$LUCE - Beaten down reversal play with +50% to +100% upsideTechnical Analysis (TA)

On the weekly chart the momentum indicators are oversold. There are early signs over of a potential reversal.

On the daily chart the price is flat and there is a small wedge formed. We need price break above 115 and then we could potentially see LUCE reach 145 and 170.

Price Target

Entry: 115

Target 1: 145 (+26%)

Target 2: 170 (+48%)

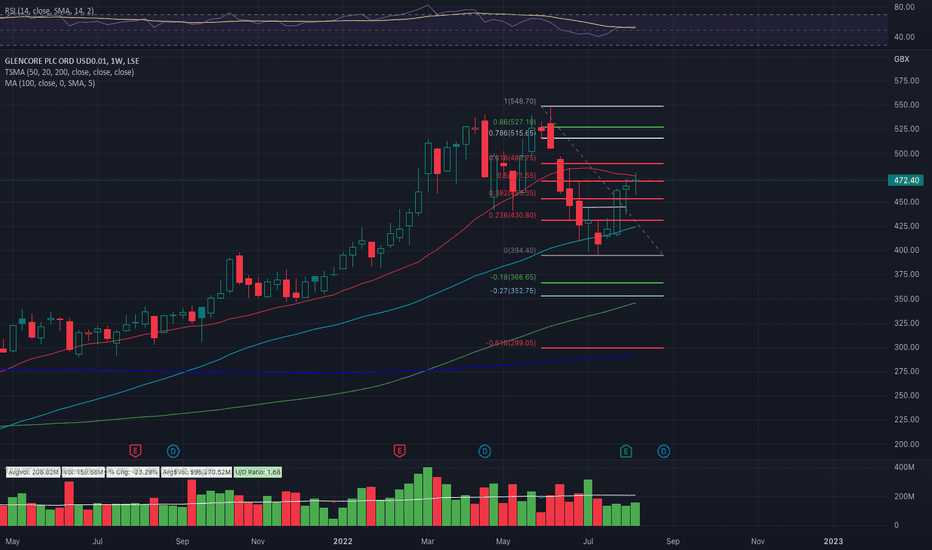

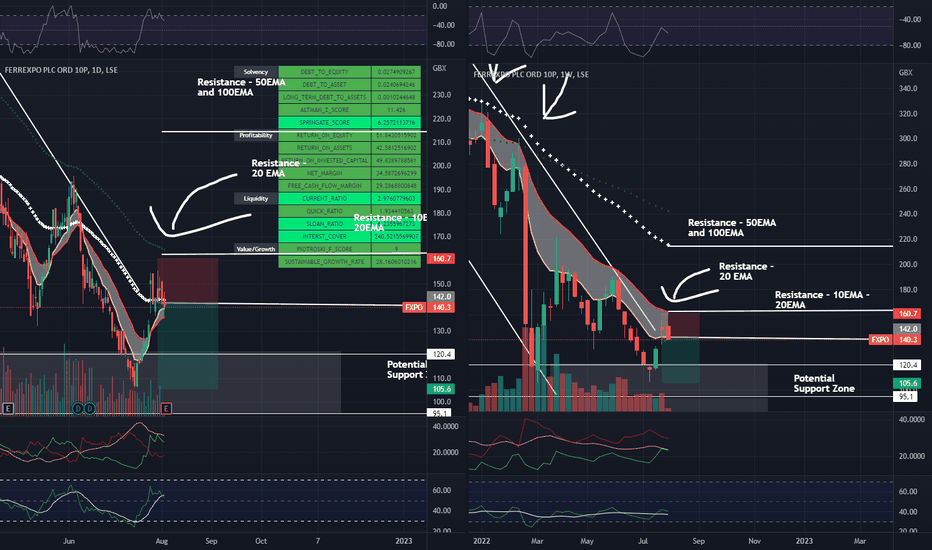

Glencore Short Weekly ChartGlencore put in a double top back in March and April and since price has fallen 28%. Looking at Fib levels on the weekly chart price has now retraced 50% and has put in a hanging man candlestick on the weekly chart. The RSI is also dropping along with volume - making a short set up lucrative for the coming days/week.

Couple this with the fact that the UK 100 has had a great run recently coming off the lows with a consistent move higher. We are now however approaching all time high resistance where the market has U-Turned five times already this year. Indicating that we are in for a U-Turn back to the 200-period average. This impending reversal of the overall UK market will give strength to short positions in this market in the coming weeks. Of course, we don’t know for sure that it will reverse it could break out to new all-time highs but probabilities are in our favour. I do however foresee a bullish run for another week until price has retraced 100%.

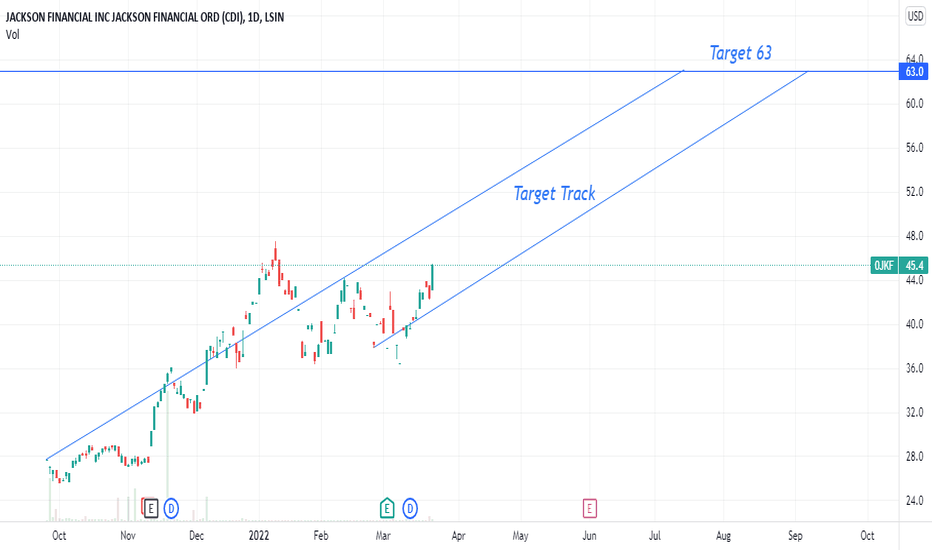

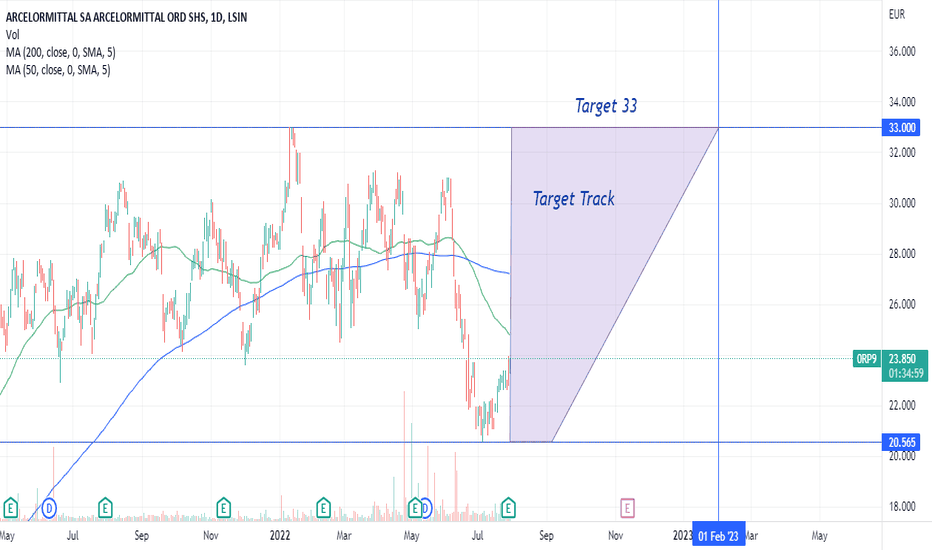

Target 63 ( 1 to 5 months )Good Breakout, Good Earnings , Fundamental and techinical is great , so Target 63 Duration 1 to 5 months..........

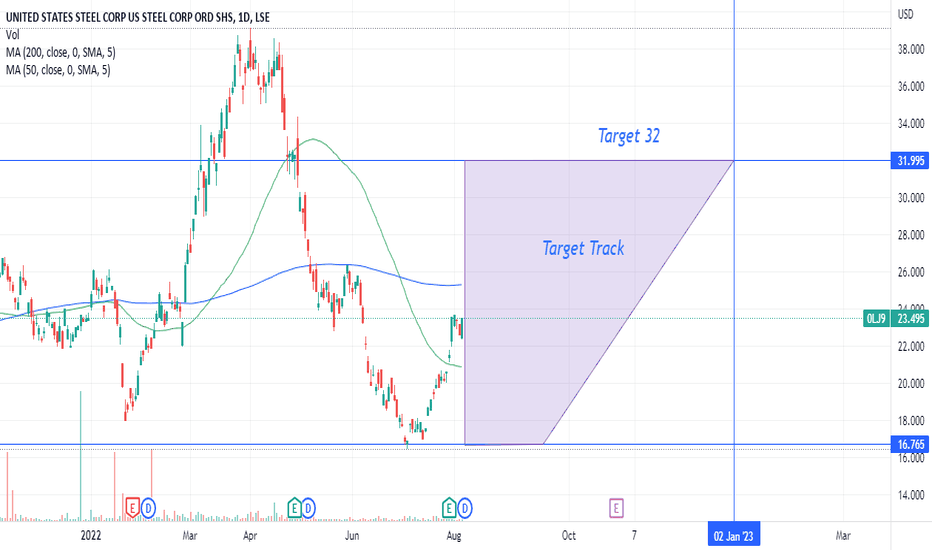

Target 32 ( 1 to 5 months )Good Technical and Fundamental ( Earnings ) So Target 32 Duration 1 to 5 months

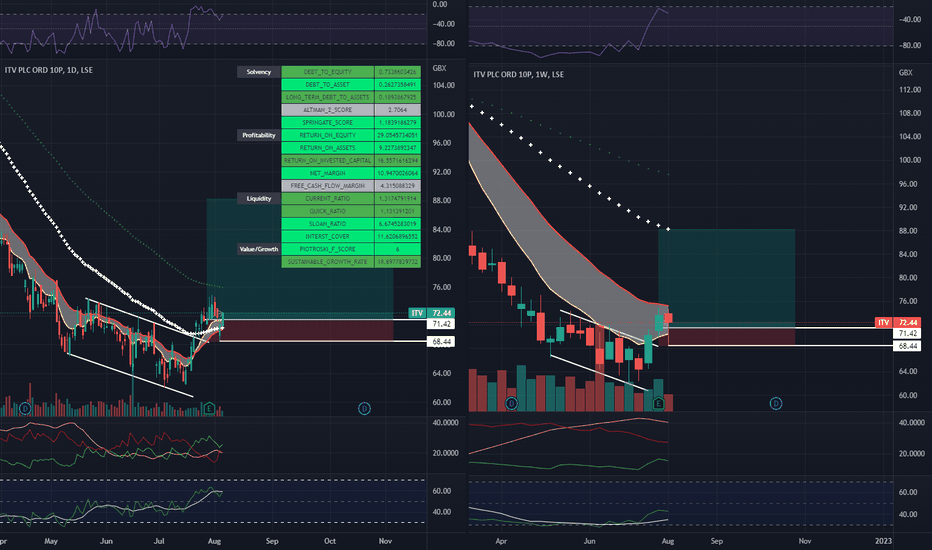

$ITV - Continuation swing with +10% to +40% upsideTechnical Analysis

Price bottomed out 3 weeks ago and the RSI + William %R

Price broke out the daily channel last week and has been consolidating above the 1D 50EMA. There is a good zone to buy before a further push above 76 and potentially 90

Price Target

Entry: 71-73

Target 1: 76 (+5%)

Target 2: 88 (+20%)

Analyst Targets: 101 (+40%

Financial Metrics

High quality as shown by the financial metrics. Undervalued with high upside/growth potential.

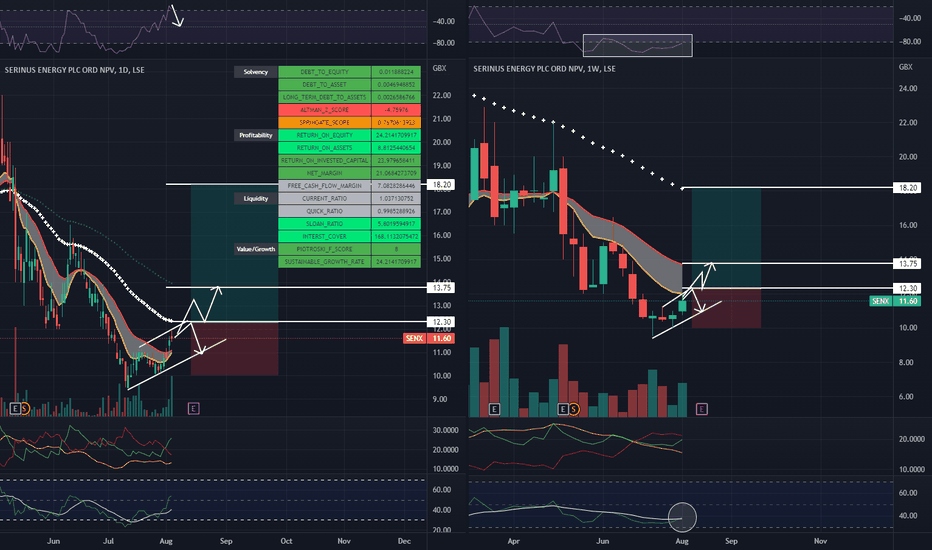

$SENX - Reversal for upside of +12% to +40% Technical Analysis

Weekly William %R and RSI are oversold.

Daily channel being created with resistance at 50EMA>

Scenario 1 - BUY

Breach of 50EMA and uses it as support.

Scenario 2: - SELL/WAIT

Bounces off 50EMA as resistance and come back down to create a higher low.

Based on the technical environment and high William %R I expect scenario 2 to happen with high low being used to propel price upwards and for a push to $13.75 to $18.50>

Price Target

Entry: $12.30

Target 1: $13.75 (+12%)

Target 2: $18.20 (+40%)

Analyst Target: $61

Fundamental/Financial Analysis (FA)

Strong financial metrics and passes quality screen.

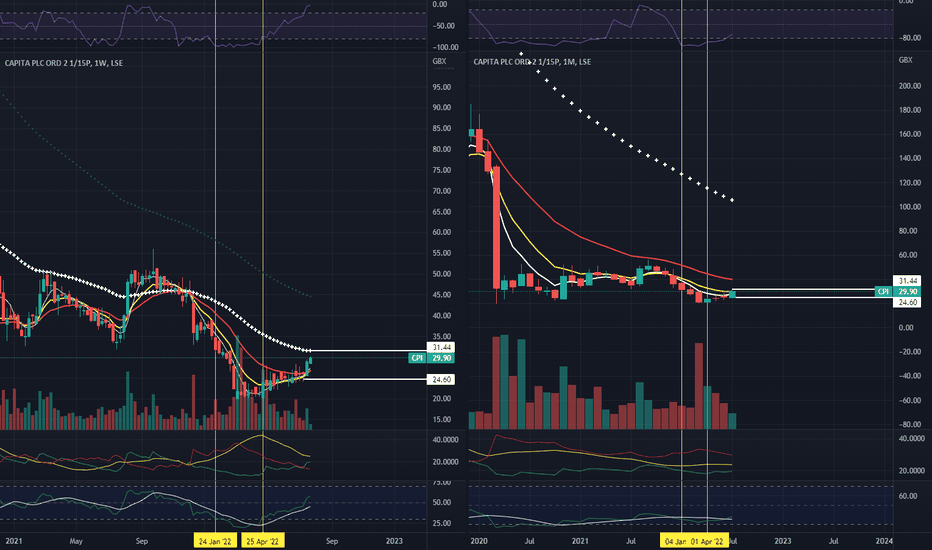

CPI - Reversal play with strong fundamentalsTechnical Analysis

Jan to April 2022 CPI entered a phase where it was oversold as shown by the 1M William %R entering below the -80 level. Signaling a potential mean reversion play or reversal play.

Since 25 April the stock has been moving upwards and is now on the verge of confirming a reversal play on the 1Wk chart but with William %R on the 1Wk chart being above -20 I expect the stock to consolidate between $31.44 and $24.60 prior to deciding its 1M and 1Wk direction.

A break below $24.60 the 1Wk continuation play would be triggered as it would show signs of low buying momentum/demand etc. and I expect the bottom of $20 to be tested again.

A break above $31.44 would signify high demand/ volume and potential shift in momentum.

Price Targets

If BUY triggered I expect an initial target of $44-$56 (+36% to +78%) with further upside expected if momentum shifts significantly in the markets or we see news/catalysts pushing price past $56.

If SELL triggered I expect an initial price target of $19-$21 (+14% to 22%) with further downside expected if it breaks support below.

Financials & Quality Screen

EV/EBIT: 3.86

ROIC: 25.02%

Piotroski F Score: 6

Excellent sustainable growth rate: 316

Emis Group UKSun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

Quilter UKSun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

Lloyds Banking UKSun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

Dassault Systemes UKSun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

Atlas Copco B UKSun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

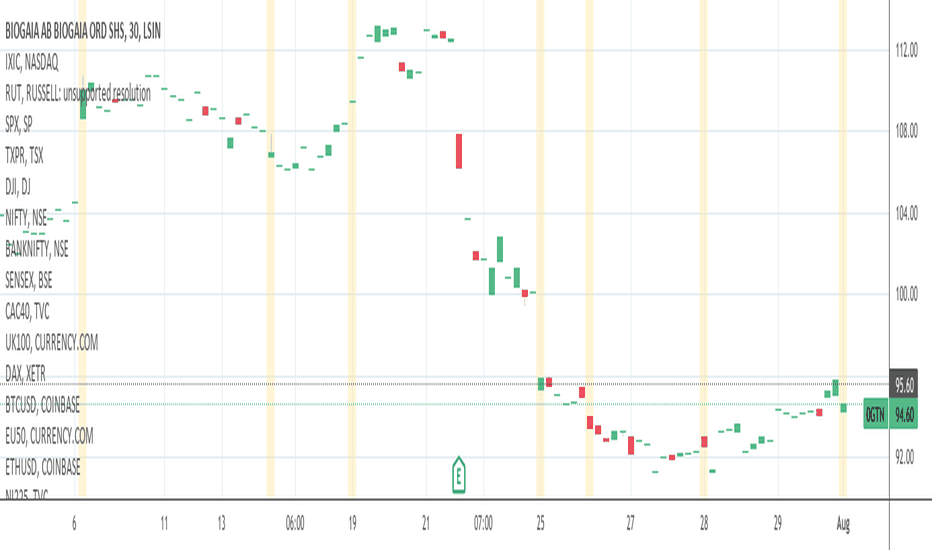

BioGaia B UKSun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

AztraZenica UKSun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

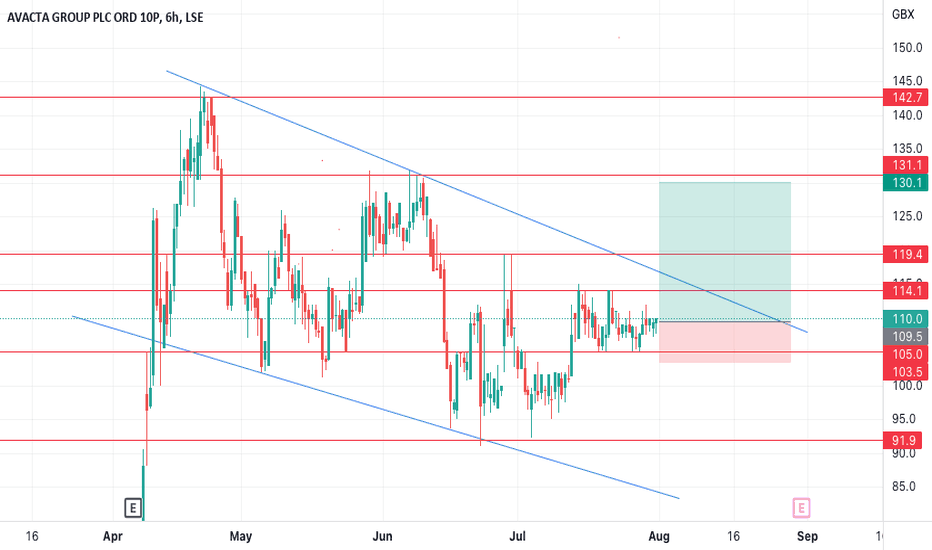

AVACTA - LTF trade ideaI know I bang on about Avacta a lot. But think we have a good trade setup here

- Bollinger bands pinching

- Accumulation/build up, approaching the top of a channel (bull flag Htf)

- Strong excitement/sentiment amongst investors

- Wider markets performing/recovering well.

- Higher lows on 1 day tf

- OBV creeping up, whilst price steps down (1 day)

* Stops would sit just below the swing lows here.

* Targets could trail cos this really could go some now.

Or entry on retest of overhead resistance as support.

I feel like we could be trading above ichimoku on 1 hour and 4 hour easily in the coming day, so taking position now could beat the crowds.

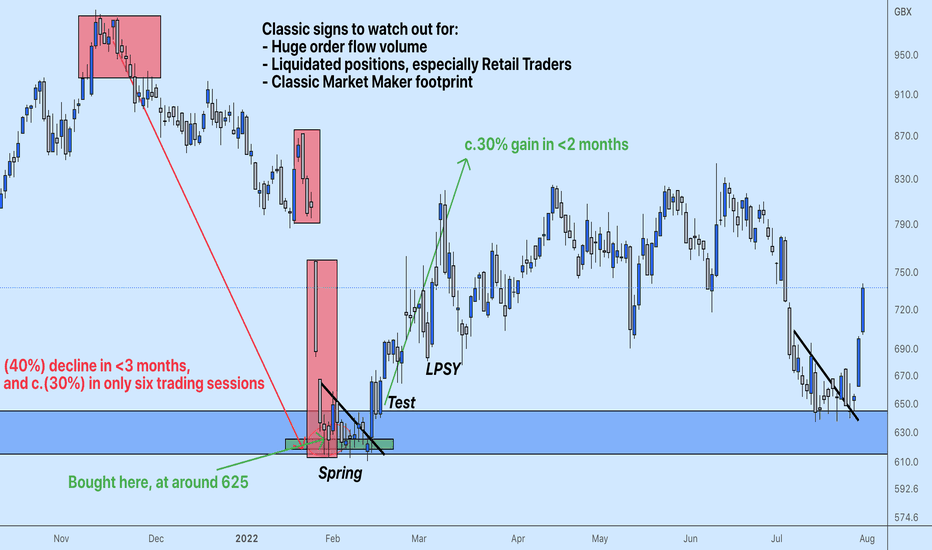

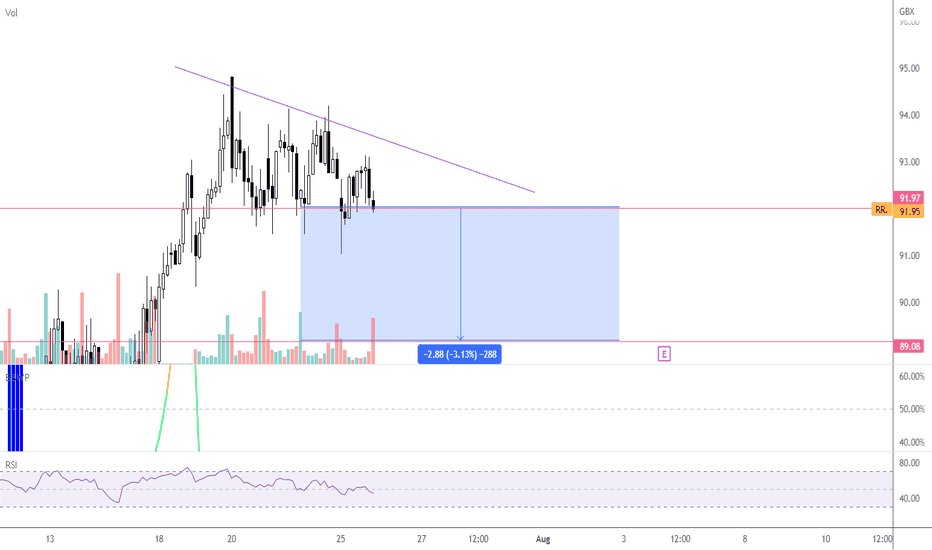

Psychology & Market Manipulation - Case StudyGood Day - hope everyone is doing well, and welcome to a brief case study of an Trade Idea we shared with VIP Members earlier this year, and executed for our Fund.

Without repeating what's above - it's clear that the market will give Retail Traders a 'Judas Goat', to induce false positions, early sells and generally spread a feeling of fear & anxiety, clouding judgement, firing up the amygdala, and feasting at an empty table, the liquidity that was so easily given up to the most powerful actors in the market: Banks & Financial Institutions.

By truly understanding liquidity, price action and psychology - you can consistently execute flawlessly, on high-risk-reward opportunities.

And that's all it comes down to, and the end of the day, when we talk about trading.

Do you agree?

Let me know in the comments below. Cheers.

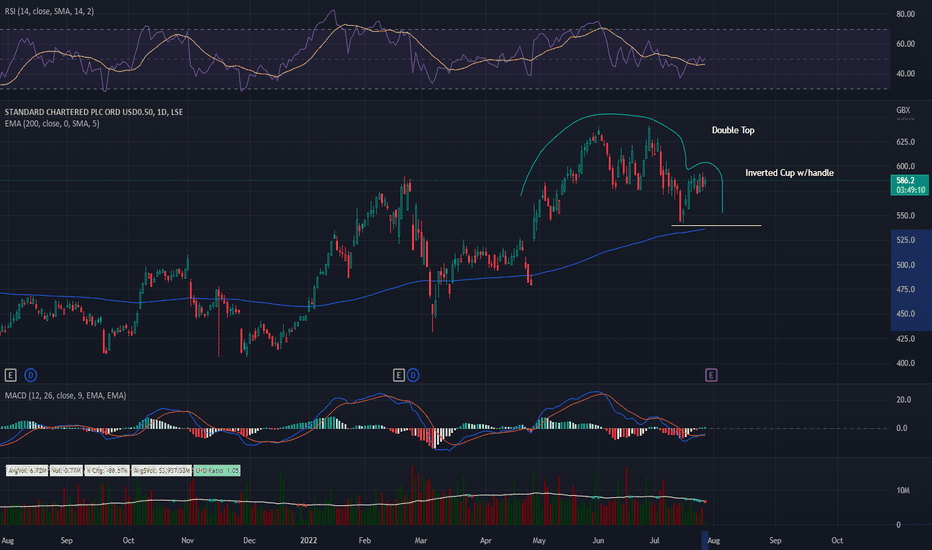

Standard Chartered Short IdeaSTAN on the daily chart has put in a double top.

An inverted cup with handle pattern is forming down towards the 200 EMA.

Once price closes below the 200 EMA I will be looking for a short position. Around £5.40

Measured move (Size of Cup) will be my first profit target at £4.32 which is also an historical support level.

Stop initially at top of handle around £5.96.