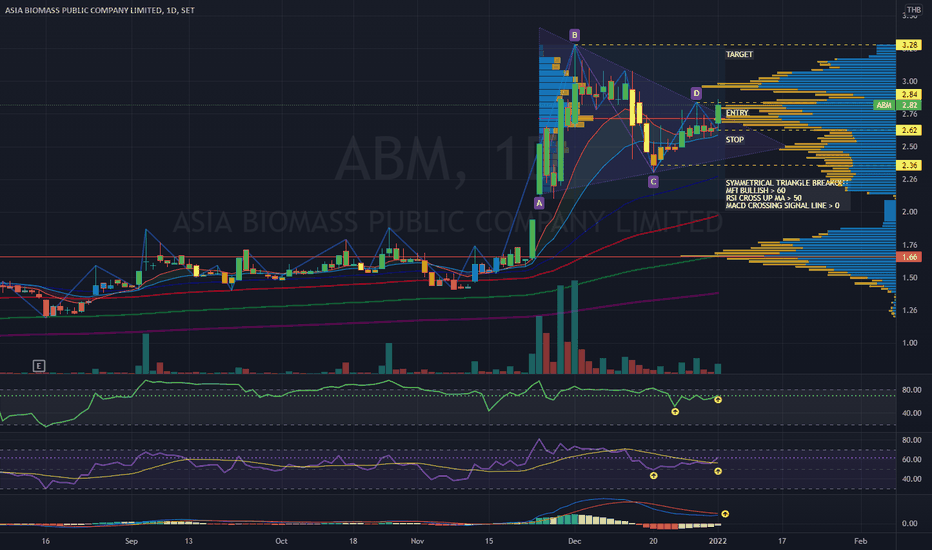

ABM | Triangle Breakout | Target ENTRY PositionABM | Thailand SET Index | Energy Sector | Chart Pattern Trading

> Chart Pattern: Symmetrical Triangle Breakout

> Price Action: ENTRY position @ Breakout with strong momentum crossing up above VOLUME PROFILE POINT OF CONTROL

> Indicator: MFI Bull momentum above 60, RSI > 50 golden cross MA line, MACD crossing up signal line above baseline 0.

Trade with AFFORDABLE risk ratio 3:1

Trust in SYSTEM indicator

Always respect STOP-LOSS

Good Luck

DP

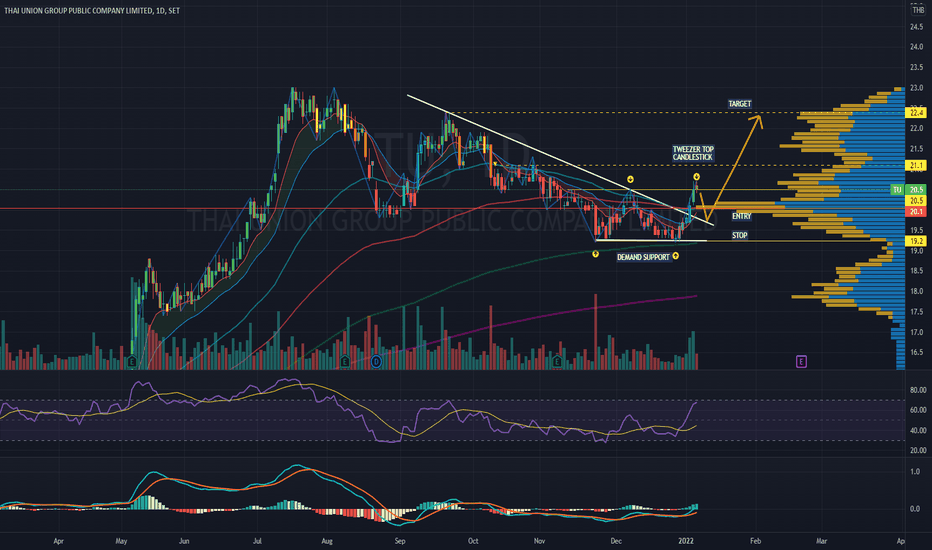

TU | Descending Breakout | Tweezer Top Entry @ Pullback / RetestTU | Thailand SET Index | Food Sector | Chart Pattern & Price Action Trading

Descending Triangle Breakout with Bearish Tweezer Top Candlestick pattern - Wait for Entry @ Pullback at retest position

Double Bottom & Top

RSI strong bullish signal

MACD about to cross the baseline 0

Trade with affordable risk ratio 3:1

Always respect your stop-loss

Good Luck

DP

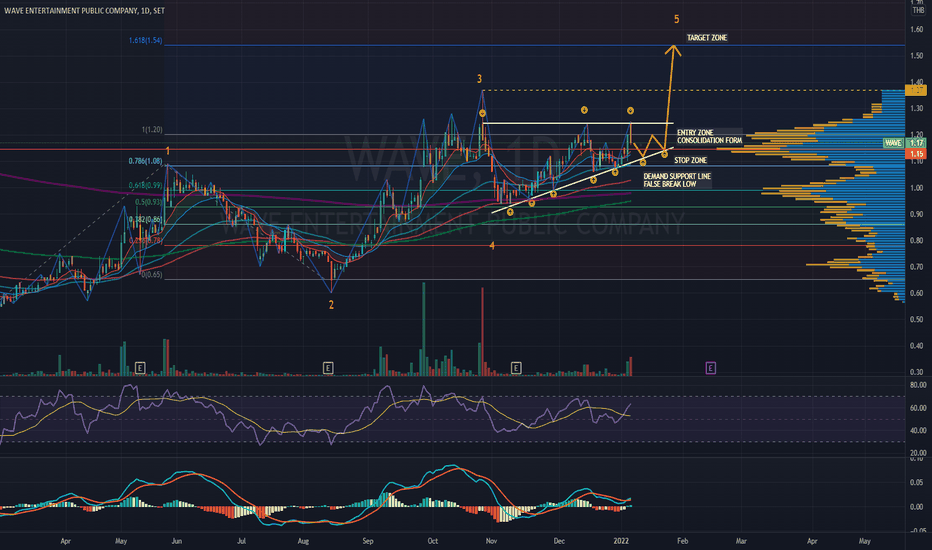

WAVE | Ascending Triangle Breakout | Elliott 3rd Wave ResistanceWAVE | Thailand SET Index | Media Sector | Chart Pattern Trading

Let's challenge ourselves to catch it before breakout once forming a tight consolidation candlestick pattern below the key resistance of Elliott Wave 3.

Chart Pattern: Ascending Triangle

Price Action: Speculative buy before the breakout

Indicator:

RSI and MACD bullish golden cross above baseline.

Trade with affordable risk ratio 3:1

Always respect your stop-loss

Good Luck

DP

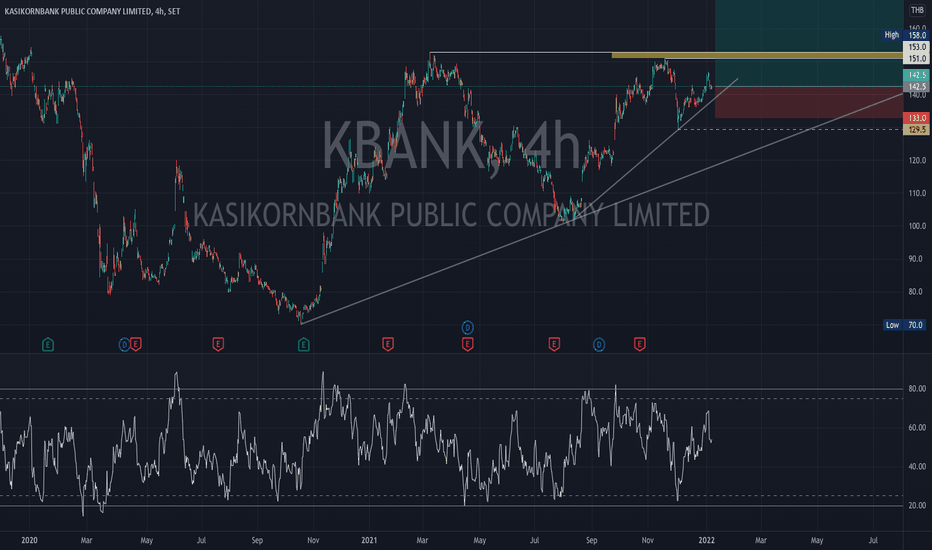

Update KBANK: Jan 8, 2022My first condition is bullish bias but the secutity price have to move and break resistance zone between 151 - 153 THB and stand on that zone with strong buyer force or large buying volume, then this security can hike up to target price around 180 THB. In another way, the price cannot break the resistance zone and stand on that zone then security price will drop to at least 123 THB.

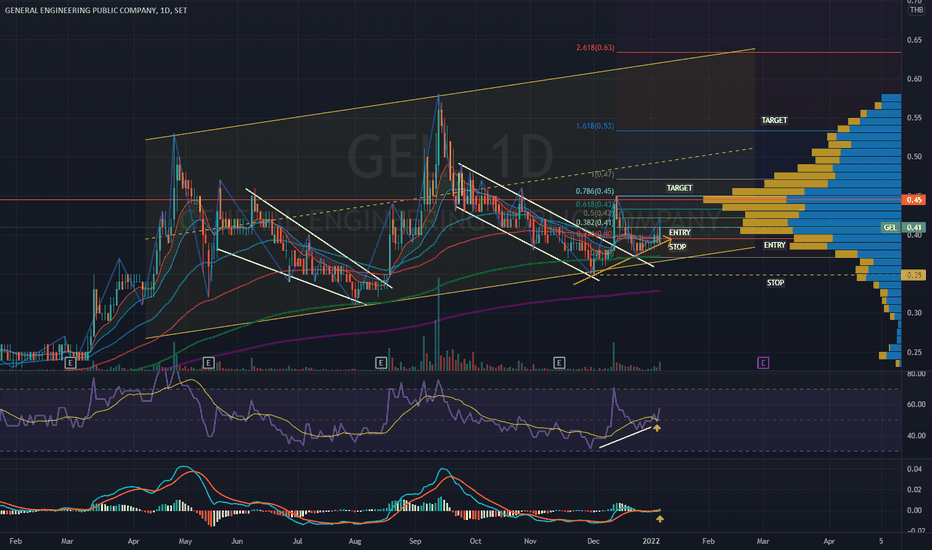

GEL | Parallel Channel Breakout | Target Entry@Pullback GEL | Thailand SET Index |Construction Material Sector | Price Action Trading

Chart Pattern: Falling Parallel Channel Bullish Reversal

Price Action: Bullish Breakout Entry at PULLBACK position

Target estimated for short-term / long-term shot

Indicator:

> Support line just above EMA200

> RSI bullish signal above MA line

> MACD golden cross above baseline 0

Trade with affordable risk ratio 3:1 at least

Always respect your stop-loss

Good Luck

DP

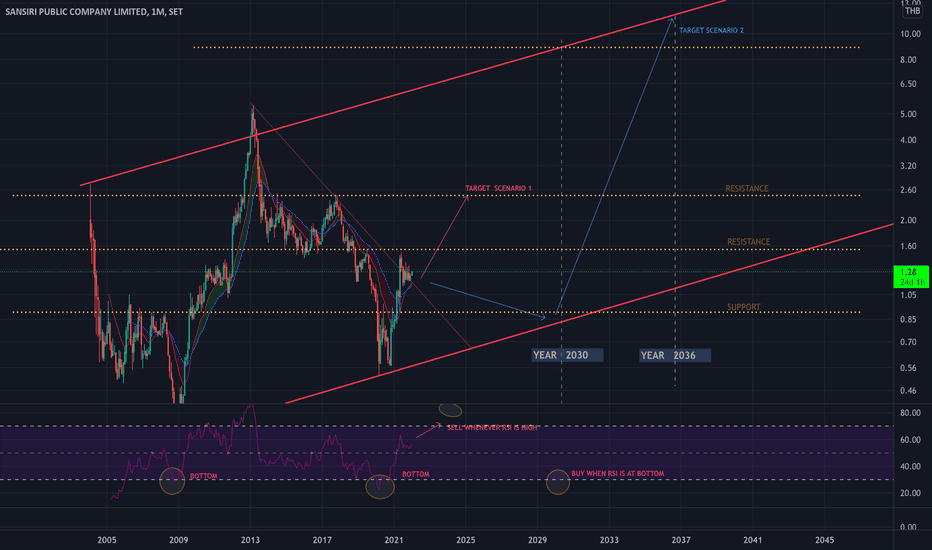

SIRI : Everything is on the chart,

Actually I really like the CEO.. He's skillful, great executive vision and very well-management

If I didn't do this technical analysis then I'd think it could grow a lot faster

but this is the normal speed of real estate sector i guess.. .

For the time line its only estimation. I could be faster

Fundamental is great, the company is investing in crypto/digital asset

more info DYOR

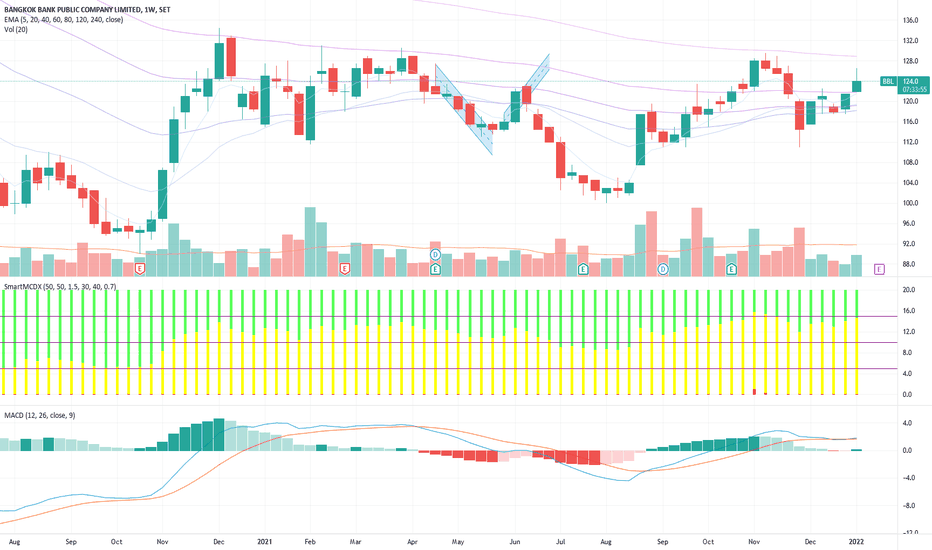

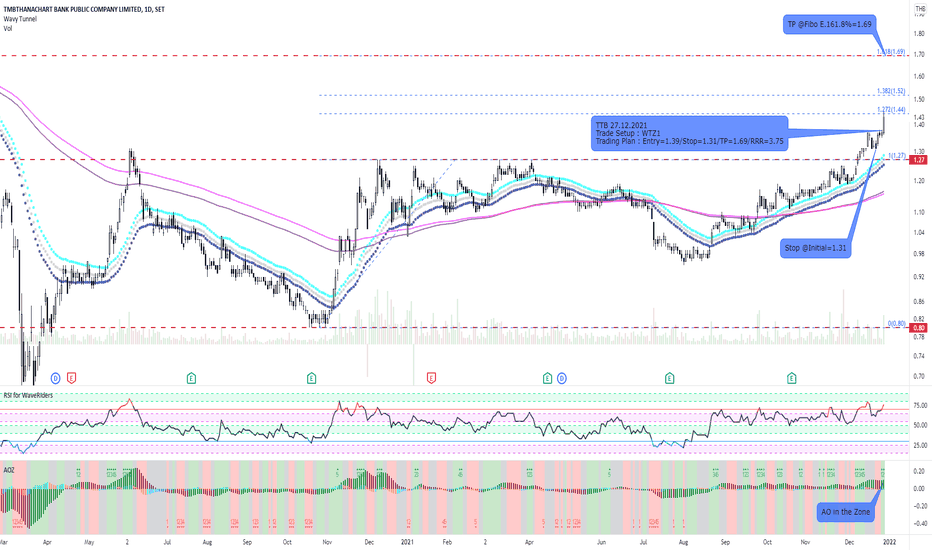

Thai SET impact from covid19 delta and omicron bad omensBBL ; price plummetted after fear started , when situation got to the worst, price already go up for days, as many can speculate the end of delta wave

at a point, price open gap up, which favor strategy of short and DCA buy back over weeks

gap up 23 aug , dropdown wks=... not quite gap down, more gradual price downtrend, downswing = 9, upswing= 11

kbank ; gap up 23 aug , dropdown wks=4, downswing = 9, upswing= 13

TMB bank (TTB) ; gap up 23 aug , dropdown wks=4, downswing = 17, upswing= 20+ up to now(jan22)

siam cement company (SCC) ; same time gap up but last only 2-3 wks then down for 14 wks, now on uptrend for 4 wks but will see extent of omicron impact

siam cement's paper&packaging company (SCGP) since ipo in 2020 it soared up and up, its theme of online shopping play important role in covid-era. So contradicting price fall

when others went up in late august & start 6 wks downtrend. jan 2022 might start another down trend, as we already had 13 uptrend candles (TD sequential 13)

but will SCGP be seen as covid-defensive stock might limit its downside

From my humble, non-expert, nooby personal opinion, Thai's bluechip stocks could be in danger of omicron impact.

Fundamentally ; afternoon of 5th Jan 2022, SET start falling, without apparent drop but retrospectively ,we guessed insider who seen omicron rising selling a chunk. 6th is public awareness of both us interest rate amped up & earning yield gap in downtrend, Thailand’s institutional side sells twice as much as foreign investor with 3x local investor buying the SET at 1660.

growth of income/profit from SET100/SET50 depends on both domestic economy & tourism alike which both of which would be crippled by this covid19's wave

Technically ' Thai's SET50 index plummetted 8 of last 8 times it hit resistance/support of 979- 999.

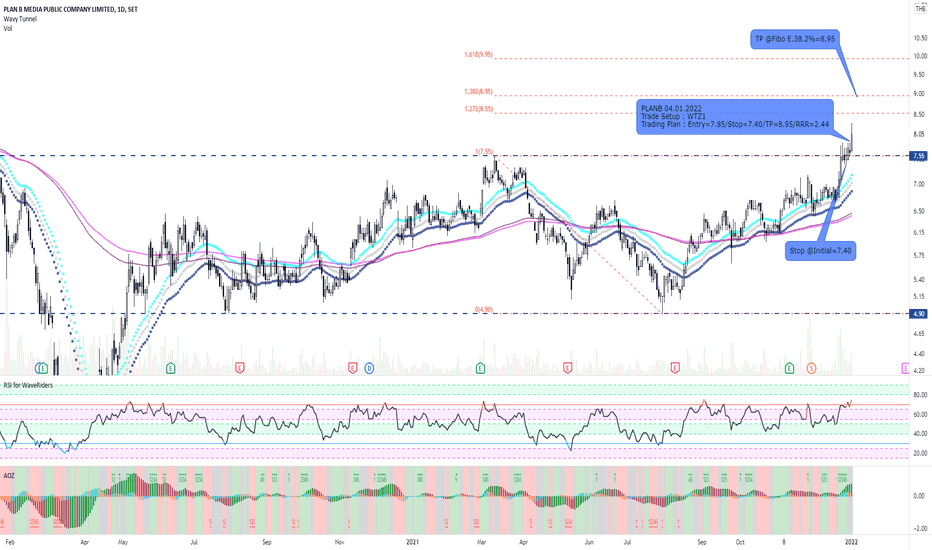

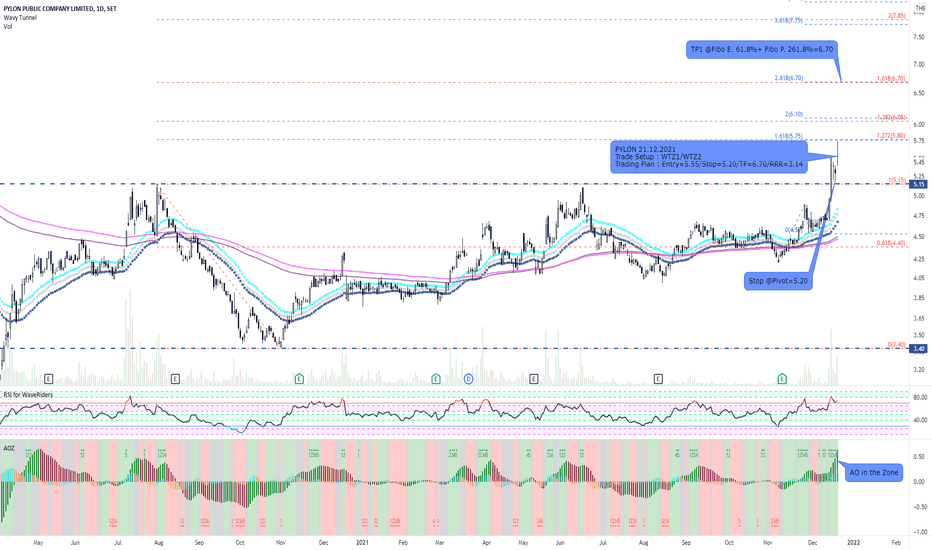

AWC and WTZ1 SetupBefore expecting WTZ1 trade Setup, we could take this opportunity to speculate AWC testing the upper range due to closing above POC of VP with gained volume. I made the 1st plan for trading preparation. If it can break out the upper range, we will make another plan for this stock. Good Luck

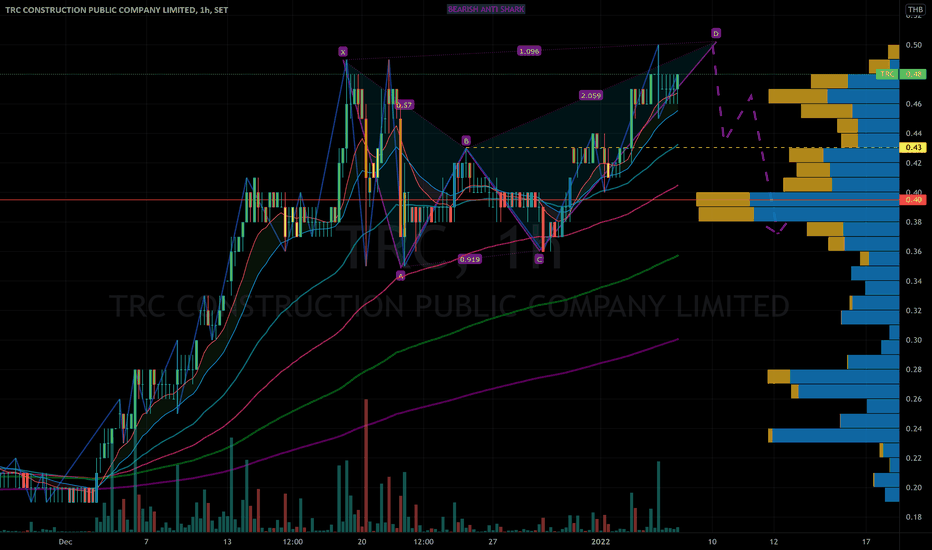

TRC | Bull Trap Beware | Anti Shark Bearish Harmonic | DowntrendTRC | Thailand SET Index | Construction Sector | Chart Pattern Trading

Chart Pattern: Anti Shark Harmonic Bearish Pattern - Bull Trap

Price Action: Short Entry @ low breakout recommendation - Target Downtrend at the Shark tail

Good Luck

DP

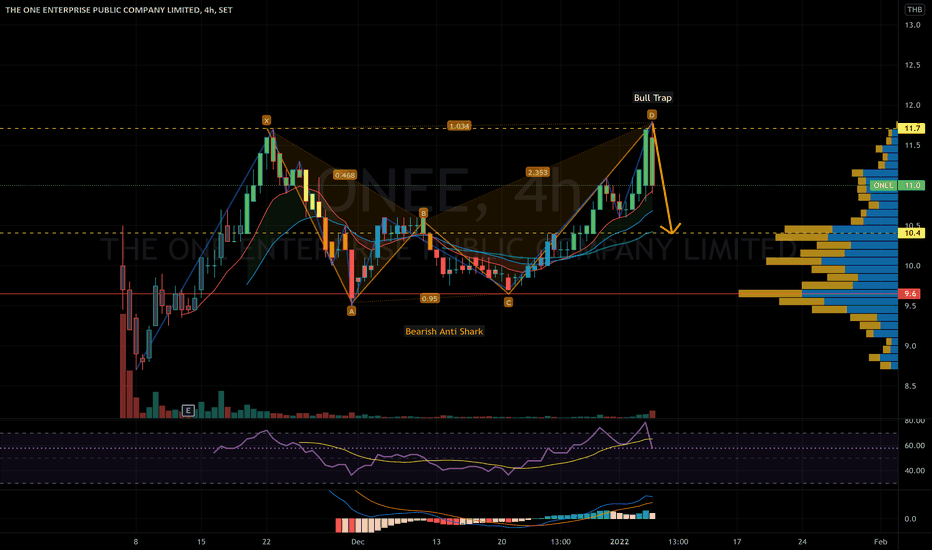

ONEE | Bearish Anti Shark Harmonic | Bull Trap | Entry@Pullback?ONEE | Thailand SET Index | Media Sector | Price Action & Chart Pattern Trading

Chart Pattern: Anti Shark Bearish Harmonic

Price Action: Short Entry @ Breakout avoid Bull Trap and could be entry @ pullback position for speculative buy

Indicator:

> RSI down dead cross MA line still on high bullish side above 50.

> MACD remains upside above baseline 0

Stop-loss @ Shark’s tail position - target at shark’s head until further new pattern changes

Trade with affordable risk ratio 3:1

Always respect your stoploss

Good Luck

DP

MDX | Bearish ABCD Harmonic Pattern | Completed 5th Elliott WaveMDX | Thailand SET Index | Energy Sector | Price Action & Chart Pattern Trading

Chart Pattern: Bearish ABCD Harmonic Pattern

Price Action: Short Entry @ Low Breakout Channel

Completed Elliott 5th Wave correction ABC phase. What do you think? let me know

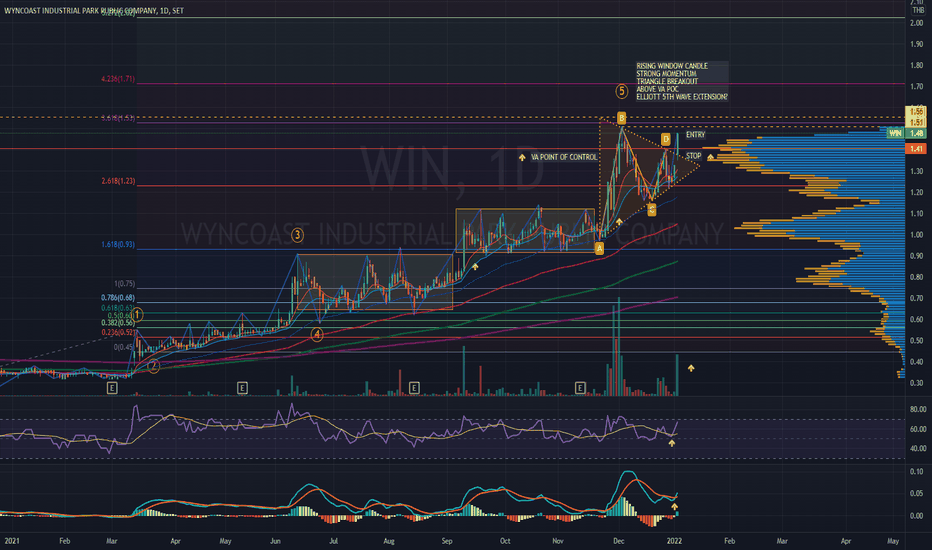

WIN | Strong Momentum Rising Window Candle- Triangle Breakout WIN | Thailand MAI Index | Price Action & Chart Pattern Trading

Chart Pattern: Symmetrical Triangle Strong Momentum Breakout - possible new high Elliott 5th Wave Extension

Price Action: Entry @ New High Breakout supported with strong momentum with Rising Window Bullish Candlestick

Indicator:

> RSI: Bullish signal cross up MA line

> MACD: Golden cross way above baseline 0 - indicating strong bullish

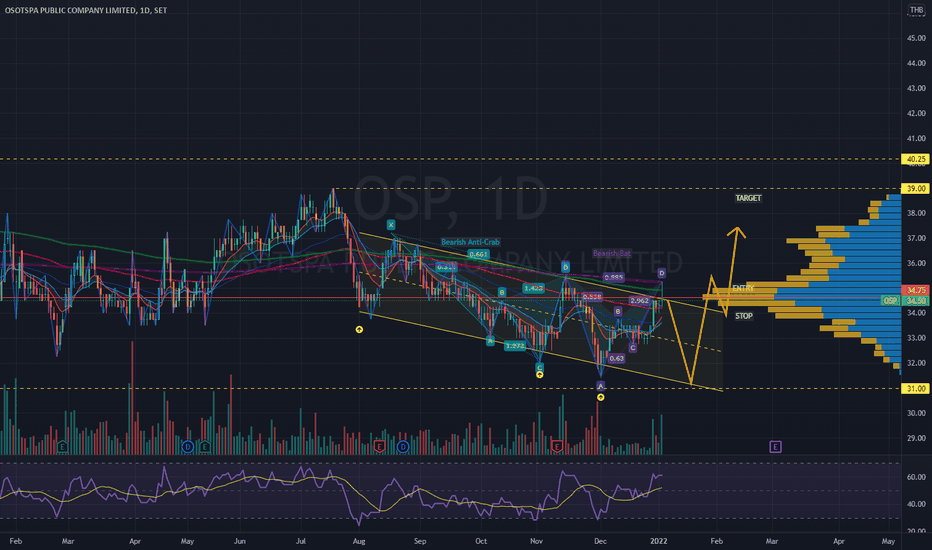

OSP | Bull Trap | Falling Channel Harmonic Pattern | Tight StopOSP | Thailand SET Index | Food Sector | Chart Pattern Trading

Chart Pattern: Falling Channel Bearish Harmonic Pattern

Price Action: Watch out for BULLISH TRAP and FLASE REVERSAL BREAKOUT or Make ENTRY with tighter STOP-LOSS

Indicator:

> RSI & MACD Bullish Trap

Trade with affordable risk

Trust in your system indicator

Always respect STOP-LOSS

Good Luck

DP

INTUCH | Bull Trap | Bearish Butterfly Harmonic PatternINTUCH | Thailand SET Index | ICT Sector | Chart Pattern Trading

> Chart Pattern: Bearish NEN STAR and BUTTERFLY in PARALLEL CHANNEL - Bull trap

> Price Action: Beware of BULLISH TRAP | Entry Position@Breakout with tighter stop-loss

> Indicator: BULLISH TRAP

Trade with AFFORDABLE RISK

Trust in your SYSTEM

Always respect STOPLOSS

Good Luck

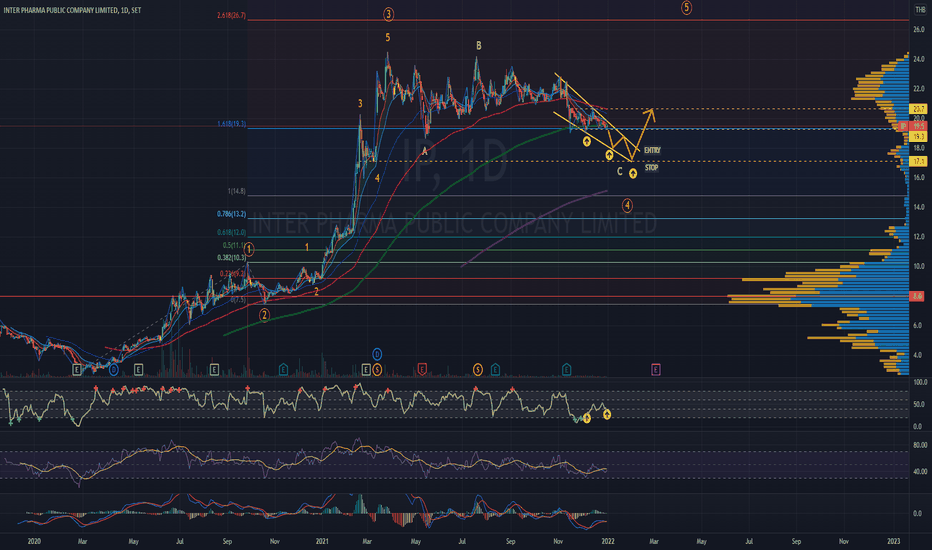

IP | Falling Wedge Reversal| MFI Divergence | Elliott 4th Wave?IP | Thailand SET Market | Price Action Trading | Elliott Wave Tracing

Chart Pattern: entering Falling Wedge Reversal Pattern

Price Action: Downtrend area of consolidation

Entry Position: Buy on BREAKOUT of FALLING WEDGE

Indicator:

> MFI - Money Flow Divergence - Banker accumulation phase

> RSI - Sideway up below 50

> MACD - Golden cross below baseline 0

Trust SYSTEM & INDICATOR | Never panic trade

Trade affordable RISK | Ratio 3:1

Always respect STOP-LOSS

Good Luck

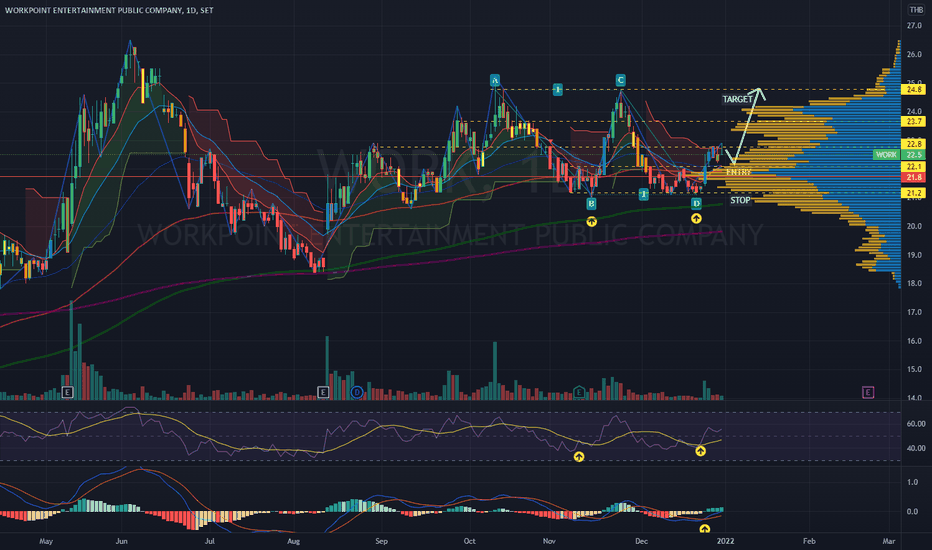

WORK | Harmonic ABCD | Entry @ Pullback |Gravestone DOJIWORK | Thailand SET Index | Media Sector | Price Action Trading

Chart Pattern: Harmonic ABCD Bullish Pattern

Price Action: Entry @ Pullback from bullish breakout with Gravestone DOJI candlestick

Stop-loss Position - 3 - 5% below Volume Profile POINT OF CONTROL

Risk Ratio: 3:1 minimum

Indicator:

> RSI bullish divergent crossover

> MACD golden crossing over baseline 0

Always respect your stop-loss

Good Luck

HNY 2022

ITEL | Bullish Flag Breakout | Entry PositionITEL | Thailand SET Index | ICT Sector | Price Action Trading

Chart Pattern: Falling Wedge Reversal

Price Action: Bullish Breakout with Breakaway Candle

Indicator:

> RSI & MACD golden cross above baseline

Placing your stop-loss 5-7% below the entry, there may be some pullback

Risk ratio: 3:1 minimum

Always respect your stop-loss

Good Luck

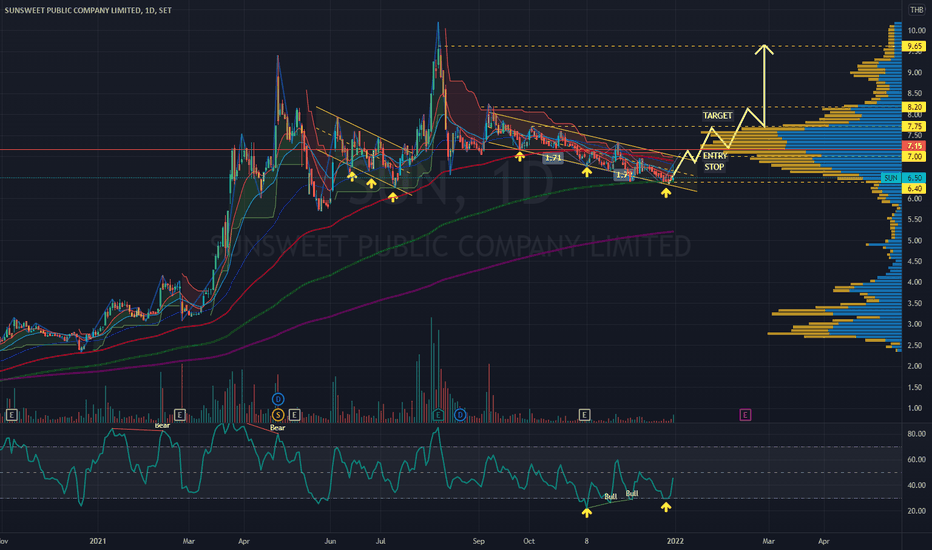

SUN | Possible Powerful 3-Drive Harmonic Pattern |Entry@BreakoutSUN | Thailand SET Index | Food Sector | Chart Pattern Trading

Chart Pattern: Possible a powerful THREE-DRIVE HARMONIC REVERSAL

Price Action: Entry@Breakout and Retest Area of Support

Indicator: RSI Bullish Divergence

Always respect your stop-loss

Good Luck

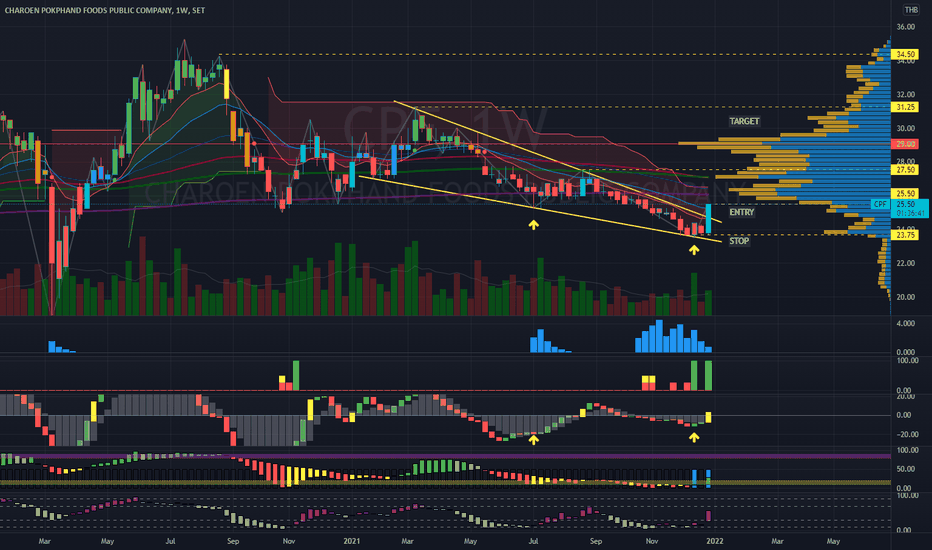

CPF | Week Timeframe | Bullish Wedge Breakout | Entry & Target CPF | Thailand SET Index | Food Sector | Price Action Trading

Price Action | Bullish Engulfing candlestick strong momentum

Chart Pattern | Falling Wedge Bullish Breakout

Indicator:

> Banker Smart Money & Chip Volume Support

> BBD Banker divergent signal

> Fund Flow uptrend bottom signal

> KDJ STO on the uptrend channel

Place your stop-loss zone 5-7% below ENTRY

Recommended Risk Ratio minimum 3:1

Always respect your stop-loss

Good Luck

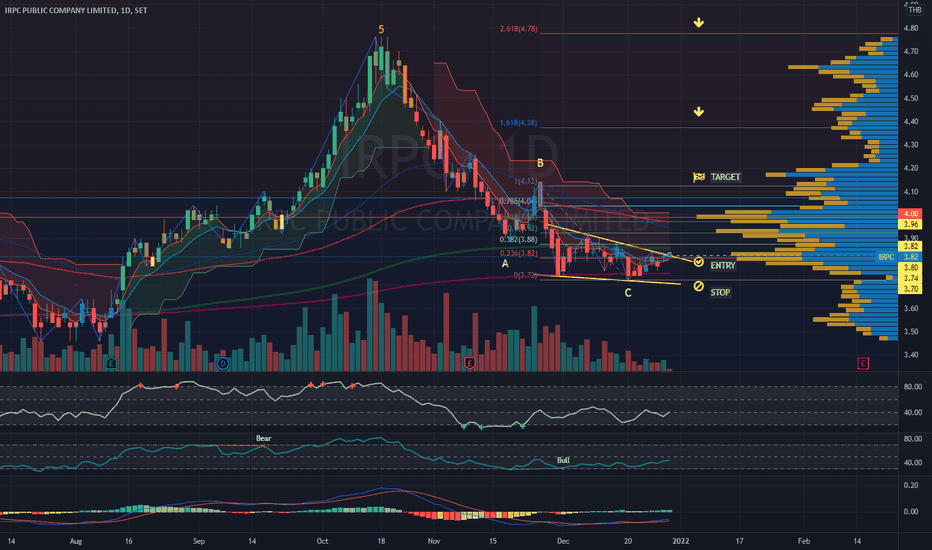

IRPC | Bullish Wedge Breakout | Target for uptrendIRPC |Thailand SET Index | Energy Sector | Price Action Trading

Price Action | Bullish Breakout

Chart Pattern | Reversal Wedge

Indicator:

> MFI - Money Flow-in support

> RSI Bullish Signal

> MACD golden cross - crossing up 0

Fundamental Factor: Oil price bullish trend

Risk Ratio: 3:1 minimum

Always respect your stop-loss

Good Luck