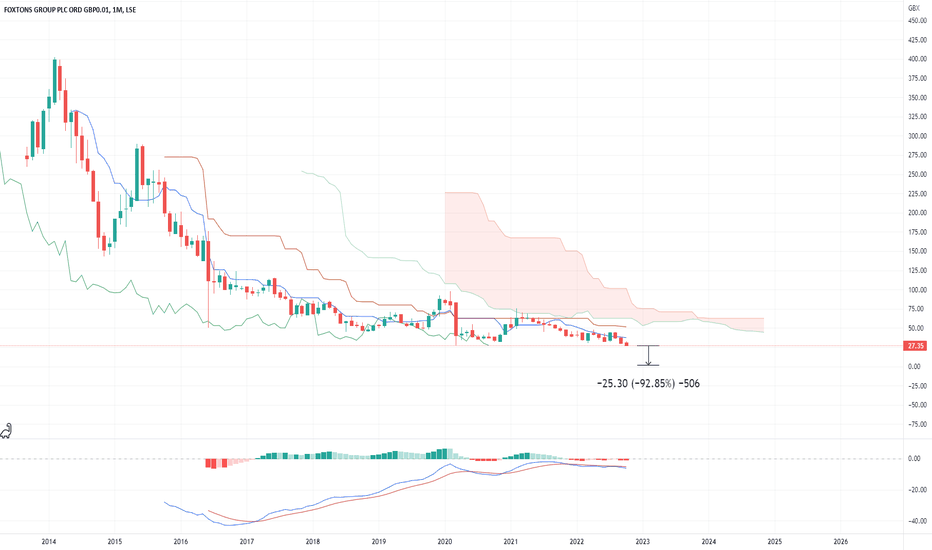

Foxtons shares are going to be delistedThe UK housing market can be regarded as one of the largest real estate speculative fraudulent bubbles in the global economy, such as hong kong real estate, china estate market, Paris, new york, Florida, and California real estate markets. Hounding and Commercial real estate developers and real estate brokers are going to go bust, because they have leveraged their balance sheet of very cheap debt collateralized by inflated real estate prices. The housing market and commercial real estate market already are in multibillion dollars debt collateralized by negative equity and real estate brokers are going to collapse with the whole housing market.

Observing The chart of Foxtons the trendline of the share price, to investors these dynamics have been clear for some time.

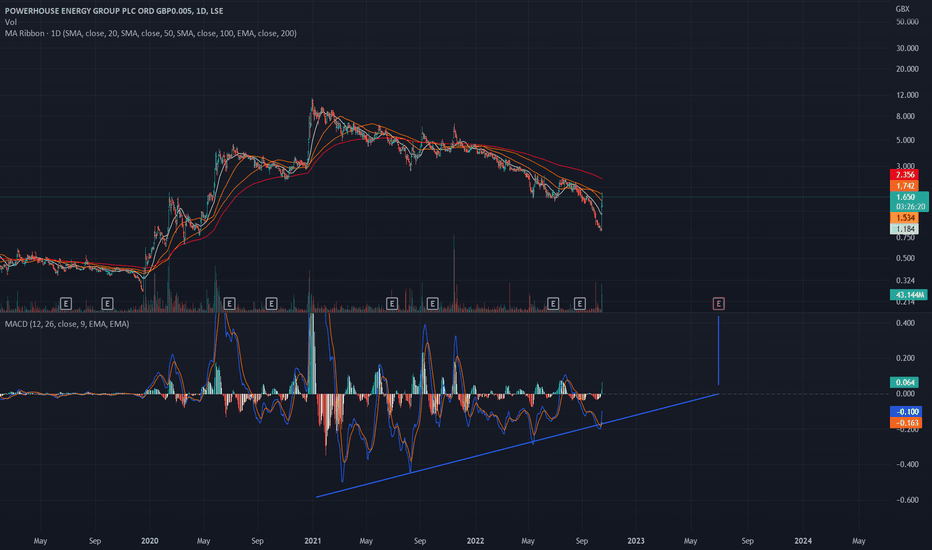

PHE Breakout and RSI Positive DivergenceRecent breakout of PHE - 50% on Friday after announcement meeting can be found on IG trading or other platforms. I play about wih this looking for some channels but then realised the RSI positive divergece building - aims itself firmly at the next earnings report- how will it play out? are we looking at retesting the highs?

JET2 PLC LSE STOCK MARKET , at support, Long ?LSE:JET2

Jet2 like the rest of the aviation market had a terrible time performance wise due to covid and lock downs, price now at a long term support, i expect it to be respected and bounce from here, perfect place for a buy, fundamentals for Jet are great as well as the technicals which i have indicated in my TA.

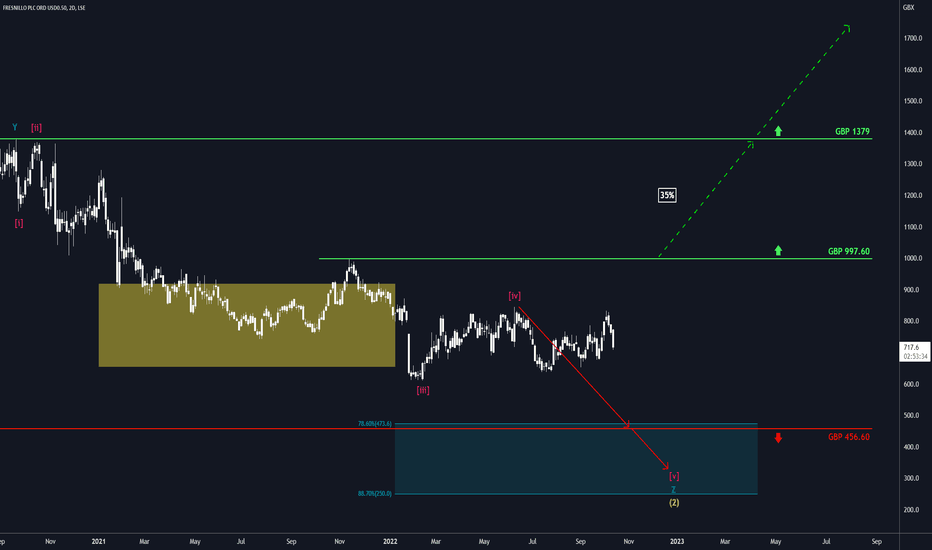

Fresnillo: ReasonableFresnillo is back to being reasonable and – in accordance with our expectations – has moved downwards again. Now, it should keep up this drive to make it below the support at GBP 456.60 and thus into the turquoise zone between GBP 473.60 and GBP 250.00, where it should finish wave (2) in yellow. There is a 35% chance, though, that Fresnillo could escape above the resistance at GBP 997.60, thus triggering further ascent above the next mark at GBP 1379.

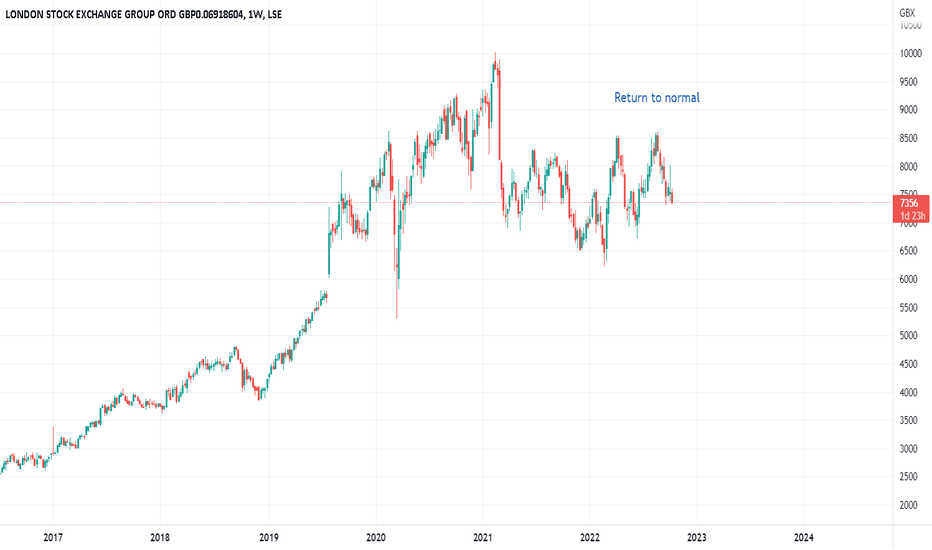

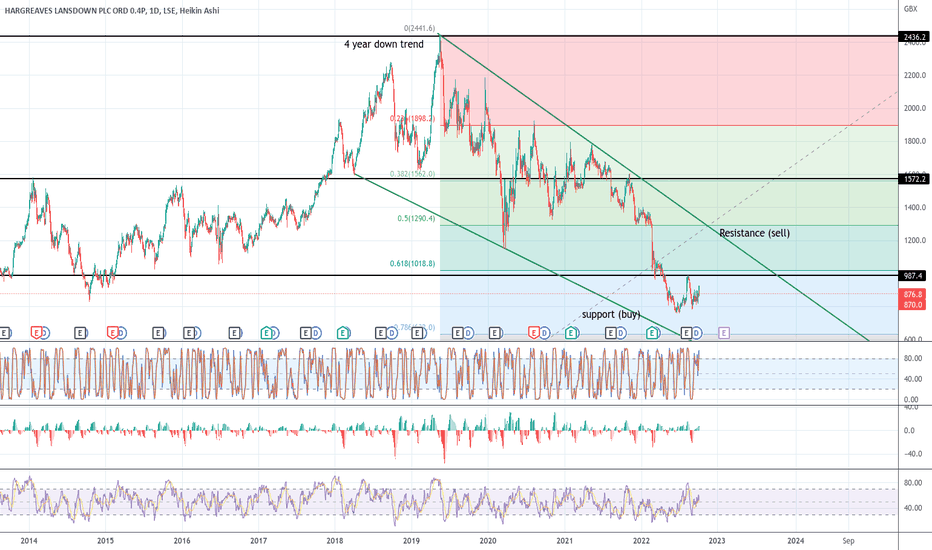

hargreaves landowns stock, long term down trendLSE:HL.

1d candle chart, 4 year downtrend, short for me, maybe 2026 this thing will turn around,

support and resistance marked, for sensible entry and exits.

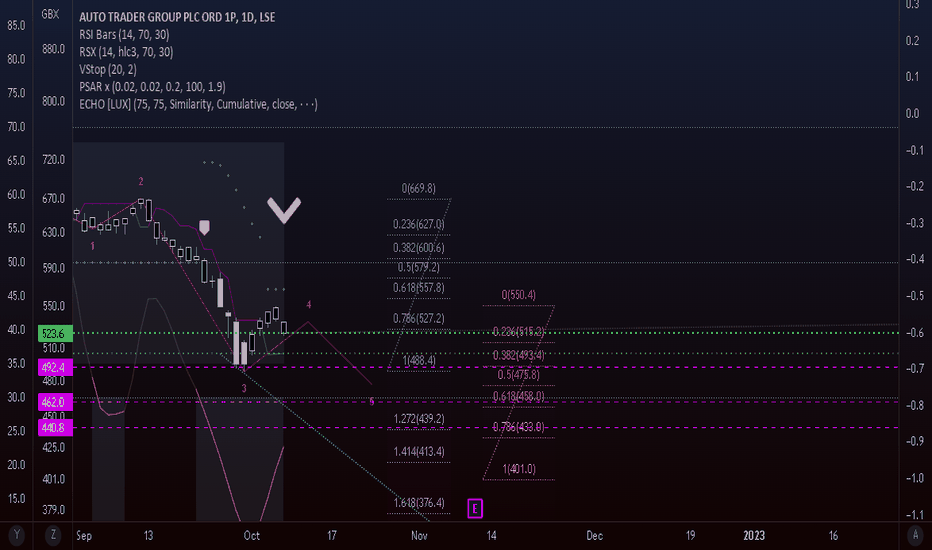

Trade it in, Auto Trader. AUTOAuto Trader is heading for a final leg in a downward impulse. Clear picture on the Elliott, backed up by indicators on the daily. Good luck!

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Confirmation level, where relevant, is a pink dotted, finite line. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe.

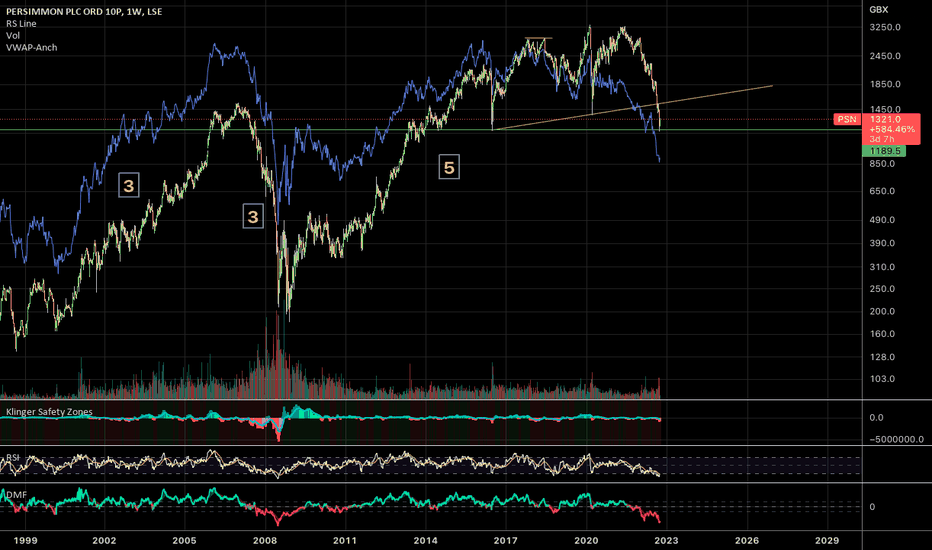

$PSNBig UK constructor.. I think the last swing high is in 3 rather than a 5 as labelled but we have 5 waves down from highs in A and trendline a logical place to reshort. You can see it held prior 4 ...unlike a lot of stocks it could not take out pre Covid highs in spite of speculative buying frenzy post Covid

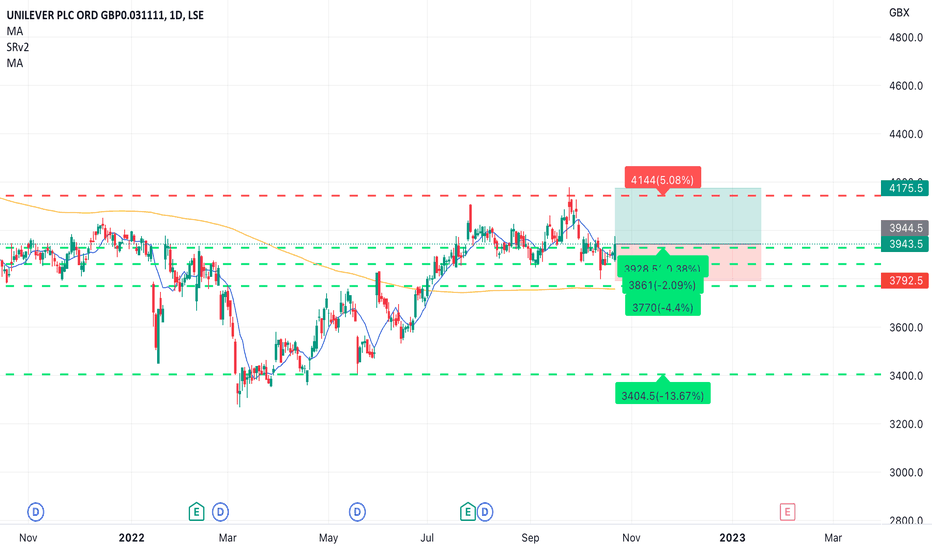

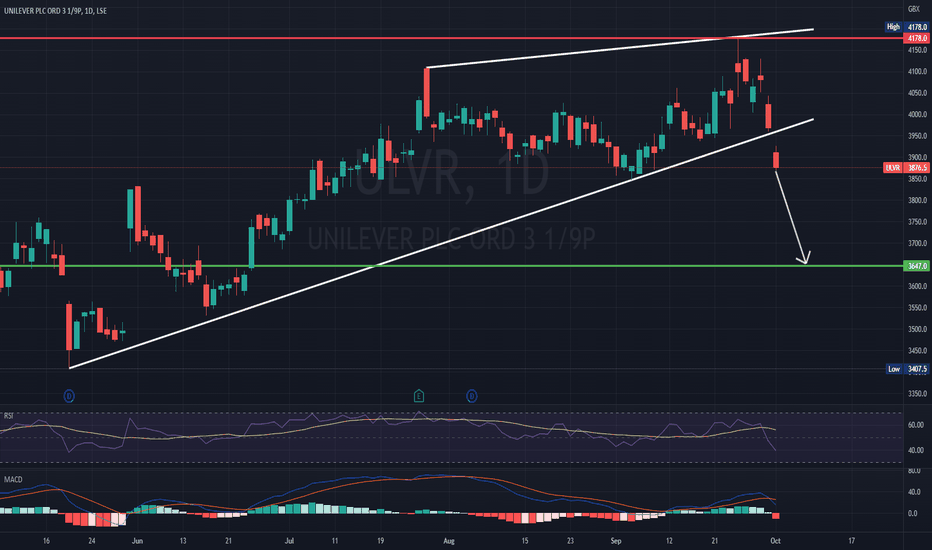

Unilever (ULVR.l) bearish scenario:The technical figure Rising Wedge can be found in the daily chart in the UK company Unilever PLC (ULVR.l). Unilever plc is a British multinational consumer goods company. Unilever products include food, condiments, ice cream, cleaning agents, beauty products, and personal care. Unilever is the largest producer of soap in the world, and its products are available in around 190 countries. The Rising Wedge broke through the support line on 04/10/2022. If the price holds below this level, you can have a possible bearish price movement with a forecast for the next 31 days towards 3 647.00 GBp. Your stop-loss order, according to experts, should be placed at 4 178.00 GBp if you decide to enter this position.

In the first half of 2022, Unilever's growth accelerated again as its robust sales in the U.S., India, and other markets easily offset its lockdown-induced disruptions in China. It also raised its prices to offset the impact of inflation. For the full year, it expects underlying sales to grow by more than 6.5%.

Unilever's underlying earnings per share (EPS) rose 5.5% in 2021, but grew just 1% year-over-year in the first half of 2022 as the inflation and currency headwinds squeezed its margins. It expects its underlying operating margin to decline about 240 basis points to 16% this year.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

THG PLC: Reversal and Bullish Island Pattern1) I believe that the bullish wedge pattern (June-August) is still valid with the price target of 88.

2) Island Pattern, which is reversal and bullish.

3) Price to book ratio: 0.32

4) Insiders are buying the stock at these levels.

1st target: 88

2nd target: 104.85 (gap)