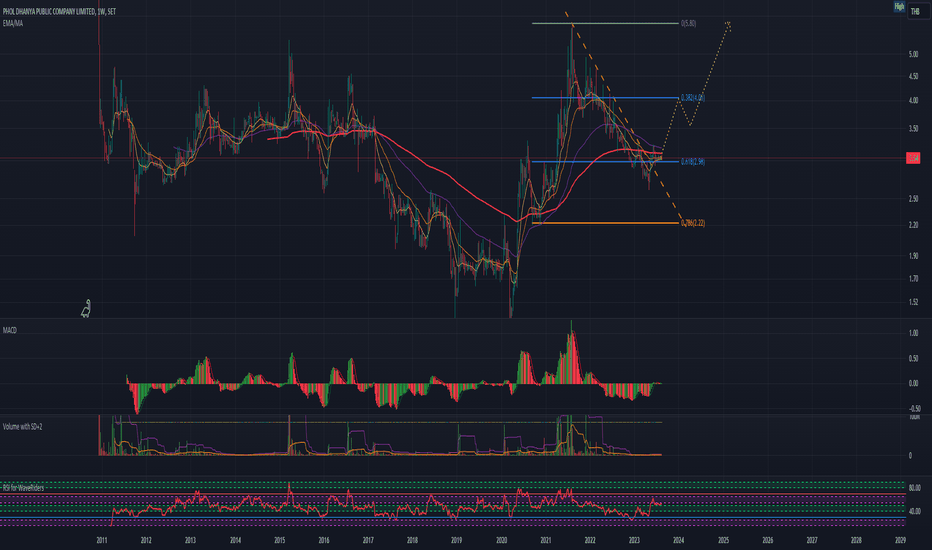

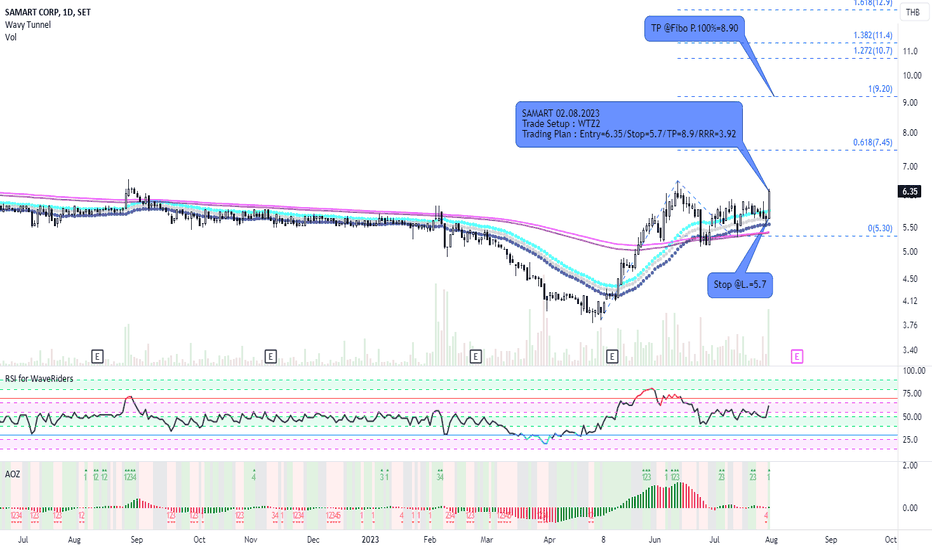

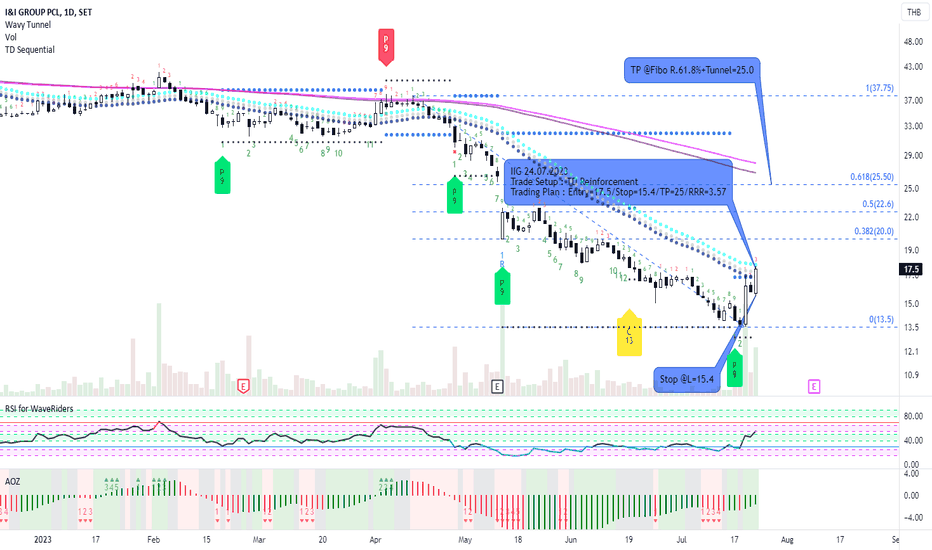

HL and WTZ4If seeing the revenue stream of this company, you will find hidden performance of this stock. Technical tools also confirm reversal signal on the chart. I apply WTZ4, one of my favorite setup, for trading with competitive rewards. Don't forget to calculate your risks well before trading. Good luck!

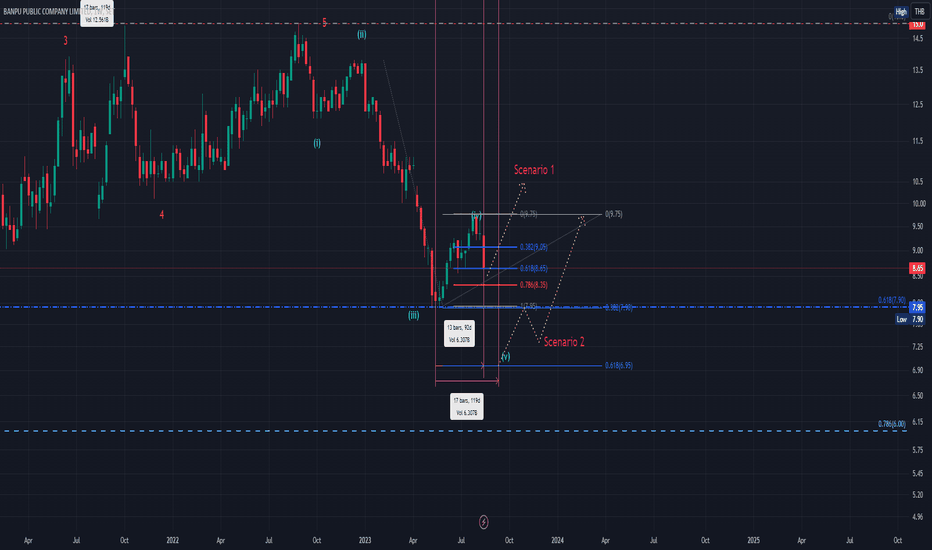

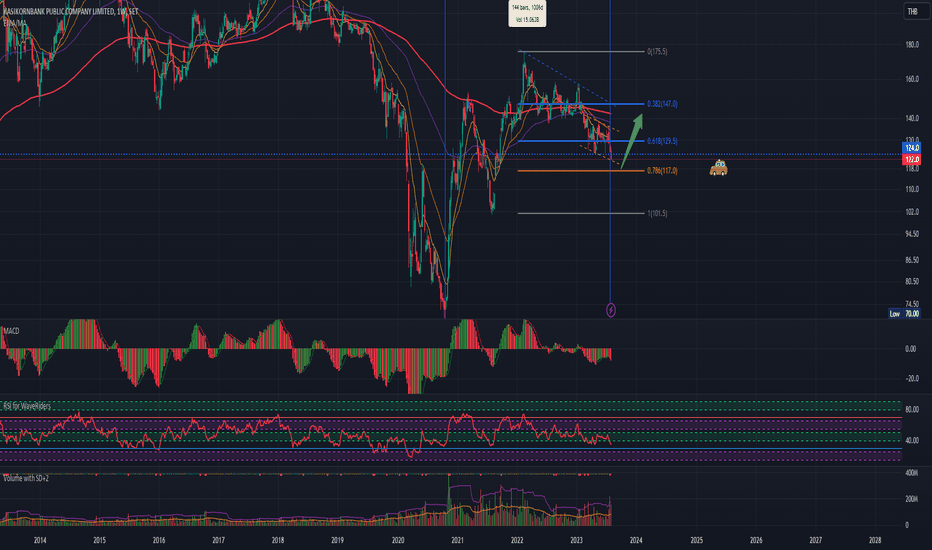

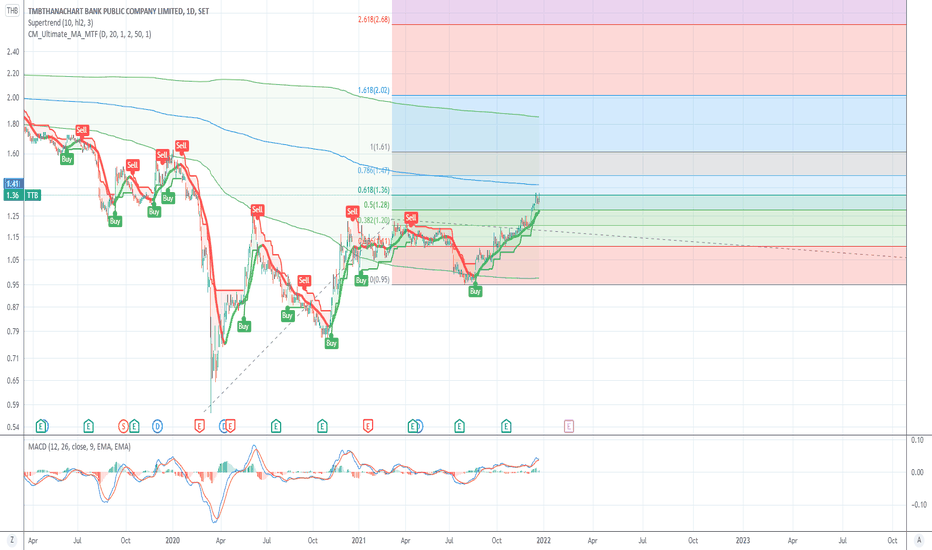

BANPU Accumurate BUY

BANPU Accumulate BUY

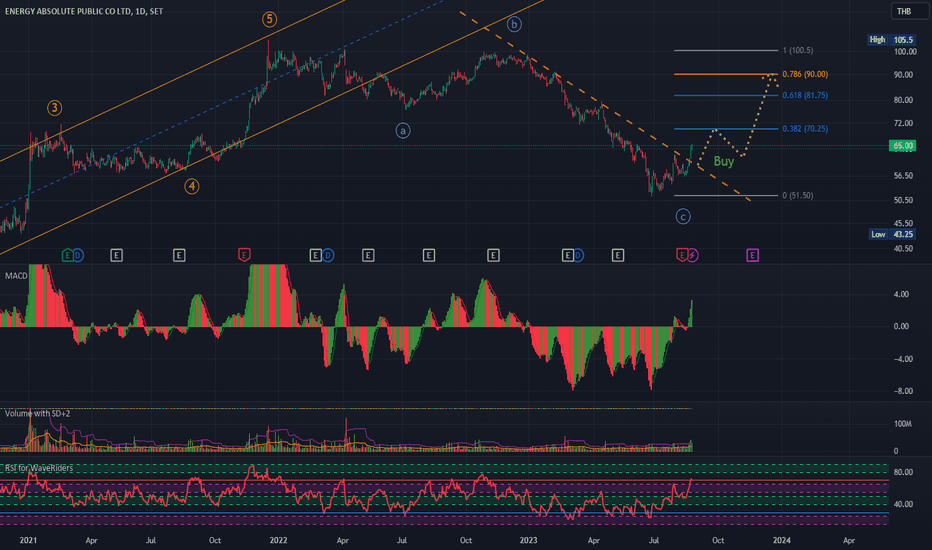

Scenario 1 : Current price pull back to 61.8% possible to reverse up as of W2 but still posible reach to 78.6% level

Scenario 2 : Not end C Correection W5 , it possible price will be drop to 61.8 level as end of W5

But generaly can accumurate buy , due to High dividend Yield ++

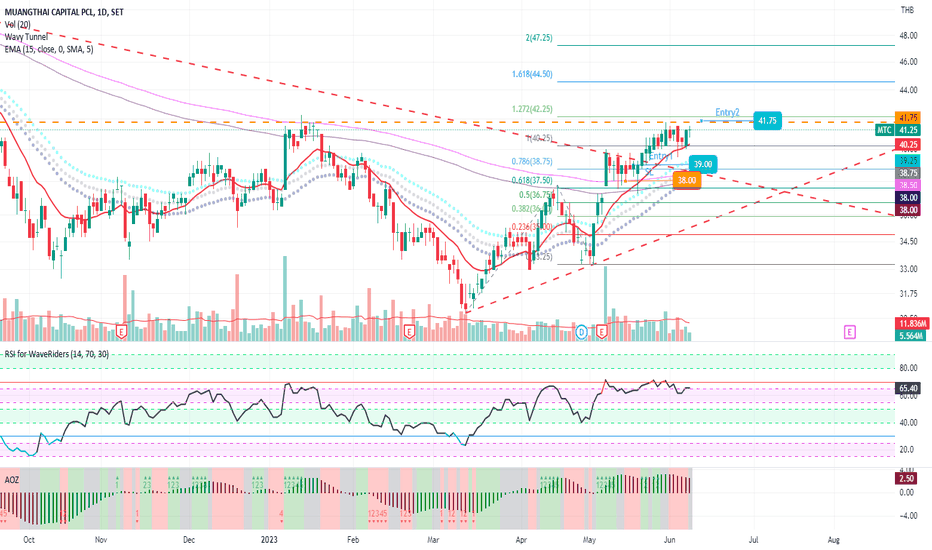

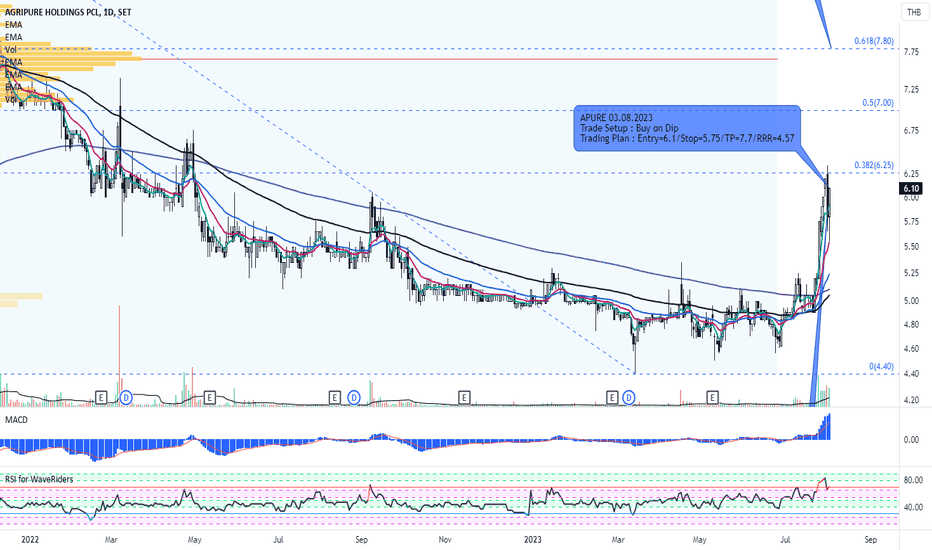

APURE and Buy on DipAPURE has been rallied on uptrend during recent weeks. I made another entry by applying buy on dip setup after the first one was triggered last week. POC of VA. and Fibo. R.61.8% was measured for the first target. Don't forget to managing your risks well before trading. Good Luck!

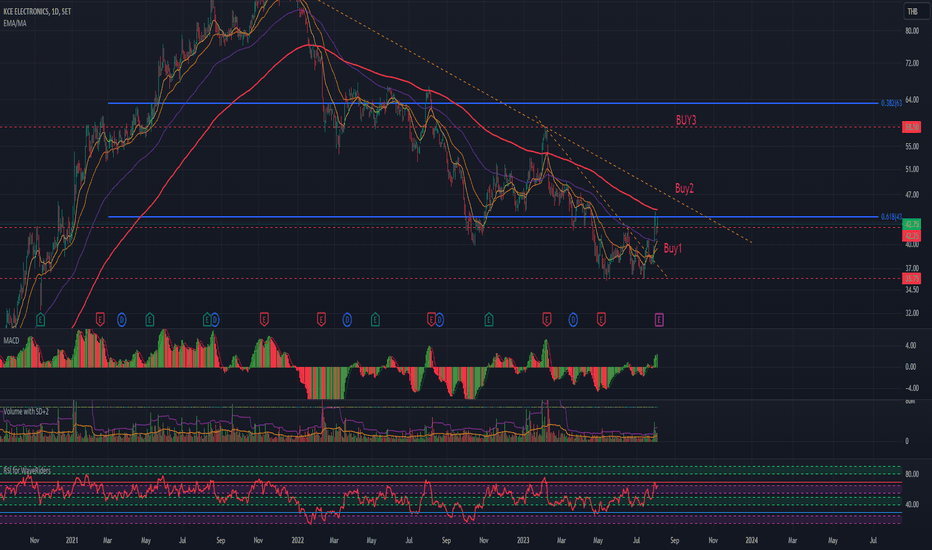

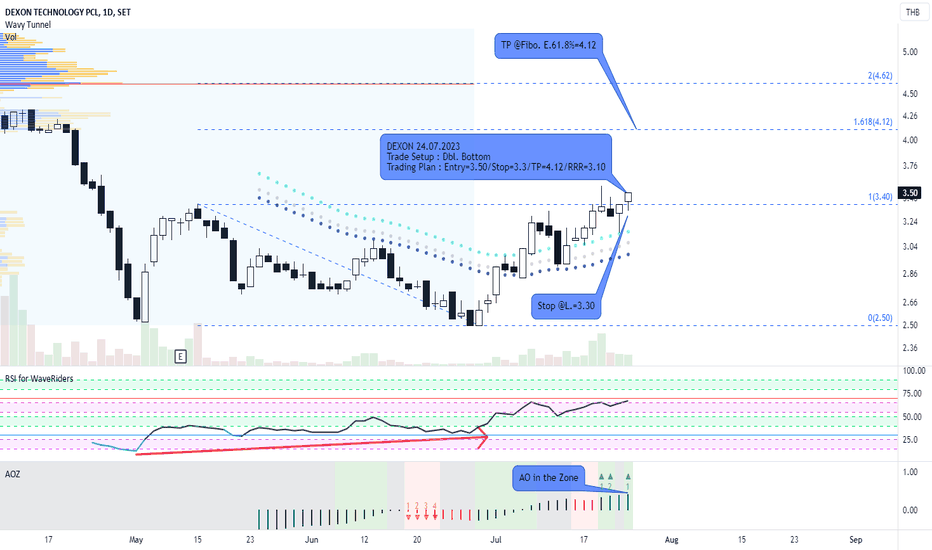

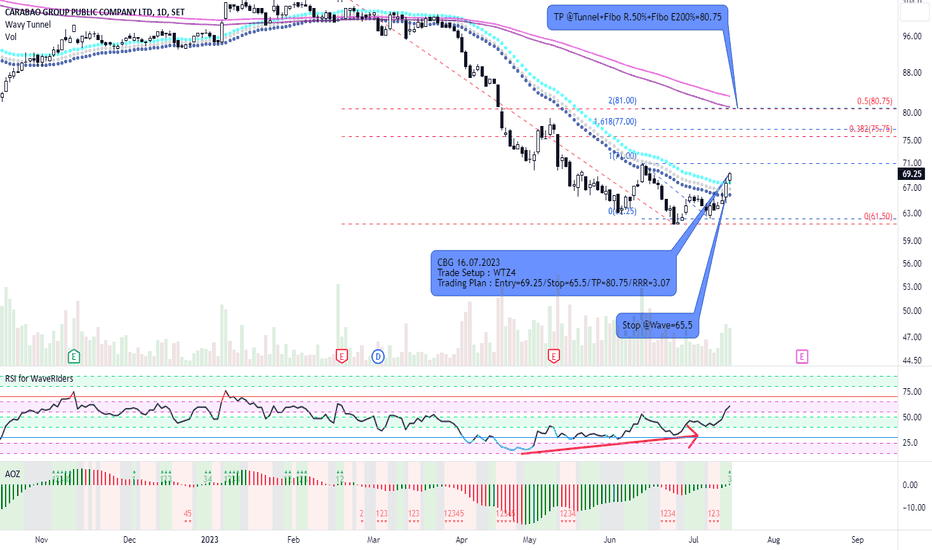

CBG and WTZ4CBG has moved in downtrend for several months before bullish divergence and other reversal signal appear. I apply WTZ4, one of my favorite setup, for trading strategy. The setup sometimes offer competitive rewards depending on chart patterns. However, don't forget to managing your risks well before trading. Good Luck!

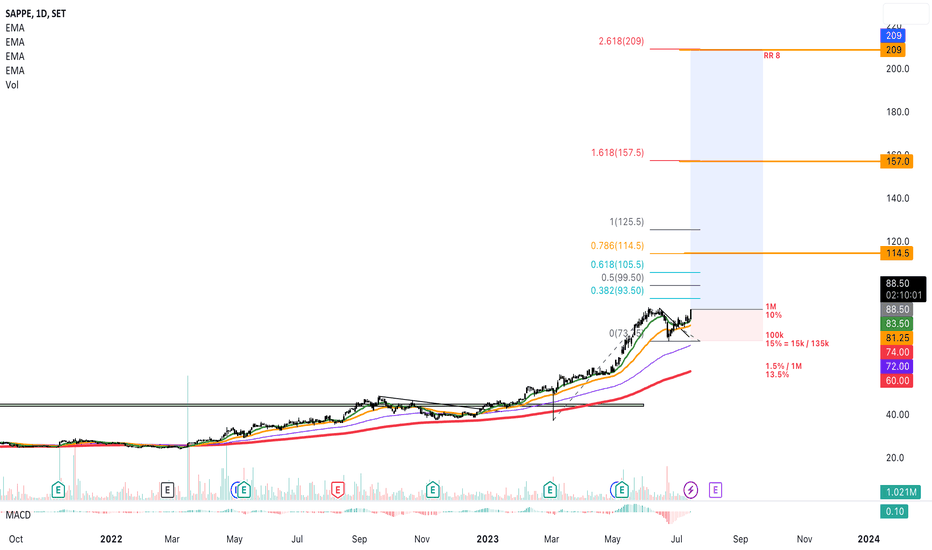

SAPPE (THAI STOCK) 14 FRIDAY JUL 2023The price of SAPPE is very strong. I notice that it created strong up trend since breakout of 2021 trend line.

The price been in strong up trend since then. even the news about inflation and war cannot affect the price of this stock.

Currently, the price is forming bullish flag pattern and wait for break out

TIPCO Completed Rounded Bottom Wave 4 Towards Wave 5 CompletionAccumulation which started since 2021 is come to completion with the completed rounded bottom. Market is trading above the Year Open and have been consistently edging higher on a series of Higher Lows weekly candles. Bullish above 9.50 towards 11.5 (4 years High), breaking which will open further rise to 12.4/5.

A daily/weekly close below 9.30 will invalidate the bullish idea.

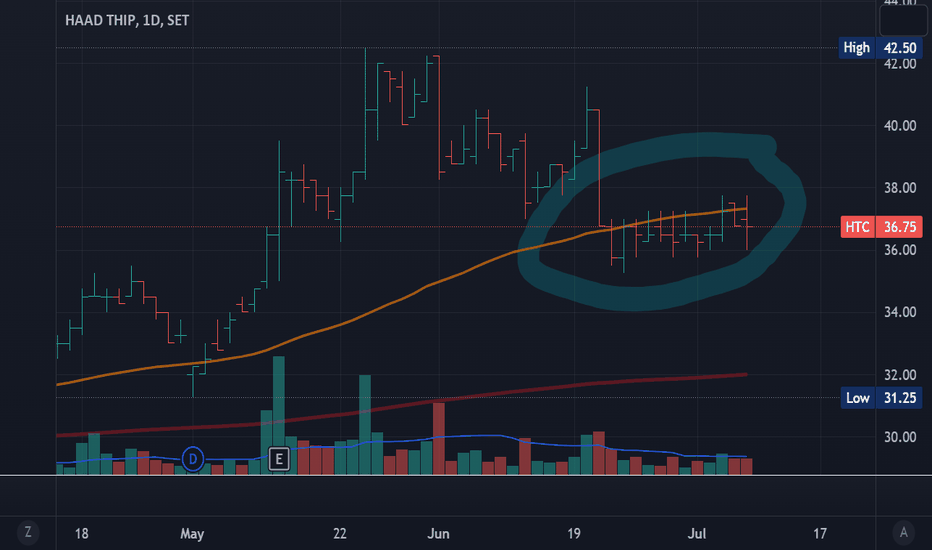

A High tight flag?XO has impressively gone up double in just a couple of months, responding the good news that the company has successfully penetrated the US market for the first time.

The chart seems to be forming a High tight flag pattern. The price although did a break on 3rd of July, until today it has gone sideway instead of continuing the bull run. Considering volatility, I don't see a good contraction here but a noticeable long red candle on 21st June 2023 with massive volume (distribution?).

I gave it a pass this time, and monitored closely...

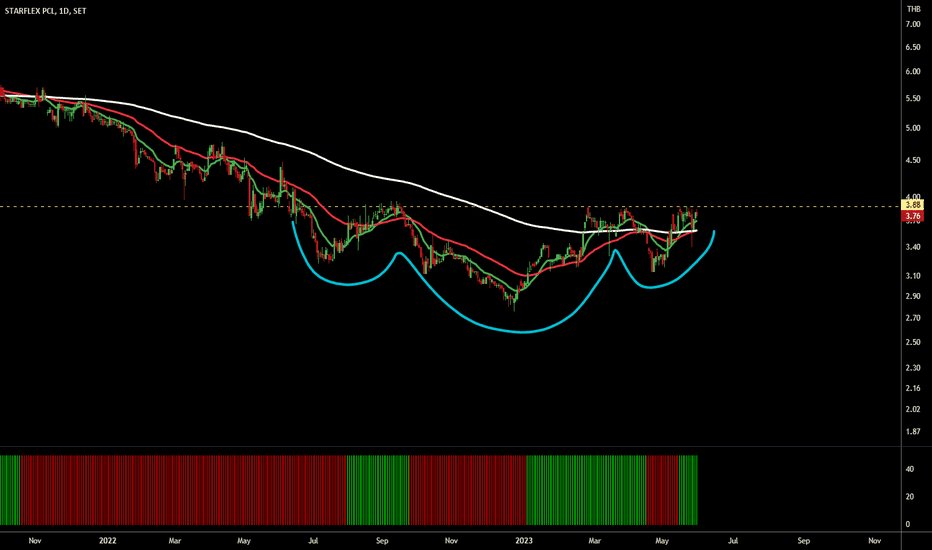

SFLEX looking good as a big head and shoulder First, Fundamentally, this stock just got JV with one of the Asean's biggest stock in packaging industry like SCGP. This could possibly be a new S-curve for SFLEX. The latest quarterly earning is +204.69%, ROE 8.60%, Freefloat 50.60% (note that its next 2 quarters could also got positive earning due to low base profit on the last year).

Technically, this stock got a big head and shoulder awaits to be breakout. Also, its tf week is looking good for the new uptrend wave.

Let's hope for a good one ^^

"WP" the next "XO" and "SKY" ??No need much to said, the stock (WP) close higher than EMA200 in TF day for the first time, with Buy Signal and First day Uptrend bias. It's looking pretty similar to earlier Big Bull of this year like SKY and XO (you guys can type both of this stock in SET to check them out). Just trader with a good stoploss and if it really a Big Bull just ride along with it!!