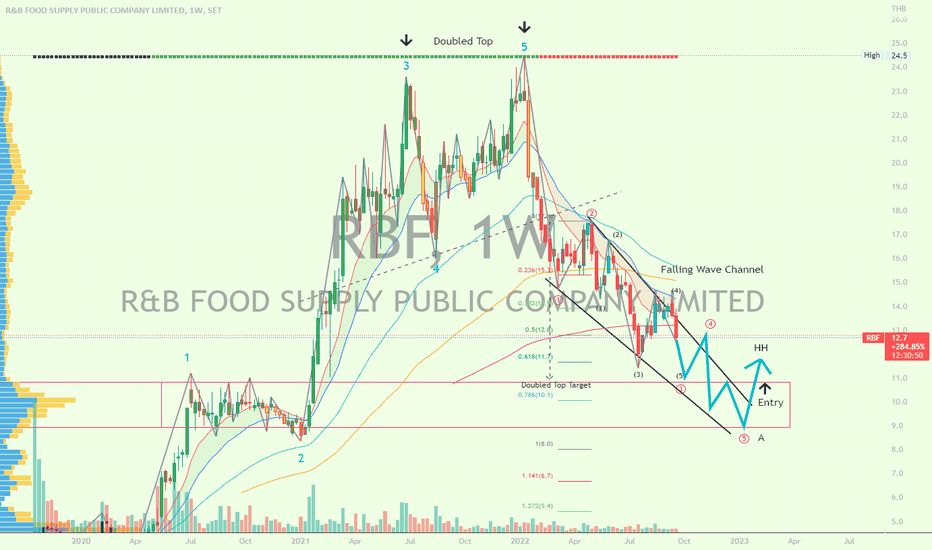

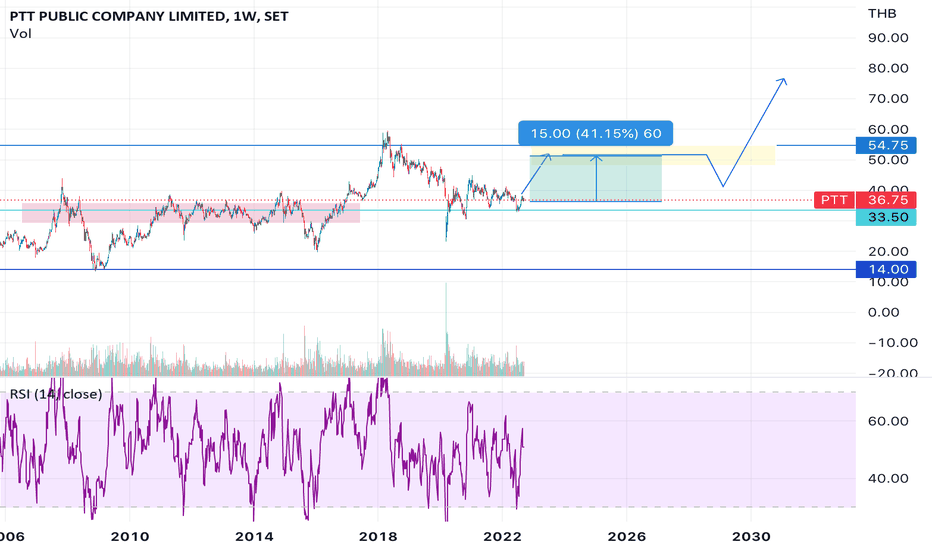

RBF | Wave Analysis | Target Projection - Ending DiagonalPrice action and chart pattern trading

> Falling wave channel pattern, possible downtrend 3-wave ending diagonal pattern

> Target doubled top zone previous wave 1 - 2 as price rejection is expected, followed by tight candlestick consolidation.

> Entry @ downtrend channel breakout from the consolidation, MACD and RSI bullish signal

> there are other strategies you can use, including using indicators and using patterns like triangle, ABCD , XABCD, and head and shoulders .

Always trade with affordable risk and respect your stoploss, nothing is 100%.

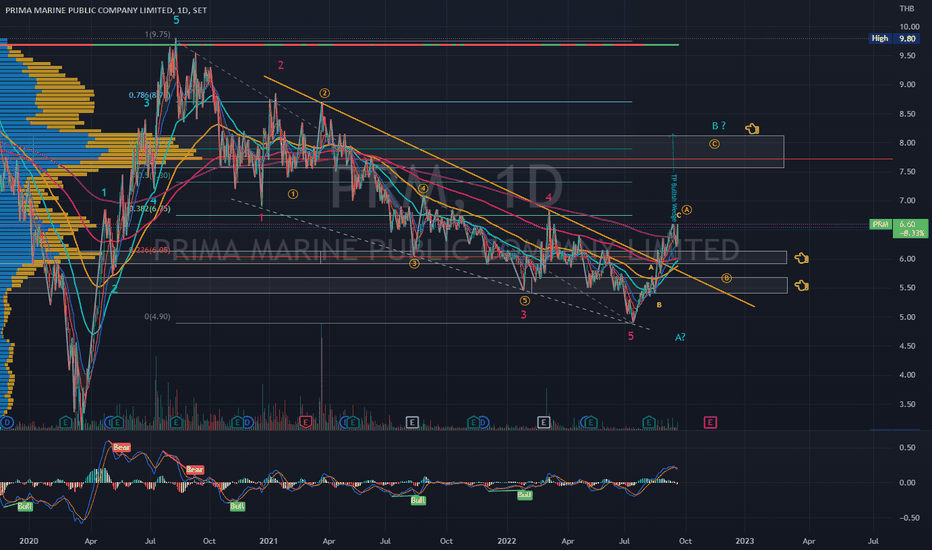

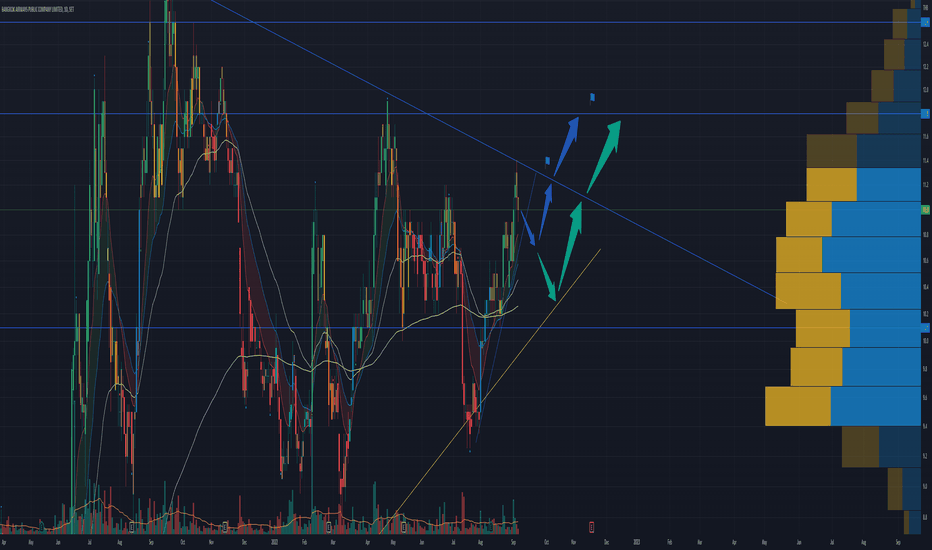

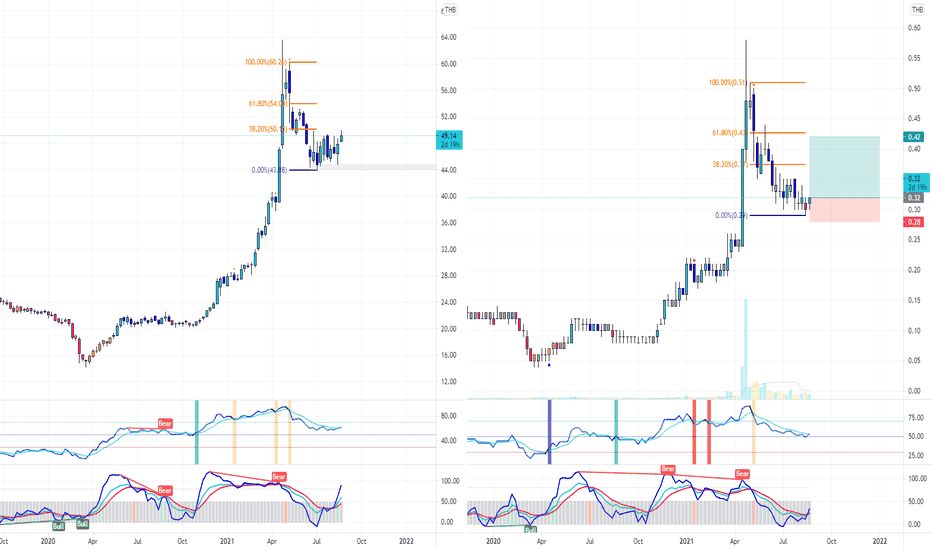

PRM | Elliott Wave Analysis | B-wave Buy on dip trading setupPrice action and chart pattern trading:

> Falling wedge correction wave with strong breakout uptrend if you didn't catch the first uptrend, here is the setup for buying the dip.

> status MACD dead-crossing the signal line, possible correction is coming.

> 1st Entry @ strong POC support near 6 baht or SMMA25 zone

> 2nd Entry @ falling wedge retest zone about 0.618 retracement

> Target B wave uptrend near 2-wave downtrend or 0.618-0.786 retracement zone also equals to the target of the falling wedge with a + 30-40%% upside.

> Stoploss @ slightly below the 2nd entry zone -10% downside.

> Risk reward ratio: 3:1

Buying the dip is an important strategy you can use to trade the financial market. Apart from the dollar cost averaging and Fibonacci retracement, there are other strategies you can use, including using indicators and using patterns like triangle, ABCD, XABCD, and head and shoulders.

Always trade with affordable risk and respect your stoploss, nothing is 100%.

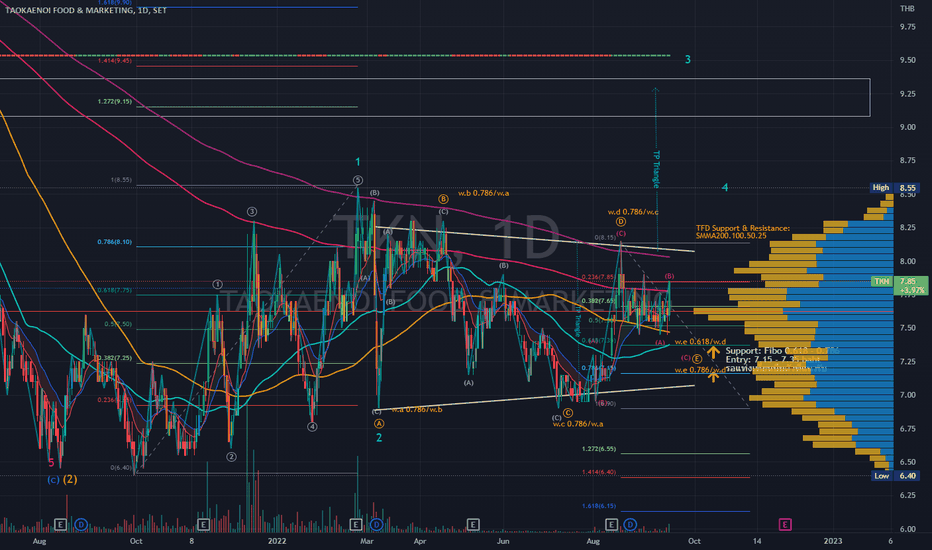

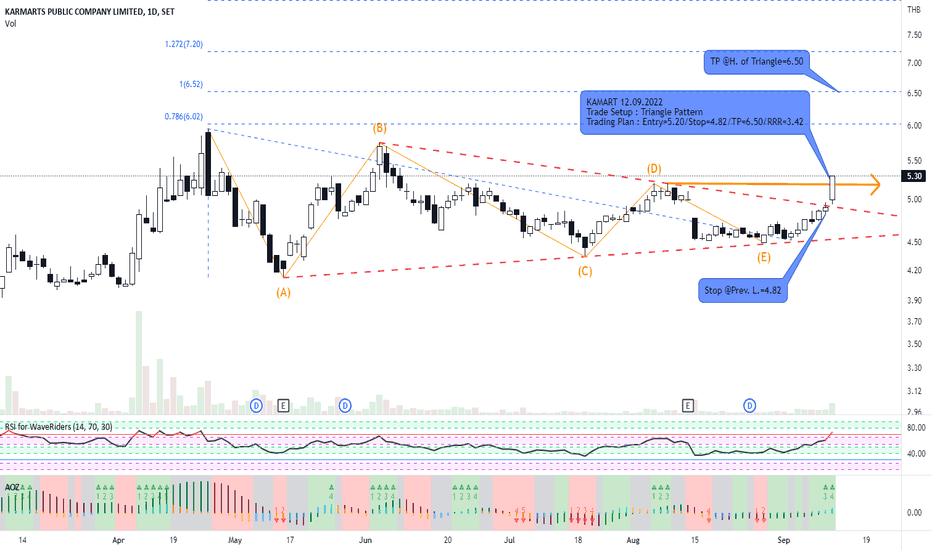

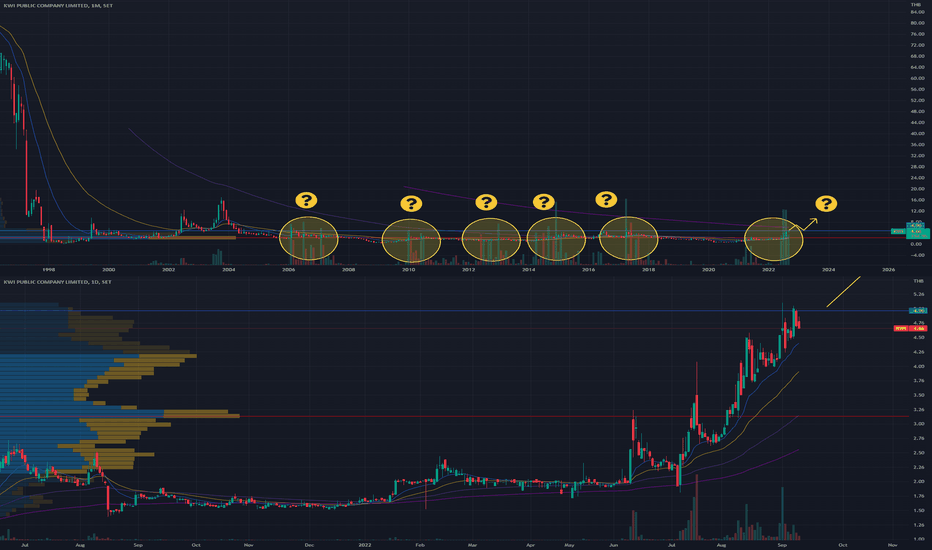

TKN | Wave Analysis | Possible Upcoming Impulse 3-Wave ForecastPrice action and chart pattern trading setup

> Wave pattern: 2-Wave Triangle ABCDE - possible upcoming wave E before rising impulse 3 wave.

> Entry: Support level SMMA50 and SMMA20 @ 0.618 and 0.786 retracement zone

> Target: 3 -wave triangle breakout plus distance of the triangle channel 1.272 extension zone of main 1-wave +15-20%

> Stoploss: Lower triangle support zone -7-8%

> Risk reward ratio: 3:1

Always trade with affordable risk and respect your stoploss

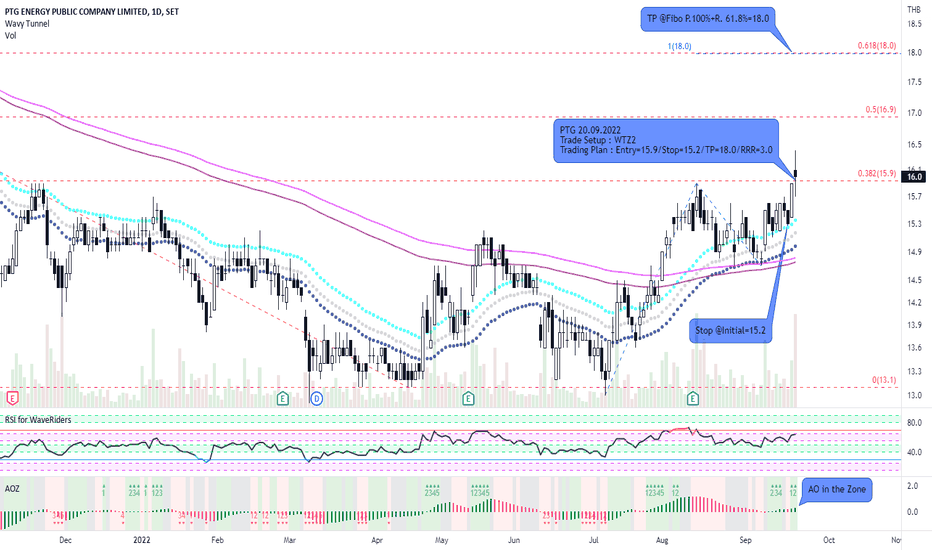

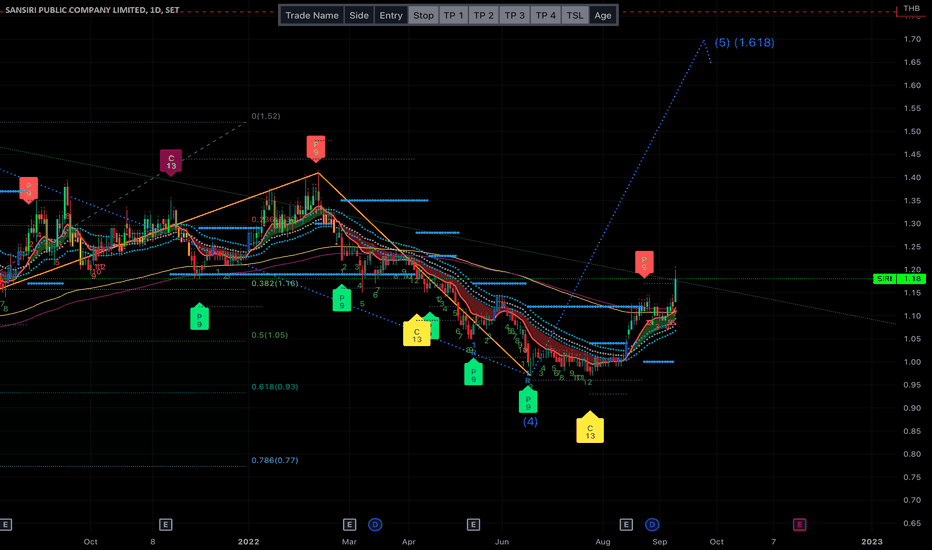

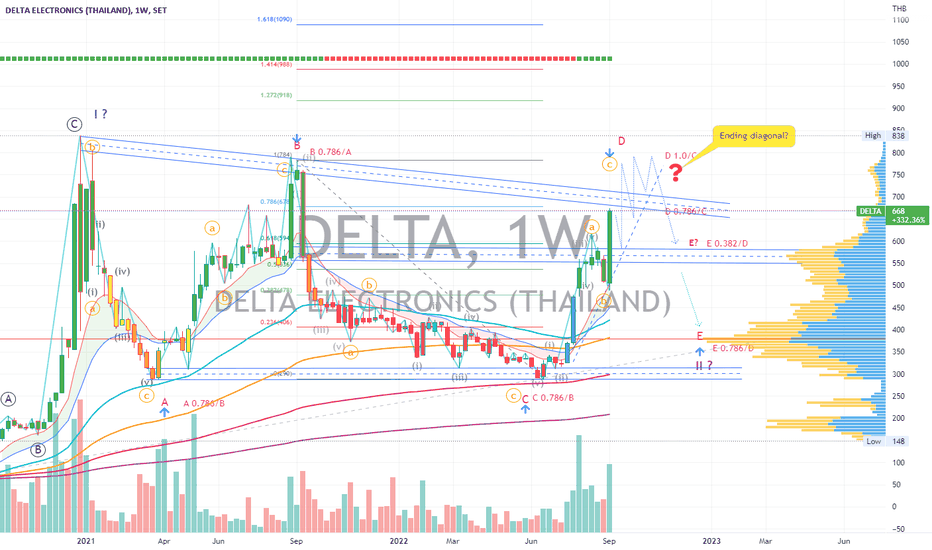

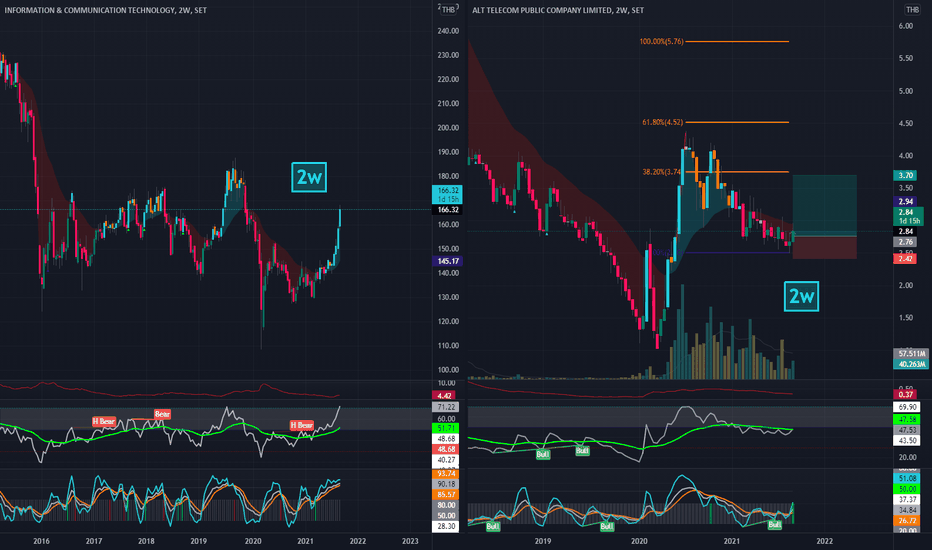

DELTA | Wave Analysis | Target Projection - Take Profit ZonePrice action and chart pattern trading setup - take profit position

> A descending triangle major wave 2 - ABCDE pattern with 3-3-3-3-3 complex structure

> Target: a possible scenario of making D-wave with an upcoming ending diagonal at the upper resistance of the triangle 0.786-1.0 retracement +15-20% upside

> Stoploss: at the previous high position a-wave - 8% downside

> Risk reward ratio: 2:1 approx.

> After completing the D-wave could possibly retrace downward trend 0.382 - 0.786 for the final E-wave which is the most difficult wave to predict.

Always trade with affordable risk and respect your stoploss

Good luck

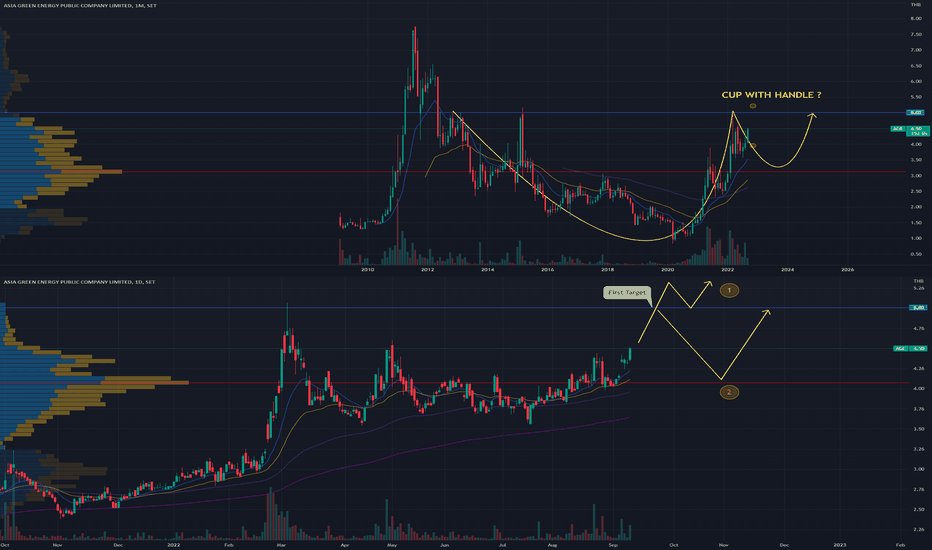

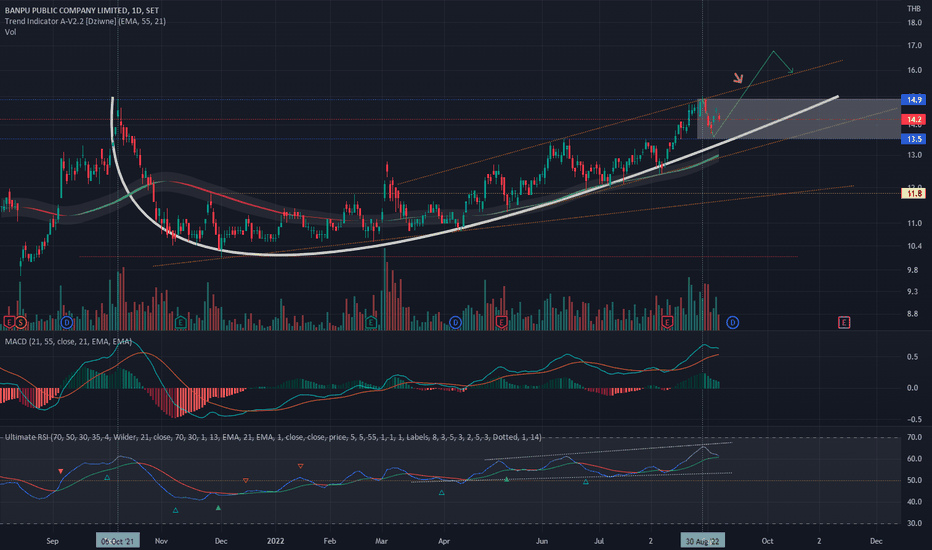

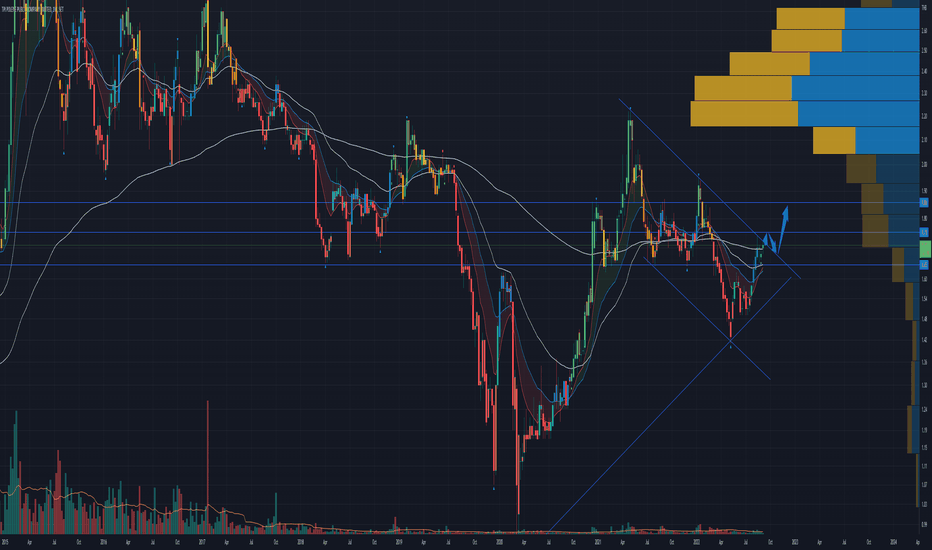

CBG | Wave Analysis | Leading Diagonal 2-Wave Price action and chart pattern trading setup

> A possible 2-wave leading diagonal pattern ending at 0.786 retracement zone

> Entry @ downtrend breakout with reversal pattern - watch for double bottom / inverse head & shoulders / triangle wave candlestick consolidation

> Target @ 0.786-1.0 retracement to previous 1-wave + 10 - 12%

> Stoploss @ the lowest position -4-5%

> Risk reward ratio: 2.5:1

Always trade with affordable risk and respect your stoploss

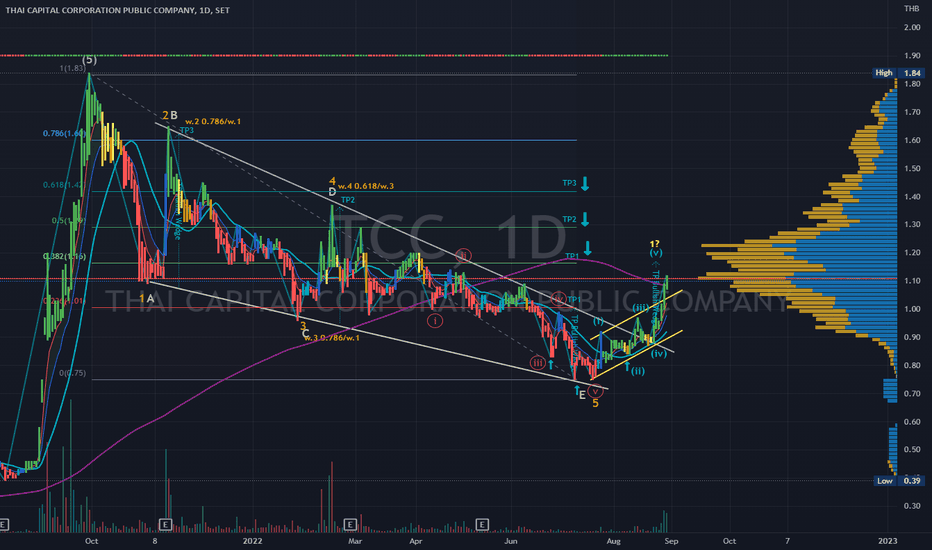

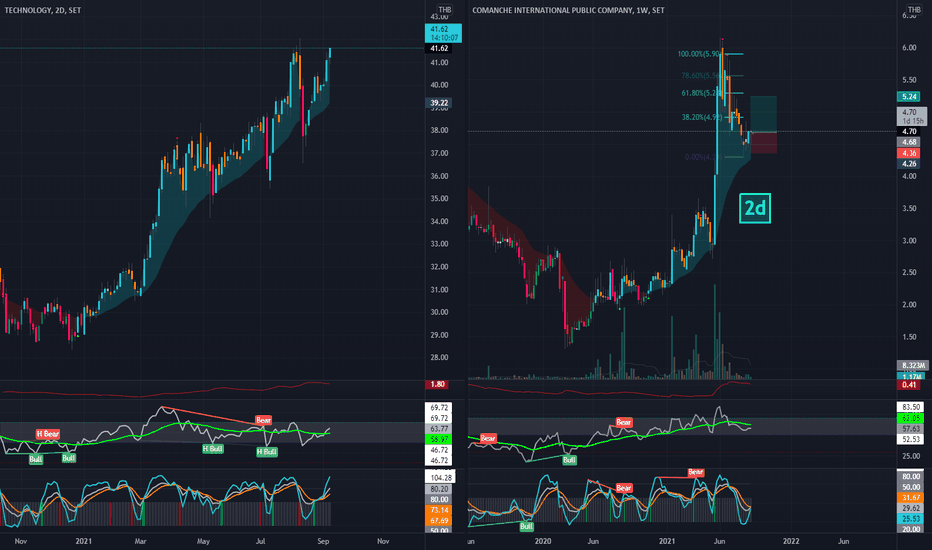

TCC | Wave Analysis | Falling Wedge Breakout TargetElliott Wave Projection - Price action and chart pattern trading

> Bullish Wedge Elliott Wave downtrend channel breakout

> Key resistance SMA200

> TP1 @ 0.382 retracement of previous wave 5 - volume profile point of control zone equal to distance of wave E to the falling wedge breakout point

> TP2 @ 0.5 retracement - upper resistance of key volume profile zone = distance of wave C > D from breakout point

> TP3 @ 0.618 retracement - equal to the distance of A>B +30%

> Entry @ Pullback SMA200 zone

> Stoploss @ SMA20 zone -10%+

> Risk reward ratio: 3:1

Always trade with affordable risk and respect your stoploss

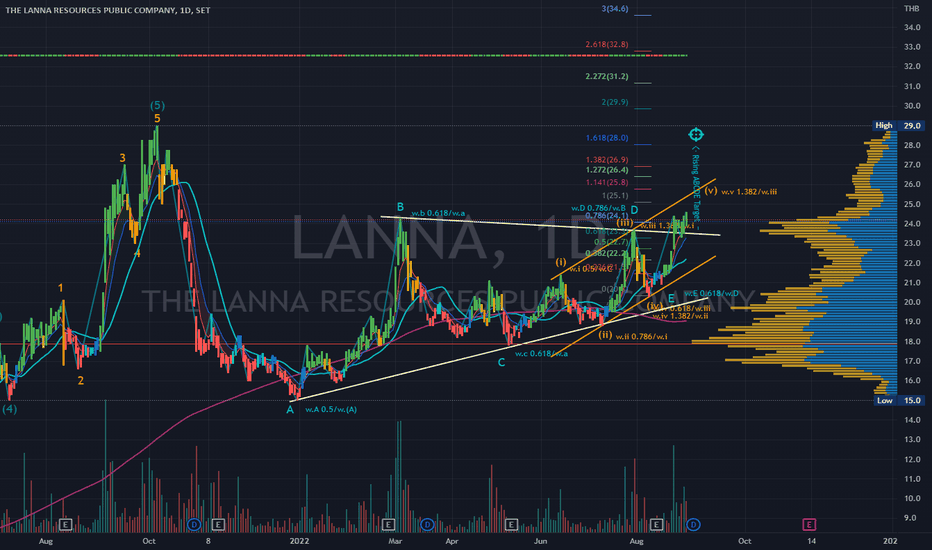

LANNA | Wave Analysis | ABCDE Triangle Breakout TargetPrice action and chart pattern trading

> Elliott Wave Projection - Rising triangle wave ABCDE breakout pattern

> TP1 @ Upper channel resistance wave v leading diagonal - 1.382 extension of wave iii +12% upside

> TP2 @ 1.618 extension of wave D +18% upside

> Stoploss @ SMA20 - 6-7%

> Risk reward ratio: 2.5-3:1

Always trade with affordable risk and respect your stoploss

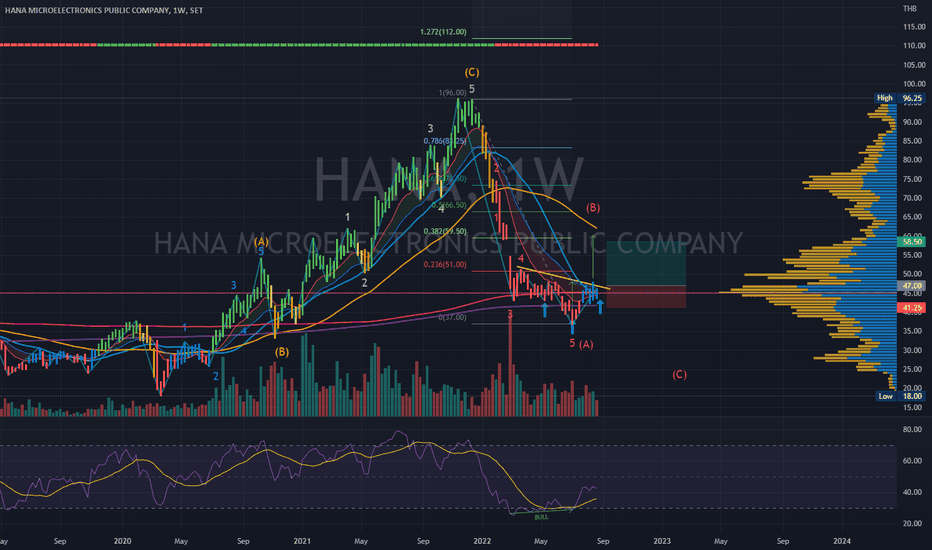

HANA | Elliott Wave Projection | Inverse Head&ShouldersPrice action and chart pattern trading setup

> Elliott wave projection downtrend breakout with inverse head & shoulders pattern

> A possible wave B rebound targeting 0.382 - 0.5 retracement of A

> Entry @ H&S breakout SMA25W

> Target @ 0.382 retracement of Wave A / SMA50W zone +25%

> Stoploss @ right shoulder / SMA400W -12%

> Risk reward ratio: 2:1

Indicator:

> RSI Week bullish divergence, breakout MA line

> MACD Week golden cross below baseline

Always trade with affordable risk and respect your stoploss

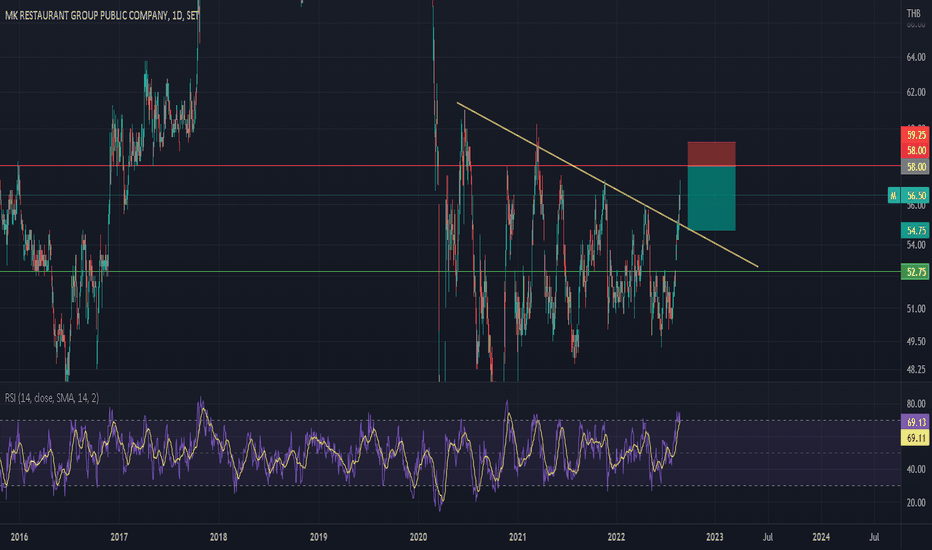

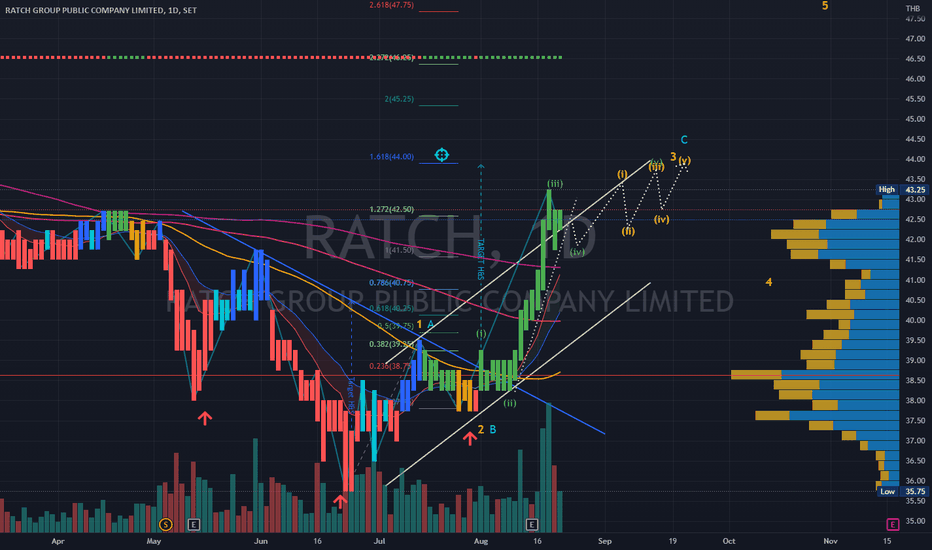

RATCH | Elliott Wave Analysis -Uptrend rising wedge projectionPrice action and chart pattern trading - take profit position

> Rising/Bearish Wedge false breakout wave iv correction

> Target Inverted Head & Shoulders 1.618 extension of wave 1 or A

> Recommend take some profit along upcoming wave (iii) of wave v of wave 3 or C should be the longest wave.

> Indicator: RSI / MACD should start showing bearish divergence during the next cycles