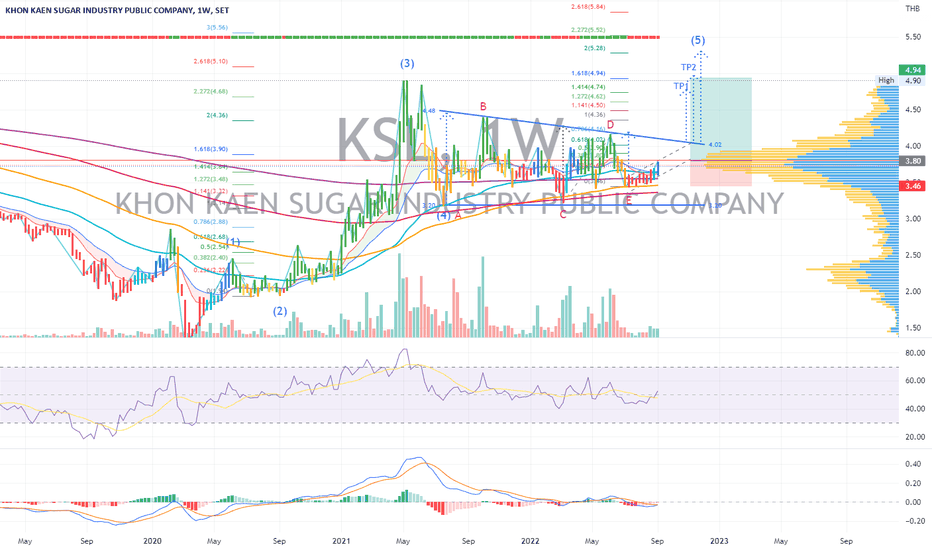

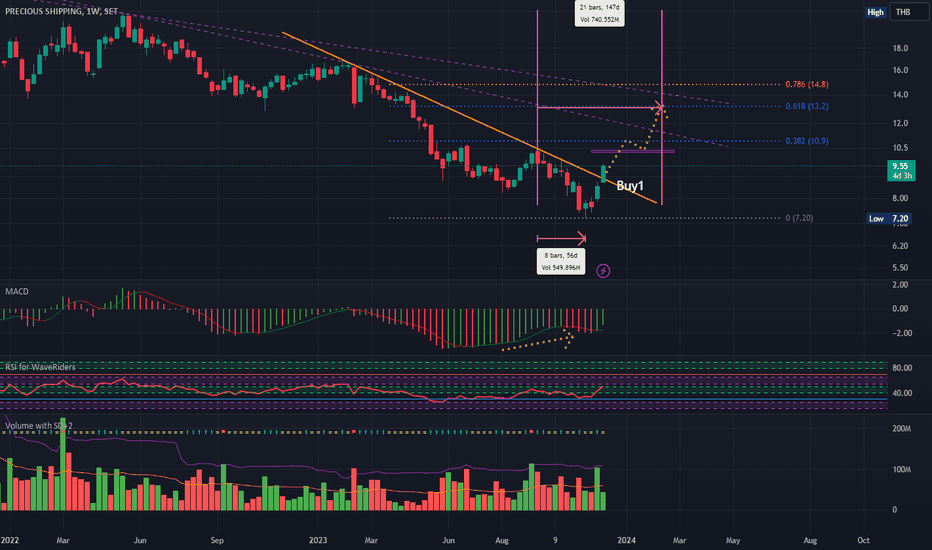

KSL | Wave Projection | Triangle ABCDE Wave SetupPrice action and chart pattern trading setup

> A possible uptrend scenario with ABCDE symmetrical triangle major wave 4 ending E - wave position, just above SMMA200/100/50 week making its way up to the triangle resistance wave D.

> Target: Wave projection target breakout triangle resistance from position E-wave as TP1 +30% upside

> Stoploss: E-Wave position -8% - 10%

> Risk reward ratio: 3:1

Indicator:

> RSI weekly: bullish signal crossed up MA line above 50.

> MACD weekly: golden crossing signal line slightly below zero.

Company financial with ongoing outstanding performance +YOY and +QOQ for 3 consecutive years and quarters.

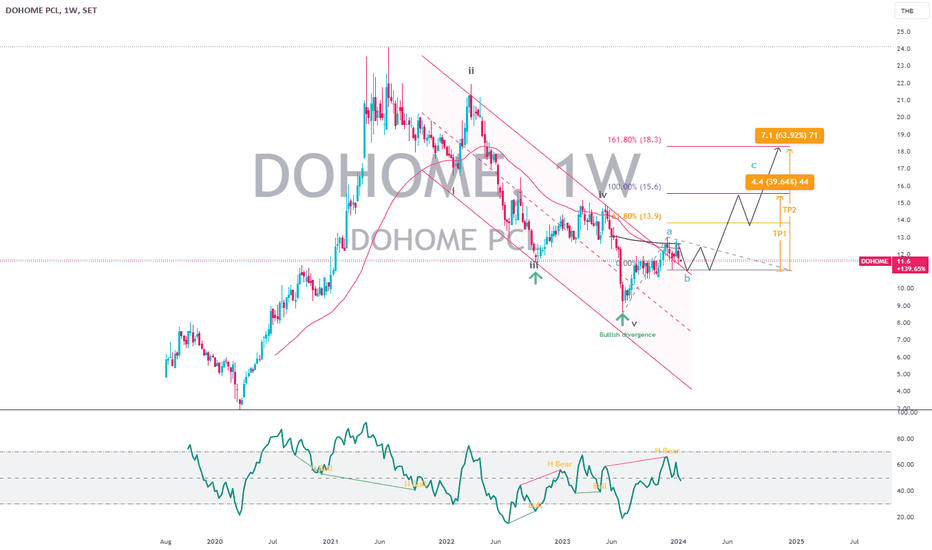

DOHOME| ABC bullish pattern - Breakout Position EntryAfter a long mega bull flag formation breakout and retesting its support

Now a potential ABC wave bullish pennant in progress

Entry: Pennant breakout confirmation

SL: Below pennant

T1: 100% ext. Fibonacci - 15+ baht

T2: 161.8% - 18+ baht

Indicator: RSI week bullish divergence breakout

Always trade with affordable risk, respect your stop

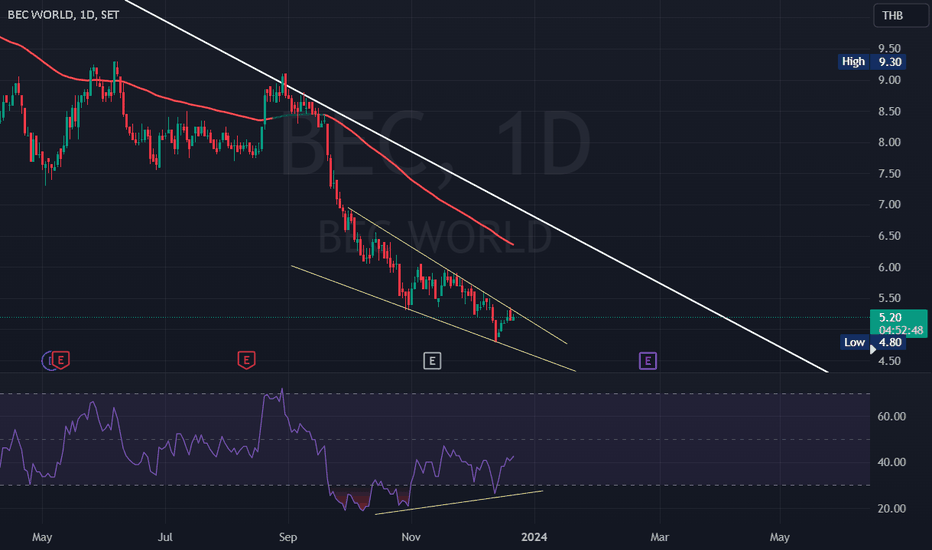

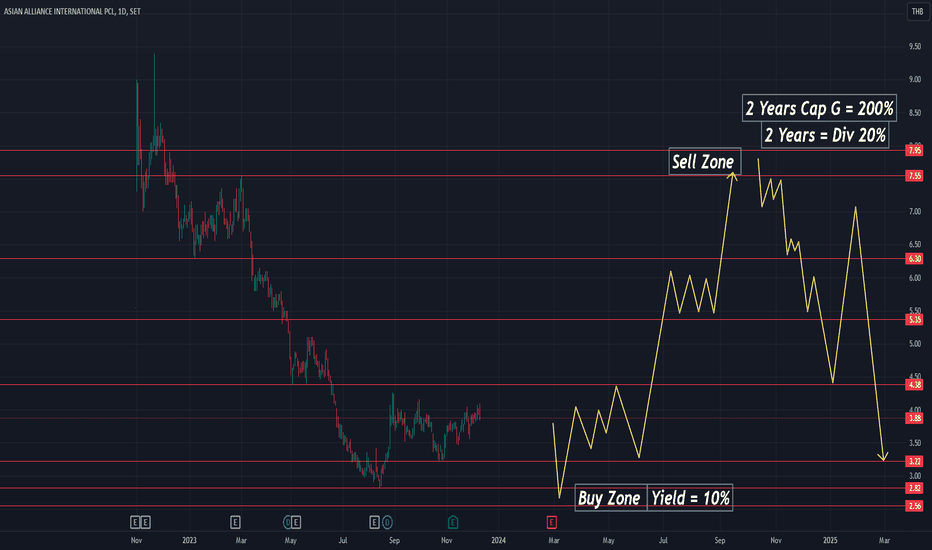

AAI (TH Stock)Premium Pet Food (Small Cap)

Stock Name : AAI

Same Industry : TU, ITC

Forecast with Revenue reversal, High margin goods sale, Branding repurchase, OEM from overseas.

Technical: waiting for people's fear of the SET index or stock price break from the downtrend zone.

2 Years Expectation for 200% Capital gain + 10% Dividend Yield per year.

PRIME overvalued and heavily undervalued intrinsically. Long.Book value at 0.76. Fair Price at 0.90. Intrinsic value still between 0.87 and 1.17. Prediction/target at 1.06 within the year according to chart pattern as long as Q3 has fair results (cannot over-expect since there it is the energy sector's low season). If PRIME solves it's problems and there is good financial lubrication expect at least 100% gains. Worth the risk. Long.

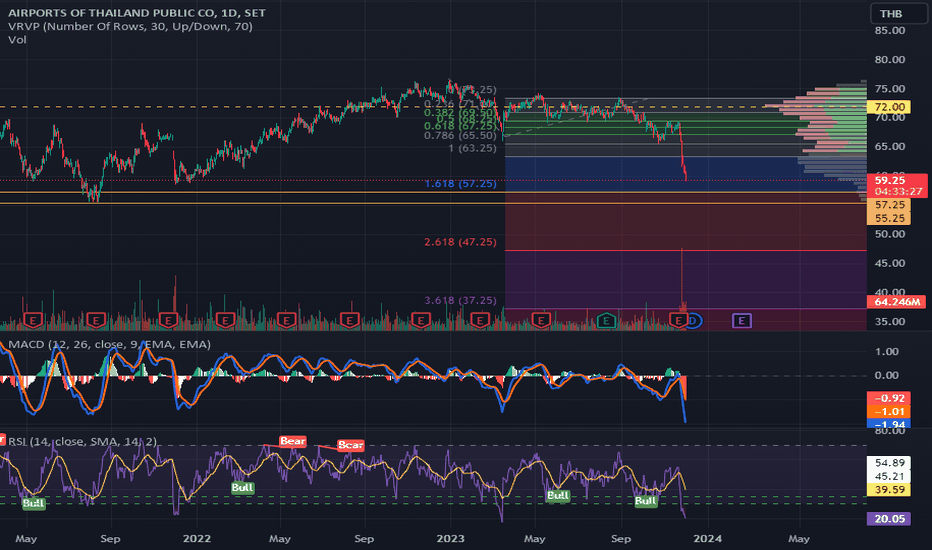

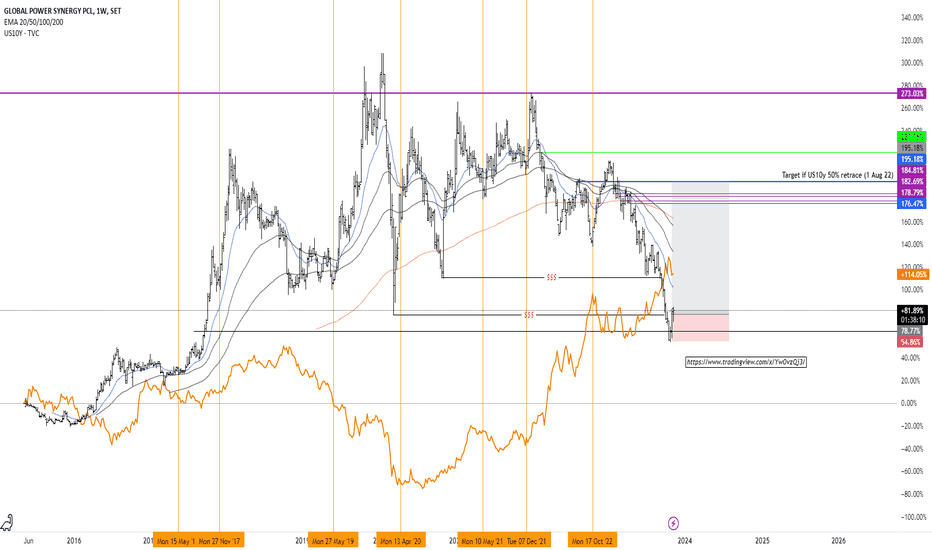

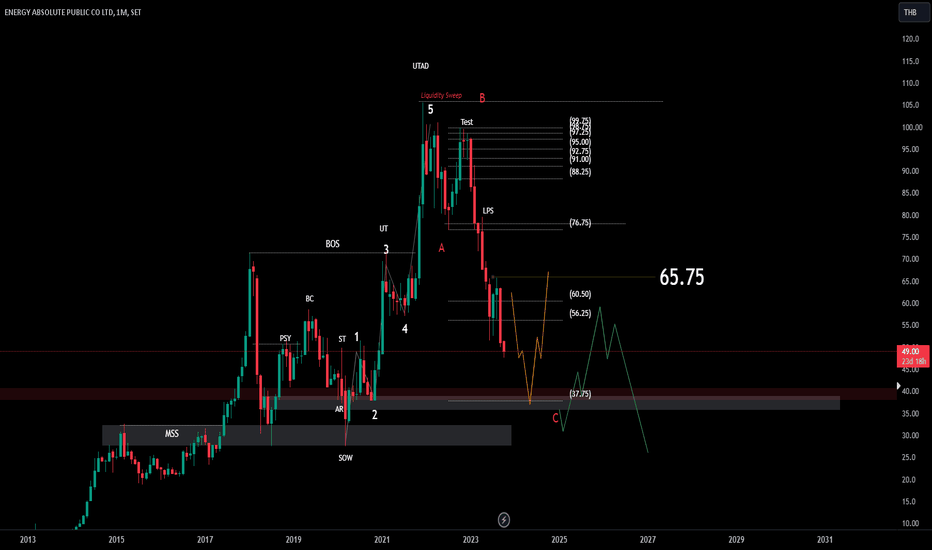

GPSC We can see that GPSC is correlated with US10Y.

.

US10Y is at a peak level of 5.00% , And with a possible of retracement to 50% Equilibrium of the highest and the lowest of US10Y which is at 2.680% (as of1 Aug 22)

.

With this information we can target GPSC at the same level of 1 Aug 22 which is 71 Baht.

.

Entry around this level will possibly gain around 65%.

.

.

.

.

🧅Disclaimer :There are risks associated with investing in securities. Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible. Some high risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods. This is Not Financial Advice

🧅JUST AN OPINION OF THE ONION.🧅

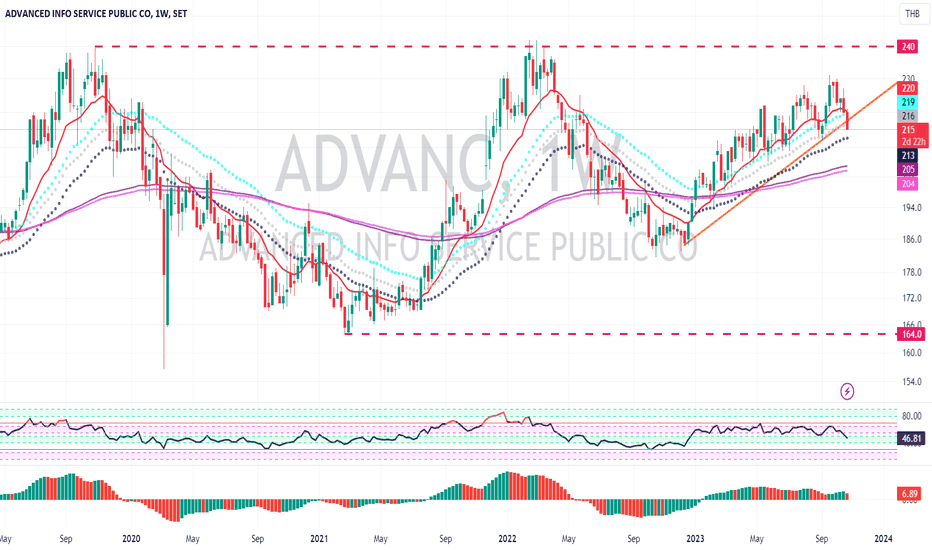

ADVANC , Week Chart ADVANC , Week Chart , have been sideway in the trading range since 2020

and this week is the first week that price start reverse down and break out the trendline.

RSI and AO show weak momentum signal.

We should monitor how deep that this chart go down by using the daily chart to monitor more detail.

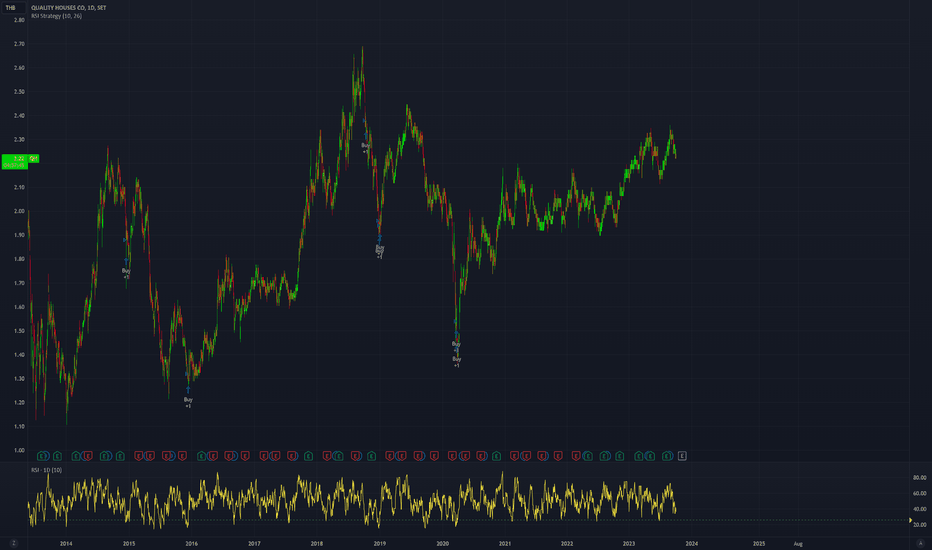

QH is holding about 20% of HMPRO HMPRO is the largest home improvement stock in Stock Exchange of Thailand in terms of number of branches and market share. However, an interesting fact that many investors, especially Thai investors, do not know is

QH is holding 4 publicly traded securities: HMPRO LHFG QHPF QHHR

Just only the market value of the HMPRO stock held by QH is almost double of the market value of QH. So basically, this is an asset plays stock with consistently high dividend yield.

Potentials

- Institutions can take over QH and sell all marketable securities held by QH.

- If nobody take overs QH, QH still pays consistently high dividend yield (about 7%).

- FCF was spent to payback debts. Since QH is having low debts now, the future FCF may be paid as a more dividend.