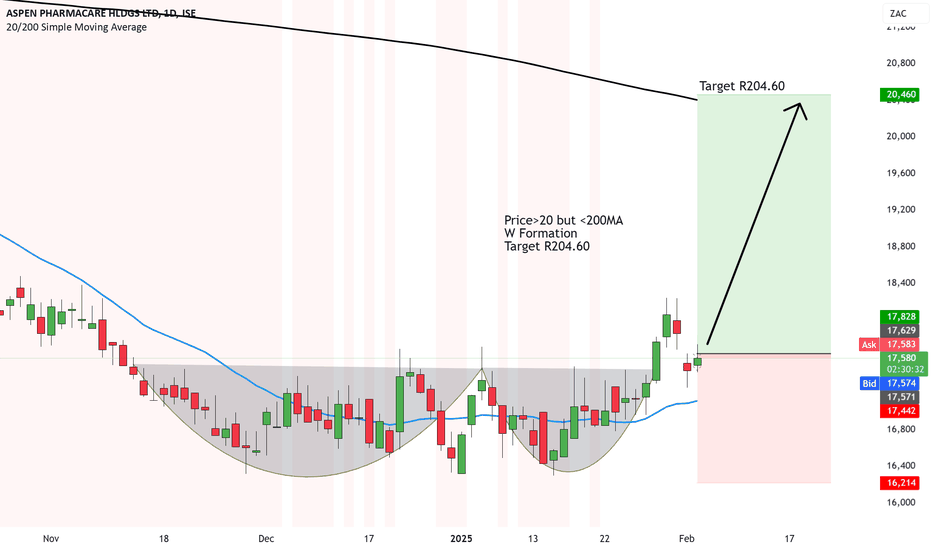

Aspen showing upside to R204 despite Trump pulling funds from SAOk this isn't the best formation.

We have the price above 20MA but still below 200MA.

On the other hand, we have a solid bottom formed and a W Formation along with a Box Formation with it.

So with the pull back and the retest, we could get a bounce up which will send the price to potentially R204.60

Even though Trump has pulled funding from South AFrica due to the Expropriation Bill being announced, this will pull funds from Healthcare, to developments and more...

But it seems like the Fair value of Aspen is underpriced and the market is likely to turn up from here. SO I am bullish for now.

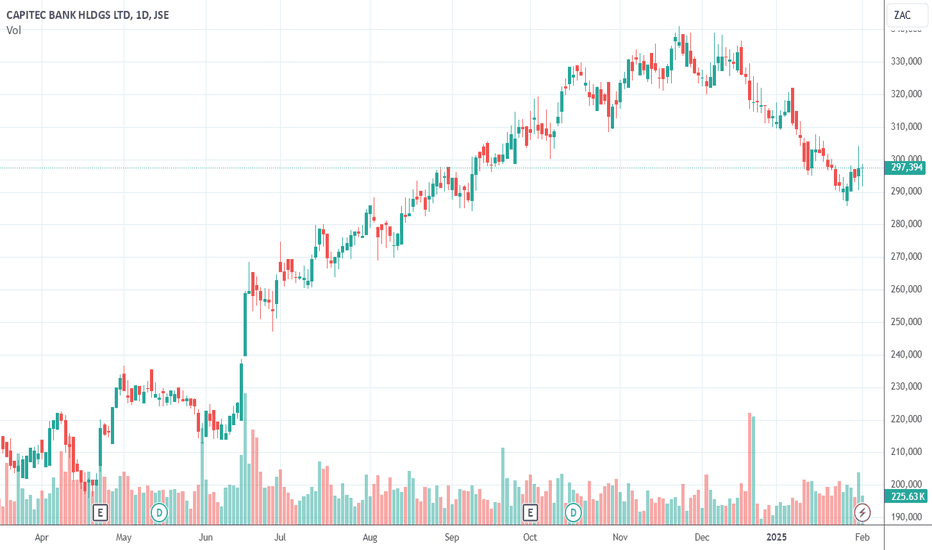

Our opinion on the current state of CAPITEC(CPI)Capitec Bank (CPI) is now South Africa's largest bank by customer numbers, with 21.1 million clients. Originally launched by PSG, Capitec has been a major disrupter in the local banking industry, steadily gaining retail market share from traditional banks by offering a simplified, lower-cost solution—particularly targeting the previously unbanked population.

The company continues to expand rapidly, adding approximately 90,000 funeral policies per month. Its annual average HEPS growth of 32.2% per annum since 2003 is an exceptional record, making it a standout performer on the JSE. In our view, Capitec is a "must-have" for any private investor's portfolio.

PSG has unbundled its Capitec holding to unlock shareholder value. However, despite its large customer base, Capitec still holds less than 10% of South Africa’s retail deposit base, as most of its clients are in the lower LSM segments.

On 19th January 2022, Capitec announced a BBBEE transaction, granting about R1 billion worth of shares to long-term employees who had been with the company since early 2019. While this share issuance caused temporary dilution and a decline in share price, it reflects Capitec’s commitment to transformation and employee retention.

Recent Financial Performance

In its results for the six months to 31st August 2024, Capitec reported:

- Operating profit up 41%

- Headline earnings per share (HEPS) up 36%

- Return on equity (ROE) at 29%

- Credit loss ratio at 7.6%

- Value-added services revenue up 79% to R2 billion

The company stated, "In August 2019, our ecosystem comprised mainly Personal Banking (Retail Bank). We had 12.6 million clients and offered the GlobalOne transacting and savings accounts, as well as unsecured term loans, credit cards, and credit facilities. Despite challenges such as COVID-19, the war in Ukraine, instability in the Middle East, and poor global and South African macroeconomic conditions, we have grown our active client base to 23.2 million and have built an enhanced ecosystem."

Future Outlook

In a trading statement for the year to 28th February 2025, Capitec estimates that HEPS will increase between 28% and 32%. The company attributes this to "the improvement in the credit impairment charge and credit loss ratios (CLRs) seen in the second half of the 2024 financial year, which has continued into the 2025 financial year."

Technical Analysis

The share has been rising steadily since June 2023. It is currently trading at a price-to-earnings (P/E) ratio of 27.93, which is well above the JSE Overall Index (14.51) and higher than other leading banks. Despite this premium valuation, Capitec remains an exceptional long-term investment due to its strong growth trajectory and market position.

We believe Capitec should be accumulated on weakness. It was added to the Winning Shares List (WSL) on 4th November 2023 at 185,496c, and since then, it has risen by 60% in just 14 months. Given its robust financials, innovative banking model, and customer growth, Capitec remains one of the best long-term opportunities on the JSE.

Our opinion on the current state of TRUWTHS(TRU)Truworths (TRU) is a clothing, footwear, and accessories retailer operating in Southern Africa and the UK. It is listed on both the JSE and the Namibian Stock Exchange. The company generates 70% of its South African sales on credit, making effective credit management a critical factor in its profitability.

Truworths operates in a highly competitive retail environment, contending with local players such as Woolworths, Checkers, Pick 'n Pay, Foschini Group, Mr. Price, Ackermans, and Pep, while also facing increasing pressure from international brands like Cotton On. The industry is heavily reliant on consumer confidence and spending, making it highly sensitive to economic conditions. Additionally, Truworths must continuously adapt to the fast-changing fashion landscape to maintain its appeal to consumers.

The company maintains a conservative approach, constantly refining its business model. It operates 767 stores in South Africa, 37 stores across the rest of Africa, and 132 stores in the UK, Germany, and Ireland. Truworths has also acquired Barrie Cline Ladieswear, a long-time supplier, and is launching a new low-cost value chain called "Primark" to compete with Mr. Price and Jet. It plans to roll out 15 to 20 new value stores in the coming months.

On 9th November 2023, Truworths reported that retail sales for the first 17 weeks to 29th October 2023 were up 10.9%, while online sales grew by 41%, now accounting for 4.7% of total sales. The company also noted strong UK-based Office sales, which increased by 18.9% in GBP terms and 38.8% in Rand terms.

For the six months to December 2023, Business Day reported an 8% increase in sales. However, in a trading statement for the 52 weeks to 30th June 2024, Truworths estimated HEPS would decline by 5% to 9%, while retail sales increased by 3.6%. The company attributed the decline in earnings to a reversal of previously recognized impairment losses on the Office trademarks, an indirect tax settlement in the prior period, and other once-off factors.

In an update for the 18 weeks to 3rd November 2024, the company reported a 2.8% increase in sales, with credit sales making up 46% of total revenue. While business and consumer sentiment in South Africa had improved following the formation of a government of national unity earlier in 2024, Truworths noted that this optimism had not yet translated into meaningful improvements in disposable incomes.

In a trading statement for the 26 weeks to 29th December 2024, the company estimated that HEPS would decline by 4% to 8%, while sales increased by 2.4%.

Technically, the share price declined significantly during COVID-19. We previously advised waiting for a break above its downward trendline, which occurred on 4th September 2020 at a price of 3,195c. The stock then reached a high of 11,212c on 4th November 2024 before entering a new downward trend.

Current advice: Truworths remains a solid retailer but is facing macroeconomic pressures, including constrained consumer spending. As the stock is now in a new downward trend, we recommend waiting for a clear break above the trendline before considering any new investment.

Our opinion on the current state of GEMFIELDS(GML)The Gemfields Group (GML), previously known as the Palinghurst Group, is a mining company focused on gemstone production. The group has two major projects:

1. Kagem – The world's largest producer of emeralds, located in Zambia.

2. Montepuez – A major ruby mine in Mozambique.

Additionally, the company was previously involved in Jupiter Mines, a South African manganese producer. However, in line with its strategic focus on gemstones, Gemfields disposed of 60% of its stake in Jupiter Mines when it listed on the Australian Stock Exchange (ASX) in April 2018.

The company is led by Brian Gilbertson, a former CEO of BHP Billiton, who identified the semi-precious stones market as an underdeveloped industry with potential for professional management and consolidation. Gemfields has carved out a niche for itself in this specialized sector, where competition remains relatively limited. Like all commodity shares, however, it carries risks, with its success tied to the fluctuating prices of emeralds and rubies in international markets, as well as geopolitical and operational risks associated with mining in third-world countries.

On 24th October 2022, Gemfields announced that operations at Montepuez had resumed after an insurgent attack on a mine 12km away on 20th October 2022. Security concerns remain a factor in the region. On 7th August 2023, the company announced plans to construct a new processing plant that would triple ruby output from the Montepuez mine.

In its results for the six months to 30th June 2024, Gemfields reported revenue of $128 million, down from $153.6 million in the previous period. Headline earnings per share (HEPS) fell by 25%. The company commented, *"Gemfields is working through a complex year, balancing the availability of cash with the considerable investments we're making at the Kagem emerald mine in Zambia, the Montepuez ruby mine in Mozambique, and our development assets."*

In an operational update for the full year ending 31st December 2024, Gemfields reported total revenue of $196 million and net debt of $80.5 million. The company stated, "Emerald exports are, since 1 January 2025, paused while Zambia's reintroduced 15% export duty remains in place. Kagem anticipates that the duty may be revoked and allow a commercial-quality emerald auction to go ahead in Q1 2025."

A strategic update on 23rd December 2024 cited lower revenue from recent auctions due to:

1. Oversupply of Zambian emeralds by a competitor.

2. Lower production of premium rubies at Montepuez.

3. Weaker luxury and gemstone market conditions.

This share tends to be volatile, largely due to fluctuations in the luxury goods market and the nature of the gemstones it sells. Technically, Gemfields' share price rose strongly from an island formation, entering a solid upward trend until July 2023 when the trendline was broken.

At present, the share remains in a downward trend, and we recommend waiting for a break above the new downward trendline before considering entry. While the company has long-term potential, it remains subject to both market-driven and operational risks.

Our opinion on the current state of VODACOM(VOD)Vodacom (VOD) is South Africa's largest provider of airtime and data services for mobile phones. It operates as a subsidiary of the international telecom company Vodafone. Its main competitors include MTN, Cell-C, and Telkom. The mobile industry has faced continuous pressure from declining voice revenue, partially offset by a sharp increase in data usage.

One disadvantage of investing in Vodacom is its foreign ownership. This was highlighted when its share price dropped 7% in two days due to concerns that Vodafone might be forced to sell its non-European subsidiaries. Vodacom has operations in Mozambique, Tanzania, the DRC, and Lesotho. The company is also looking to expand into Ethiopia, Africa’s fastest-growing economy, with a population of 105 million.

On 2nd December 2019, the Competition Commission ruled that Vodacom and MTN must cut their interconnect fees by between 30% and 50%. Since interconnect fees represent a significant portion of Vodacom's revenue, this led to a 5% drop in its share price. To diversify its revenue streams, Vodacom is launching a "super-app" in partnership with Jack Ma’s Alipay to boost non-voice income. Additionally, the company has spent R4 billion to mitigate the impact of loadshedding.

We believe that while Vodacom has strong fundamentals, it may take some time for the share to regain its former highs.

In its results for the six months to 30th September 2024, Vodacom reported a 1% increase in revenue, but headline earnings per share (HEPS) declined by 19.4%. Financial services revenue grew by 7.8%, contributing 11.4% to group service revenue. The company had 206 million customers and provided financial services to 83 million. Vodacom stated, "While our bottom line was impacted by various one-offs, I am confident that we are poised for a stronger second half performance."

In a trading update for the three months to 31st December 2024, Vodacom reported revenue up 1.6%, with service revenue rising by 11.6%. The company noted, "...the quarter was positively impacted by accelerated growth in South Africa's prepaid market, in addition to another stellar performance in Egypt and Tanzania, while network operators in Mozambique, including Vodacom, have been hampered by post-election tensions since October 2024."

Technically, the share fell from its high of 16,214 cents on 1st April 2022. We previously advised waiting for a clear break above its downward trendline, which occurred on 25th July 2024 at 9,836 cents. Since then, it has climbed to 11,611 cents, although it dipped slightly after the latest results.

At current levels, Vodacom appears relatively cheap, offering a dividend yield (DY) of around 3.93%. However, it operates in a dynamic environment where technology advancements and regulatory shifts present ongoing risks. While Vodacom remains a solid dividend payer and a stable telecom business, investors should be aware of potential regulatory and industry changes that could impact future performance.

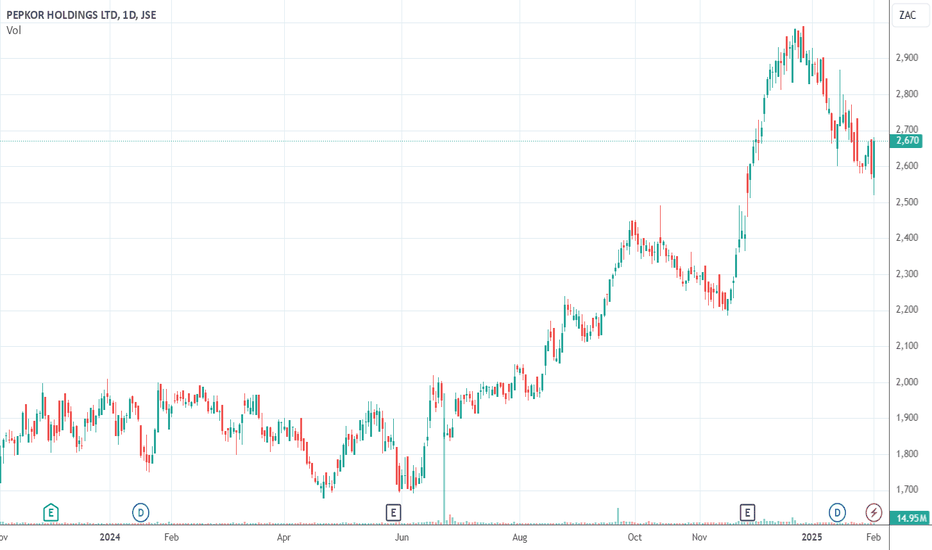

Our opinion on the current state of PEPKORH(PPH)Pepkor Holdings (PPH), previously known as Pep, is 71.01% owned by Steinhoff International. Following the collapse of the Steinhoff group due to admitted "accounting irregularities," the directors decided to revert to the name Pepkor Holdings to distance the company from negative publicity. The group operates well-known retail brands, including Ackermans, PEP Stores, Bradlows, and HiFi Corporation.

Since the Steinhoff scandal in December 2017 and the impact of the COVID-19 pandemic, Pepkor's share price fell to as low as R10 per share in May 2020. However, the company staged a strong recovery over the next year, more than doubling in value. To strengthen its financial position, Pepkor raised R1.9 billion through an accelerated book-build, using the proceeds to reduce debt as a precautionary measure.

On 3rd February 2022, Pepkor announced the acquisition of 87% of the Brazilian clothing retailer Avenida, expanding its international footprint. However, in April 2022, the company's Isipingo distribution center suffered significant flood damage in KwaZulu-Natal, leading to a temporary closure. The company confirmed that it had adequate insurance to cover the losses.

In its results for the year to 30th September 2024, Pepkor reported revenue growth of 7.8%, with headline earnings per share (HEPS) increasing by 10.3% on a comparable basis. However, its net asset value (NAV) fell slightly by 1% to 1,588.5 cents per share. The company highlighted, "The Clothing and General Merchandise segment (CGM) increased revenue by 5.2% to R61.4 billion (7.0% on a 52-week basis), while the Furniture, Appliances and Electronics segment (FAE) increased revenue by 4.5% to R11.0 billion."

In a trading update for the three months to 31st December 2024, Pepkor reported group revenue up 12.1%, with traditional retail sales increasing by 9.5%. The company stated, "Performance was driven by robust sales growth and market share gains in traditional retail, with significant growth sustained in fintech. Gross profit margin improved, mainly driven by the growth in the Fintech segment."

Technically, the share has been in a strong upward trend since May 2023, and this momentum appears likely to continue. While Pepkor remains a high-quality investment, it is potentially vulnerable to declines in consumer spending.

A significant development occurred on 23rd September 2024 when Pepkor was added to the JSE Top 40 index, replacing Amplats. This inclusion is expected to attract increased institutional interest, further strengthening its position in the market.

Our opinion on the current state of MPACT(MPT)Mpact (MPT) is a leading producer of paper and plastics packaging in Southern Africa. The company specializes in recycling paper and cardboard, manufacturing corrugated cardboard containers for various industries, and producing polystyrene trays for the food industry. It operates 20 manufacturing facilities and employs over 5,000 people, with South African sales accounting for 86% of its revenue.

Mpact's business is influenced by consumer spending, which has been under pressure due to COVID-19 and more recently affected by the Ukraine crisis. Additionally, weather patterns impact the demand for corrugated containers used in fruit and other agricultural products, particularly in the Cape region. The company has prioritized cash preservation in the current economic climate but has benefited from a shift to local suppliers during the pandemic.

In its results for the six months to 30th June 2024, Mpact reported revenue slightly down at R6.17 billion, while headline earnings per share (HEPS) fell to 144.6 cents from 211.6 cents in the prior period. However, the company’s net asset value (NAV) increased by 9% to 3,411 cents per share. The company stated, "The uncertain socio-political environment leading up to the national elections, high levels of loadshedding that continued until the end of March, high inflation, and interest rates all contributed to weak consumer and business sentiment."

Mpact’s share price declined from a high of R51 in April 2016 to as low as R8 in March 2020 but has since recovered to 2,902 cents. At this level, it is trading on an earnings multiple of 5.66, which appears cheap. While the share has been moving sideways since August 2022, there are indications that it may be entering a new upward trend.

On 1st August 2024, Mpact announced the sale of its Versapak business for R267.7 million as part of its strategic portfolio adjustments. Additionally, on 3rd February 2024, the company announced that its shares would begin trading on the A2X exchange from 11th February 2024, providing investors with an alternative trading platform.

Overall, Mpact remains a well-managed company with strong fundamentals. Its low valuation presents a potential opportunity for long-term investors, particularly if consumer spending improves and the company’s upward trend materializes. However, economic uncertainties, loadshedding, and inflationary pressures remain key risks to monitor.

Our opinion on the current state of ARCMITTAL(ACL)ArcelorMittal (ACL) is South Africa's largest steel producer and has managed to survive in an industry where competitors like Highveld Steel have disappeared. The company was severely impacted by the sub-prime crisis, with its share price falling from a high of R260 in June 2008 to as low as 25 cents in August 2020. Since then, it has staged a strong recovery, reaching 1,052 cents before recent challenges reversed its upward momentum.

The company has had to navigate multiple challenges, including the collapse of the local construction industry, once a major consumer of steel, and the influx of cheap Chinese steel being dumped onto the South African market. While imports have slowed, ArcelorMittal successfully secured tariffs to discourage further dumping. At its lowest point in July 2020, the company appeared close to closure, but it was rescued by a rising steel price and severe cost-cutting measures.

In its results for the six months to 30th June 2024, the company reported a 3% decline in revenue and a headline loss of 100 cents per share, compared to a loss of 40 cents in the previous period. The company cited "difficult local and regional trading conditions, and the negative volume and direct cost impact of operational interruptions of the two blast furnaces at Vanderbijlpark" as major factors affecting financial performance.

In an update on 3rd July 2024, ArcelorMittal reported that the Longs steel product operations ("Longs Business") had remained operationally stable in the first half of 2024. However, the Flats steel product operations ("Flats Business") in Vanderbijlpark had suffered from significant instability at its blast furnaces in April and May 2024. The company emphasized that "intensive cash management actions" had kept net borrowings within tolerable levels.

In its third-quarter update for 2024, the company reported an EBITDA loss of R466 million, compared to a profit of R52 million in Q3 2023. This loss was primarily driven by the Longs Business. In a trading statement for the full year ending 31st December 2024, ArcelorMittal estimated a headline loss of between 450 cents and 466 cents per share, significantly worse than the previous period's loss of 170 cents. These results abruptly ended the company's new upward trend, sending the share price back down towards support at around 100 cents.

On 6th January 2025, ArcelorMittal announced its decision to wind down and close its Longs steel division, leading to a sharp drop in the share price. This move signals further financial strain and restructuring efforts as the company attempts to stabilize its operations.

While ArcelorMittal has previously recovered from extreme lows, the recent setbacks highlight its vulnerability to steel prices, operational challenges, and weak local demand. The stock remains highly volatile and should be approached with caution until clearer signs of stability and profitability emerge.

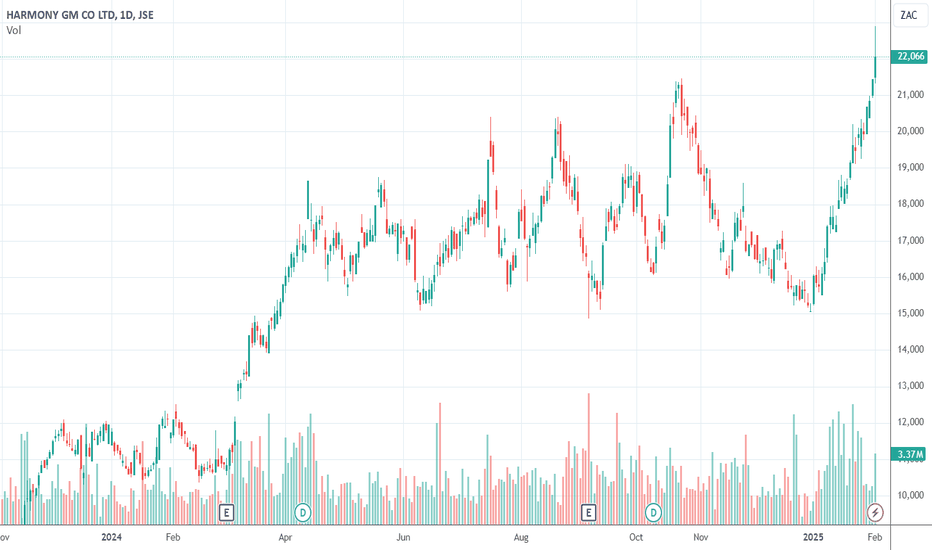

Our opinion on the current state of HARMONY(HAR)Harmony (HAR) was historically considered South Africa’s most marginal gold mining operation until it successfully integrated Mponeng gold mine into its portfolio. The development of Mponeng and its processing plant is expected to cost around US$2.8 billion, and Harmony has yet to secure its share of the required capital, which amounts to approximately R20 billion.

In 2021, the company acquired Mponeng for R4.2 billion. As the world’s deepest mine, Mponeng presents all the challenges associated with ultra-deep-level mining. Despite these difficulties, it has become a key asset in Harmony’s portfolio. The company is also investing in renewable energy, having built a 30MW solar park in the Free State, with further plans to expand green power capacity by an additional 80MW.

On 6th October 2022, Harmony announced the acquisition of 100% of the Eva copper project in Australia for R4.1 billion. This move signals a strategic shift, potentially reducing the company’s reliance on precious metals over time. Eva is expected to commence production in three years, adding an estimated 260,000 ounces of gold and 1.7 billion pounds of copper to Harmony’s reserves.

On 3rd April 2024, Harmony announced that it had signed a five-year wage agreement with all of its unions, providing labor stability.

In its results for the year to 30th June 2024, Harmony reported an underground grade of 6.11 grams per ton, a 6% increase in gold production, and an 11% rise in the US dollar gold price received. Headline earnings per share (HEPS) surged to 1,852 cents, up from 800 cents in the previous period. The company stated, "By investing in our higher-grade gold mines, expanding our surface retreatment business, and growing our international gold and copper assets, we will continue to transform and de-risk Harmony as we go from strength to strength."

In an operational update for the three months to 30th September 2024, Harmony reported gold production down by 1%, although Mponeng’s production increased by 28%. The recovered grade improved to 6.32 grams per ton, while costs rose by 14%. The gold price received increased 21% to $2,356 per ounce. Harmony also reported a "strong, flexible balance sheet with net cash position increasing to R6.3 billion (US$362 million) and liquidity of R15.7 billion (US$909 million) in cash and undrawn facilities."

For the six months to 31st December 2024, Harmony estimated gold production of between 790,000 and 805,000 ounces, with higher recovered grades. The company stated, "All of our underground operations (except Target 1, which is still in a turnaround process after being recapitalized) generated meaningful positive operating free cash flows."

Technically, while the share remains volatile, it is in a strong upward trend. It is highly sensitive to movements in the gold price and the rand/US dollar exchange rate. Harmony was added to the Winning Shares List (WSL) on 16th November 2023 at 9,920 cents. It is now trading at 22,067 cents, reflecting strong investor confidence and the company’s positive operational momentum.

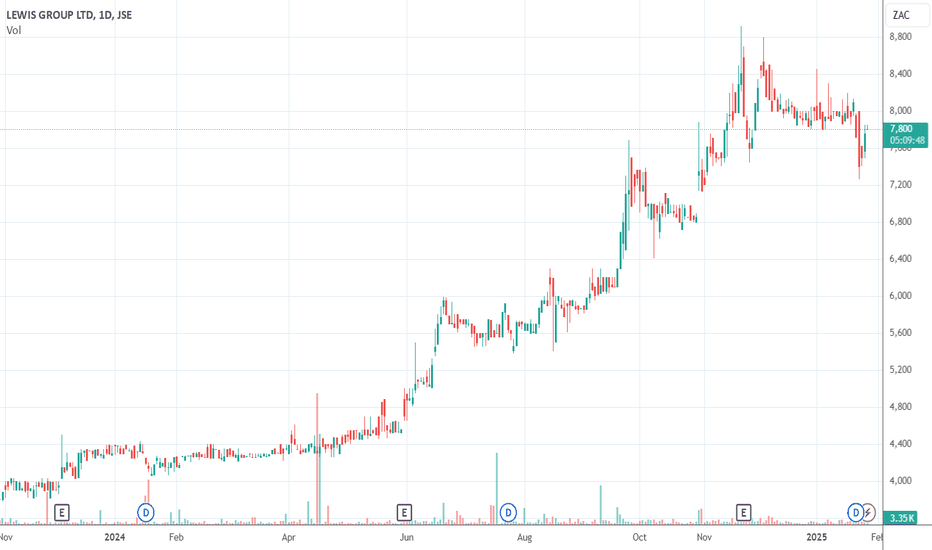

Our opinion on the current state of LEWIS(LEW)Lewis (LEW) is a retailer specializing in furniture and electrical appliances, operating through 840 stores under the Lewis (498 stores), Beares (150 stores), Best Home (170 stores), Bedzone (12 stores), and United Furniture Outlets (39 stores) brands. Of these, 138 stores are located in neighboring countries. The company conducts 59.9% of its business on credit, offering customers credit insurance and other financial products. It plans to expand the number of UFO stores from 39 to 70 in the coming years.

At its current levels, Lewis is trading at a price-to-earnings (P/E) ratio of just 7.95, with a share price significantly below its net asset value (NAV). Remarkably, the company remains debt-free, a rarity among listed retailers in the post-COVID-19 period. Lewis is currently executing a share buy-back program, aiming to repurchase 10% of its issued share capital. So far, it has bought back 29.9 million shares at an average price of R34.20 per share.

We have consistently noted that Lewis represents a bargain investment opportunity. It is poised to benefit directly from any increase in consumer spending. The company is tightly managed, operates a vast store footprint, and has grown both organically and through acquisitions. While its position as a furniture and white goods retailer makes it vulnerable to economic downturns, the current valuation makes it an attractive buy. Among South African retailers, Lewis stands out as one of the few performing well under challenging economic conditions.

In its results for the six months to 30th September 2024, Lewis reported revenue growth of 13.6% and a 49.1% increase in headline earnings per share (HEPS). The company highlighted, "The strong credit sales growth trend continued, with credit sales increasing by 16.9% and cash sales declining by 6.7%. Credit sales accounted for 69.4% of total merchandise sales (H1 2024: 64.4%)."

In a trading update for the nine months to 31st December 2024, the company reported total revenue up 13.6%, with credit sales increasing by 13.1% and cash sales rising by 14.4% in the final quarter. Black Friday sales were notably strong, reflecting robust consumer spending at the close of 2024.

This share remains one of the best-managed businesses on the JSE. The company believes its valuation on the JSE is underestimated by 30%, which we consider a conservative estimate. Lewis was added to the Winning Shares List (WSL) on 1st December 2023 at a price of 4150c and is now trading 86.9% higher at 7756c. Technically, the share is in a strong upward trend and continues to present a compelling investment opportunity for private investors seeking well-managed, undervalued stocks with solid growth potential.

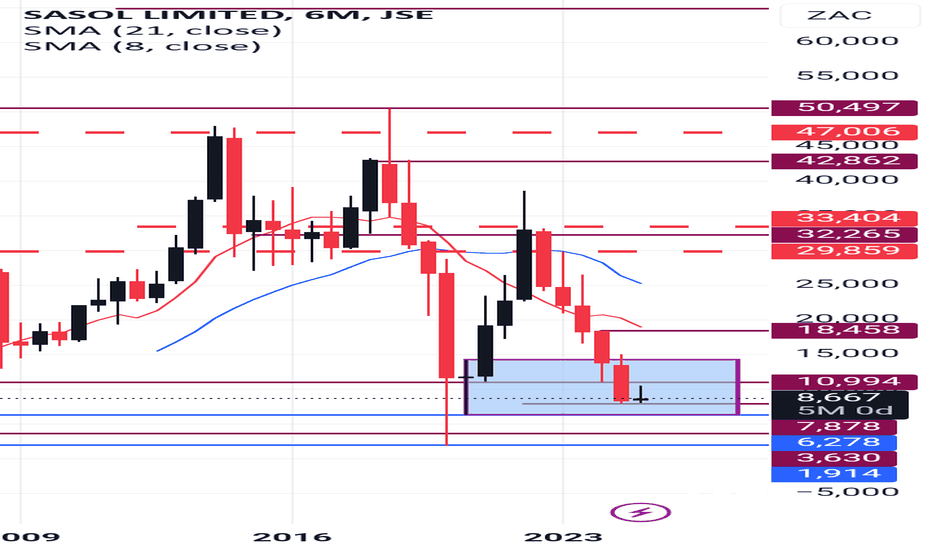

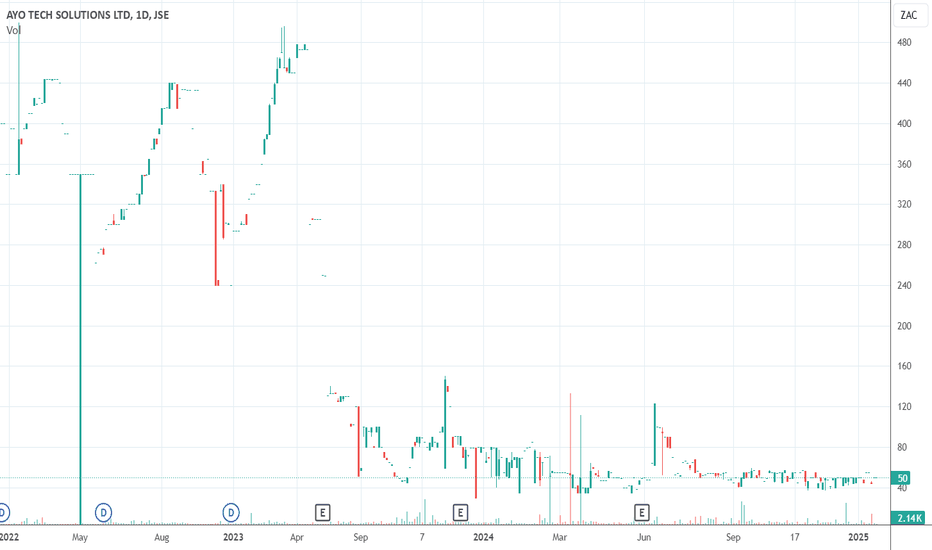

Our opinion on the current state of AYOAYO is a black-owned technology company spun out of AEEI, which still holds a 49.4% stake in the business. The company has faced significant controversy, particularly surrounding a massive R4.3 billion investment by the Public Investment Corporation (PIC). This investment has been the subject of legal action, which was finally settled on 31st March 2023, with AYO agreeing to pay the PIC R619 million. The settlement has left many questioning the financial integrity of the deal, with allegations that PIC pensioners lost billions of rands.

AYO shares listed at R43 but dropped dramatically, reaching a low of 105c. The share has since recovered slightly and is currently trading around 305c after its latest results. However, trading volumes remain extremely thin, with many days seeing no activity at all. The company employs approximately 1,400 people, and a significant portion of its income appears to come from interest on the remaining PIC funds.

Concerns about AYO’s governance and financial reporting have persisted for years. Former financial director Siphiwe Nodwele testified before the Mpati Commission that the company is likely only worth R700 million. Former CFO Naahied Gamieldien also admitted to adjusting margins to artificially inflate profits, resulting in the company’s profit doubling. These admissions, along with other governance issues, have cast doubt on the company’s reported financials.

In October 2019, the Financial Sector Conduct Authority (FSCA) raided the offices of Iqbal Survé, who is associated with AYO, as part of an ongoing investigation. In addition, FNB closed AYO's bank accounts due to reputational risks. While AYO announced on 30th April 2021 that it had put in place "alternative third-party solutions" to enable continued trading, these actions have not alleviated investor concerns.

On 1st June 2021, British Telecom (BT) severed ties with Sekunjalo, citing "misrepresentation of facts" presented to Parliament’s Standing Committee on Finance. Further governance lapses were highlighted on 10th February 2022, when the JSE barred two AYO directors from serving as directors of listed companies for five years due to their failure to ensure accurate financial reporting. On 22nd December 2022, the JSE publicly censured AYO for engaging in related-party transactions without complying with listing requirements.

In its results for the year to 31st August 2024, AYO reported revenue down by 17% and a headline loss per share of 71.81c, an improvement from the previous year’s loss of 176.46c per share. Despite these figures, trust in the company’s reporting remains low, and we cannot recommend the share to private investors.

On 6th September 2023, the JSE publicly censured AYO director Khalid Abdulla for breaching listing requirements and failing to fulfill his fiduciary duties. He was fined R2 million, while AYO was fined R6.5 million. On 14th June 2024, AYO announced the appointment of Dr. N.A. Ramatlhodi as Chairperson.

Most recently, on 24th January 2025, AYO disclosed that a shareholder with a 0.13% stake in the company had filed a court application for its liquidation. AYO is opposing this application, further adding to the company's challenges.

Given its history of governance failures, legal controversies, and unreliable reporting, we strongly advise private investors to avoid this share. The ongoing uncertainties, legal battles, and reputational risks make it a highly speculative and potentially dangerous investment.