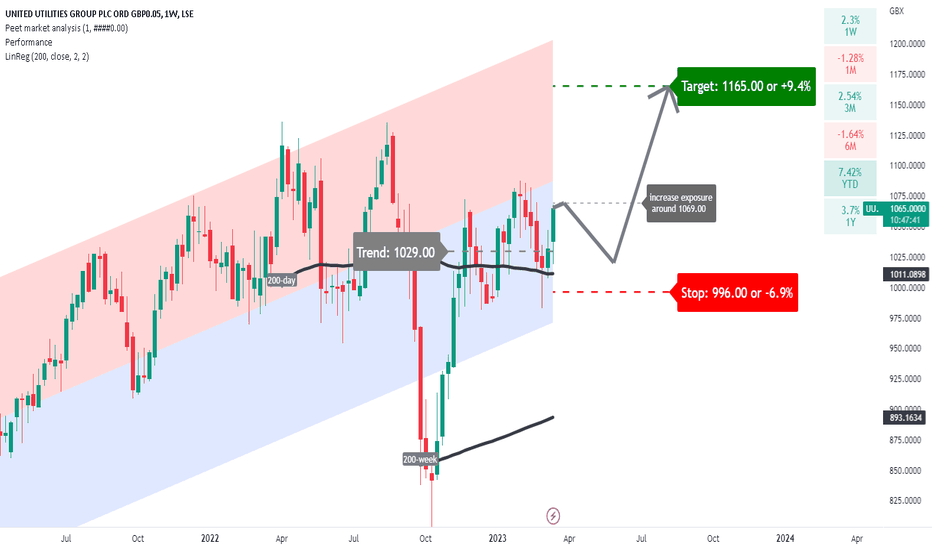

UU. building above its 200-dayA price action above 1029 supports a bullish trend direction.

Negate the bullish bias for a break below 996 (stop-loss).

Increase long exposure for a break above 1069.

Upside target is at 1165 (upper range of the linear regression channel pattern.

When a stock is building a base just above its 200-day simple moving average, it can sugegst a potential bullish trend as the stock price is finding support at this level.

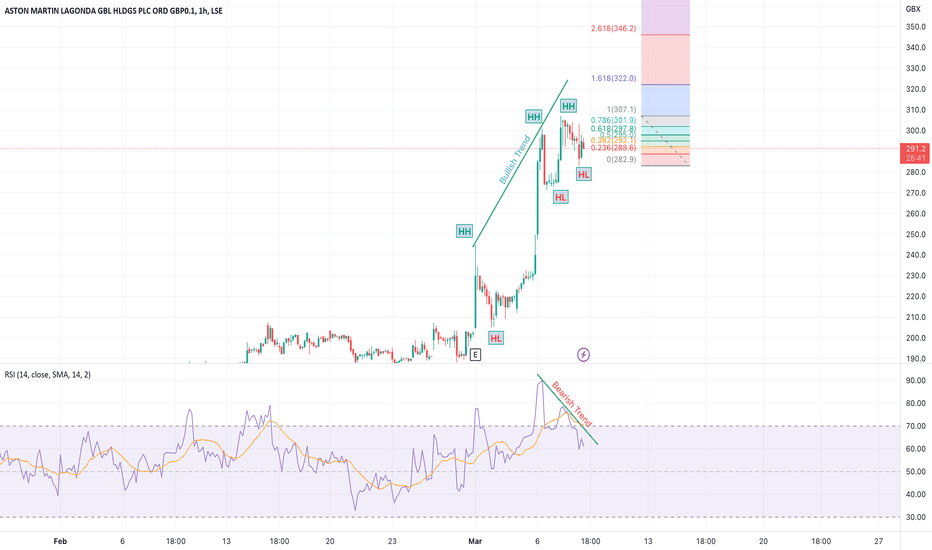

Aston Martin Formula 1Aston Martin Aramco Cognizant Formula 1 team is driving the stock, at its peak, it is up 61% from the AMR 23 Reveal, with the biggest price rise coming the morning after a magic podium for Fernando Alonso, and a stunning upset for Ferrari and Mercedes. The question is, will this happen again? in Jeddah, Melbourne, or later in the season?

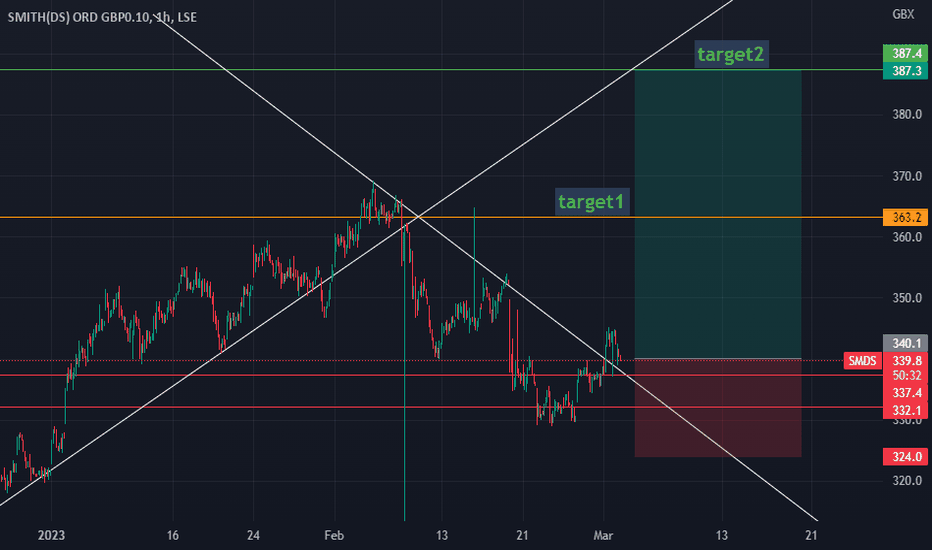

long position on SMDSMy strtegy is based on price action with the reading of certain indicators that I like whilerespecting all the values that define the stock maket

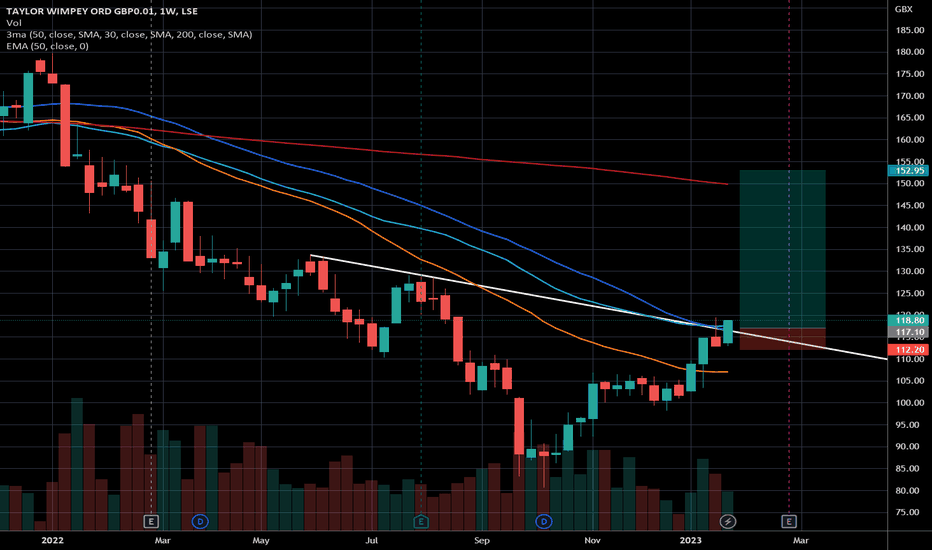

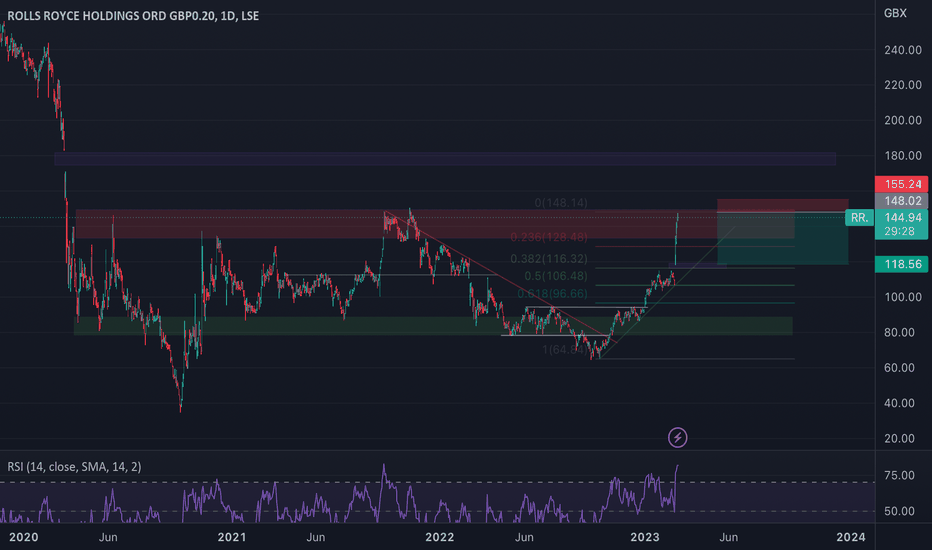

RR. Short if 150+ not breachedThinking this is a great overbought trade here.

RSI 75 overbought conditions.

Massive gap too be filled around 115

Entered zone of previous sellers(resistance)

ideally for a long position it would fill this gap and then bounce again which coincides with the .38 fib that's present in that zone.

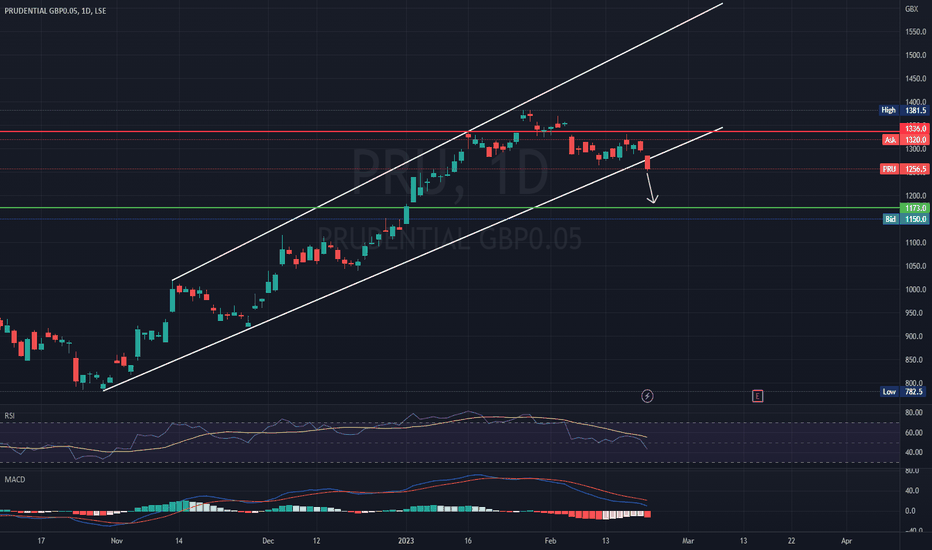

Prudential (PRU.l) bearish scenario:The technical figure Channel Up can be found in the daily chart in the UK company Prudential plc (PRU.l). Prudential plc is a British multinational insurance company. It was founded in London in May 1848 to provide loans to professional and working people. The Channel UP broke through the support line on 22/02/2023. If the price holds below this level, you can have a possible bearish price movement with a forecast for the next 25 days towards 1 173.20 GBX. According to experts, your stop-loss order should be placed at 1 336.00 GBX if you decide to enter this position.

Prudential's stock increased significantly by 41% over the past three months. But the company's key financial indicators appear to be differing across the board and that makes us question whether or not the company's current share price momentum can be maintained.

While the company does have a high rate of reinvestment, the low ROE means that all that reinvestment is not reaping any benefit to its investors, and moreover, its having a negative impact on the earnings growth.

Prudential's earnings have declined over five years, contributing to shareholders 21% loss.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

Bidstack long Bullish divergence on the RSI

ema's look like flattening out/turning upwards

Morning star candlestick at the alltime low

Increase in volume generally since start of January

Big gap to fill above

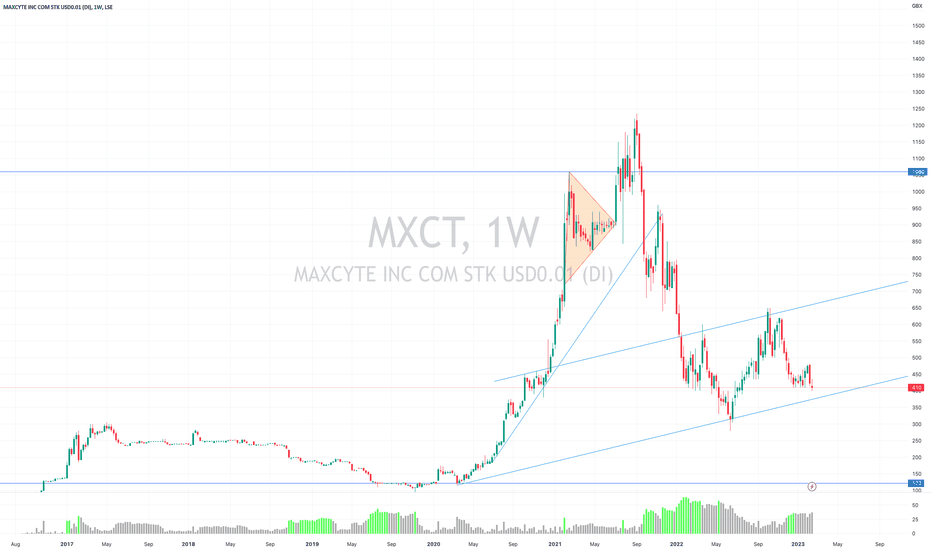

MXCT WAIT FOR BACKTESTMXCT - no advice given

looks to me like a successful backtest makes for a reasonable opportunity

behaving nicely