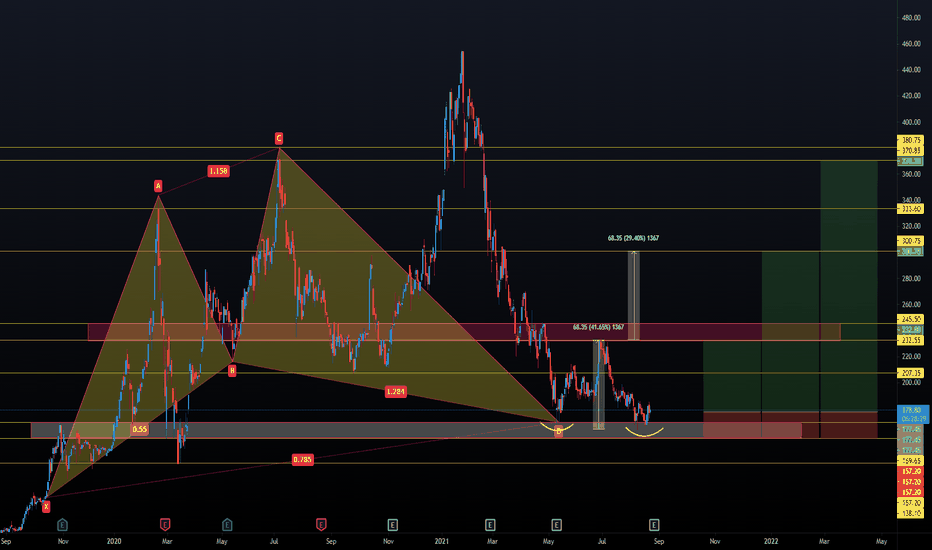

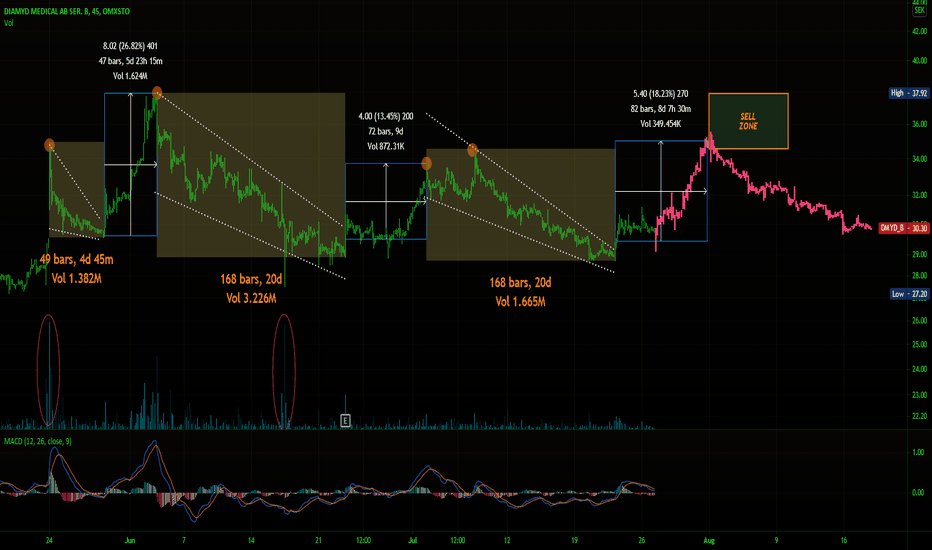

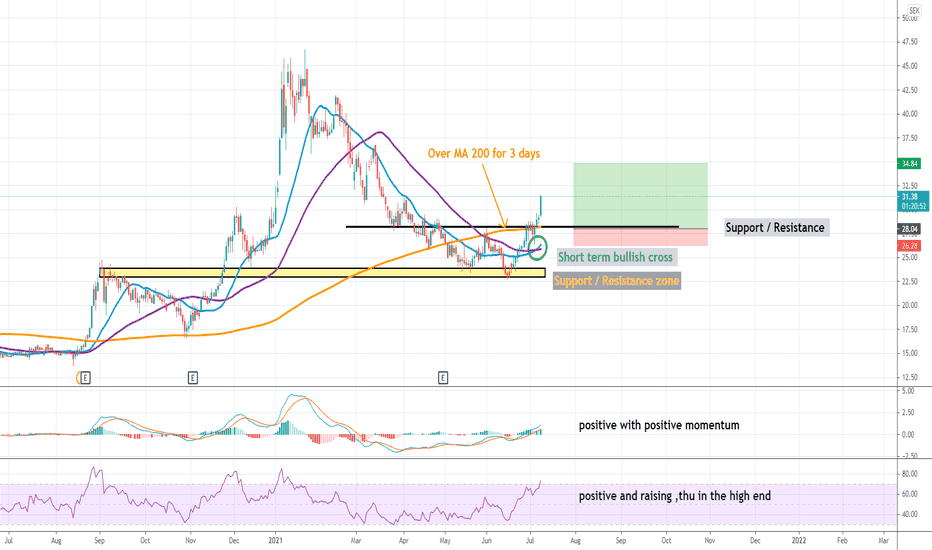

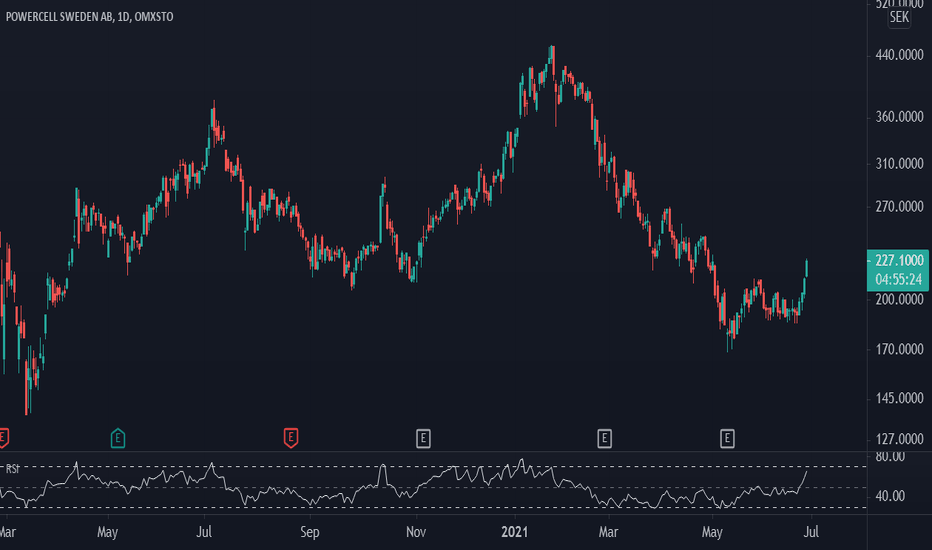

PCELL at important inflection point. Possible reversal!PCELL is at a very critical inflection point. This area is where reversals happen so if this level holds, we could see a beautiful reversal towards the upside. Bullish cypher aswell with the beautiful double bottom confirming the low of the harmonic. Bullish divergence as well on the MACD histogram and the RSI. Really good entry right here! Good Luck traders!

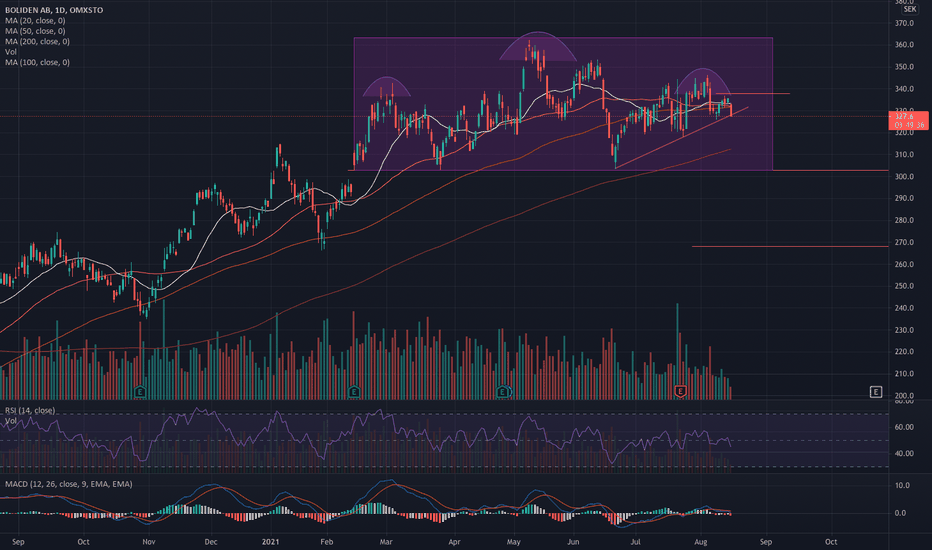

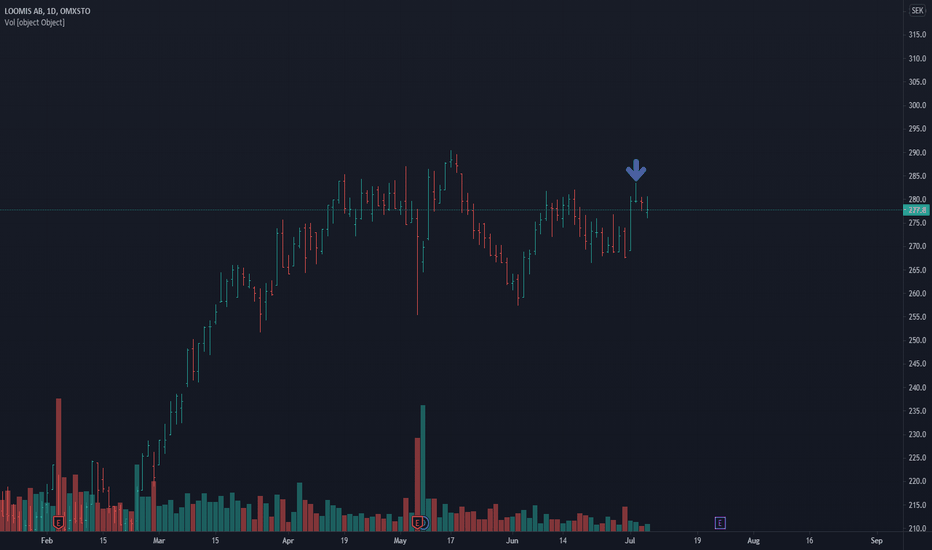

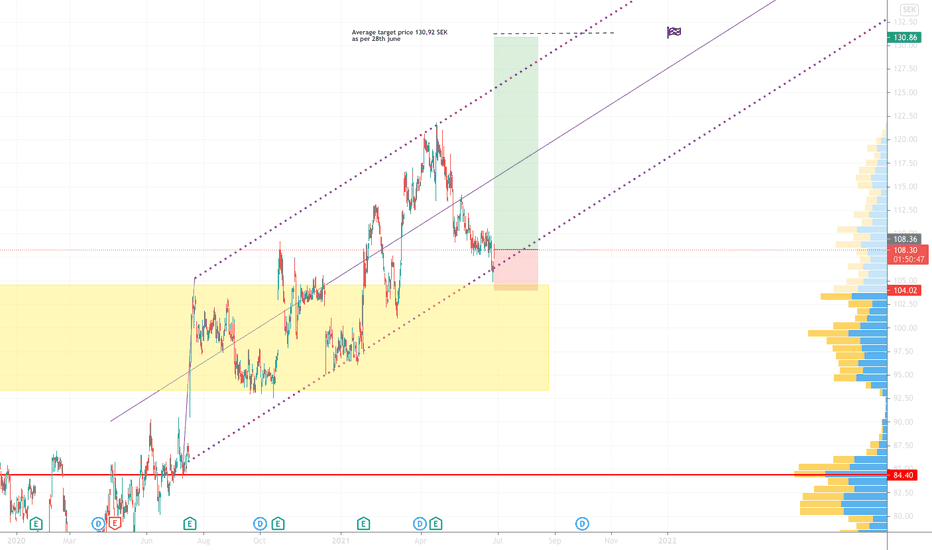

Short, Boliden Taking short position in belief that the Head and Shoulder formation will be effected. Bearish Marubozu/MA-20 cross after resistance level (5/8), charging phase and strong red Candle hopefully starting the fall down to 302. If so, the Head and Shoulder formation is completed and a continued fall down to level of support at 270 is to be expected.

Target, 302 and 270.

Stoploss, 337

Entry, 328 (16/8)

Short.

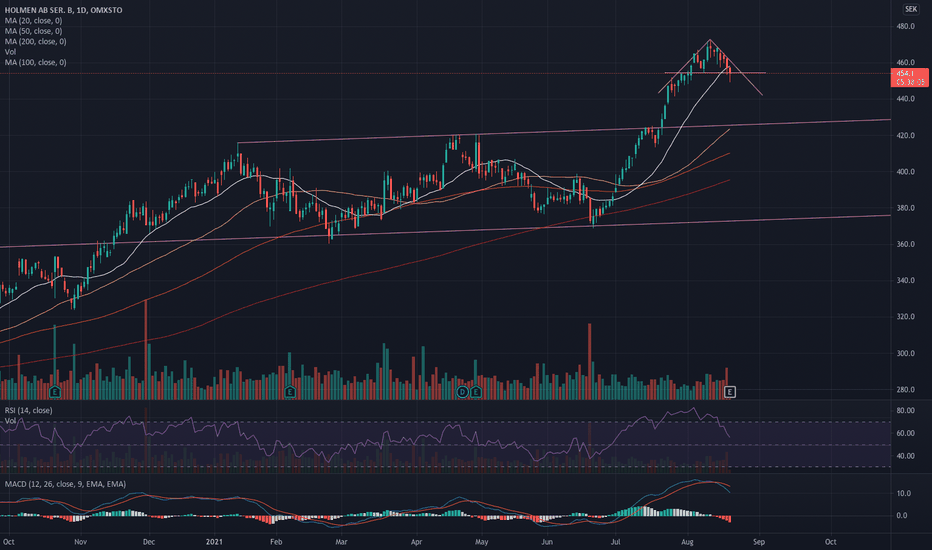

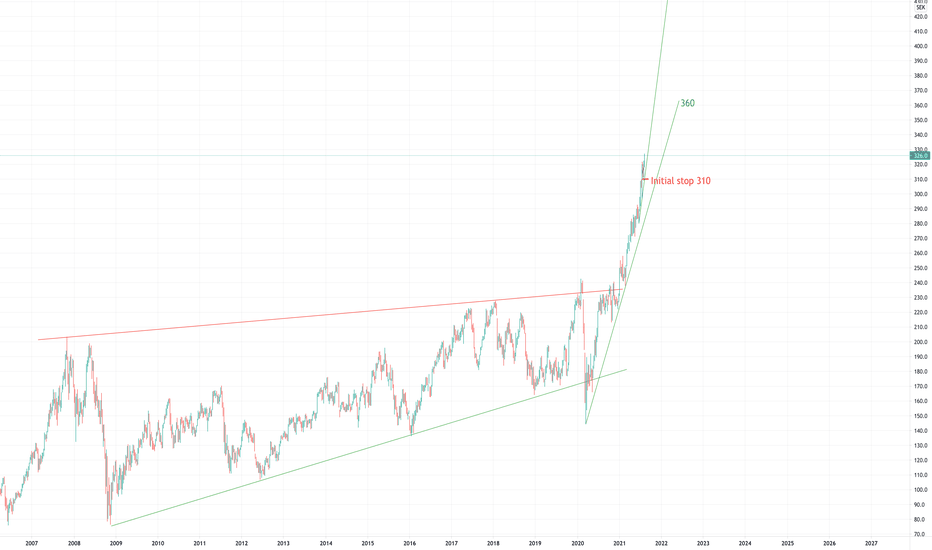

ABB of SwedenABB went sideways in a wedge pattern since 2009 and broke out to the upside in February of 2021. The stock is in a strong upward trend and is showing confirming downward/sideways flag patterns. After the recent breakout to a new all time high (ATH) the strong trend is likely to continue and the stock seems to be going through a fundamental reevaluation by the market which seems to have discovered the potential of the company, which is operating among other things in the automation and robotics segment.

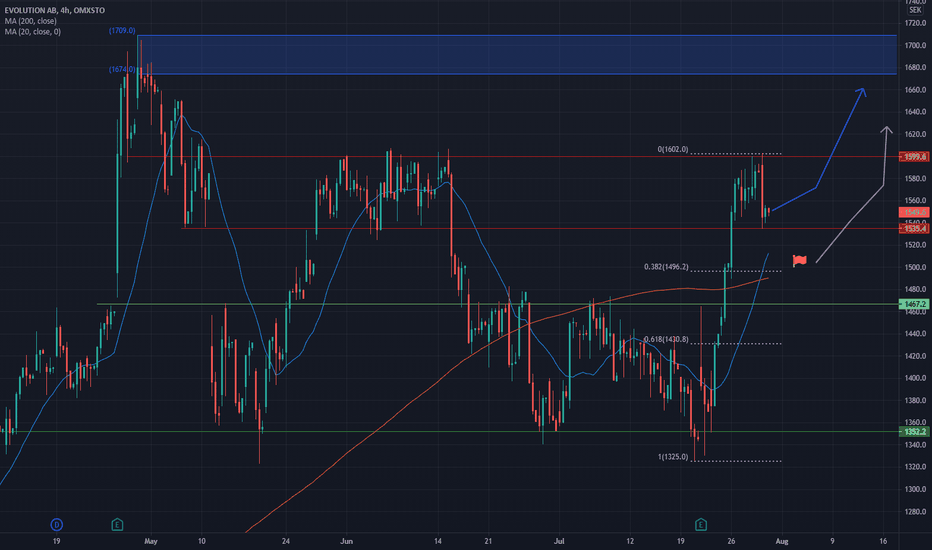

EVO towards ATHFollowing an impressive rally from 1330 lows last week price has once again reached and rejected at 1600, after finding support at the 1535 I expect another break-out attempt would clear 1600 and put us on track to previous highs at 1674 and beyond. A retrace towards the 1505-1495 zone might also give a setup next leg up.

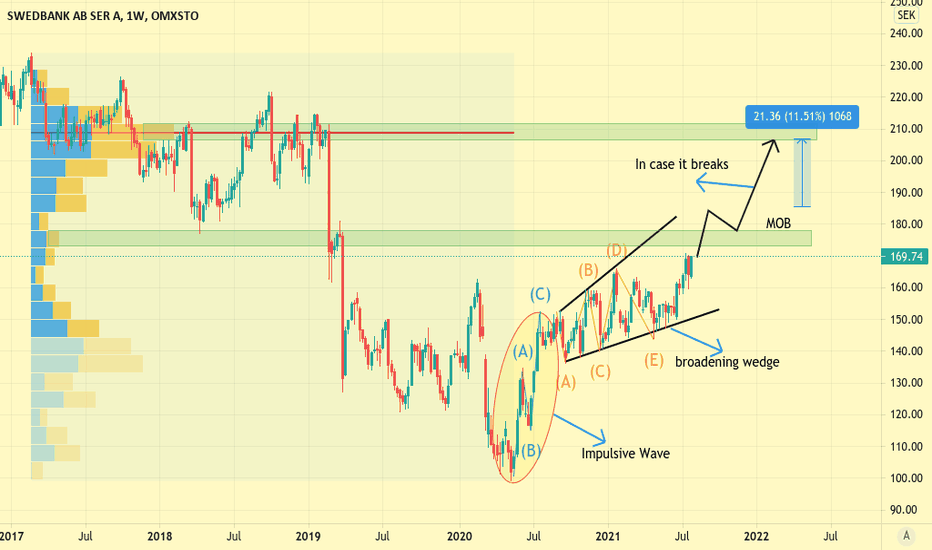

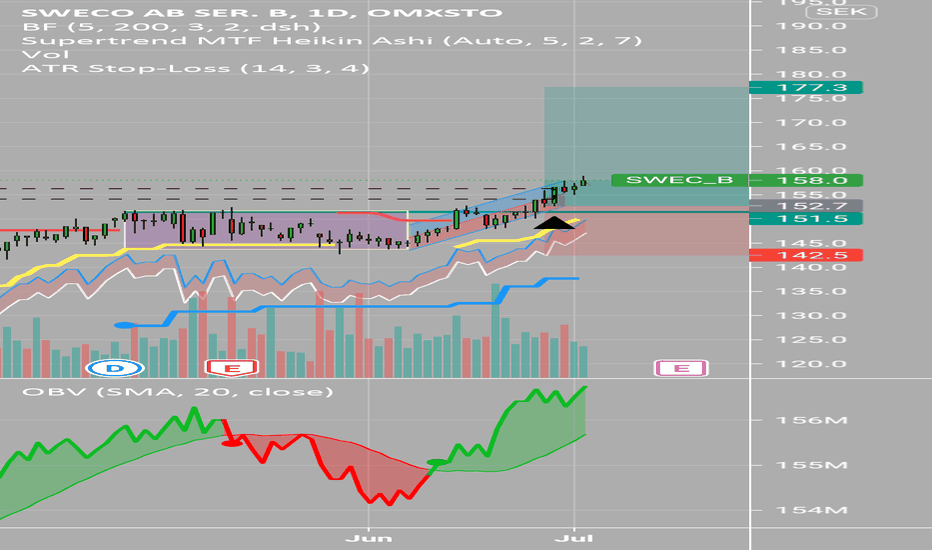

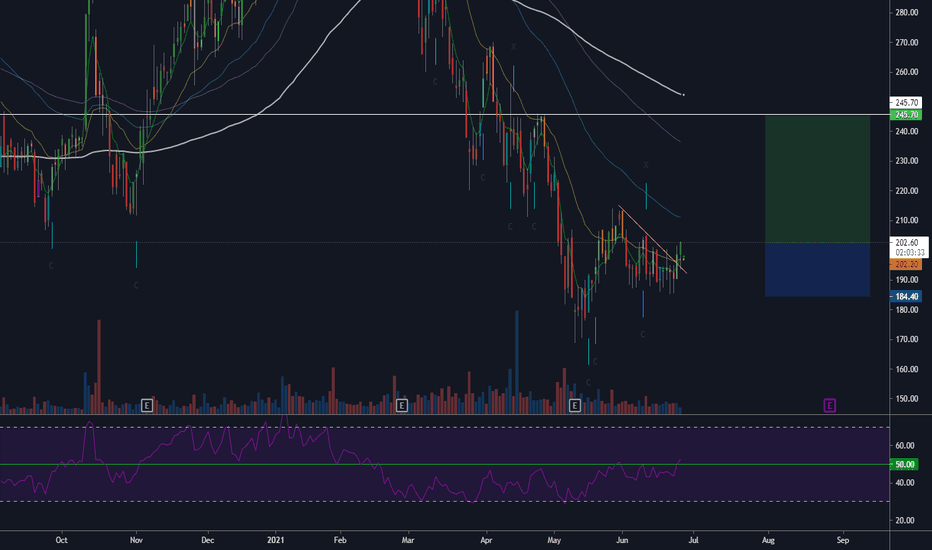

My Swedbank stock prediction in the coming weeksAfter a strong impulsive wave, the stock has been traded in a broadening wedge as a correction. Currentlyu we are waiting for a price movement against the Make or Break levels at 172-178 SEK. If we se a strong breakout to these levels. We'll wait for the first high on the daily timeframe and enter after the breakout targeting the 205-210 levels. The another scenario is a bounceback from these MOB levels.

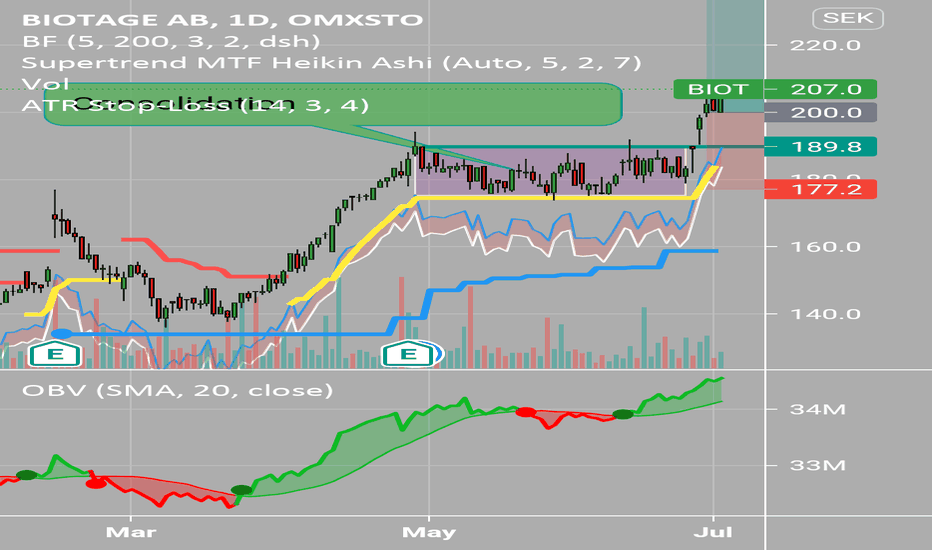

Biotage AB - nice move upStrong buy, breakout of horisontal channel. Used Supertrend by LoneSomeTheBlue.

$PCELL break in market structureThese companies in the hydrogen bussines took serious hits after massive runs seen last year, to me they dropped enough to look for positions.

Took a postion based on the higher low, now looking for that higher high to confirm HTF break in marketstructure.

Will add on break of local high.

Very bullish for these kind of diruptive technology, market for renewables is going to explode this decade.

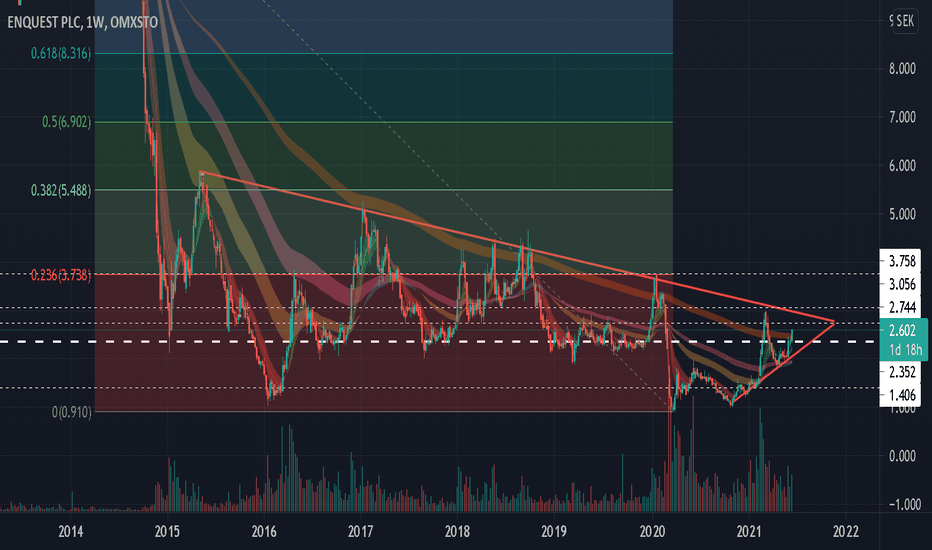

$ENQ (stockholm) $BRENT - ENQUEST PLC Super cash flow and big winner on this oil price..

possible break out of a 6 year old resistance trend line

48 000 - 52 000 Boepd per day

$500-600M profit expected on $65 hedged oil price (180 days)

1280M debt as of 1/1 2021, payed back in 12 months..

Market cap $500M

Trading Idea - AAC #ClydeSpace (mid-term/long-term)BUY

ENTRY: 2.285 SEK

TARGET: 2.910 SEK (27% profit mid-term)

STOP: 2.130 SEK

AAC Clyde Space AB, formerly AAC Microtec, is a company based in Sweden, which is mainly active in the aerospace industry. The company operates as a provider of space solutions and systems for state, commercial and educational purposes.

1.) The current zone represents a good entry point for investors who are interested in the company over a medium to long term period. The securities is near the support at 2.00 SEK - calculated on weekly rate data.

2.) The predicted growth for the coming year is one of the strengths of the company.

3.) The financial situation of the company looks excellent, which gives it a considerable investment capacity.