BOL Uptrend StartingBOL has turned bullish after a long downtrend, now trading at 6.20 THB. Price has broken above the 52-week SMA (5.55 THB), suggesting a potential shift into a new uptrend.

Analysis

Price reclaiming above the long-term moving average indicates a trend reversal.

RSI is currently at 65 — not yet ove

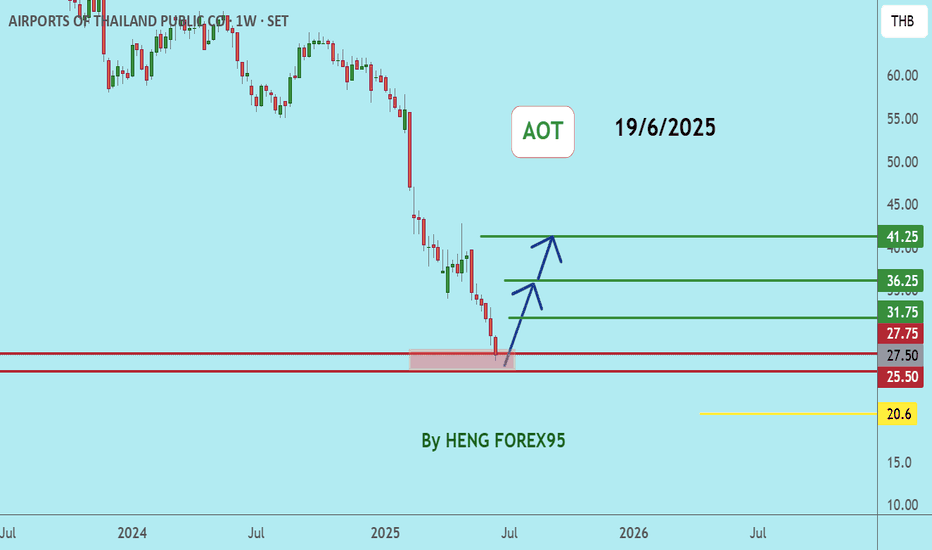

AOTAOT price is now near the support zone of 27-25. If the price cannot break through the 25 baht level, it is expected that the price will rebound. Consider buying in the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suita

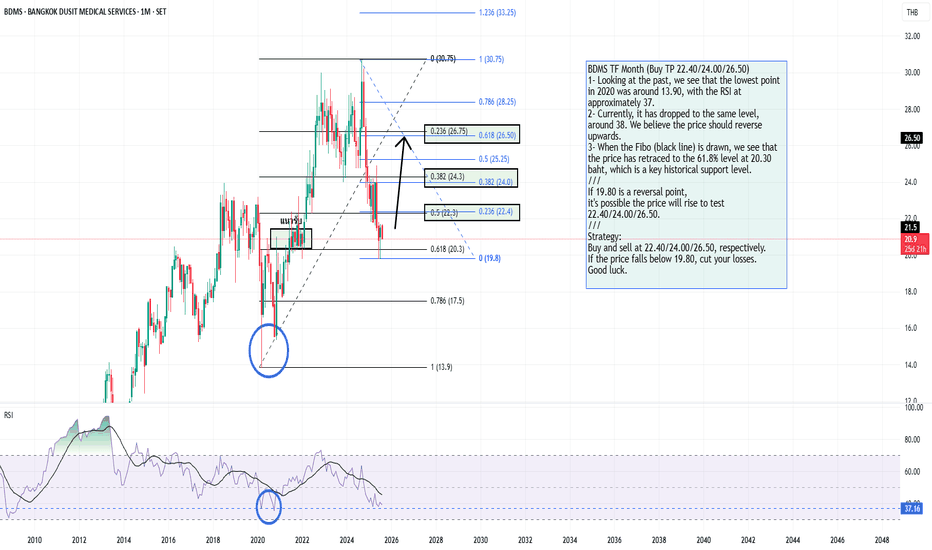

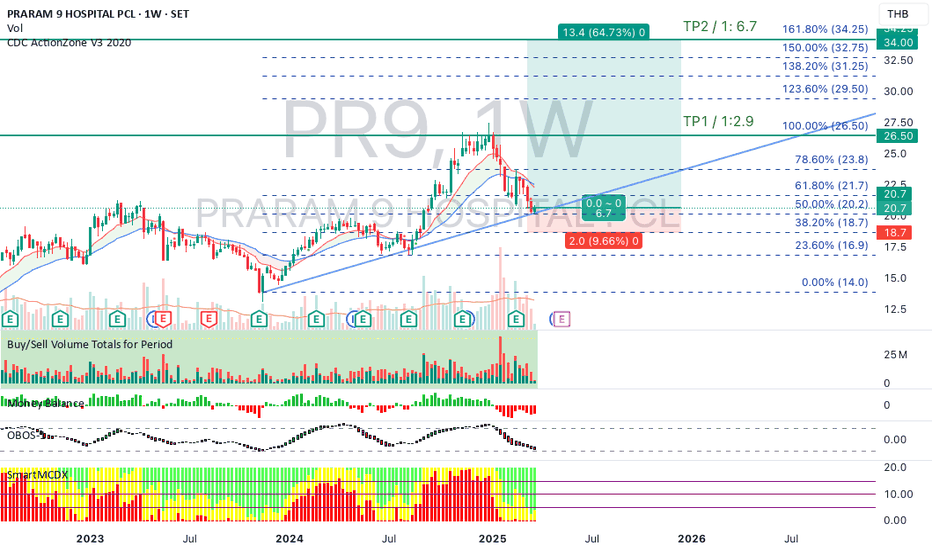

BDMS TF Month (Buy TP 22.40/24.00/26.50)BDMS TF Month (Buy TP 22.40/24.00/26.50)

1- Looking at the past, we see that the lowest point in 2020 was around 13.90, with the RSI at approximately 37.

2- Currently, it has dropped to the same level, around 38. We believe the price should reverse upwards.

3- When the Fibo (black line) is drawn, we

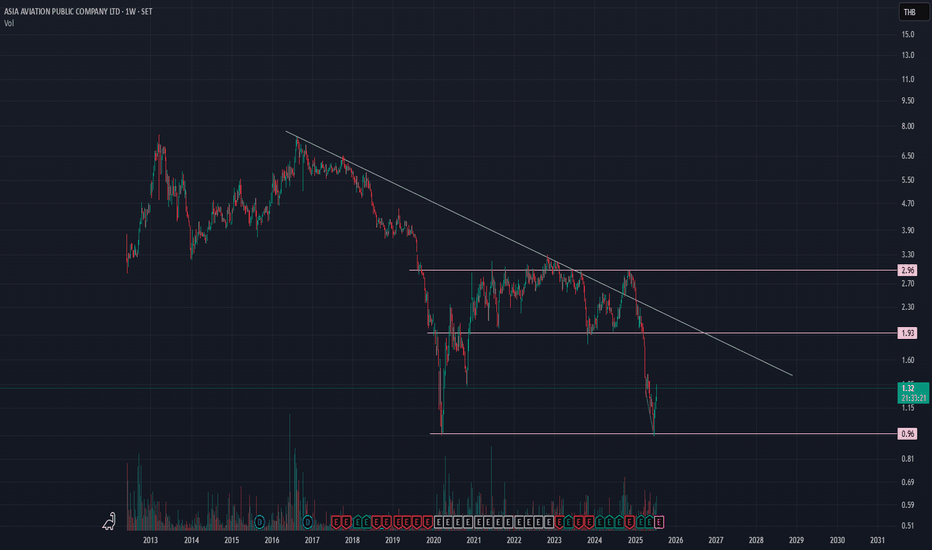

AirAsia. Most popular domestic airline of Thailand.AirAsia has become most popular domestic airline in Thailand. They now hiring more and more mechanic and investing more airplane on their fleet.

The chart showed false break-out once because SET pull it down the whole market which normal.

Buy now not the Q4. Even how bad Thai economy been but we

NEX, BYDSET: NEX & BYD Technical Analysis - Key Resistance Levels Ahead

NEX POINT PCL (NEX) - BULLISH REVERSAL**

- **Current Price:** 0.98 THB

- **Target 1:** 1.02 THB (+4.1%)

- **Target 2:** 1.05-1.07 THB (+7.1% - +9.2%)

- **Stop Loss:** 0.85 THB (-13.3%)

- **Risk/Reward:** 1:2.5

BEYOND SECURITIES PCL (BYD

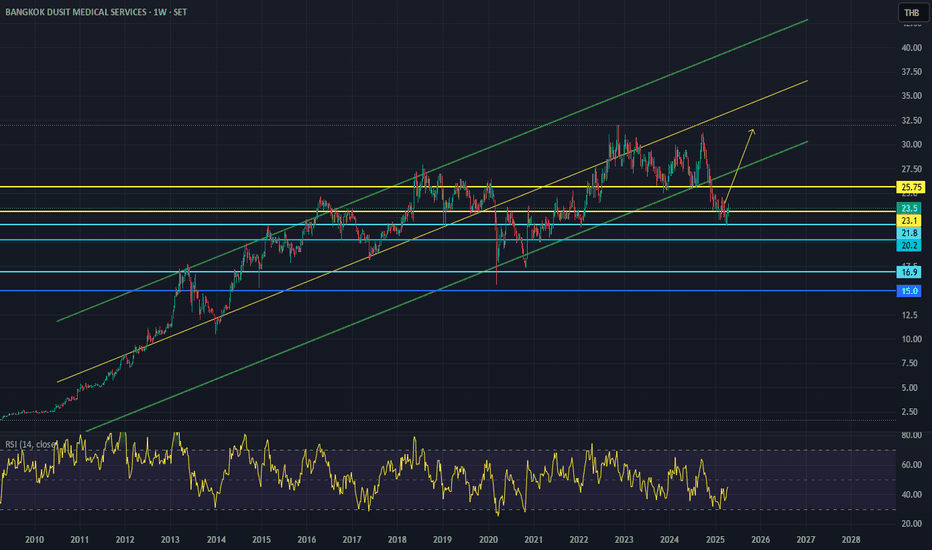

BDMS BDMS: Perfect Entry Point? 🏥📈

Looking at BDMS (Bangkok Dusit Medical Services) - this setup is screaming opportunity! 🔍

The chart is telling us a clear story:

Price just bounced off the long-term uptrend channel support (green line) 💪

Currently trading at 23.5 THB with a perfect rejection at the 23

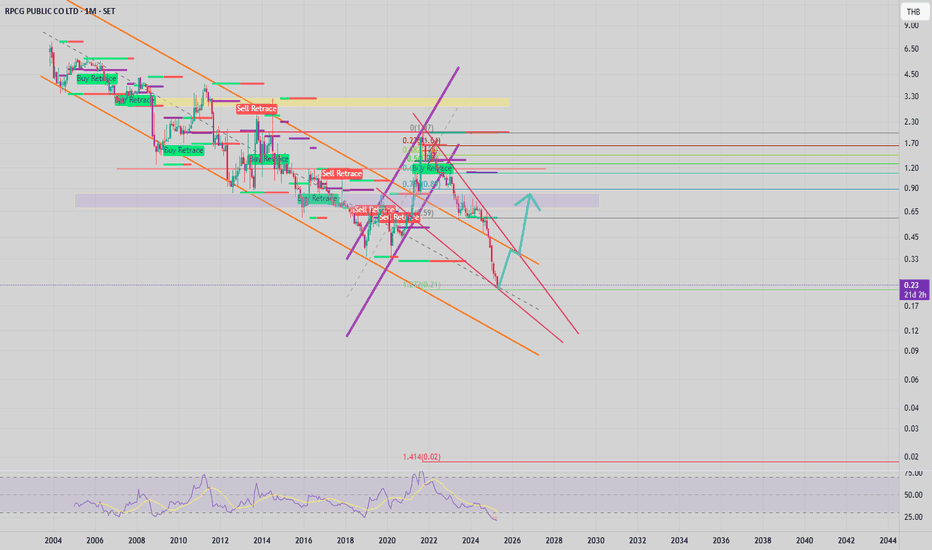

RPC falling wedge pattern? RPC has historically exhibited occasional large bullish candlesticks indicative of sudden upward momentum. Currently, the stock is significantly oversold, trading at its lowest price on record. It has now retraced to the 1.272 Fibonacci level, suggesting a potential setup for a rebound or a technica

See all popular ideas

Community trends

Hotlists

Stock collections

All stocksTop gainersBiggest losersLarge-capSmall-capLargest employersHigh-dividendHighest net incomeHighest cashHighest profit per employeeHighest revenue per employeeMost activeUnusual volumeMost volatileHigh betaBest performingHighest revenueMost expensivePenny stocksOverboughtOversoldAll-time highAll-time low52-week high52-week lowSee all

Sector 10 matches | Today | 1 week | 1 month | 6 months | Year to date | 1 year | 5 years | 10 years |

|---|---|---|---|---|---|---|---|---|

| Technology Services | ||||||||

| Electronic Technology | ||||||||

| Retail Trade | ||||||||

| Finance | ||||||||

| Consumer Durables | ||||||||

| Consumer Non-Durables | ||||||||

| Health Technology | ||||||||

| Producer Manufacturing | ||||||||

| Consumer Services | ||||||||

| Communications |