Unbound Group PLC: M&A Target for WoolOvers/Marwyn at

tradingview.sweetlogin.com

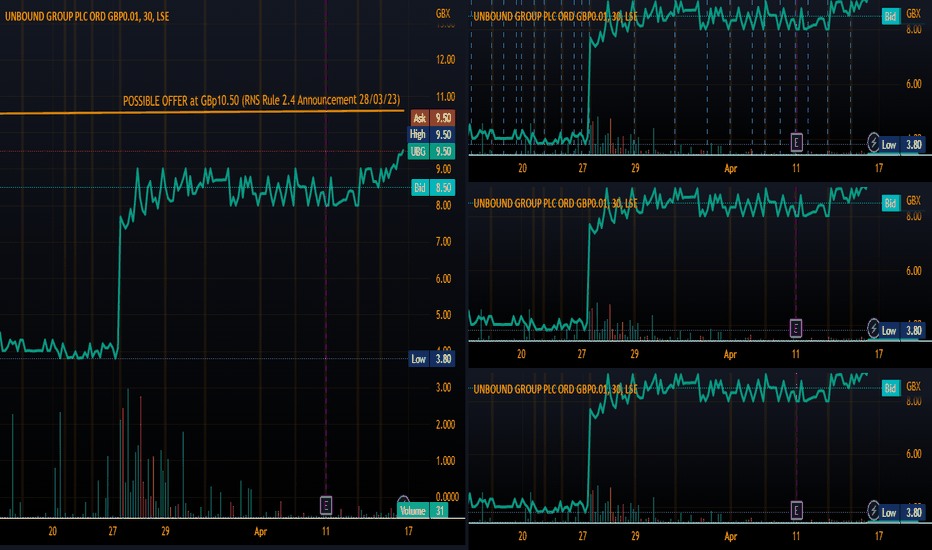

On 05 April 2023, Unbound Group PLC, UK listed online footwear seller, announced that they received an unconditional competing proposal from Marwyn Investment Management LLP ("Marwyn"), an acquisition vehicle, offering to provide a £10 million investment via an equity placing at an issue price of GBp 10.50 per Unbound share ("the Fundraise"). This represents a 29.31% premium to the closing price of GBp 8,12 on 04 April 2023, one trading day before the announcement. The fundraising offer matches the previous competing potential offer from WoolOvers Group Limited dated on 28 March 2023 and represents a 162.5% premium to the closing price of GBp 4.08 on 27 March 2023, one trading day before the beginning of the merger siege situation.

The current Merger Arbitrage spread is at 10.53% based on a closing price of GBp 9.5 on 14 April 2023, the last trading day before publishing this story.

Marwyn's offer intendeds to be a cornerstone to, but not conditional on, a wider equity placing. In addition, Marwyn has proposed that all existing shareholders should have an opportunity to participate in the offer. Marwyn's proposal is unconditional both as to diligence requirements and as to the quantum of additional capital contributed by existing Unbound shareholders but the proposal is subject to certain other terms and conditions, principally: 1) the granting by the Takeover Panel of a waiver of the obligation for Marwyn to make a general offer for the Company under Rule 9.0 of the City Code on Takeovers and Mergers ("the Code") which would otherwise be triggered by the Fundraise; and 2) the approval of Unbound's EGM of the resolutions necessary to implement the Fundraise.

Previously, on 28 March 2023, Unbound Group PLC, UK listed online footwear seller, announced that it is in discussions with WoolOvers Group Limited, a UK knitwear and footwear seller for the elderly, in relation to a cash offer for the entire issued and to be issued share capital of Unbound Group. The possible offer of GBp 10.50 per share represents a 162.5% premium to the closing price of GBp 4.08 on 27 March 2023, one trading day before the announcement. This values Unbound Group at £6.85 million.The possible offer is subject to certain pre-conditions, including due diligence, financing arrangements and unanimous recommendation by the board of Unbound Group PLC. There are various risks and uncertainties, including regulatory approvals, shareholder approvals, market conditions and other factors. According to an undisclosed source close to the situation the bidder will be seeking at least 90% acceptances from the existing shareholders.

WoolOvers now have until 25 April 2023 to either announce a firm intention to make an offer for Unbound in accordance with Rule 2.7 of the UK Takeover Code or announce that it does not intend to make an offer for Unbound.

However, unconfirmed takeovers have on average only a 30% chance of completing, according to an undisclosed source familiar with the UK takeover regime. Should the offer go through, it is expected to commence no later than 23 May 2023 and to become unconditional as to acceptances no later than by 24 July 2023 according to the same source.

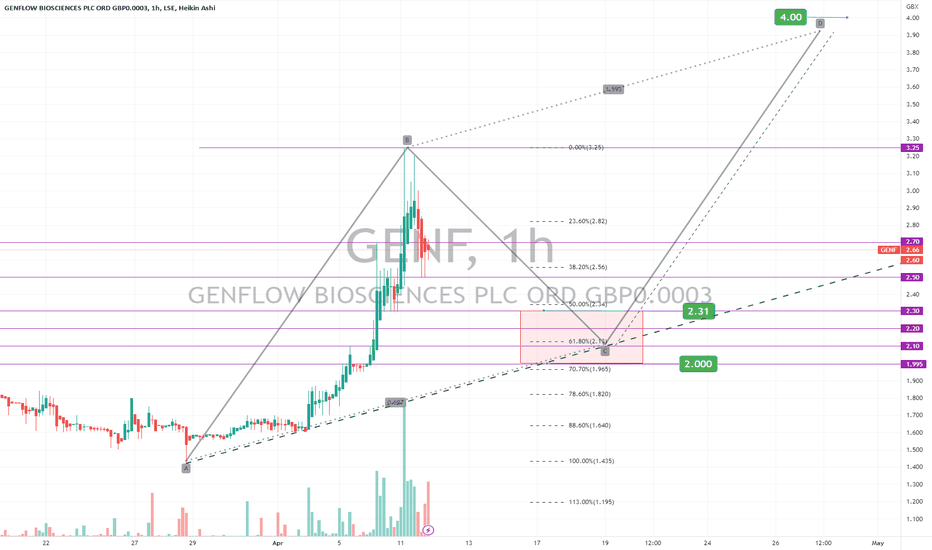

#GENF #GenflowABCD harmonic pattern possibly in play, next move is a bearish move down to the C leg, at a price point where the 61.8 fib retracement around the 2p area. the next impulse move will be after the C leg part of the harmonic has formed and will see a zone around the 4p area, The 4p will be a tough one to crack so we should expect some resistance around that area. possible downside after the 4p gets tagged.

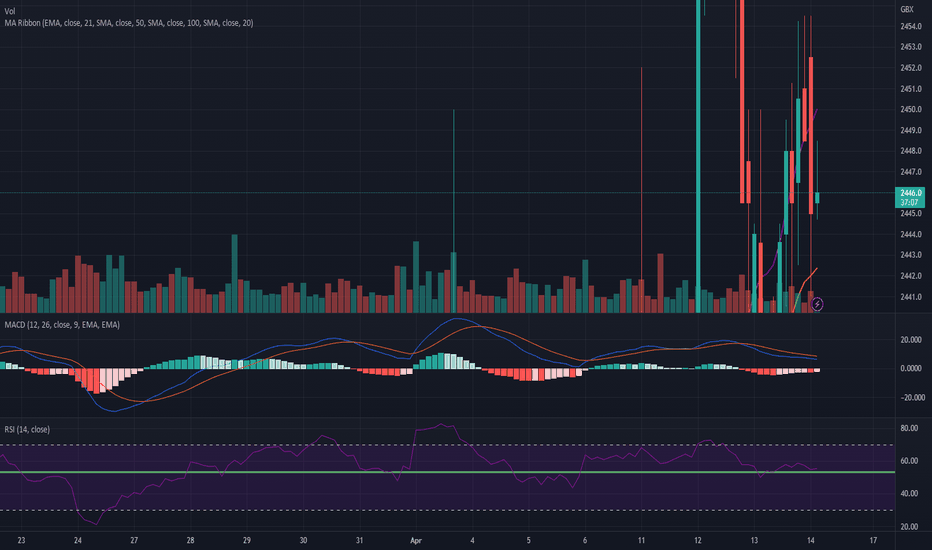

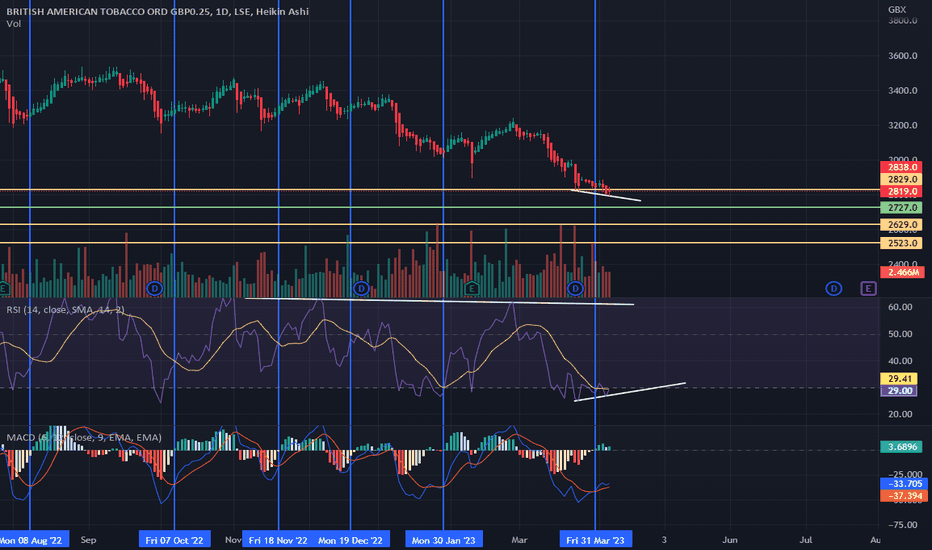

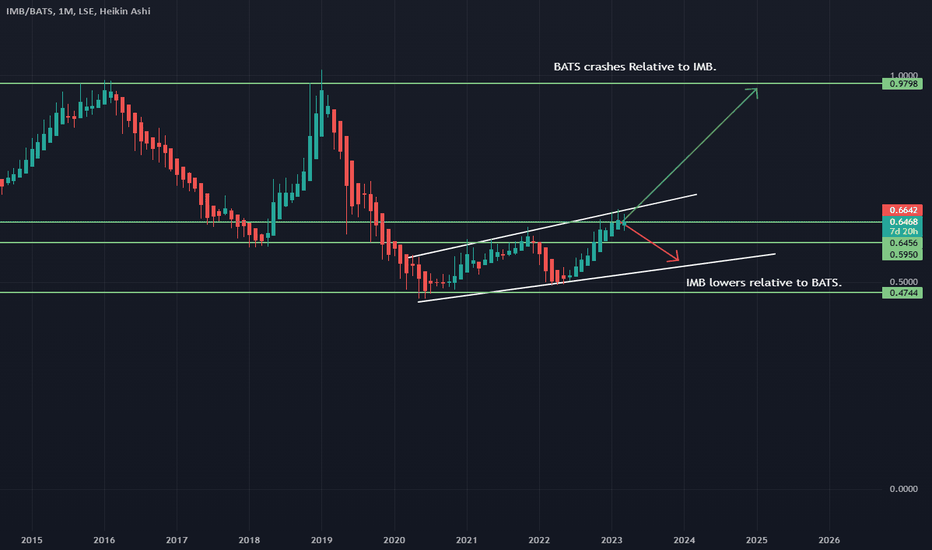

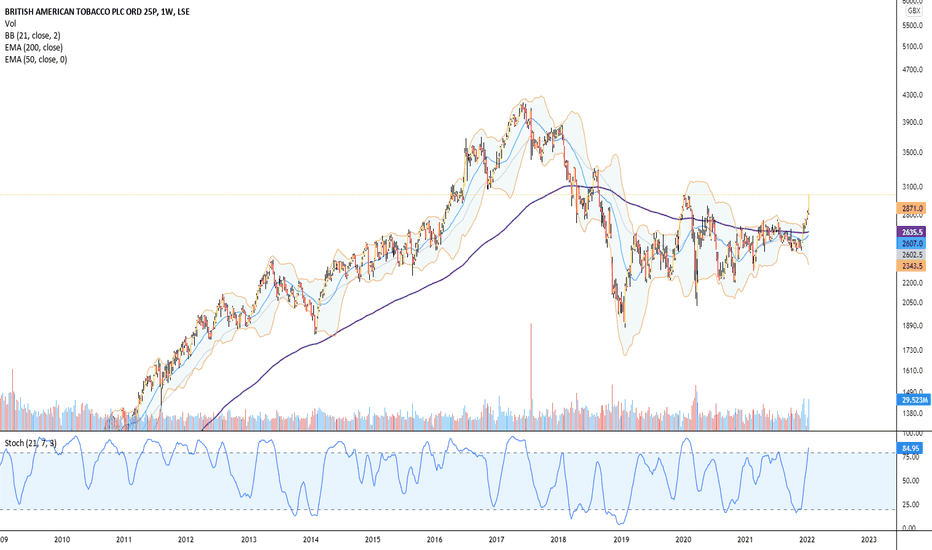

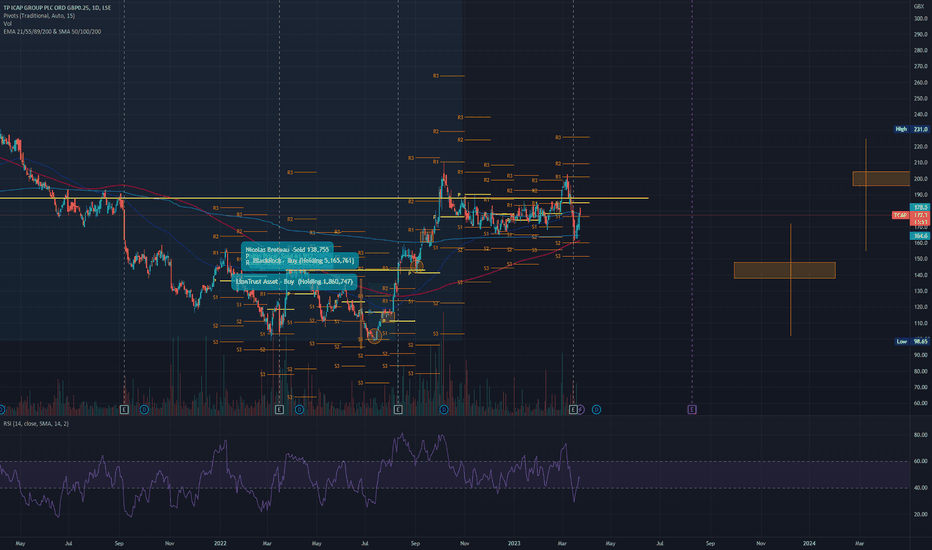

BATS... Time to buy the bottom of the Dip?!Here we see BATS on the daily, there are three factors indicating the price may have found a bottom...

1) The RSI has formed a divergence, the RSI MA has hit the oversold 30 bar (which is a rarity).

2) The MACD has had a crossover, albeit in the lower half.

3) the share price has hit a key level, in it being the major resistance level prior to the breakout in 2021.

Also, let us note that BATS has a "buy" rating, and price target of £35 to £41, and is currently yielding over 8%.

Obviously there might be something happening with the company behind the scenes, but I think that is unlikely as we can see insiders have been doing nothing but buying...

www.lse.co.uk

Therefore, if I had sold out, which I should have done at £36, I would more than be happy buying back in now. However I didn't sell any, as my average was only £28, so I will top up on this drop and more so if we are lucky to see £26 again.

Thanks!

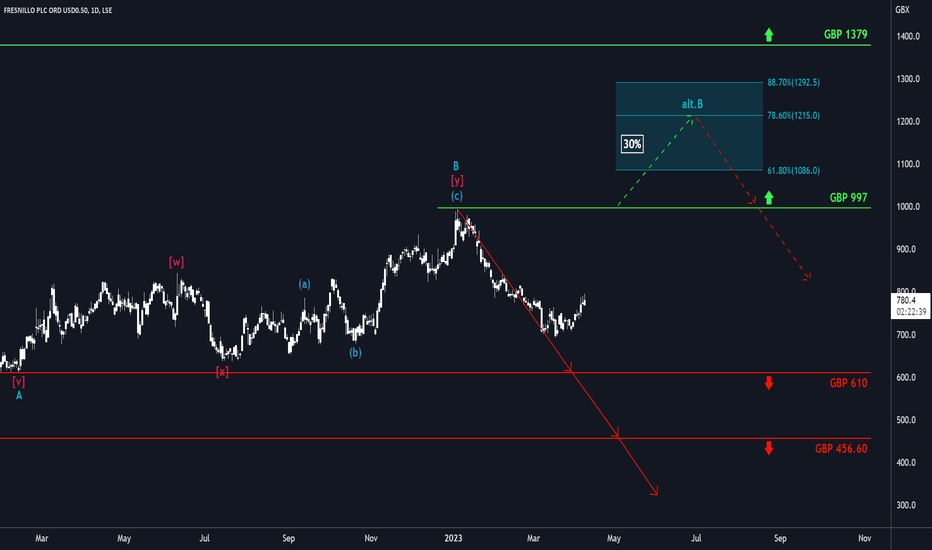

Fresnillo: Easter Egg Hunt 🥚🐣🐰Has Fresnillo gotten lost, hunting for Easter eggs? We don’t think so! We rather understand the share to be swerving, interspersing its way with a little counter movement. Soon, the course should return to the main path and fall below both the supports at GBP 610 and GBP 456.60 to continue the descent. However, a 30% chance remains for Fresnillo to make a more extensive detour. In that case, the share would climb above the resistance at GBP 997 to develop wave alt.B in turquoise in the turquoise zone between GBP 1086.00 and GBP 1292.50 first before heading downwards again.

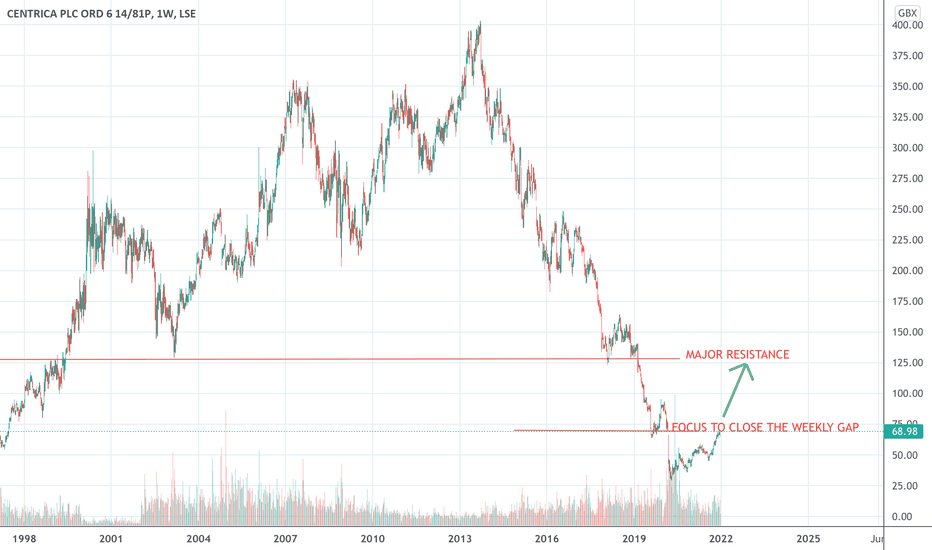

CENTRICA major turnaroundClosing the weekly gap could be a major triggering point for a major trend reversal while targeting a major resistance at 1.2£ area, at least.

For mainland Europe, Centrica might be an unfamiliar name. This energy giant, headquartered in the UK, on the back of climate change, undergoes a historical fundamental business model shift effort, while exiting energy exploration and production and trying to emerge as customers’ services and solutions company of the future.

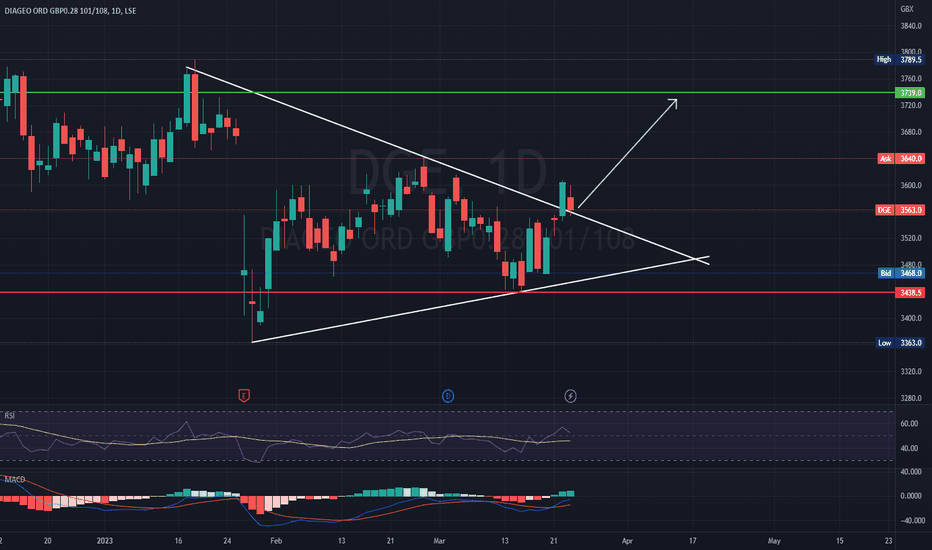

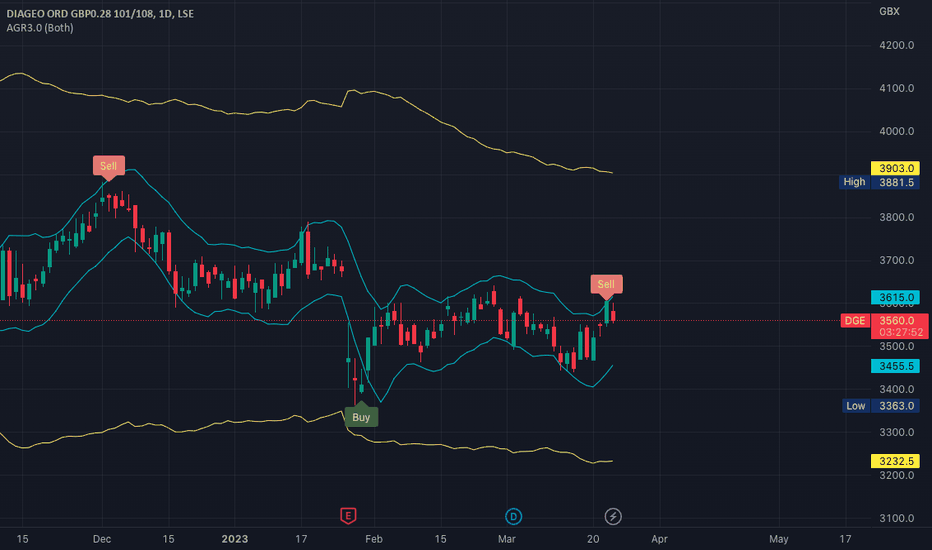

Diageo plc (DGE.l) bullish scenario:The technical figure Triangle can be found in the daily chart in the UK company Diageo plc (DGE.l). Diageo plc is a British multinational alcoholic beverage company. It is a major distributor of Scotch whisky and other spirits. Distilleries owned by Diageo, produce 40% of all Scotch whisky with over 24 brands, such as Johnnie Walker, J&B and Vat 69. Its leading brands include Johnnie Walker, Guinness, Smirnoff, Baileys liqueur, Captain Morgan rum and Tanqueray and Gordon's gin. The Triangle broke through the resistance line on 23/03/2023. If the price holds above this level, you can have a possible bullish price movement with a forecast for the next 15 days towards 3 739.00 GBX. According to experts, your stop-loss order should be placed at 3 438.50 GBX if you decide to enter this position.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Diageo managed to grow EPS by 7.3% per year, over three years. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals and cannot be held liable nor guarantee any profits or losses.