SOLAR | Rising Triangle | Entry Breakout Setup Price Action & Chart Pattern Trading

> Rising Triangle | Buy @ Breakout above EMA400

> Target zone @ Volume Profile high D-shape Point of Control - Fibonacci Retracement 0.786

> Stop Zone @ the lowest triangle

Indicator Support:

> Smart Money and Banker Chip Volume

> BBD signal - positive above baseline

> Fund flow reversal pattern still below entry position

> KDJ uptrend ribbon

Trade with affordable risk ratio 3:1

Always respect your stoploss

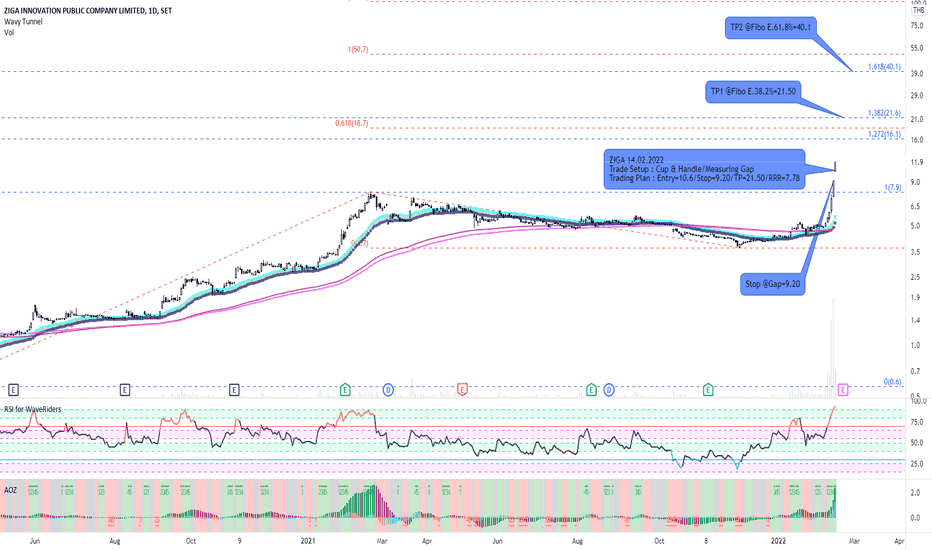

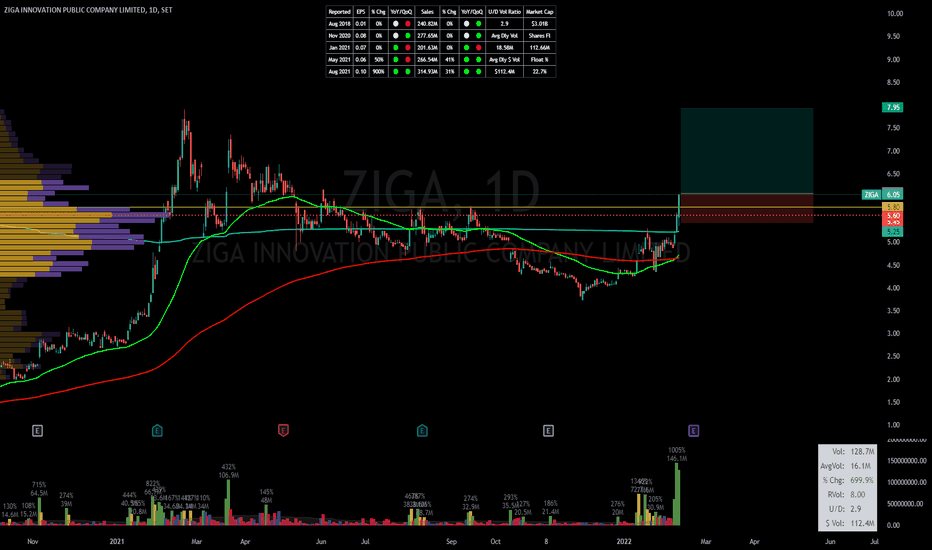

ZIGA and Cup & Handle PatternI like the Cup & Handle. When finding this pattern, I always look for another entry signal because it's strong uptrend and hard to wait for dipping. Luckily, I find a measuring gap called the gap of opportunity. When market opening, I was not hesitated to calculate position size quickly and made entry order. What will be the result, just wait and see. :o)

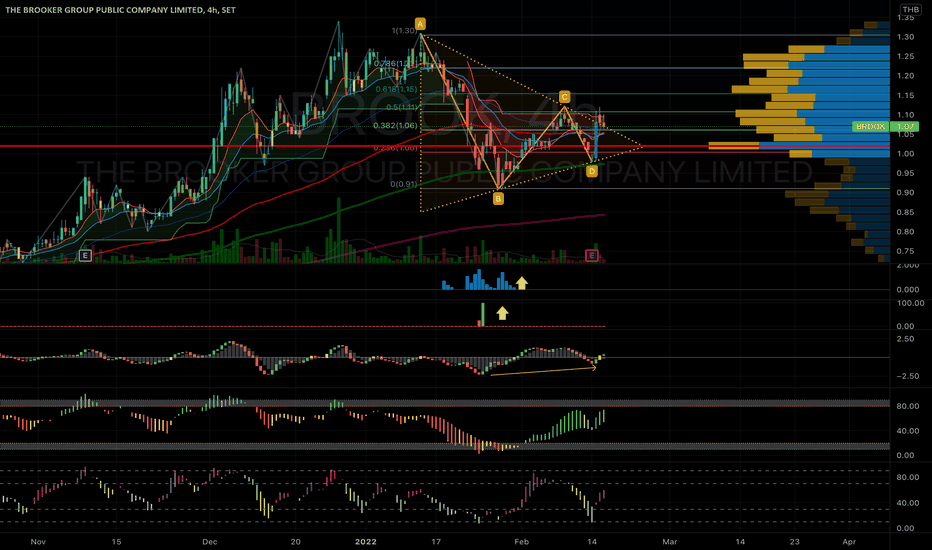

BROOK | Pennant Breakout | Entry @ Pullback SetupPrice Action and Chart Pattern Trading Setup

> Pennant Breakout and above Volume Profile POC line

> Entry @ Pullback setup - Target 0.786 - 1.0 of previous high - the key resistance of volume profile

Indicator:

> Smart Money and banker chip volume support at previous low / B position lowest pennant

> BBD bullish signal crossover base line

> Banker Fundflow strong uptrend and not overbought

> KDJ stochastic uptrend reversal

Risk Ratio: 2:1 stoploss at C position previous low pennant

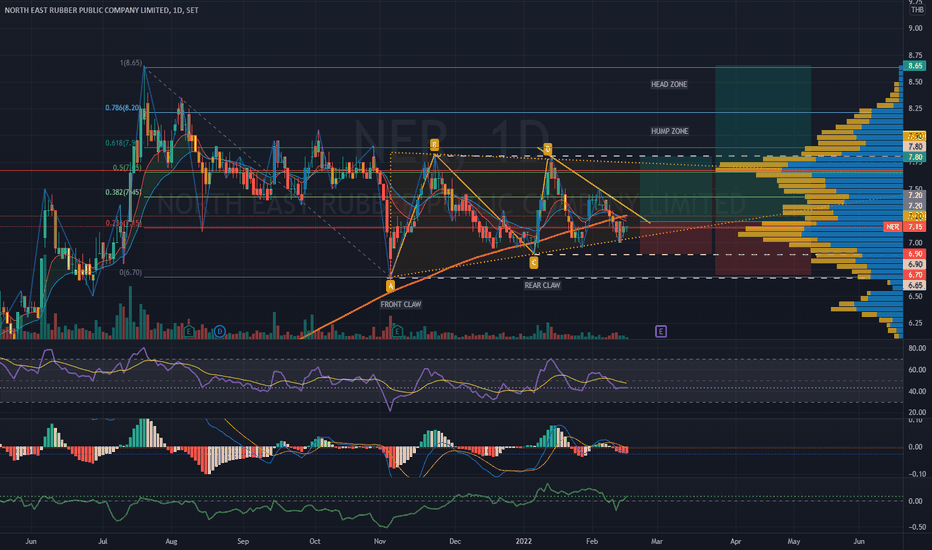

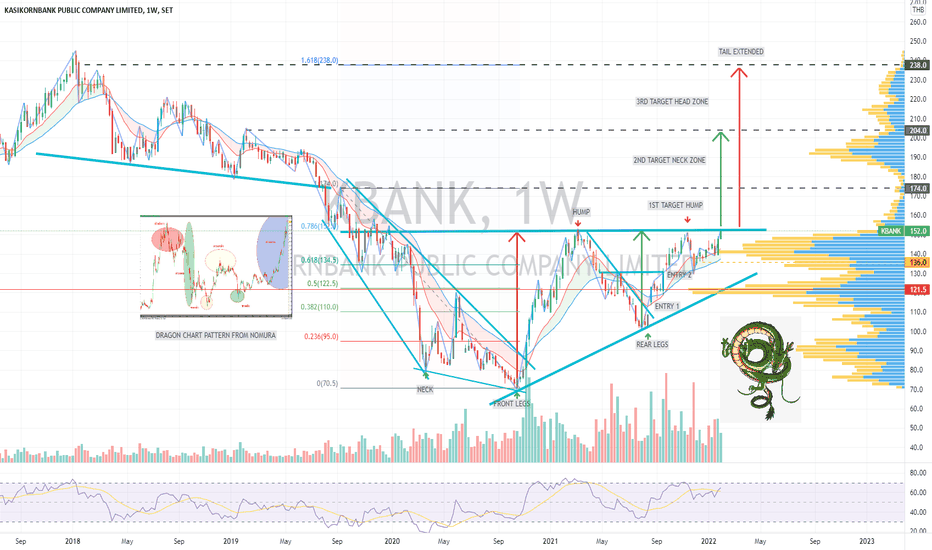

NER | Rising Triangle Dragon Pattern | Entry @ Breakout SetupPrice Action and chart pattern short-medium term trading

> Rising Triangle Dragon Pattern

> Entry @ breakout trend line SMA 200

Indicator:

> Bullish RSI crossing MA line above 50

> Rising MACD just below baseline

> CMF reversal crossed baseline 0.

Short term RR 2:1 Medium-term RR 3:1

Always respect your stoploss

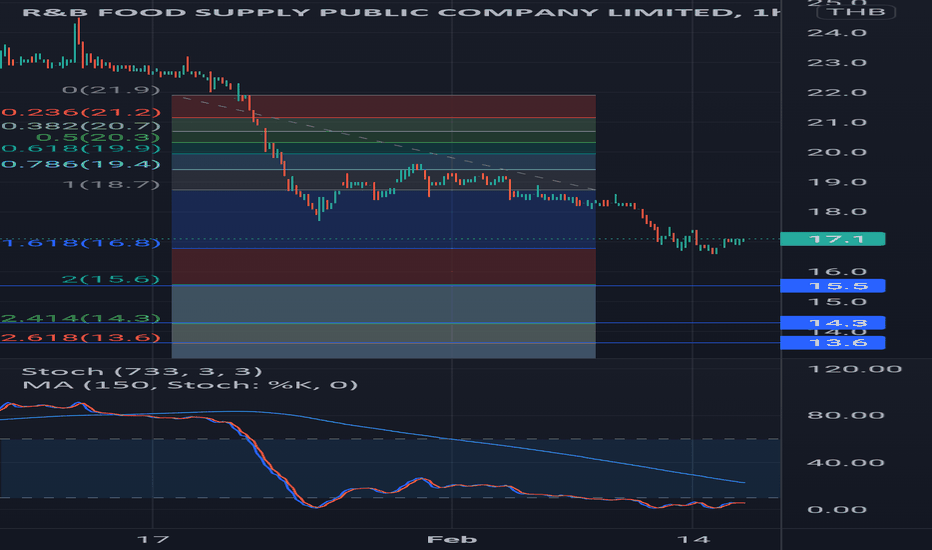

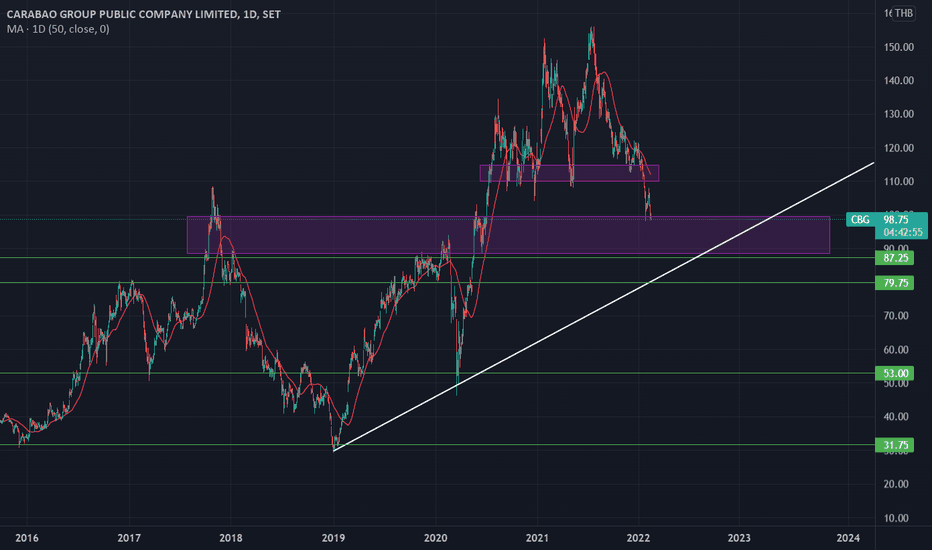

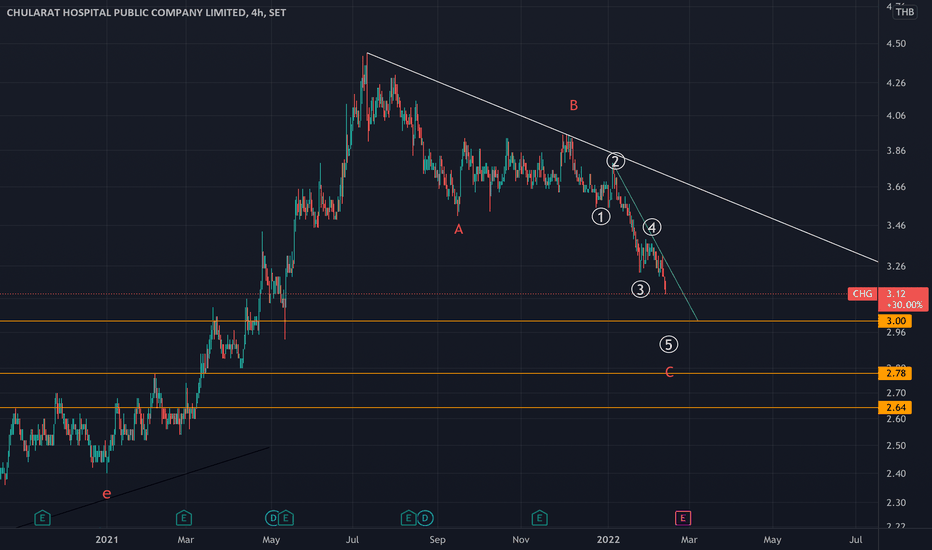

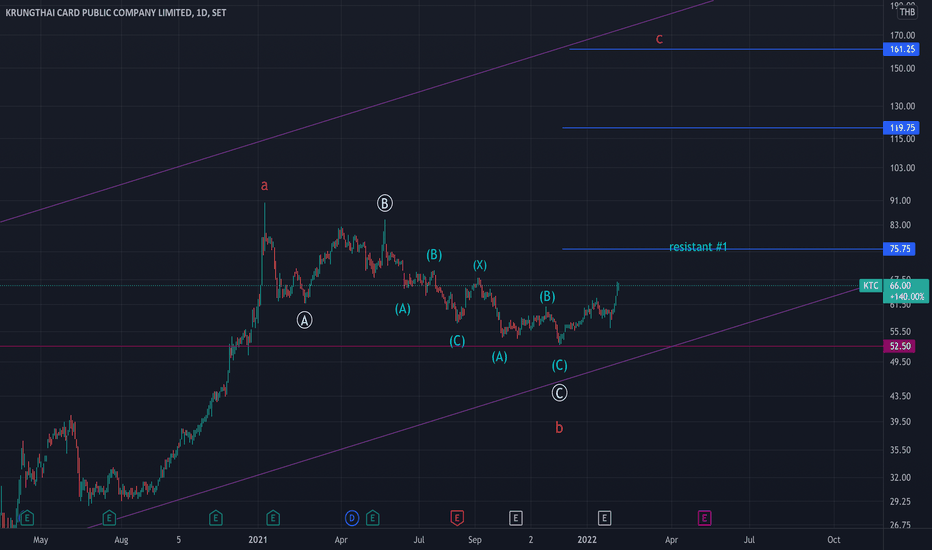

Carabao Group PCLShare has been falling because it was over-hyped and over-valued.

I am expecting more of a pullback and a retest critical support zones between (90-87 baht) (87 -80 baht). We should see a bounce at these levels, bouncing off an existing trend line . However, if that doesn't hold then we could see another meaningful correction to lower levels to bring the multiples back down to earth.

The earnings report should lead the way for direction.

If their earnings report isn't to the markets liking, then we can expect that 87 baht area to fail and gradually make its way back down to the 40 baht region.

If the Earnings report is decent and shows growing revenues and increasing margins, well, then we could see that white trend line holding and could be the catalyst for a continued uptrend.

With a P/E multiple of 32 - the market is pricing in expected earnings for the future already and is expecting big things from this company, so I would tread lightly here. Any missed guidance or revenue contractions will send the share tumbling.

Nonetheless, I will be taking my first position between 80-90 baht baht and leaving it there for the long term, and will be looking to add again in the 40 -55 baht region.

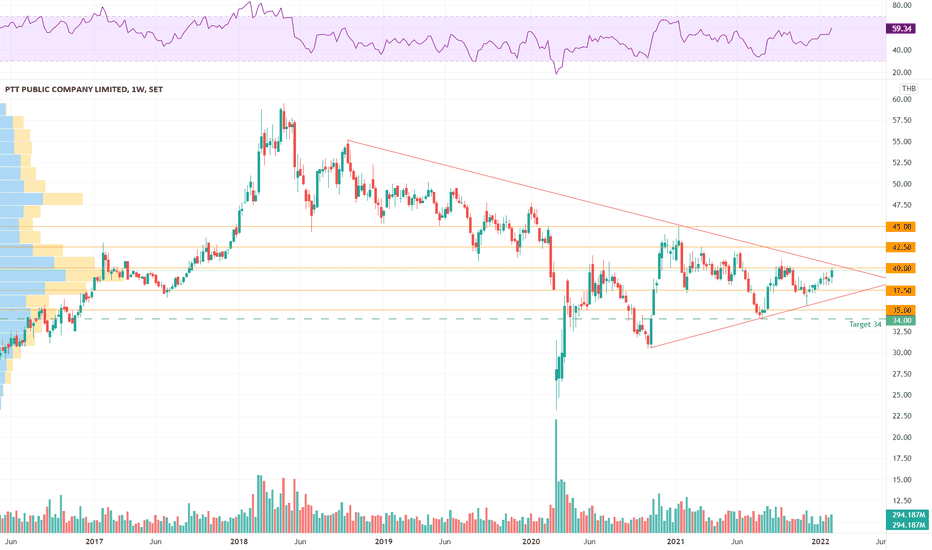

PTTGC | Dragon Pattern | Double Bottom BreakoutPrice Action & Chart Pattern Trading - Short Term Setup

> Dragon Pattern - Rectangle with ENTRY @ doubled bottom breakout

Indicator:

> Smart Money and Banker Chip Volume Support

> Banker BBD positive uptrend above baseline

> Fund flow bottom signal and reversal from the oversold area

> KDJ Stochastic changed to uptrend ribbon

RR : 2.5:1

Always respect your stoploss

Good Luck

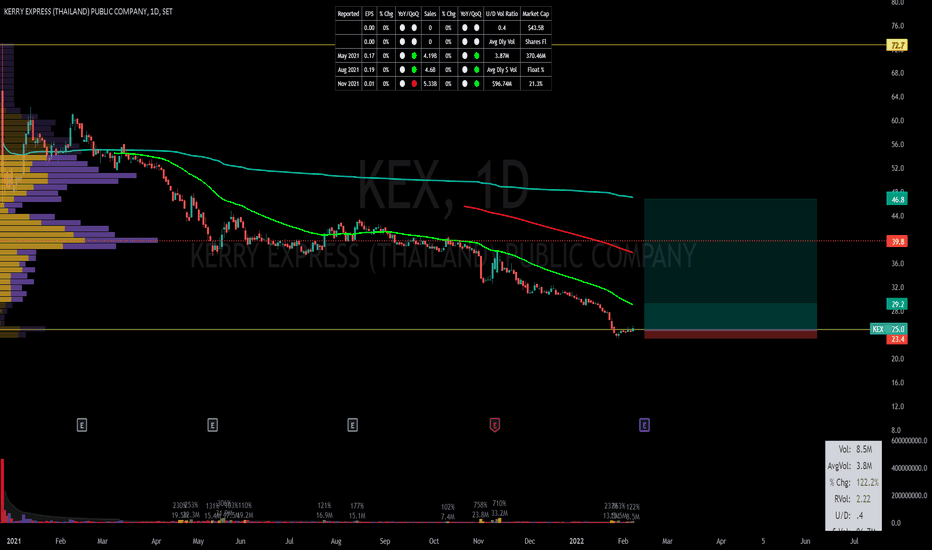

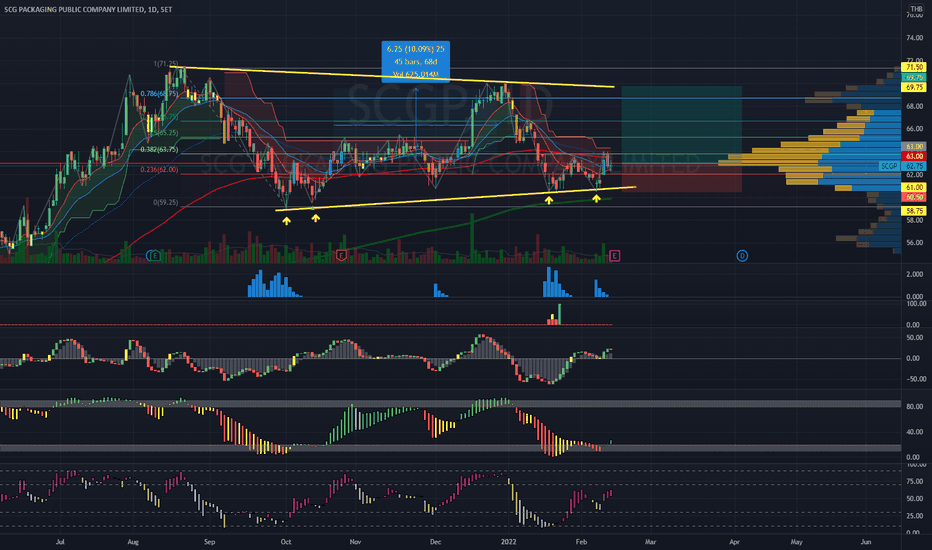

SCGP | Dragon Rectangle | Entry @ Doubled Bottom BreakoutPrice Action & Chart Pattern Trading Medium-Term Setup

> Dragon Rectangle - Doubled Claws / Bottom Breakout signal

Indicator:

> Smart Money and Banker Chip Volume support

> BBD Banker bullish signal above baseline

> Fundflow bottom with reversal pattern

> KDJ Stochastic on uptrend ribbon

RR: 2:1

Always respect your stoploss

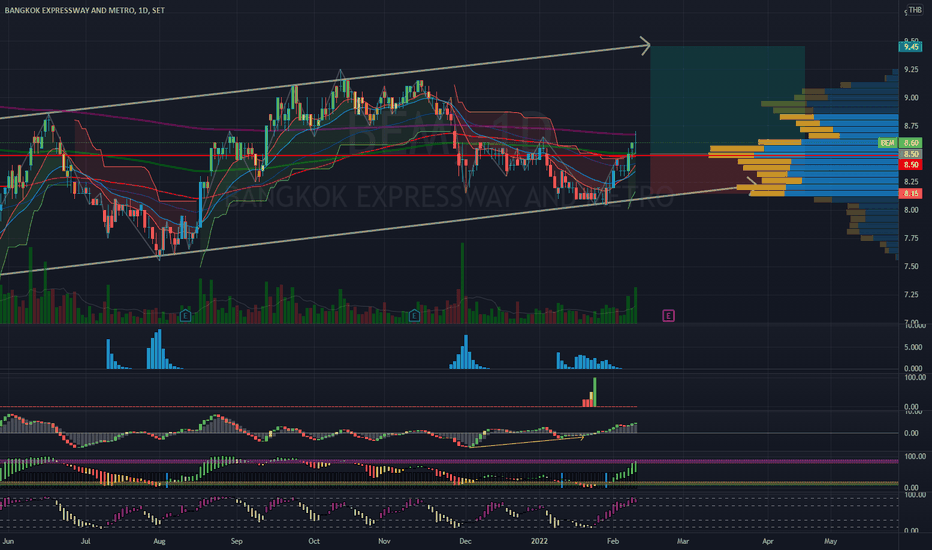

BEM | Parallel Channel | Short term trade setupPrice Action & Chart Pattern Short-term Trading

> Parallel Channel uptrend trade setup

> Entry @ bullish breakout EMA50 and EMA200

Indicator:

> Smart Money and Banker Chip Volume significant level support

> BBD bullish divergence crossed above baseline

> Fundflow strong uptrend

> KDJ strong uptrend ribbon

Trading with affordable risk ratio 2.5:1 for short term

Always respect your stoploss

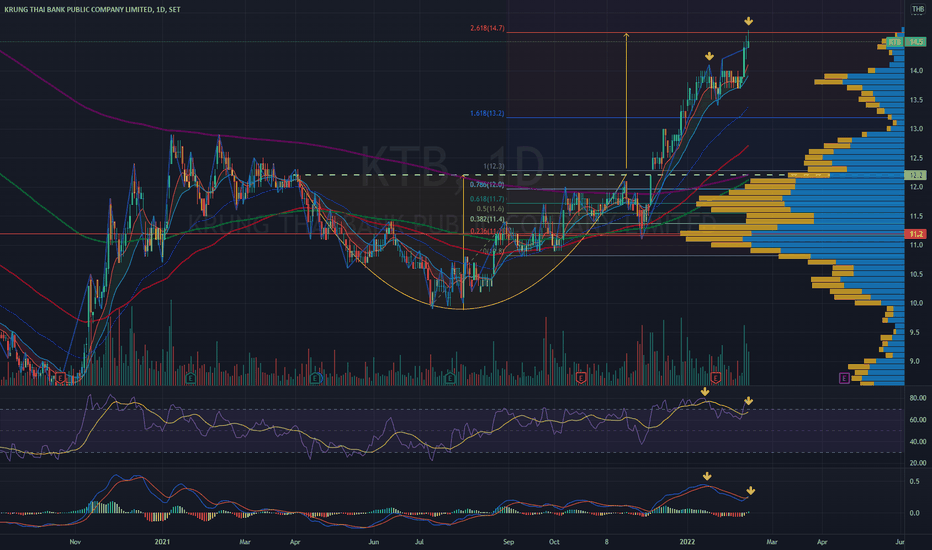

Long SET: WORK. SL Low of the Day. Huge Upside potentialLets see if this plays out. Market is in a bullish phase. WORK is above VA consolidation, with 50EMA & 200EMA sloping upwards. Have to be wary VWAP from previous milti-year high.

Stop is tight, Low of the day. If momentum bursts continue to the upside, high odds for a good run. Low risk high reward.

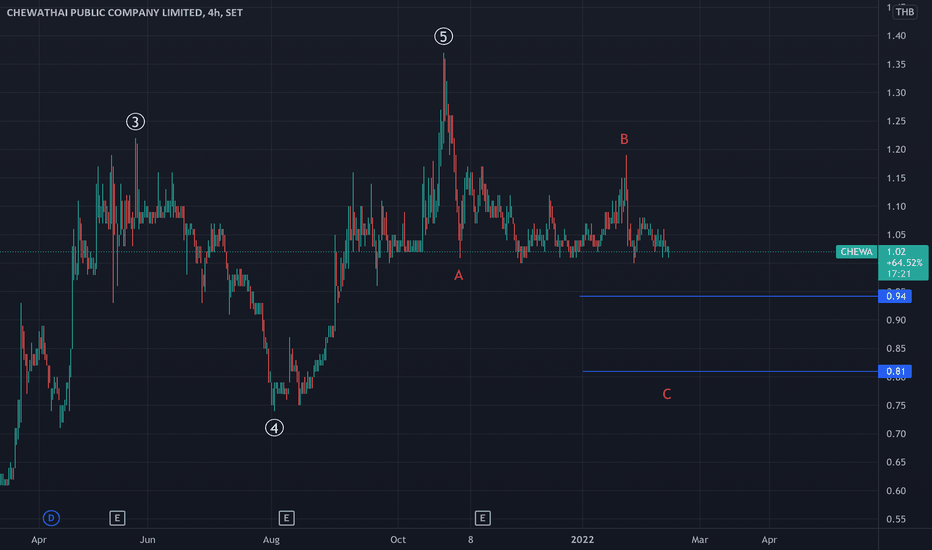

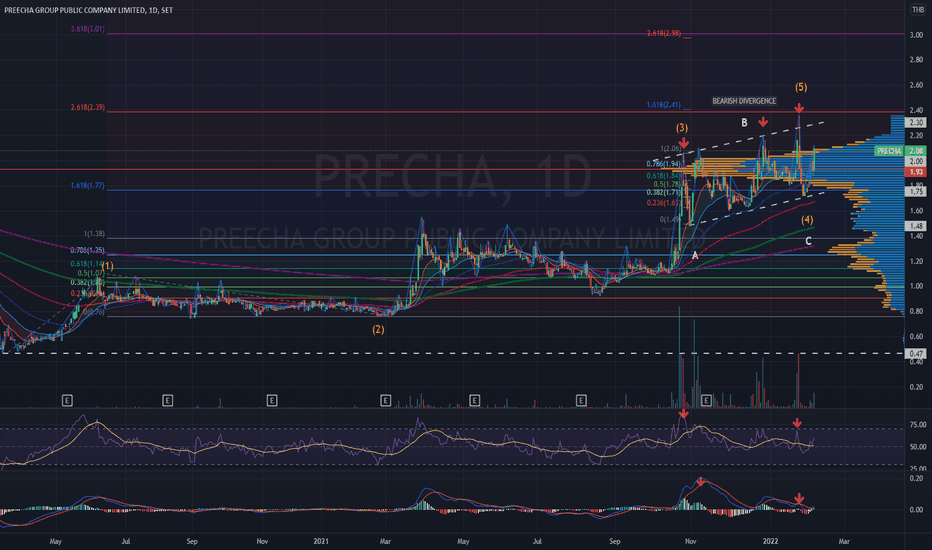

PREECHA | Elliott Wave |Bearish Divergence Wave 5| Take ProfitPrice Action & Chart Pattern Trading - Elliott Wave Projection

> Bearish Divergence signal - Wave 5 Zone - Take Profit Zone

> Limited upside for Elliott Wave 5, estimated at 1.618 of Wave 4 and 1.0 of Wave 1

> Rising Parallel channel as corrective Flat Wave 4 reversal pattern