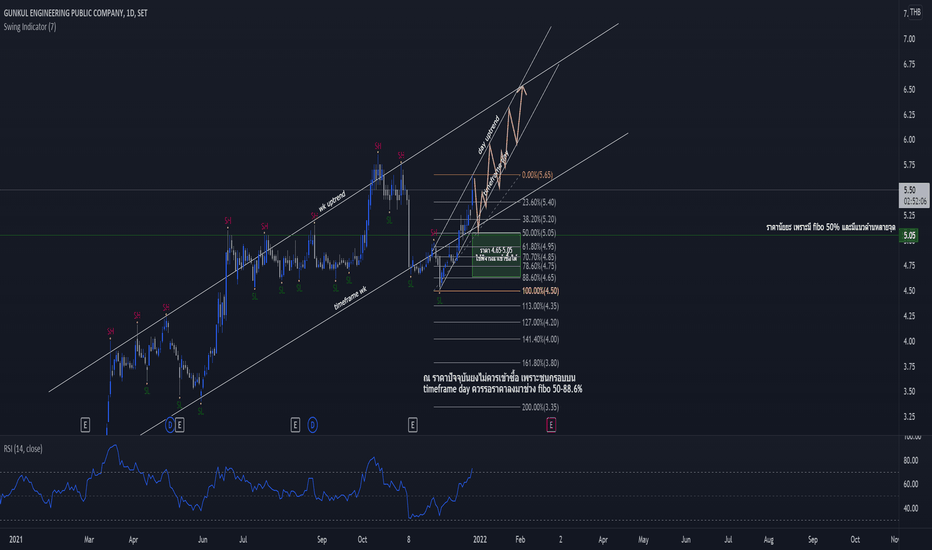

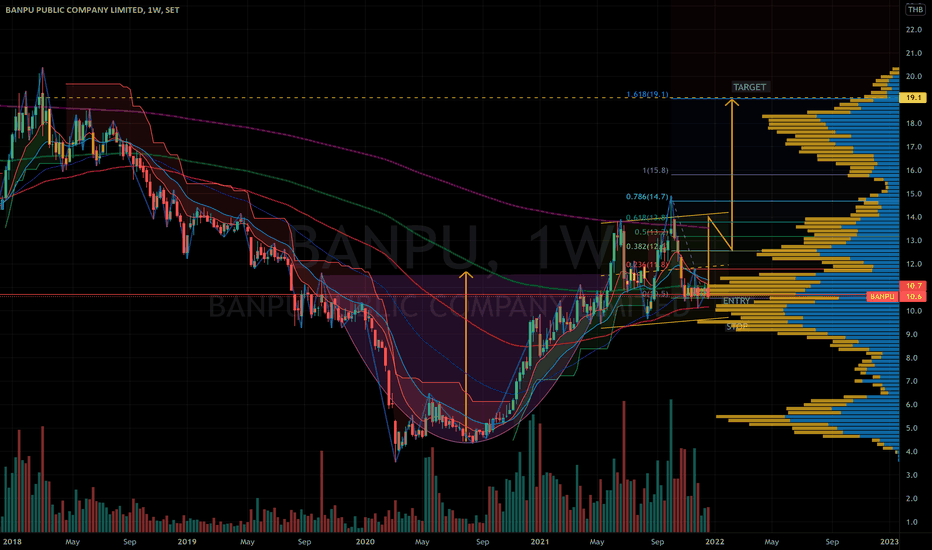

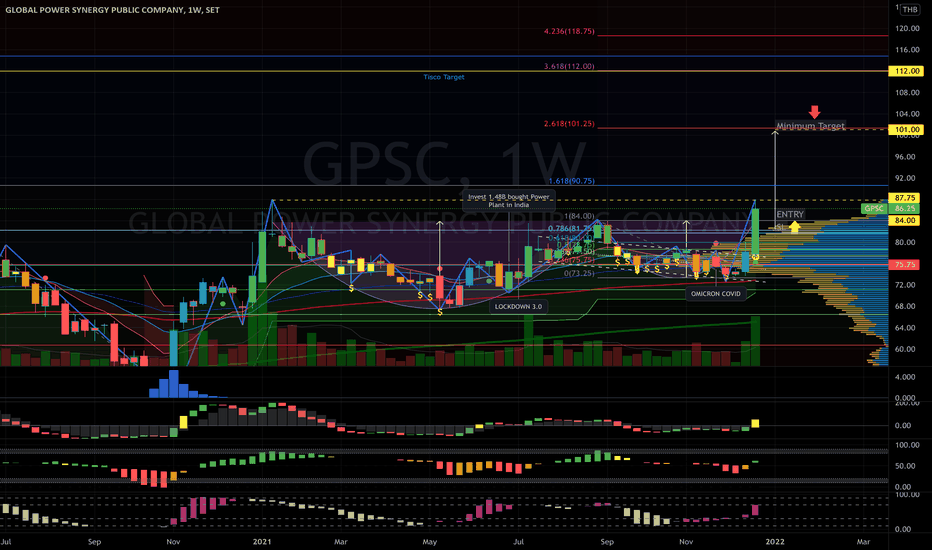

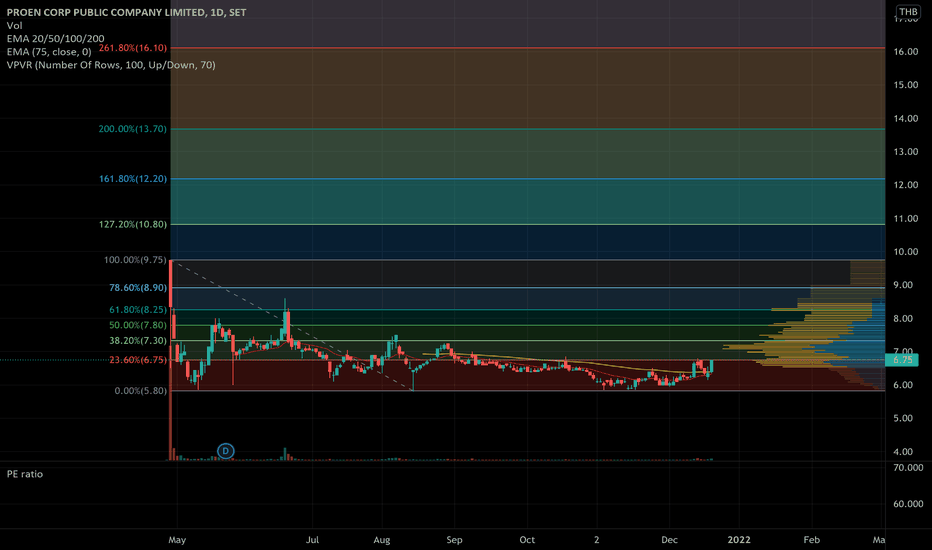

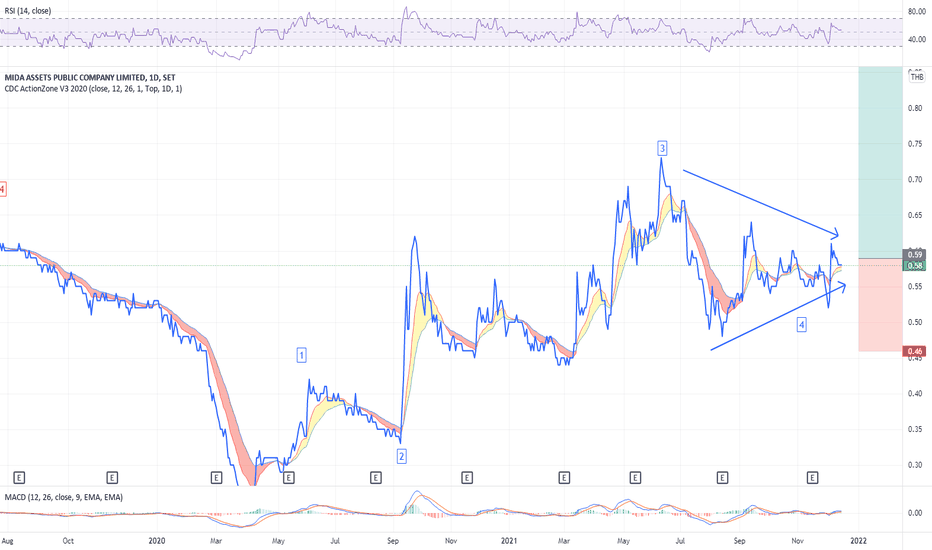

OR | Pennant Triangle Breakout | OR | Thailand SET Index | Energy Sector

Price Action:

> Strong BREAKAWAY CANDLESTICK

> Trend reversal BULLISH BREAKOUT

Chart Pattern:

> Inverted Head & Shoulders on daily timeframe

> Pennant Triangle BREAKOUT

Indicators:

> MFI - Money Flow-In cross above 60

> RSI - Bullish Power Move

> MACD - GOLDEN CROSS about to cross up 0

Minimum Risk Ratio: 3:1

Always respect your stop-loss,

Good Luck

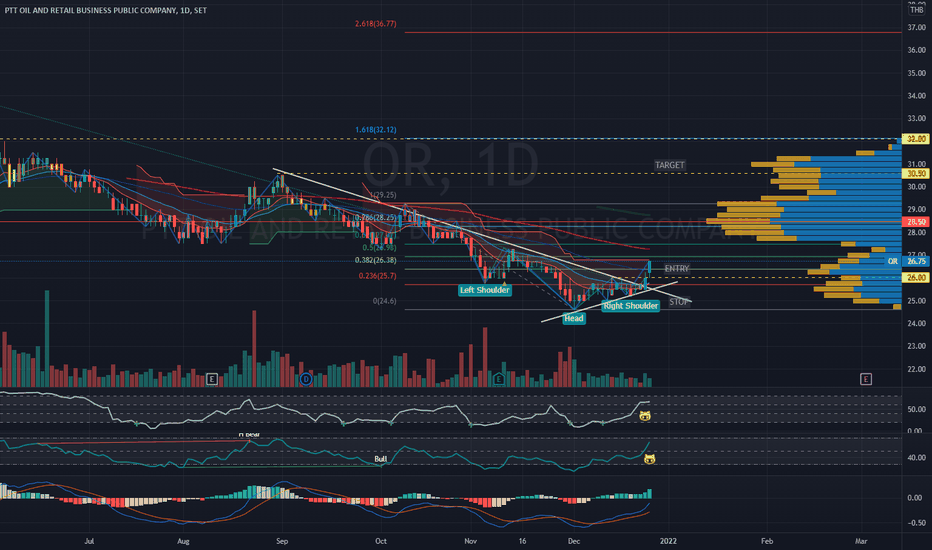

BBL | Weekly TF Inverted Head&Shoulders Target BBL | Thailand SET Index | Banking Sector

Chart Pattern Trading: Inverted Head & Shoulder weekly timeframe

Price Action Trigger: BUY ON BREAKOUT Neckline 129 Baht

Risk Ratio 3:1 minimum

Stop placement 5-10% below ENTRY POSITION

Always respect your stoploss

Good Luck

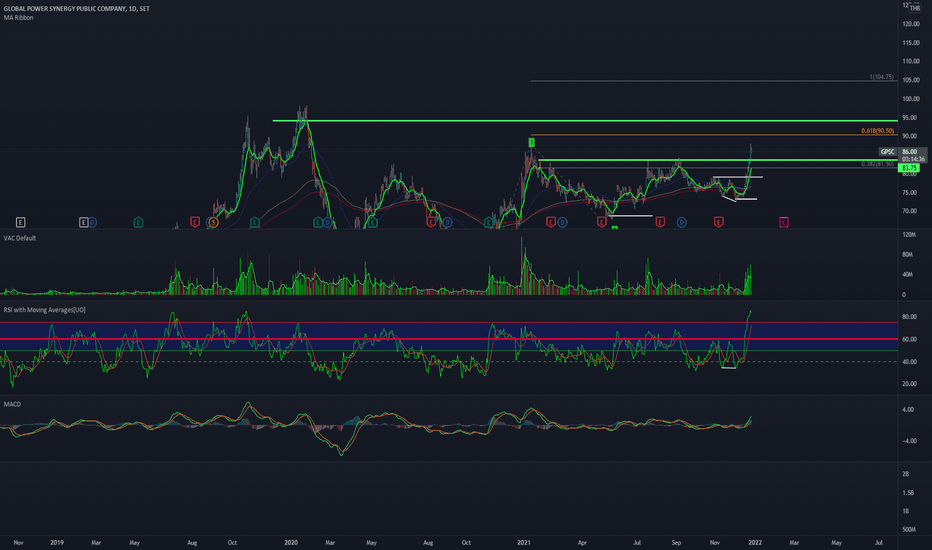

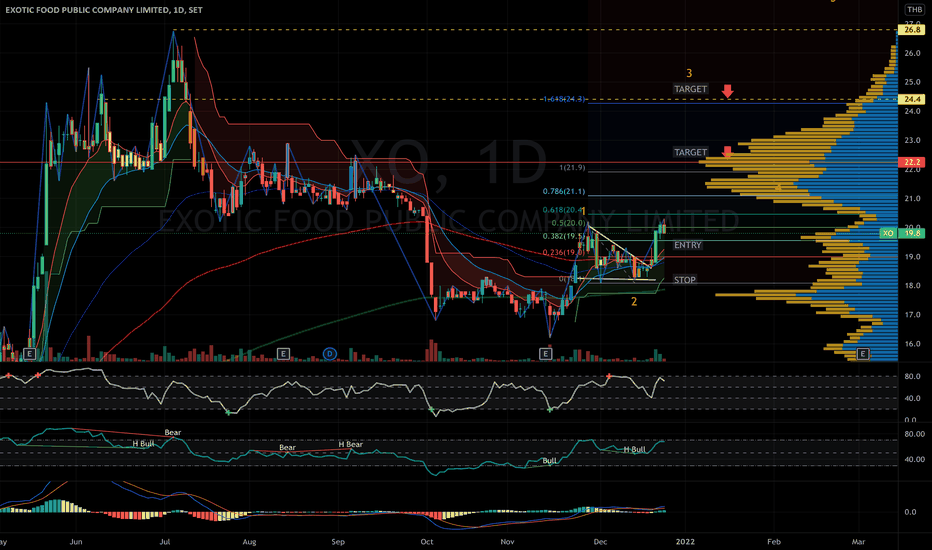

XO | Trend Breakout | Marubozu White Candlestick | Target Est.XO | Thailand SET Index | Food Sector | Target for uptrend Elliot Wave & Fibonacci Extension estimated

ENTRY Position

Price Action Trading: Trend Breakout with Marubozu White candlestick

Chart Pattern: Descending Triangle breakout

Indicator:

> MFI Money flow in

> RSI bullish signal

> MACD golden cross above zero line

Risk ratio 1:3 minimum

Stoploss 3-5% below entry

Always respect your stop-loss

Good Luck

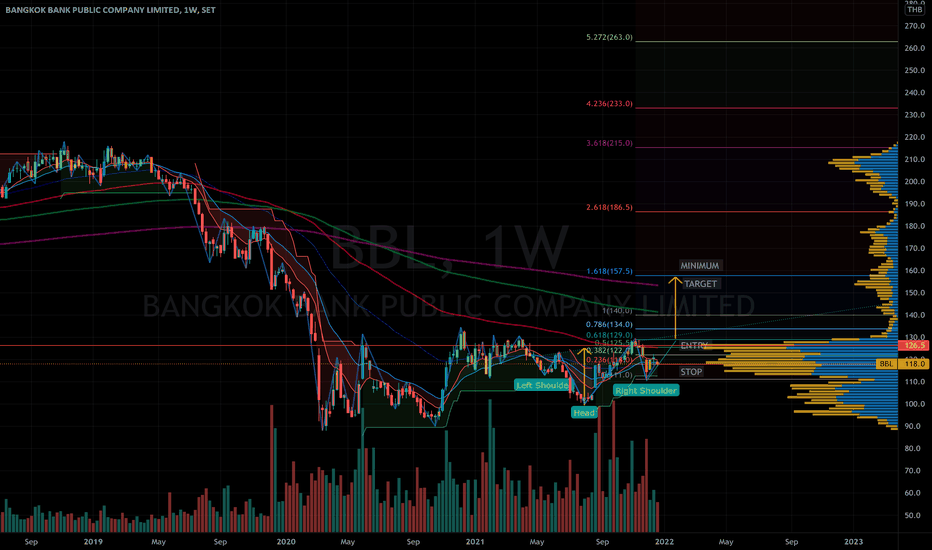

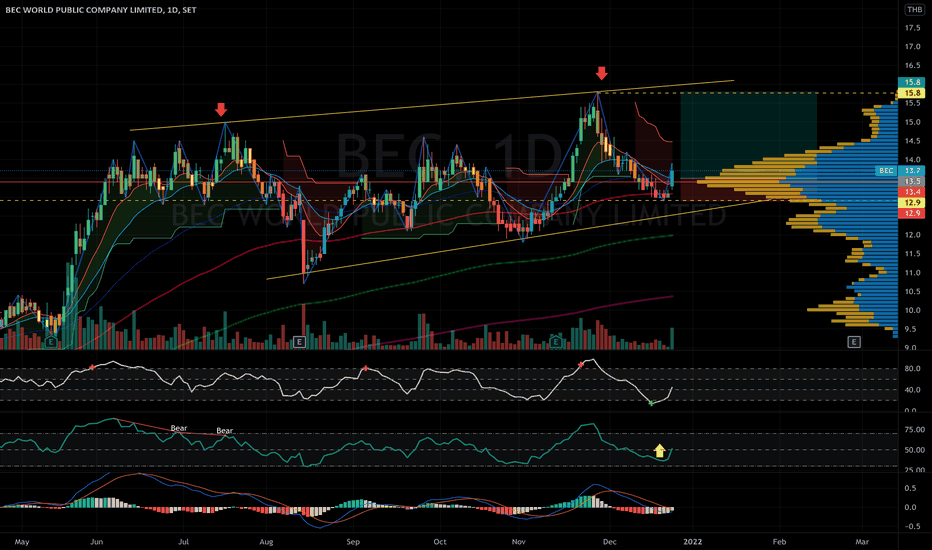

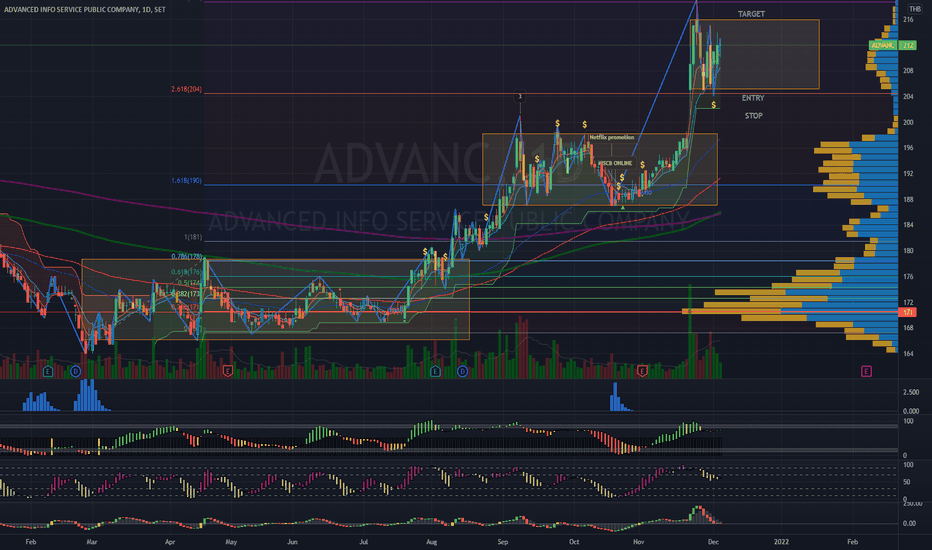

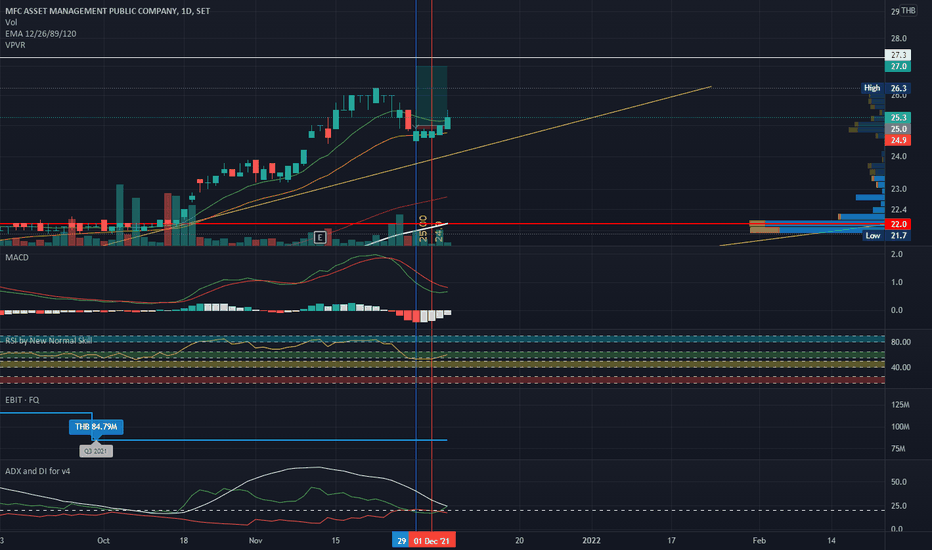

BEC | Money Flow In - RSI Bullish Signal - MACD Golden CrossingBEC | Thailand SET Index | Media Sector | Bullish Chart Pattern

Price Action: Strong bullish candlestick breakout from consolidation

Chart Pattern: Parallel Channel uptrend

Indicators:

> MFI - Money Flow - in Bullish

> RSI rebounded signal

> MACD about to make golden cross

Business Factor remains strong in Q4

Entry Position: Buy On Dip | Pullback

Always respect your stop-loss,

Good Luck

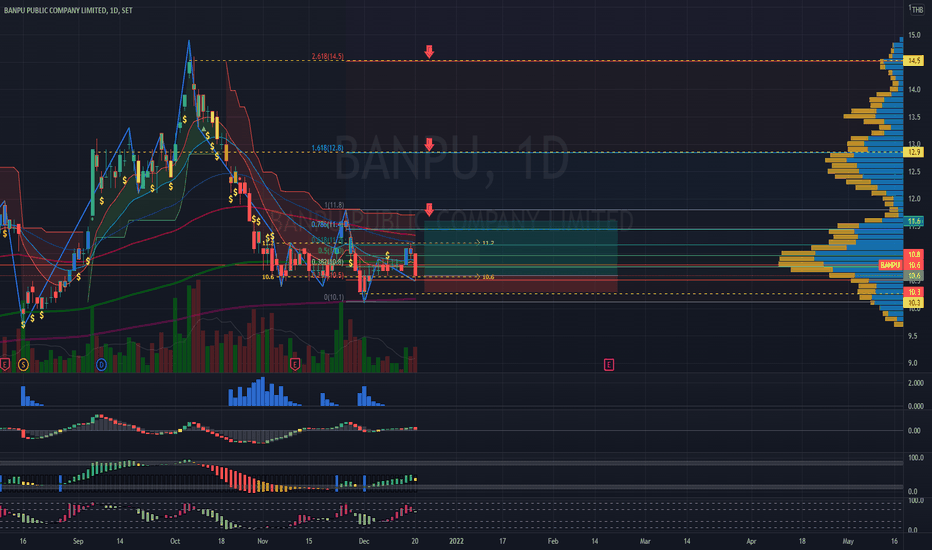

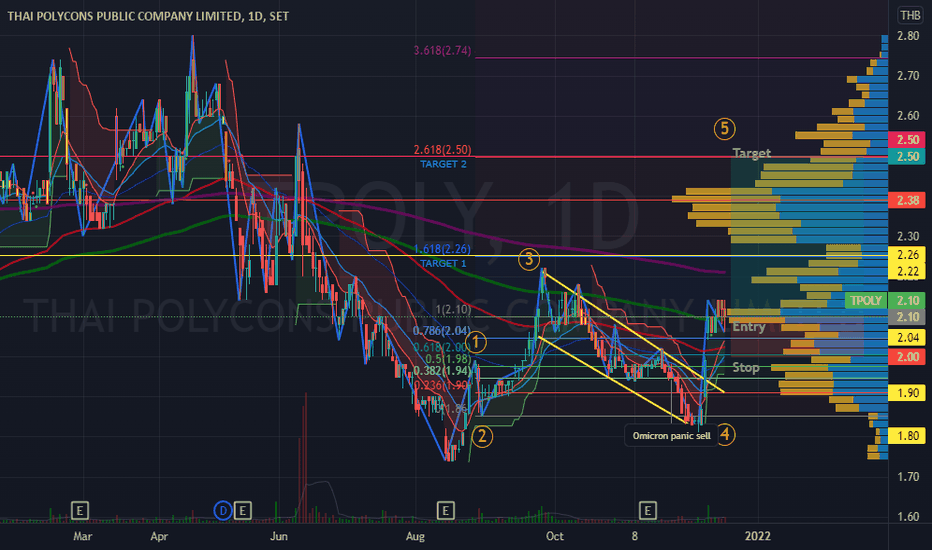

TPOLY | Falling Wedge Breakout | Buy on Dip Opportunity?TPOLY | Thailand SET Index | Construction Sector

Could be a BOD opportunity after strong breakout? The price now stands above EMA200, indicating strong uptrend signal for minor Elliot Wave 5.

Conservative ENTRY @ EMA10 | Stop loss at 3-5% below Entry

Risk Ratio | 1:4

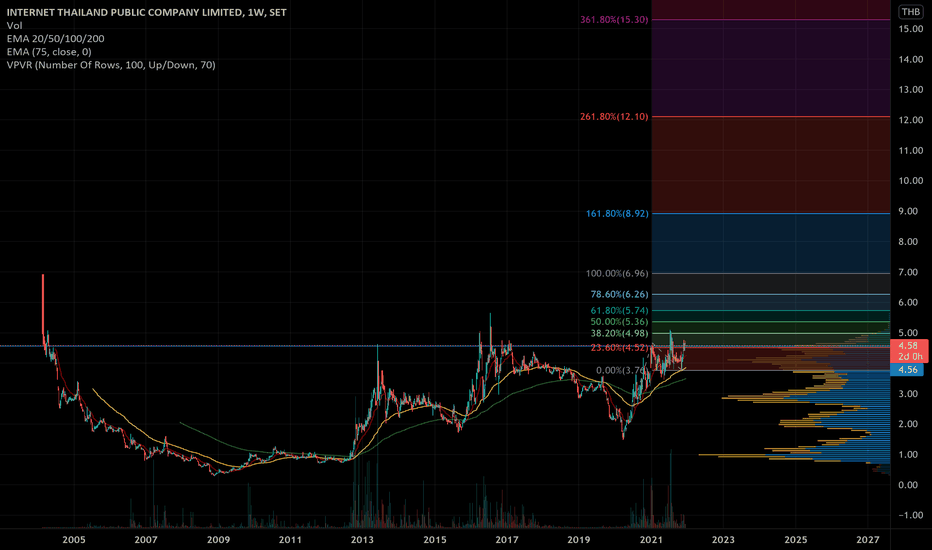

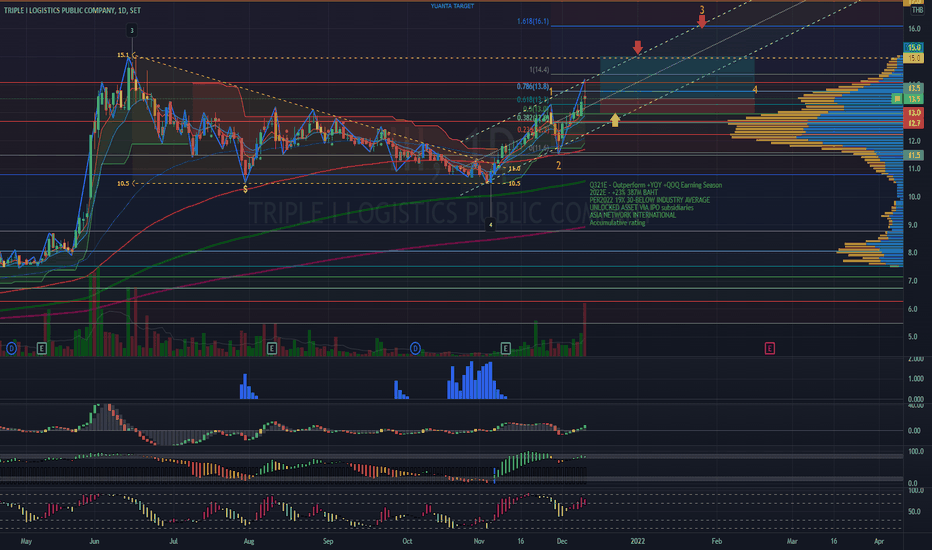

III | Target for uptrend | Previous High BreakoutIII | Thailand SET Index | Transportation Sector | Price Action | Chart Pattern

Estimated Target for Uptrend - Previous High Breakout Pattern

> Strong volume support with downtrend rejection candlestick - clearing previous ATH selling force

> Substantial Banker Volume support

> Banker Fund Flow RSI still on high side.

> Banker KDJ continuing on the rise.

Always respect your stop-loss!

Good Luck,

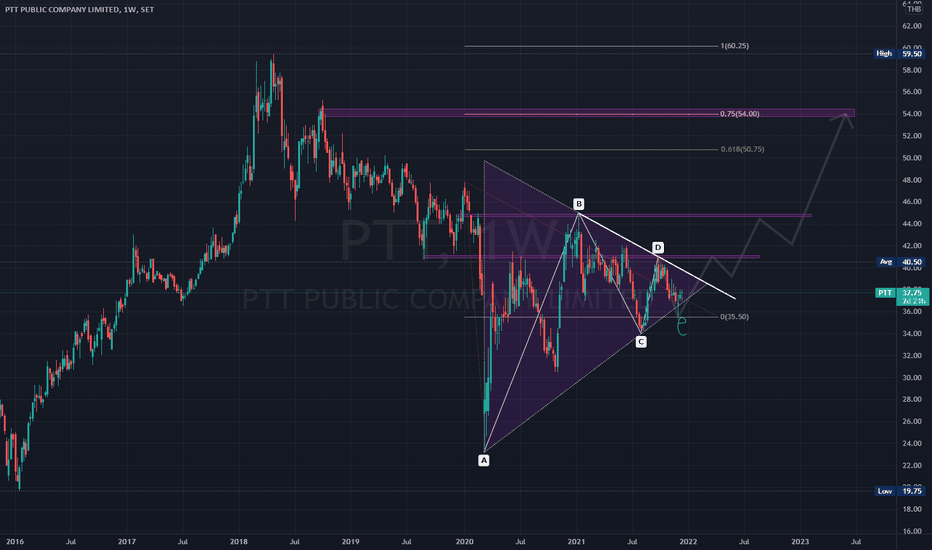

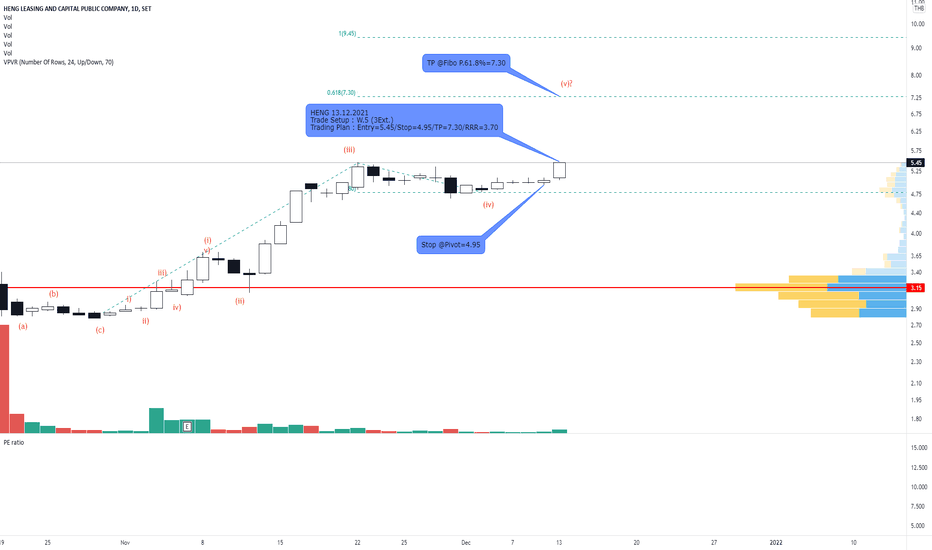

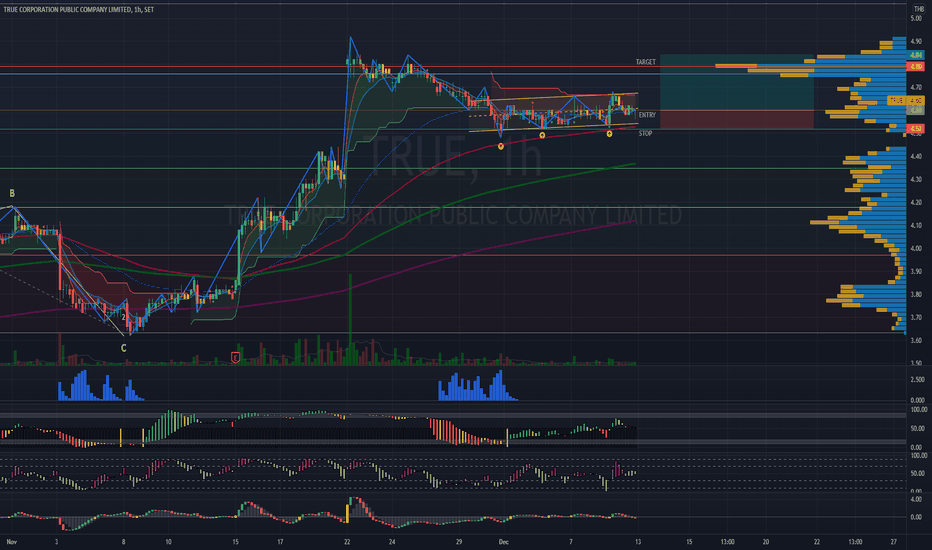

HENG and trading on W.5HENG is an IPO stock listed on Thai Stock Exchange this year. The stock has formed on a couple of impulse wave already, and then made another new high with rising volume. It's supposed to be Wave 5. However, it's unable to be guaranteed right now whether this wave is normal W.5 on W.3 Extension or W.5 Double Extension itself. No matter what's the wave, we still make the trade setup with high reward but limited risks. Enjoy.

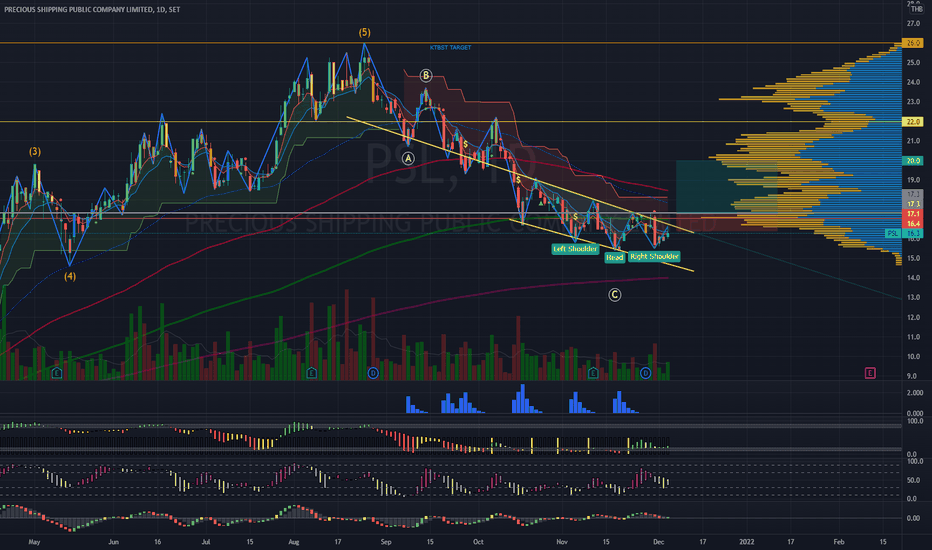

PSL | Inverse Head&Shoulder | Buy on Falling Wedge BreakoutPSL | Thailand SET Index | Transportation Sector | Chart Pattern | Price Action

> Really waiting for entry at EMA400 but this Inverse H&S appeared the first time in the main Elliott Wave Correction phase.

> Wait for confirmed trend Falling Wedge breakout EMA200 for an entry point to avoid a false break.

> Stop-loss 3-5% below entry point

> Target 21 baht at Volume Profile POC

Always respect your stop-losses,