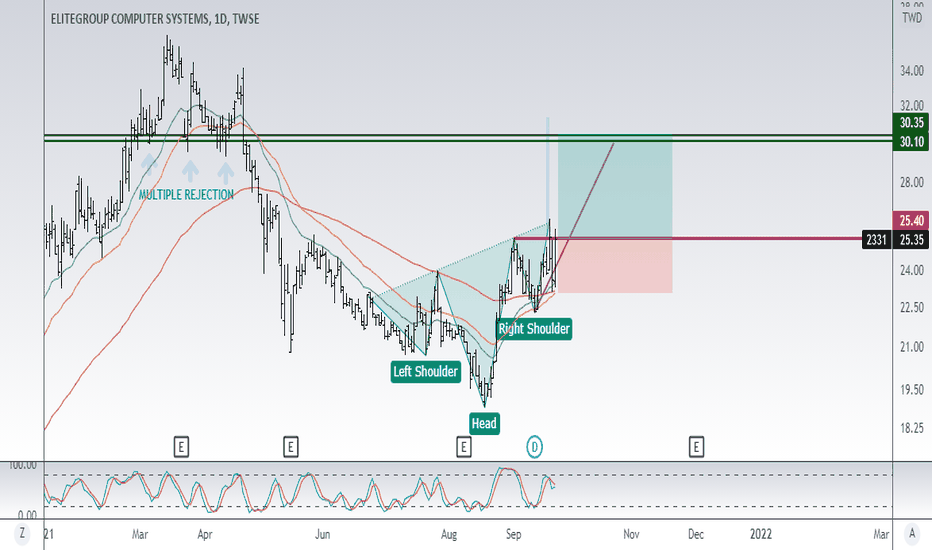

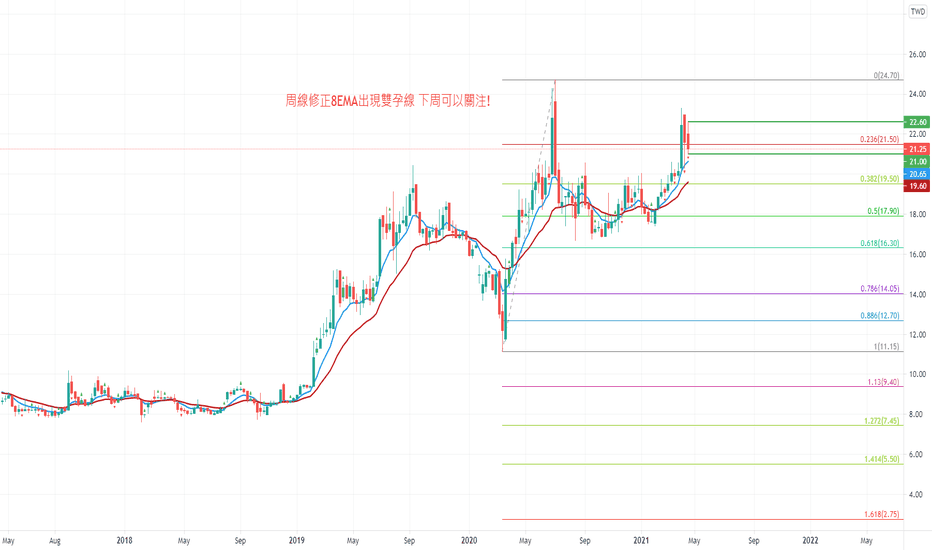

Inverted Head & Shoulders2331-D1 by the price movement is potential forming inv Head & Shoulders pattern. We foresee that 2331 has the potential to breakout neckline and has a chance to move upwards support becomes resistance 30,1

the momentum indicator is pointing down in the neutral area, entry breakout classic resistance.

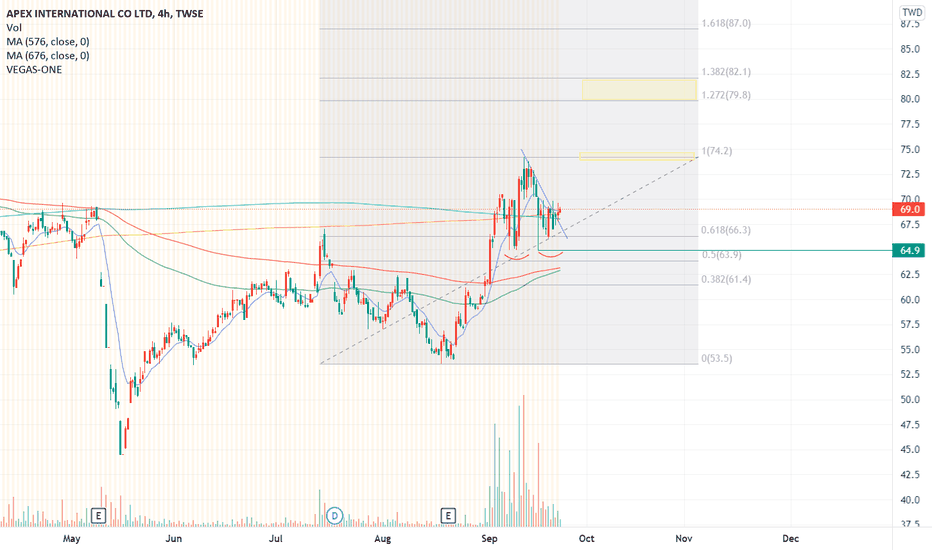

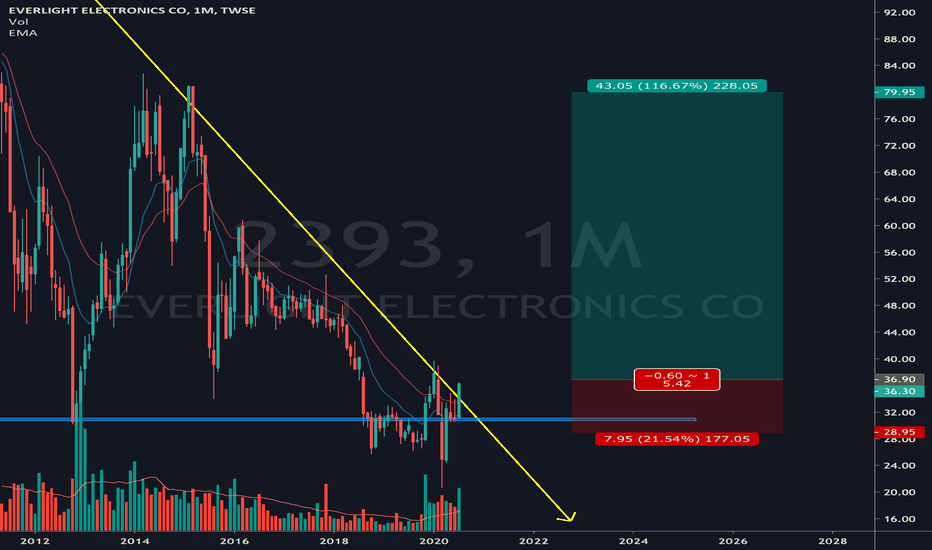

Apex Meet Vegas condition!/Trading PlanTWSE:4927

4H trend chart

Long:

1)Vegas tunnel_144/169 had a support

2)Price rally Fib(0.382) support level

3) Breaks out downtrend line

4) Breaks out 12ema

Profit Targets:

a) 74.2-----Fib(1)

b) 79.8~82.1-----Fib(1.272~1.382)

Stop losses:

a) 64.9-----previous lows

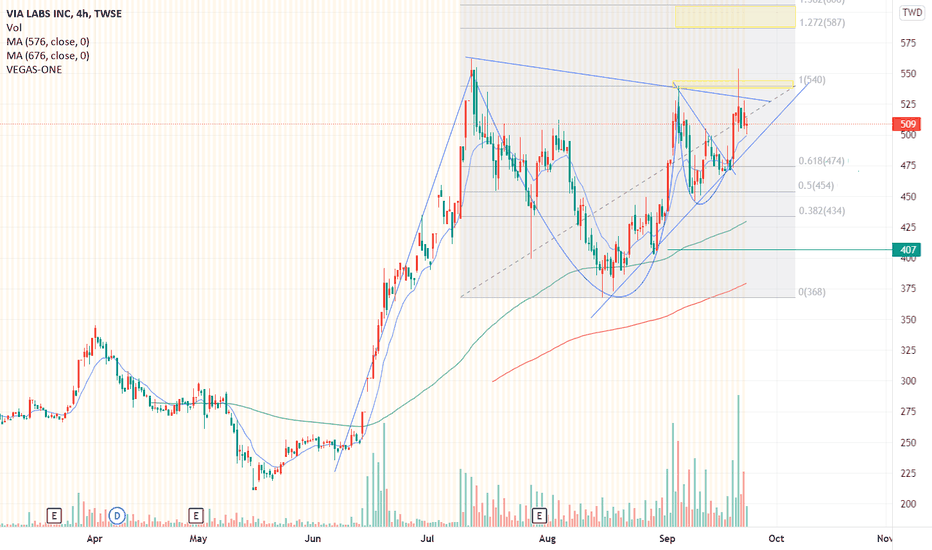

Via Labs-Cup and Handle!/Trading PlanTWSE:6756

4H trend chart

There is an obvious Cup and Handle

9/17 Handle Downtrend breakout

Next challenge: 530~540_above downtrend and Fib(1)

Hold firm above 540 is better.

So if breaks above resistance and hold steady, trading plan as below:

Profit Targets:

a) 587~606-----Fib(1.272~1.382)

b) 712-----Fib(2)

Stop losses:

a) 454-----Fib(0.5)

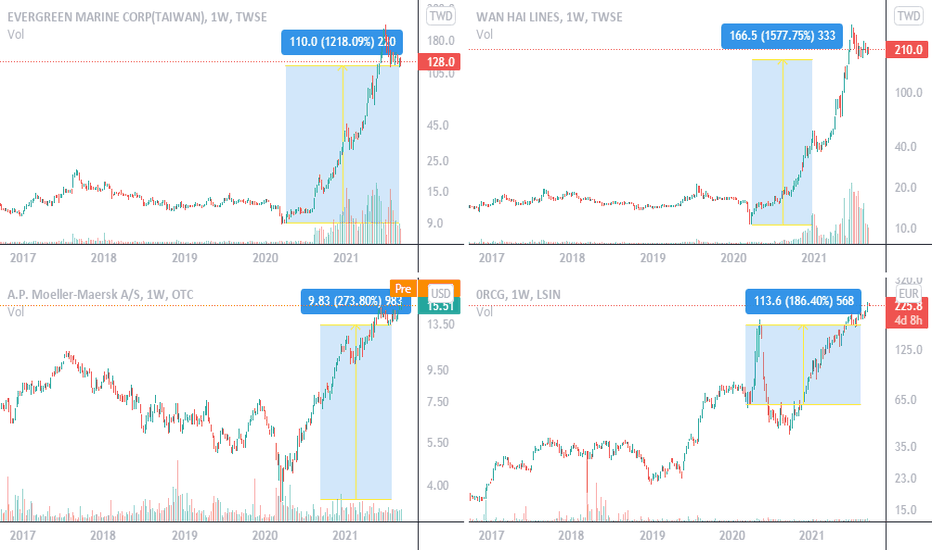

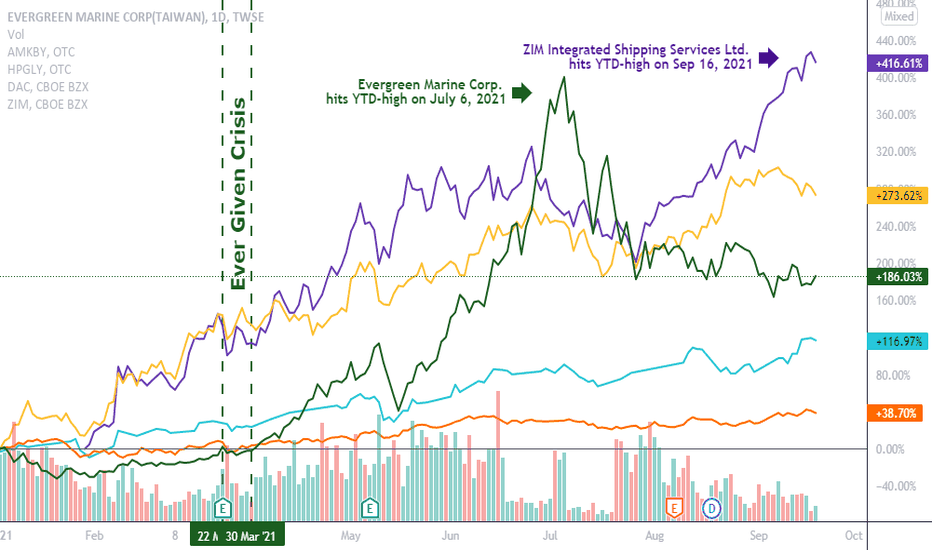

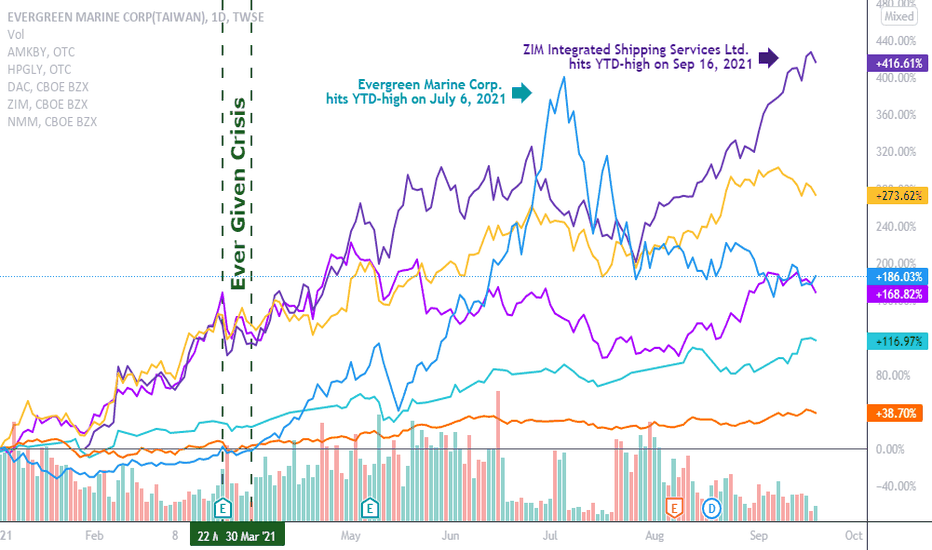

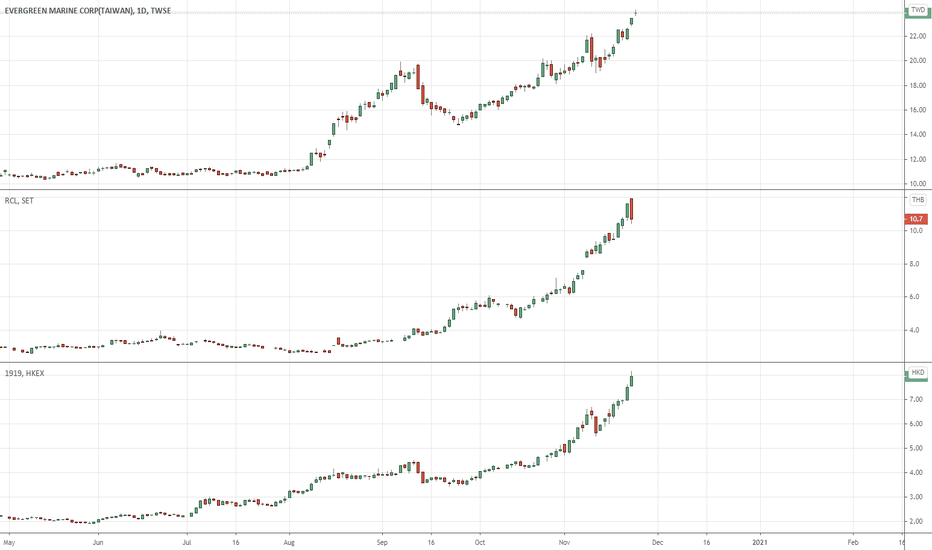

Four major shipping stocks hit new all-time highs in 2021- These four charts show how four major shipping stocks made parabolic advances off the February 2020, post-COVID-crash lows.

- The four charts are in log scale and each depicts five years of price action.

- Was the pandemic and QE infinity a boon for shipping? You bet it was.

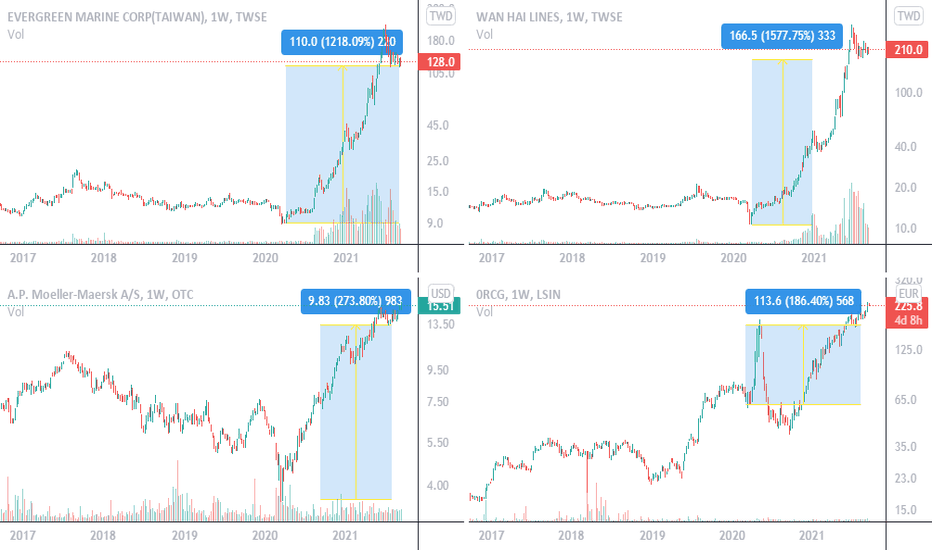

Four major shipping stocks hit new all-time highs in 2021- These four charts show how four major shipping stocks made parabolic advances off the February 2020, post-COVID-crash lows.

- The four charts are in log scale and each depicts five years of price action.

- Was the pandemic and QE infinity a boon for shipping? You bet it was.

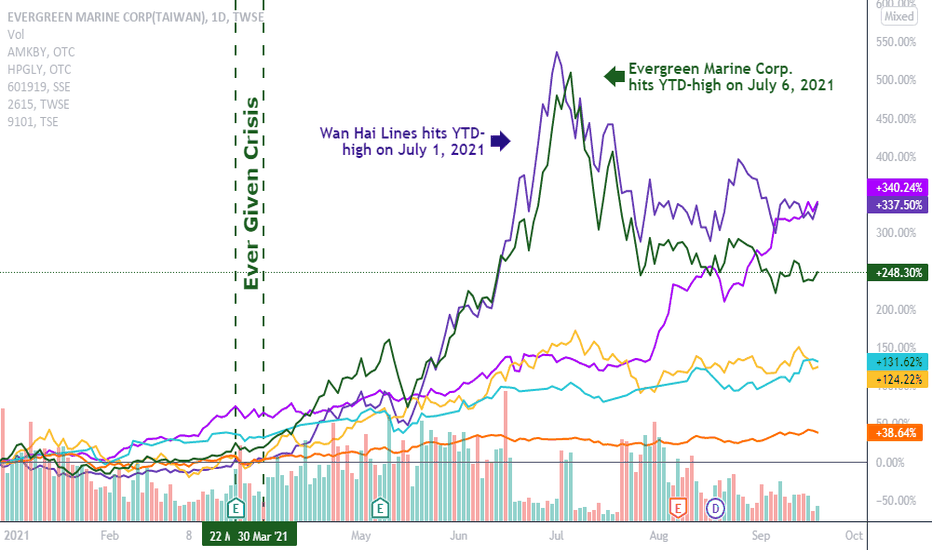

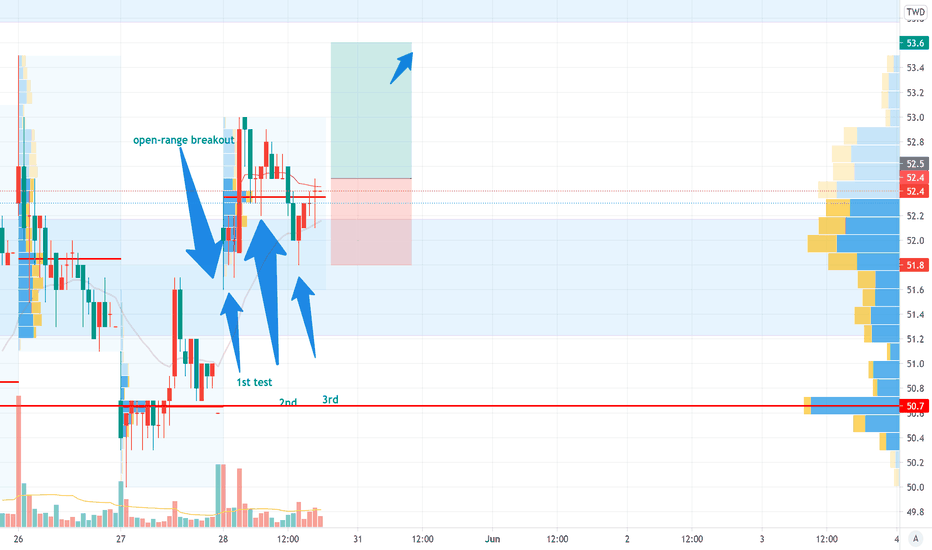

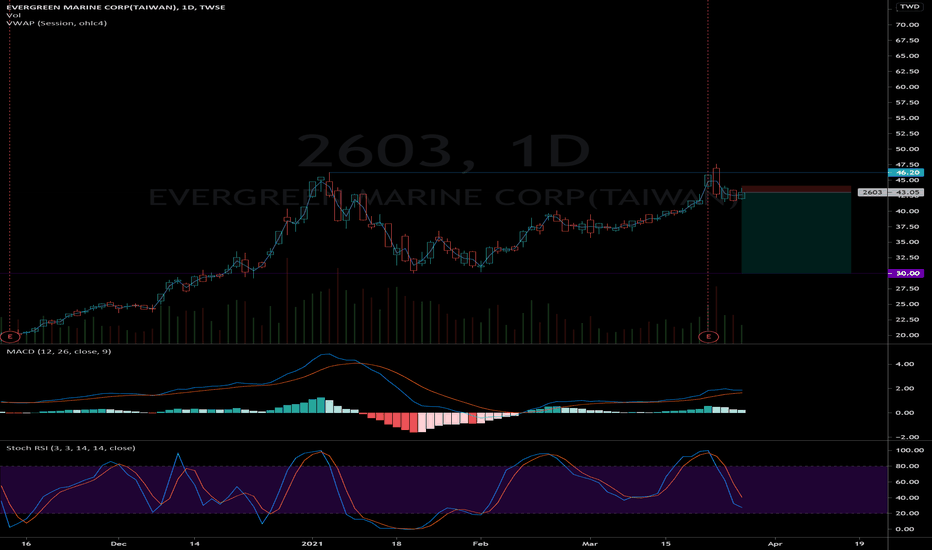

Suez Canal FiascoWe've all heard about the big ass ship stuck in Egypt's Suez Canal last week. On Tuesday morning (3/23) the 'Ever-Given' vessel, leased by Taiwanese Company EVERGREEN; was caught up in a 'Darude-like' sandstorm causing over 10 billion in damages so far and unforetold shipping delays.

The Suez accounts for 30% of imports coming into Europe from Asia. There are currently 150+ container ships caught in this costly traffic jam, where the estimated costs of waiting are upwards of $400Million/hour according to various news sources.

Looking for ways to capitalize on News events? If you have access to Asian markets; take some shorts on lease owner EVERGREEN 2603. They had positive reported earning on Monday just one day before the shitstorm and there's a definite shift in momentum back to 30-lvl support.

Also consider short positions in the vessel owner; Japanese Shoei Kisen KK. UK P&I Club Insurance is meant to cover pollution and injury, not cover hundreds of lawsuits for this costly conundrum..

Let's get it!

static01.nyt.com

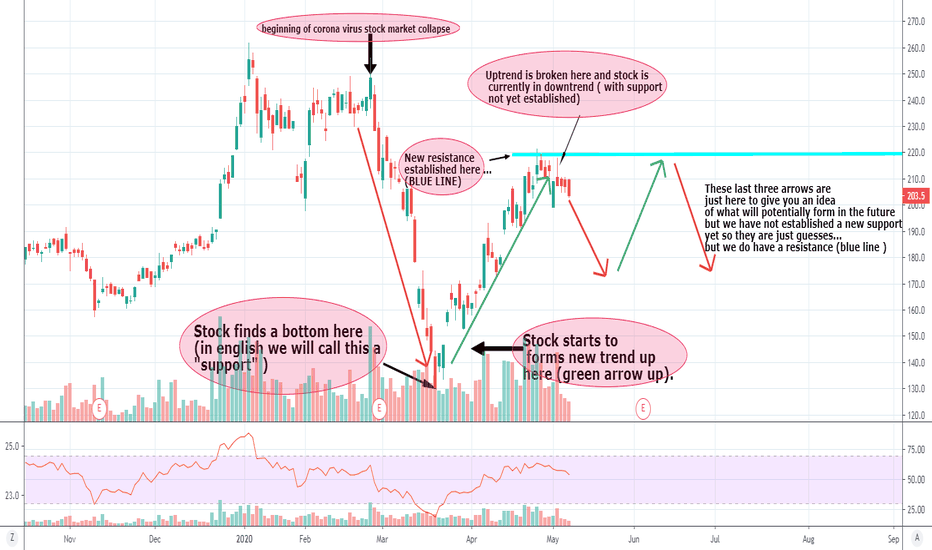

Taiwan Ticker 2492 Technical Analysis ( Walsin Tech Corp )Hi Vanessa ,

Its a little difficult for me to do a proper fundamental analysis on this stock of yours as information is a little harder to source using my current system .

However I was able to determine a bit ...

Overall the fundamentals were good , but I did get some conflicting information from different websites on their fundamental values and I don't want to give you any false info.

So , In short 2018 was an amazing year for this company but sales and earnings significantly declined after wards , although they still had positive EPS and revenue earnings reported for 2019.

They also seem to have good current cash on hand, which is good, although earnings for 2020 seem to have low expectations but I was getting some inconclusive data regarding this so I am not too sure what they are forecasting .

On their website, I did notice, on may 4th the company announced the monetary loan balance increased by

an amount exceeding 2% of WTC's net worth on its latest

financial statement which is not good news but not the end of the world either. Lots of companies are taking on additional debt to get through these times . I found that information on their websites "investor relations" section which I suggest you also take a look at too. Their website is www.passivecomponent.com, there was a Chinese version too.

I noticed they seem to be scheduled to report earnings soon too , earnings reports can greatly sway a stocks value up or down . Trading views chart tells me they are supposed to report earnings on June 2nd but I find trading views earnings dates are sometimes incorrect so I suggest you look into this on the companies Taiwanese news fees ect . It is possible that they may report a suprise in earnings and revenue and you can research their recent news reports to get an idea of your prediction of this . Most companies are reporting losses and often negative eps/earnings reports at this time though...

In any case , I think that generally speaking they are not a bad company to invest in but on technicals they are trending down at this time and my guess is they will find support around 173 . Thats just a guess though and there are many things that can change this, seeing it develop a support will tell us much more .

As I understand , you bought into this stock around 240 , obviously before the market crash . You never know but there is a good possibility that this company very well may be worth considerably less by the time this market recovers and personally , I feel now is a good opportunity for you to sell and take your loss . Sure , the stocks price could return to the 240 mark but given the circumstances and the fact that the company's debt currently exceeds its net worth, I would sell and take my loss at this time . It is in a downtrend right now though so perhaps you could sell now and buy back in after it finds a new support and then sell when it hopefully returns to the resistance . Ultimately, your call and I definitely do not want you to act only based on my advice , you need to weigh the info and decide yourself .

More important than wether you sell this or hold it though is , in the future , always always always decide on a stop loss and set one! Most professional investors will aim to never lose more than 2-5% on a single trade .

Disclaimer : My batting average seems to average between 0.60 and 0.70 ,meaning I am wrong about my guesses around 35%-40% of the time . This is all just to be regarded as a hypothesis. I am often wrong, just saying.

Good luck my friend :)