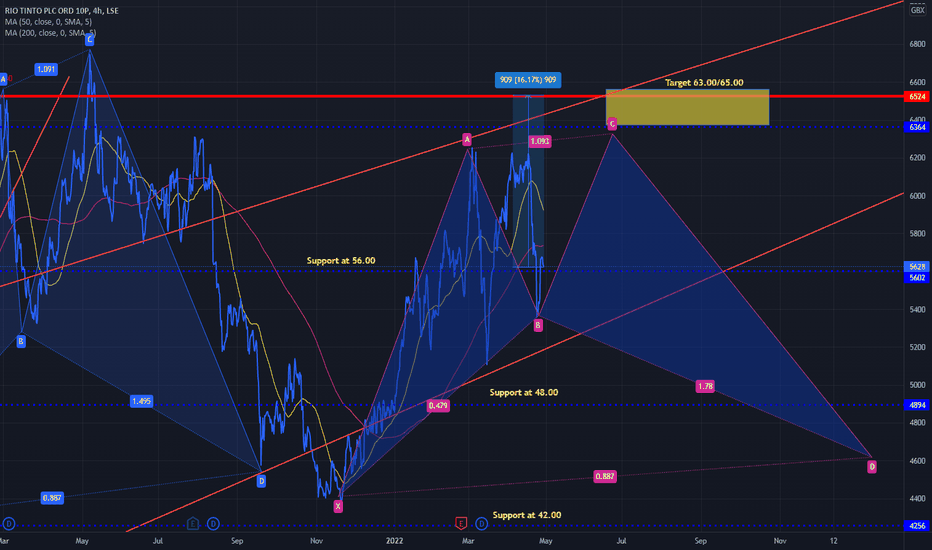

Rio Tinto (RIO)The recovery of the global economy, driven by industrial production, resulted in significant price strength for our major commodities, which we were able to capture, achieving record financial results with free cash flow of $17.7 billion and underlying earnings of $21.4 billion, after taxes and government royalties of $13.0 billion. This enables us to pay our highest total dividend ever of 1,040 US cents per share, including a 247 US cents per share special dividend, representing a 79% payout.

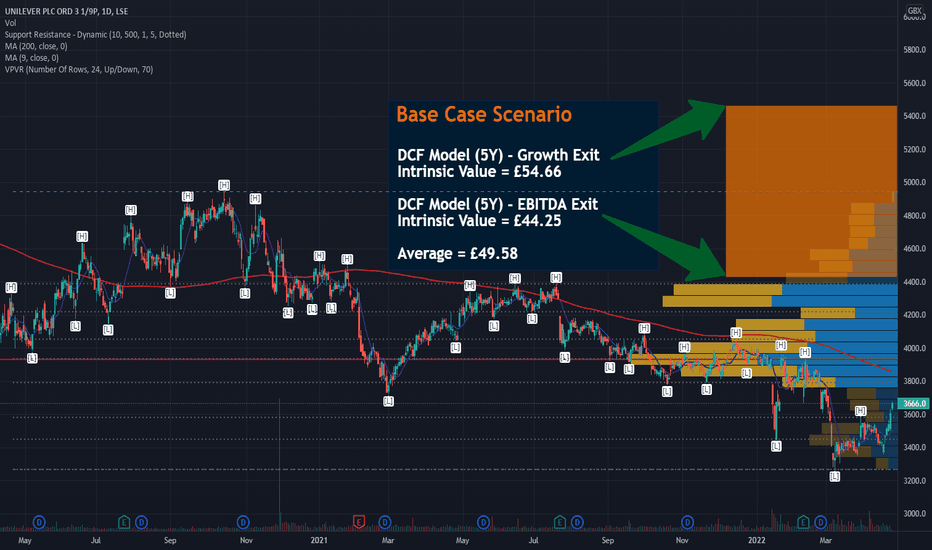

Unilever (ULVR) Intrinsic Value - DCF ModelUnilever DCF Assumptions:

Tax Rate = 23.5%

Discount Rate = 4.9%

Perpetual Growth Rate = 1.5%

EV/EBITDA Multiple = 12.5x

Transaction Date = 01/04/2022

Fiscal Year-End = 31/12/2022

Current Price = 41.92

Shares Outstanding = 2,610

Debt = 29,672

Cash = 4,495

Capex = 1,340

Base Case Scenario

In addition to the above assumptions, the below DCF model is based on our base case scenario, which assumes a revenue growth over the next five years of 5%, 3%, 3%, 3%, 3%. These assumptions are lower than analysts’ forecasts.

DCF (5Y) EBITDA EXIT MODEL:

Terminal Value

Final Forecast EBITDA (m) = €12,873

EV/EBITDA Multiple = 12.5x

TERMINAL VALUE (m) = €160,909

Intrinsic Value

Enterprise Value = €162,651

Plus: Cash = €4,495

Less: Debt = €29,672

Equity Value = €137,474

EQUITY VALUE / SHARE = €52.68 / £44.25

DCF (5Y) PERPETUAL GROWTH RATE MODEL

Terminal Value

Final Forecast FCFf (m) = €8,742

Perpetual Growth Rate = 0.5%

TERMINAL VALUE (m) = €201,447

Intrinsic Value

Enterprise Value = €195,001

Plus: Cash = €4,495

Less: Debt = €29,672

Equity Value = €169,824

EQUITY VALUE / SHARE = $65.08 / £54.66

DISCLAIMER:

All information is the author’s views, opinions, and assumptions at the time of writing, and Bull Headed Bear makes no guarantees of the information’s reliability and accuracy. The information is to be used for entertainment and informative purposes only. Bull Headed Bear and its authors reserve the right to change their views, opinions and assumptions due to many influencing factors.

Any actions taken based on the information on the website are strictly at your own risk. All investments carry a risk of loss, and you could lose all your money. Consider seeking professional advice from a financial advisor. Bull Headed Bear and its authors will not be liable for any losses or damages from the information on this site.

DISCLOSURE:

I/we have open long positions in Unilever. We have no immediate intentions of altering this position in the short term but have the right to change this if more information becomes available.

Argo Blockchain UKSun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

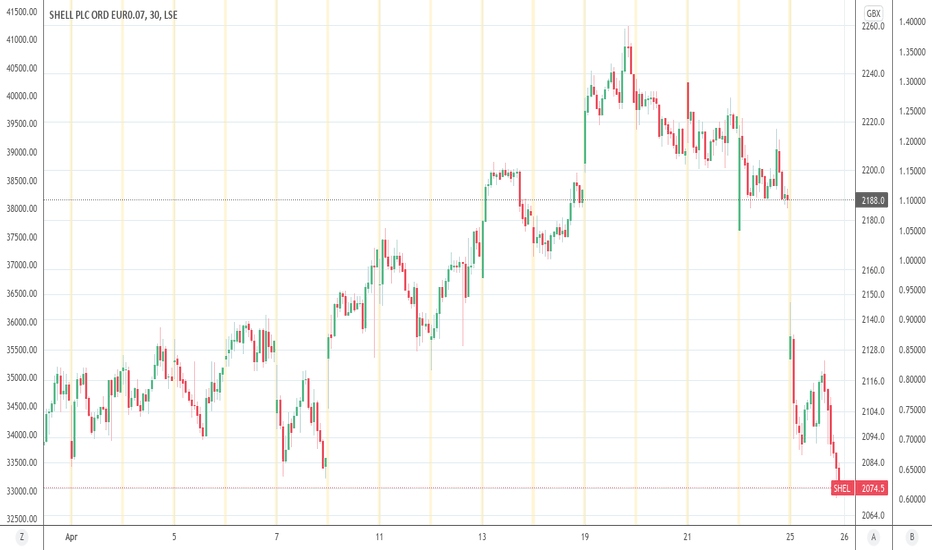

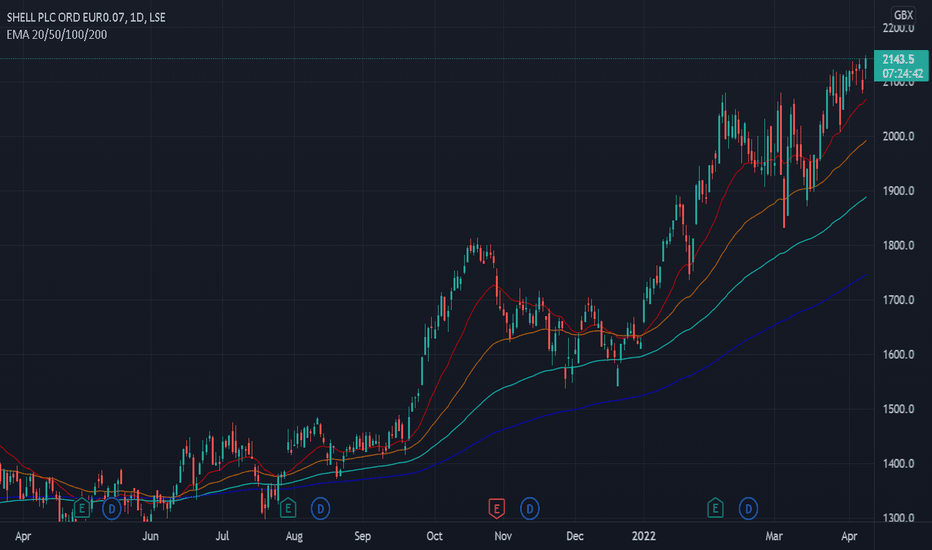

Shell UKSun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

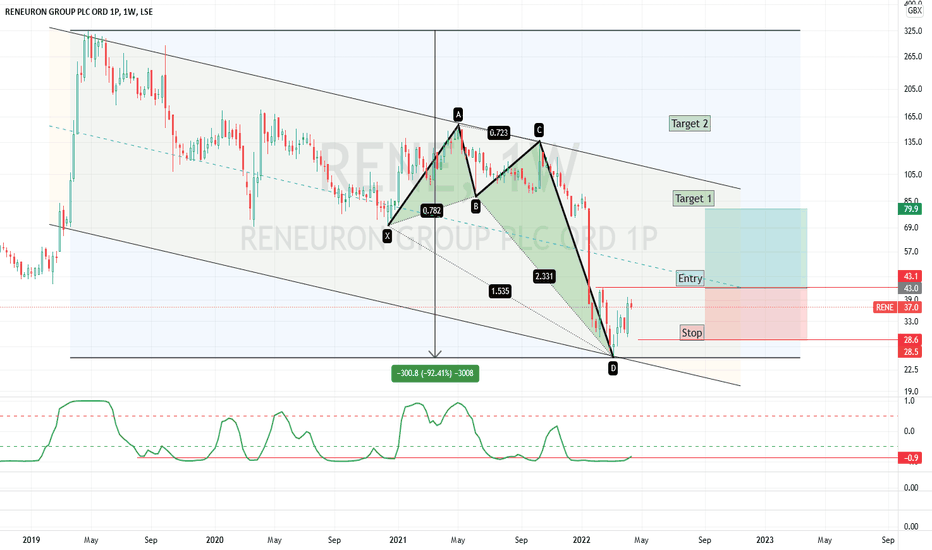

ReNeuron Group (RENE) ... a little gene therapy ??Here's something for you punters and long haulers.

From TV: ..... ReNeuron Group Plc engages in the development of novel cell based therapies that target significant areas of unmet medical need. It develops its core stem cell assets such as CTX neural cell line and human retinal progenitor cells. The company was founded by John David Sinden in 1997 and is headquartered in Pencoed, the United Kingdom.

RENE last 92% of it value from the fall of 2019 and has clawed some of that back in recent weeks.

RENE trades on the LSE and the OTC but ususally by appointment.

Apparently the analysts love it. (that scares me sometimes)

This may have a chance if the high of February is taken out.

The chart suggest is a fairly good Harmonic Butterfly pattern on this weekly image.

Targets and a Stop have been marked, suggesting a RR of just over 2.5x .

I am mentioning but probably not playing. ( depends on broader market sentiment and Biotechs in particular.)

This company presently does not turn a profit. Earnings reports are expected mid July.

Not investment advice. As always do your own due diligence, respect broader market and wold events.

Good luck

S.

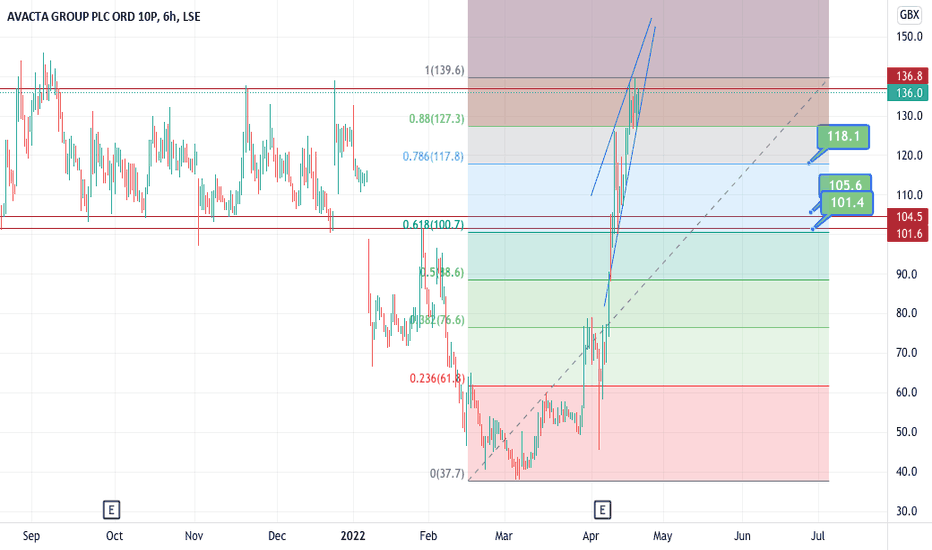

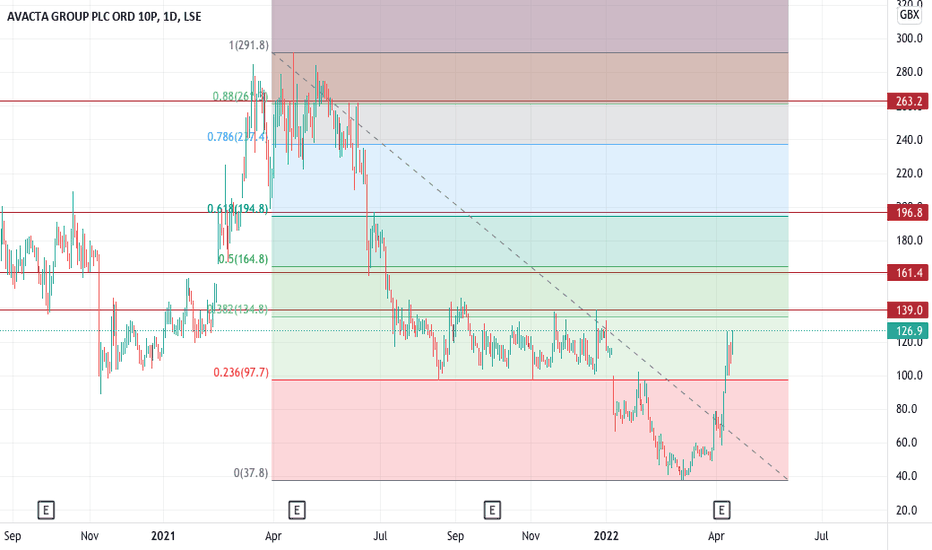

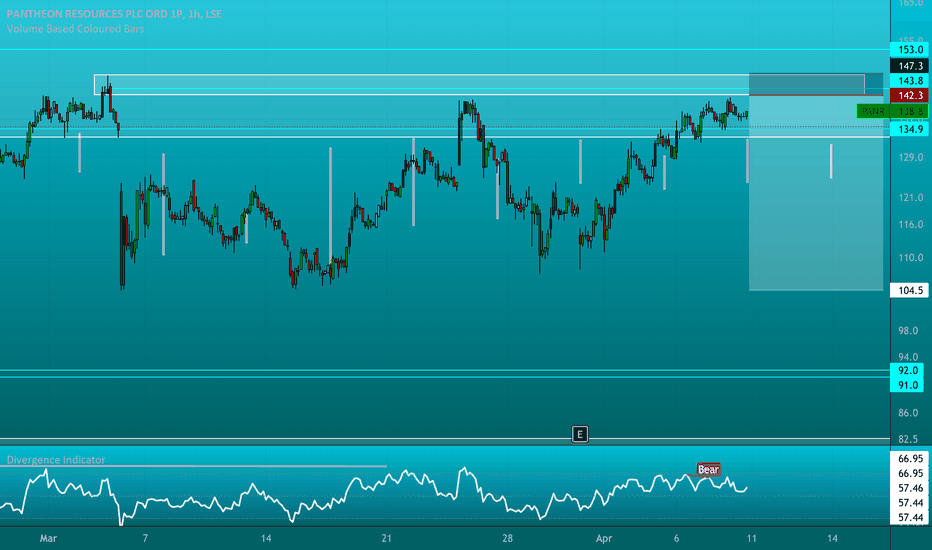

Update on AVACTAHeres my update on AVACTA

Thinking that the run could just continue, and it might. But I always feel that when I am most bullish as a result of a long run up and its time for a bit of down (for now).

Bearish divergences on 1 to 6 hour time frames.

Seem to be forming this rising wedge, that looks like it could break to the downside.

We are at historical price resistance, back within an old channel. Id be looking to buy 118-121p and then bottom of the channel once more, which also aligns with the 0.628 fib level.

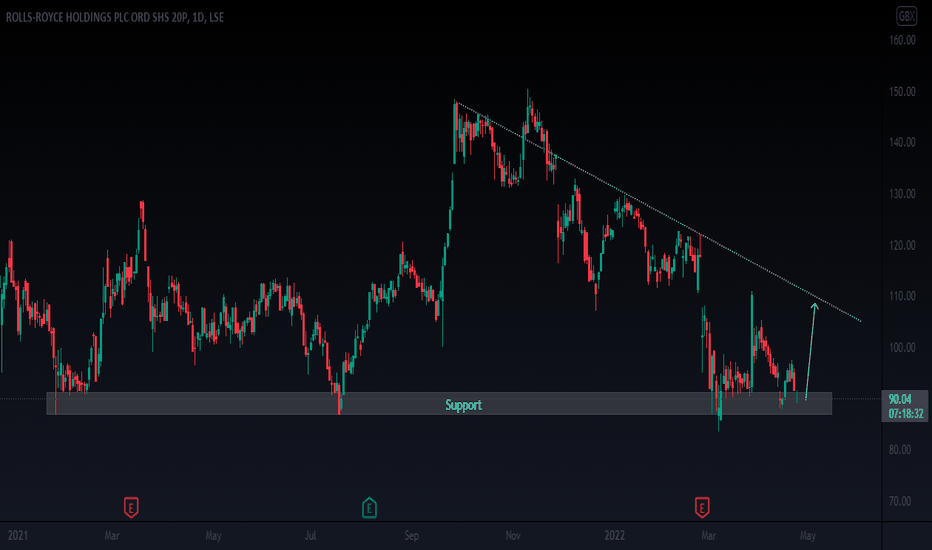

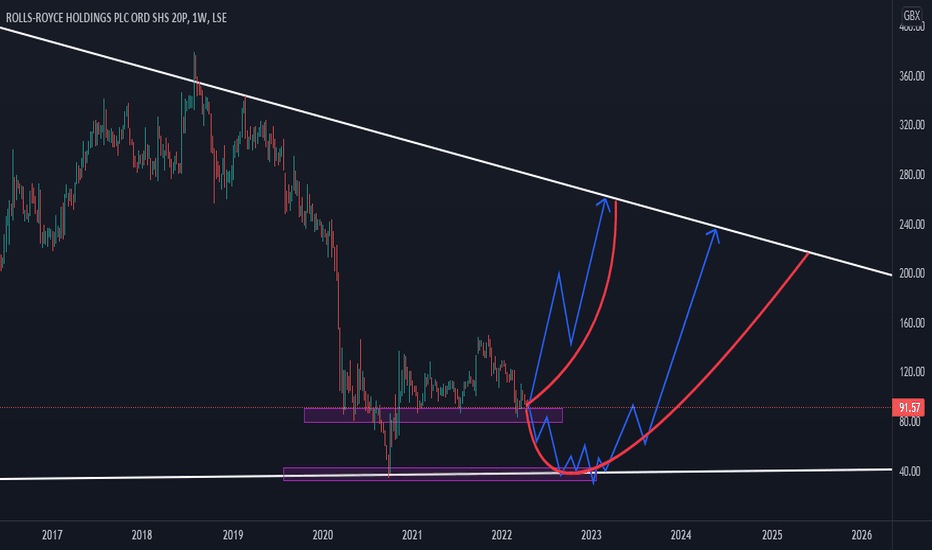

Rolls-Royce Holding (RR.) The most interesting project that Rolls Royce is carrying out is the SMR. Rolls-Royce SMR has been established as an independent company, drawing on decades of Rolls-Royce experience in nuclear design and engineering, while capturing industry leading expertise, support from the UK Government and investment from world class companies. Rolls Royce SMR was formed to develop an innovative approach to deploying nuclear power. This vision is backed by the UK Government, world class investors and an international nuclear operator.

The regulatory process has been kicked off, and will likely be complete in the middle of 2024. Company is trying to work with the UK Government, and others to get going now placing orders, so we can get power on grid by 2029.

www.reuters.com

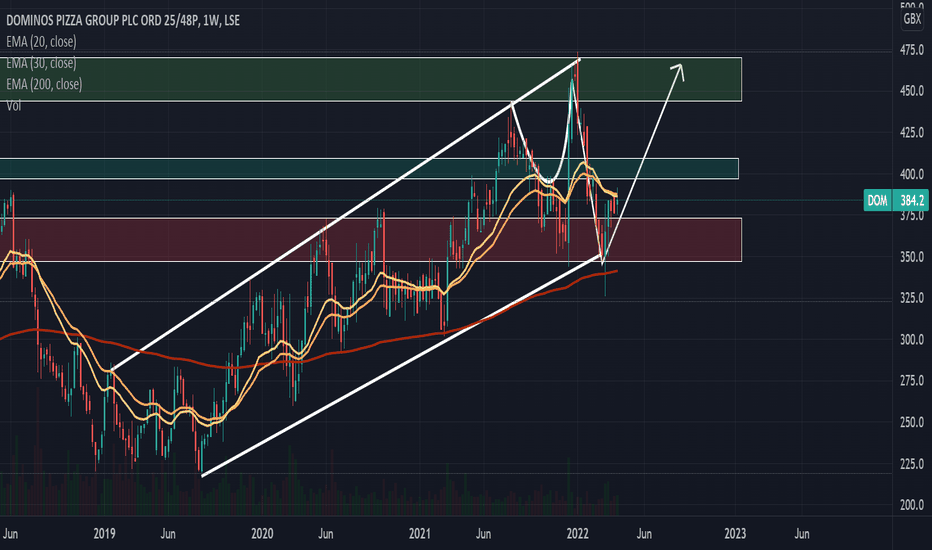

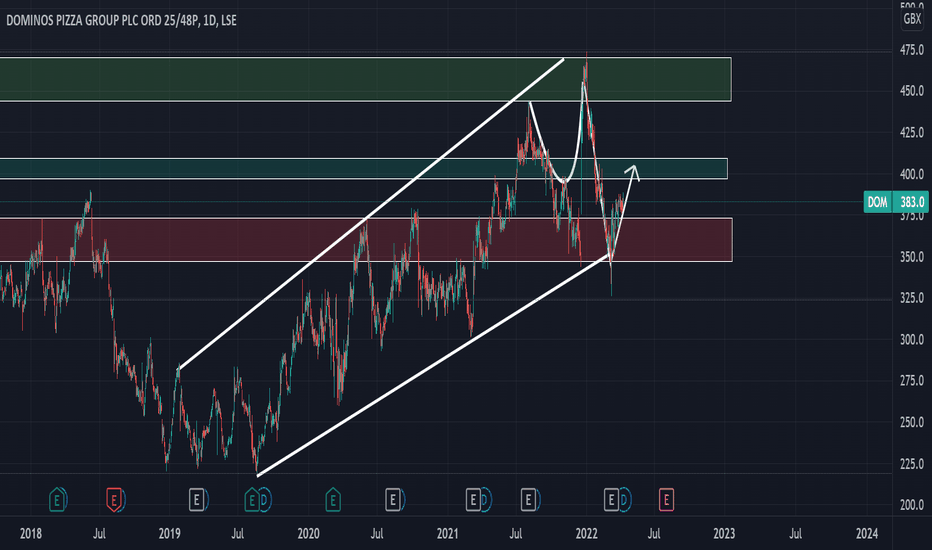

Domino's pizza to $480Huge upside here, oversold on every level keeps bouncing off the 200ma and looking for a price target of $480 fast to be honest, wall street had better expectations, but this had to do with the crappy delivery drivers and lack of employment. Things are changing in the company as far as paying the right price and as well as the cost of pizza will no longer be cheap... and well us Americans love us some delivered to the door hot pizza. Great buy opportunity here that won't retract for months to come.

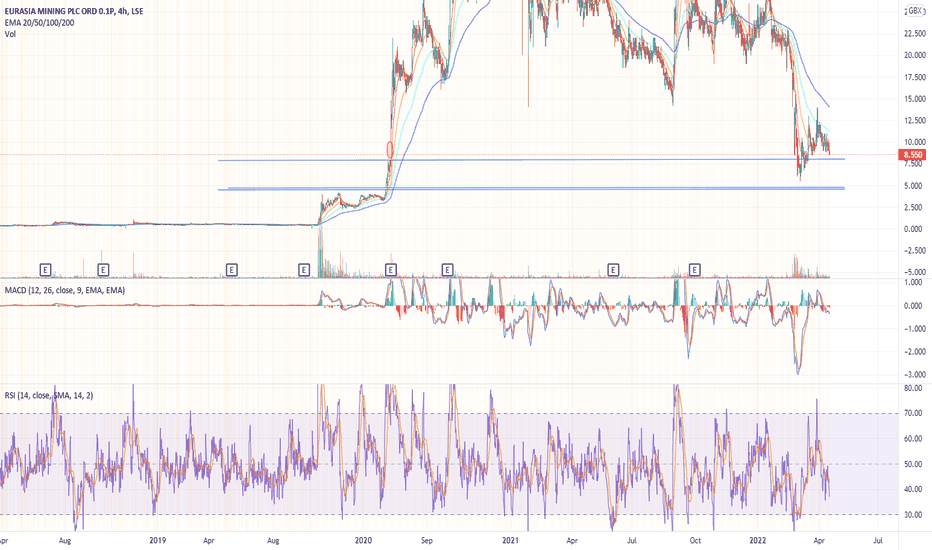

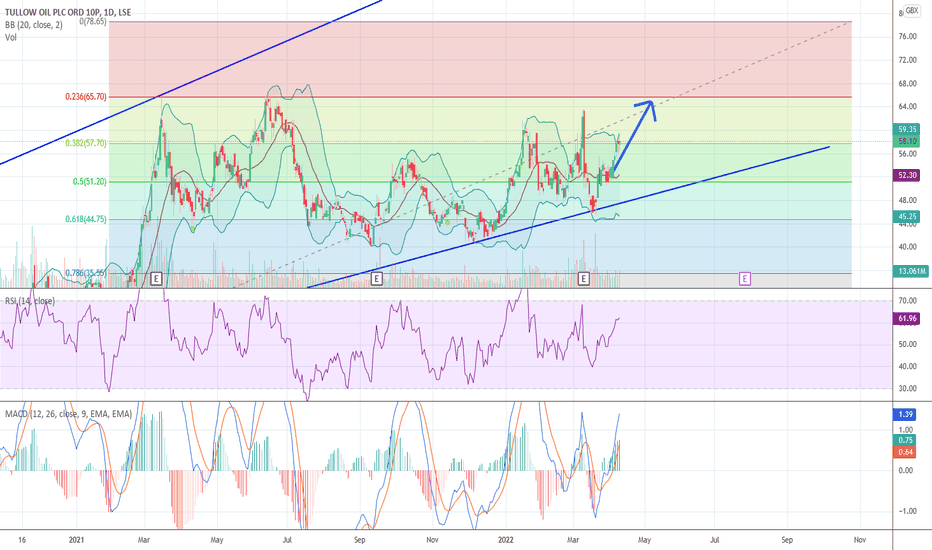

Tullow to the topTullow is looking good for a retest of the 0.236 fib level. MACD is looking like it's in decent shape and the RSI still has legs.

From a geopolitical standpoint Tullow's operations are a long way from the sabre rattling in easter Euope so this bodes well also.

Target is 65.75 GBX.

If we clear that then and resistance acts as support the next target is 78.65 GBX.

Good luck!

Cup & Handle on domino's pizza!!Anyone thinking the price of pizza going down is fooling themselves, even though it didn't meet "wall streets" expectations it met mine and i bought the dip today below the trend line, tons of possibilities here and once this stock moves it moves and can easy clear $430 this week if the market allows it. Not much volume either surprised people aren't seeing this. Clear channel up as well again up and handle has hit and formed and formed strong!