Our opinion on the current state of TFGThe Foschini Group (TFG) is an international retailer with a portfolio of 28 fashion brands. The company operates 4,083 trading outlets in 32 countries worldwide, including divisions in London, Australia, and a substantial presence in South Africa. One of TFG’s standout achievements has been its ability to establish a successful business in Australia, where many other retailers, such as Woolworths, have struggled. In 2017, TFG acquired the Retail Apparel Group (RAG) in Australia for just over $300 million and has allowed the Australian management team significant autonomy, refraining from micromanaging the business from South Africa.

Over the long term, TFG has consistently performed well in the challenging retail clothing sector in South Africa, where it faces stiff competition from both overseas brands and local retailers. It is regarded as the best of the retail clothing companies on the JSE and is well-diversified internationally, offering a valuable rand-hedge element. Although retail is typically sensitive to the business cycle, the TFG board has demonstrated an impressive ability to manage the company profitably, even in challenging environments where others have failed.

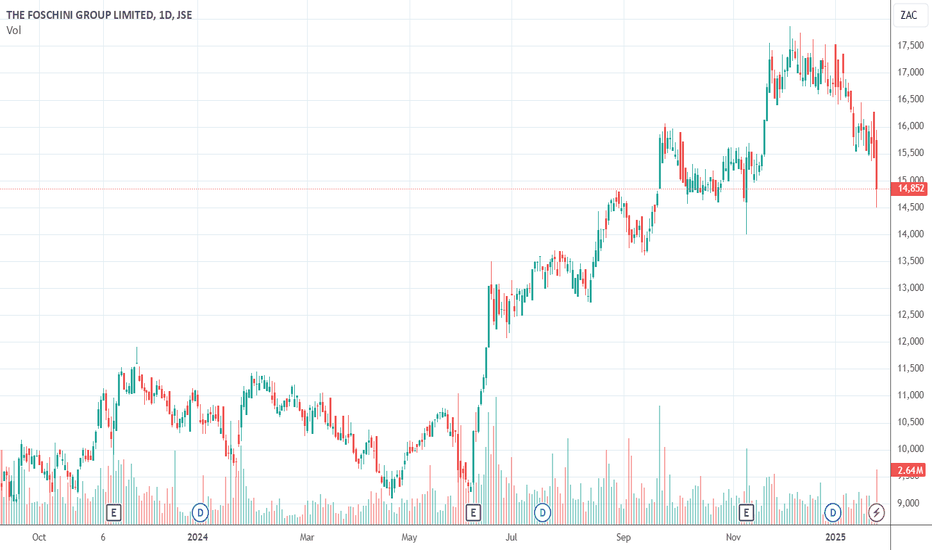

In its results for the six months to 30th September 2024, TFG reported revenue down 1.4% and headline earnings per share down 5.6%. Despite this, online sales grew by 9.9%, contributing 10.7% to total turnover, with its Bash online platform in South Africa achieving impressive growth of 47.9%. The company stated, "...the improvement from the 3.5% decline reported in our 21-week guidance in September 2024 highlights the noticeable improvement in trading activity experienced in all territories since September 2024, and through to November 2024."

In an update on the three months to 28th December 2024, TFG reported group sales up 8.4%, with online sales surging 47.2%. From June 2023, the share has been in a new upward trend, indicating growing investor confidence.

On 27th October 2024, TFG announced the acquisition of the UK fashion and lifestyle retailer White Stuff for an undisclosed amount, further expanding its international footprint.

TFG continues to be a well-managed and resilient company, capitalizing on both its strong international diversification and growing online presence. The company’s ability to adapt to market challenges and expand strategically positions it as a compelling investment. We believe TFG should be accumulated during periods of market weakness for long-term growth potential.

Our opinion on the current state of SASOL(SOL)Sasol (SOL) is a large international chemicals and energy company with roots in the oil-from-coal technology developed during apartheid-era South Africa. Approximately 50% of the company’s profits are tied directly to the oil price. Sasol’s two main growth areas are its 50% stake in the ethane cracker plant in Louisiana, America, known as the Lake Charles Chemical Project (LCCP), and its development of gas resources in Mozambique. Sasol was awarded two new licenses in Mozambique to explore for gas in an onshore area of approximately 3,000 square kilometers, which could significantly expand its existing gas projects in the Rovuma province.

One significant challenge for Sasol is its status as the largest producer of greenhouse gases in South Africa and on the JSE. Globally, it is listed among the 100 fossil-fuel companies responsible for more than 70% of greenhouse gas emissions. The company faces mounting international pressure to address its carbon emissions effectively.

Sasol’s share price saw a dramatic recovery after the COVID-19 pandemic, but this upward trend was interrupted by the decline in commodity prices, particularly oil. On 7th April 2024, the company announced that the Minister of the Environment, Barbara Creecy, had upheld its appeal against a decision by the national air quality officer, safeguarding continued operations at its Secunda oil-from-coal plant, which faced potential closure due to environmental concerns.

The company operates six coal mines, supplying 10 million tonnes of thermal coal feedstock annually to its operations in Secunda and Sasolburg, as well as to the export market. However, the massive Secunda plant, which accounts for 84% of Sasol’s scope 1 and 2 emissions, is under scrutiny. A study by Wits Business School, reported on 22nd October 2024, found that the plant could not be modified to meet emissions regulations and might have to close, with its fate now resting on government decisions.

In its results for the year to 30th June 2024, Sasol reported a 66% decline in headline earnings per share (HEPS) and a 16% drop in net asset value (NAV). These results were heavily impacted by a R58.9 billion impairment of the Chemicals America Ethane value chain, a R5.3 billion impairment of Chemicals Africa, and a R7.8 billion impairment of Secunda. The company stated, "The business benefitted from a weaker R/US$ average exchange rate, and a favourable rand oil price, however constrained margins impacted negatively on our fuels and chemicals businesses. The financial results were further impacted by various operational challenges across the business."

In a production and sales update for the six months to 31st December 2024, Sasol reported, "The civil unrest in Mozambique affected the Central Processing Facility (CPF), leading to reduced production rates in December 2024. On 4 January 2025, a fire occurred at the Natref refinery that caused damage to supporting piping and infrastructure around the Crude Distillation Unit. International Chemicals revenue improved compared to H1 FY24, though the overall business environment remains challenging."

On 16th September 2024, Sasol announced the appointment of Ms. Muriel Dube as Chairman of the Board with immediate effect.

Sasol remains a highly volatile commodity share and is currently in a long-term downward trend. Investors are advised to wait for the share to break up through its downward trendline before considering further investigation. Its future will largely depend on commodity price recovery, operational stability, and regulatory developments related to its emissions and environmental impact.

Our opinion on the current state of BHP(BHG)BHP is a global commodities company headquartered in Melbourne, Australia, with operations focused on minerals, oil, and gas. It employs approximately 62,000 people, primarily in the Americas and Australia. The company produces copper, iron, coal, oil, and gas, and holds significant stakes in some of the world's most prominent mining and resource projects.

BHP owns 57.5% of the Escondida mine in Chile, one of the largest copper producers globally, which also produces gold and silver. In Peru, it has a 33.75% interest in Antamina, which produces copper and zinc. Additionally, it owns 100% of Pampa Norte, a copper cathode producer in Chile's Atacama Desert. In Brazil, it holds a 50% stake in Samarco, which produces iron ore, and a one-third interest in Cerrejon, an open-pit coal mine in Colombia.

The company also has mineral rights in Saskatchewan, Canada, home to one of the world's largest undeveloped potash deposits. In Australia, it owns Olympic Dam, one of the world's largest copper, uranium, and gold ore bodies, as well as Western Australia Iron Ore (WAIO), a system of five mines connected by over 1,000 km of railway. BHP's Australian coal assets include Queensland Coal, comprising the Mitsubishi Alliance and Mitsui Coal, and the Mt. Arthur open-pit coal mine in New South Wales. Additionally, it owns Nickel West, a nickel operation with smelters, concentrators, and a refinery.

In petroleum, BHP owns high-quality resources in the Gulf of Mexico, Australia, and Trinidad and Tobago.

In its results for the six months to 31st December 2023, the company reported revenue up 6% and headline earnings per share (HEPS) down 48%. The tangible net asset value (NAV) per share was $8.68, compared to $8.91 in the prior period. The company stated, "At our Western Australia Iron Ore operations, we remain the lowest-cost major producer globally and in copper we set new production records at our operations in South Australia and Chile. In South Australia, our consolidated copper province has performed strongly and we are pursuing future growth options. In Canada, we’ve sanctioned Jansen Stage 2, which will almost double our planned potash production capacity. We’ve seen volatility in global commodity prices and demand in the developed world has been softer than expected. That said, China demand is healthy despite weakness in housing and India remains a bright spot."

In a report for the three months to 30th September 2024, BHP reported strong production growth across all major commodities, with copper production up 4% due to higher grades and recoveries at Escondida, and WAIO production up 3%. On 25th April 2024, BHP announced a share offer for the entire issued share capital of Anglo American, contingent on Anglo unbundling Amplats and Kumba. This offer was rejected by Anglo, as were two subsequent improved offers, but negotiations continue. The offer could potentially spark a bidding war with Rio Tinto and Glencore.

In an operations update for the six months to 31st December 2024, the company reported copper volumes up 10% and steelmaking coal up 14%. BHP stated, "We are well positioned to continue strong momentum into the second half with a number of assets now expected to deliver production in the upper half of their respective ranges, while maintaining tight cost control."

BHP is a diversified international mining company that is directly impacted by commodity prices and any recovery in the global economy. The share experienced steady growth following the upward turn of the commodity cycle in January 2016 but saw a sharp decline during the coronavirus pandemic, forming a V-bottom in March 2020. It subsequently resumed its strong upward trend but has been pressured by falling commodity prices since the start of 2024. While it remains in a long-term upward trend, it is a volatile commodity share subject to market cycles.

Our opinion on the current state of CLICKS(CLS)Clicks (CLS) describes itself as a retail-led healthcare group and operates several well-known brands, including Clicks, GNC, and The Body Shop. The Clicks chain has 782 stores, of which 585 include pharmacies, making it the largest pharmacy chain in Southern Africa. While more retail outlets are incorporating pharmacies, Clicks' main competitor remains the listed Dis-Chem. One historical drawback for the company was its involvement with the now-closed 59 Musica stores.

On 10th May 2021, Clicks announced the acquisition of Pick n Pay's pharmacy business, which included 25 in-store pharmacies. These have since been rebranded as Clicks stores, further solidifying the company's dominance in the pharmacy retail sector.

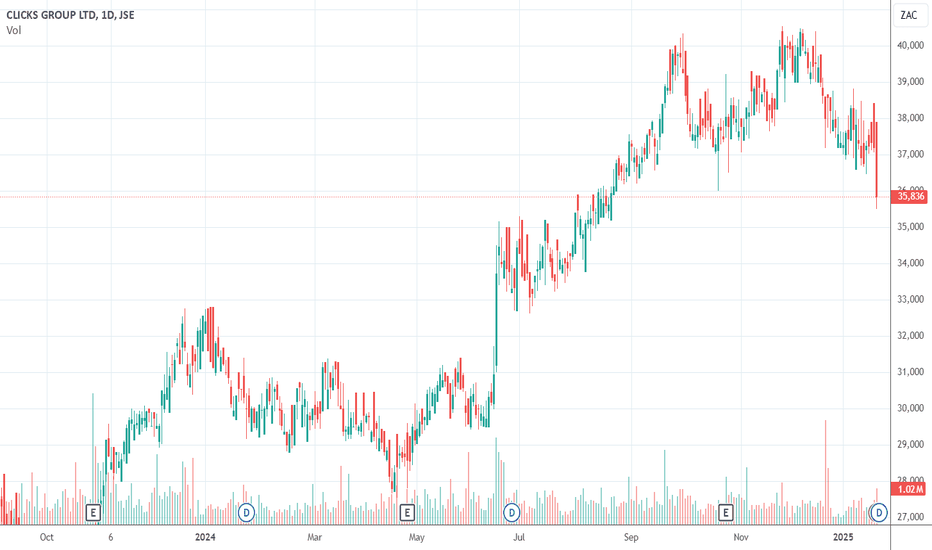

Technically, Clicks has been a standout performer on the JSE over the past two decades, with its share price rising by more than 2500% since its listing—a remarkable achievement compared to the JSE's average over the same period. Clicks is considered one of the best blue-chip shares on the JSE. It has demonstrated resilience through economic downturns and continues to perform well, proving itself to be more or less recession-proof.

In its results for the year to 31st August 2024, the company reported a 9.2% increase in group turnover and a 14.2% rise in headline earnings per share (HEPS). The company highlighted, "The Clicks chain recorded market share gains across all core health and beauty product categories, with the Clicks ClubCard loyalty programme growing to 11.8 million active members."

In an update for the 20 weeks to 12th January 2025, Clicks reported turnover growth of 8.1% and the granting of 27 new retail pharmacy licences. The company stated, "Sales in comparable stores increased by 5.9% (2024: 8.4%), with selling price inflation averaging 3.5% (2024: 7.5%) and volume growth of 2.4% (2024: 0.9%) for the period."

Despite its high price-to-earnings ratio (P/E) of 30.02, Clicks remains a compelling medium-term investment. Its consistent performance and resilience make it a "must-have" for private investors. Often referred to as a "diagonal" share, its long-term price chart has a consistent upward trajectory, moving from the bottom left-hand corner to the top right-hand corner of the screen. Clicks should be considered a staple in any private investor's portfolio and is an excellent candidate for accumulation during periods of market weakness.

Our opinion on the current state of THUNGELA(TGA)Thungela (TGA) represents Anglo American's former coal assets, which were unbundled and separately listed on the JSE and LSE to align with Anglo's policy of divesting from carbon-based fossil fuels. Anglo sold its final 8% stake in Thungela on 25th March 2022 for R1.67 billion. Thungela is a significant exporter of thermal coal in South Africa, employing over 7,500 people and exporting coal to Asia, India, Southeast Asia, and East and North African countries.

The company owns 50% of Phola, which operates a coal processing plant, and holds a 23.22% interest in the Richards Bay Coal Terminal (RBCT). It has the capacity to produce over 90 million tons of coal annually and operates seven mines in South Africa, consisting of four open-cast and three underground operations.

In its results for the six months to 30th June 2024, Thungela reported revenue up 17%, though headline earnings per share (HEPS) declined by 58%. The company noted, "Group capital expenditure of R1.5 billion, reflecting the disciplined execution of the life extension projects in South Africa - Profit of R1.2 billion, including R419 million from Australia, demonstrating the benefits from the Group's geographic diversification."

In a pre-close statement for the year ending 31st December 2024, the financial director expressed confidence in exceeding the full-year export saleable production guidance in South Africa and Australia. The company stated, "The various Transnet Freight Rail (TFR) initiatives, supported by the coal industry, have allowed for the annualised run rate to 30 November 2024 to increase to approximately 52Mt, or 56Mt."

Thungela's share began trading on the JSE on 7th June 2021, dropping from an initial price of 2600 cents to 2190 cents. Initially estimated to be worth a minimum of 4400 cents, the share climbed to a high of 37,752 cents on 16th September 2022. Since then, it has moved sideways and downward, influenced by lower coal prices and challenges with Transnet. As a single-commodity share, it is inherently volatile and heavily reliant on Transnet's ability to transport coal to ports.

The company has committed to paying out at least 30% of its "adjusted operating free cash flow" in dividends. However, its performance is likely to remain subdued, drifting sideways unless coal prices experience a meaningful increase.

On 21st January 2025, Thungela announced that its CEO, July Ndlovu, will retire in July 2025 and will be succeeded by Moses Madondo, who will assume the role on 1st August 2025. This leadership transition adds an element of uncertainty to the company's strategic direction as it continues to navigate the challenges of its operating environment.

Our opinion on the current state of SOUTH32(S32)South32 (S32) was spun out of BHP Billiton in 2015, inheriting all of BHP's South African coal assets. It has since established itself as a diversified miner of base metals and minerals, including zinc, coal, aluminium, silver, lead, nickel, and manganese. The company operates in South Africa, South America, and Australia.

In 2020, South32 separated its South African coal assets, particularly those supplying Eskom, into a separate entity, which was sold to Seriti on 1st June 2020. Concurrently, the company acquired the remaining 83% of Arizona Mining, which it did not already own. Arizona Mining holds extensive interests in zinc, manganese, and silver, described by South32's CEO, Graham Kerr, as "...one of the most exciting base metal projects in the world." This move reflects South32's broader strategy to distance itself from South Africa due to administrative and legislative uncertainties, a trend also observed with BHP and Anglo American. Kerr has stated that "...mining exploration is out of the question in South Africa until the new mining charter is finalised."

Despite moving away from South African investments, South32 retains ownership of its South Deep mine for the time being. The company has also committed to a $1.4 billion share buy-back program. As part of its sustainability goals, South32 is transitioning its Hillside smelter to renewable energy sources, aiming to reduce reliance on Eskom over the next decade.

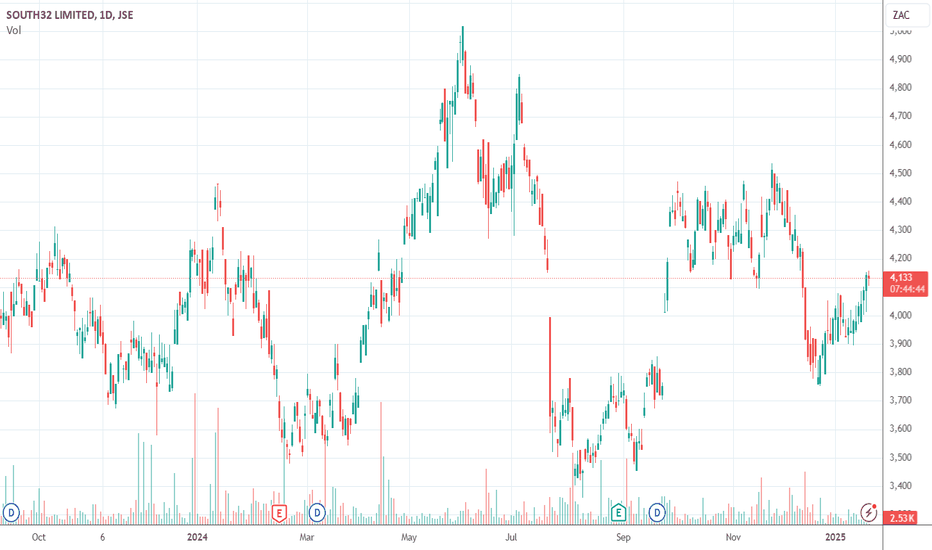

In its results for the year to 30th June 2024, South32 reported a 3% decline in revenue and headline earnings per share (HEPS) of 6.5 cents (US), down from 22.6 cents in the previous year. The company stated, "Improved operating performance, disciplined cost management, and higher prices for our key commodities lifted our financial results to finish the year. As a result, we recorded FY24 Underlying EBITDA of US$1.8 billion and Underlying earnings of US$380 million."

In a report for the three months to 30th September 2024, South32 announced the completion of the sale of Illawarra Metallurgical Coal, receiving upfront cash proceeds of US$964 million. The company expanded its capital management program by US$200 million and commenced an on-market share buy-back. It maintained FY25 production guidance for all operations, with aluminium production increasing by 5% as Hillside Aluminium tested its maximum technical capacity.

In an update for the three months to 31st December 2024, South32 reported a 14% increase in quarterly alumina production and returned US$169 million to shareholders through dividends and share buy-backs. The company highlighted its strong balance sheet and platform for growth in minerals and metals critical to the global energy transition, stating, "Having successfully divested Illawarra Metallurgical Coal in the September 2024 quarter, we have a strong balance sheet and platform for growth in minerals and metals critical to the world's energy transition."

Technically, the share experienced an upward trend following the COVID-19 pandemic but has been in decline since March 2022 due to falling commodity prices. South32 remains a volatile commodity share, influenced by global commodity price trends and its strategic positioning in the energy transition market.

Our opinion on the current state of M&R-HLD(MUR)Murray and Roberts (MUR) is a large South African construction company that has faced significant challenges over the years, including the sub-prime crisis and a slump in construction spending following the 2010 World Cup. These issues caused the share price to fall from a double-top formation around R100 per share to a low below R5 in May 2020. The company has since focused on consolidating and reducing costs. It has rebranded itself as a "multinational engineering and construction Group focused on the natural resources market sectors," with three primary business platforms: underground mining, oil & gas, and power & water.

On 27th March 2023, the company announced the sale of its Australian operations (65% of Insig Technologies) for A$1, effectively disposing of A$7 million in liabilities. On 8th December 2023, it was reported that the company would reduce its debt from R2 billion in April 2023 to R350 million, aided by Cementation Canada Inc.'s renewed banking facility agreement with a Canadian bank, providing CAD40 million.

In its results for the year to 30th June 2024, the company reported revenue of R13.5 billion, up from the previous year's R12.5 billion, but an attributable loss of R138 million. The net asset value fell to 350 cents per share, down from the previous year's 407 cents. The company noted, "Reduced diluted continuing headline loss per share 24 cents (FY2023: 71 cents loss) - Net cash, including advance payments and working capital improvements R0.4 billion (FY2023: R0.3 billion net debt)."

In a trading statement for the six months to 31st December 2024, the company estimated that HEPS would fall by at least 20%, causing the share price to enter a new downward trend. Despite these struggles, the company announced on 15th July 2024 that it had secured a $200 million multi-year contract in Latin America, providing a potential lifeline for its operations.

On 22nd November 2024, the company's board of directors announced that MUR met the Companies Act definition of being "financially distressed" and that the best course of action was to enter into business rescue. As a result, trading in the company's shares was suspended on the JSE.

On 20th January 2025, the company reported that it had secured an additional R250 million in funding, which may provide some relief as it navigates its financial difficulties. However, MUR remains a high-risk investment with significant debt and operational challenges.

Our opinion on the current state of MERAFE(MRF)This is a ferrochrome operation controlled by Glencore, which operates mines, furnaces, and smelters in Mpumalanga and Limpopo. The Glencore-Merafe joint venture can produce up to 2.3 million tons of ferrochrome per annum. Merafe gets 20.5% of the proceeds, and the balance goes to Glencore.

The problem is electricity supply, because smelters require huge amounts of current. The 15.6% increase in Eskom tariffs last year was a major factor, and the current year's increase of just under 10% from 1st April 2022 is a further problem. The company is concerned about Eskom's ability to supply additional power for expansion. Their Lion 3 expansion has accordingly been suspended until this difficulty can be overcome. All smelters except Lydenburg are operating.

The availability of trains from Transnet to move its product is another problem. Obviously, this is a commodity share and has risks, but the world's demand for stainless steel did increase with the economic boom in America, but that now appears to be coming to an end.

In its results for the six months to 30th June 2024, the company reported revenue down 0.4% and headline earnings per share (HEPS) of 28.2c compared with earnings of 42c in the previous period. Ferrochrome production was down 17%, and the company's net asset value (NAV) increased 3%.

In a production update for the nine months to 30th September 2024, the company reported attributable ferrochrome production up 2%. A production report for the year to 31st December 2024 showed ferrochrome production up 0.3% on the year and down to 70 kilotons in the quarter from the previous quarter's 75 kilotons.

Technically, the share reached a high of 192c on 4th April 2022 and was trending down until a rally in September 2022. It has found some brief support at 104c per share and then trended up—but the rally was short-lived.

It remains a volatile commodity share.

Our opinion on the current state of NUMERAL(XII)Previously known as "Go Life International" (GLI), Numeral is a company listed in Mauritius with a secondary listing on the JSE's Alt-X market. The company operates in the "nutraceuticals" sector, focusing on products associated with alternative medicine. These products are not pharmaceuticals but claim to provide health benefits. Numeral was established to acquire and exploit nutraceutical-producing companies in South Africa, currently owning Go Life Health Products and Gotha Health Products.

In its results for the six months to 31st August 2023, the company reported zero revenue and a headline loss per share (HEPS) of 0.0051 cents (US), compared with a loss of 0.0044 cents in the previous period. The company stated, "...the asset base had been completely eroded, which required a full write-off of all the underlying investments of $34,851,774 in 2020. The recapitalisation process was completed in the first quarter of 2023. The Board approved subscription agreements for the issue of 465,000,000 new shares, of which 132,500,000 were the treasury shares recovered above."

In its financials for the nine months to 30th November 2023, the company again reported zero revenue and a headline loss per share of 0.07 cents (US), with a net loss of $80,777 and a negative net asset value (NAV). The company has faced challenges, including delays in publishing its financial statements.

Until Numeral can generate revenue and improve the free float and tradability of its shares, it remains an impractical investment for private investors. On 6th November 2023, the company's board announced a proposal to change its name from "Go Life International" to "Numeral Limited."

In a trading statement for the six months to 31st August 2024, the company estimated a 292% increase in HEPS. However, in an update for the nine months to 30th November 2024, it reported unchanged turnover but an improvement in HEPS to 0.0283 cents, compared with 0.007 cents in the previous period.

While the increase in HEPS is a positive development, the company’s lack of revenue generation, history of financial delays, and negative NAV indicate significant risks. Until these issues are addressed, Numeral is unlikely to appeal to private investors seeking practical and stable opportunities.

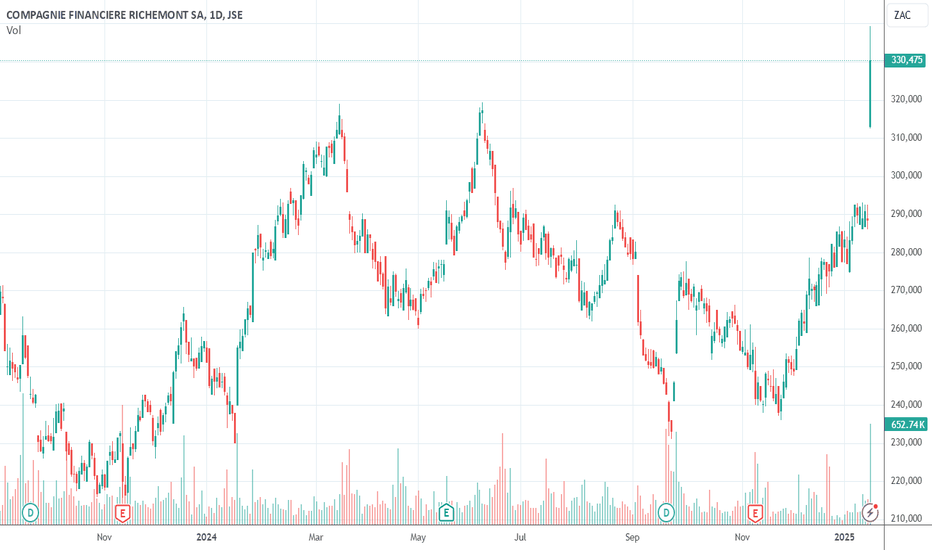

Our opinion on the current state of RICHEMONT(CFR)Richemont (CFR) is the world's second-largest supplier of luxury goods, controlled by the Rupert family in Stellenbosch. Its sales are entirely overseas, making it an excellent rand-hedge. The company owns a prestigious portfolio of luxury brands, including Mont Blanc, Cartier, Lancel, Jaeger-LeCoultre, Van Cleef, and Piaget. Richemont has successfully expanded its online presence, with online sales now accounting for 21% of its turnover. This growth has been driven by the acquisition of Yoox-Net-A-Porter (YNAP) and Watchfinder, a UK-based online group, as well as a joint venture with Alibaba. Through this partnership, Richemont has developed apps to penetrate the Chinese market and offer its luxury goods via Alibaba's Tmall Luxury Pavilion.

Richemont is well-positioned to benefit from the global economic recovery following the COVID-19 pandemic. While the company experienced a decline in sales during the pandemic, its aggressive shift toward online sales positions it for continued growth. However, Richemont's performance is influenced by the Chinese economy's slowdown, developments in Central and Eastern Europe, and fluctuations in the rand's strength.

In its results for the six months to 30th September 2024, Richemont reported sales of just over 10 billion euros, down 1%, with headline earnings per share (HEPS) of 2.862 euros, compared to 3.577 euros in the prior period. The company noted, "Solid growth in sales across all regions, except for Asia Pacific; double-digit growth in the Americas, reinforcing the US' position as the largest individual market for the Group. Continued growth in direct-to-client sales, now accounting for 76% of Group sales."

In an update for the third quarter ended 31st December 2024, Richemont reported a 10% increase in sales, achieving its highest-ever quarterly sales of 6.2 billion euros. This strong performance caused the share price to rise sharply.

Although the share trades at a price-to-earnings ratio (P/E) of 17.8, which is relatively high, Richemont remains a compelling investment for its strong rand-hedge characteristics and its exposure to the global luxury market. However, investors should consider its dependence on the Chinese consumer and its sensitivity to global economic conditions when evaluating this stock.

Our opinion on the current state of PPCPPC is a leading manufacturer and supplier of cement, aggregates, ready-mix, lime, limestone, and fly-ash in Africa. The company operates eleven cement factories located in South Africa, Botswana, the DRC, Zimbabwe, Rwanda, and Ethiopia, with a combined production capacity of 11.5 million tons. It produces aggregates at its Mooiplaas quarry in Gauteng, the largest aggregates producer in South Africa, and operates 26 batching plants for ready-mix concrete in South Africa and Mozambique.

The company successfully re-negotiated its lending arrangements, avoiding the need for a highly dilutive rights issue. No dividends have been paid in the last five years. PPC faces challenges from the carbon tax implemented on 1st June 2019, costing the company between R100 million and R120 million annually. PPC intends to pass this cost on to consumers, which could reduce its competitiveness against foreign imports unless tariffs are increased. The company's growth strategy focuses heavily on expansion into other African markets.

PPC, like much of the construction industry, has struggled due to a lack of new government and quasi-government projects in South Africa. To compensate, the company has been cutting costs and investing in other African markets. However, the cement industry remains oversupplied, presenting ongoing management challenges. PPC has also benefited from the South African government's "localisation" policy, which requires government operations to purchase locally produced cement.

In its results for the six months to 30th September 2024, PPC reported revenue down by 4.2% and headline earnings per share (HEPS) of 22 cents, compared with 20 cents in the previous period. The company stated, "Cost discipline and price growth were the main drivers of the recovery in the results and margin of the SA & Botswana group despite the lower sales volumes in the period."

PPC is currently building a state-of-the-art plant in the Western Cape in partnership with Sinoma, the world's largest cement equipment producer, at a cost of R3 billion. The company has been in an upward share price trend since October 2022, which is expected to continue. PPC has conducted a R200 million share buy-back and reduced its debt by 20%. On 28th August 2024, the company announced a special dividend of 33.5 cents per share following the sale of its 51% stake in Cimerwa in Rwanda.

Looking ahead, PPC is well-positioned to benefit from South Africa's new government of national unity (GNU) and the anticipated reduction in interest rates. However, the company's performance will remain closely tied to broader economic and infrastructure trends across its operating regions.

Our opinion on the current state of KAROO(KRO)Cartrack was restructured into a new international listing under the name Karooooo (KRO) on 21st April 2021. The company operates in the vehicle recovery, insurance, telematics, and fleet management sectors across 24 countries. With a 92% recovery rate, Karooooo claims to lead the industry. The company has shown remarkable organic growth, with its subscriber base increasing by 21% compound annually over the past six years. Approximately 96% of Karooooo's turnover is annuity income, ensuring stable and predictable revenue streams.

The company was founded by Zak Calisto, who owns 68,5% of the Singapore-based firm. Its rapidly growing annuity income, combined with its rand-hedge characteristics, makes Karooooo an attractive investment for private investors. It has also been drawing strong institutional interest. With minimal working capital requirements, the company's annuity income covers its overheads even before the start of each month. Investors are encouraged to accumulate this share during periods of market weakness.

On 7th December 2020, the company announced plans to list on NASDAQ with an inward listing on the JSE, enabling access to international capital markets. On 12th February 2024, Karooooo announced a share buyback plan to purchase up to 1 million of its own ordinary shares in the market.

In its results for the six months to 31st August 2024, Karooooo reported earnings per share (EPS) up 31%, with a 17% increase in subscribers to 2,136,610. Subscription revenue grew by 15%. The company stated, "Cartrack delivered record operating profit of ZAR293 million, up 16% (Q2 2024: ZAR252 million). The gross profit margin expanded to 74% (Q2 2024: 71%) and the operating profit margin remains at 29% (Q2 2024: 29%). Karooooo Logistics operating profit grew by 20%."

In an update for the third quarter to 30th November 2024, Karooooo reported that Cartrack's subscribers had increased 17% since 30th November 2023, while subscription revenue rose 19% in US dollar terms. The company added, "Cartrack reported a growth of 7% in operating profit to ZAR316 million (Q3 2024: ZAR295 million). The gross profit margin improved to 74% (Q3 2024: 73%)."

Although the share trades at a price-to-earnings ratio (P/E) of 31,53, making it relatively expensive, its outstanding growth record and rand-hedge qualities make it a compelling investment. We continue to regard this share as a "must-have" for private investors and recommend buying it on any market weakness.

Our opinion on the current state of JUBILEE(JBL)Jubilee Metals Group (JBL) is a diversified metals recovery company that re-processes mine waste and surface materials. It is listed on both the London AIM market and the JSE's Alt-X. The company operates in South Africa, the UK, Madagascar, and Australia, and is involved in a joint venture in Zambia to produce lead, zinc, and vanadium. Its primary products are platinum group metals (PGMs) and chrome. A key asset is its 63% stake in the Tjate project, which is assessed to include the world's largest undeveloped block of platinum ore with an estimated potential of 65 million ounces on the Western Limb of the Bushveld Igneous Complex. In recent years, however, Jubilee has "pivoted towards a smelting and beneficiation strategy as a cashflow survival strategy."

Jubilee is currently spending about R154 million to consolidate its PGM retreatment business by acquiring a reprocessing plant and some dumps. This expenditure includes the purchase of a chrome processing operation and 1,8 million tons of tailings from PlatCro Minerals. The company is a low-cost producer but remains subject to fluctuations in the platinum and base metals markets.

In its results for the year to 30th June 2024, the company reported revenue up 20,2% and chrome concentrate production up 20%. However, 6E PGM production decreased by 14,2%, while copper production increased by 17,1%. The company stated, "Group EBITDA decreased by 7.1% to US$27.7 million (FY2023: US$29.8 million), supported by increased chrome production helping partially offset the impact of the sharp decline in PGM EBITDA."

In an update for the three months to 30th September 2024, Jubilee reported a production target of 1,800 tonnes of copper units for H1 FY2025, ending December 2024, with plans to increase to approximately 4,200 tonnes for H2 FY2025, totaling approximately 6,000 tonnes for the full year based on current assumptions. However, in an operational update for the six months to 31st December 2024, the company reported copper production of 1,454 tons, falling short of the 1,800-tonne target due to "power constraints." The company noted, "Roan upgrade and commissioning completed, reaching ramp-up throughput targets of a combined 45,000 tonnes per month during the period before experiencing shutdowns due to power constraints."

On 7th October 2024, Jubilee announced it had increased its stake in project "G" to 65% and secured an additional 2 megawatts of power from an independent power producer (IPP).

In our view, this share is one of the better options in the mining sector but remains highly volatile and risky. Investors are advised to wait for a clear break above the share's long-term downward trendline, which has not yet occurred.

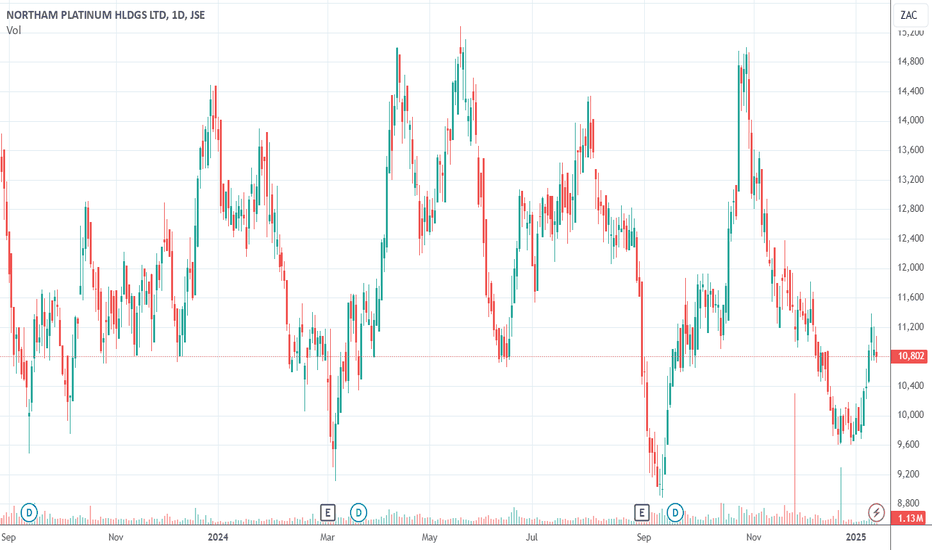

Our opinion on the current state of NORTHAM(NPH)Northam (NPH) is a fully empowered platinum mining company operating in the Bushveld Complex. In the current difficult legislative environment, where the third mining charter is regarded as unfriendly from an investment point of view, Northam stands out as the only mining house actively acquiring new properties. It has come to an arrangement with Anglo American to exploit a property adjacent to its Zondereinde mine, which is the deepest platinum mine in South Africa. Additionally, it has purchased Eland Platinum from Glencore for R175m, with plans to re-start operations at a cost of R2bn.

On 29th October 2019, the company announced the acquisition of Maroelabult for R20m. This property, located west of the Eland mine with an analogous ore body, has accelerated the production timeline for Eland and required minimal capital. With the Eland acquisition, Northam also gained a concentrator plant capable of processing up to 250 000 tons a month. In return, Glencore secured the right to market all of Northam's chrome. To further enhance its processing capabilities, Northam recently commissioned a new smelter to address its platinum ore backlog, estimated to be worth about R2,5bn.

Zondereinde is a deep-level mine that faces challenges typical of mining at depth, whereas Booysendal is a shallow, mechanised mine that is easier to manage. Both mines are profitable; however, Northam consistently reports losses due to the preference dividends that must be paid under its empowerment structure. Once Booysendal is complete, the company is expected to generate strong cash flows. The appointment of Mcebisi Jonas (former South African Minister of Finance) and Jean Nel (previous CEO of Aquarius Platinum) as non-executive directors strengthens the board significantly.

The company has expressed its intention to double its workforce as it aims to become a major global supplier of PGMs. With plans to increase PGM production to 1 million ounces in the coming years, Northam is seen as one of the better options in the industry. It has also sold its Impala shares for R3,1bn, bolstering its financial position.

The PGM industry is currently facing challenges, including depressed PGM prices, high inflation, global geopolitical uncertainties, and Eskom load curtailment events in South Africa. In its results for the year to 30th June 2024, Northam reported revenue down 22,2% and headline earnings per share (HEPS) down 81,6%. However, in a production update for the six months to 31st December 2024, refined PGM production was up 3,7%, and chrome production increased by 7,5%. The company noted, "PGM production from Zondereinde remains on target, despite a stoppage during November as a result of a failure of a primary Eskom feed substation. Chrome concentrate production has benefitted from increased UG2 milling and further incremental improvements in chrome recovery."

Since April 2021, the share has experienced a steady decline, falling substantially. Despite this, Northam has a promising long-term future but remains a volatile commodity share. Investors are advised to wait for a clear break above the downward trendline before considering further action.

Our opinion on the current state of THARISA(THA)Tharisa (THA) is a mining company that mines and beneficiates platinum group metals (PGMs) and chrome. The company is listed in London and on the JSE. The Tharisa mine on the south-west limb of the Bushveld Igneous Complex (BIC) is an open-pit operation with an estimated life of 17 years. The company owns a subsidiary, Arxo Metals, which beneficiates chrome to produce high-grade chrome concentrates. The company is planning to expand into the Great Dyke area of Zimbabwe.

In our view, this is one of the best mining investments on the JSE with a cost of production that is well below current metals prices and some good options for expansion. The company has been involved in the Vulcan Plant, which will improve chrome recovery to 82% from 65% and cost $54,2m. The target is to reach 200 000 ounces of PGMs (platinum group metals) and 2 million tons of chrome ore production using a proprietary technology. The open-pit operation is relatively low-cost and does not have the problems associated with underground operations. The company is planning to build a 5MW furnace that will enable it to produce iron alloys rich in platinum group metals, which would sell for a far better price.

On 27th March 2023, the company announced that it had raised $130m (about R2,3bn) in finance from ABSA and Soc Gen. In its results for the year to 30th September 2024, the company reported PGM production up 0,3% and chrome production up 7,6%. Revenue was up 11%, and headline earnings per share (HEPS) were down by 0,7%. The company said, "Other operating expenses increased by 15.9% to US$66.6 million (2023: US$57.4 million). The largest cost component of other operating expenses was employee-related expenses of US$33.7 million, which contributed 50.7% to total other operating expenses. EBITDA totalled US$177.6 million (2023: US$136.8 million), a 29.8% increase primarily due to the strengthening of chrome prices and despite the decrease in the PGM basket price."

In a production report for the first quarter to 31st December 2024, the company reported PGM production of 29,9koz—down from 37,1koz in the previous quarter. The company said, "PGM prices averaging at US$1 381/oz for the quarter (Q4 FY2024: US$1 370/oz) - Average metallurgical grade chrome concentrate prices at US$271/t for the quarter (Q4 FY2024: US$314/t) - Group cash on hand of US$175.1 million (30 September 2024: US$217.7 million), and debt of US$86.1 million (30 September 2024: US$108.8 million)."

Technically, the share is well-traded, with over R200 000 worth of shares changing hands on average each day. The share has been falling since July 2024 due to declining commodity prices. The share remains a risky commodity counter dependent on the international prices of the commodities it produces.

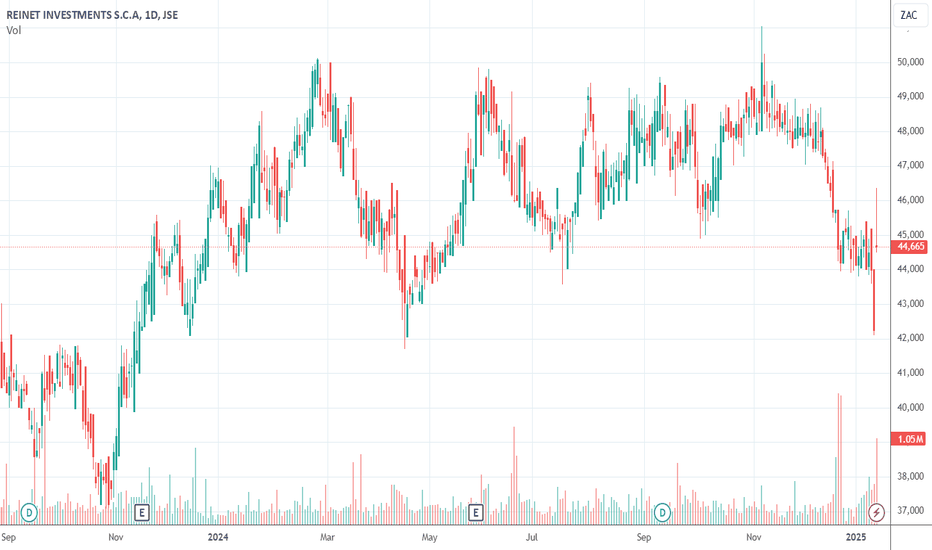

Our opinion on the current state of REINET(RNI)Reinet (RNI) is an investment holding company whose main asset is a holding of roughly 2,12% of British American Tobacco (BAT) worth about $1,8bn, which now accounts for 31% of its net asset value (NAV)—down from 85% ten years ago. This decline from a year ago is because the price of BAT shares has fallen. Most of this reflects the more difficult legal environment for tobacco, especially in the US, where the Food and Drug Administration is considering changing the laws on menthol cigarettes.

In our view, Reinet shows no great urgency to divest itself of the BAT stake, which continues to contribute good dividends from growth in third-world countries, while cigarette sales in first-world countries fall. As the price of BAT has fallen, the other assets in the Reinet portfolio have become more significant. The largest of these is its 46% stake in Pension Insurance Corporation (Penscorp), which now represents 36,8% of its portfolio.

Aside from Penscorp, the company also owns a spread of private equity investments, which account for around 15% of the portfolio. The company has a compound growth rate of 8,8% per annum since March 2009. In its results for the six months to 30th September 2024, the company reported a net asset value (NAV) of 3625 euro cents per share—up from 3089c a year earlier. The company said, "Reinet has no direct exposure to Russia, Ukraine, or the Middle East through its underlying investments or banking relationships and has not experienced any significant direct impacts in respect of interest rate fluctuations or inflation."

The share is obviously a rand-hedge and, although it fell from its high of R343 in February 2020 to lows in January 2021, we advised waiting for a break up through its long-term downward trendline. That break came on 16th September 2019 at R270 per share. It is now trading for R480.31. It obviously took a hit as a result of the BATS announcement that it was writing the value of its US operation down by GBP25m (R595bn), resulting in a 10% fall in the BATS share price.

This share benefits from any weakness in the rand, and investors should consider the rand's future prospects before buying. On 13th January 2025, Reinet announced that it had sold its entire holding of BATS, which was 24% of the value of its total portfolio, for GBP 1,221bn.

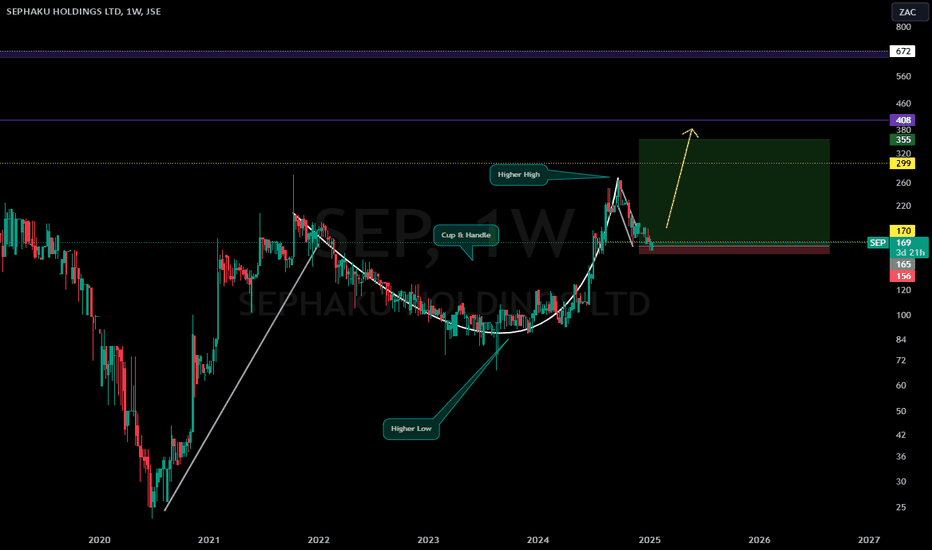

Momentum-shift for Sephaku Holdings signals buyers' interest. Sephaku Holdings Limited had a taste of gravity in April 2015 when it tumbled from highs of R10.22 and went headfirst to smell lows of 23c by June 2020. The stock consolidated to close the week of the 11th of October 2021 at R2.06.

From this point we saw interested buyers closing the coming weeks in a “cup and handle pattern”, effectively printing a higher swing low and closing higher than R2.06 in September 2024 at R2.64.

Price is currently in the handle of the pattern, trading in a steep flag above the 49 Week EMA, currently resting at R1.68.

After closing the week of 02 December 2024 at R1.94, we expected the stock to pullback and retest the R1.68 zone before moving higher and that was achieved now in Jan 2025.

Recommended BUY positions can be initiated by using limit orders, or waiting to see a bullish reaction at the 49 Week EMA.

Entry – R1.68

Stop Loss: R1.56

Target 1: R2.99

Target 2: R3.63

Target 3: R4.08

A Weekly close above R4.65 could see the stock reach R5.24 and R6.42.

Below R1.55 the stock will call sellers to have a party and may plumet to 38c.

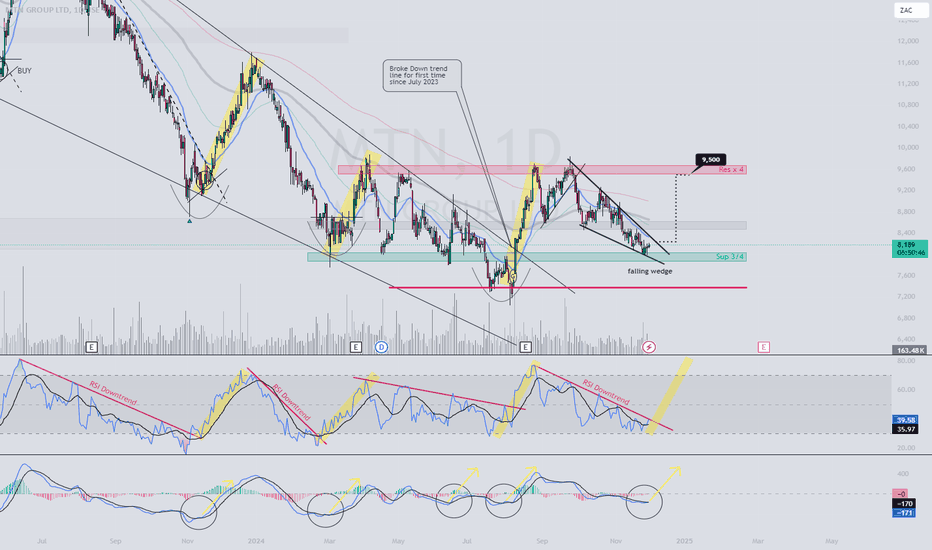

MTN Group Ltd MTN Group Ltd (JSE: MTN) has been in a downtrend since September, failing to break the resistance around 96.00.

A bullish falling wedge is forming, suggesting a potential breakout with a target around 95.00. The current price is testing a key support zone at 81.70, which has held in 3 out of the last 4 tests. RSI and MACD indicators are showing signs of bullish momentum, with the RSI potentially breaking its downtrend line, similar to past upward movements.

Watch for a breakout above the wedge and RSI trend line for confirmation of a bullish shift.

Target: 88.50 (initial) and 95.00 (major).

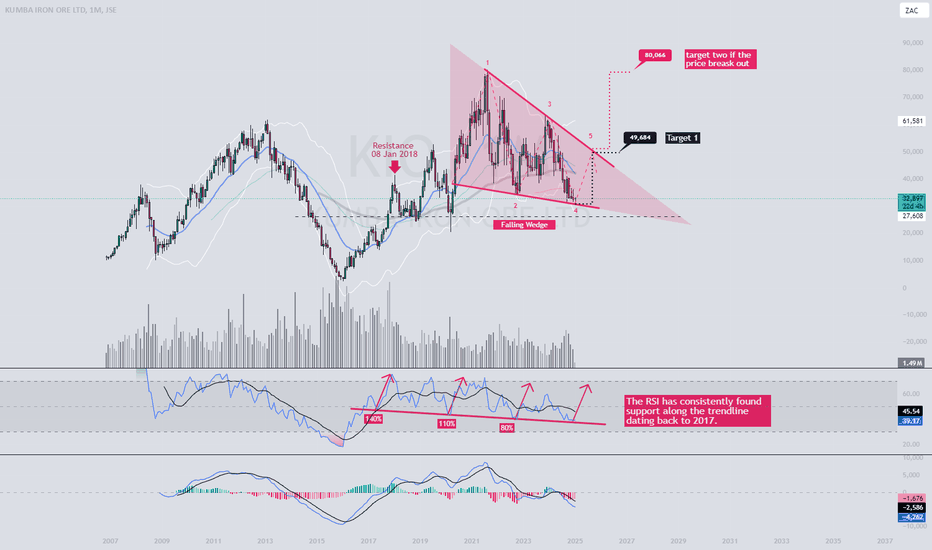

KIO (Kumba Iron Ore) 1M Chart AnalysisKIO (Kumba Iron Ore) 1M Chart Analysis

Building on the previous analysis, the KIO monthly chart shows a large falling wedge. If the price finds support at the lower trendline (4), it could rebound toward the upper trendline, with an initial target around 495.

RSI supports a potential bounce, maintaining a trendline that has held since 2017. Confirmation of support at these levels could signal a bullish reversal.

Key risks:

China's Economy: Stimulus efforts face challenges from weak housing markets and high debt, which could limit iron ore demand.

Geopolitical Tensions: Trade tensions add uncertainty to market stability.

Iron Ore Market Dynamics: Analysts predict that China's iron ore imports could reach a record high of up to 1.27 billion tons in 2025, driven by abundant supplies from top producers. However, steel demand is expected to decline by 1.5% in 2025, following a 4.4% decrease in 2024, due to a prolonged property crisis. This scenario suggests potential downward pressure on iron ore prices, with forecasts ranging from $75 to $120 per ton in 2025.

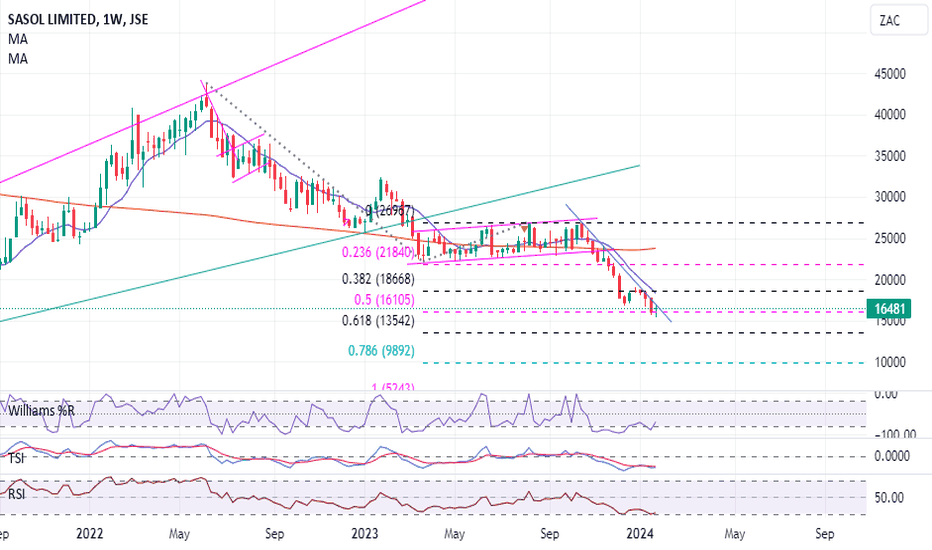

Sasol Ready to Reverse TrendWe have previously detailed the short position on Sasol (see linked idea), now we analyze the bullish case, Sasol price has diverged from Brent, brent is seeking a daily cycle high while Sasol is seeking a cycle low. Here we see a Hammer candle forming at the point of the 0.50 retracement of downtrend. This area is also a support level set by price as it moved out of COVID low while RSI is showing a double bottom. Indications are that price will move upwards, it is in pursuit of a yearly low. The brent chart shows price bouncing on 200 week moving average support that forms a falling wedge with the resistance. If this move plays out Sasol bulls will be happy to accumulate at current level, the implication for inflation due to sharp rising oil will be something to watch.

* Risk accepting investors can buy based on reversal Hammer candle.

* Risk averse investors are best to wait for full confirmation that the cycle has turned when price closes above the blue trendline as well as the 10 week moving average (also blue).

Our opinion on the current state of BELL(BEL)Bell (BEL) is a manufacturer and distributor of heavy equipment, earth-moving equipment to the mining, construction, agriculture, and waste management industries. As such, it has been directly impacted by the slowdown in construction since 2008 and the collapse of the mining industry. Bell's articulated dump trucks are exported worldwide from South Africa and Germany. Bell also has dealerships for a number of other global manufacturers, giving it a product range of over 120 products. Roughly 60% of its business comes from outside South Africa. The company employs 3200 people, of whom 88,6% are in South Africa.

The CEO of Bell, Gary Bell, has indicated to *Business Day* that the company would consider delisting with 1A Bell making an offer to minorities (but he did not disclose at what price). Some of those minority shareholders are now saying that the board has a fiduciary duty to put the company up for sale to the highest bidder. On 18th February 2021, the company announced that a deal had been struck for 1A Bell to buy a further 31,4% of Bell, giving it a 70% stake at R10 per share—a 13% discount to the share price.

In its results for the six months to 30th June 2024, the company reported revenue up 6% and headline earnings per share (HEPS) down 6%. The company said, "Demand for ADTs in the USA remained surprisingly strong and despite high inventory levels across the entire industry, which made for a significantly more competitive environment, we were successful in improving our market share position over the period in this strategic market. Certain southern hemisphere markets for our ADT product, including South Africa and Zambia where demand is traditionally driven by mining, proved more resilient than the northern hemisphere market across Europe and the UK."

In a trading statement for the year to 31st December 2024, the company estimated that HEPS would fall by at least 40%. The company said, "The expected decrease in earnings for the year ending 31 December 2024 is mainly due to these weaker conditions in most of the markets that the group is active in." The share trades over R3m worth of shares on average each day, making it suitable for a private investor.

There was an on-balance-volume (OBV) buy signal on 7th September 2023 at 1752c per share. Since then, the share has moved up to 4200c. On 15th July 2024, the company announced that the Bell family had made a firm offer to buy out the 30% of Bell which it did not own at R53 per share—which is an 82,3% premium to the 30-day volume-weighted average price (VWAP) of the price of 11th July 2024 (3100c). The offer was not accepted by a general meeting of shareholders held on 12th September 2024, causing the share price to fall heavily. Since then, it has been drifting down.

On 23rd October 2024, Bell announced a restructuring plan aimed at consolidating operations and reducing costs in underperforming segments, particularly in the northern hemisphere markets. While management remains optimistic about maintaining a foothold in key markets, the overall market conditions have presented significant challenges, causing some hesitation among investors.

Our opinion on the current state of GEMFIELDS(GML)The Gemfields Group (GML) (previously Palinghurst Group) is a mining group that has two major projects: (1) Kagem, the world's largest producer of emeralds (in Zambia) and rubies (at Montepuez in Mozambique); (2) Jupiter Mines, a South African producer of manganese. The group is led by Brian Gilbertson, previously the CEO of BHP Billiton. Gilbertson identified that the semi-precious stones market was under-developed and offered an opportunity for consolidation and professional management—hence the Gemfields operation. Jupiter was listed on the Australian Stock Exchange (ASX) in April of 2018 and in the process, Gemfields disposed of 60% of that company in line with its decision to cease being a diversified mining company and to focus purely on gemstones.

The share is fairly well-traded with approximately R5m worth of shares changing hands on average every day. Like all commodity shares, it is risky, and its fortunes depend on the prices of emeralds and rubies on the international market—as well as the risks associated with mining in third-world countries. It appears to have found a niche for itself where there is very limited competition, and it should do well as the world economy recovers.

On 24th October 2022, the company announced that operations have resumed at MRM and key personnel had returned following an insurgent attack on a mine about 12km away on 20th October 2022. On 7th August 2023, the company announced that it would construct a new processing plant that would triple its output from the Montepuez ruby mine.

In its results for the six months to 30th June 2024, the company reported revenue of $128m, down from $153,6m in the previous period. Headline earnings per share (HEPS) fell 25%. The company said, "Gemfields is working through a complex year, balancing the availability of cash with the considerable investments we're making at the Kagem emerald mine ("Kagem") in Zambia, the Montepuez ruby mine ("MRM") in Mozambique and our development assets."

Technically, the share rose off an island formation and entered a strong new upward trend which lasted until July 2023 when the trendline was broken. We recommend waiting until the new downward trendline is broken—which has not yet happened. On 11th June 2024, the company announced the appointment of Bruce Cleaver as Chairman. In a report on 19th June 2024, the company said that in June 2024 auctions, it had sold $68,7m worth of rubies at an average price of $316,95 per carat.

In a strategic update on 23rd December 2024, the company said that lower revenue from recent auctions was due to (1) oversupply of Zambian emeralds by a competitor (2) lower production of premium rubies at Montepuez and (3) weaker luxury and gemstone market. This share tends to be volatile for a variety of reasons, but mostly because of the volatile nature of the product which it sells.

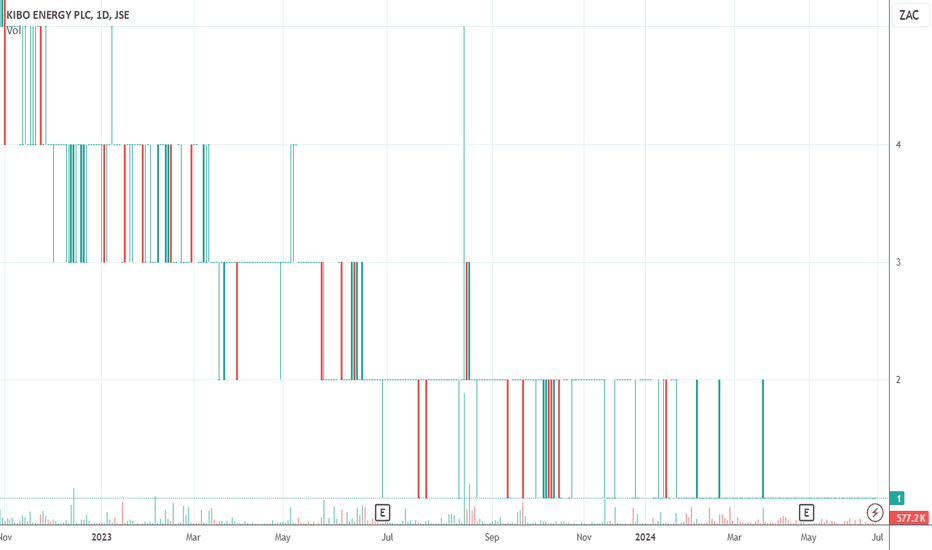

Our opinion on the current state of KIBO(KBO)Kibo (KBO) is an African-oriented energy exploration company listed on the AIM (Alternative Investment Market) of the London Stock Exchange and on the Alt-X (Alternative Exchange) of the JSE. The company began exploration activities in Tanzania, holding 100% of the Mbeya project in coal and other minerals, which has been disappointing. It has since expanded to have interests in Mozambique (65% of the Benga coal power station, which they announced was progressing well on 30th January 2019 and again on 9th May 2019) and Botswana (85% interest in the Mabasekwa coal power project).

In its results for the six months to 30th June 2024, the company reported revenue of GBP202,258 and a loss of GBP492,055. The company said, "...a material uncertainty exists which may cast significant doubt on the Group’s ability to continue as a going concern."

On 7th June 2024, the company announced a partly conditional fundraise with gross proceeds of £500,000 raised at a placing price of 0.015p. Mohammed Ashraf was proposed to join Kibo as Executive Director and Chief Executive Officer.

On 23rd December 2024, the company announced its financial results, including the consolidated results of MAST Energy Developments Plc. Total revenues were £341,207 (2022: £1,036,743), while the operating loss was £5,518,089 (2022: £10,570,952 loss).

The main problem with this share is that it is extremely thinly traded or untraded, which precludes it for private investors. It is also in one of the riskiest areas of investment—energy exploration—and it is running at a loss. We see no benefit in buying this penny stock unless you are prepared to speculate.