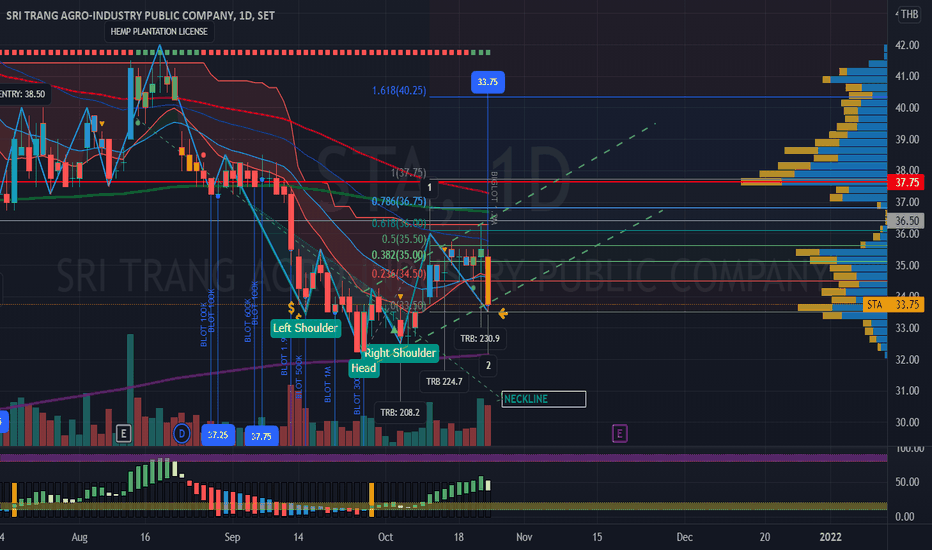

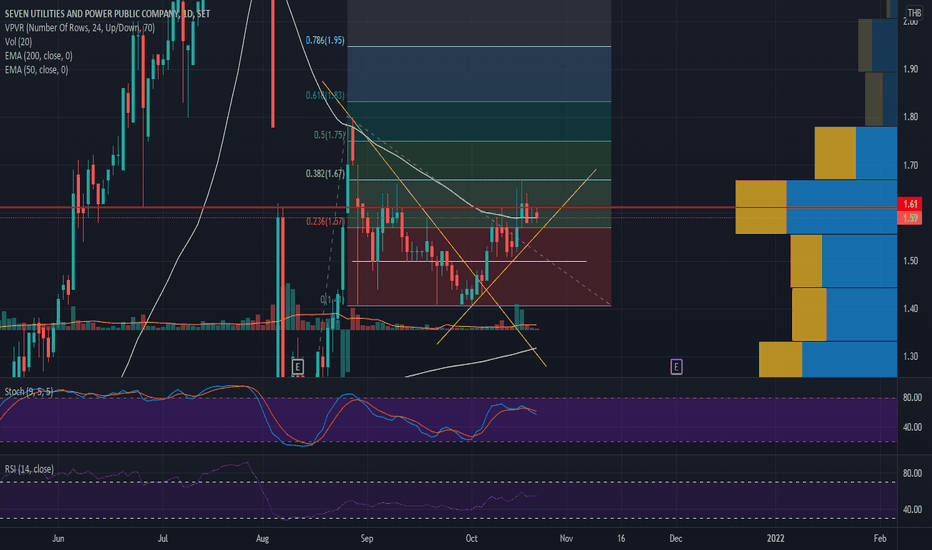

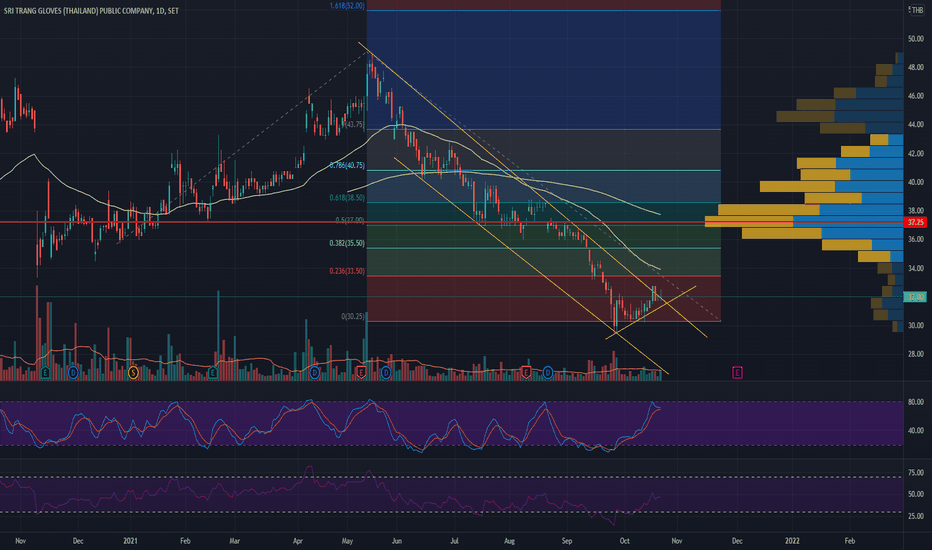

STA| Testing support - Rising Wedge - TP 37.75| SL 32.50STA | Thailand SET Index | Agricultural Sector | Price Action Trading

> Testing the support rising wedge if dropped below 33.00 would reset the uptrend pattern

> Strong Smart Money and Banker Chip signal

> Big Lot Volume Support Continuously

> CDC Actionzone - buy position

Fundamental Factor:

> Positive +YOY Q321E performance

> New business Hemp Plantation government FDA approval

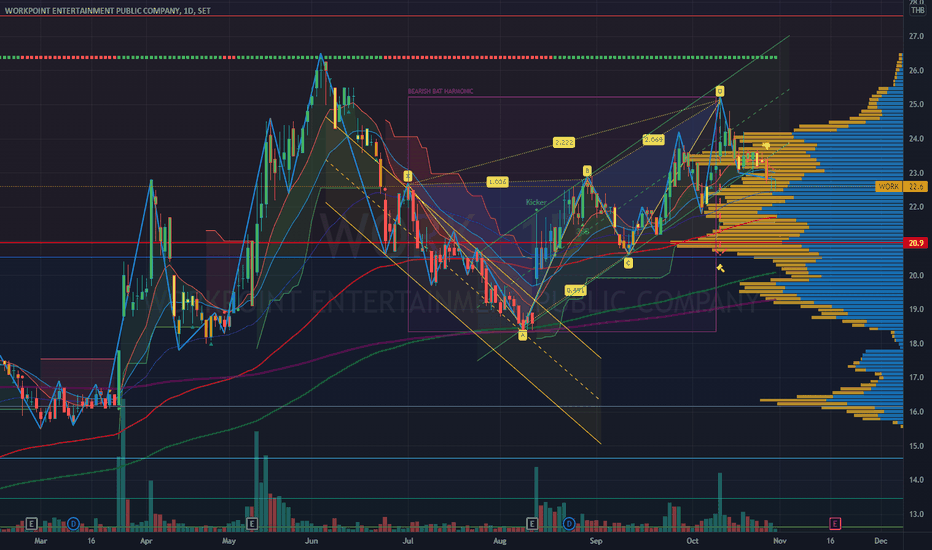

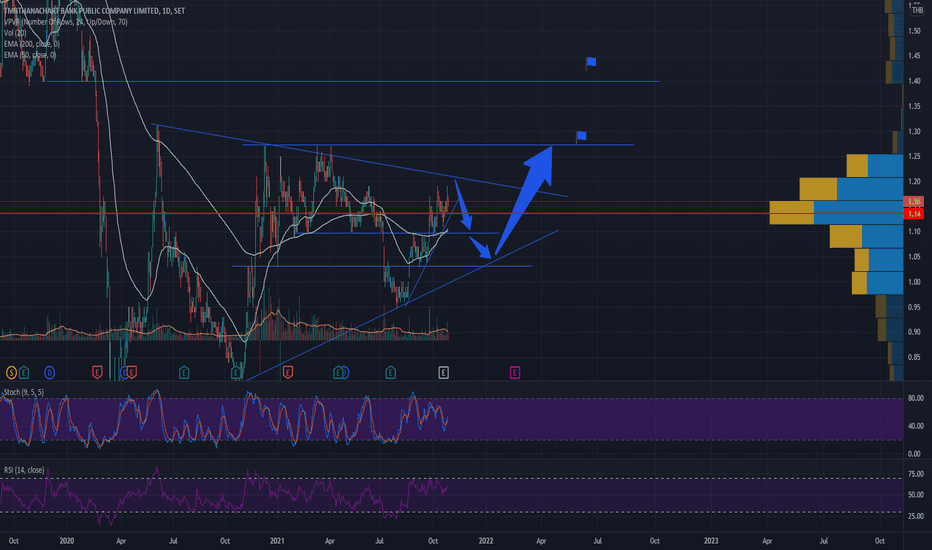

WORK | Bearish Bat | Take Profit Position BreakoutWORK | Thailand SET Index | Media Sector | Chart Pattern | Price Action Analysis

> Take Profit position

> Rising Wedge Breakout

> Bearish Bat Harmonic Pattern

> Banker Fund Flow BBD dead cross 0

> RSI bearish divergent

> 1st Target Bearish Bat at Bat position C around EMA100

Always respect your stop-loss,

Goodluck

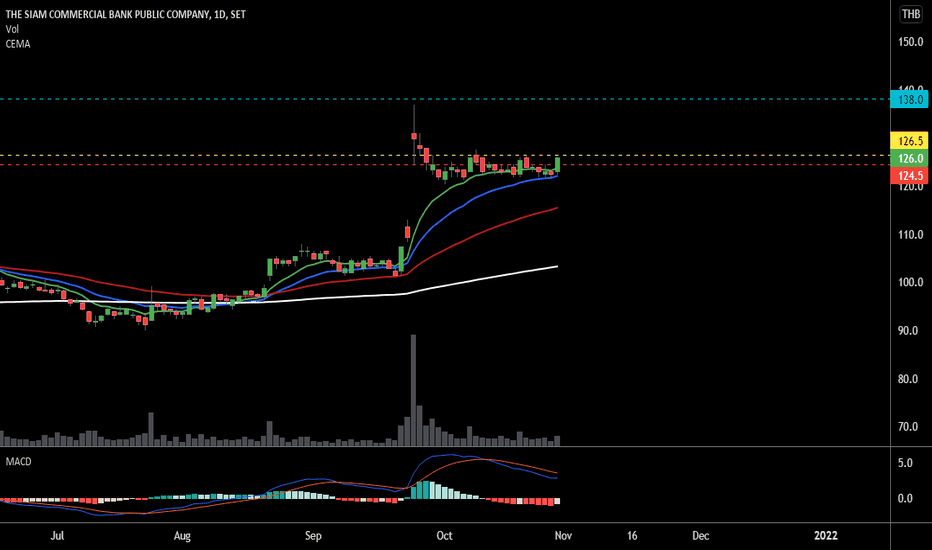

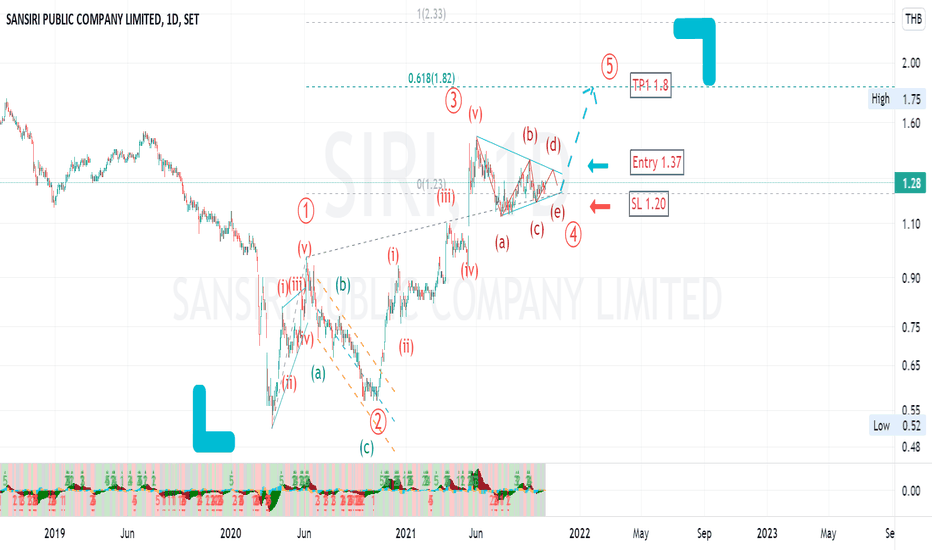

SCB is a strong uptrend and could continue with a Bull

SCB is relatively stronger than SET with very low retracement level, it could has continue with another bull wave

the plan is to buy when the price Break at the Yellow line (126.50) and stop loss at the Red line (124.50)

its first target price is at the Blue line (138.50) sell 1/2 of the amount, the rest keep riding with the EMA10 or EMA20 depends on your preference.

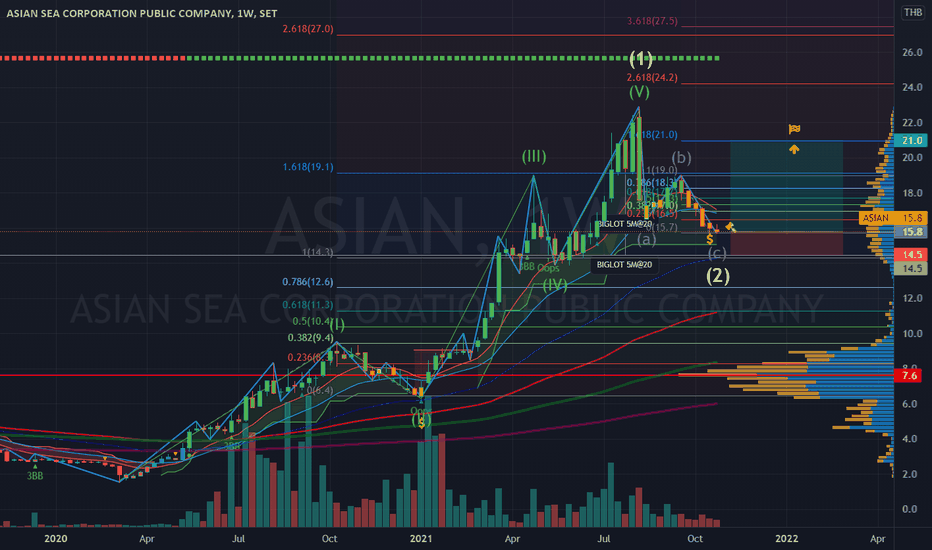

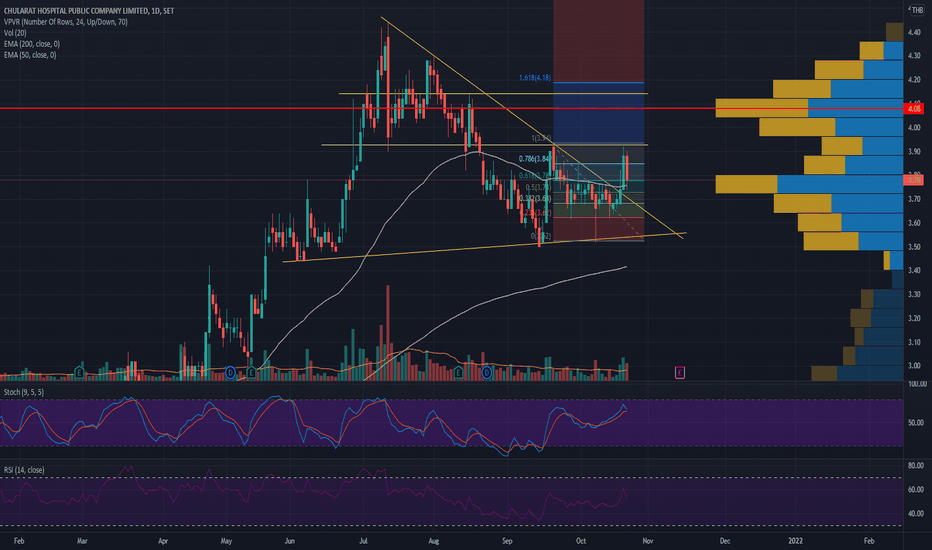

ASIAN | Supercycle Elliott Wave & Volume Profile | Long-term BuyASIAN | Thailand SET Index | Food Sector | Elliott Wave & Volume Profile Analysis for long term Buy Setup

Well today I found this nice rally wave pattern and volume profile that is about to make a new Supercycle Wave Uptrend. This weekly timeframe chart has always been in the positive direction for about 2 - 3 years already and I think it is about to make a breakout into an impulse SUPERCYCLE WAVE 3.

> 1st Target Price 19.0 (if you decided not to go for a long shot)

> 2nd Target Price 21.0

Stop-loss just below Supertrend support in week timeframe 14.5

Risk Ratio: 1:4 (TP 21.0) upside 32%.

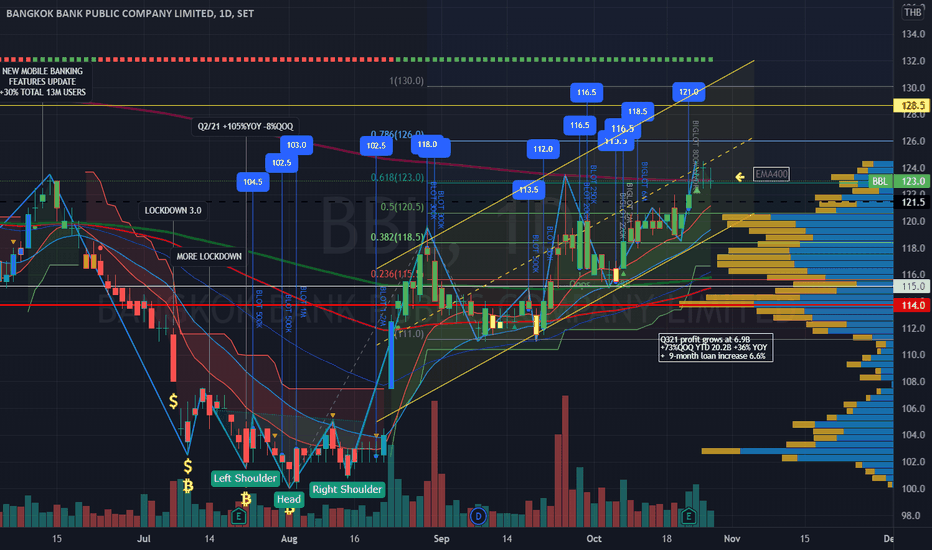

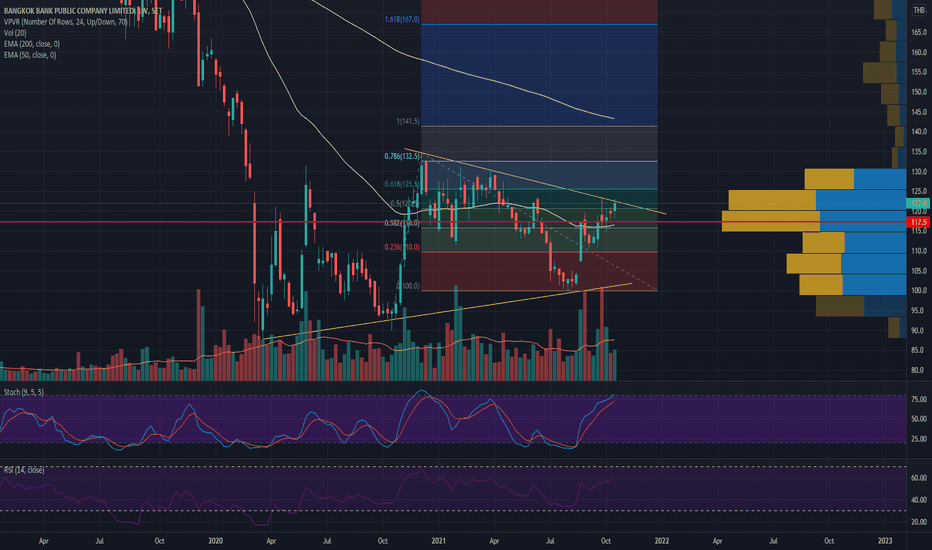

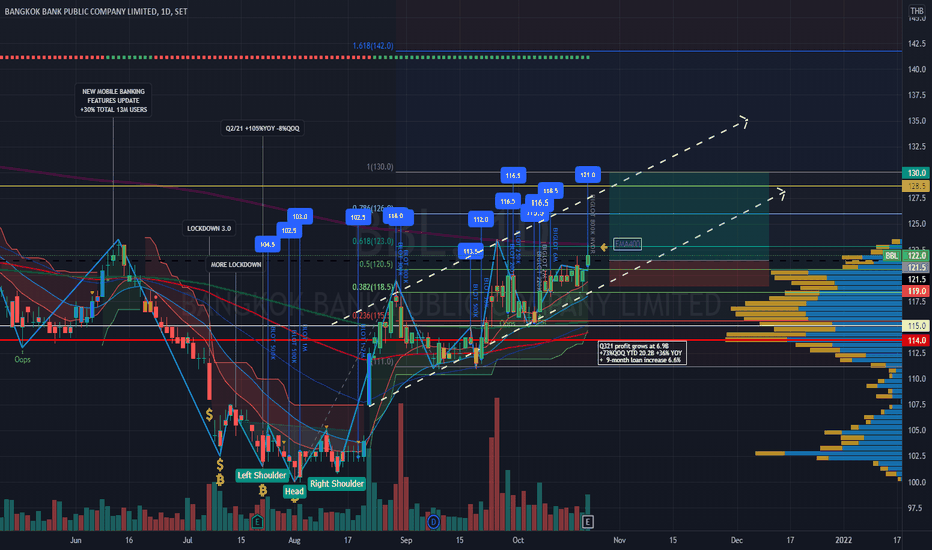

BBL| Finally crossing up EMA400| 3rd (Last) Buy Position| TP 160BBL | Thailand SET Index | Bank Sector | Price Action Analysis | Chart Pattern | 3rd (Last) Buy Position for run trend long-term investment strategy

Rising Wedge Pattern - Crossing up EMA400 - good sign for long-term buy

Final Target Price 160.0 @ Primary Elliot Wave 5

Moving up Stop-loss 119.0 EMA20

1st Buy @ Inverse Head & Shoulders Breakout

2nd Buy @ primary Elliot Wave 2 position

> Q321 strong performance +YOY +QOQ

> Big lot volume support continuously

Always respect your STOP-LOSS

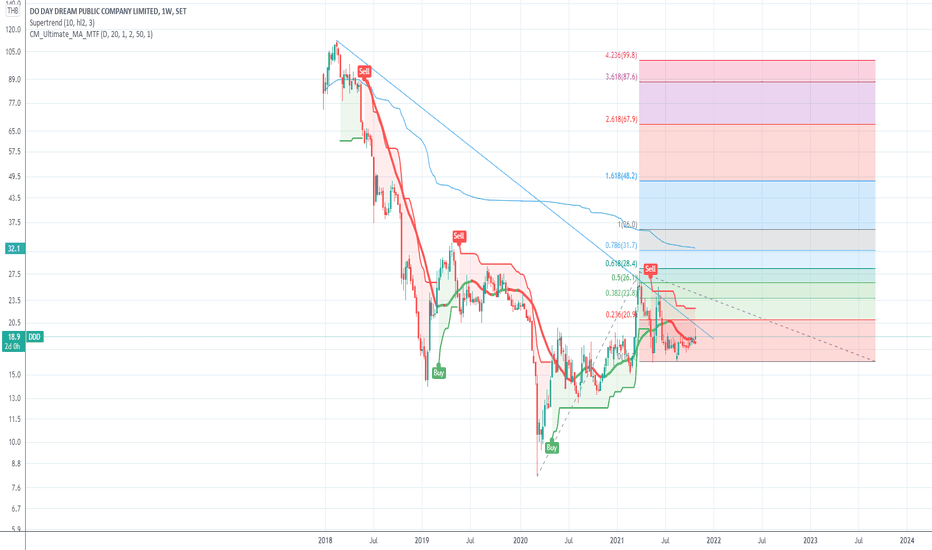

DDD Long TP: 26"A company without any debts cannot go bankrupt." At the worst point for the retail/personal care products, the management team has managed to turn a profit in the first half of 2021, mainly targeting The Philippines. VWAP lies at about 32THB. There is room for growth yet with DDD with multiple brands and markets, especially with the pent up demand from China. Financially, DDD is very strong with a fair-to-expensive price and consistent dividend payment. As 2022 approaches, DDD has high expectations ahead, and should be able to meet them with 30% increase in revenue (not necessarily profit margins).

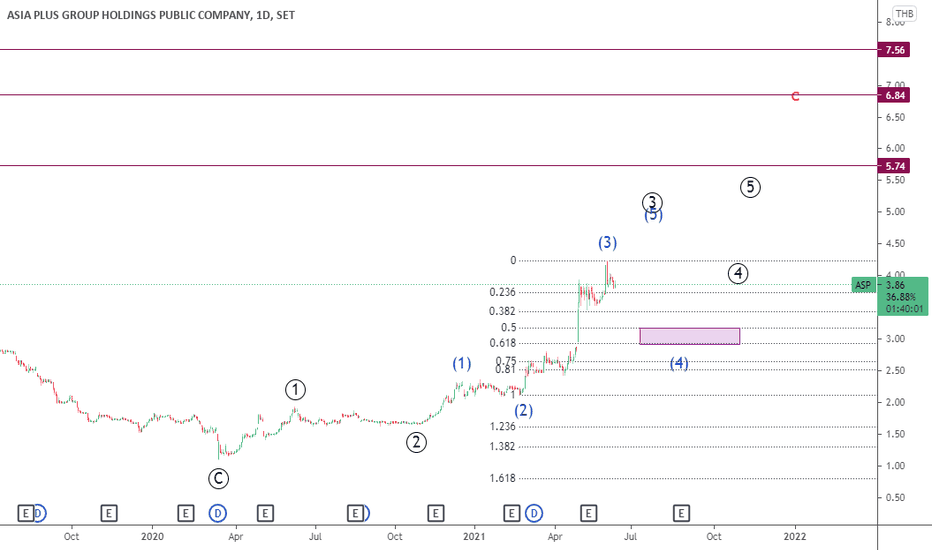

ASP (THAILAND) - ELLIOT WAVE ANALYSIS- Month TF:we are currently in Cycle wave C - expect price to with TP as 5.74, 6.84, and 7.56 respectively.

- Date TF: Within the Cycle Wave C, we are in an Intermediate Wave (4) of Primary Wave . Hence, we can expect a minor retracement to around 2.90 to 3.16 area. A good opportunity to enter would be at the end of Intermediate Wave(4).

THAILAND SET: STA - EXPECT TURNAROUND TP - 47.00 | STOP LOVE 30> STA has successfully received a hemp cultivation license from the FDA.

> On an experimental plot with a total area of 5 rai in Lampang Province To sell all seeds, leaves and roots obtained from planting to customers as agreed upon by contract.

> DIGITAL TRACEABILITY: Proactively make a difference by applying Digital Traceability principles to every produce from the farm. The source of seeds can be monitored and viewed digitally in real time. Hoping to build new businesses to strengthen the Sri Trang Group.

> VOLUME PROFILE: Retracing back to main volume profile - 47.50

> TARGET PRICE: The first target price to break EMA200 at 37.00.

> RISK: LOWER RUBBER FUTURE PRICE CONTINUED.

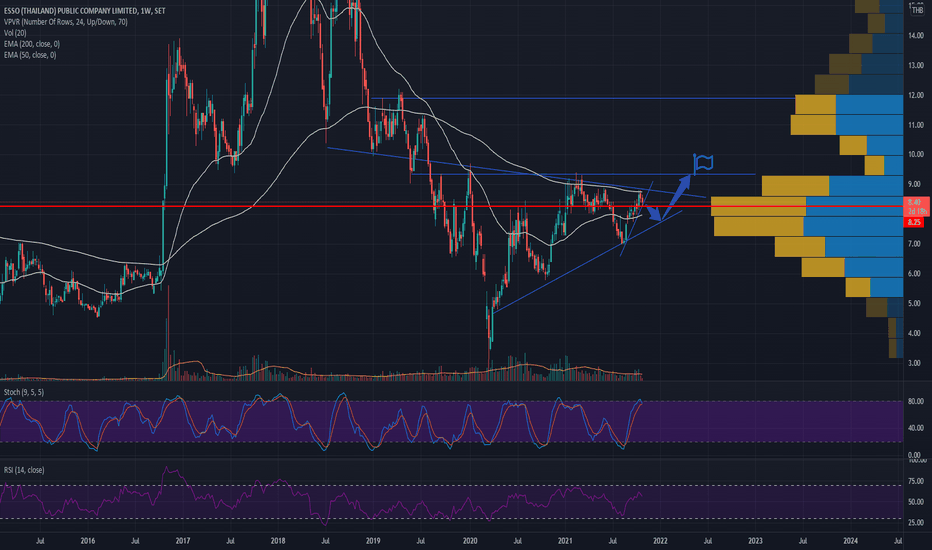

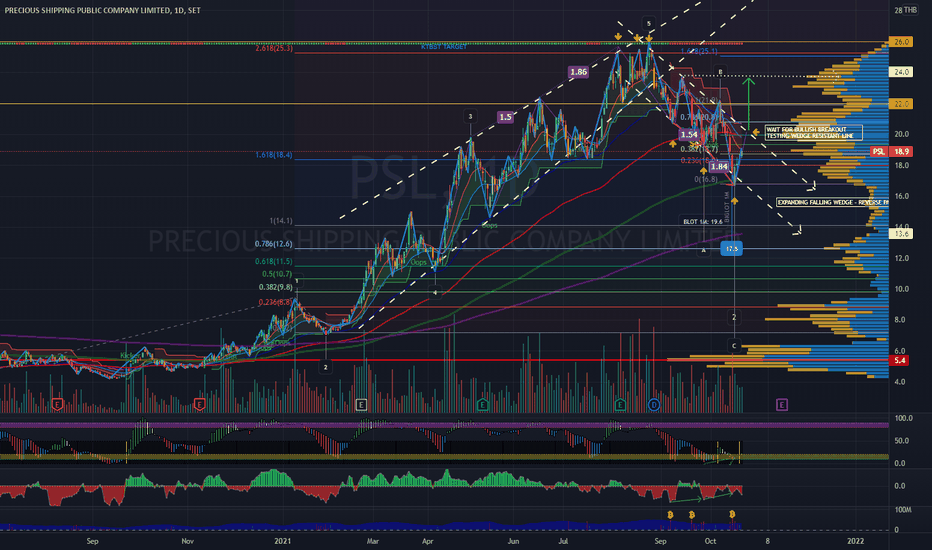

PSL | Re-entry Position @ Bullish Breakout 3 Drive Falling WedgePSL | Thailand SET Index | Transportation Sector | Re-entry Buy Position @ Bullish Breakout Falling Wedge Resistant Level - a possible Elliot Wave Position 2 of Grand Supercycle correction phase.

The PRICE ACTION TRIGGER of BUY position is the BULLISH BREAKOUT of the resistance of the 3-DRIVE FALLING WEDGE reversal pattern, possibly crossing up EMA100 or retesting the wedge resistance for conservative buy. I highly recommend not to get caught by false reversal trend and wait for a bullish breakout violation of the last lower low level.

> Good sign of Banker Fund Flow divergent

> Volume Accumulative Index divergent signal

> Strong Banker Chip and Smart Money signal

Upside fundamental factors:

> BDI and Supramax Index still on the upside.

> Q321E outstanding financial performance

www.kaohoon.com

BBL|Q321 +73%YOY|Sideway Up Crossing EMA400 |TP 130 SL 120BBL Sideway up crossing EMA400 - Long Run Trend Buy Position | 2nd Target Price 140 (Int. Elliot Wave 3 position Fibo 1.618)

> 1st Target Price 130 (Fibo 1.0) Aggressive Stop Loss 120 (EMA10)

> Risk ratio 3.2

>Strong Q321 performance +73%YOY +36%QOQ www.thunhoon.com

> Continuous Big Lot volume support

> BBD banker chip positive signal

> 1st Top Buy NVDR Value

> Uptrend channel of trade

> Strong buy signal SUPERTREND & CDC ACTIONZONE BUY RIBBON

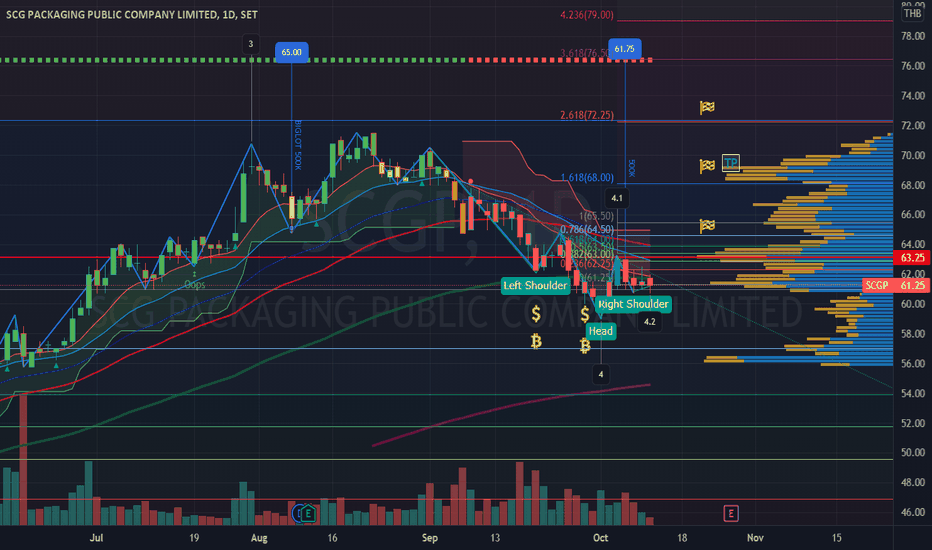

SCGP | Inverted Head & Shoulders | Buy signal - TP 68.50 (+11%)Thailand SET | SCGP | Target Price 68.50 | Resistance 64.00 EMA50 POC VA | Stop Loss 59.00

> Inverted Head & Shoulders showing Buy Signal after recent Smart Money and Banker Chips strong signals

> Main Elliott Wave Position 4 with positive banker chip signal