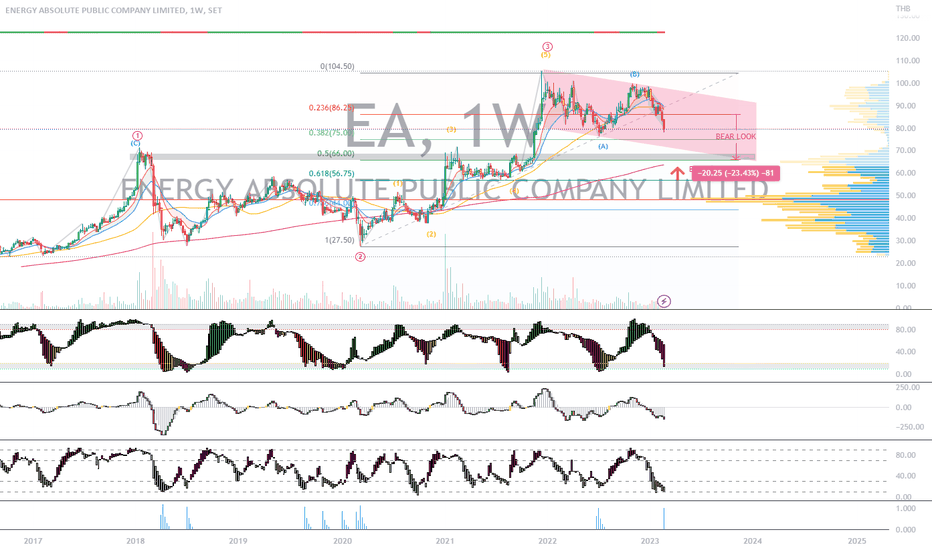

EA | Wave Analysis | Short Position - 3.C wave correction -25%Price action and chart pattern trading:

> A possible 3.C wave correction position - pullback entry at EMA20 zone - Target EMA200W / Fibo 0.5 retracement previous major 1 wave zone -25% downside - Stoploss @ wave 3.b position -10-12%

> Fundflow RSI tapping oversold zone but no bullish divergence signal

> BBD below 0 baseline potential lower price trending

> KDJ Stochastic downtrend ribbon continued

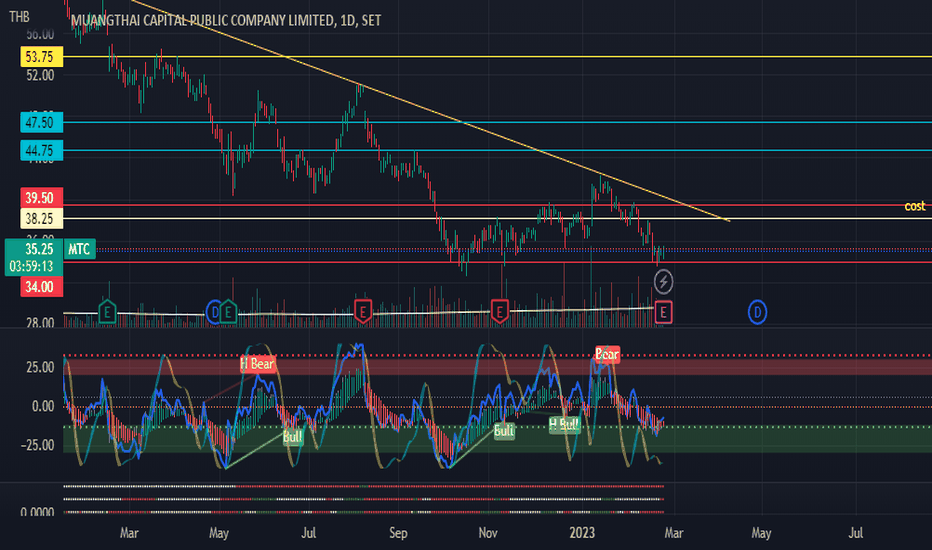

SCB | Wave Projection | Pullback Trade @ Bullish Pennant SupportPrice action and chart pattern trading:

> An possible ABC correction scenario with bullish pennant pattern or descending triangle

> The price currently SMA20 crossing below SMA50 with MACD crossing down bearish support indicator

> PULLBACK TRADE @ bullish pennant support level at a further breakdown with local doubled top pattern targeting -4.5% downside to fibonanci 0.786 extension of previous A-wave support level.

> Risk Reward Ratio 3:1

Always trade with affordable risk and respect your stoploss!

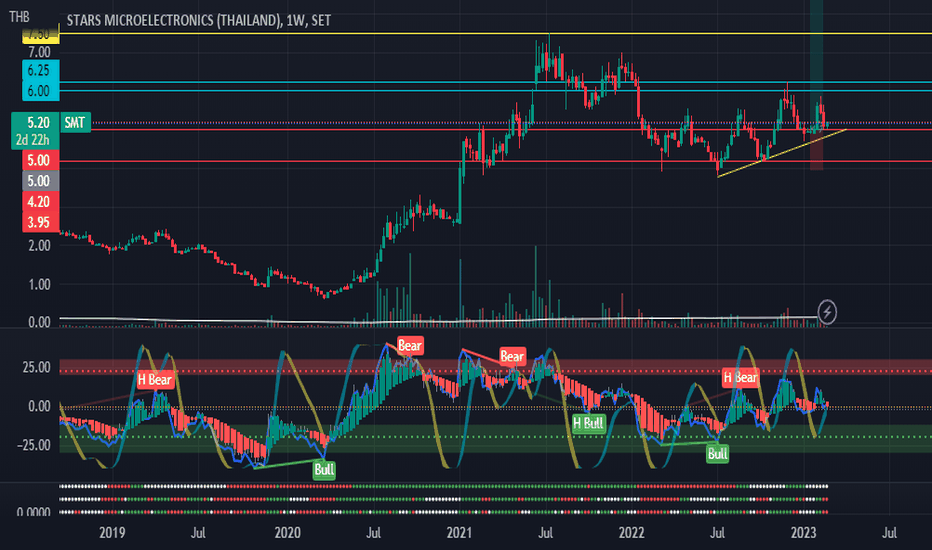

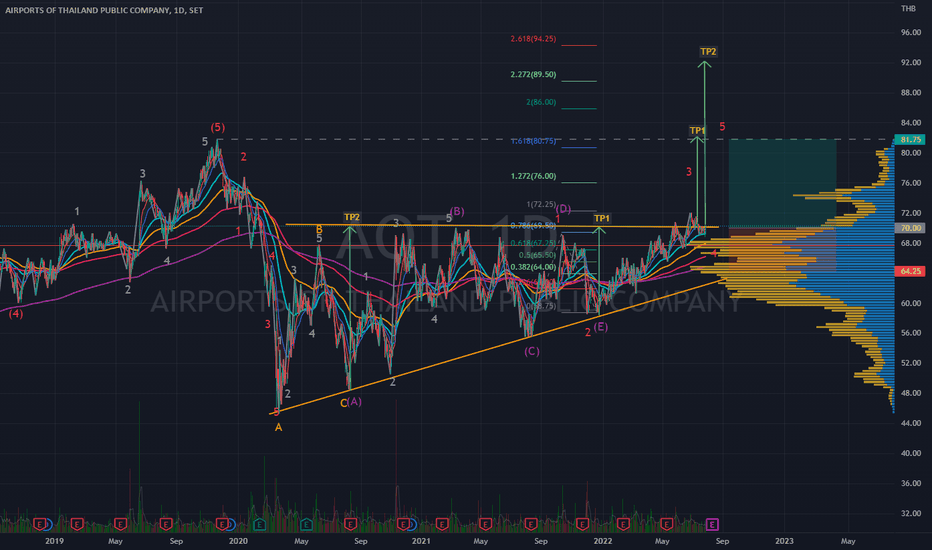

AOT | Wave Projection | Rising triangle ABCDE Uptrend TargetPrice action and chart pattern trading setup

> Rising triangle ABCDE pattern @ breakout neckline position

> TP1 estimated @ height of E wave +17% upside 1.618 extension of CDE wave

> Stoploss @ triangle support -8% downside

> RRR: 2:1

Always trade with affordable risk and respect your stop

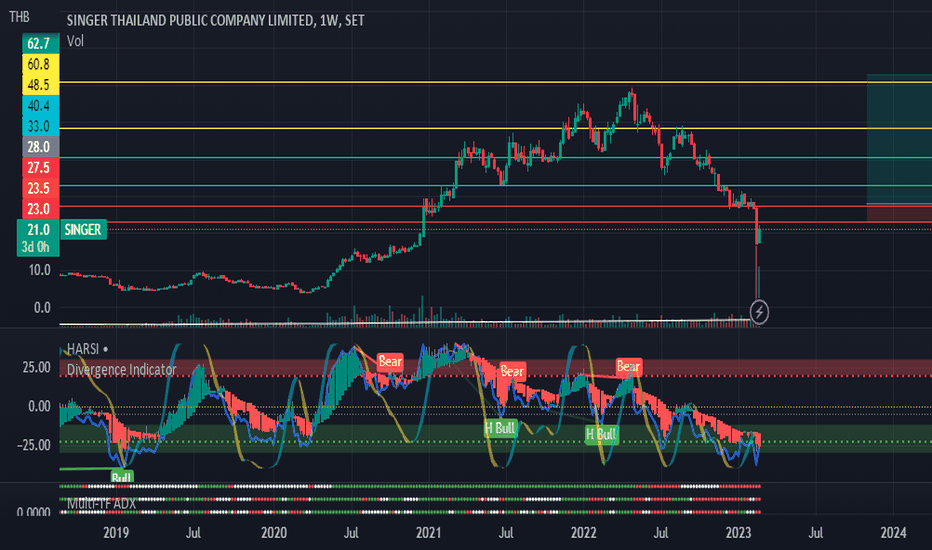

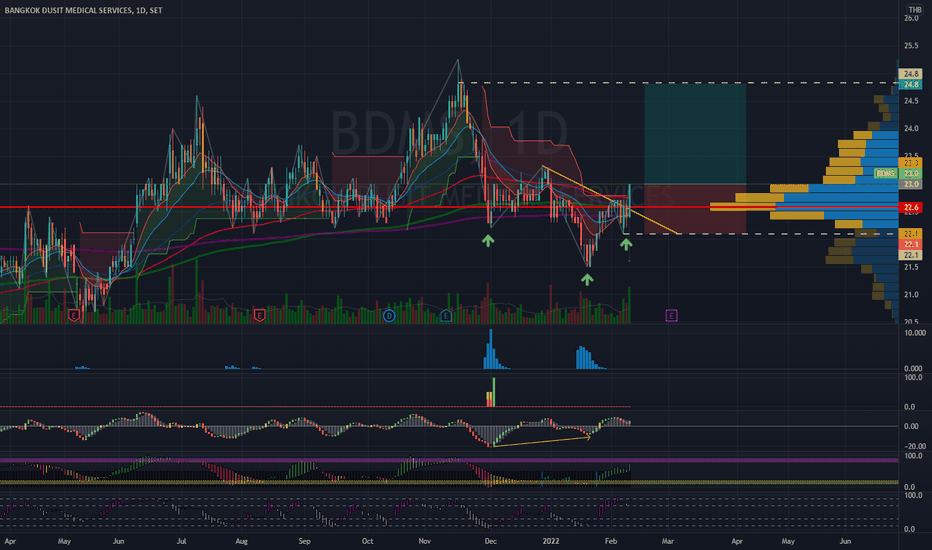

BDMS | Inverted Head & Shoulders | Entry @ Breakout SetupPrice Action & Chart Pattern Short-term Trading

> Inverted Head & Shoulders

> Entry @ Breakout Setup

> Target at previous high

> Stoploss @ right shoulder

Indicator:

> Banker Smart Money & Banker Chip Volume Support at significant level

> BBD bullish divergence crossed above baseline

> Banker Fundflow uptrend but not overbought

> KDJ ribbon on uptrend above 70

Trading with affordable risk ratio 2:1 for short term trade

Always respect your stoploss

ADVANC | Elliott Wave Projection | Complex Inverted H & SPrice action and chart pattern trading

> Elliott Wave projection possible the end of Intermediate 4-wave downtrend

> Complex inverted head & shoulders formation ABC uptrend correction

> Bullish divergence in previous 5-wave downtrend confirmation

> Entry @ neckline breakout - RSI downtrend breakout

> Target @ C-wave uptrend 1.618 extension of A-wave near volume profile POC

> Stoploss @ B-wave right shoulder

> RRR: 2:1

Always trade with affordable risk and respect your stop

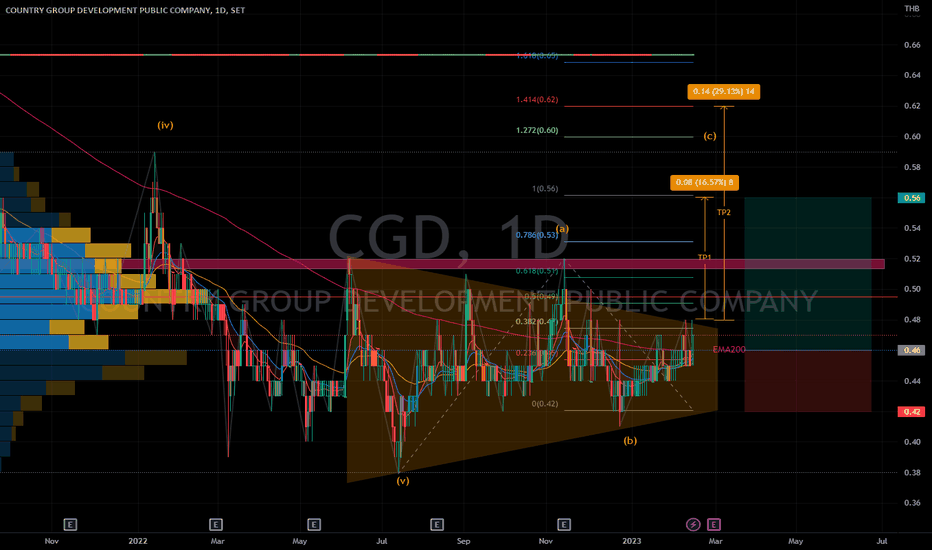

CGD | Elliott Wave Analysis | Triangle Breakout +30% UpsidePrice action and chart pattern trading:

> The current price crossover above EMA200 with squeezed symmetrical triangle pattern.

> A possible ABC 1-wave uptrend breakout with potentially +20 - 30% upside

> Entry@EMA200 zone

> Target 1 @ 0.786 - 1.0 fibonanci extension level +20% upside

> Stoploss @ right shoulder pattern wave b position -8%

Always trade with affordable risk and respect your stoploss

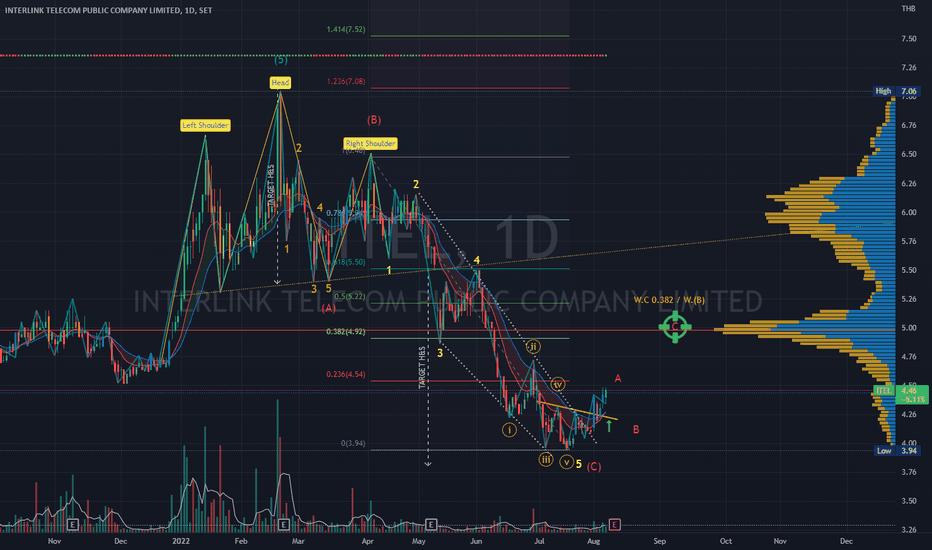

ITEL | Elliott Wave Projection | Falling Wedge BreakoutPrice action and chart pattern trading

> Elliott wave downtrend falling wedge breakout

> Inverse head & shoulders reversal pattern with breakout

> Entry @ pullback B-wave retraced near neckline zone

> Target @ 0.386 retracement of (A) wave - volume profile point of control zone

> Stoploss @ the lowest head position -10% downside

> Risk reward ratio: 2:1

Always trade with affordable risk and respect your stoploss

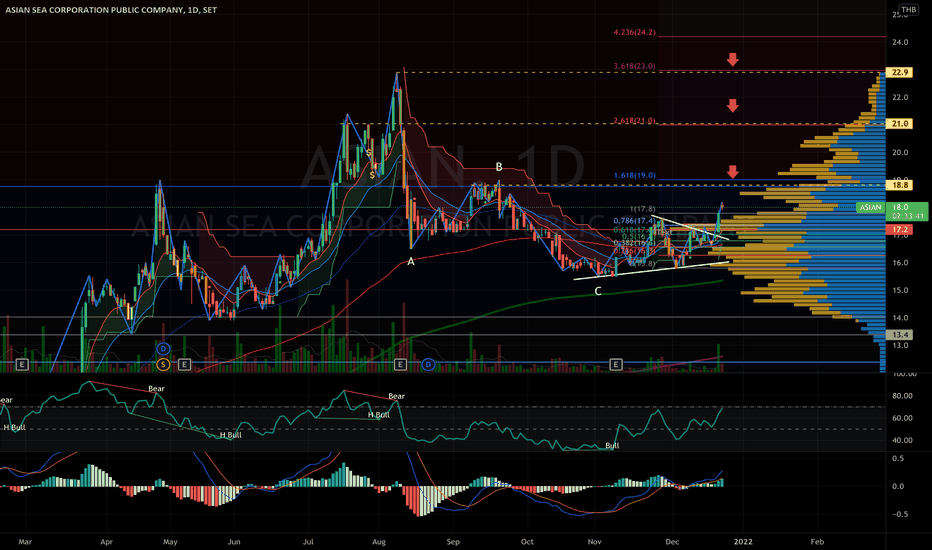

ASIAN | Triangle Breakout | Target for uptrendASIAN | Thailand Set Index | Food Sector | Target estimated for uptrend minor impulse wave

> Strong momentum breakout of triangle with area of consolidation support

> Breakaway candlestick - possible BUY ON DIP

> RSI & MACD Bullish signal

Always respect your stoploss

Good Luck

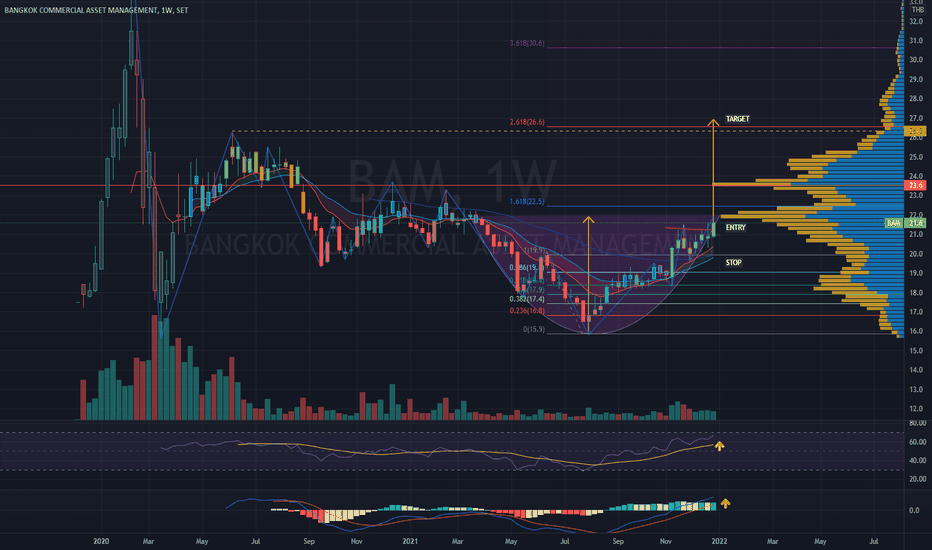

BAM | CUP & HANDLE | Estimated TARGET | ENTRY PositionBAM | Thailand SET Index | Financial Sector | Chart Pattern Trading

Chart Pattern: Cup & Handle Target Estimated on weekly timeframe

Price Action: Entry position - Buy on breakout

Indicator: RSI and MACD Bullish signal support with large gap above RSI MA and MACD signal line above 0

This is a medium to long term buy, Stop-loss possibly a bit more 5-10% below entry point

Trade with AFFORDABLE risk

Trust in your SYSTEM INDICATOR

Always respect STOP-LOSS

Good Luck

HNY 2022

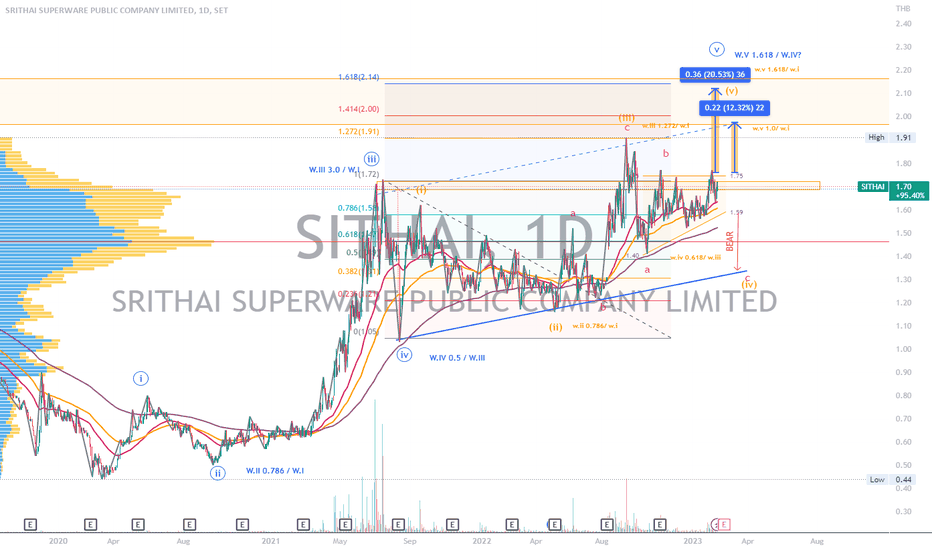

SITHAI | Elliott Wave Uptrend 5-Wave Projection | Ascending ChPrice action and chart pattern trading: Elliott Wave 5 wave projection

> Ascending channel global pattern with i - iv wave ending diagonal formation : ii wave retraced 0.786 of i wave, iii wave ABC diagonal extended 1.242 of i wave with a bull outlook of further rising.

> 4-wave could retrace below the current local rising triangle wave as a temp bear outlook.

> Final 5 wave projected between 1.0 of local i wave and 1.618 extension of iv wave

> RSI and MACD bullish signal above baseline.

Always trade with affordable risk and respect your stoploss.

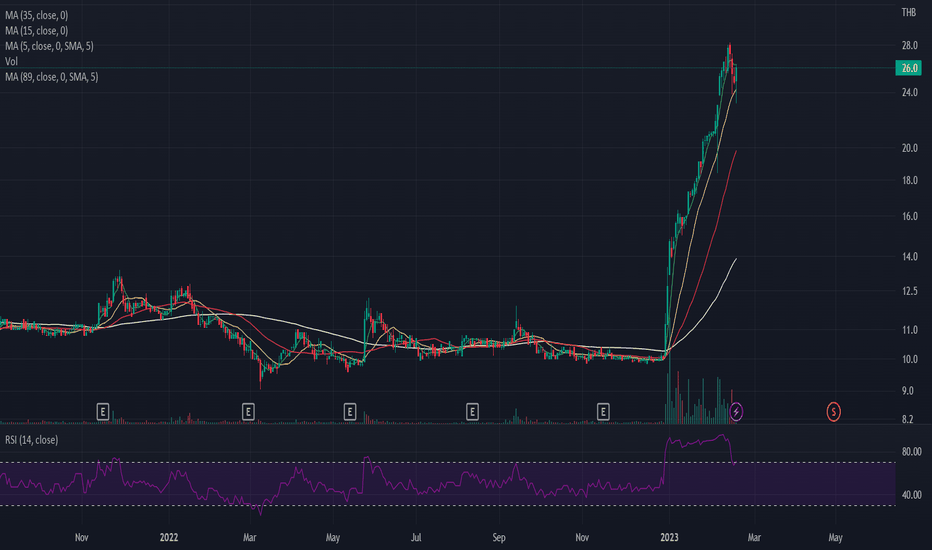

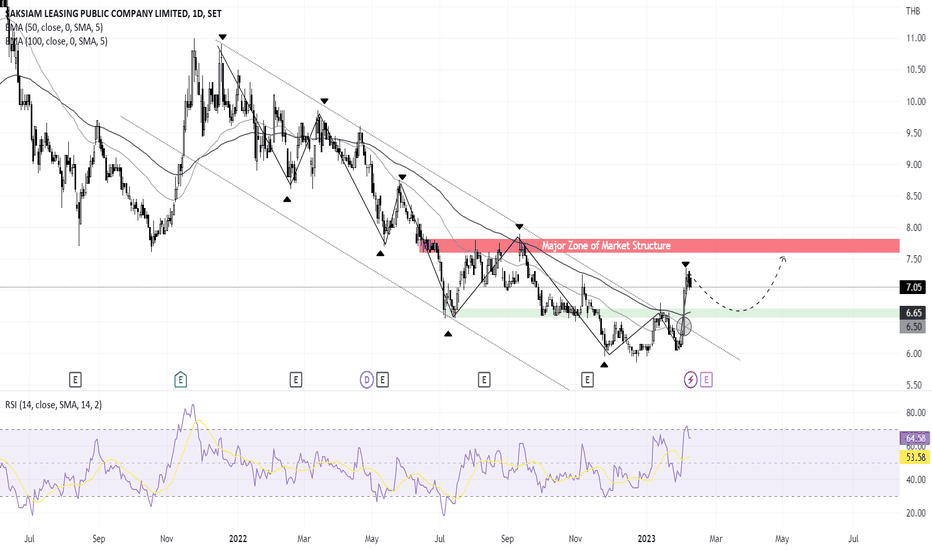

SAK bullishness*NO fundamental analysis*

SAK is on the rage after breaking out the significant trend line. Now, it is heading to the major zone of the market structure. If it breaks the red zone, it will lead to a huge move to the upside.

The RSI is also supporting the price on potential bullishness.

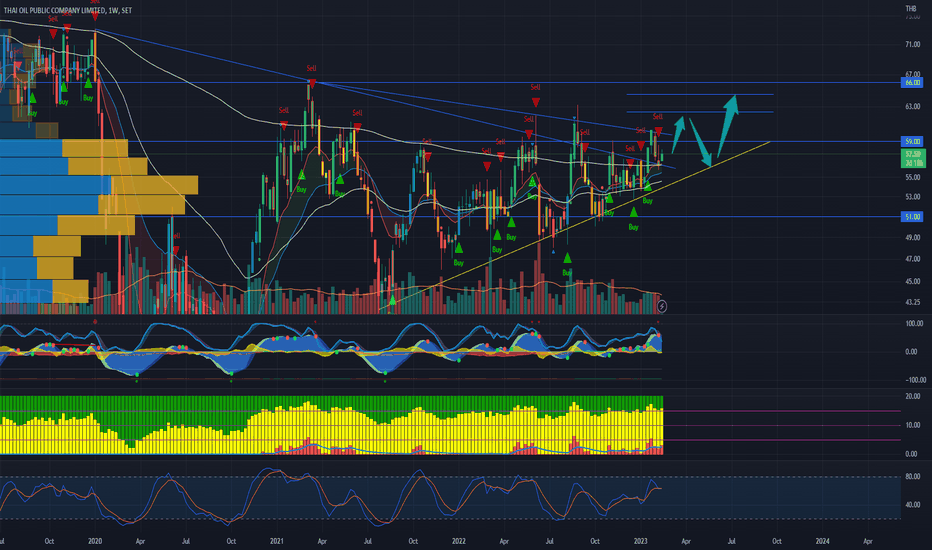

PTTGC upside*NO fundamental analysis*

My bias is on a long side for PTTGC, a stock in SET.

Technically, the LH and the main trend line is broken. It implies that bearishness has shifted out from the market. It is a better try to buy, but we need to be patient for the throw back to demand zone.

The RSI is getting hotter which significantly shows bullishness in this stock.

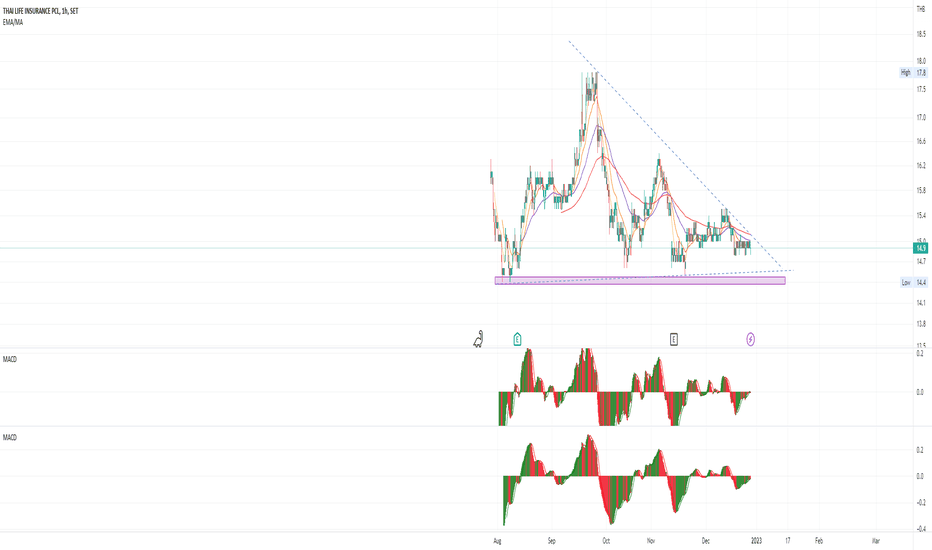

BTG | Elliott Wave Projection | Inv. H&S Breakout +8%Price action and chart pattern trading setup:

> A potential reversal pivot point with an inverted head & shoulders breakout and pullback ENTRY

> Target: 1.0-1.618 fibonanci extension ABC uptrend wave +7-8%

> Stop: Inv. head zone position -4%

> RRR: 2:1 minimum

Always trade with affordable risk and respect your stoploss

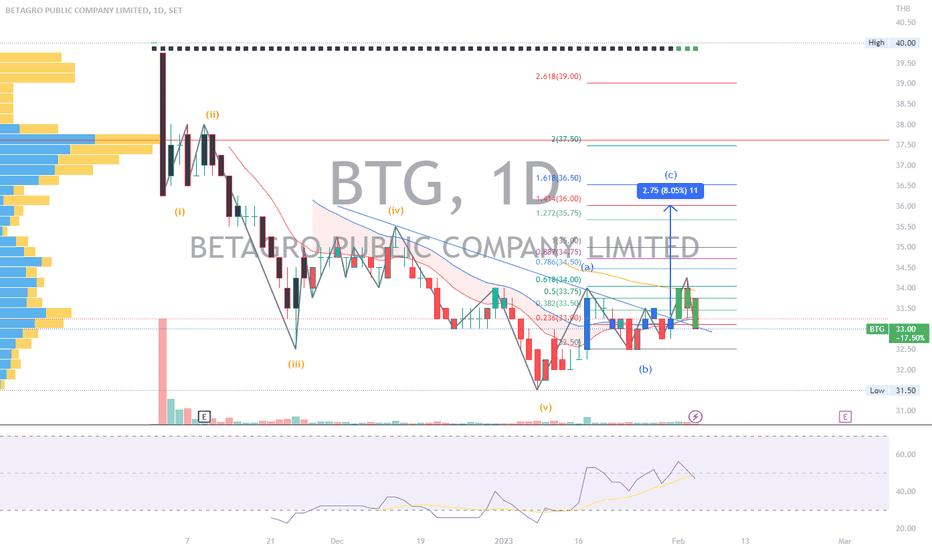

CPALL | Elliott Wave Projection | Bull Flag Pullback Entry +20%Price action and chart pattern trading

> A potential mega bull flag major 4 wave breakout & retest SMA200W for entry opportunity

> Target: 1.414 - 1.618 fibonanci extension +15-20%

> Stop: -7 - 8% SMA20W - 50W zone

> RRR: 2:1 minimum

Always trade with affordable risk and respect your stoploss

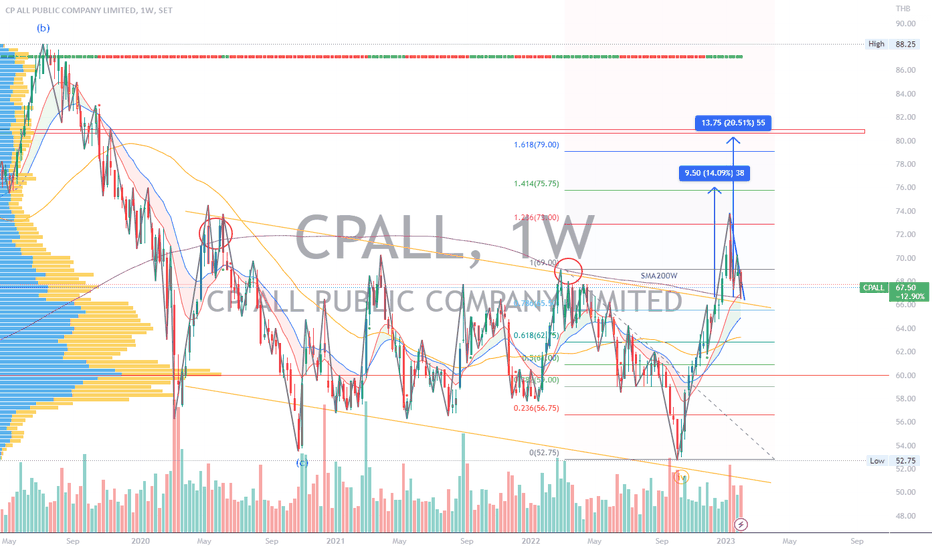

TTB | Wave Analysis | Triangle 4-wave Trading SetupPrice action and chart pattern trading

> An overall global leading diagonal pattern with a possible A -wave uptrend with minor triangle 4-wave

> Target minor 5-wave of local A wave at 0.5 - 0.618 retracement global 4 wave +8-10%

> Stoploss @ lower triangle support - 3 - 4%

> RRR: 2.5:1

Always trade with affordable risk and respect your stoploss, nothing is 100%!