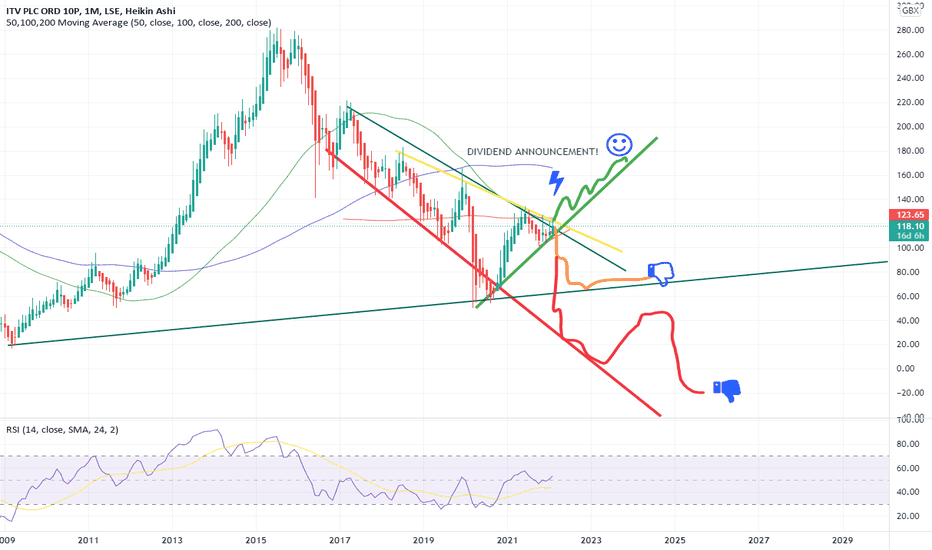

ITV: I want to Break Free!I want to break free... Of this downrend!

Is the sell off over? Will the dividend announcement send the price back up?

ITV is undervalued, but it's hit the top bound in a multi- year sell off, what will happen next week? (News isn't good, inflation, Ukraine etc).

I bought in at £1.12, it stands at £1.23, and my stop loss is at £1.15!

We could see any one of the three scenarios take place! I'm poised for the good one! But be ready to get out!

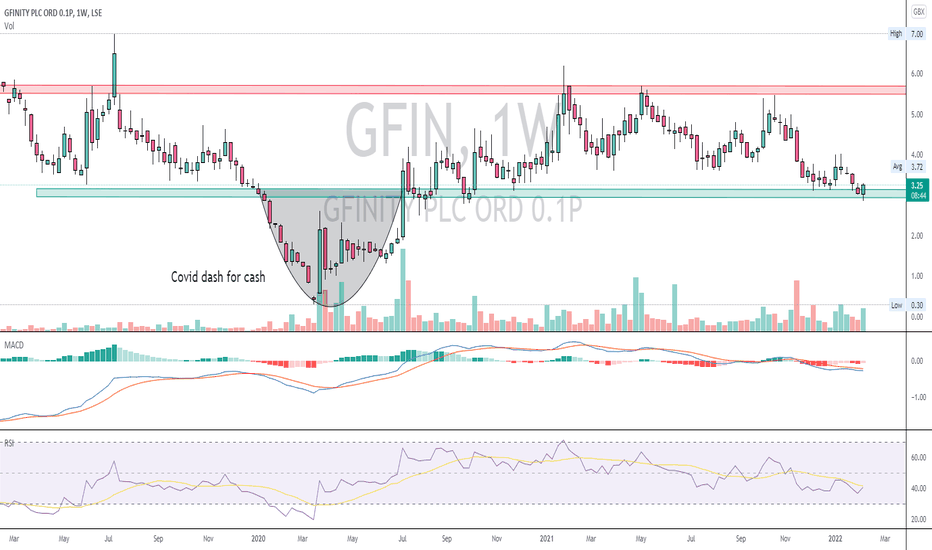

Bullish engulfing - weeklyStrong bullish engulfing candle on the weekly timeframe at area of historic strong support for GFINITY. RSI rising.

Trading update due in next 2 weeks with HY accounts due out by 2nd week in March. All indications from the company are that they are seeing enormous growth in the digital media side of their business. Monthly Active Users growing exponentially as well as the revenue per user increasing from around 5p at start of 2021 to 20p by end Dec 2022 - Twin engines of growth for anyone who has read 100-baggers.

Business significantly undervalued compared to peers, has top management, is operating in a hot sector, has low debt, low fixed costs, high margins, and is rapidly growing revenues, fast approaching profitability (July 2022), cashed up & highly scalable.

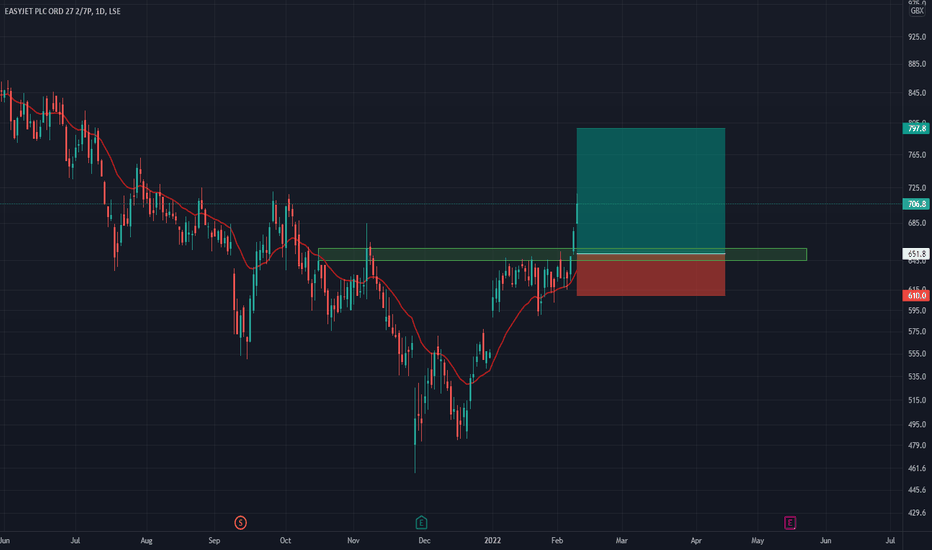

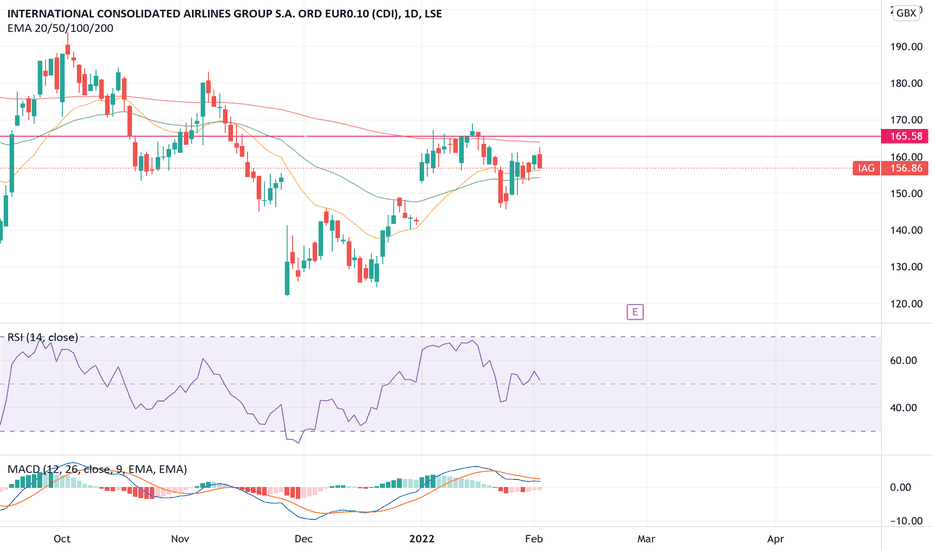

EasyJet to Fly Higher? EasyJet - Short Term - We look to Buy at 651.8 (stop at 610.0)

Preferred trade is to buy on dips. Previous resistance, now becomes support at 650.00. The bias is still for higher levels and we look for any dips to be limited. The medium term bias remains bullish. 20 1day EMA is at 635.00. We look for a temporary move lower.

Our profit targets will be 797.8 and 855.00

Resistance: 725.00 / 750.00 / 800.00

Support: 650.00 / 600.00 / 590.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

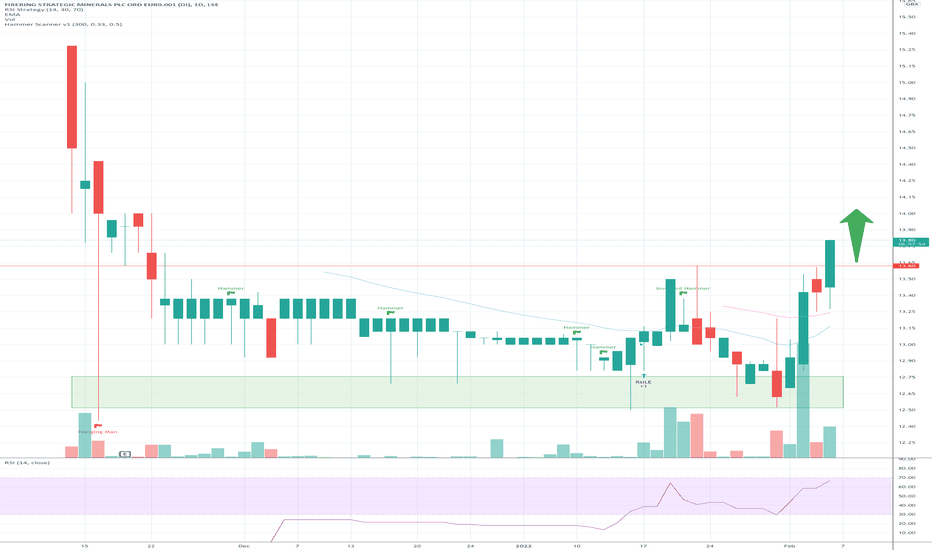

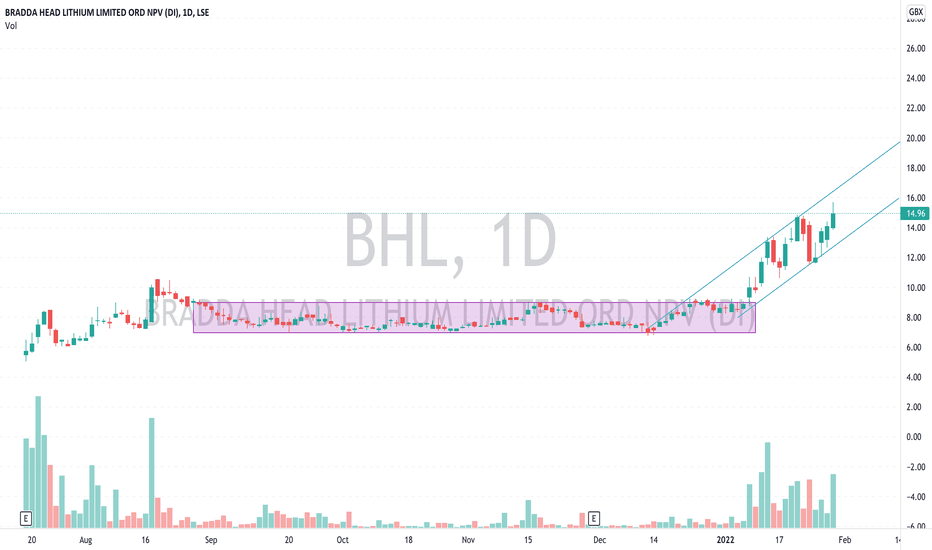

#FRG #FireringstrategicmineralsWith 80% of #Lithium supplied by China, the need for supplies elsewhere in the world couldn’t be more in demand.

#FRG #Fireringstrategicminerals is perfectly placed for the huge demand expected in next 10 yrs for Lithium to power the #EV market

Really starting to move, good volume, needs to hold 13.6 at the close to continue even higher

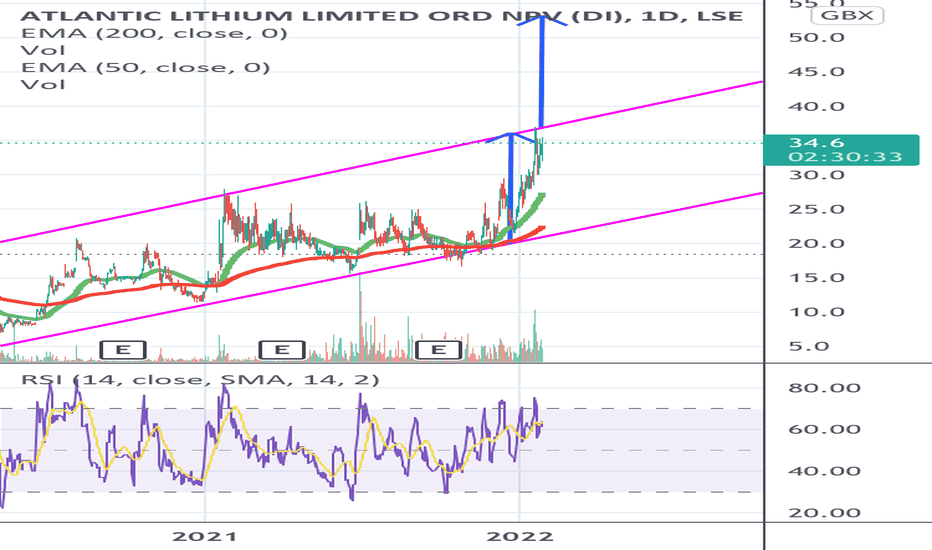

Atlantic Lithium Ascending ChannelALL in a bullish channel and rebounded off the ascending upper trend line.

Sell off occurred at 37p with a move back down to 30p.

However strong buying since then has brought price action back up to 35p with good volume.

A breakout of this channel could see price target of 17p above the upper trend line which at current levels would be a move from 37p to 54p.

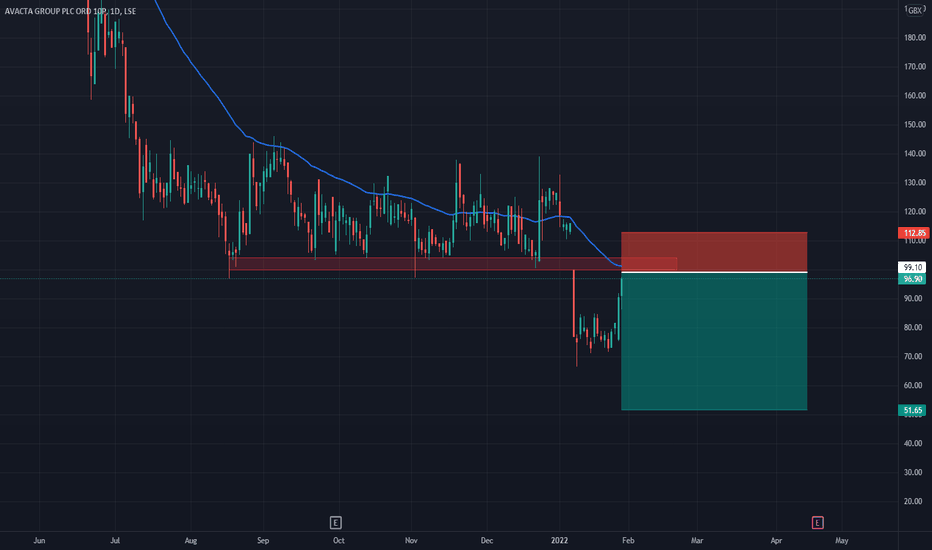

Avacta at Key Level Avacta Group - Short Term - We look to Sell at 99.10 (stop at 112.85)

Preferred trade is to sell into rallies. Previous support level of 105.00 broken. 50 1day EMA is at 100.00. Previous support at 105.00 now becomes resistance. Trading close to the psychological 100.00 level. Further downside is expected although we prefer to set shorts at our bespoke resistance levels at 105.00, resulting in improved risk/reward.

Our profit targets will be 51.65 and 33.70

Resistance: 105.00 / 130.00 / 150.00

Support: 70.00 / 50.00 / 40.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

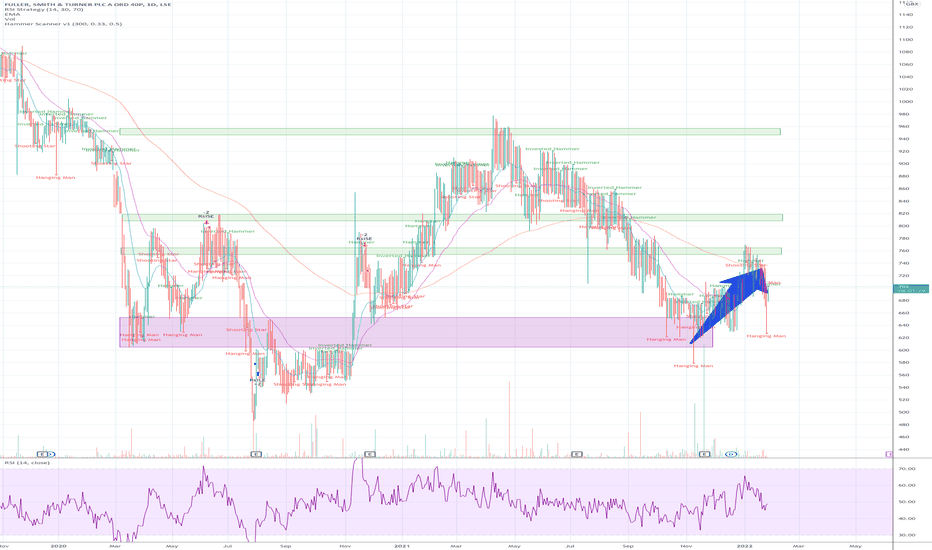

#FullerSmith&turner #FSTA - Returning to P making now host open #FullerSmith&turner #FSTA

Returning to profit making now hosp re-opened

Positioned well in market against competitors within rate hike environment – only the strong survive

Assets worth more than the current share price (£400m)

Positive cash flow

Make sure you take profits at these levels on our way up to 1000p (Berenberg Bank upgraded)

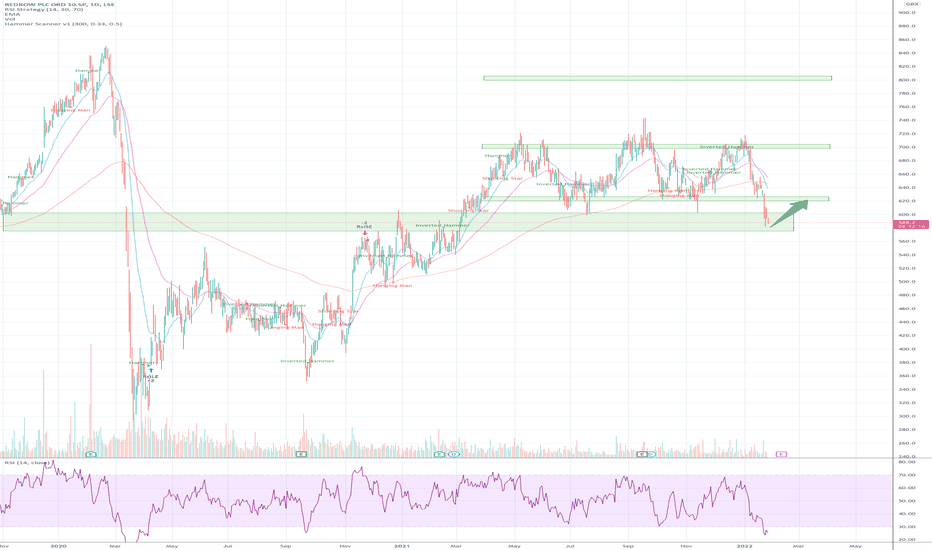

#Redrow #RDW - Reached area of significant value and support#Redrow #RDW

Reached area of significant value and support

Profit making

Strong positive cash flow

Low P/E

Divi

Perfect for rate hikes and inflation

Make sure you take profits at these levels on our way up to £8 (Deutsche Bank upgraded)