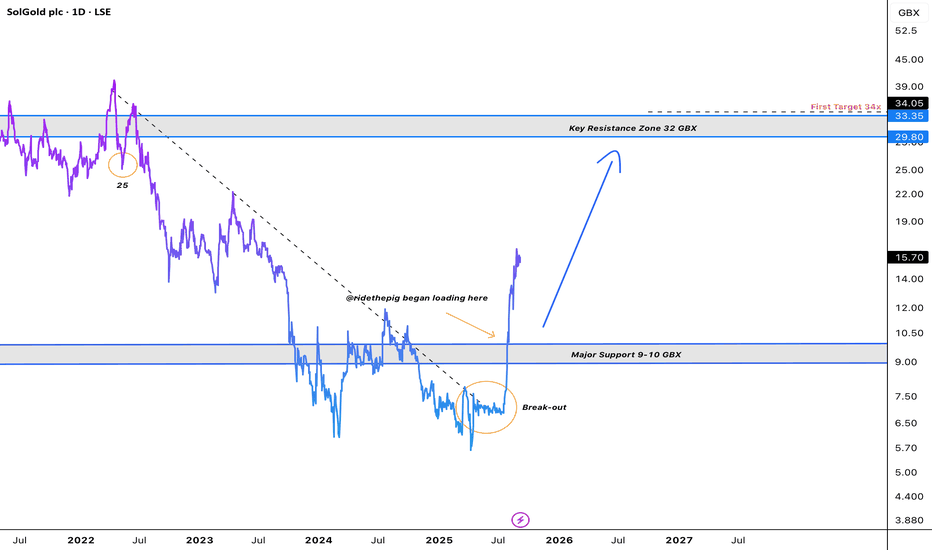

Heads up... SolGold just broke a 4-year descending triangle...Got in at 10.5p while everyone's chasing AI nonsense. Now sitting at 15.7p and this is just the warm-up.

My friend Sean Tufford put me onto the LSE:SOLG SolGold telegram and here's what hit me - we need 80+ new major copper mines by 2030 just to electrify the world. Takes 20 years to build one.

The math is broken. Copper is the new oil.

The Setup That's Printing

Position: Loaded at 10.5p

First Target: 34p

Franco Nevada and Osisko just wired $750M for streaming rights. That's not a bet, that's conviction.

Why This Goes Parabolic:

Cascabel isn't some exploration play. It's one of the largest copper-gold deposits on the planet that's not owned by a major. Yet.

540Mt reserves. First quartile costs. 28-year mine life that could triple.

Trading at 0.11x NAV while peers sit at 0.30x. The market's asleep.

Jiangxi Copper took a 12% stake at 45% premium. BHP owns 10%. Newmont owns 10%.

Three majors circling like sharks.

The Trade:

The 4-year triangle break is your signal. The institutional money flooding in is your confirmation.

From 10.5p to 34p = 224% minimum. That's just getting back to the old highs before the real move starts.

Once the market wakes up to what $5 copper means for a first-quartile producer, this rips to 50p+.

Stay long. Outguess the crowd.

The descending triangle was the accumulation. Now we ride the impulse wave.

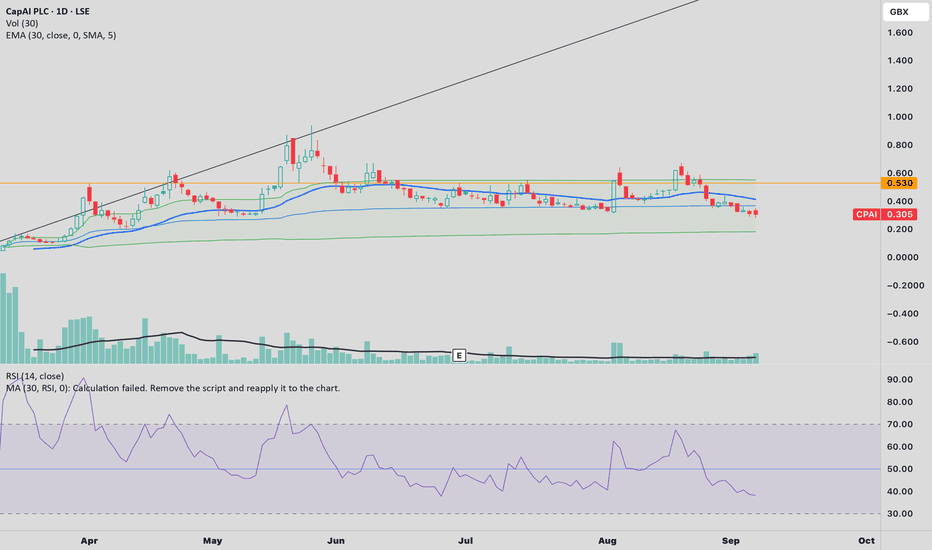

CPAIPrice has been consolidating for 3 months after the ATH & double-top from the end of May.

Currently able to buy below the vwap since Ronjon Nag’s appointment earlier this year.

Rising trend line which was touched multiple times back in spring points to 1.7p -2p range going into Q4.

Price has retraced 50% + since 19th August.

The bigger the base - the further into space…

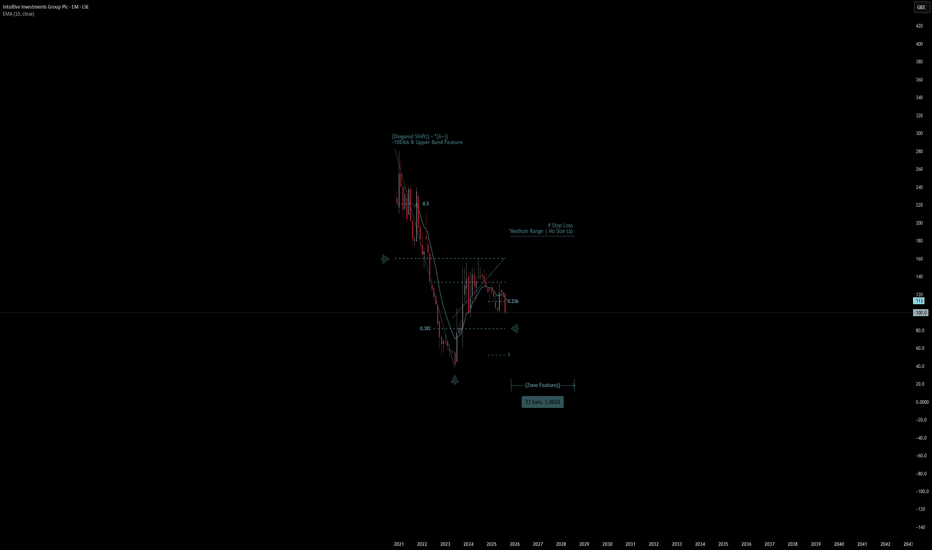

Intuitive Investments Group Plc | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set Up

3. Break & Retest Set Up

Notes On Session

# Intuitive Investments Group Plc

- Double Formation

* (Diagonal Shift)) - *(A+)) - *10EMA - Short Entry | Subdivision 1

* (Medium Range)) | No Size Up - *1.5RR | Completed Survey

* 33 bars, 1002d | Date Range Method - *Downtrend Argument))

- Triple Formation

* (P1)) / (P2)) & (P3)) | Subdivision 2

* Monthly Time Frame | Trend Settings Condition | Subdivision 3

- (Hypothesis On Entry Bias)) | Regular Settings

* Stop Loss Feature Varies Regarding To Main Entry And Can Occur Unevenly

- Position On A 1.5RR

* Stop Loss At 170 GBX

* Entry At 124 BGX

* Take Profit At 50.0 GBX

* (Downtrend Argument)) & No Pattern Confirmation

- Continuation Pattern | Not Valid

- Reversal Pattern | Not Valid

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Sell

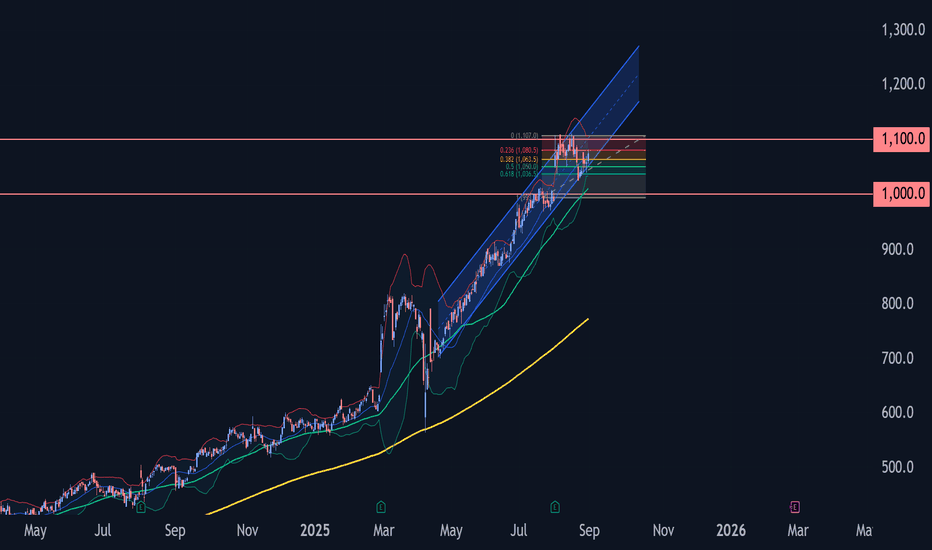

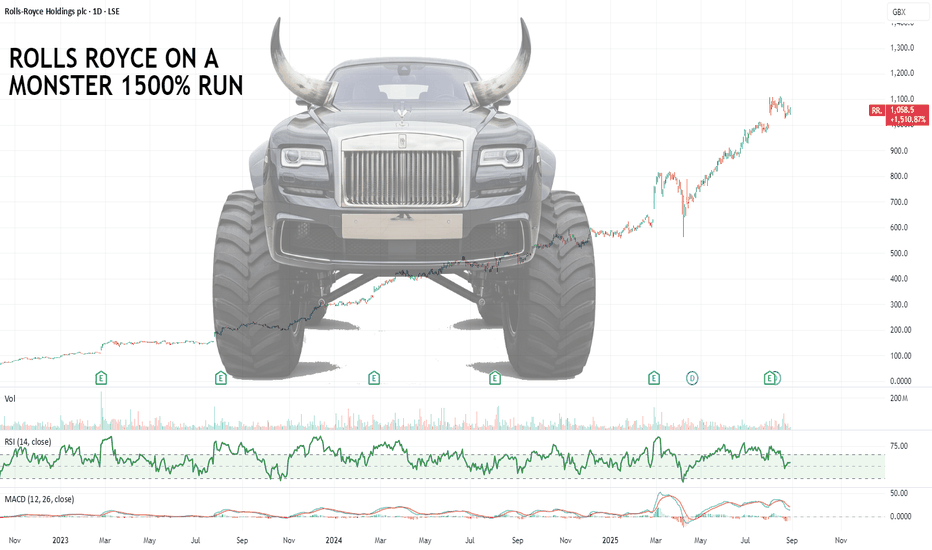

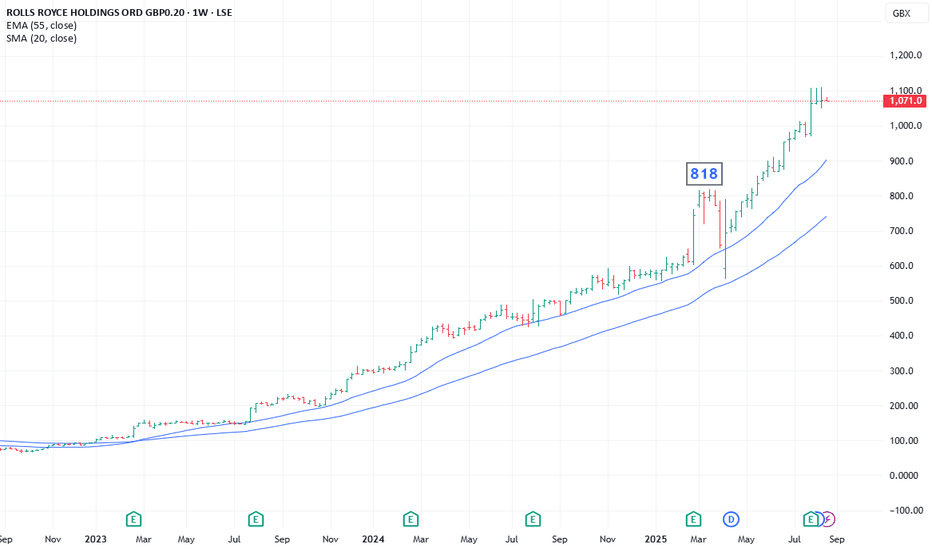

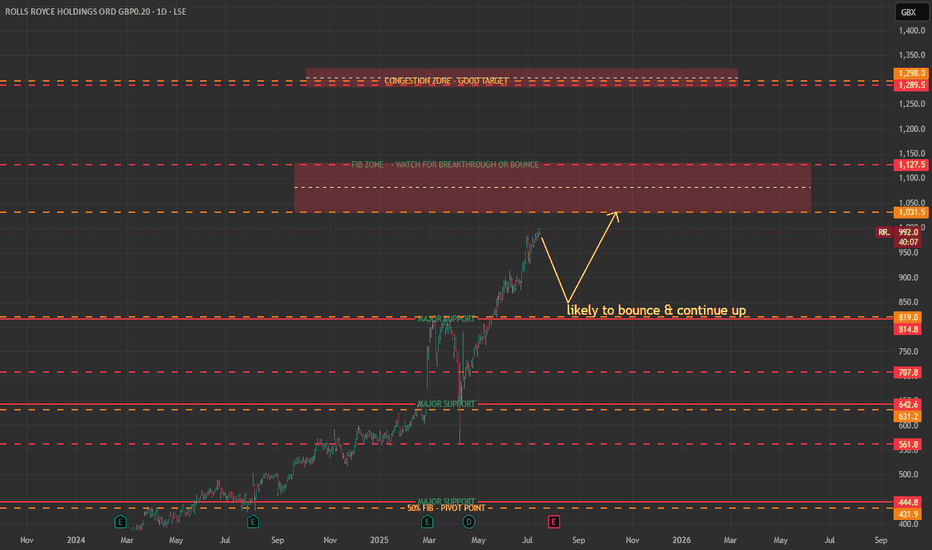

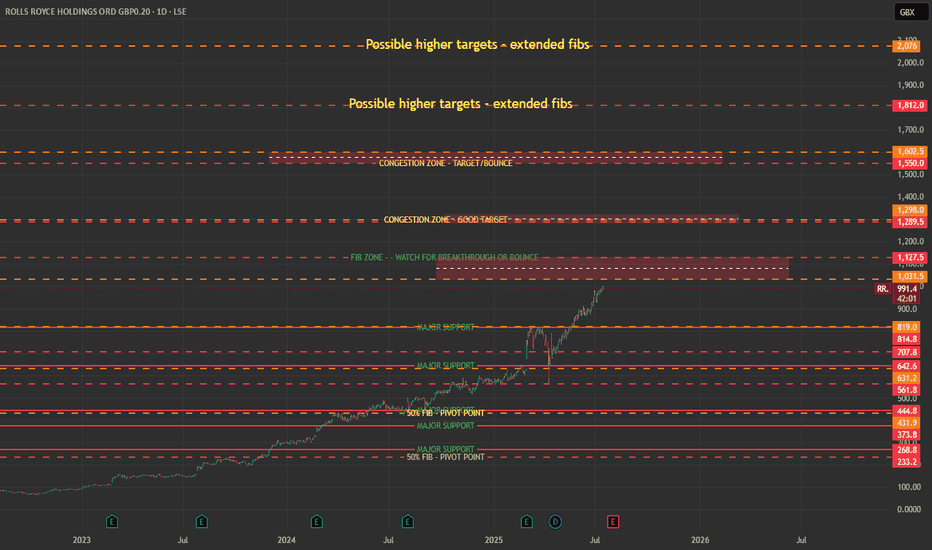

Rolls-Royce Wave Analysis – 29 August 2025

- Rolls-Royce reversed from round support level 1000.00

- Likely to rise to resistance level 1100.00

Rolls-Royce recently reversed from the support zone between the round support level 1000.00 (former resistance from July), support trendline of the daily up channel from May, lower daily Bollinger Band and the 50% Fibonacci correction of the upward impulse from July.

The upward reversal from this support zone stopped the earlier short-term ABC correction (ii).

Given the clear daily uptrend, Rolls-Royce can be expected to rise to the next resistance level 1100.00 (which stopped the earlier impulse wave i).

Rolls Royce on a MONSTER of a run.Shares are up roughly 1500% since November 2022 and my first thought was who is buying all these cars, but quickly realised that it was all the "other" engines and equipment that they produce and especially defense contracts that are powering this whopper of a rally.

Either way a truly monster run that might be about to continue after its recent pullback.

Worth a watch.

Market Watch: Rolls Royce📈 Since April, the stock has almost doubled, running in a very strong bull trend. Right now though, it looks like that move is pausing:

• Current resistance around 1111.5 vs. the previous high of 1109 → clear consolidation zone

• Loss of upside momentum with the daily RSI flattening

• Key support sits at 1051, with a notable gap between 1008–1037 (exhaustion gap or measuring gap?).

On the weekly chart, the trend is still very extended, underpinned by the 55-week moving average. We’ve often seen mean reversion back to the 20-week MA, which currently sits at 903.

🔎 Bottom line:

• This market remains in a bull trend above the 55-week MA

• A corrective dip lower is possible, but not necessarily a reversal

• A pullback to the moving average could actually be healthy.

👉 Watching closely for whether this is just consolidation — or the start of a bigger correction.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

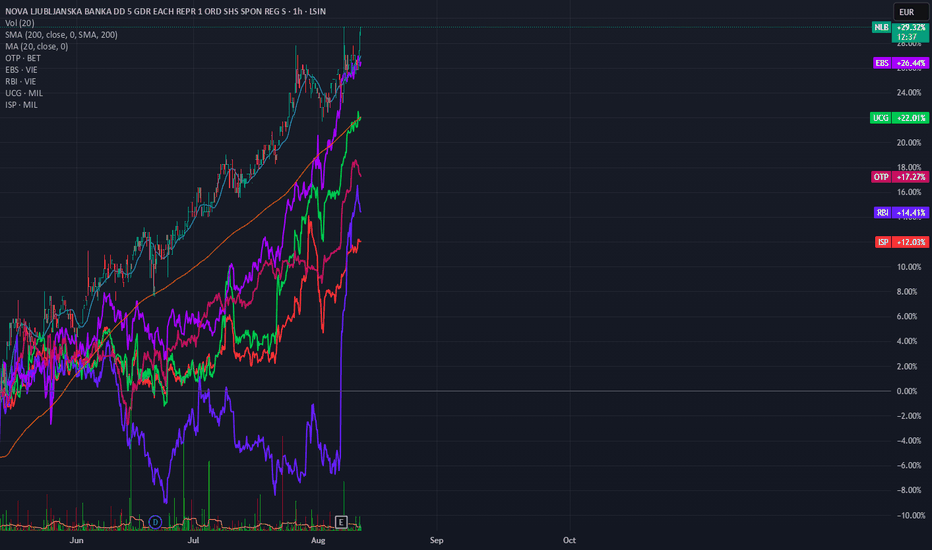

NLB Banka Vision: Achieving €2 B Revenue and €1 B ProfitNLB Banka stands at a pivotal moment in its journey. Guided by a bold vision set forth by its Board of Directors, the bank is primed to transform into a leading financial powerhouse across Southeastern Europe (SEE). This vision is not merely aspirational; it is rooted in a clear, actionable roadmap that leverages the synergies of mergers and acquisitions (M&A) and organic growth, even amidst a challenging macroeconomic environment. By aligning its strategic initiatives with its core strengths, NLB Banka is well-positioned to achieve its ambitious targets of €2.2 billion in revenue and €1 billion in profit.

The Current Landscape

As of today, NLB Banka operates in a market characterized by both opportunities and challenges. While the SEE region offers significant growth potential due to underpenetrated financial markets, the current economic environment presents hurdles such as declining interest rates and inflationary pressures. The growth of the bank’s loan portfolio has been a bright spot, but it has faced challenges in fully offsetting the compression in net interest margins.

Nevertheless, NLB Banka's resilience and adaptability are evident. Its robust digital transformation initiatives, enhanced risk management frameworks, and customer-centric approach have provided a solid foundation to capitalize on growth opportunities. The Board recognizes that achieving its revenue and profit targets requires not only sustaining the current momentum but also scaling its operations strategically.

The Strategic Roadmap

To achieve €2.2 billion in revenue and €1 billion in profit, the Board has outlined a three-pronged strategy:

1. Accelerated Growth through M&A

The SEE region remains fragmented, with numerous mid-sized banks and financial institutions operating across borders. NLB Banka sees this as an opportunity to establish itself as a consolidator in the region. By acquiring strategically aligned banks and integrating their operations seamlessly, NLB Banka can expand its market share, customer base, and product offerings.

Target Markets: Focused acquisitions in high-potential markets such as Serbia, Croatia, and North Macedonia.

Synergies: Realizing cost efficiencies through operational integration and leveraging economies of scale.

Cross-Selling: Expanding the reach of its digital platforms and diversified product portfolio to acquired customer bases.

The successful execution of these M&A activities will enable NLB Banka to accelerate revenue growth while creating a strong competitive moat in the SEE region.

2. Organic Growth Through Innovation and Customer Focus

Organic growth remains a cornerstone of the bank’s strategy. By deepening relationships with existing customers and attracting new ones, NLB Banka aims to drive sustainable growth.

Digital Transformation: Continued investment in cutting-edge digital banking solutions to enhance customer experience and operational efficiency.

SME and Retail Expansion: Growing its SME and retail loan portfolios in underbanked areas of SEE.

Green and Sustainable Financing: Aligning with global trends by offering products such as green bonds and sustainable investment options, catering to environmentally conscious customers and businesses.

Customer-Centric Approach: Leveraging data analytics to personalize product offerings and improve customer retention.

3. Operational Excellence and Cost Optimization

Achieving the profit target of €1 billion requires more than just revenue growth; it demands a relentless focus on operational efficiency.

Streamlined Processes: Continued simplification of internal workflows to reduce costs.

Automation and AI: Using advanced technologies to enhance decision-making and automate routine operations.

Cost Synergies from M&A: Realizing savings through shared resources and consolidated systems.

Overcoming Challenges

The Board is acutely aware of the challenges that lie ahead. Declining interest rates, inflationary pressures, and regulatory hurdles require proactive measures to mitigate risks. NLB Banka’s strong capital position and risk management expertise will play a pivotal role in navigating these challenges. Additionally, the diversification of revenue streams—including fee income from wealth management, insurance, and payments—will further insulate the bank from macroeconomic volatility.

The Vision Realized

By 2028, NLB Banka envisions itself as the undisputed leader in SEE banking, with a robust footprint across the region. The successful execution of its M&A and organic growth strategies will not only drive financial performance but also position the bank as a key partner in the economic development of the SEE region.

At €2.2 billion in revenue and €1 billion in profit, NLB Banka will have proven that a clear vision, combined with strategic execution and operational excellence, can overcome even the most challenging of economic landscapes. This is not just a story of growth; it is a testament to the resilience, innovation, and leadership that define NLB Banka.

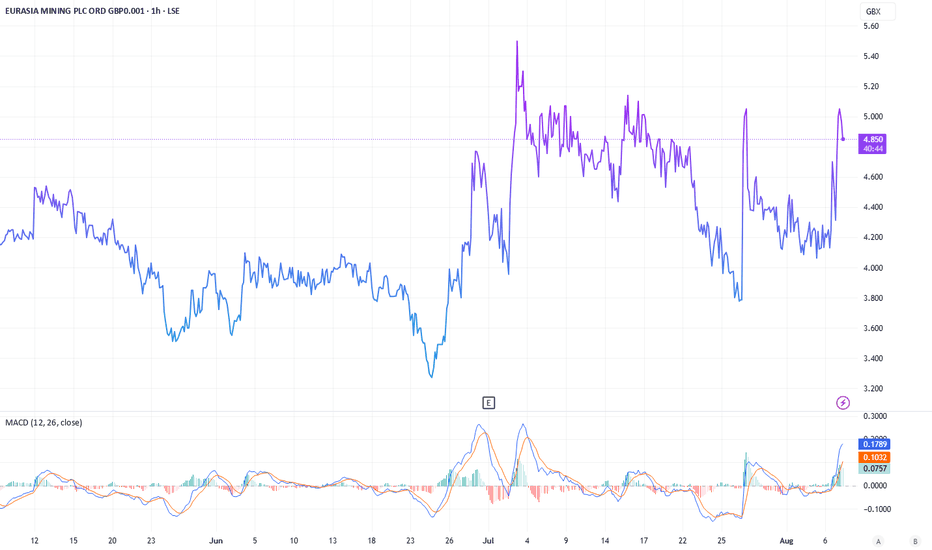

Eurasia Mining: A Strategic Opportunity in Precious MetalsExpanding Market Presence with Dual Listing

Eurasia Mining PLC (LON:EUA), a London-based mining company, has established itself in the exploration and production of platinum group metals (PGMs) and gold, recently expanding its reach through a dual listing on the Astana International Exchange (AIX) in Kazakhstan. The accomplishment was achieved in this year's July, builds on its long-standing presence on the London Stock Exchange's Alternative Investment Market (AIM), where it has been listed since 1996. The AIX listing, finalized with the appointment of SQIF Capital as market maker, enhances liquidity and broadens access, particularly in emerging markets. With no new shares issued, the shares remain fully fungible between London and AIX, ensuring seamless trading. Eurasia is capitalizing on growing global demand for critical minerals, driven by automotive and renewable energy sectors.

Diversified Portfolio of Critical Metals

The company’s asset portfolio centers on PGMs - iridium, osmium, palladium OANDA:XPDUSD , platinum OANDA:XPTUSD , rhodium LSE:XRH0 , and ruthenium—alongside gold TVC:GOLD , copper CAPITALCOM:COPPER , and nickel $CAPITALCOM:NICKEL. These metals are integral to technologies like catalytic converters and hydrogen fuel cells, which benefit from tightening emissions regulations and the expanding hydrogen economy. Eurasia’s operations emphasize cost efficiency, with open-pit mining techniques that reduce expenses compared to traditional underground methods. For instance, production costs at its key sites are among the lowest in the PGM sector, approximately $300 per ounce, due to streamlined processes that avoid costly drilling and blasting.

Key Projects Driving Growth

One notable project in Eurasia’s portfolio - the Tylai-Kosvinskoye deposit. It’s one of the world’s largest alluvial PGM and gold reserves. With over 11 tons of PGMs and gold currently estimated, and total resources exceeding 20 tons under JORC standards, this group of 12 assets has seen substantial progress. In 2025, five of these sites entered commercial production, supported by five operational processing plants, with a sixth slated for launch in the second half of the year. Eurasia is capable of scaling up its operations, backed by existing infrastructure such as roads, power lines, and maintenance facilities, which minimizes the need for large-scale capital investment.

Advancing the "Monchetundra" Project

Another crucial component is the so called "Monchetundra" project, a cluster of licenses hosting approximately 60 tons of PGMs and gold, plus 258,000 tons of copper and 390,000 tons of nickel. A contract with Sinosteel for a turnkey processing plant, expected to be completed within two years, also signals further growth potential. These metals are critical for electric vehicle batteries and renewable energy applications, align with global trends toward decarbonization. Eurasia’s diversified portfolio, spanning PGMs, gold, and battery metals, positions it to benefit from both traditional and emerging demand drivers.

Strong Financial and Institutional Support

The company’s financial strategy supports its operational ambitions. In March 2025, Eurasia raised £3.2 million through a private placement of 72 million shares to U.S. and U.K. institutional investors at 4.37 pence per share, reinforcing its capital base. Institutional ownership now accounts for 58% of Eurasia’s shares, a signal of confidence from major investors like BlackRock, often viewed as a marker of asset reliability. The funds are earmarked for maintaining the London listing and supporting the AIX launch, enhancing marketability without diluting existing shareholders. As of August, Eurasia’s market capitalization stands at approximately £140 million, with 80.51% of its stock in free float, reflecting strong liquidity.

Experienced Management and Strategic Partnerships

Eurasia’s management team brings extensive experience in mining, with a track record of advancing projects from exploration to production. Strategic partnerships, such as with Sinosteel, and government-backed incentives like tax breaks and loan subsidies, strengthens the company’s outlook. For example, the Monchetundra project has already received 70% of its required capital investment, reducing future funding needs and accelerating development timelines.

Navigating Market Opportunities and Risks

Market dynamics further enhance Eurasia’s appeal. The PGM market is buoyed by robust demand, particularly for palladium and platinum in automotive catalytic converters and hydrogen technologies. Gold prices, a key component of Eurasia’s portfolio, continue their upward trajectory. Analysts project Eurasia’s share price could range from £0.03 to £0.06 in 2025, potentially reaching £0.08 to £0.15 by 2030, driven by production growth and market trends. However, risks remain. Including commodity price volatility, potential technological shifts reducing PGM demand, and the need for additional financing, which could lead to dilution.

Positioning for Global Investor Access

Eurasia’s dual listing on AIX opens access to a broader investor base, particularly in Central Asia and the Global South, where interest in critical minerals is rising. The company's focus on transparency, backed up by regular updates and resource estimates in line with JORC, should strengthen investor trust. Investors are advised to conduct thorough research, considering both the growth potential and inherent risks of the mining sector, as Eurasia continues to develop its assets and navigate global market trends.

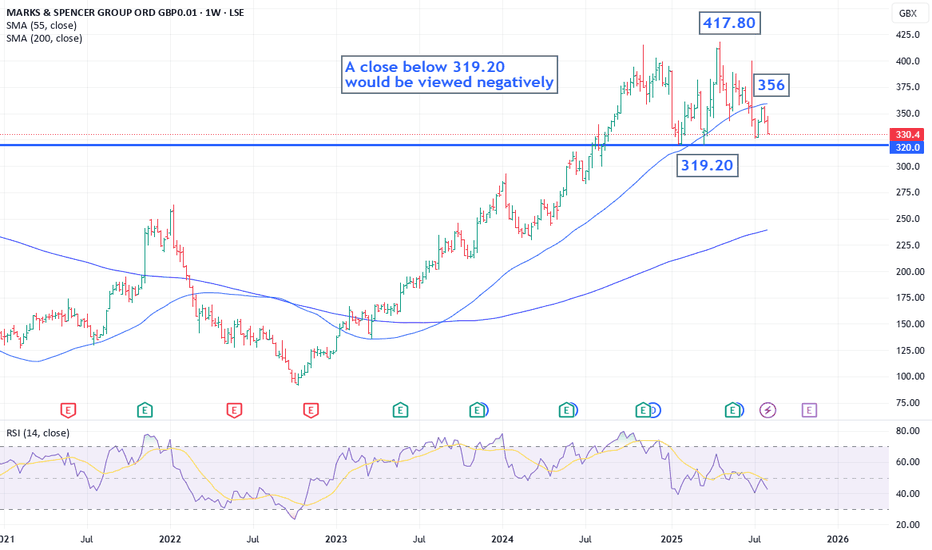

Marks & Spencer: A Rocky Start to Fiscal 2026Despite a strong start to the year, Marks & Spencer’s momentum has been overshadowed by a major cyberattack, disrupting online operations from April through July. While their reshaping strategy continues to deliver gains in volume, market share, and profitability, the breach is expected to dent fiscal 2026 operating profit by ~£300M.

An analyst warns of short-term reputational damage, and shares are down ~12% YTD.

📊 Technical View:

The price remains under pressure. A weekly close below 319.20 (Jan low) would complete a sizeable double top, with a potential 100-point downside target. The 200-week moving average at 239 is our initial target.

Upside resistance? The 55-week moving average at 359. Unless that’s cleared, pressure likely remains.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

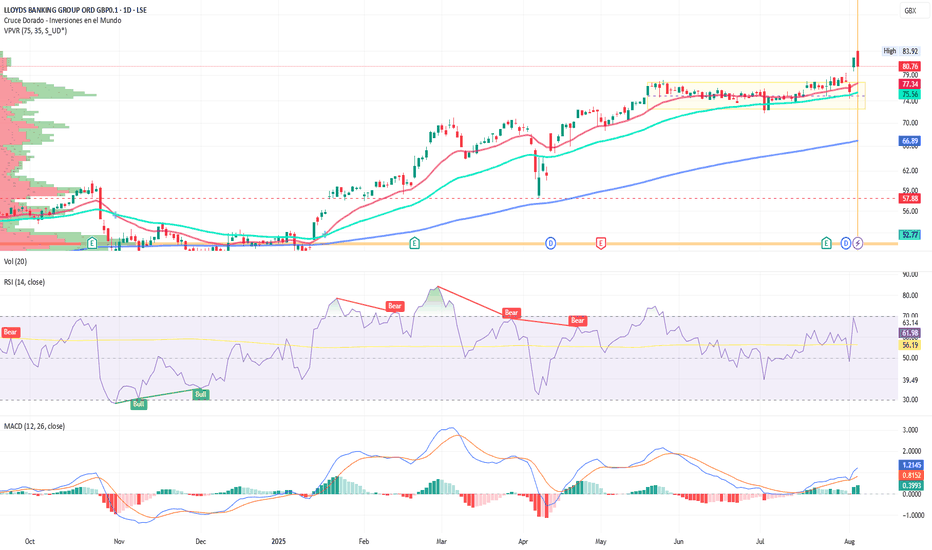

British Banks Dodge a Legal BulletBritish Banks Dodge a Legal Bullet, but Still Face Billion-Pound Costs

Ion Jauregui – Analyst at ActivTrades

The UK Supreme Court relieves financial institutions from paying up to £44 billion over the car finance scandal. The FCA is preparing compensation plans that could cost up to £18 billion.

British banks have narrowly avoided a legal blow that threatened one of the largest payouts in their recent history. The UK Supreme Court ruled against applying broad compensations for inflated commissions on car finance agreements—a case that could have cost the sector up to £44 billion.

The decision was met with relief by the market. Shares of Close Brothers Group, Lloyds Banking Group, Barclays, and Bank of Ireland, all with direct or indirect exposure to auto loans, posted significant gains following the verdict.

However, the legal outcome does not mark the end of the matter. The Financial Conduct Authority (FCA) has announced it is working on a more limited compensation plan, which could result in payouts between £9 billion and £18 billion. Lloyds, one of the most affected entities, currently holds a provision of £1.2 billion, which its management believes will not need to be significantly increased.

Moody’s has rated the situation as credit negative for the UK banking sector, warning that despite the favorable ruling, regulatory and reputational risks remain.

Fundamental Analysis of Lloyds

Lloyds Banking Group (LSE: LLOY) remains a cornerstone of the UK financial system. Backed by strong capital ratios and a diversified portfolio, the bank has managed to weather regulatory and macroeconomic challenges in the post-Brexit, inflationary environment.

In its latest quarterly report, Lloyds posted a net profit of £1.63 billion, beating market expectations. The bank reported a ROTE of 15.3% and a CET1 ratio of 13.9%, providing a solid buffer to absorb potential future shocks. Additionally, the board announced an interim dividend of 0.92 pence per share, underscoring its commitment to shareholder returns despite ongoing uncertainties.

Technical Analysis of Lloyds (LSE: LLOY)

Lloyds has shown remarkable technical momentum so far this fiscal year. After hitting lows of £49.93 in January and forming a base that led to a golden cross of moving averages, the stock experienced a temporary dip to £57.88 following the announcement of new US tariffs.

Since then, the share price has advanced steadily, recently touching a new all-time high of £83.92 after forming a clear accumulation zone between May and July. This week, the stock decisively broke out of that range, entering what appears to be a potential “blue-sky” scenario, with no defined resistance levels above.

The move is supported by a bullish MACD crossover and increased trading volume, signaling momentum strength.

On the other hand, the RSI, currently at 61.98, indicates a slight moderation in the trend, especially after Tuesday's bearish candle, which could hint at a short-term correction toward the point of control (POC) at £75.20.

Key Indicators:

• MACD: Expanding, confirming strong upward momentum.

• RSI: At 61.98, suggesting moderate overbought conditions and possible pullback.

• Moving averages: Diverging, reinforcing the bullish trend structure.

Levels to Watch:

• Support: £77.50 – a break below this level could trigger a return to the accumulation zone.

• Resistance: With no clear ceiling in place, a continuation of the current breakout could see the stock approach the £90 mark.

In summary, while a short-term pullback is possible if regulatory pressure intensifies, Lloyds' technical outlook remains firmly bullish, supported by growing volume and strong momentum signals.

Dodging the Bullet

The Supreme Court ruling provides short-term relief for the UK banking sector, but the financial impact of the car finance scandal remains unresolved. As the FCA outlines its compensation plan, Lloyds stands out for its solid fundamentals and bullish technical setup—albeit with room for short-term corrections. The UK banking industry, although momentarily having dodged a bullet, still faces unresolved regulatory challenges and market scrutiny. The case has reignited the debate around sales practices in the UK auto finance market, a segment that until recently had avoided the level of oversight applied to other financial products.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance and forecasting are not a synonym of a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success.

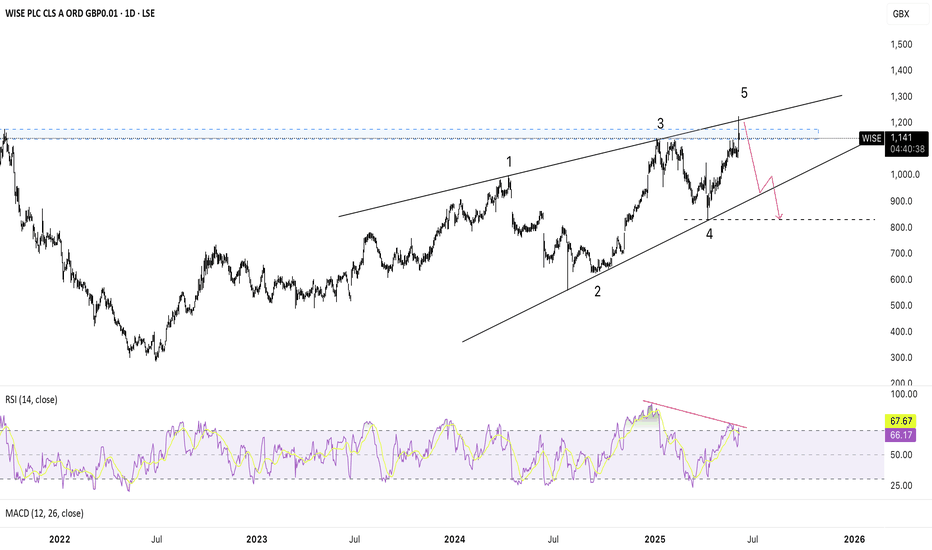

Short WISE as leading diagonal has been completedWISE can be shorted with the first target at the lower edge of the diagonal and then, at around 800 pence (start of wave 5), if move lower confirmed.

Clear RSI divergence shows trend reversal in the short-term at least (until touching lower band of the diagonal). So the lowest upside is around 14-16% here.

SL can be set to 1230 pence.

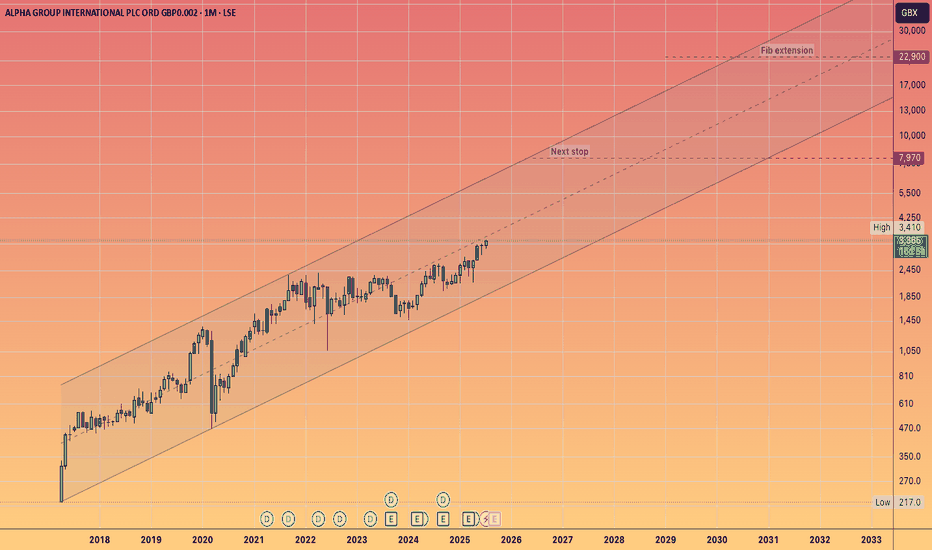

ALPHA GROUP INTERNATIONAL will keep its momentum going!#ALPHA is a fintech company that offers currency risk management and payment solutions.

With a price-to-earnings ratio of approximately 12,

it signifies a solid investment for a growth-oriented fintech firm that is increasing its earnings by about 20 to 25% annually.

In light of the #UKX breaking through and reaching new highs, and beginning to accelerate towards my long-standing projections that the FTSE would hit 5 figures, ALPHA appears to be a unique opportunity in the UK markets, which, as we know, are relatively sparse compared to the USA.

Given the inability to purchase shares of #Revolut, it is likely that capital will flow into this ticker.