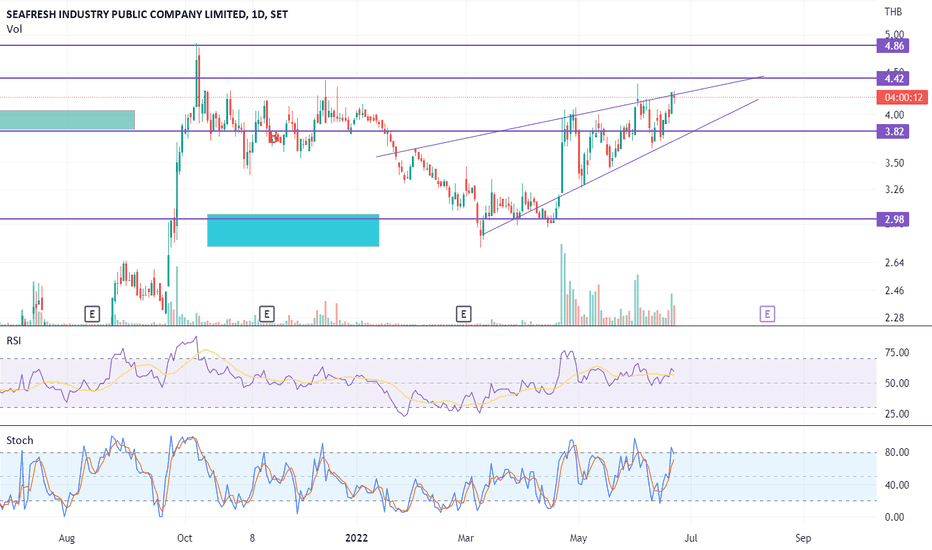

GPSC | Wave Projection | Bullish Dragon Flag SetupPrice action and chart pattern trading setup

> Bullish Dragon pattern in correction wave A, possible reversal for uptrend wave B

> Entry @breakout channel dragon ridge

> Target @ 0.618 retracement of previous top SMA200 zone

> Stoploss at the low A position - RRR: 2:1 downside -7%

Indicator:

> MACD bullish divergence signal crossing up baseline 0.

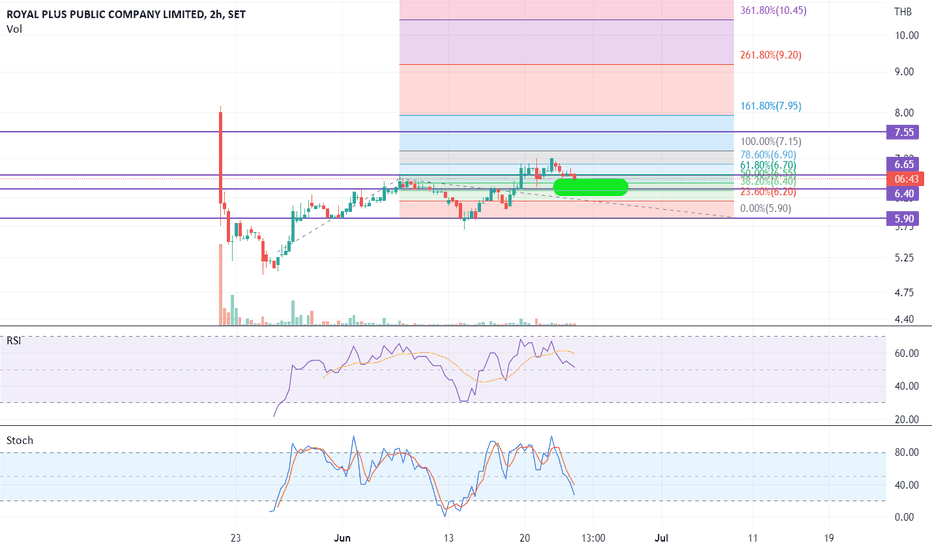

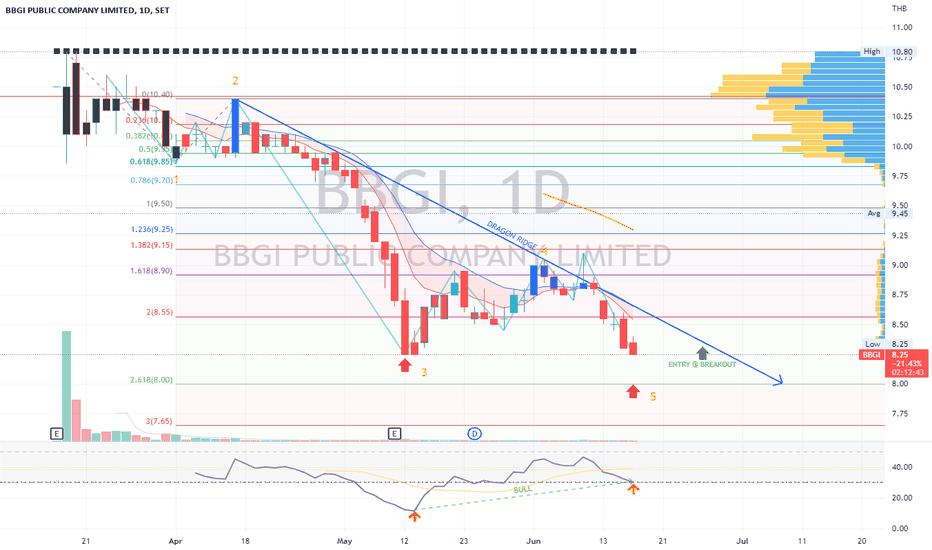

BBGI | Wave Projection Dragon Pattern - Bullish divergencePrice action and chart pattern trading setup

> An impulse downtrend Elliott Wave channel with a dragon pattern forming rear legs

> possible upcoming bullish divergence signal at the next support 8.00 baht targeting 2.618 extension

> Entry @ dragon ridge breakout

> Short term target @ previous wave 4 position

> Medium term target @ wave 1 and wave 2 position + 15 - 20% upside

> RRR: 2:1 for short term and 3:1 for medium term trade

Always trade with affordable risk and respect your stoploss

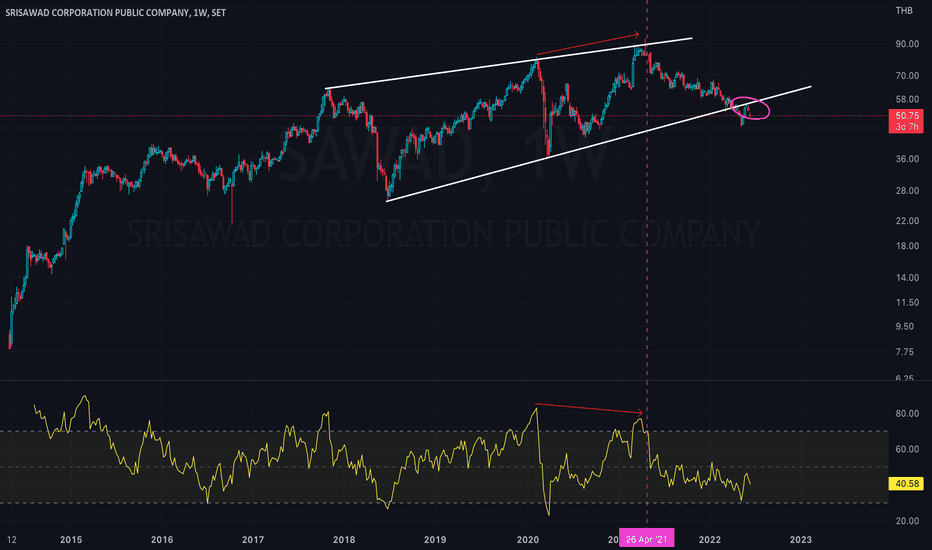

TOP | Wave Projection - Leading Diagonal Trading SetupPrice action and chart pattern trading

> Leading diagonal - contracting triangle pattern

> Entry @ triangle support

> Target @ Wave 3 position + 20% upside for short term trade

> RRR: 2:1 with -10% downside

> Long term trading target primary wave 5 at 1.618 extension zone at 75 baht +40% upside

Always trade with affordable risk and respect your stoploss

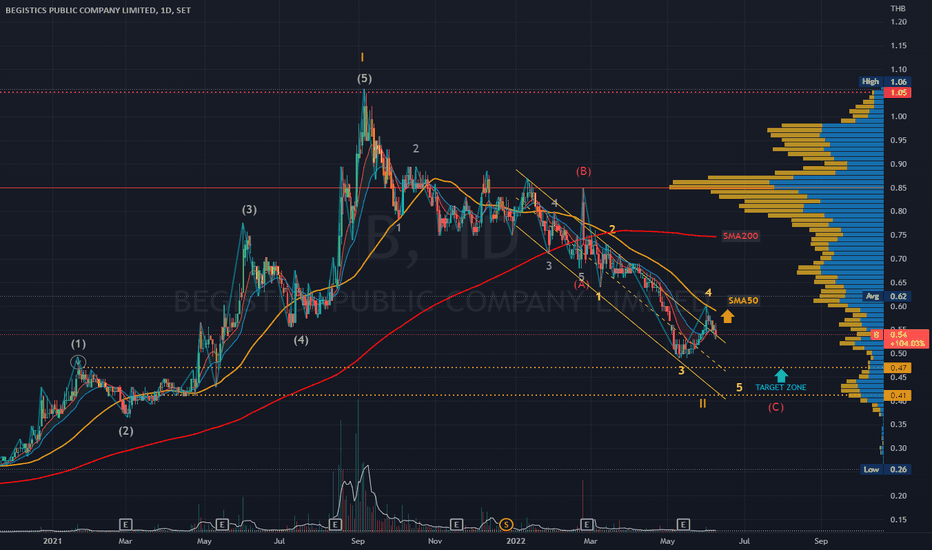

B | Wave Projection | Downtrend channel breakout Price action and chart pattern trading setup

> ABC Zigzag wave correction with a breakout at wave 4 downtrend channel

> Target downtrend zone at Fibonacci 1.0 extension - 0.45 baht price

> A possible upcoming bullish divergence for wave 5 with ending diagonal pattern

> Wait for retest at the low position?

always trade with affordable risk and respect your stoploss

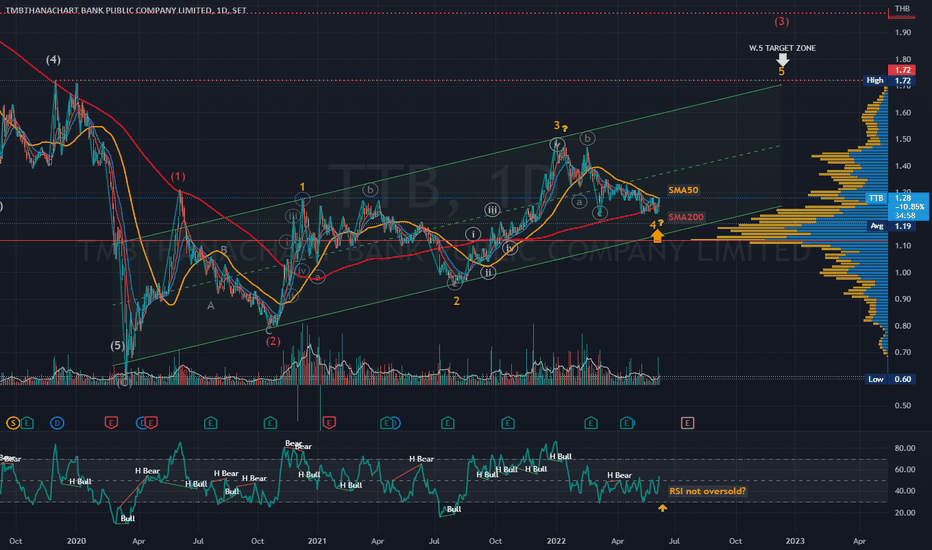

TTB | Wave Analysis - Possible Target DowntrendPrice action and chart pattern trading

> A possible target downtrend is within the range at SMA200 zone

> Wave 4 Zigzag family ABC currently retraced 0.5 Fibonacci of wave 3 which slightly overlapped with wave 1 is still valid.

> Long Entry @ SMA50 breakout zone as dynamic wave resistance

> Stoploss @ the lowest position of wave C- 5-6% downside

> 1st target at the high Wave 3 position + 15 -20%: RRR: 2.5:1

> Wave 5 uptrend target estimated at the channel upper resistance zone, targeting at 1.618 extension of Wave 1 - 1.60 - 1.70 baht

Always trade with affordable risk and respect your stoploss.

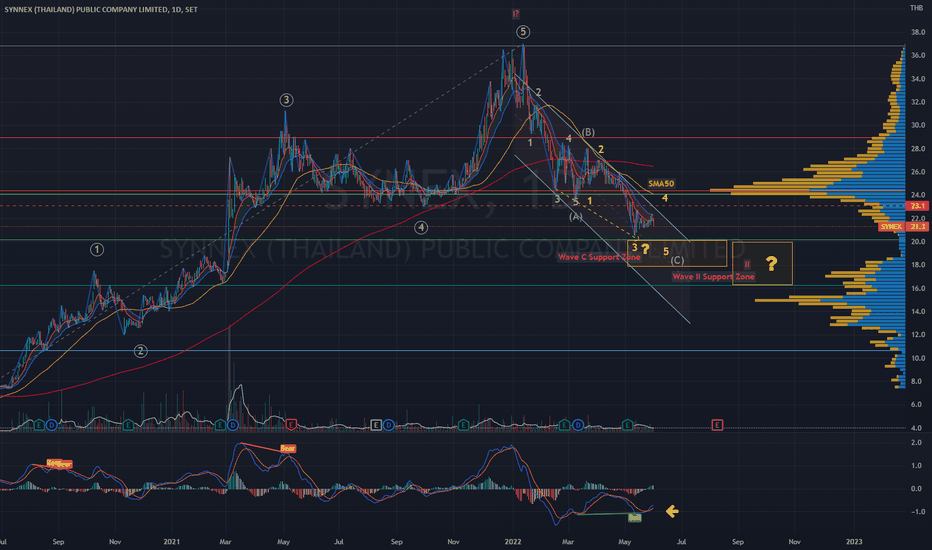

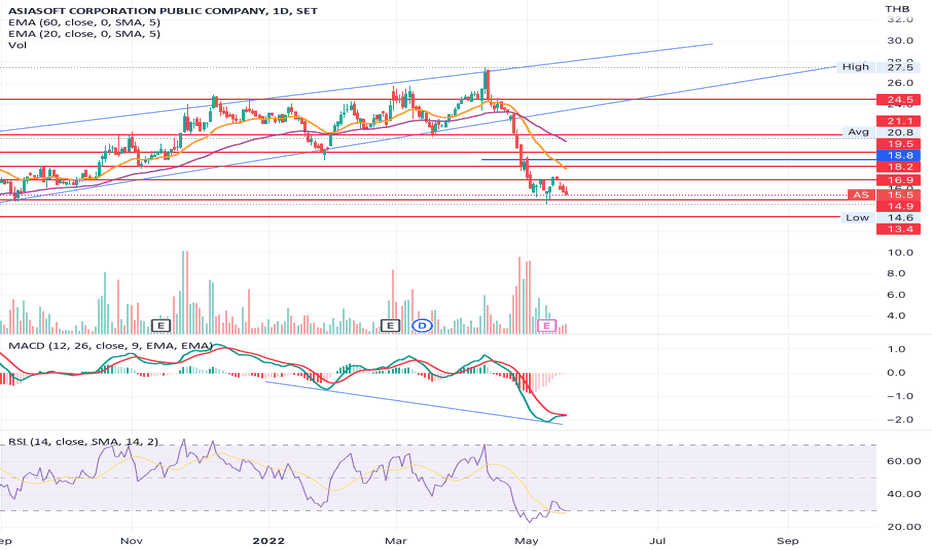

SYNEX | Wave Analysis - Bullish Divergence Ending Diagonal?Price action and chart pattern trading

> A potential downtrend wave C leading to an ending diagonal with the first MACD bullish divergence

> Long Entry - wait for Elliott Channel breakout to confirm the end of the downtrend

> Target Wave 4 rebounded at SMA50 Zone

> The target wave 5 downtrend at support Wave C and Wave II zone are closed in range.

Indicator:

MACD - first bullish divergence

Always trade with affordable risk and respect your stoploss

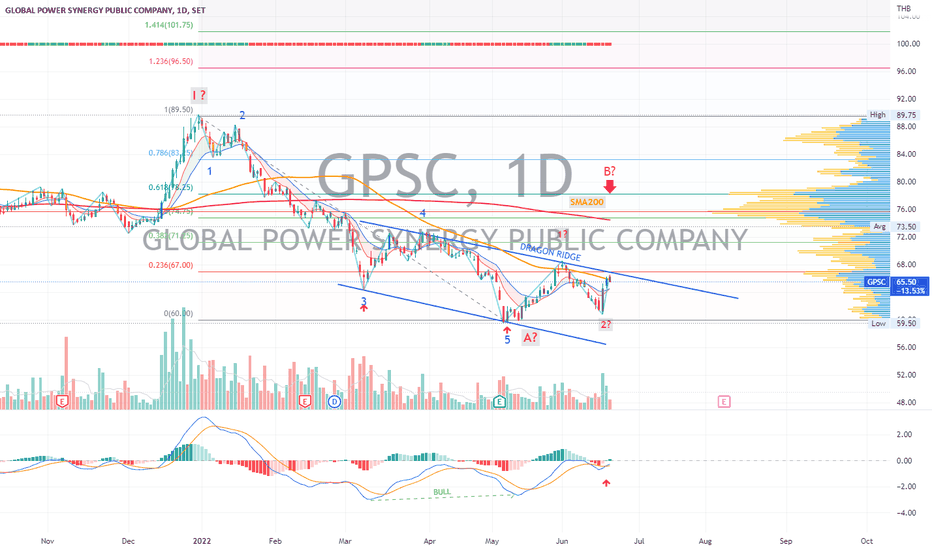

PTTGC | Wave Analysis | Downtrend Target Wave II ProjectionPrice action and chart pattern trading

> ABC correction wave 2 is around the corner within the zone 0.5 retracement of wave I.

> The current wave C extended 1.213 of wave A

> Upcoming Elliott Channel breakout to confirm end of downtrend correction

> Long Entry @ Channel breakout near SMA50 zone

> Short-term target at SMA200 / Volume Profile Point of Control

> Medium term trade target at 0.786 - 1.0 Wave I position

> Stoploss at the lowest point of Wave C zone

> RRR: 2:1 for short term and 3:1 for medium term trade

Indicator:

RSI above 50 with bullish divergence signal

Always trade with affordable risk and respect your stoploss.

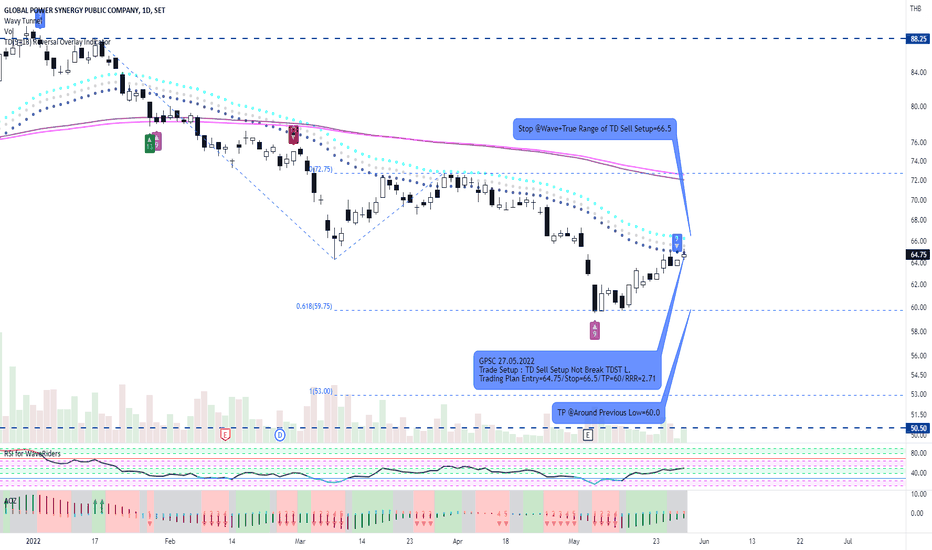

GPSC and TD Sell Setup not Break TDST L.GPSC is still moving in downtrend although it rebounded during previous weeks. However, it's interesting when TD sell setup is counted and unable to break TDST Level. That's supposed the stock is still moving in the same trend. The previous low is expected as the target price while another side of wave line is applied for stop loss. Enjoy your trading.

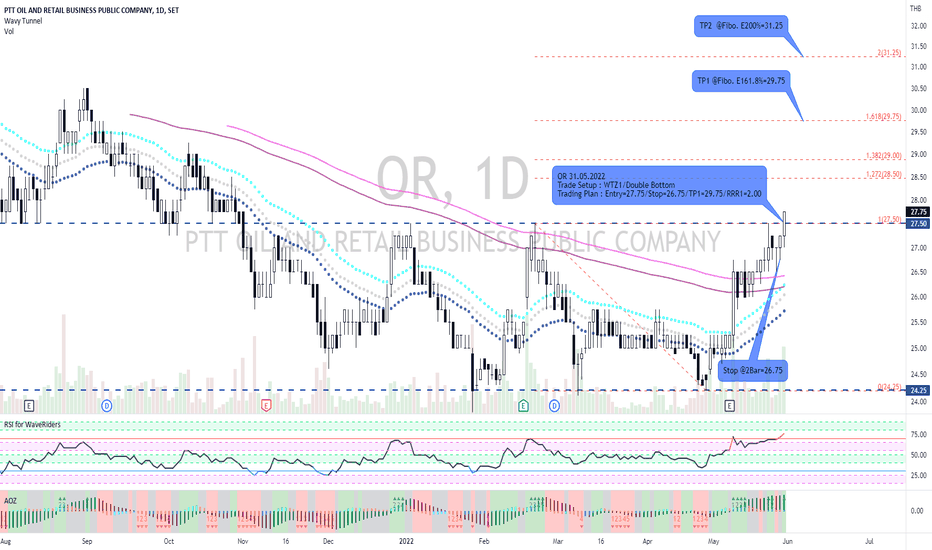

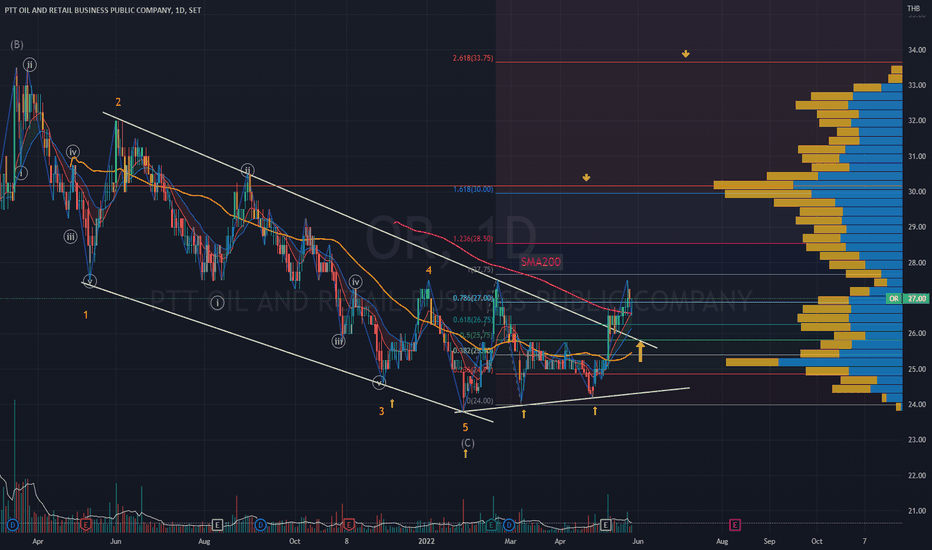

OR | Wave Analysis Mapping- Channel Breakout - Pullback TradePrice action and chart pattern trading

> Elliottwave downtrend channel confirmed breakout crossover SMA200 heaven/hell line - RSI TFD already overbought - Pullback trade for medium-term is recommended

> Target @ volume profile POC 1.618 extension zone and 2.618 zone for 2nd target

> Stoploss @ Wave 5 zone Inverted Head or right Shoulders

> RRR: 2:1 downside less than 10%

Always trade with affordable risk and respect your stoploss

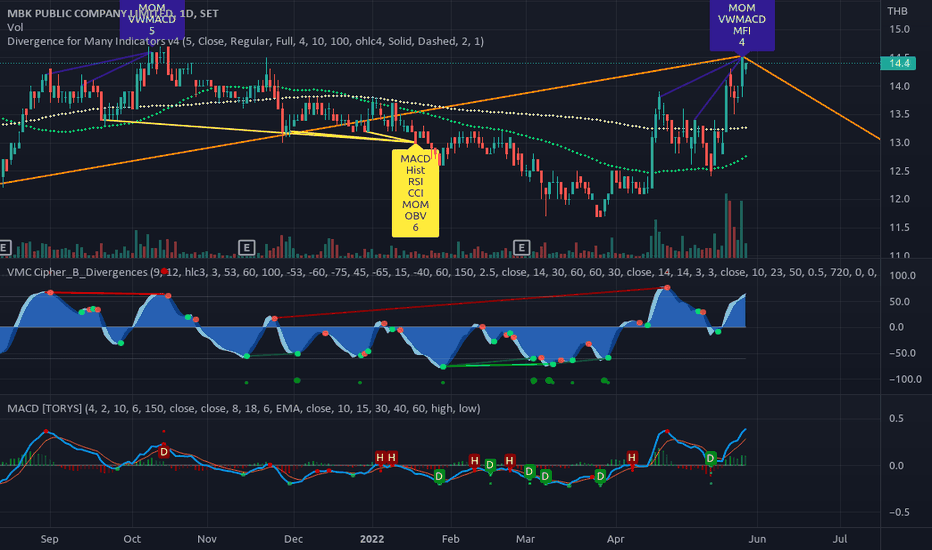

MBK Intermediate Negative Down TP@12.8Intermediate Negative Down TP@12.8

Investors should be cautious about any and all stock recommendations and should consider the source of any advice on stock selection.

The information and publications are not intended to be and do not constitute financial advice, investment advice, trading advice.

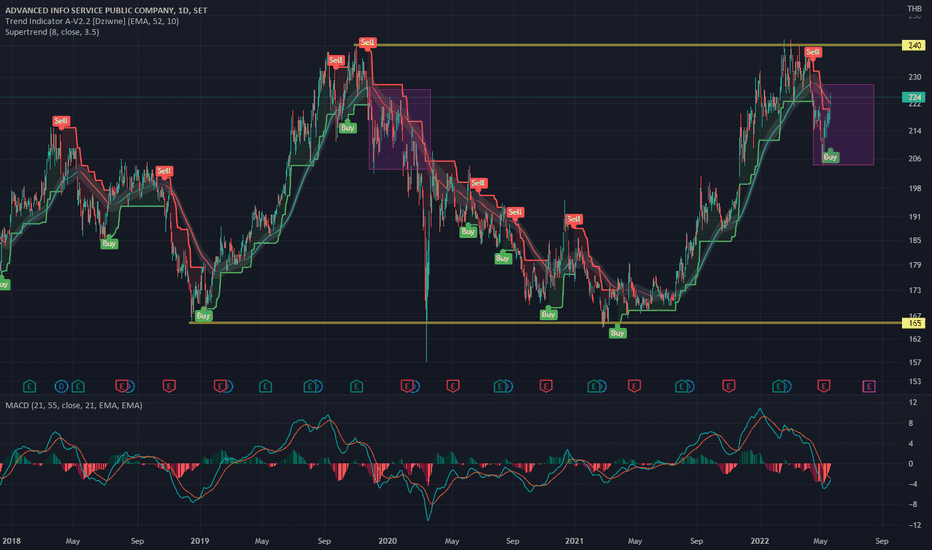

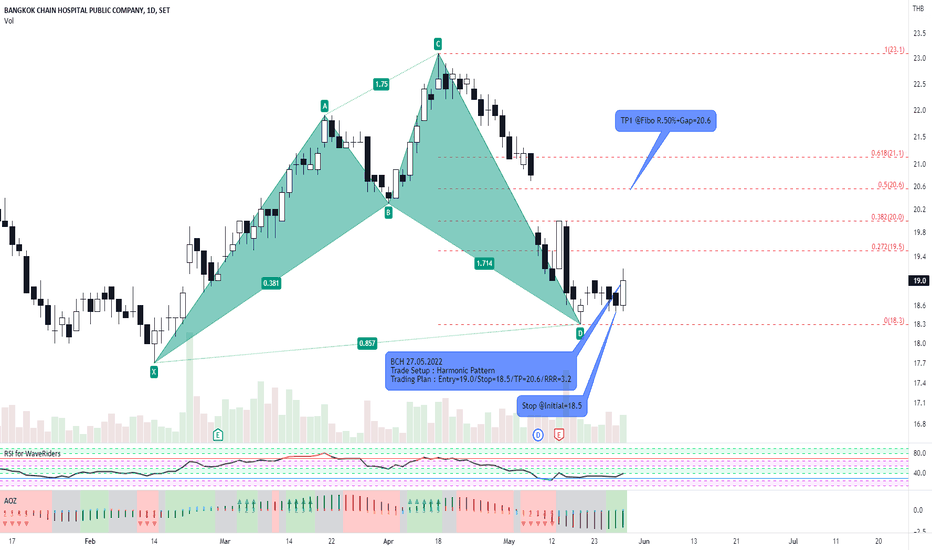

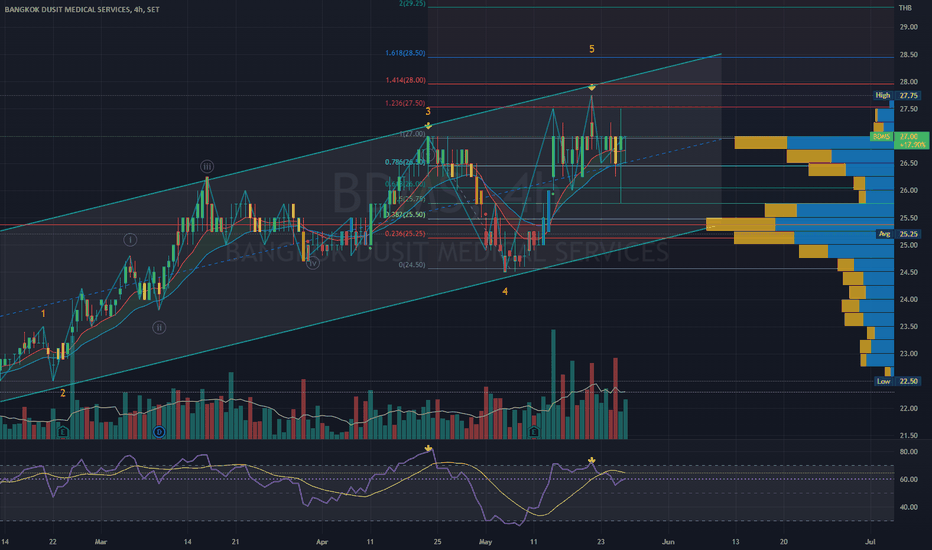

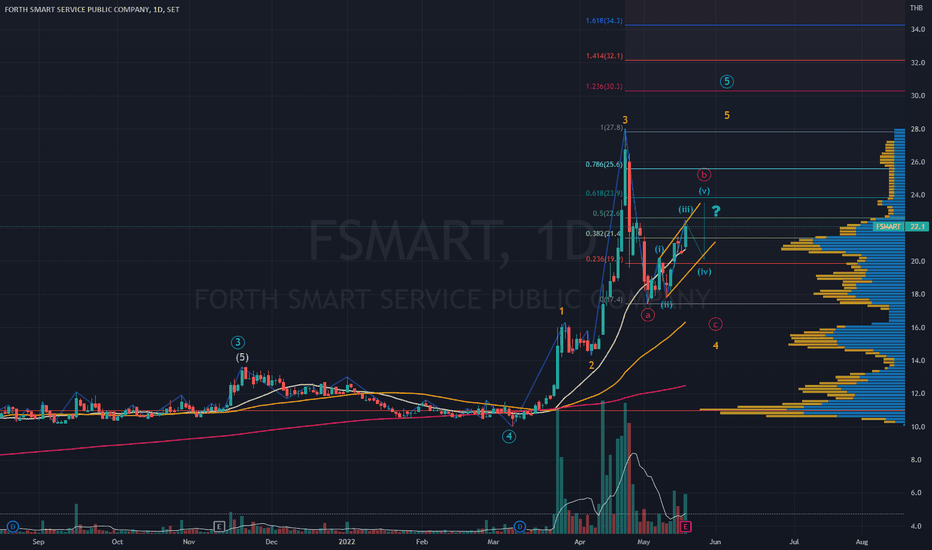

BDMS | Bearish Divergence - Ending Diagonal Limited UpsidePrice action and chart pattern trading

> A Rising Elliott channel pattern with bearish divergence indicating limited upside for ending diagonal

> Minor wave 5 estimated at 1.618 retracement of wave 4 | 28.00 - 29.00 baht zone

> Take profit at the upper resistance zone

Always trade with affordable risk and respect your stoploss

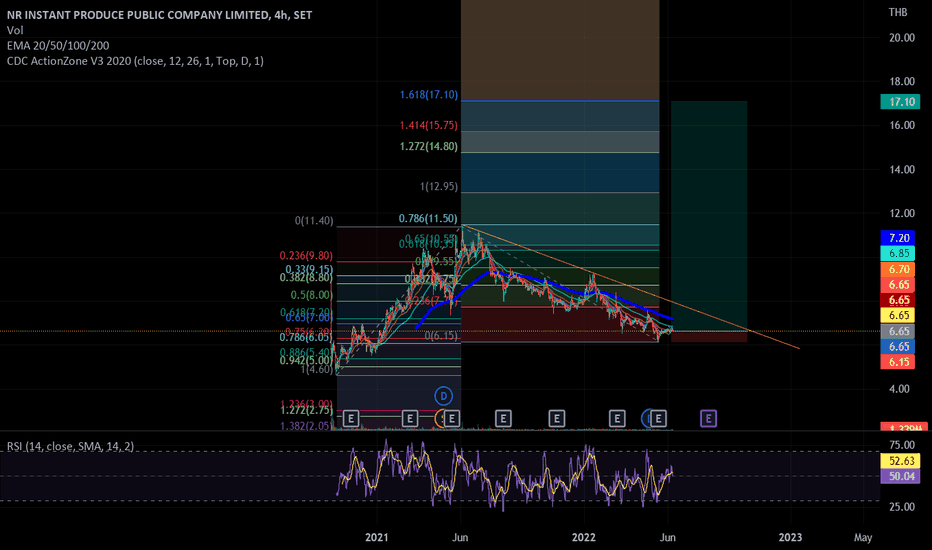

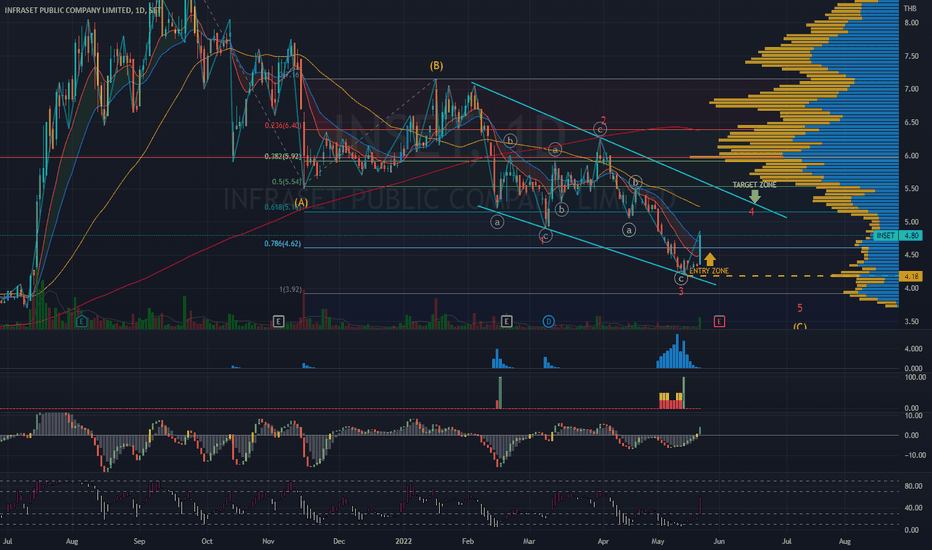

INSET | Downtrend Elliott Bullish Flag - Ending DiagonalPrice action and chart pattern trading setup - short term trade

> Downtrend Bullish Elliott Flag - Ending Diagonal Pattern

> Entry @ Pullback EMA10 - 20 zone

> Target @ upper flag resistance zone / SMA50

> Stoploss - the lowest position of wave 3

> RRR: 1.5:1 short term trade

Indicator:

> Smart money volume support

> Banker chip entry signal

> BBD bullish divergence signal golden cross baseline

> KDJ stochastic strong uptrend momentum

Always trade with affordable risk and respect your stoploss