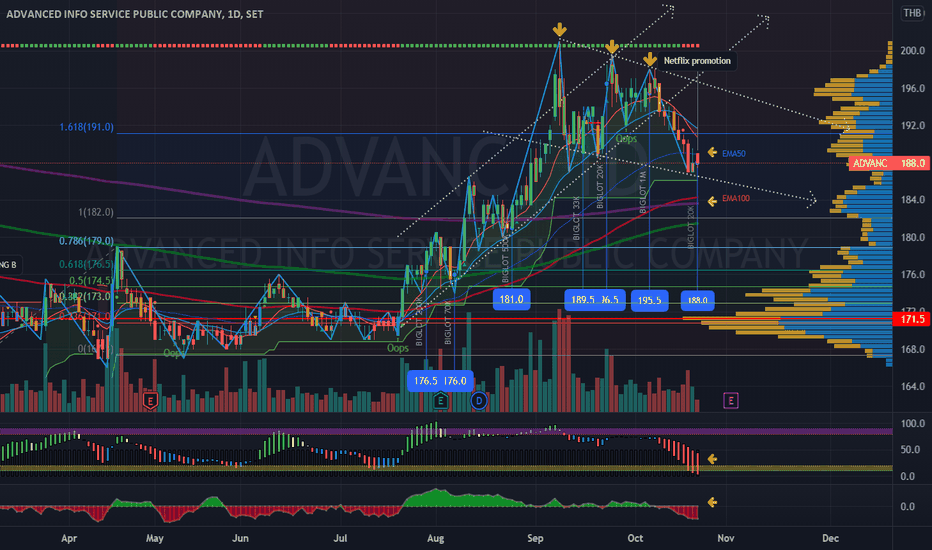

ADVANC| Trend reversal | retesting Falling Wedge EMA50ADVANCE | Thailand SET Index | ICT Sector | Price Action Analysis | SL - Falling Wedge Support Line

> Recent breakout uptrend channel of trade into downtrend channel - Falling Wedge Pattern - Primary WAVE 4 - ABC correction phase

> Possible trend reversal - wait for positive Banker Fund Flow signal before entering

> Retesting the Falling Wedge Support line if failed, possible to drop to EMA100.

> Smart Money signal - wait for fund flow divergent to confirm

> Volume Accumulation Index turning to Distribution (green color)

Upside fundamental factors:

> Positive +YOY upcoming earnings

> Current laggard stock price

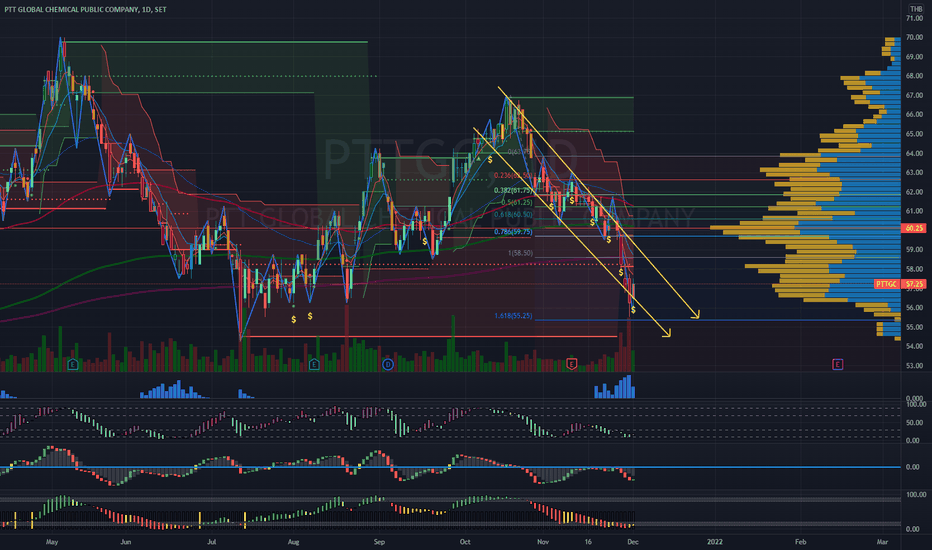

PTTGC | Target downtrend | Falling Wedge Reversal PatternPTTGC | Thailand SET Index | Petro Sector

> Estimated target downtrend with Falling Wedge Reversal Chart Pattern

> Multiple BOTTOM signal

> CCI | MACD | RSI divergent signal continued

> Buy signal - wait for confirmed breakout pattern before entering

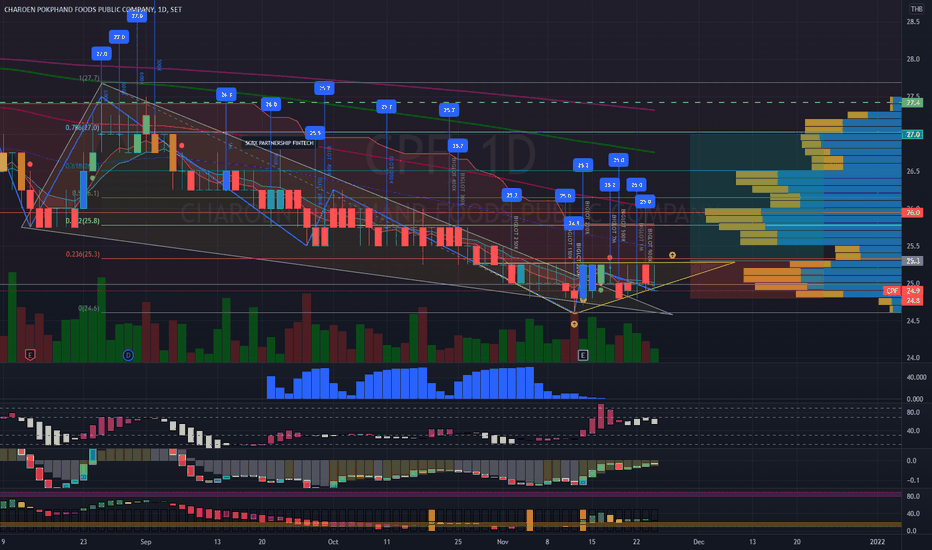

CPF | Trend Reversal Pattern Rising Triangle CPF | Thailand SET Index | Food Sector | Trend Reversal Chart Pattern | Rising Triangle

> Wait for candle breakout

> Multiple Bottom signals

> Banker Chip & Big Lot volume continuous supports

> MACD approaching golden cross (crossing up 0)

> RSI Ribbon strong divergent

Stoploss just above triangle bottom - Price Target at Fibo 0.786 - 1.00

Risk Ratio 1:3 minimum

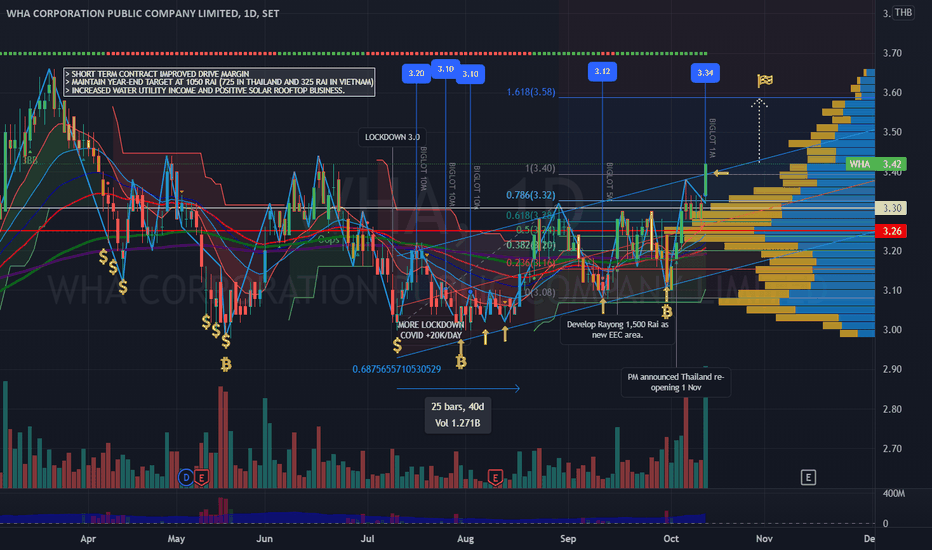

WHA | Breakout channel of trade | buy signal | TP 3.60 SL 3.30WHA breakout channel of trade upward trend - strong buy signal target price 3.60, stop loss 3.30

> Strong volume big lot 1 mil share push

> VA dominant on buy side

> positive BBD banker chip / fund flow

> average broker annual target price 4.80 - 5.00.

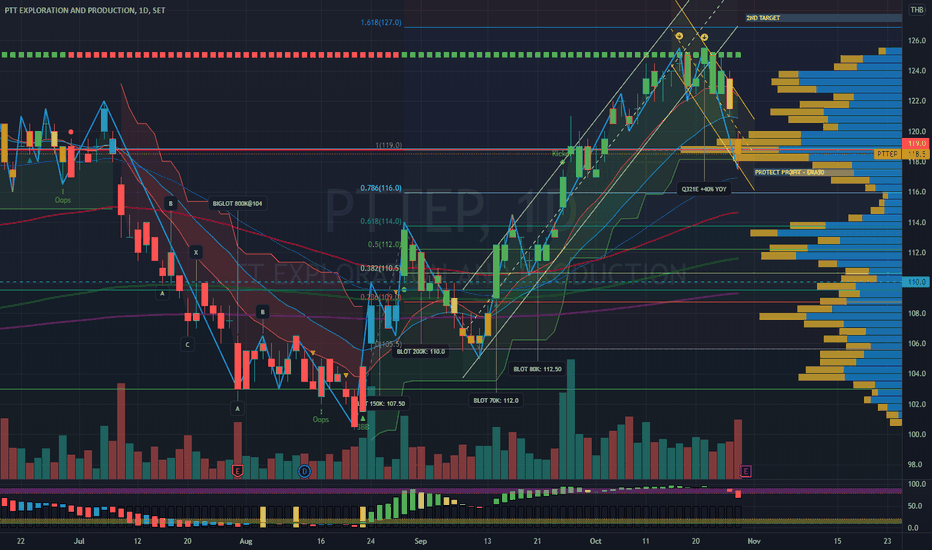

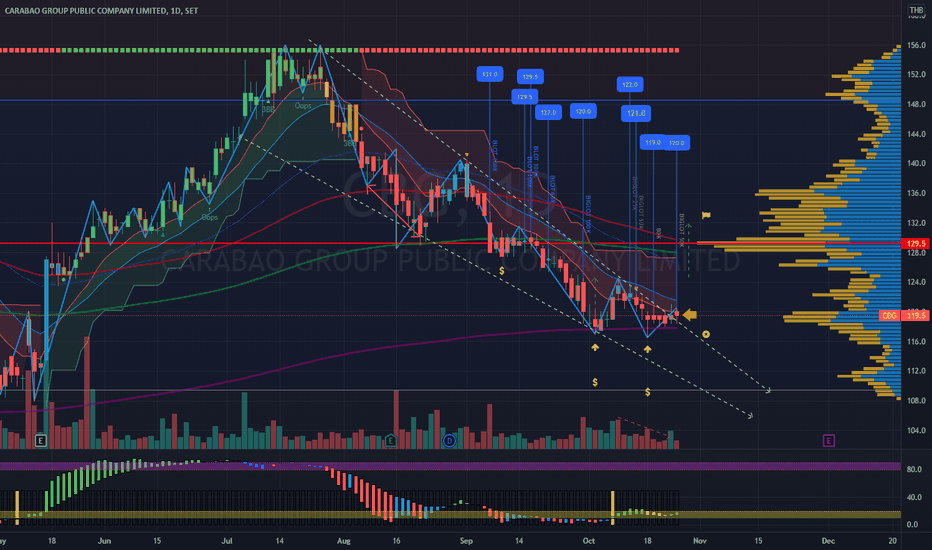

PTTEP | Q321E +40% Sell On Fact | Buy signal@RSI reboundPTTEP | Thailand SET Index | Price Action Analysis

This is my 3rd Buy position and decided not to take profit as the oil price continue to claim.

> Chart Pattern: Double Top and declining to test the Supertrend support.

> Banker Chip Volume support at EMA50 @ 117.0

> Buy position when RSI rebound, TP1: 127.0 TP2: 140 Timing mid-term trading about 1-2 month SL: slightly below EMA50

Always respect your stop-losses!

Best of luck

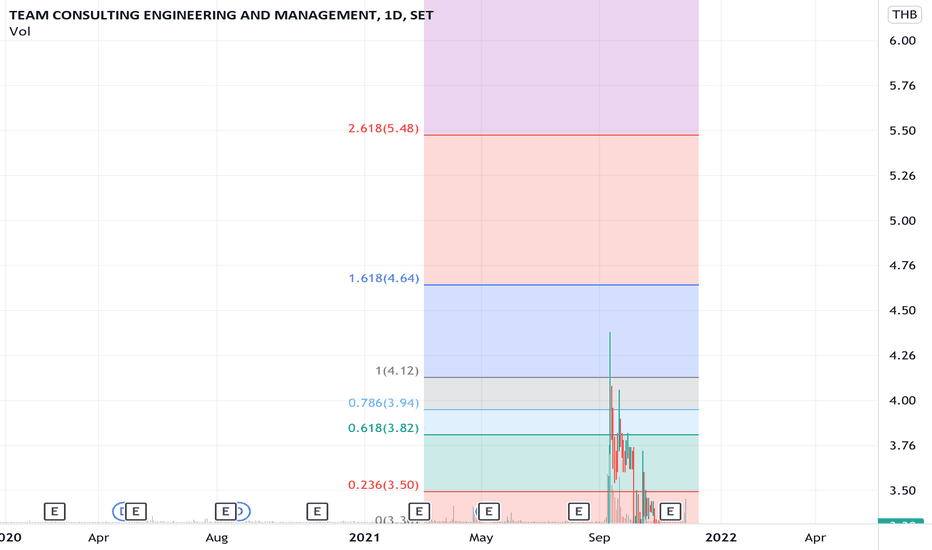

Wice is one stock with strong fundamental support. SET:WICE

Wice is one of my favorite stocks which has profit over Covids19 and still keep in the strong trend in price until hit new ATH at 14.00 baht.

The Fibonacci extension target will be 14.7 and next 15.9.

However the price is going up around 100% this year, please consider to invest.

TIPH and AB=CD Trade SetupTIPH and AB=CD Trade Setup. According to this pattern, if it breaks out the previous high or at least the end of b of wave iv, it possibly to test the Fibo. P. 100% as the same level of Fibo Ext. 61.8%. The price breaking TDST L. is another supporting signal to decide to buy TIPH. at the limited risks. Take this opportunity and control your risks well.

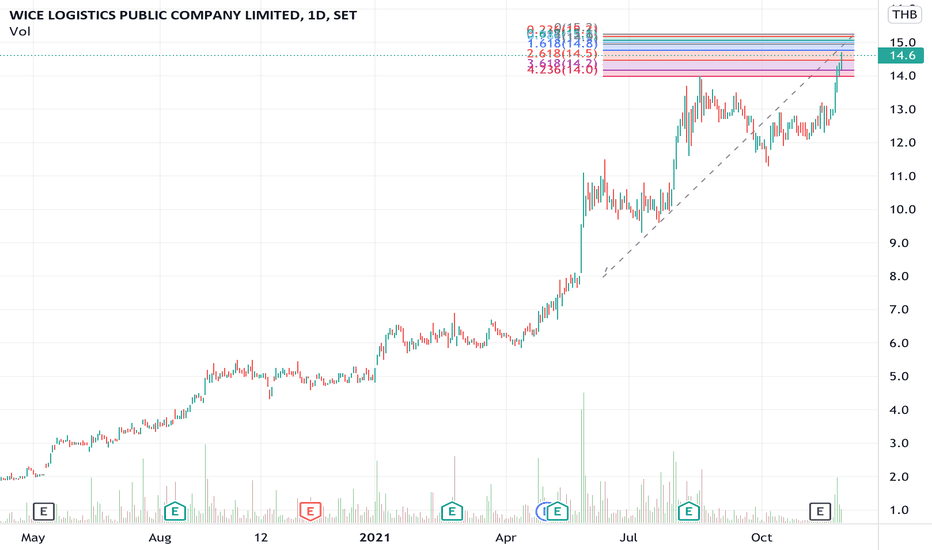

Jmart Day 48.75 (at the end of the road, prepare to go down)Jmart Day 48.75 (at the end of the road, prepare to go down)

+1. Price Arrival at the end of the road 2.618%

+2. The 50.50-50.75 line is a significant resistance.

caused by the overlapping of the Fibo line

---------

Sell strategy

First target 45.75-46.50 if unable to stand down

Target two 42.75-43.25

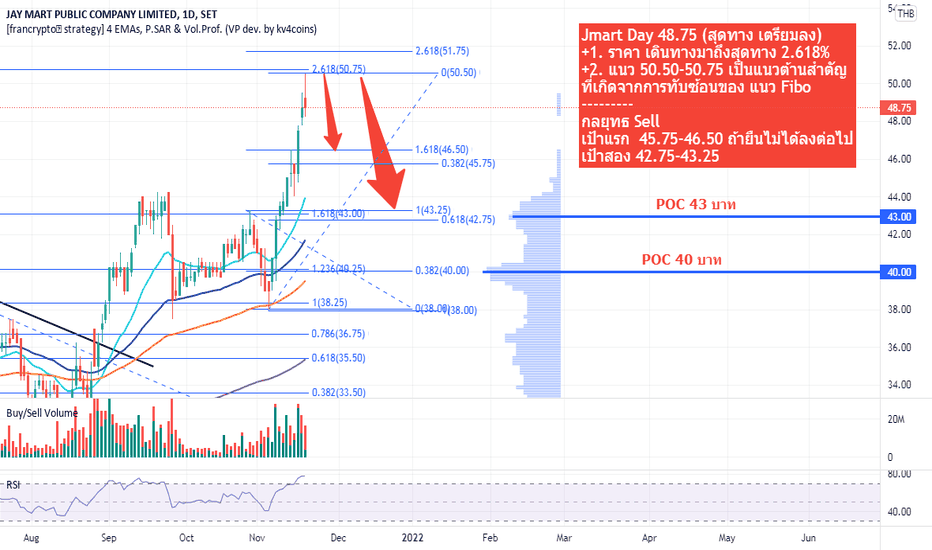

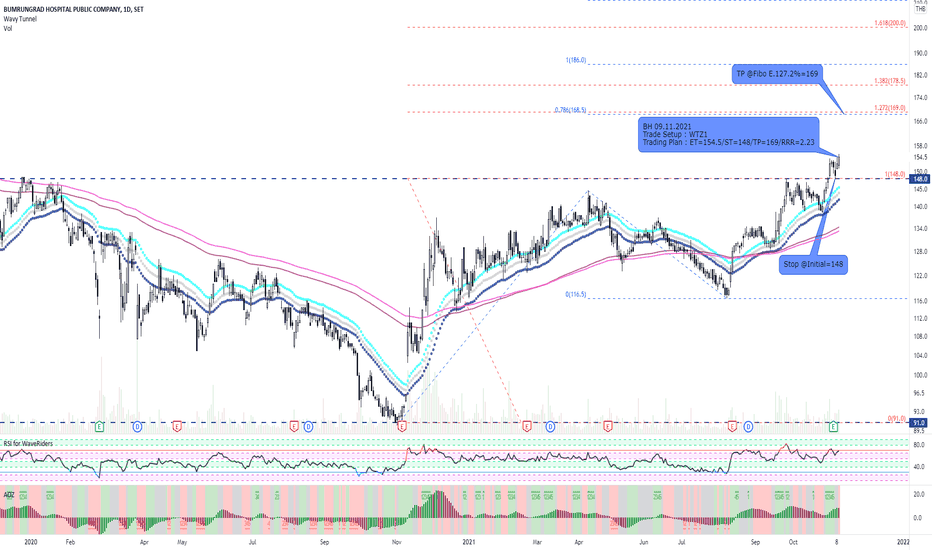

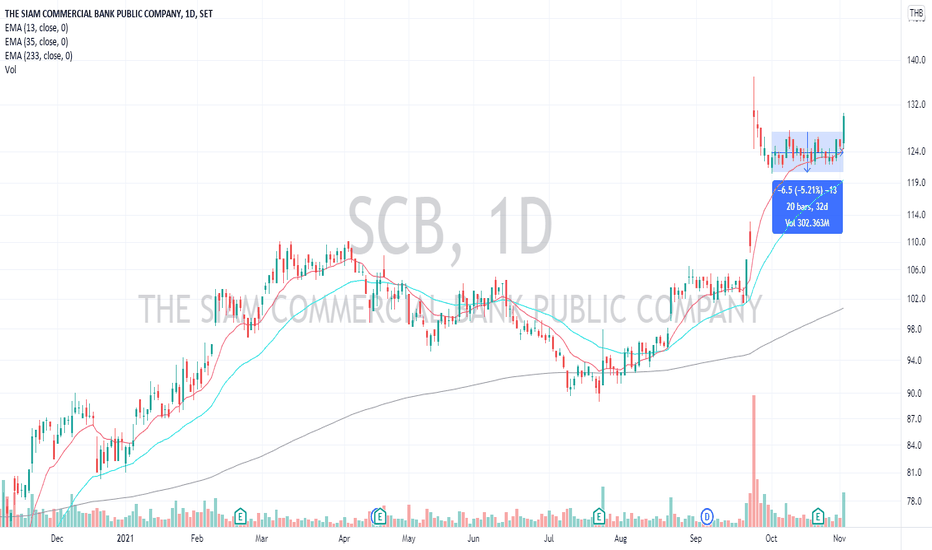

CBG | Potential Trend Reversal | Falling Wedge Breakout TP 132 CBG | Thailand SET Index | Food Sector | Price Action & Chart Pattern Analysis

Potential Trend Reversal - Short Rebound | Bullish Divergent Signal |

> Falling Wedge Breakout Target Price 132.0 based on Double Bottom - Stop Loss EMA400 or 1st Bottom 117.0

> Big Lot volume support continuously

> Banker Fund Flow positive

> RSI strong divergent for a bullish signal

To avoid false breakout, highly recommend waiting for a bullish violation of the last higher low.

Always respect your stop-loss,

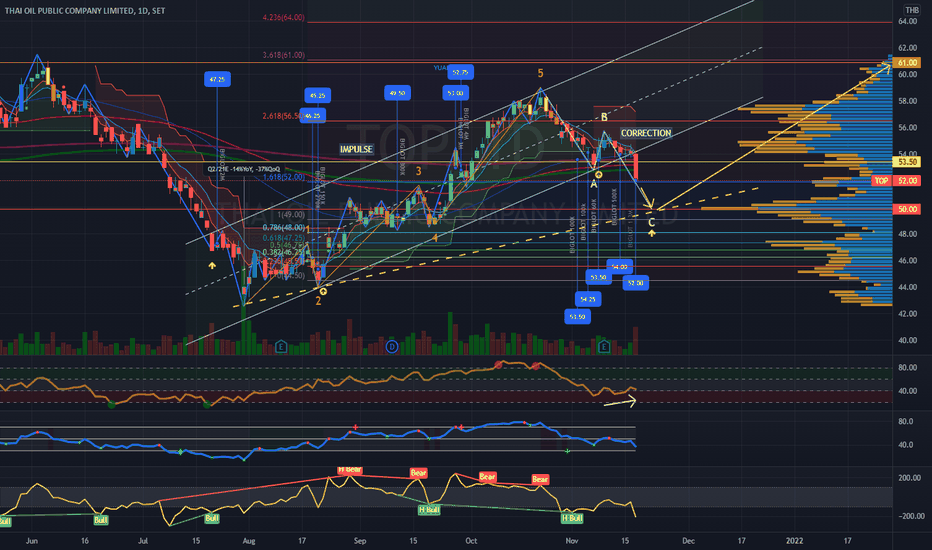

TOP | Elliott Wave Correction ABC Wave Position | MFI Divergent TOP | Thailand SET Index | Energy Sector | Correction ABC Wave about to end - Expect a rebound in near future.

> MFI Money Flow Index Divergent

> RSI tapping oversold position

> Elliott Wave Correction C position estimated at 1.0 of A Fibonacci.

Wait for a completed C position rebound signal or breakout before entering our first lot.

Stoploss can be placed at the lowest point of the C position.

Always respect your stop-loss,

Goodluck

BEC| Buy Signal Breakout | Strong Q321 TP 14.5 SL 12.5BEC | Thailand SET Index | Media Sector | Chart Pattern Breakout

> Bullish Butterfly Pattern - Channel trend breakout

> Strong Banker Chip and Big Lot volume support

> Banker Fundflow positive trend

> Supertrend/ CDC Action Buy Signal

> RSI uptrend

> Strong Q321 fundamental result performance

> Target Price 1| 14.5 Stop-loss 12.5 Risk Ratio 1:3

Always respect your stop-loss,

Goodluck

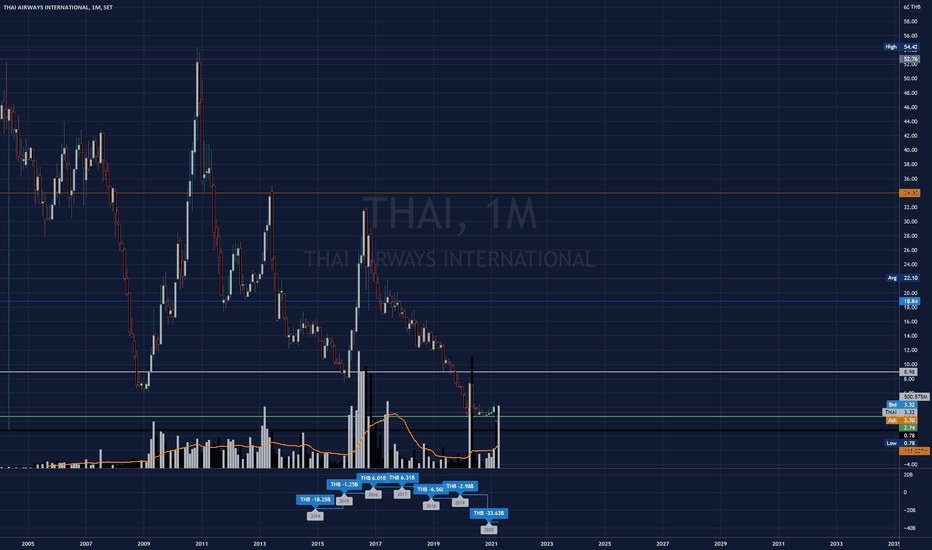

Thai Airways International - THAI BULLOnce the country starts opening up, expanding operations more you'll see a flow of interest enter the market.

You know me, know my trading style I BUY LOW SELL HIGH!

Expecting this one to rally soon enough.

Thailand is the Tourist go to destination!

SET:THAI

Thai Airways International - Since 1961

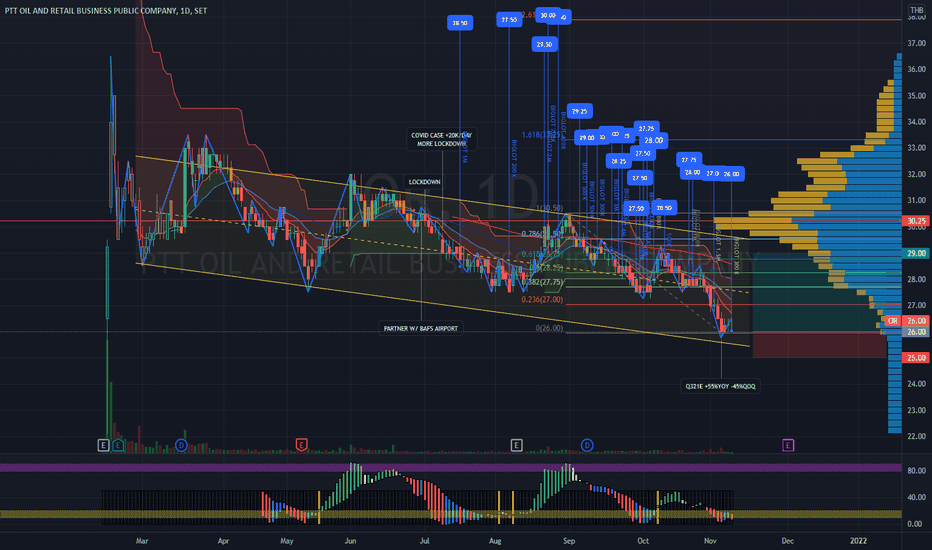

OR | Q3/21 E +55%YOY -45%QOQ Company Performance Spec BuyOR | Thailand SET Index | Chart Pattern | Price Action | Speculative Buy Target Price 29.0

> OR | Q3/21E Strong financial performance +55% YOY -45%QOQ

> Reversal Falling Flag Chart Pattern

> Buy position at Falling Flag Support Line 26.0

> Stoploss just below the support line 25.0

> Risk ratio: 1:3

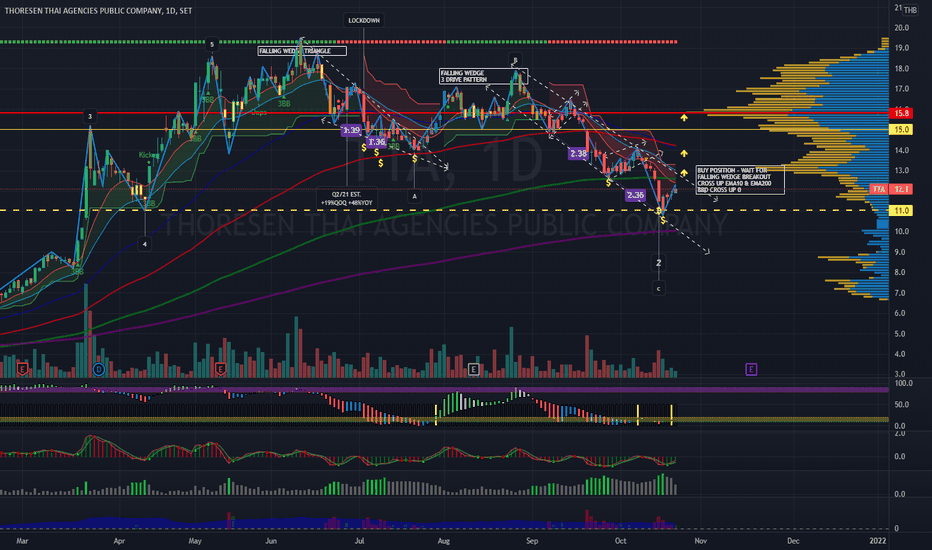

TTA | Re-entry Point Breakout Falling Wedge 3 Drive PatternTTA | Thailand SET Index | Transportation Sector

Target Price 16.00 at Volume Profile POC | Aggressive Stop loss at Falling Wedge downtrend line or conservative SL 11.0.

Risk ratio: 3.5

After a sharp declining trend crossing below EMA200 - completing Elliot Wave 2 Grand Supercycle, a possible bullish chart 3 DRIVE PATTERN

> Buy position | Re-entry point at Falling Wedge Breakout

> Crossing up EMA10 / EMA200 - signal for uptrend

> Previously strong Smart Money and Banker Chip signal

> Triple bottom of 3 Drive Pattern - a reversal pattern

> Q321E expected outstanding financial performance

www.kaohoon.com